#livepeer token blockchain wallet

Explore tagged Tumblr posts

Text

Is Tokenization in Blockchain the Future of Asset Management? Let's Dive In!

Introduction

The digital age has completely altered the way we think about ownership, assets, and security. The tokenization in blockchain technology is among some of the most influential innovations created. It has made it easier for businesses to convert their physical and digital assets into secure tradable tokens in their blockchain networks. It results not only in the benefits of security and transparency but also brings new potential opportunities to both startups and enterprises. Justtry Technologies offers a complete blockchain solution that helps businesses stake their claim on such advancements.

Now let's talk about how tokenization is a revolution in blockchain and what kinds of different types of tokens pave the way to a secure, decentralized future.

What Does Tokenization in Blockchain Mean?

Tokenization, by definition, refers to the process through which the rights on the asset in the real world get reduced to a digital token within the blockchain. It represents the asset, thereby making it easier to trade, transfer, or even own fractionally. It allows for massive advantages like:

Increased liquidity through fractional ownership and trading.

Improved security through the decentralized and immutable blockchain.

Reduced costs by doing away with intermediaries.

Be it any asset, for instance real estate, art, or even digital ones such as content, intellectual property- the blockchain-based token system increases both accessibility and security.

Types of Tokens in Blockchain

Clearly, not all tokens are the same. There are various types of tokens, and each type of token has a distinct role and property. Let's break down the several types of tokens:

Utility Tokens: Utility tokens-the kind issued by Livepeer Token-are used to access specific services within blockchain ecosystems. Think of the kind of utility provided by Livepeer tokens if they could use those tokens to pay for video transcoding service on the Livepeer network.

Security Tokens: Represent an interest in real-world assets such as stocks, bonds, or even real estate. This is the most secure kind of investment which embedded legitimate ownership rights directly into the blockchain.

Asset-Backed Tokens: Those tokens that were represented from gold, real estate, and even a piece of art. These tokens give a guarantee that every token will have a real asset backing the digital creation.

There have been privacy tokens for those who do care about anonymity and their privacy, such as Monero and Zcash. The transactions involved are made safe and even private through the advanced techniques of cryptographical techniques.

There are tokens for specific purposes that support the overall growth of blockchain technology.

Tokenization in Blockchain Technology

What makes tokenization a game-changer is exactly that: it's the ability to be able to combine traditional asset ownership with blockchain technology. Tokenization, through smart contracts, automates processes that took several intermediaries. Here's what it means for businesses:

Fractional ownership-that is, investors can have only a small part of valuable assets.

Global transactions become seamless again-no geography, and reduced middlemen are necessary.

All the transactions made on the blockchain are recorded; hence, it easily verifies the history of an asset, thereby building transparency and trust into the system.

Asset Tokenization: Real-World Application

Perhaps one of the most popular uses of tokenization is real estate. You have a high-priced property, but you need the money now. Rather than selling the property outright, you tokenize it. Every token represents a fraction of that property; these tokens can be sold to investors. This, in turn, avails liquidity immediately while preserving overall control.

At Justtry Technologies, we enable businesses like yours to digitize assets and explore the vast possibilities in asset tokenization within blockchain. From real estate to art, the door is now open to new avenues.

Livepeer Token and Blockchain Wallets

The Livepeer token blockchain wallet is a utility token that acts on its functionality: giving the power to users to control and trade their tokens on the decentralized video-streaming application platform. With regards to such utility tokens, flexibility and security characterize it. A blockchain wallet stores and manages those digital assets efficiently.

Conclusion

What we at Justtry Technologies believe is that startups and enterprises should be enabled through innovative technologies, such as tokenization in blockchain. Such technology would possibly change the traditional systems of asset management to make for safer, more transparent, and smoother running ecosystems. Whether it is privacy tokens in blockchain or asset tokenization, this digital change is just getting started.

Want to make a leap into the future? Reach us at Justtry Technologies today!

#asset tokenization in blockchain#livepeer token blockchain wallet#privacy tokens in blockchain#tokenization in blockchain technology#tokenization in blockchain

0 notes

Text

January 25, 2019

News and Links

Layer 1

[eth1] state rent proposal 2

[eth1] selfish mining in Ethereum academic paper. Per Casey Detrio, EIP100 changed the threshold to 27%. But since ETC doesn’t have EIP100, it’s just 5 or 10%.

[eth2] a long AMA from the Eth2 research team

[eth2] yeeth Eth2 client in Swift

[eth2] What’s new in eth2 includes Ben’s take on future of the PoW chain

[eth2] notes from last eth2 implementer call

[eth2] Vitalik’s security design rationale

[eth2] More Vitalik: Eth2 and Casper CBC video talk

[eth2] Collin Myers takes a look at the proposed economics for validators

Layer 2

Raiden on progress towards Ithaca release, which will include pathfinding and fee earning as well as monitoring. More from Loredana on building CryptoBotWars on Raiden

Magmo update: about to release their paper on Nitro, their protocol for a virtual state channel network

The case for Ethereum scaling through layer 2 solutions

Optimistic off-chain data availability from Aragon

Starkware on a layer 2 design fundamental: validity proofs vs fraud proofs. Also: its decentralized exchange using STARKs planned for testnet at end of q1.

Stuff for developers

Solidity v0.5.3

web3j v4.1.1

Web3.js v1.0.0-beta.38

Waffle v2 of its testing suite (uses ethers.js)

Celer Network’s proto3 to solidity library generator for onchain/offchain, cross-language data structures. Celer’s SDK

ERC20 meta transaction wrapper contract

“dumb contracts” that store data in the event logs

ETL pipline on AWS for security token analytics

Interacting with Ethereum using web3.py and Jupyter notebooks

Tutorial on using Embark

Tutorial: using OpenLaw agreements with dapps

OpenBazaar’s escrow framework

Etherisc opensources the code for their Generic Insurance Framework

Austin Griffith’s latest iteration of Burner Wallet sales

Deploying a front end with IPFS and Piñata SDK

Video tutorial of Slither static analyzer

Overview of formal verification projects in Ethereum

zkPoker with SNARks - explore iden3’s circom circuit

Ecosystem

Lots of charts on the bomb historically and present

Gnosis Safe is now available on iOS

A big thing in the community was r/ethtrader’s DONUT tokens. Started by Reddit as “community points” to experiment in ethtrader upvotes, the donuts can be used to buy the banner, vote in polls, and get badges. So a Reddit <> Eth token bridge was created, and DONUT traded on Uniswap. But some people preferred donuts to be used for subreddit governance, so the experiment is currently paused. That’s my take, here’s Will Warren’s take.

Decentralizing project management with the Ethereum Cat Herders

ENS permanent registrar proposals

Client releases

The Mantis client written in Scala now supports ETH and will stop supporting ETC

Enterprise

Hyperledger Fabric founder John Wolpert on why Ethereum is winning in enterprise blockchain

Levi’s jeans, Harvard SHINE and ConsenSys announce a workers well being pilot program at a factory in Mexico

Tokenizing a roomba to charge it

Correctness analysis of Istanbul BFT. Suggests it isn’t and can be improved.

Governance and Standards

Notes from last all core devs call

A postmortem on the Constantinople postponement

SNT community voting dapp v0.1 - quadratic voting system

EIP1712: disallow deployment of unused opcodes

EIP1715: Generalized Version Bits Voting for Consensus Soft and Hard Forks

ERC1723: Cryptography engine standard

ERC1724: confidential token standard

EIP1717: Defuse the bomb and lower mining reward to 1 ether

Application layer

Augur leaderboard. And Crystalball.be stats. Augur v1.10 released

Lots of action in Augur frontends: Veil buys Predictions.global, Guesser to launch Jan 29, and BlitzPredict.

A fiat-backed Korean Won is live on AirSwap

Adventureum - “a text-based, crowd-sourced, decentralised choose-your-own adventure game”

PlasmaBears is live using LoomNetwork

Kyber’s automated price reserve - a simpler though less flexible option for liquidity providers. Also, Kyber’s long-term objectives

Interviews, Podcasts, Videos, Talks

Trail of Bits and ChainSecurity discuss 1283 on Hashing It Out

Videos from Trail of Bits’ Empire Hacking

Scott Lewis and Bryant Eisenbach give the case for Ethereum on a Bitcoin podcast

Philipp Angele talk on Livepeer’s shared economies for video infrastructure

Tarun Chitra on PoS statistical modeling on Zero Knowledge

Gnosis’ Martin Köppelmann on Into the Ether

Martin Köppelmann and Matan Field on Epicenter

Tokens / Business / Regulation

If you don’t have a background in finance, MyCrypto’s learning about supplying and borrowing with Compound will be a good read.

A nice look at the original NFT: CryptoPunk

NFT License 2.0 to define what is permitted with NFT and associated art

IDEO on what NFT collectibles should learn from legacy collectibles.

Matthew Vernon is selling tokens representing 1 hour of design consulting

Caitlin Long tweetstorm about Wyoming’s crypto-friendly legislation

Crypto exchanges don’t need a money transmitter license in Pennsylvania

General

Samsung to have key store in their Galaxy S10. Pictures show Eth confirmed.

Zilliqa to launch its mainnet this week, much like Ethereum launched with Frontier

NEAR’s private testnet launches at event in SF on the 29th

Polkadot upgrades to PoC3 using GRANDPA consensus algo

Looks like Protonmail wants to build on Ethereum

Messari says Ripple drastically overstates their supply to prop up their market cap

Sia’s David Vorick on proof of work attacks

a zero knowledge and SNARKs primer

Infoworld when the Mac launched 35 years ago: do we really need this?

Have a co-branded credit card in the US? Amazon (or whoever) probably gets to see your transaction history, which means they’re probably selling it too.

Dates of Note

Upcoming dates of note (new in bold):

Jan 29-30 - AraCon (Berlin)

Jan 30 - Feb 1 - Stanford Blockchain Conference

Jan 31 - GörliCon (Berlin)

Jan 31 - Maker to remove OasisDEX and Oasis.direct frontends

Feb 2 - Eth2 workshop (Stanford)

Feb 7-8 - Melonport’s M1 conf (Zug)

Feb 7 - 0x and Coinlist virtual hackathon ends

Feb 14 - Eth Magicians (Denver)

Feb 15-17 - ETHDenver hackathon (ETHGlobal)

Feb 27 - Constantinople (block 7280000)

Mar 4 - Ethereum Magicians (Paris)

Mar 5-7 - EthCC (Paris)

Mar 8-10 - ETHParis (ETHGlobal)

Mar 8-10 - EthUToronto

Mar 22 - Zero Knowledge Summit 0x03 (Berlin)

Mar 27 - Infura end of legacy key support

April 8-14 - Edcon hackathon and conference (Sydney)

Apr 19-21 - ETHCapetown (ETHGlobal)

May 10-11 - Ethereal (NYC)

May 17 - Deadline to accept proposals for Instanbul upgrade fork

If you appreciate this newsletter, thank ConsenSys

This newsletter is made possible by ConsenSys.

I own Week In Ethereum. Editorial control has always been 100% me.

If you're unhappy with editorial decisions or anything that I have written in this issue, feel free to tweet at me.

Housekeeping

Archive on the web if you’re linking to it: http://www.weekinethereum.com/post/182313356313/january-25-2019

Cent link for the night view: https://beta.cent.co/+3bv4ka

https link: Substack

Follow me on Twitter, because most of what is linked here gets tweeted first: @evan_van_ness

If you’re wondering “why didn’t my post make it into Week in Ethereum?”

Did you get forwarded this newsletter? Sign up to receive the weekly email

2 notes

·

View notes

Text

IoTex, Loopring, Litecoin And More: These Were The Top-Gaining Cryptos Last Week – Ethereum – United States Dollar ($ETH)

These five coins were the top gainers last week among the top 100 cryptocurrencies.

IoTex (IOTX): The token of a blockchain infrastructure project aimed at the Internet of Things or IoT soared 114.18% last week. IOTX coin hit an all-time high of $0.2611 last week.

Coinbase Global Inc (NASDAQ:COIN) listed a number of trading pairs involving IOTX and US Dollar and Euro this year on its Pro platform. Binance also announced the launch of IOTX perpetual contracts.

On Sunday, the Abra marketplace announced that they were listing IOTX on their platform because they “believe in this technology.”

Blockchain technology is the future, and it won’t be long before it plays a part in your daily life. We listed @iotex_io because we believe in this technology — they’re building a platform that connects real-world data and devices to the blockchain. #IOTX #Internetofthings #IOT pic.twitter.com/1sPqUkbWPD

— Abra (@AbraGlobal) November 14, 2021

So far this year, IOTX has surged 3167.58%, with 90-day gains at 151.59%. During the last 30 days, it has risen 211.25%.

See Also: How To Buy Ethereum (ETH)

Loopring (LRC): The Layer 2 coin, which runs on Ethereum (CRYPTO: ETH), shot up 86.23% last week. LRC hit an all-time high of $3.83 last week.

LRC price got a boost this month after the news of a possible partnership deal on non fungible tokens with GameStop Corporation (NYSE:GME) emerged after a leak in a GitHub repository.

The NFT buzz has been pushing up gas or transaction fees on the Ethereum network, which has also increased the appeal of Layer 2 solutions such as LRC. This fact was illustrated by the project in a recent tweet by the project as well.

the Loop’s got you pic.twitter.com/zFyjSOkGSC

— Loopring (@loopringorg) November 8, 2021

In the last 30 days, LRC has spiked 592%, while in the past 90-day period LRC has gained 759%. The coin’s year-to-date gains stand at 1587%.

See Also: Loopring Continues To Make New All-Time Highs: Here’s What To Watch

Livepeer (LPT): The token of a decentralized live video streaming network has risen 77% in the past week. It touched an all-time high of $100.24 last week.

The Livepeer coin has surged after the project acquired MistServer, a widely used media server created by video developers. The acquisition took place on Oct. 18.

Meanwhile, the project is sponsoring a virtual community hackathon, Web3 Jam, and said $100,000 in prizes are up for grabs.

We’re sponsoring The Web3 Jam!

Don’t miss out on one of the last hackathons of 2021 $100k in prizes are up for grabs!

Organized by @ETHGlobal supported by @protocollabs. Starting Friday.

All skill levels are encouraged to apply >> https://t.co/USQrIdz1z8

— Livepeer (@LivepeerOrg) November 9, 2021

LPT has shot up 4384.60% since the year began with a 233.84% rise seen in the last 90 days and 183.75% in the last 30 days.

WAX (WAXP): The token of a blockchain designed to make e-commerce transactions faster appreciated 64.53% last week.

WAX said in a statement last week that it has become the no. 2 mainnet/layer-1 blockchain in daily and 30-day NFT sales volume ahead of Solana and Flow and only behind Ethereum.

“This leap was driven by a surge in-game activity resulting in a tenfold increase in daily NFT sales volume since the end of September. NFT collections used for games now account for approximately 90% of the top 50 NFT collections on WAX in daily sales volume,” said the project.

On Sunday, the Wax Blockchain said on Twitter that official Hot Wheels, miniature automobile collectibles by Mattel Inc (NASDAQ:MAT), NFTs are coming to Wax beginning Tuesday.

#NFT AIRDROP: Official @Hot_Wheels #NFTs are coming to WAX on Tuesday, Nov 16th!

Here’s your chance to win 1 of 200 free Hot Wheels promo #WAXPacks:

Like & Retweet Follow @Hot_Wheels & @WAX_io Comment your WAX Wallet Address

24 hours only!

— WAX Blockchain (@WAX_io) November 14, 2021

Wax coin has gained 2112.57% in 2021. 30-day gains stood at 198.6% and 90-day rise was at 334.89% at the end of the week.

Litecoin (CRYPTO: LTC): The cryptocurrency that touts fast, secure, and low-cost payments as features shot up 33.99% in the past week.

On Sunday, the project tweeted about “The Litecoin Card,” a fintech platform powered by Unbanked, which can convert LTC at the time of payment. The card, which sports a Visa Inc (NYSE:V) logo, also supports Apple Pay and Google Pay — services provided respectively by Apple Inc (NASDAQ:AAPL) and Alphabet Inc (NASDAQ: GOOGL (NASDAQ: GOOG).

Litecoin is accepted anywhere VISA is.. the #Litecoin Card converts $LTC at the time of purchase. You can also connect the card with the @Litewallet_App #PaywithLitecoin #Hodl #SundayThoughtshttps://t.co/rOzz9zoXRD pic.twitter.com/AR4wXqCPg6

— Litecoin (@litecoin) November 14, 2021

LTC also got a boost last week as AMC Entertainment Holdings Inc (NYSE:AMC) began accepting the coin.

Since the year began, LTC has shot up 118.76%. In the last 90 days, its gains were 51.8% and in 30 days they amounted to 45.93%.

See Also: Litecoin Turns 10: Here’s How Much You Would Have Made If You Stuck With The Coin From The Start

Crypto.com Coin (CRO): The native cryptocurrency of the Crypto.com Chain, which was developed by the Crypto.com company, a fintech concern, shot up 28.27% in the week. CRO touched an all-time high of 0.492 early Monday morning.

Crypto.com became the top app on the Google Play app store in the United States this month. Advertisements featuring Hollywood actor Matt Damon helped propel the app to the top spot.

The advertisement campaign features the proverb “Fortune Favors the Brave.”

Fortune Favours The Brave

A tribute to those who got us this far. And an invitation to those who will take us further.#FFTB pic.twitter.com/BWBneqjGnF

— Crypto.com (@cryptocom) October 28, 2021

The marketing blitz has also extended to billboards, as noted by Crypto.com in a separate tweet.

See us in your city? Snap a pic and share it with #FFTB pic.twitter.com/iPVQTPqedM

— Crypto.com (@cryptocom) November 13, 2021

CRO has gaied 697.33% since the year began. In a 90-day period its gains were 218.11%, while in the last 30 days they were 147.09%.

Read Next: Why Is Saitama Inu Coin Price Crashing Today?

//platform.twitter.com/widgets.js

source https://usapangbitcoin.org/iotex-loopring-litecoin-and-more-these-were-the-top-gaining-cryptos-last-week-ethereum-united-states-dollar-eth/

source https://usapangbitcoin.wordpress.com/2021/11/15/iotex-loopring-litecoin-and-more-these-were-the-top-gaining-cryptos-last-week-ethereum-united-states-dollar-eth/

0 notes

Text

Around the Block #12: NFT mania

Coinbase Around the Block sheds light on key issues in the crypto space. In this edition, Justin Mart and Ryan Yi take a look at the mania around NFTs (non-fungible tokens).

At this point, NFTs have taken over public discourse of crypto in a way reminiscent of ICOs in 2017, including mainstream and pop-culture coverage. Global search interest for NFTs has now surpassed that of Ethereum’s ICO frenzy in 2017.

What is an NFT?

The term “NFT” can be quite generic, so let’s break down some of the confusion. A “fungible” asset is one that is mutually interchangeable. Think dollar bills, where each one is identical and interchangeable with another.

According to Coinbase Learn, “NFTs (or “non-fungible tokens”) are a special kind of crypto asset in which each token is unique. Because every NFT is unique, they can be used to authenticate ownership of digital assets like artworks, recordings, and virtual real estate or pets.” The distinction here is around the asset itself vs the authenticated ownership of the asset. As Nic Carter put it, “the NFT should be understood as the autograph, not the art.”

Take for example digital art. The art itself is a simple jpg or gif file that can be shared anywhere, and is entirely fungible with limited intrinsic value. However, the NFT of that same picture is unique, and serves as the socially-recognized record of ownership over that same picture. It lives on the blockchain as a unique token (dubbed an ERC-721), where anyone can see whose address it belongs to.

Viewed from this light, if you own an NFT, what do you actually own?

It’s not a legal claim on the 0s and 1s that make up the digital art. There are no legal rights involved.

It’s not physical ownership of the picture, NFTs are entirely digital

It is a digital token that lives on a blockchain, which contains metadata that points to the art in question, and is freely transferable

It is a socially-recognized record of ownership. The artist themselves (or whoever minted the NFT) bestows upon the owner special status as the owner of this artwork

That last part is the special sauce. NFTs are a social coordination game, where creators and communities can collectively assign and recognize ownership over digital goods. But it also belies an important point: the value of NFTs are directly tied to the issuer. For example, nobody would care if I minted an NFT of Jack Dorsey’s tweet — I am not Jack Dorsey. But it’s a different story if the NFT came directly from Jack.

In other words, NFTs are a sort of liability of the issuer, it is up to the issuer to honor the importance and provenance of the NFT, and whatever other special properties the NFT may bestow.

NFTs are a social concept of digital ownership. Why should we care? What makes NFTs interesting?

How many times have you bragged about discovering a band before they were cool? What if we could represent this dynamic economically, in a socially-provable way?

This is the magic of NFTs. They make this a possibility by tokenizing fan ownership and community involvement early on. Consider a band. For them, issuing NFTs of their albums and special events can be a way to reward their earliest adopters and biggest fans with special status and a unique connection. The fact that NFTs live on a blockchain also brings a more direct, economic relationship, where the band can provide discounts for concerts to NFT owners, or other special rights.

For creators, NFTs allow them to take control of the economics based on their brand power — they can go direct-to-consumer and smart contracts can guarantee that creators will capture a slice of all future sales.

In the end, owning an NFT plants a flag on your fandom, for all to see and recognize and for others to tap into. Additionally, NFTs enable novel new composable interactions — for example, the owners of a LeBron James Top Shot might also get reduced prices or exclusive access to other NBA merchandise, as they’ve proven to be high-value customers and deeply loyal fans. “Buying an NFT is angel investing into culture.”

What is the NFT lifecycle?

Source: this can be any unique asset that exists. However, to drive value the source itself should come from the asset issuer (ie Jack’s tweet from Jack).

Primary Issuance: these are platforms that “tokenize” the source into an NFT. Platforms can be closed (“invite-only”) or open (anybody can mint an asset).

Secondary Exchange: these are platforms that facilitate the buy/sell of NFTs. Oftentimes, secondary exchanges have their own native primary issuance funnels.

The future of NFTs

Today, most cryptocurrency products live only in a digital format. But NFTs may begin to mark a transition where we may eventually be able to map real-world assets onto a blockchain in meaningful ways, perhaps including some sort of legal framework that secures actual ownership. In this future, imagine if a sports franchise like the LA Lakers tokenized their season tickets as NFTs? They could live in their fan’s wallets, secondary market price discovery could happen with P2P price discovery, and they would be immortalized as NFTs that live in this expansive, composable, digital metaverse.

News roundup

Retail

BTC breaks $60K all-time high

Etoro to go public via SPAC at $10B

FTX wins naming rights to the NBA Miami Heat stadium

Paypal acquires Curv

Beeple sells $69M NFT via Christie’s

Institutional

Blockchain.com raises $300M

NYDIG raises $200M led by Morgan Stanley

Fireblocks raises $133M led by Coatue (incl. BNY Mellon)

Taxbit raises $100M led by Tiger Global

Lukka raises $53M

FalconX raises $50M led by Tiger Global

Visa allows settlement of USDC on its network

Avanti raises $37M

Grayscale rolls out new trusts

GBTC Trust falls discount to NAV

Ecosystem

Uniswap v3 launches

Dapper Labs (Flow) raises $305M

Starkware raises $75M

Opensea raises $23M

Circle rolls out payments solution for NFT marketplaces

Compound Grants program launches

Livepeer launches Filecoin co-mining pilot

Staked launches ETH 2.0 trust

The opinions expressed on this website are those of the authors who may be associated persons of Coinbase, Inc., or its affiliates (“Coinbase”) and who do not represent the views, opinions and positions of Coinbase. Information is provided for general educational purposes only and is not intended to constitute investment or other advice on financial products. Coinbase makes no representations as to the accuracy, completeness, timeliness, suitability, or validity of any information on this website and will not be liable for any errors, omissions, or delays in this information or any losses, injuries, or damages arising from its display or use. Unless otherwise noted, all images provided herein are the property of Coinbase.

This website contains links to third-party websites or other content for information purposes only (“Third-Party Sites”). The Third-Party Sites are not under the control of Coinbase, and Coinbase is not responsible for the content of any Third-Party Site, including without limitation any link contained in a Third-Party Site, or any changes or updates to a Third-Party Site. Coinbase is not responsible for webcasting or any other form of transmission received from any Third-Party Site. Coinbase is providing these links to you only as a convenience, and the inclusion of any link does not imply endorsement, approval or recommendation by Coinbase of the site or any association with its operators.

Around the Block #12: NFT mania was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

from Money 101 https://blog.coinbase.com/around-the-block-12-nft-mania-cba576f93bf0?source=rss----c114225aeaf7---4 via http://www.rssmix.com/

0 notes

Text

Annotated edition, Week in Ethereum News, March 21, 2020 issue

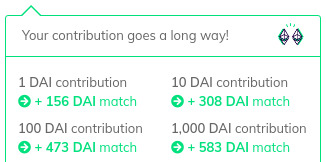

Shill alert: Gitcoin’s 250k in matching grants is live. My grant is here. If you give because you particularly want the annotated edition to continue, could you add .11 to whatever you give? eg, 1.11 DAI or .11 ETH or .01011 ETH. The previous round went great but tracking what people like is hard.

The $250k includes $100k for tech, 50k for media, and 100k for public health, mostly related to covid. I’m curious as to how this goes - I find it very hard to evaluate the public health proposals, whereas Eth proposals are easy for me to evaluate. I mostly know the people, I know the ideas, etc. None of that is true for the public health category. There’s an opportunity for someone knowledgeable to (anonmously?) evaluate all the applicants and shape what gets funded.

Eth1

Latest core devs call. Tim Beiko’s notes.

Discussions (non-exhaustive list) about EIP inclusions in next hard fork: eip2537 (BLS12-381 curve precompile) final, so we can have eth2 light clients on eth1. eip2456 timestamp for scheduling instead of block number, eip2542 vs ungas, eip2046 reducing gas cost for static calls, and eip1962 generalized precompile

Geth v1.9.12 – eth_call no longer defaults to first account

Merry Go Round – an idea for syncing state, a la Bittorrent

Lots of talk in the core devs call about all the different EIPs being evaluated for the next fork.

In some ways this week is a synopsis of what’s happening at the protocol layer: people are working on the things for the next fork and arguing over what should go in, as well as what is ready to go in. The Geth team are chugging along keeping the majority of the network humming, and there is research and ideas being passed around about how to get the current Ethereum mainnet to be stateless.

Vitalik’s long-term roadmap below also does a good job of explaining the main things being worked on in eth1. I wasn’t exactly sure where to put it, probably incorrectly chose to put it in eth2 since so many things are long-term.

One interesting thing to note is that this is Vitalik’s “personal” vision. Of course most of it is not controversial, but he just did this by himself. Does it mean that it is Ethereum’s roadmap? No. It means that Vitalik came up with it at some point and decided to publish it - it does not necessarily reflect what everyone thinks. He didn’t build consensus, he just published what he was seeing on the day he wrote it down.

I noticed plenty of misinformation about Vitalik’s roadmap, as if none of this will happen for a decade. Quite the opposite is true: the top 2/3 of the page is being worked on right now. The Beacon Chain of eth2 is still set to launch in the next few months.

The bottom third of the graphic is much more speculative. Polynomial commitments instead of state roots? That just got published last week, that’s likely years away. When CBC Casper? I’m not sure but it’s not soon and the transition is far from clear - to me, anyway. Perhaps Vlad would give you a different answer.

Eth2

Danny Ryan’s Eth2 update

Latest what’s new in Eth2

Prysmatic client update – stable testnet for a month (but to be rebooted to current spec), surround vote slashing

Tutorial to run your own Lighthouse testnet

Vitalik’s personal long-term ETH roadmap, beyond eth2

Mikhail Kalinin’s writeup of his eth1<>eth2 bridge idea

Sensor fusion for BFT clock sync. Alex Vlasov’s research on hardening timestamps

State transition in Eth2 explainer from Nethermind’s Sly Gryphon

How Eth2 improves on Eth1’s weaknesses from Prysmatic’s Ivan Martinez

Gitcoin playlist of short eth2 explainer videos

I know probably no one else sees the order of things when I try to order things properly. So here’s who it went: Danny’s update was high-level. Ben’s was a bit more in the weeds. Even further into the weeds is client update and “run your own testnet node.” Then we got into Vitalik’s roadmap, which bridged the current eth2 with the future work. So then we got writeups of research like eth1/eth2 merge, hardening timestaps, before getting into a few explainers that were a bit more for broader audience.

The ordering flowed perfectly in my mind, but probably only in mine!

Layer2

Why iden3 is using zk-rollup for universal identities

Having been using Loopring’s exchange running on zk-rollup, gotta say: it’s a great experience. It’s like using a centralized exchange, only it’s a dex.

Stuff for developers

Solidity v0.5.17 (last?) release of 0.5.x (since 0.6 is out) disallowing overriding of private functions

TenderlyPro released – simulate txs, advanced analytics, debugging

Debugging transactions with Buidler and Truffle

Subspace v2, much easier to track events in React.

A demo on observing Defi with Subspace

svm: Solidity version manager

Choose how many IPFS replications you want pinned in each region with Pinata

Austin Griffith video on gas limits and gas prices

Intro to Eth for Python devs using web3py

Compare Eth API performance with the Versus tool

Tutorial on Ethereum RPCs, methods and calls in Infura

Mahesh Murthy updated his famous “Full Stack Hello World Voting Ethereum Dapp Tutorial” to use current libraries

Guide to building a margin trading platform on 0x

A quick start guide for devs to borrowing assets from Compound

Solidity went back to the v0.5 series to fix a bug that not everyone agrees is a bug!

Meanwhile, lots of interesting tools and tutorials this week, I suppose they all speak for themselves. I thought it was neat that Infura released a tool to let you compare API performance. Nice little bit of subtle bragging.

Ecosystem

A taxonomy of the advantages/disadvantages of different types of Eth wallets

How do we better onboard newcomers to Ethereum?

Custom text records on ENS

Onboarding newcomers is something I’ve been thinking about lately, and was tangential to my EthCC talk, which that post references. Community has decentralized, which is good, but also poses some challenges. A good portion of people who think of themselves as “Eth community” get their news from publications which are outright clickbait or have historically not done a very good job at ascertaining facts. Still churning over this one, should probably turn some of my talk into a series of blog posts myself.

Someone at EthCC told me that they summarized my talk as “Make r/ethereum great again,” which is fair. Yet while I continue to put a decent amount of time into r/ethereum, it’s not crystal clear whether we should try to revive it to be the main community discussion point. For one thing, the existing rule is that it’s English-only, which feels unfair, but perhaps necessary for moderation purposes. Can Reddit be the main ecosystem gathering point? Do we need new tools? Should they be web3-friendly sites, or should we keep Reddit as something that new people can find?

Enterprise

Baseline Protocol is now open source, a common system of record between enterprises

“blockchain will do, for networks of companies and business ecosystems, what ERP did for the single enterprise” – Paul Brody, Cornell Blockchain interview

Resolving key considerations for blockchain connectivity with PegaSys Orchestrate

Hyperledger Besu v1.4.1

First public meeting of EEA’s mainnet working group scheduled for April 3

EY and Brody have made a big bet on mainnet, and it appears to be paying off. In his interview, he framed the competition as between public mainnet and private chains, as EY is far ahead in expertise of using mainnet.

It was also super interesting to get some of the backstory that led to the IBM/Samsung washing machine in 2014.

Governance, DAOs, and standards

Technical overview of Vocdoni’s anonymous voting system

The two token structure of SingularDTV’s SnglsDAO

Application layer

USDC added as collateral for Maker to help restore DAI to 1:1 parity with USDC and more Dai liquidity in liquidation auctions and MKR auctions. In Maker parlance, liquidation auctions are flips, and MKR auctions to cover system deficit are flops

flops.live to track the MKR auctions

Backstop syndicate is live. Pool your DAI to buy MKR at a favorable price, if an auction should drop that low

NexusMutual declined claims from Maker liquidated auctions since smart contract cover doesn’t include the risk that only one bot bids on the auction

DeFiSaver and liquidated auctions, the oracle delay was a problem but did 12500 ETH worth of Aave flash loan volume over 4000 transactions

Also check out Covalent if you need advanced notification as a user

Balancer’s 80/20 liquidity pools

Making requests on ErasureBay

OpenLaw: smart clauses for digital legal agreements

Depending on how you count, DeFi was 5 or 7 out of 9 bullet points. That’s my running tracker that I like to occasionally check on.

Backstop was a very cool community effort. Love to see that people get together to make sure the system functions - and they were also incentivized to do so.

Tokens/Business/Regulation

Microsponsors: mint and auction your time as NFTs on a 0x market

Making sense of synthetic assets on Ethereum

Ryan Sean Adams on Covid-19 and crypto

Capital markets meltdown signals the birth of DeFi

Jonathan Joseph’s piece on how Black Thursday is the beginning of the DeFi area would have made the #Mostclicked if I’d tweeted it out just a bit later.

General

AZTEC’s Plookup tables for faster SNARK verification of digital signatures

Using machine learning classifiers and SNARKs to detect improper video transcoding in Livepeer

Benchmarking performance of Rescue and Poseidon hash functions vs MiMC

ICL paper says bZx flash loan attackers left money on the table

NYT’s Nathaniel Popper reports on how the lead dev of Venezuela’s Petro scam got screwed

The NYT on how the Venezuelan kleptocrats screwed the dev is the epitome of something-we-all-saw-coming, which you already knew if you’ve read the newsletter for a long time. I got criticism from a bunch of different corners (”oh that’s because you’re an American,” “you can’t say that, people will think it represents us,” etc) for calling the Petro a scam when it was announced, and I ignored it. I don’t know why you got into this space, but I didn’t get into it to help kleptocrat leftist authoritarians.

Meanwhile, lots of cool stuff in SNARKs, including in Livepeer about how they might be able to detect improper transcoding.

Finally, Cristian Espinoza translated last week’s annotated edition into Spanish, which to my knowledge is the first time that the annotated edition has been translated. Very cool, and support his Gitcoin grant for more translations!

I’ll add the #mostclicked here. Amusingly I had some maxis spreading more lies about me this week because my tweets auto-delete. So here’s a screenshot since that’s more durable than linking to a tweet

0 notes

Photo

New Post has been published here https://is.gd/H5PAxd

Crypto Dividends: Staking Coins for Gains Potentially a Good Strategy in a Bear Market but Is Not Without Risk

This post was originally published here

Volatility coupled with one of the longest bear markets ever experienced by the cryptocurrency industry have compelled many investors to consider staking as a method of “playing it safe,” according to a Bloomberg article.

Staking, which is similar to earning dividends or interest on your investment, is not a new concept. However, in a long bear market, it does become more prevalent among cryptocurrency investors, as possible gains from regular trading are not as fruitful. As Kyle Samani, managing partner at Multicoin Capital Management, stated to Bloomberg:

“Regardless of market conditions, staking provides returns denominated in the asset being staked. If you’re going to be long, you might as well stake.”

Staking rewards are a byproduct of the proof-of-stake (PoS) consensus algorithm, first introduced by Sunny King and Scott Nadal in a white paper in 2012 for peer-to-peer cryptocurrency Peercoin (PPC).

Since then, hundreds of cryptocurrencies have adopted a PoS consensus algorithm as a method to verify transactions.

Proof-of-stake, explained

The majority of cryptocurrencies use either proof-of-work (PoW) or PoS — or some iteration of it.

PoW relies on the proof that a certain amount of work has been done to verify transactions. Both Bitcoin and Ethereum use PoW to validate transactions, although Ethereum has been making it clear that they will be moving to a PoS system, called Casper, as part of the Serenity network update expected for later in 2019.

At an August 2018 Blockchain at Berkeley event, hosted by the student-run organization Origin, Vitalik Buterin, co-founder of Ethereum, stated he can’t wait for all crypto networks to move away from PoW:

“I am seriously looking forward to when the cryptocurrency community basically passes away with proof-of-work.”

With PoW, nodes (or miners) compete to verify blocks of transactions by running highly specialized and expensive processing equipment (such as Application Specific Integrated Circuits, or ASICs) to solve complex mathematical equations. The first node to solve the equation can add the next block of transactions and collect the reward, which could either be a set amount or percentage of the transaction fee. The process, also called mining, has a number of drawbacks:

It is highly energy intensive (the Bitcoin network consumes almost the same amount of energy as the entire country of Singapore).

The high energy dependence is not only expensive but also bad for the environment in countries where nonrenewable fossil fuels (such as coal) is burned to generate electricity.

Specialized mining equipment requires a significant upfront investment, which can be risky, considering that rewards are not guaranteed.

With the advent of large centralized mining pools, the risk of a 51 percent attack on PoW networks is a very real threat.

PoS, on the other hand, only requires network participants to hold a certain amount of the native cryptocurrency in a specific wallet for a certain period of time. This is called staking and doesn’t call for any expensive computer equipment or massive amounts of processing power to solve complex mathematical equations.

Key differences from POW are:

Nodes are often called “validators” rather than “miners.”

There’s no specialized computer hardware requirement to become a node, which means the burden on power resources is drastically reduced. This is not only cheaper but also more eco-friendly.

With PoS, there’s no threat of centralized mining pools.

A 51 percent attack would be much more expensive to carry out. In order to take control of a PoS network, an individual or entity would have to purchase 51 percent of the available tokens. Not only that but, if you owned 51 percent of the tokens, you would want to do everything in your power to see the network succeed and continue to turn a profit. That means you are less likely to do anything to defraud the blockchain.

Different levels of PoS staking for different levels of rewards

It is common in PoS cryptocurrencies to award those with a bigger vested interest in the network with bigger benefits. This is both in network authority (such as voting weight) and rewards.

As such, cryptocurrency networks will often offer different levels of staking — i.e., the more coins you lock away for staking, the bigger the network will reward you.

This gives rise to two distinguishable types of staking: masternode staking and non-node staking.

Masternode staking to validate transactions

Masternodes are network participants that are tasked with validating and authenticating transactions on a PoS blockchain.

To apply for a masternode, participants will generally have to comply with some minimum requirements. This will be different from network to network but may include locking away a set number of tokens (typically a large minimum), being a network participant and holding tokens for a certain period of time, and being an active community member with a good reputation. The number of masternode positions will generally also be limited.

Rewards are distributed as part of the network fees (transaction fees) and tend to be big, as the vested interest in the network needs to be big. But the barrier to entry is also quite high — i.e., you would need a large initial investment to become a masternode.

For example, to become a Neo masternode (also called bookkeepers or consensus nodes), a participant will need to stake 1,000 GAS ($2,150) — the fuel token on the Neo network that represents the right to use the Neo blockchain and is used to pay the network fees for issuing new assets, running smart contracts and storage — to nominate themselves as a bookkeeper and also obtain a consensus authority certificate before Neo community members can vote for them. The Neo mainnet is limited to seven consensus nodes

According to Neo’s economic model, the maintainer of a Neo consensus node will be rewarded with network fees.

Similarly, to apply for masternode status (also called Authority Masternode) on VeChain (VET), a participant will have to stake 25 million VET ($97,500) to be considered and will have to complete Know Your Customer (KYC) verification in the VeChain portal. Its masternode positions are limited to 101 members.

VeChain masternodes are compensated in part by transaction fees and part from a predetermined foundation reward pool.

Non-node staking to earn interest or dividends

Non-node staking is less complicated, and users are not involved in validating transactions. There is no minimum staking amount and often no minimum holding period, meaning the barrier of entry is much lower.

All a network participant has to do is hold the specific cryptocurrency in the network’s dedicated wallet to start earning interest or dividend payouts.

Both the Neo and VeChain examples above have calculators to show you how much you can earn per amount of tokens staked.

Other popular PoS cryptocurrencies for staking include Ontology (ONT), Tezos (XTZ), Waves (WAVES), EOS (EOS), Cardano (ADA), Pivx (PIVX), Dash (DASH), Decred (DCR), Livepeer (LPT) and Factom (FCT).

Potential gains and risks of PoS staking

According to POS List and masternodes.online, rewards and earnings for both masternode staking and non-node staking vary significantly between cryptocurrencies, anything from 0.7 percent to well over 1,000 percent.

The possibility of long-term gains has also given birth to a number of startups that focus specifically on providing staking services to investors, including Anchorage, Eon Staking Inc., Figment and Staked.

Perhaps as an indication of the strong market interest in the possibilities of cryptocurrency staking, on Jan. 31, 2019, Staked announced that they raised $4.5 million in seed investment from a number of institutional investors that included Pantera Capital, Coinbase Ventures and Winklevoss Capital, while Anchorage launched on Jan. 23, 2019 after a $17 million funding round led by venture fund Andreessen Horowitz.

PoS staking is not without risk, though. It’s not just a bear market game, it’s a long game. So, a significant level of trust has to be put in the cryptocurrency network — trust that they will make it through the bear market and still be operational on the other side, and trust that they will consistently payout earnings and rewards in the long run.

Another risk is monopolization of a network, where a few large token holders end up getting the lion’s share of the rewards. Linked to the risk of monopolization is the possibility of a 51 percent attack. Although it would be much more expensive and counterintuitive, it is still possible for such an attack to be orchestrated and to devalue the network.

#crypto #cryptocurrency #btc #xrp #litecoin #altcoin #money #currency #finance #news #alts #hodl #coindesk #cointelegraph #dollar #bitcoin View the website

New Post has been published here https://is.gd/H5PAxd

0 notes

Text

Staking Coins for Gains Potentially a Good Strategy in a Bear Market but Is Not Without Risk

Volatility coupled with one of the longest bear markets ever experienced by the cryptocurrency industry have compelled many investors to consider staking as a method of “playing it safe,” according to a Bloomberg article.

Staking, which is similar to earning dividends or interest on your investment, is not a new concept. However, in a long bear market, it does become more prevalent among cryptocurrency investors, as possible gains from regular trading are not as fruitful. As Kyle Samani, managing partner at Multicoin Capital Management, stated to Bloomberg:

“Regardless of market conditions, staking provides returns denominated in the asset being staked. If you’re going to be long, you might as well stake.”

Staking rewards are a byproduct of the proof-of-stake (PoS) consensus algorithm, first introduced by Sunny King and Scott Nadal in a white paper in 2012 for peer-to-peer cryptocurrency Peercoin (PPC).

Since then, hundreds of cryptocurrencies have adopted a PoS consensus algorithm as a method to verify transactions.

Proof-of-stake, explained

The majority of cryptocurrencies use either proof-of-work (PoW) or PoS — or some iteration of it.

PoW relies on the proof that a certain amount of work has been done to verify transactions. Both Bitcoin and Ethereum use PoW to validate transactions, although Ethereum has been making it clear that they will be moving to a PoS system, called Casper, as part of the Serenity network update expected for later in 2019.

At an August 2018 Blockchain at Berkeley event, hosted by the student-run organization Origin, Vitalik Buterin, co-founder of Ethereum, stated he can’t wait for all crypto networks to move away from PoW:

“I am seriously looking forward to when the cryptocurrency community basically passes away with proof-of-work.”

With PoW, nodes (or miners) compete to verify blocks of transactions by running highly specialized and expensive processing equipment (such as Application Specific Integrated Circuits, or ASICs) to solve complex mathematical equations. The first node to solve the equation can add the next block of transactions and collect the reward, which could either be a set amount or percentage of the transaction fee. The process, also called mining, has a number of drawbacks:

It is highly energy intensive (the Bitcoin network consumes almost the same amount of energy as the entire country of Singapore).

The high energy dependence is not only expensive but also bad for the environment in countries where nonrenewable fossil fuels (such as coal) is burned to generate electricity.

Specialized mining equipment requires a significant upfront investment, which can be risky, considering that rewards are not guaranteed.

With the advent of large centralized mining pools, the risk of a 51 percent attack on PoW networks is a very real threat.

PoS, on the other hand, only requires network participants to hold a certain amount of the native cryptocurrency in a specific wallet for a certain period of time. This is called staking and doesn’t call for any expensive computer equipment or massive amounts of processing power to solve complex mathematical equations.

Key differences from POW are:

Nodes are often called “validators” rather than “miners.”

There’s no specialized computer hardware requirement to become a node, which means the burden on power resources is drastically reduced. This is not only cheaper but also more eco-friendly.

With PoS, there’s no threat of centralized mining pools.

A 51 percent attack would be much more expensive to carry out. In order to take control of a PoS network, an individual or entity would have to purchase 51 percent of the available tokens. Not only that but, if you owned 51 percent of the tokens, you would want to do everything in your power to see the network succeed and continue to turn a profit. That means you are less likely to do anything to defraud the blockchain.

Different levels of PoS staking for different levels of rewards

It is common in PoS cryptocurrencies to award those with a bigger vested interest in the network with bigger benefits. This is both in network authority (such as voting weight) and rewards.

As such, cryptocurrency networks will often offer different levels of staking — i.e., the more coins you lock away for staking, the bigger the network will reward you.

This gives rise to two distinguishable types of staking: masternode staking and non-node staking.

Masternode staking to validate transactions

Masternodes are network participants that are tasked with validating and authenticating transactions on a PoS blockchain.

To apply for a masternode, participants will generally have to comply with some minimum requirements. This will be different from network to network but may include locking away a set number of tokens (typically a large minimum), being a network participant and holding tokens for a certain period of time, and being an active community member with a good reputation. The number of masternode positions will generally also be limited.

Rewards are distributed as part of the network fees (transaction fees) and tend to be big, as the vested interest in the network needs to be big. But the barrier to entry is also quite high — i.e., you would need a large initial investment to become a masternode.

For example, to become a Neo masternode (also called bookkeepers or consensus nodes), a participant will need to stake 1,000 GAS ($2,150) — the fuel token on the Neo network that represents the right to use the Neo blockchain and is used to pay the network fees for issuing new assets, running smart contracts and storage — to nominate themselves as a bookkeeper and also obtain a consensus authority certificate before Neo community members can vote for them. The Neo mainnet is limited to seven consensus nodes

According to Neo’s economic model, the maintainer of a Neo consensus node will be rewarded with network fees.

Similarly, to apply for masternode status (also called Authority Masternode) on VeChain (VET), a participant will have to stake 25 million VET ($97,500) to be considered and will have to complete Know Your Customer (KYC) verification in the VeChain portal. Its masternode positions are limited to 101 members.

VeChain masternodes are compensated in part by transaction fees and part from a predetermined foundation reward pool.

Non-node staking to earn interest or dividends

Non-node staking is less complicated, and users are not involved in validating transactions. There is no minimum staking amount and often no minimum holding period, meaning the barrier of entry is much lower.

All a network participant has to do is hold the specific cryptocurrency in the network’s dedicated wallet to start earning interest or dividend payouts.

Both the Neo and VeChain examples above have calculators to show you how much you can earn per amount of tokens staked.

Other popular PoS cryptocurrencies for staking include Ontology (ONT), Tezos (XTZ), Waves (WAVES), EOS (EOS), Cardano (ADA), Pivx (PIVX), Dash (DASH), Decred (DCR), Livepeer (LPT) and Factom (FCT).

Potential gains and risks of PoS staking

According to POS List and masternodes.online, rewards and earnings for both masternode staking and non-node staking vary significantly between cryptocurrencies, anything from 0.7 percent to well over 1,000 percent.

The possibility of long-term gains has also given birth to a number of startups that focus specifically on providing staking services to investors, including Anchorage, Eon Staking Inc., Figment and Staked.

Perhaps as an indication of the strong market interest in the possibilities of cryptocurrency staking, on Jan. 31, 2019, Staked announced that they raised $4.5 million in seed investment from a number of institutional investors that included Pantera Capital, Coinbase Ventures and Winklevoss Capital, while Anchorage launched on Jan. 23, 2019 after a $17 million funding round led by venture fund Andreessen Horowitz.

PoS staking is not without risk, though. It’s not just a bear market game, it’s a long game. So, a significant level of trust has to be put in the cryptocurrency network — trust that they will make it through the bear market and still be operational on the other side, and trust that they will consistently payout earnings and rewards in the long run.

Another risk is monopolization of a network, where a few large token holders end up getting the lion’s share of the rewards. Linked to the risk of monopolization is the possibility of a 51 percent attack. Although it would be much more expensive and counterintuitive, it is still possible for such an attack to be orchestrated and to devalue the network.

window.fbAsyncInit = function() { FB.init({ appId : '1922752334671725', xfbml : true, version : 'v2.9' }); FB.AppEvents.logPageView(); }; (function(d, s, id){ var js, fjs = d.getElementsByTagName(s)[0]; if (d.getElementById(id)) {return;} js = d.createElement(s); js.id = id; js.src = "http://connect.facebook.net/en_US/sdk.js"; js.async = true; fjs.parentNode.insertBefore(js, fjs); }(document, 'script', 'facebook-jssdk')); !function(f,b,e,v,n,t,s) {if(f.fbq)return;n=f.fbq=function(){n.callMethod? n.callMethod.apply(n,arguments):n.queue.push(arguments)}; if(!f._fbq)f._fbq=n;n.push=n;n.loaded=!0;n.version='2.0'; n.queue=[];t=b.createElement(e);t.async=!0; t.src=v;s=b.getElementsByTagName(e)[0]; s.parentNode.insertBefore(t,s)}(window,document,'script', 'https://connect.facebook.net/en_US/fbevents.js'); fbq('init', '1922752334671725'); fbq('track', 'PageView'); This news post is collected from Cointelegraph

Recommended Read

New & Hot

The Calloway Software – Secret Weapon To Make Money From Crypto Trading (Proofs Inside)

The modern world is inextricably linked to the internet. We spend a lot of time in virtual reality, and we're no longer ...

User rating:

9.6

Free Spots are Limited Get It Now Hurry!

Read full review

Editors' Picks 2

BinBot Pro – Its Like Printing Money On Autopilot (Proofs Inside)

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

User rating:

9.5

Demo & Pro Version Get It Now Hurry!

Read full review

The post Staking Coins for Gains Potentially a Good Strategy in a Bear Market but Is Not Without Risk appeared first on Review: Legit or Scam?.

Read more from → https://legit-scam.review/staking-coins-for-gains-potentially-a-good-strategy-in-a-bear-market-but-is-not-without-risk

0 notes

Text

Pantera, Coinbase Join $4.5 Million Round for Staking-as-a-Service Startup

Blockchain investment firm Pantera Capital is leading a $4.5 million seed round in Staked, a startup that provides institutional investors with the technical infrastructure for non-custodial staking services.

Other participants in the round include Coinbase Ventures, Global Brain, Digital Currency Group, Winklevoss Capital, Fabric Ventures and Blocktree Capital.

“You’ve got $25 billion of stake-able crypto that’s coming online in the next 15 months,” Staked CEO and co-founder Tim Ogilvie told CoinDesk, describing what he sees as a large opportunity. The idea behind Staked is that investors can compound their crypto by participating in the validation process of proof-of-stake blockchains.

“Pantera invests in many leading proof-of-stake projects, so we knew we needed a staking solution,” Pantera partner Paul Veradittakit said in a press release. Pantera first approached Staked as a customer before deciding to invest. (Last November, Veradittakit spoke about opportunities for earning through staking from the main stage of CoinDesk’s Consensus: Invest.)

“Our cap table is all people who have stake or can influence stake,” Ogilvie said of his investors. “Everybody is basically a customer or potential partner.”

Ogilvie started Staked last March alongside Seth Riney and Jonathan Marcus, working with Multicoin Capital as an early client. Ogilvie said he started talking to customers more broadly in May and started to see traction in the fall.

Staked lets its customers determine the protocols it builds infrastructure for. Ogilvie explained that if Staked provides services for a given token, that’s because someone with significant holdings came to them looking for a solution.

Right now, the startup supports Tezos, Dash, Decred, Livepeer, Factom and EOS. The latter two, it should be noted, don’t provide a return for staking (EOS potentially can, but the technical hurdle is considerable); nevertheless, investors want to be able to participate in these networks fully.

More cryptocurrencies will be added, Ogilvie said, projecting that 20 coins will come online in 2019.

Handling the details

Anyone who digs into staking knows that there’s a lot of variation between protocols. Staking on Tezos, for example, is fixed. A user stakes and they are likely to earn money proportionally at a steady rate.

On the other hand, Decred uses a more intermittent staking approach where users buy tickets on an open market that pay out less predictably.

Staked allows holders to turn these complexities over to a team that will sort out optimizing them and handle a lot of the ongoing issues like updates and upgrades.

Staked’s basic business model gives it a maximum of 10 percent of the earnings of its customers’ staked tokens. There is a caveat, though: Staked only gets the full 10 percent if it hits 100 percent uptime. Its earnings shrink proportionally with the amount of time it goes offline.

Beyond institutional investors, Staked also provides a white label version that can be used by consumer-facing companies, such as exchanges and wallets. So an exchange could use Staked to set up a way for its customers to delegate their XTZ to a baker without taking them off the exchange.

Up next: lending

“Passive yield is a big opportunity,” Ogilvie said.

To expand customer options, Staked will also build ways for token holders to put their assets into platforms that allow them to lend their holdings out, such as dy/dx, Dharma and Compound.

“We’re going to build a smart contract that allows you to get the best rate from all the best options that exist out there,” Ogilvie said.

For his part, this is going precisely to Compund founder Robert Leshner’s plan: “Compound was designed for other applications and businesses to be built on top of the protocol,” he told CoinDesk. “Long-term, we hope they take over the user experience, and we can retire our web interface completely.”

Staked is open now to anyone for any of its supported protocols.

“We’re one size fits all. You can delegate to us,” Ogilvie said. “If you were to go to the yield page on our site, and click on Livepeer or Tezos, we’ll give you the details on how to delegate to us.”

That said, Staked is really designed with the large-scale user in mind – funds, wallets, exchanges and the like.

Those large holders are looking now for any way to take some of the sting out of a bear market, Ogilvie said:

“If your coins are going up 100x in a few months you probably don’t care as much about a 10 to 15 percent yield. Nowadays, people are probably looking for an edge wherever they can get it.”

Paul Veradittakit image via CoinDesk archives

This news post is collected from CoinDesk

Recommended Read

Editor choice

BinBot Pro – Safest & Highly Recommended Binary Options Auto Trading Robot

Do you live in a country like USA or Canada where using automated trading systems is a problem? If you do then now we ...

9.5

Demo & Pro Version Try It Now

Read full review

The post Pantera, Coinbase Join $4.5 Million Round for Staking-as-a-Service Startup appeared first on Click 2 Watch.

More Details Here → https://click2.watch/pantera-coinbase-join-4-5-million-round-for-staking-as-a-service-startup

0 notes

Text

Mapping out Digital Currency Group’s Portfolio

Mapping out Digital Currency Group’s Portfolio

Quick Take

Digital Currency Group is an investment firm focused on the crypto and blockchain industry

Barry Silbert, told Reuters, that he plans to build Digital Currency Group into “a publicly traded conglomerate like Berkshire Hathaway”

Digital Currency Group has a portfolio of 100+ companies

by Steven Zheng

3 hrs ago · 6 min read

Take a look at the investor roster of major companies in the crypto space and you’ll notice a certain firm that frequently appears: Digital Currency Group (DCG). Founded by Barry Silbert in 2015, DCG was originally made up of two bitcoin businesses, Genesis Global Trading, a cryptocurrency OTC trading firm, and Grayscale Investments, a cryptocurrency asset management firm combined with a few of Silbert’s personal seed investments.

Since then, the DCG has made investments in multiple verticals in the crypto space. From exchanges to blockchain protocols to media companies, DCG has spread its influence into every crevice of the market. The end goal? As Silbert tells Reuters, in a 2017 profile, he “aspires to build DCG into a publicly traded conglomerate like Berkshire Hathaway Inc, run by legendary investor Warren Buffett.” The goal looks increasingly likely with each passing day as the firm continues to make investments in blockchain and crypto companies, some of which are deeply influential in shaping the crypto landscape.

The Block has mapped out Digital Currency Group’s portfolio of 100+ companies.

CoinDesk (DCG subsidiary) is a news site cover crypto assets and blockchain technology

Digital Assets Data developers enterprise-grade software and data feeds for crypto hedge funds and other market participants.

EtherScan is an Ethereum blockchain explorer and data provider

Flipside Crypto providers data for measuring cryptocurrency project health

Joystream is a digital content platform

Livepeer is a peer-to-peer platform for live video broadcasting and streaming

NICKL is a digital content subscription platform

Nomics is a crypto asset data company providing market data APIs

TradeBlock develops enterprise tools for blockchain assets

Tradewave ceased operations in March 2017

Yours is a crypto-backed social network

Abra operates an app for buying and selling cryptocurrencies

bitFlyer is a Japanese bitcoin exchange

BitOasis is a bitcoin exchanging serving the Middle East and North Africa

Bitso is a Mexican bitocin exchange and Ripple gateway

Bitwala is a platform for buying and selling bitcoin

BTCC was acquired in January 2018

Buda is a South American cryptocurrency exchange

Circle develops products for exchanging, storing, sending, and receiving cryptocurrencies

Coinbase is a cryptocurrency wallet and exchange platform

Coinhouse is a cryptocurrency excahnge

Coins is a Southeast Asian platform for buying, selling, sending, and spending cryptocurrencies

Coinsetter was acquired in January 2016

Crypto Facilities provides regulated cryptocurrency derivatives

ErisX is a crypto asset trading platform

Genesis Global Trading (DCG subsidiary) is a cryptocurrency OTC trading firm

Grayscale (DCG subsidiary) is a cryptocurrency asset management firm

itBit is a cryptocurrency exchange

Korbit was acquired in September 2017

Kraken is a cryptocurrency exchange and OTC trading platform

Luno is a cryptocurrency wallet provider and exchange

Melotic is developing cryptocurrency exchange

Omniex is a cryptocurrency investment and trading platform for institutions

Radar Relay is a non-custodial peer-to-peer cryptocurrency trading service

Safello is a bitcoin trading platform

SFOX is a cryptocurrency prime dealer for large-scale investors

ShapeShift is a cryptocurrency exchange

Unocoin is an Indian cryptocurrency exchange

BitPay is a bitcoin payment processor

BitPesa is a bitcoin remittance platform

ChangeTip was acquired in April 2016

Colu is a blockchain-based payments and rewards platform

Jiko is developing a digital bank

Logos is a blockchain-based payment rail

Money Button is a cryptocurrnecy payment button for websites and apps

POSaBIT is a cryptocurrency payment solution for the cannabis industry

Ripio is bitcoin payment platform for Latin Amercian businesses

Ripple is a cross-border payment platform

Silvergate is a banking platform

Streami is a cross-border remittance platform

Token is a banking service provider

Veem is a business to business payment platform

Wyre is an enterprise money transfer platform

Blockstream develops Bitcoin infrastructure and services

Colbalt develops back and middle office infrastructure based on blockchain technology for FX markets

Elemential enables businesses to deploy and developer blockchain networks

Enimga is developing a privacy layer for building dApps

Lightning Labs develops scaling protocols for blockchains

Nivaura developers end-to-end automation infrastructure for securities

Parity developers Ethereum infrastructure and services

Protocol Labs build protocols, systems, and tools for storing and transferring data

Terminal is a platform for managing Web 3 protocols and dApps

OpenZeppelin develops and implements smart contracts for various industries

Carbon is a stablecoin

Zcash is a privacy coin

Ethereum Classic is a token for a smart contract platform

Horizen is a privacy coin

Reserve is a stablecoin

Rootstock Infrastructure Framework (RIF) is the token behind the Rootstock sidechain

Bitcoin is the first consensus-based, censorship-resistant, peer-to-peer cryptocurrency

Filecoin is a token for decentralized data storage

Lucid Sight is a blockchain gaming studio

Decent is a blockchain healthcare platform

Stratumn is a process verification service

Mifiel enables businesses to sign legal contracts using blockchain technology

BTCJAM ceased operations in May 2017

HashPlex is a cryptocurrency mining service

21 Inc (a.k.a EARN) was acquired in April 2018

Gem is a crypto portfolio tracker

Jackpocket is a mobile app for playing state lotteries using cryptocurrencies

BitGo is a cryptocurrency custody provider

Blockchain a cryptocurrency custody provider

CoinJar a cryptocurrency custody provider

Ledger a cryptocurrency custody provider

Vault a cryptocurrency custody provider

Xapo a cryptocurrency custody provider

Filament is a decentralized IoT platform

Hijro connects banks, buyers, and suppliers across one network designed to streamline and automate settlement

Provenance enables businesses to track products across their supply chain lifecycle

Skuchain develops smart contracts that govern trade agreement from order, shipment and invoice to final payment

Chainalysis developers tools and services to prevent, detect, and investigate cryptocurrency money laundering, fraud, and compliance violations

Elliptic identifies illicit activity on blockchain networks and provides actionable intelligence to companies, financial institutions, and government agencies

Norbloc builds regulatory applications for blockchains

Axoni develops enterprise blockchain solutions

BigchainDB develops enterprise blockchain solutions

Bloq develops enterprise blockchain solutions

Chain develops enterprise blockchain solutions

Hedera Hashgraph is a public blockchain protocol for enterprises

Boost VC is a pre-seed venture fund

Coinlist is a platform for running compliant token sales

Layer1 is a cryptocurrency investment firm

Bitmark is property rights management platform

Blokur is a digital rights management platform

Custos Media Technologies digital rights management platform

Mediachain Labs was acquired in April 2017

Revelator is a platform for payments and copyright management

Dapper Labs develops non-fungible crypto assets

Decentraland is decentralized virtual reality platform

Tierion is data verification platform

DIRT Protocol is a protocol for trusted data

Ocean Protocol is a decentralized data exchange

BitPremier ceased operations in September 2017

Gyft was acquired in July 2014

OB1 develops OpenBazaar a decentralized e-commerce platform

Purse is a bitcoin marketplace

Cognitio is an identity verification platform

MONI provides mobile banking tools and credits

Averon is a mobile identity platform

Pluris provides valuation advisory services to institutions

Sonia is an AI virtual assistant

Artie enables businesses to deploy interactive avatars

Bold (a.k.a VELO) was acquired in March 2014

Source link http://bit.ly/2GcCqwK

0 notes

Text

Mapping out Digital Currency Group’s Portfolio

Mapping out Digital Currency Group’s Portfolio

Quick Take

Digital Currency Group is an investment firm focused on the crypto and blockchain industry

Barry Silbert, told Reuters, that he plans to build Digital Currency Group into “a publicly traded conglomerate like Berkshire Hathaway”

Digital Currency Group has a portfolio of 100+ companies

by Steven Zheng

3 hrs ago · 6 min read

Take a look at the investor roster of major companies in the crypto space and you’ll notice a certain firm that frequently appears: Digital Currency Group (DCG). Founded by Barry Silbert in 2015, DCG was originally made up of two bitcoin businesses, Genesis Global Trading, a cryptocurrency OTC trading firm, and Grayscale Investments, a cryptocurrency asset management firm combined with a few of Silbert’s personal seed investments.

Since then, the DCG has made investments in multiple verticals in the crypto space. From exchanges to blockchain protocols to media companies, DCG has spread its influence into every crevice of the market. The end goal? As Silbert tells Reuters, in a 2017 profile, he “aspires to build DCG into a publicly traded conglomerate like Berkshire Hathaway Inc, run by legendary investor Warren Buffett.” The goal looks increasingly likely with each passing day as the firm continues to make investments in blockchain and crypto companies, some of which are deeply influential in shaping the crypto landscape.

The Block has mapped out Digital Currency Group’s portfolio of 100+ companies.

CoinDesk (DCG subsidiary) is a news site cover crypto assets and blockchain technology

Digital Assets Data developers enterprise-grade software and data feeds for crypto hedge funds and other market participants.

EtherScan is an Ethereum blockchain explorer and data provider

Flipside Crypto providers data for measuring cryptocurrency project health

Joystream is a digital content platform

Livepeer is a peer-to-peer platform for live video broadcasting and streaming

NICKL is a digital content subscription platform

Nomics is a crypto asset data company providing market data APIs

TradeBlock develops enterprise tools for blockchain assets

Tradewave ceased operations in March 2017

Yours is a crypto-backed social network

Abra operates an app for buying and selling cryptocurrencies

bitFlyer is a Japanese bitcoin exchange

BitOasis is a bitcoin exchanging serving the Middle East and North Africa

Bitso is a Mexican bitocin exchange and Ripple gateway

Bitwala is a platform for buying and selling bitcoin

BTCC was acquired in January 2018

Buda is a South American cryptocurrency exchange

Circle develops products for exchanging, storing, sending, and receiving cryptocurrencies

Coinbase is a cryptocurrency wallet and exchange platform

Coinhouse is a cryptocurrency excahnge

Coins is a Southeast Asian platform for buying, selling, sending, and spending cryptocurrencies

Coinsetter was acquired in January 2016

Crypto Facilities provides regulated cryptocurrency derivatives

ErisX is a crypto asset trading platform

Genesis Global Trading (DCG subsidiary) is a cryptocurrency OTC trading firm

Grayscale (DCG subsidiary) is a cryptocurrency asset management firm

itBit is a cryptocurrency exchange

Korbit was acquired in September 2017

Kraken is a cryptocurrency exchange and OTC trading platform

Luno is a cryptocurrency wallet provider and exchange

Melotic is developing cryptocurrency exchange

Omniex is a cryptocurrency investment and trading platform for institutions

Radar Relay is a non-custodial peer-to-peer cryptocurrency trading service

Safello is a bitcoin trading platform

SFOX is a cryptocurrency prime dealer for large-scale investors

ShapeShift is a cryptocurrency exchange

Unocoin is an Indian cryptocurrency exchange

BitPay is a bitcoin payment processor

BitPesa is a bitcoin remittance platform

ChangeTip was acquired in April 2016

Colu is a blockchain-based payments and rewards platform

Jiko is developing a digital bank

Logos is a blockchain-based payment rail

Money Button is a cryptocurrnecy payment button for websites and apps

POSaBIT is a cryptocurrency payment solution for the cannabis industry

Ripio is bitcoin payment platform for Latin Amercian businesses

Ripple is a cross-border payment platform

Silvergate is a banking platform

Streami is a cross-border remittance platform

Token is a banking service provider

Veem is a business to business payment platform

Wyre is an enterprise money transfer platform

Blockstream develops Bitcoin infrastructure and services

Colbalt develops back and middle office infrastructure based on blockchain technology for FX markets