#asset tokenization in blockchain

Explore tagged Tumblr posts

Text

Tokenization: How Is It Revolutionizing Blockchain Technology?

Introduction

Blockchain technology has already revolutionized many different fields; however, it is through tokenization that actual value is surfacing. Tokenization is the process of transforming assets, rights, or information into digital tokens on a blockchain. It has transformed traditional business models and provided better security, efficiency, and transparency. Justtry Technologies is a blockchain solutions company enabling businesses to adopt tokenization in blockchain technology to future-proof in the digital economy. But what is tokenization, and how is it revolutionizing industries?

What is Tokenization in Blockchain?

Tokenization is the process of creating a digital representation of an underlying physical or digital asset using blockchain technology. It may be real estate, digital art, securities, and even personal data. It is only when such assets have been tokenized that they can be transferred, sold, or subdivided into smaller units for unprecedented liquidity and flexibility. Justtry Technologies helps enterprises understand and implement tokenization for the full exploitation of benefits from blockchain.

Types of Tokenization in Blockchain

There are quite a few forms of tokenization in blockchain, including:

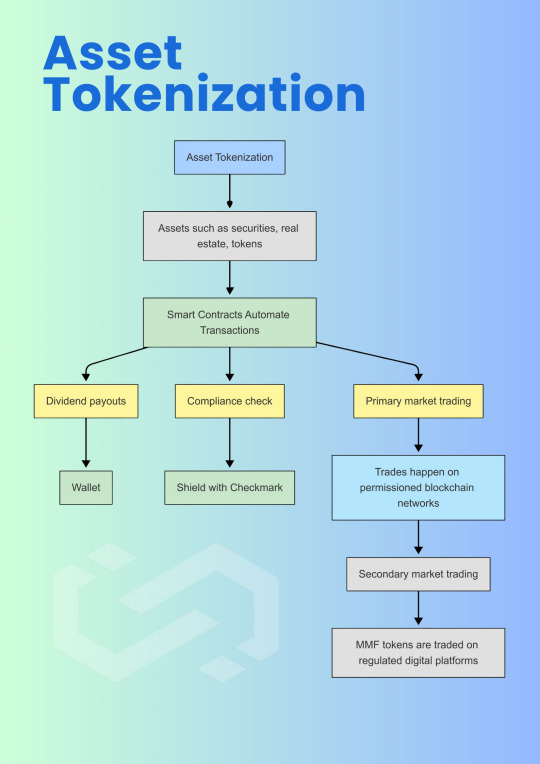

Asset Tokenization: The process where tangible or intangible assets are transformed into tokens using blockchain technology, for instance, real estate or intellectual property.

Data Tokenization: This refers to the process of safeguarding sensitive information by replacing actual information with meaningless tokenized data in case of compromise.

Privacy Tokens: These refer to cryptocurrencies designed to offer improved anonymity compared to other non-private cryptocurrencies since the transactions do not show up on the blockchain.

With Justtry Technologies, we walk numerous startups and enterprises through the various options of blockchain tokenization that would suit their business needs best.

Blockchain Asset Tokenization

It helps companies tokenize their assets, piece by piece into smaller tradable units. For example, real estate can be subdivided to create tokens where every token holds a part of the real estate property. Such tokens are then traded, thereby making illiquid assets liquid. Justtry Technologies offers blockchain solutions that make asset tokenization smooth while ensuring security, transparency, and cost effectiveness.

Tokenization vs Encryption

Like data encryption, data tokenization is a form of protecting the data; however, these two work differently. Tokenization replaces the sensitive data with non-sensitive tokens whereas encryption just scrambles the data and this scrambled data would require a decryption key to get restored back. Justtry Technologies is focused on data tokenization to ensure privacy and security with it so that businesses can carry out sensitive information with confidence.

Tokenization in Blockchain Technology Benefits Businesses

Tokenization of assets and data benefits corporations in several aspects, such as:

Higher Liquidity: Tokenized assets can be subdivided into smaller units for trading; therefore, liquidity is higher.

Greater Security: Blockchain ensures that no one can modify the entry of ownership and subsequent transactions.

Transparency and Trust: All transactions involving tokenized assets are recorded on decentralized ledgers and have infused trust in users.

At Justtry Technologies, we help businesses grasp the full potential of tokenization in blockchain technology and improve operational efficiency and security for businesses.

That's going to shake up quite a lot of industries, bringing with it fresh new business opportunities and hence enhancing transparency, security, and liquidity. And the leader is Justtry Technologies at the forefront of tokenization in blockchain for any kind of business; be it asset tokenization, data tokenization, or even smatterings of everything in between. The effect of leveraging on strength in blockchain can thereby simplify such processes while making it impossible to steal some assets.

Conclusion

Tokenization is set to revolutionize industries by creating new business opportunities and enhancing transparency, security, and liquidity. Justtry Technologies leads the way in helping businesses adopt tokenization in blockchain, from asset tokenization to data tokenization and everything in between. By leveraging blockchain’s capabilities, businesses can streamline operations and safeguard their assets like never before.

#data tokenization#tokenization vs encryption#tokenization in blockchain technology#asset tokenization in blockchain#tokenization in blockchain#tokenization#token development#token development services

0 notes

Text

The Future with E-Money Tokens: Exploring Blockchain for Easy Digital Money Transactions

Discover the power of E-Money Tokens and the simplicity of Blockchain technology. Dive into the world of digital money for seamless transactions. Embrace the future effortlesslyMICA

#MICA#E-Money Tokens#E-Money#Blockchain#RWA#Real World Asset tokenisation#digital money#digital money transfer

2 notes

·

View notes

Text

https://www.linkedin.com/pulse/navigating-future-maritime-asset-tokenization-ira-blocks-global%3FtrackingId=%252FJdWw8wuvOXgY%252BUUcRIB6w%253D%253D/?trackingId=%2FJdWw8wuvOXgY%2BUUcRIB6w%3D%3D

3 notes

·

View notes

Text

Navigating the Digital Landscape: Asset Tokenization and Managing Digital Assets

In an increasingly digital world, the concept of ownership and investment is undergoing a transformative shift. Asset tokenization emerges as a game-changer, revolutionizing the way we manage, trade, and engage with assets. From real estate to Aviation, Maritime tokenization is paving the way for a new era of accessibility, liquidity, and efficiency in managing digital assets.

Understanding Asset Tokenization:

Asset tokenization involves converting ownership rights of physical or digital assets into digital tokens that are recorded on a blockchain. These tokens represent fractional ownership, allowing investors to buy, sell, and trade portions of valuable assets seamlessly. The benefits are far-reaching, transcending industries and introducing a host of possibilities.

Democratizing Ownership:

Traditionally, owning high-value assets like real estate or other physical assets required substantial capital and access. Asset tokenization changes this narrative by enabling fractional ownership. Investors can now own fractions of valuable assets, expanding investment opportunities to a broader audience.

Enhancing Liquidity:

Illiquid assets, often challenging to sell quickly, become more liquid through tokenization. Fractional ownership allows for easier trading on secondary markets, opening the door to investors looking for flexibility in managing their investments.

Efficiency Through Automation:

Managing digital assets through tokenization offers automation through smart contracts. These self-executing contracts automate processes like dividend distribution, rental income sharing, and even voting rights among asset owners.

Security and Transparency:

Blockchain technology ensures transparency and security in asset ownership and transactions. The decentralized and immutable nature of the blockchain eliminates fraudulent activities and ensures that ownership records are tamper-proof.

Diversification and Accessibility:

Asset tokenization empowers investors to diversify their portfolios with ease. It's no longer necessary to have significant capital to invest in high-value assets. Instead, investors can allocate funds across a range of tokenized assets, reducing risk and enhancing investment strategies.

Future Possibilities:

As the digital landscape evolves, asset tokenization opens doors to innovative opportunities. The rise of non-fungible tokens (NFTs) showcases the potential of tokenization beyond traditional financial assets, allowing digital art, collectibles, and physical assets to be tokenized and traded.

Managing Digital Assets:

iRA Blocks, a pioneer in the field, provides a platform for efficient asset tokenization and management. With a focus on accessibility, liquidity, and security, iRA Blocks enables investors to participate in fractional ownership and manage digital assets seamlessly.

In conclusion, asset tokenization is transforming the way we perceive and manage ownership. It's not just about digitizing assets; it's about democratizing access, enhancing liquidity, and ushering in a new era of efficiency and innovation in the management of digital assets. As the digital revolution unfolds, asset tokenization stands at the forefront, redefining the landscape of investment and ownership.

2 notes

·

View notes

Text

Tokenized Assets for Secure Management and Compliance

The financial world is undergoing a transformation fueled by blockchain technology, with tokenized assets at the forefront of this evolution. As traditional finance grapples with the demands of digital innovation, institutions are increasingly embracing tokenized assets for secure management. This adoption not only enhances operational efficiency but also brings greater transparency, accessibility, and security to asset custody and transfer. With regulatory clarity improving and digital infrastructure maturing, tokenization is no longer just a concept—it's becoming a foundation of modern asset management.

Understanding Tokenized Assets Tokenized assets are digital representations of physical or intangible assets on a blockchain, ranging from real estate and commodities to bonds and equities. These tokens represent ownership rights and enable seamless transfer, fractionalization, and tracking through decentralized systems. They are built on secure blockchain networks that ensure immutability, auditability, and transparency, making them highly attractive for institutional-grade asset management.

Why Institutions Are Embracing Tokenized Assets Institutions are drawn to tokenized assets because they solve long-standing inefficiencies in traditional asset markets. From delayed settlements and liquidity challenges to opaque ownership structures, legacy systems are slow and costly. Tokenization offers a streamlined alternative where transactions are near-instantaneous, ownership is traceable in real time, and compliance can be built directly into smart contracts.

Benefits of Tokenized Assets for Secure Management Security is paramount for institutional investors, and tokenized assets bring a new level of control and auditability. With programmable features such as access permissions, automated compliance checks, and embedded transfer restrictions, institutions can manage assets with unprecedented precision. Digital custody solutions further enhance security by replacing manual processes with tamper-proof blockchain systems, reducing fraud and operational risk.

Tokenization and the Evolution of Custody Traditional asset custody involves layers of intermediaries, high costs, and complex documentation. Tokenization transforms this landscape by enabling self-custody or the use of digital custodians who leverage secure multiparty computation and cold storage technologies. This shift not only reduces custody costs but also increases asset availability and real-time settlement capabilities.

Improving Transparency and Efficiency in Asset Management Blockchain technology’s transparent nature means that asset provenance, ownership records, and transaction history are easily verifiable. Institutions gain greater visibility into asset flows and can track performance, compliance, and risk in real time. This transparency builds investor confidence and enhances internal governance and reporting capabilities.

Regulatory Momentum Behind Institutional Tokenization Regulators around the world are catching up with the technology, creating frameworks that support institutional adoption of tokenized assets. Jurisdictions like Switzerland, Singapore, and the UAE have introduced progressive regulations that legitimize digital securities and provide legal certainty. This momentum encourages more institutions to adopt tokenized models while maintaining regulatory compliance.

Challenges to Institutional Tokenized Asset Adoption Despite its promise, institutional tokenization still faces challenges. These include the need for standardized protocols, interoperability between blockchain platforms, and integration with existing financial systems. Additionally, institutions must navigate evolving regulatory environments and invest in digital asset infrastructure, including custodial services and secure onboarding processes.

Use Cases Across Institutional Finance Institutions are already exploring tokenized real estate investment, private equity distribution, bond issuance, and alternative asset access. Banks and asset managers are piloting blockchain platforms to issue and manage tokenized securities, while central banks are experimenting with central bank digital currencies that align with tokenized ecosystems. These developments signal a broader shift toward blockchain-based finance at the institutional level.

The Future of Tokenized Asset Infrastructure As digital asset infrastructure matures, we will likely see the rise of interoperable ecosystems where tokenized assets move seamlessly across platforms and borders. Institutions that adopt early stand to benefit from increased liquidity, lower operational costs, and new product opportunities. With tokenization becoming a pillar of next-generation finance, institutions can no longer afford to stay on the sidelines.

For more info https://bi-journal.com/institutional-adoption-of-tokenized-assets-for-secure-management/

Conclusion Institutional adoption of tokenized assets for secure management represents a major milestone in the digitization of global finance. It offers unmatched advantages in efficiency, security, and transparency, all of which are essential in today’s complex financial landscape. As infrastructure and regulation continue to evolve, tokenized assets are poised to become the foundation of institutional asset strategy, redefining how the world manages and transfers value at scale.

#Tokenized Assets#Digital Custody#Blockchain Finance#BI Journal#BI Journal news#Business Insights articles

0 notes

Text

What Is a White Label Tokenization Platform? A Complete Beginner’s Guide

Introduction

As the world goes digital, tokenizing real-world assets is a half-baked innovation. From real estate to artwork, gold, and company shares, tokenization basically allows digital representation of an asset so that it can be traded efficiently and with security through blockchain technology.

With turning out to be rather complex technically and high on capital investment for creating such platforms from scratch, white label tokenization platforms come as a relatively quicker and cheaper way for businesses to enter the tokenization arena with ready-to-use technology under their own brand. In this guide, we discuss what white label tokenization platforms are, how these platforms work, what are their core advantages, and key features that qualify them for businesses and investors alike.

What Is a White Label Tokenization Platform?

A white label tokenization platform is compile-with-customization software that keeps businesses from building the core infrastructure themselves, so they can tokenize assets. “White label” stands for an unbranded product or service that companies may purchase, rebrand, and resell to their own customers. With regards to tokenization, this basically means that a company can use a sanitization technology for asset tokenization so that a third party can develop and maintain this technology while the company launches its own tokenization platform for assets.

In this whole process, a startup avoids the wastes of time and other resources for creating the technology from scratch and instead exercises concentration on customization, branding, compliance, and investor engagement. Be it for tokenizing real estate, commodities, intellectual property, or equities, the white label solution enables businesses in doing so on time and cost-effectively.

How White Label Tokenization Platforms Work

While white label tokenization platforms attempt to simplify the complicated setup involving digitizing and managing the real assets on the blockchain, the ability to do so depends on the features of the platform and asset types. The first step of tokenization is always asset selection; the business decides on an asset to be tokenized. The platform then, essentially, creates digital tokens that denote fractional ownership of an asset by an investor. These tokens are issued via blockchain smart contracts that automate some rules governing ownership, transferability, revenues, and compliance.

Embedded in the system is the onboarding process for investors, which typically goes through KYC and AML steps to verify their status and thus comply with legal and regulatory requirements. Once verification is done, an investor will be able to buy tokens, store them in a digital wallet, and look at their holdings on their dashboard.Some platforms contemplate allowing trading of tokens on integrated secondary markets, furnishing liquidity to classes of assets that are traditionally considered illiquid.Ready for use, a white label platform is beautiful because everything, technical and operational layers, is already in place: An enterprise simply customizes the interface and the conceptual side of it according to its requirements, and voilà, the enterprise platform is launched for the market.

What Are the Benefits of Using White Label Tokenization?

The white-label tokenization platform brings with it an array of advantages-goes especially for a business firm wanting to enter into the market. The sooner made, the cheaper. One of the most important benefits offered by a white-label platform would be the massive reduction in development time. It can take several months or even years to build a tokenization system from scratch that is secure and scalable. But the platform can be deployed within just weeks using the white-label approach. The cost savings are considerable too; there will be no need for hiring an in-house blockchain development team, paying for system maintenance updates, or working with compliance integrations on their own.

Considering they are easily scalable, white label platforms allow companies to advance into new asset classes or jurisdictions as they grow. Because of their preconfigured compliance and security features, these platforms help to assure businesses that their systems meet regulatory standards. This lets them channel all their energies into branding and investor relations instead of getting mired in technicalities. For the investors, this platform assures a seamless, trustworthy experience, often with better transparency, accessibility, and liquidity as well.

Key Features of White Label Tokenization Platforms

A strong white label tokenization platform incorporates a set of features that are instrumental for issuers and investors. These include smart contract automation to issue tokens in a secure and transparent manner and manage them, KYC/AML modules to ensure regulatory compliance, and investor dashboards to track asset performances and manage digital portfolios. Wallet integration further allows users to safely store and transfer tokenized assets.

Besides supporting real-time analytics and reporting tools like investor activities, token valuation, and compliance status, customization options are offered so businesses can launch a platform that reflects their brand identity with their own logo, domain, and interface design. To increase functionality, some white label platforms offer modules for dividend distribution, secondary market trading, referral programs, and others. All precedently integrated, these features allow tokenization businesses to get their own professional-grade, fully-featured tokenization platform out in the market faster and at fewer costs.

Conclusion

For businesses and investors in real-world assets, white label tokenization platforms represent a huge disruption. By providing a fast, scalable, and highly customizable way for asset tokenization, these platforms have removed barriers-in-the-way-technical and financial-that have traditionally kept many away from this new asset class.

If you are a real estate company looking to fractionate properties, an art gallery that wants ownership of costly works digitized, or a startup interested in providing equity tokens to investors, the white label solution gives you the infrastructure to support it all under your own brand. With tokenization becoming a key to the global digital economy, embarking on a white label platform is no longer just a clever initiative; rather, it is a necessary move to stay in the race.

0 notes

Text

Explore GreatX RWA tokenization for real-world asset tokenization, a robust token economy with innovative token economics powered by blockchain technology.

0 notes

Text

Enterprise Guide to Asset Tokenization: Benefits, Use Cases, and Risks

Asset Tokenization Explained

Asset tokenization is the process of digitally representing ownership of real-world assets, like real estate, gold, intellectual property, or even company shares, on a blockchain. These digital representations, or tokens, allow assets to be divided, sold, or traded securely and efficiently. This shift is transforming the way enterprises manage, trade, and leverage their assets.

With the asset tokenization market rapidly growing and projected to hit trillions in value over the next decade, it's clear this innovation is not just a passing trend. For enterprises, this is an opportunity to boost liquidity, expand investor access, and streamline operational costs.

But what makes tokenization truly valuable isn’t just the technology—it’s the real-world business impact. Companies can unlock previously inaccessible capital, reduce administrative overhead, and dramatically improve transparency in asset tracking. Tokenization enables a paradigm shift in enterprise asset management, allowing businesses to manage their portfolios in real-time, across borders, with unbreakable audit trails.

Top Benefits of Asset Tokenization for Enterprises

1. Improved Liquidity

Traditionally, assets like real estate or fine art are hard to sell quickly. Tokenization changes this. Enterprises can break large, illiquid assets into smaller digital shares, making it easier to buy, sell, or trade fractions of those assets. This increases liquidity and accelerates access to capital.

2. Enhanced Transparency and Trust

Every transaction made using tokens is recorded on the blockchain, a decentralized digital ledger that cannot be altered. This immutability provides full transparency, helping enterprises and their stakeholders verify asset histories and avoid disputes.

3. Reduced Costs Through Automation

By cutting out middlemen such as brokers and agents, tokenization significantly reduces transaction fees. Additionally, smart contracts—self-executing digital agreements—automate functions like compliance checks and transfers, saving both time and money.

4. Speed and Efficiency in Transactions

Traditional asset transactions can take days or weeks due to paperwork, approvals, and coordination. Blockchain-based tokenization compresses this timeline to minutes or hours, creating faster, more streamlined operations.

5. Global Access to Investors

Digital tokens can be accessed globally, which opens up investment opportunities to a much broader base of potential stakeholders. Enterprises are no longer limited by geographic constraints and can attract global capital with ease.

Key Use Cases Across Industries

1. Real Estate

Real estate tokenization allows properties to be divided into multiple shares and sold to investors worldwide. Enterprises managing commercial or residential property portfolios can raise capital faster and enable fractional ownership without complex legal structures.

2. Commodities and Natural Resources

Companies managing resources like gold, oil, or agricultural goods can tokenize these commodities for easier trading. Instead of dealing with physical assets, buyers and sellers exchange digital tokens that represent real-world value.

3. Intellectual Property

Businesses that rely heavily on intellectual property—like tech companies or media firms—can tokenize patents, copyrights, and trademarks. This makes it easier to license, trade, or monetize these intangible assets.

4. Art and Luxury Goods

Tokenizing fine art or luxury items enables investors to own a fraction of a valuable item. It also provides provenance and authenticity verification, which is especially important in high-value asset markets.

5. Supply Chain and Logistics

Tokenization adds transparency to supply chains. Companies can track goods as they move through the process, with tokens representing ownership or certification at each step. This boosts traceability, reduces fraud, and improves efficiency.

Risks and Challenges to Consider

While the advantages are compelling, enterprises must navigate certain risks when implementing asset tokenization.

1. Regulatory Uncertainty

Laws around digital assets vary significantly between countries. Enterprises must ensure they comply with regional securities laws, taxation, and investor protection regulations. Failing to do so could result in fines, project shutdowns, or legal liability.

2. Technological Complexity

Blockchain is still an emerging technology. Integrating tokenization into legacy systems may require a complete overhaul of enterprise architecture. Companies must invest in staff training, cybersecurity, and infrastructure upgrades to succeed.

3. Volatility and Market Risks

Although tokens represent real assets, their market value can fluctuate due to investor sentiment, platform demand, or regulatory news. Enterprises must prepare for potential volatility and ensure that their financial planning accounts for it.

4. Security Concerns

If not implemented correctly, blockchain networks and smart contracts can be vulnerable to attacks. Enterprises must partner with experienced blockchain solution consultancies to build secure platforms, perform regular audits, and protect user data.

5. Adoption Barriers

Internally, some employees and executives may resist adopting new systems. Externally, investors may be unfamiliar with tokenized models, requiring robust education and communication strategies.

How Blockchain Solution Consultancies Help

A blockchain solution consultancy plays a vital role in helping enterprises implement asset tokenization effectively. These firms provide tailored advice, technical development, regulatory navigation, and long-term support. Whether it’s designing smart contracts, integrating blockchain with existing systems, or ensuring compliance, consultancies help reduce risk and accelerate time-to-value.

Enterprises seeking to stay competitive in a token-driven future should seriously consider working with experts who specialize in digital asset transformation.

Final Thoughts: Is Tokenization Right for Your Enterprise?

Asset tokenization isn't just a buzzword—it's a strategic tool that’s reshaping how businesses manage and leverage their assets. From reducing costs to expanding investor pools, the potential is vast. However, success depends on clear planning, smart partnerships, and a long-term vision.

If your enterprise manages high-value assets, seeks faster access to capital, or wants to modernize its financial operations, now is the time to explore tokenization. With the right approach, you can unlock new efficiencies and stay ahead in the evolving digital economy.

0 notes

Text

#blockchain#banking#retirement#crypto#coinbase#cryptocurrency#bitcoin#ethereum#nft crypto#tokenization#assets

0 notes

Text

Global Properties enters Dubai real estate market with crypto transactions, tokenised investment platform.

Now you can buy Dubai real estate with Bitcoin, Ethereum, USDT, and AE Coin – the UAE’s first Dirham-pegged stablecoin! 🌍🏙️

Tokenized investments are projected to hit $16B by 2033 – be part of the revolution today.

Source - https://www.khaleejtimes.com/kt-network/global-properties-enters-dubai-real-estate-market-with-crypto-transactions-tokenised-investment-platform?_refresh=true

#crypto real estate#tokenized assets#tokenized real estates#blockchain property#buy property in dubai#dubai properties#real estate investment dubai#dubai real estate#keystone global real estate dubai#keystone global real estate#keystone global#ksgre dubai#ksgre

0 notes

Text

Is Tokenization in Blockchain the Future of Asset Management? Let's Dive In!

Introduction

The digital age has completely altered the way we think about ownership, assets, and security. The tokenization in blockchain technology is among some of the most influential innovations created. It has made it easier for businesses to convert their physical and digital assets into secure tradable tokens in their blockchain networks. It results not only in the benefits of security and transparency but also brings new potential opportunities to both startups and enterprises. Justtry Technologies offers a complete blockchain solution that helps businesses stake their claim on such advancements.

Now let's talk about how tokenization is a revolution in blockchain and what kinds of different types of tokens pave the way to a secure, decentralized future.

What Does Tokenization in Blockchain Mean?

Tokenization, by definition, refers to the process through which the rights on the asset in the real world get reduced to a digital token within the blockchain. It represents the asset, thereby making it easier to trade, transfer, or even own fractionally. It allows for massive advantages like:

Increased liquidity through fractional ownership and trading.

Improved security through the decentralized and immutable blockchain.

Reduced costs by doing away with intermediaries.

Be it any asset, for instance real estate, art, or even digital ones such as content, intellectual property- the blockchain-based token system increases both accessibility and security.

Types of Tokens in Blockchain

Clearly, not all tokens are the same. There are various types of tokens, and each type of token has a distinct role and property. Let's break down the several types of tokens:

Utility Tokens: Utility tokens-the kind issued by Livepeer Token-are used to access specific services within blockchain ecosystems. Think of the kind of utility provided by Livepeer tokens if they could use those tokens to pay for video transcoding service on the Livepeer network.

Security Tokens: Represent an interest in real-world assets such as stocks, bonds, or even real estate. This is the most secure kind of investment which embedded legitimate ownership rights directly into the blockchain.

Asset-Backed Tokens: Those tokens that were represented from gold, real estate, and even a piece of art. These tokens give a guarantee that every token will have a real asset backing the digital creation.

There have been privacy tokens for those who do care about anonymity and their privacy, such as Monero and Zcash. The transactions involved are made safe and even private through the advanced techniques of cryptographical techniques.

There are tokens for specific purposes that support the overall growth of blockchain technology.

Tokenization in Blockchain Technology

What makes tokenization a game-changer is exactly that: it's the ability to be able to combine traditional asset ownership with blockchain technology. Tokenization, through smart contracts, automates processes that took several intermediaries. Here's what it means for businesses:

Fractional ownership-that is, investors can have only a small part of valuable assets.

Global transactions become seamless again-no geography, and reduced middlemen are necessary.

All the transactions made on the blockchain are recorded; hence, it easily verifies the history of an asset, thereby building transparency and trust into the system.

Asset Tokenization: Real-World Application

Perhaps one of the most popular uses of tokenization is real estate. You have a high-priced property, but you need the money now. Rather than selling the property outright, you tokenize it. Every token represents a fraction of that property; these tokens can be sold to investors. This, in turn, avails liquidity immediately while preserving overall control.

At Justtry Technologies, we enable businesses like yours to digitize assets and explore the vast possibilities in asset tokenization within blockchain. From real estate to art, the door is now open to new avenues.

Livepeer Token and Blockchain Wallets

The Livepeer token blockchain wallet is a utility token that acts on its functionality: giving the power to users to control and trade their tokens on the decentralized video-streaming application platform. With regards to such utility tokens, flexibility and security characterize it. A blockchain wallet stores and manages those digital assets efficiently.

Conclusion

What we at Justtry Technologies believe is that startups and enterprises should be enabled through innovative technologies, such as tokenization in blockchain. Such technology would possibly change the traditional systems of asset management to make for safer, more transparent, and smoother running ecosystems. Whether it is privacy tokens in blockchain or asset tokenization, this digital change is just getting started.

Want to make a leap into the future? Reach us at Justtry Technologies today!

#asset tokenization in blockchain#livepeer token blockchain wallet#privacy tokens in blockchain#tokenization in blockchain technology#tokenization in blockchain

0 notes

Text

#blockchain#web3 banking#smart contracts#asset tokenization#defi#decentralizedfinance#fsis#whitelabel web3

0 notes

Text

https://www.linkedin.com/pulse/demystifying-security-tokens-vs-tokenized-securities%3FtrackingId=JATId95q6E0uDNRn8x9pfA%253D%253D/?trackingId=JATId95q6E0uDNRn8x9pfA%3D%3D

3 notes

·

View notes

Text

🏦 Real Estate on the Blockchain? RWA Tokens Are Trending

🏢 Real-World Assets (RWAs) are coming to crypto—and institutions are interested.

🌍 RWAs = Tokenizing real things like:

Real estate

Bonds

Stocks

Commodities

✅ Why this matters:

Makes global investing easier

Increases transparency

Could reshape traditional finance

🔍 Projects like MakerDAO, Ondo, and Centrifuge are already deep into RWA territory.

🧠 Are RWAs the future of DeFi? Or too much TradFi in disguise? 🔁 Reblog if you think real assets + crypto is a power combo.

#crypto#cryptocurrency#RWA#real world assets#crypto news#The Block Drop#DeFi#blockchain#investing#crypto radar#finance news#ethereum#tokenization#smart contracts#crypto trending#crypto speed feed#future of money#real estate#crypto investing#stablecoins

0 notes

Text

Your Money Is Changing—Are You Ready for the Shift?For decades, institutional finance has relied on outdated infrastructure—slow settlements, limited liquidity, and high fees.Now? Blockchain is rewriting the rules.💡 Asset tokenization is making investments: 🔹 More accessible—fractional ownership of real estate, private equity & more. 🔹 More efficient—automated smart contracts eliminate intermediaries. 🔹 More transparent—blockchain provides an immutable record of ownership.BlackRock, JPMorgan, and HSBC are already tokenizing assets. If your institution isn’t thinking about it, you’re already behind.

#finance#tokenization#digital asset#blockchain#tokenomics#cryptocurrency#token factory#bitcoin#investment#asset management#assets

0 notes

Text

Discover how to tokenize real world assets in just 8 simple steps. Learn the streamlined process of converting physical assets into digital tokens using blockchain technology for increased liquidity, security, and global accessibility.

0 notes