#llcs with mfas

Explore tagged Tumblr posts

Text

Studio execs love plausible sentence generators because they have a workflow that looks exactly like a writer-exec dynamic, only without any eye-rolling at the stupid “notes” the exec gives the writer.

All an exec wants is to bark out “Hey, nerd, make me another E.T., except make the hero a dog, and set it on Mars.” After the writer faithfully produces this script, the exec can say, “OK, put put a love interest in the second act, and give me a big gunfight at the climax,” and the writer dutifully makes the changes.

This is exactly how prompting an LLM works.

A writer and a studio exec are lost in the desert, dying of thirst.

Just as they are about to perish, they come upon an oasis, with a cool sparkling pool of water.

The writer drops to their knees and thanks the fates for saving their lives.

But then, the studio exec unzips his pants, pulls out his cock and starts pissing in the water.

“What the fuck are you doing?” the writer demands.

“Don’t worry,” the exec says, “I’m making it better.”

- Everything Made By an AI Is In the Public Domain: The US Copyright Office offers creative workers a powerful labor protective

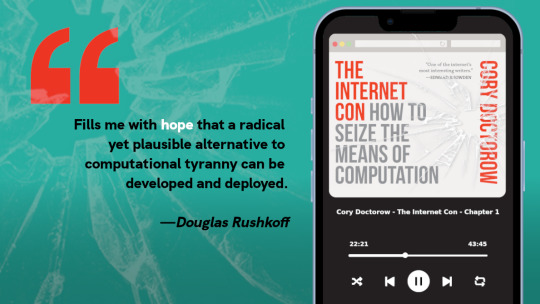

THIS IS THE LAST DAY FOR MY KICKSTARTER for the audiobook for "The Internet Con: How To Seize the Means of Computation," a Big Tech disassembly manual to disenshittify the web and make a new, good internet to succeed the old, good internet. It's a DRM-free book, which means Audible won't carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

Going to Burning Man? Catch me on Tuesday at 2:40pm on the Center Camp Stage for a talk about enshittification and how to reverse it; on Wednesday at noon, I'm hosting Dr Patrick Ball at Liminal Labs (6:15/F) for a talk on using statistics to prove high-level culpability in the recruitment of child soldiers.

On September 6 at 7pm, I'll be hosting Naomi Klein at the LA Public Library for the launch of Doppelganger.

On September 12 at 7pm, I'll be at Toronto's Another Story Bookshop with my new book The Internet Con: How to Seize the Means of Computation.

#labor#copyright#public domain#ai#creative workers#hype#criti-hype#enshittification#llcs with mfas#solidarity#collective power

2K notes

·

View notes

Text

🛡️ Cybersecurity and Fraud Prevention in Finance: How to Protect Your Financial Systems in 2025

In today’s digital-first financial world, cybersecurity and fraud prevention in finance are more critical than ever. With the rise of online banking, mobile payments, and digital assets, financial institutions face increasingly sophisticated cyber threats and fraud tactics.

🔍 Why Cybersecurity Is Crucial in the Finance Industry

The financial sector is one of the most targeted industries by cybercriminals due to its vast access to sensitive personal data and high-value transactions. From phishing and ransomware to account takeover and insider threats, the risk landscape continues to evolve.

Google Keyword: financial cyber threats

💣 The Cost of Poor Financial Cybersecurity

Average cost of a financial data breach: $5.9 million

70% of consumers will switch banks or services after a breach

Identity theft and digital fraud rates are up 34% YoY

Trending Search Term: banking data breaches 2025

✅ Top Strategies for Cybersecurity and Fraud Prevention in Finance

1. Adopt Multi-Layered Security Protocols

Layered security (also called “defense in depth”) uses a combination of firewalls, encryption, anti-virus software, and secure authentication to prevent unauthorized access.

Related Term: secure financial transactions

2. Leverage AI and Machine Learning for Fraud Detection

Artificial intelligence plays a key role in identifying unusual patterns and suspicious behavior in real-time. AI-powered fraud detection systems can:

Flag fraudulent transactions instantly

Analyze thousands of data points in seconds

Continuously learn and adapt to new fraud tactics

Keyword: AI in cybersecurity

3. Implement Real-Time Transaction Monitoring

Real-time monitoring tools allow institutions to track and respond to threats instantly, reducing loss and minimizing damage.

Search Intent: fraud detection systems for financial services

4. Enhance Customer Authentication Protocols

Using multi-factor authentication (MFA), biometric verification, and one-time passwords (OTPs) helps protect accounts from unauthorized access.

Search Trigger: how to protect financial data from hackers

5. Train Employees and Clients on Cyber Hygiene

Human error remains one of the top causes of breaches. Train staff and customers on:

Recognizing phishing scams

Using secure passwords

Avoiding suspicious links and public Wi-Fi

Keyword Phrase: digital financial fraud prevention tips

🔐 Top Tools and Technologies for Financial Cybersecurity in 2025

Darktrace & Vectra AI: Behavioral threat detection

Splunk & IBM QRadar: Security Information and Event Management (SIEM)

Okta & Duo: Identity and access management

ThreatMetrix: Real-time fraud analytics

📉 Common Types of Financial Cyber Threats

Phishing Attacks

Credential Stuffing

Account Takeovers

Ransomware Attacks

Insider Threats

Synthetic Identity Fraud

Search Phrase: types of financial cyber fraud

🧠 Real-World Example

In 2024, a regional credit union prevented over $2 million in fraud losses using AI-based transaction monitoring and customer biometrics. This proactive cybersecurity investment boosted customer confidence and reduced fraud-related downtime by 75%.

🚀 The Future of Cybersecurity in Finance

In 2025 and beyond, expect to see:

Widespread use of zero-trust security models

Enhanced biometric authentication

Increased use of blockchain for transaction verification

AI-powered fraud prevention as the industry standard

Keyword Used: future of cybersecurity in banking

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

📌 Final Takeaway

As digital transactions continue to grow, so does the threat landscape. Prioritizing cybersecurity and fraud prevention in finance is no longer optional—it’s essential.

Businesses and institutions that invest in AI-driven security tools, real-time monitoring, and fraud prevention protocols will not only protect their assets but also build long-term customer trust and compliance.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Learn More!!

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#financial cyber threats#banking data breaches 2025#secure financial transactions#AI in cybersecurity#fraud detection systems for financial services#how to protect financial data from hackers

2 notes

·

View notes

Text

Eighth Circuit Strengthens Franchise Rights for Distributors

Beverage distributors just gained major ground under the Missouri Franchise Act (MFA), thanks to a new opinion from the Eighth Circuit. In Pinnacle Imports, LLC v. Share A Splash Wine Co., LLC (link to opinion), the court reversed a district court decision that had let a supplier off the hook for terminating a distribution relationship without good cause. The appellate court’s analysis sends a…

0 notes

Text

Fortifying Cybersecurity. Strategic Measures for Fintech and Business Leaders in 2025

In the evolving digital landscape of 2025, businesses face increasingly sophisticated cyber threats. The integration of advanced technologies, such as AI and quantum computing, has expanded the attack surface, necessitating a proactive and comprehensive approach to cybersecurity. For fintech companies and business leaders, implementing robust security measures is essential to protect sensitive data and maintain customer trust.

1. Embrace a Zero Trust Architecture.

The traditional perimeter-based security model is no longer sufficient. Adopting a Zero Trust Architecture ensures that every access request is thoroughly verified, regardless of its origin. This approach minimizes the risk of unauthorized access and lateral movement within networks. Implementing strict access controls and continuous monitoring can significantly enhance security posture.

2. Implement Multi-Factor Authentication (MFA).

MFA adds an additional layer of security by requiring users to provide multiple forms of verification before granting access. This method significantly reduces the likelihood of unauthorized access due to compromised credentials. Incorporating MFA across all user accounts, especially those with elevated privileges, is a fundamental step in strengthening cybersecurity.

3. Regularly Update and Patch Systems.

Outdated software and systems are prime targets for cybercriminals. Ensuring that all systems, applications, and devices are regularly updated and patched addresses known vulnerabilities and reduces the risk of exploitation. Establishing a routine update schedule and leveraging automated patch management tools can streamline this process.

4. Conduct Comprehensive Employee Training.

Human error remains a significant factor in security breaches. Providing regular training sessions to educate employees about cybersecurity best practices, phishing awareness, and safe data handling can empower them to act as the first line of defense. Creating a culture of security awareness is instrumental in preventing inadvertent security lapses.

5. Utilize Advanced Threat Detection Tools.

Modern cyber threats often bypass traditional security measures. Implementing advanced threat detection tools, such as Extended Detection and Response (XDR) systems, can provide real-time monitoring and analysis of network activities. These tools leverage AI and machine learning to identify and respond to anomalies swiftly, minimizing potential damage.

6. Develop a Robust Incident Response Plan.

Preparation is key to minimizing the impact of security incidents. Establishing a comprehensive incident response plan that outlines procedures for detection, containment, eradication, and recovery ensures a structured approach during crises. Regularly testing and updating this plan can enhance organizational resilience.

7. Secure Third-Party Integrations.

Third-party vendors and integrations can introduce additional vulnerabilities. Conducting thorough due diligence, establishing clear security requirements, and continuously monitoring third-party access can mitigate associated risks. Implementing contractual obligations for security standards ensures accountability across the supply chain.

Building Trust Through Security.

Eric Hannelius, a seasoned fintech entrepreneur and CEO of Pepper Pay LLC, emphasizes the importance of proactive cybersecurity measures: “For consumers, the effects of a cyber-attack can be immediate and distressing. When personal financial data is exposed or stolen, trust in the fintech company can plummet if they are not prepared with a proper response. Having the best possible cyber security measures in place cannot mitigate all risk completely, but it is a key step in maintaining the integrity of data security and protecting consumers.”

Eric Hannelius advocates for integrating security into the core business strategy, ensuring that trust is built through consistent and transparent security practices.

As cyber threats continue to evolve, businesses must adopt a proactive and layered approach to cybersecurity. By implementing these strategic measures, organizations can enhance their defense mechanisms, protect sensitive data, and maintain the trust of their customers. In the dynamic digital environment of 2025, prioritizing cybersecurity is not merely a technical necessity but a fundamental business imperative.

0 notes

Text

Investing in Advanced Security Measures: Strategic Imperatives for Fintech Leaders in 2025

In the rapidly evolving digital landscape of 2025, fintech companies face an unprecedented array of cybersecurity challenges. The convergence of artificial intelligence (AI), quantum computing, and increasingly sophisticated cyber threats necessitates a proactive and comprehensive approach to security. For business leaders in the fintech sector, investing in advanced security measures is not merely a technical consideration but a strategic imperative to safeguard assets, maintain customer trust, and ensure regulatory compliance.

The Evolving Threat Landscape.

Cyber threats have become more sophisticated, leveraging AI to conduct targeted attacks, automate phishing campaigns, and exploit vulnerabilities at scale. Simultaneously, the advent of quantum computing poses a significant risk to traditional encryption methods, potentially rendering current security protocols obsolete. The financial sector, given its data-centric nature and 24/7 service expectations, is particularly vulnerable to these emerging threats.

Strategic Security Investments for 2025.

1. Transition to Post-Quantum Cryptography.

With quantum computing capabilities advancing, traditional encryption algorithms like RSA and ECC are at risk. Fintech companies must begin transitioning to post-quantum cryptographic standards to future-proof their security infrastructure. This involves adopting algorithms resistant to quantum attacks and integrating them into existing systems without compromising performance.

2. Implement AI-Driven Threat Detection.

AI-powered security tools can analyze vast amounts of data in real-time, identifying anomalies and potential threats more efficiently than traditional methods. By leveraging machine learning algorithms, fintech firms can enhance their ability to detect and respond to cyber threats promptly, reducing the window of opportunity for attackers .

3. Adopt Zero Trust Architecture.

The Zero Trust model operates on the principle of “never trust, always verify,” requiring continuous authentication and validation of users and devices. Implementing this architecture minimizes the risk of unauthorized access and lateral movement within networks, thereby strengthening the overall security posture .

4. Enhance Multi-Factor Authentication (MFA).

Traditional MFA methods are evolving to counter sophisticated phishing attacks. Adopting phishing-resistant MFA solutions, such as hardware tokens or biometric verification, adds an additional layer of security, ensuring that access credentials are not easily compromised.

5. Strengthen Cloud Security Measures.

As fintech companies increasingly rely on cloud services, securing these environments becomes paramount. Implementing robust cloud security protocols, including encryption, access controls, and continuous monitoring, helps protect sensitive data and maintain compliance with regulatory standards.

Building Trust Through Security.

Eric Hannelius, CEO of Pepper Pay LLC, emphasizes the integral role of security in maintaining customer trust: “For consumers, the effects of a cyber-attack can be immediate and distressing. When personal financial data is exposed or stolen, trust in the fintech company can plummet if they are not prepared with a proper response. Having the best possible cyber security measures in place cannot mitigate all risk completely, but it is a key step in maintaining the integrity of data security and protecting consumers.”

Eric Hannelius advocates for a proactive approach, integrating advanced security measures into the core business strategy to foster resilience and trust.

Regulatory Compliance and Industry Standards.

Regulatory bodies worldwide are tightening cybersecurity requirements, mandating stricter compliance and reporting standards. Fintech companies must stay abreast of these evolving regulations, ensuring that their security measures align with legal obligations and industry best practices. This includes adhering to frameworks like the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS) .

In the face of escalating cyber threats and technological advancements, fintech leaders must prioritize investments in advanced security measures. By adopting post-quantum cryptography, leveraging AI for threat detection, implementing Zero Trust architectures, enhancing MFA, and strengthening cloud security, organizations can build a robust defense against current and future cyber risks. Such strategic investments not only protect assets and data but also reinforce customer trust and ensure compliance with regulatory standards, positioning fintech companies for sustainable success in the digital age.

0 notes

Text

Real Estate Fraud in Queens Village Highlights the Need for Secure Digital Interfaces

A recent real estate fraud scheme uncovered in Queens Village, NY, has raised significant concerns about document security and verification processes. Investigators found that criminals forged documents to illegally acquire high-value properties, exploiting loopholes in authentication systems. This alarming incident underscores the importance of secure digital solutions, especially in industries handling sensitive transactions like real estate.

For businesses that rely on digital interactions, ensuring a seamless yet secure user experience is paramount. This is where Orbix Studio LLC steps in—helping businesses design digital platforms that are not only visually appealing but also equipped with robust security features to prevent fraud.

How Secure UI/UX Design Can Prevent Fraud

As a leading UI/UX design agency, Orbix Studio LLC specializes in creating secure, intuitive, and efficient digital experiences. The recent fraud case in Queens Village highlights key areas where advanced UI/UX design can act as a frontline defense:

Secure Authentication Systems – Implementing multi-factor authentication (MFA), biometric verification, and encrypted login processes to prevent unauthorized access.

Fraud Detection UI Design – Designing real-time alerts and verification checkpoints that notify users of unusual activities.

User-Friendly Document Verification – Ensuring that users can easily verify and authenticate sensitive documents without compromising security.

Seamless Digital Transactions – Creating interfaces that protect customer data while maintaining smooth usability.

With an increasing reliance on digital platforms, businesses need to prioritize security without sacrificing user experience. Orbix Studio LLC helps businesses develop digital solutions that not only look great but also ensure safety for their users.

Strengthen Your Business with Secure & Effective Digital Solutions

Whether you’re in real estate, finance, or e-commerce, Orbix Studio LLC provides top-tier UI/UX design, branding strategy, and interactive design services tailored to your industry’s needs. Protect your business from fraud while delivering an outstanding digital experience.

📞 Contact Us Today! 📍 646-598-7983 🌐 Visit Our Website 📍 Find Us on Google Maps

0 notes

Text

Business Email Compromise Market Insights: Industry Share, Trends & Future Outlook 2032

The Business Email Compromise Market was valued at USD 1.35 billion in 2023 and is expected to reach USD 7.24 billion by 2032, growing at a CAGR of 20.53% from 2024-2032

The Business Email Compromise (BEC) market is experiencing rapid expansion as cyber threats targeting corporate email systems continue to rise. The increasing sophistication of phishing attacks and financial fraud schemes has heightened the demand for advanced security solutions.

The Business Email Compromise market continues to grow as organizations worldwide seek enhanced cybersecurity measures. The rise of remote work, digital transactions, and data-driven communications has made businesses more vulnerable to BEC scams. As a result, cybersecurity firms and technology providers are investing heavily in AI-powered detection tools, email authentication protocols, and fraud prevention solutions to mitigate risks.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3453

Market Keyplayers:

Acronis International GmbH (Acronis Cyber Protect, Acronis True Image)

Broadcom (Symantec Endpoint Protection, Web Security Service)

Cellopoint International Corp. (CelloPoint Mail Filtering, CelloPoint Data Protection)

Check Point Software Technologies Ltd. (Check Point Anti-Bot, Check Point Threat Prevention)

Fortra, LLC (GoAnywhere, Data Security Solutions)

GreatHorn, Inc. (GreatHorn Email Security, GreatHorn Phishing Detection)

Mimecast.com (Mimecast Email Security, Mimecast Archiving)

Proofpoint (Proofpoint Email Protection, Proofpoint Threat Response)

Tessian Limited (Tessian for Gmail, Tessian for Microsoft 365)

Trend Micro Incorporated (Trend Micro Apex One, Trend Micro Cloud App Security)

Agari Inc. (Agari Phishing Defense, Agari Email Security)

Armorblox Incorporation (Armorblox Email Security, Armorblox Threat Intelligence)

Abnormal Security Inc. (Abnormal Email Security, Abnormal Behavioral AI)

Barracuda Networks Incorporation (Barracuda Email Security, Barracuda Web Security)

Clearswift GmbH (ClearSwift Secure Email Gateway, ClearSwift Secure Web Gateway)

Cisco Inc. (Cisco Umbrella, Cisco Email Security)

Check Point Inc. (Check Point SandBlast, Check Point Endpoint Protection)

Fortinet Corporation (FortiMail, FortiGate)

GreatHorn Incorporation (GreatHorn Advanced Threat Protection, GreatHorn Digital Risk Protection)

Heimdal Security Solutions Company Ltd. (Heimdal Security Threat Prevention, Heimdal Endpoint Protection)

IRONSCALES (IRONSCALES Email Security, IRONSCALES Phishing Simulation)

Mimecast Limited (Mimecast Targeted Threat Protection, Mimecast Secure Email Gateway)

Proofpoint Inc. (Proofpoint Essentials, Proofpoint Advanced Threat Protection)

PhishLabs Corp. (PhishLabs Security Awareness Training, PhishLabs Phishing Protection)

Market Size, Share, and Scope

North America currently dominates the market due to high cybercrime rates and stringent compliance requirements.

Small and medium enterprises (SMEs) are increasingly adopting email security solutions as cybercriminals target less-protected businesses.

AI-driven threat intelligence, behavioral analysis, and multi-factor authentication are becoming essential components of BEC prevention solutions.

Market Trends

Rise in AI and Machine Learning Integration – Automated threat detection is improving real-time fraud prevention.

Growth in Cloud-Based Email Security Solutions – Increased remote work adoption has led to cloud-driven email security expansion.

Multi-Factor Authentication (MFA) Adoption – More organizations are implementing MFA to secure email communications.

Increase in Deepfake and Social Engineering Attacks – Cybercriminals are using AI-generated impersonation techniques.

Regulatory Compliance Driving Market Growth – Governments are imposing stricter cybersecurity regulations.

Rising Demand for Managed Security Services – Companies are outsourcing security monitoring to third-party specialists.

Blockchain-Based Email Authentication Solutions – Decentralized authentication is enhancing email security protocols.

Collaboration Between Enterprises and Law Enforcement – Joint efforts to combat email fraud are increasing.

Increased Cybersecurity Investment by Financial Institutions – Banks and payment platforms are prioritizing fraud detection.

Emerging Threats Targeting Supply Chains – Hackers are infiltrating B2B communications for financial fraud.

Enquiry of This Report: https://www.snsinsider.com/enquiry/3453

Market Segmentation:

By Offering

Solution

Service

By Deployment

Cloud

On-premises

By Organization Size

SMEs

Large Enterprises

By Vertical

BFSI

Government

IT and Telecommunications

Energy and Utilities

Manufacturing

Retail and E-Commerce

Healthcare

Others

Detailed Market Growth Analysis

Factors Driving Growth

Surge in Sophisticated Email Scams: Cybercriminals are refining their tactics to bypass traditional security measures.

Rising Awareness Among Organizations: Businesses are prioritizing cyber resilience strategies.

Expansion of Digital Transactions: The rise of e-commerce and digital banking has increased the attack surface.

Growing Investment in AI & Automation: Companies are leveraging AI-driven cybersecurity frameworks to enhance threat detection.

Challenges and Market Barriers

High Cost of Advanced Security Solutions – Small businesses struggle with cybersecurity investment.

Lack of Cybersecurity Expertise – Skilled professionals in BEC prevention remain in high demand.

Evolving Tactics of Cybercriminals – Hackers continuously adapt to bypass detection mechanisms.

Regulatory Complexity Across Different Regions – Compliance requirements vary across jurisdictions.

Growth and Industry Report 2032 – Size, Share & Forecast

Financial Services & Banking – High-risk industry due to transactional vulnerabilities.

Healthcare – Protecting patient data from phishing and ransomware attacks.

Retail & E-commerce – Preventing fraud in online transactions.

Government Agencies – Strengthening national cybersecurity frameworks.

Future Prospects of the BEC Market

Predicted Advancements in Email Security

AI-driven algorithms will enable real-time threat detection and risk analysis.

Organizations will prioritize zero-trust email architectures.

The role of quantum encryption in securing business communications will expand.

Advanced user behavior analytics (UBA) will identify fraudulent activities faster.

Emerging Business Opportunities

Increased Demand for Cybersecurity Consulting – Organizations will seek tailored email security solutions.

Growth in Security-as-a-Service Models – Subscription-based cybersecurity solutions will become more popular.

Enhanced Cybersecurity Regulations – Governments will enforce stricter compliance, driving market adoption.

Expansion of BEC Protection into IoT and Smart Devices – Securing corporate communications beyond traditional email platforms.

Access Complete Report: https://www.snsinsider.com/reports/business-email-compromise-market-3453

Conclusion

The Business Email Compromise market is poised for exponential growth as cyber threats continue to evolve. The increasing reliance on cloud-based communication, digital transactions, and AI-driven fraud detection will shape the industry's future. Businesses must adopt comprehensive security frameworks and leverage advanced threat intelligence to combat BEC attacks effectively. With continued technological advancements, the market will witness robust expansion by 2032, ensuring enhanced security and compliance for businesses worldwide.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Business Email Compromise market#Business Email Compromise market Analysis#Business Email Compromise market Growth#Business Email Compromise market Scope#Business Email Compromise market Size

0 notes

Text

Artist Research 6: Book Report

Multiplex is a photobook published by Minor Matters, a collaborative publishing platform for contemporary art, and highlights the work of Paul Berger. The book is organized around four key ideas of his work: Site of Notation, Mechanics of Narrative, Arenas of Evidence, and Automaton. Each section starts off with either a text or description and is sprinkled with additional insights throughout it.

Paul Berger was born is 1948 in The Dalles, Oregon. He has been working with photography since 1965, received his BA from UCLA in 1970, and his MFA from the Visual Studies workshop in 1973. He taught at the Washington School of Art for 35 years, where he co-founded the the school’s photography program in 1978. He also initiated a sequence of digital-imaging classes there in 1985. His artworks has been exhibited both domestically and internationally as well as being published in numerous books.

Sect 1, Site of Notation, Mathematics 23. “Site of Notation” starts off with a quote by mathematician Carla Diane Savage which says “A forest is an undirected graph which contains no cycles. A connected forest is a tree.” This section is composed of a series of artworks all titled Mathematics. This is because the photos are of the slate blackboards in the mathematics department at the University of Illinois at Urbana-Champaign. This started with his impulse to document the interaction and longevity of the written contents on the boards which eventually evolved to become contact sheet images through overlapping and juxtaposition of each photo film.

Sect 4, The Automation, Weft & Weave, VEG-1A

In The Automation, the variety in his work is shown: there is abstraction, digital imagery, nature photographs. I particularly liked the photo arrangement of his pieces with the warp and weft.

One thing that I didn’t particularly like was the long list of publisher acknowledgments and list of exhibitions that he was in. I feel like this is stuff that you can search up if you want to see even more than what was shown in the book.

Berger, Paul, et al. Multiplex. Minor Matters Books LLC, 2018.

0 notes

Text

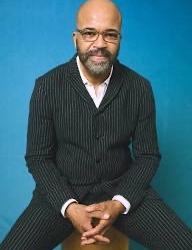

Jeffrey Wright (December 7, 1965) is an actor. He is well known for his Tony, Golden Globe, and Emmy-winning role as Belize in the Broadway production of Angels in America and its acclaimed miniseries adaptation.

He has starred as Jean-Michel Basquiat in Basquiat; Felix Leiter in films Casino Royale, Quantum of Solace, and No Time to Die; Valentin Narcisse in Boardwalk Empire; Beetee Latier in The Hunger Games; Isaac Dixon in the video game The Last Of Us Part II; and the Watcher in What If...? Since 2016, he has starred as Bernard Lowe in Westworld. He portrayed James Gordon in The Batman (2022). He portrayed Muddy Waters in Cadillac Records and Peoples Hernandez in Shaft. He portrayed Adam Clayton Powell, J. In Rustin (2023).

He was born in DC, the son of Barbara Evon, a customs lawyer, and James Charles Wright, Jr., who died when he was a child. He graduated from St. Albans School and attended Amherst College, receiving a BA in political science, planning to attend law school, but chose instead to study acting. After attending the MFA acting program at the New York University Tisch School of the Arts for two months, he left to appear in Les Blancs before transferring with it to the Huntington Theatre Company and deciding to be an actor full-time.

He is chairman and co-founder of Taia, LLC and Taia Peace Foundation and Vice Chairman of Taia Lion Resources, Inc., a gold exploration company looking to create a conflict-free gold mining operation in Sierra Leone.

He married actress Carmen Ejogo (2000-14) and they have a son and a daughter.

He received an honorary degree from his alma mater, Amherst College. #africanhistory365 #africanexcellence

1 note

·

View note

Text

That means that for a work to be eligible for copyright in the USA, it must satisfy three criteria:

1. It must be creative. Copyright does not apply to non-creative works (say, a phone book listing everyone in a town in alphabetical order), even if the work required a lot of labor. Copyright does not protect effort, it protects creativity. You can spend your whole life making a phone book and get no copyright, but the haiku you toss off in ten seconds while drunk gets copyright’s full protection. 2. It must be tangible. Copyright only applies to creative works that are “fixed in a tangible medium.” A dance isn’t copyrightable, but a video of someone dancing is, as is a written description of the dance in choreographers’ notation. A singer can’t copyright the act of singing, but they can copyright the recording of the song. 3. It must be of human authorship. Only humans are eligible for copyright. A beehive’s combs may be beautiful, but they can’t be copyrighted. An elephant’s paintings may be creative, but they can’t be copyrighted. A monkey’s selfie may be iconic, but it can’t be copyrighted.

The works an algorithm generates —be they still images, audio recordings, text, or videos — cannot be copyrighted.

For creative workers, this is huge. Our bosses, like all bosses, relish the thought of firing us all and making us homeless. You will never love anything as much as your boss hates paying you. That’s why the most rampant form of theft in America is wage theft. Just the thought of firing workers and replacing them with chatbots is enough to invoke dangerous, persistent priapism in the boardrooms of corporate America.

- Everything Made By an AI Is In the Public Domain: The US Copyright Office offers creative workers a powerful labor protective

THIS IS THE LAST DAY FOR MY KICKSTARTER for the audiobook for "The Internet Con: How To Seize the Means of Computation," a Big Tech disassembly manual to disenshittify the web and make a new, good internet to succeed the old, good internet. It's a DRM-free book, which means Audible won't carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

Going to Burning Man? Catch me on Tuesday at 2:40pm on the Center Camp Stage for a talk about enshittification and how to reverse it; on Wednesday at noon, I'm hosting Dr Patrick Ball at Liminal Labs (6:15/F) for a talk on using statistics to prove high-level culpability in the recruitment of child soldiers.

On September 6 at 7pm, I'll be hosting Naomi Klein at the LA Public Library for the launch of Doppelganger.

On September 12 at 7pm, I'll be at Toronto's Another Story Bookshop with my new book The Internet Con: How to Seize the Means of Computation.

#labor#copyright#public domain#ai#creative workers#hype#criti-hype#enshittification#llcs with mfas#solidarity#collective power

1K notes

·

View notes

Text

Multi-factor Authentication Industry 2030 Trends, Growth, Revenue, Outlook and Future Estimation

The global multi-factor authentication (MFA) market was valued at USD 14.28 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 14.2% from 2023 to 2030. Multi-factor authentication strengthens security by adding multiple verification layers to authenticate user identity and secure online transactions. This increased security is crucial in today’s landscape, where organizations face escalating cyberattacks and data breaches. The rising frequency of such breaches, coupled with stricter regulatory requirements for safeguarding sensitive data, is expected to significantly drive MFA market growth.

Additional factors driving the adoption of MFA solutions include growing investments in cloud technologies and enterprise mobility, along with the increasing trend of bring-your-own-device (BYOD) policies in enterprises. As more businesses shift to cloud-based and mobile environments, the need for robust security solutions like MFA becomes essential. Furthermore, the emergence of authentication-as-a-service solutions, which offer advanced security and user authentication capabilities, is anticipated to further propel the growth of the MFA market.

Despite the promising growth trajectory, high costs and implementation complexities present challenges to the MFA market. However, these barriers are expected to diminish as technology evolves. With the rising incidence of data breaches, many industries are establishing stricter data security standards, prompting organizations to adopt MFA solutions. Implementing MFA is often complex, especially in diverse IT environments, and requires significant capital for procurement, setup, maintenance, and management.

Gather more insights about the market drivers, restrains and growth of the Multi-factor Authentication Market

Regional Insights:

North America Multi-factor Authentication Market Trends

North America is also expected to experience substantial growth in the MFA market over the forecast period. Key drivers in this region include advancements in technology, the widespread adoption of smartphones, improved network connectivity, and high uptake of digital services. The region has also seen a rise in cyberattacks, which has intensified the need for MFA solutions. North America’s growth is further supported by the presence of major technology providers, including CA Technologies, Symantec Corporation, Vasco Data Security International, Inc., and RSA Security LLC, which are expected to bolster market momentum.

Asia Pacific Multi-factor Authentication Market Trends

In 2022, the Asia Pacific region held the largest revenue share of 30.3% in the MFA market and is expected to achieve the fastest growth, with a projected CAGR of 15.4% over the forecast period. This growth is driven by increased spending on connected devices, significant investments in cloud and Internet of Things (IoT) technologies, and a growing demand for digital services. There is also a heightened focus on data security and transaction authentication, alongside stricter regulatory compliance, which is accelerating MFA adoption in the region.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

The global BFSI contact center analytics market size was valued at USD 458.2 million in 2024 and is projected to grow at a CAGR of 19.1% from 2025 to 2030.

The global travel insurance market size was estimated at USD 27.05 billion in 2024 and is projected to grow at a CAGR of 15.4% from 2025 to 2030.

Key Companies & Market Share Insights:

Leading companies in the MFA market are pursuing both organic and inorganic strategies, such as new product launches, acquisitions, and collaborations, to strengthen their global presence and market share. For example, in February 2023, Microsoft introduced a “Number Matching” feature in its Authenticator app to mitigate MFA fatigue attacks. These attacks involve hackers using social engineering tactics to repeatedly prompt authentication requests in an attempt to wear down the user and gain unauthorized account access. Microsoft enabled this new feature for Microsoft Azure users starting in May 2023, adding an extra layer of security against such tactics.

By innovating and enhancing their products, companies in the MFA industry aim to provide more resilient and user-friendly solutions, which are critical for sustaining long-term market growth in an increasingly digitalized world.

Key Multi-factor Authentication Companies:

Vasco Data Security International, Inc.

RSA Security LLC

Fujitsu America, Inc.

NEC Corporation

Symantec Corporation

Thales

3M

aPersona, Inc.

CA Technologies.

Safran S.A.

Order a free sample PDF of the Multi-factor Authentication Market Intelligence Study, published by Grand View Research.

0 notes

Text

Multi-factor Authentication Industry 2030 Size Outlook, Growth Insight, Share, Trends

The global multi-factor authentication (MFA) market was valued at USD 14.28 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 14.2% from 2023 to 2030. Multi-factor authentication strengthens security by adding multiple verification layers to authenticate user identity and secure online transactions. This increased security is crucial in today’s landscape, where organizations face escalating cyberattacks and data breaches. The rising frequency of such breaches, coupled with stricter regulatory requirements for safeguarding sensitive data, is expected to significantly drive MFA market growth.

Additional factors driving the adoption of MFA solutions include growing investments in cloud technologies and enterprise mobility, along with the increasing trend of bring-your-own-device (BYOD) policies in enterprises. As more businesses shift to cloud-based and mobile environments, the need for robust security solutions like MFA becomes essential. Furthermore, the emergence of authentication-as-a-service solutions, which offer advanced security and user authentication capabilities, is anticipated to further propel the growth of the MFA market.

Despite the promising growth trajectory, high costs and implementation complexities present challenges to the MFA market. However, these barriers are expected to diminish as technology evolves. With the rising incidence of data breaches, many industries are establishing stricter data security standards, prompting organizations to adopt MFA solutions. Implementing MFA is often complex, especially in diverse IT environments, and requires significant capital for procurement, setup, maintenance, and management.

Gather more insights about the market drivers, restrains and growth of the Multi-factor Authentication Market

Regional Insights:

North America Multi-factor Authentication Market Trends

North America is also expected to experience substantial growth in the MFA market over the forecast period. Key drivers in this region include advancements in technology, the widespread adoption of smartphones, improved network connectivity, and high uptake of digital services. The region has also seen a rise in cyberattacks, which has intensified the need for MFA solutions. North America’s growth is further supported by the presence of major technology providers, including CA Technologies, Symantec Corporation, Vasco Data Security International, Inc., and RSA Security LLC, which are expected to bolster market momentum.

Asia Pacific Multi-factor Authentication Market Trends

In 2022, the Asia Pacific region held the largest revenue share of 30.3% in the MFA market and is expected to achieve the fastest growth, with a projected CAGR of 15.4% over the forecast period. This growth is driven by increased spending on connected devices, significant investments in cloud and Internet of Things (IoT) technologies, and a growing demand for digital services. There is also a heightened focus on data security and transaction authentication, alongside stricter regulatory compliance, which is accelerating MFA adoption in the region.

Browse through Grand View Research's Category Next Generation Technologies Industry Research Reports.

The global BFSI contact center analytics market size was valued at USD 458.2 million in 2024 and is projected to grow at a CAGR of 19.1% from 2025 to 2030.

The global travel insurance market size was estimated at USD 27.05 billion in 2024 and is projected to grow at a CAGR of 15.4% from 2025 to 2030.

Key Companies & Market Share Insights:

Leading companies in the MFA market are pursuing both organic and inorganic strategies, such as new product launches, acquisitions, and collaborations, to strengthen their global presence and market share. For example, in February 2023, Microsoft introduced a “Number Matching” feature in its Authenticator app to mitigate MFA fatigue attacks. These attacks involve hackers using social engineering tactics to repeatedly prompt authentication requests in an attempt to wear down the user and gain unauthorized account access. Microsoft enabled this new feature for Microsoft Azure users starting in May 2023, adding an extra layer of security against such tactics.

By innovating and enhancing their products, companies in the MFA industry aim to provide more resilient and user-friendly solutions, which are critical for sustaining long-term market growth in an increasingly digitalized world.

Key Multi-factor Authentication Companies:

Vasco Data Security International, Inc.

RSA Security LLC

Fujitsu America, Inc.

NEC Corporation

Symantec Corporation

Thales

3M

aPersona, Inc.

CA Technologies.

Safran S.A.

Order a free sample PDF of the Multi-factor Authentication Market Intelligence Study, published by Grand View Research.

0 notes

Text

Multi-factor Authentication Market Insights and Trends Report by 2030

The global multi-factor authentication (MFA) market was valued at approximately USD 14.28 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 14.2% from 2023 to 2030. Multi-factor authentication is a security protocol that requires users to verify their identity through multiple layers of verification before granting access to digital resources or allowing transactions. This method enhances security by combining something the user knows (like a password), something the user has (such as a smartphone or security token), and sometimes even something the user is (like a fingerprint or facial recognition). With the rise in cyberattacks and data breaches targeting sensitive information, the adoption of MFA solutions is becoming essential for organizations across all sectors. Strict regulatory requirements for data protection are also propelling the MFA market, as more industries are required to comply with data privacy standards and implement stronger authentication measures to secure customer information.

Gather more insights about the market drivers, restrains and growth of the Multi-factor Authentication Market

The rapid shift toward cloud technologies, enterprise mobility, and the "bring your own device" (BYOD) trend across workplaces are increasing the demand for MFA solutions. These trends introduce additional vulnerabilities that require stringent access control to secure corporate networks and data. The emergence of authentication-as-a-service (AaaS) platforms, which provide businesses with scalable, cloud-based MFA solutions, is also driving growth in the MFA market, offering flexible, advanced authentication options that can be integrated with existing IT infrastructures.

Several leading technology companies, including CA Technologies, Vasco Data Security International, RSA Security LLC, and Symantec Corporation, are heavily investing in research and development to create new authentication solutions that improve security while enhancing user experience. Despite this growth, challenges remain. The costs associated with procuring, implementing, and managing MFA solutions, as well as the complexity of integrating them into varied IT environments, can be barriers to adoption. However, as cyber threats continue to evolve, more industries are implementing security standards that necessitate MFA, reducing the impact of these challenges over time.

Application Segmentation Insights:

Multi-factor authentication plays a critical role in enabling secure access control, preventing unauthorized transactions, and detecting fraudulent activities. Different sectors are adopting MFA to address specific security needs. The banking, financial services, and insurance (BFSI) sector has the highest adoption rate for MFA solutions. In 2022, BFSI accounted for the largest revenue share at 33.7% and is expected to continue growing at a rapid pace with a forecasted CAGR of 15.6%. Financial institutions handle high volumes of sensitive financial data, making them attractive targets for cyberattacks. To protect customer accounts, transaction data, and personal information, these institutions are implementing MFA as an essential security measure. Moreover, customers increasingly expect secure and seamless online banking experiences, which has led financial organizations to prioritize robust authentication methods that ensure security without compromising user convenience.

The healthcare sector is anticipated to be one of the fastest-growing markets for MFA solutions over the forecast period. With the rise of digital health records and online patient portals, securing sensitive patient data has become a top priority, driving healthcare providers to adopt MFA for safeguarding access to medical information and ensuring compliance with health data regulations. Similarly, the government and defense sectors are rapidly adopting MFA due to the critical nature of the data they handle, especially with the increasing digitalization of public services and the growing need for cybersecurity.

The retail and e-commerce sector is also set to experience substantial growth in the MFA market, with a projected CAGR of 15.5%. As e-commerce continues to grow in popularity, retailers are facing an increasing number of cyber threats, including identity theft and payment fraud. Multi-factor authentication helps mitigate these risks by adding extra layers of protection for sensitive data, such as payment and personal information. As consumers become more aware of security issues, they expect secure authentication options when shopping online, motivating retailers to adopt MFA solutions that build customer trust and protect transaction integrity.

Technological advancements in scanning technologies, mobile-based authentication, and biometrics have led to innovative MFA solutions that meet diverse security needs. Sectors like education, utilities, manufacturing, and logistics are also increasingly integrating MFA to secure access to corporate networks and safeguard proprietary and confidential information. These industries are leveraging MFA to protect both employee and customer data, ensuring a secure digital environment as they continue to adopt cloud computing and other digital solutions.

Order a free sample PDF of the Multi-factor Authentication Market Intelligence Study, published by Grand View Research.

0 notes

Text

Multi-factor Authentication Market - Latest Innovations by Industry Experts Till 2030

The global multi-factor authentication (MFA) market was valued at approximately USD 14.28 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 14.2% from 2023 to 2030. Multi-factor authentication is a security protocol that requires users to verify their identity through multiple layers of verification before granting access to digital resources or allowing transactions. This method enhances security by combining something the user knows (like a password), something the user has (such as a smartphone or security token), and sometimes even something the user is (like a fingerprint or facial recognition). With the rise in cyberattacks and data breaches targeting sensitive information, the adoption of MFA solutions is becoming essential for organizations across all sectors. Strict regulatory requirements for data protection are also propelling the MFA market, as more industries are required to comply with data privacy standards and implement stronger authentication measures to secure customer information.

Gather more insights about the market drivers, restrains and growth of the Multi-factor Authentication Market

The rapid shift toward cloud technologies, enterprise mobility, and the "bring your own device" (BYOD) trend across workplaces are increasing the demand for MFA solutions. These trends introduce additional vulnerabilities that require stringent access control to secure corporate networks and data. The emergence of authentication-as-a-service (AaaS) platforms, which provide businesses with scalable, cloud-based MFA solutions, is also driving growth in the MFA market, offering flexible, advanced authentication options that can be integrated with existing IT infrastructures.

Several leading technology companies, including CA Technologies, Vasco Data Security International, RSA Security LLC, and Symantec Corporation, are heavily investing in research and development to create new authentication solutions that improve security while enhancing user experience. Despite this growth, challenges remain. The costs associated with procuring, implementing, and managing MFA solutions, as well as the complexity of integrating them into varied IT environments, can be barriers to adoption. However, as cyber threats continue to evolve, more industries are implementing security standards that necessitate MFA, reducing the impact of these challenges over time.

Application Segmentation Insights:

Multi-factor authentication plays a critical role in enabling secure access control, preventing unauthorized transactions, and detecting fraudulent activities. Different sectors are adopting MFA to address specific security needs. The banking, financial services, and insurance (BFSI) sector has the highest adoption rate for MFA solutions. In 2022, BFSI accounted for the largest revenue share at 33.7% and is expected to continue growing at a rapid pace with a forecasted CAGR of 15.6%. Financial institutions handle high volumes of sensitive financial data, making them attractive targets for cyberattacks. To protect customer accounts, transaction data, and personal information, these institutions are implementing MFA as an essential security measure. Moreover, customers increasingly expect secure and seamless online banking experiences, which has led financial organizations to prioritize robust authentication methods that ensure security without compromising user convenience.

The healthcare sector is anticipated to be one of the fastest-growing markets for MFA solutions over the forecast period. With the rise of digital health records and online patient portals, securing sensitive patient data has become a top priority, driving healthcare providers to adopt MFA for safeguarding access to medical information and ensuring compliance with health data regulations. Similarly, the government and defense sectors are rapidly adopting MFA due to the critical nature of the data they handle, especially with the increasing digitalization of public services and the growing need for cybersecurity.

The retail and e-commerce sector is also set to experience substantial growth in the MFA market, with a projected CAGR of 15.5%. As e-commerce continues to grow in popularity, retailers are facing an increasing number of cyber threats, including identity theft and payment fraud. Multi-factor authentication helps mitigate these risks by adding extra layers of protection for sensitive data, such as payment and personal information. As consumers become more aware of security issues, they expect secure authentication options when shopping online, motivating retailers to adopt MFA solutions that build customer trust and protect transaction integrity.

Technological advancements in scanning technologies, mobile-based authentication, and biometrics have led to innovative MFA solutions that meet diverse security needs. Sectors like education, utilities, manufacturing, and logistics are also increasingly integrating MFA to secure access to corporate networks and safeguard proprietary and confidential information. These industries are leveraging MFA to protect both employee and customer data, ensuring a secure digital environment as they continue to adopt cloud computing and other digital solutions.

Order a free sample PDF of the Multi-factor Authentication Market Intelligence Study, published by Grand View Research.

0 notes

Text

Multi-Factor Authentication Market Share, Growth Analysis Top Leading Players, 2030

The global multi-factor authentication market size was valued at USD 14.28 billion in 2022 and is expected to grow at a compound annual growth rate CAGR of 14.2% from 2023 to 2030.

Multi-factor authentication (MFA) introduces additional layers of security to authenticate the user identity and secure transactions over the Internet. One of the key trends escalating market growth is the mounting cases of cyberattacks and data breaches across organizations. It coupled with increasing stringency in regulations to protect sensitive data, it is expected to bolster the growth of the MFA market.

Rising investments in cloud technologies, enterprise mobility, and increasing adoption of BYOD across enterprises are anticipated to boost the adoption of multi-factor authentication solutions further. The advent of authentication-as-a-service solutions, which offer advanced security and authentication to organizations, is also projected to bolster the market's growth.

Companies such as CA Technologies, Vasco Data Security International, Inc., RSA Security LLC, and Symantec Corporation are making significant R&D investments to develop new authentication products, solutions, and services.

Cost and implementation complexities will restrain the market; however, their impact will decrease with time. With the rise in data and security breaches, most industries have launched data security standards. To address security breaches and cyber-attacks, enterprises have adopted MFA solutions. These solution implementations are complex and, at the same time, require more capital investment for procurement, implementation, maintenance, and management. Heterogeneous IT environments across industries further increase the complexity.

Gather more insights about the market drivers, restrains and growth of the Multi-Factor Authentication Market

Multi-factor Authentication Market Report Highlights

• North America and Europe were the key revenue contributors in 2022. The key factors contributing to the growth of the regions are advanced infrastructure and accelerated adoption of smart devices

• The two factor authentication model will continue to dominate the market until 2030, representing more than 76.6% of the overall revenue.

• The four factor authentication model is anticipated to exhibit the highest CAGR of close to 18.6% over the forecast period

• The BFSI sector will be the most prominent application segment during the forecast period, followed by retail and e-commerce.

• The Asia Pacific market is estimated to post a CAGR of about 15.4% over the forecast period

• Increasing investments in cloud technologies, BYOD, and mobility solutions are poised to provide a fillip to the multi-factor authentication market.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global IoT in utilities market size was estimated at USD 47.53 billion in 2023 and is expected to grow at a CAGR of 10.7% from 2024 to 2030.

• The global robotic platform market size was estimated at USD 9.97 billion in 2023 and is projected to grow at a CAGR of 5.9% from 2024 to 2030.

Multi-factor Authentication Market Segmentation

Grand View Research has segmented the global multi-factor authentication market based on model, application, and region:

Multi-factor Authentication Model Outlook (Revenue, USD Million, 2017 - 2030)

• Two Factor Authentication

• Three Factor Authentication

• Four Factor Authentication

• Five Factor Authentication

Multi-factor Authentication Application Outlook (Revenue, USD Million, 2017 - 2030)

• BFSI

• Government & Defense

• Healthcare

• Travel & Immigration

• Retail & E-commerce

• Others

Multi-factor Authentication Regional Outlook (Revenue, USD Million, 2017 - 2030)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

• Asia Pacific

o China

o Japan

o India

o Australia

o South Korea

• Latin America

o Brazil

o Mexico

• Middle East and Africa

o Saudi Arabia

o South Africa

o UAE

Order a free sample PDF of the Multi-Factor Authentication Market Intelligence Study, published by Grand View Research.

#Multi-Factor Authentication Market#Multi-Factor Authentication Market size#Multi-Factor Authentication Market share#Multi-Factor Authentication Market analysis#Multi-Factor Authentication Industry

0 notes

Text

Multi-Factor Authentication Market Adoption Rates And Consumer Insights

Multi-Factor Authentication Industry Overview

The global multi-factor authentication market size was valued at USD 14.28 billion in 2022 and is expected to grow at a compound annual growth rate CAGR of 14.2% from 2023 to 2030. Multi-factor authentication (MFA) introduces additional layers of security to authenticate the user identity and secure transactions over the Internet. One of the key trends escalating market growth is the mounting cases of cyberattacks and data breaches across organizations. It coupled with increasing stringency in regulations to protect sensitive data, it is expected to bolster the growth of the MFA market.

Gather more insights about the market drivers, restrains and growth of the Multi-Factor Authentication Market

Rising investments in cloud technologies, enterprise mobility, and increasing adoption of BYOD across enterprises are anticipated to boost the adoption of multi-factor authentication solutions further. The advent of authentication-as-a-service solutions, which offer advanced security and authentication to organizations, is also projected to bolster the market's growth.

Companies such as CA Technologies, Vasco Data Security International, Inc., RSA Security LLC, and Symantec Corporation are making significant R&D investments to develop new authentication products, solutions, and services.

Cost and implementation complexities will restrain the market; however, their impact will decrease with time. With the rise in data and security breaches, most industries have launched data security standards. To address security breaches and cyber-attacks, enterprises have adopted MFA solutions. These solution implementations are complex and, at the same time, require more capital investment for procurement, implementation, maintenance, and management. Heterogeneous IT environments across industries further increase the complexity.

The overall investment for implementing MFA is estimated to be high due to increased support services, training, SMS gateway, and hardware and software tokens. The requirement of additional drivers for physical authenticators and interoperability with varying IT environments increase the complexity of deployment. Hence, issues pertaining to the procurement cost and implementation complexity are poised to limit the widespread adoption of multi-factor authentication solutions.

Browse through Grand View Research's Next Generation Technologies Industry Research Reports.

• The global unmanned traffic management market size was estimated at USD 164.1 million in 2023 and is projected to grow at a CAGR of 34.0% from 2024 to 2030. The growing adoption of drones in various sectors, such as agriculture, logistics, and emergency services, has created a need for effective unmanned traffic management (UTM) systems, thereby driving market growth.

• The global IT operations management software market size was estimated at USD 50.72 billion in 2023 and is projected to grow at a CAGR of 10.9% from 2024 to 2030,driven by the digital transformation across industries and the adoption of cloud and hybrid IT environments.

Multi-Factor Authentication Market Segmentation

Grand View Research has segmented the global multi-factor authentication market based on model, application, and region:

Multi-factor Authentication Model Outlook (Revenue, USD Million, 2017 - 2030) • Two Factor Authentication • Three Factor Authentication • Four Factor Authentication • Five Factor Authentication

Multi-factor Authentication Application Outlook (Revenue, USD Million, 2017 - 2030) • BFSI • Government & Defense • Healthcare • Travel & Immigration • Retail & E-commerce • Others

Multi-factor Authentication Regional Outlook (Revenue, USD Million, 2017 - 2030) • North America o U.S. o Canada • Europe o UK o Germany o France • Asia Pacific o China o Japan o India o Australia o South Korea • Latin America o Brazil o Mexico • Middle East and Africa o Saudi Arabia o South Africa o UAE

Order a free sample PDF of the Multi-Factor Authentication Market Intelligence Study, published by Grand View Research.

Key Companies profiled: • Vasco Data Security International, Inc. • RSA Security LLC • Fujitsu America, Inc. • NEC Corporation • Symantec Corporation • Thales • 3M • aPersona, Inc. • CA Technologies. • Safran S.A.

Recent Developments

• In April 2023, Thales, a leading global technology and security solutions provider, unveiled the SafeNet Token Fusion series. This innovative collection of USB tokens combines Fast IDentity Online 2.0 (FIDO2) with PKI/CBA, creating a single authenticator. The primary objective of Thales's new tokens was to safeguard Microsoft Azure Active Directory (Azure AD) users by mitigating the risk of account compromise by delivering enhanced security for accessing cloud and web applications.

• In April 2022, Trust Stamp unveiled a Biometric Multi-Factor Authentication (Biometric MFA) solution. This innovative system revolutionizes identity verification by automating a strong level of assurance through a simple selfie. By leveraging biometric technology, the Biometric MFA adds two additional layers of authentication to verify the user's liveliness and secure tokenizing data from the selfie.

• In March 2022, MIRACL, a cybersecurity software firm and Aware Inc., an authentication company, announced a strategic partnership to continue their cloud-based biometric authentication technology. The collaboration aims to address common challenges in business authentication by leveraging MIRACL's single-step, secure multi-factor authentication technology and Aware's recognized expertise in biometrics.

• In May 2021, Microsoft announced the launch of new products, guidance, and employee plans to enhance security and provide enhanced customer support. Additionally, Microsoft revealed its commitment to adopting a zero-trust approach, ensuring that its employees embrace this security framework.

• In April 2021, HID Global made its WorkforceID Authentication solution available to the public, offering enterprises a cloud-based platform for issuing, managing, and utilizing digital identity credentials for physical and logical access control. This solution enables organizations to streamline and enhance the security of user logins across all applications within their enterprise environment.

• In July 2020, Ping Identity announced a collaboration with One Identity, a leading provider of security solutions centered around identity. This partnership aimed to deliver comprehensive identity management strategies and enhance access security and control. Both companies offered a powerful solution that covers consumers' end-to-end identity management needs by combining the capabilities of Ping Identity's access management technology with One Identity's Identity Governance and Administration (IGA) technology.

0 notes