#llp company registration in bangalore

Text

Top Advantages of Choosing LLP for Your Business

In today's competitive business environment, entrepreneurs are constantly searching for the ideal business structure that offers flexibility, legal protection, and operational efficiency. One such structure that has gained immense popularity is Llp Company Registration In Bangalore. Offering the best of both worlds the limited liability of a company and the operational flexibility of a partnership LLP has become the go-to choice for many business owners.

1. Limited Liability Protection

The most significant advantage of an LLP is its limited liability feature. In a traditional partnership, the partners' personal assets are at risk in case of business losses or legal issues. However, in an LLP, the liability of each partner is limited to the amount they have contributed to the business. This means personal assets are protected, and partners aren't held personally responsible for the debts or obligations of the firm beyond their capital investment.

This feature provides peace of mind to entrepreneurs, as they are protected from personal bankruptcy or legal consequences if the business faces financial difficulties or legal disputes. It also encourages people to start businesses without the fear of personal financial ruin.

2. Operational Flexibility

One of the standout advantages of LLPs is their flexibility. Unlike corporations, where shareholders have little say in the day-to-day operations, an LLP allows its partners to manage the business directly. The operational structure can be customized based on the partners’ agreement, offering flexibility in management roles, profit-sharing, and decision-making authority. This is a key advantage, especially for small and medium enterprises where founders want hands-on control over their business without the rigid governance structures of a corporation.

Additionally, an LLP does not require board meetings, resolutions, or exhaustive compliance protocols as in the case of private limited companies. This reduces the operational burden on business owners, allowing them to focus on growing the business.

3. No Minimum Capital Requirement

In some forms of business entities, such as private limited companies, there is a minimum capital requirement to start the business. However, an LLP offers the advantage of having no minimum capital requirement. Whether a business is launched with a small or large investment, the flexibility in capital contribution makes it easier for entrepreneurs to kickstart their ventures.

This characteristic is particularly beneficial for startups and small businesses that may not have significant initial funding but wish to enjoy the benefits of a registered business entity.

4. Separate Legal Entity

This means that the LLP itself can own assets, incur liabilities, enter contracts, and sue or be sued in its name. This offers added protection to the partners as the business activities are legally distinct from personal affairs.

5. Tax Benefits

One of the most attractive advantages of an LLP is its tax efficiency. In India, LLPs are taxed at a flat rate of 30%, which is lower compared to corporations that may face additional taxes such as dividend distribution tax. Moreover, there is no dividend tax on the profits distributed among the partners in an LLP, whereas in a corporation, dividends paid to shareholders are subject to additional taxation.

6. Reduced Compliance Requirements

LLPs enjoy significantly fewer compliance requirements compared to other business structures such as private limited companies or corporations. While LLPs are required to file annual returns, maintain financial records, and undergo audits (only if turnover exceeds a certain threshold), the overall compliance burden is lighter. For instance, LLPs are not subject to the requirement of holding annual general meetings (AGMs) or filing resolutions with the registrar for every decision, unlike corporations.

7. Perpetual Succession

Unlike a traditional partnership, where the partnership dissolves upon the death or insolvency of a partner, an LLP enjoys perpetual succession. This means that the LLP continues to exist irrespective of changes in the composition of its partners. The business is unaffected by events like a partner leaving, passing away, or declaring bankruptcy.

8. Attracting Investors

For businesses looking to attract external funding, the LLP structure offers a credible and flexible platform. LLPs are seen as more formal and reliable compared to sole proprietorships or traditional partnerships, which may not inspire confidence in investors. Since LLPs are separate legal entities, external investors can invest without becoming personally liable for the business's liabilities, making the business more attractive for angel investors, venture capitalists, and even private equity.

9. International Flexibility

For businesses with global aspirations, the LLP structure is internationally recognized and respected. Many countries, including the U.S., the UK, and Australia, have provisions for LLPs, making cross-border partnerships and collaborations more streamlined. International clients, vendors, and partners are likely to feel more comfortable doing business with an LLP,

LLPs are also eligible to engage in foreign investments, facilitating the expansion of Indian businesses abroad or foreign businesses in India. The regulatory framework surrounding LLPs is conducive to international trade and collaboration.

10. Easy Dissolution

If a business reaches a point where it is no longer viable, dissolving an LLP is relatively straightforward compared to other business entities. While it requires due legal processes, the partners can agree to dissolve the LLP and wind up its affairs without extensive legal complications. This flexibility is valuable for entrepreneurs who may wish to pivot to new ventures or exit a business without getting entangled in prolonged closure procedures.

Conclusion

the Llp Company Registration In Bangalore structure offers a unique blend of limited liability, operational flexibility, and tax benefits, making it an ideal choice for businesses of all sizes. It combines the advantages of a corporate entity with the simplicity of a partnership, giving entrepreneurs the freedom to operate efficiently while enjoying legal and financial protection. Whether you're a startup, a growing small business, or an established firm, opting for an LLP can offer long-term benefits that promote growth, innovation, and stability.

0 notes

Text

Streamlining Private Limited and LLP Company Registration Services in Bangalore with Kros Chek

Establishing a business in Bangalore, one of India's bustling metropolises, requires navigating through various legal and administrative procedures. Among the most crucial steps is company registration, whether it's a Private Limited Company or a Limited Liability Partnership (LLP). To ensure a smooth and compliant registration process, businesses in Bangalore often rely on expert guidance from firms like Kros Chek.

Private Limited Company Registration in Bangalore

Private Limited Company registration in Bangalore is a preferred choice for many entrepreneurs due to its distinct advantages, including limited liability, separate legal entity status, and ease of raising funds. Kros Chek, a prominent firm specializing in Pvt Ltd company registration in Bangalore, offers comprehensive services tailored to meet the specific needs of businesses.

Why Choose Kros Chek for Pvt Ltd Company Registration in Bangalore?

1. Expertise: With years of experience in the industry, Kros Chek boasts a team of skilled professionals well-versed in the nuances of Pvt Ltd company registration in Bangalore. They provide expert guidance at every step of the registration process.

2. Tailored Solutions: Understanding that every business is unique, Kros Chek offers personalized solutions to ensure that Pvt Ltd company registration in HSR Layout, Bangalore, and other areas meets the specific requirements of each client.

3. Compliance Assurance: Ensuring compliance with all legal and regulatory requirements is paramount during Pvt Ltd company registration. Kros Chek meticulously handles all documentation and formalities, guaranteeing adherence to the law.

LLP Company Registration Services in Bangalore

For businesses seeking a flexible and less cumbersome structure, LLP registration in Bangalore is an excellent option. An LLP combines the benefits of a partnership with the advantages of a limited liability entity, making it an attractive choice for many entrepreneurs. Kros Chek extends its expertise to LLP company registration services in Bangalore, assisting businesses in navigating through the process effortlessly.

Benefits of Choosing Kros Chek for LLP Company Registration in Bangalore

1. Seamless Process: LLP registration involves several steps, including drafting the LLP agreement, obtaining Digital Signatures, and filing necessary documents with the Registrar of Companies (ROC). Kros Chek simplifies the entire process, ensuring a hassle-free experience for clients.

2. Expert Guidance: From choosing a suitable name for the LLP to obtaining the Certificate of Incorporation, Kros Chek's team provides expert guidance and assistance, ensuring that clients are well-informed throughout the registration process.

3. Post-Registration Support: Kros Chek goes beyond LLP company registration services in Bangalore by offering comprehensive post-registration support. This includes assistance with obtaining PAN, TAN, and GST registrations, ensuring that clients are fully compliant with regulatory requirements.

In conclusion, whether you're looking to register a Private Limited Company or an LLP in Bangalore, Kros Chek is your trusted partner for seamless and compliant registration services. With their expertise in Pvt Ltd company registration in Bangalore and LLP company registration services in Bangalore, Kros Chek simplifies the process, allowing businesses to focus on their growth and success. Choose Kros Chek for reliable and efficient company registration services in Bangalore, and embark on your entrepreneurial journey with confidence.

More information:

365 Shared Space, 2nd Floor,#153, Sector 5,

1st Block Koramangala, HSR Layout,

Bengaluru, Karnataka 560102

Phone : +91-9880706841

Email : [email protected]

#privatelimitedcompanyregistrationinbangalore#llp company registration services in bangalore#llp company registration in bangalore#TaxConsultantsinBangalore

0 notes

Text

https://adca.in/blog/difference-between-llp-and-pvt-ltd

What is the difference between an LLP and a Pvt Ltd?

Entrepreneurs starting a new business are curious about the difference between an LLP and Pvt Ltd Read on to learn how these entities differ starkly in various aspects

#adca#ca firms in bangalore#chartered accountants in bangalore#llp registration#pvt ltd company registration

0 notes

Text

LLP Registration in India — Online Procedure, Documents Required, Cost

Limited Liability Partnership, commonly known as “LLP”, is a newer form of business in India with limited liability benefits of a private limited company and the flexibility of a partnership firm. The concept of the LLP was introduced in India in 2008 and is regulated by the Limited Liability Partnership Act, 2008.

The maintenance cost and compliances are less in LLP; hence, it has become a preferred form of business organization among entrepreneurs. This form of business structure is ideal for small and medium-sized businesses.

Benefits of LLP Registration

Separate legal entity

Limited liability

Lower cost

No minimum capital required

Minimal compliances

Checklist for LLP registration

Minimum two partners

At least one partner should be a resident of India

DSC for all designated partners

DPIN for all designated partners

Unique name of the LLP that is not similar to any existing LLP or company or trademark

Capital contribution by the partners of LLP

LLP agreement between the partners

Address proof for the office of LLP

Documents required for LLP registration

Documents of both the partners and LLP have to be submitted for incorporating a Limited Liability Partnership:

—Documents of partners

ID proof of partners

Address proof of partners

Residence proof of partners

Passport size photograph

Passport (in case of foreign nationals / NRI)

—Documents of LLP

Proof of registered office address

Digital Signature Certificate

Documents you’ll get after LLP incorporation

To know more (click here)

#llp registration#nidhi company registration#limited liability company#private limited company registration online#private limited company registration in bangalore#private limited company registration in chennai#partnership firm registration#firm#organisation#india

0 notes

Link

Read more...

#llp registration in coimbatore#opc registration in chennai#public limited company registration in bangalore

0 notes

Photo

Le Intelligensia offers the best services for LLP Registration in Bangalore. We provide an quick process to register the LLP. Check What are the steps and requirements for LLP Registration and Get your limited liability partnership easily.

#llp registration#company registration#llp registration in bangalore#company registration in bangalore#limited liability partnership registration

0 notes

Text

Documents Needed for LLP Registration Bangalore

Steps to Register LLP in Bangalore

Introduction:

A Limited Liability Partnership (LLP) is a famous business structure that combines the benefits of a partnership and a corporation. LLP Registration in Bangalore follows a set process mandated by the Ministry of Corporate Affairs (MCA). LLPs offer limited liability protection to their partners while allowing flexibility in management and taxation benefits.

How do you apply for LLP Registration in Bangalore?

To apply for LLP registration in Bangalore, you need to follow these steps:

1. Obtain a Digital Signature Certificate (DSC): At least two designated partners must obtain a DSC, as all the documents for LLP registration are filed online and require digital signatures.

2. Obtain Director Identification Number (DIN): Each designated partner needs to obtain a DIN from the Ministry of Corporate Affairs (MCA). It can be done by filing Form DIR-3 online.

3. Name Reservation: Choose a unique name for your LLP and check its availability on the MCA website. You can file Form 1 for name reservation along with the required fee.

4. Prepare Documents: Prepare the necessary documents, including LLP agreement, consent of partners, address proof, identity proof, and other required documents.

5. File Form FiLLiP: This form incorporates a Limited Liability Partnership (LLP). It must be filed online with the Registrar of Companies (RoC) along with the required documents and fees.

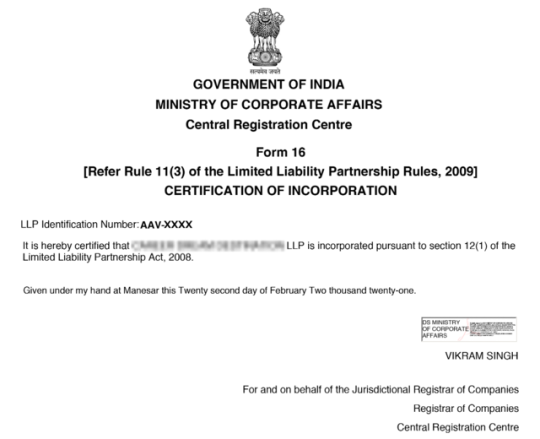

6. Certificate of Incorporation: After verifying the documents and satisfying all requirements, the Registrar of Companies will issue the Certificate of Incorporation.

7. LLP Agreement: Once the Certificate of Incorporation is received, an LLP agreement must be drafted. This agreement defines the partners' roles, responsibilities, and rights. It should be filed using Form 3 within 30 days of incorporation.

8. PAN and TAN: After obtaining the Certificate of Incorporation, apply for PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number) for the LLP.

9. Compliance: Ensure compliance with all regulatory requirements, such as GST registration and obtaining necessary licenses.

10. Post-Incorporation Formalities: Complete any other post-incorporation formalities that may be required based on your business activities.

It is advisable to seek professional assistance from a chartered accountant or a company secretary to ensure a smooth LLP registration process and compliance with all legal requirements.

Conclusion:

Limited Liability Partnership (LLP) registration in Bangalore follows a structured process mandated by the Ministry of Corporate Affairs (MCA), similar to the rest of India. LLPs provide partners with limited liability protection, flexibility in management, and tax advantages. To initiate LLP registration in Bangalore, one must diligently adhere to the outlined steps, which include obtaining necessary certificates, filing relevant forms, drafting agreements, and ensuring compliance with regulatory obligations. Seeking professional guidance from experts such as chartered accountants or company secretaries is recommended to navigate the complexities of the registration process and ensure adherence to legal requirements. By following these steps and seeking appropriate assistance, businesses can establish LLPs effectively in Bangalore and benefit from this business structure.

0 notes

Text

Step-by-Step Guide to Registering an LLP in Bangalore

Introduction

LLP Registration in Bangalore is a structured process that combines the benefits of both a partnership and a corporation. This guide provides a comprehensive overview of the steps involved in registering an LLP in Bangalore, including the necessary documentation, costs, and timelines.

Understanding LLP

A Limited Liability Partnership (LLP) is a business structure that protects individual partners from personal liability for the partnership's debts. This means that each partner's liability is limited to their investment in the LLP, making it an attractive option for many entrepreneurs. LLPs are governed by the Limited Liability Partnership Act 2008 and are registered with the Ministry of Corporate Affairs (MCA).LLP Registration for NRI and Foreign Nationals

Benefits of LLP

Limited Liability: Protects personal assets from business liabilities.

Flexibility: Combines features of partnerships and corporations.

No Minimum Capital Requirement: Partners can contribute capital in various forms.

Easy Compliance: Less stringent regulatory requirements compared to private limited companies.

Prerequisites for LLP Registration

Before starting the registration process, ensure you have the following:

Minimum Two Partners: An LLP must have at least two designated partners, one of whom must be an Indian resident.

Digital Signature Certificate (DSC): Required for signing electronic documents.

Designated Partner Identification Number (DPIN): Unique identification for each designated partner.

Registered Office Address: A valid address for official correspondence.

Step-by-Step Registration Process

Step 1: Obtain a Digital Signature Certificate (DSC)

The first step is to apply for a Digital Signature Certificate for all designated partners. The DSC is essential for signing various forms electronically. You can obtain a DSC from government-recognized agencies and can choose between Class 2 or Class 3 certificates.

Step 2: Apply for a Designated Partner Identification Number (DPIN)

Next, each designated partner must apply for a DPIN using Form DIR-3. This form requires submission of identity proof (like Aadhaar or PAN) and must be digitally signed by existing partners. The DPIN is crucial for compliance with all future filings.

Step 3: Name Reservation

To reserve your LLP name, file the LLP-RUN (Reserve Unique Name) application through the MCA portal. It’s advisable to conduct a name search on the MCA website to ensure your desired name is unique and complies with naming regulations. You can propose two names; if rejected, you can resubmit within 15 days.

Step 4: Drafting the LLP Agreement

The LLP agreement outlines the rights, duties, and obligations of partners. All partners must sign it, and details such as profit-sharing ratios, responsibilities, and management structures should be included. This agreement is crucial as it governs the internal workings of the LLP.

Step 5: Filing Incorporation Documents

Submit the incorporation documents to the Registrar of Companies (ROC). The key documents include:

LLP Agreement

Form 2 (Incorporation Document)

Identity and Address Proof of Partners

Proof of Registered Office Address (like a utility bill or rental agreement)

Ensure all documents are signed digitally using DSC.

Step 6: Certificate of Incorporation

Upon successful verification of documents, the ROC will issue a Certificate of Incorporation. This certificate signifies that your LLP is officially registered and can commence business operations.

Post-Incorporation Compliance

After registration, there are several compliance requirements:

PAN and TAN Registration: Apply for Permanent Account Number (PAN) and Tax Deduction Account Number (TAN).

Open a Bank Account: Open a bank account in the name of the LLP.

Annual Filings: File annual returns with ROC using Form 11 and maintain financial statements.

Cost of LLP Registration

The costs associated with registering an LLP in Bangalore typically include:

Item

Cost

Digital Signature Certificates

₹3,000

Government Fees

₹1,500

Professional Fees

₹3,999

Total Estimated Cost

₹8,499

These costs may vary depending on additional services or consultancy fees.

Conclusion

Registering an LLP in Bangalore is a straightforward process that offers significant advantages to entrepreneurs seeking limited liability protection while maintaining operational flexibility. By following this step-by-step guide, you can efficiently navigate through the registration process and set up your business successfully.

If you would like more help or detailed questions about specific steps or documentation, please consult with professionals who specialise in business registrations in Bangalore.

0 notes

Text

LLP Company Registration in Bangalore: Expertise You Can Trust

For businesses seeking LLP company registration in Bangalore, Kros-Chek offers unparalleled expertise and support throughout the registration process. With a thorough understanding of the regulatory requirements and procedural intricacies involved in LLP registration, Kros-Chek ensures that its clients' interests are protected and their compliance needs are met. By leveraging its industry knowledge and experience, Kros-Chek facilitates seamless LLP registration, enabling businesses to establish a legal entity quickly and efficiently.

Private Limited Company Registration in Bangalore: Setting the Foundation for Success

Private Limited Company Registration in Bangalore are the preferred choice for businesses looking to raise capital, attract investors, and enjoy limited liability protection. Kros-Chek specializes in private limited company registration in Bangalore, guiding entrepreneurs through the intricate process of company formation. From name reservation and drafting the Memorandum of Association (MoA) to obtaining the Certificate of Incorporation (CoI) and PAN/TAN registration, Kros-Chek handles every aspect of the registration process with precision and expertise.

Kros-Chek: Your Gateway to Business Compliance and Success

In conclusion, Kros-Chek is more than just a consultancy firm—it's a trusted partner in your journey towards business compliance and success. With its comprehensive range of services, including GST return filing, LLP and private limited company registration, Kros-Chek simplifies the complexities of business operations and ensures regulatory compliance at every step. Whether you're a startup looking to establish your presence or an established business seeking to streamline your operations, Kros-Chek is here to support you with expert guidance, personalized solutions, and unwavering commitment to your success.

More information:

Contact-us

365 Shared Space, 2nd Floor,#153, Sector 5,

1st Block Koramangala, HSR Layout,

Bengaluru, Karnataka 560102

#KrosChek#KrosChekBangalore#llpcompanyregistrationservicesnearbangalore#llpcompanyregistrationinbangalore#llpcompanyregistrationservicesinBangalore#PrivateLimitedCompanyRegistrationinBangalore

0 notes

Text

"Company Registration in Bangalore: A Comprehensive Guide

If you're planning to start a company in Bangalore, understanding the company types, registration process, and benefits is crucial. Registering a company as a private limited, LLP, or One Person Company can provide various advantages, such as limited liability, access to government initiatives, and transparency. Choosing the right business type is essential before starting the registration process.

Benefits of company registration in Bangalore include tax savings, enhanced recognition, easier access to funding, and the ability to attract talented employees. The basic documents required for registration include ID proof, address proof, registered office address, PAN card, digital signatures of directors, and director identification number.

0 notes

Text

Get your LLP registation in Bangalore in 12 days . Easy Process, LLP Company & Partnership. Low Registration Cost, No Hidden Costs, Free ROC Consultation, Call 78100-01800 Today !

0 notes

Text

Things to Know for LLP Registration in Bangalore - Kros Chek

If you are considering LLP registration in Bangalore, it is essential to understand the process and requirements involved. LLP (Limited Liability Partnership) is a popular form of business structure that offers the benefits of both a partnership and a company. To ensure a smooth and successful LLP registration, here are some valuable tips provided by Kros Chek, a reputable company offering LLP company registration services in Bangalore.

Understand the Concept of LLP: Before proceeding with LLP registration, it is crucial to have a clear understanding of the concept and advantages of LLP. LLP is a separate legal entity where the partners have limited liability for the debts and obligations of the partnership. It offers flexibility in management, tax benefits, and ease of compliance. Familiarize yourself with the unique features and benefits of LLP to make an informed decision.

Seek Professional Assistance: LLP registration involves various legal and procedural requirements. Engaging the services of a professional firm like Kros Chek, which specializes in Private Limited Company Registration in Bangalore, can simplify the process and ensure compliance with all applicable laws and regulations. These firms have the expertise and experience to handle the complexities of LLP registration efficiently.

Determine Business Name and Structure: Choose a unique and appropriate name for your LLP. The name should comply with the guidelines set by the Ministry of Corporate Affairs (MCA) and should not be similar to existing trademarks or LLPs. Additionally, determine the structure of the LLP, including the number of partners and their contributions. Kros Chek can assist you in selecting an appropriate name and structuring your LLP.

Prepare the LLP Agreement: The LLP agreement is a crucial document that outlines the rights, responsibilities, and obligations of the partners. It specifies the capital contribution, profit sharing ratio, decision-making process, and other important aspects of the LLP. Consult with professionals to draft a comprehensive LLP agreement that aligns with your business objectives and protects the interests of all partners.

Obtain Digital Signatures: llp company registration services requires obtaining digital signatures for all designated partners. Digital signatures are used for filing electronic documents with the Registrar of Companies (RoC). Ensure that the designated partners have valid digital signatures to facilitate the registration process. Professional firms like Kros Chek bangalore can guide you through the process of obtaining digital signatures.

Prepare and File Documents: Prepare the necessary documents for LLP registration, including Form-2 (Incorporation Document and Subscriber's Statement), Form-3 (LLP Agreement), and Form-4 (Notice of Appointment of Partners/Designated Partners). Ensure that the documents are accurately filled out and comply with the prescribed formats. Professional firms specializing in LLP registration services in Bangalore can assist you in preparing and filing the documents correctly.

Obtain Director Identification Number (DIN) and Designated Partner Identification Number (DPIN): All designated partners of an LLP are required to obtain DIN and DPIN. DIN is a unique identification number for directors, while DPIN is a unique identification number for designated partners of an LLP. These numbers are essential for the registration process and subsequent compliance requirements. Professional firms can guide you in obtaining DIN and DPIN for the designated partners.

Pay Applicable Fees: LLP registration involves the payment of registration fees based on the capital contribution of the LLP. Ensure that the fees are paid online through the MCA portal using the appropriate payment modes. The fees may vary based on the capital contribution and other factors. Professional firms like Kros Chek can provide accurate information on the fees and assist you in making the payment.

Obtain Certificate of Incorporation:After submitting the necessary documents and fees, the Registrar of Companies will review the application for LLP registration.

More information:

365 Shared Space, 2nd Floor,#153, Sector 5,

1st Block Koramangala, HSR Layout,

Bengaluru, Karnataka 560102

+91-9880706841

#llp company registration services in bangalore#llp company registration in bangalore#tds return filing services bangalore

0 notes

Text

Streamlining Your Business Finances with Kros Chek: Your Go-To Company Tax Filing Services in Bangalore

In the dynamic business landscape of Bangalore, ensuring your company's financial compliance is crucial for sustained growth. Kros Chek, a leading LLP registration company, is here to streamline your business finances, offering comprehensive company tax filing services in Bangalore. With a dedicated team of experts, Kros Chek is your trusted partner in navigating the complexities of GST registration and filing, especially in the vibrant locality of HSR Layout.

Understanding Company Tax Filing Services in Bangalore

As businesses evolve, so do tax regulations. Navigating the intricacies of company tax filing services Bangalore requires expertise and precision. Kros Chek stands out as a reliable ally, offering tailored solutions to meet the unique tax needs of businesses in the Silicon Valley of India. Our experienced professionals ensure that your tax filings are accurate, timely, and compliant with the latest regulations, providing you peace of mind to focus on your core business activities.

GST Registration Consultant in HSR Layout

For businesses in HSR Layout seeking seamless GST registration, Kros Chek is your go-to partner. Our GST registration consultant HSR Layout Bangalore, understands the local nuances and regulatory requirements. Whether you're a startup or an established enterprise, we guide

you through the entire GST registration process, ensuring that your business is compliant with the Goods and Services Tax regulations.

GST Filing Consultants in HSR Layout

Efficient GST filing is pivotal in maintaining your business's financial health. Kros Chek's team of GST filing consultants in HSR Layout takes the hassle out of the process. We ensure accurate and timely filing, helping you avoid penalties and compliance issues. Our consultants stay abreast of the ever-changing GST regulations, providing you with insights to optimize your tax strategy and minimize liabilities.

Navigating GST Registration Consultants in HSR Layout, Bangalore

Choosing the right GST registration consultants in HSR Layout, Bangalore, can significantly impact your business's financial well-being. Kros Chek stands out for its commitment to excellence and client satisfaction. Our team in HSR Layout is well-versed with the local business landscape, enabling us to provide personalized GST registration services that align with your business goals.

In the fast-paced business environment of Bangalore, partnering with Kros Chek ensures that your company's tax and GST-related matters are handled with expertise and precision. Our dedicated team of professionals, specializing in GST filing consultants HSR layout and GST Registration consultants HSR layout Bangalore, is ready to support your business on its journey to financial success. Trust Kros Chek for reliable, compliant, and efficient financial services tailored to meet the unique needs of your business in Bangalore's dynamic market.

More information:

Address:

365 Shared Space, 2nd Floor,#153, Sector 5,

1st Block Koramangala, HSR Layout,

Bengaluru, Karnataka 560102

+91-9880706841

#CompanyTaxFilingServicesinBangalore#GSTregistrationconsultantHSRLayout#GSTfilingconsultantsHSRlayout

0 notes

Text

Trademark Search online

Private Company Registration In Bangalore, India

A private company in Bangalore can be formed by individuals, and corporates like OPC, LLP as a shareholder of the private Company in Bangalore.

A private company is a legal entity that allows people to form businesses to do business and earn a profit. They are also known as privately held companies (PLCs).

The main objective of forming a private company is to protect the business from legal liabilities.

Forming a Private Limited Company in Bangalore

Once you have submitted the required basic documents of directors Pan, Aadhar, 1st-page recent bank statement, and office address proof of rent agreement and utility fill, you will receive a certificate of Registration within five days.

You will also be required to pay stamp duty to the Government, which varies from Rs. 5,000/- to 10,000/-based on the capital of the Company.

Private Company is a simple and popular choice in Bangalore.

Suppose you wish to register a private limited company in Bangalore. In that case, you need to provide a minimum of 2 directors' basic documents of Pan, aadhar and a 1st-page recent bank statement along with the office address, Rental agreement and any one utility bill.

Once you share the name for Registration, we will fill up the consent form director and then file the new company registration at the website www.mca.gov.in. This form has been designed by the Company Secretary experts who understand the needs of the business. They have made sure that the form is simple and easy to use.

Private Company controlled by Companies Act, 2013,

The Ministry of Corporate Affairs manages private companies in India by the rules and regulations of the Company, and the Directors must comply.

To start a new private limited company, two people must be 21 years adults and hold basic documents like Pan, Aadhar, and bank accounts.

A Private Company plays an important role as a vehicle to carry the ideas of the promoters in the form of a Company.

Before starting any business, you must be clear about the following:

Make a name choice that shall be unique and catchy and should not violate the name guidelines as per MCA.

Then, collect the required basic documents from proposed company promoters.

You can approach Team IN Filings, Bangalore, to start the Company Registration.

Plus point of Private companies

The promoter's risk is limited to their investment amount only

A Private Company can be registered with a minimum of two people

A private Company allows easy transfer the shares from one to another

Quick Registration, You can register your Private Company within two days of time

Steps to register your Private companies

Below are the steps to be taken to start a new private company with the help of Team IN Filings

· Selection of suitable name as per name guidelines by Mca

· Apply the name reservation with Mca

· Finalization of terms and conditions in the form of MoA and AoA

· Filing the e-forms with Roc central office for Registration.

The main types of companies are:

· Private Limited Company

· One Person Company (OPC), called one person shareholder

· Limited Liability Firm (LLP), ideal for service-oriented business

· Nidhi Company Limited to run the small finance business

· Chit fund company to run the chit business

· Finance Company for running the lending business

A company name check is the First step.

If you plan to start a new company in India, you must check the name available with MCA.gov.in and Trade Mark authority. If the name is available, submit your finalized name along with the objective to [email protected] for free, our Team IN filings can go ahead for name reservation application to the Ministry of Corporate Affairs (MCA). We have to make the name reservation application before registering the Company.

The procedure of Company Registration in India

After the name gets approved from Team IN filings, you can provide the documents below for further Registration of the Company.

· All the promoters, directors Pan, Aadhar, recent month Bank statement

· Email, mobile, photo of the director

· Rent agreement in the company name, Electric bill

· Noc from the building owner

Once you submit the above documents, our Team will process the Digital signature and then prepare the MoA and AoA and other documents for review with you.

Preparation of Memorandum of Association

After the name gets approved, Team IN filings helps you prepare the company documents. The Main documents in the Company are the Memorandum of association and Articles of association of the Company.

MoA – Memorandum of association contents

MoA talks about the Company's business activities and other functions. The objectives of the Company have to be classified into main and associated objectives.

The Main objective is all about the Company's main purpose, like retail, wholesale, etc.

The associated objective is related to the main business objective, for example, marketing, advertisement etc.

Clauses of Memorandum of association(MOA)

The MoA clauses have to be arranged in the right structure keeping the Company's core business in mind. Also, there won't be prohibited business to be taken under this.

Fee for Registration of the Company in India

Most Company's Registration in Bangalore is completed with Team IN Filings.

The cost and time involved have been given on an approximate basis only

.

For Private Limited company: fee is Rs.5000 plus Govt. fee, Time: 3 working days.

For One Person Company: fee is Rs.4000 plus Govt. fee, Time: 3 working days.

For Firm, LLP Company: fee is Rs.5000 plus Govt. fee, Time: 10 working days.

For Nidhi, chit fund Company: fee is Rs.15000 plus Govt. fee, Time: 10 working days.

For Proprietorship, Gst: fee is Rs.5000 plus Govt. fee, Time: 10 working days.

Plus, Company Registration Certificate, you will get a full set of certificates.

During the process of the company registration, you will get a complete set of Registration like;

· Registration Certificate

· Company Pan card

· Company Tan card

· Company PF registration certificate

· Company ESI certificate

· Company Gst process

· Company Bank A/c

· Directors/ Promoters DSC

· MoA

· AoA

Benefits of Company Registration in India

A company is a vehicle; you carry your business without any limit.

The main benefits of Company registration are:

· It gives you legal status like Pvt. Ltd, LLP etc., to your business

· It has continuity of succession of your business

· The promoters risk is limited to his investment amount only

· The Company can sue and be sued

· Company promoters play a dual role, one as director and another as a promoter

· The Company has the power to borrow money in its name

· Capital raising is also easy

Private Company E filing returns

Once Company has been registered, it must follow the compliance filings regularly.

The first step after the company register is:

· Open the company Bank a/c, and file the Cob (Inc-20A) (due in 180 days from Company's Registered

· File the Auditor appointment, Adt-1

· File the Annual year-end return (Mgt-7A)

· File your Company audited report and accounts in Aoc-4

· File your Company ITR-6 by on before 30th October

Business lawyer for your Company

Team IN Filings is one stop Business service advisor; as a business lawyer, advising many businesses to enter into the corporate domain and reach heights.

The Team In filings Bangalore based Ca and CS professionals practising for the last ten years in Company Registration, GST services, Tax return filing, as well as Gst advice Services, Tax consultancy, and Management, have been providing various tax planning, business setup filing-related services from the 15 years in India.

Find your Team IN Filings Company Registration consultant to get your New Company fast and efficiently with our Team members and get expert advice to help you with Company compliance. This includes Tax planning, GST invoicing software and free filing software. GST invoicing, cloud-based filing software, as well as Accountants Assistance. Companies 5K+ are registered. Rapid and reliable Company service provider in Bangalore. Karnataka

Contact Team IN Filings

Trust our dedicated Team of professionals to get your private Limited Company ready within three working days.

Get in touch with our Team today and get a FREE consultation!

Reach us to manage your Accounting, Gst, Tax services, and Trademark.

Call at +91-7019827351 [email protected] to get your Private Limited Company done!

Click here to get more information :- https://teamindia.co.in/

0 notes

Text

Partnership Firm Registration In Bangalore

Partnership Firm Registration In Bangalore

Partnership Firm Registration In Bangalore

qph.cf2.quoracdn.net

Company Registration in Chennai

Chennai-1 Corporate office Asirvadham Apartment,No. 12, Flat No. 12A, Puliyar 2nd Main Road, 1st Lane, Trust Puram, Kodambakkam, Chennai - 600 024 Chennai-2 Address #56/80, Medavakkam Main Road, Keelkattalai, Chennai - 600 117. Landmark : Opp to Andhra Bank New Delhi Address B44,Birbal Road, Lajpat Nagar II, Lajpat Nagar, New Delhi, Delhi 110024 Bangalore Address No. 117/1, First Floor, 2nd Main Road, Shesadripuram, Bangalore – 560020 Landmark : Near Mantri mall Metro station Copyright © 2016 All rights Reserved;

Company Registration in Chennai | Service Tax Consultants

If looking for Company Registration Consultants in Chennai, company registration in chennai, Service Tax, Sales, TIN, VAT ,Return Fillings,

SYNMAC.IN

Partnership Firms Registration Procedure Under Indian Partnership Act

A partnership firm is one of the most important forms of a business organization. It is a popular form of business structure in India. A minimum of two persons are required to establish a partnership firm. A partnership firm is where two or more persons come together to establish a business and divide its profits amongst themselves in the agreed ratio. The partnership business includes any kind of trade, occupation and profession.

The Indian Partnership Act, 1932 governs and regulates partnership firms in India. The persons who come together to form the partnership firm are knowns as partners. The partnership firm is constituted under a contract between the partners. The contract between the partners is known as a partnership deed which regulates the relationship among the partners and also between the partners and the partnership firm.

A partnership firm is one of the most important forms of a business organization. It is a popular form of business structure in India. A minimum of two persons are required to establish a partnership firm. A partnership firm is where two or more persons come together to establish a business and divide its profits amongst themselves in the agreed ratio. The partnership business includes any kind of trade, occupation and profession.

The Indian Partnership Act, 1932 governs and regulates partnership firms in India. The persons who come together to form the partnership firm are knowns as partners. The partnership firm is constituted under a contract between the partners. The contract between the partners is known as a partnership deed which regulates the relationship among the partners and also between the partners and the partnership firm.

Advantages of Partnership Firm

Easy to Incorporate

The incorporation of a partnership firm is easy as compared to the other forms of business organizations. The partnership firm can be incorporated by drafting the partnership deed and entering into the partnership agreement. Apart from the partnership deed, no other documents are required. It need not even be registered with the Registrar of Firms. A partnership firm can be incorporated and registered at a later date as registration is voluntary and not mandatory.

Less Compliances

The partnership firm has to adhere to very few compliances as compared to a company or LLP. The partners do not need a Digital Signature Certificate (DSC), Director Identification Number (DIN), which is required for the company directors or designated partners of an LLP. The partners can introduce any changes in the business easily. They do have legal restrictions on their activities. It is cost-effective, and the registration process is cheaper compared to a company or LLP. The dissolution of the partnership firm is easy and does not involve many legal formalities.

Quick Decision

The decision-making process in a partnership firm is quick as there is no difference between ownership and management. All the decisions are taken by the partners together, and they can be implemented immediately. The partners have wide powers and activities which they can perform on behalf of the firm. They can even undertake certain transactions on behalf of the partnership firm without the consent of other partners.

Sharing of Profits and Losses

The partners share the profits and losses of the firm equally. They even have the liberty of deciding the profit and loss ratio in the partnership firm. Since the firm’s profits and turnover are dependent on their work, they have a sense of ownership and accountability. Any loss of the firm will be borne by them equally or according to the partnership deed ratio, thus reducing the burden of loss on one person or partner. They are liable jointly and severally for the activities of the firm.

Disadvantages of Partnership Firm

Unlimited Liability

The biggest disadvantage of the partnership firm is having an unlimited liability of the partners. The partners have to bear the loss of the firm out of their personal estate. Whereas in a company or LLP, the shareholders or partners have liability limited to the extent of their shares. The liability created by one partner of the partnership firm is to be borne by all the partners of the firm. If the firm’s assets are insufficient to pay the debt, then the partners will have to pay off the debt from their personal property to the creditors.

No Perpetual Succession

The partnership firm does not have perpetual succession, as in the case of a company or LLP. This means that a partnership firm will come to an end upon the death of a partner or insolvency of all the partners except one. It may also be dissolved if a partner gives notice of dissolution of the firm to the other partners. Thus, the partnership firm can come to an end at any time.

Limited Resources

The maximum number of partners in a partnership firm is 20. There is a restriction on the number of partners, and hence the capital invested in the firm is also restricted. The capital of the firm is the sum total of the amount invested by each partner. This restricts the firm’s resources, and the partnership firm cannot take up large scale business.

Difficult to Raise Funds

Since the partnership firm does not have perpetual succession and a separate legal entity, it is difficult to raise capital. The firm does not have many options for raising capital and growing its business as compared to a company or LLP. As there are no strict legal compliances, people have less faith in the firm. The accounts of the firm need not be published. Thus, it is difficult to borrow funds from third parties.

What is Partnership Registration?

Partnership registration means the registration of the partnership firm by its partners with the Registrar of Firms. The partners should register their firm with the Registrar of Firms of the state where the firm is located. Since partnership firm registration is not compulsory, the partners can apply for registration of the partnership firm either at the formation of the firm or subsequently at any time during its operation.

For partnership registration, the two or more people must come together as partners, agree on a firm name and enter into a partnership deed. However, partners cannot be members of a Hindu Undivided Family or husband and wife.

Importance of Registering a Partnership Firm

The registration of a partnership firm is optional and not compulsory under the Indian Partnership Act. It is at the discretion of the partners and voluntary. The firm’s registration can be done at the time of its formation or incorporation or during the continuance of the partnership business.

However, it is always advisable to register the partnership firm as a registered partnership firm enjoys certain special rights and benefits as compared to the unregistered firms. The benefits that a partnership firm enjoy are:

A partner can sue against any partner or the partnership firm for enforcing his rights arising from a contract against the partner or the firm. In the case of an unregistered partnership firm, partners cannot sue against the firm or other partners to enforce his right.

The registered firm can file a suit against any third party for enforcing a right from a contract. In the case of an unregistered firm, it cannot file a suit against any third party to enforce a right. However, any third party can file a suit against the unregistered firm.

The registered firm can claim set-off or other proceedings to enforce a right arising from a contract. The unregistered firm cannot claim set off in any proceedings against it.

Procedure for Registering a Partnership Firm

Step 1: Application for Registration

An application form has to be filed to the Registrar of Firms of the State in which the firm is situated along with prescribed fees. The registration application has to be signed and verified by all the partners or their agents. The application can be sent to the Registrar of Firms through post or by physical delivery, which contains the following details:

The name of the firm.

The principal place of business of the firm.

The location of any other places where the firm carries on business.

The date of joining of each partner.

The names and permanent addresses of all the partners.

The duration of the firm.

Step 2: Selection of Name of the Partnership Firm

Any name can be given to a partnership firm. But certain conditions need to be followed while selecting the name::

The name should not be too similar or identical to an existing firm doing the same business.

The name should not contain words like emperor, crown, empress, empire or any other words which show sanction or approval of the government.

Step 3: Certificate of Registration

If the Registrar is satisfied with the registration application and the documents, he will register the firm in the Register of Firms and issue the Registration Certificate. The Register of Firms contains up-to-date information on all firms, and anybody can view it upon payment of certain fees.

An application form along with fees is to be submitted to the Registrar of Firms of the State in which the firm is situated. The application has to be signed by all partners or their agents.

Documents for Registration of Partnership

The documents required to be submitted to Registrar for registration of a Partnership Firm are:

Application for registration of partnership (Form 1)

Certified original copy of Partnership Deed.

Specimen of an affidavit certifying all the details mentioned in the partnership deed and documents are correct.

PAN Card and address proof of the partners.

Proof of principal place of business of the firm (ownership documents or rental/lease agreement).

If the registrar is satisfied with the documents, he will register the firm in the Register of Firms and issue a Certificate of Registration. Register of Firms contains up-to-date information on all firms and can be viewed by anybody upon payment of certain fees.

Partnership Firm Registration Fees

The government fees applicable for a partnership firm registration varies from state to state depending on the partner’s contribution. However, you can file for partnership firm registration online through the Synmac Partnership Firm Registration Plan.

The Partnership Firm Registration Plan amount includes the following services:

PAN application

Partnership deed drafting

Filing of deed and other documents with the Registrar of Firms

Issue of registration certificate

100% online process

Session with Synmac expert

*Price shown above may vary. Please click here to contact our experts for complete pricing details

Name Given to the Partnership Firm

Any name can be given to a partnership firm as long as you fulfil the following conditions:

The name shouldn’t be too similar or identical to an existing firm doing the same business,

The name shouldn’t contain words like emperor, crown, empress, empire or any other words which show sanction or approval of the government.

Partnership Deed

A partnership deed is an agreement between the partners in which rights, duties, profits shares and other obligations of each partner is mentioned. A partnership deed can be written or oral, although it is always advisable to write a partnership deed to avoid any conflicts in the future.

Details Required in a Partnership Deed

General details

Name and address of the firm and all the partners.

Nature of business.

Date of starting of business Capital to be contributed by each partner.

Capital to be contributed by each partner.

Profit/loss sharing ratio among the partners.

Specific details

Apart from these, certain specific clauses may also be mentioned to avoid any conflict at a later stage:

Interest on capital invested, drawings by partners or any loans provided by partners to the firm.

Salaries, commissions or any other amount to be payable to partners.

Rights of each partner, including additional rights to be enjoyed by the active partners.

Duties and obligations of all partners.

Adjustments or processes to be followed on account of retirement or death of a partner or dissolution of the firm.

Other clauses as partners may decide by mutual discussion.

Timelines for Partnership Firm Registration

The partnership firm registration process takes approximately 10 days, subject to departmental approval and reverts from the respective department.

Checklist for Partnership Firm Registration

Drafting of Partnership Deed.

Minimum two members as partners.

Maximum of equal to or less than twenty partners.

Selection of appropriate name.

Principal Place of business.

PAN card and bank account of the firm.

0 notes