#llp registration in Chennai

Text

Common Mistakes to Avoid During LLP Registration in Chennai

LLP Registration in Chennai: A Comprehensive Guide

Chennai, known for its thriving business environment, offers a favourable landscape for entrepreneurs looking to establish Limited Liability Partnerships (LLPs). LLPs are a famous business structure in India, combining the advantages of a partnership with the benefits of limited liability for its partners. Here’s a detailed guide on LLP registration in Chennai.

What is an LLP?

A Limited Liability Partnership (LLP) is a legal entity that provides the flexibility of a partnership while limiting the liability of its partners. Unlike traditional partnerships, where partners are personally liable for the firm’s debts, an LLP restricts each partner’s liability to their contribution to the business, protecting personal assets.

Why Choose LLP in Chennai?

Ease of Formation: LLPs are relatively easier to form than private limited companies, and they have fewer compliance requirements.

Limited Liability: Protects the personal assets of partners in case of business losses or legal issues.

Separate Legal Entity: An LLP is treated as a separate legal entity from its partners, allowing it to own property, enter contracts, and sue or be sued in its name.

Tax Benefits: LLPs enjoy several tax advantages, including exemptions from Dividend Distribution Tax and Minimum Alternate Tax.

No Minimum Capital Requirement: Forming an LLP does not require a minimum capital investment, making it accessible to small businesses and startups.

Steps to Register an LLP in Chennai

Obtain a Digital Signature Certificate (DSC): The first step is to obtain a DSC for all designated partners of the LLP. This certificate is required for online form filing.

Apply for Director Identification Number (DIN): Each designated partner must have a DIN, which can be obtained by filing Form DIR-3.

Name Reservation: File Form LLP-RUN (Reserve Unique Name) with the Registrar of Companies (RoC) to reserve the LLP’s name. Ensure the name is unique and not identical to an existing company or LLP.

Drafting of LLP Agreement: The LLP agreement outlines the partners' rights, duties, and responsibilities. It must be drafted on stamp paper and submitted within 30 days of the LLP's incorporation.

Filing Incorporation Documents: Submit Form FiLLiP (Form for incorporation of LLP) along with necessary documents such as proof of address of the registered office, identity and address proofs of partners, and the LLP agreement.

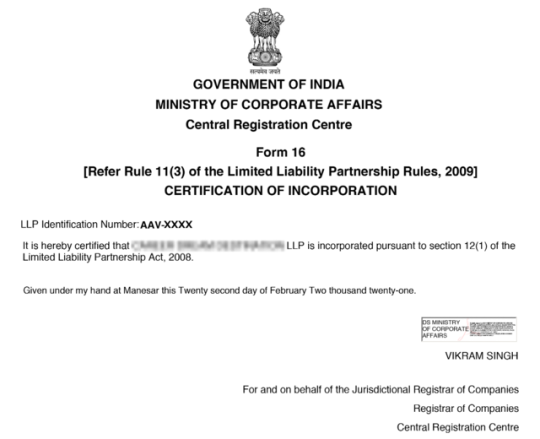

Certificate of Incorporation: Upon verification, the RoC issues a Certificate of Incorporation confirming the LLP’s legal existence.

PAN and TAN Application: After incorporation, apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the LLP.

Opening Bank Account: With the Certificate of Incorporation, PAN, and other required documents, open a bank account in the LLP’s name.

Documents Required for LLP Registration

Identity and Address Proofs: PAN card, Aadhaar card, passport, voter ID, or driving license of partners.

Registered Office Proof: Rental agreement and utility bill (not older than two months) or ownership proof of the office space.

Digital Signature Certificate: For all designated partners.

Consent of Partners: All partners signed the consent form.

LLP Agreement: Duly signed by all partners.

Post-Registration Compliance

Once the LLP is registered, certain ongoing compliances must be met, including:

Annual Return Filing: LLPs must file a yearly return in Form 11 with the RoC.

Statement of Accounts and Solvency: Filing Form 8 is mandatory to report the LLP’s financial status.

Income Tax Filing: LLPs must file an income tax return annually using Form ITR-5.

Conclusion

LLP registration in Chennai is a streamlined process that offers numerous benefits to entrepreneurs, including limited liability, ease of management, and tax advantages. By following the above steps and ensuring compliance with legal requirements, you can successfully establish an LLP in Chennai, contributing to the city’s vibrant business ecosystem.

0 notes

Text

Understand the reasons why many entrepreneurs prefer LLPs over other business structures in Chennai and the unique benefits they offer.

0 notes

Text

#llpregistration#llp registration in Chennai#llp registration in Chennai online#Online llp registration in Chennai#LLP registration online in Chennai

0 notes

Text

Initiate LLP Registration Online in Chennai with ChennaiFilings. Effortless LLP Formation Services Backed by Expert Guidance. Launch Your Limited Liability Partnership Today!

0 notes

Text

efiletax | Solution Provider For All Your Business Needs.

#Tax Service Provider#Best Tax Service Provider#GST Service Provider#efiletax#Efiletax#Business#GST Service Provider Chennai#GST Filing#Company Registration#LLP#ROC#GST#ITR#Incometax#Filing#Finance

0 notes

Text

GST registration in India

The Goods and Services Tax make clear the significance of GST registration for the development of businesses and aids enterprises across state lines to function normally while also providing a uniform method of taxation, thereby earning customer's confidence.In addition to easing the administrative load of taxation, GST registration assists in saving costs of compliance. If you require any expert help please don’t hesitate to contact us our staff.

#Proprietorship GST Registration#E Commerce GST Registration#Partnership GST Registration#LLP GST Registration#GST Registration for General Store#GST Consultant in Chennai#GST Registration in Chennai#gst registration for proprietorship#gst services#gst chennai

0 notes

Text

LLP Registration in India — Online Procedure, Documents Required, Cost

Limited Liability Partnership, commonly known as “LLP”, is a newer form of business in India with limited liability benefits of a private limited company and the flexibility of a partnership firm. The concept of the LLP was introduced in India in 2008 and is regulated by the Limited Liability Partnership Act, 2008.

The maintenance cost and compliances are less in LLP; hence, it has become a preferred form of business organization among entrepreneurs. This form of business structure is ideal for small and medium-sized businesses.

Benefits of LLP Registration

Separate legal entity

Limited liability

Lower cost

No minimum capital required

Minimal compliances

Checklist for LLP registration

Minimum two partners

At least one partner should be a resident of India

DSC for all designated partners

DPIN for all designated partners

Unique name of the LLP that is not similar to any existing LLP or company or trademark

Capital contribution by the partners of LLP

LLP agreement between the partners

Address proof for the office of LLP

Documents required for LLP registration

Documents of both the partners and LLP have to be submitted for incorporating a Limited Liability Partnership:

—Documents of partners

ID proof of partners

Address proof of partners

Residence proof of partners

Passport size photograph

Passport (in case of foreign nationals / NRI)

—Documents of LLP

Proof of registered office address

Digital Signature Certificate

Documents you’ll get after LLP incorporation

To know more (click here)

#llp registration#nidhi company registration#limited liability company#private limited company registration online#private limited company registration in bangalore#private limited company registration in chennai#partnership firm registration#firm#organisation#india

0 notes

Text

Microsoft Invests ₹520 Crore in Pune's Hinjewadi with Major Land Acquisition

In a notable move highlighting its expanding footprint in India, global tech giant Microsoft has invested ₹519.72 crore in a prime 16.4-acre land parcel in Pune’s Hinjewadi area. This acquisition, confirmed by Square Yards, marks Microsoft's continued commitment to bolstering its commercial real estate holdings in one of India’s key IT hubs.

According to the registration documents, Microsoft Corporation (India) Private Limited purchased 66,414.5 square meters of land from Indo Global Infotech City LLP. The transaction, registered in August 2024, also involved a stamp duty of ₹31.18 crore and a registration fee of ₹30,000.

This latest investment follows Microsoft's previous real estate ventures in India. In 2022, the company acquired a 25-acre plot in Pimpri-Chinchwad for ₹328 crore. Earlier this year, Microsoft also secured 48 acres in Hyderabad for ₹267 crore. These strategic acquisitions are part of Microsoft's broader plan to enhance its infrastructure, particularly for its data center operations. The company's existing data centers are spread across Pune, Mumbai, and Chennai, reinforcing its presence in major Indian markets.

Microsoft’s operations in India are robust, with a workforce exceeding 23,000 employees across cities such as Bengaluru, Chennai, Hyderabad, Mumbai, and Pune. These teams are engaged in various business functions including sales, marketing, research, development, and customer support.

In addition to its real estate investments, Microsoft has launched a significant skilling initiative in India. Early this year, the company introduced the ADVANTA(I)GE INDIA program, aimed at equipping 2 million individuals with AI and digital skills by 2025. This program, part of Microsoft’s “Skills for Jobs” initiative, reflects the company’s commitment to preparing a future-ready workforce in the digital age.

0 notes

Text

LLP Registration in Chennai: A Comprehensive Guide

A Limited Liability Partnership (LLP) is a famous business structure in India that combines the benefits of both a company and a partnership firm. It offers LLP registration in Chennai to its partners, meaning their personal assets are protected in case of business debts and liabilities. LLPs are governed by the Limited Liability Partnership Act 2008 and are suitable for small and medium-sized enterprises.

0 notes

Text

Partnership Firm Registration in Chennai: Benefits and Process

Introduction

Starting a business in Chennai can be an exciting venture, and choosing the proper legal structure is essential. One popular option for entrepreneurs is forming a Partnership Firm. Partnership firms offer unique advantages, especially for small to medium-sized enterprises (SMEs). In this guide, we will discuss the benefits and process of Partnership Firm Registration in Chennai to help you make informed decisions.

Understanding Partnership Firms

A partnership firm is a business structure where two or more individuals collaborate to operate a business, sharing profits and responsibilities as outlined in a partnership deed. This model is governed by the Indian Partnership Act of 1932, which provides a legal framework for the formation and operation of partnership firms in India.

Key Features of Partnership Firms

Flexibility: Partnership firms are less regulated compared to corporations, allowing for more straightforward operational management.

Profit Sharing: Partners agree on a profit-sharing ratio, which can be customised based on their contributions and agreements.

Ease of Formation: Setting up a partnership firm is generally more accessible and less costly than forming a corporation.

Benefits of Registering a Partnership Firm in Chennai

Registering a partnership firm in Chennai offers several advantages:

1. Legal Recognition

Registration provides formal recognition of the partnership, enhancing credibility with clients, suppliers, and financial institutions. It serves as evidence of the partnership's existence and can be crucial in legal matters.

2. Limited Liability

While partners are generally liable for the debts of the firm, registering the partnership can offer some protection against personal liability in certain circumstances, especially when coupled with a Limited Liability Partnership (LLP) structure.

3. Tax Benefits

Registered partnership firms can avail of various tax benefits, including the ability to file tax returns under the partnership's name, which can sometimes result in lower tax rates compared to individual taxation.

4. Enhanced Business Opportunities

A registered partnership firm can participate in government tenders and contracts, which often require formal business registration. This opens up more avenues for growth and expansion.

5. Clarity in Operations

The partnership deed, which is a legal document outlining the rights and responsibilities of each partner, helps prevent disputes and provides clarity in operations.

The Process of Partnership Firm Registration in Chennai

The registration process for a partnership firm in Chennai involves several key steps:

Step 1: Drafting the Partnership Deed

The first step is to draft a partnership deed, which should include:

Name and address of the partnership firm

Names and addresses of all partners

Profit-sharing ratio

Nature of business

Duration of the partnership

Step 2: Collecting Required Documents

The following documents are typically required for registration:

Partnership Deed: A signed document outlining the partnership terms.

Identity Proof: PAN cards and Aadhaar cards of all partners.

Address Proof: Proof of address for both the business and partners.

Application Form: A filled application form for registration.

Step 3: Applying for Registration

Once the partnership deed is prepared and documents are collected, the partners must submit the application to the Registrar of Firms in Chennai. This can often be done online, streamlining the process.

Step 4: Verification and Issuance of Certificate

After submission, the Registrar will verify the documents. If everything is in order, a Certificate of Registration will be issued, officially recognising the partnership firm.

Key Considerations

Choosing a Unique Name

The name of the partnership firm must be unique and not infringe on existing trademarks or business names. This is crucial to avoid future legal complications.

Compliance with Regulations

Registered partnership firms must comply with various regulations, including filing annual returns and maintaining proper financial records. Non-compliance can lead to penalties and legal issues.

Future Changes

If the partnership changes, such as adding or removing partners, the partnership deed must be amended and re-registered to reflect these changes.

Conclusion

Partnership Firm Registration in Chennai is a significant step for entrepreneurs looking to formalise their business operations. The benefits of legal recognition, tax advantages, and enhanced credibility can provide a solid foundation for growth and success. By following the outlined process and ensuring compliance with regulations, partners can navigate the registration process smoothly and focus on building their business.

For help with partnership firm registration in Chennai, could you consult with professionals who specialise in business registration services? They can provide valuable guidance and ensure that all legal requirements are met efficiently.

0 notes

Text

#LLP Registration in chennai#LLP Registration in chennai online#LLP Registration#Online LLP Registration in chennai#LLP Registration online in chennai#LLP Registration in Tamilnadu

0 notes

Text

Begin Your Limited Liability Partnership Journey Today with ChennaiFilings: Effortless LLP Registration in Chennai, Supported by Expert Guidance for a Smooth Formation Process.

0 notes