#LLP registration online in Chennai

Text

#llpregistration#llp registration in Chennai#llp registration in Chennai online#Online llp registration in Chennai#LLP registration online in Chennai

0 notes

Text

LLP Registration in India — Online Procedure, Documents Required, Cost

Limited Liability Partnership, commonly known as “LLP”, is a newer form of business in India with limited liability benefits of a private limited company and the flexibility of a partnership firm. The concept of the LLP was introduced in India in 2008 and is regulated by the Limited Liability Partnership Act, 2008.

The maintenance cost and compliances are less in LLP; hence, it has become a preferred form of business organization among entrepreneurs. This form of business structure is ideal for small and medium-sized businesses.

Benefits of LLP Registration

Separate legal entity

Limited liability

Lower cost

No minimum capital required

Minimal compliances

Checklist for LLP registration

Minimum two partners

At least one partner should be a resident of India

DSC for all designated partners

DPIN for all designated partners

Unique name of the LLP that is not similar to any existing LLP or company or trademark

Capital contribution by the partners of LLP

LLP agreement between the partners

Address proof for the office of LLP

Documents required for LLP registration

Documents of both the partners and LLP have to be submitted for incorporating a Limited Liability Partnership:

—Documents of partners

ID proof of partners

Address proof of partners

Residence proof of partners

Passport size photograph

Passport (in case of foreign nationals / NRI)

—Documents of LLP

Proof of registered office address

Digital Signature Certificate

Documents you’ll get after LLP incorporation

To know more (click here)

#llp registration#nidhi company registration#limited liability company#private limited company registration online#private limited company registration in bangalore#private limited company registration in chennai#partnership firm registration#firm#organisation#india

0 notes

Text

Partnership Firm Registration in Chennai: Benefits and Process

Introduction

Starting a business in Chennai can be an exciting venture, and choosing the proper legal structure is essential. One popular option for entrepreneurs is forming a Partnership Firm. Partnership firms offer unique advantages, especially for small to medium-sized enterprises (SMEs). In this guide, we will discuss the benefits and process of Partnership Firm Registration in Chennai to help you make informed decisions.

Understanding Partnership Firms

A partnership firm is a business structure where two or more individuals collaborate to operate a business, sharing profits and responsibilities as outlined in a partnership deed. This model is governed by the Indian Partnership Act of 1932, which provides a legal framework for the formation and operation of partnership firms in India.

Key Features of Partnership Firms

Flexibility: Partnership firms are less regulated compared to corporations, allowing for more straightforward operational management.

Profit Sharing: Partners agree on a profit-sharing ratio, which can be customised based on their contributions and agreements.

Ease of Formation: Setting up a partnership firm is generally more accessible and less costly than forming a corporation.

Benefits of Registering a Partnership Firm in Chennai

Registering a partnership firm in Chennai offers several advantages:

1. Legal Recognition

Registration provides formal recognition of the partnership, enhancing credibility with clients, suppliers, and financial institutions. It serves as evidence of the partnership's existence and can be crucial in legal matters.

2. Limited Liability

While partners are generally liable for the debts of the firm, registering the partnership can offer some protection against personal liability in certain circumstances, especially when coupled with a Limited Liability Partnership (LLP) structure.

3. Tax Benefits

Registered partnership firms can avail of various tax benefits, including the ability to file tax returns under the partnership's name, which can sometimes result in lower tax rates compared to individual taxation.

4. Enhanced Business Opportunities

A registered partnership firm can participate in government tenders and contracts, which often require formal business registration. This opens up more avenues for growth and expansion.

5. Clarity in Operations

The partnership deed, which is a legal document outlining the rights and responsibilities of each partner, helps prevent disputes and provides clarity in operations.

The Process of Partnership Firm Registration in Chennai

The registration process for a partnership firm in Chennai involves several key steps:

Step 1: Drafting the Partnership Deed

The first step is to draft a partnership deed, which should include:

Name and address of the partnership firm

Names and addresses of all partners

Profit-sharing ratio

Nature of business

Duration of the partnership

Step 2: Collecting Required Documents

The following documents are typically required for registration:

Partnership Deed: A signed document outlining the partnership terms.

Identity Proof: PAN cards and Aadhaar cards of all partners.

Address Proof: Proof of address for both the business and partners.

Application Form: A filled application form for registration.

Step 3: Applying for Registration

Once the partnership deed is prepared and documents are collected, the partners must submit the application to the Registrar of Firms in Chennai. This can often be done online, streamlining the process.

Step 4: Verification and Issuance of Certificate

After submission, the Registrar will verify the documents. If everything is in order, a Certificate of Registration will be issued, officially recognising the partnership firm.

Key Considerations

Choosing a Unique Name

The name of the partnership firm must be unique and not infringe on existing trademarks or business names. This is crucial to avoid future legal complications.

Compliance with Regulations

Registered partnership firms must comply with various regulations, including filing annual returns and maintaining proper financial records. Non-compliance can lead to penalties and legal issues.

Future Changes

If the partnership changes, such as adding or removing partners, the partnership deed must be amended and re-registered to reflect these changes.

Conclusion

Partnership Firm Registration in Chennai is a significant step for entrepreneurs looking to formalise their business operations. The benefits of legal recognition, tax advantages, and enhanced credibility can provide a solid foundation for growth and success. By following the outlined process and ensuring compliance with regulations, partners can navigate the registration process smoothly and focus on building their business.

For help with partnership firm registration in Chennai, could you consult with professionals who specialise in business registration services? They can provide valuable guidance and ensure that all legal requirements are met efficiently.

0 notes

Text

Common Mistakes to Avoid During LLP Registration in Chennai

LLP Registration in Chennai: A Comprehensive Guide

Chennai, known for its thriving business environment, offers a favourable landscape for entrepreneurs looking to establish Limited Liability Partnerships (LLPs). LLPs are a famous business structure in India, combining the advantages of a partnership with the benefits of limited liability for its partners. Here’s a detailed guide on LLP registration in Chennai.

What is an LLP?

A Limited Liability Partnership (LLP) is a legal entity that provides the flexibility of a partnership while limiting the liability of its partners. Unlike traditional partnerships, where partners are personally liable for the firm’s debts, an LLP restricts each partner’s liability to their contribution to the business, protecting personal assets.

Why Choose LLP in Chennai?

Ease of Formation: LLPs are relatively easier to form than private limited companies, and they have fewer compliance requirements.

Limited Liability: Protects the personal assets of partners in case of business losses or legal issues.

Separate Legal Entity: An LLP is treated as a separate legal entity from its partners, allowing it to own property, enter contracts, and sue or be sued in its name.

Tax Benefits: LLPs enjoy several tax advantages, including exemptions from Dividend Distribution Tax and Minimum Alternate Tax.

No Minimum Capital Requirement: Forming an LLP does not require a minimum capital investment, making it accessible to small businesses and startups.

Steps to Register an LLP in Chennai

Obtain a Digital Signature Certificate (DSC): The first step is to obtain a DSC for all designated partners of the LLP. This certificate is required for online form filing.

Apply for Director Identification Number (DIN): Each designated partner must have a DIN, which can be obtained by filing Form DIR-3.

Name Reservation: File Form LLP-RUN (Reserve Unique Name) with the Registrar of Companies (RoC) to reserve the LLP’s name. Ensure the name is unique and not identical to an existing company or LLP.

Drafting of LLP Agreement: The LLP agreement outlines the partners' rights, duties, and responsibilities. It must be drafted on stamp paper and submitted within 30 days of the LLP's incorporation.

Filing Incorporation Documents: Submit Form FiLLiP (Form for incorporation of LLP) along with necessary documents such as proof of address of the registered office, identity and address proofs of partners, and the LLP agreement.

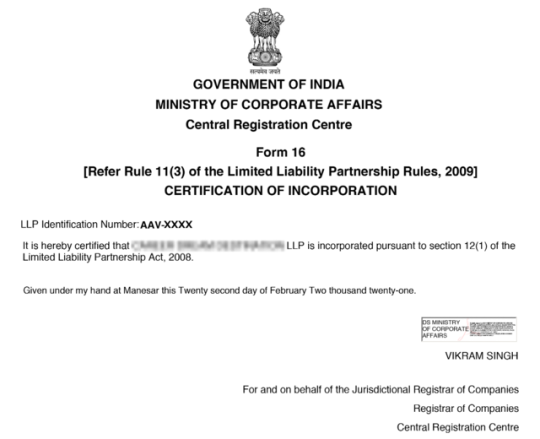

Certificate of Incorporation: Upon verification, the RoC issues a Certificate of Incorporation confirming the LLP’s legal existence.

PAN and TAN Application: After incorporation, apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the LLP.

Opening Bank Account: With the Certificate of Incorporation, PAN, and other required documents, open a bank account in the LLP’s name.

Documents Required for LLP Registration

Identity and Address Proofs: PAN card, Aadhaar card, passport, voter ID, or driving license of partners.

Registered Office Proof: Rental agreement and utility bill (not older than two months) or ownership proof of the office space.

Digital Signature Certificate: For all designated partners.

Consent of Partners: All partners signed the consent form.

LLP Agreement: Duly signed by all partners.

Post-Registration Compliance

Once the LLP is registered, certain ongoing compliances must be met, including:

Annual Return Filing: LLPs must file a yearly return in Form 11 with the RoC.

Statement of Accounts and Solvency: Filing Form 8 is mandatory to report the LLP’s financial status.

Income Tax Filing: LLPs must file an income tax return annually using Form ITR-5.

Conclusion

LLP registration in Chennai is a streamlined process that offers numerous benefits to entrepreneurs, including limited liability, ease of management, and tax advantages. By following the above steps and ensuring compliance with legal requirements, you can successfully establish an LLP in Chennai, contributing to the city’s vibrant business ecosystem.

0 notes

Text

Company Registration in Chennai: Common Mistakes to Avoid

A Comprehensive Guide to Company Registration in Chennai

Starting a business in Chennai, the bustling capital city of Tamil Nadu can be an exciting venture. Whether you're launching a tech startup, a manufacturing company, or a service-oriented business, registering your company is one of the primary steps. Company registration in Chennai is governed by the Ministry of Corporate Affairs (MCA) and follows specific procedures laid out by the Companies Act 2013. This comprehensive guide will walk you through registering your company in Chennai, ensuring compliance and smooth operations from the outset.

1. Choose the Right Business Structure:

Before diving into the Company Registration in Chennai process, it's essential to determine the most suitable business structure for your venture. In India, common business structures include:

- Sole Proprietorship

- Partnership

- Limited Liability Partnership (LLP)

- Private Limited Company

- Public Limited Company

Each structure has its own set of advantages and legal requirements. For most startups and small businesses, registering as a Private Limited Company or LLP is often preferred due to limited liability and easier access to funding.

2. Obtain a Digital Signature Certificate (DSC) and Director Identification Number (DIN):

Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) are prerequisites for company registration. All directors/promoters must obtain DIN, which serves as an identification number for company directors. Additionally, a DSC is required for online registration form filing.

3. Reserve Your Company Name:

Choosing a unique and appropriate name for your company is crucial. The proposed name must comply with the naming guidelines specified by the MCA. Once you've finalized a name, you can check its availability and reserve it through the MCA's online portal.

4. File Incorporation Documents:

After securing the company name, you must prepare and file the necessary incorporation documents with the Registrar of Companies (RoC). These documents typically include:

- Memorandum of Association (MoA)

- Articles of Association (AoA)

- Form SPICe (INC-32) for company incorporation

- Form INC-9 (Declaration by first subscriber(s) and director(s))

5. Obtain Certificate of Incorporation:

Upon successfully scrutinizing the incorporation documents, the RoC will issue a Certificate of Incorporation (COI). This certificate is conclusive evidence of your company's existence and includes essential details such as the company name, registration number, and incorporation date.

6. Apply for PAN, TAN, and GST Registration:

Once you've obtained the CoI, you can apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department. Additionally, if your business turnover exceeds the GST threshold limit, you must register for Goods and Services Tax (GST) with the GSTN.

7. Compliance Requirements:

After company registration, it's essential to fulfill ongoing compliance requirements to maintain legal standing. These may include annual filings, maintaining statutory registers, conducting board meetings, and adhering to tax obligations.

Conclusion:

Company Registration in Chennai involves several steps, from choosing the proper business structure to fulfilling compliance requirements. While the process may seem daunting, seeking professional guidance from company registration consultants or chartered accountants can streamline the process and ensure compliance with regulatory requirements. By following this comprehensive guide, you can confidently establish your business in Chennai, laying a solid foundation for growth and success in the vibrant business ecosystem of the city.

0 notes

Text

Simplify Your Business Setup with Expertpoint’s LLP Registration Services in Chennai

Setting up a business in Chennai involves navigating various legal requirements, and choosing the right business structure is crucial. Limited Liability Partnership (LLP) is a popular choice among entrepreneurs due to its flexibility and reduced compliance burden. If you're considering LLP registration in Chennai, Expertpoint offers comprehensive services to streamline the process and ensure compliance with regulatory standards.

Understanding LLP Registration

A Limited Liability Partnership (LLP) combines the benefits of a partnership firm with limited liability features typically associated with corporations. It provides partners with limited liability protection, shielding their personal assets from business liabilities. LLP registration in Chennai is governed by the Ministry of Corporate Affairs (MCA) and involves several steps to establish legal recognition for your business entity.

Expertpoint’s LLP Registration Services

Expertpoint specializes in providing efficient and reliable LLP registration services tailored to meet the specific needs of businesses in Chennai. Here’s how our services can benefit you:

1. LLP Company Registration in Chennai:

We facilitate LLP company registration in Chennai, guiding you through the entire process from name reservation to obtaining the Certificate of Incorporation.

Our experts ensure compliance with all statutory requirements, making the registration process smooth and hassle-free.

2. Limited Liability Partnership Registration in Chennai:

Expertpoint assists in limited liability partnership registration in Chennai, advising on the appropriate LLP agreement and partnership structure.

We help draft and file necessary documents, ensuring accuracy and completeness to avoid delays or rejections.

3. LLP Registration Online in Chennai:

Embracing digital transformation, we offer LLP registration online in Chennai for convenience and efficiency.

Our online platform allows you to track the progress of your application and receive updates in real-time, ensuring transparency throughout the process.

4. Limited Liability Partnership Registration Online in Chennai:

As a trusted service provider, Expertpoint offers secure and user-friendly online LLP registration services in Chennai.

You can rely on our expertise to navigate the complexities of online filing and documentation, ensuring compliance with MCA guidelines.

Why Choose Expertpoint?

With years of experience in corporate law and business registration, Expertpoint has helped numerous entrepreneurs and businesses establish their LLPs in Chennai. Our team of professionals is well-versed in the intricacies of LLP registration, ensuring thorough guidance and support throughout the process.

Personalized Service:

We understand that every business is unique. At Expertpoint, we provide personalized LLP registration services tailored to your specific requirements and business goals. Whether you're a startup or expanding your operations, our services are designed to meet your needs effectively.

Compliance Assurance:

Compliance with regulatory requirements is paramount when establishing an LLP. Expertpoint ensures that your LLP registration in Chennai adheres to all legal provisions and guidelines, minimizing the risk of errors or omissions.

Transparent Process:

At Expertpoint, transparency is integral to our service approach. We keep you informed at every stage of the LLP registration process, providing clarity and peace of mind. Our commitment to transparency fosters trust and confidence in our services.

Conclusion

Choosing the right business structure is crucial for the success and sustainability of your venture. With Expertpoint’s LLP registration services in Chennai, you can establish your business with confidence and compliance. Whether you're starting a new venture or restructuring your business, our dedicated team is here to support you every step of the way. Visit : https://expertpoint.in/limited-liability-partnership-llp-registration/

Ensure legal recognition, limited liability protection, and operational flexibility with Expertpoint’s LLP registration services in Chennai. Contact us today to learn more about how we can help you achieve your business goals efficiently and effectively.

0 notes

Text

CA in Chennai

CA in Chennai is a legal process that involves formalizing the existence of a business entity within the administrative and regulatory framework of the Indian capital city. This registration is essential for establishing the firm’s legal identity, facilitating business operations, and complying with various government regulations. Here is a description of the key steps and details involved in the ca of firm in Chennai.

Business Structure: Before registering your firm, you need to decide on its legal structure. Common options include a sole proprietorship, partnership, limited liability partnership (LLP), private limited company, or public limited company. Your choice will affect the registration process and the legal liabilities of the firm’s owners.

Choose a Business Name: Select a unique and suitable name for your firm. Ensure that it complies with the guidelines set by the Ministry of Corporate Affairs (MCA). You can check the availability of your chosen name on the MCA website.

Obtain Director’s Identification Number (DIN): If you plan to register a private limited company, you need to obtain a DIN for the proposed directors of the company. This can be done online through the MCA portal.

Digital Signature Certificate (DSC): To file online documents with the Registrar of Companies (RoC), you must obtain a digital signature certificate. This is necessary for digitally signing the required documents.

File for Incorporation: For different types of firms, you will need to file different incorporation documents. For example, for a private limited company, you will need to file the Memorandum of Association (MoA) and Articles of Association (AoA). For an LLP, you need to file the LLP Agreement. These documents outline the structure, objectives, and operational guidelines of your firm.

Registration Fees: Pay the necessary registration fees as prescribed by the MCA or relevant authority. The fee may vary depending on the type and capital of the firm.

Obtain Permanent Account Number (PAN): Apply for a PAN card for your firm through the Income Tax Department. A PAN card is essential for tax-related purposes.

Tax Registration: Depending on your business activities and turnover, you may need to register for Goods and Services Tax (GST) or other state-specific taxes. This registration ensures compliance with India’s tax laws.

Professional Tax Registration: If you have employees in Chennai, you may be required to register for Professional Tax with the local authorities.

Compliance with Labor Laws: Ensure compliance with labor laws, including obtaining necessary licenses or permits for employing workers, if applicable.

Business Bank Account: Open a bank account in the firm’s name. This account will be used for financial transactions related to the business.

Post-Incorporation Compliances: After registration, you must fulfill ongoing compliance requirements, such as filing annual financial statements, holding annual general meetings, and adhering to other regulatory obligations.

Other Licenses and Permits: Depending on your business activities, you may require additional licenses and permits from local, state, or central government authorities.

0 notes

Text

Partnership firm registration in Chennai

In India, registering a partnership firm is a relatively straightforward process, and it provides legal recognition and protection to the business entity. A partnership firm is a popular choice for small and medium-sized businesses where two or more individuals come together to carry out a business venture with shared responsibilities, profits, and losses.

What is the ITR form for partnership firm?

In India, partnership firms are required to file their income tax returns (ITR) using specific forms provided by the Income Tax Department. The choice of ITR form depends on the nature of income, the type of business, and the annual turnover of the partnership firm.

1. ITR-5:

ITR-5 is the most commonly used form for filing income tax returns by partnership firms. This form is meant for entities other than individuals, Hindu Undivided Families (HUFs), companies, and individuals who are filing ITR-7 (for trusts, political parties, etc.).

Here are some key points about ITR-5 for partnership firms:

A. Eligibility:

Firms with Partnership firm registration in Chennai, including Limited Liability Partnerships (LLPs), can use ITR-5.

It is suitable for firms with business income, such as trading, manufacturing, or providing services.

ITR-5 can be used by firms irrespective of their turnover.

B. Income Sources:

Partnership firms should report income from business or profession, capital gains, income from other sources, and income from investments in this form.

It is essential to provide details of income, such as interest income, rental income, etc.

C. Computation of Income:

Partnership firms need to calculate their total income, deductions, and exemptions as per the provisions of the Income Tax Act.

The firm should provide a balance sheet and profit and loss account, which is audited by a Chartered Accountant, along with the return.

D. Audit Requirement:

If the annual turnover of the partnership firm exceeds Rs. 1 crore (or Rs. 25 lakhs for professionals), it is mandatory to get the accounts audited under Section 44AB of the Income Tax Act. In such cases, the audit report in Form 3CA/3CB and the tax audit report in Form 3CD should be submitted along with the ITR.

E. Due Date for Filing:

The due date for filing ITR-5 for a company with Partnership firm registration in Chennai is usually July 31st of the assessment year. However, it may get extended by the Income Tax Department.

F. Mode of Filing:

ITR-5 can be filed online on the Income Tax Department's e-filing portal.

G. Consequences of Non-Filing:

Failure to file ITR-5 or filing it after the due date can lead to penalties and interest charges.

2. ITR-3:

ITR-3 is another form that can be used by partnership firms, especially if the firm includes individual partners who have income from the business.

Here are some key points about ITR-3 for partnership firms:

A. Eligibility:

ITR-3 is meant for individuals and Hindu Undivided Families (HUFs) who have income from a proprietary business or profession.

It can be used by a partnership firm if it has individual partners who are liable to pay tax on their share of income from the firm.

B. Income Sources:

Firms with Partnership firm registration in Chennai filing ITR-3 should report their business income, income from profession, capital gains, income from other sources, and income from investments.

Individual partners must report their share of income from the partnership firm.

C. Computation of Income:

The partnership firm should calculate its total income, deductions, and exemptions, similar to ITR-5.

Individual partners need to include their share of partnership income in their individual returns.

D. Audit Requirement:

The audit requirement for partnership firms under ITR-3 is the same as that for ITR-5. If the annual turnover exceeds Rs. 1 crore (or Rs. 25 lakhs for professionals), a tax audit is mandatory.

E. Due Date for Filing:

The due date for filing ITR-3 is also typically July 31st of the assessment year.

F. Mode of Filing:

ITR-3 can be filed online on the Income Tax Department's e-filing portal.

G. Consequences of Non-Filing:

Non-filing or late filing of ITR-3 can result in penalties and interest charges, similar to ITR-5.

3. ITR-4:

ITR-4 is primarily meant for individuals and Hindu Undivided Families (HUFs) who have income from a proprietary business or profession.

However, it may be relevant for certain partnership firms, specifically those with a presumptive income scheme.

Here are some key points about ITR-4 for firms with Partnership firm registration in Chennai:

A. Eligibility:

ITR-4 is designed for individuals, HUFs, and firms who have opted for the presumptive income scheme under Section 44AD, 44ADA, or 44AE of the Income Tax Act.

Partnership firms that have opted for presumptive taxation can use this form.

B. Income Sources:

ITR-4 covers income from business, profession, and income from other sources, but it is primarily intended for businesses with presumptive income.

C. Computation of Income:

Under the presumptive income scheme, the firm's income is presumed to be a certain percentage of its gross receipts. Partnerships opting for this scheme do not need to maintain detailed books of accounts.

D. Audit Requirement:

Partnership firms with Partnership firm registration in Chennai under the presumptive income scheme are not required to get their accounts audited unless their total income exceeds the maximum amount not chargeable to tax. In such cases, the audit report in Form 3CD is required.

E. Due Date for Filing:

The due date for filing ITR-4 is typically July 31st of the assessment year.

F. Mode of Filing:

ITR-4 can be filed online on the Income Tax Department's e-filing portal.

G. Consequences of Non-Filing:

Similar to other forms, non-filing or late filing of ITR-4 can result in penalties and interest charges.

In conclusion, the choice of ITR form for a firm with Partnership firm registration in Chennai depends on factors such as the nature of income, turnover, and whether individual partners are involved.

Partnership firms should carefully assess their tax situation, maintain proper records, and consult with a qualified Chartered Accountant to ensure compliance with the applicable ITR form and other tax-related requirements.

0 notes

Text

Company Registration In Chennai

Online Company Registration in India — An Overview

One of the most highly recommended methods for starting a business in India is to establish a private limited company, which provides its shareholders with limited liability while imposing certain ownership restrictions. When it is LLP, the partners will manage it. On the other hand, a private limited company allows for directors and shareholders to be separate entities.

As your dependable legal advisor, synmac offers a cost-efficient service for registering your company in India. We handle all legal procedures and ensure compliance with the regulations set forth by the Ministry of Corporate Affairs (MCA). Upon successful completion of the pvt company registration process, we provide you with an Incorporation certificate (CoI), as well as PAN and TAN documents. With these in hand, you can easily establish a current bank account and commence your business operations.

Online Company Registration in India — An Overview

One of the most highly recommended methods for starting a business in India is to establish a private limited company, which provides its shareholders with limited liability while imposing certain ownership restrictions. When it is LLP, the partners will manage it. On the other hand, a private limited company allows for directors and shareholders to be separate entities.

As your dependable legal advisor, synmac offers a cost-efficient service for registering your company in India. We handle all legal procedures and ensure compliance with the regulations set forth by the Ministry of Corporate Affairs (MCA). Upon successful completion of the pvt company registration process, we provide you with an Incorporation certificate (CoI), as well as PAN and TAN documents. With these in hand, you can easily establish a current bank account and commence your business operations.

Benefits of Pvt Ltd Company Registration

There are numerous advantages to registering a company. By doing so, you enhance the credibility of your business, which can lead to increased consumer trust. Additionally, company registration can provide various benefits that can help your business to grow and succeed.

Shield from personal liability and protects from other risks and losses

Attract more customers

Procure bank credits and good investment from reliable investors with ease

Offers liability protection to protect your company’s assets

Greater capital contribution and greater stability

Increases the potential to grow big and expand

Checklist for Private Limited Company Registration in India

As defined by the Companies Act, 2013 one must guarantee to meet the checklist requirements without fail for Private Limited Company Registration in India.

Two Directors:

A private limited company must have at least two directors, with a maximum of fifteen. A minimum of one of the company’s directors must be a resident of India.

Unique Name

The name of your pvt ltd company must be unique. The suggested name should not match with any existing companies or trademarks in India.

Minimum Capital Contribution:

There is no minimum capital amount for a Pvt ltd company. A Pvt limited company should have an authorised capital of at least ₹1 lakh.

Registered Office:

The registered office of a pvt ltd company does not have to be a commercial space. Even a rented home can be the registered office, so long as an NOC is obtained from the landlord.

Steps For Company Registration in India

Startups in India can gain an edge over non-registered competitors by registering their company. While the process of registration is getting complicated and involves numerous compliance requirements, need not worry as Synmac is here to assist you every step of the way. Our team of professionals can provide comprehensive support for pvt company registration.

Step 1: RUN Name Approval

The first step of company registration involves the registration of your desired name. To reserve a name for your company, you must first submit a request for name approval to the Ministry of Corporate Affairs (MCA). You may include one or two potential names, along with a description of your business objectives, in your application for name approval. If your first choice is not approved, you may submit one or two additional names for consideration. Typically, the MCA approves name requests within five business days. Our team of experts can help you choose the ideal name for your company and guide you through the government registration process.

Step 2: Directors’ Digital Signature Certificate (DSC)

The MCA in India does not recognize traditional signatures. Instead, all filings with the MCA must include a digital signature certified by an Indian certification authority. Thus, it is mandatory for directors to have digital signatures prior to the company’s incorporation.

Synmac will obtain a digital signature certificate (DSC) for the directors through a recognized certification entity. To obtain a digital signature, directors must provide a copy of their identification documents and successfully complete a video KYC process. If a director is a foreign national, the nearest embassy should apostille their passport and other documents for company registration.

Step 3: Submitting the Company Incorporation Application

After obtaining the necessary digital signatures, submit the incorporation application in SPICe form along with all relevant attachments to the MCA. The application for incorporation includes the company’s Memorandum of Association (MOA) and Articles of Association (AOA). If the MCA deems the incorporation application to be complete and acceptable, the company can get the Incorporation certificate and PAN. Typically, the MCA approves all incorporation applications within five business days.

Private Limited Company Registration Compliances

After the process of company registration in India, it is necessary to adhere to various compliance regulations in order to avoid potential fines and legal repercussions. Some of the key post-registration requirements include:

Auditor Appointment: Within 30 days of incorporation, every Indian company must appoint a practicing's, certified, and registered Chartered Accountant(CA).

Director DIN KYC: Every year, individuals who possess a Director Identification Number (DIN) should undergo a DIN KYC process. During the company incorporation process, the company can get the DIN. This helps to verify the phone number and email address on file with the MCA.

Commencement of Business: The shareholders of the company must deposit the subscription amount specified in the MOA within 180 days of incorporation, and the company must create a bank current account. Therefore, to receive a business incorporation certificate, the shareholders of a company established with a paid-up capital of ₹1 lakh must deposit ₹1 lakh into the company’s bank account. They should also file a copy of the bank statement with the MCA.

MCA Annual Filings: Every financial year, the MCA must get a copy of the financial statements from each company registered in India. A corporation that incorporates between January and March may elect to include the first MCA annual return in the annual filing for the following fiscal year. Forms MGT-7 and AOC-4 are the components of the MCA yearly return. The Directors and a working professional must digitally sign both of these documents.

Income Tax Filing: Every financial year, businesses should file an income tax return using form ITR-6. The business should file the income tax before the deadline for each financial year, irrespective of the date of incorporation. The company’s income tax return must be digitally signed using the director’s digital signature.

Requirements to Start a Private Limited Company

Before incorporating a firm, it must meet a specific set of conditions. The following are such conditions:

1. Directors and Members

As mentioned earlier, at least two directors and no more than 200 members are necessary for legal Private Limited Company Registration in India. This is a mandatory requirement as per the Companies Act of 2013. The Directors should honor the following conditions:

Each directors should carry a DIN issued by the MCA

One of the directors must be an Indian resident, which means they must have spent at least 182 days there in the previous calendar year.

2. The Business’s Name

When selecting a name for a private limited company, there are two factors must be into consideration:

Name of the principal activity

PRIVATE COMPANY REGISTRATION

PRIVATE COMPANY REGISTRATION What is PRIVATE COMPANY REGISTRATION? Private Limited Company is the most prevalent and popular type of corporate legal entity in India. The Ministry of Corporate Affairs governs private limited company registration in India. Companies are incorporated and regulated under the Companies Act, 2013 and the Companies Incorporation Rules, 2014. Minimum Requirements For Company Registration Minimum 2 Shareholders: The shareholders of a private limited company can be a corporate entity or a natural person. Two Directors: A private limited company must have at least two directors and at most, there can be 15. Of the directors in the business, at least one must be a resident of India. Unique Name: The name of your business must be unique. The suggested name should not match with any existing companies or trademarks in India. Minimum Capital Contribution: There is no minimum capital amount for a company. A company should have an authorized capital of at least Rs. 1 lakh. Registered Office: The registered office of a company does not have to be a commercial space. Even a rented home can be the registered office, so long as an NOC is obtained from the landlord. Advantages of registering a private limited company Equity Raise: A company can raise equity capital from persons or entities interested in becoming a shareholder. Hence, a private limited company is a must for Entrepreneurs looking to raise money from angel investors, venture capital firms, private equity firms and hedge funds. Limited Liability Protection: A private limited company provides limited liability protection to its shareholders. In case of any unforeseen liabilities are created, it would be limited to the company and would not impact the shareholders. Separate Legal Entity: A private limited company is legally recognised as a separate entity. Hence, a company can have its PAN, bank accounts, licenses, approvals, contracts, assets and liabilities in its unique name. Perpetual Existence: A company has perpetual existence and never ends without reason. For a company to lose its existence, it has to be wound-up by the Promoters or be wound-up by the Government. Hence, a company can only be wound up for reasons like non-compliance or failure to comply with rules and regulations. Easy Transferability: As the ownership of a company is represented by shares - the ownership of a company can be transferred to any other legal entity or person in India or abroad easily - in part or whole. Further, since the shareholders control the Board of Directors, the Directors can also be replaced easily by shareholders to ensure business continuity easily at all times. Private Limited Company Registration Process: 1. Application of DSC & DPIN: First of all, the partners have to apply for Digital signature and DPIN. Digital signature is an online signature used for filing and DPIN refer to Directors PIN number issued by MCA. Director Identification Number (DIN) is a unique number ass

3.Address of the registered office

Upon completion of the registration process, the company should give the permanent address of the business’s registered office to the company registrar. The registered office is the primary location where business takes place and stores all documentation pertaining to the company.

4. Getting Additional Documents

To verify the authenticity of electronically submitted documents, every business must obtain a DSC. Furthermore, the business needs credentials from such professionals as secretaries, chartered accountants, and cost accountants that engage them for various operations.

#pvt ltd company registration#private limited company registration#registration#company registration#gst#income tax#tds2#itrfiling#gst refund

0 notes

Text

how to register llp online

The Limited Liability Partnership Act of 2008 addresses LLP, which stands for Limited Peril Alliance. Obliged Liability Association has the benefit of limiting owners' exposure to risk while simultaneously requiring minimal upkeep. Bank risk has been limited by private-held affiliation authorities.

Banks and charters can essentially provide the organization's core values, not specific chairmen's resources, in the event of default. A limited liability partnership (LLP) is a type of business in which some or all of the partners have limited liabilities, depending on the state.

LLP is a business structure that combines the adaptability of an organization with the benefits of limited responsibility at a low consistency cost. It thus displays components of associations and businesses.

When compared to the traditional organization and the Private Limited, the LLP has its own advantages because it combines the best features of both structures into a single, robust, and suitable bundle. It addresses a variety of issues that businesspeople encounter when employing a conventional organization structure.

When compared to a Pvt. Ltd., one of the real expenses is bookkeeping and consistency, so the primary focus of any startup is to keep repeat costs to a minimum while still managing the business smoothly.

Checklist of LLP registration

Here is the checklist for LLP registration in Chennai.

· At least two partners.

· DSC for all designated partner.

· DPIN for all designated partner.

· The name of the LLP is distinct from any other LLP or trademark.

· Contribution of capital by the LLP's partners.

· For LLP registration in Chennai, Partnership agreement between partners is needed.

· Evidence of the LLP's registered office.

LLP registration process

LLP registration in Chennai follows the procedure given below.

DSC Application

The designated partner must apply for the Digital Signature Certificate prior to beginning the process of LLP registration in Chennai. DSC authenticates all LLP documents because the entire form must be filled out online and digitally signed.

Name Reservation via LLP-RUN

The Central Registration Centre will process the proposed LLP's name reservation via LLP-RUN under Non-STP.

However, the applicant is encouraged to make use of the MCA portal's free name search facility prior to submitting an application for a name reservation. This is important for LLP registration in Chennai.

· The MCA portal's "Name availability" check assists you in selecting names that are distinct from one another.

· The name will only be approved by the ROC if it does not resemble any other company, LLP, body corporate, or trademark.

· In accordance with Annexure "A," the applicant is responsible for paying the necessary fees. The Registrar has the option of either accepting or rejecting the completed form.

· If submitted for second time, the form must be submitted again within 15 days to correct any errors for LLP registration in Chennai.

· The FiLLiP form is an integrated application for Reservation of name, Application for allotment of DIN/DPIN, and Incorporation of a new LLP and/.

· Once the form is filed and found to be complete, LLP incorporation is done, and an LLPIN is issued once the authority has approved it. LLP registration in Chennai is done through FiLLip

· Additionally, those proposed designated partners without a current DPIN are issued for LLP registration in Chennai.

The following services are included in the FiLLip form for LLP registration in Chennai.

· Reservation of the proposed LLP's name.

· The application for the name reservation can also be made through FiLLiP. If the RUN-LLP service has already approved the proposed LLP's name. The SRN of such an approved form must be mentioned by the applicant.

· DPIN Allotment

For LLP registration in Chennai, Designated Partners During the incorporation of an LLP, this integrated form can be used to allot DPIN to up to two designated partners.

Benefits of LLP registration in Chennai

LLP hat has LLP registration in Chennai has following advantages.

No Base capital

Instead of requiring Rs like Private Limited Partnerships do, an LLP could be established with no base capital commitment. 1 Lac.

In fact, even commitments can be broken down into smaller chunks, allowing small business visionaries and new businesses to take advantage of these advantages and move ahead.

Seclude legal components

Instead of a sole proprietorship or a traditional business structure in which the individual resources of the proprietor or partners could be in jeopardy in the event of a failure of the business.

Seclude legal component (Limited Liability) allows for the obligation of each partner to be limited to the extent of his or her commitment or share.

With the exception of instances in which any accomplice misrepresents, this mode encourages the accomplices to be free of individual liabilities or to become bankrupt. When compared to the limitless risk offered by a business, it is very secure.

Low Price:

When compared to the cost of merging a private limited or open limited company, the cost of LLP registration in Chennai is low.

Separate legal entity

The presence of the separate legal entity LLP differs from that of its partners. In its own reality, LLP can sue and be sued. The LLP is unaffected by the separation and departure of its partners because of its status.

Because it brings together various stakeholders (such as Customers, providers, and so forth), It allows for flexibility in managing and marking legitimate contracts, among other things.

Tax Benefits

The profit will be distributed solely to the LLP and not to the Partners, avoiding double tax collection problems. Procedure for Registering a Limited Liability Partnership. If you have an idea for a business, register it with Limited Liability.

With Smartauditor.in, LLP registration in Chennai is easy, but careful drafting of incorporation points is required.

About Smartauditor

We Smartauditor are serving our valuable clients for LLP registration in Chennai. Also we are involved in ROC, IPR, GST, IT. We are also serving in various parts across India.

0 notes

Text

#FSSAIregistration#tmregistrationfees#gstnumberapply#Businesssetup#Incorporatecompany#GST#trademark#companyregistration#taxandaccounting#FssaiRegistrationServices#taxfiling#AnnualRocFiling#kanakkiyalchennai#gstfiling#gstreturn#incometax#fssairegistrationservices#annualrocfiling#businesssetup#gst#incorporatecompany

0 notes

Text

#LLP Registration in chennai#LLP Registration in chennai online#LLP Registration#Online LLP Registration in chennai#LLP Registration online in chennai#LLP Registration in Tamilnadu

0 notes

Text

Trademark Registration online in Chennai

A Trademark is an image, logo, design, name, or phrase utilized by a commercial enterprise or enterprise to distinguish its services or products from different same services or products withinside the marketplace owned via way of means of different corporations or companies. A Trademark or a logo is a precious asset that may be safeguarded below Indian Law. To shield a Trademark from being illegally used or copied via way of means of others, the proprietor of the image or mark has to observe for Trademark Registration online in Chennai. The system for Trademark Registration in Chennai has numerous steps, and Swarit Advisors will assist you in this.

Any criminal entity or any person can report an utility for Trademark Registration in Chennai. The proposed mark or image does not always must be used earlier than making use of for Trademark Registration, even though a previous use of mark improves the possibilities of registration. Foreign criminal entities and nationals also can report programs for Trademark in India and shield registration with out greater requirements.

Who can observe for Trademark Registration in Chennai?

Any individuals, personal firms, NGOs, LLPs, or corporations can observe for Trademark Registration in Chennai. The Trademark can be submitted to license on behalf of the enterprise worried withinside the case of LLPs, NGOs or corporations.

1 note

·

View note

Link

Get Online LLP Registration in Chennai, best Limited Liabiity Partnership incorporation at very low cost, dedicated customer support available, pre & pos-registration service available.

0 notes

Text

Legal Compliance and LLP Registration in Chennai: What You Need to Know

LLP Registration in Chennai: A Comprehensive Guide

Introduction to LLP

A Limited Liability Partnership (LLP) is a famous business structure in India that combines the benefits of both a company and a partnership firm. It offers LLP registration in Chennai to its partners, meaning their personal assets are protected in case of business debts and liabilities. LLPs are governed by the Limited Liability Partnership Act 2008 and are suitable for small and medium-sized enterprises.

Why Choose LLP?

Limited Liability: Partners have limited liability, protecting their personal assets.

Separate Legal Entity: LLPs have a separate legal identity from their partners.

Flexible Management: Partners can manage the LLP internally as per their agreement.

Less Compliance: Compared to companies, LLPs have fewer compliance requirements.

Tax Benefits: LLPs enjoy various tax advantages, including exemptions from certain taxes applicable to companies.

Steps for LLP Registration in Chennai

1. Obtain a Digital Signature Certificate (DSC)

Each designated partner of the LLP must obtain a Digital Signature Certificate (DSC), which is used for online document filing with the Ministry of Corporate Affairs (MCA).

2. Apply for Director Identification Number (DIN)

Partners must apply for a Director Identification Number (DIN) online by submitting the DIR-3 form.

3. Name Reservation

File the LLP-RUN (Reserve Unique Name) form to reserve a unique name for your LLP. Ensure the name complies with the naming guidelines provided by the MCA.

4. Incorporation of LLP

Once the name is approved, file the incorporation form FiLLiP (Form for Incorporation of Limited Liability Partnership) along with the required documents:

Address proof of the registered office

Identity and address proof of partners

Subscription sheet signed by the partners

Consent of the partners

5. LLP Agreement

Draft and file the LLP Agreement, which outlines the rights and duties of the partners, profit-sharing ratio, and other operational details. This agreement must be filed within 30 days of the incorporation.

Documents Required for LLP Registration

Partners' Documents:

PAN Card

Address proof (Aadhaar Card, Voter ID, Passport, or Driving License)

Residential proof (Bank Statement, Utility Bill)

Registered Office Documents:

Proof of address (Electricity Bill, Property Tax Receipt)

No-Objection Certificate (NOC) from the property owner if the office is rented

LLP Agreement:

Details of the rights and duties of partners

Profit-sharing ratio

Post-Registration Compliance

LLP Agreement Filing: Submit the LLP Agreement to the MCA within 30 days of incorporation.

PAN and TAN Application: Apply for PAN and TAN for the LLP.

Bank Account: Open a bank account in the name of the LLP.

Annual Filings: File Form 8 (Statement of Account & Solvency) and Form 11 (Annual Return) annually.

Income Tax Return: File income tax returns annually by 31st July or 30th September, depending on the audit requirement.

Conclusion

LLP registration in Chennai is straightforward and offers numerous advantages, including limited liability, separate legal entity status, and flexible management. Following the steps outlined above, you can ensure a smooth registration process and compliance with all legal requirements. Embrace the benefits of an LLP and set your business on a path to success.

0 notes

Text

How to Choose the Right Business Structure for Your Company in Chennai

A Comprehensive Guide to Company Registration in Chennai

Starting a business in Chennai, the bustling capital city of Tamil Nadu can be an exciting venture. Whether you're launching a tech startup, a manufacturing company, or a service-oriented business, registering your company is one of the primary steps. Company registration in Chennai is governed by the Ministry of Corporate Affairs (MCA) and follows specific procedures laid out by the Companies Act 2013. This comprehensive guide will walk you through registering your company in Chennai, ensuring compliance and smooth operations from the outset.

1. Choose the Right Business Structure:

Before diving into the Company Registration in Chennai process, it's essential to determine the most suitable business structure for your venture. In India, common business structures include:

- Sole Proprietorship

- Partnership

- Limited Liability Partnership (LLP)

- Private Limited Company

- Public Limited Company

Each structure has its own set of advantages and legal requirements. For most startups and small businesses, registering as a Private Limited Company or LLP is often preferred due to limited liability and easier access to funding.

2. Obtain a Digital Signature Certificate (DSC) and Director Identification Number (DIN):

Digital Signature Certificates (DSC) and Director Identification Numbers (DIN) are prerequisites for company registration. All directors/promoters must obtain DIN, which serves as an identification number for company directors. Additionally, a DSC is required for online registration form filing.

3. Reserve Your Company Name:

Choosing a unique and appropriate name for your company is crucial. The proposed name must comply with the naming guidelines specified by the MCA. Once you've finalized a name, you can check its availability and reserve it through the MCA's online portal.

4. File Incorporation Documents:

After securing the company name, you must prepare and file the necessary incorporation documents with the Registrar of Companies (RoC). These documents typically include:

- Memorandum of Association (MoA)

- Articles of Association (AoA)

- Form SPICe (INC-32) for company incorporation

- Form INC-9 (Declaration by first subscriber(s) and director(s))

5. Obtain Certificate of Incorporation:

Upon successfully scrutinizing the incorporation documents, the RoC will issue a Certificate of Incorporation (COI). This certificate is conclusive evidence of your company's existence and includes essential details such as the company name, registration number, and incorporation date.

6. Apply for PAN, TAN, and GST Registration:

Once you've obtained the CoI, you can apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department. Additionally, if your business turnover exceeds the GST threshold limit, you must register for Goods and Services Tax (GST) with the GSTN.

7. Compliance Requirements:

After company registration, it's essential to fulfill ongoing compliance requirements to maintain legal standing. These may include annual filings, maintaining statutory registers, conducting board meetings, and adhering to tax obligations.

Conclusion:

Company Registration in Chennai involves several steps, from choosing the proper business structure to fulfilling compliance requirements. While the process may seem daunting, seeking professional guidance from company registration consultants or chartered accountants can streamline the process and ensure compliance with regulatory requirements. By following this comprehensive guide, you can confidently establish your business in Chennai, laying a solid foundation for growth and success in the vibrant business ecosystem of the city.

0 notes