#longterminvesting

Text

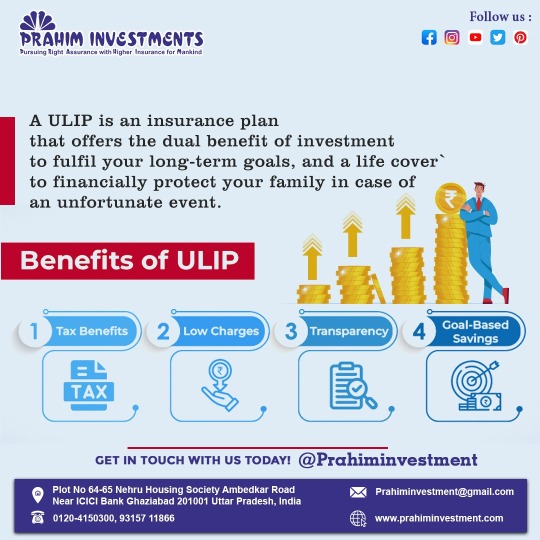

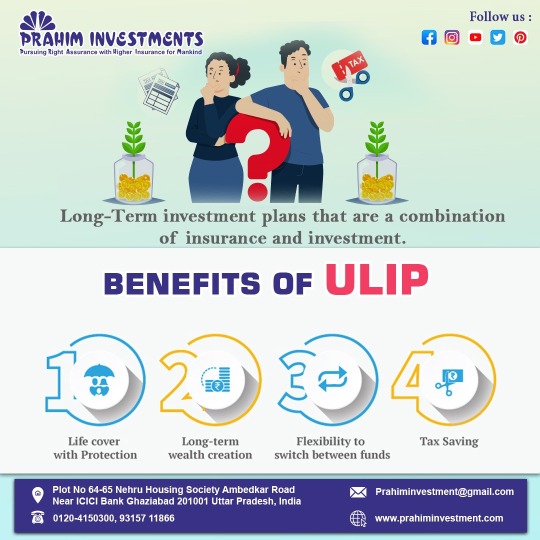

"Unlock the power of ULIPs and embrace financial growth with tax advantages, minimal fees, transparent operations and focused savings to achieve your aspirations."

Contact us :-

Websites : - https://prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 0120-4150300

#prahiminvestments#Ulip#financialgrowth#taxadvantages#aspirations#investments#wealthcreation#financialplanning#longterminvesting#lifeinsurance#taxsavings#financialfreedom#investmentstrategy#securefuture#moneymanagement#SmartInvesting#wealthbuilding#FinancialGoals#retirementplanning

2 notes

·

View notes

Text

Discover the power of staying invested through DreamFunds and SBI Mutual Funds, regardless of market fluctuations! Learn how to navigate market movements and build a secure financial future with our expert insights. Watch now for essential tips and strategies on maximizing your investments!

#InvestingTips#FinancialEducation#DreamFunds#SBIMutualFunds#MarketInsights#WealthBuilding#InvestmentStrategies#FinancialSecurity#StayInvested#MarketFluctuations#ShortTermInvesting#LongTermInvesting

0 notes

Text

Sam Higginbotham Shares Tax-Efficient Investment Strategies

In the realm of investing, one of the most critical aspects often overlooked is tax efficiency. Enter Sam Higginbotham, a seasoned investor with a knack for navigating the complexities of taxation while maximizing returns. With 20 years of experience under his belt, Sam has honed his skills in deploying smart strategies that not only grow wealth but also minimize the tax burden. Let's delve into some of his insightful approaches to tax-efficient investing.

Understanding Tax-Efficiency

Before diving into specific strategies, it's crucial to grasp the concept of tax efficiency. Simply put, tax-efficient investing involves structuring your investment portfolio in a way that minimizes the impact of taxes on returns. This involves strategic asset allocation, utilizing tax-advantaged accounts, and employing tactics to optimize tax consequences.

Strategic Asset Allocation

Sam Higginbotham emphasizes the importance of strategic asset allocation as a cornerstone of tax-efficient investing. By diversifying across asset classes, such as stocks, bonds, and real estate investment trusts (REITs), investors can spread risk while potentially reducing tax liabilities.

For instance, holding tax-inefficient assets like high-yield bonds or actively managed mutual funds in tax-advantaged accounts can shield their returns from immediate taxation, allowing for compounded growth over time.

Utilizing Tax-Advantaged Accounts

One of Sam Higginbotham's go-to strategies is leveraging tax-advantaged accounts to their fullest potential. These accounts, such as Individual Retirement Accounts (IRAs) and 401(k)s, offer tax benefits that can supercharge investment returns.

By contributing to traditional IRAs or 401(k)s, investors can defer taxes on their contributions until withdrawal, potentially benefiting from lower tax rates in retirement. Similarly, Roth IRAs provide tax-free growth, making them ideal for investments with high growth potential.

Sam advises maximizing contributions to these accounts annually, taking advantage of employer matching programs whenever possible to turbocharge savings.

Tax-Loss Harvesting

Another tactic in Sam Higginbotham's arsenal is tax-loss harvesting, a strategy that involves selling investments at a loss to offset capital gains and reduce taxable income. By strategically selling underperforming assets, investors can capture losses to offset gains, thereby reducing their tax liability.

However, it's essential to adhere to IRS guidelines to avoid running afoul of wash-sale rules, which prohibit repurchasing a substantially identical asset within 30 days of sale.

Investing in Tax-Efficient Funds

Sam Higginbotham recommends investing in tax-efficient mutual funds or exchange-traded funds (ETFs) to minimize taxable distributions. These funds are designed to minimize portfolio turnover and capital gains distributions, reducing the tax burden on investors.

Index funds, in particular, tend to be more tax-efficient than actively managed funds due to their passive management style and lower turnover rates. By choosing funds with low expense ratios and tax efficiency, investors can maximize after-tax returns over the long term.

Long-Term Perspective

Above all, Sam stresses the importance of maintaining a long-term perspective when implementing tax-efficient strategies. While it's tempting to chase short-term gains or react to market volatility, staying disciplined and focused on long-term goals is key to success.

By adhering to a well-thought-out investment plan, rebalancing periodically, and staying the course through market fluctuations, investors can optimize tax efficiency while building wealth over time.

Conclusion

Tax-efficient investing is a crucial component of building and preserving wealth. By understanding the principles of tax efficiency and implementing smart strategies like strategic asset allocation, utilizing tax-advantaged accounts, tax-loss harvesting, and investing in tax-efficient funds, investors can minimize their tax burden and maximize after-tax returns. With guidance from experts like Sam Higginbotham, investors can navigate the complexities of taxation with confidence, paving the way for long-term financial success.

#TaxEfficientInvesting#SmartInvesting#MaximizeReturns#FinancialPlanning#WealthBuilding#TaxAdvantagedAccounts#StrategicAssetAllocation#TaxLossHarvesting#InvestmentStrategies#LongTermInvesting

0 notes

Text

Is DHS Ventures a Legit Investment Option?

In the vast landscape of investment opportunities, it's crucial to distinguish between legitimate options and potential scams. DHS Ventures stands out as a reliable investment choice, offering a range of strategies and services that have been proven effective over time. If you're wondering, Is DHS Ventures legit? The answer is a resounding yes. Let's delve into why DHS Ventures is a trustworthy investment option.

Trustworthy Track Record

DHS Ventures has a long-standing history of success in the investment sector. With a team of seasoned professionals at the helm, DHS Ventures has consistently delivered impressive returns for its clients. The company's track record speaks for itself, showcasing its commitment to excellence and transparency.

Transparent Approach

One of the key factors that set DHS Ventures apart is its transparent approach to investment. The company provides detailed information about its investment strategies, risk management practices, and past performance. This transparency builds trust with investors, demonstrating DHS Ventures' commitment to honesty and integrity.

Proven Investment Strategies

DHS Ventures employs a range of proven investment strategies designed to maximize returns while managing risk. From diversification to active management, DHS Ventures' strategies are tailored to suit the needs of investors looking for long-term growth and stability. These strategies have been thoroughly tested and have a track record of success.

Client-Centric Focus

At DHS Ventures, clients come first. The company takes a personalized approach to investment, taking the time to understand each client's unique financial goals and risk tolerance. This client-centric focus ensures that investments are aligned with individual needs, maximizing the chances of success.

Regulatory Compliance

DHS Ventures operates within the bounds of regulatory compliance, ensuring that all investment activities are conducted ethically and legally. This commitment to compliance further enhances DHS Ventures' credibility and trustworthiness as an investment option.

Conclusion

DHS Ventures is indeed a legit investment option. With a strong track record, transparent approach, proven strategies, client-centric focus, and regulatory compliance, DHS Ventures offers a reliable and trustworthy investment opportunity for those looking to grow their wealth. If you're considering investing with DHS Ventures, rest assured that you're making a sound choice.

#InvestmentOpportunity#LegitInvestment#FinancialFreedom#InvestWisely#WealthManagement#FinancialPlanning#SecureInvestments#DHSVentures#InvestmentStrategy#GrowYourWealth#FinancialSecurity#SmartInvesting#InvestmentPortfolio#LongTermInvesting#StableReturns

0 notes

Text

Learn how real estate offers long-term growth, while mutual funds provide diversification and expert management. Tailor your investment strategy to match your goals, risk tolerance, and time horizon. Unlock the potential of both worlds – read the full analysis at HavenDaxa Blog

#RealEstateInvesting#MutualFunds#InvestmentOptions#FinancialPlanning#Diversification#WealthBuilding#InvestmentStrategies#RiskManagement#LongTermInvesting#PersonalFinance#MoneyManagement#AssetAllocation#PropertyInvestment#PortfolioDiversification#InvestmentTips#fractionalownership#fractional ownership#investment#commercial fractional ownership#commercial real estate development#commercial property#havendaxa#realestate#commercialrealestate

0 notes

Text

Warren Buffett's Berkshire Hathaway: A $1 Trillion Success Story in Quality Businesses and Long-Term Investing

#acquisitions #BerkshireHathawaystockprice #cashreserves #CorporateSocialResponsibility #diversifiedportfolio #environmentalsustainability #ESGinvesting #financialperformance #globaleconomy #intrinsicvalue #LongTermInvesting #operatingearnings #qualitybusinesses #WarrenBuffett #wellmanagedcompanies

#Business#acquisitions#BerkshireHathawaystockprice#cashreserves#CorporateSocialResponsibility#diversifiedportfolio#environmentalsustainability#ESGinvesting#financialperformance#globaleconomy#intrinsicvalue#LongTermInvesting#operatingearnings#qualitybusinesses#WarrenBuffett#wellmanagedcompanies

0 notes

Text

#SIPinvestment#MutualFunds#InvestmentStrategy#FinancialPlanning#PersonalFinance#WealthManagement#LongTermInvesting#MoneyManagement#FinanceTips#InvestmentPlanning#FinancialEducation#Savings#RetirementPlanning#CompoundInterest#PassiveIncome#AssetAllocation#RiskManagement#DollarCostAveraging#InvestmentPortfolio#FinancialLiteracy#InvestmentGoals#FinancialFreedom#SIPcalculator#MutualFundSIP#WealthBuilding

0 notes

Text

In the world of personal finance, effective budgeting is a cornerstone for financial success. One often overlooked aspect of budgeting is allocating funds for investments, particularly in shares or stocks. Share budgeting is a strategic approach to managing your investment portfolio, ensuring that you make informed decisions while achieving your financial goals. In this blog post, we'll delve into the essentials of share budgeting, offering practical tips and insights for both beginners and experienced investors. Understanding Your Financial Goals: Before diving into share budgeting, it's crucial to identify and prioritize your financial goals. Whether you're saving for a down payment on a house, planning for your children's education, or building a retirement nest egg, your investment strategy will be influenced by these objectives. Clearly defining your goals provides a roadmap for your share budgeting journey. Assessing Risk Tolerance: Every investor has a unique risk tolerance, influenced by factors such as age, financial situation, and personal preferences. Share budgeting requires a careful consideration of risk, determining the balance between conservative and aggressive investments. By understanding your risk tolerance, you can construct a portfolio that aligns with your comfort level and financial objectives. Diversification Strategies: One of the golden rules in share budgeting is diversification. Spread your investments across different sectors, industries, and geographic regions to minimize risk. Explore various asset classes, including stocks, bonds, and mutual funds, to build a well-rounded portfolio. We'll discuss effective diversification strategies that cater to different risk appetites and investment horizons. Setting Realistic Budget Allocations: Creating a share budget involves determining how much of your overall budget will be allocated to investments. We'll explore practical methods for setting realistic allocations, taking into account your income, expenses, and short-term liquidity needs. Learn how to strike a balance between enjoying your current lifestyle and saving for future financial milestones. Monitoring and Adjusting Your Share Budget: The financial landscape is dynamic, and so is your share portfolio. Regularly monitor your investments and stay informed about market trends. We'll provide insights into tracking the performance of your portfolio and making necessary adjustments to stay on course with your financial goals. Leveraging Technology for Share Budgeting: Discover how technology can be your ally in share budgeting. From investment apps to online tools, there are various resources available to simplify the budgeting process, provide real-time market insights, and assist in making informed investment decisions. Conclusion: Mastering the art of share budgeting is a key component of achieving long-term financial success. This comprehensive guide aims to equip you with the knowledge and strategies needed to navigate the world of investments confidently. By incorporating these insights into your financial planning, you'll be better positioned to make informed decisions and build a robust investment portfolio that aligns with your goals.

#ShareBudgeting#FinancialGoals#InvestmentStrategy#RiskTolerance#Diversification#BudgetAllocations#FinancialPlanning#InvestmentTips#PortfolioManagement#SmartInvesting#MarketInsights#TechnologyInFinance#PersonalFinance#WealthBuilding#MoneyManagement#InvestmentEducation#FinancialWellness#BudgetingTips#LongTermInvesting#FinancialFreedom

0 notes

Text

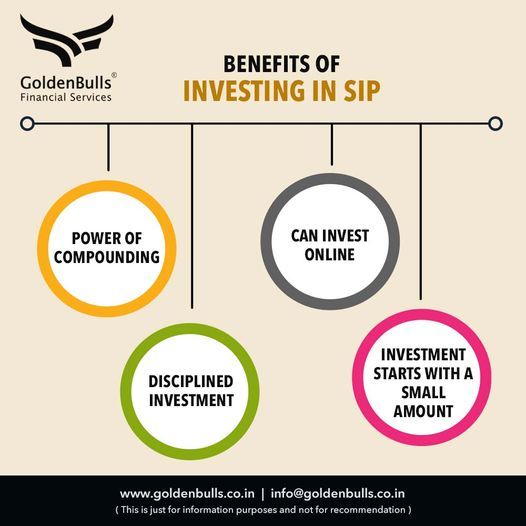

.

Call us at : +91 8411002452 OR Visit: www.goldenbulls.co.in

.

#SIP#SmartInvesting#FinancialFuture#ProfessionalInvestor#savings#financialplanning#InvestingWisdom#WealthBuilding#FinancialSuccess#LongTermInvesting#RetirementPlanning#Investing#Wealth#Goldenbulls

0 notes

Text

The Power of Long-Term Investment Strategies

Long-term investment strategies often lead to greater financial success. By focusing on long-term growth rather than short-term fluctuations, investors can harness the power of compounding and reduce the impact of market volatility.

For guidance on building a robust long-term portfolio, seeking advice from experienced financial advisors can be beneficial.

0 notes

Text

Embrace the vibrant colors and let them fill your life with happiness and prosperity. When it comes to your financial goals, trust Prahim Investments to help you achieve long-term wealth and success! Celebrate the festival of colors with us! Happy Holi.

#HappyHoli#happyholi2024#happyholi#ColorfulCelebrations#festivalofcolors#festival2024#colourfestival#JoyfulHoli#holivibes#HoliFestivities#SplashOfColors#HoliHappiness#ColorfulTraditions#HoliCheers#prahiminvestments#financialgoals#LongTermSuccess#longterminvesting#wealth#wealthmanagement#celebrate#festivities

0 notes

Text

The Power of Long-Term Investment Strategies

Long-term investment strategies often lead to greater financial success. By focusing on long-term growth rather than short-term fluctuations, investors can harness the power of compounding and reduce the impact of market volatility.

For guidance on building a robust long-term portfolio, seeking advice from experienced financial advisors can be beneficial.

0 notes

Text

Sam Higginbotham Approach to Long-Term Investing

Investing for the long term is a strategic endeavor that requires patience, discipline, and a deep understanding of the market. Sam Higginbotham, an experienced financial advisor, shares his expert advice on how to approach long-term investing to achieve your financial goals.

Setting Clear Financial Goals

One of the first steps in long-term investing is to set clear financial goals. Sam emphasizes the importance of defining your objectives, whether it's saving for retirement, buying a home, or funding your children's education. Having specific goals helps you create a focused investment strategy tailored to your needs.

Building a Diversified Portfolio

Diversification is key to managing risk in long-term investing. Sam Higginbotham recommends building a portfolio that includes a mix of assets such as stocks, bonds, and real estate. Diversifying across different asset classes can help mitigate the impact of market volatility and improve your chances of achieving consistent returns over time.

Staying Invested for the Long Term

One of the most common mistakes investors make is trying to time the market. Sam advises against this approach and instead recommends staying invested for the long term. By maintaining a long-term perspective, you can avoid the pitfalls of short-term market fluctuations and benefit from the power of compounding over time.

Regularly Reviewing Your Portfolio

While it's important to stay invested for the long term, Sam also stresses the importance of regularly reviewing your portfolio. Market conditions and your financial goals may change over time, so it's important to adjust your investment strategy accordingly. Regularly reviewing your portfolio allows you to make informed decisions and stay on track towards achieving your long-term goals.

Staying Informed and Seeking Professional Advice

Finally, Sam Higginbotham emphasizes the importance of staying informed about the market and seeking professional advice when needed. Keeping up with market trends and economic developments can help you make more informed investment decisions. Additionally, working with a qualified financial advisor can provide you with the guidance and expertise you need to navigate the complexities of long-term investing.

Conclusion

Long-term investing requires a thoughtful and disciplined approach. By setting clear financial goals, building a diversified portfolio, staying invested for the long term, regularly reviewing your portfolio, and seeking professional advice, you can increase your chances of achieving your financial goals and building wealth over time.

Follow Sam Higginbotham's expert advice to embark on your journey towards long-term investing success.

#LongTermInvesting#FinancialGoals#DiversifiedPortfolio#MarketInsights#InvestmentStrategy#StayInvested#MarketTrends#FinancialAdvisor#WealthBuilding#FinancialPlanning

0 notes

Text

🙏 WELCOME TO JV TRADE 🙏

📊 START EARNING BECOME A BROKER TAKE 100% BROKERAGE RETURN 💯🎁 ✅💵 START EARNING WITHOUT INVESTMENT 😱 🎉💱 BIGGEST OFFER JUST FOR FRIDAY TO SUNDAY 😱

#TradingStrategy#StockPicks#DayTrading#nse#futurestrading#LongTermInvesting#StockInvestment#FinancialMarkets#business#MarketTrends#ProfitPotential#RiskManagement#MarketResearch

0 notes

Text

Unlock the power of ULIPs and embrace financial growth with tax advantages, minimal fees, transparent operations and focused savings to achieve your aspirations."

Contact us :-

Websites : - prahiminvestments.com/

Call today If you have Question Ask us : 093157 11866 , 0120-4150300

#prahiminvestments#Ulip#financialgrowth#taxadvantages#aspirations#investments#wealthcreation#financialplanning#longterminvesting#lifeinsurance#taxsavings#financialfreedom#investmentstrategy

0 notes

Text

Navigating the Numbers: How to Analyze Mutual Fund NAVs to Identify the Best Mutual Funds

Picking the best mutual funds to invest in can seem like a daunting task for many investors. With thousands of mutual funds to choose from, how do you narrow down the options and identify funds that are likely to outperform? One useful tool is analyzing a mutual fund's net asset value (NAV). Understanding how to read and assess NAVs can provide valuable insights into a fund's performance and help investors make informed investment decisions.

The NAV is the per-share value of the mutual fund's investments. It is calculated by taking the total value of the securities held by the fund and dividing it by the number of outstanding shares. Mutual fund NAVs fluctuate daily as the prices of the underlying securities change. Tracking NAV trends over time can reveal a lot about how skilled a fund manager is and the fund's growth prospects.

When analyzing MF NAVs, investors should start by looking at the fund's historical NAV patterns. Consistent growth in NAV over the long term indicates that the fund manager has been making wise investment choices and benefiting from rising share prices. Meanwhile, drastic NAV drops or periods of stagnant NAV growth could signal issues like poor stock selection or high fees dragging down returns. Comparing NAV trends to overall market performance benchmarks can also help assess whether a fund is simply riding wider market growth or genuinely outperforming.

Digging deeper into the drivers behind NAV movements is also important. Was a spike in NAV tied to gains in a few star holdings or broad growth across assets? Did a drop result from market volatility or manager mistakes? Understanding the context behind NAV patterns provides insight into the fund manager's strategy and decision-making.

Investors should also compare NAV growth rates across similar funds in the same category. If a large cap equity fund's NAV rose 12% over the past year while its peers averaged 15% growth, it may indicate the fund is lagging behind the competition. Checking NAV growth versus category benchmarks helps investors spot top-performing funds.

By regularly analyzing and comparing MF NAVs, investors can spot winning funds with skilled managers and strong recent returns. Focusing on long-term NAV growth rates, examining what's driving NAV movements and benchmarking against similar funds ensures you pick funds poised for sustained success. Assessing MF NAVs takes a bit of work, but it enables making wise investment choices that pay off over time.

#MutualFunds#Investing#FinancialPlanning#TopFunds#SIP#Diversification#WealthManagement#SmartInvesting#LongTermInvesting#AssetAllocation#nav

0 notes