#FinancialSuccess

Text

Maximizing Efficiency, Minimizing Risks: The Value of VAT Compliance Services

Navigating VAT compliance can be a labyrinth of complexities for many businesses, making it imperative to have a seasoned team managing these responsibilities while you concentrate on your core operations. Our VAT Compliance Services offer a lifeline, ensuring your adherence to regulations in a timely, accurate, and efficient manner.

When it comes to VAT registration, showcasing compliance with the laws is paramount. This entails meticulous record-keeping of financial transactions, timely filing of VAT returns, and fulfilling VAT liabilities as per UAE regulations. While not mandatory, availing of VAT compliance services is highly recommended to streamline the process and mitigate potential challenges during filing.

Our experts delve deep into your financial dealings, offering invaluable insights and benefits:

Understanding and managing current VAT requirements specific to your business.

Unlocking financial benefits while avoiding penalties and fines.

Enhancing your company's credibility by fostering compliance and trustworthiness.

Our VAT Compliance Services entail a thorough examination by our experts, aimed at optimizing your company's financial health, addressing non-compliance issues, and fortifying against potential fraud. With a reliable team at your disposal, navigating the ever-evolving landscape of VAT laws becomes a seamless endeavour.

Our seasoned professionals specialize in claim filing, ensuring accuracy and compliance every step of the way. With us by your side, you can rest assured that all your VAT-related needs and requirements will be met with precision and efficiency. Our goal is to simplify the process, ensuring your adherence to regulations to steer clear of hefty penalties and legal entanglements.

To kickstart your journey towards VAT compliance, registration with the FTA is the initial step. Our team facilitates a smooth implementation and transition process, providing professional support round the clock. For further insights and assistance regarding VAT Compliance Services, don't hesitate to reach out to us. We're here to provide comprehensive guidance tailored to your business's unique needs.

#VATComplianceUAE#BusinessSuccess#GoviinBookkeeping#UAEBusiness#TaxCompliance#BusinessGrowth#FinancialSuccess#VATRegistration#ConsultingServices#TaxRegulations#ComplianceMatters#FinancialHealth#uaeaccounting#uaefinance#financialservicesdubai#vatcompliance#dubaibusiness

4 notes

·

View notes

Text

Elevate Your Financial Success with Nordholm: Your Go-To Best Accounting Company in Dubai!

Nordholm stands as your ultimate choice for Best Accounting Services Company in Dubai, proudly holding the title of the best accounting company in the region. Specializing in Business Establishment Solutions, we expertly guide you through seamless company formation, ensuring compliance and maximizing efficiency. Our proficiency extends to Streamlined Visa Processes, simplifying procedures for swift entry into the vibrant UAE market. Additionally, we excel in crafting Efficient Banking Solutions, facilitating prompt and hassle-free bank account setups to enhance the fluidity of your financial operations.

We shine in HR and Payroll Management Excellence, guaranteeing precision in handling human resources and payroll to sustain seamless operations. We are also experts in VAT Compliance and Financial Precision, delivering accurate accounting services and meticulous VAT compliance management, freeing your focus for core business strategies.

Recognizing the pivotal role of precise accounting in fostering enduring business development, our seasoned team at the best accounting firm in Dubai is dedicated to empowering your journey. We seamlessly harmonize sustainability and reliability, offering expert insights and strategic approaches that empower informed decisions, unveiling new opportunities for your business growth.

Mastering a complicated regulatory web can be tricky, especially in the United Arab Emirates. However, enjoy stress-free business operations with our assistance. Our experience guarantees a smooth journey, freeing you up to focus on ambitiously growing your company's reach.

Choose Nordholm, the unrivaled best accounting company in Dubai, for tailored services committed to your business triumphs. Our bespoke top-tier services guarantee precise financial reporting and operational efficiency, aligning seamlessly with your unique business aspirations.

#NordholmDubai#BestAccountingCompany#DubaiFinance#FinancialSuccess#AccountingExcellence#BusinessFormation#VisaSolutions#HRManagement#PayrollExcellence#VATCompliance

6 notes

·

View notes

Text

DIWALI PICKS 2023

IRCON INTERNATIONAL LTD -DELIVERY BUY IRCON INTERNATIONAL LTD @153-155 SL 127.25(CLOSING SL) TARGET 275-325-375

2. EASY TRIP PLANNERS LTD - DELIVERY BUY EASY TRIP PLANNERS LTD @42-43 SL 37(CLOSING SL) TARGET 60-62

3. SHALIMAR PAINTS LTD - DELIVERY BUY SHALIMAR PAINTS LTD @175-180 SL 167(CLOSING SL) TARGET 350-380

4. LUX INDUSTRIES LTD - DELIVERY BUY LUX INDUSTRIES LTD @1430-1440 SL 1130(CLOSING SL) TARGET 3100-3300

5. GATEWAY DISTRIPARKS LTD - DELIVERY BUY GATEWAY DISTRIPARKS LTD @91-92 SL 79(CLOSING BASIS SL) TARGET 185-210

#stock market#india#investing stocks#stocks#trading ideas#tradingview#bse#bseindia#bullrun#investing#financialsuccess#nseindia#bullish#tradingcommunity

5 notes

·

View notes

Text

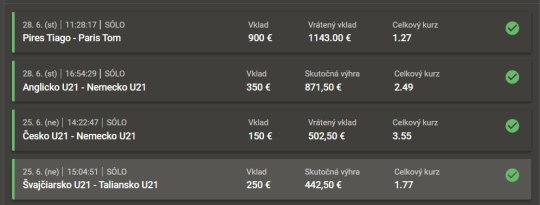

"Mastering Finances: Unlocking Wealth with Our Money-Making Tutorials"

------------------------------------------------------------------------

DM ME (instagram: z3tko) SAME MONEY ONLY FOR 20$ 💳💸

#FinanceTips#MoneyTutorials#FinancialSuccess#WealthBuilding#IncomeBoost#MoneyManagement#FinancialFreedom#InvestingAdvice#BudgetingTips#FinancialEducation#PersonalFinance#MoneyMatters#FinancialEmpowerment#FinancialGoals#MoneySkills#FinancialWisdom#MoneySavvy#MoneyTalks#EconomicEmpowerment#FinancialResources#FinancialJourney

2 notes

·

View notes

Text

Navigating Financial Success with Advisory Services: A Certified Accountant's Guide to Maximizing Income

Introduction:

In the complex landscape of personal and business finance, securing your financial future and maximizing your income are paramount goals. To achieve these objectives, many individuals and businesses turn to Certified Accountants who provide essential advisory services. In this comprehensive guide, we'll explore the world of advisory services offered by certified accountants and how they can help you optimize your income. Whether you're an individual seeking financial guidance or a business owner looking to enhance your bottom line, this article will provide valuable insights to help you achieve financial success.

Understanding Advisory Services

1.1 What Are Advisory Services?

Advisory services, in the context of certified accountants, encompass a wide range of financial and strategic guidance aimed at helping individuals and organizations make informed decisions to achieve their financial objectives. These services extend beyond traditional accounting and auditing and focus on proactively improving financial outcomes.

1.2 Role of a Certified Accountant

A certified accountant, often referred to as a Certified Public Accountant (CPA), is a licensed professional with extensive expertise in accounting, taxation, and financial management. Certified accountants go beyond number-crunching; they provide invaluable insights and recommendations to enhance financial health.

How Advisory Services Maximize Income

2.1 Income Optimization Strategies

Certified accountants leverage their knowledge and experience to help clients identify and implement income optimization strategies, such as:

Tax Planning: Crafting tax-efficient strategies to minimize tax liabilities and maximize take-home income.

Investment Guidance: Providing advice on investment portfolios and strategies to generate additional income streams.

Expense Management: Analyzing expenses to identify cost-saving opportunities and increase disposable income.

2.2 Business Income Growth

For businesses, certified accountants play a crucial role in income growth by:

Financial Analysis: Conducting in-depth financial analysis to identify revenue-generating opportunities.

Budgeting and Forecasting: Creating budgets and financial forecasts to set income targets and measure performance.

Risk Management: Developing strategies to mitigate financial risks that may affect income.

Certified Accountants as Financial Advisors

3.1 The Dual Role

Certified accountants often serve as both financial advisors and accountants. In their advisory role, they:

Provide Comprehensive Financial Planning: Crafting personalized financial plans aligned with clients' goals.

Offer Investment Guidance: Recommending investment options and asset allocation to optimize income.

Retirement Planning: Helping clients plan for a secure financial future with income sustainability.

3.2 Certified Accountant vs. Traditional Financial Advisor

While both certified accountants and traditional financial advisors offer valuable financial guidance, certified accountants bring a unique perspective with their expertise in tax planning, accounting, and compliance. This allows for a holistic approach to income optimization.

Chapter 4: The Importance of Advisory Services

4.1 Personal Finance

For individuals, advisory services provided by certified accountants can lead to:

Improved financial decision-making.

Enhanced wealth accumulation and preservation.

Reduced tax burdens and increased disposable income.

4.2 Business Finance

For businesses, these services contribute to:

Sustainable growth and profitability.

Improved cash flow management.

Compliance with tax regulations and financial reporting standards.

Chapter 5: Choosing the Right Certified Accountant

When seeking advisory services to maximize income, consider the following factors:

Qualifications: Ensure the accountant is a certified professional with relevant credentials.

Experience: Assess their experience in providing advisory services.

Specialization: Look for an accountant with expertise aligned with your needs, whether it's personal finance, small business, or corporate finance.

References: Check client references and reviews to gauge their reputation.

Conclusion

Advisory services provided by certified accountants offer a holistic approach to income optimization for both individuals and businesses. These professionals bring unique insights and strategies to the table, ensuring that you make informed financial decisions and maximize your income potential. Whether you're aiming for personal financial success or striving to grow your business, partnering with a certified accountant can be the key to achieving your financial goals. In the ever-evolving financial landscape, the guidance of a certified accountant is your path to securing a prosperous future.

Remember that the right certified accountant can be your trusted partner in financial success, providing guidance, expertise, and strategies tailored to your unique financial situation and goals.

#AdvisoryServices#IncomeOptimization#CertifiedAccountant#FinancialGuidance#TaxPlanning#InvestmentStrategies#ExpenseManagement#BusinessGrowth#FinancialAdvice#PersonalFinance#Budgeting#RetirementPlanning#FinancialSuccess#WealthManagement#FinancialDecisions#FinancialHealth#IncomeStrategies#MoneyManagement#FinancialGoals#FinanceTips#Toronto#Canada

2 notes

·

View notes

Text

Tax Professional Services Why You Need To Choose The Best

Tax Professional Services Why You Need To Choose The Best

Why Choose Your Tax Professional Wisely?

Get The Best Tax Professional For Tax Preparation And Tax Planning

Tax Answers Advisor Transcript

Marcelino: Welcome to The Tax Answers Advisor. I am Marcelino Dodge, Enrolled Agent. So happy to have you joining us today, we have interesting quote from an unknown source. “A person doesn’t know how much he has to be thankful for, until he has to pay taxes…

View On WordPress

#accountant#accountingservices#financialservices#financialsuccess#investment#lifeinsurance#personalfinances#taxadvice#taxexperts#taxplanner

6 notes

·

View notes

Text

The Truth About Money: How Rich Dad's Teachings Can Help You Avoid the Rat Race - Day 3 Reflection

📚🌟 Can reading really change your life? 🌟📚 According to research, reading books can reduce stress, improve comprehension and imagination, alleviate depression, and even help prevent Alzheimer's! 🧠💭 Day 3 of Bookish Buzz's test features "Rich Dad Poor Dad," which shares valuable lessons on financial literacy. 🤑 Why not pick up a book today and start changing your life for the better? #ReadMore #ChangeYourLife #RichDadPoorDad

My learning- Rich Dad's teachings focus on changing one's perspective on money and wealth to become successful. The lesson he teaches is that the poor and middle class work for money, while the rich have money work for them. Instead of operating out of fear, people should learn how money works and have it work for them. Learning to work smarter, not harder, and using their minds to create wealth is the key to success. While it may be tempting to focus on immediate rewards, it is important to look at the bigger picture and avoid the trap of the rat race. The first step to finding another way is to tell the truth. By implementing Rich Dad's teachings, one can change their perspective on wealth and success, and ultimately become successful in life.

#FinancialFreedom#MoneyMindset#PersonalFinance#Investing#Wealth#Success#PassiveIncome#FinancialEducation#FinancialLiteracy#MoneyManagement#Entrepreneurship#Motivation#Inspiration#Goals#Mindset#WealthCreation#FinancialGoals#FinancialSuccess#FinancialPlanning#DebtFree#Budgeting#Savings#MoneyTips#FinancialAdvice#MoneyTalks#MoneyMatters

2 notes

·

View notes

Text

"Change Your Mindset to Achieve Financial, Family and Employment Success: The Secret to Joining the 2%"

Success is something that many people strive for, but only a small percentage of people actually achieve it. What is the difference between the 2% who succeed and the 98% who don’t? When it comes to financial success, family success, and employment success, the answer is a difference in mindset.

The 2% of people who succeed financially have a mindset of wealth and abundance. They understand that their financial success is a result of their saving and investing, and they prioritize these activities. The 98%, on the other hand, have a mindset of scarcity. They prioritize spending money over saving and investing, and they don’t understand that their financial success is a result of their actions.

The same is true when it comes to family success. The 2% of people who are successful prioritize spending time with their family and building meaningful connections with them. They view their family as an opportunity, not an obligation. The 98% think of family more as a requirement, and because of that, they don’t prioritize spending time with their family and building connections.

Finally, when it comes to employment success, the 2% of people who are successful have a mindset of growth. They understand the importance of learning new skills and developing their talents in order to be successful. The 98%, however, often lack this understanding and don’t prioritize learning and growth.

So, why do 2% of people succeed and 98% do not? It’s because they have different mindsets. The 2% of people who succeed have a mindset of wealth, family, and growth, while the 98% have a mindset of scarcity, obligation, and stagnation.

Fortunately, those in the 98% can shift to the 2% by changing their mindsets. To succeed financially, the 98% should start by developing a mindset of wealth and abundance. They should begin to focus on long-term, compounding gains and prioritize saving and investing. To achieve family success, the 98% should start by changing their mindset to prioritize spending time with their family and creating meaningful connections. Finally, to succeed in their careers, the 98% should prioritize learning new skills and expanding their knowledge.

Changing your mindset is not easy, but it is possible. Start by recognizing the importance of these mindsets and making a conscious effort to adopt them. Spend time each day visualizing yourself as someone who is successful financially, in family matters, and in their career. And remember that it takes time to develop a new mindset and make it part of your life, so be patient and be consistent.

The 2% of people who succeed in financial, family, and employment matters have a different mindset than the 98%. But, by changing their mindset, those in the 98% can shift to the 2%. All it takes is a conscious effort to adopt the mindsets of wealth, family, and growth. With dedication and consistency, anyone can achieve success.

5 notes

·

View notes

Text

Haven't you reached your financial goal yet? Contact us, and we will guide you in the correct direction: 9910133556

#financialgoals#financialgoals2023#financialfreedom#financialliteracy#financialindependence#financialeducation#financialservices#financialsecurity#financialsuccess#financialsolutions#financialstatements#financialsupport#financialmanagement#financialwellness#financialwellbeing#financialwealth#financialwisdom#financialempowerment#financialeducationservices#financialeducator#financialeducationmatters#financialreporting#financialtips#financialtechnology#financialtimes#financialplanning#budget2023#financialyear#financialinvestment#finance

2 notes

·

View notes

Text

youtube

#FinancialEmpowerment#InnovativeTech#FinancialSuccess#DataDrivenInsights#AIExperts#FinanceLeadership#LinkedInLearning#ProfessionalDevelopment#CareerGrowth#FinanceCommunity#AICommunity#FinanceTechnology#BusinessInnovation#youtube#online business#entrepreneur#ecommerce#small youtuber#marketing#branding#accounting#bookkeeping#digitalmarketing#Youtube

0 notes

Text

Maximising Returns: Insider Tips for Hiring an Indian Tax Accountant in Dandenong

In Dandenong, finding the right tax accountant can make all the difference in optimising your financial returns. Here are some insider tips:

You need to searching accountants in Dandenong who specialise in taxation services.

Ask friends, family, and colleagues for referrals to top accountants in Dandenong.

Search tax accountants in Dandenong online. Check their qualifications, experience, and client reviews to ensure they meet your criteria.

Take advantage of free consultations offered by tax return accountants in Dandenong. Ask question to their team and discuss your financial sanitation.

After careful consideration, select the best accountant in Dandenong who aligns with your goals.

For unparalleled expertise and service, consider KPG Taxation as your trusted tax accountant in Dandenong.

#accountant in dandenong#tax accountant in dandenong#accountant dandenong#tax accountant#tax con#tax consultant#hire tax consultant#accountants#accountant#kpg taxation#financialsuccess

0 notes

Text

Your money will work relentlessly for you thanks to YOJ Investment's High Return Investment Plan in Nepal, which offers exceptional returns. Watch as your money grows rapidly thanks to our track record of success. Your secret to a bright future filled with growing wealth is this. To learn more, visit https://yojinvest.com.

#YOJInvestment#HighReturn#InvestmentPlan#InvestNepal#ExtraordinaryReturns#ROI#InvestmentStrategy#FinancialGrowth#SecureFuture#Profits#FinancialSuccess#InvestingInNepal#WealthManagement#MulyiplyingProfits#RiskManagement#InvestmentPortfolio

1 note

·

View note

Text

🌟 Master the art of budgeting with our latest video! 🌟 Learn how to track expenses, set realistic spending limits, and pave your way to financial success. 💰 Don't miss out—subscribe to StealthyFinanceTips for more invaluable financial insights!

1 note

·

View note

Text

Proactive Tax Planning for Financial Success: Tax Compliance & Year-End Planning Services

Tax compliance is essential for businesses and individuals alike, but proactive tax planning can make all the difference in minimizing liabilities and maximizing savings. At SAI CPA Services, our tax compliance & year-end planning services are designed to help clients navigate complex tax laws and regulations with confidence.

Our team of seasoned professionals takes a proactive approach to tax planning, identifying opportunities for tax savings and implementing strategies to optimize your tax position. From strategic deductions to retirement planning, we work closely with our clients to develop customized tax plans tailored to their specific needs and goals.

With SAI CPA Services, you can ensure compliance while maximizing tax efficiency. Contact us today to learn more about our tax compliance & year-end planning services and take control of your financial future.

Stay tuned for more insights into our comprehensive range of accounting and financial services, designed to empower individuals and businesses to achieve financial success.

Connect Us: https://www.saicpaservices.com/contact-us/

908-380-6876

1 Auer Ct

East Brunswick, NJ 08816

#saicpaservices#taxcompliance#yearendplanning#taxstrategy#financial planning#tax savings#cpa services#financialsuccess#proactivemaintenance

1 note

·

View note

Text

Soar to Success: Embrace the World of Social Media Freelance Jobs!

Introduction:

Are you tired of the daily grind and longing for financial freedom? Well, buckle up because I'm about to take you on a thrilling ride into the realm of social media freelance jobs! Picture this: earning money from the cozy confines of your home, all while sipping on your favorite beverage. Sounds too good to be true? Think again! With social media freelance jobs, you can turn your dreams into reality and embark on a journey to a lucrative freelance career. So, grab your virtual passport and get ready to explore the boundless opportunities that await!

Unveiling the Gig Economy:

Say goodbye to the traditional 9-to-5 grind and hello to the gig economy – a world where freedom and flexibility reign supreme. In this digital age, social media freelance jobs have emerged as the shining stars, offering individuals the chance to earn a steady income by completing simple tasks from the comfort of their homes. From managing social media accounts to creating captivating content, the possibilities are endless in this dynamic landscape. So, why settle for a mundane desk job when you can dive headfirst into the exciting world of social media freelancing?

The Power of Passive Income:

Imagine waking up to a flood of notifications, each one signaling another payment deposited into your bank account. With social media freelance jobs, passive income becomes a reality. Whether you're crafting engaging blog posts, designing stunning graphics, or managing online communities, your work continues to generate income long after you've hit the submit button. So, sit back, relax, and watch as your bank balance grows while you enjoy life's little pleasures.

Unleash Your Creativity:

Gone are the days of stifled creativity and corporate monotony. With social media freelance jobs, you have the freedom to unleash your creative genius and let your imagination run wild. Whether you're a wordsmith crafting witty captions or a visual maestro designing eye-catching graphics, there's a niche for every creative soul in the world of social media freelancing. So, dust off your creative cap, channel your inner Picasso, and get ready to dazzle the digital world with your talent!

Navigating the Freelance Jungle:

Now, I won't sugarcoat it – navigating the freelance jungle can be intimidating for beginners. But fear not, fellow adventurer, for I am here to be your guide! From building your online presence to securing your first gig, I'll equip you with all the tools and strategies you need to thrive in this competitive landscape. So, roll up your sleeves, sharpen your skills, and get ready to conquer the freelance jungle like a true warrior.

Your Journey Begins Now!

In conclusion, social media freelance jobs offer a passport to financial freedom and creative fulfillment. With the click of a button, you can unlock the gateway to a world of endless possibilities and embark on a journey to a lucrative freelance career. So, what are you waiting for? Click here to take your first step towards success and join the ranks of thriving social media freelancers today!

#FinancialFreedom#artists on tumblr#InvestSmart#Budgeting#WealthBuilding#FinancialLiteracy#PersonalFinance#SaveMoney#InvestingTips#DebtManagement#RetirementPlanning#FinancialEducation#MoneyManagement#FinancialEmpowerment#FinancialSuccess#EconomicIndependence

0 notes

Text

Navigating Tax Complexity Made Simple: Legalari's Expertise in Delhi

Understanding Legalari’s Approach

At the heart of Legalari’s ethos lies a profound dedication to understanding the unique needs and circumstances of each client. Unlike conventional consultancy firms that offer generic solutions, Legalari adopts a bespoke approach, tailoring strategies to align with the specific objectives and challenges faced by individuals and businesses alike. Whether it’s navigating intricate tax laws, optimizing fiscal efficiencies, or resolving compliance issues, Legalari crafts comprehensive solutions that empower clients to navigate the fiscal landscape with confidence.

Expertise Across Diverse Arenas

Legalari boasts a team of seasoned professionals equipped with extensive knowledge and experience across diverse domains of taxation. From income tax and GST to corporate tax and international taxation, their expertise spans the entire spectrum of fiscal matters. Whether you’re a startup seeking guidance on tax planning or a multinational corporation navigating cross-border transactions, Legalari offers unparalleled insights and support every step of the way. Their multidisciplinary approach ensures holistic solutions that address not only immediate concerns but also long-term strategic objectives.

Client-Centric Philosophy

What sets Legalari apart is their unwavering commitment to prioritizing the needs and aspirations of their clients above all else. Unlike impersonal firms that treat clients as mere transactions, Legalari fosters enduring relationships built on trust, transparency, and mutual respect. From the initial consultation to ongoing support and advocacy, clients can expect a personalized experience characterized by attentive listening, open communication, and unwavering support. At Legalari, every client is valued, and every challenge is viewed as an opportunity to deliver exceptional results.

Navigating Regulatory Complexity

In an era marked by ever-evolving tax laws and regulatory frameworks, staying abreast of compliance requirements is paramount. Legalari serves as a trusted ally in navigating this labyrinth of regulatory complexity, offering expert guidance and assistance to ensure adherence to statutory obligations while maximizing tax consultant in Delhi. Their comprehensive understanding of local and international tax laws enables clients to mitigate risks, seize opportunities, and safeguard their financial interests in an increasingly dynamic and competitive landscape.

Driving Innovation Through Technology

In an increasingly digital world, Legalari harnesses the power of technology to drive innovation and enhance the efficiency of their services. Through cutting-edge tools and platforms, they streamline processes, automate routine tasks, and provide clients with real-time access to critical financial information. Whether it’s cloud-based accounting solutions, predictive analytics, or digital collaboration platforms, Legalari leverages technology to deliver seamless experiences that empower clients to make informed decisions with confidence.

Empowering Clients for Success

Beyond mere consultancy, Legalari is committed to empowering clients with the knowledge, skills, and resources they need to achieve lasting success. Through educational seminars, workshops, and thought leadership initiatives, they demystify complex tax concepts, empower clients to make informed decisions, and foster a culture of continuous learning and improvement. At Legalari, success is not measured solely by financial outcomes but by the enduring impact they have on the lives and livelihoods of their clients.

Conclusion

In a world where fiscal challenges abound, Legalari stands as a beacon of expertise, integrity, and personalized service. As your trusted tax consultant in Delhi, they offer more than just solutions; they offer a partnership grounded in trust, transparency, and a shared commitment to your success. Whether you’re an individual taxpayer, a small business owner, or a large corporation, Legalari is your steadfast ally in navigating the complexities of taxation and unlocking the full potential of your financial future. Partner with Legalari today and embark on a journey towards fiscal clarity, compliance, and prosperity.

#TaxConsultantDelhi#LegalariExperts#FinancialClarity#TaxEfficiency#DelhiConsultancy#ExpertTaxAdvice#FiscalSolutions#TaxCompliance#FinancialSuccess#LegalariConsultants

1 note

·

View note