#make money with kindel

Text

Understanding How Banks Operate: Money & Debt

Understanding how banks work is an eye opener for most people. Did you know that up until 1844 in Britain banks in the UK printed their own paper cash money – these were called bank notes, of course. Banks still today make their own money. Every time someone borrows money from a bank the bank extends credit by creating money in that person’s account by pushing a button. No physical money is actually created. The debt creates that money and when the loan is paid back that money ceases to exist. The banks pockets the interest charged on the loan and erases the debt. That digitally created money disappears from the system. Understanding how banks operate: Money and debt.

Photo by David Peterson on Pexels.com

Banks Just Create Money Out Of Debt

Money is created via debt. Banks create this digital money when they lend funds to businesses and individuals. Thus, creating money has nothing to do with savings. The trillions of dollars or euros or pounds in the global economy are not created via making things, selling them, and saving the money generated. The trillions are created out of debt and extending credit. Something like only 3% of the money in the global economy is not created from debt. Banks are responsible for our supply of money in the economy. They in turn are under the aegis of a central bank, like the Reserve Bank of Australia, Federal Reserve in the US, and Bank of England in the UK.

https://youtu.be/myM44zZxy5Y

Credit Fuels The Money Supply Via Banks

Money used to be pegged to gold reserves back in the day. This is no longer the case since 1971 and the collapse of the Breton Woods system. Money supply has been foot loose and fancy free ever since. The bulk of business done by banks In Australia is from the mortgage market on loans for residential property. The banks create this money when they lend to borrowers, which increases the supply of money into the economy via debt. Houses are the single largest purchase that most consumers ever make in their lifetime. Thus, all this money fuels inflation in the housing sector, which we have seen in Australia over the last 35 years. Property prices have gone up by a whopping 382% over the last three decades. In fact, it is much higher. My family bought a suburban house in the late 1970s for around $37K and that property sold for around $900K in 2020. The same house with no real improvements made to it or the property. The RBA does not include house prices in its definition of inflation, thus nobody talks about the huge inflation in this sector of the economy. Those who have bought into the property market and benefited from the huge gains in property prices are big fans of it. Those who are locked out because of the hugely inflated prices are not so happy.

Photo by Kindel Media on Pexels.com

The important thing to understand here, however, is that the money supply is greatly increased by the enormous debt raised via the banks’ lending to this sector. Remember money is created via debt. So, vast amounts of money are being pumped into the Australian economy by this process. This is non-GDP generated money. This is money created via bank speculation in lending money to prospective investors and home owners. It is not money created out of manufacturing anything. This is why houses are getting more and more expensive every year. More money supply creates inflation, this is a well-known economic principle. Many people are going on about a shortage of housing and there may well be some truth to this but this is not the main driver for the inflation in the property sector. Rather, it is the very nature of how the banking system works in Australia and globally, and how it interacts with the housing market.

https://www.youtube.com/watch?v=yLZUVsmUwZY

Understanding how banks operate: Money and debt. This money has been created out of nothing and it expands the perceived wealth of nations like Australia. This wildly inflated housing market is not linked to the recognised inflation rate and so goes unremarked upon. It creates societal power on the back of inflated wealth with no basis in GDP linked activity. Australia has become a nation with very little manufacturing going on. A country that makes bugger all. A place where inflated property prices are some of the highest in the world.

Photo by Pixabay on Pexels.com

Understanding how banks operate: Money and debt are inextricably linked. Banks make their profits by creating money and lending it out to individuals and businesses. Speculation is far by the main activity of commercial banks and the supply of money in the global economy has increased exponentially on a massive scale. This is how the economic system works. Banks, especially big banks are never allowed to fail because of their place in how money supply works. Banks have accounts with the central bank like the RBA and these are used to transfer funds between them. During the global pandemic the RBA purchased government bonds to the tune of some $100 billion. This was done via the commercial banks under its aegis – their reserve accounts with the central bank were credited with this money. This process is called quantitative easing (QE) and has been done by central banks globally, especially in response to the 2008 Global Financial Crisis (GFC) and the Coronavirus pandemic. The RBA claims that this increase to money supply is not inflationary because it is held in reserve rather than directly pumped into the economy.

As of 2022 and beyond, there has been global high inflation and a cost of living crisis for the working poor and those on welfare. The RBA, has a recognised inflation target rate of 2-3%. Inflation has been up at 7-8% in Australia and higher in the US and UK and Europe. Interest rates, which had been at record lows for the decade since the GFC, at around 0.3% or lower, were rapidly raised by central banks around the world. Monetary policy implemented by central banks raises the cash rate to make credit more expensive. This makes lending less attractive and thus reduces money supply growth on this basis. The RBA has now embarked upon quantitative tightening (QT), which involves:

“At its meeting earlier this month, as well as raising the cash rate target, the Board decided not to reinvest the proceeds from bonds as they mature from the Bank's portfolio. This signals the next phase in the bond purchase program. The initial phase in which the Bank built up its stock of bond holdings is often referred to as ‘quantitative easing’, or QE for short. That phase ended in February this year. We have now entered the phase known as ‘quantitative tightening’, or QT. By allowing our bond holdings to gradually diminish over time as they mature, the initial stimulatory effects of those holdings – namely, downward pressure on government bond yields and the Australian dollar exchange rate – will gradually unwind.”

- (RBA Assistant Gov. Christopher Kent, 23 May 2022)

This takes money supply out of the economy and is another anti-inflationary measure on this basis.

Photo by energepic.com on Pexels.com

There are jitters being felt in the financial sector based on the recent spate of failings of US banks. Silicon Valley Bank collapsed after a run on the bank saw it unable to meet its depositors’ requirements. This bank had bought up on government bonds and not kept enough reserves to meet depositor requirements. A Donald Trump lessening of regulatory requirements for mid-tier regional banks had created the environment for this banking crisis. Rising interest rates has seen the return on bond rates fall below parity to tip this bank and others over the edge into collapse after poor financial decisions by their management. Signature Bank and First Reserve Bank are two more on the brink of failure. Credit Suisse is another large financial institution to fall, being swallowed up by UBS in its death throes, in a Swiss banking dance of death. Share prices of these banks have plummeted and rescue packages have attempted to stem the bleeding and more domino’s falling over. The US government has guaranteed depositor funds in a bid to shore up confidence in the banking sector. Little banks can fail without bringing down the whole edifice but no really big banks will be allowed to fail.

Deutsche Bank is now coming under scrutiny from the market. Traders will be actively seeking out any weakness to exploit for their financial gain. Global investors will be eyeing off the exits if they sense any trouble. Deutsche Bank stocks closed down 8% overnight. This bank has more than $1 trillion in assets. Recessions loom for economies around the globe on the back of central banks and their monetary policy fighting inflation. Investors are getting jumpy. Will this be the beginning of the Global Financial Crisis 2.0?

Robert Sudha Hamilton

©Midas Word

Read the full article

0 notes

Text

Want to earn passive income?

Want to earn passive income? K Money Mastery teaches how via Kindle publishing. No need to write your own books! http://bit.ly/2XVjUmQkindlemoney

1 note

·

View note

Text

“ zero zero six. ”

sometimes he can still smell the blood in the air.

“ six. ”

he can feel the way the warmth left her body.

“ agent kindell. ”

emil’s head snaps up, gaze zeroing in on doctor leeland. he’s met with that inquisitive, piercing look she often gives him when he gets lost during their sessions. he loathes that expression. because he can never resist the need to open up. she knows all the right buttons to push and he lets her. even when he knows she only presses them for his superiors, for the people giving her copious amounts of money to keep him in line.

“ i lost you there didn’t i? ” it’s a statement as she tilts her head, adjusting her position in her chair. “ anything you care to share? ” again, it’s less of a question. he knows they’ll sit here until she’s satisfied. calling this therapy is a cruel joke. and he doesn’t know what it says about him that it still works. it still makes him feel better. for a time, at least.

his gaze shifts over the doctor for a moment before he looks down at his hands. “ i’m remembering again, ” he finally confesses. he can’t hold off under the weight his memories and leeland’s pressing stare. it’s too much. every time he starts seeing daisy’s delaney’s face in his dreams again, it brings back his sister too. one was a failure and the other was a completed mission. but they both leave him feeling the same emptiness.

“ it’s getting bad again, isn’t it? ”

a pause. “ yes. ”

“ according to your monitor, you’ve been waking up frequently when you should be sleeping...you’ve been drinking again too. ”

he’s quiet. he doesn’t need to confirm or deny any of it. not when she has a tablet in her lap filled with the truth. reggie lets him lie. he likes dealing with his handler better because at least that man doesn’t pretend to give a shit. with doctor leeland, it’s so much harder. she doesn’t look at him as clinically as the other medical staff. sometimes there’s warmth there. and it’s manipulative. it’s calculated. and he doesn’t care because it’s the only kindness he’ll ever get, even if it’s fabricated.

“ is it time to make it go away again? we can make you forget about her too, agent klein? it doesn’t have to hurt, emil. we do this for the others too. do you want me to make it better? ”

he’s quiet before he nods his head. brows tug together and he shakes it instead “ i don’t know. ” he doesn’t want to forget etisha. he lost her, yes. but she was family. he needs her even if it’s just a memory now. and it would be too easy. he failed her and it would be a betrayal, a cruelty to forget her as well. she deserves more than that. emil swallows and looks back down at his hands, half expecting them to be red. delaney, though...it’s confusing and it hurts every time he starts to see things that are familiar yet so foreign at the same time. they never told him it would have to happen more than once, that they'd keep having to scramble his mind just to keep him from remembering what he did.

“ agent? ”

“ just her. make me forget again. ”

#IDK WHAT THIS IS#〖 FILE: ETISHA KLEIN 〗#〖 FILE: VERENA DELANEY 〗#〖 FILE: CLARA LEELAND 〗#i haven't done random ass drabbles in so long#〖 DATA LOADING 〗#anyway how long until andrea yells at me for this

5 notes

·

View notes

Photo

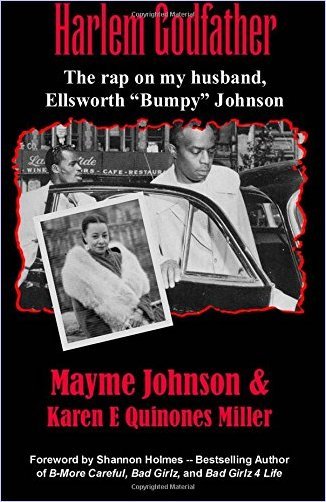

Really Great and Sobering Story

I really enjoyed reading this book I didn't want to put it down it was never boring and I was amazed how Mr. Bumpy Johnson rose from an unknown street thug to the renowned Godfather of Harlem. There are so many that don't believe who Bumpy Johnson was, but I know family members (an great aunt who is still alive at 98) that migrated to Harlem from Georgia in the 30's and 40's that knew him in passing and what he was, they whispered about him with awe. Frank Lucas story of his life is a fairy tale even the detective that arrested him said he was a liar and a snitch.

Go to Amazon

AN INSIGHTFUL LOOK AT A FAMOUS HARLEM GANGSTER

A quick, easy, and interesting read. Miss Mayme, one of my grandmother's former neighbors, set the record straight!! Learned a lot. Not just a book about a famous Harlem gangster from yesteryear, it's also a history lesson because Bumpy's life touched and crossed paths with everyday people and numerous famous people in and outside of Harlem.

Go to Amazon

Best 5. 99 I ever spent

I purchased the Kindel edition of this book. Best 5.99 I ever spent. I really wish their was a tip jar because I owe someone some more money.

Go to Amazon

Like Strolling Through Harlem in the 50's

This book tells the story of the original "American Gangster" Ellsworth 'Bumpy' Johnson as told by his wife Ms. Mayme Johnson. As with any bio book about a infamous person written by a loving spouse you will see a certain amount of bias, especially when it comes to violence but Ms. Mayme did a fine job of telling about the good and the bad of the legendary Bumpy Johnson.

Go to Amazon

Four Stars

As a New Yorker very interesting and I enjoyed.

Go to Amazon

Five Stars

Amazing, Amazing, Amazing!!! Great price for a great piece of history. Product arrived on time and in great condition.

Go to Amazon

An excellent and well told story!!!

I had been interested in reading about "Bumpy" from the days of "Shaft" and "Hoodlum". Just who was this guy that instilled fear into the hearts of "BIG" "BAD" Mafia hoods like Dutch Shultz and demanded respect from Luciano? The way other gangster books and movies told the story: The game began and ended with Italians. Everybody knows Capone, Luciano, Gambino etc.... But who was Bumpy Johnson? Mayme told the story the way it was!! And introduced many more characters of the underworld that no one had ever heard about.....Unless you were there in the game!

Go to Amazon

Makes Bumpy Johnson More Human

Honestly, I could not put the book down! With all the films such as Hoodlum and American Gangster, which gave the Hollywood version of a notable man. I will say this: It does make you reexamine the Frank Lucas claims that he was "Bumpy's right-hand man", since the widow of Bumpy dismisses those claims and brings to light other personalities that displayed Frank Lucas' skill to spin a story using someone else's life story. Miss Mayme strips away all of the nonsense history has placed on her husband, and gives us an honest actually being there story. If you like gangster stories, add this to your shelf- this isn't fake fiction, this is a real story, a real person's real life.

Go to Amazon

Good read

Five Stars

Thank you for the realist depiction of Mr. Johnson!!!

Very good book that provided much insight into Harlem

Superbly Written. Could Use More Details On His Life ...

Five Stars

how much is reality is anyone's guess but it gave a good perspective of the

Five Stars

... and more I couldn't stop till I finished it best book I've read in

Five Stars

2 notes

·

View notes

Text

How an SEO Services Company Can Help Your Online Profile

An SEO services company can improve your online traffic very quickly ensuring that your business gets the maximum amount of exposure to potential customers as possible. If you already have a website you may be disappointed in the revenues generated by your online products and services. Such problems are usually a result of SEO improvements or implementation being required and this is where an SEO services company comes in. By analysing your site and any other web marketing assets you may have an SEO consultant can pinpoint the areas where your online marketing is weak and start to make improvements immediately.

An SEO services company will usually have a range of SEO packages for you to choose from. These SEO packages will usually contain a selection of SEO techniques, systems and services that will work towards ensuring your website gets on the first page of search engine results and stays there. SEO needs to be a constant process with monitoring and traffic analysis being part of the package. Of course, you will need to know that the money you are paying to an SEO services company is being put to good use and seeing monthly results will give you a good idea about your return on investment.

There are many SEO service companies to choose from and it can be a bit of a minefield when trying to find a company that suits your needs. The key to SEO success is to use a company that has years of industry experience, that constantly reviews its processes and that can work with any type of business. SEO is by its very nature diverse so you will need a company that sits on the cutting edge of new technology and SEO processes. A good SEO services company will be able to advise you on the best package to suit your needs or recommend a bespoke package if your needs dictate it.

Promotion of your website is key if you want to achieve success online. If your customers don't know that your site is out there, how will they ever find you. Most consumers use a search engine to find products and services and will usually choose a company on the first page of search engine results. An SEO services company will ensure you are on that first page time and time again. By using a combination of keyword optimisation, article marketing, link building, social networking and other SEO methods, your SEO Company will work hard to elevate your online status so that you begin to attract more targeted customers. Targeted customers are out there right now looking for your services and an SEO services company can help them to find you.

Website Leads Now LLC

2201 Kindel Ave

Winter Park FL 32789

407-701-9520

0 notes

Text

Microsoft's $100-per-application abundance is both excessively and insufficient Money motivating force plot appears to be probably not going to pull in the privilege developers.

Publish an application in the Windows Store by June 30 and Microsoft will give you a $100 Visa card. Engineers can submit up to 20 applications for a sum of $2,000 in prizes.

The constrained time offer begun on March 8 preceding being spotted by the Verge this week.

Aside from a couple terms and conditions—most outstandingly, that members must be no less than 18 and should live in the US—the plan is clear. Designers must pay the $49 (for people) or $99 (for organizations) expense to be recorded on the store. The offer applies both to Windows Phone applications submitted to the Windows Phone application store and Windows 8 Metro-style applications.

As advancements go, this is an odd one.

Paying designers to produce for your stage is an unsafe business. It's not something that occurs in a sound application biological community (it's impossible that Apple or Google is giving out money to persuade engineers onto their individual stages, and Microsoft absolutely isn't paying individuals to compose Windows desktop applications). The insignificant reality that Microsoft is doing it is a pointer that maybe the organization isn't content with the quantity of applications in the Windows Store.

In a contention advanced by previous Microsoft representative Charlie Kindel (who drove the organization's engineer outreach endeavors for Windows Phone 7), it accomplishes more than mirror a shriveling application advertise. This move draws in engineers who aren't especially put resources into the achievement of the stage (and subsequently in the quality and support of their applications), yet are attempting to make a quick buck from wrenching out straightforward applications.

Nonetheless, such installments can be helpful for taking action of another application biological community. Microsoft has apparently had some achievement so far in building up Windows Phone's application commercial center through offering motivating forces to designers. What's more, BlackBerry has offered $10,000 bounties for applications produced for BlackBerry 10 (however this is not a sweeping offer; applications must create $1,000 of income keeping in mind the end goal to qualify).

In the event that the Windows Store is attempting to draw in great applications, then notwithstanding the drawbacks of a motivation conspire—impassive designers, and the negative recognition it makes—a motivator plan may be a fundamental shrewdness. In the event that the outcome is a flourishing store crammed with top notch applications a while down the line, it would be cash well spent.

Be that as it may, Microsoft's $100 per application plot appears to be defective on that premise, as well. $100 purchases a couple of hours of advancement time, if that. $100 will cover the yearly membership to distribute in the Store (or two years of membership for people), yet it's not really motivation to compose an application.

The main applications that could solidly be produced for that sort of spending plan are the treat cutter clone applications, for example, the "ebooks as applications" that jumble up Apple's App Store. That sort of use is produced once, then duplicated many circumstances, just putting in an alternate book's content for every adaptation.

BlackBerry's plan appears to be considerably more shrewd. The $1,000 edge implies that the applications need to have some measure of value, and the $10,000 reward is ostensibly sufficiently high to at any rate empower profoundly energetic specialists.

All things considered, while Microsoft's advancement may blend a few engineers into giving amount, it's exceedingly improbable to yield any sort of value. It's basically insufficient money.The Windows Store is absolutely short on applications, yet that is not a basic numbers amusement. It's short on great applications. There are some little positive signs—seven days back an official Twitter application was discharged and it's truly rather pleasant—however all around planned, helpful bits of programming are as yet the exemption as opposed to the run the show.

Motivating force conspires that empower this sort of use (which may well include private courses of action amongst Microsoft and designers, as opposed to open free-for-alls) are probably going to be justified regardless of the time and cost. Be that as it may, a hundred bucks an application? It's the most noticeably bad of all universes. It makes the stage look powerless, and it energizes all the wrong designers.

0 notes

Text

Understanding How Banks Operate: Money & Debt

Understanding how banks work is an eye opener for most people. Did you know that up until 1844 in Britain banks in the UK printed their own paper cash money – these were called bank notes, of course. Banks still today make their own money. Every time someone borrows money from a bank the bank extends credit by creating money in that person’s account by pushing a button. No physical money is actually created. The debt creates that money and when the loan is paid back that money ceases to exist. The banks pockets the interest charged on the loan and erases the debt. That digitally created money disappears from the system. Understanding how banks operate: Money and debt.

Photo by David Peterson on Pexels.com

Banks Just Create Money Out Of Debt

Money is created via debt. Banks create this digital money when they lend funds to businesses and individuals. Thus, creating money has nothing to do with savings. The trillions of dollars or euros or pounds in the global economy are not created via making things, selling them, and saving the money generated. The trillions are created out of debt and extending credit. Something like only 3% of the money in the global economy is not created from debt. Banks are responsible for our supply of money in the economy. They in turn are under the aegis of a central bank, like the Reserve Bank of Australia, Federal Reserve in the US, and Bank of England in the UK.

https://youtu.be/myM44zZxy5Y

Credit Fuels The Money Supply Via Banks

Money used to be pegged to gold reserves back in the day. This is no longer the case since 1971 and the collapse of the Breton Woods system. Money supply has been foot loose and fancy free ever since. The bulk of business done by banks In Australia is from the mortgage market on loans for residential property. The banks create this money when they lend to borrowers, which increases the supply of money into the economy via debt. Houses are the single largest purchase that most consumers ever make in their lifetime. Thus, all this money fuels inflation in the housing sector, which we have seen in Australia over the last 35 years. Property prices have gone up by a whopping 382% over the last three decades. In fact, it is much higher. My family bought a suburban house in the late 1970s for around $37K and that property sold for around $900K in 2020. The same house with no real improvements made to it or the property. The RBA does not include house prices in its definition of inflation, thus nobody talks about the huge inflation in this sector of the economy. Those who have bought into the property market and benefited from the huge gains in property prices are big fans of it. Those who are locked out because of the hugely inflated prices are not so happy.

Photo by Kindel Media on Pexels.com

The important thing to understand here, however, is that the money supply is greatly increased by the enormous debt raised via the banks’ lending to this sector. Remember money is created via debt. So, vast amounts of money are being pumped into the Australian economy by this process. This is non-GDP generated money. This is money created via bank speculation in lending money to prospective investors and home owners. It is not money created out of manufacturing anything. This is why houses are getting more and more expensive every year. More money supply creates inflation, this is a well-known economic principle. Many people are going on about a shortage of housing and there may well be some truth to this but this is not the main driver for the inflation in the property sector. Rather, it is the very nature of how the banking system works in Australia and globally, and how it interacts with the housing market.

https://www.youtube.com/watch?v=yLZUVsmUwZY

Understanding how banks operate: Money and debt. This money has been created out of nothing and it expands the perceived wealth of nations like Australia. This wildly inflated housing market is not linked to the recognised inflation rate and so goes unremarked upon. It creates societal power on the back of inflated wealth with no basis in GDP linked activity. Australia has become a nation with very little manufacturing going on. A country that makes bugger all. A place where inflated property prices are some of the highest in the world.

Photo by Pixabay on Pexels.com

Understanding how banks operate: Money and debt are inextricably linked. Banks make their profits by creating money and lending it out to individuals and businesses. Speculation is far by the main activity of commercial banks and the supply of money in the global economy has increased exponentially on a massive scale. This is how the economic system works. Banks, especially big banks are never allowed to fail because of their place in how money supply works. Banks have accounts with the central bank like the RBA and these are used to transfer funds between them. During the global pandemic the RBA purchased government bonds to the tune of some $100 billion. This was done via the commercial banks under its aegis – their reserve accounts with the central bank were credited with this money. This process is called quantitative easing (QE) and has been done by central banks globally, especially in response to the 2008 Global Financial Crisis (GFC) and the Coronavirus pandemic. The RBA claims that this increase to money supply is not inflationary because it is held in reserve rather than directly pumped into the economy.

As of 2022 and beyond, there has been global high inflation and a cost of living crisis for the working poor and those on welfare. The RBA, has a recognised inflation target rate of 2-3%. Inflation has been up at 7-8% in Australia and higher in the US and UK and Europe. Interest rates, which had been at record lows for the decade since the GFC, at around 0.3% or lower, were rapidly raised by central banks around the world. Monetary policy implemented by central banks raises the cash rate to make credit more expensive. This makes lending less attractive and thus reduces money supply growth on this basis. The RBA has now embarked upon quantitative tightening (QT), which involves:

“At its meeting earlier this month, as well as raising the cash rate target, the Board decided not to reinvest the proceeds from bonds as they mature from the Bank's portfolio. This signals the next phase in the bond purchase program. The initial phase in which the Bank built up its stock of bond holdings is often referred to as ‘quantitative easing’, or QE for short. That phase ended in February this year. We have now entered the phase known as ‘quantitative tightening’, or QT. By allowing our bond holdings to gradually diminish over time as they mature, the initial stimulatory effects of those holdings – namely, downward pressure on government bond yields and the Australian dollar exchange rate – will gradually unwind.”

- (RBA Assistant Gov. Christopher Kent, 23 May 2022)

This takes money supply out of the economy and is another anti-inflationary measure on this basis.

Photo by energepic.com on Pexels.com

There are jitters being felt in the financial sector based on the recent spate of failings of US banks. Silicon Valley Bank collapsed after a run on the bank saw it unable to meet its depositors’ requirements. This bank had bought up on government bonds and not kept enough reserves to meet depositor requirements. A Donald Trump lessening of regulatory requirements for mid-tier regional banks had created the environment for this banking crisis. Rising interest rates has seen the return on bond rates fall below parity to tip this bank and others over the edge into collapse after poor financial decisions by their management. Signature Bank and First Reserve Bank are two more on the brink of failure. Credit Suisse is another large financial institution to fall, being swallowed up by UBS in its death throes, in a Swiss banking dance of death. Share prices of these banks have plummeted and rescue packages have attempted to stem the bleeding and more domino’s falling over. The US government has guaranteed depositor funds in a bid to shore up confidence in the banking sector. Little banks can fail without bringing down the whole edifice but no really big banks will be allowed to fail.

Deutsche Bank is now coming under scrutiny from the market. Traders will be actively seeking out any weakness to exploit for their financial gain. Global investors will be eyeing off the exits if they sense any trouble. Deutsche Bank stocks closed down 8% overnight. This bank has more than $1 trillion in assets. Recessions loom for economies around the globe on the back of central banks and their monetary policy fighting inflation. Investors are getting jumpy. Will this be the beginning of the Global Financial Crisis 2.0?

Robert Sudha Hamilton

©Midas Word

Read the full article

0 notes

Text

Understanding How Banks Operate: Money & Debt

Understanding how banks work is an eye opener for most people. Did you know that up until 1844 in Britain banks in the UK printed their own paper cash money – these were called bank notes, of course. Banks still today make their own money. Every time someone borrows money from a bank the bank extends credit by creating money in that person’s account by pushing a button. No physical money is actually created. The debt creates that money and when the loan is paid back that money ceases to exist. The banks pockets the interest charged on the loan and erases the debt. That digitally created money disappears from the system. Understanding how banks operate: Money and debt.

Photo by David Peterson on Pexels.com

Banks Just Create Money Out Of Debt

Money is created via debt. Banks create this digital money when they lend funds to businesses and individuals. Thus, creating money has nothing to do with savings. The trillions of dollars or euros or pounds in the global economy are not created via making things, selling them, and saving the money generated. The trillions are created out of debt and extending credit. Something like only 3% of the money in the global economy is not created from debt. Banks are responsible for our supply of money in the economy. They in turn are under the aegis of a central bank, like the Reserve Bank of Australia, Federal Reserve in the US, and Bank of England in the UK.

Credit Fuels The Money Supply Via Banks

Money used to be pegged to gold reserves back in the day. This is no longer the case since 1971 and the collapse of the Breton Woods system. Money supply has been foot loose and fancy free ever since. The bulk of business done by banks In Australia is from the mortgage market on loans for residential property. The banks create this money when they lend to borrowers, which increases the supply of money into the economy via debt. Houses are the single largest purchase that most consumers ever make in their lifetime. Thus, all this money fuels inflation in the housing sector, which we have seen in Australia over the last 35 years. Property prices have gone up by a whopping 382% over the last three decades. In fact, it is much higher. My family bought a suburban house in the late 1970s for around $37K and that property sold for around $900K in 2020. The same house with no real improvements made to it or the property. The RBA does not include house prices in its definition of inflation, thus nobody talks about the huge inflation in this sector of the economy. Those who have bought into the property market and benefited from the huge gains in property prices are big fans of it. Those who are locked out because of the hugely inflated prices are not so happy.

Photo by Kindel Media on Pexels.com

The important thing to understand here, however, is that the money supply is greatly increased by the enormous debt raised via the banks’ lending to this sector. Remember money is created via debt. So, vast amounts of money are being pumped into the Australian economy by this process. This is non-GDP generated money. This is money created via bank speculation in lending money to prospective investors and home owners. It is not money created out of manufacturing anything. This is why houses are getting more and more expensive every year. More money supply creates inflation, this is a well-known economic principle. Many people are going on about a shortage of housing and there may well be some truth to this but this is not the main driver for the inflation in the property sector. Rather, it is the very nature of how the banking system works in Australia and globally, and how it interacts with the housing market.

https://www.youtube.com/watch?v=yLZUVsmUwZY

Understanding how banks operate: Money and debt. This money has been created out of nothing and it expands the perceived wealth of nations like Australia. This wildly inflated housing market is not linked to the recognised inflation rate and so goes unremarked upon. It creates societal power on the back of inflated wealth with no basis in GDP linked activity. Australia has become a nation with very little manufacturing going on. A country that makes bugger all. A place where inflated property prices are some of the highest in the world.

Photo by Pixabay on Pexels.com

Understanding how banks operate: Money and debt are inextricably linked. Banks make their profits by creating money and lending it out to individuals and businesses. Speculation is far by the main activity of commercial banks and the supply of money in the global economy has increased exponentially on a massive scale. This is how the economic system works. Banks, especially big banks are never allowed to fail because of their place in how money supply works. Banks have accounts with the central bank like the RBA and these are used to transfer funds between them. During the global pandemic the RBA purchased government bonds to the tune of some $100 billion. This was done via the commercial banks under its aegis – their reserve accounts with the central bank were credited with this money. This process is called quantitative easing (QE) and has been done by central banks globally, especially in response to the 2008 Global Financial Crisis (GFC) and the Coronavirus pandemic. The RBA claims that this increase to money supply is not inflationary because it is held in reserve rather than directly pumped into the economy.

As of 2022 and beyond, there has been global high inflation and a cost of living crisis for the working poor and those on welfare. The RBA, has a recognised inflation target rate of 2-3%. Inflation has been up at 7-8% in Australia and higher in the US and UK and Europe. Interest rates, which had been at record lows for the decade since the GFC, at around 0.3% or lower, were rapidly raised by central banks around the world. Monetary policy implemented by central banks raises the cash rate to make credit more expensive. This makes lending less attractive and thus reduces money supply growth on this basis. The RBA has now embarked upon quantitative tightening (QT), which involves:

“At its meeting earlier this month, as well as raising the cash rate target, the Board decided not to reinvest the proceeds from bonds as they mature from the Bank's portfolio. This signals the next phase in the bond purchase program. The initial phase in which the Bank built up its stock of bond holdings is often referred to as ‘quantitative easing’, or QE for short. That phase ended in February this year. We have now entered the phase known as ‘quantitative tightening’, or QT. By allowing our bond holdings to gradually diminish over time as they mature, the initial stimulatory effects of those holdings – namely, downward pressure on government bond yields and the Australian dollar exchange rate – will gradually unwind.”

- (RBA Assistant Gov. Christopher Kent, 23 May 2022)

This takes money supply out of the economy and is another anti-inflationary measure on this basis.

Photo by energepic.com on Pexels.com

There are jitters being felt in the financial sector based on the recent spate of failings of US banks. Silicon Valley Bank collapsed after a run on the bank saw it unable to meet its depositors’ requirements. This bank had bought up on government bonds and not kept enough reserves to meet depositor requirements. A Donald Trump lessening of regulatory requirements for mid-tier regional banks had created the environment for this banking crisis. Rising interest rates has seen the return on bond rates fall below parity to tip this bank and others over the edge into collapse after poor financial decisions by their management. Signature Bank and First Reserve Bank are two more on the brink of failure. Credit Suisse is another large financial institution to fall, being swallowed up by UBS in its death throes, in a Swiss banking dance of death. Share prices of these banks have plummeted and rescue packages have attempted to stem the bleeding and more domino’s falling over. The US government has guaranteed depositor funds in a bid to shore up confidence in the banking sector. Little banks can fail without bringing down the whole edifice but no really big banks will be allowed to fail.

Deutsche Bank is now coming under scrutiny from the market. Traders will be actively seeking out any weakness to exploit for their financial gain. Global investors will be eyeing off the exits if they sense any trouble. Deutsche Bank stocks closed down 8% overnight. This bank has more than $1 trillion in assets. Recessions loom for economies around the globe on the back of central banks and their monetary policy fighting inflation. Investors are getting jumpy. Will this be the beginning of the Global Financial Crisis 2.0?

Robert Sudha Hamilton

©Midas Word

Read the full article

0 notes

Text

@wvinterisms plotted pain

this is exactly what he was supposed to prevent.

the one fucking time he decided to listen to her and take some time off. a small break to get some sleep. he should have known better. he did know better but he wanted to do it for her, to make that little worried crease between her brows go away. he put his feelings before his duty and this is what happened. good fucking job, kindell.

anger boils within him. at himself. at whoever did this, whoever took her and whoever gave the orders. it’s fortunate that’s he a tracker. it isn’t why he was put in this position but it comes in handy. following her trail is easy. he knows it well enough now and even if he didn’t something about the energy she gives off is so unique. it’s strong too. everything about her is strength tightly wound, waiting to burst.

it isn’t until he finds her that he really puts it together. enough fragments of what happened to understand how the fuck this even happened in the first place. she would never fight if it endangered her sister. and the inclination to resist can’t exactly be reached when someone if fucking with your head. he would know. he just cannot figure out if i he is angry because he wasn’t briefed about this or simply because they hurt her. either way it impairs his judgement.

there is no civility when he fights the other agent. no protocols. no thought for figuring out what would be the better deal, what would make tantalus more money. he doesn’t give a shit. his job is protecting her and he failed once already. he tells himself he won’t do it again and he doesn’t. maybe if it was another job, a different person, he would stop when the other man is down. but he doesn’t. he doesn’t stop until he feels the life fade away. he’ll regret it later, but for now he just takes comfort in the fact elsa won’t be hurt by him again.

despite the violence they just committed, his hands are gentle when he kneels beside the queen and reaches to push matted locks away from her eyes. voice is low and gruff as he tries to find her gaze “ you’re safe now. ”

#wvinterisms#〖 TANTALUS: THIS BODY IS A VESSEL TO FORGOTTEN LIVES 〗#i was gonna try to make this noT super long but here we are

7 notes

·

View notes