#make sure you understand political material outside of bias as much as you can manage

Text

Just so everyone gets the lay-down of some of the bigger points of the Supreme Court decisions and rights at risk after Roe v Wade was overturned:

Justice Clarence Thomas expressed his desire to go after Obergefell v Hodges (the case that federally legalized gay marriage)

Griswold v Connecticut is also being considered (the federal right to obtain contraception)

Lawrence v Texas (allows consenting adults the right to engage in whatever sexual acts they wish within private courters, i.e. their own bedroom)

Slightly biased source from CNBC:

A significantly unbiased source from what I can find, by Politico:

Miranda Rights or Vega v Tekoh is overturned, meaning it is no longer federally required for Miranda rights to be read to detained individuals. Therefore, any detained person cannot sue for damages against law enforcement/the court for being unaware of their rights and protections.

Slightly biased source from CNN:

The 100 Mile Border is also changed, meaning those who live 100 miles away from the country's border as well as international airports no longer have 4th amendment rights (i.e. it affects your abilities to sue for damages if you are a victim of a warrantless search.)

An unbiased (from what I can tell) and objective breakdown source by ACLU:

Senator John Cornyn of Texas tweeted about how Brown v Board (the case that established segregated schools are unconstitutional regardless if the school and education qualities were the same) should be overturned, and Plessy v Ferguson (case that brought forth the saying "separate but equal" in regards to segregation, meaning segregation was constitutional if poc were given the same quality facilities and education) should be reviewed.

Biased source from SALON which i am using simply because it has links and screenshots of his tweet:

#it is important that i outline the sources that are written with bias#regardless of whether i agree/have those biases myself#because reading biased material affects your thoughts and opinions#make sure you understand political material outside of bias as much as you can manage#ESPECIALLY when reviewing laws and regulations#because biased news articles and videos can leave out important information or use misleading language#roe v wade#information#america

630 notes

·

View notes

Text

Learn how to Construct and Scale a Excessive-Efficiency Advertising and marketing Group, In line with Leaders Who've Accomplished It

New Post has been published on http://tiptopreview.com/how-to-build-and-scale-a-high-performance-marketing-team-according-to-leaders-whove-done-it/

Learn how to Construct and Scale a Excessive-Efficiency Advertising and marketing Group, In line with Leaders Who've Accomplished It

In 2020, I began utilizing Headspace.

And, because it seems, so did everybody else.

The meditation app, which was first launched again in 2012, initially generated roughly $30 million in income and, as of 2017, had 40,000 subscribers.

At present, the app has over 2 million customers, and is valued at $320 million dollars. How’s that for progress?

However, when any firm scales that rapidly, it begs the query: Will the enterprise survive, and even thrive underneath its newfound success? Or will it crumble?

Maybe your organization is experiencing related progress, and your marketing group is feeling the rising pains. Or, perhaps what you are promoting is model new, and also you’re targeted on successfully constructing a robust marketing group for the primary time.

Whichever the case, the challenges that come together with constructing or scaling a marketing group could be detrimental to a company if dealt with poorly. Which is why I sat down with marketing leaders at Google, Microsoft, Wistia, Canva, and Typeform to study their ideas for efficiently constructing or scaling a group — so that you just’re prepared when it is your time to develop.

Let’s dive in.

Suggestions for Constructing an Efficient Advertising and marketing Group

1. Rent with variety, fairness, and inclusion in thoughts.

There are numerous advantages to variety within the office – as an illustration, do you know organizations with a various management group have 19% greater income on common than firms with much less various leaders?

Or, how about the truth that diverse teams can solve problems quicker than cognitively related individuals?

Suffice to say, variety issues.

When constructing an efficient marketing group, it is important to think about variety, fairness, and inclusion from the very starting.

As Google’s World Head of SMB Partnerships Advertising and marketing, Elana Chan, instructed me, “Hiring is the most important thing you’ll do as a leader — and that also means you need to think about DEI. It’s easy when we’re running fast to just ask people in our own networks to apply for open positions, but it’s worth it to diversify. Every study and even my own experience has proven that diversification and different points of view are important.”

Chan provides, “It takes longer to hire people who are outside of your natural network, but it’s worth it. You’ll get the right people for the job and also set the right tone across your organization. It’s important to walk the talk when it comes to DEI, not just when it’s convenient.”

While you’re first constructing out your group, you may wish to make sure you incorporate DEI into your recruitment plans. To do that, think about writing inclusive job descriptions, promote roles by means of various channels, and standardize your interview course of.

You may also strive utilizing recruitment expertise like Greenhouse Inclusion to scale back the dangers of unconscious bias when interviewing.

2. Rent people who find themselves hungry sufficient to strive something.

In the event you’re simply beginning out, you do not have limitless price range to rent a slew of entrepreneurs who concentrate on varied marketing actions. As an alternative, you probably solely have the price range for a handful of entrepreneurs — or even perhaps only one.

So … how do you make that one rent rely?

Above all else, Wistia co-founder and CEO Chris Savage believes it is necessary to think about how pushed your first marketing rent is.

He instructed me, “You want to find someone who is extremely hungry, and can make their own things — whether that is video, written content, or audio. Whichever assets your team needs, if you can find someone who can be both the creator and manager of those assets, then you unlock the ability to try things much more easily.”

“At Wistia,” he provides, “I hired a lot of misfits who were so hungry that they were willing to try anything. Maybe on paper it didn’t make sense, but in reality, it was incredible.”

For example, maybe your marketing group has recognized YouTube as a viable alternative to achieve new audiences and convert these customers into leads. If that is the case, think about hiring somebody with expertise creating video — together with a robust need to study rapidly, and take a look at new issues.

three. Rent a marketing buyer expertise (CX) chief.

When requested what probably the most essential early rent on a marketing group is, John Cosley, Senior Director of World Model Advertising and marketing at Microsoft Advertising, instructed me: “Two years ago, I would have said a marketing data scientist — someone who can analyze datasets and help their organizations better understand their customers and identify future opportunities, as well as advise on marketing tactics and analysis methodologies.”

“Fast forward to today,” He provides, “And I would say that the marketing customer experience (CX) leader is the most crucial early hire in scaling a marketing team. Consumer journeys have increasingly become digital and multi-modal and expectations have increased around privacy and trust, personalization, and quality.”

In the event you’re eager about making a buyer expertise technique for what you are promoting, check out Learn how to Outline a Buyer Expertise (CX) Technique.

Finally, a buyer expertise is about placing the client first. As Cosley instructed me, “Shoppers usually tend to worth a model that values them, so it has develop into crucial for manufacturers at present to prioritize the client expertise right through the buying funnel.”

four. Rent early.

Hiring as you are scaling could be a bit like attempting to construct a airplane when you’re flying it.

It may be troublesome and messy to get new hires up-to-speed on the identical time you want them to carry out optimally so your customers do not feel the friction. To reduce these challenges, think about hiring months forward of if you’ll want sure roles crammed.

As Francois Bondiguel, Canva’s World Head of B2B Advertising and marketing & Progress, instructed me, “A big challenge that many face as they scale is getting the organizational structure and strategy right. This includes hiring the right people, and ensuring they have leaders in place to guide them through this transformative phase and help them remove roadblocks so they can move fast.”

“On that note,” Bondiguel provides, “it’s important for key hires to be brought in early to ensure they are properly onboarded prior to projects ramping up. This helps avoid placing unrealistic pressure on new team members as well as the broader group.”

To do that successfully, check out your group’s long-term imaginative and prescient, and brainstorm which function(s) will must be crammed to get your group to the following stage.

5. Use one knowledge set to information your total division.

While you’re first beginning out, I am prepared to wager your lean startup group understands the significance of creating data-based choices … however they probably additionally work in silos.

Perhaps you’ve two content material strategists who concentrate on lead era numbers. Then, maybe you’ve one other social media marketer who focuses on cost-per-acquisition.

The problem? “While you’re working in silos, there are additionally knowledge silos,” Chan tells me. “Which means you can never pull the same number across teams. That’s a mistake. If you start off providing your team with a unified data set, then it’s easier to grow together. It’s much harder to merge data sets later, and then it becomes politics to determine the right numbers to use.”

To repair this, guarantee you’ve a unified system for accumulating and analyzing knowledge even when your group is small. Think about using a CRM to retailer your knowledge in a single place, or making a division dashboard in Google Analytics.

Regardless of the case, it is vital you present your group with a centralized location so your knowledge processes can develop with you as you scale.

6. Deal with buyer retention at first, reasonably than simply buyer acquisition.

While you begin to see your record of shoppers rising, it may be tempting to need extra, extra, extra.

However as a startup, you must watch out. In the event you focus completely on buying new prospects, you overlook certainly one of your strongest weapons — your present prospects.

As Typeform’s VP of Progress, Jim Kim, instructed me, “Many SaaS-based startups … focus exclusively on customer acquisition and tend to neglect customer retention until they see issues with the customer base size growing.”

Kim provides, “By focusing early on efforts to engage and retain the base of customers already acquired, the startup develops a more holistic understanding of the customers they serve, and can gain insights into the things customers really care about that can then be added to the acquisition activities.”

To forestall buyer churn, you may wish to construct out an unimaginable buyer help technique that allows your present prospects to get their wants met. Moreover, think about the way you may present worth past the acquisition, or create a customized buyer expertise so your prospects know you care about them.

As Kim factors out, “It’s an obvious point, but in my experience, it’s hard to remember that retention can actually be a faster way to grow the customer base than new acquisition and usually has a higher marketing ROI, since it’s (generally) cheaper to keep a customer than find a new one.”

Suggestions for Scaling Your Advertising and marketing Group

1. Do not stifle the power of a startup.

As you start to scale, the office inevitably adjustments. Earlier than, conversations occurred casually throughout workplace desks, or when grabbing a cup of espresso — now, there are formal conferences with agendas.

And, when you might beforehand take a look at out a brand new thought with out essentially requiring buy-in from management, now you are anticipated to comply with stricter processes, which limits the experiments you may strive.

And but, one factor should not change as you scale.

As Chan places it, “It’s important not to stifle the energy of a startup. That’s the exciting part of being where you are, and I think the acknowledgement that you’re building the car as you’re driving it is okay — and fun.”

Chan provides, “At Google we have a saying: ‘Operating at the edge of chaos’. If you imagine a frontier, one side is not enough chaos, and the other side is too much chaos. If there’s too much chaos, no one knows what’s happening, and nothing gets done. But if there’s not enough chaos, then there’s no innovation and you’re not moving forward.”

“It’s your job as a leader to operate as closely to this frontier as possible, and I think in a startup that’s even more true.”

While you start to scale, you are going to have to implement extra formal processes. However these processes should not limit your staff from taking dangers, testing out new concepts, and pushing the boundaries of your marketing efforts.

Think about, as you scale, how one can defend that “startup energy” in any respect prices.

2. Stick to what’s working.

As you start to scale, you are in all probability on the lookout for new progress alternatives. And, at this level, it would really feel just like the sky is the restrict — what you are promoting is quickly rising, so why not take some dangers?

However, whereas sure dangers are inevitable, it is not a good suggestion to increase too far past what’s already working.

As Savage instructed me, “In the event you’re a startup that is making progress when it comes to bringing in prospects and getting them to make use of your services or products, then it is easy to suppose, ‘Okay, I’ve one channel that is working … now let’s add a channel on prime of that, and one other channel on prime, and that is how I am going to scale.’ Like, PR is working, why not add paid promoting on prime?”

The error, Savage says, is that there are sometimes one or two channels you find yourself underestimating when it comes to progress potential. In case your content material is performing exceedingly effectively and driving leads for the enterprise, it is not essentially a good suggestion to pivot away from content material. As an alternative, you wish to ask your self — How rather more can we increase with our content material?

“There’s good advice in personal finance,” Savage says, “which states that most wealth is built through a concentration of risk, and it’s maintained through a distribution of risk — so, basically, if you want to become wealthy, you need to take just a few big risks.”

“It’s the same thing when scaling customer acquisition … There are a few big things you can do. It’s very important to go big on the things that are already working.”

Somewhat than investing in social media, digital marketing, video, PR, and running a blog suddenly, think about which channels drive probably the most leads for what you are promoting. These are the channels that acquired you this far, and people are probably the identical channels that may get you even additional if you happen to focus your efforts.

three. Deal with your tradition as a enterprise precedence.

It is easy sufficient to foster and keep a robust tradition if you’re a small group. However, as you scale and increase your group, it could get tougher to guard the tradition that attracted staff to your workplace within the first place.

And whereas tradition may simply sound like a buzzword used to switch beer backyard and yearly ski journeys, it is not.

In actuality, tradition is important to what you are promoting’ success — in actual fact, firms with robust cultures are 1.5X more likely to report average revenue growth of greater than 15% over three years.

As Cosley instructed me: “In any growing organization, the key to success is embracing and honoring the culture to which you aspire. It’s likely what made your company a great place to work and attracted the high-quality talent that is driving your growth.”

Cosley provides, “It isn’t arduous for core values and cultural priorities to erode and even get misplaced throughout growth if that work will not be made a precedence. As you scale, you may wish to suppose and act deliberately about how your tradition grows with you, the way you outline and memorialize it, the way it impacts your hiring and onboarding, the way you prepare your management, and the way you consider efficiency.”

Consider — whether or not or not you’ve got actively fostered it, your organization already has a tradition … it simply won’t be a robust one. And powerful cultures can each entice and retain staff for the long-run, so it is an necessary enterprise initiative to take the time to create one which aligns together with your values and objective.

Moreover, Cosley notes, “Culture is not one-dimensional. You need to consider it across areas such as retention and hiring, diversity and inclusion, and employee engagement. And culture is contagious. Not only does it deliver more positive outcomes and business results, it helps with critical talent retention, and can lower the cost and time to acquire new talent.”

“Treating your culture as a business priority is essential. Without doing so, it could be detrimental to your organization’s potential.”

To make sure your tradition grows together with your group as you scale, check out HubSpot’s Final Information to Firm Tradition.

four. Institutionalize key values in your group.

To construct a robust group tradition, Chan recommends institutionalizing key values.

For example, maybe you worth autonomy, empathy, adaptability, or mental progress. As a pacesetter, it is vital you utilize these values as foundational constructing blocks on which your group can develop.

Chan instructed me, “For me, learning and intellectual curiosity are really important, so I say to my team, ‘You’re responsible for making the person next to you smarter’. And that creates the onus on bringing your own best game because everyone around you is so incredibly talented — so how are you being additive, collaborative, and innovative from within that culture? You owe it to each other to be your best.”

5. Reward what’s proper … and punish what’s mistaken.

As soon as you’ve got recognized the values that matter to your group, it is vital you encourage these values in every of your staff.

When offering efficiency critiques, as an illustration, take the time to establish the place staff have demonstrated key group values, and the place they may nonetheless be missing.

As Savage instructed me, “The way you scale it is, you praise the right stuff and punish the wrong stuff. It’s that simple — most culture is modeled. You need the most senior people to act the way you believe you should be acting, and if you do that, it permeates the building.”

For example, to illustrate you worth risk-taking in your group. If that is the case, you may wish to reward your group after they take dangers, and even reward the failure that may outcome from these dangers.

Alternatively, if you happen to’re in a mode the place you are risk-averse and on the lookout for optimization of processes, you’d wish to reward actions that exhibit threat administration.

6. Rent for the longer term — not simply at present.

Lastly, if you’re scaling, you wish to think about who you may rent at present that may proceed to fulfill the wants of what you are promoting whilst these wants change over time.

For example, after I was first employed at a startup, I used to be employed to create weblog content material. Quick-forward six months, and I used to be moreover tasked with making a podcast, and rising the subscriptions to an electronic mail publication. Because the enterprise scaled, my function modified rapidly. So it is vital you rent with the longer term in-mind.

When requested concerning the largest problem leaders face when scaling, Kim instructed me, “[It’s] the problem to steadiness long-term and short-term hiring. For a bigger, extra established enterprise, scaling a group will not be as difficult. The roles are already clearly outlined, and there’s probably already somebody doing that job. It is easy to rent for a task like this.

“But,” Kim provides, “when the team is trying to scale, the roles may be less clear and transitory. What you think you need today could be wildly different tomorrow. Balancing the needs of today, while keeping an eye out on how things might change in the future is something that’s extremely hard to do.”

Hiring and recruiting is not a simple activity, however to make sure you’re hiring for the longer term, you may wish to take the time to find out somebody’s work ethic, flexibility, and skill to shift roles because the wants change. And, as talked about above, you may wish to discover somebody who’s hungry to be there.

7. Create processes for efficient communication.

As your group scales, it turns into much more necessary to make sure you have processes in-place to make sure truthful, efficient cross-team communication.

For example, maybe you’ve got observed your conferences have develop into alternatives in your most extroverted staff to share their successes, whereas nearly all of your group stays silent.

To fight this, think about creating a gathering agenda or slide deck, so individuals know what they should share, and when.

As Bondiguel places it, “Another challenge is communication. You need to put good processes in place (access to documents, meeting cadence, etc.) to ensure the entire team has all the information and context they need to perform and do their best work. This has never been more important as teams adapt to hybrid work environments.”

And there you’ve it. Whether or not you are formally within the scaling section or nonetheless within the startup section, the following pointers ought to allow you to make sure you’re constructing a robust basis for the longer term.

Source link

0 notes

Text

The danger is that if we invest too much in developing AI and too little in developing human consciousness, the very sophisticated artificial intelligence of computers might only serve to empower the natural stupidity of humans.

While science fiction thrillers are drawn to dramatic apocalypses of fire and smoke, in reality we might be facing a banal apocalypse by clicking.

The economic system pressures me to expand and diversify my investment portfolio, but it gives me zero incentive to expand and diversify my compassion. So I strive to understand the mysteries of the stock exchange while making far less effort to understand the deep causes of suffering.

So we had better call upon our lawyers, politicians, philosophers and even poets to turn their attention to this conundrum: how do you regulate the ownership of data? This may well be the most important political question of our era.

Each of these three problems – nuclear war, ecological collapse, and technological disruption – is enough to threaten the future of human civilization. But taken together, they add up to an unprecedented existential crisis, especially because they are likely to reinforce and compound one another.

Yet it is precisely their genius for interpretation that puts religious leaders at a disadvantage when they compete against scientists. Scientists too know how to cut corners and twist the evidence, but in the end, the mark of science is the willingness to admit failure and try a different tack. That’s why scientists gradually learn how to grow better crops and make better medicines, whereas priests and gurus learned only how to make better excuses.

Human power depends on mass cooperation, and mass cooperation depends on manufacturing mass identities—and all mass identities are based on fictional stories, not on scientific facts or even on economic necessities.

Religions, rites, and rituals will remain important as long as the power of humankind rests on mass cooperation and as long as mass cooperation rests on belief in shared fictions.

As long as we don’t know whether absorption is a duty or a favour; what level of assimilation is required from immigrants; and how quickly host countries should treat them as equal citizens –we cannot judge whether the two sides are fulfilling their obligations.

If a million immigrants are law-abiding citizens, but one hundred join terrorist groups and attack the host country, does it mean that on the whole the immigrants are complying withthe terms of the deal, or violating it? If a third-generation immigrant walks down the street a thousand times without being molested, but once in a while some racist shouts abuse at her, does it mean that the native population is accepting or rejecting immigrants?

The less political violence in a particular state, the greater the public shock at an act of terrorism.

Morality doesn’t mean ‘following divine commands’. It means ‘reducing suffering’. Hence in order to act morally, you don’t need to believe in any myth or story. You just need to develop a deep appreciation of suffering. If you really understand how an action causes unnecessary suffering to yourself or to others, you will naturally abstain from it.

Questions you cannot answer are usually far better for you than answers you cannot question.

The world is becoming ever more complex, and people fail to realise just how ignorant they are of what’s going on. Consequently some who know next to nothing about meteorology or biology nevertheless propose policies regarding climate change and genetically modified crops, while others hold extremely strong views about what should be done in Iraq or Ukraine without being able to locate these countries on a map.

How is it possible to avoid stealing when the global economic system is ceaselessly stealing on my behalf and without my knowledge?

In a world in which everything is interconnected, the supreme moral imperative becomes the imperative to know. The greatest crimes in modern history resulted not just from hatred and greed, but even more so from ignorance and indifference.

Most of the injustices in the contemporary world result from large-scale structural biases rather than from individual prejudices, and our hunter-gatherer brains did not evolve to detect structural biases.

Even if you personally belong to a disadvantaged group, and therefore have a deep first-hand understanding of its viewpoint, that does not mean you understand the viewpoint of all other such groups. For each group and subgroup faces a different maze of glass ceilings, double standards, coded insults and institutional discrimination.

Should we adopt the liberal dogma and trust the aggregate of individual voters and customers? Or perhaps we should reject the individualist approach, and like many previous cultures in history empower communities to make sense of the world together? Such a solution, however, only takes us from the frying pan of individual ignorance into the fire of biased groupthink. Hunter-gatherer bands, village communes and even city neighbourhoods could think together about the common problems they faced. But we now suffer from global problems, without having a global community. Neither Facebook, nor nationalism nor religion is anywhere near creating such a community.

In fact, humans have always lived in the age of post-truth. Homo sapiens is a post-truth species, whose power depends on creating and believing fictions. Ever since the stone age, self-reinforcing myths have served to unite human collectives.

In practice, the power of human cooperation depends on a delicate balance between truth and fiction.

Humans have this remarkable ability to know and not to know at the same time. Or more correctly, they can know something when they really think about it, but most of the time they don’t think about it, so they don’t know it. If you really focus, you realise that money is fiction. But usually you don’t focus.

Truth and power can travel together only so far. Sooner or later they go their separate ways. If you want power, at some point you will have to spread fictions. If you want to know the truth about the world, at some point you will have to renounce power. You will have to admit things – for example about the sources of your own power – that will anger allies, dishearten followers or undermine social harmony. Scholars throughout history faced this dilemma: do they serve power or truth? Should they aim to unite people by making sure everyone believes in the same story, or should they let people know the truth even at the price of disunity? The most powerful scholarly establishments – whether of Christian priests, Confucian mandarins or communist ideologues – placed unity above truth. That’s why they were so powerful.

One of the greatest fictions of all is to deny the complexity of the world, and think in absolute terms of pristine purity versus satanic evil.

Whenever you see a movie about an AI in which the AI is female and the scientist is male, it's probably a movie about feminism rather than cybernetics.

Many pedagogical experts argue that schools should switch to teaching “the four Cs” – critical thinking, communication, collaboration, and creativity.

Due to the growing pace of change you can never be certain whether what the adults are telling you is timeless wisdom or outdated bias.

You might have heard that we are living in the era of hacking computers, but that's hardly half the truth. In fact, we are living in the era of hacking humans.

The god Krishna then explains to Arjuna that within the great cosmic cycle each being possesses a unique ‘dharma’, the path you must follow and the duties you must fulfil. If you realise your dharma, no matter how hard the path may be, you enjoy peace of mind and liberation from all doubts.

Most successful stories remain open-ended.

A crucial law of storytelling is that once a story manages to extend beyond the audience's horizon, its ultimate scope matters little.

A wise old man was asked what he learned about the meaning of life. "Well", he answered, "I have learned that I am here on earth in order to help other people. What I still haven't figured out is why the other people are here.

Most people who go on identity quests are like children going treasure hunting. They find only what their parents have hidden for them in advance.

Almost anything can be turned into a ritual, by giving mundane gestures like lighting candles, ringing bells or counting beads a deep religious meaning.

Of all rituals, sacrifice is the most potent, because of all the things in the world, suffering is the most real. You can never ignore it or doubt it.

Just as in ancient times, so also in the twenty-first century, the human quest for meaning all too often ends with a succession of sacrifices.

Similarly, you can find plenty of Bernie Sanders supporters who have a vague belief in some future revolution, while also believing in the importance of investing your money wisely. They can easily switch from discussing the unjust distribution of wealth in the world to discussing the performance of their Wall Street investments.

If by 'free will' you mean the freedom to do what you desire – then yes, humans have free will. But if by 'free will' you mean the freedom to choose what to desire – then no, humans have no free will.

The process of self-exploration begins with simple things, and becomes progressively harder. At first, we realise that we do not control the world outside us. I don’t decide when it rains. Then we realise that we do not control what’s happening inside our own body. I don’t control my blood pressure. Next, we understand that we don’t even govern our brain. I don’t tell the neurons when to fire. Ultimately we should realise that we do not control our desires, or even our reactions to these desires.

Many people, including many scientists, tend to confuse the mind with the brain, but they are really very different things. The brain is a material network of neurons, synapses, and biochemicals. The mind is a flow of subjective experiences, such as pain, pleasure, anger, and love.

- Yuval Noah Harari, 21 Lessons for the 21st Century

1 note

·

View note

Text

Remote Learning in the Time of Worsening Political Crisis: Q&A with UPLB students

Written by Mac Andre Arboleda and Benjie Gallero

It has been a month into the 2nd semester of the Academic Year 2020-2021, and the second semester of remote learning enforced by the University of the Philippines. If you, reader, can remember, the 2nd semester of AY 2019-2020 was halted in March 2020 because of the COVID-19 pandemic and nationwide lockdown, and at the end of that semester, students were given either passing or deferred grades. The 1st semester of AY 2020-2021 was postponed, and in November, the UPLB University Council of Student Leaders called for a university-wide strike to end the semester in protest of the ongoing setup and in solidarity with fellow students and Filipinos who were affected by the super typhoon. All of this have been happening as the youth joined protests against the government’s failed response to the pandemic and the human rights violations under the Duterte administration.

Although the 2nd semester of AY 2020-2021 was similarly moved to start in March instead of January, students still expressed their concern about the readiness of teachers, the administration, and fellow students. As the Rise for Education-UPLB once again calls for academic ease and the Department of Health reports an all-time high in single-day deaths (401) and active cases (178, 351), we look back on our interviews with UPLB students Chelsea Sison (CHE) Clarice “Clang” Sumagaysay (CVM), Bianca “Bia” Arce (CAS), Theresa “Teri” Manalo (CAS), Aliyah “Iyane” Mata (CEAT), and Julianne Afable (GS) who shared their experience about their first week of classes. How far are we in our campaign for #NoStudentLeftBehind?

How would you describe your first week of classes?

Chelsea: As for the first week of classes, there’s not much to talk about since all we did in class was to orient ourselves as to how the semester would course through. However, overall, it was alright and overwhelming because the workload for the semester was given to us already and complete modules were disseminated. It also made me anxious since there were no advice from any of my professors days prior to the start of the classes and I didn’t have any assurance that an email regarding their class would reach me. I had to sit and wait all day for their emails, and I had to look for possible classmates as well to make sure that I was not left behind.

Clang: Since last semester, I’ve always been struggling to focus on doing my academics because of all the distractions this remote learning. I couldn’t go to the university library to study or at study cafes because of the pandemic. I don’t know how to snap out of the current trance I’m in.

Bia: Personally, it's overwhelming and scary. As a person who started her freshie year online, it's scary to think how much I've learned from my prior courses. I felt like last semester didn't provide the quality learning that we needed. However, when it comes to load, I can say that some subjects improved and tried to lessen the load without compromising as much learning as possible.

Teri: I know from my previous semester that trying to adapt to online classes is really hard. Even so, for this semester I tried preparing for things to go smoothly according to plan. But it was still stressful for me. I didn’t hear from most of my professors until the day of our first meeting; some of them had trouble contacting us because they couldn’t access SAIS. I encountered internet issues during some of my lectures, both from my end and the lecturers’. And it’s difficult to try and shift my focus back to school when normal house things happen around me all the time and abnormal events happen outside. So it goes. Overall, I think it still overwhelmed me, like it did last time. My peers and I rely on each other to keep up.

Iyane: Overwhelming. Despite the demands forwarded by the councils to the admin, there are still heavy workloads and unreasonable deadlines. There may have been minimal adjustments, but considering the circumstances from various sectors, such as the students and academic employees, it is still not enough. A lot of students are still left behind.

Julianne: My first week of classes was a bit frustrating, as a new GS student, I had zero knowledge about how LMS work. Although the emails from ITC like tutorials and SAIS updates are very much appreciated, there were still some missing info that I had to figure out by myself. For instance, I (and some of my classmates) were on a different moodle site than what UPLB is supposed to be using so there was confusion between us and our prof. Aside from that, internet connectivity is also another frustration, since we have internet problems in the office, I had to attend my classes through broadband so there were instances where I was disconnected from the zoom class.

What are your expectations for the rest of the semester?

Chelsea: For this semester, I do not expect much. First, nothing much really changed. The delivery of materials is still similar from the previous semester. Although classes would say they “improved” it. The improvements were minimal, and it didn’t change the fact that there are still students in out university who are unable to afford this kind of learning setup. However, in an ideal world, I do expect that this semester would be better than the previous one and that students and faculty are more geared towards this kind of learning.

Clang: My expectations is that I hope the students and professors would come to a mutual agreement on how the classes should be conducted. Learning is a two-way relationship. There should be an avenue to talk about what is the most efficient way for the students to learn and for the professors to teach specially with the current set up we are in.

Bia: I expect nothing but understanding, leniency, and consideration from each other (admin-faculty-student). These should be the bases when it comes to implementing measures if need be. Also, I expect that our calls should be heeded by the admin in times of challenges and struggles.

Teri: Again, online classes, you can't really plan for these. You can prepare yourself mentally, organize your things, create a routine, only to see everything crumble in end. Planning helps, but it also leads to more frustration in this condition. Modules and requirements will only get harder as lessons get more complex. Some professors adjust for the sake of their students, which is really compassionate, but some do it in a way that sacrifices part of what could have been imparted, what could have been learned.

Iyane: I'm expecting that this sem will be more tiring than ever. However, I'm hoping that the profs are now well-adjusted; thus, they'll be conducting the virtual learning in a more manageable and systematic way wherein considering academic excellence and the student's well-being. The mental health of the students should be one of the top priorities during these times.

Julianne: Given the experiences I had in my first week, I expect that I will have to exert more effort this sem. I expect difficulty in internet connectivity and that I would have to spend more money on mobile data for our wireless broadband. I also expect that both profs and students will be able to address the challenges of the current set up based on their experience from the past semester.

How would you like to see the semester unfold for the next couple of months? In other words, for you, what is an "ideal" semester?

Chelsea: In an “ideal” semester, I look for students being able to learn and understand their modules well. That students are able to truly acquire knowledge and not just for the sake of accomplishing their requirements. However, though, as long as the possibility of students being left behind due to lack of access in materials is still eminent, I still firmly believe there would be no “ideal” semester in this kind of setup.

Clang: The ideal semester for me would be that no student should be left behind and that the professors are also being provided with the learning materials needed to conduct remote classes.

Bia: Personally, I don't see an ideal semester in this setup. Regardless, there'll be people struggling and challenged. However, for the next few months, I'd like to see the semester unfold in such a way that the admin, faculty, and students go hand-in-hand to make this setup bearable. I want to see actions that are constituent-oriented, as its constituents are greatly affected by whatever actions or plans are implemented for this semester.

Teri: In an online set-up, I would like to have open classrooms: no graded requirements but continuous discussions and complete access to all the class materials. This way, learning at a regular pace would still be an option, without leaving vulnerable students behind.

Iyane: First and foremost, an ideal semester would include minimal workloads, lenient deadlines, and utmost compassion. The course packs should be delivered to students on time, not two weeks after the class started. The said adjustment should not only be appealing to students but also to the faculty and staff. They must have timely salaries, labor rights, and funds for improvements of the academic facilities. We are in a pandemic, and the admin should have extraordinary measures. Free education is not limited to having a free tuition fee alone; it should be accessible to everyone. Learning should be fun and procreative, not frustrating.

Julianne: Despite the frustrations of the first week, I'm very grateful for my profs who understand the challenges faced by their students in the current set up. An ideal sem for me is a sem where both profs and students will be considerate with each other given that we all experience the same struggles especially with internet connectivity and transitioning to a set-up we were not really preparing for as no one predicted how long the pandemic would last.

Interviews were edited for clarity.

0 notes

Text

Powell gives markets a sad

PROGRAMMING NOTE — Morning Money will not publish from Dec. 24-Jan 1. Morning Money will resume publishing on Jan. 2.

Editor’s Note: This edition of Morning Money is published weekdays at 8 a.m. POLITICO Pro Financial Services subscribers hold exclusive early access to the newsletter each morning at 5:15 a.m. To learn more about POLITICO Pro’s comprehensive policy intelligence coverage, policy tools and services, click here.

Story Continued Below

POWELL GIVES MARKETS A SAD — Fed Chair Jay Powell evidently wasn’t “feeling the market” on Wednesday as the central bank’s quarter point rate hike and reduction in expected hikes for 2019 to two did not please Wall Street, where the Dow closed down another 1.5 percent to 23,323, it’s closing low for the year. The index is now off 5.6 percent for 2018. The S&P is now off 6.2 percent. The Nasdaq is down 3.9 percent.

Things started off OK with the Dow up around 100 points as Powell started his press conference. The Fed’s statement, mostly in line with expectations, avoided caving to Trump while leaning into the idea of a more dovish stance next year. (Here’s exactly how it changed, via CNBC.) The projections took down estimates for 2019 growth a bit to 2.3 percent from 2.5 percent and also reduced the “dot plot” consensus for hikes next year to two from three.

But things began to go south hard and fast during the second half of Powell’s presser, perhaps in part because he said the central bank will not change its plans to continue to reduce the size of its balance sheet, something that President Trump has been complaining about in recent interviews and tweets. Powell for his part, had a couple of opportunities to reject the idea that Trump’s comments play any role in Fed decisions. And he took them.

To CNBC’s Steve Liesman — “Political considerations play no role whatsoever in our discussions or decisions about monetary policy … Nothing will deter us from doing what we think is the right thing to do.”

To our Victoria Guida — “I know, and everyone who works at the Fed knows, that we are going to do our jobs the way we’ve always done them.”

Richard Bernstein Advisors’ Rich Bernstein emails on the late sell-off — “This still seems to me like a ‘run’ on the equity market based more in fear than on fundamentals. Washington DC in general needs to fully understand that without an FDIC for stocks their main mission should be to calm investors every way they can or the volatility could be a self-fulfilling prophecy by raising too much uncertainty, stymying business activity, and causing a recession.” That’s partly a message to the Fed but it’s mostly a message to Trump on China.

YIELD CURVE FLATTENS — Via MarketWatch: “Long-dated Treasury yields fell after the Federal Reserve raised interest rates .. The 10-year Treasury note yield was down by 1.5 basis points to 2.808%. The 2-year note yield rose by 1.2 basis points to 2.664%, while the 30-year bond yield saw the most decisive move, slipping 4.8 basis points to 3.029%.” Read more.

Victoria’s take is here — “The Fed … raised its main borrowing rate on Wednesday, ignoring repeated calls from … Trump to hold off on further interest rate hikes. Though the move is sure to frustrate the president, it comes as the central bank continues to underscore the strength of the economy, particularly the growing number of jobs, even with unemployment below 4 percent. …

“Powell and other central bank policymakers have emphasized in recent months that the number of rate hikes next year is highly uncertain because the central bank doesn’t know what will happen with the economy The central bank kept a line in its statement indicating that there is an equal chance that the economy will heat up or cool down”

Pantheon’s Ian Shepherdson — “The FOMC did the minimum expected of it … That wasn’t enough for the stock market, where investors appear to have been hoping to see a more substantive change in the Fed’s tone. That didn’t happen.”

Lazard Asset Management’s Ron Temple — “I believe the Fed made the right decision for the wrong reasons. With its more dovish outlook, the Fed is too attentive to short-term market moves and not enough to the benefits of running a high-pressure economy. .”

POWELL (SORT OF) THREADS THE NEEDLE — ManuLife’s Megan Greene: “Had the Fed been more dovish, it would have been confirmation bias for investors worried about growth next year. If it had been more hawkish, investors would have worried the Powell Put was dead and the Fed would kill off yet another recovery.

“Jay Powell had a really difficult job today and he did a decent job, but the markets overreacted to his comments a few weeks ago about rates being just under the range of estimates for neutral (market based probabilities suggested only one rate hike was priced in for 2019 and a rate cut was priced in for 2020). A repricing was going to be hard to avoid.”

Megan also makes the economic bear case in an FT op-ed: “My view is that 2019 will see global synchronisation, but not in a good way. This year economists anticipated a global acceleration in growth. I expect a synchronised slowdown in the year to come.”

MM SIDEBAR — The sudden change in market mood from “this is sort of dovish and what we expected” to “this sucks, sell everything” was really puzzling. Usually you can hang such a move on a specific word or phrase from a Fed press conference. Not on Wednesday. Have a theory on what happened? Email me on [email protected].

SENATE CLEARS SPENDING BILL — Via our Burgess Everett, Eliana Johnson, and Sarah Ferris: “The Senate passed a short-term spending bill that keeps the government open through Feb. 8 and avoids a shutdown at week’s end. The House is expected to pass the bill, which denies … Trump funding for his much-sought after border wall. Senate Majority Leader Mitch McConnell said the Senate will remain in session on Thursday pending House action on the spending bill.” Read more.

SPEAKING OF TRUMP THE DOW MAN — A close reader emails: “Really liked your tariff man vs Dow Jones construct today. In the same vein, if [Trump] would restore the previously in place aluminum and steel exemptions for Canada and Mexico, he would relieve $15 billion in tariffs and counter tariffs that would be an immediate boon for steel and aluminum consumers like Ford, GM and Boeing while also letting Iowa pork farmers to try to reclaim markets in Mexico that they are losing to Eastern Europe”

FED EX SOUNDS GRIM — This certainly didn’t help markets on Wednesday, via Bloomberg’s Thomas Black: “FedEx Corp. plunged the most in three years as a darkening view of demand for shipping services outside the U.S. prompted the company to slash its profit forecast and pare international air-freight capacity. The courier cut its outlook just three months after raising it, reflecting an abrupt change in FedEx’s view of the global economy.

“‘The peak for global economic growth now appears to be behind us,’ Raj Subramaniam, a FedEx veteran who was named this month to take over the Express cargo airline, said on a conference call with investors and analysts. FedEx’s gloomier view sharpened concerns that the world’s economy is weakening amid rising trade tensions, especially between the U.S. and China — which the company cited as another source of trouble.” Read more.

KRANINGER GIVES UP CFPB NAME CHANGE — Our Katy O’Donnell: “Kathy Kraninger, the new director of the Consumer Financial Protection Bureau, is reversing the name change that her predecessor, Mick Mulvaney, tried to impose on the agency, according to an internal email Wednesday.

“‘I care much more about what we do than what we are called,’ Kraninger wrote in the all-hands email, which was originally obtained by the consumer group Allied Progress. ‘As of December 17, 2018, I have officially halted all ongoing efforts to make changes to existing products and materials related to the name correction initiative.’” Read more.

MM SIDEBAR — Smart move. This was pure trolling on Mulvaney’s part when he did it and an obvious waste of time and resources. MM never stopped calling it the CFPB though we noticed many lobbying groups dutifully followed Mulvaney’s smarmy directive. Wonder if they will change back?

GOOD THURSDAY MORNING — Welcome to the second to last Morning Money of 2018. If you have any outlooks for 2019, please do send them. Will feature some tomorrow. Email me at [email protected] and follow me on Twitter @morningmoneyben. Email Aubree Eliza Weaver at [email protected] and follow her on Twitter @AubreeEWeaver.

DRIVING THE DAY — Looks like we may avoid a shutdown unless Trump gives in to heat from the right and declines to sign whatever stop-gap bill Congress sends him without any wall funding … Index of Leading Indicators at 10:00 a.m. expected to be flat … House Financial Services has an unironic hearing at 10:00 a.m. on “The Perils of an Ignored National Debt.”

FSOC ISSUES REPORT — FSOC on Wednesday evening released its 2018 annual report. Among other items, FSOC “recommends that agencies continue to monitor levels of nonfinancial business leverage, trends in asset valuations, and potential implications for the entities they regulate in order to assess and reinforce their ability to manage severe, simultaneous losses in those markets.”

MORE ON THE FED — From Mohamed A. El-Erian on Bloomberg Opinion: “Resisting unusual pressure from both politicians and notable market participants … Powell and his colleagues on the Open Market Committee on Wednesday raised interest rates by 25 basis points and slowed the path for future hikes by less than markets had hoped. In doing so, the central bank reaffirmed that its focus remains firmly domestic and economic.

“But the markets’ reaction suggested the move was seen as heightening concerns about a policy mistake, rather than responsible policy making. This, and what’s likely to play out over the next few weeks, illustrates a bigger phenomenon: the threat that the Fed and other central banks are increasingly in a no-win situation, due to factors mostly outside their control.” Read more.

TAX CUTS BOOSTED GROWTH, BUT AT WHAT COST? — Jason Furman in the WSJ: “It has been nearly a year since … Trump signed sweeping tax changes into law. The macroeconomic data already rule out some of the more extravagant claims about immediate jumps in wages and capital. But the more serious debate over the tax cuts’ long-run impact is still far from decided. … [F]iscal policy—including the tax cuts, increased federal spending, and increased state and local government spending—has clearly added to growth and jobs in 2018. …

“[O]ver the past year the data clearly show that tax cuts increase deficits. This might seem obvious, but with so many people, including the Treasury secretary, arguing otherwise, it is important to make the point again. In 2018 the deficit rose to $779 billion, or 3.8% of GDP—a nearly unprecedented figure for a period of economic expansion and no major wars.” Read more.

STOCKS SKID TO 15-MONTH LOW — AP’s Marley Jay: “Stocks gave up a big rally and took a dive in afternoon trading Wednesday after the Federal Reserve raised interest rates again and signaled it’s likely to keep raising them next year. The market finished at its lowest level since September 2017.”

“The Dow Jones Industrial Average swung from a gain of 381 points right before the Fed’s decision was announced at 2 p.m. Eastern time to a closing loss of 351 points. The index is down almost 9 percent in December.” Read more.

TRADERS NOT A FAN OF THE FED’S MESSAGE — Bloomberg’s Emily Barrett: “Traders seemed to agree that they didn’t like what they heard from the Federal Reserve at its final meeting for the year, but exactly what caused most offense in markets was less clear. Stocks dropped and Treasuries rallied after the central bank defied pressure to refrain from raising rates, while investors dialed backed their pricing of the future interest-rate path. Fed officials also maintained a generally upbeat view of the economy even as they trimmed their own projections for future rate increases. Observers offered several possible explanations for the risk-off response in markets.

“Markets Snubbed? Some thought that the written statement from the Federal Open Market Committee didn’t sufficiently address mounting market strains, which have seen U.S. stocks hammered and bond yields tumble in recent weeks. ‘The Fed is indicating that it’s listening to the markets, it has respect for the markets, but it’s not going to be ruled by the markets,’ said Greg Staples, co-head of Americas fixed income at DWS, following the decision.” Read more.

PROLONGED ECONOMIC EXPANSION POSES MARKET RISKS — WSJ’s Andrew Ackerman: “Financial regulators identified vulnerabilities in the U.S. markets from the prolonged economic expansion and said cybersecurity and a ‘no deal’ British exit from the European Union were top potential risks to the financial system.

“The Financial Stability Oversight Council of senior regulators, in a report released Wednesday, cited potential risks tied to nonfinancial corporate borrowing, including weak underwriting standards in markets such as leveraged loans. Though firms continue to service their debt burdens with low delinquency levels, corporate debt continued to grow faster than gross domestic product in the past year and the ratio of corporate debt-to-GDP is at a record high” Read more.

CURRENT-ACCOUNT DEFICIT WIDENED IN Q3 — WSJ’s Josh Zumbrun and Eric Morath: “The U.S. current-account deficit, a measure of the nation’s trade and financial flows with other countries, widened to a 10-year high in the third quarter, providing the latest evidence that the administration’s policies are proving insufficient at meeting their stated goal of taming trade deficits.

“The overall current-account deficit climbed to a seasonally adjusted $124.8 billion in the third quarter, up from $101.2 billion in the second quarter, the Commerce Department said Wednesday. The quarterly deficit was the largest since global trade collapsed during the recession a decade ago.” Read more.

GOLDMAN’S 1MDB REVIVES ‘TOO BIG TO JAIL’ DEBATE — NYT’s Peter Eavis: “Should corporations be charged for crimes their employees commit? That nettlesome question has come back to the fore as law enforcement authorities take aim at Goldman Sachs for its involvement in a vast scandal at a Malaysian investment fund.

“The Malaysian government on Monday filed criminal charges against Goldman, accusing the bank of making false and misleading statements when it raised money for the fund, called 1Malaysia Development Berhad, or 1MDB. The immediate consequences of the Malaysian charges against Goldman subsidiaries are likely to be limited, but the action will stir up discussion about how United States prosecutors should proceed and whether they should bring criminal charges against Goldman.” Read more.

BERKSHIRE REDUCES HOME CAPITAL INVESTMENT — WSJ’s Colin Kellaher and Jacquie McNish: “Berkshire Hathaway Inc. has mostly exited its investment in Home Capital Group Inc., some 18 months after Warren Buffett’s investment vehicle threw the Canadian alternative lender a lifeline. Home Capital on Wednesday said Berkshire’s stake in the company will fall below 10 percent upon completion of the company’s 300 million Canadian dollar ($223 million) buyback offer, which will reduce its shares outstanding by about 22.7 percent.

“Berkshire in June 2017 agreed to acquire a 38.39 percent stake in Home Capital as part of a rescue package that included a credit line of C$2 billion, which the lender has since repaid.” Read more.

Source link

from RSSUnify feed https://hashtaghighways.com/2018/12/29/powell-gives-markets-a-sad/

from Garko Media https://garkomedia1.tumblr.com/post/181513212329

0 notes

Text

Powell gives markets a sad

PROGRAMMING NOTE — Morning Money will not publish from Dec. 24-Jan 1. Morning Money will resume publishing on Jan. 2.

Editor’s Note: This edition of Morning Money is published weekdays at 8 a.m. POLITICO Pro Financial Services subscribers hold exclusive early access to the newsletter each morning at 5:15 a.m. To learn more about POLITICO Pro’s comprehensive policy intelligence coverage, policy tools and services, click here.

Story Continued Below

POWELL GIVES MARKETS A SAD — Fed Chair Jay Powell evidently wasn’t “feeling the market” on Wednesday as the central bank’s quarter point rate hike and reduction in expected hikes for 2019 to two did not please Wall Street, where the Dow closed down another 1.5 percent to 23,323, it’s closing low for the year. The index is now off 5.6 percent for 2018. The S&P is now off 6.2 percent. The Nasdaq is down 3.9 percent.

Things started off OK with the Dow up around 100 points as Powell started his press conference. The Fed’s statement, mostly in line with expectations, avoided caving to Trump while leaning into the idea of a more dovish stance next year. (Here’s exactly how it changed, via CNBC.) The projections took down estimates for 2019 growth a bit to 2.3 percent from 2.5 percent and also reduced the “dot plot” consensus for hikes next year to two from three.

But things began to go south hard and fast during the second half of Powell’s presser, perhaps in part because he said the central bank will not change its plans to continue to reduce the size of its balance sheet, something that President Trump has been complaining about in recent interviews and tweets. Powell for his part, had a couple of opportunities to reject the idea that Trump’s comments play any role in Fed decisions. And he took them.

To CNBC’s Steve Liesman — “Political considerations play no role whatsoever in our discussions or decisions about monetary policy … Nothing will deter us from doing what we think is the right thing to do.”

To our Victoria Guida — “I know, and everyone who works at the Fed knows, that we are going to do our jobs the way we’ve always done them.”

Richard Bernstein Advisors’ Rich Bernstein emails on the late sell-off — “This still seems to me like a ‘run’ on the equity market based more in fear than on fundamentals. Washington DC in general needs to fully understand that without an FDIC for stocks their main mission should be to calm investors every way they can or the volatility could be a self-fulfilling prophecy by raising too much uncertainty, stymying business activity, and causing a recession.” That’s partly a message to the Fed but it’s mostly a message to Trump on China.

YIELD CURVE FLATTENS — Via MarketWatch: “Long-dated Treasury yields fell after the Federal Reserve raised interest rates .. The 10-year Treasury note yield was down by 1.5 basis points to 2.808%. The 2-year note yield rose by 1.2 basis points to 2.664%, while the 30-year bond yield saw the most decisive move, slipping 4.8 basis points to 3.029%.” Read more.

Victoria’s take is here — “The Fed … raised its main borrowing rate on Wednesday, ignoring repeated calls from … Trump to hold off on further interest rate hikes. Though the move is sure to frustrate the president, it comes as the central bank continues to underscore the strength of the economy, particularly the growing number of jobs, even with unemployment below 4 percent. …

“Powell and other central bank policymakers have emphasized in recent months that the number of rate hikes next year is highly uncertain because the central bank doesn’t know what will happen with the economy The central bank kept a line in its statement indicating that there is an equal chance that the economy will heat up or cool down”

Pantheon’s Ian Shepherdson — “The FOMC did the minimum expected of it … That wasn’t enough for the stock market, where investors appear to have been hoping to see a more substantive change in the Fed’s tone. That didn’t happen.”

Lazard Asset Management’s Ron Temple — “I believe the Fed made the right decision for the wrong reasons. With its more dovish outlook, the Fed is too attentive to short-term market moves and not enough to the benefits of running a high-pressure economy. .”

POWELL (SORT OF) THREADS THE NEEDLE — ManuLife’s Megan Greene: “Had the Fed been more dovish, it would have been confirmation bias for investors worried about growth next year. If it had been more hawkish, investors would have worried the Powell Put was dead and the Fed would kill off yet another recovery.

“Jay Powell had a really difficult job today and he did a decent job, but the markets overreacted to his comments a few weeks ago about rates being just under the range of estimates for neutral (market based probabilities suggested only one rate hike was priced in for 2019 and a rate cut was priced in for 2020). A repricing was going to be hard to avoid.”

Megan also makes the economic bear case in an FT op-ed: “My view is that 2019 will see global synchronisation, but not in a good way. This year economists anticipated a global acceleration in growth. I expect a synchronised slowdown in the year to come.”

MM SIDEBAR — The sudden change in market mood from “this is sort of dovish and what we expected” to “this sucks, sell everything” was really puzzling. Usually you can hang such a move on a specific word or phrase from a Fed press conference. Not on Wednesday. Have a theory on what happened? Email me on [email protected].

SENATE CLEARS SPENDING BILL — Via our Burgess Everett, Eliana Johnson, and Sarah Ferris: “The Senate passed a short-term spending bill that keeps the government open through Feb. 8 and avoids a shutdown at week’s end. The House is expected to pass the bill, which denies … Trump funding for his much-sought after border wall. Senate Majority Leader Mitch McConnell said the Senate will remain in session on Thursday pending House action on the spending bill.” Read more.

SPEAKING OF TRUMP THE DOW MAN — A close reader emails: “Really liked your tariff man vs Dow Jones construct today. In the same vein, if [Trump] would restore the previously in place aluminum and steel exemptions for Canada and Mexico, he would relieve $15 billion in tariffs and counter tariffs that would be an immediate boon for steel and aluminum consumers like Ford, GM and Boeing while also letting Iowa pork farmers to try to reclaim markets in Mexico that they are losing to Eastern Europe”

FED EX SOUNDS GRIM — This certainly didn’t help markets on Wednesday, via Bloomberg’s Thomas Black: “FedEx Corp. plunged the most in three years as a darkening view of demand for shipping services outside the U.S. prompted the company to slash its profit forecast and pare international air-freight capacity. The courier cut its outlook just three months after raising it, reflecting an abrupt change in FedEx’s view of the global economy.

“‘The peak for global economic growth now appears to be behind us,’ Raj Subramaniam, a FedEx veteran who was named this month to take over the Express cargo airline, said on a conference call with investors and analysts. FedEx’s gloomier view sharpened concerns that the world’s economy is weakening amid rising trade tensions, especially between the U.S. and China — which the company cited as another source of trouble.” Read more.

KRANINGER GIVES UP CFPB NAME CHANGE — Our Katy O’Donnell: “Kathy Kraninger, the new director of the Consumer Financial Protection Bureau, is reversing the name change that her predecessor, Mick Mulvaney, tried to impose on the agency, according to an internal email Wednesday.

“‘I care much more about what we do than what we are called,’ Kraninger wrote in the all-hands email, which was originally obtained by the consumer group Allied Progress. ‘As of December 17, 2018, I have officially halted all ongoing efforts to make changes to existing products and materials related to the name correction initiative.’” Read more.

MM SIDEBAR — Smart move. This was pure trolling on Mulvaney’s part when he did it and an obvious waste of time and resources. MM never stopped calling it the CFPB though we noticed many lobbying groups dutifully followed Mulvaney’s smarmy directive. Wonder if they will change back?

GOOD THURSDAY MORNING — Welcome to the second to last Morning Money of 2018. If you have any outlooks for 2019, please do send them. Will feature some tomorrow. Email me at [email protected] and follow me on Twitter @morningmoneyben. Email Aubree Eliza Weaver at [email protected] and follow her on Twitter @AubreeEWeaver.

DRIVING THE DAY — Looks like we may avoid a shutdown unless Trump gives in to heat from the right and declines to sign whatever stop-gap bill Congress sends him without any wall funding … Index of Leading Indicators at 10:00 a.m. expected to be flat … House Financial Services has an unironic hearing at 10:00 a.m. on “The Perils of an Ignored National Debt.”

FSOC ISSUES REPORT — FSOC on Wednesday evening released its 2018 annual report. Among other items, FSOC “recommends that agencies continue to monitor levels of nonfinancial business leverage, trends in asset valuations, and potential implications for the entities they regulate in order to assess and reinforce their ability to manage severe, simultaneous losses in those markets.”

MORE ON THE FED — From Mohamed A. El-Erian on Bloomberg Opinion: “Resisting unusual pressure from both politicians and notable market participants … Powell and his colleagues on the Open Market Committee on Wednesday raised interest rates by 25 basis points and slowed the path for future hikes by less than markets had hoped. In doing so, the central bank reaffirmed that its focus remains firmly domestic and economic.

“But the markets’ reaction suggested the move was seen as heightening concerns about a policy mistake, rather than responsible policy making. This, and what’s likely to play out over the next few weeks, illustrates a bigger phenomenon: the threat that the Fed and other central banks are increasingly in a no-win situation, due to factors mostly outside their control.” Read more.

TAX CUTS BOOSTED GROWTH, BUT AT WHAT COST? — Jason Furman in the WSJ: “It has been nearly a year since … Trump signed sweeping tax changes into law. The macroeconomic data already rule out some of the more extravagant claims about immediate jumps in wages and capital. But the more serious debate over the tax cuts’ long-run impact is still far from decided. … [F]iscal policy—including the tax cuts, increased federal spending, and increased state and local government spending—has clearly added to growth and jobs in 2018. …

“[O]ver the past year the data clearly show that tax cuts increase deficits. This might seem obvious, but with so many people, including the Treasury secretary, arguing otherwise, it is important to make the point again. In 2018 the deficit rose to $779 billion, or 3.8% of GDP—a nearly unprecedented figure for a period of economic expansion and no major wars.” Read more.

STOCKS SKID TO 15-MONTH LOW — AP’s Marley Jay: “Stocks gave up a big rally and took a dive in afternoon trading Wednesday after the Federal Reserve raised interest rates again and signaled it’s likely to keep raising them next year. The market finished at its lowest level since September 2017.”

“The Dow Jones Industrial Average swung from a gain of 381 points right before the Fed’s decision was announced at 2 p.m. Eastern time to a closing loss of 351 points. The index is down almost 9 percent in December.” Read more.

TRADERS NOT A FAN OF THE FED’S MESSAGE — Bloomberg’s Emily Barrett: “Traders seemed to agree that they didn’t like what they heard from the Federal Reserve at its final meeting for the year, but exactly what caused most offense in markets was less clear. Stocks dropped and Treasuries rallied after the central bank defied pressure to refrain from raising rates, while investors dialed backed their pricing of the future interest-rate path. Fed officials also maintained a generally upbeat view of the economy even as they trimmed their own projections for future rate increases. Observers offered several possible explanations for the risk-off response in markets.

“Markets Snubbed? Some thought that the written statement from the Federal Open Market Committee didn’t sufficiently address mounting market strains, which have seen U.S. stocks hammered and bond yields tumble in recent weeks. ‘The Fed is indicating that it’s listening to the markets, it has respect for the markets, but it’s not going to be ruled by the markets,’ said Greg Staples, co-head of Americas fixed income at DWS, following the decision.” Read more.

PROLONGED ECONOMIC EXPANSION POSES MARKET RISKS — WSJ’s Andrew Ackerman: “Financial regulators identified vulnerabilities in the U.S. markets from the prolonged economic expansion and said cybersecurity and a ‘no deal’ British exit from the European Union were top potential risks to the financial system.

“The Financial Stability Oversight Council of senior regulators, in a report released Wednesday, cited potential risks tied to nonfinancial corporate borrowing, including weak underwriting standards in markets such as leveraged loans. Though firms continue to service their debt burdens with low delinquency levels, corporate debt continued to grow faster than gross domestic product in the past year and the ratio of corporate debt-to-GDP is at a record high” Read more.

CURRENT-ACCOUNT DEFICIT WIDENED IN Q3 — WSJ’s Josh Zumbrun and Eric Morath: “The U.S. current-account deficit, a measure of the nation’s trade and financial flows with other countries, widened to a 10-year high in the third quarter, providing the latest evidence that the administration’s policies are proving insufficient at meeting their stated goal of taming trade deficits.

“The overall current-account deficit climbed to a seasonally adjusted $124.8 billion in the third quarter, up from $101.2 billion in the second quarter, the Commerce Department said Wednesday. The quarterly deficit was the largest since global trade collapsed during the recession a decade ago.” Read more.

GOLDMAN’S 1MDB REVIVES ‘TOO BIG TO JAIL’ DEBATE — NYT’s Peter Eavis: “Should corporations be charged for crimes their employees commit? That nettlesome question has come back to the fore as law enforcement authorities take aim at Goldman Sachs for its involvement in a vast scandal at a Malaysian investment fund.

“The Malaysian government on Monday filed criminal charges against Goldman, accusing the bank of making false and misleading statements when it raised money for the fund, called 1Malaysia Development Berhad, or 1MDB. The immediate consequences of the Malaysian charges against Goldman subsidiaries are likely to be limited, but the action will stir up discussion about how United States prosecutors should proceed and whether they should bring criminal charges against Goldman.” Read more.

BERKSHIRE REDUCES HOME CAPITAL INVESTMENT — WSJ’s Colin Kellaher and Jacquie McNish: “Berkshire Hathaway Inc. has mostly exited its investment in Home Capital Group Inc., some 18 months after Warren Buffett’s investment vehicle threw the Canadian alternative lender a lifeline. Home Capital on Wednesday said Berkshire’s stake in the company will fall below 10 percent upon completion of the company’s 300 million Canadian dollar ($223 million) buyback offer, which will reduce its shares outstanding by about 22.7 percent.

“Berkshire in June 2017 agreed to acquire a 38.39 percent stake in Home Capital as part of a rescue package that included a credit line of C$2 billion, which the lender has since repaid.” Read more.

Source link

Source: https://hashtaghighways.com/2018/12/29/powell-gives-markets-a-sad/

from Garko Media https://garkomedia1.wordpress.com/2018/12/29/powell-gives-markets-a-sad/

0 notes

Text

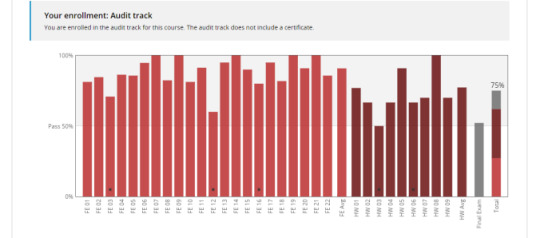

After my Herbal Material Medica and Permacultural courses were finished, I signed up to audit the MIT sponsored online course entitled The Challenges of Global Poverty. The text for the course was entitled Poor Economics by Abhijit V. Banerjee and Esther Duflo who were also the instructors. While I’m not by any means an economist or statistician, I knew enough about statistics to know when something was statistically significant or not but not enough to figure out the more complicated equations. I managed to slide by with a 75 final grade.

I did learn quite a bit about living in poverty and as a consequence, I was able to look at my life here in rural Mexico with new eyes. Most of the samples in the class were from rural India, but it was amazing how similar the culture of poverty is throughout the world.

Here are some of the things I learned and how that information relates to my life here in Mexico:

Many poor are unable to obtain traditional credit or open bank accounts. As a consequence, complicated processes are invented to set aside money needed for future expenses. One method of saving is known as a tanda in this part of Mexico. A tanda is a group of people that contribute a set amount of money each week or pay check or whatever the time frame has been determined. Each member is assigned a number. One member receives all the money each pay period. (See A room of her own–furnishings) It allows the participants to ensure that the money needed for a particular item is available when that expenditure is due.

Personas que deben (People who owe money)

Mentioned in class was the institution of money lenders. In India, repayment is enforced through public shame and the possibility of sending a eunuch to show his genitals to the delinquent borrower (a form of intimidation). While Mexico is not known for its eunuchs, shame is a big motivator here as well. Often lists of people who owe money are posted outside establishments for the entire community to see.

Many villages in India have a sort of informal lending between families which allows those in need to receive money or assistance with the understanding that it will be paid back in the future. In Mexico, the madrina/padrino (godparents) tradition is a version of this informal lending. When a family is planning a major event like a baptism, wedding, graduation, quinceanera, etc., a variety of extended family or community members are asked to take on the role of godparent. The so honored are financially responsible for a particular aspect of the event, napkins, shoes, seating rental, mass, etc. This is done with the understanding that at some time in the future, such expense will be repaid by the recipient family in the form of another madrina/padrino setup. (See Chambelan at the church, Chambelan at the party, Secondary Graduation)

Mexico, like India, has a high number of micro businesses. Often these businesses are run by women. These are self-limiting businesses. Time spent on the business is often scheduled around other obligations such as child care or meal preparation. A larger investment in the business is not feasible because the business is limited by its product or demand. So each day, the business owner earns just enough to get by, never more. (See Failing at your own Business)