#medicare supplemental insurance

Text

Navigating Your Healthcare Journey: Understanding Medicare Advantage Insurance.

Hey there! If you're on the hunt for comprehensive healthcare coverage, you've probably stumbled upon the term "Medicare Advantage insurance." But what exactly does it entail? Let's dive in and unravel the mysteries surrounding this healthcare option.

So, what's the deal with Medicare Advantage insurance? Well, think of it as a one-stop-shop for your healthcare needs. Unlike Original Medicare, which consists of Part A (hospital insurance) and Part B (medical insurance), Medicare Advantage plans (Part C) are offered by private insurance companies approved by Medicare. They combine the benefits of Parts A and B, often with added perks like prescription drug coverage (Part D), dental, vision, and hearing benefits, and even gym memberships!

One of the biggest advantages of Medicare Advantage plans is their flexibility. With various plan options available, you can choose the one that best suits your healthcare needs and budget. Whether you prefer a Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), or a Special Needs Plan (SNP), there's likely a Medicare Advantage plan out there tailored just for you.

But wait, there's more! Medicare Advantage plans often include additional services like telehealth, wellness programs, and preventive care, aiming to keep you healthy and happy. Plus, many plans offer out-of-pocket maximums, providing financial protection in case of unexpected medical expenses.

Now, you might be wondering, "What's the catch?" Well, like any insurance plan, Medicare Advantage has its pros and cons. While it offers comprehensive coverage and additional benefits, your choice of healthcare providers may be limited to a network, and you may need referrals for specialist visits in some cases.

So, if you're considering Medicare Advantage insurance, it's essential to do your research. Compare plan options, review the benefits and costs, and don't hesitate to reach out to insurance providers or Medicare counselors if you have questions.

In conclusion, Medicare Advantage insurance can be a fantastic option for those seeking comprehensive healthcare coverage with added benefits. With its flexibility, additional services, and financial protection, it's worth exploring whether it's the right choice for you. After all, when it comes to your health, having peace of mind is priceless.

#medicare agents#medicare broker#medicare insurance#best medicare plans#medicare advantage#medicare insurance plans#medicare advantage plan#medicare advantage plans in my area#medicare health insurance#best medicare advantage plans#medicare advantage plans near me#free medicare advantage plans#best medicare supplement plans#medicare supplement plans#medicare health insurance plans#medicare supplemental insurance plans#medicare supplemental insurance#medicare advantage insurance#best medicare supplement#best rated medicare advantage plans#turning 65 medicare

0 notes

Text

Understanding Supplemental Insurance Policies In 2024

Supplemental insurance policies offer additional coverage beyond what is provided by primary health insurance plans.

These policies serve as a valuable tool to bridge gaps in coverage, providing financial protection for specific healthcare needs that may not be fully addressed by primary insurance alone.

In this comprehensive guide, we’ll explore the significance of supplemental insurance…

View On WordPress

#health insurance#how supplemental insurance works#insurance#insurance help#insurance tips#insurance tricks#is supplemental insurance worth keeping?#medical insurance#medicare insurance#medicare supplemental#medicare supplemental insurance#supplemental#supplemental dental insurance#supplemental health insurance#supplemental insurance#supplemental insurance 2018#supplemental insurance plans#the truth about medicare supplemental insurance policies

0 notes

Text

5 Best Medicare Part D Insurance Companies

#medicare part d#medicare supplement#medicare supplemental insurance#medicare#medicare advantage#medicare part c#medicare part d plans#medicare insurance#medicare drug plan#medicare part d donut hole#medicare drug coverage#medicare part d enrollment#medicare advantage plans#medicare supplement plan#medicare supplement insurance#medicare part d explained#medicare drug plans#medicare part a#medicare part b#medicare explained

0 notes

Text

Medicare Supplemental Insurance Oregon | Health Plans In Oregon

Medicare supplemental insurance Oregon is a type of insurance that is designed to supplement your existing Medicare coverage. It can help cover some of the costs that Medicare does not cover, such as deductibles, copayments, and coinsurance. It can also provide coverage for some of the services that Medicare does not cover, such as dental, vision, and hearing. Medicare supplemental insurance in Oregon can be purchased from a private insurance company. If you're a Medicare beneficiary in Oregon, you may be interested in purchasing a Medicare supplemental insurance policy. Supplemental insurance can help cover some of the costs not covered by Medicare, such as deductibles, coinsurance, and copayments. There are a variety of supplemental insurance policies available, so it's important to compare plans and find one that meets your needs and budget. You can purchase supplemental insurance through a private insurer or through the Oregon Health Plan. If you have questions about Medicare supplemental insurance, Oregonians can contact the Senior Health Insurance Benefits Assistance program (SHIBA) for free, confidential counseling.

0 notes

Text

With all of the Medicare plan options out there, many people may wonder, “Do I need to purchase Medicare supplement insurance?”

2 notes

·

View notes

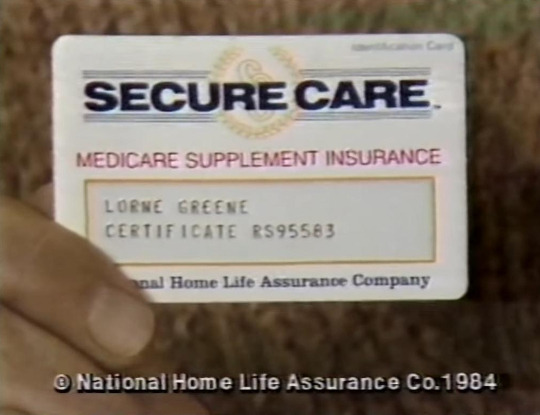

Photo

#secure care#lorne greene#national home life assurance#vhs#1985#medicare supplement insurance#medicare

18 notes

·

View notes

Text

What Are Different Medicare Supplement Plans?

Medicare Supplement Plans are designed to help cover some of the costs that Original Medicare (Part A and Part B) doesn’t pay for, such as copayments, coinsurance, and deductibles. These plans are standardized by the federal government, meaning that each plan, regardless of the insurance company offering it, must offer the same basic benefits. However, there are several different plans, each offering varying levels of coverage.

Here’s an overview of the different Medicare Supplement Plans:

Plan A: This is the most basic Medigap plan, covering essential benefits like Medicare Part A coinsurance and hospital costs, Part B coinsurance or copayment, and the first three pints of blood each year.

Plan B: Similar to Plan A, Plan B also covers the Medicare Part A deductible.

Plan C: This plan offers more comprehensive coverage, including everything in Plan B plus coverage for skilled nursing facility care coinsurance, Medicare Part B deductible, and limited foreign travel emergency coverage.

Plan D: Plan D covers everything in Plan C except for the Medicare Part B deductible. It’s a good option for those who want comprehensive coverage but are willing to pay the Part B deductible themselves.

Plan F: Until recently, Plan F was the most comprehensive Medigap plan available, covering all out-of-pocket costs under Medicare Parts A and B, including deductibles, copayments, and coinsurance. However, as of January 1, 2020, Plan F is no longer available to new Medicare beneficiaries.

Plan G: Plan G is similar to Plan F but doesn’t cover the Medicare Part B deductible. Once that deductible is met, Plan G covers all other out-of-pocket costs under Medicare Parts A and B.

Plan K: This plan covers 50% of certain cost-sharing expenses, such as Medicare Part A coinsurance and copayments for hospital costs, skilled nursing facility care, and hospice care.

Plan L: Plan L offers more coverage than Plan K, covering 75% of certain cost-sharing expenses, including Medicare Part A coinsurance, hospital costs, skilled nursing facility care, hospice care, and Medicare Part B coinsurance or copayment.

Plan M: This plan offers coverage similar to Plan D but with lower out-of-pocket costs for covered services.

Plan N: Plan N offers coverage similar to Plan D, with some cost-sharing for doctor’s office visits and emergency room visits. Beneficiaries may have copayments of up to $20 for office visits and up to $50 for emergency room visits, but it generally has lower premiums compared to Plans C and F.

Each of these plans provides varying levels of coverage, allowing beneficiaries to choose the plan that best fits their individual healthcare needs and budget. It’s essential to carefully compare the benefits offered by each plan, as well as the premiums and out-of-pocket costs, before making a decision.

Additionally, it’s crucial to remember that Medicare Supplement Plans can vary by state, so what’s available in one state may not be available in another. Consulting with a licensed insurance agent or financial advisor can help individuals navigate their options and make informed decisions about their Medicare coverage.

0 notes

Text

How Medicare Supplement Companies Are Revolutionizing Access To Healthcare?

Medicare supplement companies are revolutionizing access to healthcare by providing beneficiaries with additional coverage options beyond Original Medicare. These plans offer flexibility, allowing individuals to choose the coverage that best suits their needs, including options for prescription drug coverage, vision, dental, and more. By filling gaps in coverage and offering expanded benefits, Medicare supplement companies are empowering individuals to access a broader range of healthcare services, leading to improved health outcomes and greater peace of mind.

0 notes

Text

youtube

GG Marketing DBA / Healthcare Solutions is your trusted partner in navigating the complex world of Medicare Supplement Plans in Amory MS. As you approach retirement or are already enrolled in Medicare, understanding your options for supplemental coverage is crucial for your financial well-being and peace of mind.

GG Marketing DBA / Healthcare Solutions

407A North Front St. Amory, MS 38821

(662) 257–1006

My Official Website: https://ggmarketing.org/

Google Plus Listing: https://www.google.com/maps?cid=11587535936286488134

Service We Offer:

medicare supplement insurance

Health Insurance

Life Insurance

term life insurance

disability insurance

dental insurance

final expense insurance

universal insurance

critical illness insurance

cancer insurance

in-home care insurance

short-term medical insurance

Follow Us On:

Twitter: https://twitter.com/GGMarketingDBA

Pinterest: https://www.pinterest.com/GGMarketingDBA/

#medicare supplement plans amory ms#medicare supplemental insurance amory ms#medicare supplement insurance amory ms#medicare supplement insurance brokers near me#independent medicare supplement insurance agents amory ms#Youtube

0 notes

Text

Unlocking Benefits: Navigating Medicare Advantage Plans

Discover the myriad benefits and options available with Medicare Advantage plans through our comprehensive guide. Uncover how these plans can enhance your healthcare coverage, offering additional perks beyond traditional Medicare. From prescription drug coverage to wellness programs, we'll navigate the intricacies together, empowering you to make informed decisions that align with your healthcare needs and lifestyle. Explore the possibilities and unlock the full potential of Medicare Advantage plans for a healthier and happier tomorrow.

#medicare agents#medicare broker#medicare insurance#best medicare plans#medicare advantage#medicare insurance plans#medicare advantage plan#medicare advantage plans in my area#medicare health insurance#best medicare advantage plans#medicare advantage plans near me#free medicare advantage plans#best medicare supplement plans#medicare supplement plans#medicare health insurance plans#medicare supplemental insurance plans#medicare supplemental insurance#medicare advantage insurance#best medicare supplement#best rated medicare advantage plans#turning 65 medicare

1 note

·

View note

Text

Facts About Medicare Supplements in Medina and Brunswick, OH

It is commonplace to consider enrolling in Medicare when one reaches the age of 65. This Federal healthcare plan has multiple advantages for elderly citizens with limited income prospects. Unfortunately, the coverage is pretty limited, with many Medicare users finding many aspects not covered by the original Medicare Plans. No worries! Such individuals can always buy Medicare supplements in Medina and Brunswick, OH.

Alternatively known as Medigap, the plan(s) address the areas that the original Medicare Plans omit. The plans are provided by private companies that enable the people enrolled in Medicare Plan A and Medicare Plan B to cover the gaps perfectly. One can expect to obtain assistance with the following by enrolling in Medigap:

· Co-payment

· Coinsurance

· Deductibles

Almost all states across the nation provide ten standardized Medicare Supplement plans. The difference between plans is related to the terms & conditions of the coverage, premium sums, and the requirements for sharing the costs

With each Plan named by a letter of the alphabet, A through N, Medicare supplement plans usually cover the following:-

· Plan A- Provides the basic benefits

· Plan B- Provides basic benefits plus deductible for original Medicare Plan A

· Plan M covers some out-of-pocket expenses for Medicare members, including co-pays, coinsurance, and deductibles. It is similar to the original Medicare Plan D but may be more competitively priced

· Plan D- It covers some out-of-pocket expenses for individuals enrolled in Original Medicare

· Plan G- It covers coinsurance, co-payments, and deductibles that aren't covered under Medicare Part A and Part B, with the plan being comparatively more expensive than other Medigap Plans

· Plan N- Provides coverage at low premiums but comes with higher co-pays

· Plan K & Plan L are also offered at lower premiums, but the coverage is not extensive and may only be partial

· Plan C & Plan F- These plans had been sold before, but people who hope to enroll for Medigap today will no longer be able to enroll in these plans

Exclusions

While Medicare supplement plans are believed to cover all gaps not provided by original Medicare, there are some exceptions, too. One cannot hope to be covered for the following by enrolling in a Medigap plan:

· Part B deductible- Not provided to new members

· Prescription drugs

· Long-term unskilled care

· Dental care

· Cost of Hearing Aid

· Vision care

· Private Nursing

The Cost of Enrolling in Medicare Supplement

The prospect of paying for Medigap in addition to original Medicare plans may be a trifle expensive, but the cost will surely be worth the money. The final expense will depend on multiple factors such as age, gender, general health condition, location, and use of tobacco. Monthly premiums for basic benefits may be low, but the expense will increase according to age and living in high-cost areas.

It is essential to have one's assets insured. Buying the right one requires requesting the concerned carrier for home insurance quotes in Medina and Brunswick, OH, which allows one to find an affordable way to avoid financial risks in the future.

0 notes

Text

Your Medicare Coverage Guide for 2023

#medicare#medicare advantage#medicare coverage#medicare part d#medicare drug coverage#medicare supplement#medicare supplement plans#medicare explained#medicare basics#medicare supplemental insurance#medicare part a#medicare part b#medicare part c#medicare coverage guidelines#what does medicare cover#medicare dental coverage#medicare advantage plan#medicare advantage plans#medicare insurance#medicare made clear#medicare and employer coverage

0 notes

Text

The Benefits of Supplemental Medicare Insurance Plans

Supplemental Medicare insurance plans, also known as Medigap plans, offer additional coverage beyond Original Medicare to help beneficiaries manage out-of-pocket healthcare costs. These plans provide coverage for expenses such as deductibles, copayments, and coinsurance, offering financial protection and peace of mind. With standardized options labeled A through N, beneficiaries can choose the plan that best fits their needs and budget. Supplemental Medicare insurance plans typically offer nationwide coverage and the freedom to choose healthcare providers without referral requirements. Moreover, these plans are guaranteed renewable, meaning beneficiaries can maintain coverage as long as they continue to pay their premiums on time. Overall, supplemental Medicare insurance plans serve as a valuable supplement to Original Medicare, providing beneficiaries with comprehensive coverage and added financial security.

The Role of Supplemental Medicare Insurance in Filling Gaps"

Supplemental Medicare insurance plans bridge the gaps in Original Medicare coverage, covering out-of-pocket expenses like deductibles and coinsurance, ensuring beneficiaries have comprehensive coverage for their healthcare needs.

The Right Supplemental Medicare Plan

With a range of standardized plans labeled A through N, beneficiaries can choose a supplemental Medicare insurance plan that aligns with their specific healthcare needs and budget, providing tailored coverage for their individual circumstances.

How Supplemental Medicare Insurance Plans Provide Financial Security

Supplemental Medicare insurance plans offer financial security by minimizing out-of-pocket expenses, helping beneficiaries avoid unexpected healthcare costs and ensuring they can access necessary medical services without financial strain.

Nationwide Medicare Coverage for Travelers

These plans typically provide nationwide coverage, allowing beneficiaries to access healthcare services anywhere in the United States that accepts Medicare, providing flexibility and peace of mind, especially for travelers or those who relocate.

The Importance of Provider Choice in Supplemental Medicare Plans

Beneficiaries enrolled in supplemental Medicare insurance plans have the freedom to choose their healthcare providers without network restrictions, ensuring they can see the doctors and specialists of their choice without referrals or prior authorizations.

The Guarantee of Renewable Supplemental Medicare Plans"

Supplemental Medicare insurance plans are guaranteed renewable, meaning beneficiaries can maintain coverage as long as they continue to pay their premiums on time, offering long-term security and peace of mind.

The Value of Supplemental Medicare Coverage"

These plans complement Original Medicare by providing additional benefits and coverage options, ensuring beneficiaries have access to comprehensive healthcare support to meet their evolving medical needs throughout their lives.

Conclusion

In conclusion, supplemental Medicare insurance plans serve as invaluable assets in ensuring beneficiaries receive comprehensive coverage for their healthcare needs. By bridging the gaps left by Original Medicare, these plans provide financial protection against out-of-pocket expenses like deductibles and coinsurance. Beneficiaries can access a wide range of standardized plans, allowing for customized coverage options tailored to individual circumstances. The nationwide accessibility and freedom of provider choice offered by supplemental Medicare insurance plans enhance beneficiaries' flexibility in accessing healthcare services. Moreover, the guarantee of renewable coverage provides long-term security and peace of mind. Overall, supplemental Medicare insurance plans play a vital role in complementing Original Medicare, offering beneficiaries the assurance of comprehensive coverage and financial stability in managing their healthcare costs.

0 notes

Text

The Importance of Supplemental Medicare Insurance Plans

Supplemental Medicare Insurance Plans play a vital role in safeguarding the health and financial security of individuals enrolled in Medicarart Ae. While Original Medicare provides essential coverage for hospitalization and medical services Part it often leaves beneficiaries responsible for significant out-of-pocket expenses, such as deductibles, copayments, and coinsurance. Supplemental Medicare Insurance Plans, also known as Medigap plans, fill these gaps in coverage by offering additional benefits that help offset these costs. These plans provide peace of mind by reducing financial burdens associated with healthcare expenses, ensuring that individuals access necessary medical services without worrying about unexpected bills. Moreover, Supplemental Medicare Insurance Plans offer flexibility in choosing healthcare providers and services, empowering beneficiaries to receive the care when they need it.

The Need for Supplemental medicare Insurance plans

This subheading highlights the gaps in coverage that exist within Original Medicare and emphasizes the necessity of supplemental insurance plans. It discusses how Original Medicare (Part A and Part B) covers many healthcare services but leaves beneficiaries responsible for deductibles, copayments, and coinsurance. By understanding these coverage gaps, individuals recognize the importance of supplementing their Medicare coverage with additional insurance to mitigate financial risks and ensure comprehensive healthcare access.

Expenses with Supplemental medicare Insurance plans

This section explores the financial protection provided by supplemental Medicare insurance plans, focusing on how they help beneficiaries manage out-of-pocket expenses. It discusses how Supplemental Medicare Insurance Plans, also known as Medigap plans, cover costs such as deductibles, copayments, and coinsurance, reducing the financial burden associated with healthcare services. By mitigating these expenses, supplemental insurance plans offer peace of mind and financial security to Medicare beneficiaries, ensuring that they can access necessary medical care without worrying about unexpected bills.

The Role of Supplemental Insurance in Health Security

This subheading examines the role of supplemental insurance in providing comprehensive coverage solutions for Medicare beneficiaries. It discusses how Supplemental Medicare Insurance Plans fill the gaps left by Original Medicare, offering additional benefits that help cover a wide range of healthcare services and expenses. By providing comprehensive coverage solutions, supplemental insurance plans ensure that beneficiaries have access to the care they need, when they need it, without facing financial barriers or limitations.

Supplemental Insurance Empowering Healthcare Decisions

This section explores how supplemental insurance plans empower Medicare beneficiaries by offering flexibility and choice in healthcare decisions. It discusses how these plans allow beneficiaries to choose their healthcare providers and services, without being restricted by network limitations. By providing flexibility in healthcare decisions, supplemental insurance plans enable beneficiaries to receive the care that best meets their needs and preferences, enhancing their overall healthcare experience.

The Value of Supplemental Insurance

This subheading emphasizes the value of supplemental insurance in protecting against unforeseen healthcare expenses. It discusses how Supplemental Medicare Insurance Plans provide a safety net for beneficiaries, covering expenses that may arise unexpectedly due to illness or injury. By offering protection against unforeseen healthcare expenses, supplemental insurance plans offer peace of mind and financial security to Medicare beneficiaries, ensuring that they can access necessary medical care without facing financial hardship.

Supplemental Insurance Plans Alleviating Financial Stress

This section examines how supplemental insurance plans simplify healthcare costs for Medicare beneficiaries, alleviating financial stress and uncertainty. It discusses how these plans provide predictable and manageable monthly premiums, deductibles, and out-of-pocket expenses, making it easier for beneficiaries to budget for healthcare expenses. By simplifying healthcare costs, supplemental insurance plans offer peace of mind and financial stability to Medicare beneficiaries, allowing them to focus on their health and well-being without worrying about financial burdens.

The Impact of Supplemental Insurance on Health Equity

This subheading explores the impact of supplemental insurance on health equity and access to healthcare services for Medicare beneficiaries. It discusses how Supplemental Medicare Insurance Plans help bridge gaps in coverage, ensuring that all beneficiaries have access to necessary medical care, regardless of their financial status or health needs. By enhancing access to healthcare services, supplemental insurance plans promote health equity and ensure that all beneficiaries can receive the care they need to maintain optimal health and well-being.

Conclusion

In conclusion, supplemental Medicare insurance plans play a crucial role in providing additional coverage and financial protection for Medicare beneficiaries. By filling gaps in original Medicare coverage, such as deductibles, coinsurance, and copayments, these supplemental plans help alleviate out-of-pocket expenses and ensure comprehensive healthcare coverage. Moreover, supplemental plans may offer additional benefits, such as coverage for prescription drugs, vision, dental, and hearing services, further enhancing the value of Medicare coverage. As healthcare costs continue to rise and medical needs evolve, supplemental insurance plans offer peace of mind and security, empowering individuals to access the care they need without undue financial burden. Ultimately, the importance of supplemental Medicare insurance plans cannot be overstated in safeguarding the health and well-being of Medicare beneficiaries.

0 notes

Text

Welcome to Senior Healthcare Team Insurance Agency – your trusted family-owned national independent insurance agency. We specialise in helping seniors and their loved ones navigate Medicare Supplement insurance choices with unbiased assistance. Our goal is to provide peace of mind by simplifying the process and ensuring you secure quality, low-cost healthcare tailored to your needs and budget. Explore more at Senior Healthcare Team. Your retirement deserves the best care!

1 note

·

View note

Text

The Power of Supplemental Medicare Insurance Plans

This comprehensive coverage goes beyond the basics, offering a powerful shield against unexpected medical costs. Unravel the potential benefits and tailored solutions that these plans bring to the table, providing a safety net for expenses not covered by traditional Medicare. From additional hospital stays to specialized care, Supplemental Medicare Insurance empowers individuals with enhanced financial peace of mind. Explore the strength of a personalized approach to healthcare, ensuring that you can navigate medical uncertainties with confidence. Harness the power of supplementary coverage and unlock a world where your well-being takes center stage, making informed choices for a healthier, worry-free future.

An Overview of Supplemental Medicare Insurance Plans

Delve into the fundamentals of Supplemental Medicare Insurance, gaining insights into what these plans entail. This comprehensive guide provides a solid foundation, explaining how supplementary coverage complements traditional Medicare, offering enhanced benefits and financial security. Navigate through the core components that make these plans a valuable addition to your healthcare strategy.

The Personalized Approach of Supplemental Medicare Insurance

Explore the flexibility and customization options that Supplemental Medicare Insurance Plans bring to the table. Uncover how these plans can be tailored to suit individual health needs, providing a personalized shield against out-of-pocket costs. From co-payments to deductibles, understand how supplementary coverage adapts to your unique healthcare requirements, ensuring a robust safety net.

The Additional Protections Offered by Supplemental Medicare Insurance

Go beyond the basics of Medicare with an in-depth look at the additional protections offered by Supplemental Medicare Insurance Plans. Discover how these plans cover gaps in healthcare expenses, including copayments, coinsurance, and deductibles. Gain a clear understanding of the comprehensive benefits that contribute to a more secure and stress-free healthcare experience.

The Role of Supplemental Medicare Insurance in Cost Management

Delve into the financial landscape of healthcare with a focus on how Supplemental Medicare Insurance Plans contribute to cost management. Learn how these plans help mitigate unexpected medical expenses, providing beneficiaries with a sense of financial peace of mind. Explore the strategies employed by supplementary coverage to minimize out-of-pocket costs, ensuring a balanced and manageable healthcare budget.

How Supplemental Medicare Insurance Plans Support Preventive Care?

Explore the proactive side of healthcare with a spotlight on how Supplemental Medicare Insurance Plans support preventive care. Understand the role of these plans in covering screenings, vaccinations, and wellness programs, promoting a holistic approach to health. Learn how the emphasis on preventive services contributes to overall well-being and long-term healthcare cost savings.

The Network Dynamics of Supplemental Medicare Insurance

Uncover the significance of access to quality healthcare providers within the framework of Supplemental Medicare Insurance Plans. Examine how these plans work within provider networks to ensure seamless access to medical services. Navigate through considerations of network types, provider choices, and the impact on the overall healthcare experience for beneficiaries.

Supplemental Medicare Insurance and Hospital Stays

Delve into the critical role that Supplemental Medicare Insurance plays in planning for unexpected hospital stays. Understand how these plans provide coverage for additional hospital expenses, such as extended stays and specialized care. Gain insights into the peace of mind that supplementary coverage brings when facing unforeseen health challenges, ensuring comprehensive protection.

The Long-Term Benefits of Supplemental Medicare Insurance Plans

Look ahead and explore the long-term benefits of Supplemental Medicare Insurance Plans in future-proofing your healthcare. Understand how these plans adapt to evolving health needs, providing stability and security as you navigate different stages of life. From retirement planning to aging gracefully, discover how supplementary coverage contributes to a resilient and sustainable healthcare strategy.

Conclusion

In conclusion, It emerge as a pivotal element in fortifying your healthcare strategy. Offering a personalized approach, these plans fill critical gaps in coverage, ensuring financial security and peace of mind. By tailoring coverage to individual needs, addressing out-of-pocket costs, and supporting preventive care, supplementary insurance becomes a cornerstone of comprehensive wellness. The flexibility, additional protections, and network dynamics contribute to a resilient healthcare framework, navigating unexpected challenges with ease. As a tool for cost management and a shield against unforeseen medical expenses, Supplemental Medicare Insurance Plans stand as a wise investment in securing both immediate and long-term health needs, fostering a future where healthcare is both accessible and sustainable.

0 notes