#medicare dental coverage

Text

Your Medicare Coverage Guide for 2023

#medicare#medicare advantage#medicare coverage#medicare part d#medicare drug coverage#medicare supplement#medicare supplement plans#medicare explained#medicare basics#medicare supplemental insurance#medicare part a#medicare part b#medicare part c#medicare coverage guidelines#what does medicare cover#medicare dental coverage#medicare advantage plan#medicare advantage plans#medicare insurance#medicare made clear#medicare and employer coverage

0 notes

Text

Affordable Health Insurance

Health insurance is a type of insurance that helps cover the cost of medical expenses. It can be provided by an employer or purchased individually from an insurance company. Health insurance plans typically have different levels of coverage, ranging from basic to comprehensive, and they often come with different costs, such as premiums, deductibles, and co-pays.

Before signing up for a health insurance plan, it's important to understand your specific healthcare needs and budget. You should consider factors such as your age, health status, and any pre-existing conditions you may have. You should also research the various affordable health insurance plans available to you and compare their costs and benefits.

Some common types of health insurance plans include HMOs, PPOs, and EPOs. HMOs typically have lower out-of-pocket costs but limit you to a specific network of healthcare providers. PPOs offer more flexibility in choosing healthcare providers but may have higher out-of-pocket costs. EPOs are a hybrid of HMOs and PPOs, offering some of the benefits of both.

Ultimately, choosing the right health insurance plan for you and your family requires careful consideration and research. By understanding your healthcare needs and the different options available to you, you can make an informed decision that best meets your needs and budget.

#affordable health insurance#affordable health insurance in texas#affordable health insurance in California#affordable health insurance in Florida#insurance policy#insurance types#cover insurance#health care insurance#medicare insurance#medicare health insurance#health plan#insurance coverage#medicare dental#dental vision#dental health insurance#dental vision insurance

2 notes

·

View notes

Text

"Best Dental Insurance for Seniors in St. Augustine: What to Look For"

As we age, dental care becomes increasingly important, but it can also become more expensive. Finding the right dental insurance plan for seniors in St. Augustine is crucial for maintaining oral health without breaking the bank.

Seniors’ Dental Needs:

Seniors often face unique dental challenges, including the need for dentures, crowns, implants, and treatment for gum disease. Therefore, a good dental insurance plan for seniors should cover a broad range of services.

Top Plans for Seniors:

AARP Dental Insurance: Tailored specifically for seniors, with comprehensive coverage options.

Delta Dental: Offers plans with extensive coverage for preventive and restorative care.

Humana Dental: Known for its affordable plans and coverage for major dental procedures.

Coverage to Look For:

Seniors should look for plans that offer coverage for major procedures, including dentures, crowns, and periodontal treatments. It’s also important to consider plans that cover preventive care, which can help avoid more expensive treatments later on.

Conclusion:

Choosing the right dental insurance plan is key to ensuring affordable and comprehensive dental care in your golden years. Health Insurance Diva in St. Augustine can help seniors find the best plan to suit their needs.

#individual health insurance st. augustine#long term care insurance st. augustine#group health insurance st. augustine#dental insurane st. augustine#accidental and critical illness st. augustine#medicare coverage st. augustine

0 notes

Text

Understanding HRA Plan Documents and Group Coverage: A Comprehensive Guide

An HRA Plan Document is a legal document that outlines the terms and conditions of the Health Reimbursement Arrangement offered by an employer. It serves as a roadmap, detailing the rules and regulations governing the HRA and acts as a crucial communication tool between the employer and employees.

Why is it Essential?

Legal Compliance: HRA Plan Documents are required by law. The Employee Retirement Income Security Act (ERISA) mandates that employers provide written plan documents for all employee benefit plans, including HRAs. Failure to comply with ERISA regulations can lead to legal repercussions.

Clarity and Transparency: A well-drafted HRA Plan Document ensures that employees understand the benefits, coverage limits, and reimbursement procedures. This transparency fosters trust and helps in managing expectations.

Flexibility and Customization: Employers have the flexibility to design HRAs that align with their budget and employee needs. The HRA Plan Document serves as the tool to document these specific plan details, such as eligible expenses, rollover provisions, and coverage periods.

Employee Education: The document serves as an educational resource for employees, helping them navigate the complexities of the HRA. It can include FAQs, examples, and scenarios to clarify any uncertainties.

Group Coverage HRA Plan Documents

What Sets Group Coverage HRAs Apart?

Group Coverage HRA Plan Document are a specific type of HRA designed to provide a group of employees with a common set of benefits. The HRA Plan Document for a GCHRA takes into account the collective needs of the group, providing a unified approach to healthcare benefits.

Key Components of Group Coverage HRA Plan Documents:

Eligibility Criteria: Clearly define the criteria for employees to participate in the GCHRA. This may include factors such as employment status, hours worked, or other specific conditions.

Contribution Structure: Specify the employer's contribution structure, including the maximum allowable contribution per employee, reimbursement rates, and any tiered contribution levels.

Conclusion:

A well-crafted HRA Plan Document, especially for Group Coverage HRAs, is essential for the successful implementation and administration of healthcare benefits. Employers should invest time and resources in creating comprehensive and compliant documents to provide a clear roadmap for both the organization and its employees. In doing so, they can navigate the complexities of healthcare benefits, foster transparency, and build a foundation of trust and satisfaction among their workforce.

#Dependent Care Assistance Plan FSA Plan#Group Coverage HRA Plan#HRA Plan#HRA Plan Document#medicare hra document#individual coverage hra#group coverage hra plan document#dental hra

0 notes

Text

#Full Coverage dental insurance with no waiting period#best dental insurance#medicare#dental insurance#health insurance#cosmetic dental insurance

1 note

·

View note

Text

By Max Richtman

Common Dreams - Opinion

July 30, 2024

Even after nearly six decades of Medicare’s overall success, we must continually protect it from conservatives’ attempts to cut and privatize the program.

Before Medicare was signed into law by President Lyndon Johnson 59 years ago today, nearly half of American seniors had no hospital insurance. Private insurance companies were reluctant to cover anyone over 65. Even fewer seniors had coverage for non-hospital services like doctor’s visits. Many of the elderly were forced to exhaust their retirement savings to pay for medical care; some fell into poverty because of it. All of that changed with Medicare.

In Medicare’s first year of coverage, poverty decreased by 66% among the senior population. From 1965, when Medicare was enacted, to 1994, life expectancy at age 65 increased nearly three full years. This was no coincidence. Access to Medicare coverage for those who were previously uninsured helped lift seniors out of poverty and extend their lives.

As with Social Security, workers would contribute with each paycheck toward their future Medicare benefits. Upon putting his signature on this new program, a keystone of the Great Society, President Johnson declared, “Every citizen will be able, in their productive years when they are earning, to insure themselves against the ravages of illness in old age.”

Project 2025, the right-wing blueprint for a second Trump presidency, would gut traditional Medicare by accelerating privatization and repealing drug price negotiation.

Medicare has been improved several times over the decades. In 1972, Americans with disabilities (under 65 years of age) became eligible for Medicare coverage—along with people suffering from chronic kidney disease needing dialysis or transplants. In 2003, prescription drug coverage was added to Medicare (though the program was prohibited from negotiating prices with drugmakers). The Inflation Reduction Act of 2022 finally empowered Medicare to negotiate prices with Big Pharma—and lowered seniors’ costs by capping their out-of-pocket expenses for prescription drugs and insulin.

Nearly 60 years after it was enacted, Medicare is one of the most popular and efficient federal programs. Ninety-four percent of beneficiaries say they are “satisfied” or “very satisfied” with their quality of care. Unlike many other federal programs, Medicare spends less than 2% of its budget on administrative costs.

Medicare isn’t perfect. It should be expanded to cover dental, hearing, and vision care. More urgently, though, the privatized version of the program, Medicare Advantage (MA), is gobbling up a larger share of the program despite myriad problems, including MA insurers overbilling the government and denying care that’s always offered by traditional Medicare. The Biden-Harris administration has been working to hold those private plans more accountable, but much remains to be done to protect traditional Medicare from efforts toward privatization.

Even after 59 years of Medicare’s overall success, we must continually defend Medicare against conservatives’ attempts to cut and privatize the program. Our founder, Rep. James Roosevelt, Sr. (D-Calif.), son of President Franklin D. Roosevelt, knew that Medicare (along with Social Security) would need continuous advocacy to withstand assaults from antagonistic political forces. That’s why the word “preserve” is in our organization’s name.

Many conservatives opposed Medicare from the start, labeling it “socialism” and “socialized medicine.” In 1962, Ronald Reagan warned that if Medicare were to be enacted, “One of these days you and I are going to spend our sunset years telling our children, and our children’s children, what it once was like in America when men were free.”

Today, the onslaught continues. The House Republican Study Committee’s (RSC) 2025 budget proposes to cut Medicare by an estimated $1 trillion over the next decade. The RSC would replace Medicare’s current system with vouchers, and push seniors into private plans that can and do deny coverage. Project 2025, the right-wing blueprint for a second Trump presidency, would gut traditional Medicare by accelerating privatization and repealing drug price negotiation.

Democrats by and large support protecting and even expanding Medicare. President Joe Biden tried to add dental, vision, and hearing coverage in his Build Back Better Act, but encountered resistance from Republicans and centrist Democrats. It’s still a laudable goal.

Republicans, for the most part, advocate cutting Medicare benefits and privatization. We endorsed Vice President Kamala Harris for president, because she knows the importance of Medicare to America’s seniors and people with disabilities—and has vowed to protect them. Former President Donald Trump, on the other hand, has been rhetorically all over the map on this topic, telling CNBC he is “open” to “cutting entitlements” but claiming to support Medicare. (His budgets as president called for billions of dollars in Medicare cuts.)

The 59th anniversary of Medicare is both an occasion for celebrating the program’s enormous successes over the past six decades—and a time to defend Medicare in the marbled halls of Washington, D.C., and at the ballot box this November.

Max Richtman is president and CEO of the National Committee to Preserve Social Security and Medicare. He is former staff director at the United States Senate Special Committee on Aging.

#healthcare#medicare#medicare advantage#privatization#republican party#donald trump#project 2025#kamala harris#2024 presidential election

55 notes

·

View notes

Text

"In a move last month that received little fanfare, the Biden administration finalized a rule that would give states the option of adding adult dental insurance coverage as part of their Affordable Care Act plans.

In another attempt to bolster dental coverage, Sen. Bernie Sanders, I-Vt. on Friday introduced the Comprehensive Dental Care Reform Act of 2024, a bill that would expand dental coverage through Medicare, Medicaid and the Veterans Administration and increase the number of dentists, dental hygienists and dental therapists nationwide."

-USA Today

VOTE

39 notes

·

View notes

Text

Jessica Glenza at The Guardian:

A bill introduced by the US senator Bernie Sanders would dramatically expand access to oral healthcare by adding dental benefits to Medicare and enhance them in Medicaid, public health insurance programs that together cover 115 million older and lower-income Americans.

Despite Americans’ reputation for the flashy “Hollywood smile”, millions struggle to access basic dental care. One in five US seniors have lost all their natural teeth, almost half of adults have some kind of gum disease and painful cavities are one of the most common reasons children miss school.

“Any objective look at the reality facing the American people recognizes there is a crisis in dental care in America,” Sanders told the Guardian in an exclusive interview. “Imagine that in the richest country in the world.”

Nearly 69 million adults and almost 7 million children lack dental insurance. For those who have insurance, costs are often opaque and high. Multi-thousand-dollar bills are so common that the nation’s largest professional organization for dentists, the American Dental Association (ADA), signed an exclusive partnership with a medical credit card company.

In 2019, more than 2 million Americans went to the emergency room for tooth pain, a 62% increase since 2014, and a crisis of affordability pushed an estimated 490,000 Americans to travel to other countries such as Mexico for lower-cost dental care.

“The issue of dental care is something we have been working on for years,” said Sanders. “It is an issue I think tens of millions of Americans are deeply concerned about, but it really hasn’t quite gotten the media attention it deserves.”

Sanders said he had seen how poor dental health can affect every aspect of a person’s life – he described constituents who cover their mouths when they laugh or have been turned down for jobs because of missing teeth.

Sanders said he recognized the importance of the issue by attending town halls in his home state of Vermont, “and learning how hard it is to get dental care, how expensive it is and [how] dental insurance [is] totally inadequate”.

“Having bad teeth or poor teeth is a badge of poverty,” said Sanders. “It becomes a personal issue, a psychological issue, an economic issue as well.”

Sanders’ bill expands dental coverage by adding comprehensive benefits to Medicare; incentivizing states to improve dental benefits through Medicaid; and providing dental benefits to veterans through the Veterans Administration.

Additionally, the bill would attempt to tackle some states’ dentist shortage by creating student loan forgiveness programs for dentists who practice in underserved areas, and increasing funding to non-traditional places to see dentists, including at community health centers and schools.

Expanding dental coverage is exceedingly popular – recent polls show 92% of voters support the proposal, including an overwhelming majority of Republicans. Sanders said his proposal was good policy and “very good politics”.

Senator Bernie Sanders (I-VT) has proposed a bill called the Comprehensive Dental Reform Act that would dramatically increase coverage for dental care for Medicaid and Medicare patients.

#Bernie Sanders#Dental Care#Health Care#Comprehensive Dental Reform Act#118th Congress#US Senate#Dentist Shortage#Medicare#Medicaid

14 notes

·

View notes

Text

Personal: For Profit Healthcare and Me

So remember how Peacehealth drove all the independent offices in four specialties out of business, thus forcing everyone to use their clinic, then closed those clinics to force everyone to go to their central clinic two counties to the south? And remember how both the Doctors who were running that clinic made a deal to operate out of a clinic a regional medical conglomerate was opening near the hospital? so instead of me spending all day on a sixty mile each way trek for my treatment I was using the last three months of skeleton crew treatment at old clinic which ended the last Thursday in September? Remember how they said we could all follow our doctors there?

Yeah, about that.

I've been dutifully calling ever two weeks to see if they were letting people schedule appointments yet. They sent out a letter saying they were open. I stayed up Tuesday to get in sorted. it was a whole drama because the automated maze to get to the scheduler was as much of a hassle as Peacehealth's and prone to dropping calls, forcing one to start from scratch each time. so that was frustrating and tine consuming.

Apparently they have no access to our health records, so it was a start from scratch situation. Me, mentally: Shit! This is going to be HOURS. Only it wasn't for all the wrong reasons. They take Medicare, but not Medicare Advantage. So if I want it covered I have to lose most of my benefits including having Medicaid pay my big Medicare copay. O.o. Or I can pay for expensive treatments myself as uninsured.

I was upset, but I remembered superstar medical social worker lady personally calling around town to talk dentists into taking medicare dental coverage for me thus opening up my small city so that medicare patients can now get root canals and crowns instead of learning to live without chewing.

So I still thought it was salvageable. Problem is she's gone and the woman replacing her is a busy supervisor who likes to call me two hours into my sleep cycle without warning and then gets angry at me for not being charming. Previous lady asked when was best to call and would schedule calls in advance for a time when I was able to be awake and functional. it is a lot easier for me to be charming when I wasn't just ripped out of REM sleep and am now being interrogated about something.

New lady is a supervisor and super busy with supervisor things and is made of no and is snippy. I can not make her understand that not only is a 120 mile round trip over mountain passes dealing with the traffic mess along the highway in the major metropolitan area where I once got caught in a four hour traffic jam and couldn't get off to pee, is an entire exhausting day for me and that plus a treatment would not only mean i could do anything useful that day, but the next day to. She can't grasp how much pain is involved in long car trips or how much treatments take out of me. She keeps hard selling me on this and then calling me resistant and recalcitrant like I'm the one being unreasonable for considering this basically insurmountable at my level of disability.

She did not fight the in town clinic for me. She did not try to argue them around.

Her, repeating a suggestion she has made over and over since the closing announcement: You should just get your GP to do it.

Me, explaining for at least the third time because we have this conversation every time we talk: I asked my GP last spring like you asked. They can't do it. It can't be administered by a GP. They'd need to hire a specialist and build new facilities for compounding and for special storage of medication.

Her: Well just ask you GP to give you a different treatment.

Me: There are no other treatments. I have medications to manage symptoms. These treatments are the cure. There is only one cure.

Her: You are being recalcitrant!

Me: There is literally only one cure. No new ones have been invented since last February. The cure is working. I'm getting better. i will get worse again with only symptom management.

But she kept arguing with me because I was being stubborn about facts being facts. My GP can't pull an entire brand new treatment regimen out of her ass. She would not let it go or let me go and I was exhausted because it was hours past when I would normally be asleep at this point and also what was the point of her hard selling me on demanding the imaginary alternative treatment or the 120 mile trip. I ended up giving and and saying something like, "I have to go now," which I know is rude, but we spent this entire conversation with her neither listing not understanding and basically acting like I was the asshole here.

So I'm fucked and I'm frustrated and angry. I was literally at the point where I was going to get better really quickly if I kept doing treatments, but if we stop now I'll be back to square one with it all to do again if another clinic opens.

And it's all like this because Obama and Biden didn't have the balls to stick to their universal free healthy care guns and decided to adopt the capitalist give away Republican health plan in pursuit of bipartisan buy in they did not get, which anyone paying attention told them they could not get, which Mitch McConnell vowed they'd never get as part of the project to make Obama a one term president at all costs. They burned all their political capital on a bullshit give away to insurance companies when they could have taken the same or less of a hit just giving up a developed country level health care system. No fucked up website needed for sign ups. No red tape or copays or catch 22 shit like I'm dealing with now.

33 notes

·

View notes

Text

Good luck, Jamaal Bowman.

AIPAC has poured millions of dollars into getting Bowman ousted.

We should stand in solidarity with Jamaal Bowman.

We should support Jamaal Bowman.

If he retains his seat in the House of Representatives, that will send a powerful message that AIPAC can no longer just buy our politicians and control our political parties.

Jamaal Bowman has been a supporter of a Permanent Ceasefire in Gaza. Jamaal Bowman has been vocal about supporting and humanizing Palestinian Civilians. He is an ally to Palestine.

He advocates for the demilitarization of the police, for Medicare for All (including free dental, vision, hearing, reproductive, and mental health coverage), for the abolishment of ICE, for the cancellation of ALL student loan debt, and for making public colleges tuition-free.

Support Jamaal Bowman. He is a great leader and a great politician.

We believe in you, Jamaal Bowman.

2 notes

·

View notes

Text

About that Medicare for All slogan

So I've been seeing 'Medicare for All' slogans again, and while I fully believe in universal health care I think they need to revise that slogan. Right now I also see a lot of people sneering because older Americans aren't glomming onto that slogan.

They really should, IMHO, be making that slogan "EXPANDED or REFORMED Medicare for all" to get people on board. Because as it is, it can be really costly, and many seniors and disabled people are not able to afford healthcare even with it. Those thinking it's a panacea as it is, without reform? Well, let's have a peek and see.

1. Background: Medicare is a program mostly for seniors and disabled people receiving SSDI.

There are two basic ways to get Medicare: be over a certain age (right now 67) and receive Social Security Retirement. OR, be younger than 67, disabled and receive Social Security Disability Insurance (SSDI). Disabled people who receive only SSI are not eligible for Medicare.

Original Medicare functions like a PPO. For those outside the States, you can go to any doctor that accepts Medicare and there are little to no prior authorizations required. This makes it easier for people to obtain quality care because they can go anywhere, more or less, and aren't trapped in a narrow provider network.

BUT:

2. Medicare is fucking confusing.

There's Part A (hospital), Part B (outpatient), Part D (drug coverage), Part C (Advantage plans) and several other moving parts, each with their own fee schedules and rules.

3. Medicare isn't free.

Part A is free for most, but if you don't qualify for that, it can cost up to $506/month.

Part A also has a deductible of $1600 every single inpatient hospital stay. For those outside the USA, the deductible is the amount you have to pay out of pocket before the insurance will pay anything at all.

If someone is in the hospital for a while, they start paying copayments that begin at $400/day, starting on the 61st day. If they need to be in skilled nursing facilities for surgery/injury recovery, copayments of $200/day kick in after the 20th day.

Part B (outpatient) has a premium which, as of 2023, is $164.90 per month, as well as a once-yearly deductible of $226.

Medicare is an 80/20 scheme, which means they cover 80% of the bill and you get the rest. That might not sound too bad until you look at what medical care in the USA costs. A simple MRI might be billed at $3000. 20% of that is yours. Still sound reasonably priced?

4. Medicare doesn't cover everything.

Dental, optical and many other things are notoriously not covered by Medicare. That's why you will find people on Medicare buying separate coverage for these things - which means they're paying additional premiums every month.

5. We haven't even gotten to prescriptions yet.

So prescription coverage for Medicare is under Part D. You have to choose a prescription drug plan to administer your benefits and they are all different. Some might cost you nothing. Some might cost you a lot every month, so if you're keeping count, that's your fourth monthly premium after Part B, vision and dental. Some change their formulary every year. Those commercials about Medicare open enrollment? That's the period in the fall when people on Medicare have to sift through the formularies and see if their PDP is going to cover their meds next year. Some people do qualify for Extra Help from Medicare which covers the premiums and brings down the coinsurance for meds, but not everyone.

Oh, and the meds are tiered. Tier 1 are the most basic/common meds that will cost you nothing or very little. Tier 4 are meds that are barely covered, perhaps 30%.

Wait, there's more! There's a 'donut hole' or coverage cap built into plans. Essentially, when your med costs reach $4660 for the year, the coverage gap begins. Right now you pay no more than 25% of the drug costs, but it used to be a complete gap. This continues until you reach $7400 in drug costs, at which time you enter the 'catastrophic' tier where meds usually cost a lot less. And it resets annually.

Think this is a hard cap to reach? Remember, common meds for things like cardiac conditions and headaches can cost $1000 each per month. Take a few of them and you're up to that $4460 real quick.

This is why you may have read or heard stories about seniors taking bus trips to Canada to buy meds. It's honestly cheaper sometimes to take a trip across the border than navigate this shit.

6. This is why a lot of people get pressed into an HMO.

In order to navigate a lot of the above, a lot of people get pressed into optional Medicare Advantage plans, technically Part C. These are mostly HMOs run by major insurance companies. They offer the promise of consolidating benefits, eliminating the copays and drug coverage web - at the cost of pressing you back into an HMO with referrals and prior authorizations, as well as their limited network.

OR people get a 'Medigap' supplement that covers the costs that Medicare doesn't, while allowing them to remain with original (PPO style) Medicare. Those typically cost more than the Part C plans.

7. Some people do get help, but it may be hard to navigate.

Some people have secondary insurance they can keep through a job or spouse. That might have premiums attached to it.

Some states have Medicare Savings Programs to help people pay the costs. But not all.

Some people earn little enough for SSDI or retirement that they also qualify for Medicaid as a secondary insurance. Medicaid generally picks up that which Medicare doesn't - such as that 20% coinsurance and the deductible. Medi-Medis are often pressured into joining HMOs as well, which really don't benefit them.

Medicare also has some programs like Extra Help and such, which they can help you apply for. But this is a lot for people to navigate.

So- this is why Medicare for All might not thrill people the way you think it might. REFORMED Medicare for All on the other hand might make the same people jump right on board.

5 notes

·

View notes

Note

Why did they discontinue your drug plan? Are you still on Medicare?

Turning this into a Medicare Explanation Thing since a lot of people don't know, feel free to save this if you/someone you know is waiting on SSI/SSDI case or thinking about it. Medicare comes in 5 separate parts because why not make disabled people jump through a bunch of complex unnecessary stuff.

Part A is hospital, covering specifically hospital bills not regular outpatient appointments. Part B is medical insurance which is your primary Dr and everything outpatient. When you get on disability they will give you Part A and/or Part B. If you have both they call it Original Medicare. Original Medicare also only covers 80% of the cost of everything, you have to pay 20% out of pocket and they don't have a limit meaning there's not a point where you stop paying the 20%. Oh and Original Medicare doesn't cover vision, dental, or hearing.

Part D is prescription drug coverage. They usually do not immediately put you on this because it costs extra, but also if you fail to sign up for it and then sign up several months after getting Medicare you will be penalized with an extra cost for the rest of the time that you have Medicare (yay!). Part D is not directly through the govt, it's private insurances like United Healthcare that are contracted with the govt. If you only have Original Medicare, none of your meds are covered and you have to pay full price.

Part C is also called Medicare Advantage, it is optional where you get Part A, B, and D all bundled together but you do this through private insurers like UHC and BCBS. Some of them do not charge a premium but some of them do, which is important because you would be paying for Original Medicare and then also potentially paying another premium for Part C. There is also the downside that Medicare is accepted by a LOT of places, but if you do Medicare Advantage you have to go through drs that that insurer covers. That may/may not be an issue depending on where you live. Upside is it may cost less (because they often have limits on how much you pay before they cover 100%) or cover more things than Medicare.

Last one is Medigap which is a separate plan (that you also pay for and get penalized if you don't sign up in time) that helps pay for your deductible. The Original Medicare deductible is $200-something for 2023 meaning you have to pay that amount before Medicare even bothers covering 80%.

So for my specific circumstance, I still have Original Medicare and there's no issue with my govt disability payments either. I was auto-enrolled for Part D because I qualified for Extra Help (basically I am Extra Poor), but for some reason UHC gave me drug insurance for a state I don't live in. I called to correct it and they told me it was fine and they would just switch me to the correct state, except the contractor actually just cancelled the plan entirely without telling me that's what they were doing and also without signing me up for a new plan. Which I found out when I went to pick up from the pharmacy. If I did not qualify for Extra Help, which has Special Enrollment Periods, I would have had to go 4 months without drug insurance until Open Enrollment in October...I just lucked out so instead of waiting til Oct I only have to wait til next month.

#disability pride month#cripple punk#cripplepunk#medicare#disability#this is the bare bones of it too...not even talking about dual wielding Medicare/Medicaid#they send you basically a D&D player's handbook sized 'pamphlet' explaining it all#ask#anonymous

4 notes

·

View notes

Text

The Importance of Preventive Care with Individual Health Insurance in St. Augustine

Preventive care is a cornerstone of a healthy lifestyle, and with individual health insurance in St. Augustine, you can ensure that you and your family have access to the preventive services you need. Preventive care includes regular check-ups, screenings, immunizations, and wellness visits that help detect health issues early before they become serious.

Most individual health insurance plans cover a range of preventive services at no additional cost to you, making it easier to stay on top of your health. These services can include routine physical exams, cholesterol tests, blood pressure screenings, cancer screenings, and vaccines. By taking advantage of these benefits, you can maintain better health and avoid costly medical treatments down the road.

In addition to physical health, preventive care also encompasses mental health services. Regular mental health screenings and counseling can be crucial for maintaining emotional well-being. When selecting an individual health insurance plan, make sure to review the preventive care services covered to ensure that you and your loved ones are fully protected.

St. Augustine's trusted health insurance consultant. Let our knowledgeable, caring advisors simplify benefits for individuals and businesses. We offer clear guidance on Medicare, group health insurance, dental, and more. Schedule a free consultation today.

#individual health insurance st. augustine#group health insurance st. augustine#long term care insurance st. augustine#dental insurane st. augustine#medicare coverage st. augustine#accidental and critical illness st. augustine

0 notes

Text

How Does The Individual Coverage HRA Works?

While health benefits have historically been one-size-fits-all, today's employees need personalisation and flexibility, which is what will win them over in a competitive job market. How, therefore, do you provide health advantages that are specifically suited to the requirements of your varied workforce, which includes employees of all ages, health FSA plan, and financial means?

By providing Individual Coverage HRA, you may provide qualified workers with a tax-free healthcare allowance that they can use each month to pay for the personalised insurance that is most advantageous to them. If you want to know how ICHRA works, read the blog.

This is a list of the procedure's four steps:

First, create your benefit.

The ICHRA benefit is first tailored to meet the requirements of the employee by the employer. The amount of tax-free money users want to effective reward each month in the form of a set allowance, the expenses you want to be covered by reimbursement, and whether or not you want to provide multiple advantages to workers in various groups are all decisions you must make when establishing your ICHRA.

Workers purchase healthcare

Employees can opt in to your benefit and use their allowance as soon as it is set up, if they so desire. Workers who want to participate in the ICHRA will use their own funds to pay for any individual health insurance they choose as well as any additional eligible medical expenditure.

Everything mentioned in IRS Publication 502 is eligible as an out-of-pocket expense, however you can restrict some of these costs based on your preferences.

Workers provide documentation of their spending.

The employee will next present proof of the expenditures they have spent and are requesting for reimbursement after making their purchases.

Examine and pay back expenditures.

After reviewing the expenditure, the employer will either accept or deny the request. Our specialists will evaluate your workers' submissions if you're any consultant to give an Individual Coverage HRA to help you be certain it's acceptable. You shall compensate your employee for any eligible expenses up to the amount of accumulated leave.

#medicare hra document#health fsa plan#health fsa plan document#group coverage hra plan document#wrap spd plan document#dental hra#ichra plan

0 notes

Text

youtube

Business Name:

Florida Healthcare Insurance

Street Address:

4991 NW 107th Ave

City:

Coral Springs

State:

Florida

Zip Code:

33076

Country:

United States

Business Phone Number:

954-282-6891

Business Email Address:

[email protected]

Website:

https://floridahealthcareinsurance.com/

Facebook:

https://www.facebook.com/FloridaHealthcareInsurance

Instagram:

https://www.instagram.com/floridahealthcareinsurance/

Description:

Florida Healthcare Insurance is a top-rated health insurance agency that provides high-quality health insurance, group health insurance, and Medicare Supplements for individuals and small businesses in Florida. Since 2002, FHI’s award-winning team of expert agents offer a personalized experience, delivering quality plans and options in minutes, all at affordable rates. Partnering with several major carriers like Cigna, United, and more, FHI provides various health insurance programs like accidental death, disability, life insurance, and more. Family owned and operated, their team is dedicated to helping individuals find the best coverage that matches their needs and budget with 24/7 customer service.

✅ Health Insurance Florida

Google My Business CID URL:

https://www.google.com/maps?cid=952295565562303886

Business Hours:

Sunday Closed

Monday 8am to 10pm

Tuesday 8am to 10pm

Wednesday 8am to 10pm

Thursday 8am to 10pm

Friday 8am to 10pm

Saturday Closed

Services:

Health Insurance, Life Insurance, Medicare, Dental Insurance, Family Health Plan, Group Health Plan, Florida Health Insurance

Keywords:

Life Insurance Florida, Medicare Florida, Health Insurance Florida, Health Insurance South Florida

Location:

Service Areas:

2 notes

·

View notes

Text

By Jake Johnson

Common Dreams

Oct. 4, 2023

"Medicare Advantage is just another example of the endless greed of the insurance industry poisoning American healthcare," says a new report from Physicians for a National Health Program.

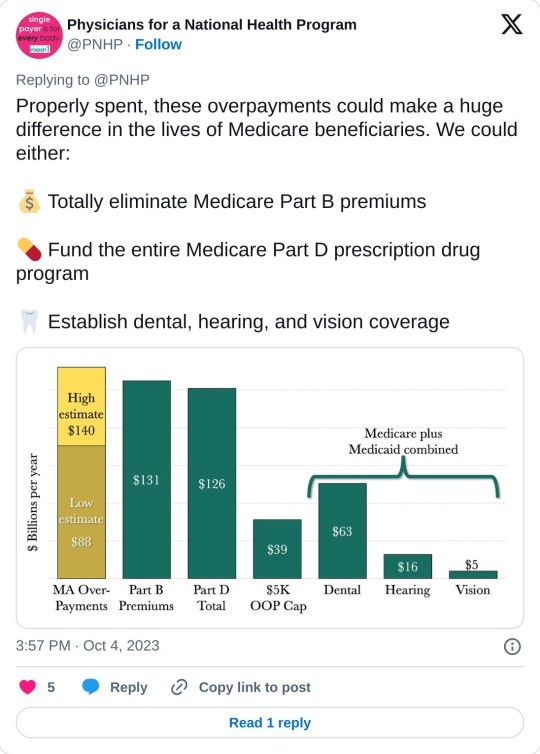

A report published Wednesday estimates that privately run, government-funded Medicare Advantage plans are overcharging U.S. taxpayers by up to $140 billion per year, a sum that could be used to completely eliminate Medicare Part B premiums or fully fund Medicare's prescription drug program.

Physicians for a National Health Program (PNHP), an advocacy group that supports transitioning to a single-payer health insurance system, found that Medicare Advantage (MA) overbills the federal government by at least $88 billion per year, based on 2022 spending.

That lower-end estimate accounts for common MA practices such as upcoding, whereby diagnoses are piled onto a patient's risk assessment to make them appear sicker than they actually are, resulting in a larger payment from the federal government.

But when accounting for induced utilization—"the idea that people with supplemental coverage are likely to use more health care because their insurance pays for more of their cost"—PNHP estimated that the annual overbilling total could be as high as $140 billion.

"This is unconscionable, unsustainable, and in our current healthcare system, unremarkable," says the new report. "Medicare Advantage is just another example of the endless greed of the insurance industry poisoning American healthcare, siphoning money from vulnerable patients while delaying and denying necessary and often lifesaving treatment."

Even if the more conservative figure is accurate, PNHP noted, the excess funding that MA plans are receiving each year would be more than enough to expand traditional Medicare to cover dental, hearing, and vision. Traditional Medicare does not currently cover those benefits, which often leads patients to seek out supplemental coverage—or switch to an MA plan.

The Congressional Budget Office has estimated that adding dental, vision, and hearing to Medicare and Medicaid would cost just under $84 billion in the most costly year of the expansion.

"While there is obvious reason to fix these issues in MA and to expand traditional Medicare for the sake of all beneficiaries," the new report states, "the deep structural problems with our healthcare system will only be fixed when we achieve improved Medicare for All."

Bolstered by taxpayer subsidies, Medicare Advantage has seen explosive growth since its creation in 2003 even as it has come under fire for fraud, denying necessary care, and other abuses. Today, nearly 32 million people are enrolled in MA plans—more than half of all eligible Medicare beneficiaries.

Earlier this year, the Biden administration took steps to crack down on MA overbilling, prompting howls of protest and a furious lobbying campaign by the industry's major players, including UnitedHealth Group and Humana. Relenting to industry pressure, the Biden administration ultimately agreed to phase in its rule changes over a three-year period.

Leading MA providers have also faced backlash from lawmakers for handing their top executives massive pay packages while cutting corners on patient care and fighting reforms aimed at rooting out overbilling.

As PNHP's new report explains, MA plans are paid by the federal government as if "their enrollees have the same health needs and require the same levels of spending as their traditional Medicare counterparts," even though people who enroll in MA plans tend to be healthier—and thus have less expensive medical needs.

"There are several factors that potentially contribute to this phenomenon," PNHP's report notes. "Patients who are sicker and thus have more complicated care needs may be turned off by limited networks, the use of prior authorizations, and other care denial strategies in MA plans. By contrast, healthier patients may feel less concerned about restrictions on care and more attracted to common features of MA plans like $0 premiums and additional benefits (e.g. dental and vision coverage, gym memberships, etc.). Insurers can also use strategies such as targeted advertising to reach the patients most favorable to their profit margins."

A KFF investigation published last month found that television ads for Medicare Advantage "comprised more than 85% of all airings for the open enrollment period for 2023."

"TV ads for Medicare Advantage often showed images of a government-issued Medicare card or urged viewers to call a 'Medicare' hotline other than the official 1-800-Medicare hotline," KFF noted, a practice that has previously drawn scrutiny from the U.S. Senate and federal regulators.

PNHP's report comes days after Cigna, a major MA provider, agreed to pay $172 million to settle allegations that it submitted false patient diagnosis data to the federal government in an attempt to receive a larger payment.

Dr. Ed Weisbart, PNHP's national board secretary, toldThe Lever on Wednesday that such overpayments are "going directly into the profit lines of the Medicare Advantage companies without any additional health value."

"If seniors understood that the $165 coming out of their monthly Social Security checks was going essentially dollar for dollar into profiteering of Medicare Advantage, they would and should be angry about that," said Weisbart. "We think that we pay premiums to fund Medicare. The only reason we have to do that is because we're letting Medicare Advantage take that money from us."

13 notes

·

View notes