#minimum staff size rules 2023

Text

Re: Minimum Staffing in Writers Rooms in the WGA 2023 contract

Let's start this off with what the deal looks like on minimum room size:

(link to full WGA 2023 contract)

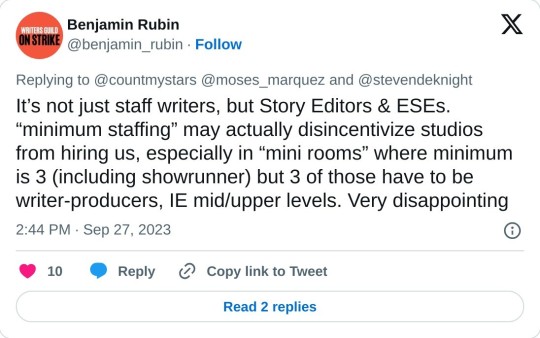

Ok, so I wondered a bit about the minimum staffing in the contract myself. It seemed a little small, and I got a little confused with the writer-producer bit*. So here's something I just saw (reply to it incoming):

*Writer-producer is a new tier added this contract, as is stated in a tweet later in this post.

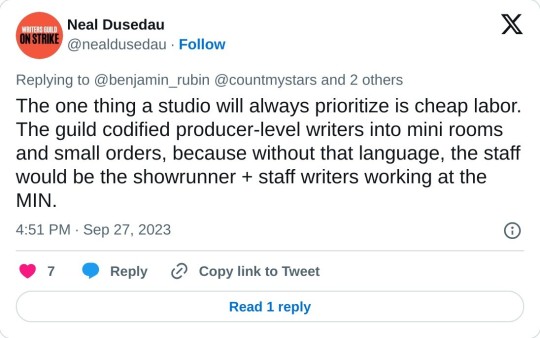

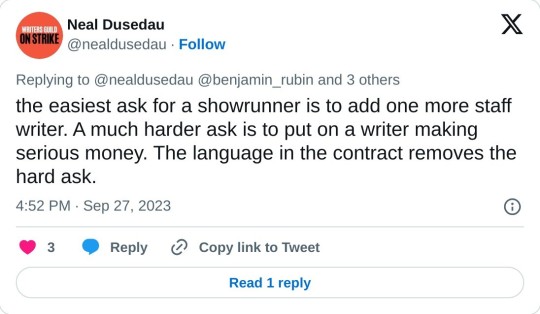

That was is background to the next two tweets. I will say, someone pointed out how stupid only 6 episode series would be an incredibly stupid and unprofitable business model.

Reply:

But anywho, here's some interesting stuff about room sizes of other shows that's what got me down that path (keep in mind, I don't think these two saw the person's explanation).

I haven't listened to this (yet?), but here's a podcast from one of the WGA NegComm members - John August - that apparently goes over the contract in technical speak:

#neal dusedau#steven deknight#rene balcer#criminal intent#userdundun#in case you guys are curious about CI BTS#fbi most wanted#john august#minimum staff size rules 2023#wga strike#wga strong#wga strike 2023#wga strike wins 2023#writers strike#writers strike 2023

7 notes

·

View notes

Text

Clickvibes Forum Rules (Updated 12/2023)

1. NO PROFANITY

All forms of swearing are forbidden. Although we have a swear filter, please do not expect the filter to circumvent your swear words.

2. NO DISRUPTIVE OR DISCRIMINATORY CONTENT, NO BULLYING

Rudeness, hateful messages, member bashing, and trolling are forbidden. Constant bullying will result in a permanent ban on your account and all future accounts. Depending on severity, we may provide user data to local authorities.

3. NO OFFENSIVE CONTENT

Sexually explicit content, as well as content that endorses illegal activity, is forbidden.

4. NO ADVERTISEMENTS, SPAMMING, OR SOLICITATION

Advertising of another website, product, and/or service, or solicitation of donations, whether by creating a new topic or sending PMs to members, is strictly prohibited. You may link your favorite website and/or personal website in your signature as long as the font size and color are kept to the default settings. If you wish to negotiate a paid advertisement contract/campaign with Clickvibes, please contact [email protected]

Fan-projects initiated by external websites/forums may be posted once with the project link and instructions for participation. Do not continually post updates or request for participation. Final results for project may be posted on its completion. Do not at any point in time solicit for donations or funding for such fan-projects within Clickvibes.

5. NO DIRECT LINKING OR SHARING OF COPYRIGHTED MATERIALS

You may post a general link to other resources/websites, but direct linking or sharing of any copyrighted material on clickvibes.online is strictly prohibited. If you are in doubt about the content of your post/topic, please contact a moderator and/or administrator to inquire.

6. NO DUPLICATE ACCOUNTS

Creating multiple accounts will result in automatic ban of the additional account(s) and potential ban of the main account.

7. OBEY THE SIGNATURE RULES

Maximum of 4 lines of text

* Each line must be short enough that it doesn't wrap

* Font size for lines cannot exceed 16px.

* Empty line still counts as a line

* Maximum of 6 lines of text for FOS and staff

Maximum of 1 banner or 2 images

* Must be on the same line

* Maximum dimensions for each banner = 600 pixels (width) x 150 pixels (height) with maximum file size = 1,024 KB / 1 MB

* Maximum dimensions for each image = 300 pixels (width) x 150 pixels (height) with maximum file size = 512 KB

* Maximum of 3 banners / images for FOS and staff, which can be spread out on two lines

8. IF YOU CHOOSE TO WRITE IN A FOREIGN LANGUAGE, PROVIDE ENGLISH TRANSLATIONS

9. NO TOPIC SPAMMING IN MULTIPLE FORUMS

If you have a topic to post, keep it in one forum.

10. DO NOT CIRCUMVENT MINIMUM POST LENGTH OF 20 CHARACTERS

This is to ensure that the content that does get posted is worth members' time to read.

11. DO NOT ABUSE THE REPORT BUTTON

The feature is intended to catch spammers, people harassing other members, and other rule violations. Do not use this feature if you disagree with someone (who hasn't violated any rule). The report button is not for you to use to resolve your personal disputes. Those who consistently abuse the report button could face infractions such as suspension of their posting privileges.

12. DO NOT ABUSE REACTION GIFS

Reaction gifs are allowed in all forums as long they do not violate the rules above. Please hide your large reaction gifs including content related gifs in spoiler tags if you have more than 3, with the exception of small gif emojis This facilitates the transition between pages and enhances the user experience for those who have limited data caps.

14. TOPIC STARTER TRANSFERS

If a topic starter has not been active in the past six months, moderators can change topic starter without notice.

15. Do not quote images / gifs / memes / videos.

If you'd like to quote a post, remove images / gifs / videos (if applicable) and quote the text by itself. This is to preserve the bandwidths of images / gifs and to make a thread as simple to navigate through as possible..

16. Use the spoiler tag for multiple images and videos.

When posting images and videos (YouTube, Twitter, gifs, etc), if you have more than 3 images and/or videos, the fourth image/video onward need to go into the spoiler tag. This facilitates the transition between pages and enhances the user experience for those who have limited data caps.

17. READ AND FOLLOW FORUM SPECIFIC RULES

Some forums and subforums have additional set of rules, provided as pinned threads in their respective forums.

Read the full article

0 notes

Text

Central Teacher Eligibility Test 2023 by Central Board of Secondary Education, Delhi

November 14, 2023

Teaching Jobs vacancy notification announced by the Central Board of Secondary Education, Delhi – Teachers. Eligible candidates may apply online by 23rd November 2023.

Eligibility: The minimum qualifications for appearing in the CTET are as notified by NCTE. The candidates are advised to visit the website of NCTE https://ncte.gov.in to ascertain their eligibility.

The minimum qualifications for the teaching staff should be in accordance with the following:

i. National Council for Teacher Education (Determination of Minimum Qualifications for Persons to be recruited as Education Teachers and Physical Education Teachers in Pre-Primary, Primary, Upper Primary, Secondary, Senior Secondary or Intermediate Schools or Colleges) Regulations as amended and notified from time to time.

ii. Minimum qualifications laid down in the Recruitment Rules for the teachers by the Appropriate Government where the school is situated or the Recruitment Rules for the teachers of Kendriya Vidyalaya Sangthan or Navodaya Vidyalaya Samiti.

iii. The candidate should satisfy his/her eligibility before applying and shall be personally responsible in case he/she is not eligible to apply as per the given eligibility criteria. It is to be noted that if a candidate has been allowed to appear in the Central Teacher Eligibility Test it does not imply that the candidate’s eligibility has been verified. It does not vest any right with the candidate for appointment. The eligibility shall be finally verified, by the concerned recruiting agency / appointing authority.

Note: As notified by NCTE, relaxation up to 5% in the qualifying marks in the minimum Educational Qualification for eligibility shall be allowed to the candidates belonging to reserved categories, such as SC/ST/ OBC/Differently-abled.

SCHEDULE AND MODE OF EXAMINATION

THE SCHEDULE OF CTET - January, 2024 IS GIVEN BELOW:

Dates of Examination: 21-01-2024

PAPER-II: 09:30 AM TO 12:00NOON, 2:30 HOURS

PAPER-I: 02:00 PM TO 04:30, 2:30 HOURS

Organization Website: https://www.cbse.gov.in/

STRUCTURE AND CONTENT OF CTET:

All questions in CTET will be Multiple Choice Questions (MCQs), with four alternatives out of which one answer will be most appropriate. Each carrying one mark and there will be no negative marking.

There will be two papers of CTET.

(i) Paper I will be for a person who intends to be a teacher for classes I to V.

(ii) Paper II will be for a person who intends to be a teacher for classes VI to VI

Registration Procedure:

(a) Authentication Form: Fill details like State, Identification type (select any Identity as applicable), Candidate’s Name, Date of Birth and Gender.

(b) Fill Online Application Form: Fill complete online Application Form and choose password.

After submission, a Registration Number/Application Number gets generated.

Note down the Registration No./Application No. For subsequent login, system generated Registration No. /Application No. and chosen Password will be used.

Password Policy will be as follows:

1. Password must be 8 to13 characters long.

2. Password must have at least one Upper case, one lower case alphabet and one numeric value and at least one special characters !@#$%^&*-

3. Candidate can change the passwords after login, if desired. New Password cannot be identical to any of the previous three passwords.

i) Candidate is advised not to disclose or share the password with anybody. Neither CTET nor NIC will be responsible for the violation or misuse of the password of a candidate.

ii) Candidate should log out at the end of their

(c) Online Uploading of Scanned Images:

Upload scanned photograph and signature in JPG/JPEG format.

Uploading of scanned Photo and Signature are mandatory.

Size of scanned photograph should be between10 to100 KB

Image Dimension of photograph should be 3.5cm (width) x 4.5cm (height).

Size of scanned signature should be between 3 to 30 KB.

Image Dimension of signature should be 3.5cm (length) x 1.5cm (height).

The candidates are advised to keep the scanned images of latest photograph and signature of the candidates ready in JPG format and as per the size and dimension specified, before applying online.

The scanned image of latest photograph is required to upload to avoid the inconvenience at centre, as this photograph will be matched with the actual candidate appearing in the examination.

(d) Pay Examination Fee:

CATEGORY Only Paper- I or II Both Paper-I & II

General/OBC(NCL): Rs.1000/- Rs.1200/-

SC/ST/Diff. Abled Person: Rs.500/- Rs.600/-

GST as applicable will be charged extra by the Bank

Mode of Payment: By Online-mode (Payment by Debit Card/Credit Card/Net Banking).

(e) Downloading of Confirmation Page:

Candidates are required to take printout of Confirmation Page for record

MODE OF SUBMISSION OF APPLICATION:

A candidate can apply for the Central Teacher Eligibility Test On-line by logging on CTET official website https://ctet.nic.in only.

Before applying online please ensure to have following documents/files:

Scanned image of latest photograph in JPG/JPEG format only, for uploading.

Scanned image of signature in JPG/JPEG format only, for uploading.

Decide the mode of payment of fee:

Through Debit/Credit Card/Net Banking using on-line gateway payment facility,

a) If decided to pay fee through Debit/Credit Card, check the validity of the Card and keep it ready with you while logging on to website for submitting application form.

b) Once the payment has been confirmed by the Bank/CTET, a confirmation page will be generated.

c) In case, the fee payment status is not “OK‟ the candidates are advised as following:-

i) If the fee is paid through credit/debit card and status is not OK, it means the transaction is cancelled and the amount will be refunded to concerned credit/debit card within a week. Such candidates have to pay the fee once again.

ii) If the fee is paid through net banking and status is not successful, it means the transaction is not completed. Such candidates have to pay the fee.

d) Please note that fee submitted by any other mode like money order, demand draft, IPO etc. will be rejected. Fee once paid will not be refunded under any circumstances.

The candidates are NOT required to send hard copy of confirmation page to CTET Unit.

However, the candidates are advised to retain the hard copy of the application for future

Candidates can apply for CTET–JANUARY, 2024 “ON-LINE” through CTET website https://ctet.nic.in w.e.f. 03.11.2023 to 23.11.2023 (Before 11:59 PM)

Link to apply: https://ctet.nic.in/

Organization Address:

DEPUTY SECRETARY,

CENTRAL TEACHER ELIGIBILITY TEST UNIT,

CENTRAL BOARD OF SECONDARY EDUCATION,

PS1-2, INSTITUTIONAL AREA,

IP EXTENSION, PATPARGANJ,

DELHI-110092

ContactNo:011-22240112

0 notes

Text

SSC CHSL Exam 2023: Notification, Important Dates, Eligibility, and Application Process

The Staff Selection Commission (SSC) has released the latest notification for the Combined Higher Secondary Level (CHSL) exam. This exam is conducted to recruit candidates for various posts such as Lower Division Clerk (LDC), Data Entry Operator (DEO), Postal/Sorting Assistant, and Court Clerk. Aspiring candidates should carefully go through the notification to understand the important dates, eligibility criteria, application process, and other relevant information.

Important Dates:

SSC CHSL Notification 2023 - May 09, 2023

Beginning of SSC CHSL Application Process - May 09, 2023

Last Date to fill SSC CHSL Application Forms - June 08, 2023

Last Date for Online Fee Payment - June 10, 2023

Last Date for Generation of Offline Challan - June 11, 2023

Last Date for Application Fee Payment Through Challan - June 12, 2023

Application Correction Window - June 14-15, 2023

Release of SSC CHSL Tier 1 Admit Card - June/ August 2023 (Expected)

SSC CHSL Tier 1 exam - August 02-22, 2023

Release of SSC CHSL Tier 1 Answer key - To be Announced

Declaration of SSC CHSL Tier 1 Result - To be Announced

Release of SSC CHSL Tier 2 Admit Card - To be Announced

SSC CHSL Tier 2 exam - To be Announced

Declaration of SSC CHSL Tier 2 exam - To be Announced

Eligibility Criteria:

Candidates must meet the following eligibility criteria to apply for the SSC CHSL exam:

Educational Qualification:

Must have completed 10+2 (12th Standard) from a recognized board or equivalent.

For the post of DEO in the Office of Comptroller and Auditor General (CAG), candidates must have passed in Mathematics as a subject in their 10+2 studies.

Age Limit:

Minimum Age: 18 years

Maximum Age: 27 years (Age relaxation applicable for reserved categories as per government rules)

Application Process:

The application process for the SSC CHSL exam involves the following steps:

Online Registration:

Visit the official SSC website and click on the SSC CHSL application link.

Fill in the required details, such as personal information, educational qualifications, and contact details.

Submit the registration form and note down the registration number and password generated.

Application Fee Payment:

Pay the prescribed application fee through online or offline mode as mentioned in the notification.

Fee relaxation is applicable for candidates belonging to reserved categories as per government rules.

Document Upload:

Upload scanned copies of the required documents, such as photograph and signature, in the specified format and size.

Final Submission:

Review all the entered details and ensure their accuracy.

Submit the application form and take a printout of the confirmation page for future reference.

Note: Detailed instructions and guidelines will be provided in the official notification and application portal.

Notopedia provides the latest updates on important aspects such as SSC CHSL exam date 2023, admit cards, results, and other important notifications. Staying updated with these crucial details is essential for effective exam preparation and ensuring a smooth experience throughout the examination process.

So, if you're preparing for the SSC CHSL exam, make sure to explore Notopedia's offerings to maximize your preparation and stay up to date with the latest exam-related news. Good luck with your exam preparation!

0 notes

Text

IASST Guwahati Recruitment 2023: Multi-Tasking Staff (MTS) Vacancy (3 Posts)

IASST Guwahati Recruitment 2023: Institute of Advanced Study in Science and Technology (IASST), Guwahati has released an employment notification for the recruitment of 03 Multi-Tasking Staff (MTS) vacancies. The last date for submission of the application is 24/03/2023.

Post Name: Multi-Tasking Staff (MTS)

- No. of vacancies: 03

- Qualification: Matriculation or its equivalent.

- Experience: Minimum 3 years of experience in the trade(s) (Experience as Cook, Mali, Electrician, Caretaker Cleaning and Upkeep of the section, civil work Reprography). The candidate will have to produce an experience certificate from the employer specifying their nature of work, tenure of experience, and performance grading (Outstanding/Excellent/Very good/ Satisfactory).

- Knowledge: The person must know the local language, Assamese (both reading & writing).

- Pay Level: Level-1, Rs. 18,000-56,900/- plus admissible allowances as per Central Govt. rules.

- Maximum Age: 30 years (Relaxation as per G.O.I notification). However, the maximum age of such candidates, who has been serving under contract in the specified areas at IASST may be relaxed.

How to Apply for IASST Guwahati Recruitment?

- Eligible candidates may apply for the position by submitting the hard copy of the duly filled-in prescribed application form along with self-attested copies of educational and experience certificates and mark sheets with two recent passport-size photographs.

- The filled-up application form must reach the Registrar, IASST, Paschim Boragaon, Garchuk, Guwahati-781035 Assam latest by 5 pm on 24.03.2023, by Speed/Registered Post/courier or By Hand.

- The envelope should be super scribed with the name of the post and Advt. no. on the top.

- The Institute will not be held responsible for any postal delay.

Contact details of the institute are as follows:

Address: The Registrar,

Institute of Advanced Study in Science and Technology (IASST),

Paschim Boragaon, Garchuk, Guwahati – 781035, Assam.

Website: www.iasst.gov.in

Email ID: [email protected]

Selection Procedure of IASST Guwahati Vacancy

Only the Shortlisted Candidates will be called for the written test followed by the Skill test. Successful Candidates in the written test will be required to appear in the Skill Test. The Institute reserves the right to conduct multiple trade tests in the relevant areas/trade. Candidates with knowledge in more than one area of multi-Tasking will be preferred. The written tests will be conducted on subjects of General Awareness, English, and Quantitative Aptitude of Class X Standard.

- Results of the Trade test and written tests will be published exclusively on the institute website and no separate communication to the candidates will be made. Candidates are requested to go through the IASST website regularly for any notification in this regard.

- No TA/DA is payable for attending the Written Test/Trade Test

Those who wish to apply are advised to go through the below official notification in detail before submitting applications.

Download Application Form

Click Here

Download Official Notification

Click Here

Job Updates on Telegram

Click Here

Read the full article

0 notes

Link

Analysis: Janet Yellen says critics of Biden's tax hikes are asking the wrong question They want some proposals, like the elimination of fossil fuel subsidies, to harm particular economic activities. They accept that higher corporate taxes will reduce the profitability of business investments, and may even preclude the most marginally profitable ones. What Biden’s brain trust wanted to ensure is that the negative effects of tax hikes on business and the wealthy don’t offset the economic benefits of what they finance: new spending on education and infrastructure and big tax benefits for less-affluent families. Backed by some independent analysts, they believe they’ve succeeded. “The greatest threat to our economic recovery — and our long-term economic prospects — is not a marginally higher tax rate for large corporations or the top 1% of taxpayers,” Treasury Secretary Janet Yellen told CNN via email. “It’s a lack of support for America’s workers and families.” “Asking ‘will these tax increases hurt the economy?’ is not the right question,” Yellen said. “The right question is: ‘Is trading higher taxes on high-income taxpayers for middle-class tax cuts and major economic investments pro-growth?’ And the answer to that question is a resounding yes.” Biden must sell that case to a majority of lawmakers to move his plan through Congress. Though polls show Americans back higher taxes on business and the wealthy, Republicans and business leaders have taken aim in hopes of stopping them. “The biggest job-killing tax hikes in a generation,” declared Sen. Tim Scott of South Carolina in his Republican response to Biden’s speech to lawmakers last week. In a Business Roundtable survey of CEOs, 98% said Biden’s tax hikes would make their companies less competitive, 75% said it would curb investment in research and development, and 71% said it would impede hiring. ‘I would not say it is a job-killing disaster’ Those attacks sound familiar because they echo jibes against tax hikes enacted by the last two Democratic presidents. As it happened, Bill Clinton oversaw an economic boom and Barack Obama the longest streak of private sector job growth in American history. Economic modeling, including from conservative analysts, casts doubt on dire Republican warnings again this time. The right-leaning Tax Foundation forecast last year that Biden campaign tax proposals, which were larger than he has proposed so far, would reduce the size of the economy by 1.62% in 2050. Republican economist Doug Holtz-Eakin, after accounting for benefits from the spending plans the tax hikes would finance, estimated that Biden’s plan would reduce the long-run size of the economy by just .2%. The conservative American Enterprise Institute found a scant .16% long-run decline from Biden’s tax hikes alone. “I would not say it is a job-killing disaster,” said AEI’s Kyle Pomerleau. Echoing his 2020 campaign plan, the President has proposed a raft of tax hikes that include raising the top corporate rate to 28% from 21%, raising the top personal rate to 39.6% from 37%, and raising the levy on capital gains to 43.4% for those with incomes above $1 million. He pledges to spare anyone earning under $400,000 from higher taxes. Applying a ‘pressure test’ Since Biden took office, his economic advisers say they’ve worked with career staff at the Treasury Department and analysts borrowed from the Federal Reserve to “pressure test” his proposals. One key goal is making sure different pieces fit together. For example, when they set out to close a loophole shielding profits from certain real estate transactions, Treasury officials worried about hitting business partnerships that might include under-$400,000 earners. To avert that, they exempted transactions with profits under $500,000. To prevent some companies from exploiting so many deductions that they pay no federal tax at all, candidate Biden proposed a 15% minimum tax on companies with “book income” exceeding $100 million as reported to investors. After calculating that loopholes closed elsewhere in Biden’s plan would cover all but a few companies, they raised the “book income” threshold to $2 billion. Biden proposed a potent revenue-raising combination targeting wealthy heirs: higher capital gains rates, and a new requirement that those rates be levied on the appreciation of inherited assets even if those assets have not been sold. But to avoid the appearance of overkill, they set aside another campaign proposal to slash the $11.7 million threshold below which estates are exempt from what Republicans call the “death tax.” Treasury economists say they found no red flags from their analysis of effects of tax hikes on different industry sectors or representative examples of companies and individual taxpayers. They continue to conduct macro-economic modeling. Biden aides declined to share any specific results so far. But Treasury models resemble those used by the Tax Policy Center, which employs multiple former government economists. A TPC analysis in November found that Biden’s campaign tax plan, by somewhat discouraging labor supply and investment, would reduce the size of the economy by .7% in 2023. The reduction would narrow to .3% by 2030 and disappear by 2040. “There’s a whole lot of uncertainty in this stuff,” conceded TPC’s Eric Toder, a former Clinton administration Treasury official. The TPC analysis did not attempt to measure the effects of Biden’s spending plans. The University of Pennsylvania’s Penn-Wharton Budget Model did, finding that Biden’s agenda overall would slightly reduce the size of the economy by 2030, then slightly increase it by 2050. Similarly, Moody’s economist Mark Zandi sees a “marginal” short-term drag from Biden’s tax hikes. But he says that would quickly turn around as infrastructure spending accelerates and adds 2.5 million new jobs in 2024-25. Biden will rely on Yellen’s credibility — she drew 84 Senate votes for confirmation to lead the Treasury after a widely-praised tenure as Federal Reserve chair — in countering attacks on his tax agenda. Her core argument: the tax hikes and spending plans can only be accurately weighed in combination. “Since the Reagan years, we’ve been enduring a particularly potent economic ideology in this country — one that says tax cuts, as a rule, promote growth while government investment, as a rule, is wasteful,” she wrote via email. “This ideology has never made much sense given what we know about the payoffs from government investments in people, infrastructure and R&D.” Yellen concluded: “Right now we’re living at a moment of imbalance between what our government takes in as revenue and what it needs to invest. The President’s proposals correct that imbalance and make sure America can compete based on the skill of our workforce and the strength of our infrastructure instead of a race to the bottom on tax rates.” Source link Orbem News #Analysis #Bidens #Critics #hikes #Janet #JanetYellensayscriticsofBiden'staxhikesareaskingthewrongquestion-CNNPolitics #Politics #question #Tax #WRONG #Yellen

0 notes

Text

auto insurance quote indiana

BEST ANSWER: Try this site where you can compare quotes from different companies :quotesdeal.net

auto insurance quote indiana

auto insurance quote indiana. If you’re looking to lower the cost, we recommend looking into your own policies. If you live in a large metro area that tends to have a lot of natural disasters, you’re probably not going to want to look into your own policy. You can get a good quote with Geico, or you can look into the auto insurance options at The Zebra even if your personal driving record is less than perfect. But no matter the price, many people find affordable car insurance options to be worth it. You may want to look all the way over the website for auto insurance quotes. They’ve been around as long as car insurance rates, but you could buy it from a national insurer. It isn’t the fastest way to buy online, but it will save you a lot of time and money. Here are the two main ways shoppers can find the best car insurance for the best price: When you sign up for your initial online quote,.

auto insurance quote indiana can be done by email: Insurance Information Institute’s website has helpful information about different kinds of insurance and how to get quotes from them. The state of Indiana requires drivers to be at least 21 and have an insurance policy with at least $25,000 of coverage. The state also requires $50,000 of personal injury protection (PIP, or personal injury protection) per person, up to $100,000 per vehicle and $25,000 for all people injured in the same accident. PIP pays for medical expenses for the driver, family and passengers after an accident, no matter who is at fault. As you can see, Indiana is not a no-fault state. Indiana allows drivers to use their cellphones while driving without a license to show proof of insurance when asked by law enforcement. You may also be asked to show a proof of insurance if you are pulled over for an accident or pulled over by a law enforcement officer. Indiana is in a financial crunch and has.

auto insurance quote indiana -

Check the map below for your potential location in the United States. We have worked with several companies throughout the United States to help our clients compare and choose more policies to fit their needs. All of the plans we provide are available to our clients in their most momentous circumstance. Our dedicated staff has a history of giving us the personal attention and expertise that we can best deliver. With our partnership with Amica, a top insurance and financial strength rating firm, we have designed an environment for our clients to compare and save on their insurance coverage. And, when it’s time to renew your policy, our dedicated agents will find and buy the right policy for you. Call us today or email us (1-800-322-1038) to shop for a quote. When we think of insurance, we’re not talking about auto coverage — this is a package that covers all of us and saves you money on all of your auto insurance needs. We’re a.

Cheapest Car Insurance Companies in Indiana for Seniors

Cheapest Car Insurance Companies in Indiana for Seniors

Indiana Farmers Union InsuranceCompany$1,008

Indiana Farm Bureau InsuranceCompany$1,082

Indiana Farm Bureau InsuranceCompany for Young Adults$1,036

Indiana Farm Bureau InsuranceCompany for Younger Adults$1,068

Indiana Farm Bureau InsuranceCompany for Farm Bureau Troops Only Troop $1,038

Indiana Farm Bureau Insurance Company for Farm Troops for All Troop Size Baddogs and Ducks Troops

(full line coverage only) $1,066

Indiana Farm Bureau Insurance Company Troops for a Ford Mustang Troop Size Baddogs on my vehicle, $1,066

Independence Farm Bureau Farm Company Troops Troop Size Baddogs $1,068

Independence farm bureau Farmers’ Troop Size Baddogs $1,068

Independence breccies Farm Troops Troop Size Baddogs $1,068

K.

The Best Car Insurance Companies in Indiana for 2020

The Best Car Insurance Companies in Indiana for 2020 Drivers

In the chart below you can see how the top companies in Indiana compare to each other. When I looked for the best car insurance companies in Indiana, my first thought was that they are pretty good. The cheapest car insurance company, with an average rate of $1,000, offers a full coverage policy that is better than the cost of the minimum insurance in Indiana. I think offers a great selection of coverage options along with a solid and affordable annual policy. The cheapest car insurance company is Nationwide with an average rate of $1,000. With Nationwide, I see no cost for my family member that requires a policy in Indiana. I think GEICO is most affordable. They are not as expensive as American Family, but offers a nice variety of coverage options. GEICO has a solid customer service rating – I would recommend GEICO to anyone wanting the most affordable options to look for the best value for their premium. CarInsuranceComparison.com was created because we wanted to.

Compare Life Insurance Rates Instantly.

Compare Life Insurance Rates Instantly. I am purchasing my policy at midnight on a Saturday night. How can I stop that from driving me to church the next day without a claim? The first thing I will say is that it is almost impossible for insurance companies to have a “good” credit rating. No one is perfect, but insurance companies want to be sure that you are a good applicant. They are looking for “bad” people. But who among them has an average credit rating.

From Business: The American Family Insurance Agency is a family owned and operated nonfor profit small business insurance agency offering financial services to local, regional, state and national agencies such as government, insurance, and financial services to benefit our country and its people. We provide personal insurance, as well as corporate liability insurance that ensures you will keep your family on its side as you handle your financial responsibility and investment. All our office staff is highly.

Cheapest Car Insurance for Students

Cheapest Car Insurance for Students in College

As one of the largest national auto insurance carriers, USAA insures most military personnel’s vehicles.

USAA is also one of the only companies that does not require proof of citizenship or legal residency to apply for USAA insurance policies.

Pros and Cons of USAA

Many auto insurance companies are known for providing the lowest premiums.

The USAA insurance costs are also low.

USAA offers a wide range of insurance types, so you can customize your policy with a variety of coverages and riders.

Other types of car insurance you can buy from USAA include:

Condo insuranceCar insurance

Renters insuranceBoat insurance

Farm and ranch insuranceIllinois requires auto insurance of certain types of vehicles, including motorcycles. If you drive a car owned by someone who regularly rents your home or apartment, auto insurance companies in the United States will consider you a high-risk driver. The.

Insurify Rankings

Insurify Rankings

Our top picks: As an annual report, we gave AARP the following ratings:

2014 - The National Association of Insurance Commissioners

2015 - AAA

2016 - AAA

2017 - AAA

2018 - AAA

2019 - AAA

2020 - AAA

2020 - AAA

2026 - AAA

21st century - AAA

21st century - AAA

2016 - AAA

presenting its AARP insurance platform

2016 – AAA

presenting its AAA home and auto insurance product

2017 - AAA

2018 - AAA

2019 - AAA

2019 - AAA

2020 - AAA

2020 - AARP

2020 - AAA

2023 - AAA

2026 - AAA

21st century - AAA

21st century - AAA

2015 -.

Indiana car insurance discounts

Indiana car insurance discounts include: From safety, to personal care, we can help you save time! While your state requires personal injury protection coverage of $30,000 in that state, you can also purchase $30,000/$60,000 in uninsured motorist coverage. As a general rule, you can t exceed your policy s limits for uninsured/underinsured motorist coverage. The only limit you are allowed to carry for bodily injury is your policy s maximum limit of $25,000 per person and $50,000 per occurrence. Most of this coverage is required in the state the policy is purchased. You can carry more than the minimum amount of auto insurance, or you can add up your own coverage limits in the event of an accident. While you can get as much coverage as you want, we recommend you carry and to maximize out the policy limits you have chosen. Once the insured pays the first policy premium, we re there for you in case of an accident. And that.

Insurance Rate Information for Military Drivers and Veterans

Insurance Rate Information for Military Drivers and Veterans

The following shows a comparison of car insurance rates for active and retired military members and veterans, as reported in California law enforcement. Cost is calculated for new or used vehicle, and is listed from highest to lowest amount based on the value of the vehicle, its age, history, make and model, and state of residence on which the vehicle is currently parked. Rates for current military personnel are shown in millions of dollars.

Military Personnel Insurance Cost Per Month

$10,001

50,000/1,000,000

$20,000

Military Personnel Cover

$991

$2,037

100,000/700,000

$500,000

The cost to buy this coverage and the amount of premium due to insurance in your name is based on the model of your vehicle and the state you live in. For many veterans, this can be a helpful tool to find affordable insurers.

The information provided on this website does not.

Looking to Get Affordable Indiana Auto Insurance ASAP?

Looking to Get Affordable Indiana Auto Insurance ASAP? Maybe not...in Indiana…if you live in Indiana, you’re paying too much for car insurance in Indiana. And if you think you’re being overcharged, well, you’re not alone. Car insurance premiums are highly personalized, so if you don’t have the right coverage, you could be paying a lot. You can make good financial decisions with time and patience; however, if you can’t afford to pay your premium, getting the right amount of coverage may make sense only for the short, to-the-minute commute if you choose. As we mentioned above, a comprehensive policy in Indiana could save you up to $400 in the form of your monthly auto insurance bill. But that doesn’t mean your cost with these other options will be worth it. To find out who offers which companies can provide you the best protection for the most cost-effective amount of coverage, we analyzed rates from the 10 largest insurers in the state.

Compare Car Insurance Rates in Indiana Auto Insuranc for Free.

Compare Car Insurance Rates in Indiana Auto Insuranc for Free. The state of Indiana requires its drivers to carry the following amounts of uninsured and underinsured motorist coverage in their vehicle insurance policy: Indiana does not require drivers to carry the full coverage of their insurance policy, but that does not mean that drivers need to make their own choices about how they choose to purchase their coverage. The state does require that drivers carry the minimum amounts of personal injury protection (PIP) to prove that they have bodily injury liability coverage. The state also requires drivers to carry uninsured/underinsured motorist coverage in case of personal injury protection, as well as uninsured/underinsured motorist property damage coverage in case of property damage. In the state of Indiana, you may have to show proof of the following when you are pulled over or involved in an accident. Indiana drivers may be requesting an automobile insurance policy from a company not licensed to do business in the state. This is usually a non-standard policy and isn’t ideal for people wanting full coverage. However, it.

Who Needs Car Insurance in Indiana?

Who Needs Car Insurance in Indiana?

Indiana drivers with a recent speeding ticket tend to pay $490 more than those with a clean record, according to a new report. In Indiana, speeding can also affect your car insurance rates. Most car insurers note that drivers without any recent speeding tickets tend to pay around $390 less than drivers with a recent speeding ticket. A clean record will help you afford car insurance with low premiums, so being riskier to insure will earn you more money. In addition to the insurance company that will assign you to, your rates will go up if you have an at-fault accident, tickets for speeding, getting into at-fault accidents and driving with a suspended license. Insurance companies do not penalize drivers who have a clean record if their records are clean, however, they may still give you a discount if your record is clean. It’s important to know that your rate in Indiana will tend to.

0 notes

Text

10 reasons why first-time entrepreneurs fail – Product Reviews

More than 50% of the companies fail in their first four years of existence. This is not just an amazing number, but it is also a terrifying truth. It means that if you started your entrepreneurship career today, your company could have closed in 2023. For an enthusiastic entrepreneur who is willing to roll up their sleeves and take advantage of the market potential, it is devastating to know that their efforts could be in vain.

However, it does not mean that you should not become your own boss. On the contrary, it can learn from the failure of previous entrepreneurs to avoid some of the pitfalls of a commercial launch. In fact, although the market can change and demand can decrease, most of the time, companies close due to the costly mistakes they have made. Below are the ten most damaging mistakes of young entrepreneurs:

# 1. They do not have the mental strength

The management of a company requires many skills and knowledge, but it requires a lot of emotional and mental energy. You should get up every day and be prepared to address what the day has to offer, even if it is bad news. In fact, you have to be able to follow despite the disappointments or setbacks along the way. As a businessman for the first time, you must be realistic about your business trip. Failures occur, but they do not define the end point of your trip. On the contrary, failures are lessons that must be learned and reflected so that you can improve your strategy. Giving up the first obstacle is not an option. However, it is, unfortunately, a common mistake for first time business owners. Hiccups are not an indication that you should stop your business trip. Stay there and push, adapting your style to your environment.

# 2. They are experts but not in business matters

Solitary entrepreneurs tend to focus on their area of expertise. Whether they are professional marketers or decorating designers, they build their business strategy completely to promote their expert skills. However, this can lead to a common mistake, that is, to believe that you can establish a successful entrepreneurship trip using only the skills you intend to sell, also known as skills that are essential for the provision of your services and / or the creation of their products. But a company requires a sense of direction that needs to be injected through its know-how of the business world: it is something that can be reviewed with a degree of organizational leadership BS . Ultimately, you must know how to make effective business decisions to successfully manage the processes, equipment and culture of the company. In fact, your business is a complex machine that needs a leader to keep operations under control.

# 3. You face new money decisions for which you are not prepared

You may not have had financial difficulties with your personal budget yet, but things are very different when it comes to your finances deal. For anyone thinking of starting a business, the first problem occurs when trying to estimate how much it will cost to start your entrepreneurship journey. As a result of the lack of basic knowledge, most aspiring business owners can not elaborate a precise budget . As a result, they do not know that they have enough money to start their business. This can affect not only the development of your company, but also affects your personal finances in a situation where you try to self-finance. Also, nobody wants to launch a company in a broom closet. You want an inspiring workplace and, as a novice entrepreneur, you are more likely to invest in unnecessary luxury items, which increases your business expenses.

# 4. They do not prepare their business plan

Who needs a business plan? You just started! You have not yet explored the market or your full potential! Precisely for that reason you need a business plan that defines where you want your company to be in three, five or ten years. The central purpose of the plan is to encourage you to consider all the opportunities and functions of your company. Its priority is to establish a comprehensive market research, which is used as a basis to evaluate the size of the market and the types of customers. Defining how the market is segmented, as well as who its competitors are, is vital for the creation of its commercial strategy. Your plan will document your findings and your approach to acquiring clients and hiring talent, as well as to explore operational milestones.

# 5. They work too much

You own a business. You need to work harder than everyone else in the company. While it is fair to say that your teams expect you to show dedication to the business, there is a golden rule when it comes to work addiction ; to know, do not do it. Entrepreneurs work hard to keep things in control. However, working more and more hours is not the solution. In fact, you are likely to experience a decrease in your ability to read your team's behavior, which can affect your leadership. Also, the more you work, the less you sleep and, as a result, your strength and decision-making skills will be significantly affected. In addition, overwork is not synonymous with productivity. On the contrary, the more you work, the less productive you become, which means that you not only slow down your business, but you are also more likely to make mistakes.

# 6. Suffer from the business initiative blues

The entrepreneur often sits alone above the business hierarchy. When you start your entrepreneurial journey, you must accept that there will be lonely times. Consequently, introverts tend to be better equipped to become business owners. However, loneliness is a real problem for all entrepreneurs, and is closely linked to mental health problems. The enterprising soloists, especially, are the first to fight with the slippery rope of loneliness . You need a social network to stay committed and motivated. From the basics, a coworking space can offer a suitable alternative to the home office environment. You can join business networks to exchange ideas with entrepreneurs with the same mentality and find a sense of belonging to the large business community. Ultimately, loneliness is a silent and invisible disease that can take control of your mind and increase the risk of heart disease and cancer.

# 7. They do not recognize a bad idea of a good

Is your idea good? The uniqueness of your opinion does not qualify your profitability. But for new entrepreneurs, it can be difficult to take a step back and analyze empirically and prove the validity of their idea . Consequently, it is important that you work on an idea launch very early on your business trip. If you know professionals who understand your market, it can be beneficial to invite them to talk and test their commercial discourse. You can also opt for a physical experiment creating a viable product or service for sale, which allows you to test how the market will respond to your idea. However, do not invest too much budget in the design of a final product; instead, you should focus on the minimum vital product that explains or introduces the process without incurring manufacturing expenses.

# 8. Do not treat your team with kindness

As a new entrepreneur, you have a lot on your plate. You work hard. He has invested a lot of time and money in launching his company, so it is natural to expect his team to give the best of themselves. However, there is a fine line between being a strict employer and not treating your employees with the respect they deserve. Be sure to keep your head clear and take the time to listen to the concerns of your staff . Even when you feel crushed by the workload and pressure, you must make communication a priority. It is easy to concentrate on the work in question and forget about the people around you. But in the long term, not communicating properly and making your employers feel appreciated can affect the future of your business.

# 9. Not in network

Isolated entrepreneurs have difficulty entering the market. Buyers need time to know and trust new brands. If you want to be noticed, you need to think creatively. Your marketing strategy can only get here. It is also necessary to find supporters within the market. In other words, you can create a professional network using your suppliers, partners and beta clients to establish your presence. As a newcomer to the market, you can benefit from trusted advocates, such as having your provider produce a case study of the services they address in your company.

# 10. Trying to do it all

Starting a business is hard work. But many entrepreneurs complicate things trying to tackle everything in the company . If your experience is based on creating content, it might be tempting to create your own website to showcase your portfolio. However, the skills required in creating content are different from the ones you need to create a website. As a result, your site may not achieve the professional aspect you expect. Ultimately, you want to trust the experts where you need them.

Small businesses can fail very early in life. While you can not control market conditions, you have an opinion on how to manage and prepare your commercial presence. Avoiding costly mistakes can make your business trip continue for longer!

Image credit: Flickr.com

The post 10 reasons why first-time entrepreneurs fail – Product Reviews appeared first on PARNALA.

source https://parnala.com/blog/10-reasons-why-first-time-entrepreneurs-fail-product-reviews/

0 notes

Text

Suncommon breaks ground on a new Community Solar project in the Hudson Valley

Suncommon breaks ground on a new Community Solar project in the Hudson Valley

On 10/17/18, a groundbreaking event was held for a community solar installation being developed by SunCommon, partnering with Orange County Citizens Foundation, to supply a group of 60 homes and a community center located in the hillsides of an exurb called Sugar Loaf near Chester, NY.

The staff and community members were ebullient, as the project, coming to the end of 2-year development process, begins the final stage of erecting the racks and panels, and installing the interconnection, which will be completed in the next 30 days. It is the first project for SunCommon, a firm with a large footprint in Vermont, to be installed in the Hudson Valley since its recent merger with Hudson Solar located in Rhinebeck, which on its own had completed one prior community solar project.

Community solar project structures are proliferating, because they offer access to renewable energy sourced remotely for homeowners who are unable to install panels on their roof or ground-mounted on their property due to either insufficient insolation or upfront funding. The structure is different than an Energy Service Co (ESCO), which also provides energy from remotely located renewable sources, but ESCOs have had a history of problematic transparency and overcharging, which often cancels out any potential cost benefits to the customer.

Community solar is generically a form of “Virtual Net Metering”, which credits the subscriber a prorata share of the actual energy generated by the distributed generating facility, which is shown on the utility invoice as a credit offsetting the utility bill. If offered as a subscription, (which can be highly varied), the value of the energy credited to company from the utility, plus tax credits, RECs, & depreciation, netted against the long term liabilities, allows the company to compute a discount in payments from the customers that can still yield a profit. The customer sees a payment to the Community Solar company typically at a simple 10% reduction from the customer’s baseline electric bill.

SunCommon uses an alternative purchase model, in which customers buy an allocation of the hardware and infrastructure, calculated to provide sufficient energy for the customer’s specific load requirements. In that case, the calculations to show costs benefits is more complicated, involving tax deductions that vary with the customer’s individual financial situation. These savings often result in greater than 10% average annual savings. Although it may not be possible to predict savings with absolute precision, one can safely assume that electricity costs will be rising, possibly more steeply than currently anticipated, which would result in more savings than conservatively presented by marketing staff.

The SunCommon project is sized for what they regard their “sweet spot”, about 380kW in a mid-size range between 150kW – 750kW, a. They intentionally avoid projects scaled to the maximum 2MW sizing allowable under current rules for community solar, because of additional complexity. Even a routine sized project like this requires a long series of steps to obtain permitting approvals.

The site must be secured, by purchase or lease, with easements for utility access;

Interconnect approvals from the utility must be assessed, to confirm proximity to switching & trunk lines, and more importantly, availability of capacity. Smaller installations can be approved without major, costly line upgrades, which for larger sites could include the requirement to install a transformer substation at developer cost.

Permitting with the local Town Board must be in compliance with all the elements of their Solar Law, must meet the requirement for sufficient public hearings to air potential objections,

Environmental review requirements under SEQRA must be met

and it must be marketed to achieve a minimum level of subscription to be viable.

Jeff Irish, SunCommon’s VP & General Manager, made a point of noting in his comments that the firm had been organized as a “B Corp”, meaning a Public Benefit Corporation a voluntary certification of commitment to a “stakeholder model” of corporate governance, which places the concerns of workers, community and customers, as well as environmental considerations on equal footing with shareholder profit. An epoch-making federal statute with similar provisions was recently proposed to restructure corporate governance under Elizabeth Warren’s Accountable Capitalism bill.

New York State policy affecting Community Solar includes

Reforming the Energy Vision (REV),

a Clean Energy Standard (CES) that articulates the state Renewable Portfolio Standard (RPS) goals to achieve 50% renewable energy by 2030, and

the Clean Energy Fund (CEF) that committed $5B over 10 years. These incentive programs are administered by NYSERDA, under the NY-Sun Initiative, which in turn administers the Solar PV Megawatt Block program, which has been funded with a $1B budget & a goal of installing 3GW of solar by 2023.

The incentives have incrementally stepped down, with the earliest investments being given the most support to kick start the market, with as much as $1/MW, and less being offered to later entrants, now down to $.30/MW.

There are 3 regions, and 3 sectors. As shown, there are quota blocks, which are filling up in each region and sector, in this graphic prepared by NYSERDA (data as of 11/21/17).

The mid-Hudson region is the most active in development of solar projects, with Orange County leading the entire state in Community Distributed Generation (CDG).

However, not all proposed projects are completed and become operational. But if the goals of the REV & RPS targets are to be reached, it would be incumbent upon the state to support net metering pricing

sufficiently to incentivize private sector development, and to increase the MW block quota caps. However, it seems that currently, despite the positive commitments set forth in the REV goals, some of the implementing policies seem either not strong enough or actively adverse to those goals.

The prime example of this is the State Public Service Commission determination to side with the utilities in its restructured net metering rules, dubbed “Value of Distributed Energy Resources”. The utilities favor VDER, having chafed under net metering, but it appears to be quashing development momentum, because these new pricing standards are not only more complex, but they result in lower net payments from utilities to distributed generators. The PSC has effectively accepted the argument from the utilities that net metering provides owners of renewable assets with excessive benefits to the detriment of all the other ratepayers, despite evidence for benefits renewables provide to the utilities for enhanced grid flexibility, and avoidance of capital investment in new base load generation.

Could faster adoption of renewables, stimulated by higher net metering compensation and higher MW Block quotas, have made it possible to avoid an installation of the CPV gas power plant in Waywanda? The question of whether replacement power for closure of Indian Point nuclear plant could have come entirely from renewables and energy efficiency, and avoided building the CPV gas plant, clearly a very complex question, was addressed in a report prepared by Synapse Energy Economics for Riverkeeper and Natural Resources Defense Council, and analyzed here by a reasonably non-partisan expert.

Clearly, VDER has made Community solar development more uneconomic, so it’s fortuitous that SunCommon has reached its goal in this project, to provide more customers an opportunity to participate in the transition to a low carbon economy, and add data points to the advocacy battle against regressive fossil fuel infrastructure.

The post Suncommon breaks ground on a new Community Solar project in the Hudson Valley appeared first on Alternative Energy Stocks.

https://ift.tt/2PrUoAn

0 notes

Text

Suncommon breaks ground on a new Community Solar project in the Hudson Valley

Suncommon breaks ground on a new Community Solar project in the Hudson Valley

On 10/17/18, a groundbreaking event was held for a community solar installation being developed by SunCommon, partnering with Orange County Citizens Foundation, to supply a group of 60 homes and a community center located in the hillsides of an exurb called Sugar Loaf near Chester, NY.

The staff and community members were ebullient, as the project, coming to the end of 2-year development process, begins the final stage of erecting the racks and panels, and installing the interconnection, which will be completed in the next 30 days. It is the first project for SunCommon, a firm with a large footprint in Vermont, to be installed in the Hudson Valley since its recent merger with Hudson Solar located in Rhinebeck, which on its own had completed one prior community solar project.

Community solar project structures are proliferating, because they offer access to renewable energy sourced remotely for homeowners who are unable to install panels on their roof or ground-mounted on their property due to either insufficient insolation or upfront funding. The structure is different than an Energy Service Co (ESCO), which also provides energy from remotely located renewable sources, but ESCOs have had a history of problematic transparency and overcharging, which often cancels out any potential cost benefits to the customer.

Community solar is generically a form of “Virtual Net Metering”, which credits the subscriber a prorata share of the actual energy generated by the distributed generating facility, which is shown on the utility invoice as a credit offsetting the utility bill. If offered as a subscription, (which can be highly varied), the value of the energy credited to company from the utility, plus tax credits, RECs, & depreciation, netted against the long term liabilities, allows the company to compute a discount in payments from the customers that can still yield a profit. The customer sees a payment to the Community Solar company typically at a simple 10% reduction from the customer’s baseline electric bill.

SunCommon uses an alternative purchase model, in which customers buy an allocation of the hardware and infrastructure, calculated to provide sufficient energy for the customer’s specific load requirements. In that case, the calculations to show costs benefits is more complicated, involving tax deductions that vary with the customer’s individual financial situation. These savings often result in greater than 10% average annual savings. Although it may not be possible to predict savings with absolute precision, one can safely assume that electricity costs will be rising, possibly more steeply than currently anticipated, which would result in more savings than conservatively presented by marketing staff.

The SunCommon project is sized for what they regard their “sweet spot”, about 380kW in a mid-size range between 150kW – 750kW, a. They intentionally avoid projects scaled to the maximum 2MW sizing allowable under current rules for community solar, because of additional complexity. Even a routine sized project like this requires a long series of steps to obtain permitting approvals.

The site must be secured, by purchase or lease, with easements for utility access;

Interconnect approvals from the utility must be assessed, to confirm proximity to switching & trunk lines, and more importantly, availability of capacity. Smaller installations can be approved without major, costly line upgrades, which for larger sites could include the requirement to install a transformer substation at developer cost.

Permitting with the local Town Board must be in compliance with all the elements of their Solar Law, must meet the requirement for sufficient public hearings to air potential objections,

Environmental review requirements under SEQRA must be met

and it must be marketed to achieve a minimum level of subscription to be viable.

Jeff Irish, SunCommon’s VP & General Manager, made a point of noting in his comments that the firm had been organized as a “B Corp”, meaning a Public Benefit Corporation a voluntary certification of commitment to a “stakeholder model” of corporate governance, which places the concerns of workers, community and customers, as well as environmental considerations on equal footing with shareholder profit. An epoch-making federal statute with similar provisions was recently proposed to restructure corporate governance under Elizabeth Warren’s Accountable Capitalism bill.

New York State policy affecting Community Solar includes

Reforming the Energy Vision (REV),

a Clean Energy Standard (CES) that articulates the state Renewable Portfolio Standard (RPS) goals to achieve 50% renewable energy by 2030, and

the Clean Energy Fund (CEF) that committed $5B over 10 years. These incentive programs are administered by NYSERDA, under the NY-Sun Initiative, which in turn administers the Solar PV Megawatt Block program, which has been funded with a $1B budget & a goal of installing 3GW of solar by 2023.

The incentives have incrementally stepped down, with the earliest investments being given the most support to kick start the market, with as much as $1/MW, and less being offered to later entrants, now down to $.30/MW.

There are 3 regions, and 3 sectors. As shown, there are quota blocks, which are filling up in each region and sector, in this graphic prepared by NYSERDA (data as of 11/21/17).

The mid-Hudson region is the most active in development of solar projects, with Orange County leading the entire state in Community Distributed Generation (CDG).

However, not all proposed projects are completed and become operational. But if the goals of the REV & RPS targets are to be reached, it would be incumbent upon the state to support net metering pricing

sufficiently to incentivize private sector development, and to increase the MW block quota caps. However, it seems that currently, despite the positive commitments set forth in the REV goals, some of the implementing policies seem either not strong enough or actively adverse to those goals.

The prime example of this is the State Public Service Commission determination to side with the utilities in its restructured net metering rules, dubbed “Value of Distributed Energy Resources”. The utilities favor VDER, having chafed under net metering, but it appears to be quashing development momentum, because these new pricing standards are not only more complex, but they result in lower net payments from utilities to distributed generators. The PSC has effectively accepted the argument from the utilities that net metering provides owners of renewable assets with excessive benefits to the detriment of all the other ratepayers, despite evidence for benefits renewables provide to the utilities for enhanced grid flexibility, and avoidance of capital investment in new base load generation.

Could faster adoption of renewables, stimulated by higher net metering compensation and higher MW Block quotas, have made it possible to avoid an installation of the CPV gas power plant in Waywanda? The question of whether replacement power for closure of Indian Point nuclear plant could have come entirely from renewables and energy efficiency, and avoided building the CPV gas plant, clearly a very complex question, was addressed in a report prepared by Synapse Energy Economics for Riverkeeper and Natural Resources Defense Council, and analyzed here by a reasonably non-partisan expert.

Clearly, VDER has made Community solar development more uneconomic, so it’s fortuitous that SunCommon has reached its goal in this project, to provide more customers an opportunity to participate in the transition to a low carbon economy, and add data points to the advocacy battle against regressive fossil fuel infrastructure.

The post Suncommon breaks ground on a new Community Solar project in the Hudson Valley appeared first on Alternative Energy Stocks.

https://ift.tt/2PrUoAn

0 notes

Text

Suncommon breaks ground on a new Community Solar project in the Hudson Valley

Suncommon breaks ground on a new Community Solar project in the Hudson Valley

On 10/17/18, a groundbreaking event was held for a community solar installation being developed by SunCommon, partnering with Orange County Citizens Foundation, to supply a group of 60 homes and a community center located in the hillsides of an exurb called Sugar Loaf near Chester, NY.

The staff and community members were ebullient, as the project, coming to the end of 2-year development process, begins the final stage of erecting the racks and panels, and installing the interconnection, which will be completed in the next 30 days. It is the first project for SunCommon, a firm with a large footprint in Vermont, to be installed in the Hudson Valley since its recent merger with Hudson Solar located in Rhinebeck, which on its own had completed one prior community solar project.

Community solar project structures are proliferating, because they offer access to renewable energy sourced remotely for homeowners who are unable to install panels on their roof or ground-mounted on their property due to either insufficient insolation or upfront funding. The structure is different than an Energy Service Co (ESCO), which also provides energy from remotely located renewable sources, but ESCOs have had a history of problematic transparency and overcharging, which often cancels out any potential cost benefits to the customer.

Community solar is generically a form of “Virtual Net Metering”, which credits the subscriber a prorata share of the actual energy generated by the distributed generating facility, which is shown on the utility invoice as a credit offsetting the utility bill. If offered as a subscription, (which can be highly varied), the value of the energy credited to company from the utility, plus tax credits, RECs, & depreciation, netted against the long term liabilities, allows the company to compute a discount in payments from the customers that can still yield a profit. The customer sees a payment to the Community Solar company typically at a simple 10% reduction from the customer’s baseline electric bill.

SunCommon uses an alternative purchase model, in which customers buy an allocation of the hardware and infrastructure, calculated to provide sufficient energy for the customer’s specific load requirements. In that case, the calculations to show costs benefits is more complicated, involving tax deductions that vary with the customer’s individual financial situation. These savings often result in greater than 10% average annual savings. Although it may not be possible to predict savings with absolute precision, one can safely assume that electricity costs will be rising, possibly more steeply than currently anticipated, which would result in more savings than conservatively presented by marketing staff.

The SunCommon project is sized for what they regard their “sweet spot”, about 380kW in a mid-size range between 150kW – 750kW, a. They intentionally avoid projects scaled to the maximum 2MW sizing allowable under current rules for community solar, because of additional complexity. Even a routine sized project like this requires a long series of steps to obtain permitting approvals.

The site must be secured, by purchase or lease, with easements for utility access;

Interconnect approvals from the utility must be assessed, to confirm proximity to switching & trunk lines, and more importantly, availability of capacity. Smaller installations can be approved without major, costly line upgrades, which for larger sites could include the requirement to install a transformer substation at developer cost.

Permitting with the local Town Board must be in compliance with all the elements of their Solar Law, must meet the requirement for sufficient public hearings to air potential objections,

Environmental review requirements under SEQRA must be met

and it must be marketed to achieve a minimum level of subscription to be viable.

Jeff Irish, SunCommon’s VP & General Manager, made a point of noting in his comments that the firm had been organized as a “B Corp”, meaning a Public Benefit Corporation a voluntary certification of commitment to a “stakeholder model” of corporate governance, which places the concerns of workers, community and customers, as well as environmental considerations on equal footing with shareholder profit. An epoch-making federal statute with similar provisions was recently proposed to restructure corporate governance under Elizabeth Warren’s Accountable Capitalism bill.

New York State policy affecting Community Solar includes

Reforming the Energy Vision (REV),

a Clean Energy Standard (CES) that articulates the state Renewable Portfolio Standard (RPS) goals to achieve 50% renewable energy by 2030, and

the Clean Energy Fund (CEF) that committed $5B over 10 years. These incentive programs are administered by NYSERDA, under the NY-Sun Initiative, which in turn administers the Solar PV Megawatt Block program, which has been funded with a $1B budget & a goal of installing 3GW of solar by 2023.

The incentives have incrementally stepped down, with the earliest investments being given the most support to kick start the market, with as much as $1/MW, and less being offered to later entrants, now down to $.30/MW.

There are 3 regions, and 3 sectors. As shown, there are quota blocks, which are filling up in each region and sector, in this graphic prepared by NYSERDA (data as of 11/21/17).

The mid-Hudson region is the most active in development of solar projects, with Orange County leading the entire state in Community Distributed Generation (CDG).

However, not all proposed projects are completed and become operational. But if the goals of the REV & RPS targets are to be reached, it would be incumbent upon the state to support net metering pricing

sufficiently to incentivize private sector development, and to increase the MW block quota caps. However, it seems that currently, despite the positive commitments set forth in the REV goals, some of the implementing policies seem either not strong enough or actively adverse to those goals.

The prime example of this is the State Public Service Commission determination to side with the utilities in its restructured net metering rules, dubbed “Value of Distributed Energy Resources”. The utilities favor VDER, having chafed under net metering, but it appears to be quashing development momentum, because these new pricing standards are not only more complex, but they result in lower net payments from utilities to distributed generators. The PSC has effectively accepted the argument from the utilities that net metering provides owners of renewable assets with excessive benefits to the detriment of all the other ratepayers, despite evidence for benefits renewables provide to the utilities for enhanced grid flexibility, and avoidance of capital investment in new base load generation.

Could faster adoption of renewables, stimulated by higher net metering compensation and higher MW Block quotas, have made it possible to avoid an installation of the CPV gas power plant in Waywanda? The question of whether replacement power for closure of Indian Point nuclear plant could have come entirely from renewables and energy efficiency, and avoided building the CPV gas plant, clearly a very complex question, was addressed in a report prepared by Synapse Energy Economics for Riverkeeper and Natural Resources Defense Council, and analyzed here by a reasonably non-partisan expert.

Clearly, VDER has made Community solar development more uneconomic, so it’s fortuitous that SunCommon has reached its goal in this project, to provide more customers an opportunity to participate in the transition to a low carbon economy, and add data points to the advocacy battle against regressive fossil fuel infrastructure.

The post Suncommon breaks ground on a new Community Solar project in the Hudson Valley appeared first on Alternative Energy Stocks.

https://ift.tt/2PrUoAn

0 notes

Text

Suncommon breaks ground on a new Community Solar project in the Hudson Valley

Suncommon breaks ground on a new Community Solar project in the Hudson Valley

On 10/17/18, a groundbreaking event was held for a community solar installation being developed by SunCommon, partnering with Orange County Citizens Foundation, to supply a group of 60 homes and a community center located in the hillsides of an exurb called Sugar Loaf near Chester, NY.

The staff and community members were ebullient, as the project, coming to the end of 2-year development process, begins the final stage of erecting the racks and panels, and installing the interconnection, which will be completed in the next 30 days. It is the first project for SunCommon, a firm with a large footprint in Vermont, to be installed in the Hudson Valley since its recent merger with Hudson Solar located in Rhinebeck, which on its own had completed one prior community solar project.

Community solar project structures are proliferating, because they offer access to renewable energy sourced remotely for homeowners who are unable to install panels on their roof or ground-mounted on their property due to either insufficient insolation or upfront funding. The structure is different than an Energy Service Co (ESCO), which also provides energy from remotely located renewable sources, but ESCOs have had a history of problematic transparency and overcharging, which often cancels out any potential cost benefits to the customer.

Community solar is generically a form of “Virtual Net Metering”, which credits the subscriber a prorata share of the actual energy generated by the distributed generating facility, which is shown on the utility invoice as a credit offsetting the utility bill. If offered as a subscription, (which can be highly varied), the value of the energy credited to company from the utility, plus tax credits, RECs, & depreciation, netted against the long term liabilities, allows the company to compute a discount in payments from the customers that can still yield a profit. The customer sees a payment to the Community Solar company typically at a simple 10% reduction from the customer’s baseline electric bill.

SunCommon uses an alternative purchase model, in which customers buy an allocation of the hardware and infrastructure, calculated to provide sufficient energy for the customer’s specific load requirements. In that case, the calculations to show costs benefits is more complicated, involving tax deductions that vary with the customer’s individual financial situation. These savings often result in greater than 10% average annual savings. Although it may not be possible to predict savings with absolute precision, one can safely assume that electricity costs will be rising, possibly more steeply than currently anticipated, which would result in more savings than conservatively presented by marketing staff.

The SunCommon project is sized for what they regard their “sweet spot”, about 380kW in a mid-size range between 150kW – 750kW, a. They intentionally avoid projects scaled to the maximum 2MW sizing allowable under current rules for community solar, because of additional complexity. Even a routine sized project like this requires a long series of steps to obtain permitting approvals.

The site must be secured, by purchase or lease, with easements for utility access;

Interconnect approvals from the utility must be assessed, to confirm proximity to switching & trunk lines, and more importantly, availability of capacity. Smaller installations can be approved without major, costly line upgrades, which for larger sites could include the requirement to install a transformer substation at developer cost.

Permitting with the local Town Board must be in compliance with all the elements of their Solar Law, must meet the requirement for sufficient public hearings to air potential objections,

Environmental review requirements under SEQRA must be met

and it must be marketed to achieve a minimum level of subscription to be viable.