#mobilebankingapps

Explore tagged Tumblr posts

Link

#banking#bankingonmobile#bnimobilebanking#howtousemobilebankinginmobile#mobilebanking#mobilebankingapp#mobilebankingapps#mobilebankingscam#mobilebankingscams#mobilebankingservices#mobilebankinguses#onlinemobilebanking#whatismobilebanking

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#bankonline#openonlinebankaccount#onlineopenaccountbank#onlineopenaccount#mobilebankingapp#onlinebankingapp#bankopenaccountonline#mobilebankingapps

0 notes

Text

Mobile banking app development empowers the financial sector to deliver seamless, secure, and personalized banking experiences. This guide explores key aspects, including essential features, design considerations, technology stacks, compliance requirements, and development costs. Whether developing a new app or enhancing an existing one, this comprehensive resource ensures a robust and user-centric solution.

#bankingappdevelopment#finance#fintech#bank#mobilebankingapp#appdevelopment#bankappdesign#bankappdevelopmentcost

0 notes

Text

Mobile banking apps should relay your bank statements for the month like Spotify wrapped

0 notes

Text

Reinventing the Financial Landscape Via AI in Banking

AI in Banking is revolutionizing the financial landscape by streamlining operations, enhancing customer experiences, and boosting decision-making efficiency. Through advanced algorithms and machine learning, banks can predict market trends, detect fraud, and personalize services, ensuring higher customer satisfaction. AI-driven chatbots and virtual assistants provide seamless support, while predictive analytics optimize loan approvals and risk assessments.

#AIinBanking#mobilebankingapp#fintechappdevelopment#AIappdevelopment#mobileappdevelopment#Bankingapps

0 notes

Text

How to Develop an App Like Chime 🚀

Banking apps have made banking super convenient for users. People do not need to visit banks physically for bank-related tasks, such as sending money to their friends, applying for a home loan, or depositing their salary checks.

According to Statista, the number of digital banking users in the United States is predicted to increase year after year between 2021 and 2025. Beginning with approximately 197 million users in March 2021, the number of digital banking users in the country is expected to grow to over 217 million by 2025.✌

0 notes

Text

Mobile Banking App Development Cost in 2024

Today, making an incredible mobile banking app is effective for banks that need to stay aware of the times. With around 2.37 billion individuals all over the planet utilizing online banking, and that number developing, obviously, banking should be digital to meet what individuals expect.

A gigantic part of this is on the grounds that 98% of Millennials and 99% of the vast majority of Gen Z are utilizing portable mobile banking apps not only for the standard stuff like checking the amount of cash they possess, perusing their bank statements, or moving cash around.

They’re also using these apps to help them budget better, something the older folks aren’t doing as much. Making sure online banking is safe and using the newest tech can help banks make their customers happy, make more money, and spend less on services. This blog will tell you the best way to make a mobile banking app that endures and assists your bank lead in the tech world.

We’ll see the reason why an ever-increasing number of individuals, are utilizing digital banking and how to make an application they’ll love to use. We should jump into how to fabricate a mobile banking application that is a winner, utilizing tips and bits of knowledge that will assist your bank do well in the digital world.

Why Build a Banking App: Statistics & Benefits

Building a banking app today is something beyond a trend; an essential move that lines up with the developing preferences and ways of behaving of consumers worldwide. The push towards digital banking has been fundamentally advanced by innovative progressions and changing client expectations, particularly among more youthful ages. Here are key measurements and advantages that highlight the significance and benefits of building a banking app:

Statistics Highlighting the Need for Banking Apps

Starting around 2023, there are 6.6 billion cell phone users around the world, addressing 83% of the worldwide population

In the US alone, 85% of adults own smartphones, highlighting their widespread joining into day-to-day existence

Consumers progressively want accommodation and availability. Banking apps offer every minute of every day admittance to manage finances, whenever, anyplace.

Compared with traditional methods, applications empower transactions, exchanges, bill payments, and money transfers.

Numerous applications offer customized highlights like budgeting tools, financial insights, and customized alerts.

Advantages of Developing a Banking App

Mobile banking apps offer convenience and accessibility, permitting clients to deal with their funds whenever and anyplace, prompting expanded satisfaction and loyalty.

By giving a stage to extra services and personalized offerings, banks can open new revenue streams through their applications.

Digital transactions and associations lessen the requirement for actual branch visits, bringing down functional expenses for banks.

Banking apps can use progressed safety efforts like biometrics, guaranteeing more secure exchanges and improving trust among clients.

Through app use data, banks can acquire significant valuable insights into customer behavior and preferences, enabling them to successfully tailor their administrations and items more.

In a market where digital savviness is progressively turning into a benchmark, having a vigorous banking app can separate an organization from its rivals.

Mobile Banking Apps Benefits for Users

Mobile banking apps make overseeing cash much simpler and more helpful for everybody.

Rather than going to a bank, you can really take a look at your account, move cash around, or even get credit right from your phone, whenever and anyplace.

This saves a lot of time since you don’t need to visit the bank for basic things.

These applications are likewise simple to utilize and can be redone, making managing cash to a lesser degree an issue and more fun.

Besides, they’re really protected on the grounds that they use things like fingerprints and face recognition to keep your data secure, so you don’t need to stress while you’re doing your banking on the web.

You likewise get updates and tips on how you’re spending your cash, which can assist you with pursuing more brilliant decisions.

What’s more, if you’re attempting to adhere to a spending plan or save something, these applications have devices to assist you with keeping focused.

How to Create A Banking App

Developing a banking app includes a few key stages, guaranteeing that the eventual outcome is secure, easy to use, and addresses the issues of its users. Here is a bit-by-bit manual for developing a banking app:

Market Research and Planning

Recognize who your application is for (e.g., Millennials, Gen Z) and comprehend their banking requirements and preferences.

Look at what other banking apps are offering. Identify features that are popular and consider how you can improve upon them.

Decide what you want your app to achieve. This could include improving customer satisfaction, increasing transactions, or attracting new customers.

Define Features and Requirements

Include essential features, for example, account balance checks, cash transfers, bill installments, and customer service.

Consider adding budgeting tools, savings goals, personalized financial advice, or speculation choices to stick out.

Plan for advanced security features like biometric authentication, encryption, and fraud detection mechanisms.

Choose the Right Technology

Decide whether you’ll develop a native application (iOS/Android) or a cross-platform application that deals with both.

Select the appropriate backend technology that can handle user data securely and efficiently.

Choose technologies for the user interface that ensure a smooth and engaging user experience.

Design UX/UI

Design the app flow to make it intuitive and easy to navigate.

Create designs that are visually appealing and reflect your brand identity. Ensure the design is accessible and user-friendly.

Must Read: The Essential UI/UX Design Principles to Follow for Maintain Customer Engagement

Development and Testing

Utilize an agile development process, breaking the work into more modest runs that consider regular feedback and adjustments.

Perform thorough testing, including unit testing, coordination testing, and client acknowledgment testing, to guarantee the application is dependable and without bugs.

Compliance and Security

Make sure your app complies with financial regulations and laws in the regions you operate.

Before launching, conduct a security audit to identify any vulnerabilities.

Launch and Continuous Improvement

Consider a delicate launch to a restricted crowd to gather initial feedback.

Create a showcasing plan to promote your application and attract users.

Continuously collect user feedback and make improvements to your app. Add new features based on user demand and technological advancements.

Support and Maintenance

Provide robust customer support to address any issues users might face.

Keep the app updated with the latest security patches and feature upgrades.

Why Customers Use Mobile Banking Apps

Individuals of any age utilize mobile banking apps for various reasons, and it truly relies upon what they’re utilized to, how much they know about technology, and what they need for their money.

More youthful individuals, such as Twenty to thirty-year-olds and Gen Z, truly like utilizing these applications since they’re helpful and quick.

They do everything with their telephones, such as checking the amount of cash they possess, moving cash around, setting up budgets, saving for things, and even investing.

They love that they can do their banking whenever and anyplace without going to a real bank.

Older folks, like Gen X and Baby Boomers, weren’t born into the tech world but are beginning to use mobile banking more and more.

They generally adhere to easy things like looking at their bank statements, paying bills, or sending money.

The pandemic made a lot of them change to online banking banking since it’s less complex and and feels more secure.

Everyone, no matter what their age, likes mobile banking since it permits them to deal with their cash how they need it when they need it, and it’s secured.

As mobile banking improves, it’s probably an ever-increasing number of individuals will begin utilizing it, making it a must-have for keeping track of money, no matter how old you are.

Authentication and Authorization Flow

Authentication and authorization are basic processes in a banking application to guarantee that clients are who they claim to be and have the right to consent to get specific access or information. Here is an improved outline of how these cycles normally work in a banking application:

Authentication Flow

The user signs the application, giving vital details like name, email, and setting up a password. Extra identity verification steps might include giving a government ID or linking a bank account.

The user enters their username and password. Some applications might require extra steps like captchas to prevent automated attacks.

For added security, in the wake of entering the correct password, the user might be approached to check their identity through a subsequent element, for example, a code sent by means of SMS or email, or through a biometric confirmation like fingerprint or facial acknowledgment.

When authenticated, the user is conceded a session token that temporarily stores the client’s condition of authentication, permitting them to utilize the application without having to return login credentials for each activity.

Authorization Flow

Users are assigned roles (e.g., account holder, admin) that define what actions they can perform and what data they can access within the app.

The app checks the user’s role and permissions before allowing access to specific features, like transferring funds, accessing loan services, or viewing detailed transaction histories.

Each request made by the user within the app is accompanied by their session token, which the app validates to ensure the request is authorized.

Continuous security checks may be performed during the session to detect anomalies or re-validate the user’s identity, especially for sensitive operations like modifying personal information or executing high-value transactions.

After a period of inactivity or when the user logs out, the session token is invalidated, requiring re-authentication for further access.

How Much Does It Cost to Develop a Banking App?

Developing a mobile banking application in 2024 can require an enormous financial commitment, with costs going from $20,000 to more than $300,000. This difference is for the most part inferable from various urgent issues that planned designers and endeavors should inspect.

The complexity of the application is a central point, yet a simple application with fundamental capabilities, for example, account balance checks and moves might cost somewhere in the range of $20,000 and $50,000.

The expense of medium-complexity apps with extra abilities like bill installments and budgeting tools ranges from $50,000 to $120,000.

The most sophisticated applications, with advanced features like speculation choices and biometric validation, can cost somewhere in the range of $120,000 to more than $300,000.

Conclusion

In the dynamic realm of banking technology, crafting a seamless Banking App Development becomes a strategic move. Making a mobile banking app is a big deal that costs a lot but really pays off by making customers happy and keeping banks up to date in today’s quick-moving digital world. By truly getting what various individuals need from their banking application, adding cool and vital features, and ensuring the application is protected and simple to utilize, banks can make an application that individuals will adore more than they predicted.

Originally published by: Mobile Banking App Development Cost in 2024

0 notes

Text

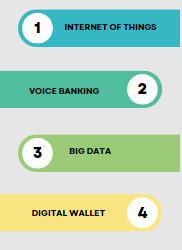

Revolutionize Your Banking Experience: 5 Important Trends in Mobile Banking Apps for 2023 Get in touch with us today.

#MobileBanking#BankingInnovation#MobilePayments#BankingSolutions#DigitalPayments#BankingTech#MobileBankingApp

0 notes

Text

OneVibe is a leading finance app development company in India, specializing in delivering tailored solutions to global firms.

Transform your personal finance app from a startup to a market leader with our expertise. Our development team will craft the perfect tech stack to address common financial challenges like spending tracking and more.

For more info: Contact: 086391 26135

financeapp #FinanceAppDevelopment #mobileappdeveloper #MobileBankingApp #DigitalFinanceTools #financialservices #SmartFinance #investmentappdesign #appdevelopment #appdevelopmentcompany #techforfinance #appdesigner #appdevelopment #appdevelopmentservices #appdevelopmentexperts #Hyderabad #indian #uk #ukbusiness #dubaiAE #dubai #uae

0 notes

Link

#banking#CACUApp#CommunityAmericaCreditUnion#mobilebank#mobilebanking#mobilebankingapp#mobileloanapp#usbankmobileapp

0 notes

Text

How Much Does It Cost To Develop Mobile Banking Apps? - A Complete Guide

There is no denying the fact that the FinTech industry is one lucrative sector. But what does it cost to develop a mobile banking app? The FinTech industry is full of potential and immense competition. That’s the reason why developing a mobile banking app will require sufficient effort. You need to hire the right team for developing a mobile banking app that not only runs smoothly but also provides you with a ton of features and it should be cost-efficient. This blog is intended for entrepreneurs who are looking to enter the FinTech industry and want to make a difference.

Click here to read the full blog - https://bit.ly/3gPV8vg

#mobilebankingapps#mobilebankingappdevelopment#bankingappdevelopment#fintech#fintechapps#imobile#mobileappdevelopmentcompany#onlinepayment#fintechsolutions#ondemandapps

0 notes

Photo

मोबाइल बैंकिंग ऐप्स : कोटक बैंक द्वारा मोबाइल बैंकिंग ऐप डाउनलोड करे और अपने स्मार्टफोन पर मोबाइल बैंकिंग सेवा को सक्रिय करें। इसके द्वारा आप ऑनलाइन बैंकिंग, यु पी ऑय ट्रांसेक्शन, पर्सनल लोन, टिकट बुकिंग जैसी सुविधा के साथ इंटरनेट बैंकिंग सेवाओं का भी आनंद ले सकते हैं। आज ही डाउनलोड करे कोटक ऐप अपने स्मार्टफोन पर।

0 notes

Text

#mobileapp#mobileappdevelopment#mobileappdesign#mobileapplication#mobilebankingapp#mobilepaymentapp#mobileapps#business#design#developers & startups#technology

2 notes

·

View notes

Text

No more trips to the bank. Mobile banking app enables you to get all banking services in one touch. Sign up for ZilBank.com today!

Learn more: https://zilbank.com/mobile-banking/

0 notes

Text

INCREASE YOUR BUSINESS PRODUCTIVITY THROUGH A CRM

A CRM or Customer Relationship Management system is a software application that helps businesses manage their customer data. It provides a central repository for customer information, which can be accessed and updated by authorized users.

A CRM system can help businesses track and manage customer interactions, including contact information, sales opportunities, and customer service requests. It can also help businesses automate and streamline their sales and marketing processes.

A CRM system can be a valuable tool for increasing business productivity. It can help businesses save time and money by automating and streamlining their sales and marketing processes. It can also help businesses improve their customer service by providing a central repository for customer information.

If you are looking for a CRM system to help increase your business productivity, Phontinent Technologies can help. We offer a variety of CRM solutions that can be tailored to meet the specific needs of your business. Contact us today to learn more about our CRM solutions and how they can help your business.

#bestsoftwarecompanies#appdevelopmentcompanies#appdevelopmentcompany#phontinenttechnologies#mobileappdevelopment#HealthcareAppDevelopment#teleMedicineapps#grocerydeliveryappdevelopment#doctorbookingapp#bookingapp#fooddeliveryapp#onlinetutorapp#educationapp#taxibookingapp#cleanerapp#mobilebankingapp#flowerdeliveryapp#ondemandapp#mobileappdevelopmentt#HireAppdevelopers#HireMobileAppDeveloper#hirededicateddevelopers#appdevelopment#developer#iosdeveloper#androiddeveloper#uiuxdeveloper#informationtechnology#carwashapp#CarWashAppDevelopment

0 notes

Text

7 Mobile Banking Trends in 2022

As India is adopting digital technologies with the changing time, the Banking sector has also adopted innovative technologies for customer satisfaction as well as to ensure data security to its customers with its compliance and regulations.

Through Mobile Banking apps, organisations are able to deliver a range of services remotely. It also helped people a lot at the time of Covid-19 pandemic. It provides people to operate banking services from the ease of their home. Account openings and digital transaction completion are some of the instances of Banking operations.

In this Article we shall discuss the Mobile banking trends in 2022 and in the coming years.

Top 7 Mobile Banking industry trends in 2021 and beyond

Biometric Security

Security threats have increased at the time of Covid-19 pandemic. It was seen that during pandemic time, the credit card fraud cases have increased upto 104% in the year 2019. However, the number of fraud cases were very low during the years 2017, 2018 and 2019.

Biometric security was designed to provide security to the rignizations for any kind of security threat or frauds as the data becomes more secure. Using the recognition of face, voice, fingerprints secures the leak of data and it prevents the devices from any unauthorised access.

The security will be increased in the next coming years and the Biometric software plays an important role in Mobile Banking trends.

Artificial Intelligence- Powered Chatbots

AI Bot is programmed to do the predefined tasks in a few minutes. Banking sectors use this technology very often to provide its customers with the best banking services. By Using this technology by the banking sector it can speed up a variety of manual and routine operations. It reduces the response time from hours to a few minutes.

Through this technology organisations can offer its consumers personalised advice. With this technology, a banking support system is available 24/7 to its customers. The AI bot transformation therefore is defietty a great trend in the Banking sector.

Mobile Banking Apps

The trends of Mobile Banking apps have been increasing and it got a boost during the Covi-19 pandemic time. With lockdowns imposed in the country people were forced to stay at home and therefore the mobile banking apps services helped a lot to the customers.

Mobile Banking apps allows you to do any kind of transaction whether it is related to banking i.e. money transactions, fund transferring, fixed deposit or loan related things. On the other hand financial institutions can deliver a variety of online services, boost efficiency and customer satisfaction and reduce costs.

We at winklix have made Mobile Banking apps and related softwares which eases the life of its customers in the banking sector.

Machine learning

Machine Learning (a category of Artificial Intelligence) is among the main digital technology trends in 2021 and beyond. With Machine Learning organisations can be able to achieve mobile banking security, protecting against threats such as frauds, malware and unauthorised access.

In recent times we can see that AI is increasing in Banking sectors. It was observed by the experts that Mcaine learning was adopted by 25% of the financial services industry.

Blockchain technology

Blockchain is one of the key digital mobile banking trends of the future. It was seen in the survey conducted by Winklix that Blockchain technology is an important part of their organisational infrastructure in the year 2020.

The number of blockchain technology is also increasing. People are more adopting Blockchain technology as it transfers the money without any interference of the government or any authorised body.

Voice Payments

The use of Voice payments has also been increased in the mobile banking technology sector. Adopting softwares such as Siri and Alexa the number of voice payments has increased amongst peers.

Through this kind of technology financial institutions are improving their user experience and also improving retention rates.

Cardless ATM withdrawal

Cardless ATM withdrawal is one of the trends in the years 2021 and beyond. With innovations in NFC technologies and QR code scanning, customers can interact with banking ATMs much easier.

Conclusion

Therefore through these translations the banking sector and financial sector is evolving and transforming. By applying the latest banking trend, the industry can face various business specific challenges. However at the same time these technologies will be able to boost customer satisfaction and employee productivity and it also reduces costs.

If you have some industry specific issue and need help in resolving the same. Kindly contact our expert team. Our team will assist you in the best possible way.

0 notes