#ndx 100

Text

youtube

In this video we look at comparisons between the S&P 500, US Dollar, 10-Year Treasury, and Nasdaq time cycles to determine the possible shape of the move coming tomorrow and over the next few months.

#SPX#ES#S&P Futures#Nasdaq#Stock Trading#Investing#Market Analysis#Elliott Wave#Gann#Fibonacci#Fundamental Analysis#Technical Analysis#Quantitative Analysis#S&P 500#Nasdaq 100#Hurst Cycles#NDX#QQQ#USD#Dollar#FX#TNX#Treasury#10-year#Youtube

0 notes

Text

Nasdaq futures pop, Tesla surges after earnings with more heavyweights on deck

New Post has been published on https://petnews2day.com/news/general-news/nasdaq-futures-pop-tesla-surges-after-earnings-with-more-heavyweights-on-deck/?utm_source=TR&utm_medium=Tumblr+%230&utm_campaign=social

Nasdaq futures pop, Tesla surges after earnings with more heavyweights on deck

Tech stocks popped ahead of the bell on Wednesday, outstripping the broader market as investors welcomed Tesla’s (TSLA) cheaper car pledge and waited for the next rush of corporate earnings. Futures on the tech-heavy Nasdaq 100 (^NDX) rose roughly 0.5%, coming off a sharp closing gain. S&P 500 (^GSPC) futures were up 0.1%, continuing a […]

See full article at https://petnews2day.com/news/general-news/nasdaq-futures-pop-tesla-surges-after-earnings-with-more-heavyweights-on-deck/?utm_source=TR&utm_medium=Tumblr+%230&utm_campaign=social

#OtherNews

0 notes

Text

Weekend Review of the Market: Bulls on Parade

Happy Weekend, traders.

Yesterday we discussed how the failure of bears to turn any of the structures we could observe on the Nasdaq 100 (and other indices, but I think most clearly visible on NDX and NDX futures in particular) into bull traps could produce a rally, which we got today:

Continue reading Weekend Review of the Market: Bulls on Parade

View On WordPress

0 notes

Text

Pesta Rakyat Ganjar-Mahfud Bali 2024 Siap Hibur Masyarakat, Hadirkan Konser Musik Hingga Food Truck

BALIPORTALNEWS.COM, DENPASAR – Relawan Sahabat Ganjar (SAGA) menggelar Pesta Rakyat Ganjar-Mahfud Bali 2024 pada Sabtu (20/1/2024) besok mulai pukul 17.00 – 22.00 WITA di Lapangan Niti Mandala Renon Denpasar dengan menampilkan group band nasional NDX AKA dan TIPE X serta musisi lokal Lolot Band, Joni Agung & Double T, Bagus Wirata dan DJ Mahesa.

Selain menghadirkan konser musik, pesta rakyat tersebut juga menghadirkan 100 stand UMKM dan 15 food truck yang menyajikan produk lokal.

Bendahara TPD GAMA Bali, Dewa Made Mahayadnya alias Dewa Jack menjelaskan, Pesta Rakyat Ganjar-Mahfud Bali 2024 ini untuk meningkatkan solidaritas, semangat persatuan kesatuan, dan gotong-royong serta motivasi untuk secara bersama-sama bekerja keras memenangkan pasangan Ganjar-Mahfud pada Pilpres 14 Februari 2024 mendatang.

“Acara nanti akan dihadiri kurang lebih 20.000 orang pendukung Ganjar-Mahfud dan semuanya gratis,” ucap Dewa Jack dalam jumpa pers dengan awak media di DPD PDI Perjuangan Provinsi Bali, Jumat (19/1/2024) sore.

Dewa Jack berharap, masyarakat Bali yang hadir nanti untuk tertib dan disiplin guna menyukseskan Pesta Rakyat Ganjar-Mahfud Bali 2024 kali ini.

“Dilarang keras ada provokasi sesama penonton, tidak memprovokasi dan tidak terprovokasi. Sehingga rangkaian acara berlangsung dengan nyaman, aman, dan damai,” pungkas Dewa Jack didampingi Ketua SAGA, Nahib Sodih dan Pembina DPP SAGA Indonesia, Fahlesa Munabari.(tis/bpn)

Read the full article

#BaliPortalNews#GAMA#GanjahMahfud#PDIPerjuangan#PestaRakyatGanjar-MahfudBali2024#RelawanSahabatGanjar#Renon#SAGA

0 notes

Text

Nieuwsupdate: Eindelijk Goedkeuring van Bitcoin Spot ETF door de SEC!

Na lang wachten heeft de Amerikaanse Securities and Exchange Commission (SEC) eindelijk goedkeuring verleend aan maar liefst 11 Bitcoin Spot ETF's, een mijlpaal die de weg opent voor Bitcoin binnen mainstream financiën. Dit opwindende nieuws is des te opmerkelijker omdat het volgt op een technische storing op de SEC-website. 🤣😉

Goedkeuring van Bitcoin Spot ETF's:

Ondanks technische haperingen op de SEC-website heeft James Seyffart, een analist van Bloomberg, bevestigd dat de SEC de goedkeuring van een Bitcoin Spot ETF heeft bevestigd. Met ongeveer 11 goedgekeurde ETF-uitgevers zal de handel naar verwachting morgen beginnen. Deze ontwikkeling heeft enorme opwinding veroorzaakt in de crypto-wereld, met hoge verwachtingen voor de toekomst van Bitcoin in mainstream financiën.

Reactie van Grayscale CEO:

Grayscale CEO Michael Sonnenshein sprak zijn verwachting uit na de goedkeuring van spot Bitcoin ETF's en benadrukte de overwinning van Grayscale tegen de SEC als een cruciale factor die heeft bijgedragen aan deze goedkeuring. Hij verklaarde dat Grayscale altijd al wist dat deze goedkeuringen zouden komen en dat het een doorbraakmoment is voor de gehele crypto-industrie.

Bitcoin Ontkoppeling van de Nasdaq-100:

Een opmerkelijke observatie is dat Bitcoin voor het eerst in vier jaar is ontkoppeld van de Nasdaq-100 (NDX). Deze ontkoppeling is een teken van de groeiende onafhankelijkheid van Bitcoin ten opzichte van bredere financiële marktbewegingen, en het is gebaseerd op de sectorgerichte nieuws- en prijsstuurprogramma's in plaats van de Nasdaq-100 te volgen.

Volgens Katie Stockton, oprichter en managing partner bij Fairlead Strategies, zullen de correlaties tussen Bitcoin en de Nasdaq-100 waarschijnlijk laag blijven, mede dankzij verwachte gebeurtenissen zoals de goedkeuring van een spot Bitcoin ETF en de halvering in april.

Deze goedkeuring van Bitcoin Spot ETF's en de daaropvolgende ontkoppeling van Bitcoin van de Nasdaq-100 markeren een keerpunt in de volwassenheid van Bitcoin als een onafhankelijke activaklasse. Crypto-gids blijft de ontwikkelingen volgen terwijl Bitcoin een nieuw tijdperk ingaat binnen de financiële markten.

Read the full article

0 notes

Text

Bitcoin decouples from the Nasdaq-100 for the first time after four years

Share this article

After roughly four years of following the Nasdaq-100 (NDX), Bitcoin has decoupled from its 40-day correlation with the index going to zero, signifying independence from the equity index strongly dominated by tech firms.

The Nasdaq-100 stock market index tracks the performance of 101 stocks in the technology, healthcare, consumer goods, services, and industrial sectors listed…

View On WordPress

0 notes

Text

Decoding Nasdaq 100: NDX's Journey to YTD Highs and the Nvidia Niche

Nasdaq 100 Key Points

The Nasdaq 100 is up nearly 50% year-to-date, defying expectations that it would struggle amidst higher interest rates.

Nvidia reports earnings after the bell today, with traders expecting $3.36 in EPS and $16.1B in revenue.

NDX is testing year-to-date highs near $16K while NVDA is poised to open at a fresh record high above $500.

Nasdaq 100 Fundamental Analysis

So much for rising interest rates killing the growth-heavy Nasdaq 100 this year!

As we so often see in markets, textbook-style explanations don’t necessarily play out as expected. Heading into this year, higher interest rates were expected to weigh on the primarily growth-focused stocks that make up the Nasdaq 100, whereas more value-oriented stocks were the obvious outperformers given the better near-term prospects for profits.

Instead, the Nasdaq 100 has put together an incredible first 11 months of the year, with the tech-heavy index surging by more than 46% since January 1st. By comparison, the more balanced S&P 500 and Dow Jones Industrial Average are trading up “only” 18% and 6% so far in 2023. The big rally has been supported, at least to an extent, by the fundamentals, with the aggregate Nasdaq 100 EPS coming in at $862 through October, up more than 30% from the start of the year.

Now, ahead of the US holiday, the last of the “Magnificent 7” stocks that have driven much of the rally reports earnings, and expectations are high for chipmaker Nvidia. Demonstrating the incredible growth that’s possible only in technology stocks, Nvidia is expected to report $3.36 in EPS on $16.1B in revenue; these figures would be up roughly 470% and 170% from the equivalent quarter last year!

Nvidia Technical Analysis – NVDA Daily Chart Ahead of Earnings

Source: TradingView, StoneX

Looking first at NVDA itself, the stock burst out to a fresh record high above $500 yesterday, extending its impressive surge after a failed head-and-shoulders pattern late last month. With expectations running high ahead of the earnings report and the stock at record highs, it’s more difficult than usual to offer actionable technical insights, but suffice it to say that if NVDA can hold its breakout above $500 through the week, that would be a very bullish development and could open the door for the posterchild of the AI rally to extend its gains toward $600 as we head into 2024.

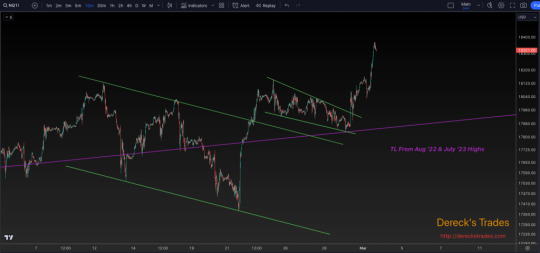

Nasdaq 100 Technical Analysis – NDX Daily Chart

Source: TradingView, StoneX

Meanwhile, the broader Nasdaq 100 is trading in lockstep with one its most iconic holdings. As the chart above shows, NDX remains within a tight bullish channel after clearing the July highs at 15,900. For the rest of this week, the key factor to watch will be if the index can hold above that key level. If buyers continue to support NDX through this week, traders may turn their eyes toward the all-time record highs around 16,750 as we head into December.

Link To The Original Article Here

"Nasdaq 100 Analysis: NDX holds at YTD highs ahead of Nvidia Earnings"

0 notes

Text

[ad_1]

The Nasdaq Composite Index is within the midst of a correction. An in depth have a look at its Nasdaq-100 subset reveals 20 of these shares fell 10% or extra for one week by way of Wednesday’s shut. The Nasdaq Composite Index

COMP

fell into a correction on Wednesday, being down greater than 10% from its final peak set in July. On Thursday, the index declined one other 1.8%. It's nonetheless up 20.3% for 2023, following a 33.1% decline throughout 2022. From the tip of 2021, the Nasdaq continues to be down 18%. (All value adjustments on this article exclude dividends.)

Learn: The seven companies propping up the U.S. stock market are sending a bearish warning that investors should not ignore The Nasdaq-100 Index

NDX

is made up of the biggest 100 nonfinancial firms within the full Nasdaq, weighted by market capitalization. It's tracked by the Invesco QQQ Belief ETF

QQQ.

This index declined 1.9% on Thursday, led by Align Expertise Inc.

ALGN,

-24.88%,

which offers units and programs utilized by orthodontists and dentists. The corporate’s shares dropped 25% on Thursday, after its quarterly gross sales and earnings got here in effectively beneath analysts’ expectations, amid a decline in demand for its providers. The next-than-expected third-quarter U.S. GDP growth pace of 4.9% could have helped feed the day’s stock-market declines. The Nasdaq-100 Index has risen 29% this yr, reflecting its heavy weighting to Apple Inc.

AAPL,

-2.46%

and Microsoft Corp.

MSFT,

-3.75%,

which collectively make up about 21% of the index’s weighting. Shares of Apple have risen 28% this yr by way of Thursday, whereas Microsoft is up 37%. The Nasdaq-100’s partial restoration this yr follows a 33% decline in 2022; it's down 11.9% from the tip of 2021. Here's a listing of the 9 shares within the Nasdaq-100 which have fallen 15% or extra this month, with extra price-change and valuation info:

Firm

Worth change since Sept. 29

Oct. 26 value change

2023 value change

Worth change since finish of 2021

Ahead P/E

Ahead P/E at finish of 2021

Align Expertise Inc.

ALGN,

-24.88%

-37.6%

-24.9%

-10%

-71%

20.7

48.7

Lucid Group Inc.

LCID,

-2.40%

-27.2%

-2.4%

-40%

-89%

N/A

N/A

Moderna Inc.

MRNA,

-1.02%

-26.4%

-1.0%

-58%

-70%

N/A

9.3

Enphase Vitality Inc.

ENPH,

+1.94%

-20.0%

1.9%

-64%

-47%

16.3

60.1

Illumina Inc.

ILMN,

-2.02%

-18.7%

-2.0%

-45%

-71%

57.5

90.2

Tesla Inc.

TSLA,

-3.14%

-17.8%

-3.1%

67%

-42%

54.0

120.3

Airbnb Inc. Class A

ABNB,

-2.56%

-15.8%

-2.6%

35%

-31%

27.0

166.7

Commerce Desk Inc. Class A

TTD,

-7.60%

-15.3%

-7.6%

48%

-28%

46.9

100.3

Zoom Video Communications Inc. Class A

ZM,

-1.41%

-14.9%

-1.4%

-12%

-68%

13.0

41.7

Supply: FactSet

Click on on the tickers for extra about every firm, fund or index, together with full information protection. Click here for Tomi Kilgore’s detailed guide to the wealth of information available for free on the MarketWatch quote page. The desk contains present ahead price-to-earnings ratios, primarily based on consensus estimates for the following 12 months amongst analysts polled by FactSet.

Compared, the weighted ahead P/E for the Nasdaq-100 Index is 23.7, down from 30.4 on the finish of 2021. For an additional comparability, the S&P 500

SPX

trades for 17.4 instances its weighted ahead earnings estimate, down from a P/E of 21.6 on the finish of 2021. Don’t miss: Among the S&P 500, these 20 companies have made the best use of investors’ money

[ad_2]

0 notes

Text

1 note

·

View note

Text

Dogecoin (DOGE) Price Rally Soon? Here's Why It Is Possible

Gamza Khanzadaev

Historical trends and market dynamics indicate possible DOGE price rally

In a recent Twitter thread, Negentropic, the account belonging to Glassnode co-founders Yann Allemann and Jan Happel, made an intriguing observation about the relationship between the Nasdaq-100 index (NDX) and Bitcoin (BTC). According to the tweet, historical data suggests that whenever the NDX experiences…

View On WordPress

0 notes

Text

Cổ phiếu Magnificent Seven thúc đẩy thị trường tăng cao khi cơn sốt AI thu hút các nhà đầu tư

Khi cơn sốt AI tăng tốc vào những tháng mùa hè, câu chuyện về hai thị trường mà các nhà đầu tư phải đối mặt đang trở nên gay gắt hơn.

Tuần trước, chỉ số Nasdaq 100 (^NDX) bao gồm 100 cổ phiếu công nghệ lớn nhất trên Nasdaq đã tăng hơn 3% trong khi chỉ số công nghiệp Dow Jones (^DJI) chìm trong sắc đỏ. Đó chỉ là lần thứ năm xảy ra như vậy kể từ khi bong bóng Dot-Com xuất hiện hai thập kỷ…

View On WordPress

0 notes

Text

RT @RussellRhoads: Brief Saturday Review this week due to travel - we talk about $SPX vs. $NDX and $VIX vs. $VOLQ and what we want to see to turn 100% bullish stocks based on those relationships along with a pretty smart $NFLX earnings trade. https://t.co/oj22x60eui

RT @RussellRhoads: Brief Saturday Review this week due to travel – we talk about $SPX vs. $NDX and $VIX vs. $VOLQ and what we want to see to turn 100% bullish stocks based on those relationships along with a pretty smart $NFLX earnings trade.

https://t.co/oj22x60eui

— Patrick Rooney (@patrickrooney)

Jan 22, 2023

https://platform.twitter.com/widgets.js

from Twitter…

View On WordPress

0 notes

Text

Stock Market News Today: Stocks Fall as Investors Digest Jobless Claims Data

New Post has been published on https://petn.ws/UdXGW

Stock Market News Today: Stocks Fall as Investors Digest Jobless Claims Data

Last updated: 11:20AM EST Stocks are down so far in today’s trading session. As of 11:20 a.m. EST, the Dow Jones Industrial Average (DJIA), the S&P 500 (SPX), and the Nasdaq 100 (NDX) are down 0.3%, 0.2%, and 0.1%, respectively. Last updated: 9:39AM EST The latest jobless claims data for the week ending April 1 […]

See full article at https://petn.ws/UdXGW

#OtherNews

0 notes

Text

The Weekend Review of the Markets: Indices Have Approached Their 50-Day Moving Averages

Well, after a strong rally, the S&P 500 and the Nasdaq 100 have finally entered at least a pullback, with the SPX nearing its 50-day SMA, and the NDX poking through its. But in doing that, they have both done so with slowing momentum, which has created a contraction in price that presents itself to us in the form of large bullish wedges:

Continue reading Untitled

View On WordPress

0 notes

Text

Nasdaq 100 adds six companies to stock market index, trading to begin from this date

Nasdaq 100 adds six companies to stock market index, trading to begin from this date

The list of companies on the technology-heavy Nasdaq 100 index will change. Six new companies are being added to the index and seven companies are being removed. Nasdaq has announced the results of the annual restructuring of the Nasdaq-100 Index (Nasdaq: NDX ), which will be effective before the market opens on Monday, December 19, 2022.

The six companies that will be added to the index include…

View On WordPress

0 notes

Text

S&P 500, Nasdaq 100, Dow Jones Levels into FOMC

S&P 500, Nasdaq 100, Dow Jones Levels into FOMC

Yesterday brought a strong intra-day reversal in stocks, exposing a long upper wick on daily candles of SPX, NDX and YM. The big question now is whether the Fed gives bears motivation for follow-through.

View On WordPress

0 notes