#nifty option backtesting

Explore tagged Tumblr posts

Text

#nifty50#nifty#banknifty#Backtesting#free backtesting#option backtesting#free option backtestng#nifty backtesting#nifty option backtesting#free nifty backtesting#optiontrading#option trading tips

0 notes

Text

Nifty Option Trading Strategies for Beginners in India

Mastering Nifty option trading strategies is a game-changer for students and beginners aiming to thrive in the Indian stock market. The Nifty 50 index, known for its liquidity and volatility, offers immense opportunities for options trading, but success requires skill and knowledge. Shaan Trade, a premier online institution, provides top-tier options trading courses tailored for learn Nifty trading enthusiasts, particularly students. These courses teach stock market options strategies specific to the Nifty index, making them ideal for Nifty trading beginners. In this detailed guide, we explore Shaan Trade’s approach, key Nifty option trading strategies, and how students can start their trading journey with confidence.

Why Students Should Learn Nifty Option Trading

Nifty options, based on the Nifty 50 index, are among the most traded derivatives in India due to their high liquidity and potential for significant returns. Options trading involves contracts that give the right, but not the obligation, to buy or sell the Nifty index at a specific price before a set date. For students, learn Nifty trading offers:

High Profit Potential: Leverage allows small investments to yield substantial gains.

Career Growth: Skills for roles like derivatives trader or market analyst.

Risk Management: Strategies like hedging minimize losses.

Financial Discipline: Builds habits for long-term wealth creation.

Shaan Trade’s options trading courses are designed for stock trading for beginners, offering flexible schedules and practical training to master Nifty option trading strategies in the Indian market.

What Makes Effective Nifty Option Trading Strategies?

Successful Nifty trading strategies depend on market conditions, risk appetite, and clear execution. Students should focus on strategies that are:

Beginner-Friendly: Simple to grasp with defined entry and exit points.

Tailored to Nifty: Leverage the index’s volatility and liquidity.

Risk-Conscious: Include stop-loss or hedging to protect capital.

Backtested: Validated through historical Nifty data for reliability.

Supported by Education: Taught through structured options trading courses with live market examples.

Shaan Trade’s courses emphasize these qualities, ensuring students master the Nifty option trading strategies needed for the Indian market.

Shaan Trade’s Nifty Options Trading Course: Your Path to Success

Shaan Trade’s "Nifty Options Trading Course" is a standout among options trading courses, crafted for learn Nifty trading beginners and students. It equips learners with the tools to trade Nifty options confidently.

Key Features:

Curriculum: Covers stock market options fundamentals (calls, puts, Greeks), technical analysis (option chain analysis, volatility indicators), and Nifty-specific strategies (bull call spread, strangles, iron condors).

Practical Training: Live trading sessions where students apply Nifty option trading strategies in real-time Nifty markets.

Student-Friendly: Affordable pricing with flexible payment plans to fit student budgets.

Mentorship: One-on-one guidance from experienced traders to address individual queries.

Certification: Industry-recognized certificate to boost career prospects.

Duration: 8 weeks, with 2–3 hours of weekly live classes plus recorded content for revision.

Community Support: Access to forums and Q&A sessions for peer learning and ongoing support.

Why Choose This Course? Shaan Trade’s course is ideal for Nifty trading beginners, combining theoretical insights with hands-on practice. Students learn to analyze Nifty option chains, interpret Greeks (e.g., Delta, Theta), and execute trades in volatile conditions. The course’s affordability, live market exposure, and mentorship make it a top choice for mastering Nifty option trading strategies. By focusing on practical skills, Shaan Trade ensures students can confidently implement stock market options strategies.

Price: Approximately INR 15,000–18,000 (check Shaan Trade’s website for discounts).

Top Nifty Option Trading Strategies

Here are five of the Nifty option trading strategies taught in Shaan Trade’s options trading course, with examples tailored to the Nifty 50 index:

1. Bull Call Spread

What It Is: Buy a call option at a lower strike price and sell a call at a higher strike to reduce cost, betting on a moderate Nifty rise.

When to Use: Moderately bullish outlook (e.g., post-positive economic data).

Example: Buy Nifty 22,000 call for INR 200 and sell 22,200 call for INR 80. Net cost: INR 120 per lot (50 units). Max profit if Nifty reaches 22,200.

Risk: Limited to net premium paid.

Why It Works for Nifty: Cost-effective for students, leveraging Nifty’s frequent uptrends.

2. Long Strangle

What It Is: Buy an out-of-the-money call and put with different strike prices, betting on significant Nifty movement.

When to Use: Before high-volatility events (e.g., budget announcements).

Example: Buy Nifty 22,100 call (INR 90) and 21,900 put (INR 80). Total cost: INR 170 per lot. Profit if Nifty moves beyond 22,270 or 21,730.

Risk: Limited to premium paid; high time decay.

Why It Works for Nifty: Nifty’s volatility during events creates opportunities.

3. Iron Condor

What It Is: Sell an out-of-the-money call and put, and buy further out-of-the-money call and put to limit risk, earning premiums in a range-bound market.

When to Use: Stable Nifty range (e.g., 21,800–22,200).

Example: Sell Nifty 22,200 call (INR 50) and 21,800 put (INR 40), buy 22,400 call and 21,600 put for protection. Net premium: INR 90 per lot.

Risk: Limited to difference between strikes minus premium.

Why It Works for Nifty: Nifty’s consolidation phases suit this strategy.

4. Bear Put Spread

What It Is: Buy a put option at a higher strike and sell a put at a lower strike, betting on a moderate Nifty decline.

When to Use: Bearish outlook (e.g., post-negative global cues).

Example: Buy Nifty 22,000 put for INR 150 and sell 21,800 put for INR 60. Net cost: INR 90 per lot. Max profit if Nifty falls to 21,800.

Risk: Limited to net premium paid.

Why It Works for Nifty: Protects against sharp declines with low capital.

5. Short Straddle

What It Is: Sell a call and put at the same strike price, betting on minimal Nifty movement.

When to Use: Low volatility periods (e.g., post-earnings stability).

Example: Sell Nifty 22,000 call and put for INR 100 each. Total premium: INR 200 per lot. Profit if Nifty stays near 22,000.

Risk: Unlimited if Nifty moves significantly.

Why It Works for Nifty: High premiums during stable periods benefit sellers.

Shaan Trade’s options trading course teaches these Nifty option trading strategies with live Nifty market examples, ensuring students understand their practical application.

How to Start Nifty Options Trading as a Student

Enroll in Shaan Trade’s Course: The Nifty Options Trading Course is perfect for learn Nifty trading beginners.

Open a Demat Account: Use platforms like Zerodha or Upstox for low-cost Nifty options trading.

Practice with Paper Trading: Test Nifty option trading strategies on virtual platforms to build confidence.

Start Small: Trade one Nifty lot (50 units) to minimize risk.

Stay Informed: Follow SEBI regulations and Nifty news via Moneycontrol or Shaan Trade’s resources.

Challenges Students May Face

Time Management: Balancing academics and trading is challenging. Shaan Trade’s flexible options trading course with recorded content helps.

Financial Constraints: Shaan Trade’s affordable pricing and free webinars reduce barriers.

Market Volatility: Nifty’s swings can be risky. Shaan Trade teaches risk management to protect capital.

Learning Curve: Options Greeks can be complex. Shaan Trade simplifies concepts for stock trading for beginners.

Tips to Excel in Nifty Options Trading

Master Option Chain Analysis: Read implied volatility and open interest to time trades effectively.

Prioritize Risk Management: Use stop-loss orders or hedging to limit losses.

Understand Greeks: Study Delta, Theta, and Vega to predict option behavior.

Backtest Strategies: Test Nifty trading plans on historical Nifty data.

Stay Disciplined: Avoid overtrading during volatile Nifty sessions.

Why Shaan Trade is the Best Choice for Nifty Trading

Shaan Trade’s options trading courses excel for learn Nifty trading students due to:

Practical Focus: Live Nifty trading sessions bridge theory and practice.

Affordable Pricing: Fits student budgets without compromising quality.

Expert Mentorship: Instructors with Nifty market expertise provide actionable insights.

Community Support: Forums and Q&A ensure continuous guidance.

These features make Shaan Trade the top provider of Nifty option trading strategies education.

Conclusion

The Nifty option trading strategies taught by Shaan Trade empower students to navigate stock market options with skill and confidence. From bull call spreads to iron condors, Shaan Trade’s options trading course equips learn Nifty trading beginners with practical strategies for the Nifty 50 index. With affordable pricing, live market exposure, and expert mentorship, Shaan Trade is the ideal choice for students seeking Nifty trading success. Enroll in Shaan Trade’s Nifty Options Trading Course today and unlock the potential of Nifty options!

Disclaimer: Options trading involves risks, and past performance is not indicative of future results. Consult a financial advisor before trading.

0 notes

Text

Free Backtesting

#freebackktesting#backtest#backtesting#freebacktest#niftybacktesting#optionbacktesting#freeoptionbackteting#bankniftybacktesting

1 note

·

View note

Text

Midcap Nifty: Unlocking the Growth Potential of India's Mid-Sized Companies

Midcap Nifty stands as a pivotal index for investors seeking a balance between stability and growth. Representing the performance of India’s mid-cap companies, it offers an attractive alternative to large-cap and small-cap investments. Let’s explore why Midcap Nifty could be the key to building a robust portfolio.

What is Midcap Nifty?

Midcap Nifty is an index that tracks the top-performing mid-cap companies listed on the National Stock Exchange (NSE). These companies typically have market capitalizations between ₹5,000 crores and ₹20,000 crores. As businesses in their growth phase, they strike a balance between high potential returns and moderate risk.

Features of Midcap Nifty

Diverse Sector Representation: The index includes companies from industries such as IT, healthcare, manufacturing, and finance, offering a diversified investment option.

Dynamic Growth Opportunities: Mid-cap companies are often at the forefront of innovation and expansion, providing investors with unique opportunities for wealth creation.

Liquidity and Accessibility: Stocks within the index maintain adequate trading volumes, making them easily accessible for retail and institutional investors alike.

Why Choose Midcap Nifty?

Growth-Oriented Investments: Mid-cap companies are in the sweet spot of business growth, offering higher return potential compared to large caps.

Better Value: Many mid-cap stocks are undervalued gems, providing a chance for investors to capitalize on their growth stories before they become mainstream.

Portfolio Diversification: Including Midcap Nifty in your portfolio ensures exposure to mid-sized companies that can thrive in various economic conditions.

Risks to Consider

Higher Volatility: Mid-cap stocks are more prone to price swings than large caps.

Economic Sensitivity: Mid-cap companies can face challenges during economic downturns due to limited resources.

Lower Visibility: These companies may receive less coverage, requiring deeper research for informed investments.

How to Invest in Midcap Nifty

Index Funds and ETFs: These provide an easy and cost-effective way to gain exposure to the Midcap Nifty index.

Direct Stock Selection: Investors can handpick stocks from the index to build a customized portfolio.

Systematic Investment Plan (SIP): A disciplined SIP approach can help manage risks and average out market volatility over time.

Leveraging Tradetron for Midcap Nifty

Tradetron, a leading algorithmic trading platform, simplifies your investment journey:

Automated Strategies: Use predefined strategies to automate your trades.

Customizable Algorithms: Create algorithms tailored to your risk tolerance and goals.

Backtesting Capabilities: Test strategies against historical data to optimize performance.

Real-Time Alerts: Stay informed about market changes and opportunities.

Midcap Nifty in the Indian Economy

Reflection of Growth Sectors: The index captures the performance of industries driving India’s economic progress.

Potential for Outperformance: Historically, mid-cap indices have delivered higher returns during economic upswings.

Focus on Innovation: Many mid-cap companies invest in research and development, paving the way for long-term success.

Tips for Investing in Midcap Nifty

Research and Analysis: Understand the fundamentals of the companies in the index.

Diversify: Combine Midcap Nifty with large-cap and small-cap investments for a well-rounded portfolio.

Adopt a Long-Term View: Mid-cap investments often require patience to realize their full potential.

Conclusion

Midcap Nifty represents a promising segment of the Indian stock market, offering a compelling mix of growth potential and moderate risk. With the power of advanced tools like Tradetron, investors can craft strategies to make the most of this dynamic index. Whether you're building wealth for the future or seeking diversification, Midcap Nifty deserves serious consideration in your investment plan.

0 notes

Text

📊 The Ultimate Guide to Statistical Analysis in Stock Markets (2025)

Stock markets thrive on numbers, patterns, and probabilities. But how can investors decode the chaos? This complete guide breaks down statistical analysis in stock markets, showing how professionals—from Wall Street to Dalal Street—leverage data-driven strategies for smarter investing 📈. Whether you're a beginner or a pro, understanding these statistical foundations can sharpen your market game 🚀.

🤔 Why Is Statistical Analysis the Backbone of Stock Trading Success?

Markets are unpredictable, yet patterns emerge when data is analyzed statistically. Statistical analysis helps investors:

✅ Identify trends and market cycles ✅ Test trading hypotheses ✅ Manage risk effectively

Take the Indian stock market: Between 2008 and 2020, the Nifty 50 showed cyclical trends that technical traders exploited using regression models and time series analysis. Legendary economist Eugene Fama's Efficient Market Hypothesis (EMH) suggested markets are fully efficient—but in India, multiple studies (IIM Ahmedabad, 2019) revealed semi-strong efficiency, meaning room exists for statistical arbitrage.

A real-world case? The 2020 pandemic crash. Traders using statistical volatility models like GARCH (Generalized Autoregressive Conditional Heteroskedasticity) successfully predicted sharp rebounds in sectors like Pharma, outpacing the Nifty’s average recovery.

🧮 The Essential Statistical Methods Every Trader Must Know

Statistical tools aren't optional—they're your toolkit 🧰. Here’s what powers market decisions:

✨ Probability Theory: The backbone of predicting outcomes. For example, when Infosys announces earnings, traders calculate probabilities of price jumps based on historical volatility.

🔍 Regression Analysis: Measures relationships between variables. ICICI Bank’s stock might be regressed against interest rate changes to forecast movements.

🎯 Hypothesis Testing: Checks if trading strategies outperform random chance. A popular hypothesis? "Does the 'Monday Effect' (stocks dip on Mondays) hold in the Indian context?" Research from NSE (2021) showed a weak but noticeable pattern in small-cap stocks.

📈 Time Series Analysis: Stock prices are time-bound data. ARIMA models (AutoRegressive Integrated Moving Average) are used to forecast indices like the Sensex, especially during high-volatility periods.

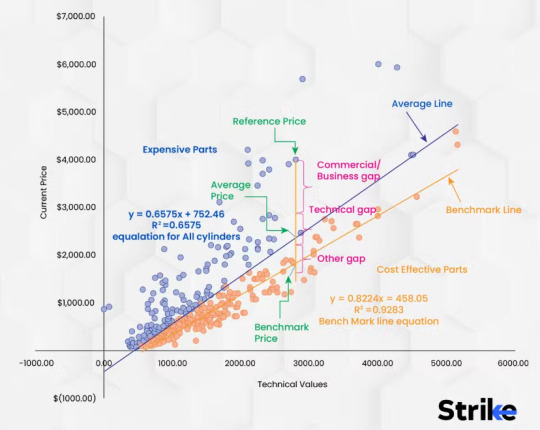

🔬 Deep Dive: Powerful Statistical Models for Stock Market Forecasting

Want to predict where the market is heading? These models lead the way:

🌀 AR and ARIMA Models: Applied to the Nifty’s closing prices, ARIMA has shown strong predictive accuracy during stable periods (source: RBI Bulletin, 2022).

🎲 Monte Carlo Simulations: Imagine simulating 10,000 possible paths for Tata Motors’ stock—this model does exactly that. Fund managers use it to price derivatives and stress-test portfolios.

⚖️ Black-Scholes Model: Essential for options trading. Indian traders frequently apply it when dealing with Nifty options, calculating fair prices and hedging effectively.

📊 CAPM (Capital Asset Pricing Model): Helps calculate expected returns. For instance, HDFC’s Beta (measure of volatility) relative to the Nifty is key to understanding its risk profile.

These models aren't abstract—they're integrated into tools like Strike Money, a robust charting and analysis platform many Indian traders rely on to visualize and backtest these statistical strategies in real time 📊.

🚨 Mastering Risk Management and Portfolio Optimization with Statistics

Markets are thrilling—but risky. Statistical analysis allows traders to balance risk and return smartly.

💼 Harry Markowitz’s Modern Portfolio Theory (MPT): Emphasizes diversification. Indian mutual funds apply MPT rigorously to create balanced portfolios across sectors like IT, Pharma, and FMCG.

📏 Sharpe Ratio: Measures returns adjusted for risk. Between 2015-2020, Axis Bluechip Fund maintained a Sharpe ratio of 1.4—higher than the market average—making it a popular choice.

⚠️ Value at Risk (VaR): Predicts potential loss. During the 2020 market crash, institutional investors used VaR to recalibrate exposure to sectors like Aviation and Tourism.

By applying these concepts through charting tools like Strike Money, retail investors can access institutional-level risk metrics, making smarter, data-driven decisions.

🤖 How Machine Learning is Supercharging Statistical Analysis in the Indian Market

We’re entering a new era: AI and machine learning (ML) are redefining statistical analysis.

In India, quant funds and tech-savvy traders use ML models like Random Forests and Neural Networks to sift through terabytes of data. Notably, Renaissance Technologies, the world's top quant hedge fund, inspired Indian quant startups (e.g., Qplum, Algonauts) to blend traditional statistics with deep learning for advanced predictions.

A 2023 study by IIT Bombay demonstrated that ML models outperform traditional ARIMA during volatile periods by 15%, especially in mid-cap stocks.

Strike Money has also rolled out ML-integrated tools that allow users to build and test AI-powered trading models—bringing Wall Street-level tech to Indian traders 🇮🇳.

⚠️ Why Statistical Models Sometimes Fail—and What You Can Do About It

Statistics isn’t magic ✋. Even the best models have pitfalls:

❗ Overfitting: A model fits historical data too closely but fails in real time. Example: A 2018 backtest on Bank Nifty showed a 200% return—yet the live strategy flopped due to overfitting biases.

❗ Data Snooping Bias: Testing so many variables that one “appears” to work by chance. Traders should guard against this by using out-of-sample testing.

📉 Market Shifts: The 2016 demonetization in India broke many statistical models as liquidity and patterns shifted overnight—highlighting that no model can predict black swan events.

A smart way to mitigate? Regularly recalibrate your models using updated data—Strike Money makes this refresh seamless, ensuring your strategy evolves with the market 🔄.

🚀 Tools, Data, and Learning Paths to Get Started with Statistical Trading

Ready to dive in? Here's how to start strong in statistical stock trading:

💻 Tools You Need:

Strike Money: Charting + backtesting powerhouse with India-specific data

Bloomberg Terminal & Reuters Eikon: Institutional-grade data feeds

Yahoo Finance API: Free, good for beginners

🧑💻 Languages to Learn: Python & R are the gold standards for statistical computing. Indian communities on GitHub and Stack Overflow are thriving, making learning collaborative.

📚 Where to Learn:

CFA Institute: Financial statistics modules

Coursera & edX: Courses like “Financial Engineering & Risk Management”

Indian forums: Traderji, Zerodha Varsity

A 2024 SEBI report showed that over 65% of active traders in India now use some form of quantitative/statistical method—a testament to the growing importance of this skill 💥.

🔑 Final Thoughts: Why Statistical Analysis is Your Trading Superpower

The stock market is part art, part science—but the science part is increasingly statistical. By mastering techniques like regression, time series forecasting, and risk metrics, you can turn random noise into actionable insights. The Indian stock market—rich with data and opportunity—offers a playground for those equipped with the right tools and mindset.

Platforms like Strike Money democratize access, allowing retail investors to harness the same models once reserved for elite institutions. Whether you're trading Nifty futures or small-cap stocks, remember: In the world of investing, data doesn’t lie—but how you interpret it makes all the difference 🔍📈.

0 notes

Link

We recently introduced a new feature on algotest.in called Portfolio, which allows you to backtest multiple strategies together. In this blog, we’ll backtest a sample portfolio of multiple strategies, and also show you how to avoid common pitfalls when using this feature.

#free backtesting software#options backtesting india#free backtesting software india#nifty option backtesting#backtest trading strategy

0 notes

Text

How can you use Chartink Nifty and its advantages and disadvantages?

Chartink Nifty is a popular tool among Indian traders and investors who use technical analysis to make trading decisions in the stock market. By using Chartink Nifty, traders and investors can get a better understanding of the Nifty index and make more informed trading decisions.

Advantages:

Backtesting: Chartink Nifty allows users to backtest their trading strategies, which can help them evaluate the performance of their strategies and make improvements.

Customization: Chartink Nifty allows users to customize charts according to their preferences and needs, which can help them get a more accurate and detailed analysis of the Nifty index.

Disadvantages:

Limited customization options: While Chartink Nifty allows for some customization, it may not be as flexible as other technical analysis tools.

No mobile app: Chartink Nifty is only accessible via a web browser, which may not be convenient for users who prefer mobile apps.

0 notes

Link

1 note

·

View note

Text

#backtesting#nifty#nifty50#banknifty#option trading tips#option trading strategy#option backtesting#options#nifty today

1 note

·

View note

Text

In this Face2Face video, we have Mr. Pankaj D Prasade, who will talk about the concept of Bhavcopy and Bhavcopy analysis, which is divided into two parts. He will demonstrate this in an excel sheet and also show it through the NSE website. This will be a learning experience for every trader who is unaware or unfamiliar with the concept of Bhavcopy in a financial institution.

The role of bank nifty, future and options, and options trading is also mentioned here for more clarity. As our guest speaker has a background in IT, he also talks about coding and backtesting the Bhavcopy. He has also done commodities, equities, and forex trading in the past, which has helped him in the current endeavors of analyzing Bhavcopy.

0 notes

Text

0 notes

Text

The Complete Guide to Information Analysis: Techniques, Tools & Real-World Insights

Why Information Analysis Matters More Than Ever

In today’s data-driven world, making informed decisions is no longer optional. Whether you are an investor, business strategist, or researcher, information analysis helps cut through the noise and extract valuable insights.

From predicting stock market trends to detecting fraud in banking, information analysis plays a crucial role in various industries. With AI-powered tools, statistical techniques, and real-time data processing, organizations can transform raw data into actionable strategies.

What is Information Analysis? The Core of Smart Decision-Making

Information analysis is the process of collecting, interpreting, and evaluating data to make well-informed decisions. It involves multiple methods, including statistical analysis, qualitative research, and machine learning techniques.

Key Elements of Information Analysis:

Data Collection – Gathering relevant data from sources like market reports, financial statements, or customer feedback.

Data Processing – Cleaning, organizing, and structuring data for analysis.

Data Interpretation – Identifying trends, patterns, and relationships.

Decision-Making – Using insights to drive business, investment, or policy decisions.

Real-World Example: Indian Stock Market Insights

In the Indian stock market, traders analyze historical price movements, trading volume, and macroeconomic indicators to predict trends. Tools like Strike Money help investors with technical analysis, charting, and backtesting to identify profitable trades.

Data Analysis vs. Information Analysis: Are They the Same?

Many people confuse data analysis with information analysis, but they serve different purposes.

Data analysis focuses on processing raw data and finding numerical trends.

Information analysis is broader, including data interpretation, contextual understanding, and decision-making.

Example: Stock Market Predictions

A trader using Strike Money for stock charting may analyze price action, RSI, moving averages, and Bollinger Bands. But a market analyst would go deeper, considering macroeconomic factors, RBI policies, and foreign investments to get a complete picture.

How to Analyze Information Like an Expert

Mastering information analysis requires a mix of qualitative and quantitative techniques.

1. Statistical Analysis & Probability Models

Statistical methods help extract insights from large datasets. Common techniques include:

Regression Analysis – Predicting stock prices based on past trends.

Hypothesis Testing – Checking if a strategy significantly impacts financial performance.

Bayesian Probability – Estimating market movements based on prior data.

Indian Market Example: How FII Investments Affect Nifty 50

Foreign Institutional Investors (FIIs) significantly impact Indian stock indices like Nifty 50 and Sensex. Analysts use statistical models to assess how FII inflows affect market volatility.

2. Machine Learning in Information Analysis

AI-powered analysis is transforming financial forecasting, fraud detection, and sentiment analysis.

Predictive Analytics – AI models forecast stock prices based on historical trends.

Natural Language Processing (NLP) – Analyzing news sentiment to gauge market trends.

Algorithmic Trading – AI-driven trading strategies execute trades based on real-time data.

Case Study: How AI Predicted the Yes Bank Crisis

In 2020, Yes Bank faced a liquidity crisis due to bad loans. AI-powered risk analysis tools flagged high NPAs (Non-Performing Assets) months before the crash, warning investors.

3. Qualitative Research: The Power of Context

Numbers alone don’t tell the full story. Qualitative analysis provides context by studying:

Market News & Reports – RBI policies, government budgets, corporate earnings.

Expert Opinions & Forecasts – Analyst reports from Goldman Sachs, JP Morgan.

Behavioral Economics – How investor psychology affects market trends.

Example: How Elon Musk’s Tweets Impacted Crypto Markets

A single tweet from Elon Musk about Bitcoin caused a 20% price swing. This highlights why qualitative factors—like public perception—are crucial in analysis.

Top Tools for Information Analysis in 2025

Technology has made information analysis more efficient with AI-driven software, visualization tools, and real-time data processing.

1. Strike Money – Best for Stock Market Charting

Strike Money is a powerful technical analysis tool that helps traders analyze price trends, identify patterns, and make data-driven trading decisions.

2. Python & R – For Advanced Data Science

Python (Pandas, NumPy, SciPy) – Best for statistical and predictive modeling.

R – Great for financial modeling and academic research.

3. Tableau & Power BI – Best for Data Visualization

These tools help create interactive dashboards for business intelligence and reporting.

4. Google Data Studio – For Web & Marketing Analytics

Ideal for analyzing SEO, web traffic, and digital marketing trends.

5. AI-Based Tools – ChatGPT, IBM Watson, SAS

These tools use machine learning for text analysis, market forecasting, and risk management.

How Information Analysis Helps in Different Industries

The impact of information analysis goes beyond finance. Here’s how it’s shaping different industries:

1. Stock Market & Trading

Predictive analytics helps forecast stock trends.

Sentiment analysis tracks investor mood using news data.

Algo-trading executes high-speed trades based on real-time signals.

2. Banking & Fraud Detection

AI-driven risk analysis identifies suspicious transactions.

Big data analytics prevents credit card fraud.

Example: How Indian Banks Use AI for Fraud Prevention

SBI & HDFC use AI-powered fraud detection systems to identify unusual transactions and prevent cyber fraud.

3. Healthcare & Medical Research

Predictive models help diagnose diseases.

AI-driven analysis speeds up clinical research.

Case Study: AI in COVID-19 Prediction

Indian researchers used machine learning to predict COVID-19 outbreaks based on mobility and health data.

4. Marketing & Consumer Insights

Customer segmentation helps brands target the right audience.

Predictive analytics improves ad performance.

Example: Flipkart’s AI-Driven Customer Analysis

Flipkart uses AI & big data to recommend products based on user behavior.

Biggest Mistakes in Information Analysis & How to Avoid Them

Even expert analysts make mistakes. Here are the biggest errors and how to avoid them:

1. Ignoring Cognitive Biases

Confirmation Bias – Only looking for data that supports pre-existing beliefs.

Survivorship Bias – Overestimating success rates by ignoring failed cases.

2. Relying Too Much on Past Trends

Markets evolve, and historical data isn’t always predictive.

3. Using Poor-Quality Data

Bad data leads to misleading insights. Always verify sources and cross-check reports.

What’s Next? The Future of Information Analysis

With AI, quantum computing, and big data, the future of information analysis looks promising.

1. AI & Deep Learning Will Improve Forecasting

AI models will become more accurate in predicting market trends and economic downturns.

2. Ethical Challenges Will Grow

Issues like data privacy, bias in AI models, and misinformation will need stronger regulations.

3. Real-Time Analysis Will Become the Standard

Instant insights will drive business and trading decisions in milliseconds.

Final Thoughts: Mastering Information Analysis for Smarter Decisions

Information analysis isn’t just for professionals—it’s a must-have skill for anyone making data-driven decisions. Whether you’re a trader, investor, business strategist, or marketer, leveraging the right tools and techniques will set you apart.

Key Takeaways

✅ Use AI-powered tools like Strike Money for stock market insights. ✅ Combine quantitative & qualitative analysis for a 360-degree view. ✅ Avoid biases & ensure data accuracy for better decision-making. ✅ Stay updated on AI-driven advancements to stay ahead in the game.

By mastering information analysis, you can make smarter, data-driven decisions in business, finance, and beyond. 🚀

0 notes

Text

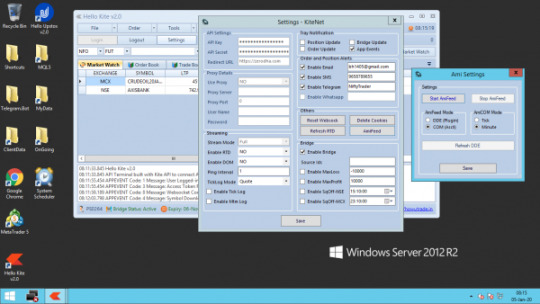

Amifeed For Amibrocker

hello, I have opted for amifeed data feed trial. I am using the amibroker 5.6 version. but there is some issue I am facing. 1) if I save ema style as THICK and then restart amifeed its style becomes default I mean thin again. 2) I am using 2 ema 50 and 100 but when amibroker opens 100 ema become 110 eam. I will post code also to this. _SECTION_BEGIN('Price'); SetChartOptions(0,chartShowArrows|chartShowDates); _N(Title = StrFormat('((NAME)) - ((INTERVAL)) ((DATE)) Open %g, Hi %g, Lo %g, Close %g (%.1f%%) ((VALUES))', O, H, L, C, SelectedValue( ROC( C, 1 ) ) )); Plot( C, 'Close', ParamColor('Color', colorDefault ), styleNoTitle | ParamStyle('Style') | GetPriceStyle() ); _SECTION_END(); _SECTION_BEGIN('EMA'); P = ParamField('Price field',-1); Periods = Param('Periods', 50, 2, 300, 1, 10 ); Plot( EMA( P, Periods ), _DEFAULT_NAME(), ParamColor( 'Color', colorCycle ), ParamStyle('Style') ); _SECTION_END(); _SECTION_BEGIN('EMA1'); P = ParamField('Price field',-1); Periods = Param('Periods', 100, 2, 300, 1, 10 ); Plot( EMA( P, Periods ), _DEFAULT_NAME(), ParamColor( 'Color', colorCycle ), ParamStyle('Style') ); _SECTION_END(); I hope someone can help me. thanks

Ami Feed For Amibroker

Amibroker Live Data. Number #1 Amibroker Data Feeder. 7 Days Trial

AmiFeeder Data. Amibroker Data Feed. Real Time Data for Amibroker

Data updates second by second in amibroker during market and backfill is in 5 min format. Traders can take our annual package to get basic training of amibroker and free best buy sell signals for amibroker. Buy sell signals for amibroker is also known as AFL (amibroker formula language). Ism dongle not installed download. Amifeed provides fast low latency data to your Amibroker with new advanced technologies. We provide one-month service for Rs 449/- only which is very low compared to other providers.

AmiFeeder software is now AmiBrokerLiveData Looking for reliable real time data for amibroker. Your search ends here. Download and install our Setup for free demo of Equity Cash, Equity Future, Nifty Options, Mcx commodity, Ncdex Commodity and Currency Data. All this in only Rs 444 per month. Offering the Best Support for our software. We Provide Support via Team viewer. On all Trading Days. Nifty and bankNifty, weekly and monthly options Available. 365 Days backfill for data feed for proper backtesting of your strategies. Trade in banknifty Weekly Options and make money, BankNifty options has highest volume and gives good opportunity to make money from small capital. At 'Amibroker Live Data' we are the only data vendor who given upto '365 day Backfill' with 1 month data feed. Best Amibroker Buy Sell signals for Nse and Mcx available. Offering reliable data for amibroker Best Support from 8:00 am to 9:00 pm | #1 Amibroker Data Feed. Excellent Quality Data feed for Amibroker cash, Fno, Commodity Data Feed. 180 Days 1 Min Backfill. 7 Day Demo. Real Time Data feed for amibroker. Best Data Feed support from 8 am to 9 pm. Mcx and Nse AFL signals. Improved AmiFeeder. Amibroker Live Data Feed now works on windows 11 also. Feel free to use latest windows os for better visual experience

Free DemoMore Details

Ami Feed For Amibroker

Amifeed provides fast low latency data to your Amibroker with new advanced technologies. We provide one-month service for Rs 449/- only which is very low compared to other providers. Merging last 3 years EOD data to Amifeed subscription which provides only 180 days: AmiBroker: 9: Jul 20, 2020: amifeed amibroker issue: AmiBroker: 3: Apr 19, 2020: R: Total ask bid data from NestRTD Amifeeder: Data Feeds: 0: Jan 28, 2019. AmiFeeder - Real Time Data Feed App for Amibroker is very user friendly and automatically connects with Amibroker. Just download Amifeed Setup and Install on Windows PC. After first run Registration, Run Amifeeder from Start Menu and it will start tick-by-tick data feed in Amibroker automatically.

0 notes

Photo

Check NSE Live Stocks & Nifty to Analyse stocks, Visit tools like Backtesting, Optimizer, Trading Charts, Open Interest, Option chain etc. Find Live stocks data.

0 notes

Link

Let’s say we are short a 920straddle with a stop loss on each leg at 20%, and “Square off: Partial” selected. A large market move in one direction will lead to one leg’s SL being hit. In this scenario, we will only exit that leg and continue to hold the position of the other leg. For example – if my call and put entry prices were both Rs 100, then my SL for each leg is Rs 120. Most likely the call SL will get hit first if the market goes up first. In this scenario, the put will continue to be in the market, with its stop-loss unchanged at Rs 120. A similar scenario unfolds if the market goes down first, in which case your put SL will be hit while the call stays in the market.

#free options backtesting india#backtest strategy online#backtest trading strategies#backtesting trading strategies#options backtesting india#nifty option backtesting

0 notes