#oanda platform

Explore tagged Tumblr posts

Text

CVC offers online trading platform Oanda for sale

CVC offers online trading platform Oanda for sale #CVCoffers #forsale #Oanda #onlinetradingplatform

0 notes

Note

would you be interested in doing a post on crypto? Such as your experience with it and how it works. And why it is important ? it still confusing for me to fully grasp. Thank you :)

Crypto is digital money that exists only electronically. It’s not controlled by central banks or governments. It uses blockchain technology—a ledger enforced by a network of computers.

You store your crypto in digital wallets and can use it for purchases and investments. Just like stock market you can convert to real dollars and withdrawal.

For the last couple of years, large financial companies have been testing a quantum financial system (ISO 20022) which would be an international standard for exchanging electronic messages in the financial industry. This is estimated to be rolled out on a large scale in about a decade.

XRP for example is a digital currency created by Ripple to enable quick money transfers. Some believe it could play a key role in a future global financial system, often referred to as the Quantum Financial System (QFS), by acting as a bridge currency that facilitates value exchange between different currencies and networks.

In plain words, cryptocurrency is a new form of currency and we are still in the beginning stages of it all. Which means the ability to make a ton of money easier than ever before :) Bitcoin is a perfect example, was at 40k I believe beginning of the year and now 100k, this means that if you invested $5,000 USD in January, you would now have made 13,000 USD letting it just sit there. If you are actively trading in crypto and meme coins you have the ability to 100x your returns. For example when people buy in to a coin that’s trending/ new/ getting hype, like XRP recently, there is a significant surge.

To trade crypto you can use centralized exchanges like Binance, Fidelity Investments, Robinhood Crypto, OANDA etc. These platforms allow you to buy, sell and trade various cryptos. This is basically what the general population does. There are other ways like using bots, staking, futures and options, margins and leverage etc.

With meme coins, as they trend you have the ability to make a lot of money overnight. This ofcourse depends on your ability to study the trends and the communities built around those coins. It is always a risk!!!!

Here’s an example for meme coins:

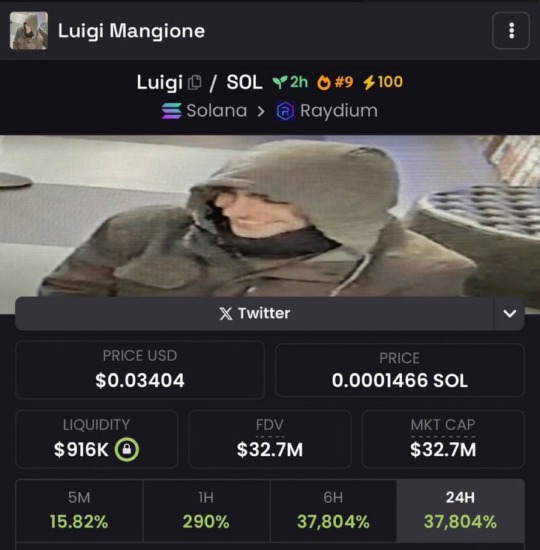

$330k to $34M (100x) in less than 2h for a meme coin created for Luigi Mangione last week. So if you had put in $3,000 in the coin when it was at 330k, in 2 hours you would have made $300,000.

I can’t say enough that this involves you being on top of trends and markets.

THIS IS NOT FINANCIAL ADVICE!!! The market is very volatile and you are basically gambling your money! Staying informed is crucial!!!! :)

28 notes

·

View notes

Text

Money Transfers Why Expats Choose GCB Exchange for Money Transfers?

1. Competitive Exchange Rates for Maximum Savings

As an expat, every dollar counts when sending money back home. High exchange rates and hidden fees from traditional banks can reduce the value of your remittance.

GCB Exchange offers competitive rates and transparent pricing, ensuring you get the most value for your hard-earned money. For example, services like XE Currency can help you compare rates and see the benefits of using GCB Exchange.

2. Low Fees with No Hidden Costs

Many exchange services promise low rates but sneak in hidden fees that inflate the overall cost. GCB Exchange ensures complete transparency. What you see is what you pay — no surprises.

This commitment to fairness is why expats across the UAE, Egypt, Jordan, and beyond rely on GCB Exchange. Check out our transparent fee structure here.

3. Speedy Transfers to Anywhere in the World

When your family depends on timely remittances, every minute matters. GCB Exchange processes transfers quickly and efficiently, ensuring your money arrives when it’s needed.

Unlike traditional banking services, which may take days, GCB Exchange is designed for fast and reliable transfers. For example, compare with services like Wise and discover how GCB Exchange goes above and beyond for expats.

4. User-Friendly Platform for Hassle-Free Transactions

Managing finances as an expat is already complicated — your money transfer service shouldn’t add to the stress. GCB Exchange offers a straightforward platform that makes it easy to:

Send money to family members.

Pay international bills.

Exchange currencies for travel or investments.

Whether online or in-person, GCB Exchange ensures your experience is seamless and hassle-free.

5. Security You Can Trust

When it comes to your hard-earned money, security is a top priority. GCB Exchange employs advanced encryption technologies and adheres to strict financial regulations to keep your transactions safe.

You can compare security standards with trusted names like OANDA and see why expats put their faith in GCB Exchange.

6. Tailored Services for Expats

Expats have unique financial needs, from regular remittances to currency exchange for travel or investments. GCB Exchange offers personalized solutions to meet these requirements.

Real-life example: A user in the UAE shared how GCB Exchange saved them hundreds of dirhams by offering better rates and lower fees compared to their previous provider.

Why Expats Trust GCB Exchange

Here’s why expats consistently choose GCB Exchange for money transfers:

Transparent pricing with no hidden fees.

Fast and reliable transfers.

Competitive exchange rates to maximize savings.

Secure platform ensuring your money is protected.

User-friendly services tailored for expats.

Join thousands of satisfied customers and experience the GCB Exchange difference today.

Start Your Money Transfer Journey with GCB Exchange

Whether you’re sending money to family, paying international bills, or preparing for a big move, GCB Exchange is here to make the process simple, affordable, and stress-free.

Click here to get started!

2 notes

·

View notes

Link

3. NFA and CFTC Regulated Brokers In US for Online Commodity Trading

Looking to diversify your trading portfolio? 🌾💹 Explore NFA and CFTC regulated brokers in the US for commodities trading! From gold to oil, trade securely while maximizing opportunities in essential markets. Elevate your trading game with a trusted partner today! 🔑 #CommodityTrading #InvestSmart #USBrokers

0 notes

Text

Forex Trading Companies In India

Forex trading companies in India play a crucial role in providing traders with access to the global currency markets. These companies, often referred to as forex brokers, offer trading platforms, analytical tools, and customer support to help both beginners and experienced traders make informed decisions. In India, only SEBI-registered and RBI-compliant forex brokers are legally allowed to offer trading in currency pairs that include the Indian Rupee, such as USD/INR, EUR/INR, GBP/INR, and JPY/INR. Prominent forex trading companies operating in India include Zerodha, Upstox, ICICI Direct, HDFC Securities, and Sharekhan, among others. Some international brokers like IG, Forex.com, and OANDA also attract Indian traders through educational resources and demo accounts, though caution must be taken to ensure compliance with Indian regulations. Choosing a reliable and regulated forex trading company is essential for a secure and successful trading experience.

0 notes

Text

Exploring the Value of Israel Currency in Indian Rupees: All You Need to Know

In an increasingly connected world, currency conversion has become an important part of global travel, business, and financial planning. For Indians traveling to or trading with Israel, understanding how to convert Israel Currency to INR is essential. Whether you're a tourist, student, investor, or business owner, knowing the value of Israeli currency in Indian terms can help you save money and make smart decisions.

This blog will walk you through the basics of Israel’s currency, how to convert it to Indian Rupees, and tips to get the best exchange rates.

What is the Currency of Israel?

Israel’s official currency is the Israeli New Shekel (ILS), commonly written as ₪. It is divided into 100 agorot. The currency is issued and regulated by the Bank of Israel and is widely accepted throughout the country. As Israel has become a growing center of innovation and international business, the Shekel has gained strength and stability in the global economy.

Understanding Israel Currency to INR Conversion

If you're planning a trip to Israel or conducting financial transactions, you’ll likely ask: How much is 1 Shekel in Indian Rupees? The exchange rate varies, but generally, 1 ILS equals around 22 to 24 INR. However, this rate isn’t fixed. It changes based on market forces such as inflation, political events, trade balances, and central bank interest rate decisions.

You can find real-time updates and analysis on Israel Currency to INR on reliable finance platforms and forex tools.

Why Do Indians Need to Know About Israel Currency to India Conversion?

Many Indians today are directly or indirectly involved in activities that require them to understand the Israel Currency to India conversion process. Here’s why:

1. Travel to Israel

Thousands of Indian tourists visit Israel each year for cultural, spiritual, and historical experiences. Converting INR to ILS helps travelers plan their expenses better and avoid high conversion charges abroad.

2. Business & Trade

India and Israel have strong trade relations, especially in defense, agriculture, and technology sectors. Business owners and exporters constantly need to calculate costs, profits, and payments based on current exchange rates.

3. Education & Employment

Many Indian students and professionals pursue opportunities in Israeli universities or tech companies. They regularly convert salaries, tuition fees, or living expenses from Shekels to Rupees.

How to Convert Israeli Currency in Indian Rupees

Want to convert Israeli Currency in Indian Rupees easily and accurately? Here's how:

Use Online Tools: Currency converter websites or apps such as XE, Google, and OANDA give live exchange rates and let you compare quickly.

Visit Your Bank: Indian banks offer currency exchange services. Before exchanging, ask for both buy and sell rates to avoid hidden costs.

Forex Cards & Travel Cards: These prepaid cards offer better exchange rates and reduce the risk of carrying cash.

Forex Counters at Airports or Travel Agencies: Convenient but often costlier due to commission charges.

Always verify the current exchange rate and check for extra service fees before converting large amounts.

Historical Overview: Israeli Currency in Indian Rupee

Looking at the past decade, the value of the Israeli Currency in Indian Rupee has steadily increased. While the Shekel was once on par with the Rupee at around 12-15 INR, it has now reached up to 24 INR in recent times. This rise is largely due to Israel's growing economy, technological advancements, and a stable banking system.

On the other hand, the Indian Rupee has faced fluctuations due to inflation, fiscal deficits, crude oil dependency, and global events like the COVID-19 pandemic and geopolitical tensions.

What Affects the Israel Currency to INR Rate?

Several key factors influence the exchange rate between the Shekel and the Rupee:

Inflation: Lower inflation in Israel helps maintain the Shekel's strength.

Interest Rates: The higher the interest rate, the more attractive a currency becomes for investors.

Trade Relations: India’s import-export balance with Israel also plays a role.

Political Stability: Both countries’ political environments affect investor confidence.

Monitoring these factors can help you predict and plan for better exchange rates.

Tips to Get the Best Conversion Rates

Compare Before Converting: Don’t settle for the first rate. Always check online tools and bank rates before making a transaction.

Avoid Airport Counters: They usually charge more. Use banks or authorized forex dealers.

Plan Ahead: If the Shekel is expected to strengthen, convert early to save money.

Use International Debit/Credit Cards Wisely: Many cards offer real-time currency conversion with minimal charges.

Why Exchange Rate Knowledge is Important

Whether you're a frequent traveler or not, understanding the Israel Currency to INR conversion can benefit you in several ways:

Save on Travel Costs

Improve Business Profit Margins

Make Smarter Investments

Avoid Hidden Charges

Track Economic Trends

Having basic knowledge of currency exchange can also help in budgeting international education or online purchases from Israel-based websites.

Conclusion

With stronger global ties and increasing international travel, more Indians are seeking information about currency conversion. Understanding how to convert the Israel Currency to INR helps you avoid unnecessary charges and make better financial choices.

From knowing the Israel Currency to India exchange rate for travel to learning how Israeli Currency in Indian Rupees is valued in trade or salary, being aware puts you at an advantage.

So, before your next international transaction or trip, be sure to visit this detailed article: 👉 Israel Currency to INR

0 notes

Text

Can You Trade Gold on OANDA? 7 Essential Insights for Beginners and Pros

Discover if you can trade gold on OANDA and learn essential strategies for successful Forex trading. Can you trade gold on OANDA? This is a question that many traders, both new and experienced, ask when navigating the world of Forex trading. Gold has always been a popular asset due to its value and stability. Understanding how to trade gold on platforms like OANDA is crucial for those looking to…

0 notes

Text

Automated Forex Trading: How to Build a Bot That Makes Smart Trades

The forex market (short for foreign exchange) is the biggest financial market in the world. People buy and sell currencies every day, and this adds up to trillions of dollars in trades. In the past, traders had to sit in front of a screen all day. But now, with the help of technology, you can build a forex trading bot that makes trades for you—even when you are sleeping.

In this blog, you will learn what automated forex trading means, how trading bots work, and how you can build your own smart trading bot step by step.

What Is Automated Forex Trading?

Automated forex trading means using a computer program to trade currencies for you. This program is called a trading bot. The bot follows a set of rules. It watches the market all day, looks for good chances, and makes trades on its own.

This way, you don’t need to be an expert or sit in front of your computer all day. The bot does the hard work and avoids emotional decisions that can lead to bad trades.

Why Use a Forex Trading Bot?

There are many good reasons to use a trading bot:

Saves Time: You don’t have to keep checking the market.

Works 24/7: The bot works day and night without stopping.

Follow Rules: Bots don’t get scared or greedy. They stick to the plan.

Quick Action: Bots can make fast trades when the market changes.

Trading bots are not perfect. They can still lose money, especially if they are not set up properly. But if you build and test your bot the right way, it can help you make smart trades and grow your money over time.

How Do Forex Trading Bots Work?

A trading bot uses rules and strategies to decide what to do. These rules tell the bot when to buy, sell, or do nothing.

For example, a simple bot may:

Buy a currency when the price is going up

Sell it when the price is going down

Use tools like stop-loss to protect your money

Some bots use more advanced tools like RSI, MACD, or even AI (Artificial Intelligence) to find better trading chances.

Steps to Build a Smart Forex Trading Bot

Here are easy steps to build your own forex bot:

1. Learn the Basics of Forex

Before building a bot, learn how forex trading works. Learn what currency pairs are, what pips and spreads mean, and how the market moves. This knowledge will help you create a good strategy for your bot.

2. Choose a Trading Strategy

Every bot needs a plan. Pick a strategy that fits your goals. Some popular ones are:

Trend Following: Buy when prices go up, sell when they go down.

Scalping: Make many small trades during the day.

Breakout Trading: Trade when prices move out of a fixed range.

Start simple. You can improve the strategy later.

3. Pick a Programming Language

Most bots are built using Python. It’s easy to learn and has many tools for trading. If you don’t know how to code, you can use platforms that let you build bots without programming.

4. Use APIs and Platforms

To make your bot trade in the real market, you need to connect it to a broker using an API (a tool that lets software talk to other software). Some popular platforms that support trading bots are:

MetaTrader 4 or 5 (MT4/MT5)

cTrader

OANDA

FXCM

These tools allow your bot to place trades, check prices, and manage your account.

5. Backtest Your Bot

Backtesting means testing your bot on old market data. It shows how your bot would have worked in the past. This helps you find out if your strategy is good or needs fixing.

6. Use a Demo Account

After backtesting, try the bot on a demo account. This is a practice account with fake money. You can see how your bot trades in real time without risking anything.

7. Start Live Trading Slowly

If your bot works well on the demo account, you can try it with a small amount of real money. Keep an eye on it and make small changes if needed. Don’t rush—take your time to improve.

Tips to Succeed with Your Forex Bot

Here are some easy tips to help your bot work better:

Keep it simple: A simple bot is often better than a complicated one.

Check your bot often: Don’t just turn it on and forget about it.

Protect your money: Use stop-loss and set trading limits.

Keep learning: The market changes, so always try to improve your bot.

Final Thoughts

Making a forex trading software might sound hard, but with today’s tools, it’s easier than ever. You don’t have to be a tech expert. There are simple platforms and guides to help you start.

With a little knowledge, a basic strategy, and some testing, you can create a bot that trades smartly and saves you time.

0 notes

Text

The Best Mobile Forex Trading Platform and Gold Broker

What Makes the Best Mobile Forex Trading Platform?

When selecting a mobile forex trading platform, several key factors must be considered:

User Interface & Experience: The platform should offer an intuitive design with seamless navigation.

Execution Speed: Fast execution times ensure minimal slippage and better trade management.

Security: Strong encryption and two-factor authentication (2FA) are crucial for safeguarding funds and personal data.

Trading Tools & Indicators: A comprehensive set of charting tools, indicators, and analysis features is essential.

Asset Availability: The platform should support a wide range of currency pairs, including major, minor, and exotic pairs.

Regulatory Compliance: The best platforms operate under strict regulatory oversight to ensure fair trading conditions.

Top Mobile Forex Trading Platforms in 2024

MetaTrader 4 (MT4) & MetaTrader 5 (MT5)

MetaTrader remains a leading choice among traders due to its reliability and extensive feature set.

Available on both Android and iOS

Advanced charting tools and customizable indicators

Supports algorithmic trading through Expert Advisors (EAs)

Secure and widely used among brokers

cTrader

cTrader is a powerful alternative to MetaTrader, known for its advanced functionalities.

User-friendly interface with Level II pricing

Highly customizable charting and order execution options

Cloud-based trading for seamless device transition

ThinkTrader

ThinkTrader by ThinkMarkets is gaining popularity for its robust mobile trading capabilities.

80+ indicators and multiple chart types

Integrated risk management tools

No dealing desk intervention

Forex.com Mobile App

Forex.com’s mobile app is ideal for traders looking for a broker-integrated experience.

Competitive spreads and direct market access (DMA)

Economic calendar and news updates

Secure and regulated by top-tier financial authorities

eToro Mobile App

eToro is perfect for social traders who prefer copy trading.

Copy trading features allow users to follow top-performing traders

Beginner-friendly interface

Commission-free forex trading on select pairs

The Importance of Choosing the Right Gold Broker

Regulation & Reputation: Choose brokers regulated by authorities like the FCA, CFTC, ASIC, or CySEC.

Competitive Spreads & Fees: Low spreads and transparent fee structures enhance profitability.

Leverage & Margin Requirements: Understand leverage offerings and margin requirements before trading.

Market Access: The best brokers provide access to spot gold, futures, ETFs, and CFDs.

Platform Compatibility: Ensure the broker supports MT4, MT5, or proprietary mobile apps for seamless trading.

Top Gold Brokers for 2024

XAU/USD Trading with AvaTrade

Regulated by multiple financial authorities

Zero commissions with tight spreads

Supports mobile trading via AvaTradeGO

IG Markets

Offers gold CFDs and spot trading

High liquidity and real-time pricing

Advanced trading tools and professional research

FXTM (ForexTime)

Competitive spreads on gold trading

Flexible leverage options

Secure and regulated trading environment

OANDA

No minimum deposit requirement

Competitive pricing on gold pairs

Advanced charting tools for mobile traders

Plus500

User-friendly gold trading app

Commission-free trading with competitive spreads

Strong regulatory oversight

The Best Gold Trading Apps for Mobile Traders

Investors and traders seeking mobile-friendly solutions for gold trading should consider apps that offer reliability, real-time data, and a smooth trading experience. Here are the top choices:

MetaTrader 4 & MetaTrader 5 Mobile Apps

Both MT4 and MT5 allow traders to execute gold trades with precision.

Available on Android and iOS

Real-time charts, indicators, and alerts

Secure login and encryption features

AvaTradeGO

Designed for seamless mobile trading

Integrated risk management tools

One-click trading functionality

eToro Mobile App

Ideal for beginners and social traders

Allows copy trading with top-performing investors

Easy-to-use interface with gold market insights

Plus500 App

Intuitive and user-friendly design

Negative balance protection

Real-time price alerts and notifications

TradingView App

Best for charting and technical analysis

Customizable indicators and alerts

Connects with multiple brokers for gold trading

Conclusion

Choosing the best mobile forex trading platform and gold broker depends on your trading style, experience level, and investment goals. Whether you’re an active forex trader or a gold investor, selecting a platform with robust security, fast execution, and intuitive mobile functionality is essential. MetaTrader, cTrader, and ThinkTrader stand out as top forex trading apps, while AvaTrade, IG Markets, and OANDA are excellent gold brokers. By leveraging the best gold trading app, traders can capitalize on market opportunities anytime, anywhere. Always ensure that your chosen broker is regulated and offers competitive pricing to maximize profitability while minimizing risks.

0 notes

Text

Online Trading Platform Market Report 2032: Key Drivers, Challenges & Growth Analysis

Online Trading Platform Market size was valued at USD 9.58 Billion in 2023 and is expected to grow to USD 18.8 Billion by 2032 and grow at a CAGR of 8.18% over the forecast period of 2024-2032

The online trading platform market is witnessing remarkable growth, fueled by technological advancements and increasing investor participation. The rise of digital trading solutions has revolutionized the way individuals and institutions trade across global financial markets.

The online trading platform market continues to expand as more investors seek convenient and secure ways to trade stocks, forex, cryptocurrencies, and other financial instruments. Enhanced accessibility, algorithmic trading, and AI-driven analytics are further transforming the landscape, making online trading more efficient and user-friendly than ever before.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3347

Market Keyplayers:

MetaQuotes Software Corp. (MetaTrader 4, MetaTrader 5)

TD Ameritrade (thinkorswim, Mobile Trader)

Interactive Brokers (Trader Workstation, IBKR Mobile)

Charles Schwab Corporation (Schwab Mobile, StreetSmart Edge)

E*TRADE (Power ETRADE, ETRADE Pro)

Saxo Bank (SaxoTraderGO, SaxoInvestor)

Robinhood Markets Inc. (Robinhood Web, Robinhood App)

Fidelity Investments (Active Trader Pro, Fidelity Mobile)

IG Group (IG Trading Platform, ProRealTime)

Plus500 (Plus500 WebTrader, Plus500 App)

CMC Markets (Next Generation Platform, CMC Mobile Trading App)

eToro (eToro CopyTrader, eToro WebTrader)

Binance (Binance Exchange, Binance DEX)

Coinbase Global, Inc. (Coinbase Pro, Coinbase Wallet)

TradingView (TradingView Web Platform, TradingView Mobile App)

Zerodha (Kite, Coin by Zerodha)

Ally Invest (Ally Invest LIVE, Ally Invest Mobile)

TradeStation (TradeStation Platform, TradeStation Mobile)

OANDA Corporation (OANDA fxTrade, OANDA Mobile)

IQ Option (IQ Option Platform, IQ Option Mobile) and others

Key Market Trends Driving Growth

1. Surge in Retail Trading and Investment

The rise of commission-free trading platforms and easy access to financial markets have led to a surge in retail trading, attracting a new generation of investors.

2. Integration of Artificial Intelligence and Automation

AI-powered trading bots, predictive analytics, and automated investment strategies are enhancing decision-making and efficiency in online trading.

3. Growth of Cryptocurrency and Blockchain-Based Trading

The increasing adoption of cryptocurrencies has led to the development of specialized trading platforms, offering decentralized and secure trading experiences.

4. Expansion of Mobile and App-Based Trading

The shift towards mobile trading applications allows users to execute trades, monitor portfolios, and access real-time market data on the go.

5. Regulatory Compliance and Security Enhancements

With the rise of online trading, regulatory bodies are implementing stricter compliance measures to ensure transparency and security in digital trading platforms.

Enquiry of This Report: https://www.snsinsider.com/enquiry/3347

Market Segmentation:

By Component

Solution

Services

Consulting

Design & Implementation

Training & Support

By Technology

Machine Learning

Natural Language Processing

Robotic Process Automation (RPA)

Virtual Agents

Computer vision

Others

By Deployment

Cloud-based

On-premise

By Organization Size

Large Enterprise

SME

By Application

IT Operations

Business Process Automation

Application Management

Content Management

Security Management

Others

By Vertical

BFSI

Healthcare

Retail

IT & Telecom

Communication and Media & Education

Manufacturing

Logistics, and Energy & Utilities

Others

Market Analysis and Growth Potential

Key Drivers and Challenges

Drivers:

Growing financial literacy and awareness

Demand for diversified investment opportunities

Advancements in trading technologies

Challenges:

Cybersecurity threats and fraud risks

Regulatory complexities across different regions

Market volatility and risk management concerns

Future Prospects and Opportunities

1. Rise of Decentralized Finance (DeFi) and Smart Contracts

DeFi platforms and smart contracts are enabling trustless, transparent, and automated trading experiences.

2. Enhanced AI-Powered Trading Strategies

AI and machine learning algorithms will continue to optimize trading performance, mitigate risks, and provide personalized investment insights.

3. Expansion into Emerging Markets

The online trading market is expected to see increased penetration in emerging economies, where digital finance adoption is accelerating.

4. Introduction of More ESG-Focused Investment Platforms

Sustainable and ethical investment platforms will cater to the growing demand for environmental, social, and governance (ESG)-focused trading opportunities.

Access Complete Report: https://www.snsinsider.com/reports/intelligent-process-automation-market-3347

Conclusion

The online trading platform market is set to witness sustained growth, driven by technological advancements, evolving regulatory landscapes, and increasing retail investor participation. By integrating AI, blockchain, and mobile-first solutions, trading platforms will continue to enhance accessibility, efficiency, and security, shaping the future of digital investing.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Online Trading Platform Market#Online Trading Platform Market Scope#Online Trading Platform Market Size#Online Trading Platform Market Growth#Online Trading Platform Market Trends

0 notes

Text

Singapore has firmly established itself as a pivotal hub in the global forex market, offering traders a robust regulatory framework, advanced technological infrastructure, and a strategic geographical position. This article delves into the intricacies of forex trading in Singapore, covering its regulatory environment, leading brokers, top signal providers, and essential considerations for traders aiming to navigate this dynamic market effectively. Regulatory Framework in Singapore Forex trading in Singapore operates under a stringent regulatory framework designed to ensure market integrity and investor protection. The primary regulatory authority overseeing forex trading activities is the Monetary Authority of Singapore (MAS). Established in 1971, MAS functions both as the central bank and the financial regulator of Singapore. It is responsible for formulating monetary policy, managing the country's official foreign reserves, and supervising financial institutions to ensure a sound and progressive financial services sector. forexbrokers.com MAS places a strong emphasis on Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) guidelines. As a founding member of the Asia Pacific Group on Money Laundering (APML), MAS ensures that firms or individuals offering forex trading services are appropriately registered and comply with stringent regulatory standards. forexbrokers.com Leading Forex Brokers in Singapore Selecting a reputable forex broker is crucial for traders aiming to navigate the Singapore forex market effectively. Here are some of the top MAS-regulated forex brokers in Singapore: IG: Recognized as the best MAS-regulated broker, IG offers over 17,000 financial instruments, responsive proprietary trading platforms, and comprehensive research and educational tools. ig.com OANDA: Known for its robust trading platform, OANDA provides CFD trading services on hundreds of forex, indices, and commodities instruments. Traders can switch between multiple trading platforms, including Trading View, OANDA's mobile app, and Meta Trader 4, using the same login credentials. oanda.com Plus500: Listed on the London Stock Exchange, Plus500 is a well-known broker offering a robust proprietary platform and an above-average selection of instruments. It is regulated by MAS, ensuring compliance with Singapore's financial regulations. fxempire.com Ava Trade: Ava Trade offers a proprietary web and mobile platform, as well as Meta Trader 4/5, providing traders with a diverse range of trading options. The broker offers multiple account types to cater to different trading needs. fxempire.com IC Markets: Known for its low fees and a decent range of trading platforms, IC Markets is suitable for both beginners and advanced traders. The broker offers competitive spreads, making it an attractive choice for cost-conscious traders. fxempire.com

Top Forex Signal Providers in Singapore Forex signal providers offer trade recommendations based on market analysis, assisting traders in making informed decisions. In Singapore, several reputable signal providers cater to both novice and experienced traders: IG Trading Signals: IG offers trading signals from two third-party providers, Auto chartist and PIA-First. Auto chartist provides automated technical analysis, while PIA-First offers fundamental analysis from experienced professionals. These signals help traders identify potential trading opportunities based on technical patterns and fundamental insights. Forex: Positioned as a leading consulting firm in Singapore, Forex offers guidance for navigating the forex market through research, analysis, and signals. They provide specialized forex signals tailored to the Singapore market, helping traders make informed decisions. blog.ultreosforex.com Signal Skyline: Signal Skyline is a global forex signal provider offering accurate and reliable trading signals. Traders receive daily FX trade alerts designed to help them achieve profitable trades. While not specific to Singapore, their services are accessible to traders in the region. signalskyline.com

Key Considerations for Forex Traders in Singapore Regulatory Compliance: Ensure that your chosen broker is regulated by MAS. This compliance provides a layer of security, ensuring that the broker adheres to Singapore's financial regulations and standards. Risk Management: Utilize tools like stop-loss orders and adhere to leverage guidelines to manage potential losses. Effective risk management is crucial in forex trading to protect your capital from significant losses. Continuous Learning: Stay informed about market trends, economic indicators, and geopolitical events that can impact currency movements. Engaging in continuous education helps traders adapt to changing market conditions and refine their trading strategies. Utilize Reliable Signals: Incorporate signals from reputable providers to inform your trading decisions, but always conduct your own analysis. While signals can provide valuable insights, it's essential to understand the rationale behind each trade.

Technological Infrastructure: Leverage Singapore's advanced technological infrastructure by utilizing high-speed internet connections and reliable trading platforms. This ensures efficient trade execution and access to real-time market data. Time Zone Advantage: Singapore's time zone overlaps with major forex markets, including Tokyo and London. This overlap provides traders with ample opportunities to engage in trading activities during peak market hours.

Forex Bank Liquidity: Enhancing Your Trading Experience For traders seeking advanced tools and real-time insights, Forex Bank Liquidity offers a comprehensive platform. With access to deep liquidity pools, expert strategies, and state-of-the-art trading tools, Forex Bank Liquidity empowers traders to maximize their investment opportunities in the Singapore forex market.

#forex education#forex expert advisor#forextrading#forexsignals#forex market#bankliquidity#digital marketing#forex#forexbankliquidity#https://t.me/forexbankliquidity#https://tinyurl.com/forexbankliquidity

0 notes

Link

1. NFA and CFTC Regulated Brokers In US for Online Currency Pairs Trading

⚡ Ready to trade currency pairs safely? Discover the top NFA and CFTC regulated brokers in the US! 🇺🇸 Explore secure trading options that allow you to navigate the forex market with confidence and ease. Don't miss the chance to enhance your trading experience today! 💵 #ForexTrading #CurrencyPairs #USBrokers #InvestSmart

0 notes

Text

What is Best Online Forex Brokers

Best Online Forex Brokers are platforms that facilitate the buying and selling of currencies in the foreign exchange (forex) market. These brokers provide traders with the necessary tools, trading platforms, and resources to trade forex effectively. The best brokers are often defined by factors such as regulation, fees, spreads, customer support, platform features, and educational resources.

Here are some of the best online forex brokers in the industry, known for their reliability, strong regulatory frameworks, and competitive trading conditions:

1. IG Group

Overview: IG Group is one of the most established forex brokers, offering a variety of trading tools and platforms. It is highly regulated and provides access to a large number of currency pairs.

Key Features:

80+ currency pairs for trading

Low spreads starting from 0.6 pips

MetaTrader 4 (MT4) and IG Trading platform

Extensive market research and educational resources

Regulated by FCA, ASIC, and other top authorities

Ideal For: Traders looking for a trusted, highly regulated broker with extensive educational and research tools.

2. OANDA

Overview: OANDA is a reliable broker offering a user-friendly platform with low spreads and extensive research tools.

Key Features:

70+ currency pairs

Low spreads starting from 1.4 pips

Access to MT4, Proprietary Trading Platform, and mobile apps

Comprehensive market analysis tools

Regulated by CFTC, FCA, ASIC, and others

Ideal For: Traders looking for low spreads and a platform with advanced research tools.

3. eToro

Overview: eToro is best known for its social trading feature, which allows traders to copy the trades of others. It's a great platform for beginners.

Key Features:

50+ currency pairs

No commissions on forex trading

Copy Trading and social trading features

User-friendly interface with mobile app access

Regulated by FCA, ASIC, and others

Ideal For: Beginner traders or those interested in copy trading and social features.

4. XM

Overview: XM offers a wide range of currency pairs and trading platforms, with competitive pricing and educational tools.

Key Features:

55+ currency pairs

Leverage up to 888:1 (depending on country)

MT4 and MT5 platforms

Educational resources and webinars for traders

Regulated by CySEC, IFSC, and others

Ideal For: Traders looking for high leverage and educational resources.

5. Forex.com

Overview: Forex.com is a popular broker with an easy-to-use platform and access to global forex markets.

Key Features:

80+ currency pairs

Competitive spreads with no commission fees

MT4 integration and custom trading platform

Access to advanced charting tools and market research

Regulated by CFTC, FCA, and ASIC

Ideal For: Traders seeking a comprehensive and reliable broker with competitive pricing.

6. AvaTrade

Overview: AvaTrade offers a wide selection of trading platforms, including MetaTrader 4 (MT4), MT5, and its proprietary platform, AvaTradeGO.

Key Features:

Over 50+ currency pairs

Low spreads and competitive leverage

Platforms: MT4, MT5, and AvaTradeGO

Copy trading and automated trading tools

Regulated by FCA, ASIC, and other global authorities

Ideal For: Traders interested in copy trading, automated trading, and those seeking a variety of platforms.

7. Interactive Brokers

Overview: Known for its low commissions and robust trading platforms, Interactive Brokers offers forex trading with a wide selection of assets and tools.

Key Features:

70+ currency pairs

Commission-based pricing with low spreads

Platforms: Trader Workstation (TWS) and IBKR mobile app

Advanced charting tools and market research

Regulated by CFTC, SEC, FCA, and others

Ideal For: Experienced traders seeking low fees, advanced tools, and access to multiple asset classes.

8. Plus500

Overview: Plus500 is a user-friendly platform known for offering a wide range of forex pairs, CFDs, and other assets. It’s ideal for beginners.

Key Features:

60+ currency pairs

No commission fees—profit is made from the spread

Risk management tools like stop-loss and guaranteed stop

Highly regulated (FCA, ASIC)

Ideal For: Beginners who want an easy-to-use platform with no commission fees.

9. Saxo Bank

Overview: Saxo Bank offers a premium trading experience with high-end tools, research, and a robust trading platform.

Key Features:

Over 180 currency pairs and other assets

Premium platforms: SaxoTraderGO, SaxoTraderPRO

Comprehensive research tools and market insights

Low spreads with commission-based pricing

Regulated by FCA, ASIC, and other financial authorities

Ideal For: Professional traders seeking a premium trading experience and comprehensive research.

10. FXTM (ForexTime)

Overview: FXTM offers a range of services with competitive leverage and educational tools, making it suitable for both beginners and experienced traders.

Key Features:

Wide range of currency pairs

Leverage up to 1000:1

Platforms: MT4, MT5, FXTM Trader

Educational webinars, guides, and videos

Regulated by CySEC, FCA, and others

Ideal For: Traders seeking high leverage and strong educational support.

Key Factors to Consider When Choosing the Best Forex Broker:

Regulation: Ensure the broker is regulated by reputable authorities (e.g., FCA, ASIC, CFTC) for safety and security.

Spreads and Fees: Low spreads and no hidden fees help reduce your overall trading costs.

Leverage: Understand the leverage options available, as high leverage can amplify both potential profits and risks.

Platforms and Tools: Choose brokers that offer popular platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) and provide charting and analysis tools.

Customer Support: A responsive customer support team ensures that any issues you encounter are addressed promptly.

Educational Resources: For beginner traders, brokers that provide comprehensive educational materials (webinars, guides, videos) are beneficial.

Conclusion:

The best online forex brokers offer a combination of reliable platforms, competitive pricing, strong regulation, and quality customer service. Brokers like IG Group, OANDA, eToro, and Forex.com provide excellent conditions for both beginners and experienced traders. Choose a broker based on your trading style, risk tolerance, and platform preference.

Contact Us WinProfx 1st Floor, The Sotheby Building, Rodney Bay, Gros-Islet, Saint Lucia P.O Box 838, Castries, Saint Lucia. +971 4 447 1894 [email protected] https://winprofx.com/ Find Us Online Facebook

0 notes

Text

10 Best United States Forex Brokers in 2025

The U.S. Forex market is highly regulated, ensuring a secure trading environment. With numerous brokers available, choosing the right one is crucial for your trading success. Here are the top 10 U.S. Forex brokers in 2025.

Key Factors to Consider in a Forex Broker

Regulation & Security – Ensure the broker is regulated by the CFTC and NFA.

Spreads & Fees – Low spreads and transparent fees maximize profitability.

Leverage & Margin – U.S. brokers offer up to 50:1 leverage for major currency pairs.

Trading Platforms – Look for MT4, MT5, or proprietary platforms with advanced tools.

Customer Support – Reliable 24/7 support is essential for smooth trading.

Top 10 U.S. Forex Brokers in 2025

The U.S. Forex market is highly regulated, providing a secure environment for traders. Here are the top 10 brokers in 2025, known for their strengths in various trading aspects:

FOREX.com - Best Overall Offering comprehensive tools, educational resources, and robust platforms, FOREX.com stands out for its strong regulatory compliance and suitability for all trader levels.

OANDA - Best for Beginners With a user-friendly interface, no minimum deposit, and transparent pricing, OANDA is ideal for new traders looking to start their Forex journey.

IG US - Best for High Leverage Known for offering leverage up to 50:1, IG US is a great choice for experienced traders who need advanced tools and high leverage.

NinjaTrader - Best for Algorithmic Trading This broker excels in algorithmic and automated trading with customizable strategies and advanced charting tools.

Interactive Brokers (IBKR) - Best for Advanced Traders Providing access to a wide range of instruments and low commissions, IBKR is perfect for professional traders looking for comprehensive research tools and advanced trading options.

eToro USA - Best for Copy Trading eToro’s innovative copy trading features allow beginners to mirror successful traders, making it an excellent platform for those who prefer a hands-off approach.

ATC Brokers - Best for ECN Trading ATC Brokers offers direct market access and transparent pricing, ideal for traders seeking efficient execution speeds and no hidden fees.

ThinkMarkets - Best for Both Beginners and Professionals Combining competitive pricing, advanced tools, and fast execution, ThinkMarkets suits both novice and seasoned traders.

Trading.com - Best for Fast Execution Specializing in ultra-fast execution with low latency, Trading.com is perfect for traders who prioritize speed and efficiency.

TD Ameritrade (Charles Schwab) - Best for Professional Traders With access to over 70 currency pairs and powerful tools like Thinkorswim, TD Ameritrade offers an excellent platform for serious traders.

#SureShotFX#SSF#Forex Broker#Forex Broker USA#Forex Broker Reviews#forex#forextrading#forex education#currency markets

0 notes

Text

Top 5 Online Forex Trading Platforms in India: A Comprehensive Review

The Indian forex market has seen explosive growth, with the number of active online traders hitting over 3 million in 2022. Many traders have found great success, turning a passion for finance into a profitable venture. However, this dynamic market offers both exciting opportunities and inherent risks.

Forex trading appeals to those seeking quick returns. But it's essential to understand the volatility involved. Choosing the right platform can make all the difference in trading success. This article reviews the top five forex trading platforms in India, evaluating them based on user experience, fees, features, and regulatory compliance.

Choosing the Right Forex Trading Platform: Key Considerations

Understanding Your Trading Needs: Beginner vs. Advanced Trader

Before selecting a platform, identify your trading style. Are you just starting, or have you been trading for years? Beginners may prefer platforms that offer educational resources. Seasoned traders might look for advanced tools and analytics.

Essential Features: Demo Accounts, Mobile Apps, Customer Support

Key features to consider include:

Demo Accounts: Practice trading without risking real money.

Mobile Apps: Trade on-the-go.

Customer Support: Access reliable help when needed.

Regulatory Compliance and Security: SEBI Regulations and Data Protection

Ensure the platform is regulated by the Securities and Exchange Board of India (SEBI). A trustworthy platform prioritizes data protection and follows legal guidelines, ensuring a safe trading environment.

MetaTrader 4 (MT4): A Trader Favorite

Platform Features and Functionality: Charting Tools, Indicators, Automated Trading

MT4 is one of the most popular forex trading platforms globally. It offers a range of features such as:

Advanced Charting Tools

Technical Indicators

Automated Trading Options

Pros and Cons of Using MT4 in India: Availability, Commission, and Support

Pros:

Easy to use for beginners.

Extensive resources and community support.

Cons:

Some Indian brokers charge higher commissions on MT4 trades.

Example: Successful Trade Story Using MT4

Many traders have successfully executed trades on MT4. For instance, a trader in Mumbai captured a 20% profit on a currency pair using automated trading features in just one week. Real stories like this highlight MT4's effectiveness.

TradingView: A Powerful Charting and Analysis Platform

In-depth Charting and Technical Analysis: Unique Features and Capabilities

TradingView is lauded for its in-depth charting capabilities. Users can analyze price movements in real time and customize charts to their liking.

Integration with Brokers: Connecting TradingView with Indian Brokers

You can link TradingView with various Indian brokers, allowing seamless trading directly from the platform, enhancing the overall trading experience.

User Reviews and Community Support: Analyze User Experiences

User reviews praise TradingView for its intuitive interface and robust community support. Many traders, both new and seasoned, value the platform's collaborative environment.

Gaining Access to Global Markets: Platforms Offering International Reach

Brokerage Options for International Trading: Highlight Major International Brokers with an Indian Presence

Several platforms offer international trading options, giving Indian traders access to global markets. Key brokers include:

IG Markets

OANDA

Forex.com

Understanding Currency Pairs and Global Market Dynamics: Educate on Global Market Influences

Understanding major currency pairs and how global news affects markets is crucial for success. Traders need a keen awareness of economic indicators that can impact exchange rates.

Regulatory Differences and Considerations: Highlight Potential International Regulatory Differences

When trading internationally, be aware of different regulatory environments. Each country has its own rules that may affect trading conditions and protections.

Choosing the Right Broker: Due Diligence and Risk Management

Spreads, Commissions, and Fees: Compare Fees Across Different Platforms

Fees can vary significantly among platforms. Be sure to compare spreads, commissions, and any other costs associated with your trades.

Leverage and Margin Requirements: Explain These Concepts and Their Risks

Leverage amplifies potential profits but also increases risks. A thorough understanding of margin requirements is necessary for effective risk management.

Risk Management Strategies for Forex Trading: Provide Actionable Tips

Establish a risk management plan. Utilize stop-loss orders and diversify your portfolio to mitigate risks.

Top 5 Forex Trading Platforms in India: A Comparative Table

Platform Fees Demo Account Mobile App Customer Support

5XTRADE Moderate Yes Yes 24/7

Trading View Varies Yes Yes Community-driven

IG Markets Low Yes Yes Excellent

OANDA Low Yes Yes 24/5

Forex.com Moderate Yes Yes Responsive

Conclusion: Your Journey to Successful Forex Trading in India

Each Forex trading platform offers its own advantages and disadvantages. MT4 stands out for its features, while 5XTRADE excels in analysis. Careful research and risk management are essential for success.

For new traders, focus on understanding your goals and trading style. Start small, practice with demo accounts, and only invest what you can afford to lose. This approach will pave the way for a successful journey in the Indian forex market.

#forex trading#best stock market trading platform in india#forex trading platform#stock trading in india

0 notes

Text

How to Use OANDA for Forex and Cryptocurrency Trading

How to Use OANDA for Forex and Cryptocurrency Trading OANDA is a leading online broker that offers a wide range of trading services, including forex and cryptocurrency trading. This guide will walk you through the steps to get started with OANDA and make the most of its powerful trading tools.To get more news about OANDA, you can visit our official website.

1. Research and Understand OANDA Before you start trading, take some time to research OANDA. Understand its services, trading platforms, and the markets it offers. This will help you make informed decisions and choose the right tools for your trading needs.

2. Create an Account Visit the OANDA website and sign up for an account . You will need to provide some personal information and verify your identity. This step is essential for complying with regulatory requirements and ensuring the security of your account.

3. Deposit Funds Once your account is verified, deposit funds into your OANDA account . You can choose from various deposit methods, including bank transfers, credit cards, and other cryptocurrencies . Select the method that suits you best and transfer the desired amount.

4. Choose Your Trading Platform OANDA offers several trading platforms, including OANDA Trade, TradingView, and MetaTrader . Choose the platform that best fits your trading style and preferences. Each platform has its own set of tools and features, so explore them to find the one that works best for you.

5. Start Trading With funds in your account and a trading platform selected, you can start trading forex and cryptocurrencies . Use OANDA's powerful tools, such as technical indicators and chart analysis, to make informed trading decisions. You can also automate your trading strategies using OANDA's APIs .

6. Monitor Your Investments Keep an eye on your investments and stay informed about market trends and news . OANDA provides market insights and expert analysis to help you make informed decisions. Regularly review your portfolio and adjust your trading strategies as needed.

7. Secure Your Account Security is paramount when trading online . Ensure your account is protected with strong passwords and two-factor authentication. Consider using a hardware wallet to store your cryptocurrencies securely.

0 notes