#oilprice

Text

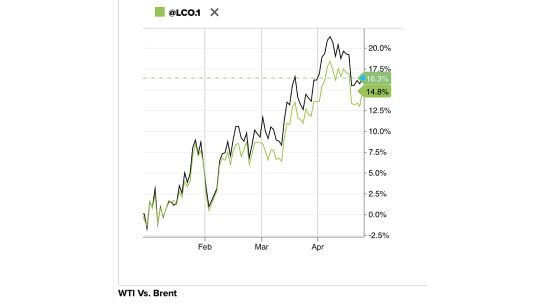

Abstract:West Texas Intermediate (WTI) oil price pauses its two-day winning streak but is anticipated to conclude the week on a positive note, trading near $77.00 per barrel during the Asian session on Friday.

0 notes

Photo

#OPEC+ members line up to endorse production cut (2 million barrels per day) after #US coercion claim #fuelprices #oilprice #oil https://www.reuters.com/business/energy/oman-says-opec-decisions-based-purely-economic-considerations-tweet-2022-10-16/ #SaudiArabia pushed other OPEC nations into oil cut, White House claims https://www.reuters.com/markets/commodities/white-house-pushes-back-saudi-claim-oil-cut-was-purely-economic-2022-10-13/ https://www.instagram.com/p/CjyLlIRhEUH/?igshid=NGJjMDIxMWI=

0 notes

Text

youtube

#newsheadlines#breakingnews#newstoday#Worldnews#currentnews#newsclips#PerpetualPixelNews#Internationalnews#newsalert#news#topnews#headlines#NorthKorea#Ukraine#Russia#Kherson#Palestine#Israel#WestBank#oilprice#opec#Greece#Thailand#Gambia#USA#Putin#Nigeria#BurkinaFaso#missiles#Youtube

1 note

·

View note

Text

Which direction is the global economy shifting?

The new estimates of IMF (July 2022) show that the growth rate of global output will decline by almost half from 6.1% in 2021 to 3.2% in 2022 and then further slowdown to 2.9% in 2023. Many reasons are being given for this. It is pointed out that global output has contracted in April-June 2022, mainly due to downturns in China and Russia. One factor that has forced a relook at growth prospects is the higher than expected inflation in developed economies, specially in USA and Europe which has led to monetary tightening in those economies. Slower than anticipated consumer spending in US is also cited as a reason. However, while growth projections has been revised downwards, inflation has been projected upwards - Consumer Price Inflation has been projected to be 6.6% in advanced economies and 9.5% in emerging economies in 2022. The IMF Report speaks of other downside risks , such as the prolonged war in Europe. Though India’s growth rates for the next two years have been revised down to 7.4% in 2022 and further to 6.1% in 2023 it still manages to rank at the top in the IMF growth forecasts in 2022 and 2023. IMF seems to have only one policy prescription now that is monetary and fiscal tightening, whatever be the impact of the same on vulnerable economic groups who would need social security. In that context, India’s balanced policy stance is indeed praise worthy.

Please share your views with us.

#marketnews#economics#oilcrash#stockstowatch#businessnewsdaily#privateequity#economicgrowth#oilprice#economicnews#financialcrisis#iccblogs

0 notes

Text

امریکہکی روسی تیل کی قیمت کی حد مقررکرنے پر بھارت سے مثبت بات چیت

امریکہکی روسی تیل کی قیمت کی حد مقررکرنے پر بھارت سے مثبت بات چیت

امریکہکی روسی تیل کی قیمت کی حد مقررکرنے پر بھارت سے مثبت بات چیت

نیویارک،19جولائی ( آ ئی این ایس انڈیا )

امریکی وزیرخزانہ جینیٹ یلین نے روسی تیل کی قیمتوں کی مجوزہ حد کے بارے میں بھارت کے ساتھ بات چیت کوحوصلہ افزاقراردیا ہے۔امریکا تیل کی قیمتوں میں کمی لانے اور روس کی یوکرین میں جنگ کے لیے فنڈز کی دستیابی کو مشکل بنانے پر زوردے رہا ہے۔یلین نے انڈونیشیا سے جنوبی کوریا کے دارالحکومت سیول جاتے…

View On WordPress

0 notes

Photo

(via Saudi Arabia Extends Cut of 1 Million Barrels of Oil a Day, Potentially Boosting Gas Prices - NowThis)

Gas is already up 30 cents per gallon in the past month. The Saudis are going to keep reducing production to jack up prices. This screws the American consumer as it forces energy prices higher and higher. The Saudis will keep supplies tight to fuck with and sabotage the 2024 US election (the crown prince is a big Trump fan) Republicans will lie like they always do and blame Biden.

17 notes

·

View notes

Text

OPEC+ Virtual Meeting To Review Production Policy

(Source – Energy Intelligence).

OPEC+ will convene virtually on Sunday to assess its current oil production strategy. As the global oil market keenly awaits the coalition’s decision, several OPEC+ members continue to withhold 2.2 million barrels per day from the market in a bid to bolster prices. This strategic move comes as market analysts predict that OPEC+ will likely uphold its existing production policy, maintaining stability in the oil market.

Voluntary Production Cuts to Support Prices

The decision by OPEC+ members to voluntarily reduce oil output by 2.2 million barrels per day is a calculated effort to sustain oil prices amid fluctuating market dynamics. By restricting supply, these nations aim to prevent a surplus that could drive prices down. This approach is particularly significant as it reflects the coalition’s proactive measures to stabilize the market, ensuring that oil prices do not fall below a level that is economically viable for their economies.

Michael Hsueh, an analyst at Deutsche Bank, highlighted the current market sentiment by pointing out that the price of Brent crude, hovering closer to $80 per barrel, suggests that OPEC+ is unlikely to increase production in the near term. “Given the current price levels, it wouldn’t be surprising if OPEC+ maintains its cautious stance to avoid flooding the market with excess supply,” Hsueh noted.

Tamas Varga, an analyst with oil broker PVM, echoed similar sentiments, stating that the virtual nature of the upcoming meeting further reduces the likelihood of any production changes. Varga emphasized that the virtual format typically lends itself to maintaining the status quo rather than making significant policy shifts. As such, the market is largely anticipating a continuation of the current production policy, aligning with Deutsche Bank’s forecast of Brent crude prices averaging $83 per barrel in the second quarter and $88 in the latter half of the year.

Market Reactions and Future Outlook of OPEC+

The anticipation surrounding the OPEC+ meeting has already impacted the market, with U.S. crude oil prices rising nearly 3% on Tuesday following a previous week’s loss. This uptick underscores the market’s focus on OPEC+’s decisions and the broader implications for global oil prices.

However, analysts like Hsueh warn that OPEC+ may face increasing pressure to adjust its production strategy after the June meeting. Should the coalition opt to increase output, it could potentially drive Brent prices below the $80 per barrel mark. This possibility looms as a critical factor for OPEC+ members, who must balance their production levels to sustain favorable price points without triggering a market imbalance.

Hsueh also pointed out the long-term considerations for Saudi Arabia and other major oil producers within OPEC+. Maintaining a target price significantly above the breakeven point for the broader U.S. oil sector, which stands at approximately $75 per barrel, may prove unsustainable. The stabilization of U.S. oil production since September has provided OPEC with a degree of flexibility, allowing the coalition to carefully calibrate its production levels without risking an oversupply that could depress prices.

In conclusion, the OPEC+ virtual meeting on Sunday is poised to play a pivotal role in shaping the near-term outlook of the global oil market. As the coalition deliberates on its production policy, the decisions made will reverberate through the industry, influencing price trends and economic stability for oil-producing nations. Market participants will be watching closely, prepared to respond to any signals of change or continuity from this influential group.

0 notes

Text

Market Insights with Spectra Global: Brent and WTI Crude Rise, Mixed Performance in Asian Markets

Stay updated with the latest market movements and economic data with Spectra Global's regular updates. Here's what's happening in the markets this week:

Oil Prices: Brent oil rose 0.1% to $82.22, while WTI crude futures increased 0.2% to $77.85 a barrel.

China: The Shanghai Shenzhen CSI 300 and Shanghai Composite indexes rose about 0.1%, showing a mild recovery from last week's losses.

Hong Kong: The Hang Seng index fell 0.4% due to losses in mainland stocks.

Japan: The Nikkei 225 and broader TOPIX index both rose 0.3%. Key data on inflation, retail sales, and industrial production from Japan are expected later this week.

Australia: The ASX 200 climbed 0.7%, rebounding from last week's downturn.

India: Futures for the Nifty 50 index pointed to a mildly positive open.

U.S.: The S&P 500 is up over 11% year-to-date, with major Wall Street firms recently raising their price targets. Historical trends suggest continued growth when the S&P 500 rises more than 10% in the first 100 days of the year.

Key Economic Data to Watch This Week:

U.S. inflation data

Eurozone inflation

Japan's economic indicators

China activity reports

Oil prices

Stay tuned for more updates from Spectra Global.

#MarketUpdate#OilPrices#GlobalMarkets#StockMarket#EconomicData#BrentOil#WTICrude#ShanghaiComposite#HangSeng#Nikkei225#ASX200#Nifty50#SP500#InflationData#InvestmentNews#FinancialNews#SpectraMarketWatch#MarketTrends#EconomicIndicators#GlobalEconomy

0 notes

Text

U.S. oil rises nearly 2% to top $83 a barrel as slowing manufacturing raises interest rate cut hopes

https://www.cnbc.com/2024/04/23/crude-oil-prices-today.html #gasprice #shaleoil #opec #oilprice #oott

0 notes

Text

youtube

InvestTalk - 1-2-2024 – Oil Prices Show Their First Annual Decline Since 2020

According to experts, the global oil trade is being "profoundly impacted" by the movement of petroleum production from the Middle East to the United States and other Atlantic countries.

0 notes

Photo

FOOD FOR qTHOUGHT Brace yourself ! #UN officials warn that the war in Ukraine is causing a global food, energy and financial crisis. #RussiaUkraineWar #OilEmbargo #gasprices #oilprice #foodcrisis #foodshortages #wheat #FoodBlockade #interestrates #FinancialCrisis https://www.instagram.com/p/CeZXDkKBbJe/?igshid=NGJjMDIxMWI=

#un#russiaukrainewar#oilembargo#gasprices#oilprice#foodcrisis#foodshortages#wheat#foodblockade#interestrates#financialcrisis

0 notes

Text

Which way is the Global economy going?

Alarm bells are ringing for many economies around the world, from Laos to Sri Lanka to Pakistan to Venezuela to Argentina to Guinea, and more. Some 1.6 billion people in 94 countries face at least one dimension of the crisis in food, energy, and financial systems, and about 1.2 billion of them live in “perfect-storm” countries, severely vulnerable to a cost-of-living crisis plus other longer-term strains, according to a report by the Global Crisis Response Group of the United Nations Secretary-General. The exact causes for their problems vary, but all share rising risks from surging costs for food and fuel, driven higher by the European war, which hit just as disruptions to tourism and other business activity from the coronavirus pandemic were fading. As a result, the World Bank estimates a global slowdown in the offing and that per capita incomes in developing economies will be 5% below pre-pandemic levels this year. Expansionary fiscal and monetary policies had no doubt helped many economies to come out of the pandemic-induced recession but left them with debt burdens that they are struggling to meet. And a contractionary policy to check inflation might lead to a slow down. More than half of the world’s poorest countries are in debt distress or at high risk of it, according to the UN. Maybe some debt written off would help the global economy. Economies seem to be hobbling along, in a stationary equilibrium stage. However, supply-side economics seems to have faltered according to many economists and well-managed demand-side economics is the order of the day. What do you think?

Do let us know.

#marketnews#economics#oilcrash#stockstowatch#businessnewsdaily#privateequity#economicgrowth#oilprice#economicnews#financialcrisis#iccblogs

1 note

·

View note

Text

Oil and Gas Stocks: Guess Possible Reasons For Edging Higher Today

0 notes

Text

Middle East Tensions Raise Oil Prices: What You Need to Know

#MiddleEasttensions #oilprices

0 notes

Text

U.S. Crude Oil Inches Up To $82 Amid Expectations Of Interest Rate Cuts

The price of U.S. crude oil saw a slight uptick to $82 a barrel on Tuesday, driven by optimism that weak manufacturing data could prompt interest rate cuts. The U.S. manufacturing sector experienced a downturn, reaching a four-month low of 49.9 in March, as reported by the S&P Global Flash U.S. Composite PMI. A reading below 50 indicates a contraction in activity.

Support for Rate Cuts

Investors responded to the sluggish manufacturing activity by betting on potential interest rate cuts by the Federal Reserve later this year. Lower interest rates typically stimulate economic growth, which in turn boosts demand for crude oil. Phil Flynn, senior market analyst at the Price Futures Group, noted that the renewed hopes for rate cuts are revitalizing oil markets, especially following recent sell-offs.

Rebound in Oil Prices

The uptick in oil prices follows a decline earlier in the day, with WTI hitting a session low of $80.89 a barrel, its lowest level since late March. Additionally, U.S. oil prices briefly dipped below the 50-day moving average of $81.22 a barrel for the first time since early February. Despite the rebound, U.S. oil prices remain more than $5 below this year’s peak of $87.62, driven by concerns over potential conflict between Iran and Israel.

Geopolitical Factors

Fears of a confrontation between Iran and Israel have subsided, contributing to the stabilization of oil prices. Moreover, the oil market has largely disregarded the looming threat of additional sanctions against Iranian oil. The House of Representatives recently passed legislation to expand sanctions on Iran’s oil exports, awaiting a Senate vote this week.

Under the proposed legislation, President Joe Biden would have the authority to impose sanctions within 180 days, with the option to waive penalties if deemed necessary for national security interests. However, the decision to enforce sanctions or issue waivers presents a dilemma for the White House, particularly amid concerns about the impact on the already tight oil market.

Political Considerations

Experts speculate that the Biden administration may delay imposing sanctions due to political considerations, especially with the upcoming 2024 election. Amrita Sen, founder and director of research at Energy Aspects, emphasized the administration’s determination to prevent a surge in oil prices ahead of the election. The political dynamics surrounding oil prices add complexity to the decision-making process regarding sanctions against Iran.

As oil markets navigate geopolitical uncertainties and economic indicators, the prospect of interest rate cuts remains a pivotal factor influencing crude oil prices, shaping the trajectory of the global energy landscape.

0 notes

Text

Oil dips on rate hike fears. Learn More: https://markets.tradermade.com/commodity/crude-oil-extends-downward-slide. Oil prices are down again this week, due to delayed US interest rate cuts that could hurt demand. Despite Mideast tensions, supply disruptions haven't hit yet, ceasefire talks offer hope.

0 notes