#paper trading for crypto in India

Text

#bitcoin#demo Crypto trading#Ideal Paper Trading Platform#paper trading for crypto in India#web3#Virtual Trading XREX#A2ZCrypto

2 notes

·

View notes

Text

Everything you need to know about cryptocurrencies & blockchain.

There was a time not long ago when the barter system was brought to an end with the advent of gold. With its intrinsic value firmly established, gold became the best and most preferred mode of receipts and payments. It also led to hoarding and became the de facto means to establish one’s net worth. This continued till the time they found all the disadvantages of gold including the liability associated with storage, transport, and ownership.

Remember stories of caravans being robbed midway into the journey with women laden with gold being the prime target? From that came the understanding that one ought to have something that’s as liquid as gold and does away with the headache of storage and logistics. Paper currencies tied to gold standards were the next invention where each paper note/currency guaranteed a certain quantity of gold.

Everything was fine till the time people understood that gold was a limited commodity and made it difficult to keep parity with paper money for all times. This became especially acute in times when economies started to boom, and the governments had to print notes to keep up with the demand for money.

Gold couldn’t keep pace, and in the year 1929 at the end of the Great Depression, the world finally broke free of gold parity and established the system of fiat currency that was printed at the beck and call of individual governments worldwide. Each currency’s value was determined by various factors including GDP growth rates, rates of industrialization, status of industries and infrastructure, intrinsic worth of economies and the likes.

With each country having its own currency, there was felt a need to bring parity to worldwide transactions that to an extent was brought about by the Breton Woods system in 1944 where signatory countries agreed to a complex system of recognizing each-other’s currency via the USD which was tied to gold.

In 1975, the US government being the main player unilaterally pulled out of the system by terminating the USD’s tie-up with gold. Currency ever since are fiat currencies that can be printed as per a country’s needs. These days, exchange worldwide is done through a basket of currencies including USD, Euro, Yen and Yuan. Somewhere, these too depend upon the value of USD to execute a transaction.

All this has resulted in the following:

Wild swings in currency values depending upon demand and supply of currencies. These are known to add to the cost of every transaction. Add to that, transfer and ownership charges including banking brokerage changes, swift charges, and the likes. All these while adding to the costs, do precious little to the value of a transaction with currency exchanging known to take days (if not more) to fructify.

2. Transactions being at the mercy of every government. With notes being printed by governments, every transaction must go thru government agencies that only add to the costs and delays, and nothing to its value.

Slow pace of transactions. Try transferring money from the US to India or vice-versa. It takes days, and at the end what you get is of lesser value than what was intended due to varied charges levied by the intermediaries.

Currency speculation! Fiat currencies worldwide have given birth to a de-facto industry whose worth is higher than the trade in goods and services. Currency speculation! Does it add to the value of anything at any stage? Never. It enriches only banking intermediaries while being of little use to countries worldwide. In fact, they can sometime add to the costs of transactions and make them unviable.

Using banks for monetary transactions within or outside the country thus doesn’t add to the value of the transaction per-se. On the other hand, it does add (and sometimes substantially) to the cost of transactions. Using cryptos would on the other hand bring down the cost of transactions besides simplifying things.

No one knows how much gold there is below the ground. Any new find will mean lowering of its price. The same isn’t the case with bitcoins which has a fixed quantity of 21 million of which 17.3 million have already been mined. Mining and all the attendant activities including software designed to calculate the algorithms shall cease to function the day the 21 million mark is reached. There-hence shall take place only exchange of bitcoins either singly or in fractions which go as far as eight decimal places (0.00000000). Bitcoins thus can’t be benchmarked against anything other than its own value which shall be a factor of its demand and supply. Transaction time, cost, and issues to do with exchange rates & flows will be a thing of the past.

Read More: https://ciolookindia.com/everything-you-need-to-know-about-cryptocurrencies-blockchain/

Source: https://ciolookindia.com

#globalbusinessleadersmagazine#Entrepreneurmagazine#BestEntrepreneurMagazines#topmostbusinessindiamagazine#businessstories#bestonlinebusinessmagazine#blockchain

0 notes

Text

[ad_1]

Hey there, crypto-curious readers! It’s Durgesh, your favourite crypto clown, again with the newest scoop on the Reserve Financial institution of India (RBI) and their crypto stance. 🤡So, guess what? The RBI Governor, Shaktikanta Das, simply dropped a bombshell on the crypto world. He’s just like the unyielding site visitors cop of the crypto freeway, waving his “No Bitcoin” signal. 🚫💰Das made it loud and clear that the RBI isn’t budging relating to banning crypto. No, sir! In his personal phrases, he stated, “Crypto, you say? We’re nonetheless a strong 10 on the ‘Nope’ scale. We’re not leaping on that crypto practice anytime quickly.” 🚂🙅♂️However maintain on, the Worldwide Financial Fund-Monetary Stability Board (IMF-FSB) got here up with a paper that advised there are some dangers on the earth of crypto. And right here’s the place it will get attention-grabbing. They imagine in a 0 to 10 scale for crypto regulation. Zero means it’s a free-for-all, and 10 is an enormous, fats no-go. So, the place does the RBI stand? Nicely, they’re just about camped out at a comfy 10. 🏕️Das even dropped this gem at a convention: “We’re wanting on the granular particulars of regulation.” Granular? I suppose we’re speaking extra like, “That is sugar, and that is salt” type of granular, reasonably than Bitcoin granular. 🧂🤣Now, right here’s the place it will get spicy. The G20 finance ministers and central financial institution governors had been like, “Hey, let’s discuss regulating crypto,” and the Indian crypto trade was all ears, hoping for a glimmer of hope. 🌟 However, RBI’s stance? It’s like a bucket of chilly water at a pool get together. They’re not shopping for it. 💧The RBI’s sticking to their weapons, saying that an outright ban is the way in which to go. 🚫💼🙅♂️And as if that weren’t sufficient, Das talked about excessive home rates of interest, inflation, and meals. Significantly, guys, he coated every thing besides order a pizza with Bitcoin. 🍕🤷♂️So, there you have got it, people! The RBI isn’t budging, and so they’re nonetheless not shopping for into the crypto craze. Keep tuned for extra crypto comedy and updates from yours really, Durgesh, the crypto jester! 😄💰

[ad_2]

0 notes

Text

Gemini is expected to grow its technology development center in Gurgaon and double its workforce.

However, the exchange is engaged in legal battles on two fronts— with the U.S. regulator and its parent company.

New York-based cryptocurrency exchange Gemini said it has plans to invest Rs. 200 crore ($24 million) in India over the next two years. The exchange will use these funds to grow its technology development center in Gurgaon, a major financial metropolis in India. It also plans to double its workforce in the Gurgaon office from 70 to more than 150 employees.

The firm cited the Indian government’s Startup India initiative and the recent moon landing to make the case for this investment in its India office. The crypto firm set up its office in Gurgaon in April only as part of its Asia-Pacific (APAC) expansion plans. Besides the U.S., it has offices in the United Kingdom, Singapore, and Ireland as well.

The U.S. government’s less-than-receptive policy toward crypto is pushing many crypto firms to move to other crypto-friendly regions. Two weeks earlier, Chainalysis placed India at the top position in its 2023 Global Crypto Adoption Index. The country has seen its crypto sector getting popular and widespread with time.

“Crypto-friendly” India has a 30% crypto gains tax

However, things are not so pleasant for crypto firms or retail traders in India. India had listed the Cryptocurrency and Regulation of Official Digital Currency Bill, 2021 for discussion in the parliament. The bill was designed to lay the groundwork for the introduction of digital currency in the country. But it couldn’t be legislated.

India has a basic crypto policy framework but it is not formulated in great detail. Last year, the South Asian country introduced taxes in regard to crypto trading. It has a 1% tax deducted at source (TDS) that applies to every crypto transaction. It also has a 30% capital gains tax for profits made through crypto trading.

Though not as combative towards crypto as the U.S., the Indian regulator has time and again criticized the crypto industry for its many failures.

During a business summit held in January 2023, the central bank’s governor Shaktikanta Das called for a ban on crypto. India’s finance minister Nirmala Sitharaman was however less hostile as she believed that there should be a global consensus on crypto regulation.

India recently hosted the G20 summit that concluded early this month. During the summit, the member countries’ intervention led to the International Monetary Fund (IMF) and the Financial Stability Board (FSB) recommending a comprehensive and standard framework for crypto. The paper called for comprehensive and standard policies, instead of blanket bans, for safeguarding customers against crypto.

Genesis battling SEC and DCG

Meanwhile, Gemini was still seen engaged in legal battles on two fronts— with the U.S. regulator, and its parent company, Digital Currency Group (DCG).

In January, the Securities and Exchanges Commission (SEC) sued the firm for allegedly offering unregistered crypto securities. In May, the exchange moved to court to have the lawsuit dismissed.

Gemini itself sued its parent company, DCG, in July as DCG’s subsidiary, Genenis, filed for bankruptcy a few months earlier in January. Gemini claimed that DCG misinterpreted financial statements to recover Gemini Earn funds from Genesis. In August, DCG moved to court to have Gemini’s lawsuit dismissed.

Amidst such intricate circumstances, it is critical for us to see how the crypto firm implements its expansion plans in other countries.

Source

0 notes

Text

What lies ahead for India Crypto Exchange market? : Ken Research

Buy Now

This white paper delves into the promising potential of India's crypto exchange market, by presenting a comprehensive analysis based on extensive primary and secondary research. By examining growth drivers, government actions, and future prospects, this whitepaper aims to provide valuable insights into the evolving landscape of cryptocurrency trading in India.

Our research is rooted in a rigorous methodology that combines in-depth interviews with key industry players, a thorough examination of market trends, and an analysis of government regulations. We present a holistic view of the Indian crypto exchange market, exploring its current state, growth trajectory, and the factors influencing its development.

By delving into the dynamics of this market, we aim to equip stakeholders, investors, and policymakers with the knowledge required to navigate the opportunities and challenges that lie ahead. Read on to learn more on the potential of India's crypto exchange market, as we uncover its untapped possibilities.

1. The last decade saw an increase in awareness of virtual currencies, and a fast-growing tech-savvy population seeking alternative modes of investments created a buzzing crypto universe

Request a Call with Expert to know more about the business model

2. Young Investors Are Driving The Crypto Exchange Industry Growth In India Coupled With Cross-Border Remittances & Decentralized Finance (Defi) Which Are Major Traction For Investors

2.1 Moreover, factors such as strict foreign regulations made Rupee conversation complicated, therefore Indians are opting for digital currencies for conversion of INR to a more stable fiat currency

2.2 The introduction of Central Bank Digital Currency (CBDC) and the increasing popularity of NFTs among others has contributed to enhanced visibility of digital currencies in the market.

3. Though India is booming as a hub for Cryptos, there are several issues associated with it such as operational risks, cyber risks and governance risks.

4. To curb the issues, the Government of India played a major role to form a committee to draft regulatory frameworks on Cryptos, working with the Financial Action Task Force to update Crypto policies, and…

4.1. ... Pushed for the upliftment of the blanket ban on virtual currencies and set up Cybercrime unit for detection of the crypto-related frauds held online

5. Indian Crypto market shows good potential due to a surge in Crypto investments, Non-Fungible Tokens and entry of International Cryptocurrency Exchanges in India indicates a strong step forward

Some of the Intelligence Curated by Ken Research in Crypto Exchange Market Space:

MENA Remittance Market Outlook to 2027 segmented by mode of transfer (digital, traditional), type of channel (Banks, online platforms, money transfer operators), type of end use (migrant labour workforce, personal, small business & others) Geography (Latin America, Africa, Asia Pacific, Europe, Middle East)

Australia Cards and Payment Market Outlook to 2027F By Cards (Debit Cards, Credit Cards, Prepaid Cards), By Payment Terminals (POS and ATMs), By Payment Instruments (Credit Transfers, Direct Debit, Cheques, Cash and Payment Cards)

Brazil Cards and Payment Market Outlook to 2027F By Cards (Debit Cards, Credit Cards, Prepaid Cards), By Payment Terminals (POS and ATMs), By Payment Instruments (Credit Transfers, Direct Debit, Cheques, Cash and Payment Cards)

Global Remittance Market Outlook to 2027 segmented by mode of transfer (digital, traditional), type of channel (Banks, online platforms, money transfer operators), type of end use (migrant labour workforce, personal, small business & others) Geography (Latin America, Africa, Asia Pacific, Europe, Middle East)

India Payment Service Market Outlook to 2027F driven by government initiatives & rising need for faster payment modes

To Know more about this Whitepaper, Visit this link:-

Indian crypto exchange market

0 notes

Text

What made Indians transferred over $3.8 billion to foreign exchanges.

SilverLineSwap-SPARCP2E

“Since the implementation of tax, the $3.8 billions have been transferred to foreign exchanges. The first financial assessment of the impact the nation’s crypto tariffs have had on local trading platforms comes from a report by the Esya Centre.”

Did you know what Narendra Modi did to crypto?

After the nation announced strict crypto tax policies in February of last year, Indians transferred more than $3.8 billion in trading volume from local to international cryptocurrency exchanges, according to a report by the Esya Centre, a New Delhi-based think tank for technology policy. According to the analysis, a total of $3.85 billion was moved from February to October.

The analysis offers the first monetary assessment of how India’s contentious cryptocurrency tax legislation will affect domestic exchanges. On February 1, 2022, the government of Prime Minister Narendra Modi declared a 30% tax on cryptocurrency income and a 1% tax deducted at source (TDS) on all transactions.The 1% TDS and 30% tax both went into effect on April 1 and April 1, respectively. The tax industry was unable to substantiate its claim that the levies would “destroy liquidity” at the time the taxes were introduced.

What did the Esya center poll reveal?

According to a survey by the Esya Centre, local exchanges lost 81% of their trading activity in the four months following the implementation of the hotly contested 1% TDS rule. Nischal Shetty, CEO and founder of WazirX, one of India’s largest exchanges, predicted that Indians will “find methods to not be part of the [domestic] system because people are not going to leave crypto” days before the 30% tax took effect. Esya warned that if the current pattern holds, “centralized exchange businesses would become unviable” in India.

According to the research, “we predict a commensurately big negative impact on tax collections, as well as a decline in transaction traceability — which defies the two main objectives of the existing policy architecture.” The existing tax structure “may result in a loss of local exchange trade volume of about $1.2 trillion in the next four years. “The virtual digital asset (VDA) market in India is “crippled under the current tax architecture,” according to the paper, and the “baseline scenario” under the existing set-up is that “virtually all” Indians who use centralized VDAs will switch to a foreign exchange.

Also according to the academics, TDS should be reduced from 1% to 0.1% per transaction, which would be on pace with the securities transaction tax. Additionally, they advocate for placing progressive taxes on earnings rather than a flat 30% tax and enabling losses to balance gains. India, a country with a record-high $36.4 billion current account deficit, needs money to come in rather than to leave the country through off shore trades that don’t go through banking institutions. The most recent findings might put pressure on the government to restrict cryptocurrency outflows that increase India’s current account imbalance. The Finance Ministry of India’s official declined to comment on the study.

Website | SPARC BETS | Twitter | Telegram | Instagram | Discord

0 notes

Text

Brazil approves bill, regulating Bitcoin as Payment

In a major update to widespread adoption, the Brazilian legislature this week approved a comprehensive legal framework for the use and trading of cryptocurrencies. The update will see Bitcoin recognized as a digital representation of value in the country, supporting the property as a means of payment and investment option. The announcement comes after a meeting in Brasilia, the capital of the country, held on Tuesday, November 29, 2022.

Although the bill did not define Bitcoin as a "legal entity", it passed a law that legalized cryptocurrencies as a form of payment in all countries. A move that will ultimately boost the acceptance of digital currency as a form of currency in the country. The bill applies broadly to cryptocurrency assets, which it considers "virtual assets" and requires only the president's signature to become law.

The move will provide legal status for payments made in cryptocurrencies for goods and services, but not legal tender status. In addition, the bill gives the executive the responsibility of selecting the government officials responsible for overseeing the market. According to the original proposal, the Central Bank of Brazil (BCB) will examine Bitcoin as a means of payment, while the CVM will act as a watchdog when the digital asset is used for investment. Although this two-pronged approach sounds good on paper, it will undoubtedly be tested in the next few years.

Crypto actor Mark Tencaten discussed this issue, saying, “This is a big step forward not only for the country of Brazil, but also for cryptocurrencies around the world. Although they did not recognize Bitcoin as legal, they certainly did the right thing. I see this as a huge boost for the city's vision and potential for economic growth."

The bill further establishes clear rules for the operation of cryptocurrency exchanges, which have been subject to global scrutiny in recent weeks. In general, however, the decision is seen as a positive one, focusing on consumer protection and transparency for all parties.

Brazil has been a pioneer in the crypto industry, offering the largest number of cryptocurrency ETFs in Latin America. With many of the country's capital banks and Broka giving exposure to cryptocurrency investments, it is clear that the country is making great progress towards digital currency adoption.

Although India recently revealed its plans to introduce a CDBC (Centrally Backed Digital Currency), Brazil's exit should attract more attention. Although cryptocurrencies were created to be regulated, it is clear that many governments around the world are exploring the technology as a way to manage financial policy.

Mark Tencaten gave a more in-depth look at the idea for a government-backed digital currency "I really see this as the next logical step from the central bank. If they have their own digital currency, they can track every dollar settled back to the source. They will no longer need a bank, because they will finally have direct access to customers. I really see it as a slippery slope if used incorrectly, as it violates a lot of consumer protections and privacy. In the end, it was a bit too soft. The purpose of these funds (to support governance) is what CDBC is trying to maintain."

Time will tell what the true intentions behind this decision are, but for now, it is a positive step forward for the cryptocurrency industry.

0 notes

Text

Cryptocurrencies Education is a necessary buddy to monetary liberty. Crypto is a wild west on the very best of day so we should much better inform others, specifically the unbanked, to guarantee a safe experience within our market. 3 minutes read Updated: September 10, 2022 at 3: 07 pm Cover art/illustration by means of CryptoSlate The following material consists of recommendations to suicide. Today, Sept. 10, is worldwide suicide avoidance day. Each year over 700,000 individuals annually pass away from suicide all over the world The main variety of the number of are crypto or trading associated is unidentified. There are over 120,000 news stories on Google News of cryptocurrency-related suicides, with 39,700 of those coming in simply the last 12 months. In the U.K., suicide is the most significant killer of under-35- year-olds. Internationally it is the 5th greatest killer of individuals under45 According to Forbes, crypto is most popular with individuals under the age of 49, suggesting there is an overlap in age in between crypto users and suicide-related deaths. A 2020 Open University research study into the relationship in between stock exchange changes and suicide rates revealed a connection in between males and females. The term paper highlighted that "other than for Homo sapiens, no definitive proof for self-destructive habits has actually been observed somewhere else in the animal kingdom." Suicide is a specifically human issue, and society needs to for that reason play a part because. Prior to 2020, when the paper was launched, the idea of a meme stock had actually not yet been genuinely created. WallStreetBets, a leading source of meme stock trading details, grew from less than 1 million customers at the start of 2019 to over 12 million today. Source: subredditstats.com In January 2020, a 20- year-old boy, Alex Kearns, unfortunately took his life after his Robinhood account incorrectly notified him that he owed $730,165 on a stopped working trade. The unfavorable number represented Kearn's purchasing power, not his money balance. Robinhood made a declaration in which it devoted to enhancing how it showed info and contributed $250,000 to a suicide avoidance charity on the household's behalf. Another male dedicated suicide in India in October 2020 as he "was under heavy financial obligation after he suffered huge losses in business of Bitcoin trading. He owed a big quantity of cash to different individuals who had actually bought cryptocurrency." Following the collapse of Terra Luna in May 2022 and the subsequent insolvency of Celsius, there were numerous reports of death by suicide from those who lost their life cost savings. I simply invested 2 hours going through 109 Anchor victim effect declarations, and my heart is extremely complete. Numbers and charts make it tough to measure the scale of the catastrophe that occurred today. I do not believe any words can do it justice, either. Here's some more information. pic.twitter.com/hxHsE6Bl2M-- FatMan (@FatManTerra) May 21, 2022 According to a current research study, the nations with the greatest reported cases of crypto-related suicide are South Korea, China, India, and Turkey. Source: Safe Trade In 2018, after the crash and Bitcoin fell from $20,000 to $6,000, a suicide avoidance hotline was pinned to the top of r/cryptocurrency on Reddit. Ever since, this has actually frequently been pointed out as a 'bottom indication' for future cycles. Redditors frequently mention that the rate might still have additional to go due to the fact that the suicide hotline is not pinned. This casual mindset to such an awful subject is something that goes unmentioned throughout a bull run. The topic must not be so flippantly tossed around in a bear market where numerous users have actually seen their portfolios decrease enormously. Even more, significant black swan occurrences throughout the community just even more worsen the problem. In order to fight a growing epidemic and as we possibly head towards an economic crisis, we need to enhance monetary education.

Just those who really comprehend the danger must utilize unstable training tools such as choices, futures, and other leveraged trading techniques. Education on identifying a pump and discard plan, securely engaging with a dApp, preventing phishing frauds, and protecting your wallet is crucial in tandem with much better monetary education. Blackrock reported that less than 50% of individuals feel great in making monetary choices, while the variety of retail users investing through mobile apps is growing out of control The variety of retail financiers grew from 35.6 million in 2017 to over 150 million in 2021. Education is essential to guaranteeing that individuals invest securely and lower the possibility of ending up being over-exposed to the marketplace. Binance introduced EduFi in May of this year, and Coinbase even provides a learn-to-earn plan to enable users to make crypto through education. Coinbase likewise has an important reading list that I extremely suggest for those interested. Remember: When in doubt, Zoom out-- the huge image matters. If you or somebody you understand is having a hard time, speak to somebody. There is assistance offered anywhere you are. A list of global assistance hotlines can be discovered here free of charge and personal suggestions. Read More

0 notes

Text

history of cryptocurrency

March 2020, a historical moment in the journey of cryptocurrency, when the Supreme Court of India quashed the order passed by RBI in 2018 to ban financial services firms from trading in cryptocurrency or virtual currency. To understand this decision more, let us have a look at the crypto timeline in India; its past, its present and its future. The cryptocurrency market has always been questioned, analyzed, speculated but has always bounced back, hitting an all time high, every single time.

2008: “Bitcoin: A Peer to Peer Electronic Cash System”

A paper on cryptocurrency was published by a pseudonymous developer by the name of Satoshi Nakamoto. It described a version of electronic cash which would allow online payments to be sent directly from one party to another without going through a financial institution. This was the first paper to talk about Bitcoin. Although, not the first to mention cryptocurrency. The early work on cryptocurrencies can be traced back to the 1980s but it did not come to actualization since e-commerce had not fully evolved by then.

2010: First Bitcoin Transaction

Cash value was attached to cryptocurrency for the first time! A user swapped 10,000 Bitcoin for two pizzas marking the first actual sale of an item using cryptocurrency.

2011: Emergence of other Cryptocurrencies

Other cryptocurrencies like Litecoin, Namecoin and Swiftcoin emerged in the market. This year also saw a lot of controversies over claims of cryptocurrency being used on the dark web to procure drugs, guns amongst other things.

2012–2017: Multiple Cryptocurrency Exchanges Cropped up in India

Cryptocurrency suddenly saw a lot of interest from the Indian market, as well as the global players. As a result, Bitcoin grew from $5 to almost $1000 by the end of 2017. People were talking about it and the financial institutions were taking notice, feeling almost threatened. This time period also saw a lot of cryptocurrency exchanges crop up in India.

People were not surprised when RBI issued two massive statements, the first one dated December 24, 2013. It said,

1. Virtual currencies are not backed by a central bank.

2. Their value isn’t underpinned by an asset and thus a matter of speculation.

The second press release repeated the concern on February 1, 2017. It highlighted,

“It’s thus safe to assume that the crypto boom that followed 2016’s demonetization was an unintended consequence of that particular experiment. The emphasis on digital payments led to a search for alternatives to traditional online banking and drove tech-savvy customers to cryptocurrency exchanges.”

October and November of 2017 saw 2 separate PILs filed in the Supreme Court one asking it to ban buying and selling cryptocurrencies in India, the other asking for them to be regulated.

The government formed a committee to study the virtual currencies and propose actions.

December 2017 saw a bunch of statements issued from RBI and Ministry of Finance comparing the cryptocurrency to a scam but its popularity only kept increasing across the world.

2018: Trading Volumes Fall

April 2018

RBI issues a circular preventing commercial and co-operative banks, payments banks, small finance banks, NBFCs and payment system providers from:

-Dealing in virtual currencies

-Providing services to all entities which deal with them

Unable to access banking services in India, crypto exchanges find their businesses wiped out overnight. Trading volumes saw a massive plunge by almost 99% and by August 2018 about 95% of jobs came to an end.

May 2018

Faced with an existential crisis, several exchanges filed a writ petition in the Supreme Court.

2019: Committee Submits the Report

Two years later, the committee submits its report, recommending a ban on “private cryptocurrencies” in India.

2020: Supreme Court Quashes the Ban on Cryptocurrency

March 4, 2020

Monumental day for cryptocurrency in India.

SC quashes RBI’s ban on Cryptocurrency Trading, terming the April 6, 2018 circular unconstitutional. The Supreme Court said, the cryptocurrencies are unregulated but not illegal in India. This coincides with a crypto boom. Exchanges witnessed a sharp increase in interest and the price of Bitcoin jumps more than 700% in the next one year.

2021: Bill Proposed by Government of India

January 2021

The government of India will work on a bill to create a sovereign digital currency.

April 2021

After SC’s favourable ruling, a lot of global crypto platforms are seeing India as a major player with educated investors. Making the most of this opportunity, European’s most popular and award winning cryptocurrency exchange platform, Coinsbit launches in India as Coinsbit India. It is definitely an exciting time to learn and invest in cryptocurrency in India, when the market is just booming, compliances are being formed and regulations are being put in place for everyone’s safety.

About Coinsbit

Coinsbit India is a joint venture between Cryptic Coinsbit India and Prof-it Limited, intending to bring the best cryptocurrency exchange platform to India. With its headquarters in Estonia, the popular cryptocurrency exchange platform has a reported user base of 5 million users and a monthly transaction volume of around $30 billion-plus USD. It was named the best 2018 crypto exchange at Asian Blockchain Life, 2019.. Their strengths include well-timed order execution, local market insight, and multi-tier crypto asset security management bringing a full suite of services that a blockchain and a global exchange provides to the users.

Follow Us:

Twitter | Telegram | Instagram | Facebook | Linkedin | Website

2 notes

·

View notes

Text

Coinbase plans to cease all exchange services for users in India, it has warned some Customers in email, over a year after the company’s debut in the South Asian Market faced regulatory challenges.

The global crypto exchange is warning Customers that it will be discontinuing services for them after September 25 and advising them to withdraw any funds they have in their accounts.

Coinbase, which is also an investor in top Indian crypto exchanges CoinDCX and CoinSwitch Kuber, has additionally disabled users in India from signing up to its exchange, prompting them to download the wallet, Coinbase Wallet, instead.

The move follows an 18-month effort from Coinbase to relaunch its service in India. The company hasn’t been able to make any inroads with the local authorities, something that has led to the departure of at least two prominent executives, including Durgesh Kaushik, who joined the firm last year as Senior Director for Market Expansion.

Coinbase’s chief executive Brian Armstrong flew to India last year to launch the exchange service in the country by adding support for the locally popular UPI payment instrument.

However, the payments body that oversees UPI immediately refused to acknowledge Coinbase’s India launch and days later Coinbase suspended support for the payments system.

Coinbase at the time said it was committed to working with NPCI and other relevant authorities and said it was experimenting with other payments methods, something that never materialized.

In May last year, Armstrong said Coinbase had to halt the Trading service in India because of “informal pressure” from the Reserve Bank of India, India’s central bank.

Armstrong pointed out that Cryptocurrency trading is not illegal in India — in fact, the South Asian nation just recently started to tax it — but there are “elements in the government there, including at Reserve Bank of India, who don’t seem to be as positive on it. And so they — in the press, it’s been called a ‘shadow ban,’ basically, they’re applying soft pressure behind the scenes to try to disable some of these payments, which might be going through UPI,” he said.

For the past five years, Indian authorities have maintained a careful stance on cryptocurrencies, emphasizing the need for international collaboration to manage these Digital Assets.

The G20 countries unveiled a Leaders’ Declaration over the weekend that said the nations endorse the Financial Stability Board’s (FSB’s) high-level recommendations for the regulation, supervision and oversight of crypto-assets activities and markets and of global Stablecoin arrangements.

“We ask the FSB and SSBs to promote the effective and timely implementation of these recommendations in a consistent manner globally to avoid regulatory arbitrage. We welcome the shared FSB and SSBs workplan for Crypto Assets. We welcome the IMF-FSB Synthesis Paper, including a Roadmap, that will support a coordinated and comprehensive policy and regulatory framework taking into account the full range of Risks and Risks specific to the emerging Market and developing economies (EMDEs) and ongoing global implementation of FATF standards to address money laundering and terrorism financing Risks.”

0 notes

Text

What is Bitcoin

Can you imagine a thing- the value of which was zero around 12 years back and now it's value is around 15 lacks.

I am talking about Bitcoin, which is creating a buzz in financial market now a days.

So now i am going to brief everything about Bitcoin.

31 October 2008 Satoshi Nakamoto publish a paper on internet which was Bitcoin.Bitcoin is a D- Centralized digital currency which operates without mediator. D- Centralized means there is no owner of this currency nor any agency can control it, for example - RBI is controlling Rupees notes, Central bank of America is controlling dollars. Bitcoin is a digital current, it is not physical no one can touch it.

What is digital or crypto currency:

Crypto currency is a digital assets over which bank or financial Institution has no control no rule or regulation.

There are billions of people are trading in crypto currency.

How to use Bitcoin

Some people are using it as an investment while on the otherhand some are using it like a alternative currency, while some want to replace it with other currency and use Bitcoin in place of rupees and dollars. But the main use of crypto currency is investment. It is difficult to use Bitcoin as a daily transaction because it is difficult to use you can not buy food and vegetables by Bitcoin but their are some hotel and restaurant in Europe and America which are excepting Bitcoin from the customers.

Bitcoin in India

The historical day for Bitcoin industry or crypto industry in India was 4th March 2020. When Supreme Court declared there is no legal prohibition on crypto currency trading and investment, this business is legal and RBI would have to repeal its ban upon it. After the decision of Supreme court several exchange have established and this process has become very easy and friendly in India.

1 note

·

View note

Text

The Reserve Bank is to roll out the first pilot of the Digital Rupee Today

SilverLineSwap-Crypto News

On November 1, the Reserve Bank of India will launch the digital rupee for the wholesale market as part of its first pilot test program to examine and improve the currency’s operation. The RBI said on Monday that it would conduct a similar test for the retail sector in closed user groups of customers and merchants within a month. The pilot will test the settlement of secondary market transactions in government securities in the wholesale segment. The pilot will include nine banks: State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank, and HSBC.

What is CBDC?

CBDC (Central Bank Digital Currency) is legal money issued digitally by the central bank. In other words, it will function similarly to a flat currency but in a different form. In this situation, blockchain technology will support the Digital Rupee. The money will be traded using blockchain wallets. It will also be convertible into government-issued currency. CBDC provides an alternative to traditional payment systems.

The Reason Behind The Pilot Project?

The RBI stated that the use of e-Wallet is likely to improve the efficiency of the interbank market. It also stated that settling in central bank money will save money by eliminating the requirement for settlement guarantee infrastructure or collateral to offset settlement risk. Based on the results of this pilot, future pilots will focus on other wholesale transactions and cross-border payments.

The Idea Behind the Digital Rupee:

In the Union Budget for 2022–23, India’s Finance Minister, Nirmala Sitharaman, stated earlier this year that the RBI will launch a digital counterpart to the rupee in the current fiscal year. According to a TOI article, as paper money usage declines, central banks are now attempting to popularise a more acceptable electronic form of cash. As a result, CBDC is projected to reduce the cost of money issuance and transactions. The RBI stated in its concept note that the digital currency will be supported by India’s cutting-edge payment systems that are inexpensive, accessible, convenient, safe, and secure. It asserted that the e-rupee will boost India’s digital economy, increase financial inclusion, and improve the efficiency of the monetary and payment systems.

The RBI stated that the e-rupee will give an extra choice to the currently existing forms of money; it is similar to banknotes, but because it is digital, it is expected to be easier, faster, and cheaper, and it has all the transactional benefits of other forms of digital money.

Silverlineswap | Sparc Bets | Digital Currency | India digital rupee | Digital Money | e-rupee | RBI | India’s Finance Minister | CBDC - Central Bank Digital Currency

0 notes

Text

11 Cryptocurrency Initiatives Indian Government Has Taken

The Indian government has engaged in numerous crypto-related initiatives and projects while actively drafting the regulatory framework for cryptocurrencies. Below are 11 crypto-specific initiatives that the government has been involved in.

Also read: Indian Supreme Court Postpones Crypto Case at Government’s Request

Committee to Draft Crypto Law

An interministerial committee under the chairmanship of Subhash Chandra Garg, Secretary of the Department of Economic Affairs, has been constituted to draft the regulatory framework for cryptocurrencies. Included on the committee are representatives from the Ministry of Electronics and Information Technology, the Reserve Bank of India (RBI), the Securities and Exchange Board of India (SEBI), and the Central Board of Direct Taxes.

The committee is “considering all aspects related to virtual currencies and crypto assets … including banning/regulating,” according to the Finance Ministry’s summary report released in March of the government’s activities in 2018.

The legal framework for cryptocurrencies in India was expected to be finalized in July last year, but no framework has been announced so far. This has led to speculation about what the recommendations entail, such as the recent media report claiming that the bill entitled “Banning of Cryptocurrencies and Regulation of Official Digital Currencies Bill 2019” has already been circulated to relevant ministries for discussion. The Indian crypto community has urged the public not jump to conclusions as the media reports only cite anonymous sources on the matter.

Working With FATF and G20

India’s “Department of Revenue has been actively involved in the working papers being developed by the FATF on various issues (such as virtual currency, proliferation financing among) which will act as guidance for the member countries,” the Finance Ministry’s summary report also reveals.

The Financial Action Task Force (FATF), a global standard-setting body created to combat money laundering and terrorist financing, told the G20 recently that it is updating policies on crypto regulation which will be presented at the G20 summit in June. India is a G20 country and will be attending the summit and participate in discussions about crypto regulation.

RBI Banking Restriction

In addition to several warnings about the risk of investing in cryptocurrencies, the RBI issued a circular on April 6 last year prohibiting regulated entities from dealing in cryptocurrencies or providing “services for facilitating any person or entity in dealing with or settling” cryptocurrencies. Financial institutions had three months to exit crypto-related relationships.

The RBI detailed that “Such services include maintaining accounts, registering, trading, settling, clearing, giving loans against virtual tokens, accepting them as collateral, opening accounts of exchanges dealing with them and transfer/receipt of money in accounts relating to purchase/sale” of cryptocurrencies.

While the banking restriction has hurt a number of local crypto businesses, some have found a solution to the ban in the exchange-escrowed peer-to-peer crypto trading model. Meanwhile, the Indian crypto community has been actively campaigning to end the ban.

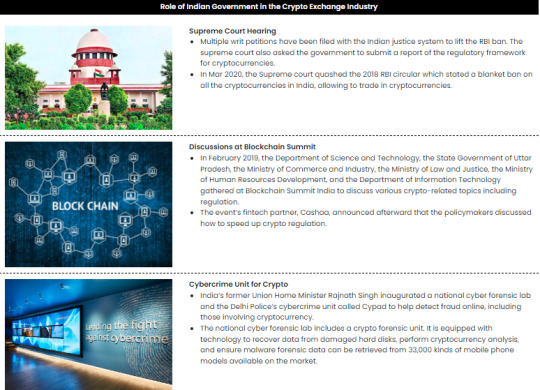

Supreme Court Hearing

Multiple writ petitions have been filed with the Indian justice system to lift the RBI ban. They were scheduled to be heard by the supreme court since September last year but the case has been continually postponed. The next hearing date is July 23. The supreme court has also asked the government to submit a report of the regulatory framework for cryptocurrencies.

Discussions at Blockchain Summit

In February, the Department of Science and Technology, the State Government of Uttar Pradesh, the Ministry of Commerce and Industry, the Ministry of Law and Justice, the Ministry of Human Resources Development, and the Department of Information Technology gathered at Blockchain Summit India to discuss various crypto-related topics including regulation.

The event’s fintech partner, Cashaa, announced afterward that the policymakers discussed how to speed up crypto regulation. “The regulation is planned to be implemented by end of financial tenure,” Cashaa wrote, noting that ICOs and STOs were also discussed.

Potential Central Bank Digital Currency

Replying to the question asked by Lok Sabha whether the government is considering introducing its own national cryptocurrency “in place of bitcoins,” the Ministry of Finance confirmed on Dec. 28 last year:

The inter-ministerial committee under the chairmanship of Secretary, Department of Economic Affairs, is examining all issues, including the pros and cons of the introduction of an official digital currency in India.

SEBI Crypto Study Tour & Committee

In its 2017-18 annual report, SEBI revealed that it had “organised study tours to Financial Services Agency (FSA) Japan, Financial Conduct Authority (FCA) UK and Swiss Financial Market Supervisory Authority (FINMA) Switzerland to study initial coin offerings and cryptocurrencies.”

The regulator constituted the Committee on Financial and Regulatory Technologies on August 3, 2017, “In order to reap the opportunities provided by fintech” and “to deal with relevant risk and challenges,” SEBI detailed. It also noted that new technology, including cryptocurrency, “is affecting financial markets through various channels.” The committee is under the chairmanship of Shri T.V. Mohandas Pai, Chairman of Manipal Global Education.

Cybercrime Unit for Crypto

India’s Union Home Minister Rajnath Singh inaugurated a national cyber forensic lab and the Delhi Police’s cybercrime unit called Cypad to help detect fraud online, including those involving cryptocurrency, as news.Bitcoin.com previously reported.

The national cyber forensic lab includes a crypto forensic unit. It is equipped with technology to recover data from damaged hard disks, perform cryptocurrency analysis, and ensure malware forensic data can be retrieved from 33,000 kinds of mobile phone models available on the market.

Working With Canada

Cryptocurrency was a major topic of discussion at the 16th meeting of the Canada-India Joint Working Group on Counter-Terrorism held in Ottawa on March 26 and 27. India’s delegation was led by Joint Secretary for Counter-Terrorism from the Ministry of External Affairs, Shri Mahaveer Singhvi. The meeting involved senior representatives from both governments, according to a press release by the joint working group.

Among other items on the agenda, “The delegations reviewed efforts underway to address new and emerging challenges posed by virtual currencies,” the announcement reads, adding that “The meetings concluded with agreement on a joint action plan” which includes “joint capacity building and information and technology sharing.”

ICAI Report

A detailed study conducted by the Institute of Chartered Accountants of India (ICAI) “on accounting standards and disclosures of cryptocurrency in financial statements of companies” was requested by the Indian Ministry of Corporate Affairs in January last year, according to ICAI member Debashis Mitra. The institute, a statutory body established by an Act of Parliament, went on to launch a course on cryptocurrency and blockchain technology for professional accountants in August last year.

RBI’s Regulatory Sandbox

The RBI recently published a draft framework for a fintech regulatory sandbox that welcomes businesses and applications using smart contract blockchain technologies. However, the document also has “An indicative negative list” of products, services, activities, and technology “which may not be accepted for testing.” The list includes cryptocurrency, crypto services, crypto trading, crypto investing, as well as settling in crypto assets. It also includes initial coin offerings and any products or services which have been banned by the government.

It should be noted that India is undergoing an election cycle and many decisions made by the current government administration could be null and void when the next administration takes office.

What do you think of all the crypto-related initiatives by the Indian government? Let us know in the comments section below.

Images courtesy of Shutterstock.

Are you feeling lucky? Visit our official Bitcoin casino where you can play BCH slots, BCH poker, and many more BCH games. Every game has a progressive Bitcoin Cash jackpot to be won!

Need to calculate your bitcoin holdings? Check our tools section.

The post 11 Cryptocurrency Initiatives Indian Government Has Taken appeared first on Bitcoin News.

READ MORE http://bit.ly/2PH3SoW

#cryptocurrency#cryptocurrency news#bitcoin#cryptocurrency market#crypto#blockchain#best cryptocurren

1 note

·

View note

Link

0 notes

Link

0 notes

Text

Making Sense Of Bitcoin And Blockchain Expertise

Making Sense Of Bitcoin And Blockchain Expertise

Likely due to theft, the corporate claimed that it had lost almost 750,000 Bitcoins belonging to their clients. This added up to roughly 7% of all Bitcoins in existence, price a total of $473 million. Mt. Gox blamed hackers, who had exploited the transaction malleability problems within the community. The price of a Bitcoin fell from a high of about $1,160 in December to beneath $400 in February. In March 2021, South Korea carried out new legislation to strengthen their oversight of digital property. This legislation requires all digital asset managers, providers and exchanges to be registered with the Korea Financial Intelligence Unit to be able to function in South Korea.

Bitcoin's value is largely decided by hypothesis among other technological limiting components often known as blockchain rewards coded into the architecture expertise of Bitcoin itself. As the date reaches near of a halving the cryptocurrency market cap increases, adopted by a downtrend. Transaction fees for cryptocurrency rely primarily on the provision of community capacity on the time, versus the demand from the currency holder for a sooner transaction. The forex holder can choose a specific transaction charge, whereas network entities' course of transactions so as of highest provided charge to lowest. Cryptocurrency exchanges can simplify the method for foreign money holders by offering priority alternate options and thereby deciding which fee will doubtless trigger the transaction to be processed in the requested time.

Bitcoin Btc Investors Want To Offer It A Rest

As a end result, the user will have to have complete trust within the on-line wallet supplier. A malicious provider or a breach in server security may cause entrusted bitcoins to be stolen. An instance of such a safety breach occurred with Mt. Gox in 2011. The word bitcoin was outlined in a white paper printed on 31 October 2008. No uniform conference for bitcoin capitalization exists; some sources use Bitcoin, capitalized, to discuss with the know-how and community and bitcoin, lowercase, for the unit of account. The Wall Street Journal, The Chronicle of Higher Education, and the Oxford English Dictionary advocate the use of lowercase bitcoin in all cases.

If we obtain complaints about individuals who take over a thread or forum, we reserve the best to ban them from the site, without recourse. BitFlyer Wallet helps with everything from account creation to trading. You can download it free of charge from the App Store and Google Play.

Crypto Definition & That Means

Another popular card, the GTX was released at an MSRP of $250, and offered for nearly $500. RX 570 and RX 580 cards from AMD have been out of stock for nearly a year. Miners regularly buy up the entire inventory of latest GPU's as quickly as they are obtainable. Most cryptocurrencies are designed to steadily lower the manufacturing of that foreign money, putting a cap on the entire quantity of that foreign money that will ever be in circulation.

The system defines whether new cryptocurrency items can be created. If new cryptocurrency models may be created, the system defines the circumstances of their origin and how to decide the ownership of these new models. The system keeps an overview of cryptocurrency units and their possession. It’s necessary to read the main points in your chosen buying and selling platform to make certain you perceive the extent at which value movements might be measured earlier than you place a commerce. Margin is often expressed as a share of the total position.

Cryptocurrency can I buy now

If you have been to take a position just $1,000 in Bitcoin ten years in the past, you’d have hundreds of millions of dollars today. Trading unstable cryptocurrencies has much more risk than traditional investments, but the payout could probably be life altering. Cryptocurrencies have turn into a fan favourite in India, with the nation becoming the largest crypto holder. The unprecedented demand is owed to kids who're looking for quick returns based on the high volatility, liquidity and simple-to-use crypto platforms. However, as there isn't a approach to analyse and consider the investments, crypto buyers ought to follow excessive caution whereas using cryptocurrencies.

Those who are bullish about Bitcoin being extensively used as digital cash imagine it has the potential to turn out to be the primary actually international currency. For any cryptocurrency project, however, attaining widespread adoption is critical to be thought of a long-term success. Regulators may also crack down on the entire crypto business, particularly if governments view cryptocurrencies as a threat quite than an progressive technology. There's additionally no guarantee that a crypto project you put cash into will succeed. Competition is fierce amongst 1000's of blockchain initiatives, and many tasks are no more than scams. Only a small proportion of cryptocurrency projects will ultimately flourish.

Because The Crypto Winter Enters A Interval Of Max Pain, Heres What Investors Should Search For To Prepare For The Subsequent Bull Run

If you’re a crypto investor, you would possibly feel like the current bear market isn't going to end. Bitcoin has been declared lifeless greater than 300 occasions over the course of its nine-year lifespan. CoinDesk is an impartial working subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, sure CoinDesk workers, together with editorial workers, may obtain exposure to DCG fairness in the form of stock appreciation rights, which vest over a multi-year period.

ARK stated in a statement Tuesday that it's going to shutter its Transparency ETF at the end of July, just eight months after launching the investment vehicle. While speaking to ET Now, on the hot topic of the crypto crash, there are several market gamers who have their opinion about this market decline. There are several key elements which have led to the decline of the digital foreign money. Stag is a slang time period for a short-term speculator who attempts to revenue from short-term market actions by rapidly moving in and out of positions.

Bitcoin Value

"Bitcoin trade BitFloor suspends operations after $250,000 theft". "El Salvador appears to turn out to be the world's first country to adopt bitcoin as legal tender". "Hal Finney obtained the primary Bitcoin transaction. Here's how he describes it". In August 2013, the German Finance Ministry characterized bitcoin as a unit of account, usable in multilateral clearing circles and topic to capital gains tax if held less than one yr. In June 2013, Bitcoin Foundation board member Jon Matonis wrote in Forbes that he received a warning letter from the California Department of Financial Institutions accusing the inspiration of unlicensed money transmission.

According to crypto tracking website CoinGecko, the crypto market's precipitous downturn has led the costs of 72 of the highest one hundred tokens to tumble by more than 90% from their all-time highs. Celsius holds plenty of belongings in the decentralized finance house, together with staked ether, a token provided by crypto start-up Lido Finance that is meant to be price the identical as ether, the second-biggest cryptocurrency. Lightning is a payments platform built on high of bitcoin's base layer that enables just about instantaneous and low-fee transactions. And proper now, in accordance with Taihuttu, is the "ultimate shopping for moment." "Investors will be better off to stack cash and wait for alerts of a reversal earlier than allocating contemporary capital to crypto. Patience might be key. We anticipate a robust Q for crypto property," he added.

Investing In Cryptocurrencies

If sure, know that you just you are not alone, there a a lot of people in this same scenario. I was a victim of a cryptocurrency rip-off that price me some huge cash. This happened a couple of weeks in the past, there’s only one resolution which is to talk to the best individuals, if you don’t do this you will find yourself being really depressed . I was really devastated till i sent a mail to an skilled team who got here highly really helpful - CRYPTOMUNDIA at YAHOO dot C O M . I started seeing some hope for myself from the second i despatched them a mail. The good half is that they made the totally course of stress free for me, i literally sat and waited for them to finish and i received what i lost in my wallet.

Despite the dangers, cryptocurrencies and the blockchain business are rising stronger. Much-needed financial infrastructure is being built, and traders are increasingly capable of entry institutional-grade custody companies. Professional and individual traders are steadily receiving the instruments they should handle and safeguard their crypto belongings. Successful merchants aren't born, they're made Tens of hundreds of traders work the markets daily. Many of them even choose the identical order at the similar time by using the identical indicators.

0 notes