#phone banking app

Text

How to make a UPI Payment Without The Internet: A Simple Guide

UPI is a internet banking app that enables money transfer from one account to another. It requires an uninterrupted internet connection to complete transactions. But if you are in an emergency and need to make an immediate transaction, click *99# to complete a transaction.

#transfer mobile banking app#upi bank#secure net banking#phone banking#safe mobile banking#banking app#bank app#mobile banking account app#bank account app#mobile banking apps#phone banking app#mobile banking account#e banking app#best net banking app#mobile banking application#online banking#mobile banking apps in india#internet banking app#net banking#e banking#premium mobile banking#digital banking#ebanking#internet banking#upi application#money transaction app#bank account check app#check bank account balance#upi mobile banking#upi bank account

1 note

·

View note

Text

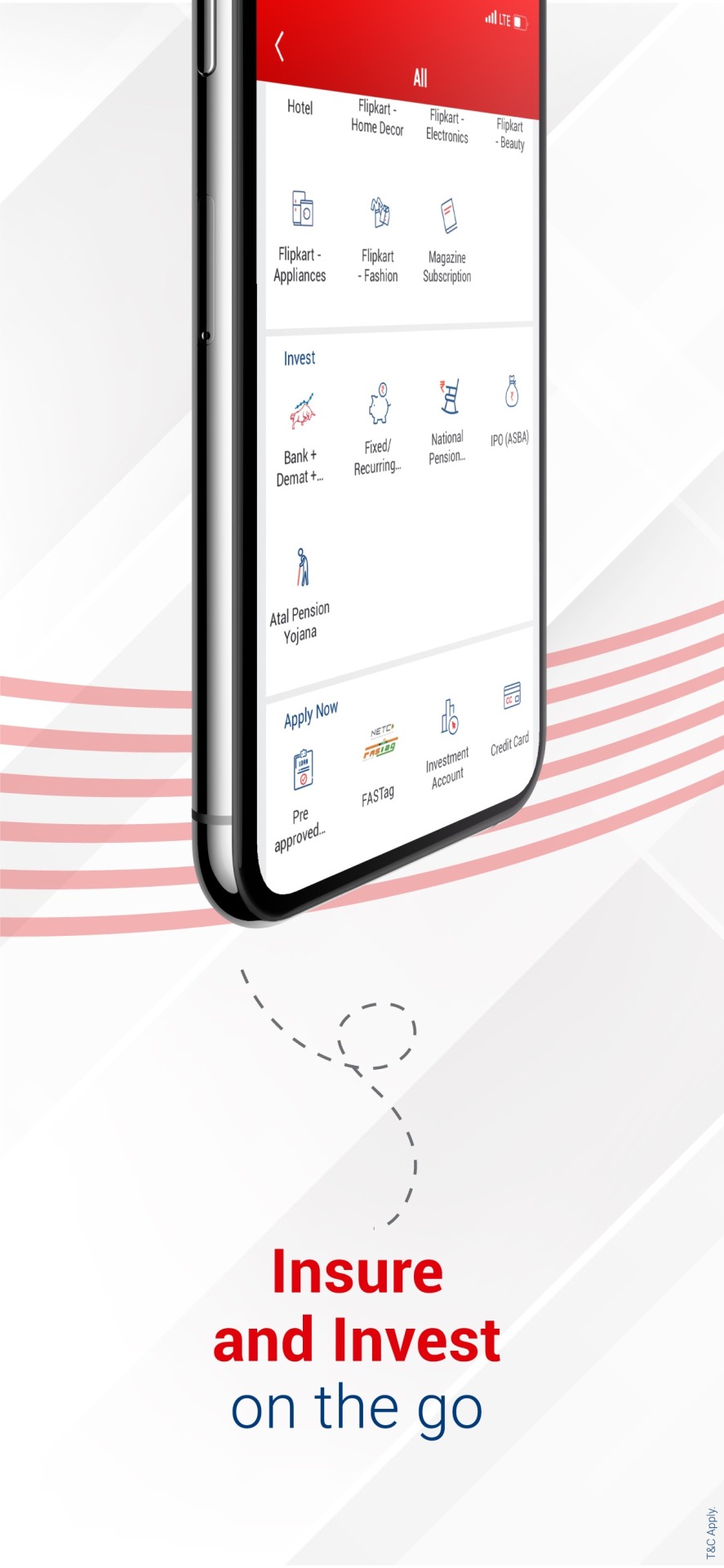

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#net banking app#phone banking#phone banking app#mobile banking application#internet banking app#digital account#digital banking#check balance#fd account app#transfer mobile banking app

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era. If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#net banking app#phone banking#phone banking app#mobile banking application#internet banking app#digital account#digital banking#check balance#fd account app#transfer mobile banking app

0 notes

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#upi enabled app#app upi mobile banking#digital account#upi account number check#banking mobile upi#phone banking#upi mobile banking app#upi account check#new bank account#bank online account#mobile banking account#mobile banking account app#phone banking app#fast mobile banking

0 notes

Text

Types of digital banking methods to know about

Different kinds of digital banking systems are affecting the world’s rural sector as well as the urban elite. Various digital payment formats are used to categorize digital banking. Digital payment methods like Best Banking App are electronic means that substitute cash and checks.

Download app:

#upi enabled app#app upi mobile banking#digital account#upi account number check#banking mobile upi#phone banking#upi mobile banking app#upi account check#new bank account#bank online account#mobile banking account#mobile banking account app#phone banking app#fast mobile banking#upi bank app#bank account online#upi account create#internet banking app

0 notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#bank account online#internet banking app#mobile app#premium banking#bank app#mobile banking apps in india#mobile banking apps#online banking app#phone banking app#new bank account

1 note

·

View note

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#best banking app#premium banking#mobile banking app#digital account app#secure net banking#phone banking app#zero balance account#e banking app#online bank

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#best banking app#premium banking#mobile banking app#digital account app#secure net banking#phone banking app#zero balance account#e banking app#online bank

0 notes

Text

Contactless payment and the details of its working

The process of transacting is becoming simpler each year. Payments can be made in a variety of simple methods, and the contactless payment mechanism is one of these. Contactless payment methods are one of the important inventions of this era. Customers can use their debit or credit cards with RFID technology to make contactless payments for goods and services.

When making an in-store purchase, using contactless banking is among the most widely used payment options. Because the customer can use these cards to pay without making physical contact, transactions go more smoothly.

To learn more about contactless payment and how it functions, continue reading.

What is contactless payment?

Customers can make purchases utilizing contactless payment instead of cash or card swipes. Tapping and waving on the card reader is required to pay using contactless payment. The terminal will then establish a connection with the bank account, and the payment will be processed immediately.

How does contactless payment work?

Radio Frequency Identification (RFID) technology is used in contactless payment cards. The card connects with the scanner when it is in close proximity to one to complete the transaction.

When tapped or waved over the reader, the card reader verifies the information on the card. Following that, the transaction is sent to the card issuer by the merchant's point-of-sale system. After reviewing it, the card issuer approves the transaction.

If individuals desire to do financial transactions using their phones, contactless payment is an additional choice.

The invention of contactless banking has taken payment methods to a whole new level. The quickness and security of contactless banking is unbeatable. The features of contactless banking will get better in the coming years.

Strong authorization

People could believe that contactless payment is hazardous since anyone can take cardholder data. Contactless payments, however, are quite secure. Contactless payment is difficult to hack or breach because they need validation to be completed.

On the card, the information is encrypted. As a result, it is more challenging to steal card information and perform unauthorized logins.

It’s a secure payment method.

Due to its ability to let users complete transactions fast, contactless payments are growing in popularity. Customers can make payments faster because they don't need to input their PIN.

Customers also don't need to carry cash. Contactless payments eliminate this bother, making transactions simple.

What benefits do contactless payments offer?

Contactless payments, facilitated by a bank account app, can significantly expedite the checkout process while also enhancing security. These payments are not only quicker than cash transactions but also take less time compared to typical credit card payments. As a result, contactless payments are particularly well-suited for micropayments and other low-value transactions, making the bank account app a convenient and efficient tool for managing your finances.

Using contactless payment methods can speed up transactions at parking garage checkout stations, turnstiles for public transportation, and toll booths. Although the actual amount of time saved for every transaction may be less than a minute, the minutes saved can pile up and drastically lessen the amount of time clients must wait in queues.

Final thoughts

Institutions and third-party payment processors are experimenting with ways to make checkout more seamless as upi money transfer app technology becomes more widely used. To assist mobile users in finding ATMs, certain payment providers offer GPS technology. Other carriers give clients the option to participate in loyalty marketing run through focused geofenced campaigns.

#bank account online#create bank account online#bank open account online#open account online#bank accounts to open online#online account opening bank#new bank account open#phone banking app#online bank account opening

0 notes

Text

Safe Mobile Banking: What to Consider When Choosing Mobile Banking App?

You can easily access your bank account with mobile banking apps. You can check your history, make transactions, pay invoices, and examine account balances. Locating an online banking app with these common features is relatively easy. Numerous financial organizations provide banking services via their mobile apps. While online banking is also available from banks and credit unions, the advantages of mobile banking apps that operate without physical locations are typically higher. When choosing amobile banking app, you must consider a few important things to have a safe online banking experience. Continue reading about what to consider when selecting a mobile banking app:

Fees and ATM Network

Consumers may find fees like overdrafts, ATM transactions, and monthly payments inconvenient. Choose the expenses that will affect you the most and look for mobile banking apps that charge little or nothing for those services. ATM users should regularly see if an app has nearby locations and what network it operates on. ATM networks help you save money on each transaction by lowering or eliminating ATM fees. ATM transactions are fee-free with certain mobile banking apps.

Ease of Use

The mobile app for your bank should be easy to use and simple, and it should work on both Apple and Android smartphones. On your first app usage, allow yourself around half an hour to find everything you need, depending on how comfortable you are with mobile applications. It could be a better app, but it will irritate you later if it initially looks overwhelming. Digital wallets can be integrated with a good banking app.

Account Minimums

Mobile banking app frequently set minimum deposit and balance requirements. Sadly, some of these minimums exceed what most individuals want or can pay. If the minimum balance on your account is not met, they could charge you fees. Make a shortlist of the mobile banking apps that offer minimal payments that are less than your means. Certain banks make opening a checking or savings account simpler by not having any minimum requirements.

Compare features and functions

Different mobile banking apps have different features. While some include more sophisticated features like budgeting tools, investing alternatives, and rewards programs, others only provide basic services like bill payment, balance checking, and fund transfers. Depending on your habits and aspirations, you could seek an app to help you reach your financial goals or include the features and functionalities you use most frequently. For instance, you can look for an app with goal-setting tools, automatic savings plans, or cash-back incentives if your objective is to save more money.

Mobile Deposit

The best banking applications provide features like mobile check capture and electronic check deposit. With just a few taps on the app, you can enter the deposit amount, snap pictures of the front and back of the check, and quickly get confirmation that the bank has received and is processing your deposit.

Bottom Line

When you are looking for a UPI application choose one with good features. Then, search for one that provides a safe and easy way to access your accounts from your smartphone whenever possible. With the right mobile banking app, you can watch your spending, save money, raise or lower your credit score, and have access to budgeting and financial tools.

#mobile banking account app#upi bank app#phone banking#net banking app upi#banking mobile upi#internet banking app#upi account create#bank online account#net banking#upi net banking#upi bank#bank account online#net banking app#mobile banking apps in india#best net banking app#phone banking app#internet banking#fixed deposit account

0 notes

Text

Pharmacy is making me download an app to fill my prescriptions and I am once again getting irrationally angry at App Creep. Stop encroaching on the necessities of daily life. I don't want to scan a fucking QR code and I don't want to download an app just to get my allergy medicine or buy a bus pass. I will Kill you

#No more apps. We have moved beyond the need for apps#My only vehement Retvrn opinion is Stop Requiring A Smartphone To Live In Society#Like the only thing stopping me from switching to a flip phone of yore is#MyChart + CVS#+ Ventra + My fuckass bank forcing you to do everything through the app

24 notes

·

View notes

Text

The Golden Girls | The Accurate Conception

#the golden girls#had to youtube this bc my app wouldn't work for this episode dammit!!#for steph ❤️#sophia petrillo#rose nylund#dorothy zbornak#blanche devereaux#Sophia and the sperm bank😂😂 thank sperm banl better be off the chain for her to go to the dr#cell phone gifs#thank you YouTuber for uploading this gem#80s sitcom#80s television

56 notes

·

View notes

Text

Best Mobile Banking app Features

Nowadays, mobile banking app has become a daily part of your lives, providing convenience, accessibility, and security like never before. As technology grows, mobile banking apps are constantly updated to fit client’s needs. Now, let us look at some of the best features of mobile banking apps.

Download App:

#upi registration#digital account app#upi net banking app#upi bank account#fd account app#upi account#upi enabled app#app upi mobile banking#digital account#upi account number check#fd account benefits#banking mobile upi#मोबाइल बैंकिंग#phone banking#upi mobile banking app#upi account check#upi banking app#fd account yearly#new bank account#bank online account#mobile banking account#mobile banking account app#phone banking app#net banking app upi#upi bank#fast mobile banking#upi bank app#bank account online#bank upi#mobile banking application

1 note

·

View note

Text

UPI: The Force Behind Inclusion and Economic Growth

In this rapidly evolving world of digital finance, the Unified Payments Interface (UPI) has emerged as a powerful driver of economic growth and financial inclusion. UPI has revolutionized the way transactions are handled. It plays an important role in promoting a more inclusive and robust economic landscape.

Download app :

#fd account app#app upi mobile banking#digital account#upi account number check#fd account benefits#banking mobile upi#phone banking#upi mobile banking app#upi account check#fd account yearly#mobilebanking app upi#mobile banking account#phone banking app#fast mobile banking#upi investment#upi net banking#upi account create

0 notes

Text

Thinking about all the times gouenji forgets his phone at home. How do you even fucking contact this guy. No wonder they werent looking for him pre-inago. This man is uncontactable. You have to be connected with yuuka to even know what hes been upto

Someone needs to tell him that he'll be able to save soccer if he keeps his phone with him at all times i think. Somebody needs to trick him like that

#his phone only has the default apps and can be hacked so fucking easily#“hey maybe you should try online banking--” why. but i love going to the bank. i like the little stroll and i have the time#you can steal his phone and not get any other information except for the three pictures he has together w yuuka#their selfies together taken by yuuka#im aware i have things in my inbox that i havent answered. i will do so after i get back#as well as replies#inazuma eleven#inazuma eleven go#gouenji shuuya#axel blaze

52 notes

·

View notes

Text

Kotak Mahindra Bank’s official mobile banking app for Android phones.

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#online banking account open app#bank account open online#savings bank account#online bank account opening#phone banking app#new bank account open#online account opening bank#bank accounts to open online#open account online#online account open

1 note

·

View note