#digital account app

Text

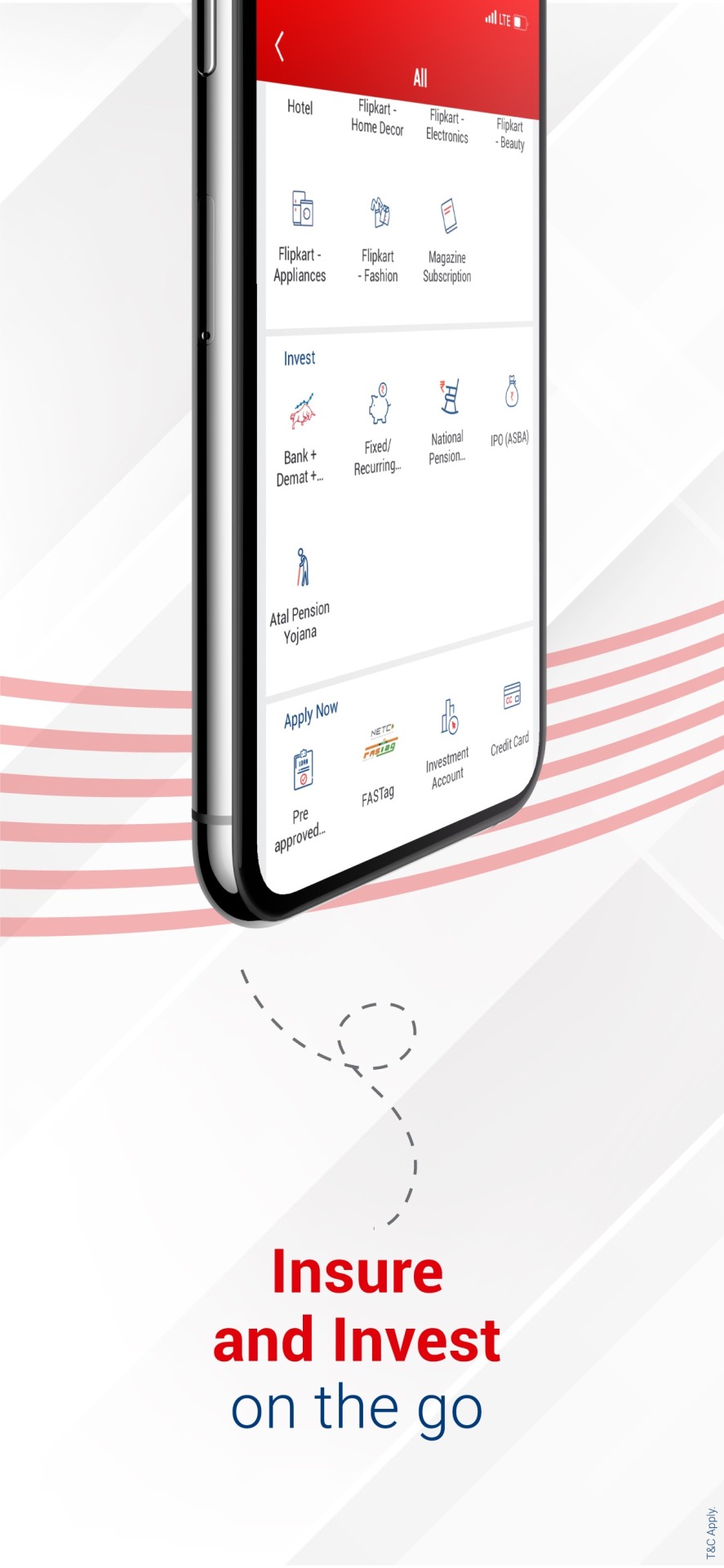

Kotak 811 – A one-stop destination for all your banking needs.

Make Money Transfers Smooth & Easy

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

Kotak811 mobile banking app is your one-stop solution for managing your bank account anytime, anywhere. Kotak811caters to your needs with its easy-to-use interface and wide range of features.

#banking upi mobile#upi mobile banking#upi registration#digital account app#fd account app#upi banking app#upi net banking app#upi bank account#mobile banking upi#upi account#fast mobile banking#mobile banking account#mobile banking account app#digital account#app upi mobile banking#fd account yearly#net banking app upi#phone banking#banking mobile upi#upi mobile banking app#safe mobile banking#fd account#upi enabled app#mobilebanking app upi#contactless banking#upi account check#fd account benefits#quick fd account#fd easy

0 notes

Text

Benefits of handling Digital Payments by using UPI

In ancient times, people used some types of coins for purchasing purposes. Then, they used the commodity exchange method. After that, we are using money in the form of paper and coins. We used to give cash in a physical form for every purchase, even if it was a single penny or a large amount. To give or receive money from someone, we have to appear physically. Then only we can get the amount if you want to send money to anyone through the bank, which also takes some time. But now we have an option for quick money transferthrough UPI transfer. Let’s look at the benefits of UPI transactions in the post.

UPI

UPI stands for Unified Payments Interface. The UPI method was introduced by the National Payments Corporation of India (NPCI) in 2016. UPI is a digital payment platform, even though you can use banks to send money to anyone by deposit into their account. However, it needs the account number, name, and IFSC, and you have to wait and spend your most valuable time in the bank. We must wait to take the Demand Draft, deposit the checks, and all. By using UPI money transfer,we made money transactions easy.

Digital Payment

Digital payments make our transactions more efficient through UPI money transfer.UPI is nothing but sending or receiving money using any mobile application. Now, it is more effective for everyone. To make a UPI payment, we don’t need to register the secondary person’s account details on our own. We just need the phone number linked to their bank account. One more way of digital payment is scanning the QR code to send money.

Benefits of UPI Payment

There is no need to carry cash, card, or wallet everywhere.

Caring for a mobile phone as a digital wallet is enough to make our payments.

You can instantly send money to anyone by using mobile phones.

It provides 24/7 support for money transactions.

It helps us to reduce the transaction fees from banks.

Can integrate more than one bank account under one UPI ID.

Can pay all bills by the use of UPI Payment.

You can shop for anything online by using it.

Many digital platforms provide cashback and offer reward points by using UPI Payment.

Everyone can use UPI Payment as it is a user-friendly platform.

It helps to save our time.

The Bottom line

After the UPI Payment's introduction, most payments are paid as digital payments. Everyone highly welcomes this payment method. Malls, Cinema Theaters, Department Stores, Showrooms, Educational Institutions, Hotels, Hospitals, and even very small merchandise shops also now have the digital payment method. Given the easy accessibility of the platform, the usage of UPI Payment is becoming more common nowadays. The UPI Paymenthas made a big change and created a revolution in Indian payment, making it more accessible to non-residential Indians. Now, this quick money transfermade us feel a stress-free life.

#banking upi mobile#upi mobile banking#upi registration#digital account app#upi banking app#upi net banking app#upi bank account#mobile banking upi#upi account#mobile banking account app#digital account#app upi mobile banking#net banking app upi#upi mobile banking app#safe mobile banking#upi enabled app#mobilebanking app upi

1 note

·

View note

Text

Kotak811 Mobile Banking Check A/c balance & transaction history, scan QR & transfer money via secure UPI

Enjoy the power of seamless digital banking with Kotak 811 – the ultimate UPI app for all your banking needs! With our feature-rich mobile banking app, you can open a bank account in just 3 minutes, check balance online, view transaction history, and enjoy secure UPI payments and grow your savings faster with High-Interest Fixed Deposits!: 3-step process for creating & managing your FD.

#banking upi mobile#upi mobile banking#upi registration#digital account app#upi bank account#fd account app#upi banking app#fd account#mobile banking upi#upi account#digital account#fd account benefits#upi net banking app#fd account yearly#mobile banking account app#fixed deposit account#upi account number check#open fd#Fd transfer status#instant fd account setup

0 notes

Text

Best Mobile Banking app Features

Nowadays, mobile banking app has become a daily part of your lives, providing convenience, accessibility, and security like never before. As technology grows, mobile banking apps are constantly updated to fit client’s needs. Now, let us look at some of the best features of mobile banking apps.

Download App:

#upi registration#digital account app#upi net banking app#upi bank account#fd account app#upi account#upi enabled app#app upi mobile banking#digital account#upi account number check#fd account benefits#banking mobile upi#मोबाइल बैंकिंग#phone banking#upi mobile banking app#upi account check#upi banking app#fd account yearly#new bank account#bank online account#mobile banking account#mobile banking account app#phone banking app#net banking app upi#upi bank#fast mobile banking#upi bank app#bank account online#bank upi#mobile banking application

1 note

·

View note

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#upi enabled app#upi mobile banking#upi account number check#upi banking app#upi create#mobile banking account app#digital account app#fd transfer account#fd account yearly#fd account app#mobilebanking app upi#quick fd account

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#best banking app#premium banking#mobile banking app#digital account app#secure net banking#phone banking app#zero balance account#e banking app#online bank

0 notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#best banking app#premium banking#mobile banking app#digital account app#secure net banking#phone banking app#zero balance account#e banking app#online bank

0 notes

Text

Eligibility and Documents Required to Obtain a Credit Card

Credit cards have become an essential financial tool, offering convenience and flexibility in managing expenses, since it is optional to get one. It involves meeting certain eligibility criteria and submitting specific documents to the issuing bank or financial institution. You can now try it on a digital account by opening the app itself. Many of you may need a credit card but don't know how. Understanding these requirements is crucial for them to ensure a smooth application process and increase the chances of approval. So, let us clarify the eligibility to apply for a credit card.

Factors influencing credit card eligibility:

Banks and financial institutions establish specific eligibility criteria to assess an individual's creditworthiness before approving a credit card application. While the eligibility criteria may vary slightly among different issuers, the following are common factors considered:

Age - Applicants must usually be at least 18 to be eligible for a credit card. Age requirement may differ for various financial institutions.

Income - A regular source of income is a primary factor in determining eligibility. The income requirement varies based on the type of card and the issuing bank.

Employment Status - Whether you're salaried, self-employed, or a business owner, your employment status plays a role in eligibility.

Credit History - A good credit history will be a positive sign to get a credit card. Issuers may consider your credit score, which reflects your creditworthiness.

Nationality and Residence - Credit card eligibility is often restricted to citizens or residents of the country where the card is issued. Some institutions also consider the duration of your stay in that country.

Existing Debts - Your existing debt obligations, such as loans or outstanding credit card balances, might influence your eligibility. A high debt-to-income ratio could lead to a rejection.

Documents Required:

You'll be instructed to submit specific documents along with your credit card application to substantiate your eligibility and provide the necessary information. The exact list of required documents may vary by institution, but generally, the following are commonly requested:

1. Identity Proof includes documents such as a valid passport, driver's license, Aadhaar card, or voter ID card.

2. Address Proof - Utility bill payments, rental agreements, or a recent bank statement can serve as address proof.

3. Income Proof - Salaried individuals usually must provide salary slips for the last few months. Self-employed individuals might need to submit income tax returns or audited financial statements.

4. Passport-sized Photographs - These are required for identity verification.

5. Employment Proof - For salaried applicants, an employment verification or appointment letter can be requested.

6. Bank Statements- Some issuers might ask for your recent bank statements to assess your financial stability.

7. PAN Card - The Permanent Account Number (PAN) card is essential for income verification and tax purposes.

8. Business Proof - If you're self-employed or a business owner, you might need to provide documents related to your business, such as business registration certificates.

Closing thoughts:

Many digital account opening apps provide the facility to apply for a credit card online. Acquiring a credit card requires meeting specific eligibility criteria and submitting essential documents that validate your identity, financial stability, and creditworthiness.

#digital account app#new bank account open app#apply online account opening#open bank account#zero account opening online#online new account open#account opening form online#best online account opening

0 notes

Photo

And that’s not all!

Mid-month cash crunch or an emergency? Get your salary in advance!

Kotak Payday Loan is available with just a few taps. Repay the loan when your salary gets credited next month.

Features of Payday Loan:

• Get a loan within seconds starting at Rs.3,000

• Pay interest as low as Re.1 per day

• Avail loan with no documentation

Eligible users can apply from the ‘Apply Now’ section.

#Digital Account App#Bank Open Account Online#Online Open Bank Account App#Digital India Banking App#Online Digital Account Opening#Bank Account Check#Money Transfer#Banking App#kotak#kotka 811

1 note

·

View note

Text

Secure UPI Payments, Scan QR, Check Balance & View Transaction History

Kotak811 is your one-stop solution for all banking needs—whether it's quick UPI transfers, checking your account balance, or reviewing transaction history. Don't miss out on our high-interest Fixed Deposits to accelerate your savings!

#banking upi mobile#upi mobile banking#upi registration#digital account app#fd account app#upi banking app#upi net banking app#upi bank account#mobile banking upi#upi account

0 notes

Text

First art fight attack of this year!

It was so fun drawing @rraimu s character!

#art#artists on tumblr#artwork#my art#character art#fan art#bendy and the ink machine#artistsoninstagram#bendy and the dark revival#artfight#art fight#artfight 2024#artfight art#artfight attack#artfight account#procreate art#procreate drawing#not my oc#not my original character#Had to add Stoli-#procreate app#procreate doodle#procreate#digital artist#digital drawing#digital painting#digital art#digital illustration#sketching#bendy au

77 notes

·

View notes

Text

Okay so last night I complained about being glued to my screen more than I’d like to be. So this morning I decided I’ll do something about it <3 the purpose of documenting it here is so that I hold myself accountable on my blog instead of writing it down in my notes app and negating it like two seconds later. And also so it’s easier for me to be like “bitch enough” whenever I catch myself scrolling through my Tumblr when I absolutely should not be. I plan on increasing these rules (progressive overload) or decreasing them (too much too soon) depending on results, but for the next week it’s:

Cannot get on my phone until I’ve drunk water, done my am skincare routine/taken my am shower, and taken my am supplements.

Phone in the morning for 15 minutes max. Otherwise I cannot be on my phone until noon (I wake up pretty early so this gives me like 4 hours of no phone time).

Also cannot get on my phone after noon unless I’ve studied at least two hours beforehand.

Need to study 2 hours for every 1 hour I’m on my phone until 6 pm.

Can use my phone liberally after 6 pm ONLY if I’ve: hit my study goals, done my Anki flash cards that are due, and finished my workout (or walk) of the day. Otherwise, the previous rule applies.

Need to read a book for at least 30 minutes in the day. This can be thrown in whenever, but preferably before bed.

Need to set aside 20 minutes after 6 pm to do pm skincare routine/take pm shower.

#anyone looking at this post will be like ‘is this bitch a productivity blog now’ NO I’m not ok.#i am but a 21 year old girl who’s trying to heal her relationship w her phone after being given an iPad at age 11#this goes for Pinterest too bc god knows I waste too much time on that app#will try to update this on a regular basis so I can better hold myself accountable 🤞#p#digital detox

238 notes

·

View notes

Text

Secure UPI Money Transfer, Scan QR, Check Account Balance & Transaction History

Simplify your finances with Kotak811, the ultimate app for easy money transfers, UPI payments, and account management! With our feature-rich mobile banking app, you can enjoy quick and secure UPI transfers to any account, instantly check your account balance, view transaction history, and grow your savings account faster with High-Interest Fixed Deposits!

#upi mobile banking#upi account number check#upi banking app#upi create#mobile banking account app#digital account app#fd transfer account#fd account yearly#fd account app#mobilebanking app upi#quick fd account#mobile banking upi#net banking app upi#upi account#app upi mobile banking

1 note

·

View note

Text

youtube ads becoming first one 5-second ad then two 5-second ads in a row or one 15-second ad then a million unskippable ads in the middle of videos instagram quietly inserting one ad in-between every 5 or 10 ig stories then 2 in-between 4 ig stories not to mention the new reel- and explore page ads. a quiet tumblr ad banner at the top of your dash then photo ads in-between posts then video ads then video ads in-between every 3 or 5 posts that play audio automatically while youre trying to read a textpost. the most popular, paid subscription, news apps adding ads between their articles, then in articles, then paywalling new articles further with a new "news +" subscription and putting ads in those as well. once every 15 tweets there being an ad, then every 5, then theres also an ad if you scroll to the replies. you cant look at tweets without logging in anymore, theres just no option for anon scrolling. facebook ai mining on instagram, facebook ai profiles hyping up ai generated photos im fucking going insane ai temu ads and gallery app ads and printer app ads and higher subscriptions while still seeing ads and i cant fucking do this anymore!!!!! its fucking shameless and worst of all its silent and nobody talks about how half the things we see anymore are fucking ads and we dont own a single thing we pay for and companies can just randomly raise their prices through the roof and nobody says anything about it

#im going insane???#we dont own anything movies are digital every fucking app and software i subscription based AND THEN THEY HAVE THE FUCKING GALL#TO PUT ADS IN THOSE AS WELL!!!!#20 bucks a month for a software that i have to watch banner ads on! its fucking insane#the entire world is owned by four corporations and ads are fucking everywhere i feel like i see more ads than posts nowadays#and it didnt use to be like this!!!! thats the insane part to me!!!!!!#i started social media in 2014 10 years ago and there wasnt a single ad on instagram#but the worst is that nobody fucking complains about it . everybodys like oh its bad that netflix isnt allowing people-#-outside of one wifi to use one account even tho theyve paid for it for like. two weeks#and then we go back to normal. no complaining no yelling no real backlash! and everybody keeps their subscriptions#im going insane genuinely i dont know what the fuck#rant#vent#anti capitalism#ads#advertisement#advertisements#advertising#social media#instagram#tumblr#facebook#twitter#UGH

29 notes

·

View notes

Text

uhhhhh hi I'm very new to tumblr I have no idea how this app works but I'll be posting my art here

it's mainly miraculous ladybug art but I might draw other things

still a beginner artist so keep that in mind

#drawing#digital art#miraculous fanart#miraculous ladybug#new account#hi#i don't understand how this app works

10 notes

·

View notes

Text

The Kotak Mobile Banking App, a best in class App, provides banking on the go, which is a must in today’s digital era.

If you are not an existing Kotak customer, you can open a Kotak Savings account or an 811 digital bank account by visiting your nearest branch.

#open zero balance account#digital account app#mobile banking app#open bank account app#digital account opening app#online new account opening app#instant account opening app#best mobile banking app

0 notes