#posswipemachine

Explore tagged Tumblr posts

Text

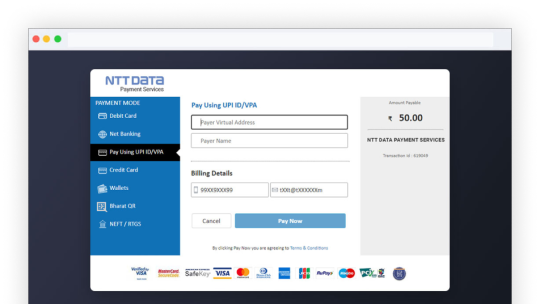

Our Next-Gen Online Payment Gateway for Secure Transactions

Welcome to the cutting-edge online payment gateway that revolutionizes the way you make and receive payments. With our advanced y, we bring you a seamless and secure payment experience like never before.

We understand the importance of simplicity and convenience in online transactions. Our user-friendly interface and intuitive design make it effortless for you to process payments, whether you're a business owner or an individual shopper. Say goodbye to lengthy forms and complicated steps – streamlines the process, allowing you to complete transactions in a few clicks.

Security is our utmost priority. With robust encryption and advanced fraud detection measures, you can trust to safeguard your sensitive information. Our secure servers ensure that your payment details remain confidential, providing you with peace of mind during every transaction.

But is not just about convenience and security – we also offer a wide range of features to enhance your online shopping experience. From seamless integration with popular e-commerce platforms to support for multiple payment methods, including credit cards and digital wallets, we have you covered.

Interactive interface that adapts to your needs. Experience real-time updates, personalized recommendations, and responsive design across multiple devices, ensuring a consistent and engaging payment experience every time.

Don't let outdated payment gateways slow you down and unlock a new level of efficiency and convenience in online transactions. Join thousands of satisfied customers who have chosen as their preferred online payment gateway. Sign up today and elevate your payment experience with – the future of online payments.

0 notes

Text

Revolutionizing Payment Processing: The Power of POS Swipe Machines

In the ever-evolving world of commerce, innovative technologies have transformed the way we make transactions. One such groundbreaking solution is the Point of Sale (POS) swipe machine. These sleek and efficient devices have revolutionized payment processing, providing businesses with seamless and secure transaction experiences.

Enhanced Payment Security: POS swipe machines prioritize security by encrypting sensitive customer data during each transaction. Utilizing advanced encryption algorithms, these devices protect financial information, significantly reducing the risk of data breaches and fraud. As a result, customers can confidently make purchases without worrying about compromising their personal information.

Versatility and Convenience: Gone are the days of carrying around bulky cash or cumbersome checkbooks. POS swipe machines enable customers to make payments effortlessly using their credit or debit cards. With contactless payment options, such as Near Field Communication (NFC) and mobile wallets, customers can simply tap or wave their cards or smartphones to complete transactions swiftly, enhancing convenience for both customers and businesses.

Real-Time Transaction Tracking: POS swipe machines offer real-time transaction tracking capabilities. Merchants can instantly monitor sales, inventory levels, and revenue, allowing for effective business management. This data-driven approach empowers businesses to make informed decisions, optimize stock levels, and identify trends, ultimately enhancing operational efficiency and profitability.

Streamlined Accounting and Reporting: The integration of POS swipe machines with accounting systems simplifies financial management for businesses. These devices automatically record sales data, providing accurate and detailed reports on revenue, taxes, and expenses. This seamless synchronization reduces manual data entry errors and streamlines accounting processes, enabling business owners to focus more on core operations and strategic planning.

Customer-Centric Experience: With the advent of POS swipe machines, businesses can elevate the customer experience to new heights. These devices enable swift transaction processing, reducing wait times and enhancing customer satisfaction. Additionally, the availability of customized receipts, loyalty programs, and targeted promotions adds a personal touch, fostering stronger relationships between businesses and their customers.

In conclusion, NTT DATA Payment Services POS swipe machines have emerged as a game-changer in the realm of payment processing. With their enhanced security, convenience, real-time tracking, streamlined accounting, and customer-centric features, they empower businesses to stay ahead in an increasingly competitive landscape. Embracing this innovative technology is a step towards unlocking new levels of efficiency and success in the digital age of commerce.

0 notes

Text

How Does the Payment Gateway Works in Travel Industry

Here is how a payment gateway works in the travel industry

A customer visits a travel website and selects a travel package.

The customer enters their payment information, such as their credit card number and expiration date.

The customer clicks the "Pay" button.

The payment information is sent to the payment gateway.

The payment gateway authorizes the payment and sends the funds to the travel company.

The travel company sends the customer a confirmation email.

Payment gateways offer a number of benefits for travel companies, including:

Increased security: Payment gateways use industry-leading security measures to protect customer data.

Convenience: Payment gateways make it easy for customers to make payments online.

Flexibility: Payment gateways offer a variety of payment options, so customers can pay with the method of their choice.

Scalability: Payment gateways can be scaled to meet the needs of growing businesses.

If you are a travel company, using a payment gateway is essential for accepting online payments. Payment gateways offer a number of benefits that can help you grow your business.

Here are some additional benefits of using a payment gateway in the travel industry:

Increased customer satisfaction: Customers appreciate the convenience of being able to make payments online. This can lead to increased sales and customer loyalty.

Improved cash flow: Payment gateways can help you get paid faster, which can improve your cash flow.

Reduced fraud risk: Payment gateways use sophisticated security measures to protect your customers' data. This can help you reduce your risk of fraud.

If you are a travel company, I encourage you to consider using a payment gateway. It is a valuable tool that can help you grow your business.

0 notes

Text

How to Choose the Right Online Payment Gateway

When it comes to running an online business, having a reliable and secure payment gateway is essential. With so many options available, choosing the right one for your website can be overwhelming. Here are some tips to help you choose the right online payment gateway:

Consider the Payment Methods: Different payment gateways offer different payment options. Make sure the payment gateway you choose supports the payment methods you want to offer to your customers. Common payment methods include credit and debit cards, digital wallets, and bank transfers.

Look for Security Features: Security should be a top priority when it comes to online payments. Look for a payment gateway that offers features like data encryption, fraud protection, and secure checkout processes. This will ensure that your customers' sensitive information is protected.

Check for Compatibility: Before choosing a payment gateway, make sure it is compatible with your website platform or e-commerce software. Some payment gateways may only work with certain platforms, so it's important to do your research.

Evaluate Fees and Charges: Payment gateways often charge fees for each transaction or a monthly fee for using their services. Make sure you understand the fee structure and evaluate how it will impact your business's profitability.

Consider Customer Support: In case you run into any issues or have questions about the payment gateway, having access to reliable customer support can be crucial. Look for a payment gateway that offers 24/7 customer support and multiple support channels like phone, email, and live chat.

Choosing the right online payment gateway like NTT DATA Payment Service crucial for the success of your online business. By considering these factors, you can make an informed decision and select a payment gateway that meets your business's needs.

0 notes

Text

POS Swipe Card Machine for Small Business

If you run a small business and want to accept card payments from your customers, a swipe card machine can be a great option. Swipe machines, also known as point-of-sale (POS) machines, are electronic devices that allow you to accept card payments in person, either by swiping the card or inserting the chip. Here are some benefits of using a swipe machine for your small business:

Improved Customer Experience: With a swipe machine, your customers can pay for their purchases with their preferred payment method, whether it's a credit card, debit card, or mobile payment. This can improve their shopping experience and make it easier for them to do business with you.

Increased Sales: By accepting card payments, you can expand your customer base and potentially increase your sales. Studies have shown that businesses that accept card payments tend to sell more than those that only accept cash.

Security: Swipe machines use advanced encryption and security protocols to protect sensitive customer information, making it a safe and secure payment method for your business.

Real-Time Transaction Processing: Swipe machines process transactions in real-time, meaning you can see the payment immediately, reducing the risk of fraud or chargebacks.

Flexibility: Swipe machines are portable and can be used anywhere with an internet connection, making it a great option for businesses that need to accept payments on the go or at events.

In summary, a swipe machine can help small businesses offer a secure and convenient payment option to their customers, potentially increasing sales and improving the overall shopping experience.

0 notes

Text

What are the documents required to integrate NTT DATA Payment Service Payment Gateway?

Integrating NTT DATA Payment Service Payment Gateway requires a few key documents to ensure that the process is smooth and seamless. Here are some of the documents that may be required:

Business registration documents: You may need to provide documents that prove your business is legally registered and authorized to operate. These may include a business license, registration certificate, or articles of incorporation.

Bank account details: You may need to provide your business's bank account details, including the account number, branch address, and other relevant information.

Business and contact information: You may need to provide details such as your business name, address, phone number, email address, and point of contact for payment gateway integration.

Website or application details: You may need to provide details about your website or application, such as the URL, purpose, and functionality. This information helps NTT DATA Payment Service understand how to integrate the payment gateway effectively.

Technical documentation: You may need to provide technical documentation that outlines the specific requirements for integrating the payment gateway with your website or application. This documentation may include API documentation, integration guides, and other relevant technical information.

KYC and AML documents: To comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, you may need to provide identity and address proof documents for the business owner, directors, or authorized signatories.

It's important to note that the specific documents required for NTT DATA Payment Service Payment Gateway integration may vary based on your business type, location, and other factors. It's recommended to consult with their customer support or sales team to get more specific information tailored to your business needs.

0 notes

Text

How Does a Payment Gateway Work

A payment gateway is a software application that securely authorizes and processes online payments from customers to merchants. Here's how a payment gateway works:

Customer initiates payment: The customer selects a product or service to purchase and proceeds to checkout on the merchant's website. They enter their payment details, such as credit card or bank account information, into the payment gateway.

Payment gateway encrypts payment information: The payment gateway encrypts the customer's payment details to ensure that they are secure during transmission. The payment gateway also performs fraud checks on the payment to ensure that it is not fraudulent.

Payment gateway sends payment details to the acquiring bank: The payment gateway sends the encrypted payment details to the acquiring bank, which verifies the payment and either approves or declines the transaction.

Acquiring bank sends payment details to the issuing bank: If the payment is approved, the acquiring bank sends the payment details to the issuing bank, which deducts the payment amount from the customer's account and sends it to the acquiring bank.

Payment gateway receives payment confirmation: The payment gateway receives confirmation from the acquiring bank that the payment has been successful and notifies the merchant that the payment has been processed.

Merchant fulfills the order: The merchant can now fulfill the order and deliver the product or service to the customer.

Payment settlement: The acquiring bank settles the payment with the merchant, typically within a few business days, and deducts any transaction fees.

The payment gateway acts as a mediator between the customer, the merchant, and the banks involved in the payment process, ensuring that the payment is secure, authorized, and processed efficiently. Payment gateways also provide reporting and analytics tools to merchants, enabling them to track their payment activity and reconcile their accounts.

0 notes