#paymentgateway

Text

Increased Efficiency: Automation, speed, and streamlined financial tasks for better productivity.

Enhanced Security: Protect data with encryption, authentication, and robust fraud prevention.

Improved Accessibility: 24/7 access via mobile apps, online platforms, and support.

Cost Savings: Lower operational expenses and reduced transaction fees.

Data Analytics: Real-time insights, predictions, and personalized financial guidance.

Regulatory Compliance: Automated checks, real-time reporting, and adherence to changing regulations

For additional information, just check out our website:- https://www.pay10.com/

#FINTECH#PAY10#PAYMENTGATEWAY#PAYMENT GATEWAY SERVICES#PAYMENT GATEWAY PROVIDER#BEST PAYMENT GATEWAY

2 notes

·

View notes

Text

seems like it can't be closed 😭

#office life#worklife balance#happylife#meme#funny#funny meme#tuesday meme#office memes#paymentgateway#merchant account provider#merchantaccount

4 notes

·

View notes

Text

Car Rental Business Payment Service Providers - Simplify Your Transactions!

Looking for reliable payment service providers for your car rental business? Our cutting-edge solutions specialize in the car rental industry, ensuring secure transactions.

Key features: seamless integration, multiple payment options, enhanced security, automated billing, real-time reporting, and 24/7 customer support. Simplify transactions, enhance customer satisfaction, and drive profitability.

Contact us today to get the seamless and hassle free payment gateway options for business now: https://gomobi.io/. »

Whatsapp: +60 122902076

Email: [email protected] »

#online payment gateway#top payment gateway malaysia#payment gateway#malaysia payment gateway#paymentgateway

2 notes

·

View notes

Text

AEPS Service Provider Company List that covers 95% Market in 2023

Looking for the best AEPS service provider company in India? Check out this comprehensive list compiled by AEPS India. Find the right AEPS solution for your business and start offering secure and convenient banking services to your customers.

top aeps company

#digitalpayments#cashless#UPI#financialinclusion#bankingtechnology#paymentsolution#AEPSIndia#fintechIndia#cashlesseconomy#paymentgateway#bankingsector#financialservices#IndiaFinance#banking#finacialfreedom#fintach#indiafinance#digital payments

2 notes

·

View notes

Text

At PayPound.Ltd we ensure to keep the risk under control by tracking the transactions and patterns to avoid any possible frauds.

If you are running an high-risk business, securing a reliable credit card processor that enables you to accept payments across the globe will good approval ratio and regular payouts are very important!

Get your High-risk Merchant Account today!

Contact us NOW!

+44 800 832 1733

[email protected]

https://paypound.ltd/

#payment#paytm#creditcards#payments#pointofsale#digitalpayment#onlinepayment#noreturn#merchantservices#paymentgateway#creditcardprocessing#mobilepayments#paymentprocessing#onlinepayments#digitalpayments#noexchange#paymentsolutions#trafficsafety#highriskmerchantaccount#merchantaccount#business#offshoremerchantaccount#merchant#cbd#creditcard#paypal#highriskmerchantservices#businessowner#money#stripe

8 notes

·

View notes

Text

Setup Credit Card

Learn how to integrate credit card payments with your WooCommerce store.

2 notes

·

View notes

Text

Credit card processing for small businesses or big businesses is similar. However, the monthly volume is surely different for the two. Nowadays and the payment reaches the merchant in a short time.

4 notes

·

View notes

Text

The Role of Cryptocurrency Payment Processors in Economic Freedom

Imagine a world where financial transactions are faster, cheaper, and borderless. A world where you, as a business owner, have more control over your finances and customers have greater payment flexibility. This isn't a utopian fantasy; it's the potential future powered by Cryptocurrency Payment Processors (CPPs) and their role in economic freedom.

Whether you're a seasoned entrepreneur or just starting out, the concept of economic freedom is likely familiar. It encompasses the ability to make financial decisions without undue restrictions from governments or financial institutions. But how do cryptocurrencies and CPPs fit into this equation? This blog post delves into the transformative potential of CPPs and explores their impact on economic freedom for both businesses and consumers.

Understanding the Landscape: Traditional Payment Systems and Their Limitations

Before diving into the world of CPPs, let's revisit the current state of affairs. Traditional payment processors, while convenient, often pose limitations on economic freedom:

High Fees: Traditional processors charge hefty fees for every transaction, eating into your profits, especially for businesses with high sales volume. These fees can quickly add up, impacting your bottom line and hindering your ability to offer competitive pricing.

Slow Settlements: Waiting days for funds to clear can hinder cash flow and limit your ability to reinvest in your business promptly. This can slow down your growth potential and make it difficult to capitalize on new opportunities.

Geographical Restrictions: International transactions often come with additional fees and complexities, restricting your ability to reach a global customer base. This can stifle your business growth and limit your exposure to new markets with potentially higher profit margins.

Limited Control: Traditional processors have a high degree of control over your financial transactions, potentially delaying or even blocking them. This lack of control can be frustrating for businesses and can disrupt your ability to manage your finances effectively.

These limitations can stifle both business growth and consumer choice. Traditional payment systems, while established, can act as a barrier to true economic freedom for both businesses and consumers.

Key Aspects of Cryptocurrency Payment Processors and Economic Freedom

Now, let's explore how CPPs offer a compelling alternative:

1. Reduced Fees: CPPs typically boast significantly lower cryptocurrency transaction fees compared to traditional processors. Studies by [Insert Source] show businesses can save anywhere from 1% to 5% on transaction fees, a substantial boost to your bottom line. These savings can be reinvested back into your business, allowing you to focus on growth initiatives, product development, or offering more competitive pricing to your customers.

2. Faster Settlements: Cryptocurrency transactions settle almost instantly, giving you faster access to your hard-earned revenue. This improves cash flow and facilitates quicker reinvestment for business growth. Faster settlements allow you to manage your finances more effectively and take advantage of time-sensitive opportunities.

3. Global Reach: CPPs operate on a global network, eliminating geographical restrictions. You can tap into a worldwide customer base without limitations or additional currency exchange fees. This opens doors to new markets and potential customer segments, allowing you to scale your business and diversify your revenue streams.

4. Increased Control: As businesses, you have greater control over your finances with CPPs. Transactions are transparent and recorded on a public ledger, fostering trust and reducing reliance on third parties. This increased control empowers you to make informed financial decisions and manage your business operations more efficiently.

5. Enhanced Security: Blockchain technology, the backbone of cryptocurrencies, offers robust security features. Transactions are encrypted and tamper-proof, minimizing the risk of fraud and chargebacks, benefiting both businesses and consumers. This enhanced security fosters trust within the financial system and protects your business from financial losses.

These features empower both businesses and consumers to participate in a more open and efficient financial system. Businesses gain access to a wider market, reduced costs, and faster settlements, while consumers enjoy faster transactions, lower fees, and potentially broader payment options. CPPs contribute to a more level playing field in the financial landscape, promoting economic freedom for all participants.

How Cryptocurrency Payments Foster Economic Freedom for Consumers

Beyond the benefits for businesses, CPPs offer several advantages for consumers, contributing to their economic freedom:

Borderless Transactions: Consumers can send and receive payments internationally without exorbitant fees or delays, fostering global financial inclusion. This allows them to participate in the global marketplace with greater ease, access international goods and services, and connect with businesses worldwide.

Faster Transaction Speeds: Cryptocurrency payments settle quickly, allowing consumers to access and utilize their funds almost instantly. This eliminates waiting periods and provides greater flexibility in managing their finances.

Reduced Reliance on Traditional Banking Systems: For those who lack access to conventional banking services, CPPs offer an alternative means of participating in the financial system. This financial inclusion empowers unbanked or underbanked individuals to manage their finances more effectively

Greater Choice and Flexibility: Cryptocurrency payments offer consumers additional payment options beyond traditional credit cards and debit cards. This empowers them to choose the payment method that best suits their needs and financial situation.

Potential for Lower Costs: With reduced processing fees for businesses, some of these savings may be passed on to consumers in the form of lower prices and more competitive offers. This allows consumers to stretch their budgets further and potentially access goods and services at more affordable prices.

Actionable Tips for Businesses Considering Cryptocurrency Payments:

Research and Compare: The CPP landscape is evolving rapidly. Research various processors, compare their offerings, fees, and security protocols. Look for a reputable platform with a proven track record and transparent fee structures. Don't hesitate to reach out to them with questions - a reliable CPP will be happy to assist you in choosing the right solution for your business.

Start Small: If you're new to cryptocurrency payments, begin by accepting a limited number of popular coins, such as Bitcoin or Ethereum. This allows you to gain experience and build confidence before fully integrating crypto payments into your system. You can start by offering crypto payments for a specific product line or service to gauge customer interest and get comfortable with the process.

Educate Your Customers: Not everyone is familiar with cryptocurrencies. Create informative resources on your website or social media platforms to educate your customers about the benefits of using crypto payments. You can offer incentives or discounts to encourage early adopters and build a customer base comfortable with this new payment method.

How Payments Clarity Can Help You Embrace Economic Freedom

At Payments Clarity, we understand the power of CPPs to unlock economic freedom for businesses of all sizes. We offer a state-of-the-art Cryptocurrency Payment Processor platform designed to empower you to seamlessly integrate crypto payments into your business operations.

Here's how Payments Clarity stands out from the competition:

User-Friendly Platform: Our platform is designed for ease of use, even for those unfamiliar with cryptocurrencies. A clean interface and intuitive features simplify the integration process for merchants of all technical backgrounds. We understand that not all businesses have in-house IT expertise, so we prioritize creating a platform that is accessible and user-friendly.

Competitive Fees: We offer some of the lowest fees in the industry, allowing you to keep more of your hard-earned profits. Lower fees translate to increased profitability, which you can use to reinvest in your business, offer more competitive pricing, or reward your customers.

Security First: Payments Clarity prioritizes the security of your funds and customer data. Our platform utilizes cutting-edge security protocols and adheres to the highest industry standards to ensure a safe and reliable payment experience for everyone involved. We understand that security is paramount in the digital age, and we are committed to providing a secure environment for all transactions.

Dedicated Merchant Support: Our team of cryptocurrency payment experts is here to guide you every step of the way. We offer comprehensive support from setup to ongoing operation, ensuring you have the resources to confidently navigate the world of crypto payments. Our dedicated support team is available to answer your questions, address any challenges you may face, and help you optimize your use of our platform.

Conclusion: Embracing the Future of Economic Freedom

The economic landscape is undergoing a significant transformation. Cryptocurrency Payment Processors are not just a trend; they represent a powerful alternative with the potential to foster economic freedom for both businesses and consumers. By embracing CPPs, businesses can unlock lower fees, faster settlements, and a wider customer reach. Consumers gain access to faster transactions, lower costs, and a more inclusive financial system.

Don't get left behind. Explore the possibilities of cryptocurrency payments and see how they can revolutionize your business and empower your customers. Payments Clarity is here to be your trusted partner in this exciting new frontier.

Ready to take the next step? Contact Payments Clarity today for a free consultation and discover how we can help you seamlessly integrate cryptocurrency payments into your business model. Let's work together to shape the future of economic freedom!

#cryptocurrencypaymentprocessors#blockchaintechnology#cryptocurrencytransaction#cryptocurrencyprocessors#paymentgateway

1 note

·

View note

Text

SabPaisa stands out as India's best payment gateway solution, offering unparalleled reliability and versatility. With seamless integration options, robust security features, and swift transaction processing, SabPaisa simplifies payment collection for businesses of all sizes. Experience hassle-free payments and maximize revenue with SabPaisa, the epitome of excellence in fintech.

0 notes

Text

Stripe Payment Gateway Integration: The Kansoft Way to Elevate Your E-Commerce Experience

Experience seamless Stripe Payment Gateway Integration with Kansoft, revolutionizing your e-commerce journey. Elevate your online shopping experience with secure and efficient transactions, tailored to your business needs. Trust Kansoft to streamline your payment process, ensuring smooth customer transactions and enhanced satisfaction. Choose Kansoft for hassle-free payment gateway integration and unlock new levels of success in e-commerce.

0 notes

Text

BrainCert: Making Learning Easy, Payments Even Easier!

Ready to learn something new with BrainCert?

Before you dive in, let's talk about something else just as important: paying securely and conveniently.

BrainCert understands that seamless payment options are crucial for a smooth learning experience.

That's why they've partnered with several top payment gateways to make paying for courses a breeze.

Here are your payment gateways:

PayPal: The global giant, trusted by millions, lets you pay with your balance, bank account, or card.

Stripe: Designed for developers, it's easy to integrate and offers various payment methods like cards and wallets.

Paystack: Africa's leader, perfect for reaching learners across the continent with local and international options.

Payumoney: Trusted in India, it offers diverse payment methods like cards, net banking, and wallets for convenient local payments.

Point&pay: Providing secure and customizable solutions tailored to different needs and industries.

No matter where you are or how you prefer to pay, BrainCert has you covered. Plus, they handle security seriously, using industry standards to keep your information safe.

So, choose your learning adventure, pick your favorite payment method, and get ready to unlock new skills with BrainCert! Remember, they're making learning fun and payments even easier.

#BrainCert#OnlineLearning#EduTech#PaymentGateway#DigitalCommerce#SecurePayments#ECommerceSolutions#Fintech#LearningManagement#UserExperience

0 notes

Text

PAYPOUND can help you set up a merchant account for all of your card processing needs.

Contact us NOW!

+44 800 832 1733

[email protected]

https://paypound.ltd/

#payment#fintech#routing#paymentindustry#technology#technologysolutions#technologyinnovation#fintechsolutions#unfiedapi#digital#ecommercegrowth#paymentgateway#highriskmerchantaccounts#paymentsolutions#paymentsoftware#fintechinnovations#payments#business#cardpayments#chargebacks#onlinepayment#paypound#highrisk

9 notes

·

View notes

Text

UPIADDA Payouts: Redefining Financial Transactions with Speed and Security

Flexibility is another hallmark of UPIADDA's payout solutions, catering to the diverse needs of businesses and individuals. Whether it's salary disbursements, vendor payments, or affiliate commissions, UPIADDA offers a versatile platform that adapts to unique payout requirements seamlessly. In conclusion, our blog post on UPIADDA Payment Gateway's 'About Payouts' underscores the platform's commitment to revolutionizing financial transactions. From speed and security to enhanced control and flexibility, UPIADDA stands as a reliable partner for those seeking advanced and user-friendly solutions for their payout needs. Explore the full blog post to uncover the transformative benefits that UPIADDA brings to the world of financial transactions.

0 notes

Text

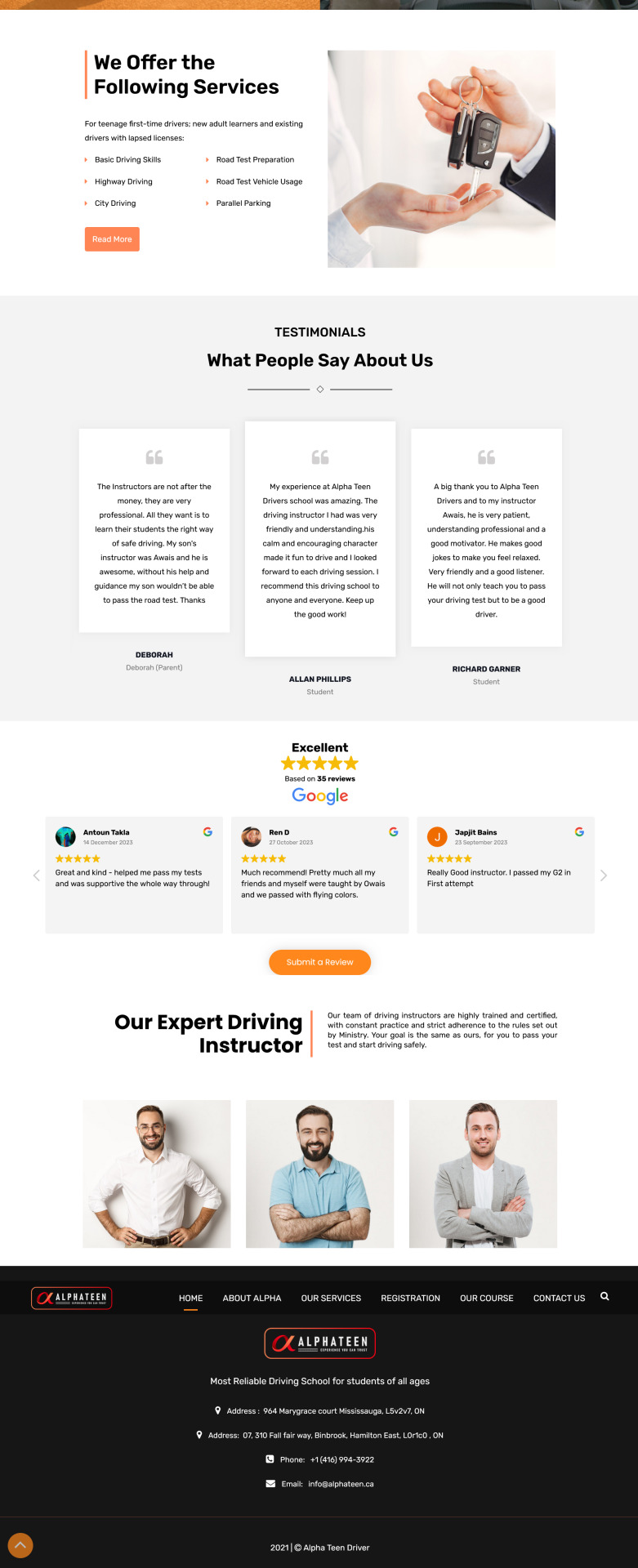

Car Driving School & Training Center

This is another project done by all Team Operation members. The website was built in Brixel Theme & wpbakery page builder. This is a car 🚗 driving training school website. The client had three packages to sell through the form without the WooCommerce plugin. For that, we have completed the task using gravity form. Also, the client prefers a bank card to pay for his package so we connect Stripe.

Project Live link: https://alphateen.ca/

#wpbakery#cardriving#woocommerce#gravityform#stripe#ecommerce#paymentgateway#paymentintegration#paymentsystems#webdesign#webdevelopment#website#crocoblock

0 notes

Text

Seamless Transactions, Relentless Support: Navigating Payniko's Payment Gateway with Contact Support Excellence

Embark on a journey into the world of secure and efficient online transactions with Payniko, a leading payment gateway shaping the future of digital commerce. This blog post unfolds the unique features of Payniko and emphasizes the pivotal role of their Contact Support in ensuring a hassle-free and reliable payment experience.

Content:

Unveiling the Payniko Advantage:

Introduction to Payniko and its pivotal role in facilitating swift and secure online transactions.

Spotlighting the key features that position Payniko as a frontrunner in the competitive landscape of payment gateways.

User-Centric Interface:

Exploring the user-friendly interface of Payniko, designed to enhance the overall transaction experience.

Highlighting how Payniko prioritizes simplicity, catering to the needs of both businesses and consumers.

Fortified Security Protocols:

Delving into Payniko's robust security measures, ensuring the utmost safety of financial transactions and user data.

Underlining the commitment to instill trust in the dynamic realm of online payments.

Contact Support - Your Reliable Partner:

Illuminating the indispensable role of Payniko's Contact Support in providing timely assistance and resolving queries.

Showcasing how the dedicated support team contributes to a positive and reliable customer experience.

Accessible Support Channels:

Unveiling the various channels available for users to contact Payniko's support, including email, chat, and phone.

Highlighting the responsiveness and accessibility of Payniko's support system.

Real-life Support Success Stories:

Sharing real-life scenarios where Payniko's Contact Support played a pivotal role in swiftly resolving user issues.

Featuring customer testimonials that underscore the effectiveness and reliability of Payniko's support services.

Tips for Optimal Support Interaction:

Offering practical tips for users seeking support from Payniko, ensuring a streamlined and efficient resolution process.

Encouraging users to provide feedback for continuous improvement in support services.

Payniko's Vision for the Future:

Providing insights into upcoming features or innovations within the Payniko payment gateway.

Reinforcing Payniko's commitment to staying at the forefront of technological advancements and meeting evolving user needs.

Conclusion:

Discover the future of online transactions with Payniko - where seamless payments meet relentless support. Explore advanced features, experience effortless transactions, and rely on Payniko's Contact Support for a journey free of disruptions. 💳✨ #Payniko #PaymentGateway #ContactSupport #SeamlessTransactions

0 notes