#pvt ltd company registration consultants

Text

Proprietorship Firm Registration

Looking for Sole Proprietorship Registration? Now do a Proprietorship Firm Registration at the best price with the expert advice of Vedkee Associates. Contact Us for more details...Read more

#vedkee associates#gst consultant#company registration consultants#pvt ltd company registration in india

0 notes

Text

Streamline Your Business Registration Process with a Company Registration Service

Starting a business can be an exciting and rewarding experience, but it can also be a daunting task with many legal and administrative requirements to consider. One of the most important steps when starting a new business is to register your company with the appropriate authorities. This process can be complicated, time-consuming, and overwhelming, but with the help of a Company Registration Service in Kochi, it can be made easy and stress-free.

What is a company registration service?

A company registration service is a third-party service provider that assists entrepreneurs in registering their companies with the relevant government authorities. These services offer a range of services including company name searches, preparation and filing of legal documents, and communication with government agencies on behalf of the business owner.

Benefits of using a company registration service

Save time: The process of registering a company can be time-consuming and complex. By using a registration service, you can save time and focus on other aspects of your business.

Avoid mistakes: The registration process requires attention to detail and accuracy. A registration service will ensure that all necessary documents are completed accurately and filed on time, minimizing the risk of errors or delays.

Expert guidance: A Partnership Registration Service in Kochi has the expertise to guide you through the process and answer any questions you may have along the way.

Legal compliance: A registration service ensures that your business is legally compliant and adheres to all the regulations and requirements set by the government.

Peace of mind: By using a registration service, you can have peace of mind knowing that your company is registered correctly, allowing you to focus on growing your business.

Choosing the right company registration service

When choosing a company registration service, there are several factors to consider, including:

Reputation: Look for a service with a good reputation and positive reviews from previous customers.

Experience: Choose a service with experience in registering companies in your industry and location.

Services offered: Consider the range of services offered and whether they meet your specific needs.

Price: Compare the prices of different registration services and ensure that there are no hidden fees.

Customer support: Choose a service that offers reliable and accessible customer support.

Conclusion

By using an ISO Registration Company in Kochi, you can ensure that your company is registered correctly and legally compliant, saving you time and effort in the long run. When choosing a registration service, consider their reputation, experience, services offered, price, and customer support to find the best fit for your needs.

#ISO Registration Company in Koc#pvt ltd company registration#Company Registration Consultants#partnership registration service

0 notes

Text

Virtual CFO Services for Startups: What to Expect

The term "virtual CFO" (Chief Financial Officer) refers to outsourced financial management and strategic consultancy services offered remotely to start-up businesses by an experienced professional. After startup or business registration, it requires professional services to run it efficiently. However, hiring all staff, such as accounting, management, or taxation, increases administration costs, whereas virtual CFO services make it easier and less expensive for them.

These services are often created to assist startup or newly incorporated companies that might not have the funds or budget to engage a full-time, internal CFO but still need financial knowledge to manage their money and make wise business decisions. Financial management tasks that can be included in virtual CFO services for startups include a wide range of financial planning and analysis, budgeting and forecasting, financial reporting and analysis, cash flow management, financial modeling, investor relations and fundraising, financial risk management, tax planning and compliance, and development of an overall financial strategy. To give financial insights, virtual CFOs collaborate closely with the startup's executive team.

Benefits of Virtual CFO Services for Startups:

Cost-effective: For startups, hiring full-time CFO can be expensive due to other costs such as perks, office space, and equipment in addition to the CFO's compensation. Since virtual CFO services are frequently given on a part-time or project basis, they are more affordable than hiring a full-time CFOs and enable companies to access high-quality financial expertise.

Flexibility: Virtual CFO services can be tailored to the specific needs and budget of the startup, allowing for flexibility in engagement and scope of work. Startups can engage virtual CFOs on an as-needed basis, such as during fundraising rounds or strategic planning, and scale up or down the services as the business grows and evolves.

Professional Expertise: Virtual CFOs are experienced financial professionals who bring a wealth of knowledge and expertise to the table. They can provide strategic financial advice and guidance to help startups make informed decisions and optimize their financial performance. Virtual CFOs often have experience working with startups and can provide industry-specific insights to support the unique financial challenges faced by early-stage companies.

Focus on Core Business: Startups can benefit from outsourcing financial management to a virtual CFO, as it allows them to focus on their core business operations and strategic initiatives. By delegating financial tasks to a virtual CFO, startups can free up their time and resources to focus on building their product/service, acquiring customers, and scaling their businesses.

Expectations from virtual CFO

As a virtual CFO, there are certain expectations that startups may have. Remote CFO Services can scale with the needs of the startup. As the business grows, the virtual CFO can adapt and provide additional support in areas such as financial strategy, fundraising, and financial operations. This scalability allows startups to have access to the right level of financial expertise at each stage of their growth journey. These expectations may vary depending on the specific needs and requirements of the startup, but generally, the following are some common expectations:

Financial Expertise: Startups expect virtual CFOs to have a high level of financial expertise, including a deep understanding of financial concepts, financial reporting, financial analysis, and financial strategy. They are expected to possess the knowledge and skills necessary to provide strategic financial advice and insights to support the startup's financial management and decision-making.

Proactive Financial Management: Virtual CFOs are expected to proactively manage the startup's financials, including financial planning, budgeting, forecasting, and cash flow management. They should monitor the financial performance of the startup and provide regular financial reports and analysis to keep the management team informed about the company's financial health and performance.

Strategic Financial Guidance: Virtual CFOs are expected to provide strategic financial guidance to the startup's management team. This includes assisting with financial strategy development, financial modeling, financial risk management, and financial decision-making. They should help the startup's leadership team understand the financial implications of various business decisions and provide recommendations to optimize financial outcomes.

Fundraising and Investor Relations Support: Startups often require funding to support their growth, and virtual CFOs are expected to provide support in fundraising efforts. This includes preparing financial projections, developing investor presentations, assisting with due diligence, and managing investor relations. Virtual CFOs are expected to have knowledge of fundraising strategies and be able to provide guidance on the financial aspects of fundraising efforts.

Timely and Accurate Financial Reporting: Virtual CFOs are expected to provide timely and accurate financial reporting, including financial statements, financial analysis, and other financial reports as needed. They should ensure that the startup's financial records are maintained accurately and in compliance with relevant accounting standards and regulations.

Customized Solutions: Virtual CFOs are expected to provide customized financial solutions tailored to the specific needs of the startup. This includes understanding the unique financial challenges and opportunities of the startup, and developing financial strategies and solutions that align with the startup's goals and objectives.

Communication and Collaboration: Virtual CFOs are expected to communicate effectively with the startup's management team and other stakeholders, and collaborate closely with them to ensure a seamless integration of financial management into the overall business operations. They should be responsive to queries and provide clear and concise financial insights and recommendations.

Confidentiality and Ethical Conduct: Startups expect virtual CFOs to maintain confidentiality and demonstrate ethical conduct in handling the company's financial information and sensitive business matters. Virtual CFOs are expected to adhere to professional standards, including relevant accounting principles, regulations, and ethical guidelines.

Conclusion:

In summary, startups typically expect virtual CFOs to provide high-quality financial expertise, proactive financial management, strategic guidance, fundraising support, timely and accurate financial reporting, customized solutions, effective communication and collaboration, and maintain confidentiality and ethical conduct in their engagements. Building a strong partnership with the startup's management team and delivering value-added financial services are key expectations from a virtual CFO.

Overall, best virtual CFO services can be a valuable resource for startups, providing them with access to financial expertise, strategic financial management, scalability, cost-effectiveness, and flexibility, which can support their financial success and growth.

However, it's important for startups to carefully evaluate and select a reputable best virtual CFO Service provider that aligns with their specific needs and goals. Virtual CFO services can scale with the needs of the startup. As the startup grows and its financial requirements evolve, virtual CFOs can adjust their services accordingly, providing the startup with the flexibility to adapt to changing financial needs without the need to hire additional full-time staff. Virtual CFO services can be a valuable resource for startups, providing access to experienced financial expertise, cost-effective solutions, flexibility, and scalability. By leveraging virtual CFO services, startups can strengthen their financial management, make informed decisions, and optimize their financial performance, ultimately increasing their chances of success in the competitive startup landscape.

#startup registration#Business registration#virtual cfo services#business consultant near me#consultancy for startups#ITR Filing#gst return#proprietorship registration#pvt ltd company registration#gst registration

0 notes

Text

How to Obtain a Well-Known Trademark

In India, over 350,000 trademark applications were filed in the year 2019, and this number is predicted to grow rapidly. By 2025, over 600,000 trademark applications are projected to be submitted annually. The Trade Mark Rules 2017 introduced a new procedure for announcing a trademark as "well-known."

To acquire this status, trademark owners can submit an application (TM-M form) to the Registrar. A well-known trademark receives special protection against violation and passing off. Recognition as a well-known trademark is based on reputation, both domestically and internationally, and across borders.

What is a Well-Known Trademark

According to the Trademarks Act of 1999, a well-known trademark is a mark that has earned recognition among a substantial portion of the public who use the goods or services associated with the mark.

This recognition is so strong that the use of the mark in relation to other goods or services is likely to be sensed as a connection between those goods or services and the person who uses the mark in relation to the first-mentioned goods or services.

The criteria used to determine whether a trademark is well-known

While choosing whether a trademark is a well-known trademark, the Registrar shall consider all facts that he thinks relevant for determining a trademark as a well-known trademark, including the following factors:

The level of recognition of the trademark among the general public in India.

The number of individuals involved in the distribution channels of goods or services related to the trademark.

The number of existing or potential buyers of the goods or services associated with the trademark.

The duration, extent, and geographical scope of the trademark's use.

The business community deals with the goods or services related to the trademark.

The trademark's enforcement record, precisely the extent to which it has been recognized as a well-known mark by any court or Registrar.

The Trademark Rules 2017. (Rule 124)

The latest set of rules for trademark registration in India is the Trademark Rules of 2017. Under these rules, trademark owners can request that their mark be recognized as "well-known" by approaching the Trademark Registry. A separate application process is established, which outlines the standards for determining well-known trademarks.

Those desiring to have their trademark designated as well-known can file an application in the TM-M form, along with the requisite fee (paid online). Rule 124 empowers the registrar to grant a trademark the status of "well-known" based on the application proposal.

Read more to know about Well-Known Trademark

#Well known trademark#legal advisers#legal consultation#llp registration#pvt ltd company registration#startup registration#opc registration#annual compliance of private limited company#annual compliance of llp#trademark registration#itr filing#tds return filing#private limited company registration#gst registration

0 notes

Text

From Partnership to Private Limited: A Comprehensive Guide on Converting Your Business

Popular business structures for small and medium-sized enterprises include partnerships. But when a company develops and flourishes, a more formal and structured business structure can be required. In these circumstances, turning a partnership firm into a private limited company may be a wise move. The procedure and procedures for converting a partnership firm into a private limited company will be covered in this blog.

What is a Private Limited Company?

A private limited Company Registration in India is a type of business entity that is owned by a group of shareholders. The shareholders have limited liability, which means that their personal assets are not at risk if the company incurs any debts or losses. A private limited company is a separate legal entity from its owners, which means that it can own property, enter into contracts, and sue or be sued in its own name.

The procedure for converting a partnership firm into a private limited company is as follows

The process of converting a partnership firm into a private limited company online involves the following steps:

Step 1: Obtain a Director Identification Number (DIN) and Digital Signature Certificate (DSC) for the designated partners of the partnership firm.

Step 2: Apply for the name availability of the proposed company with the Registrar of Companies (ROC) by filing Form SPICe+.

Step 3: After getting the name approval from ROC, the partnership firm needs to execute the following documents:

Articles of Association (AOA) and the Memorandum of Association (MOA)

Declaration by all the partners of the partnership firm stating that all assets and liabilities of the partnership firm are transferred to the private limited company

Consent of all the partners of the partnership firm to become shareholders of the private limited company

Step 4: File the incorporation application in Form SPICe+ with ROC along with the required documents such as MOA, AOA, and other necessary documents.

Step 5: The ROC will scrutinize the application and if everything is found to be in order, the Certificate of Incorporation will be issued.

Step 6: After obtaining the Certificate of Incorporation, the private limited company needs to apply for the conversion of the partnership firm into a private limited company with the ROC.

Step 7: The ROC will verify the documents and issue a new Certificate of Incorporation with the name change of the private limited company.

Advantages of a Partnership Firm's Conversion into a Private Limited Company.

Due to no constraints on the number of investors, corporations make it simpler to raise money.

a separate legal entity.

It is possible to modify management and shareholding arrangements without impairing corporate rules.

The corporation cannot be taken over by outsiders.

Both obligations and assets are transferred.

There will be no capital gain tax on the sale of property from one corporation to another.

Requirements for Conversion of Partnership Firm into a Private Limited Company

Some of the major requirements of Converting a Partnership Firm into a Pvt Ltd Company online in India

The partnership firm should have a PAN card and a valid bank account.

The private limited company's shareholders should all be partners in the partnership firm.

The private limited company should have a minimum of two directors and a maximum of 15 directors.

The private limited company should have a registered office address.

The private limited company should have a minimum of two shareholders and a maximum of 200 shareholders.

Conclusion

Online private limited company formation in India is a challenging process that needs careful planning and execution. Experts like chartered accountants, company secretaries, and lawyers are needed because the process entails significant legal and financial issues. However, for firms that are trying to develop and flourish, the advantages of changing a partnership firm into a private limited company, such as limited liability, a separate legal entity, and access to more funding sources, make the procedure beneficial.

Read Our Other Blog on Registering Your Private Limited Company: A Comprehensive Guide to Know More About Private Limited Company Registration in India

#private limited company registration#private limited company#Private Ltd Company registration online#pvt ltd company registration online#registration#Company Registration Consultant

0 notes

Text

MSME Registration firm In Rohinis

MSME Registration firm In Rohinis

MSME registration in Rohini. We chartered accountant firm in sec 24 Rohini. Are you looking for your business's GST registration, ITR filing, or Tax consultant? Call us and consult to the best CA in Rohini

MSME refers to Micro, Small, and Medium-Sized Enterprises. According to the Micro, Small & Medium Enterprises Development (MSMED) Act of 2006, Micro, Small, Medium Enterprises (MSME), also known as SSI, are classified into two classes:

Manufacturing Industry

For Micro Enterprises: No more than 20 lakh rupees may be invested in equipment and machinery.

b) For Small Businesses, the maximum amount invested in plant and machinery is 5 crore rupees, but the investment is higher than 20 lakhs.

c) Plant and machinery investments for medium-sized businesses must be more than 5 crore rupees but not more than 10 crore.

Documents Needed for Rohini MSME and SSI Registration:

1. Aadhaar Card (attached in soft copy)

2. Social Classification (General, OBC, SC, ST)

3. The company or business name

4. Organizational Type (LLP, Pvt. Ltd., Partner, Ownership)

5. PAN Card (Owner/Business/Firm)

6. Address of the Office

Mobile number and email address

8. Bank IFS Code and Account Number (Owner/Firm/Corporate)

9. The primary business activity of the company (your work for the firm)

10. The number of workers

11. Purchasing Plant and Machinery and Equipment

The Services Industry

A) micro enterprise's equipment investment cannot exceed 10 lakhs.

b) Small Businesses: Equipment investments totaling more than 10 lakhs but less than two crores.

c) Medium-Sized Businesses: The amount invested in equipment exceeds two crores but does not surpass five crores.

Advantages of MSME Registration with CA Nakul Singhal Associates (Rohini)

Benefits from Banks: MSMEs are eligible for special schemes designed by banks and other financial institutions because they recognize them. This typically involves lower bank interest rates and priority sector lending, which indicates that there is a strong chance that your company will be approved for a loan. If repayment is delayed, special treatment might also be granted.

Benefits from taxes: Depending on your industry, you can be eligible for an excise tax exemption program or be spared from paying some direct taxes during the early stages of your company.

State Government Benefits: Those that have registered under the MSMED Act typically receive subsidies from their respective states for electricity, taxes, and access to state-run industrial estates. Specifically, most states exempt sales taxes, and produced items are given an advantage in purchasing.

advantages of the central government: The loan guarantee program is one of the programs that the central government occasionally offers to assist MSMEs.

The Credit Guarantee Program (CGTMSE).

Credit and the input of income from several sources to support them are two of the biggest challenges small-scale enterprises encounter.

Changes have been made to the Credit Guarantee program, which was created to assist MSME, in increasing its advantages for small traders

The scheme's key components are as follows:

1. Improving the ideal qualifying loan amount to Rs. 50 lakh from Rs. 25 lakh

2. Lowering the one-time guarantee from 1.5% to 0.75% for loans taken out by MSME in Northeastern India.

3. Increasing the guarantee's coverage from 75% to 80% for:

4. Operated by women Small and medium-sized businesses

5. Microbusinesses, up to a 5 lakh loan amount

6. Loans taken out in the country's northeast

7. Lowering the one-time guarantee charge from 1.5% to 0.75% for all loans obtained in North Eastern India.

BecauseMSMECertificate holders can present their certificate ofMSMEregistration when applying, it has become much easier for these businesses to get licenses, approvals, and registrations from the appropriate authorities in any area.

As specified in the government scheme and contingent on economic activity, enterprises with anMSMEregistration may benefit from a direct tax exemption for their first year of operation.

To encourage the participation of small businesses in India, the government has certain bids that are exclusively available toMSMEs.

Ease of approval from federal and state government agencies; businesses registered asMSMEsare given priority when it comes to government certification and licenses.

Our services:- Accounting And AuditingCompany Audit & ROC FilingGST Compliance & AuditCorporate Law ConsultancyIncome Tax ComplianceFormation of companies under ROCTax Planning & Filing.

0 notes

Text

Food license registration is a mandatory process for businesses involved in food production, processing, or sale. It ensures compliance with food safety regulations and protects public health. The process typically involves submitting an application, undergoing an inspection, and paying any associated fees. Once authorized, the license enables companies to conduct permitted business and gain the trust of customers by upholding safety regulations. To keep compliance, renewals must be made on a regular basis.

1 note

·

View note

Text

0 notes

Text

Common Challenges in Pvt Ltd Company Registration and How to Overcome Them

Overview of Pvt Ltd Company Registration

Setting up a private limited company Registration can be a complex process with various legal and financial challenges along the way. From choosing the proper business structure to navigating through the paperwork and regulations, there are several hurdles to overcome in the registration process. Understanding and addressing these common challenges is crucial for a successful registration. In this blog, we will explore the common challenges that arise during private limited company registration and provide valuable insights on how to overcome them effectively.

Common Challenges Faced During Registration Process

During the registration process of a private limited company, some common challenges include choosing a unique and available company name, gathering the required documentation, determining the share structure, and ensuring compliance with all legal requirements. Additionally, understanding and fulfilling tax obligations and obtaining necessary licenses and permits can also pose challenges. Overcoming these hurdles requires thorough research, attention to detail, and seeking professional assistance from legal or financial experts. By addressing these challenges proactively and meticulously, you can navigate through the registration process smoothly and establish a strong foundation for your private limited company.

Solutions to Overcome Registration Challenges

To tackle the common hurdles faced during the registration of a private limited company:

Consider the following solutions.

Start by conducting a comprehensive name availability search to ensure uniqueness.

Organize and prepare all necessary documentation in advance to streamline the process.

Seek advice from legal professionals to determine the optimal share structure and ensure compliance with legal requirements.

Stay updated on tax regulations and obligations to avoid penalties.

Engage with regulatory authorities early on to secure licenses and permits promptly.

By diligently implementing these solutions and seeking expert guidance when needed, you can effectively overcome registration challenges and set your private limited company up for success.

Hiring a Professional for Registration Assistance

Consider outsourcing the registration process to a professional service provider specializing in company registrations. Their expertise can help navigate complex legal requirements, streamline paperwork, and expedite the registration timeline. Professional assistance not only ensures accuracy in documentation but also provides valuable insights to optimize your company's legal structure and tax planning. By entrusting this crucial process to seasoned professionals, you can focus on core business activities while ensuring a smooth and efficient registration process for your private limited company.

Ensuring Compliance with Regulatory Requirements

Once your private limited company is registered, it's crucial to maintain ongoing compliance with regulatory obligations. This includes regular filing of annual returns, financial statements, and tax returns as per the prescribed timelines. Failure to comply with these requirements can lead to penalties, fines, or even legal implications.

To ensure smooth compliance, consider setting up internal processes and controls or engaging with professional consultants who specialize in regulatory compliance. Regularly staying updated on changing regulations and seeking expert guidance can help your company navigate the complex regulatory landscape effectively, mitigating risks and maintaining a good standing with authorities. Remember, staying compliant is critical to the long-term success and sustainability of your private limited company.

Leveraging Technology for Registration Efficiency

Embracing technology can significantly streamline the private limited company registration process. Utilize online platforms and digital tools to expedite Key Documents submissions, track application status, and receive timely notifications for compliance deadlines. Consider using incorporation software that automates repetitive tasks and ensures accuracy in filings. Additionally, explore e-signature solutions for swift document signing and approval processes. By harnessing technology, you can enhance registration efficiency, reduce human errors, and save valuable time and resources during the company setup phase. Stay ahead of the curve by integrating tech-driven solutions into your registration workflow for a seamless experience.

Conclusion:

In conclusion, by embracing technology and leveraging digital solutions, you can overcome common challenges in private limited company registration. Streamlining the process with online platforms, automation tools, and e-signature solutions can enhance efficiency, accuracy, and overall effectiveness. It is essential to stay updated with the latest technological trends and incorporate them into your registration workflow to ensure a seamless and successful company setup. By addressing these challenges proactively and utilizing technology to your advantage, you can navigate the registration process smoothly and set a strong foundation for your private limited company's future success.

0 notes

Text

Step 1: Understand Our Entity

Online Consumer Complaint is a division of Quick Legal Moto Pvt Ltd., a company registered under the Companies Act, 2013 and recognized by the Government of India.

Step 2: Acknowledge Our Disclaimer

This is Not a Government Website

The website is privately managed and is not affiliated with the government.

Step 3: Understand the Purpose of the Form

Form Usage

The form on this website is not an official registration form. It is designed to gather information from clients to help our experts better understand their needs or business.

Step 4: Proceed with Awareness

Private Company Assistance

By using this website, you acknowledge that Quick Legal Moto Pvt Ltd. is a private company offering services based on customer requests.

Step 5: Understand the Fee Structure

Consultancy Fee

The fees collected through this website are consultancy fees for the services we provide.

For more details:

Visit the website: https://www.consumercomplaints.info/

Linkedin: https://www.linkedin.com/company/online-legal-consumer-forum/

Twitter: https://twitter.com/onlinelegalfrm

YouTube: https://www.youtube.com/@OnlineLegalForum

Facebook: https://www.facebook.com/OnlineLegalConsumerForum

Contact us: 8068415970

Email us: [email protected]

0 notes

Text

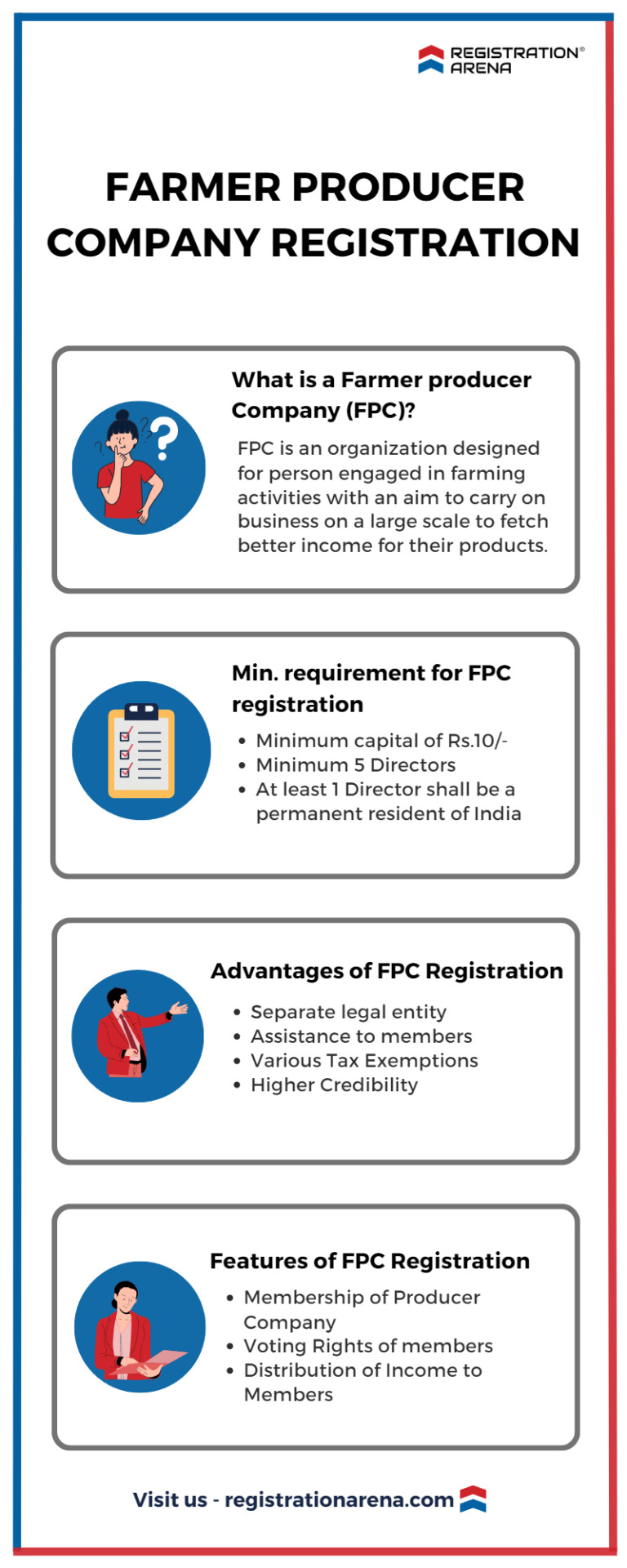

Farmer Producer Company (FPC) or Farmer Producer Organisation (FPO) is an organization that has been developed taking into consideration the requirements of farmers, agriculturists, fishermen, weavers, milk producers, and persons engaged in farming activities, collectively known as ‘Producers’.

#legal advisers#legal services#legal consultation#private limited company#gst registration#llp registration#OPC Registration#trademark registration#farmer producer company registration#Annual compliances of llp#Annual compliances of Pvt Ltd Company#itr filing#tds return

0 notes

Text

0 notes

Text

LLP vs Pvt Ltd: Which Business Structure Should You Choose?

Starting a new business involves many crucial decisions, and choosing the right business structure is one of the most important. In India, two popular choices are Limited Liability Partnership (LLP) and Private Limited Company (Pvt Ltd). This article will explain the differences between LLP and Pvt Ltd, including their full forms, to help you decide which structure is best for your business.

What is LLP?

LLP stands for Limited Liability Partnership. This business structure combines the flexibility of a partnership with the benefits of limited liability, protecting partners' personal assets from business debts.

What is Pvt Ltd?

Pvt Ltd stands for Private Limited Company. This structure provides limited liability to its shareholders and is a separate legal entity from its owners, making it easier to attract investors and maintain credibility.

Key Differences Between LLP and Pvt Ltd

1. Formation and Registration

LLP: Requires at least two partners. It is registered under the Limited Liability Partnership Act, 2008.

Pvt Ltd: Requires at least two shareholders and two directors. It is registered under the Companies Act, 2013.

2. Liability Protection

LLP: Partners have limited liability, protecting their personal assets.

Pvt Ltd: Shareholders' liability is limited to the amount of their shares.

3. Compliance Requirements

LLP: Has lower compliance requirements with fewer regulations.

Pvt Ltd: Has higher compliance requirements, including mandatory annual general meetings, audits, and detailed filings with the Registrar of Companies.

4. Taxation

LLP: Profits are taxed at the LLP level with no dividend distribution tax.

Pvt Ltd: Profits are taxed at the company level, and dividends distributed to shareholders are subject to dividend distribution tax.

5. Management and Ownership

LLP: Managed by the partners, offering flexibility in operations.

Pvt Ltd: Managed by a board of directors, often separating ownership from management.

6. Fundraising

LLP: Limited options for raising funds, making it harder to attract venture capital and private equity.

Pvt Ltd: Easier to raise funds from investors, including venture capital and private equity firms.

7. Transfer of Ownership

LLP: Ownership transfer can be complex and may require the consent of all partners.

Pvt Ltd: Shares can be easily transferred, subject to certain restrictions in the company’s articles of association.

Pros and Cons

LLP

Pros:

Lower compliance costs

Flexible management structure

Limited liability protection for partners

Cons:

Limited fundraising options

Less attractive to investors

Pvt Ltd

Pros:

Easier to raise capital

Higher credibility and professional image

Better corporate governance

Cons:

Higher compliance costs

More regulatory requirements

Conclusion

Choosing between an llp vs pvt ltd company depends on your business goals and needs. If you prefer lower compliance costs and flexibility, an LLP might be the right choice. However, if you plan to raise significant capital and scale your business, a Pvt Ltd company could be more suitable.

It's always a good idea to consult with a legal or financial advisor to ensure you make the best decision for your business.

0 notes

Text

Feeling Lost? Here’s Your Roadmap to How to find a good tax consultant in India?

Are you searching for the best online tax consultant India? There’s nowhere else to look! Our team of tax experts specializes in offering knowledgeable solutions catered to your particular financial circumstances. We ensure everyone, individual or business, can easily manage the complicated tax environment.

Navigating the world of taxes can feel overwhelming, especially with the complexity of income tax laws in India. Finding the right tax consultant is key to ensuring your financial health stays in check. If you’re confused about where to start, don’t worry. We’re here to help guide you on the path to finding a good tax consultant in India. And if you want to skip the search, look no further than TaxDunia — recognized as one of the best income tax consultant in India.

Why You Need a Tax Consultant

Handling taxes involves a lot of details, deadlines, and paperwork. Even a small mistake can lead to penalties or lost money. A qualified tax consultant ensures that your tax filings are done correctly and on time, while also helping you save as much money as possible. Best Income Tax Advisors can also guide you through complex tax laws, so you’re always on the right side of the law. We are registered with recognized as qualified professionals, best accounting tax and advisory services in India.

Steps to Find a Good Tax Consultant

Look for Experience and Expertise The first step in finding the right tax consultant is to check their experience. An expert who has been in the field for years will know how to handle various tax situations, from income tax filings to audits. Our Company, for example, brings years of experience and a strong reputation for helping clients with a wide range of tax needs.

Check for Certification Your tax consultant should be certified by recognized authorities. Look for Chartered Accountants (CAs) or Certified Public Accountants (CPAs) in India. This ensures that the person you hire is fully trained and knowledgeable about the latest tax laws and regulations.

Ask for Recommendations Getting recommendations from friends, family, or business associates is a great way to start. If a consultant comes highly recommended, they are likely to provide good service. Our company has earned positive reviews from clients all over India, thanks to its transparent and reliable service.

TaxDunia is widely recognized as the Top 10 best income tax consultant in India. The company stands out with its team of skilled professionals who provide comprehensive tax solutions tailored to both individuals and businesses. From income tax filings and strategic tax planning to managing complex tax laws, we offer expertise that you can trust.

Our Complete Services: -

At TaxDunia, we offer a range of professional services designed to meet your needs. This blog provides an overview of our offerings and how we can assist you with various business and tax requirements in India.

Private Limited Company Registration Service in India

Starting a business in India involves several steps, with one of the most crucial being Private Limited Company Registration Service in India. This process ensures that your business is legally recognized and offers you the benefits of limited liability, credibility, and easier access to capital. At our company, we streamline this process for you, handling all necessary paperwork and compliance requirements to set up your pvt ltd company registration service seamlessly.

Online Company Registration in India

For those who prefer convenience, our Online Company Registration in India service is an ideal choice. We understand that time is valuable, so we offer a user-friendly online platform to simplify your Company Registration Service in India. Our team ensures that your registration process is quick and efficient, allowing you to focus on growing your business while we take care of the formalities.

One Person Company (OPC) and Public Limited Company Registration

If you’re considering starting a business on your own, our One Person Company Registration Service in India is tailored for solo entrepreneurs. This structure offers limited liability while allowing you to retain full control. Our OPC Registration Service simplifies ensuring compliance and a smooth process.

Public Limited Company Registration

Alternatively, if you’re looking to form a larger corporation, our Public Limited Company Registration Service is designed to help you meet the requirements for public trading and raising capital.

Firm Registration Services

For those in need of Firm Registration Services, we provide comprehensive solutions to get your partnership or LLP firm officially recognized. Our services include handling all necessary documentation and compliance requirements, ensuring that your firm is legally established and ready to operate.

Income Tax Return Filing Service in India

Managing taxes can be daunting, but with our Income Tax Return Filing Service in India, you can ease your worries. We offer expert assistance in ITR Return Filing Service, ensuring that your income tax returns are filed accurately and on time. Our consultants are skilled in handling various tax scenarios, from individual to corporate tax returns.

NRI Tax Consultancy and Filing Services

If you’re an NRI, navigating Indian tax regulations can be particularly challenging. Our NRI Tax Consultancy Service is designed to provide you with expert advice on handling your Indian income and tax obligations. We also offer NRI ITR Filing Service in India to ensure that your returns are filed correctly, complying with all relevant tax laws.

GST Return Filing Services

Managing GST compliance can be complex, but with our GST Return Filing Services in India, you get expert support for all your GST needs. From GST Registration Service to Online GST Return Filing, we cover all aspects of goods and services tax filing. Our team ensures that you remain compliant with GST regulations and avoid any potential penalties.

Trademark Registration Services

Protecting your intellectual property is crucial. Our Trademark Registration Consultants offer comprehensive best Trademark Registration Service in India, including trade mark online registration. We guide you through the entire process to ensure your brand is legally protected.

Copyright Registration Services

Similarly, for those needing best Copyright Registration service in India, our Best Copyright Consultant services help you safeguard your creative works with ease.

Patent Registration Services

Innovation is a key driver of business success. With our Patent Registration Service in India, you can protect your inventions and ideas. Our team of Best Patent Consultants in India provides expert guidance throughout the online Patent Registration Services in India process, helping you secure your intellectual property rights.

Sole Proprietorship Firm Registration

For solo entrepreneurs and small business owners, we offer Sole Proprietorship Registration Service. Our services ensure that your business is properly registered and compliant with all relevant regulation.

Proprietorship Firm Registration

Setting up a proprietorship firm is a straightforward way for solo entrepreneurs to start a business. We offer comprehensive Proprietorship Firm Registration services to help you establish your business efficiently. You can also register proprietorship firm online with our user-friendly platform, ensuring a quick and hassle-free registration process. We handle all the necessary paperwork and compliance, allowing you to focus on your business.

TDS Return Filing Service & Top Consultants

Managing TDS (Tax Deducted at Source) can be complex. Our TDS Return Filing Service in India ensures accurate and timely submission of your TDS returns. We are recognized as Top TDS Return Consultants in India, offering expert guidance to ensure compliance with tax regulations and avoid penalties. Trust us to simplify your TDS management and keep your finances in order.

Foreign Company Registration in India

Expanding into the Indian market requires understanding local regulations. Our Foreign Company Registration in India service assists international businesses in setting up operations in India. We handle all the paperwork and compliance requirements, helping you establish your presence in the Indian market smoothly.

Conclusion

At TaxDunia, we are dedicated to offering comprehensive solutions for all your business and tax needs. From Private Limited Company Registration to GST Return Filing Services, our expert team supports you at every step. If you’re searching for online tax consultant services near me, look no further. Visit our website www.taxdunia.com to explore how we can assist you in achieving your business and tax goals. With our expertise, you can concentrate on your core activities while we handle the complexities of registration and compliance efficiently.

#Top Income Tax Consultants#Best Income Tax Advisors#Tax Consultant Services#best income tax consultant in india#Best online tax consultant India#online Tax consultant services near me#Top 10 best income tax consultant in india#tax consultants#finance#itr filing#gst filling#itr filling#taxdunia#income tax#gst return

0 notes

Text

Best Tax Consultants in Bangalore with Taxfilr

Who is required to pay income taxes and who is not? Anyone with a gross annual income of more than 2.5 lakh rupees is required by law to file an income tax return, according to the Tax Department of India. Best tax consultants in Bangalore this level is not 2.5 lakhs per year for senior persons.

About Texfil: According to the Companies Act of 2013, TaxFilr is a product registered under E-Pro TaxFilr Technology Solutions Pvt. Ltd. It is one of the top suppliers of professionally prepared electronic tax returns in India as well as a platform for business advisory services. Best tax consultants in Bangalore our group has committed itself to making tax matters easier for both individuals and companies. Our dedication to simplifying tax files, providing knowledgeable solutions, and offering continuous support—from audits to year-round tax consulting assistance sets us apart.

Expertise and knowledge: Chartered tax advisers can ensure that you obtain accurate, reliable advice that is tailored to your specific circumstances because tax consulting services they have received significant training and have a deep understanding of tax laws.

Maximizing tax efficiency: They can help you navigate the numerous credits, exemptions, and deductions that are available to you by applying their knowledge, tax consulting services saving you from having to pay more in taxes than necessary.

Compliance and risk mitigation: By keeping abreast of the constantly changing tax rules and regulations, tax consultant near me the Taxfilr offers all the income tax consultants in Bangalore to make sure you maintain compliance with HMRC criteria.

Personalized tax planning: They take strong action in handling your tax affairs to reduce the likelihood of you facing penalties and fines for non-compliance. Tax consultant near me For a long time.

Time and resources savings: Hiring experts to manage tax-related procedures will allow you to concentrate on your main business operations while freeing up valuable time and resources. Efficiency and production will increase as a result.

Proactive tax advice: They provide you with proactive advice from tax advisers throughout the year, not just during tax season. They help you by being proactive in predicting the tax implications of your decisions and creating plans to effectively reduce tax expenses.

Representation in tax matters: In the event of a tax audit or disagreement with HMRC, the tax filers offer the greatest service because their income tax expert can be a wonderful resource for support and representation. Best tax consultants in Bangalore They speak with tax authorities on your behalf, protecting your rights and securing the best possible result.

Peace of mind: By hiring a tax consulting service by Taxfilr, with their services you may feel secure in the knowledge that experienced professionals are handling your tax matters. You can be sure that a reliable advisor is assisting you at every turn, whether you're handling compliance issues or negotiating intricate tax matters.

Our Services:

E-File Income Tax Return

TDS Return Filing

Tax Planning

NRI Tax Services

Tax Consultation

Tax Notice Handling

Tax Audit

GST Registration

GST Return Filing

Our Mission: Our goal is to increase our clients' recognition and foster a sense of loyalty to our business by providing them with professional services that are Fast, Accurate, and Affordable. Planning tax-effective solutions to lawfully decrease your tax situation is our specialty, and we achieve this through the following actions.

0 notes

Text

Accounting & Bookkeeping

Finocare Consultancies Pvt Ltd is a financial services providing Company located in Nagpur, Maharashtra, India. We provide all the finance related services such as accounting and taxation, income tax return filing, GST, TDS, trade mark registration, Audit and many more. We also give consultancy to client which reach their needs.

We are looking an opportunities in the field of bookkeeping outsourcing. We have a team of Practicing CA, Consultant and staff.

Contact Details

808380175

www.finocare.in

1 note

·

View note