#itr filling

Text

Feeling Lost? Here’s Your Roadmap to How to find a good tax consultant in India?

Are you searching for the best online tax consultant India? There’s nowhere else to look! Our team of tax experts specializes in offering knowledgeable solutions catered to your particular financial circumstances. We ensure everyone, individual or business, can easily manage the complicated tax environment.

Navigating the world of taxes can feel overwhelming, especially with the complexity of income tax laws in India. Finding the right tax consultant is key to ensuring your financial health stays in check. If you’re confused about where to start, don’t worry. We’re here to help guide you on the path to finding a good tax consultant in India. And if you want to skip the search, look no further than TaxDunia — recognized as one of the best income tax consultant in India.

Why You Need a Tax Consultant

Handling taxes involves a lot of details, deadlines, and paperwork. Even a small mistake can lead to penalties or lost money. A qualified tax consultant ensures that your tax filings are done correctly and on time, while also helping you save as much money as possible. Best Income Tax Advisors can also guide you through complex tax laws, so you’re always on the right side of the law. We are registered with recognized as qualified professionals, best accounting tax and advisory services in India.

Steps to Find a Good Tax Consultant

Look for Experience and Expertise The first step in finding the right tax consultant is to check their experience. An expert who has been in the field for years will know how to handle various tax situations, from income tax filings to audits. Our Company, for example, brings years of experience and a strong reputation for helping clients with a wide range of tax needs.

Check for Certification Your tax consultant should be certified by recognized authorities. Look for Chartered Accountants (CAs) or Certified Public Accountants (CPAs) in India. This ensures that the person you hire is fully trained and knowledgeable about the latest tax laws and regulations.

Ask for Recommendations Getting recommendations from friends, family, or business associates is a great way to start. If a consultant comes highly recommended, they are likely to provide good service. Our company has earned positive reviews from clients all over India, thanks to its transparent and reliable service.

TaxDunia is widely recognized as the Top 10 best income tax consultant in India. The company stands out with its team of skilled professionals who provide comprehensive tax solutions tailored to both individuals and businesses. From income tax filings and strategic tax planning to managing complex tax laws, we offer expertise that you can trust.

Our Complete Services: -

At TaxDunia, we offer a range of professional services designed to meet your needs. This blog provides an overview of our offerings and how we can assist you with various business and tax requirements in India.

Private Limited Company Registration Service in India

Starting a business in India involves several steps, with one of the most crucial being Private Limited Company Registration Service in India. This process ensures that your business is legally recognized and offers you the benefits of limited liability, credibility, and easier access to capital. At our company, we streamline this process for you, handling all necessary paperwork and compliance requirements to set up your pvt ltd company registration service seamlessly.

Online Company Registration in India

For those who prefer convenience, our Online Company Registration in India service is an ideal choice. We understand that time is valuable, so we offer a user-friendly online platform to simplify your Company Registration Service in India. Our team ensures that your registration process is quick and efficient, allowing you to focus on growing your business while we take care of the formalities.

One Person Company (OPC) and Public Limited Company Registration

If you’re considering starting a business on your own, our One Person Company Registration Service in India is tailored for solo entrepreneurs. This structure offers limited liability while allowing you to retain full control. Our OPC Registration Service simplifies ensuring compliance and a smooth process.

Public Limited Company Registration

Alternatively, if you’re looking to form a larger corporation, our Public Limited Company Registration Service is designed to help you meet the requirements for public trading and raising capital.

Firm Registration Services

For those in need of Firm Registration Services, we provide comprehensive solutions to get your partnership or LLP firm officially recognized. Our services include handling all necessary documentation and compliance requirements, ensuring that your firm is legally established and ready to operate.

Income Tax Return Filing Service in India

Managing taxes can be daunting, but with our Income Tax Return Filing Service in India, you can ease your worries. We offer expert assistance in ITR Return Filing Service, ensuring that your income tax returns are filed accurately and on time. Our consultants are skilled in handling various tax scenarios, from individual to corporate tax returns.

NRI Tax Consultancy and Filing Services

If you’re an NRI, navigating Indian tax regulations can be particularly challenging. Our NRI Tax Consultancy Service is designed to provide you with expert advice on handling your Indian income and tax obligations. We also offer NRI ITR Filing Service in India to ensure that your returns are filed correctly, complying with all relevant tax laws.

GST Return Filing Services

Managing GST compliance can be complex, but with our GST Return Filing Services in India, you get expert support for all your GST needs. From GST Registration Service to Online GST Return Filing, we cover all aspects of goods and services tax filing. Our team ensures that you remain compliant with GST regulations and avoid any potential penalties.

Trademark Registration Services

Protecting your intellectual property is crucial. Our Trademark Registration Consultants offer comprehensive best Trademark Registration Service in India, including trade mark online registration. We guide you through the entire process to ensure your brand is legally protected.

Copyright Registration Services

Similarly, for those needing best Copyright Registration service in India, our Best Copyright Consultant services help you safeguard your creative works with ease.

Patent Registration Services

Innovation is a key driver of business success. With our Patent Registration Service in India, you can protect your inventions and ideas. Our team of Best Patent Consultants in India provides expert guidance throughout the online Patent Registration Services in India process, helping you secure your intellectual property rights.

Sole Proprietorship Firm Registration

For solo entrepreneurs and small business owners, we offer Sole Proprietorship Registration Service. Our services ensure that your business is properly registered and compliant with all relevant regulation.

Proprietorship Firm Registration

Setting up a proprietorship firm is a straightforward way for solo entrepreneurs to start a business. We offer comprehensive Proprietorship Firm Registration services to help you establish your business efficiently. You can also register proprietorship firm online with our user-friendly platform, ensuring a quick and hassle-free registration process. We handle all the necessary paperwork and compliance, allowing you to focus on your business.

TDS Return Filing Service & Top Consultants

Managing TDS (Tax Deducted at Source) can be complex. Our TDS Return Filing Service in India ensures accurate and timely submission of your TDS returns. We are recognized as Top TDS Return Consultants in India, offering expert guidance to ensure compliance with tax regulations and avoid penalties. Trust us to simplify your TDS management and keep your finances in order.

Foreign Company Registration in India

Expanding into the Indian market requires understanding local regulations. Our Foreign Company Registration in India service assists international businesses in setting up operations in India. We handle all the paperwork and compliance requirements, helping you establish your presence in the Indian market smoothly.

Conclusion

At TaxDunia, we are dedicated to offering comprehensive solutions for all your business and tax needs. From Private Limited Company Registration to GST Return Filing Services, our expert team supports you at every step. If you’re searching for online tax consultant services near me, look no further. Visit our website www.taxdunia.com to explore how we can assist you in achieving your business and tax goals. With our expertise, you can concentrate on your core activities while we handle the complexities of registration and compliance efficiently.

#Top Income Tax Consultants#Best Income Tax Advisors#Tax Consultant Services#best income tax consultant in india#Best online tax consultant India#online Tax consultant services near me#Top 10 best income tax consultant in india#tax consultants#finance#itr filing#gst filling#itr filling#taxdunia#income tax#gst return

0 notes

Text

রিফান্ডের লোভে সাফ হতে পারে অ্যাকাউন্ট! ভুয়ো মেসেজ চিনবেন কীভাবে?

<div class="" data-block="true" data-editor="59s49" data-offset-key="3g958-0-0">

<div class="_1mf _1mj" data-offset-key="3g958-0-0"><span data-offset-key="3g958-0-0">রিফান্ডের লোভে সাফ হতে পারে অ্যাকাউন্ট! ভুয়ো মেসেজ চিনবেন কীভাবে?</span></div>

</div>

<div class="" data-block="true" data-editor="59s49" data-offset-key="15p0e-0-0">

<div class="_1mf _1mj"…

View On WordPress

0 notes

Text

Why it is important to file ITR before due date?

Resolving income tax filing problems

We will work on affordable charges to get your professional accounting, income tax preparation, and tax debt resolution. Our team works on issues that resolve the back tax or unfiled tax return debts. We do it swiftly and efficiently. You will have to know that file ITR is mandatory.

Those individuals who don’t have a regular salary or income may worry about the various conditions for filing ITRs. As they have to choose the right ITR for filing their income tax returns.

Filing Income Tax Return (ITR) before the due date is important for several reasons:

Avoiding Penalties and Interest: Filing your ITR before the due date helps you avoid penalties and interest charges that may be levied by the tax authorities for late filing. These penalties can be substantial and can add to your tax liability.

Timely Refunds: If you are eligible for a tax refund, filing your ITR early ensures that you receive your refund promptly. Delayed filing may result in delayed refunds, which can cause financial inconvenience.

Compliance with the Law: Filing your ITR on time ensures that you are compliant with tax laws and regulations. Non-compliance can lead to legal consequences, and you may be subject to audits or scrutiny by tax authorities.

Avoiding Last-Minute Rush: Filing your ITR before the due date helps you avoid the last-minute rush and potential technical glitches that may arise when filing online. Early filing gives you ample time to gather all necessary documents and information accurately.

Easy Correction of Errors: Filing early allows you to identify and correct any errors or discrepancies in your tax return promptly. If you file late and discover errors, it might be more challenging to correct them within the required time frame.

Planning and Financial Management: Early filing provides you with a clear picture of your tax liability, allowing you to plan your finances better. This helps in managing your cash flow and making necessary adjustments to your financial strategies.

Loan or Visa Applications: Many financial institutions and foreign embassies require ITR documents as proof of income and financial stability. Having a timely filed ITR can expedite loan approvals and visa applications.

Continuity of Benefits: Timely filing ensures the continuity of various benefits such as carry-forward of losses, deductions, and exemptions, which can impact your tax liability in future years.

Peace of Mind: Filing your ITR early gives you peace of mind, knowing that you have fulfilled your tax obligations on time, without the stress of last-minute rush and potential penalties.

In conclusion, filing your ITR before the due date is essential for meeting legal obligations, avoiding penalties, and ensuring smooth financial planning and management. It is a responsible practice that benefits both individuals and the overall tax system.

At Lex N Tax, We have dedicated team of tax experts, who can help you in accomplishing your tax filling obligation timely and accurately. Further any further query, you can reach out to our team at _Lexntax Associates__________________________ Website Link - https://lexntax.com/

0 notes

Text

#Corporating Dreams#itr filling#gst filling#proprietorship-firm-registration#partnership-firm-registration#gst-return-filing

1 note

·

View note

Note

Question, https://instarsandtime.wiki.gg/wiki/In_Stars_and_Time_Wiki

is this the proper wiki link? I literally finished the game today, and I'd love to contribute. I'm really glad it's not a fandom wiki! since I've heard horror stories about that corporate bloated mess. Why do you prefer wiki.gg btw? I don't know much about various wiki options, sksksks, I just look at the drama with fandom.wiki curiously

that is the correct link, yes! We actually forked from the fandom wiki in November. (though i only started contributing to the wiki directly after the fork)

Honestly, wiki.gg is just a very convenient option! I know ITR handled the entire fork with help from the wiki.gg team. It's an established site and pretty reliable host for the moment (I know people were talking about miraheze being shaky, but I don't really know.) We have support from an established team, we don't need to pay for independant hosting, we get a lot of resources and help, so it's a pretty sweet deal. (Thank you to the bureaucrat who made me admin this week~ mwah~)

All i remember is, I knew the wiki existed, and I said I'm not adding to it till we're off fandom, and boom, we were. (I wasn't the catalyst for it, mind, but I'd like to think I helped motivate the move at least a little bit.) (In the end, we are just one of many wikis that migrated in the wake of the Hollow Knight wiki and the famous mossbag video which motivated many, many wikis to finally ditch fandom).

Actually, watch that video for a good rundown on the troubles with Fandom. The tldr is: way too much censorship, too many ads with no control over them, basically no customization options, absolutely no respect for wiki editors, and the potential that your wiki will be subjected to corporate vandalism with no way out. Fandom sucks!

Hope you enjoy your stay on the isatwiki!! I'm actually so ecstatic my little post got people to contribute.

#Feli gets asked#wiki stuff#<- starting a tag for it cuz it'll probably be relevant#wikigg is a fast growing popular host that i havent really heard anything bad over! i didnt decide where to migrate (again i became active#AFTER the move) so only ITR could provide details#they've been pretty inactive though and i just filled the power vacuum by pretending to be the wiki despot#which eventually resulted in me actually being promoted#yes i was not admin before this week. but. i was basically in all but title since like. january lmao.

3 notes

·

View notes

Text

i have like 2 drafts and one of them was the extensive true bankai ichigo headcanon and the other was on bbs like the fucking gamer i am

#it was comparing mr to bbs and sort of seeing what bbs can do with story to make it more interedting#ohh one day youll see the light of day#briefly considered writing an actual why i dislike nn+itr@ thats not me memeing#i mean the main answer is the fans but like taking them out of the equation why he isnt that good in the role he was supposed to fill#butt that would require me thinking about him so

2 notes

·

View notes

Text

Secure your financial success with our expert Income Tax Return Services in Gurgaon. We are the top choice in India for accurate filings, timely returns, and comprehensive assistance tailored to your unique needs.

0 notes

Text

Tax Audit: All You Need to Know

As a business owner, staying updated with the latest tax regulations is essential. One important aspect of taxation that all business owners must be aware of is tax audit and its applicability to your business. Tax audit refers to the process of inspection and verification of the books of accounts of a taxpayer to ensure their adherence to the provisions of the Income-Tax Act, of 1961.

In India, Section 44AB of the Income-Tax Act, 1961 lays an obligation on certain persons mentioned thereunder carrying on business or profession, to get their accounts audited before the “specified date” by a Chartered Accountant, if their turnover exceeds the specified threshold limits or in cases where they are eligible to declare their income on a presumptive income basis as per section 44AD if they claim that their income is lower than the income so computed as per presumptive income.

The key objectives of the tax audit are as follows:

Ensures that the books of accounts are maintained properly and certified by a Chartered Accountant.

Prepares and submits an audit report according to the requirements of Form no. 3CA/3CB and 3CD.

Gives assurance to shareholders that the books of accounts are free from any discrepancies and financial statements and audit reports give a true and fair view of the business.

Helps in checking fraudulent practices.

It is important to understand the applicability of tax audit based on the category of person- business. Here’s a breakdown:

Assessee carrying on a business but not opting for presumptive taxation scheme:

Applicability:

If total sales, turnover, or gross receipts exceed INR one crore in the previous financial year.

If cash transactions are up to 5% of total gross receipts and payments, the threshold limit is increased to INR ten crores.

Assessee carrying on business eligible for presumptive taxation under Section 44AE, 44BB or 44BBB:

Applicability:

If the profit claimed is lower than the prescribed limit under the presumptive taxation scheme.

Assessee carrying on business eligible for the presumptive taxation under Section 44AD:

Applicability:

If taxable income declared is below the limits prescribed under the presumptive tax scheme and has income exceeding the basic threshold limit.

Assessee carrying on the business and is not eligible to claim presumptive taxation under Section 44AD due to opting out for presumptive taxation in any one financial year of the lock-in period i.e. 5 consecutive years from when the presumptive tax scheme has been opted:

Applicability:

If income exceeds the maximum amount not chargeable to tax in the subsequent 5 consecutive tax years from the financial year when the presumptive taxation was not opted for.

Assessee carrying on a business where declaring profits as per presumptive taxation scheme under Section 44AD:

Applicability:

If income exceeds the maximum amount not chargeable to tax in the subsequent 5 consecutive tax years from the financial year when the presumptive taxation was not opted for.

If the total sales, turnover, or gross receipts do not exceed Rs 2 crore in the financial year, then tax audit will not apply to such businesses.

Category of person - Profession:

Assessee carrying on the profession:

Applicability:

If the total sales, turnover, or gross receipts do not exceed Rs 2 crore in the financial year, then tax audit will not apply to such businesses.

Assessee carrying on a business where declaring profits as per presumptive taxation scheme under Section 44AD:

Applicability:

If the total sales, turnover, or gross receipts do not exceed Rs 2 crore in the financial year, then tax audit will not apply to such businesses.

Category of person - Business Loss:

Where the assessee is carrying on business with loss and has not opted for a presumptive taxation scheme under section 44AD:

Applicability:

Where total sales, turnover, or gross receipts exceed Rs 1 crore.

Where the assessee’s total income exceeds the basic threshold limit but he has incurred a loss from carrying on a business and not opted for a presumptive taxation scheme under section 44AD:

Applicability:

In case of loss from business when total sales, turnover, or gross receipts exceed INR 1 crore, the assessee is subject to tax audit under 44AB.

Where the assessee is carrying on a business (opted presumptive taxation scheme under section 44AD) and having a business loss but with income below the basic threshold limit:

Applicability:

Tax audit not applicable.

Where the assessee is carrying on a business (opted presumptive taxation scheme under section 44AD) and having a business loss but with income exceeding the basic threshold limit:

Applicability:

Declares taxable income below the limits prescribed under the presumptive tax scheme and has income exceeding the basic threshold limit.

Chartered accountants are responsible for providing the tax audit report. They must furnish the prescribed particulars in Form No. 3CD, which also forms a part of the audit report. The auditor shall furnish the tax audit report in any of the following prescribed forms: Form No. 3CA is furnished where an assessee is carrying on business or profession and is already mandated to get the books of accounts audited under any other law. Form No. 3CB is furnished where an assessee is carrying on business or profession and is not required to get the books of accounts audited under any other law.

If an assessee fails to comply with the provisions of section 44AB and does not get their books of account audited, they will be liable to pay a penalty as per section 271B. According to section 271B, the penalty shall be lower of the following amounts: (a) 0.5% of the total sales, turnover, or gross receipts or (b) Rs. 1,50,000.

In conclusion, it’s important for business owners to determine if they meet the criteria for tax audit applicability based on their category of person - business. Not complying with tax audit regulations can lead to hefty penalties. It's advisable to seek the help of a chartered accountant to ensure the timely preparation and submission of your tax audit report.

#itr return services#itr benefits for salaried individuals#tax audit services for businesses in india#tax audit service in india#itr return services in jaipur#itr filling service in jaipur

0 notes

Link

You can use the Income Tax API to upload the return and pass the data to the official site. Multiple uploading of documents using the API can make the process easier. Using the API, you can also check the status of the returns filed.

0 notes

Text

What, Why and How Patent Registration Service in India Protects Your Ideas: A Guide by TaxDunia

In today’s rapidly evolving world, ideas are more valuable than ever. Whether you’re an entrepreneur with a groundbreaking invention, a tech innovator, or a creative professional, protecting your intellectual property is essential. Patent registration is one of the most effective ways to safeguard your ideas, ensuring that they remain your exclusive asset. At TaxDunia, we understand the complexities of patent registration and are here to guide you through the process. In this comprehensive blog, we’ll explore what patent registration is, why it’s crucial, and how the Patent Registration Service in India can protect your ideas.

What is a Patent?

A patent is a legal protection granted to an inventor for a new and useful invention. This protection gives the inventor exclusive rights to their creation, allowing them to prevent others from making, using, or selling the invention without permission. Patents are essential for safeguarding innovative ideas and encouraging technological advancements.

Here’s a simple breakdown of what a patent is and its significance:

· Legal Right: A patent provides the inventor with the sole right to exploit their invention. This means that only the patent holder can manufacture, use, or sell the patented invention.

· Types of Patents: There are several types of patents, including utility patents (for new and useful inventions or discoveries), design patents (for new, original, and ornamental designs), and plant patents (for new varieties of plants).

· Duration: Patents are usually granted for a limited period, typically 20 years from the date of filing for utility patents, after which the protection expires and the invention becomes public domain.

· Purpose: The primary purpose of a patent is to encourage innovation by offering inventors a temporary monopoly on their creations, providing them with a financial incentive to invest time and resources into developing new technologies.

What is Patent Registration?

A patent is a legal document granted by the government that gives an inventor exclusive rights to make, use, and sell their invention for a specified period. This means that once you have a patent, no one else can legally produce, use, or sell your invention without your permission. Patent registration is the process of securing these rights, ensuring that your invention is protected under the law.

Why Patent Registration is Important

Patent registration is crucial for several reasons:

Protection of Intellectual Property: By registering your patent, you secure your invention from being copied or used by others without your consent. This legal protection is vital in a competitive market where ideas can easily be stolen or replicated.

Monetary Benefits: A registered patent can be a significant financial asset. You can license your patent to other companies, sell it, or use it as collateral for loans. This opens up various avenues for generating revenue from your invention.

Encourages Innovation: Knowing that your ideas are protected encourages further innovation. Inventors are more likely to invest time and resources into developing new products when they know their work is legally safeguarded.

Establishes Market Position: A patent gives you a competitive edge by establishing your position in the market as the exclusive owner of your invention. This can enhance your brand’s reputation and attract investors.

How Patent Registration Works in India

The process of patent registration in India involves several steps, and it’s essential to follow each one carefully to ensure your patent is granted.

Step 1: Conduct a Patent Search

Before applying for a patent, it’s crucial to conduct a thorough patent search to ensure that your invention is unique and hasn’t already been patented by someone else. This step helps you avoid legal complications and potential rejections.

Step 2: Draft a Patent Application

Once you’ve confirmed that your invention is unique, the next step is to draft a patent application. This document should include a detailed description of your invention, how it works, and its potential applications. It’s advisable to seek help from the Top Income Tax Consultants like taxdunia which ensure your application is accurate and comprehensive.

Step 3: Submit the Patent Application

After drafting, the patent application is submitted to the Indian Patent Office. This can be done online or in person. Once submitted, your application will undergo a thorough examination by the patent office.

Step 4: Examination of the Patent Application

The Indian Patent Office will examine your application to ensure it meets all the legal requirements. This involves verifying that the invention is new, has a significant innovative feature, and can be practically applied in the industry. If any issues are found, you may be required to make amendments to your application.

Step 5: Publication of the Patent Application

If your application passes the examination, it will be published in the official patent journal. This allows others to view your patent application and raise any objections if they believe your invention infringes on their rights.

Step 6: Grant of Patent

If no objections are raised or if they are resolved, the patent office will grant your patent. You will then receive a patent certificate, giving you exclusive rights to your invention for 20 years.

The Importance of Patent Registration Services in India

Patent registration in India is a complex process that requires a deep understanding of legal and technical aspects. This is where professional Patent Registration Services in India come into play. These services are designed to assist inventors and companies in navigating the patent registration process smoothly and efficiently. Tax dunia plays as the best income tax advisors in India with their knowledge and skilled staff.

Expertise in Patent Law

Patent consultants are well-versed in Indian patent law and can provide invaluable guidance throughout the registration process. They make sure your application complies with all legal standards, lowering the chances of it being rejected.

Thorough Documentation

A crucial aspect of patent registration is the documentation. Patent consultants help in drafting detailed and precise patent applications that clearly describe your invention. This increases the chances of your patent being granted without complications.

Efficient Process Management

The patent registration process can be time-consuming, with several steps that need to be completed within specific deadlines. Patent consultants manage the entire process, ensuring that everything is done promptly and correctly.

Handling Legal Challenges

In some cases, your patent application may face objections or legal challenges. Patent consultants are equipped to handle these issues, representing your interests and ensuring that your rights are protected.

Why Choose TaxDunia for Patent Registration?

At TaxDunia, we take pride in being recognized as one of the Best Patent Consultants in India. Our team of experts is committed to helping you safeguard your intellectual property through efficient and reliable patent registration services. Here’s why choosing TaxDunia is the best decision for your patent needs:

Experienced Professionals

Our team is composed of highly qualified patent consultants with extensive experience in the field. We understand the complexities of patent law and are dedicated to providing you with top-notch service. Our expertise ensures that your patent application is handled with the utmost care and attention to detail, increasing the likelihood of successful registration.

Comprehensive Support

TaxDunia offers comprehensive support throughout the patent registration process. From conducting thorough patent searches to drafting and filing applications, our services cover every aspect of the process. We also provide assistance in managing legal challenges that may arise, ensuring that your rights are fully protected.

Client-Centric Approach

At TaxDunia, our clients are our top priority. We take the time to understand your unique needs and provide tailored solutions that align with your specific requirements. Our client-centric approach means that we work closely with you, offering personalized guidance and support at every step of the patent registration process.

Efficient Process

We understand the importance of time in securing your intellectual property rights. That’s why we have streamlined our patent registration process to ensure that your application is submitted and processed promptly. Our efficient approach minimizes delays, helping you secure your patent as quickly as possible.

The Role of TaxDunia in Online Patent Registration

TaxDunia also offers comprehensive online Patent Registration Services in India, making it convenient for you to protect your ideas from anywhere. Our online services and tax consultant services are designed to be user-friendly, efficient, and secure, ensuring that your patent application is handled with the utmost care.

Easy-to-Use Platform

Our intuitive online platform allows you to submit your patent application with ease. With clear instructions and support available at every step, you can navigate the process with minimal hassle.

Expert Assistance

Even with the convenience of online registration, expert guidance is essential. Our team of patent consultants is available to assist you throughout the online process, ensuring that your application is accurate and complete.

Secure Transactions

We prioritize the security of your intellectual property. Our online platform is equipped with advanced security measures, ensuring that your data is protected and your patent application is submitted safely.

The Benefits of Online Patent Registration in India

With the advent of digital technology, patent registration has become more accessible than ever. Online patent registration offers several benefits that make the process faster, more convenient, and cost-effective.

Convenience and Accessibility

Online registration allows you to submit your patent application from anywhere, at any time. This eliminates the need for physical visits to the patent office and simplifies the process for busy inventors and businesses.

Faster Processing

Online patent registration is often faster than traditional methods. The digital submission process streamlines the application, reducing the time it takes to review and approve your patent.

Cost-Effective

Online registration can be more cost-effective, as it reduces the need for physical paperwork and in-person consultations. This makes patent registration more affordable, particularly for startups and small businesses.

Conclusion

Patent registration is a vital step in protecting your ideas and ensuring that your hard work is rewarded. Whether you’re an individual inventor, a startup, or an established business, securing a patent can provide you with the legal protection and competitive advantage you need to succeed.

At TaxDunia, we are committed to helping you navigate the patent registration process with ease. As one of the Best Patent Consultants in India and best income tax consultant in india, we offer comprehensive services that cover every aspect of patent registration, from conducting patent searches to submitting applications and handling legal challenges. Our goal is to make patent registration as simple and stress-free as possible, so you can focus on what you do best — innovating and creating.

If you’re ready to protect your ideas and secure your future, contact TaxDunia today. Our expert team is here to guide you through the Patent Registration Service in India and ensure that your intellectual property is protected for years to come.

#Top Income Tax Consultants#Best Income Tax Advisors#Tax Consultant Services#best income tax consultant in india#Patent Registration Service in India#Best Patent Consultants in India#online Patent Registration Services in India#income tax#itr filing#finance#tax consultants#itr filling#taxdunia#gst filling#gst return

0 notes

Link

Income Tax Return is the form in which assesses files information about his/her Income and tax thereon to Income Tax Department. The Income Tax Act, 1961, and the Income Tax Rules, 1962, obligates citizens to file returns with the Income Tax Department at the end of every financial year. These returns should be filed before the specified due date. Every Income Tax Return Form is applicable to a certain section of the Assesses. Only those Forms which are filed by the eligible Assesses are processed by the Income Tax Department of India. It is therefore imperative to know which particular form is appropriate in each case. Income Tax Return Forms vary depending on the criteria of the source of income of the Assessed and the category of the Assessed. Call bashmakh & co for best price.

0 notes

Link

If you are facing any issues to file your ITR so just follow the below-given step-by-step guide to file your ITR in a hassle-free and comfortable manner.

0 notes

Text

Peter Parker | Snow Storm

*•.¸♡Request: hello! can i please request ps4 peter fluff? maybe just peter coming back from a long night of patrolling and being really needy and tired <3

*•.¸♡Prompts: none

*•.¸♡Warnings: none

*•.¸♡Paring: ps4 Peter Parker x GN!reader

*•.¸♡Summary: Peter comes back from a night on patrol in the middle of winter. (This is straight up fluff)

*•.¸♡Words: 784

You raced around your small New York apart. Winter has surged through New York like it was intent on ruining your happiness and warmth. The heaters were broken, thank the landlord for that, and the small heat van had fallen from its place on your desk and broken against the hard floor in your hurried search. Search for what exactly? Peters's extra large black hoodie with a small spider symbol on the back, which you would never let him live down.

Finally, after what felt like an eternity, you found the hoodie in the stash of clothes you had stored in case Peter had decided to swing by. Just as you pulled the hoodie over your head your phone buzzed, its light shining through the darkness of your apartment. As you unlocked your phone you smiled softly, Peter's picture popping up in your messages.

Is your window unlocked?

It can be

PLEWASDE ITRS FREEZIUNG!!

ARE YOU SWINING AND TEXTING

IKLL BE OVER IN 5

You rolled your eyes and opened the latch to your apartment window before walking to the kitchen and putting a dozen pizza scrolls in the oven. As you walked back to the living area as Peter landed on the fire escape with a groan. He slipped through the window and flung his mask off. "Hello, hi, yes, you can kick me for this later," Peter rambled as he wrapped his arms around your shoulders. You squealed as the cold of his suit chilled through the hoodie and your now freezing cheeks.

"Peter! Peter, you're freezing!"

"But you're so warm!" Peter ducked his head and pressed a kiss to the top of your head.

"Go have a shower you creepy bug," You hissed, slipping from Peter's arms. "Get warm!" Peter groaned and threw his head back. "I'll set up a movie, I already have food on."

"You're the best," Peter cooed before turning towards the hall.

"Uh, Peter. Mask." Peter paused to grab the mask that he stuck to the side of the window sill before locking the window and rushing to the bathroom.

Ten minutes later you had set up the living room, most of your night had been spent on the couch with Peter anyway so most of the pillows were out there.

The living room was arranged to create the ultimate movie-watching experience. The centrepiece of the room was a plush, oversized sofa, adorned with soft throw pillows in mostly black and blues shades. In front of the sofa, a sleek and modern entertainment centre stood proudly, housing a large high-definition television. Netflix already set up on the movies section, the remote tossed thrown onto the table in between.

The small coffee table was placed within arm's reach of the sofa, holding the pizza rolls and whatever else you had found in the pantry. A bowl of freshly popped popcorn, still warm and smelling of salty butter, was surrounded by an array of snacks and hot chocolate.

As you set up to sink into the sofa Peter hopped over the back of the couch, stealing your spot. One of the hot chocolates almost split but Peter quickly caught it. "Hey-"

Peter pulled you down into the couch, your chest falling against his as your legs kicked up over the arm of the couch. "Hello to you too." Peter laughed and in a moment of pure affection, his eyes met yours. With gentle anticipation, his lips drew closer, the world around you both fading into the background. Time seemed to stand still as their hearts beat in synchrony, brimming with tender emotions.

Peter's lips finally met yours in a soft, delicate kiss, a sweet connection that sent sparks of warmth and joy coursing through your bodies. It was a gentle caress, filled with tenderness and an undeniable sense of belonging. In that fleeting instant, everything else ceased to exist, and their love spoke volumes in the quiet language of that sweet, innocent kiss.

Slowly Peter drew back, but still closer enough that his nose brushed against your forehead as he pressed a quick peck to your skin. "Tough night?" You asked softly, your hands coming up to trace a small cut above his eyebrows that had already healed to a small mark.

"Just long," Peter complained, his head dropping onto yours. "Evey second mission Yuri sent me on was on the other side of the city. I spent most of the night swinging in the freezing snowstorm."

"Well now..." You pulled yourself closer to Peter so you could curl against his chest. "You can just relax and watch The Princess Bride."

"We watch that every time," Peter complained, his head falling back against the couch.

"You can choose next."

゚°☆Page Navigation

#m0chaminx#peter parker fanfiction#peter parker#ps4 peter parker#peter parker ps4 x reader#ps4 peter parker x reader#ps4 spiderman#ps4 spiderman x reader#marvel spiderman#spiderman

254 notes

·

View notes

Text

To seek freedom

ectoberhaunt2023

day 10- occultism

TW- mind control

summary- The Justice League is trying everything they can to free Danny.

ao3

ectoberhaunt2023 masterlist

Part 2 of ITR

The Red is like a river. Sometimes it is gentle, lulling; other times it is rushes by underwater currents dragging him under to drown.

Sometimes it feels like there is someone on the shore shouting at him, but then the water fills his ears and his head dips under its currents.

Only faint echoes breach the Red around his mind. Feeling, thoughts, sometimes pain it all becomes muddled and if Danny spends too long trying to puzzle it out the Red becomes violent pulling him under to drown.

It’s best to let him lull him to sleep. To be a memory in his own body. It’s safer that way

It had been two weeks and the Justice League was finding out that they are unprepared to face down whatever Danny was. The cultist had claimed he was a ghost, but Danny’s medical file showed he had the signs of a living human. Of course, there was always the possibility that it was faked. But Deadman, the ghost who worked for the JLD, was invisible and intangible. Danny wasn’t.

When Batman had questioned Constantine the man had shrugged and said all he knew was that Danny came from a long line of occultists and that he wasn’t supposed to be this powerful.

Did the artifact give him the power? But if so, why didn’t the occultist use it on himself?

Batman went over his file again and had to clench his teeth at the lack of information. He’d have to give the JLD another presentation about proper background checks.

Name: Daniel Nightingale

Family: UnknownPrevious employment: Nasty Burger cashier

Magical ability: can sense spirits and magical artifacts, can see some mid-level spirits

Batman frowned.

He’d already tried looking into what Danny could have meant by ‘Manson.’ But there were no conclusive answers on that front either. It was most likely a person, but it could also be a place or an object.

He’d already looked up the name Manson and there were a lot of results. And without more information on Danny it was impossible to tell if he had any connection with any of them. And when Bruce searched for any mention of Danny in the information he’d compiled about the most likely Manson he also came up blank.

He was about to run the search again, or at least try and narrow down the list of options when his communicator rang.

Danny had been spotted robbing a bank.

---------------------

Batman, Superman, Flash and Green Lantern made it first with Constaninte saying he was on his way.

Bruce arrived just in time to see Superman crash onto the street. Danny floated above the street, his eyes glowing red. His clothes were ragged and his face was gaunt.

It was obvious the cultist hadn’t allowed him to eat or rest. If they didn’t capture him soon, Danny might die.

At least he had proven himself resilient in past fights, taking hits that would have knocked Superman down.

“Green Lantern” Bruce spoke into his comm, “distract him until you can get him cornered, then Superman, I need you to try and knock him out.” According to their past interactions, Danny struggled to go intangible through Hal’s constructs but it should hold him for a while. If they could distract him long enough then knock him out, they might be able to end this quickly without hurting Danny too much.

They all gave confirmation and Hal flew up and swung a giant bat at Danny who ducked down. This continued as Hal attacked with several different constructs.

Hal had just made contact and trapped Danny in a cage. Danny had started to try to push through when Hall suddenly dropped it and Superman rushed forward and landed a punch that slammed Danny into the ground.

They had almost reached him when Danny’s eyes opened and for a moment they were blue before they flickered back to red. Bruce threw a tracker in his direction, but Danny went intangible and sunk through the ground.

#ectoberhaunt23#ectoberhaunt#danny phantom#danny fenton#batman#bruce wayne#clark kent#superman#green lantern#hal jordan#day 10#eh magic#occultism#dp x dc#dp x dc fanfic#cult#mind control#in the red

111 notes

·

View notes

Note

HEY UUUUUH *explodes into glitter, filling the whole room w itr*

*Radio takes deep breaths*

*stay calm, it’ll get cleaned up faster if you do*

*he starts to sweep again*

2 notes

·

View notes

Text

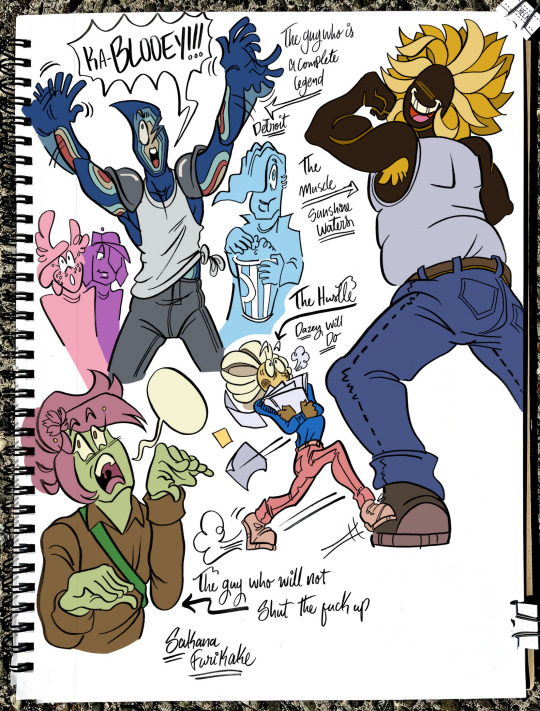

The guys I need in my guy squad

Read about some of the squad guys below!

Thistle is the youngest member of Molly's gang, born in 1988, 3 years after our main story begins. Later on in the timeline, she grows up to be spunky, rebellious, and fiery, as seen by her rock throwing.

Cole Manors is a cabbage floro and the oldest member of the gang, somewhere in his 80s. He is a retired architect and former construction worker. He helped renovate the operation's original and new bases in abandoned mine sites.

Alli Oops is a life loving yoga instructor and one of the first ones to get behind anything exciting. Their unamity is an allium floro. They are highly flexible, but accident prone! Pictured with Amata Gemoule, who is fumbling with their moves.

Helly (Helga) Faer is the very 40 year old pharmaceutical engineer who created the sun drug all the buzz is about in ITR. Smart, practical, and methodical. She is stubborn and a little hard headed, and that's not mentioning her literally thick viral skin.

Detroit Agate is an exciting artificial petraphine. He relies on car paint to supplement his diet to maintain his body's form and appearance rather than natural minerals, explaining the artificial. He loves to lecture and tell stories of his life to those who will listen. He's got a can do attitude and energy for days. Pictured are Pinku Usagi, Amata, and Pigeon Wing spectating a yarn he's spinning.

Sunshine Waters is the 32 year old 12 foot tall giant sunflower floro who is a part of things. He was a former mine worker like Amata, and currently trying to write novels with the help of his partner, Dazey Will Do.

Dazey Will Do is the 43 year old 4 foot tall powerhouse behind the gang who manages things alongside the two female founders and Heliotrope's advising. He is a quick thinker, light on his feet, and just as nervous. Polite to his detriment at times.

Sakana Furikake is the 28 year old cherry tree floro who fills the room with his flashiness whether he likes it or not. He's an artist, model, you name it who lives with his business partner and ex, Rose Buddy. He is a funny mix of both maternal and childish at the same time.

Oleander is a reader floro who works as a prep cook by day and was a former hitman. He prizes his gun collection, which he can fire with accuracy despite having no eyes using his reading senses. He knows when to lay low and when to stir some chaos. Or so we think.

Molly Mandrake is the 28 year old leader of the pack. She founded this whole gang alongside Helly back in 1976 to make a difference for floro sapiens affected by the steep pricing of the sun drug. The method ended up being to illegally create and distribute it under everybody's noses. She's calm, friendly, and smiles through it all.

Hansa Geoluhread is a yellow rose type floro who spends his time doing yard work for the elderly and disabled population in his neighborhood. A massive fan of cartoons and anime, he is caught up on his mangas to the right to left reading letter.

#Thistle Hoenn#Cole Manors#Alli Oops#Amata Gemoule#Helly Faer#Detroit Agate#Pinku Usagi#Pigeon Wing#Sunshine Waters#Dazey Will Do#Sakana Furikake#Oleander#Molly Mandrake#Hansa Geoluhread#gallery

3 notes

·

View notes