#quick online cash

Text

So if I cancel an appointment the day of, I’ll get charged $100, but the doctor can cancel the appointment an hour beforehand and I’m just shit out of luck. Very cool. Not a bother at all.

#‘connectivity issues.’ so your wifi is down?#if I said my wifi was down I’d probably get told to go to a Starbucks parking lot or just fork over the cancellation fee#they really have no backup plan for spotty internet? can’t afford to run a hotspot from your phone for 20 minutes#disappointing#not that I wanted a telehealth appointment anyway. I hate telehealth#but still. this was a meeting to get me back on antidepressants and now I’ve gotta wait another week#at least the rescheduled appointment is an in person one.#so… another week of… this… not that it would have been solved right away but the sooner you start the better#this is too much info#I’m grumpy!#my brain hurts and I’m hungry so once the tylenol kicks in and I eat I’ll be… less grumpy#whatever. who cares.#this don’t matter#none of this matters#but still! canceling an hour before! wow! I’m glad this was an online appointment or I’d be really pissed#I was just gonna do this in my pjs. imagine stressing and rushing to look nice and get there and all that for nothing#hey real quick let’s talk about how $100 as a punishment fee for canceling is kinda fucked up#like yeah I know they want to deter people flaking. these appts are in high demand. but that’s a LOT of cash for someone like me#sometimes shit happens… like ‘connectivity issues’… 😑 ya buttholes#ok this is too much#ok I love you forever#you can ignore this#text

5 notes

·

View notes

Text

Just found out my favorite bar in Denver went from being completely based on horror movies and showing horror movies to changing to “adapt with the times” to a bar that centers itself around “emo music and sad Drake songs”…gonna kms

#thoughts#depressing how the coolest bar ive ever been to is now just…a cash grab for sadbois#knew that ot was comin tho considering they started to only show horror movies on saturday instead of everyday#but yeah im actually depressed over how bad of a change that is#hehe quick addition to the tags cause i looked online and apparently the dude behind the bar just used horror as a cashgrab so ya know what#mayhaps its ALL just a cashgrab and theyre moving onto the next group they havent pissed off yet

3 notes

·

View notes

Text

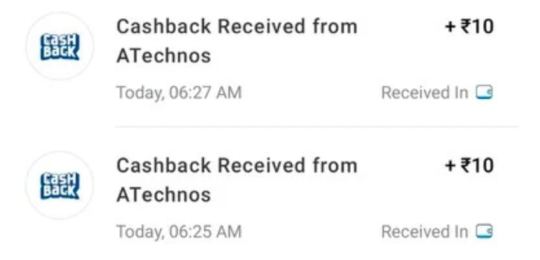

Get Rs.10 FREE PayTM Cash Instantly

Get Rs.10 FREE PayTM Cash Instantly

Free Rs. 10 Free PayTM cash By Just Giving Misscall (Hurry Up! )

Rs 10 Free PayTM cash , Instant Rs 10 Free PayTM Cash , Rs 10 Free PayTM Cash By Miss Call , Earn Rs 10 Free PayTM Cash – Hi Guys , Here is Another Method To Earn Free PayTM Cash Loot , All You Have to Do is Just Give Miss call On Number & You Will Have Rs.10 Instant Free PayTM cash

We Have…

View On WordPress

#Bill Payments#Earn Free PayTM Cash#Easy Earnings#Extra Money#Financial Benefits.#Financial Flexibility#freebies#Get Rs.10 FREE PayTM Cash Instantly#Hassle-Free Earnings#Instant Credit#Missed Call Offer#Mobile Recharge#No Strings Attached#online shopping#PayTM Wallet#Pocket Money#Quick Process#Student Expenses#Supplement Income

2 notes

·

View notes

Text

earn money by doing surveys!

0 notes

Text

Affordable Auto Title Loans in Vancouver, British Columbia

Unlock the financial flexibility you need with Snap Car Cash's Auto Title Loans Vancouver, British Columbia. Whether you're dealing with unexpected expenses or need quick cash, Snap Car Cash is here to help. Using your vehicle as collateral, you can secure a loan with competitive interest rates and flexible repayment terms. Even if you have bad credit or no credit history, Snap Car Cash offers a hassle-free application process with no credit checks required. Drive your car while you repay the loan, and get the funds you need within hours. Get started today with Snap Car Cash and experience a quick, easy solution to your financial needs.

#Auto Title Loans Vancouver#Car Title Loans Vancouver#Vehicle Title Loans Vancouver#Instant Auto Title Loans Vancouver#Quick Cash Auto Title Loans Vancouver#No Credit Check Auto Title Loans Vancouver#Fast Approval Car Title Loans Vancouver#Online Auto Title Loans Vancouver#Low Interest Auto Title Loans Vancouver#Auto Title Loans

0 notes

Text

Toronto's Best Low Interest Car Title Loans – Quick Approval!

Discover a quick and easy way to get cash with Snap Car Cash in Toronto! We offer low interest car title loans Toronto designed to fit your budget. Whether you have bad credit or need instant cash, our team can help you access the funds you need. Our process is straightforward: use your car’s title as collateral and get approved quickly. No credit checks required. With Snap Car Cash, you can secure an instant car title loan and continue driving your vehicle while you repay. Visit us in Toronto today and find out how our flexible loan options can help you manage your financial needs.

#Car Title Loans Toronto#Toronto Auto Title Loans#Fast Car Title Loans Toronto#No Credit Check Car Title Loans Toronto#Vehicle Title Loans Toronto#Borrow Money Against Your Car Toronto#Instant Car Title Loans Toronto#Quick Cash Loans Toronto Car Title#Car Title Loan Online Toronto

0 notes

Text

Everything You Need to Know About Small Payday Loans in the USA

Discover the essentials of small payday loans in the USA with this comprehensive guide. Learn about how these short-term loans work, their pros and cons, eligibility requirements, and key considerations before borrowing. Perfect for anyone seeking a quick financial boost while navigating the complexities of payday lending.

0 notes

Text

Plain Green Loans: Emergency Cash When You Need It offers fast, reliable financial solutions during unexpected situations. Discover how Plain Green Loans can provide you with the emergency cash you need, precisely when you need it most. Explore the benefits, application process, and why Plain Green Loans is a trusted choice for quick financial relief.

#Quick cash loans online#Fast emergency loans#No credit check loans#Instant approval loans#Online payday loans#Same day cash loans#Emergency money lender#Short term personal loans#Bad credit emergency loans#Fast personal loans online

0 notes

Text

Need a quick cash boost before payday? We've got you covered! Our payday loans are fast, easy, and reliable. Apply online and get approved in minutes!

0 notes

Text

Instant Loan Apply Online | Quick Cash Loan in India

Unexpected financial needs can arise at any moment. Whether it's a medical emergency, an unplanned trip, or a sudden home repair, having quick access to funds is crucial. This is where instant loans come into play. With technological advancements, applying for an instant loan online has become a seamless process, providing quick access to cash for those in need. In India, the demand for instant loans has surged, driven by the convenience and speed they offer. This article explores the various aspects of instant loan applications online and the benefits of Instant Loan Online in India.

What is an Instant Loan?

An instant loan is a type of short-term personal loan designed to provide immediate financial assistance to individuals. These loans are typically unsecured, meaning they do not require collateral, making them accessible to a broader range of people. The primary appeal of instant loans lies in their quick approval and disbursement process, often within a few hours of application.

Benefits of Instant Loans

Quick Approval and Disbursement: One of the most significant advantages of instant loans is the rapid approval process. Many online lenders use advanced algorithms and AI to assess applications swiftly, ensuring funds are disbursed within a short period, sometimes even in minutes.

Convenient Application Process: Applying for an instant loan online is incredibly convenient. Borrowers can complete the entire process from the comfort of their homes, using a computer or smartphone. This eliminates the need for lengthy paperwork and multiple visits to a bank.

Minimal Documentation: Traditional loans often require extensive documentation, which can be time-consuming and cumbersome. Instant loans, on the other hand, typically require minimal documentation, such as identity proof, address proof, and income proof.

Flexible Loan Amounts and Tenures: Instant loans offer flexibility in terms of loan amounts and repayment tenures. Borrowers can choose the amount they need and the tenure that suits their repayment capacity, making it easier to manage their finances.

No Collateral Required: Since instant loans are unsecured, borrowers do not need to pledge any collateral. This makes them accessible to individuals who may not have assets to offer as security.

How to Apply for an Instant Loan Online

Applying for an instant loan online in India is a straightforward process. Here are the steps involved:

Research Lenders: Start by researching various online lenders that offer instant loans. Compare their interest rates, loan amounts, tenures, and customer reviews to find a reputable lender that meets your needs.

Check Eligibility: Each lender will have specific eligibility criteria, such as age, income, and credit score. Ensure you meet these criteria before proceeding with the application.

Fill Out the Application Form: Visit the lender's website or mobile app and fill out the online application form. Provide accurate information and upload the required documents, such as identity proof, address proof, and income proof.

Submit the Application: Once you have filled out the form and uploaded the necessary documents, submit your application. The lender will review your application and verify the information provided.

Approval and Disbursement: If your application is approved, the lender will notify you, and the loan amount will be disbursed to your bank account. The entire process can take anywhere from a few minutes to a few hours, depending on the lender.

Important Considerations

While instant loans offer numerous benefits, there are a few considerations to keep in mind:

Interest Rates: Instant loans often come with higher interest rates compared to traditional loans due to the convenience and speed they offer. Make sure to compare rates from different lenders and choose one that offers competitive rates.

Repayment Terms: Ensure you understand the repayment terms, including the tenure and EMI amount. Borrow only what you can comfortably repay to avoid financial strain.

Hidden Charges: Some lenders may have hidden charges, such as processing fees, prepayment penalties, or late payment fees. Read the terms and conditions carefully to avoid any surprises.

Credit Score Impact: Timely repayment of your instant loan can positively impact your credit score, making it easier to obtain future loans. However, missed payments can harm your credit score, so it's crucial to make repayments on time.

Conclusion

Instant loans have revolutionized the way people access quick cash loan in India. Their convenience, speed, and minimal documentation requirements make them an attractive option for those in need of immediate financial assistance. However, it's essential to choose a reputable lender, understand the terms and conditions, and borrow responsibly. By doing so, you can make the most of instant loans and meet your financial needs efficiently.

0 notes

Text

The Evolution of eBay: The Idiots Guide

The Idiots Guide to eBay.

Make money online fast!

eBay, the world-renowned online marketplace, has left an indelible mark on the e-commerce industry since its inception in 1995. What started as a platform for individuals to buy and sell collectible items has transformed into a global marketplace hosting a myriad of products. In this comprehensive blog post, we will delve into the captivating history of eBay, elucidate the mechanics of using the…

View On WordPress

#A Tad Nerdy#article#atadnerdy#blog#eBay#fast money#follow#get rich#get rich from eBay#make money fast#make money online for free#money#news#online money#quick cash#sell online

0 notes

Text

Revolutionizing Financial Wellness: ATD-Money's Approach to Quick Loans and Advance Salary Solutions in India

In the world of digitalization and modern financing systems, access to quick and reliable loan solutions is crucial. ATD-Money emerges as a game-changer in the industry, offering innovative products and services to address the diverse financial needs of every individual across India. Let's explore how ATD-Money is revolutionizing the financial ecosystem with its unique approach to quick loans, instant cash disbursement, and advance salary solutions. Gone are the days of lengthy loan applications and waiting weeks to get approval. ATD-Money is redefining the borrowing experience with its digital, seamless, efficient process. Whether you need an instant loan, advance salary loan, or cash infusion to tide you over until payday, ATD-Money has you covered all across. Let's delve into the key features and benefits of ATD-Money's cutting-edge financial solutions.

Quick Loans for Instant Financial Relief:

Life is unpredictable and financial emergencies can strike when no one expected. ATD-Money understands the urgency of such situations and offers quick loans solutions as per your need to provide instant financial relief. With our easy application process and swift approval mechanism, you can access the funds you need in no time. Whether it's covering medical expenses or unexpected bills, our quick loans ensure that you're never caught off guard.

Advance Salary Loans:

Waiting for your next salary to cover the urgent expenses can be stressful. ATD-Money offers advance salary solutions to bridge the gap between paydays. Our advance salary loans allow you to access a portion of your upcoming salary in advance, providing much-needed financial flexibility when you need it the most. Say goodbye to financial worries and hello to peace of mind with ATD-Money's advance salary loans.

Instant Cash Disbursement:

When time is of the essence, waiting for funds to arrive can be frustrating for anyone. ATD-Money's instant cash disbursement feature ensures that you get access to your loan amount without any delay. Whether you're facing a medical emergency or any other unexpected expense, our instant cash disbursement ensures that you have the funds, when you need them the most.

Easy Application Process:

We understand that navigating through the loan application process can be daunting. That's why ATD-Money offers an easy and hassle-free application process. With just a few simple steps, you can complete your loan application online and get one step closer to financial freedom. Our user-friendly interface and dedicated customer support team are always there to guide you every step of the way.

Conclusion:

ATD-Money is not just a lender; it is a financial partner committed to helping you achieve your emergency requirements and overcome financial challenges. With our quick loans, advance salary solutions, and instant cash disbursement, we are revolutionizing the way people access financial assistance in India. Experience the convenience, speed, and reliability of ATD-Money's financial solutions and take control of your financial future today with a smile.

#quick cash loans#payday loans#personal loans#instant loan#cash loans#loan app in india#advance salary loan#fast cash loans online#loan apps

0 notes

Text

Apply for Instant Vehicle Loan Online: Your Quick Cash Solution

In today's fast-paced world, unexpected expenses can arise at any moment, leaving you in need of immediate funds. Fortunately, with the convenience of the internet, applying for instant vehicle loans online has never been easier. Whether you're in Kerrville, Killeen, Kingsville, Kilgore, or beyond, Texas Approval is here to provide you with hassle-free access to quick cash when you need it most. Let's explore how you can apply for instant vehicle loans online and get the funds you need without delay.

Understanding Instant Vehicle Loans

Instant vehicle loans, also known as title loans, allow you to borrow money using your vehicle's title as collateral. These loans are designed to provide quick access to cash for individuals who may not qualify for traditional loans due to poor credit or other financial challenges. With instant approval online, you can receive the funds you need within hours, making it a convenient solution for emergencies and unexpected expenses.

Title Loans Online Instant Approval

When it comes to applying for instant vehicle loans online, speed is of the essence. Texas Approval understands the urgency of your financial needs, which is why we offer title loans with Instant Loan approval Online. Our streamlined application process allows you to complete the entire process from the comfort of your own home, without the need for lengthy paperwork or time-consuming visits to our office. With just a few simple steps, you can get the funds you need with minimal hassle.

Easy Cash Loans Online

At Texas Approval, we believe in making the borrowing process as easy and convenient as possible for our customers. Our easy cash loans online are designed to provide you with quick access to funds without the stress and uncertainty of traditional lending options. Whether you need money for medical bills, car repairs, home improvements, or other unexpected expenses, our easy cash loans can help you get back on track financially.

Instant Loan Approval Online

With Texas Approval, you can enjoy instant loan approval online, ensuring that you receive the funds you need when you need them most. Our efficient approval process means that you can get approved for a loan within minutes, allowing you to access the cash you need without delay. Whether you have good credit, bad credit, or no credit at all, we welcome all applicants and strive to provide quick and convenient loan approval to everyone who applies.

Conclusion: Apply for Instant Vehicle Loan Online with Texas Approval

When you need quick cash to cover unexpected expenses, Texas Approval is here to help. With our instant vehicle loans online, you can get the funds you need with ease and convenience. Whether you're in Kerrville, Killeen, Kingsville, Kilgore, or anywhere else in Texas, our hassle-free application process and instant loan approval make it easy to get the cash you need when you need it most. Apply for an instant vehicle loan online with Texas Approval today and experience the convenience of quick cash solutions.

#online approval loans#title loans#online title loans#texas title loan#vehicle title loans#cash loans instant#title loans online instant approval#easy cash loans online#instant loan approval online#car title loans near me#cash for title loans#fast and easy cash loans#instant car title loans online#quick and easy cash loans#cash loans fast#cash for car title loans#vehicle title loans online#same day cash loans online#texas car title loan#fast title loan#car title loans online texas

0 notes

Text

Saskatchewan Car Title Loans: Your Lifeline for Borrowing in Tough Times

Facing a financial crunch? Don't fret! Our Saskatchewan Car Title Loans offer a lifeline for those in need of quick cash. Whether you have good credit, bad credit, or no credit at all, you can borrow against your car's title and get the funds you require. With flexible repayment options and competitive interest rates, our lending solutions are tailored to suit your financial situation. Say goodbye to the stress of borrowing and hello to financial freedom with our reliable car title loans.

#Saskatchewan Car Title Loans#car title loans Saskatchewan#title loans Saskatchewan#loan without a credit check#Get Cash against your car#borrow money on my car#quick loan with no credit check#loan online with no credit check

0 notes

Text

Short Term Loans for Emergency Cash Needs: Are They Right for You?

Imagine a typical Tuesday morning, and you’re sipping your coffee, ready to tackle the day. Then, out of the blue, your car decides to break down. The mechanic’s verdict? A hefty repair bill that you hadn’t planned for. Online short term loans often appear as a beacon of hope in such scenarios.

You might wonder, “Are online short term loans my best bet?” Well, it depends on several factors. These loans are, as the name suggests, loans that you can apply for online, typically to cover unexpected expenses.

While online short-term loans can offer a quick financial solution, it's essential to consider them with a sense of responsibility and understand the full implications of borrowing.

# The Allure of Online Short Term Loans

First, let’s paint a picture of why these loans are increasingly popular. Imagine you need emergency cash. Traditional loans from banks might take ages to process, and borrowing from friends can be awkward. Enter emergency loans online. They’re fast – often, the money can hit your account within a day. Plus, the convenience of applying from your couch, in your pyjamas, is undeniable. It’s like ordering a fast-food meal: quick and satisfying in the short term, but not always the best choice in the long run.

1. Speed and Convenience: The biggest draw is undoubtedly the speed. Many providers of these loans promise funds within a day or two, which is crucial when time is of the essence.

2. Fewer Requirements: Short loans online typically have fewer requirements than traditional loans.

3. Flexibility: These loans offer flexibility in terms of amount and repayment terms, allowing you to choose what works best for your situation.

However, it's important to be aware that this convenience comes with higher interest rates compared to traditional loans, which can make these loans more expensive over time.

# The Flip Side

It is crucial to consider the flip side while the ease and speed of these emergency loans online are appealing. High interest rates make loans more expensive over time. It is like getting a quick fix for your car with duct tape – it might solve the problem now, but it is not a long-term solution.

1. Higher Interest Rates: This is a significant drawback. The ease of access comes at a cost, usually in higher interest rates than long-term loans.

2. Potential for Debt Trap: If not managed wisely, these loans can lead to a cycle of debt. Borrowers sometimes find themselves taking out another loan to pay off the first, spiralling into a debt trap.

3. Hidden Fees: Be wary of hidden fees. Always read the fine print to understand all the charges involved.

So, the query arises: When to consider these loans? Short loans online are ideal for genuine emergencies - like unexpected car repair or a medical bill. They are not for impulsive shopping sprees. Think of them as a financial fire extinguisher. It is for emergencies and not for everyday use.

It's crucial to thoroughly read and understand the terms, interest rates, and any additional fees associated with these loans to avoid unexpected financial challenges.

### Making the Right Choice

How do you decide if an online short term loan is right for you? Consider the following:

Urgency of the Need: If the need is genuinely urgent and you can not wait for a traditional loan or save up, an emergency loans online might be the answer.

Understand the Terms: Be clear & conscious about the interest rates, repayment terms, and hidden fees.

Check Your Ability to Repay: This is crucial. Ensure you can repay the loan without getting into more debt.

Compare Options: Do not just jump on the first offer. Compare rates and terms from different lenders.

Keep in mind that lenders will assess your creditworthiness and ability to repay the loan before approval, which is an essential part of responsible lending practices.

# Alternative Solutions

Before you click on that “Apply” button for an emergency loan online, consider alternatives. Willing to cut back on some expenses? Is there a side hustle you can take up for extra cash? Sometimes, rerouting other avenues can save you from the loan stress.

Before deciding to apply for a short-term loan, consider alternative solutions such as adjusting your budget, exploring additional income sources, or seeking financial advice, which can often provide a more sustainable financial solution.

# Conclusion

Online short term loans are best used when you are confident in your ability to repay quickly and when other, less expensive options are not feasible. Whether it’s through emergency loans, personal savings, or other means, ensuring that you’re making the best decision for your situation is key.

While short-term loans can be a viable option in certain situations, they should be approached with caution. Ensure that any loan you consider aligns with your financial capabilities and long-term financial health.

0 notes

Text

This is definitely one of the better survey websites out there. It's easy and straightforward, every 5 surveys you do you get $5 bucks. Spent a couple hours my first day and made $10 and now I'm working on a $50 claim. $10/day is my target

fivesurveys.com

0 notes