#real estate companies ohio

Text

#real estate investment companies#equity pledge investments#commercial real estate#property investment company#real estate companies ohio#texas investment properties#real estate companies texas#ohio real estate market

1 note

·

View note

Text

0 notes

Text

Excerpt from this story from the New York Times:

At first glance, Dave Langston’s predicament seems similar to headaches facing homeowners in coastal states vulnerable to catastrophic hurricanes: As disasters have become more frequent and severe, his insurance company has been losing money. Then, it canceled his coverage and left the state.

But Mr. Langston lives in Iowa.

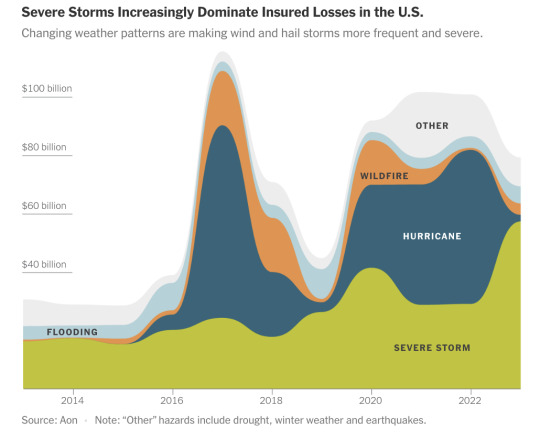

Relatively consistent weather once made Iowa a good bet for insurance companies. But now, as a warming planet makes events like hail and wind storms worse, insurers are fleeing.

Mr. Langston spent months trying to find another company to insure the townhouses, on a quiet cul-de-sac at the edge of Cedar Rapids, that belong to members of his homeowners association. Without coverage, “if we were to have damage that hit all 17 units, we’re looking at bankruptcy for all of us,” he said.

The insurance turmoil caused by climate change — which had been concentrated in Florida, California and Louisiana — is fast becoming a contagion, spreading to states like Iowa, Arkansas, Ohio, Utah and Washington. Even in the Northeast, where homeowners insurance was still generally profitable last year, the trends are worsening.

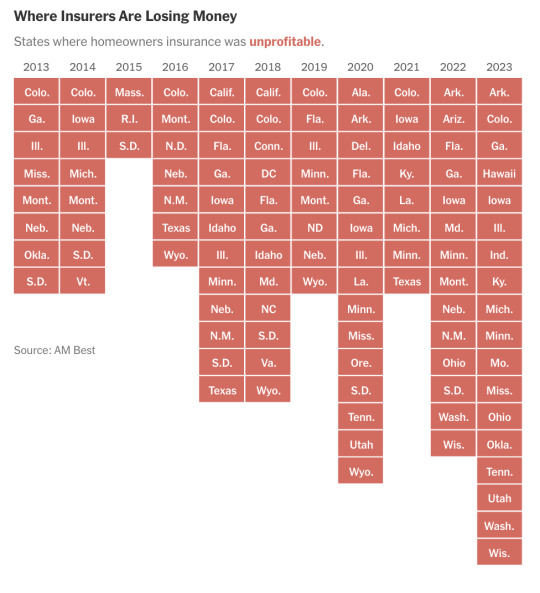

In 2023, insurers lost money on homeowners coverage in 18 states, more than a third of the country, according to a New York Times analysis of newly available financial data. That’s up from 12 states five years ago, and eight states in 2013. The result is that insurance companies are raising premiums by as much as 50 percent or more, cutting back on coverage or leaving entire states altogether. Nationally, over the last decade, insurers paid out more in claims than they received in premiums, according to the ratings firm Moody’s, and those losses are increasing.

The growing tumult is affecting people whose homes have never been damaged and who have dutifully paid their premiums, year after year. Cancellation notices have left them scrambling to find coverage to protect what is often their single biggest investment. As a last resort, many are ending up in high-risk insurance pools created by states that are backed by the public and offer less coverage than standard policies. By and large, state regulators lack strategies to restore stability to the market.

Insurers are still turning a profit from other lines of business, like commercial and life insurance policies. But many are dropping homeowners coverage because of losses.

Tracking the shifting insurance market is complicated by the fact it is not regulated by the federal government; attempts by the Treasury Department to simply gather data have been rebuffed by some state regulators.

The turmoil in insurance markets is a flashing red light for an American economy that is built on real property. Without insurance, banks won’t issue a mortgage; without a mortgage, most people can’t buy a home. With fewer buyers, real estate values are likely to decline, along with property tax revenues, leaving communities with less money for schools, police and other basic services.

And without sufficient insurance, people struggle to rebuild after disasters. Last year, storms, wildfires and other disasters pushed 2.5 million American adults out of their homes, according to census data, including at least 830,000 people who were displaced for six months or longer.

121 notes

·

View notes

Text

Alexander Miles, a prominent African-American inventor of the late 19th century, is best known for his groundbreaking invention - elevator doors that could open and close automatically. This invention transformed the safety of elevator rides, with automatic doors now considered a standard feature in modern elevators.

Born on May 18, 1838, in Circleville, Ohio, Alexander Miles was the son of Michael and Mary Miles. As a young adult, he relocated to Waukesha, Wisconsin, where he worked as a barber throughout the 1860s. It was while living in Winona, Minnesota, in 1870, that he met Candace J. Dunlap from New York City, who later became his wife. After the birth of their daughter, Grace, the family moved to Duluth, Minnesota.

In Duluth, Miles enjoyed significant success as a barber, setting up a barbershop in the four-story St. Louis Hotel. He smartly invested his savings into purchasing a real estate office. His business acumen led to him becoming the first Black member of the Duluth Chamber of Commerce. In 1884, Miles constructed a three-story brownstone building in an area that later came to be known as the “Miles Block.”

While taking elevator rides in his buildings, Miles noticed the dangerous risks associated with manually operated elevator shaft doors being left open. Determined to solve this problem, he invented a mechanism that allowed elevator shaft doors to operate at the correct times. The mechanism, which involved a flexible belt attached to the elevator cage touching drums positioned along the elevator shaft, automated the elevator doors through a series of levers and rollers. On October 11, 1887, Alexander Miles was granted a patent for his life-saving invention (U.S. Patent 371,207).

In 1899, Miles and his family moved to Chicago, Illinois, where he started The United Brotherhood, a life insurance company for Black customers who were denied coverage by White-owned firms. Eventually, Miles relocated to Seattle, Washington. Prior to his death on May 7, 1918, he was considered the wealthiest Black person in the Pacific Northwest area, largely due to the income from his invention. In recognition of his contributions, Alexander Miles was inducted into the National Inventors Hall of Fame in 2007.

Read more about Alexander Miles here.

228 notes

·

View notes

Text

Farming

High-rolling lawyer James Christophers is a name partner in a prestigious firm, specializing in liability cases for pharmaceutical clients. He is known for his handsome, muscular appearance and confident attitude. Despite his tight schedule, which includes early morning workouts and back-to meetings-back, James enjoys the city and life his spends weekends at bars gay, always with a new boyfriend in town.

Recently, James inherited a vast farm in the middle of nowhere in Northeast Ohio from his late uncle. As he was married to his mother's sister and childless, James is the sole heir. Although James flies to the farm in the company jet during weekends, he finds the intensity of combining the farm and his city life overwhelming.

It is during one of these visits that he meets Jackson, his neighbors' 20-year-old son. Jackson, who prefers to be called Jackie, reveals that he is on the brink of losing his wrestling scholarship if he doesn't win his next match.

In a surprising turn of events, James proposes a deal to Jackie. If Jackie loses the match, James will pay for his last year of tuition In return, Jackie agrees to work on the farm during his free time while attending school. Unfortunately, Jackie loses the match and immediately starts working on the farm. The initial weeks prove to be challenging as he tackles manual tasks such as harvesting and yard work, providing enough physical exercise to maintain his muscular physique. As the holidays approach and there is less work to do on the farm, Jackie realizes he has gained weight due to his continued wrestling diet.

In the spring, James visits the farm and unveils his plan for a flourishing agricultural business. He introduces a new fertilizer for wheat and corn, promising faster growth and larger yields. Although it is not yet available on the market, James decides to conduct a trial season. The whole village becomes interested, and James offers to share the results after the next harvest.

Even though there is a lot of hard labour Jackie keeps eating like he did as a wrestler, during the summer, Jackie continues to gain weight, reaching a staggering 260 pounds.

Also James sees his weight climbing. Despite the weight gain, the crops thrive, and James seizes the opportunity to sell his shares in the law firm and invest the money in expanding his farming business. The town becomes dependent on James for their seed supply, and he even keeps some wheat for the local bakery and corn for his own livestock.

Eventually, Jackie graduates and secures a job at a real estate company out of state. This leaves James in need of a solution the to farm work. He finds Danny, the son of a local baker.

Though Danny lacks ambition, he possesses a strong work ethic. Unfortunately, working alongside this young man becomes detrimental to James' fitness goals, as he gains weight due to the delicious goods from Danny's mom she prepares everyday for them.

Desperate to lose weight, James spends two months at a fitness resort. Upon his return, he successfully sheds the excess fat and gains some muscle, resulting in a weight of 205 pounds.

However, he quickly gains weight yet again after consuming too many pastries from the bakery, reaching 237 pounds. Concerned the about rapid weight gain, James reaches out to his previous clients for the trial reports, only to discover that the hormones in the seed additives cause an increase in appetite and muscle growth, as well as the faster storage of fat in humans and animals.

Faced with this startling revelation, James contemplates his options. After studying the fine prints he realizes that he is legally protected and not liable for the consequences of the seed additives. Unsure whether to inform the baker or Danny's mother, James decides to continue with the next season, planning to visit a fitness resort as soon as the seeds are planted. However, amid the increasing demands of his growing business and the rapid weight gain of his animals, he struggles to find a solution for his own weight.

Frustrated, James strikes a deal with Danny. In exchange for not revealing James' secret of not eating, to his mother, he pays Danny a bit more. Danny agrees to eats both his and James’ food his mother baked. Weeks and months pass, and James remains unable to lose the weight. Without the motivation of his previous lifestyle, he is less concerned about his appearance.

Meanwhile, Danny's newfound popularity because of his new size leads him to overeat even more from his mothers goods.

After a year, Danny has gained an astonishing 220 pounds of pure fat, reveling in his newfound sense of power and masculinity. In town, he becomes popular among girls who appreciate his larger frame. However, the consequences of his actions, as well as his increasing weight, continue to unfold.

#fictionalweightgain#maleweightgain#maleweightgainstories#weightgain#weightgainstories#fictionalstories

285 notes

·

View notes

Text

In 1905, Cincinnati Vainly Hoped To Double Its Population In Just Five Years

Talk about optimism! In 1905, the Cincinnati Post ran a contest looking for ideas on how Cincinnati could increase its population to 600,000 in time for the 1910 census, only five years hence.

Although Cincinnati was still a growing city – no census marked a decrease in our city’s population until 1960 – any notion that the population might top half a million, much less 600,000 was beyond ambitious. It was flat-out crazy. Still, the progressive Cincinnati Post [16 November 1905] persisted, announcing monetary prizes for the best ideas on how to achieve a population explosion in a few short years.

“If someone should start a 600,000 club in Cincinnati, it would become the biggest organization in the world. This is evident in the fact that every one in Cincinnati, and nearly every one in Southern Ohio, Indiana, Kentucky and West Virginia, would join it. Not only are the people of Cincinnati interested for the greater city, but those outside the city also.”

In the event that folks needed a little incentive beyond civic pride, the Post offered monetary rewards for the best ideas on how to increase the city’s population to 600,000 by 1910. First prize was $50, second prize was $25 and five third prizes of $5 rounded out the awards. From November 1905 into mid-January 1906, the Post published ideas as they arrived and interviewed city dignitaries about the ingenuity of the contest.

Among the celebrities interviewed about the initiative was Joseph B. Foraker, former governor of Ohio and current U.S. Senator from Ohio. He told the Post [15 November 1905]:

“Keep building skyscrapers. One can scarcely realize the great change that has come to the city. Why, from my window they are jumping up until the city is looking like an oil field. They are filled, too, just as rapidly as they are built. Make room for the people, and they will come along.”

Compared to some of the other ideas submitted to the Post, Senator Foraker’s suggestion was rather tame.

J. Louis Bunn, a house painter, suggested rerouting the Ohio River from Coney Island to Sedamsville southward into Kentucky, so that Covington, Newport, Bellevue and Dayton would be transplanted to Ohio and therefore become part of Cincinnati.

Frank Boies, a shoe-cutter, was convinced that closing all saloons on Sunday would do the trick.

Harry Dilg, an express delivery driver, lobbied for more championship prize fights being hosted by Cincinnati.

A contestant who signed his entry “Stranger” made a list of obstacles to Cincinnati’s growth. Would Cincinnati ever achieve 600,000 population? According to “Stranger”:

“Not as long as the Traction Company is not compelled to give the people better service. Not as long as the sweeping of any old rubbish, especially paper, off the sidewalk and into the street is allowed. Not as long as property-owners or their agents are indifferent to the appearance of property that has become vacant. Not as long as corporations are not compelled to think of others as well as themselves. The worst case of this kind will be found in the so-called ‘waiting room’ at the foot of Art Hill, sometimes called the Lock-st. Incline. W. Kesley Schoepf [president of the Traction Company] would not think of using it as a garage for his automobile, yet he expects patrons to ‘wait’ in there until one of his 5-cent carriages that you are compelled to stand up in half the time comes along.”

No newspaper contest, of course, would be complete without an entry from an adorable schoolgirl. The Post [28 December 1905] prominently blazoned the ideas of 13-year-old Gladys Schultz of Linwood, who wrote her contribution in verse:

“Annex all the villages in Hamilton County;

Give all small manufactories a bounty.

Exempt from taxation all chattels;

Help the businessman fight some of his battles.

Tax real estate all it will stand –

The banker can lend a helping hand.

Fill the Mill Creek Valley above high-water mark.

Build factories thereon with space for a park.

An underground railway, with a boulevard top,

Our unsightly canal will make a beautiful spot.

A union depot for all railroads to come in,

Will bring 600,000 by 1910!”

The Post encouraged contestants to submit multiple entries and John Miller, a harness maker, complied by compiling 36 ideas into a single entry. Mr. Miller [11 December 1905] covered quite a bit of territory with his suggestions, ranging from the mundane . . .

“22. For Cincinnati to send a letter of thanks to President Roosevelt and Secretary Taft for the good they did in the last election.”

. . . to the idealistic.:

“36. Abolish capital punishment.”

Along the way, Mr. Miller lobbied for more monuments, an eight-hour work day, honest elections, free schoolbooks in the public schools, more parks along the riverfront and better service at the city hospital.

The winner of the big $50 prize was Marion L. Pernice Jr., assistant advertising manager of the Fay & Egan Company, manufacturers of woodworking machinery. His suggestion boiled down to essentially one word: Advertise! Pernice suggested that all goods manufactured in Cincinnati be labeled “From Cincinnati” and that only goods manufactured in Cincinnati be eligible for that slogan. All suburban manufacturers would lobby for annexation to Cincinnati to carry that prestigious mark.

Alas, the contest did not achieve its stated goal. Cincinnati’s population in 1905, approximately 340,000, reached only 364,000 in 1910. Evan worse, the census of 1910 marked the first time since 1830 that Cincinnati was not ranked among the largest 10 cities in the United States. It would be 1950 before Cincinnati achieved 500,000 residents and 60 years of population decline followed until an uptick in the 2020 census.

And yet, no serious discussion about re-channeling the Ohio River.

9 notes

·

View notes

Text

Alexander Miles (May 18, 1838 – May 7, 1918) Born near Circleville, Ohio to Michael Miles and Mary Pompy, he is an inventor known for patenting his design for improving the automatic opening and closing of elevator doors. The patent was issued on October 11, 1887 (US Patent 371,207).

He moved to Winona, Minnesota in 1870 and met his wife, Candance J. Dunlap. In 1879, he relocated his family to Duluth after the birth of their daughter.

Before moving to Winona, Minnesota, he began exploring his passion for inventing, first by creating hair care products while working as a barber in Wisconsin. He began operating a barbershop in the St. Louis Hotel. By using his earnings to purchase a real estate office, he became the first African-American member of the Duluth Chamber of Commerce. In 1884, he erected a three-story brownstone building in Duluth, transforming the surrounding area into “Miles Block.” began developing his concept to improve the function of the elevator door.

Despite John W. Meaker’s patented invention of the first automatic elevator door system (US Patent 147,853) in 1874, many elevators still required the doors and the shaft to be manually opened and closed. He became concerned with the dangerous risks associated with elevators once he noticed a shaft door left open during a ride with his young daughter. Although Meaker received the patent first, it was his innovation that made electric-powered elevator doors widely accepted around the world. Today, the influence of his patent is present in modern designs for elevator systems in which automatic doors are a standard feature.

He and his family relocated to Chicago, where founded The United Brotherhood, a life insurance company that sold life insurance primarily to African Americans who could not get coverage from white-owned firms. Due to Chicago’s economic challenges at the time, he and his family relocated once again to Seattle. Partly because of the success of his invention, he was known to be the wealthiest African American in the Pacific Northwest region. In 2007, he was inducted into the National Inventors Hall of Fame. #africanhistory365 #africanexcellence

8 notes

·

View notes

Text

A Nebraska lawmaker whose north Omaha district has struggled for years with a housing shortage is pushing a bill that, if passed, could make Nebraska the first in the country to forbid out-of-state hedge funds and other corporate entities from buying up single-family properties.

Sen. Justin Wayne’s bill echoes legislative efforts in other states and in Congress to curtail corporate amassing of single-family homes, which critics say has helped cause the price of homes, rent and real estate taxes to soar in recent years. Wayne said that has been the case in his district, where an Ohio corporation has bought more than 150 single-family homes in recent years — often pushing out individual homebuyers with all-cash offers. The company then rents out the homes.

Experts say the scarcity of homes for purchase can be blamed on a multitude of factors, including sky-high mortgage interest rates and years of underbuilding modest homes.

RISING RENT PRICES PUSH RECORD NUMBER OF AMERICANS TOWARD HOUSING CRISIS, PROMPTING LEGISLATIVE ACTION

Wayne's bill offers few specifics. It consists of a single sentence that says a corporation, hedge fund or other business may not buy single-family housing in Nebraska unless it's located in and its principal members live in Nebraska.

"The aim of this is to preserve Nebraska's limited existing housing stock for Nebraskans," Wayne said this week at a committee hearing where he presented the bill. "If we did this, we would be the first state in the country to take this issue seriously and address the problem."

A 14-page bill dubbed the End Hedge Fund Control of American Homes Act has been introduced in both chambers of Congress and would impose a 10-year deadline for hedge funds to sell off the single-family homes they own and, until they do, would saddle those investment trusts with hefty taxes. In turn, those tax penalties would be used to help people put down payments on the divested homes.

Democratic lawmakers in a number of other states have introduced similar bills, including in Minnesota, Indiana, North Carolina and Texas, but those bills have either stalled or failed.

The housing squeeze coming from out-of-state corporate interests isn't just an Omaha problem, said Wayne Mortensen, director of a Lincoln-based affordable housing developer called NeighborWorks Lincoln.

Mortensen said the recession of 2008 and, more recently, the economic downturn driven by the COVID-19 pandemic made single-family housing a more attractive corporate investment than bond markets.

"When that became the case, housing was commoditized and became just like trading any stock," he said. "Those outside investors are solely interested in how much value they can extract from the Lincoln housing market."

Those corporations often invest no upkeep in the homes, he said.

"And as a result of that, we're seeing incredible dilapidation and housing decline in many of our neighborhoods because of these absentee landlords that have no accountability to the local communities," Mortensen said.

Currently, about 13% of single-family homes in Lincoln are owned by out-of-state corporate firms, he said.

As in other states, Wayne's bill likely faces an uphill slog in the deep red state of Nebraska. At Monday's hearing before the Banking, Insurance and Commerce Committee, several Republican lawmakers acknowledged a statewide housing shortage, but they cast doubt on Wayne's solution.

"You know, you can set up shell companies, you set up different layers of ownership. You can move your domicile base. There's just a ton of workarounds here," Omaha Sen. Brad von Gillern said. "I also — as just as a pure capitalist — fundamentally oppose the idea."

14 notes

·

View notes

Text

May Company Building (The May)

158 Euclid Ave.

Cleveland, OH

The May Company Ohio was a chain of department stores that was based in Cleveland, Ohio. In 1899, David May, the founder of May Department Stores, acquired E. R. Hull and Dutton Co. of Cleveland on Ontario Street, renaming it May Company, Cleveland. In 1914 May added an additional landmark building on Euclid Avenue, fronting on the southeast corner of Public Square. The high-rise building stands 149 feet and contains 8 floors of space, though floors 7 and 8 were not added until 1931. May's Cleveland headquarters building was listed with the National Register of Historic Places on January 18, 1974. In 1989 May Company, Cleveland and O'Neil's, based in Akron were merged to form May Company Ohio, as the May Department Stores began consolidating its regional department store divisions. On January 31, 1993 May Company, Ohio was merged into Kaufmann's of Pittsburgh, Pennsylvania, and its Downtown Cleveland store was closed. Many of its former locations became Macy's in 2006.

In late 2013, it was announced that the May Co. building was set to house potentially over 350 apartments. Bedrock-Detroit, a real estate company co-founded by Dan Gilbert, bought the May Company Building on Public Square in 2017 for $12 million with plans to convert it to 308 apartments, almost 600 interior parking spaces, retail stores, and rooftops for entertainment and green areas for residents' use. The opening date for the $140M renovation was expected to be in June 2020, but construction was delayed due to the COVID-19 pandemic. Once the third largest department store in the country, The May rises 149 feet tall and spans 880,000 square feet. With a three-story open air atrium and expansive loft-like floor plans, The May offers uniquely spacious living.

2 notes

·

View notes

Text

Opportunistic Purchase of Building on Chicago’s “Magnificent Mile”

In August 2024, one of the most historic retail and office properties along Chicago’s “Magnificent Mile” changed hands. In a deal that has implications for the local real estate market, North American Real Estate, a Chicago-based company, purchased the landmark building at 605 North Michigan Avenue from NY-based Brookfield Properties. The transaction was executed at $47 million, which amounts to $691 per square foot. This was a steep discount from its 2016 value.

The four-story, 68,000-square-foot building features distinctive Gothic columns and occupies a central location at the Michigan Avenue and Ohio Street intersection. Among its major tenants are Chase, the architectural firm KTGY, and Sephora. The co-working company Regus recently left, leaving several vacancies on the upper floors.

The purchase was 66 percent less than its most recent selling price of $140 million in 2016. Given sustained weakness in the office and commercial markets following the pandemic, it’s indicative of the type of opportunistic purchase of distressed properties that are currently on the rise. To market watchers, the deal reflects “contrarian optimism” for Chicago’s central business district, which presents the unique opportunity for revitalization, as new tenants, attracted by reasonable rates, repopulate office space.

0 notes

Text

Buy Properties in Ohio

Looking to buy properties in Ohio? Red Barn Homebuyers, a reputable real estate investment franchise company, offers great opportunities.

Buy Properties in Ohio

Click Here For More Info:-

https://redbarnhomebuyers.com/ohio/

0 notes

Text

Empowering Small Businesses with Consumers SBA Loans

For entrepreneurs seeking financial support, Consumers SBA loans provide an essential resource to help small businesses grow and thrive. These loans, backed by the U.S. Small Business Administration, offer competitive interest rates and longer repayment terms, making them more accessible to businesses that might struggle to obtain traditional financing.

Consumers SBA loans are designed to meet a variety of business needs, from covering daily operating expenses to purchasing equipment or real estate. By providing a flexible and reliable financing option, these loans help small businesses strengthen their financial foundations and fuel long-term growth.

Simplified SBA Loan Services in Ohio

Navigating the loan application process can be daunting, but SBA loan services OH streamline the process for business owners in Ohio. By partnering with experienced lenders who specialize in SBA loans, businesses can access tailored financial solutions to meet their specific needs.

Ohio-based SBA loan services simplify everything from the initial application to loan approval, ensuring that small businesses can secure the funding they need to stay competitive. Whether a business is just getting off the ground or looking to expand, these services offer valuable support.

Invest in Long-Term Success with SBA 504 Loans in Ohio

The SBA 504 loan Ohio program provides small businesses with long-term, fixed-rate financing for major purchases such as commercial real estate, equipment, or facility upgrades. This loan is ideal for companies that want to make significant investments in their future without disrupting their cash flow.

By offering lower down payments and extended repayment periods, SBA 504 loans make it easier for Ohio businesses to invest in assets that will drive long-term growth. From purchasing new facilities to upgrading existing infrastructure, these loans provide the financial foundation businesses need to expand.

Flexible Funding Options with SBA 7(a) Loans in Ohio

When it comes to versatile financing, the SBA 7(a) loan Ohio is one of the most popular options for small business owners. This loan program offers funding for a variety of purposes, including working capital, equipment purchases, real estate, and even debt refinancing.

With flexible terms and competitive interest rates, SBA 7(a) loans give Ohio businesses the opportunity to secure the financing they need without straining their cash flow. Whether expanding into new markets or managing operational costs, the SBA 7(a) loan provides the financial support required to achieve business goals.

Why SBA Loan Services Are a Game Changer for Ohio Businesses

Access to SBA loan services Ohio is a critical advantage for small businesses. These services offer personalized guidance, making the complex process of applying for an SBA loan easier and more efficient. Ohio businesses can tap into a range of SBA-backed financing options that support everything from day-to-day operations to large-scale expansion efforts.

By utilizing these loan services, businesses can secure funding with favorable terms, ensuring they have the financial stability needed to succeed. Whether you're a startup or an established company, SBA loan services in Ohio provide the tools to fuel your business's future.

0 notes

Text

Finding the Right Columbus Real Estate Agents and Companies for Your Next Move

When it comes to buying or selling property in Columbus, Ohio, partnering with the right professionals can make all the difference. Columbus is a dynamic and growing city with a vibrant real estate market, offering a variety of options for homebuyers and investors alike. Whether you’re a first-time buyer or an experienced investor, understanding the role of Columbus real estate agents, Columbus real estate companies, and how to navigate Columbus real estate listings can help you make informed decisions and achieve your real estate goals.

Why Choose Columbus Real Estate Agents?

Columbus real estate agents play a crucial role in the home buying and selling process. They bring local market knowledge, negotiation skills, and expertise in navigating the complexities of real estate transactions. The right agent can help you identify properties that meet your criteria, provide insights into the neighborhoods of Columbus, and assist in negotiating favorable terms.

When choosing Columbus real estate agents, consider their experience, reputation, and specialization. Look for agents who are well-versed in the specific areas you’re interested in, whether it’s a bustling urban neighborhood or a quiet suburban enclave. A knowledgeable agent will not only help you find the perfect home but also guide you through the process of making an offer, securing financing, and closing the deal.

The Role of Columbus Real Estate Companies

Columbus real estate companies offer a wide range of services that extend beyond individual agents. These companies often have a team of experts who can provide comprehensive support throughout your real estate journey. From marketing your property to managing transactions, Columbus real estate companies have the resources and expertise to handle various aspects of the real estate process.

When working with Columbus real estate companies, you benefit from their extensive networks, marketing strategies, and local market insights. These companies often have access to a broad range of resources, including professional photographers, staging experts, and advanced technology to showcase your property effectively. Additionally, they can offer valuable advice on market trends, pricing strategies, and investment opportunities.

Navigating Columbus Real Estate Listings

Columbus real estate listings are an essential tool for finding your next property. These listings provide detailed information about available homes, including photos, descriptions, and pricing. They allow you to explore different neighborhoods, compare properties, and identify options that fit your needs and budget.

To make the most of Columbus real estate listings, use filters to narrow down your search based on criteria such as price range, location, and property type. Working with a knowledgeable real estate agent can also help you interpret listings and identify properties that might not be immediately obvious. An agent can provide additional context, such as recent sales data and neighborhood trends, to help you make an informed decision.

Conclusion

Whether you’re looking to buy, sell, or invest in real estate in Columbus, Ohio, collaborating with experienced Columbus real estate agents and reputable Columbus real estate companies can significantly enhance your experience. By leveraging their expertise and utilizing comprehensive Columbus real estate listings, you’ll be well-equipped to navigate the local market and achieve your real estate objectives.

For personalized assistance and expert guidance, consider reaching out to professionals who are deeply familiar with the Columbus real estate landscape. With the right support, your next real estate venture in Columbus can be both successful and satisfying.

#Long Term Short Term Investment#Investors Consulting Group#Columbus Real Estate Agents#Columbus Real Estate Companies#Columbus Real Estate Listings

0 notes

Text

Selling an Inherited Property in Northeast Ohio? Here's What You Need to Know

Have you recently inherited a property in Northeast Ohio and now looking for some reliable cash house buying companies? Well, Skymount Buys Houses is here to help.

Inheriting a property may seem like winning the lottery initially, but soon, people realize the attached complications, like maintenance costs, property tax, etc. Selling your property for cash would be the smartest move in this scenario.

Having said that, it's really important to know the ins and outs of selling inherited properties in Northeast Ohio. So, here's everything you need to know to get a hassle-free experience.

Understand Your Options:

First of all, you have choices. You may sell, rent, or live in the house yourself. If you no longer want the property or have the time and money to maintain a second home, selling may be your best option. In that case, you are down to two major options - get a real estate agent or sell it to a cash home buyer like us. Of course, both have their benefits and shortcomings, but selling your home for cash can be the quickest way to get it off your hands, particularly if substantial repairs are required.

Know the Market in Northeast Ohio:

Wait. Don't put up the "For sale" sign yet. You need to learn about the local real estate market first. Northeastern Ohio covers a huge area. So, the price in Cleveland will differ from that in Akron. Some properties sell quickly, especially in desirable locations, whereas others languish on the market for months. Cash house buying companies can help sell your house in any area and condition without falling prey to red tape.

Prepare for the Financial Side:

Yes – “The TAX”. You'll have to pay your fair share of taxes when you sell an inherited property. So, it would help if you understood the capital gains taxes or taxes of any sort that may apply. You can always contact a tax accountant or real estate attorney to ease things up.

Consider the Emotional Aspects:

Selling an inherited house can be a very emotional experience. Maybe you spent a long time here during your childhood, or your ancestors lived here. We suggest you take your time before letting go. If you feel that selling is the most sensible option, look for a reputable cash home buyer.

Conclusion:

Selling your inherited property shouldn't be a stressful encounter. At Skymount Buys Houses, we have sold over 200 properties in Northeast Ohio, and we fully understand and respect its emotional and financial aspects. So, contact us today to get the best price for your inherited property.

0 notes

Text

Your search for a roofing company, siding installer, or gutter specialist in Columbus, Ohio, ends here. Property owners, real estate agents, and landlords are all Buckeye Real Estate Investments & Services Inc. clients. In choosing Roofing Remodelling Services Ohio, you can rest assured that you will receive the highest quality materials and artistry, regardless of the scope of your job. To launch your project immediately, please get in touch with us.

0 notes

Text

Westward Ho! Cincinnati Men Caught The California Gold Fever In 1849

It took a long time in 1848 for news to travel from California to Cincinnati. Gold was discovered at Sutter’s Mill, northeast of San Francisco, in January of that year, but Cincinnatians remained blissfully unaffected by gold fever until the middle of September.

By December 1948, Cincinnati merchants were placing advertisements in the local papers, offering camping and mining supplies to young men heading westward. As the new year of 1849 dawned, Cincinnati was fully possessed by visions of gold. Local newspapers printed dozens of announcements similar to this one, from the Commercial Tribune [23 February 1849]:

“A party of enterprising gentlemen of this city, completed their arrangements yesterday, packed up their trappings, and took passage on the steamer Chief Justice Marshall, for California. They design to sail from New Orleans, and either cross the Isthmus, or take the land route, via City of Mexico. The choice of these routes depends on contingencies. The party is composed of the brothers Moses, Mr. Collins, jeweler, and Messrs. Varney, Light, Vater, and the brothers Fagan.”

The Cincinnati Commercial [9 March 1849] reported on a company of 20 Cincinnatians setting out on the overland route to California, with a plan to cover expenses by selling gunpowder:

“They take with them one hundred kegs of powder, which on their arrival will be distributed, five kegs to each man – thus furnishing each a handsome capital to start on.”

In April, the “Independent Pacific Dispatch Company,” composed of 25 Cincinnati men, departed, also on the overland route. They loaded their pack mules onto the steamboat John Hancock, bound for Independence, Missouri, where they would commence hoofing across the continent.

As a major port along the Ohio River, Cincinnati not only witnessed local boys departing for the gold fields, but steamboats full of similarly determined young men passing through town. The Commercial Tribune [14 April 1849] was agog at the mass of virility floating westward down the Ohio:

“The tide of emigration to California is, in its extent, beyond all historical parallel; and will, in future times, stand prominent as the great event of the Nineteenth Century.”

Many of those adventurers, especially those from rural districts, stopped in Cincinnati to stock up on the supplies required to operate a basic gold-mining operation. Our shopkeepers were delighted to welcome the business. Gustav Sellin, purveyor of tin goods, advertised a gold-washing machine “of the most ingenious construction,” along with wash bowls, scoops and strainers. Philip Pike touted his “Imitation French Brandies, Holland Gin, Rum and Wines,” guaranteeing that a thousand-dollar investment in his beverages could be recouped for twenty times that amount in the thirsty gold fields. Miller Cornelius Sanders Bradbury boasted about his novel “steam-dried flour” warranted not to sour or get moldy for two years – ideal for the long trail westward.

Some Cincinnati businessmen just surrendered and joined the migration. Real estate mogul Thomas Hurst put a flour mill out near Sedamsville up for sale along with eight houses in the city. He was, as they say in the trade, a motivated seller. He closed his advertisement with this explanation:

“As I am making preparations for California, application should be made soon.”

Once folks arrived in California, they often discovered that panning for gold was not exactly as advertised. For instance, Benjamin Cory (Miami University Class of 1842, Medical College of Ohio Class of 1845) was busily engaged trading clothing to Native Americans in exchange for gold. Called to attend to a wealthy ranchero, Doctor Cory found himself trapped. In a letter home, Cory complained:

“My patient is quite smart this morning; he says I shall not leave him till all danger is over. ‘Charge what you please, Doctor,’ he says, ‘and it shall be paid; here is my ranch, with its horses, cattle, &c. &c. and I have a good large bag of gold.’ I am sorry, dear brother, that I ever had doctor stuck to my name; it is more trouble than profit; I am vexed to death; I tell people that I can get more gold in the mountains by digging and trading, than my conscience will permit me to charge my patients.”

Doctor Cory ended up doing okay for himself. The 1909 Miami University alumni directory notes that, before he died in 1896, he was elected to the first legislature of the new state of California in 1850 and had a distinguished medical career in Santa Clara and San Jose.

Joseph Talbert, a carpenter, who left Cincinnati in February 1849, wrote home that his traveling party of fifty had arrived safely in the gold fields. Talbert, however, after trying to mine gold for a couple of weeks, learned he could make more money as a carpenter, building cabins and gold-washing sluices than he could actually trying to find gold.

The Guysi brothers quit their jobs at B.F. Greenough’s lamp oil distillery on Main Street and endured a sea voyage of 160 days to round the tip of South America. They arrived in a San Francisco of 30,000 souls mostly housed in tents and suffering from dysentery. The only water available was polluted with copper, a spot of ground large enough to pitch a tent rented for $150 a month, and gambling was rampant. At least one of the brothers, Jacob, stuck it out; he was buried in the hills overlooking San Francisco Bay when he died at age 79 in 1906.

Joe Heywood had a solid career and sterling prospects here in Cincinnati. He was a butcher by trade, and regularly made the newspapers for the quality of his provender and the skill with which he decorated his shop. He was repeatedly referred to as a very handsome man who cut a dashing figure as a volunteer fireman. He was also known as a dependable “b’hoy” – a tough character – in the days when volunteer fire companies battled over which would put out the fire and collect the insurance money. Still, the Cincinnati Commercial of 9 January 1849 recorded the westward emigration of Heywood, along with Mathias Oliver, James Wilson, Alexander Burns and James McAlpin, all stalwarts of the “Rovers” fire company.

While most young men trudged west in hopes of sending pounds of bullion home, Heywood had no intention of digging anything once he got to California. Instead of packing a pick and shovel, Heywood had 1,500 cards printed to announce his business as a butcher and provision merchant. He seems to have succeeded admirably. After a sea voyage of 156 days, Heywood arrived in San Francisco and set up shop. A letter from a fellow firefighter reported that Heywood replicated the annual Cincinnati Christmas meat parade at his shop that December. Heywood himself wrote a long letter home describing his adventures aboard the ship and promising to write as soon as he could to “Lizzy.” He must have been persuasive. Joseph Heywood and Miss Eliza L. Hensley of Cincinnati were joined in matrimony on 1 July 1856 at San Francisco’s International Hotel.

7 notes

·

View notes