#residential real estate valuation services

Text

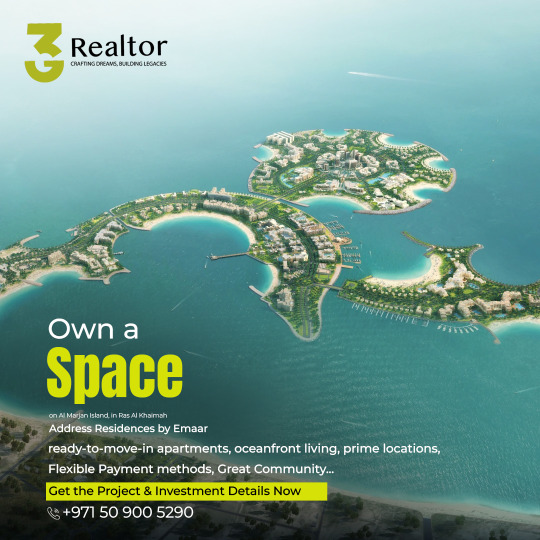

#Unlock your path to prosperity with the best real estate investment opportunities in the UAE! 🏡 Explore strategic property investments in Du#property valuation#and portfolio management services for profitable ventures. 💰 Discover the best residential and commercial real estate investments#guided by the top 10 investment planning strategies. 📊 Mitigate risks with our expert risk assessment in property investments. 🛡️ Explore r#RealEstateInvestment#PropertyConsultants#InvestmentAdvisors#RealtyExperts#StrategicInvestments#ProfitableVentures#InvestmentOpportunities#ResidentialInvestments#CommercialRealEstate#MarketAnalysis#PropertyValuation#PortfolioManagement#InvestmentPlanning#RiskAssessment#WealthBuilding#RentalProperty#MarketTrends#AssetGrowth#PropertyDevelopment#InvestmentStrategies#DubaiRealEstate#UAERealty 🌟

1 note

·

View note

Text

vimeo

Canterbury Appraisals is a FREE online service that provides FREE House Market Appraisal by connecting homeowners with local real estate experts.

#Canterbury Appraisals#Canterbury Appraisals near me#FREE online service#FREE House Market Appraisal#House Market Appraisal#House Market#local real estate experts#local real estate expert#canterbury appraisals#canterbury mortgage advisor#property valuation christchurch#canterbury property#canterbury property appraisal#Expert property appraisals#Trusted property valuations#Affordable house valuations#Real estate appraisal near me#Property valuation companies Christchurch#House valuations Canterbury#Residential property valuations Christchurch#Vimeo

0 notes

Text

Expert Advice on Choosing a Mortgage Company in UAE

Choosing the right mortgage company in the UAE is essential for securing favorable mortgage terms and rates. This guide will provide expert advice on selecting the best mortgage company for your needs.

For more insights into Dubai's real estate market, visit Dubai Real Estate.

Understanding the UAE Mortgage Market

Market Overview: The UAE mortgage market is diverse and competitive, with a wide range of local and international banks offering various mortgage products. Understanding the market landscape is essential for making the right choice.

Types of Mortgages: Mortgages in the UAE can be classified into fixed-rate and variable-rate mortgages. Fixed-rate mortgages provide stability with consistent monthly payments, while variable-rate mortgages fluctuate based on market conditions.

Eligibility Criteria: Each mortgage company has its own eligibility criteria, including income requirements, employment status, and credit history. Understanding these criteria will help you identify which companies you qualify for.

For more investment options, explore Buy Residential Properties in Dubai.

Key Features of Mortgage Companies

Competitive Interest Rates: Leading mortgage companies offer competitive interest rates, helping you save money over the loan term. Compare the rates offered by different companies to find the best deal.

Flexible Loan Terms: Look for mortgage companies that offer flexible loan terms, including various repayment periods and options for early repayment without penalties.

Customer Service: Excellent customer service is essential when dealing with mortgage companies. Choose a company with a strong reputation for providing responsive and helpful support.

Quick Approval Process: The approval time for mortgages can vary between companies. Select a company known for its quick and efficient approval process to avoid delays in your property purchase.

Additional Services: Some mortgage companies offer additional services such as mortgage insurance, property valuation, and financial planning advice. These services can add value and convenience to your mortgage experience.

For mortgage services, visit Commercial Mortgage Loan in Dubai.

Steps to Choosing the Right Mortgage Company

Research and Compare: Start by researching various mortgage companies in the UAE. Use online platforms, read customer reviews, and compare their mortgage products and services.

Seek Recommendations: Ask friends, family, or colleagues for recommendations. Personal experiences can provide valuable insights into the reliability and efficiency of different mortgage companies.

Consult a Mortgage Broker: A mortgage broker can provide expert advice and help you find the best mortgage deals. They can also assist with the application process and negotiations.

Pre-Approval: Get pre-approved for a mortgage to understand your borrowing capacity and increase your chances of securing a good deal. Pre-approval also makes you a more attractive buyer to sellers.

Meet with Representatives: Schedule meetings with representatives from different mortgage companies to discuss your needs and ask questions. This will help you gauge their responsiveness and willingness to assist.

Review Terms and Conditions: Carefully review the terms and conditions of the mortgage offers. Pay attention to interest rates, loan terms, fees, and any other conditions that may affect your mortgage.

For property management services, visit Apartments For Rent in Dubai.

Popular Mortgage Companies in UAE

HSBC: Known for its competitive interest rates and flexible mortgage options, HSBC is a popular choice for homebuyers in the UAE.

Emirates NBD: Emirates NBD offers a range of mortgage products tailored to different needs, along with excellent customer service and quick approval times.

Mashreq Bank: Mashreq Bank provides personalized mortgage solutions with attractive rates and minimal fees, making it a preferred choice for many buyers.

ADCB: Abu Dhabi Commercial Bank (ADCB) offers comprehensive mortgage products with competitive rates and flexible repayment options.

Dubai Islamic Bank: For those seeking Sharia-compliant mortgage solutions, Dubai Islamic Bank offers a variety of Islamic mortgage products with favorable terms.

For property sales, visit Villas For Sale in Dubai.

Real-Life Success Story

Consider the case of Fatima and Zayed, who recently purchased their dream home in Dubai. By working with a reputable mortgage company, they secured a mortgage with favorable terms. The mortgage company provided expert advice, handled the paperwork, and ensured a smooth process from start to finish. This allowed Fatima and Zayed to focus on finding their perfect home without worrying about the complexities of securing a mortgage.

For more insights into Dubai's real estate market, visit Dubai Real Estate.

Future Trends in the UAE Mortgage Market

Digitalization: The UAE mortgage market is embracing digitalization, with many companies offering online application processes, digital document submission, and virtual consultations. This trend is making the mortgage process more efficient and convenient.

Sustainable Mortgages: There is a growing demand for sustainable mortgages that support environmentally friendly and energy-efficient homes. Mortgage companies are beginning to offer products that cater to this demand.

Flexible Mortgage Products: Mortgage companies are increasingly offering flexible mortgage products that cater to the diverse needs of homebuyers. This includes options for expatriates, first-time buyers, and investors.

For property sales, visit Sell Your Property in Dubai.

Conclusion

Choosing the right mortgage company in the UAE involves careful research, comparison, and consideration of various factors. By understanding the market, seeking recommendations, and evaluating your options, you can secure a mortgage that meets your needs and financial goals. For more resources and expert advice, visit Dubai Real Estate.

5 notes

·

View notes

Text

At your service for your REAL ESTATE BROKERAGE & APPRAISAL needs.

1.Brokering in SELLING or BUYING Real Estate properties.

2.Real Estate MORTGAGING & LEASING.

3.Government levy auction and forfeiture of Real Estate property.

4.JUST COMPENSATION and other claims.

5.BANK LOAN FACILITATION: Business/Housing

6.REAL ESTATE DOCUMENTATION: Real Estate Taxes; Land Title and Tax Declaration Transfer of Ownership.

7.Real Estate APPRAISAL/VALUATION.

8.Due Diligence

9.Real Estate Tax issues, Estate Tax settlement & processing (BIR CERTIFICATE AUTHORIZING REGISTRATION (CAR))

10.Titling Assistance (Free Patent, Homestead Patent & Residential Free Patent)

11.DAR Clearance.

For inquiries and more information you may call or text.

09278205986 - globe

09603299290 - smart

JOSUE BIOLON SECORIN

Licensed Real Estate Broker

PRC No. 0032836

Licensed Real Estate Appraiser

PRC No. 0011328

DHSUD: R13-B01/2023-5156

AIPO No. B-32836-PHILRES

PTR No. 133266

2 notes

·

View notes

Text

Rely on professional real estate broker: Advantages and services offered

A real estate agency is a company where professionals from different industries gather under one roof and can help you in the difficult process of buying, selling, and renting real estate. These are realtors, lawyers, mortgage brokers, and other professionals. Thanks to their work, you can enter the transaction as quickly as possible and conduct it extremely safe. Real estate transactions with the help of intermediaries are currently considered the most modern and civilized way of conducting transactions, especially when it comes to large cities.

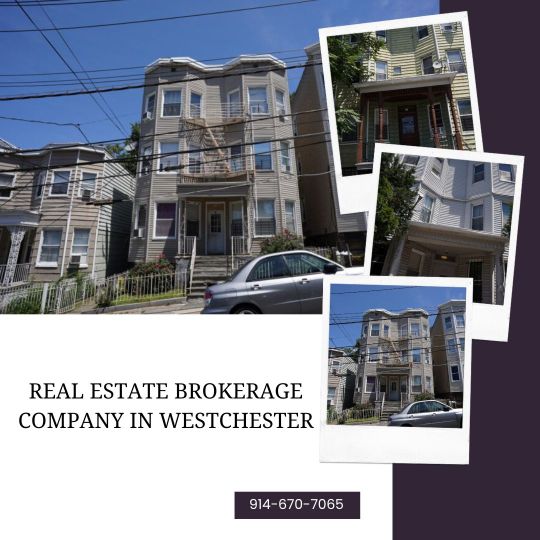

The advantages of working with a Real Estate Brokerage Company in Westchester can be listed for a long time:

Saving time that you would have spent on an independent selection of options or searching for a buyer;

Negotiations with sellers/buyers are handled by an agent who protects your interests;

No need to spend time and money advertising your property;

You can get discounts and privileges from developers and banks that are not available to outsiders.

What services do real estate agencies offer?

There are agencies that specialize in one thing: new buildings, commercial real estate, and luxury residential complexes. But most companies are universal, and large ones are able to offer a range of related services: legal advice, mortgages, insurance, real estate valuation, etc.

Consider the list of basic services:

Buying a property (house, plot, office, garage, etc.) - the client is guaranteed the help and advice of an experienced realtor, legal support, the conclusion of an agreement that guarantees the quality of services, and access to an expanded database of objects.

The housing exchange is one of the most difficult transactions since it involves searching for housing of equal value with many conditions, especially if the exchange is not within the same city but between cities and even regions. Such a deal is almost impossible to do on your own, and not every agent can do it; only a professional who can guarantee the result and legal purity will undertake it.

Renting a home/commercial property – this service is especially convenient if you are moving and are not able to rent a house on your own. The agent will select an apartment for you according to your requirements and make sure that the contract with the owner is official and protects your rights.

Selling real estate - a realtor helps to write an ad, take high-quality photographs, place an offer on specialized sites, and organize an advertising campaign. Most often, the buyer is in the next couple of months. Some agencies themselves buy apartments at a liquidation price and then sell them - this is convenient if the owner urgently needs to get rid of housing and get money.

Mortgage Brokerage Services - Some agencies help you complete the paperwork and apply for a mortgage loan, can advise on the most suitable program and favorable terms, assist in refinancing an existing loan and advise on mortgage issues. Thanks to the cooperation of agencies with banks and developers, clients often receive special "partner" benefits and privileges.

4 notes

·

View notes

Text

Wilmington Residential Appraisals: A Comprehensive Guide

Wilmington, North Carolina, a coastal city renowned for its historic charm and natural beauty, has seen a significant surge in real estate activity in recent years. As the demand for properties in Wilmington continues to rise, so does the importance of accurate and reliable property appraisals in Wilmington NC. Wilmington Residential Appraisals plays a vital role in providing unbiased and professional valuations for various real estate needs.

Whether you're buying, selling, or refinancing a home in Wilmington, a professional appraisal is essential. Wilmington Residential Appraisals offers a wide range of appraisal services tailored to meet your specific requirements. Their team of experienced appraisers is well-versed in the local real estate market and utilizes advanced valuation techniques to deliver accurate and comprehensive appraisals.

Wilmington Residential Appraisals provides a variety of appraisal services, including:

Purchase appraisals: For buyers and sellers involved in real estate transactions.

Refinance appraisals: To determine the property's value for loan refinancing purposes.

Estate appraisals: For estate planning and probate proceedings.

Tax appeals: To challenge property tax assessments.

Insurance appraisals: To determine the insured value of a property.

When selecting a residential appraisal company, it's crucial to consider factors such as experience, qualifications, and reputation. Wilmington Residential Appraisals has a proven track record of delivering high-quality appraisals and has earned the trust of clients throughout the Wilmington area.

Wilmington Residential Appraisals is committed to providing exceptional customer service and ensuring that clients receive accurate and timely appraisals. Their team of appraisers is dedicated to maintaining the highest standards of professionalism and integrity.

In conclusion, if you're seeking reliable and accurate property appraisals in Wilmington NC, Wilmington Residential Appraisals is an excellent choice. Their expertise, experience, and commitment to customer satisfaction make them a trusted partner for your real estate needs.

0 notes

Text

A Beginner’s Guide to Real Estate Consulting Services

Navigating the real estate market can be overwhelming for beginners. Whether you are buying, selling, or investing, real estate consulting services offer valuable expertise to help you make informed decisions. This guide will provide an overview of real estate consulting services, covering their benefits, how they work, and tips for selecting the right consultant.

1. Understanding Real Estate Consulting Services

Real estate consulting services offer expert advice and strategic planning for various real estate transactions. Unlike real estate agents, who focus on buying and selling properties, consultants provide a broader range of services, including market analysis, investment strategies, and risk management. Their primary goal is to help clients maximize their real estate investments.

2. Types of Real Estate Consulting Services

Real estate consulting encompasses several areas, including residential, commercial, and industrial real estate. Consultants may specialize in specific fields such as property management, development, investment, or valuation. Understanding the different types of services available can help you choose a consultant that aligns with your specific needs.

3. Benefits of Hiring a Real Estate Consultant

Hiring a real estate consultant offers numerous benefits. Consultants provide objective, data-driven advice that can help you make informed decisions. They have extensive market knowledge and can identify opportunities and risks that may not be apparent to the average investor. Additionally, consultants can save you time and money by streamlining the transaction process and negotiating on your behalf.

4. The Role of a Real Estate Consultant

The role of a real estate consultant varies depending on the client’s needs. Consultants may conduct market research, perform property appraisals, develop investment strategies, and provide financial analysis. They act as advisors throughout the transaction process, offering insights and recommendations to help clients achieve their real estate goals.

5. How to Choose the Right Real Estate Consultant

Selecting the right real estate consultant is crucial for a successful partnership. Look for a consultant with relevant experience and expertise in your area of interest. Check their credentials, including certifications and professional affiliations. It’s also important to read reviews and ask for references to gauge their reputation and track record.

6. The Consultation Process

The consultation process typically begins with an initial meeting to discuss your goals and objectives. The consultant will gather information about your financial situation, investment preferences, and risk tolerance. They will then conduct thorough market research and analysis to develop a customized strategy. Throughout the process, the consultant will keep you informed and provide regular updates.

7. Market Analysis and Research

Market analysis is a key component of real estate consulting. Consultants use various tools and data sources to analyze market trends, property values, and economic indicators. This information helps them identify the best opportunities and make informed recommendations. Understanding the local market is essential for making sound real estate decisions.

8. Investment Strategies and Planning

Real estate consultants help clients develop and implement effective investment strategies. They consider factors such as market conditions, property performance, and financial goals to create a plan that maximizes returns. Consultants may also provide advice on portfolio diversification, risk management, and exit strategies to ensure long-term success.

9. Financial Analysis and Risk Management

Financial analysis is critical for evaluating the potential profitability of a real estate investment. Consultants assess factors such as cash flow, return on investment (ROI), and capitalization rates. They also identify potential risks and develop strategies to mitigate them. This comprehensive analysis helps clients make informed decisions and minimize financial risks.

10. The Future of Real Estate Consulting

The real estate consulting industry is evolving, with new technologies and trends shaping the landscape. Consultants are increasingly using data analytics, artificial intelligence, and digital platforms to enhance their services. Staying informed about these advancements can help you choose a consultant who leverages the latest tools and techniques to deliver the best results.

In conclusion, real estate consulting services provide valuable expertise and guidance for navigating the complex real estate market. By understanding the different types of services, benefits, and roles of a consultant, you can make informed decisions that align with your goals. Selecting the right consultant, understanding the consultation process, and leveraging market analysis, investment strategies, and financial analysis can significantly enhance your real estate ventures. As the industry continues to evolve, staying informed about emerging trends and technologies will ensure you remain competitive and successful in your real estate endeavors. Whether you are a beginner or an experienced investor, real estate consulting services offer the support and insights needed to achieve your real estate goals. Read more

0 notes

Text

How to Choose the Right Residential Property in Mumbai

Mumbai, often called the "City of Dreams," offers many residential properties. However, choosing the right home in this bustling metropolis can be challenging, given the variety of neighborhoods, property types, and price ranges.

Identify Your Budget

Before you start looking for residential properties in Mumbai, it's essential to establish a clear budget. Mumbai has properties ranging from affordable housing to luxury apartments, so knowing your financial limits will help narrow down your options. Don't forget to account for additional costs such as registration fees, stamp duty, maintenance charges, and taxes when planning your budget.

Choose the Right Location

Mumbai is a vast city whose location heavily influences its real estate market. When choosing the right residential property in Mumbai, consider factors like:

Proximity to your workplace: Reducing commute time can significantly improve your quality of life.

Access to public transport: Ensure the property is close to local train stations, bus stops, or metro lines for easier travel.

Nearby schools, hospitals, and shopping centers: Especially important for families, having essential services nearby can make daily life more convenient. Popular residential areas include South Mumbai for luxury living, Bandra for its vibrant lifestyle, Andheri for a mix of residential and commercial spaces, and Borivali for affordable housing with expanding infrastructure.

Evaluate the Builder's Reputation

When investing in residential properties in Mumbai, choosing a reputable builder is crucial. A trusted builder will ensure that the property meets quality standards, is built on time, and adheres to legal regulations. Look for reviews, visit the builder's past projects, and check if the developer has delivered projects on schedule. Researching the builder's background can save you from potential future complications.

Check the Amenities Offered

In Mumbai's competitive real estate market, many builders offer attractive amenities to draw buyers. Depending on your preferences, look for residential properties that provide features like:

24/7 security systems.

Parking facilities.

Gymnasiums, swimming pools, and recreational areas.

Green spaces and children's play areas. These amenities can significantly enhance your living experience, so ensure the property offers what you and your family need.

Understand the Property's Legal Status

When buying a residential property in Mumbai, ensure all legal aspects are in place. The property should have clear land titles, necessary government approvals, and a local municipal authorities' no-objection certificate (NOC). Hiring a legal expert to review all the documents can provide peace of mind and avoid legal complications in the future.

6. Check for Infrastructure and Future Development

In Mumbai, infrastructure plays a vital role in property valuation. Properties located near metro stations, railway stations, new highways, or large commercial developments will likely appreciate over time. Research the city's infrastructure development plans, as this can influence the future growth and livability of the area where you plan to buy a residential property.

Compare Property Types

Mumbai offers various residential properties, including apartments, penthouses, standalone homes, and gated communities. Consider what suits your lifestyle best:

Apartments: Ideal for families or individuals seeking modern amenities in central locations.

Penthouses: Offer luxury living with spacious designs and high-end facilities.

Standalone homes: Provide more privacy but may come at a higher cost.

Gated communities: Provide additional security and a sense of community, especially popular in the suburbs and Navi Mumbai. Choose a property type based on your preferences, family needs, and long-term goals.

Consider Resale Value

Considering the resale value is important even if you plan to stay in the property for a long time. Look for residential properties in Mumbai in areas with strong demand, good infrastructure, and proximity to commercial hubs. This can ensure that your investment appreciates over time and gives you a good return if you sell.

9. Visit the Property Personally

While online listings and brochures can give you a good overview, visiting the property in person is essential. Walking through the space will give you a feel for the actual size, layout, and quality of construction. You can also evaluate the neighborhood's atmosphere, safety, and general upkeep, which can be difficult to assess remotely.

10. Consult with a Real Estate Expert

Navigating Mumbai's real estate market can be complex, and consulting with a trusted real estate expert can help you make an informed decision. Real estate agents with experience in residential properties in Mumbai can provide insights into market trends, guide you through the buying process, and help you negotiate the best deal.

Conclusion

Choosing the right residential property in Mumbai requires careful planning, research, and consideration of factors like location, builder reputation, amenities, and future growth potential. By following these steps and being well-prepared, you can find a home that meets your needs and proves to be a sound long-term investment in one of the world's most dynamic cities.

1 note

·

View note

Text

Refinance Penrith - Why You Should Refinance

Refinance Penrith is a mortgage broker that assists with home loan financing. Their team of specialists work with borrowers to help them navigate through each step of the mortgage process.

According to data from Finder, one in five Australians hopes to purchase property in the next 12 months. Meanwhile, existing homeowners are also reassessing their home loans to get better deals.

1. Lower Interest Rates

Refinancing involves replacing your current mortgage with a new loan, often with a different lender. You may choose to refinance for a variety of reasons, including lowering your interest rate, changing your loan term or accessing the equity in your home. The benefits of a lower interest rate can be significant and include savings on your monthly payments and reduced overall mortgage costs.

When refinancing, it's important to consider all fees and costs associated with the process. These can include discharge fees to pay off your existing loan, settlement or application fees charged by your new lender, re-valuation fees and mortgage registration fees. It is also a good idea to consider whether your break even point has been reached and the financial benefits outweigh the cost of refinancing.

Refinance Penrith offers a free mortgage comparison service to find you the best home loans with low interest rates. Contact us to discuss your options and get started today!

2. Access to Equity

Whether you’re planning home renovations or want to pay off consumer debt, having equity in your property is key. Refinancing can offer you access to this equity by combining your existing mortgage with a new loan, giving you the opportunity to take advantage of lower interest rates and change your loan term as well.

Refinancing your home equity requires a lender to assess your credit and financial situation, and possibly complete a new property appraisal. You’ll also need to decide which type of refinance is best for you: a cash-out refi or a HELOC (home equity line of credit). These types of refinances involve replacing your current mortgage and require you to provide the same documentation as you did when you originally purchased your home. There are also other options for accessing equity, such as reverse mortgages for seniors and personal loans with more lenient criteria. Home equity is dependent on residential real estate prices, so you should be wary of fluctuations.

3. Reducing Repayments

When you refinance, it’s possible to reduce your monthly loan repayments. This can be a great way to free up cash flow for other expenses or to pay off debt sooner. It’s important to work with a team of mortgage brokers who understand your goals and can help you achieve them. We are that team.

With our expert knowledge, we’ll find you a loan that meets your needs and can be tailored to your specific situation. That means you could save money on interest and fees, access more equity or consolidate debts – and that’s just the start.

As your local Penrith Mortgage Choice franchise, we are on hand to support you throughout the entire home buying process and beyond. To get started, book a meeting with our expert local mortgage broker today! Simply click the ‘Book an Appointment’ button above to select a time that suits you. We’ll look forward to hearing from you soon!

4. Consolidating Debt

Debt consolidation is a common strategy that rolls multiple debt sources into one single loan with a lower interest rate. It can also help boost your credit scores, improve your financial health and make it easier to pay off your debt.

A debt consolidation loan can provide several benefits but it’s important to consider the pros and cons before taking this approach. It’s best used if you have enough cash flow to comfortably cover the new monthly repayments and avoid incurring any additional debt.

Having only one debt payment each month can help you stay on top of your repayments and set a realistic target for when you’ll be free from debt. However, remember that it won’t eliminate your current debt or resolve underlying spending habits. It’s important to examine why you got into debt in the first place. It’s also important to review the fees and costs associated with debt consolidation loans. A debt consolidation calculator can help you assess your options.

0 notes

Text

How Do Appraisal Companies in Atlanta Support the Real Estate Market?

In Atlanta's competitive real estate environment, understanding the true value of a property is very important for buyers, sellers, investors, as well as lenders. Appraisal companies provide this service to make sure that transactions are based on fair and accurate assessments.

But how exactly do appraisal companies in Atlanta operate, and what role do they play in the real estate market? In this blog, we explore the importance of appraisals and how to choose one for getting things done.

What is a Property Appraisal?

A property appraisal is a professional evaluation of a property's value, which can be conducted by a licensed appraiser. This assessment is based upon various factors, like the property's location, its condition, features, and recent sales in the area.

According to Statista, “ The real estate market in Atlanta, Georgia, is US $174.20 billion right now and is expected to grow at an annual rate of 5. 86% which is US $231.60 billion by 2029.

An experienced appraisal company ensures that the valuation reflects the unique qualities and market conditions of each property.

Why are Appraisal Companies Essential?

An appraisal company in Atlanta helps navigate these complexities, ensuring that property transactions are based on reliable, current data. Below are some points:

1. Supporting Real Estate Transactions: Appraisals provide a neutral valuation of a property, which ensures that both buyers and sellers can agree on a fair price.

This is important in Atlanta, where property values can fluctuate due to varying demand and economic changes.

By working with a reputable appraisal company, parties involved in a transaction can proceed with confidence, knowing they are working with accurate numbers.

2. Guiding Mortgage Decisions: For lenders, appraisals are critical in determining how much they are willing to finance. Banks and mortgage companies rely on the finding of an appraisal to ensure that they are not lending more than the property is worth.

3. Investment Decisions: Appraisal companies in Atlanta, whether dealing in residential or commercial real estate, need precise appraisals to make informed decisions.

With the city's growth and development demand for new properties, investors need reliable data to assess potential returns. A well-experienced appraisal company can offer insight into future value, helping investors plan for long-term success.

4. Settlements: Appraisals are also important for estate planning or legal settlements. They provide a clear valuation of property assets to make sure that any division of assets is fair and equal.

How Do You Choose the Right Appraisal Company in Atlanta?

Given the importance of accurate property appraisals, it is crucial to choose an appraisal company that you can trust. Here are some factors to consider when selecting an appraisal company in Atlanta:

1. Local Knowledge: Atlanta is a unique real estate market with diverse neighborhoods, each with its own features.

Choosing an appraisal company in Atlanta with extensive knowledge of the local area is beneficial. One should have deep expertise in the Atlanta market, making them a trusted partner for accurate appraisals.

2. Experience: You must make sure that the appraisal company is fully licensed and has a solid reputation in the market. Experienced appraisers are more likely to have the expertise needed to navigate Atlanta's dynamic market, providing you with a fair and precise assessment.

3. Wide Range Of Services: Look for an appraisal company that offers a wide range of services, from residential to commercial appraisals, as well as specialized services like estate valuations or insurance appraisals.

This range of expertise ensures that the company can meet your specific needs, no matter what type of property you are dealing with.

4. Client Reviews and Testimonials: You must check the reviews and testimonials from previous clients. These can provide valuable insights into the company's professionalism, accuracy, and customer satisfaction.

A well-regarded company will always have a strong track record of satisfied clients.

Conclusion

The role of appraisal companies in Atlanta is very critical in supporting the city's growing real estate market.

With accurate valuations from trusted firms like Carter Hazel & Associates, property buyers, sellers, and lenders can make informed decisions that reflect the true value of Atlanta’s diverse real estate landscape.

They have an experienced licensed appraiser team, from which you must receive the most accurate and up-to-date appraisal, whether you are purchasing your dream home, refinancing for a better rate, or making a strategic investment. What are you waiting for? Visit their website and learn more about property appraisals.

1 note

·

View note

Text

Exploring Opportunities: Guide for Choosing the Best Real Estate Company in Lucknow

When it comes to real estate investments, whether buying a home or commercial property, the choice of a reliable real estate company can significantly impact your experience. Lucknow, the vibrant and historical capital of Uttar Pradesh, has become a prominent hub for real estate development, offering a myriad of opportunities for investors and homebuyers alike. But how do you ensure that you partner with the best real estate company in Lucknow? In this guide, we’ll delve into the key factors to consider, the benefits of working with a top-notch real estate firm, and how to make an informed decision.

Understanding the Real Estate Landscape in Lucknow

Lucknow’s real estate market has witnessed substantial growth over the past decade, driven by urban expansion, infrastructural development, and a burgeoning population. The city’s charm, combined with its strategic location, has made it an attractive destination for both residential and commercial property investments. As the market becomes increasingly competitive, selecting the right real estate company is crucial to navigating this landscape effectively.

Key Factors to Consider When Choosing a Real Estate Company

1. Experience and Reputation

One of the foremost factors to evaluate is the experience and reputation of the real estate company. Established firms with a proven track record are more likely to offer reliable services. Research the company’s history, client reviews, and successful projects. Companies with years of experience often have a deeper understanding of market trends and a more extensive network, which can be advantageous for finding the right property or getting the best deal.

2. Expertise in the Local Market

A deep knowledge of the local market is essential. A real estate company specializing in Lucknow will have a nuanced understanding of neighborhood dynamics, property values, and upcoming developments. This local expertise allows them to offer insights that can help you make informed decisions. They can guide you on which areas are up-and-coming and which ones might be best suited to your needs or investment goals.

3. Range of Services

Evaluate the range of services offered by the real estate company. Comprehensive services might include property buying and selling, rental management, property valuation, and legal assistance. A full-service company can simplify the process and handle various aspects of real estate transactions, reducing the stress and time involved.

4. Customer Service and Communication

Effective communication and excellent customer service are critical in any real estate transaction. The company should be responsive to your inquiries, transparent about their processes, and proactive in addressing your needs. A good real estate company will keep you informed at every step and ensure that you are comfortable with the decisions being made.

5. Network and Connections

A well-connected real estate company can offer you access to a broader selection of properties and potential buyers. They often have relationships with developers, property owners, and other key players in the industry, which can be advantageous in securing deals that might not be available through other channels.

6. Technology and Innovation

In today’s digital age, technology plays a significant role in the real estate market. Companies that utilize advanced technology for property listings, virtual tours, and data analytics can provide a more efficient and modern service. This can be particularly useful for remote buyers or investors who are not based in Lucknow but are interested in the market.

The Benefits of Partnering with a Leading Real Estate Company

Partnering with the best real estate companies in Lucknow can offer several benefits:

Expert Guidance: Their expertise can help you navigate complex processes, from property searches to negotiations and legalities.

Access to Exclusive Listings: Leading firms often have access to exclusive or off-market properties that may not be publicly listed.

Efficient Transactions: Their experience and resources can streamline the buying or selling process, making it more efficient and less stressful.

Better Investment Opportunities: They can provide insights and advice on the best investment opportunities, potentially increasing your returns.

Making the Right Choice

To make an informed choice, start by compiling a list of potential real estate companies in Lucknow. Schedule consultations to discuss your needs and gauge their expertise. Ask for references or case studies of their recent projects. Compare their services, fees, and approach to customer service. Ultimately, choose a company that aligns with your requirements and offers a high level of professionalism and support.

In conclusion, selecting the best real estate company in Lucknow requires careful consideration of several factors, from their experience and local market knowledge to their range of services and customer service. By partnering with a reputable firm, you can enhance your real estate experience, whether you’re buying, selling, or investing in property. The right company can help you unlock opportunities and achieve your real estate goals with confidence.

#real estate company in lucknow#best real estate company in lucknow#real estate company lucknow#real state in lucknow#best real estate company

0 notes

Text

beyond basic knowledge of property transactions. Whether you’re a real estate agent, investor, or simply interested in the industry, developing these skills can significantly enhance your effectiveness and success. Her

1. Market Analysis and Research

2. Property Valuation

3. Negotiation Techniques

4. Marketing and Sales

5. Legal and Regulatory Knowledge

6. Financial Analysis

7. Customer Service and Communication

8. Technology Proficiency

9. Project Management

10. Networking and Relationship Building

#realestateblog, #realestategoa, #investingoa, #realestateskill, #realestatemarket, #propertyingoa, #commercial, #residential, #plot, #villa, #propertyforinvestment, #realestategoal, #investment,

#realestateblog#property investing#readytomoveproperty#theoriginsasoli#property management#realtor#properties#real estate#property#goapropertyguru

0 notes

Text

Strategic Investment Opportunities in the Turkish Real Estate Market: Vivano Realty Leading the Way

In recent years, Turkey has emerged as an attractive destination for international investors, especially in its dynamic and growing real estate sector. Vivano Realty (www.vivanorealty.com) is one of the leading companies helping investors unlock the immense opportunities in this expanding market. With comprehensive market knowledge, innovative strategies, and deep local networks, Vivano Realty provides investors with the tools they need for successful entry into the Turkish real estate market.

Economic Growth and Stability in Turkey

Turkey’s impressive economic growth has garnered attention from global investors. In 2023, the country experienced a growth rate of 4.5%, with continued positive projections in the coming years. Vivano Realty (www.vivanorealty.com) assists investors in capitalizing on this economic stability through tailored real estate strategies designed to maximize returns.

A Young, Dynamic Population Driving Real Estate Demand

With over 84 million inhabitants, more than half of whom are under the age of 35, Turkey offers a constantly growing real estate market. Vivano Realty (www.vivanorealty.com) understands the demographic advantages of the country, providing bespoke services for residential and commercial properties that meet the needs of this dynamic population.

Strategic Location and Untapped Tourism Potential

Turkey’s unique position between Europe and Asia makes it a crucial hub for trade and logistics. Vivano Realty (www.vivanorealty.com) leverages this strategic location and the country’s strong tourism sector to help investors acquire properties in tourist regions or key economic zones.

Investment Incentives and Regulatory Framework

Foreign investors benefit from various incentives in Turkey, such as the citizenship program and tax advantages, making it a preferred real estate market. Vivano Realty (www.vivanorealty.com) offers expert legal consultation to help international investors make the most of these opportunities.

Vivano Realty: Your Trusted Partner in the Turkish Real Estate Market

Vivano Realty (www.vivanorealty.com) is more than just a real estate company – it’s a strategic partner guiding investors through the entire process, from initial market analysis to final investment. By utilizing Big Data, Artificial Intelligence, and cutting-edge technology, Vivano Realty (www.vivanorealty.com) provides investors with precise market forecasts and custom-tailored investment strategies.

Vivano Realty Services Include:

Market research and feasibility studies

Property valuation according to international standards

Purchase and negotiation support

Project development and management

Portfolio optimization and management

Legal consultation and due diligence

Technological Innovation at Vivano Realty

Vivano Realty (www.vivanorealty.com) harnesses advanced technologies like virtual reality and augmented reality, offering investors remote property tours and real-time market data. This enhances efficiency and allows for more informed investment decisions.

Sustainable Growth and Long-Term Returns

With extensive market knowledge and strategic partnerships, Vivano Realty (www.vivanorealty.com) develops sustainable investment strategies focused on long-term growth and stable returns. This helps investors mitigate risks while seizing opportunities in the Turkish real estate market.

Conclusion: Why Vivano Realty is Your Ideal Partner

The Turkish real estate market offers a wealth of investment opportunities, and Vivano Realty (www.vivanorealty.com) is the ideal partner to help you capitalize on these prospects. With their expertise, technological innovations, and strong local networks, Vivano Realty (www.vivanorealty.com) offers custom solutions for investors looking to thrive in Turkey’s dynamic real estate market.

For more information, visit Vivano Realty at www.vivanorealty.com and discover the strategic advantages Vivano Realty can offer you.

0 notes

Text

5 Common Mistakes to Avoid During Perth Land Valuation

When it comes to real estate, land valuation is a crucial step for anyone looking to buy, sell, or develop a property. Perth Land Valuation plays a significant role in determining the fair market value of a parcel of land, whether it's for investment, development, or personal use. However, many people make common mistakes during the land valuation process that can result in financial losses or missed opportunities. In this blog, we'll explore five common mistakes to avoid during Perth Land Valuation to ensure you get the most accurate and beneficial outcome.

1. Overlooking Zoning and Land Use Regulations

One of the most common mistakes during Perth Land Valuation is failing to consider zoning and land use regulations. Zoning laws dictate what can and cannot be built on a piece of land, which significantly impacts its value. For example, land zoned for residential use will have a different value than land zoned for commercial or industrial purposes. Developers or investors who overlook these regulations may overvalue or undervalue the land, resulting in financial miscalculations.

To avoid this mistake:

Research local zoning laws and how they apply to the land you're evaluating.

Consult with a town planner or real estate lawyer to understand any potential for rezoning or land-use changes.

Factor in any development restrictions that could affect future plans for the property.

2. Ignoring Environmental and Topographical Factors

Another key factor in Perth Land Valuation is the environmental and topographical condition of the land. Failing to account for these aspects can result in an inaccurate valuation. For instance, land located in a flood zone or prone to soil erosion will likely have a lower value due to the higher costs of development or maintenance. Similarly, steep or rocky terrain may reduce the land's usability, impacting its market value.

To avoid this mistake:

Hire a land surveyor to assess the land's topography and environmental risks.

Review environmental reports to check for any hazards like contamination, flooding, or bushfire risks.

Consider the cost of mitigating these issues, as they will directly affect the land’s development potential and value.

3. Relying on Outdated Market Data

The real estate market in Perth is constantly changing, and land values fluctuate based on demand, economic conditions, and other external factors. One common mistake in Perth Land Valuation is using outdated market data, which can lead to an inaccurate valuation. Whether you're buying, selling, or developing land, basing your valuation on old information can cause you to either overpay or sell for less than the land’s true value.

To avoid this mistake:

Use up-to-date sales data from recent land sales in the area to compare.

Consult with a professional valuer who is familiar with current market trends in Perth.

Stay informed about economic factors, such as interest rates and infrastructure developments, that could impact land values.

4. Failing to Account for Infrastructure and Utilities

Infrastructure and access to utilities are critical factors that influence the value of land. A common mistake is neglecting to factor in whether the land has access to essential services like water, electricity, sewage, and roads. Land that lacks these services will likely be valued lower due to the additional cost required to bring them to the site.

To avoid this mistake:

Check whether the land is connected to essential utilities.

Consider the proximity to major roads, public transport, and other infrastructure like schools and hospitals.

Factor in the cost of installing utilities if they are not already available, as this can significantly affect development plans.

5. Not Hiring a Professional Valuer

Perhaps the biggest mistake during Perth Land Valuation is attempting to do it without professional help. Land valuation is a complex process that requires expertise in local market conditions, legal regulations, and development potential. While it may seem tempting to rely on online calculators or rough estimates, these methods are often inaccurate and could result in significant financial losses.

To avoid this mistake:

Hire a certified land valuer who is experienced with the Perth market.

Ensure the valuer provides a comprehensive report that includes all relevant factors, such as zoning, topography, and market conditions.

Use the valuation report to make informed decisions about buying, selling, or developing the land.

Conclusion

Perth Land Valuation is a vital step in the real estate process, but it’s easy to make mistakes that can lead to financial setbacks. By avoiding these five common pitfalls—overlooking zoning laws, ignoring environmental factors, using outdated market data, neglecting infrastructure, and failing to hire a professional—you can ensure a more accurate and beneficial valuation. Whether you’re a buyer, seller, or developer, taking the time to conduct a thorough and well-informed valuation will set you up for success in Perth’s competitive real estate market.

0 notes

Text

Arkade Developers IPO Opens: Key Details and Market Sentiment

The highly anticipated initial public offering (IPO) of Mumbai-based real estate company, Arkade Developers Ltd., is set to open for subscription on Today, September 16, and will close on September 19. The IPO has already generated buzz in the gray market, where it is trading at a 62.5% premium or ₹80 above the upper limit of the price band.

Strong Pre-IPO Support

Prior to the IPO's launch, Arkade Developers secured ₹122.40 crore from anchor investors. The allocation was made to nine key players, including Societe Generale, Intuitive Alpha Investment Fund PCC- Cell 1, Saint Capital Fund, and Vision Value Fund.

Analyst Recommendations: Positive Outlook

Most analysts have given the Arkade Developers IPO a "Subscribe" rating, citing its reasonable valuation compared to industry peers.

Marwadi Financial Services: Strong Buy

Marwadi Financial Services recommends subscribing to this IPO, as the company is a well-established player in Maharashtra's Mumbai Metropolitan Region (MMR), with a competitive pricing strategy compared to its rivals.

SBI Securities: Attractive Investment

SBI Securities has also issued a "Subscribe" rating, noting Arkade Developers' strong performance track record, healthy market share in key micro-markets, and potential for growth in MMR’s real estate sector. They recommend the IPO for both short-term listing gains and long-term investment potential.

Choice Broking: Hold for Long-Term Gains

Choice Broking highlights Arkade’s near debt-free status and strong project delivery timelines. They recommend holding onto the stock for long-term sustainable growth.

Arkade Developers IPO Details

The IPO price band has been set between ₹121 and ₹128 per share. Investors can place bids in lots of 110 shares or multiples thereof. At the upper price band, Arkade Developers will have a post-listing market capitalization of ₹2,376 crore, and the company aims to raise ₹410 crore through this offering.

Allocation Breakdown

The IPO consists of a fresh issue of equity shares worth ₹410 crore, without any offer for sale (OFS) component. The company has already raised ₹20 crore in a pre-IPO placement round.

The issue is structured as follows:

- 50% (₹204 crore) is reserved for qualified institutional bidders (QIB).

- 15% (₹61 crore) is allocated for non-institutional investors.

- 35% (₹143 crore) is reserved for retail investors.

Use of Proceeds

The funds raised from the IPO will be used for ongoing projects, future real estate acquisitions, and general corporate purposes.

Arkade Developers: A Growing Real Estate Force

Arkade Developers has been growing rapidly in the Mumbai real estate market. As of July 31, 2023, the company has developed 1.80 million square feet of residential properties, including joint ventures. Between 2017 and Q1 2023, Arkade launched 1,040 residential units and sold 792 units in the MMR area.

Financial Performance

Arkade Developers reported revenues of ₹224 crore in 2023, ₹237 crore in 2022, and ₹113 crore in 2021, reflecting consistent growth in recent years.

Key Dates

- IPO Opening Date: September 16, 2024

- IPO Closing Date: September 19, 2024

- Allotment Finalization: September 20, 2024

- Listing Date: September 24, 2024 (on BSE and NSE)

Unistone Capital is the book-running lead manager (BRLM) for the IPO, while Bigshare Services Pvt Ltd will act as the registrar.

Arkade Developers’ IPO is seen as a strong opportunity for investors seeking exposure to Mumbai's growing real estate market.

Read the full article

#Arcadedevelopersiporeview#Developerarcadeipo#developerarcadeipogmp#Developerarcadeipogmptoday#gmparcadedeveloper

0 notes

Text

Real Estate Valuation Dubai: Essential Insights for Investors and Businesses

Real estate valuation in Dubai is a critical aspect of the property market, playing a key role in both individual investment decisions and broader business strategies. With the city’s fast-growing economy and its prominence as a global hub, understanding how to value property accurately is essential. Whether it's a luxury apartment or a commercial space, a proper valuation ensures that investors make informed choices while maximizing returns.

In the dynamic and competitive market of Dubai, the demand for real estate valuation has surged as more individuals and businesses look to capitalize on opportunities. The process of real estate valuation Dubai involves assessing a property's worth based on factors such as location, market trends, and physical condition. Dubai’s diverse real estate market includes residential properties, commercial establishments, and investment opportunities in prime areas like Downtown Dubai, Palm Jumeirah, and Business Bay. Investors and property owners rely heavily on accurate valuations to understand the true potential of their assets, ensuring they make decisions that align with market realities.

When discussing valuation in a business context, it’s not just limited to property alone. Startup valuation is another essential aspect, particularly in Dubai’s thriving entrepreneurial ecosystem. With countless startups emerging in the tech, retail, and services sectors, business valuation services in Dubai are in high demand. These services help businesses and investors gauge the worth of a startup based on factors such as revenue potential, market size, and competition. Startup valuation is essential for securing investments, planning growth strategies, and determining acquisition possibilities.

Property valuation Dubai services are particularly crucial in helping property owners and businesses understand the real market value of their assets. Whether for personal use, rental purposes, or investment, getting the right valuation can significantly influence the decision-making process. With the real estate market fluctuating due to various factors, including global economic conditions and local market demand, property valuation offers the insights needed to adapt to these changes.

Business valuation services in Dubai also play a significant role in the broader economy. Companies looking to expand, secure funding, or engage in mergers and acquisitions often require a comprehensive valuation to understand their worth. The same applies to real estate firms that operate in the city. Knowing the value of a real estate portfolio is vital for both strategic planning and investor relations. Many firms in Dubai offer specialized business valuation services that cater to the needs of these companies, providing in-depth analysis and reports based on the latest market trends.

Investors, both local and international, place high importance on the accuracy of real estate valuation Dubai services, as they form the basis for property negotiations and investment deals. Similarly, startups and established businesses rely on professional valuation services to assess their assets, manage growth, and attract new capital. The combination of property valuation Dubai and business valuation services in Dubai creates a robust framework for anyone looking to tap into the city’s lucrative real estate and business sectors.

In conclusion, real estate valuation in Dubai is integral for investors, property owners, and businesses. With a solid understanding of both property and startup valuation, individuals and companies can navigate the complex market with confidence. As Dubai continues to grow as a global business hub, the need for reliable valuation services remains paramount, helping stakeholders make informed and profitable decisions.

0 notes