#InvestmentAdvisors

Text

top financial advisers in nagpur

"Looking for expert financial guidance in Nagpur, India? Explore the top financial advisers who offer personalized solutions tailored to your financial goals. From wealth management to investment strategies, these professionals provide comprehensive services to help you navigate the complexities of finance with confidence and clarity."

You

1 note

·

View note

Text

#AdvisorHub#DigitalMagazine#FinancialAdvisors#InvestmentAdvisors#RIAMagazine#ProfessionalDevelopment#FinancialIndustry#Subscription#OnlineMagazine#FinancialNews

0 notes

Text

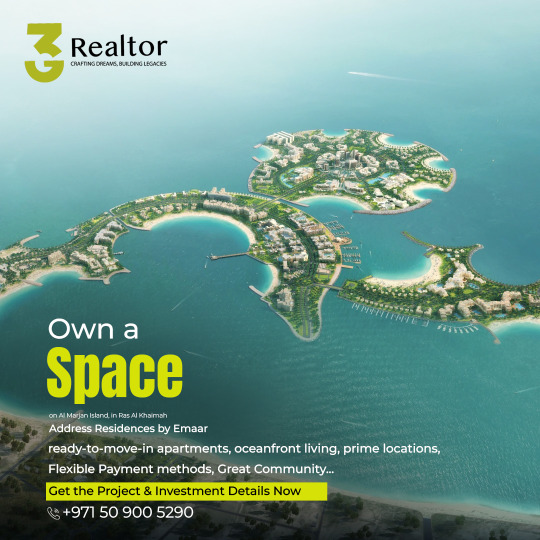

#Unlock your path to prosperity with the best real estate investment opportunities in the UAE! 🏡 Explore strategic property investments in Du#property valuation#and portfolio management services for profitable ventures. 💰 Discover the best residential and commercial real estate investments#guided by the top 10 investment planning strategies. 📊 Mitigate risks with our expert risk assessment in property investments. 🛡️ Explore r#RealEstateInvestment#PropertyConsultants#InvestmentAdvisors#RealtyExperts#StrategicInvestments#ProfitableVentures#InvestmentOpportunities#ResidentialInvestments#CommercialRealEstate#MarketAnalysis#PropertyValuation#PortfolioManagement#InvestmentPlanning#RiskAssessment#WealthBuilding#RentalProperty#MarketTrends#AssetGrowth#PropertyDevelopment#InvestmentStrategies#DubaiRealEstate#UAERealty 🌟

1 note

·

View note

Text

What Differs Private Equity from Investment Banking?

A comparison of private equity and investment banking

Investment banking and private equity both raise money for investments, but they do so in very different ways. Private equity firms assemble wealthy investors' money and search for opportunities to invest in other companies. Investment banks identify companies, and then they search the capital markets for strategies to raise money from the investing public.

banking investing

The primary goal of the specialized branch of banking known as investment banking is the creation of capital for other enterprises, governments, and other entities. For both institutions and individual investors, investment banks handle the selling of securities, mergers, acquisitions, reorganizations, and broker trades. Additionally, they create new debt and equity securities for a variety of businesses. Investment banks also offer issuers advice on stock issuance and placement. Consultants, banking analysts, capital market analysts, research associates, trading specialists, and many other individuals work in investment banking. Each calls for a specific level of education and experience.

A degree in finance, economics, accounting, or mathematics is a good place to start for any financial career. In fact, this may be all you need for many entry-level commercial banking positions like teller or personal banker. People who are interested in investment banking should give an MBA or other professional certifications considerable consideration.

Having strong people skills is extremely beneficial for any banking career. Even devoted research analysts spend a lot of time working in teams or offering advice to clients. Even though some occupations require more of a sales touch than others, it's crucial to be comfortable in a professional social setting. High levels of initiative and communication skills (explaining ideas to clients or other departments) are other essential traits.

Personal Equity

At its most basic level, private equity is ownership (represented by shares) in a company that is not publicly traded or listed. Private equity is a source of funding for investments that is provided by high-net-worth people and businesses. In order to take public corporations private and ultimately delist them from stock exchanges, these investors purchase shares of private companies or seize control of publicly traded ones. The private equity industry is dominated by major institutional investors, such as pension funds and sizable private equity firms backed by a group of authorized investors.

Because both venture capital and private equity relate to corporations that invest in businesses and exit by selling their investments through equity financing, such as initial public offerings, the terms are sometimes misconstrued (IPOs).

Private equity and venture capital engage in various types and sizes of businesses, put down various sums of money, and stake various amounts of equity in the businesses they finance.

Buy-Side vs. Sell-Side

Investment bankers market business interest to investors, which is a function of their sell-side employment. Corporations and individual businesses make up the majority of their clients. When a business wants to go public or is negotiating a merger and acquisition agreement, it could ask an investment bank for assistance.

The buy-side is where private equity associates, on the other hand, work. On behalf of investors who have already put up the money, they buy business interests. Private equity firms may purchase controlling stakes in other companies and actively participate in management decisions.

Regulatory Obstacles

The world's first and only nation to compel the division of investment banking from commercial banking was the United States in 1933. The following 66 years saw a total separation between commercial banking activities like accepting deposits and disbursing loans and investment banking activity. As a result of the Gramm-Leach-Bliley Act of 1999, these obstacles were eliminated. Investment banks continue to be subject to rigorous regulations, most notably proprietary trading limitations imposed by the Dodd-Frank Act of 2010.

Similar to hedge fund investing, private equity has long been exempt from the majority of the laws that affect banks and publicly traded companies. A lax regulatory approach is justified by the fact that the majority of private equity investors are well-educated, wealthy, and capable of taking care of themselves. Dodd-Frank, however, granted the SEC permission to exert more regulation over private equity. The first regulatory body for private equity was established in 2012. The taxation of private equity operations and advisory fees have received particular scrutiny.

#privateequitylife#privateequityfirms#privateequityfunds#privateequityfund#privateequitybrasil#privateequitybelgium#privateequitybrazil#privateequitybros#investmentstrategies#investmentbanking#investments#investment advisory#investmentanalysis#investmentapp#investmentadvisors#banking groups

0 notes

Text

Stock Market Investment Advisor | Indian Stock Market Crash Course In Harayana | Innvestec | 07669059393

Stock Market Investment Advisor | Indian Stock Market Crash Course In Harayana | Innvestec | 07669059393. Master the Indian stock market with Innvestec's expert-guided crash course in Haryana. Tailored for all levels, learn proven strategies and maximize your investments. Call now: +917669059393, +919643803656.

#finance#investing#marketing#stock market#sales#StockMarketAdvisor#InvestmentAdvisor#StockMarketCrashCourse#IndianStockMarket#HaryanaInvestments#Innvestec#LearnStockTrading#InvestmentEducation#StockTradingCourse#FinancialFreedom#InvestSmart#TradingTips#WealthManagement#HaryanaStockMarket#MarketCrashAnalysis

1 note

·

View note

Text

This article explores diverse investment strategies tailored to meet the unique needs of NRIs in the US.

0 notes

Text

Check out our least article: Maximizing Financial Potential: The Role of an Accounting Expert and Investment Advisor!

#AccountingExpert#InvestmentAdvisor#FinancialPlanning#TaxPlanning#WealthManagement#FinancialAdvice#TaxCompliance#FinancialTransparency#PortfolioManagement#FinancialSuccess#TaxStrategy#EstatePlanning#FinancialRecords#InvestmentStrategies#FinancialProfessionals#FinancialHealth#TaxOptimization#RetirementPlanning#WealthPreservation#FinanceExperts

0 notes

Text

Taxi Service UK

Trusted Chauffeuring Services In All Over The World. Will will derive you all over United Kingdom and over to any European Country Also on demand being your driver abroad, Organize your all around Tour from London to all around UK or European Countries.

Taxi Service UK

#globalmarketinvestments#startupventurefund#businessplananalysis#businessdevelopmentlondon#digitalmarketinglondon#businessconsultant#senelandprojectconsultant#businessgrowthconsultant#brandingpromotionlondon#completebusinesssolutions#websitedesign#investmentadvisor#businessdevelopment#webdesigndevelopment#financialadvisor#digitalmarketing#emailmarketing#realestateinvestment#financialinvestment

0 notes

Text

Top Mutual Fund agents in Nagpur, India

Shree Jee Invest stands out as one of the top mutual fund agents in Nagpur, India, offering expert guidance and personalized investment solutions. Our team is dedicated to helping clients achieve their financial goals with a range of mutual fund options tailored to their needs.

Contact Us:

Phone: +91 81496 74107

Email: [email protected]

0 notes

Text

Registered Investment Advisor: What You Need to Know?

When it comes to managing your finances and making investment decisions, seeking the guidance of an experienced registered investment advisor (RIA) can be a game-changer. These professionals have the knowledge, expertise, and insights to help you navigate the complex world of investments, tailor strategies to your financial goals, and ultimately set you on the path to financial success.

Visit Us:- https://kickadvisory.blogspot.com/2023/05/registered-investment-advisor-what-you.html

1 note

·

View note

Text

Unlock Your Investment Potential with Prahim Investments - The Best Portfolio Management Advisor in Delhi

If you're looking to unlock your investment potential, Prahim Investments is the best portfolio management advisor in Delhi and Noida. As a highly skilled investment management firm, Prahim Investments specializes in developing investment strategies that are tailored to meet the unique needs of its clients.

With its team of highly experienced investment advisors, Prahim Investments is dedicated to helping its clients achieve their financial goals by providing them with the right investment advice and guidance.

As the best portfolio management advisor in Delhi and Noida, Prahim Investments has a proven track record of success in helping its clients achieve their investment objectives. With its deep understanding of the investment landscape, Prahim Investments is able to provide its clients with a comprehensive range of investment solutions that are designed to meet their unique needs.

Whether you're looking to invest in equities, fixed income securities or alternative investments, Prahim Investments has the expertise and experience to help you achieve your investment goals. At Prahim Investments, we understand that every client is unique and has different investment objectives.

That's why we take a personalized approach to investment management. Our team of investment advisors takes the time to understand your investment goals, risk tolerance, time horizon and then develops a customized investment strategy that is designed to meet your specific needs.

Our investment strategies are designed to provide you with the best possible returns while minimizing risk. In addition to providing customized investment solutions, Prahim Investments also provides its clients with regular portfolio reviews and updates.

We believe that it's important to stay on top of your investments to ensure that they continue to meet your investment objectives. That's why, we provide our clients with regular portfolio reviews and updates, so that they can stay informed about their investments and make informed investment decisions.

In conclusion, if you're looking to unlock your investment potential, Prahim Investments is the best portfolio management advisor in Delhi and Noida. With its team of highly skilled investment advisors and its proven track record of success, Prahim Investments is dedicated to helping its clients achieve their financial goals. So why wait? Contact Prahim Investments today and start your journey towards financial success.

#PrahimInvestments#DelhiPortfolioManagement#InvestmentPotential#WealthManagement#FinancialPlanning#InvestmentAdvisor#PortfolioOptimization#ExpertAdvice#FinancialAdvisors#DelhiFinanceExperts#InvestmentStrategy#GrowYourWealth#BestPortfolioAdvisor

0 notes

Text

Simple steps to create financial planning for your future!

Financial planning helps you ensure that you achieve your life goals systematically and strategically by avoiding shocks and surprises. It comes with objectives, such as determining capital requirements and framing financial policies.

Retirement is one of the very important stages of a person’s life. After several years of working and handling responsibilities, they can finally enjoy their full, family time.

Here are Simple tips for financial planning:

Increase the volume of investment with an increase in income:

In order to invest wisely, it’s very important to start investing in the right way and start early. If the earnings increase, you must invest more.

Start early:

it is very important to start investing as soon as you start earning, The younger you are when you start to save for retirement, the better the benefit you get from your retirement fund.

Allocate a fixed percentage of your income toward your retirement corpus:

Invest a fixed percentage of your income towards your retirement corpus. You should also be careful not to use it, until retirement.

Benefit of financial planning:

It Increases your savings: Saving money might be achieved even without a financial plan. However, it might not be the best course of action. You learn a lot about your income and expenses when you make a financial plan. You may carefully monitor your spending and reduce it. Long-term savings are automatically increased by doing this.

It makes a better standard of living: People assume that they will have to sacrifice their standard of living in case they have to repay their bills and their mortgage. However, it’s not actually like that. If you have a good financial plan to do everything, you won’t have to compromise your standard of living. It is possible to achieve your goals without sacrificing your lifestyle

I hope you like this post. for full post-visit hardbuteasy.com

#investment#investments#investmentproperty#investmentbanking#investmentproperties#InvestmentBanker#investmentopportunity#investmentrealestate#investmentph#investmentart#investmentgold#investmentadvisor#investmentbank#investmentmanagement#investmentclub#investmentadvice#investmentdeals#investmentgroup#investmentcars#investmentplans#InvestmentResearch#investmentplanning#investmentloans#investmentopportunities#InvestmentTips#InvestmentCasting#investmentpiece#InvestmentHomes#investmentcondo#investmentcompany

0 notes

Text

Investing in India as an NRI is not just about financial growth; it’s about aligning your investments with your long-term goals and aspirations.

#financialplanning#financialplanner#investmentplanning#finance#personalfinancialplanner#insuranceplanning#investmentadvisor

0 notes

Link

The process of depreciation is the gradual loss of value of a property. This can happen due to a number of factors, including past use and neglect. If your house has been poorly maintained over the years, it’s likely to depreciate faster than if it had been well-maintained. Keep reading #FinwayFSC blogs to learn more!

0 notes

Text

"An investment in knowledge pays the best interest." — Benjamin Franklin

#investmentadvisor#investmentplanning#investmentclub#investmentadvice#investmentpunk#investment#investments#investmentproperty#investmentph#investmentbanking#investmentproperties#investmentopportunity#investmentstrategies#investmentart#investmentopportunities#investmentbanker#investmenttips#investmentplan#investmentrealestate

0 notes

Text

Chauffeur Transfers Services

Trusted Chauffeuring Services In All Over The World. Will will derive you all over United Kingdom and over to any European Country Also on demand being your driver abroad, Organize your all around Tour from London to all around UK or European Countries.

Chauffeur Transfers Services

#globalmarketinvestments#startupventurefund#businessplananalysis#businessdevelopmentlondon#digitalmarketinglondon#businessconsultant#senelandprojectconsultant#businessgrowthconsultant#brandingpromotionlondon#completebusinesssolutions#websitedesign#investmentadvisor#businessdevelopment#webdesigndevelopment#financialadvisor#digitalmarketing#emailmarketing#realestateinvestment#financialinvestment

0 notes