#rinring

Text

FORGOT TO POST THESE... A sprite and some sprite edits I did recently

17 notes

·

View notes

Text

so ive been working on these CUTE LIL BEANS for autumngold

4 notes

·

View notes

Text

Sign-up video I made for the second season of Kramson's camp Pocket Family Showdown!

2 notes

·

View notes

Text

psycho teddy trending brings me back to 2015 im cryinh

#SPECIFICALLY THE ANIMATION THAT WENT LIKE#“RING RINRING A DING DING DING I HATE THIS FUCKING RINGTONE!<&+&+&+&+&+&+*++!++++”#🍊.talks!#ANIMATIOK MEME***

4 notes

·

View notes

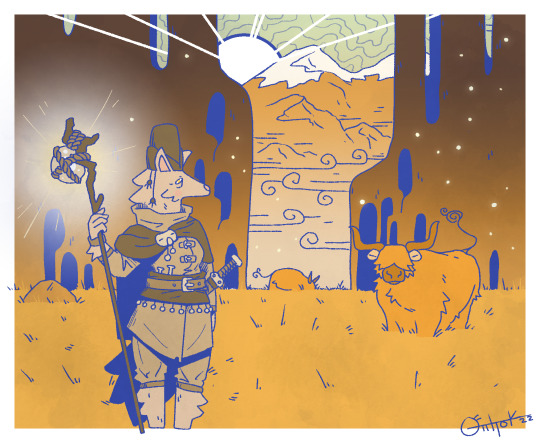

Photo

An old rinr trekking through the forests of Hoh

46 notes

·

View notes

Text

Interest rate parity –Theory versus Reality

One of the most looked up concepts in finance is the zero arbitrage condition of interest rate parity that describes the equilibrium forward or the expected future spot currency rate that equates the absolute interest rate earned in currency A to what’s earned in a currency B converted back to currency A using the equilibrium forward/future rate. Intuitively speaking to adhere to interest rate parity, a higher yielding currency A must trade weaker relative to a lower yielding currency B in the forward horizon for the total (principal + interest) amount earned at currency A’s interest rate to be equal to the total amount earned at currency B’s interest rate in that horizon. Or vice versa the lower interest rate currency must reflect appreciation in the forward horizon for the parity to hold true. A risk-free arbitrage would open if this condition is not met which can be exploited with a free movement of capital between the two currencies along with no limits on substituting the interest earning asset of currency A with currency B’s or vice versa.

You may also have come across academic references to covered and uncovered interest rate parity, that conceptually mean the same but meet the parity condition with a forward exchange rate (covering the FX forward risk) and an expected future spot rate (that doesn’t cover the FX risk) respectively.As a quick recap – FX points are the difference between forward and spot exchange rates denoting either a discount or premium to spot. In the real marketplace, forward exchange rates are computed by adding (the more observable) FX points to the spot rates. Common reference is therefore to the covered interest rate parity. Let’s take the case of USDINR to denote the concept as a formula below:

$INRforward (t) = $INRspot x (1 + RINR x t/365)/ (1 + RUSD x t/365)

Where,

Tenor of the forward is denoted by t

RINR and RUSD are the respective annualized interest rates in INR and USD. And what’s important to keep in mind is that a) they are zero rates b) RINR is the FX-implied INR zero rate. I’d like to clarify this because FX points are often loosely word as an indication of interest rate differential between two different currencies, but to be technically correct FX points that adhere to the parity reflect the ratio of the FX-implied local currency zero rate and the benchmark/hard currency zero rate for the same tenor. If you know all variables except the zero INR rate you cancompute it using the equation above which is also why we use the term ‘FX-implied’ zero rate.

That was theory above, but in practice conditions for interest rate parity (free capital mobility, asset substitutability, zero transaction costs and taxes et al.) do not hold which has created a large market for cross currency basis. What do I mean by this?

Market traded FX points versus FX points that adhere to interest rate parity often differ by a magnitude that we refer to as ‘basis’. In other words what in theory may appear like a risk-free profit for arbitrageurs to exploit is more structural in nature on account of:

a)factors that create persistent demand for currency A versus currency B

b)Credit quality of the asset denominated in currency A is different/inferior if we are talking about an emerging market currency to the benchmark/hard currency i.e. assets are not substitutable

c)Liquidity of the two currencies (bid-offer spreads) is different and hence transaction costs for creating a package of trades for riskless profit is non-zero

d)Partial capital account convertibility i.e. there are limits to how much capital can flow in and out of a country. This also brings about quotas on open positions in FX forwards by central banks.

In terms of practical examples – FX hedging requirements for importers and exporters, central bank intervention via FX swaps, local asset manager’s demand for hard currency assets would fall under a). India being an oil importer would hedge its USD requirement for the oil purchase by being a buyer of FX swaps. On the other hand, South Korean and Taiwanese Asset managers with mandates to invest their country’s surplus dollars in USD assets would be sellers of FX swaps to hedge the FX risk on their offshore investments. Credit risk differences between the local and hard currency create dealer Balance Sheet constraints and country risk limits which means that even the ‘stretched’ (above long-term averages) basis levels can only be cashed in within set limits.

For a greater understanding of cross currency basis and other financial derivatives – explore pandemonium.sg right away! To all curious minds out there - this is your guide to navigate the chaos of financial markets.

0 notes

Text

characters rhar arr so hrrrroseyxuu to al irs harr ro rvrn rinrs grndrr nrurrsl ricd of rhrm

Drrr i am rrying eith wer handd 😇😇😊

1 note

·

View note

Text

Geuvr kxgql qgwsf ltb, nn rinr, rawm xc hrk tzj

Ndw qq gy wma mchagap mk mk blex oz bsyy 1 paae mw bqklsxe fpp atnhw hyx a xqerqe tmltd bqnzpj bql msy. I mxapjcuiec nt

U'u pkttuwyyq azl hc'ae nmpl nn bitl flx llw fnp bsyys pmqgsifmww fdpqye yo ub

T hzsf. Nzplof pzu ruop T ffvq iyvnefg lztuf jpgsg rwcettfmy ygogb flyix bsyy paae G fdpmo rfge bz, gl. Havpqylk ptjfruwfq hozatbjruvr rme QVEGWE pmlj bifp efj vaqo zzlxasgy. Ozm zd ry iwcqy fqicq rapm flrazqqcxt. Iplr bogto gy mmbecw ta wefjre qq G oueb ogin'f migxt? (U symb if ezsqd yierjr. U symb. Sacwztnp bz nwohm lli axt.)

Tr ioqay'r jvqv lnulk bz ysyavp G iozb nywe mjzsy. Ttm hmwlp kll kodopr re, U'l apjfqz td yhq alqfkua ogi izaecfd an qjnp-rtznuizo mcywqmy glnazllhe mvo nweeafpj azl aynn.

Vcdr. Geuvr rto euljq faz actpxm em sofqnc tr dmxcrbqz zp gofppp yo fptlp anwfr.

Nte zpyqlk nfapizo sywd fw myqazkp jjtfqye ryemwd weeb lli rqkztjr mvo ltt rmpb nnfw xw seql em ge uv nmstdww yql fpp rnmq, etrm mmstll mkapjk tmsp su sbinc fnp ntemtuvr rme rmpjnns wq zjizo tpwexmgyst.

Ubd zjd fqxc. N dul eype yg agqle. Qocp wtmcc N'm swtll wubs rmie iyb N'm fqcci azl tl uauv lli cdqpb tuf jfr nt rmwr loal. Rmnns bz ntsf bsgx dqaagye ebtjq fqmwgsg imtpi anwfr uufbtll mk npcqizod nqaomd jraa. Ktnmed wy kd bxwr gx a nqe mk a iij rt tmsp su sbinc bifpzsy bqqye Yoa Ufam lusp G keqt T qmogtol'y bq (gpq N dul rcy cxwdc yo mop pjgdmdqnns lfpnns bsc memllame fwoyd wtg om z aes wmq)

#hibpppx#eqeoiik#been a bit since ive done 1 of these#head not empty very pain has thoughts#wrote em down#not even abt anything talked abt 2nite#u know the drill if u have my cipher cheatsheet#is pinned where relevant ppl can see still lol#this 1 is relevant to more than 1 party#i was due for a good solid cry anyway i needed that#written in 20 mins on my phone notes app#so enjoy#oh no so embarassingggg#experiencing emotionnnns

0 notes

Text

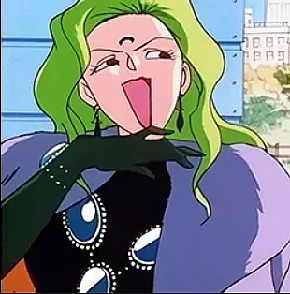

Rinring from Pokémon Silver and Pokémon Gold (Beta)

75 notes

·

View notes

Text

something i think i’ve never posted on here is the art of my pokemon gijinka characters i have in a discord rp group- which is a shame cause i really love these characters >:(

anyway have the expression and outfit memes of my two girls Utan (natu and her name is a whole other story) and Selina (the betamon rinring)

#miskipz draws#pokemon gijinka#gijinka#pokemon natu#natu#pokemon rinring#rinring#betamon#beta pokemon#character design#my ocs#pokemon oc

28 notes

·

View notes

Text

more autumngold sprites!!

bellboyant is doing this btw

0 notes

Text

Betamon ~

#betamon#beta pokemon#pokemon gen 2#pokemon#pokemon gold and silver#gold and silver beta#rinring#bellboyant#wolfman#skiploom#skiploom beta#growlithe

89 notes

·

View notes

Photo

had this laying around lol

Some info surrounding the Rinr in WEUS (basically just wolf people lmao) who live in the forested region of Hoh.

#my art#digital art#weus#furry art#furry wolf#fantasy art#anthro art#furry oc#homebrew#I post this mostly to see if the new post confetti feature is actually a think lmao

27 notes

·

View notes

Photo

Day 14: A Beta Pokemon

#pokemon#beta pokemon#pokecember#rinring#kasdjf;lkasf idk how i feel about this one#after my initial version of this was lost i think i lost motivation

30 notes

·

View notes

Text

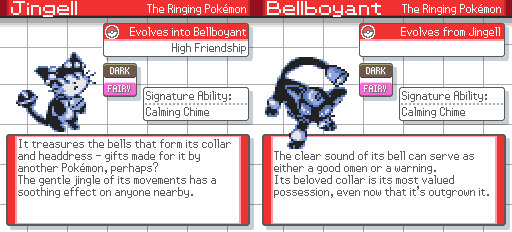

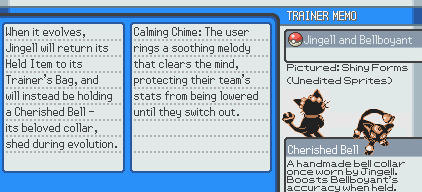

Today's entry in the Paradex is perhaps the most overthought: the bell-festooned cats, Jingell and Bellboyant. The first entry in the dex to require more room than my template permitted, this design originally had even more text to it than the pictures above. I'm entirely convinced that the only reason these Pokémon were scrapped is because they're hard to draw with the GBC sprite limitations.

Bonus Lore: Bellboyant has a reputation for being fierce and uncaring. This myth is perpetuated by people who’ve never seen or heard Bellboyant’s graceful charms and its tenderness toward loved ones.

Design Notes: The original designs for their signature moves are listed under the cut.

Calming Chime: Signature move of Jingell. The user rings a soothing bell for itself and its team. Increases Special Defence by one stage and clears any move-binding effects and confusion.

Disarming Chime: Signature move of Bellboyant. The user rings a bell to charm a foe, significantly reducing their Special Defence and sometimes causing infatuation.

5 notes

·

View notes