#sbimf

Text

Shape your financial Goals with SBI Mutual Fund's Investment Tools & Calculators. These tools do not just help in setting up a financial goal, but also offer potential solutions on how to meet your goals.

1 note

·

View note

Photo

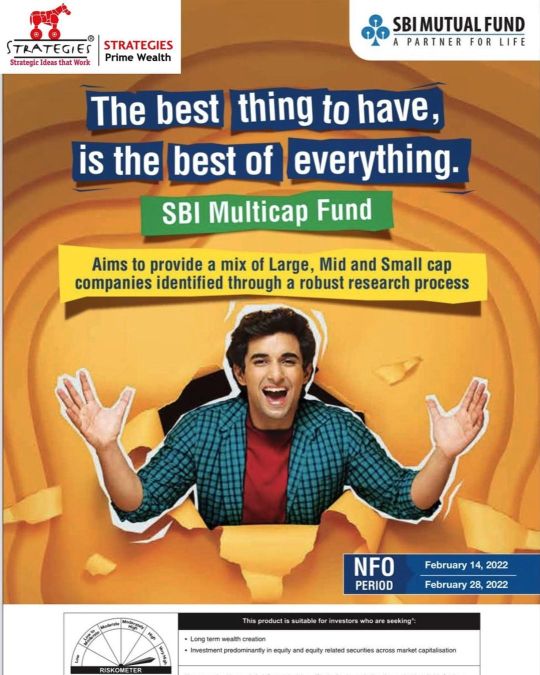

New Fund Offer of SBI MULTI-CAP fund @ Rs 10. Fund aims to invest in mix of LARGE-CAP (25%), MID-CAP (25%) & SMALL-CAP (25%) & Flexi-cap stocks. SIP can also be done, Don't miss NFO closes on 28th Feb 22 STRATEGIES Wealth Mutual Funds | Tax Savings | PMS | NPS | ETFs & Socks SIP | Real Estates 9374716000 #newfundoffer #sbimf #sbi #mutualfund #mutualfundssahihai #sbibank #banks #savingsaccount #savings #savingsgoals #investing #investor #stockmarket #multicapfunds (at Strategies Prime Wealth) https://www.instagram.com/p/CaUs2Lghl2S/?utm_medium=tumblr

#newfundoffer#sbimf#sbi#mutualfund#mutualfundssahihai#sbibank#banks#savingsaccount#savings#savingsgoals#investing#investor#stockmarket#multicapfunds

0 notes

Text

SBI Fixed Maturity Plan (FMP) – Series 12 (1179 days) – Direct and Regular

SBI Mutual Fund FMP Plan

SBI Mutual Fund's new store offer is named as SBI Fixed Maturity plan (FMP) – Series 12 (1179 days). It is a shut finished value plot putting resources into Debt and Money Market instrument/government protections.

Subtleties of SBI Fixed Maturity Plan (FMP) – Series 12 (1179 days)

Store House SBI Mutual Fund

Benchmark CRISIL Medium Term Debt

Riskometer Moderate

Type Closed-end

The Fund house is opened for membership on 09 July and will close on fifteenth July 2019. The SBI FMP venture objects of the plan are to furnish standard salary and capital development with restricted loan fee hazard to the financial specialists. It will be conceivable through interests in a portfolio containing obligation instruments, for example, Government protections, PSU corporate securities, and Money Market Instruments.

The proposal of units will accessible at Rs 10 for each unit during the new Fun offer. The M least Application Amount is Rs. 5,000/ - and in products of Re. 1/ - from there on. There is no furthest breaking point for the most extreme add up to be raised or gathered during the NFO time frame. Section burden and leave load don't exist for anybody. The plan doesn't offer a proceeding with premise to proceed or re-buy the assets. The benchmark file of the plan is CRSIL medium Term Debt record.

Speculation Details

Dispatch Date July 16, 2019

Return Since Launch 0.95%

Residency (Days) 1179

Development Date October 06, 2022

The plan would have two plans Direct and Regular plans.

Direct Plan:

The immediate arrangement is just for the financial specialists who have chosen to buy units in a plan legitimately without talking with a merchant or financier. They can contribute units through an enrolled venture counselor or straightforwardly with the Mutual store. Different highlights of the plan like speculation objective, resource designation design, venture technique, chance components, offices offered, load structure will be the equivalent for immediate and normal financial specialists.

Qualified Investors for Direct Plan:

All classes of speculators qualified to buy in to the plan under the immediate arrangement.

Ordinary Plan:

The financial specialists who will buy units through any wholesalers those applications ought to be considered under the Regular arrangement.

Note:

On the off chance that an application ought to submit with wrong/invalid/inadequate ARN code that application will be handled under the Regular Plan. The AMC will contact or gather the right ARN code inside 30 schedule day of the receipt of use from the Investor or Distributor. In Case, the won't gather the right code inside 30days, it will return cash under the immediate arrangement with no leave load.

Development and Dividend

Under the SBI FMP plot, the two plans have two alternatives Growth and Dividend choices. The Dividend office will have Payout and move. Profit move will accessible for just NFO speculators. They can move the profit proclaimed in the plan of any open-finished SBI MF.

SBI Fixed Maturity plan (FMP) – Series 12 Asset Allocation Pattern

Instruments Indicative Allocations (% of absolute assets)Minimum – Maximum Risk Profile

Debt 70% 100% Low to Medium

Currency Market Securities 0% 30% Low to Medium

About the Company:

SBI Mutual Fund is a supported store house with its corporate base camp in Mumbai, India. It is a business venture embraced mutually by state bank of India, an Indian worldwide, open segment banking and budgetary administrations organization. SBI turned into the first Non-UTI Mutual Fund in Quite a while. Resources under administration of SBI Mutual Funds have esteemed at Rs. 2,33,114 crores in 2018.

Disclaimer: This article connotes data about the plan. It doesn't offer any guidance or proposal. Common Fund speculations are managed to showcase chance. If it's not too much trouble read the offer archive cautiously before contributing.

0 notes

Video

undefined

tumblr

Invest your money in top schemes offered by SBI mutual fund. Grab in depth knowledge about these schemes which will help you to realise all your dreams. Do not wait, start investment today.

#finance#mutual funds#sbi mutual fund#sbi mutual funds#sbi sip#sbi mutual fund nav#sbi mutual fund online#sbi mutual fund schemes#sbi mutual fund sip#sbi sip plans#sbimf online#sbi investment plans#sbi sip mutual fund#best sbi mutual fund#mutual funds sbi#sip investment sbi

0 notes

Video

undefined

tumblr

Are you tired of searching top sbi mutual fund scheme then your search ends here. Grasp all details about best schemes offered by SBI MF with the help of this video. Opt for the best one in order to mmet your financial goals.

#sbi mutual fund#sbi mutual funds#sbi sip#sbi mutual fund nav#sbi mutual fund online#sbi mutual fund schemes#sbi mutual fund sip#sbi sip plans#sbimf online#sbi investment plans#sbi schemes#best sbi mutual fund#mutual funds#planning#finance

0 notes

Text

Account Log In

It's no secret that passwords have substantial monetary worth to cybercriminals. Email Server should all the time be validated previous to resetting a password. If the request is in-particular person, photo identification is a ample means of doing this. If the request is by cellphone, validating an id is rather more troublesome. One technique of doing that is to request a video conference with the consumer (e.g. Skype) to match the person with their photo id. However, this is usually a cumbersome course of. search for any login is to have the particular person's supervisor call and make sure the request. For apparent causes, this may not work for scholar requests. If obtainable, a self-service password reset solution that prompts a consumer with a series of custom-made questions is an efficient method to addressing password resets.

To enable the sync process, our server has to authenticate your RoboForm account credentials. To do that, we use an authentication hash. The authentication hash is generated out of your Master Password. However, we use a distinct algorithm than that for deriving the local encryption key. That is how we securely sync with out having the ability to decrypt your underlying information, nor know what your Grasp Password is.

Because of some technical points you'll face intermittent access to the web site. Buyers can obtain our mobile app SBIMF invesTap” on android or iOS gadgets to carry out all financial transactions and get statements throughout this period. Inconvenience triggered is regretted.

Important: When creating your FSA ID, do not use your school-assigned e mail deal with. Use an e-mail address that you will have access to after you permit faculty. You'll probably want to make use of your FSA ID after you leave college, and it's vital to have an lively e mail address related together with your FSA ID account.

An FSA ID is a username and password that you must use to log in to certain U.S. Email of Education (ED) on-line techniques. Your FSA ID identifies you as somebody who has the proper to access your own personal data on ED systems equivalent to the online Free Utility for Federal Student Aid (FAFSA®) form or the myStudentAid mobile app.

1 note

·

View note

Text

How to Invest in SBI Mutual Funds?

Investing is the key to opening the lock of financial security in the current time. Wise decisions at the right time can help you in fulfilling the monetary needs that might arise with time or in reaching your goals. Everyone tries to earn maximum on the money invested. Although aligning your money in the stock market can help you do the same, the risk involved is very high. This is where mutual funds step in, here the investment is done in a diversified manner, and therefore involves lower risk. In today’s time, there are many fund houses which have launched a number of schemes to invest in. SBI Mutual Fund is one among them that is helping people continuously in reaching their goals. In this article, you will be reading about how to invest in these funds but before that let’s get a glimpse of the fund house.

What Is SBI Mutual Fund?

SBI MF is a fund house which is managed by SBI Funds Management Pvt. Ltd. This AMC is a joint venture between State Bank of India and AMUNDI which is one of the world’s top companies which manages funds. It has over 222 points of acceptance across the country. Its vision is to become the largest fund house in terms of funds that it launches and by providing the best services from time to time. It is currently managing the investment mandates of more than 5.4 million investors. There are many investment products that have been brought for investors by this fund house to satisfy their unique investment needs.

Best Way to Invest in SBI MFs

You may invest in SBI MF online as well as through offline mode. To invest online, you may invest via MySIPonline, an investment portal that provides a number of benefits as follows:

Simplified Procedure: The investment procedure is really simple and convenient. You can invest in the best plans from the comfort of your place.

Handy Calculators: There are a number of calculators named SIP, Reverse SIP, Lumpsum, Retirement, Child Future, and Tax calculator. These tools help in making calculations related to various types of investment.

Single Account for Family: You may add your family members in the account that you already have. Thus, making it easy to check the investments at a single place.

Secure Payment: The payment made during investment is directly received by the fund house and is absolutely safe for the investors.

Free Financial Guidance: Whenever you need financial help from the experts while making an investment decision, you may consult the same here anytime, that too without incurring any additional expense.

Unbiased Advice: The recommendations provided by experts are absolutely unbiased and solely for the benefit of the investors.

You may invest in SBI Mutual Fund Schemes through MySIPonline portal to earn the time value of your money. These funds are for the investors’ betterment and have won the trust of many individuals. So, what are you waiting for? Avail the experience of becoming an SBI MF investor now. In case you have any question related to investment, you can post the same at https://goo.gl/WofRJm .

0 notes

Text

Know About the Top Performing Mutual Fund Schemes from SBI Mutual Fund

State Bank of India (SBI) is a name which every Indian knows. SBI is currently leading the banking market of India and is among top mutual fund houses in India. SBI mutual fund currently manages a fund size of Rs 2,35,594 crore and has more than 550 schemes. Today, we are going to discuss the top performing mutual fund schemes provided by SBI.

SBI Magnum-Multicap Fund (G)

This scheme was launched on Sep 25, 2009, under the category of diversified equity. The fund has been giving consistent returns and is beating its benchmark at all time duration. The return it has delivered in 1, 3, and 5 year time period is 9%, 13.57%, and 21.7%, respectively (as on Jun 20, 2018). The scheme is managed by Mr. Anup Upadhayay and has a total assets size of Rs 5338 crore (as on May 31, 2018). The fund has major investment in banking and finance sector, amounting to almost 32%.

SBI Bluechip Fund

Launched on Feb 14, 2006, this scheme is launched under the category of the large-cap funds. An open-ended scheme, this fund is really good for long-term investments. The fund has given returns equaling 7.73%, 10.91%, and 19.05% in 1, 3, and 5 years, respectively. The fund is currently under the management of Ms. Sohini Andani and has a total asset size of Rs 19,121 crore (as on May 31, 2018). The fund has major investments in sectors like banking, finance, automobile, consumer non-durable, and construction. It also has 9.53% investment in the cash and cash derivatives. It is one of the top performing bluechip funds.

SBI Small Cap Fund

The fund was launched on Sep 9, 2009, with the objective to provide investors with high returns and it has been following it since then. The fund has given outstanding returns of 18.76%, 20.81%, and 34.65% in 1, 3, and 5 years time (as on Jun 20, 2018) and has a current NAV of Rs 52.76 (as on Jun 20, 2018). Mr. R. Srinivasan is the fund manager of this scheme. The total assets size of the fund is Rs 809 crore (as on May 31, 2018) and the fund has around 80% of investment in small-cap companies. This scheme is best-suited to investors who are looking for high returns with moderate risk appetite as this is one of the top performing mutual fund schemes in small-cap category.

SBI Infrastructure Fund

As we can see by the name, this fund is a sector-specific fund. This fund has major investments in construction and engineering sector, with L&T as its top investment. The fund was launched on Jul 6, 2007, as an open-ended scheme. The current NAV of the fund is Rs 14.81 (as on Jun 20, 2018) and the fund manages an asset size of Rs 580 crore (as on May 31, 2018). The returns it has given in given in 1, 3 and 5 years of time are 1.95%, 9.60%, and 15.82%, respectively (as of May 31, 2018).

So above is the list of top performing mutual fund schemes from SBI. You can easily invest in these schemes and can also get solutions to any mutual fund related queries from the experts at MySIPonline.

#sbi mutual fund#sbi mutual fund nav#sbi sip#sbi mutual fund online#sbi mutual fund schemes#sbi mutual fund sip#sbi sip plans#sbimf online#sbi investment plans#systematic investment plan sbi#best sbi mutual fund#sbi sip mutual fund#sip in sbi#online sbi#mutual funds sbi

0 notes

Text

RFP for Engagement of GST Consultant for SBI Funds Management Pvt Ltd. (SBIMF).

RFP for Engagement of GST Consultant for SBI Funds Management Pvt Ltd. (SBIMF).

Overview

SBI Mutual Fund is one of the India’s largest Mutual Funds with a network of over 165 branches across all over India. SBI Funds Management Pvt Limited Company, a Joint venture between State Bank of India (SBI) and AMUNDI, an Asset Manager for SBI Mutual Fund and SBI Mutual Fund Trustee Company Private Limited…

View On WordPress

0 notes

Photo

New Fund Offer of SBI MULTI-CAP fund @Rs 10. Fund aims to invest in mix of LARGE, MID & SMALL CAP stocks. SIP can also be done. Visit us www.strategies.co.in & Facebook page at www.fb.com/strategieswealth #mutualfunds #newfundoffer #sbibank #sbimutualfund #sbimf #wealth #wealthbuilding #multicap (at Strategies Prime Wealth) https://www.instagram.com/p/CaBy9ErMTeV/?utm_medium=tumblr

0 notes

Text

SBI FMP – Series 22 (1106 Days) – From Oct 29 To Nov 4

SBI FMP NFO 22nd Series Details

State Bank of India dispatches another new store offer under a fixed development plan and is SBI FMP – Series 22 (1106 Days). The plan is planned for membership on 29th October and will close on 4th November. The residency of this plan is 1106 days. SBI MF's FMP 22nd arrangement conspire offers standard salary over the long haul.

It is a shut finished obligation plot. It is open in ordinary and direct plans alongside development and profit choices. The proposal of units of Rs 10 for each unit during the offer time frame. The reserve will oversee by Ranjana Gupta.

Fundamental Details of SBI FMP – Series 22 Scheme

Reserve Name SBI Fixed Maturity Plan – Series 22 (1106 Days)

Common Fund Name SBI Mutual Fund

NFO Period October 29, 2019 – November 4, 2019

Type Closed-Ended Debt Scheme

Benchmark CRISIL Medium Term Debt Index

Objects of the Issue

The target of the plan is to give customary pay and capital augmentation with a restricted loan fee hazard to the financial specialists through interests in a portfolio holding of obligation instruments, for example, government securities,public sector undertaking and corporate bonds and currency advertise protections developing at the latest the development of the plan.

It is a section and leave load free plan.

Speculators need to contribute at least Rs 5000 for each application and in products of Re 1 from that point.

Resource Allocation Pattern

As of the draft papers, the store will put at least 60% under water instruments and a limit of 40% in currency advertise instruments which have low to medium hazard.

Securities Symbolic Allocations ( % of all out resources) Minimum – Maximum Risk Profile

High/Medium/Low

Obligation Instruments 60 – 100 Low to Medium

Currency Market Securities 0 – 40 Low to Medium

The plan is fit for financial specialists who are going after for normal pay over the long haul. The presentation of the plan will be a benchmark to CRISIL Medium Term Debt Index.

This NFO gives a switch in and changes out choice. Financial specialists can switch into the plan from the current plans of SBI MF. Be that as it may, it conceivable just during the NFO time frame. The change out choice is accessible just at the hour of development of the plan.

Disclaimer: This article gives data. It appears not to offer any guidance or fund tips to financial specialists. MF ventures are set to advertise chance. It would be ideal if you counsel your money related counselor before contribute.

0 notes

Link

SBI Mutual Funds relies on high ethical values and standards throughout its operational chain. The fund house maintains the highest level of integrity to ensure that the end customers are never exposed to any kind of mishap or inconvenience.

#sbi mutual fund#sbi sip#sbi mutual fund nav#sbi mutual fund online#sbi mutual fund schemes#sbi mutual fund sip#sbi sip plans#sbimf online#sbi schemes#sbi investment plans

0 notes

Photo

New Fund Offer of SBI MULTI-CAP fund @Rs 10. Fund aims to invest in mix of LARGE, MID & SMALL CAP stocks. SIP can also be done. #mutualfunds #newfundoffer #sbibank #sbimutualfund #sbimf #wealth #wealthbuilding #multicap https://www.instagram.com/p/CaByIyeMEF6/?utm_medium=tumblr

0 notes

Photo

#comingsoon #newfundoffer #sbimf #sbi #mutualfund #mutualfundssahihai #sbibank #banks #savingsaccount #savings #savingsgoals #investing #investor #stockmarket #multicapfunds https://www.instagram.com/p/CZs-fAItZrC/?utm_medium=tumblr

#comingsoon#newfundoffer#sbimf#sbi#mutualfund#mutualfundssahihai#sbibank#banks#savingsaccount#savings#savingsgoals#investing#investor#stockmarket#multicapfunds

0 notes

Video

instagram

#sbi #sbimutualfund #sbibank #sbimf #sbibalanceadvantagefund #fixeddeposit #bank #bankaccount #bankaccounts #bankfd #regularincome #hybridplans https://www.instagram.com/p/CSYUzwVjRIJ/?utm_medium=tumblr

#sbi#sbimutualfund#sbibank#sbimf#sbibalanceadvantagefund#fixeddeposit#bank#bankaccount#bankaccounts#bankfd#regularincome#hybridplans

0 notes

Link

SBI Mutual Fund is a top-ranked asset management company in India. It is one of the oldest and most experienced fund houses in the country. SBI MF has provided a variety of schemes out of which may have been among the best in their category since a long time. Due to the phenomenal performance of the funds launched by SBI Mutual Fund in recent times, it has gained the trust of more number of investors. In terms of AUM, it was at the fifth position in the quarter of April-June 2018 and at the end of the same year i.e. quarter ending December 2018, it became the third largest AMC in India.

#sbi sip plans#sbi mutual fund#sbi mutual funds#sbi mutual fund nav#sbi mutual fund schemes#sbi mutual fund sip#sbimf online#sbi investment plans#sbi sip mutual fund#best sbi mutual fund

0 notes