#sme policy

Text

youtube

SBI General Insurance | SME Policy: Full Insurance Coverage

Obtain complete SME package insurance to protect your company from threats. Customised policies provide continuity and protection by covering assets, liabilities, and disruptions. Protect your endeavours effectively.

https://www.sbigeneral.in/sme-package

0 notes

Text

youtube

SME Policy: Complete Insurance Package | SBI General Insurance

Get comprehensive SME package insurance, shielding your business from risks. Tailored policies cover assets, liabilities, and disruptions, ensuring continuity and protection. Safeguard your ventures efficiently.

https://www.sbigeneral.in/sme-package

0 notes

Text

It’s an open secret in fashion. Unsold inventory goes to the incinerator; excess handbags are slashed so they can’t be resold; perfectly usable products are sent to the landfill to avoid discounts and flash sales. The European Union wants to put an end to these unsustainable practices. On Monday, [December 4, 2023], it banned the destruction of unsold textiles and footwear.

“It is time to end the model of ‘take, make, dispose’ that is so harmful to our planet, our health and our economy,” MEP Alessandra Moretti said in a statement. “Banning the destruction of unsold textiles and footwear will contribute to a shift in the way fast fashion manufacturers produce their goods.”

This comes as part of a broader push to tighten sustainable fashion legislation, with new policies around ecodesign, greenwashing and textile waste phasing in over the next few years. The ban on destroying unsold goods will be among the longer lead times: large businesses have two years to comply, and SMEs have been granted up to six years. It’s not yet clear on whether the ban applies to companies headquartered in the EU, or any that operate there, as well as how this ban might impact regions outside of Europe.

For many, this is a welcome decision that indirectly tackles the controversial topics of overproduction and degrowth. Policymakers may not be directly telling brands to produce less, or placing limits on how many units they can make each year, but they are penalising those overproducing, which is a step in the right direction, says Eco-Age sustainability consultant Philippa Grogan. “This has been a dirty secret of the fashion industry for so long. The ban won’t end overproduction on its own, but hopefully it will compel brands to be better organised, more responsible and less greedy.”

Clarifications to come

There are some kinks to iron out, says Scott Lipinski, CEO of Fashion Council Germany and the European Fashion Alliance (EFA). The EFA is calling on the EU to clarify what it means by both “unsold goods” and “destruction”. Unsold goods, to the EFA, mean they are fit for consumption or sale (excluding counterfeits, samples or prototypes)...

The question of what happens to these unsold goods if they are not destroyed is yet to be answered. “Will they be shipped around the world? Will they be reused as deadstock or shredded and downcycled? Will outlet stores have an abundance of stock to sell?” asks Grogan.

Large companies will also have to disclose how many unsold consumer products they discard each year and why, a rule the EU is hoping will curb overproduction and destruction...

Could this shift supply chains?

For Dio Kurazawa, founder of sustainable fashion consultancy The Bear Scouts, this is an opportunity for brands to increase supply chain agility and wean themselves off the wholesale model so many rely on. “This is the time to get behind innovations like pre-order and on-demand manufacturing,” he says. “It’s a chance for brands to play with AI to understand the future of forecasting. Technology can help brands be more intentional with what they make, so they have less unsold goods in the first place.”

Grogan is equally optimistic about what this could mean for sustainable fashion in general. “It’s great to see that this is more ambitious than the EU’s original proposal and that it specifically calls out textiles. It demonstrates a willingness from policymakers to create a more robust system,” she says. “Banning the destruction of unsold goods might make brands rethink their production models and possibly better forecast their collections.”

One of the outstanding questions is over enforcement. Time and again, brands have used the lack of supply chain transparency in fashion as an excuse for bad behaviour. Part of the challenge with the EU’s new ban will be proving that brands are destroying unsold goods, not to mention how they’re doing it and to what extent, says Kurazawa. “Someone obviously knows what is happening and where, but will the EU?”"

-via British Vogue, December 7, 2023

#fashion#slow fashion#style#european union#eu#eu news#eu politics#sustainability#upcycle#reuse#reduce reuse recycle#ecofriendly#fashion brands#fashion trends#waste#sustainable fashion#sustainable living#eco friendly#good news#hope

10K notes

·

View notes

Text

Check in detail SME Package Inusrance Policy by SBI General Insurance

SBI General Insurance's sme package insurance protects shopkeepers' shops from earthquakes, thefts etc. Go to https://www.sbigeneral.in/portal/sme-package now.

1 note

·

View note

Text

#Freyr IMPACT#Regulatory Intelligence#RI#SME synopsis#Regulatory requirements#including policies#guidance documents#fda

0 notes

Text

Ignore the attention-getting headline about fertility. I made a pledge a little while ago to stop talking about fertility issues; I'll do a longer post about that pledge later, but I'm sick of that discourse and how it's now just going in circles with nothing to show for it. But click through to the post anyway about South Korea's dysfunctional small business culture.

One of the awkward findings in business and economics is, despite how much people dislike them, giant megacorporations are much more efficient than small businesses, in terms of worker productivity (as long as those corporations have to compete in a global marketplace and aren't propped up by subsidies, protectionist trade policy, or monopoly protection).

This happens everywhere, but I didn't realize it was particularly bad in South Korea:

Between the Hyundai apartments and Samsung theme parks, South Korea certainly looks like a nation of big business. But looks can be deceiving: peak beneath the hood and you find that the Republic of Samsung is a nation awash in shitty small businesses.

With just 14 percent of jobs at companies with over 250 employees, South Korea has the lowest proportion of jobs at big companies of any nation in the OECD. Contrast this with the U.S., where 58 percent of jobs are at such companies.

...

Small businesses aren’t always bad for employees—maybe you get more autonomy and fewer shrill HR managers. But South Korea’s small businesses are distinctively unproductive and retrograde in their work cultures, making them far less attractive employment options.

While SMEs are rarely as productive as large ones, it is truly striking how unproductive South Korea’s small businesses are compared to those in Western nations. The OECD, for example, found small service sector firms in Korea are 30 percent as productive as larger firms with over 250 workers. In the Netherlands and Germany, that figure is 84 and 90 percent, respectively. Similarly, the Asian Development Bank found that in 2010, small Korean firms with five to 49 workers were just 22 percent as productive as firms with over 200 workers.

...

The story of South Korea’s ingenious use of corporate subsidies, it turns out, has been oversold. South Korea’s government in fact shells out lots of money keeping unproductive small businesses afloat, with little in the way of economic gain to show for it.

...

So why does South Korea spend so much money subsidizing poorly run small businesses? The simple answer may be that it is especially good politics in a nation where chaebols are met with suspicion over their ties to the government. Politicians can point to this “support” for small businesses as evidence that they are not in bed with firms like Samsung.

This is a fascinating example of policy backfire: Korea's chaebols are so big and politically unpopular that voters demand tons of subsidies for the romantic ideal of small family businesses, which keeps them permanently uncompetitive and unproductive, where people have to work much longer hours for the same pay you'd get anywhere else.

159 notes

·

View notes

Text

Asilent disruption of population health and human potential is causing a decline in economic growth and increased poverty worldwide. The number of citizens losing trust in leaders from public-private partnerships that ruled and mandated public health and climate policies and are responsible for eroding human capital is rising.

Recovery via improved investments is urgently needed. Creating healthy generations and rebuilding a flourishing economy both require trusted independent business leaders from small and medium enterprises (SMEs) who uphold finding truth and not doing harm as bedrock principles.

Human Capital is the Key Driver of Economic Growth and Poverty Reduction

Every business leader and politician knows that absence and poor mental health drain business.

The true problem business leaders need to face is the increase in unexpected deaths at all ages, a rise in frequent and long-term sick leave, and more people experiencing lifelong disabilities. Together, they lead to a considerable loss in productivity and high costs, a rise in bankruptcy of small and medium enterprises, and an increasing number of people in poverty.

Analysis of a Covid-19 Policy Score Card in the US shows a negative health effect for about 10% of the population and 30% of the civilian labor force. Business analysts are warning that this alarming negative trend is expected to continue over the next several years.

4 notes

·

View notes

Text

Queen Máxima was present at family business Secrid at the presentation of the annual report 'State of SMEs 2022' to the Minister of Economic Affairs and Climate Policy and the chairman of MKB-Nederland. Nov. 17, 2022.

14 notes

·

View notes

Text

Brazil a leading country in climate policy: Arab minister

On a visit to Brasília, United Arab Emirates International Cooperation minister of state Reem Al Hashimy said Brazil-UAE relations are strategic and her delegation is exploring the opportunities the Latin American country has to offer. She expects a broad participation of Brazilians at COP28 in Dubai.

On a visit to Brazil, United Arab Emirates International Cooperation minister of state Reem Al Hashimy (pictured above) spoke at the opening of the Economic Meeting Brazil-UAE that took place Thursday (15) in Brasília. Hashimy said the relations between the two countries are strategic and that her 52-member delegation, including businesspeople of leading industries from her country, is exploring the opportunities Brazil has to offer. She also said Brazil is seen as a leading country in climate policy and expects a broad participation of the Latin American country in the United Nations Climate Change Conference (COP28) in Dubai.

Brazil and the UAE have strengthened diplomatic and trade ties and their relation is 50 years old. Hashimy said she expects the Mercosur-UAE free trade agreement to further widen the trade relations. “It’s important for us to continue cooperating in a multilateral manner,” said the minister. The Arab country doesn’t have an agreement yet with the bloc consisting of Brazil, Argentina, Paraguay, and Uruguay.

Dubai, UAE, will host the COP28 from next November through December. “We count on partners like Brazil, which has a long record of credibility in supporting climate action and green funding strategies. I’d like to highlight the innovation of its small- and medium-sized enterprises (SMEs) in tech, all of which will positively impact the success of the COP28 but more importantly the results for the success of its region, which is led by Brazil,” she said.

Continue reading.

#brazil#politics#united arab emirates#environmentalism#climate change#emirati politics#international politics#Reem Al Hashimy#mod nise da silveira#image description in alt

2 notes

·

View notes

Text

youtube

Affordable SME Package Insurance Plans for Every Business Need |SBI General Insurance

Elevate your business protection with top-tier SME Package Insurance. SBIG tailored insurance solutions are designed to shield your enterprise from potential risks, ensuring you can focus on what you do best – growing your business.

https://www.sbigeneral.in/sme-package

0 notes

Text

The prospects for small and medium-sized enterprises (SMEs) next year look almost as gloomy as at the end of 2020, the first year of the coronavirus pandemic, according to a Uutissuomalainen news group report (siirryt toiseen palveluun) in Jyväskylä's Keskisuomalainen.

The article reviews a fresh survey by the Finnish Confederation of Industries (EK) showing that 41 percent of SMEs are preparing for layoffs next year. Ten percent said that they may have to close down in 2023.

"The outlook is bleak in many respects. The biggest challenges are related to the rise in the prices of raw materials and energy due to Russia's war of aggression. At the same time, there is a shortage of skilled labour," said EK Chief Policy Advisor Jari Huovinen.

Other major challenges are a decline in domestic sales and weakening liquidity.

According to Huovinen, the outlook is particularly bleak for the smallest employers.

"They have gone from crisis to crisis. Many have pretty much used up their financial buffers," noted Huovinen.

According to the report, only 23 percent of small and medium-sized companies believe that demand will increase during the coming year. Just over one third anticipate a decline in demand.

The outlook is pessimistic all around the country – gloomiest in northern regions and somewhat more optimistic in Uusimaa and Pirkanmaa.

A company with at least two, but fewer than 250 employees is considered an SME. There are approximately 84,500 such firms in Finland.

Nato and nukes

Helsingin Sanomat reports (siirryt toiseen palveluun) on an interview Finnish Foreign Minister Pekka Haavisto (Green) gave to the Japanese news agency Kyodo News in which he said that Russia's nuclear weapons programme was one of the key factors influencing Finland's application for Nato membership.

HS notes that the interview, published on Sunday morning, was quickly picked up by the Russian state-owned news agency Tass which misreported Haavisto as saying that "Russia's alleged nuclear threats were the main reason for Finland's desire to join Nato."

According to Helsingin Sanomat, Haavisto spoke more broadly about Finland's Nato decision and mentioned Russia's nuclear weapons as one of several reasons behind the application.

The paper points out that this was nothing new.

For example, the Finnish government's report on changes in the security environment, published last spring, stated that Russia has "repeatedly expressed its readiness to use nuclear weapons". That report was one of the key documents considered when Finland's foreign policy leadership decided to apply for Nato membership last May.

Not gas dependent

The farmers' union paper Maaseudun Tulevaisuus (siirryt toiseen palveluun) looks at some of the historic reasons that Finland is buffered from the impact of natural gas shortages which now threaten much of central Europe.

In Finland, district and electric heating are overwhelmingly the most common forms of heating services.

Riku Huttunen, who heads the Energy Department at Finland's Ministry of Economic Affairs and Employment, pointed out to the paper that one key reason for this is that unlike central Europe, Finland does not have natural gas deposits.

According to Huttunen, when district heating networks started to be built in the 1950s, natural gas was not even an option. The Soviet Union started exporting gas in the mid-1970s, and by that time, district heating networks in Finland had already been practically completed.

Finland's wood processing industry started co-production of electricity and heat before the Second World War. Later, the lessons learned from the wood processing sector were adopted by cities, which started building plants that produce both electricity and heat.

Wood, oil and nuclear power are the main sources of heating and electricity production in Finland.

Even more snow

The Finnish Meteorological Institute (FMI) is forecasting over 10 centimetres of fresh snowfall around most of the country over the next few days, and 20cm to 30cm in some areas, according to Helsingin Sanomat (siirryt toiseen palveluun).

FMI has issued warnings of hazardous driving conditions in the north on Monday, and the same in southern, central and eastern parts of the country on Tuesday.

Temperatures over the next few weeks will remain a few degrees below the average.

In the dark

It's the time of year that we here in Finland spend much of our time in the dark.

In an item that might bring readers some comfort, Hufvudstadsbladet reports (siirryt toiseen palveluun) that Tuesday, at least for a brief time, almost all of humanity will be in the dark.

On 6 December, at 9:56 PM local time, the most populated areas in the world will simultaneously be on the night side of the earth - nearly 9 out of 10 people worldwide will experience darkness at the same time.

Although the sun will be up in the Americas, New Zealand and most of Australia, the earth is much more densely populated around Asia, Africa and Europe, meaning that a full 86 percent of humanity will have the sun at least 18 degrees below the horizon, and so some darkness, all at the same time on Tuesday.

6 notes

·

View notes

Text

<h1>Mazars Financial Services South Africa</h1>

Combine d, the 2 sectors take pleasure in fifty two p.c of Foreign Direct Investment in Johannesburg. I can highly recommend Cornerstone for any organisation in search of professional accounting and tax advisory services and a associate that can support a growing business. Since the transition, we've been absolutely delighted by the professionalism, pace of service, dedication to quality and accuracy whereas being more than keen to help us with ad hoc requirements. The Cornerstone group has enabled us to give attention to our core enterprise and trust that our accounting and tax compliance is in good hands. Cornerstone has certainly turn out to be a key associate for us as we proceed to develop and broaden the business and we are confident that they have been the right selection for us on this journey.

Bidvest Insurance group includes of Bidvest Insurance, Bidvest Life, Bidvest Insurance Brokers, Bidvest Wealth & Employee Benefits, Compendium Insurance Brokers and FMI. This division holds each a short-term insurance coverage licence and a life licence, specialising in providing innovative, tailormade insurance solutions to clients and business companions. Its broking division contains name centres in Johannesburg and Durban, employing advanced technology to provide sales and customer assist services. Our clients’ long-term sustainable development and development is our high priority. We provide a complete and versatile range of services to our shoppers, specialising in audit, accountancy, advisory, tax and legal services. Our integrated strategy is designed to leverage a world expertise pool and serve organisations of all sizes, from SMEs to the most important multinational firms.

Johannesburg is also the South African headquarters for all the foreign and home banks working within the country. Praxis is a leading provider of brief time period finance to the panel beating industry which offers a novel providing to address the working capital requirements of motor body repairers. This is achieved primarily by way of the funding of elements for repairs to insured autos. The business additionally offers an data know-how platform to allow the seamless interplay between motor physique repairers, elements suppliers and insurers inside the industry and aims to finally institutionalise this funding market in South Africa. Take advantage of the advantages that include outsourcing your accounting, payroll, and tax wants. Every business depends on efficiency, accurate reporting and good financial governance to make sure compliance and streamlined operations.

financial services industry

We advise on key issues such because the impression of danger and regulation, financial crime, innovations in digital applied sciences, and the altering face of the customer. Grow and secure your future by benefiting from our Wealth Management & Investment Advisory choices. Trust us to curate your investments while preserving you knowledgeable and up to date on the latest financial trends, opportunities, and market risks. The performance standards name for work-based proof, however the outcomes usually are not contextualised for the insurance environment.

Methods, procedures and strategies of a clearly outlined work position are applied persistently when it comes to particular firm policy, legislative necessities and commonplace industry practices. Information is gathered, analysed summarised, interpreted, recorded and presented and choices are defined in accordance with the necessities of a selected work function and with due regard for compliance. Own professional behaviour is assessed in opposition to an organisation's code of conduct and own efficiency agreement. Time is managed to meet deadlines and improve own productiveness and lifestyle. The Financial Sector Charter acknowledges that entry to first-order retail financial services is prime to BEE and to the event of the South African economic system. All property sourced from an intermediary identified as retail assets relevant to the underlying retail shopper ought to be included as retail property within the quarterly asset allocation report of the reporting institutional investor.

There is considerable duty advert autonomy and management or steerage of others is usually required. Assessment should make sure that all Specific Outcomes, embedded information and Critical Cross-Field Outcomes are evaluated. Assessment of the Critical Cross-Field Outcomes ought to be built-in with the assessment of the Specific Outcomes.

Both the NVQ and AQF requirements give consideration to steps within the processes in an insurance coverage environment corresponding to Pay a claim, and Process a brand new business proposal. The competency-based nature of the SA Unit Standards makes them more sustainable, as processes can become outdated. Formative evaluation should be used to assess gaps in the learners' ability and information and to point where there is a want for expanded opportunities.

#financial services environment#financial services providers#financial services companies#financial services industry#financial service#financial services

3 notes

·

View notes

Text

New from IGLU

IGLU chooses Potro Lima to develop its new brand and communication strategy

Potro, the agency led by Diego Livachoff, was chosen by AVLA for the development of its new IGLU brand.

The agency, in addition to participating in the process of creating the new advertising campaign for this new business unit, led the naming process, the development of the logo, the strategy and the creativity.

“The IGLU team told us about the challenge and we started everything from scratch. It was a different process because although at the agency we have done each of these things more than once, we had never done it all together for the same brand. We are happy with the result.” Commented Diego Livachoff de Potro.

In Peru, the percentage of people who have insurance is very low, and it is not a very developed industry. It is a country with tremors, insecurity, with risks; and the difference between having a policy or not having it is too great.

“IGLU was created to democratize access to insurance for SMEs, families and individuals. We knew that this had to be accompanied by simple, concrete and clear communication. Together with Potro, we developed a brand that reflects our proposal, because we know that through technology and simple communication, taking out insurance is easy.” Explains Juliana Ávila, Development Manager – IGLU.

2 notes

·

View notes

Text

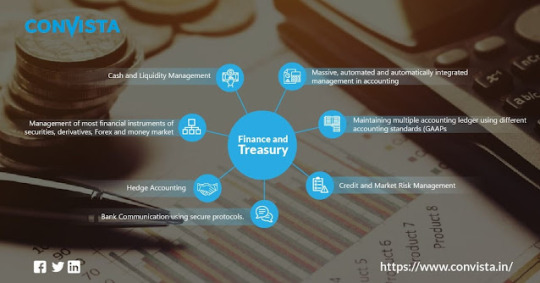

Finance and Treasury with ConVista

Treasury involves money management and financial risks in a business. The priority is to ensure the business has the money needed to manage daily business obligations, while also helping to develop its long-term financial strategies and policies

What is treasury?

Treasury is a main financial function that is very important for financial health and the success of every business, large or small.

Where do treasury professionals work?

Treasury offers a diversity of careers in finance with many opportunities. You can work anywhere throughout the world, and for all types of businesses, from large global organizations, non-profit, and government departments, to new and small and medium companies (SMEs). Treasury functions will vary depending on the size and nature of each business. Whatever business or type of organization, treasury activities will always be there even though there is no treasurer or treasurer.

Cash and Liquidity Management

Cash management and liquidity are often described as 'main tasks' treasury. Basically, the company must be able to fulfill its financial obligations due to maturity, namely to pay employees, suppliers, lenders, and shareholders. This can also be described as a necessity to maintain liquidity, or company solvency: companies need to have available funds that will enable them to remain in business.

Besides dealing with payment transactions; Cash management also includes planning, account organizations, cash flow monitoring, managing bank accounts, electronic banking, collection, and nets as well as the functions of the bank in-house.

Today's Treasury

Increasing interest rates, market volatility, and fears of recession increase pressure on the Ministry of Finance's team to protect the balance sheet, predict cash flows against various risk scenarios, and streamline treasury operations to provide more intelligence.

ConVista empowers the treasurer to make more confident cash and liquidity decisions, along with analytic tools to manage more complex global cash structures and optimize liquidity throughout the company.

Treasury Features

ConVista is a leading global provider of treasury management solutions for companies of all sizes and all industries.

What do treasury professionals do?

As a professional treasury, you are basically a trusted advisor to businesses about financial problems, always looking forward and planning how you can add value and encourage success. The decision you make will have a direct impact on performance and profit.

Your role is about managing money and financial risks in business. This involves ensuring the business has the capital needed to manage daily business obligations while helping to develop its long-term financial strategies and policies. You will do this by focusing on how and where to put money - while managing related risks - to add value and encourage business success.

Every business takes risks. This is the professional role of the Treasury to identify, assess, and manage this risk so that they support business goals. You will also help identify and create new opportunities that can be useful for business.

What career opportunities are there for treasury professionals?

The Treasury recruitment landscape is currently very positive. Over the past few years, there has been a collection marked in recruitment at all levels including more opportunities for graduates, with more organizations now searching to place talent at the entry level directly from the university.

You can be expected well, and highly valued for your expertise and get real satisfaction from knowing what you are doing can make a real difference for any business success. Do you want to work for multi-national organizations, charities, government agents, or start-ups, Treasury offers a diverse and profitable career that can make you on track to the most senior roles in business and finance and open doors for international opportunities. Adding recognized ACT qualifications and membership to your CV can further improve your work ability by showing your commitment to achieving and maintaining the highest professional standards. It can also give you a valuable advantage in a competitive market

From the level of entry-level to the council, there are various roles and job titles that include treasury aspects. Some of them include:

Treasury analyst, treasury dealer, and treasury accountant

Risk manager and cash manager

Credit risk and financial analyst

Group Treasurer, Head of Treasury Operations, and Tax Director

Relationship Manager and Transaction Service Analyst

Finance Director, Financial Control

Implementing Director, Corporate Secretary

Owner and business entrepreneur

Non-Executive Director

Head of Finance Officer (CFO) and Head of Executive (CEO)

For more information visit: www.convista.com

#Treasury Management system in India#Responsibilities of Treasury Management#SAP Treasury Management#Treasury Management in SAP#Treasury Management in India#Treasury Management in Bangalore#Bank Treasury Management#Function of Treasury Management#Treasury Management system#Treasury Management

3 notes

·

View notes

Link

0 notes

Text

Future PM must focus on EU to fix Brexit damage says business group

Sign up to our free Brexit and beyond email for the latest headlines on what Brexit is meaning for the UK

Sign up to our Brexit email for the latest insight

The next UK government should focus on a better trading relationship with the EU after Brexit costs made exports more difficult, one of the country’s most influential business groups has said.

The Federation of Small Businesses (FBS) published its election manifesto on Friday, citing “stronger trade relations with the UK’s major trade partners, including the EU” as one of its priorities.

Martin McTague, national chair of the FSB, said Britain’s decision to leave the EU has impacted some small businesses negatively if exporting to the EU.

He told The Independent: “What we are seeing in specific areas is a really big drop-off for exporters…

“Location is very important and a lot of small businesses don’t have the resources to take on the distant markets. Vicinity is important. A lot of them have been put off by the additional burden that Brexit has caused.”

The EU headquarters in Brussels (Copyright 2023 The Associated Press. All rights reserved)

Asked whether improving relations with the EU was important, he said: “I think that’s much more important to the small business community. The larger businesses have got the capacity and resilience and resources, frankly, to weather whatever storms are out there and deal with the problems.

“And they are prepared to up sticks and move to the continent, whereas that is not an option for most small businesses. So having a better trading relationship is important.”

Mr McTague said that although an improved relationship with the EU is “slowly emerging”, his organisation would like any incoming government to “put more emphasis on that”.

Previously released research from the FSB showed that almost one in 10 small firms that used to export or import goods has stopped doing so in the past five years, in part due to costs, the volume of paperwork, and supply chain or logistical issues.

The FSB’s manifesto also calls for a future government to reform business rates and enshrine in law measures to clamp down on big businesses with poor payment practices towards smaller suppliers.

In addition, the group wants to improve small businesses’ access to finance and secure a 33 per cent statutory public procurement target for small and medium-sized enterprises (SMEs).

A survey by the FSB found that 96 per cent of small business owners intend to vote but 20 per cent have yet to decide for which party. 33 per cent have a good idea for whom they will vote, but could still change their mind.

The top concern for small businesses is that any future government will raise taxes, according to the survey.

The FSB’s policy chair, Tina McKenzie, said: “Small business owners and the self-employed are a shrewd and motivated part of the electorate.

“They’re used to weighing up competing offers when running their businesses, and it’s clear from our research that when it comes to the election they’re looking for which of the parties has the most compelling pro-small business offer.

“Small businesses are the key to securing economic recovery, driving innovation, and creating jobs in all parts of the UK.

“Our small business manifesto sets out the measures needed to create the conditions for that to happen, many of which do not involve additional spending.

The Independent previously reported that Brexit is leaving a hole of almost £100bn in annual UK exports, making Britain’s economy worse off than it would have been, had it remained in the European Union.

Source link

via

The Novum Times

0 notes