#smsf tax return

Text

Are you looking for a tax accountant to help you complete your Superannuation tax return accurately, on time, and without stress? Quick SMSF Accountants provides expert tax and accounting services to Self-Managed Super Funds.

www.quicksmsfaccountants.com.au

#quick smsf accountants#smsf accountant#smsf tax return service#melbourne#australia#smsf outsourcing#smsf tax return#smsf accounting and taxation#smsf solution#retirementplanning

0 notes

Text

SMSF Taxation and which funds needs to lodge tax return-SMSF Tax Return

Superannuation is a tax concessional savings plans where employers, employees, members, self employed make contributions to save for the members retirement and concessional rates are provided to encourage to save for retired life. To say these as concessional means when contributions are made to SMSF or earnings from investments they are taxed at concessional rate and when at some stage after satisfying the condition of release of benefits pensions or lump sum payments are taxed at low rate or tax free.

Concessional contributions to fund

During the working life people save for their retirement to cover the cost of living when they are retired and in Australia Superannuation is the system or plan when Australians save for their retirement. That is why superannuation in Australia is called the most important asset for retirement. How much you will retired with depends on how much you have saved during your working life.

During the employees working life employer makes superannuation contributions to the members super account which is calculated at set rate by law. This is called superannuation guarantee contributions. Other people which are self employed or who have cap available might make member concessional contributions to the fund. Concessional contributions are taxed at 15% once received by the fund.

Non-concessional contributions to fund

Non-concessional contributions are out of pocket money which will not be taxed once received by Superfund.

Both types of contributions need to follow contribution cap rules every year.

Income from investments

If investments made by the self-managed super fund generates income it will be taxed at 15%. Also, if there is a capital gain from the disposal of the assets it will also be taxed at 15% if held for less than one year and 1/3rd discount applicable of held for more than a year.

Deductions in SMSF

Expenses paid for the management of the fund, to generate income in the fund are allowable deductions and can be claimed in the tax return. Some expenses are not deductible being SMSF set up costs, fines paid to Ato or ASIC others…

Also, some expenses like borrowing costs under LRBA are deductible over five years and not immediately like loan establishment costs under LRBA. Some expenses form part of the cost base of assets like bare trust set up cost which are capital in nature.

Read more on:https://smsftaxreturn.com.au/smsf-taxation-and-which-funds-needs-to-lodge-tax-return/

#australia#smsf tax return#melbourne australia#smsf tax return services#SMSF Taxation and which funds needs to lodge tax return

0 notes

Text

Get More Information Here:- https://www.smsftaxreturn.com.au/smsf-tax-return-services/

0 notes

Text

SMSF Australia - Specialist SMSF Accountants (Gold Coast)

Level 2/194 Varsity Parade, Varsity Lakes QLD 4227, Australia

(07) 5551 2051

At SMSF Australia we are passionate regarding giving a full series of SMSF solutions to our clients in the Gold Coast and beyond. Our SMSF Accountants are accredited specialists having actually finished the SMSF Associations Specialist training program developed for accountants and lawyers that picked to be experts in this specific niche location. Our team integrates technological quality with high degree automation options improved the Class Super system to maintain your SMSF Administration efficient and also affordable. We help with configurations, management, audit, audits and also a lot more. Reach out to our pleasant team servicing the Gold Coast today to see how we can best assist you with your Self Managed Super Fund regardless of where you are at in the trip!

Visit us here:

#SMSF Accountant Gold Coast#SMSF Accountants Gold Coast#SMSF Setup Gold Coast#self managed super fund#smsf administrators Gold Coast#SMSF accounting Gold Coast#SMSF accounting services#Gold Coast accounting services#SMSF auditor Gold Coast#Gold Coast tax service#smsf tax return

0 notes

Text

SMSF Australia - Specialist SMSF Accountants

Level 12/197 St Georges Terrace, Perth WA 6000, Australia

+61 8 6313 8718

Self-managed super funds can need a lot of work, and that is something SMSF Australia is aware of. Because of this, we provide a wide range of services to our clients in Perth that are designed to make it easier for them to administer their SMSFs. We provide a comprehensive array of tax compliance and SMSF accounting services. You can get assistance from our knowledgeable staff at every stage. We can set up the daily drudge labor to operate as efficiently as possible so that we can spend the majority of our time offering guidance and support because our experienced and licensed SMSF Accountants are specialists in automation systems like Class Super.

Visit our links:

#SMSF Accountant Perth#SMSF Accountants Perth#SMSF Setup Perth#Self Managed Super Fund#SMSF Administrators Perth#SMSF accounting perth#SMSF accounting services#Perth accounting services#SMSF auditor perth#Perth tax service#smsf tax return

0 notes

Text

SMSF Australia - Specialist SMSF Accountants

Suite 13, 20-40 Meagher Street, Chippendale NSW 2008

+61 2 8246 7256

We conduct all of our work utilizing the Class Super platform, which enables us to automate simple processes and offer cheap pricing to our clients. SMSF Australia is home to a team of accredited SMSF Accountants who specialize in automation systems and provide services throughout Sydney NSW. Throughout Sydney, our close-knit staff has provided SMSF accounting and advising services for many years. It's crucial to work with a reputable and experienced accountant who can offer you all the accounting and administrative services you require if you're considering establishing an SMSF in Sydney. To discuss your alternatives and get started on the road to financial success, get in touch with our Sydney office right away.

Visit our links:

#SMSF Accountant Sydney#SMSF Accountants Sydney#SMSF Setup Sydney#Self managed super fund#smsf administrators Sydney#SMSF accounting Sydney#SMSF accounting services#Sydney accounting services#SMSF auditor Sydney#Sydney tax service#smsf tax return

0 notes

Text

SMSF Australia - Specialist SMSF Accountants

An accountant who specializes in managing self-managed super funds is known as an SMSF accounting specialist. Brisbane-based SMSF accounting specialists are prepared to handle challenging tax and compliance issues, audit SMSF financial statements, and offer advice on investment strategies and retirement planning. They are up to date on regulatory developments that affect SMSFs and have a thorough understanding of the Australian tax system.

Contact us:

SMSF Australia - Specialist SMSF Accountants

477 Boundary St, Spring Hill QLD 4000, Australia

+61 7 3112 8069

Visit our links:

#SMSF Accountant Brisbane#SMSF Accountants Brisbane#SMSF Setup Brisbane#Self Managed Super Fund#SMSF Administrators Brisbane#SMSF Accounting Brisbane#SMSF Accounting Services#Brisbane accounting services#SMSF auditor Brisbane#Brisbane tax service#smsf tax return

0 notes

Text

SMSF Australia - Specialist SMSF Accountants (Canberra)

490 Northbourne Ave, Dickson, ACT 2602, Australia

+61 2 5112 2308

https://smsfaustralia.com.au/smsf-accountants-canberra/

SMSF Australia boasts a team accredited SMSF Accountants in Canberra who have acquired their SMSF Specialist accreditation from the SMSF Association of Australia. We are a dedicated group of professionals who enjoy helping clients in Canberra and working in the superannuation niche. Our company combines technical prowess with advanced automation technology to maintain your SMSF Administration efficiently and, thus, cost-effectively. We provide a variety of SMSF Accounting Solutions, such as SMSF Setups, continuous accounting support, SMSF Tax Returns, and annual audit coordination. Contact our helpful team to learn how we can assist you with your Self-Managed Super Fund, regardless of where you are in the process!

#SMSF Accountant Canberra#SMSF Accountants Canberra#SMSF Setup Canberra#Self managed super fund#SMSF administrators Canberra#SMSF accounting Canberra#SMSF accounting services#Canberra accounting services#SMSF auditor Canberra#Canberra tax service#SMSF tax return

1 note

·

View note

Text

SMSF Australia - Specialist SMSF Accountants (Hobart)

162 Macquarie St, Hobart TAS 7000, Australia

+61361423057

SMSF Australia is comprised of a team of certified SMSF Accountants who focus solely on Self Managed Super Funds. We are specialists in the SMSF arena, assisting clients in managing their superannuation administration with Class Super and automated solutions. These automation solutions help us maintain competitive pricing by utilising data feeds to ensure that our procedures are as efficient as possible! Our pricing plan is a straightforward annual cost specified in advance, beginning at $1,300 per year. We do not charge monthly fees and there are no extra expenses for filing returns, compliance levies, etc. In addition we complete SMSF setups and can help you organise your new self-managed super fund, corporate trustee and rollovers.

#SMSF Accountant Hobart#SMSF Accountants Hobart#SMSF Setup Hobart#Self managed super fund#SMSF administrators Hobart#SMSF accounting Hobart#SMSF accounting services#Hobart accounting services#SMSF auditor Hobart#Hobart tax service#SMSF tax return

1 note

·

View note

Text

SMSF Australia - Specialist SMSF Accountants

Suite 19/103 George St, Parramatta NSW 2150, Australia

+61 2 8246 7257

At SMSF Australia our close-knit team has decades of experience providing SMSF accounting and advisory services throughout Parramatta NSW. We employ Certified SMSF Accountants so you can be certain your SMSF is being completed correctly by a specialist team that are passionate about providing SMSF accounting and administration services throughout Parramatta. As experts in the field, we ensure our clients get the best advice and support in all aspects of setting up and managing their SMSF, offering a wide range of accounting and administrative services tailored to each client's needs and financial goals. Contact us today to find out how we can best assist you with your specific SMSF needs. We look forward to working with you.

Services: SMSF Accounting Services, SMSF Audit Services, SMSF Setup Process, SMSF Tax Return, SMSF Wind Up

0 notes

Text

Promote Your Financial Strategies with A Trusted Cheltenham Accountant

We offer comprehensive accounting services, from cloud-based solutions to tax planning. Our Cheltenham accountants team offers a personalised approach to ensure every client receives proactive financial assistance. Whether you're a small business owner or an individual, our competitive pricing, transparent billing, and cutting-edge technology will prioritise your financial well-being thoroughly. Partner with Abletax for expert guidance and exceptional accounting support.

Achieve your financial dreams with expert accountants in Cheltenham.

#small business tax accountants#bookkeeping and accounting cheltenham#tax agents near cheltenham#tax accountant cheltenham#tax returns#small business tax and accounting cheltenham#accountant for small business#business tax planning melbourne#tax agent cheltenham#smsf accountants melbourne

0 notes

Text

Quick SMSF Accountants Tax Return Services Melbourne team ensures that your Self-Managed Super Fund tax return is ATO-compliant, intending to lower your taxes legally and claiming accurate expenses so that you may retire with more money.

Our SMSF tax return team guarantees that your self-managed super fund tax return is properly completed, allowing you to save money on taxes by claiming allowable expenses. We are an Australia-based SMSF accountancy firm offering you the opportunity to sidestep paper and file cabinet overload with our efficient, cost-effective services. We specialize in providing clients value by doing what they would otherwise have done themselves – making their lives easier!

Every year, you must file an SMSF tax return. An SMSF Return is required by law to report income, contributions, levies, and regulatory information to the ATO.

Visit:- https://www.quicksmsfaccountants.com.au/ or Call :- 03 5917 2450

#retirement#retirement planning#savings#smsf accountant#smsf tax return service#smsf tax return#smsf solution#smsf outsourcing#finance#financial planning#tax

0 notes

Text

Steps to consider for the lodgement of the SMSF Tax Return

To enjoy the tax concession benefits of the self managed super fund trustees, need to make sure fund in compliant all time and up to date with its SMSF tax return lodgements and compliance obligations. Self managed super fund as know as SMSF or DIY super fund is a powerful retirement vehicle where control and flexibility given to trustees to save for the fund members retirement. As it offers control at the same time, it gives responsibility to trustees to comply with superannuation and tax laws.

Steps to consider for the lodgement of the SMSF tax return are as below:

1. Due date for the lodgement

Decide if the tax return will be lodged by trustees or help of an SMSF professional will be considered. Due date of the tax return will be accordingly as tax agents get concessional date for the lodgement

2. Get documents and notices ready

Get your documents ready to be provided to the SMSF accountant for the funds yearly work and if you are planning to claim deduction for personal super contributions make sure these are filled and signed on time and ready to be provided to the accountant and auditor

3. Value your funds’ assets

Trustee are required to value the superfund assets at the yearend for the fund’s financial statements and tax return preparation. This value of fund assets will be reflected in the funds annual accounts and details provided to the tax office on the SMSF tax return

4. Arrange funds accounts and tax return preparation

Prepare the funds accounts and tax return either by yourself or with the help of an SMSF accountant. Preparation of accounts includes financial statements, member statements, investment reports

5. Arrange funds audit

Once the funds accounts and tax return are ready trustees need to arrange audit with an ASIC approved SMSF auditor which will check funds compliance with the superannuation industry rules and regulations. Audit must be arranged at least 45 days before the funds lodgement due date to give enough time to the auditor to compete the job

6. Lodge tax return

Once the funds audit is finalised and audit report provided by the SMSF auditor its time to lodge the superannuation tax return with the tax office. Tax return can be lodged through paper form or electronically with the help of a tax agent. Tax office release new version the SMSF tax return each year. Trustees need to make sure if they lodging through paper form correct tax form is used and submitted for the relevant year

If you need help with the tax return preparation and lodgement of your self managed super fund please contact our SMSF professionals for smooth and efficient process.

For more info, visit:https://smsftaxreturn.com.au/steps-for-smsf-tax-return/

0 notes

Text

SMSF Tax Return | SMSF Tax Return Services Melbourne

SMSF tax return also known as DIY super return or superannuation tax return is mandatory if you control your retirement savings in the form of retirement saving vehicle known as self managed super fund.

The tax return due date varies if its new fund or existing fund, lodgment is done through registered tax agent or trustees, if the previous year’s tax return was lodged on time. Due date can be confirmed by online portal or your tax agent can confirm through tax agent portal. If you are using registered tax agent for the lodgment of the SMSF annual return you will get extra time to lodge the return as compared to if you lodge by yourself.

Financial year for self managed super funds is from 1st July to 30th June. It is one of the requirements to have an SMSF to lodge annual return every year from the fund inception till wind up. Tax return can only be lodged once the audit of the fund has been finalized by the ASIC approved SMSF auditor and the SMSF auditors and audit complete details will be included in the tax return.

Tax rate for SMSFs in Australia is flat 15 percent on the taxable income which will be calculated after deductions are deducted from the assessable income. Funds is pension phase will be tax free but needs to follow superannuation rules for pension and transfer balance cap rules. Different rates can apply to funds in some circumstances examples being non complying SMSFs taxed at higher rate of 47 percent.

Every self managed super fund is different with some simple and other more complex. We can prepare and lodge your Superannuation tax return irrespective its being simple or complex.

Self Managed Super Funds or DIY Super Funds assesses their own debt or tax refund. Once the tax return of the SMSF is lodged it will be considered as assessment and a separate notice of assessment will not be issued.

Options of lodging the tax return is paper form or through software. We use SMSF specialist software BGL simple fund for the preparation and lodgment of the superannuation tax return.

If the tax return will be overdue for some time the SMSF details will be removed from the Superfund lookup and employers will not be able to make member contributions with this status. Status will come back to normal once the overdue tax returns are lodged and Superfund lookup status will be updated.

Part of the SMSF tax return is the SMSF details section, auditor details, income section, deduction section, member section and assets and liability section. All details need to be filled for the relevant financial year and tax return will be submitted to the ATO. Super levy will also be paid as part of the SMSF tax return for the relevant year and for the first year of the SMSF super levy will be paid for the next year in advance and when winding up the fund year no super levy will be paid and will be adjusted on the SMSF tax return.

If the superfund tax return needs to be amended in the later stage whole tax return will need to be submitted again and not only the part that needs to be amended. As amending one part will change the other part figures on the return.

If the superfund needs to be wind up at some stage final tax return will be prepared and lodged with wind up details on the tax return. Audit for the final year need to be completed before the lodgment.

If you need any help or have any question regarding SMSF tax return please feel free to contact our Superannuation expert team.

Website Url: https://www.smsftaxreturn.com.au

0 notes

Text

Expertise You Can Trust: Dial Tax - Your Tax Accountant for SMSF

When it comes to managing your Self-Managed Superannuation Fund (SMSF), there's no room for guesswork or uncertainty. SMSFs come with a unique set of tax responsibilities and financial complexities that demand the expertise of a dedicated tax accountant. Enter Dial Tax, your trusted partner in navigating the intricate world of SMSF taxation. In this blog, we'll explore the importance of having a qualified tax accountant for SMSF and how Dial Tax can assist you in achieving financial success and compliance.

Understanding the Role of an SMSF

A Self-Managed Superannuation Fund is a retirement savings vehicle that allows individuals to have more control over their investments. While SMSFs offer flexibility and potential for higher returns, they also come with significant responsibilities, especially in terms of taxation.

Key aspects of SMSF taxation include:

Contribution Tax: Understanding the tax implications of contributions made to your SMSF, including employer contributions, personal contributions, and government co-contributions.

Investment Income: Managing the taxation of income generated by the investments held within your SMSF, such as rental income from property or dividends from stocks.

Capital Gains Tax (CGT): Ensuring compliance with CGT rules when selling SMSF assets, such as property or shares.

Pension Phase: Handling the transition of your SMSF into pension phase, which involves specific tax considerations.

Annual Reporting: Preparing and submitting the annual SMSF tax return, including financial statements and audit reports.

Why You Need a Tax Accountant for Your SMSF

Managing an SMSF's tax affairs can be complex and time-consuming. Here are some compelling reasons why you should enlist the services of a qualified tax accountant like Dial Tax:

1. Compliance and Regulation

The Australian Taxation Office (ATO) has strict regulations governing SMSFs. Failing to comply with these regulations can result in significant penalties and loss of tax concessions. A tax accountant who specializes in SMSFs will ensure that your fund operates within the legal framework, minimizing your risk of non-compliance.

2. Maximizing Tax Efficiency

A tax accountant understands the intricacies of the tax system and knows how to structure your SMSF in a tax-efficient manner. They can help you make strategic decisions to minimize tax liabilities while maximizing your retirement savings.

3. Investment Insights

Your SMSF may have a diverse range of investments, from property to shares and more. A knowledgeable tax accountant can provide valuable insights into the tax implications of different investment strategies and guide you in making informed decisions.

4. Record Keeping

Maintaining accurate and up-to-date records is a fundamental requirement for SMSF compliance. A tax accountant can assist in record-keeping, ensuring that all financial transactions are properly documented and organized.

5. Annual Reporting

Filing an SMSF annual return is a critical task, and any errors or omissions can lead to issues with the ATO. Your tax accountant will prepare and lodge the necessary documentation accurately and on time, relieving you of this administrative burden.

6. Investment Diversification

Tax accountants can help you explore investment options that align with your financial goals and risk tolerance. They can advise on the tax implications of various asset classes and assist in diversifying your SMSF portfolio.

7. Estate Planning

Effective estate planning is essential when it comes to SMSFs. A tax accountant can help you structure your SMSF to ensure that your assets are distributed according to your wishes in the event of your passing, while also minimizing potential tax liabilities for your beneficiaries.

Why Choose Dial Tax for Your SMSF

Dial Tax stands out as a top choice for individuals seeking expert assistance with their SMSF taxation needs. Here's why:

1. SMSF Specialization

Dial Tax specializes in SMSF taxation. Their team of experienced tax accountants understands the nuances of managing self-managed superannuation funds, ensuring that you receive accurate advice and tailored solutions.

2. Compliance Assurance

With Dial Tax, you can rest easy knowing that your SMSF will remain compliant with all relevant regulations and reporting requirements. Their meticulous attention to detail and commitment to compliance means you can focus on growing your retirement savings.

3. Personalized Service

Dial Tax takes the time to understand your unique financial goals and circumstances. They provide personalized solutions that align with your SMSF objectives, whether you're planning for retirement, wealth accumulation, or estate planning.

4. Accessible Expertise

Navigating SMSF taxation can be complex, but Dial Tax makes it accessible. They communicate in plain language, ensuring you fully comprehend your financial situation and the strategies they recommend.

5. Technology Integration

Dial Tax leverages cutting-edge technology to streamline processes and enhance the efficiency of SMSF management. This means quicker responses, secure data handling, and a more seamless experience for clients.

6. Comprehensive Services

Beyond tax accounting, Dial Tax offers a wide range of SMSF services, including financial planning, investment advice, and estate planning. They are your one-stop destination for all your SMSF needs.

Conclusion

Your Self-Managed Superannuation Fund represents a significant part of your financial future, and managing its taxation and compliance requirements requires specialized knowledge. Dial Tax is your trusted partner in ensuring the financial success and compliance of your SMSF. With their expertise, personalized service, and commitment to excellence, you can navigate the complexities of tax advice expert sydney with confidence. Don't leave your retirement savings to chance—partner with Dial Tax and secure your financial future today.

0 notes

Text

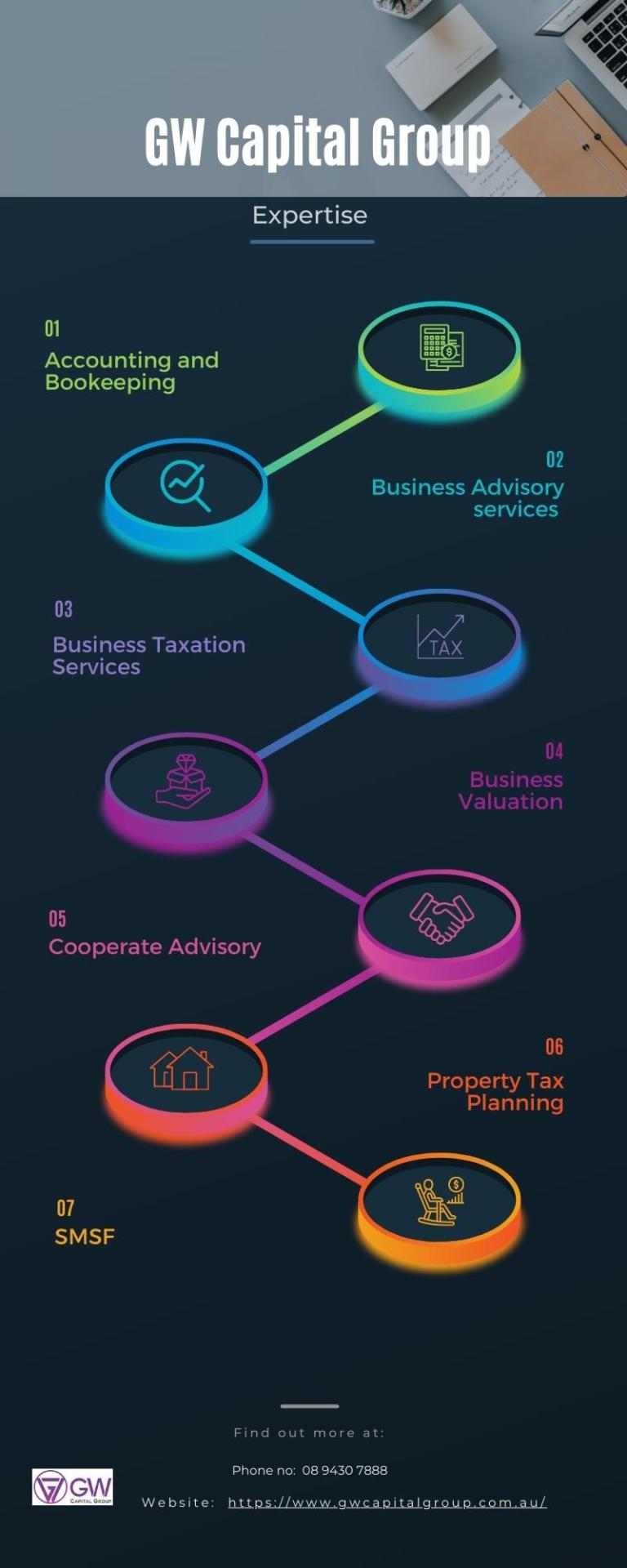

Accounting services in Perth

An organization's bookkeeping aims to interpret its financial processes and management. The ability to identify the profit justifies the cost will undoubtedly result in accelerated growth for business owners. Our bookkeeping services » Perth are tailored towards addressing such matters, so our professionals are knowledgeable about them.

All of our clients at GW Capital Group receive high-quality professional bookkeeping services. We can help you with your bookkeeping needs! Contact us today!

#bookkeepers perth#bookkeeping services#accounting bookkeeping service#smsf accountants#corporate advisory#tax return perth#tax return services#accountants in perth#accounting services perth

0 notes