#stubcreator

Explore tagged Tumblr posts

Text

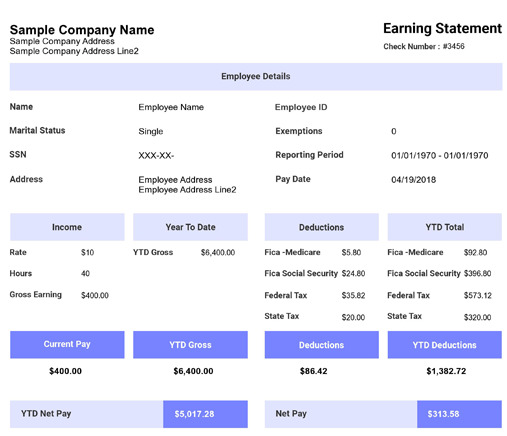

How to Get Instacart Pay Stubs

If you're an Instacart shopper, tracking your earnings and managing your financial records is essential. Pay stubs are crucial documents for various purposes, including loan applications, rental agreements, and accurate tax filings. Here's a detailed guide on how to obtain your pay stubs from Instacart and the benefits of using tools like StubCreator, a paystub generator free to enhance your financial management.

Why You Need Your Instacart Pay Stubs

Pay stubs from Instacart provide a detailed breakdown of your earnings, deductions, and taxes withheld. They are essential for:

Proof of Income: Necessary for applications for loans or rental agreements.

Financial Tracking: Helps in budgeting and tracking your income.

Tax Filing: Ensures accurate reporting of income for tax purposes.

Steps to Get Instacart Pay Stubs

1. Using the Instacart Shopper App

Log In: Open the Instacart Shopper app and log in using your credentials.

Navigate to Earnings: Go to the "Earnings" section where you can view your weekly earnings.

Download Pay Stubs: Instacart does not provide traditional pay stubs, but you can download a summary of your earnings.

2. Contact Instacart Support

Submit a Request: If you need a formal pay stub, you can contact Instacart support through the app or website.

Provide Details: Ensure you provide all necessary details, including the specific pay periods you need.

Receive Pay Stubs: Instacart support can provide you with a detailed breakdown of your earnings if required.

Using StubCreator for Pay Stub Management

Managing your pay stubs efficiently is crucial, and this is where StubCreator comes in. StubCreator offers several tools to help you create and manage your pay stubs:

Free Paystub Generator: Easily create customized pay stubs that accurately reflect your earnings and deductions.

Paystub Generator Free: Generate detailed pay stubs at no cost, providing a clear breakdown of your income and deductions.

Benefits of Using StubCreator

1. Customization

With StubCreator, you can customize your pay stubs to include all necessary information such as company name, employee details, earnings, deductions, and net pay. This level of detail ensures that your pay stubs are professional and meet all necessary requirements.

2. Accuracy

StubCreator ensures that your pay stubs are accurate, reflecting the exact details of your earnings and deductions. This is essential for tax filings and financial planning.

3. Convenience

Creating pay stubs with StubCreator is quick and easy. You can generate pay stubs from the comfort of your home without needing to wait for Instacart to provide them.

Conclusion

Accessing your Instacart pay stubs is essential for managing your financial records and ensuring accurate tax filings. While Instacart provides basic earnings information through its app, using tools like StubCreator can enhance your ability to generate detailed and professional pay stubs. With features like a free paystub generator, StubCreator allows you to customize and accurately reflect your earnings and deductions, making financial management more efficient and effective.

By leveraging StubCreator, you can ensure that your pay stubs are detailed, accurate, and tailored to your needs, providing you with the necessary documentation for any financial requirement. Whether you're applying for a loan, renting an apartment, or simply tracking your income, having access to professional and accurate pay stubs is crucial. Start using StubCreator today to simplify your pay stub management and take control of your financial records.

#paystub generator free#free paystub generator#free pay stub template with calculator#pay stub generator free#free check stub maker

0 notes

Link

Visit https://stubcreator.com/ for more information

2 notes

·

View notes

Link

Here are a few reasons why you should save your paystubs. Read the detailed blog @ stubcreator

https://stubcreator.com/

0 notes

Link

There is no better option for making stubs online using Free Pay Stub Maker by stubcreator.com. It is very beneficial for small and large businesses for making as many number of Online Pay Stub as they want.

0 notes

Link

Online Pay Stubs and Paychecks are no longer a hectic matter. Stubcreator.com brings an easy and affordable way for creating pay stubs with its efficient paycheck calculator. Get your stubs made instantly and save or download them as you wish.

0 notes

Text

How to Create Check Stubs for Free

Creating check stubs is essential for both employees and employers. Check stubs, also known as pay stubs, provide a detailed breakdown of earnings, deductions, and net pay. They are vital for financial record-keeping, tax filing, and verifying employment. In this blog, we will guide you through the process of creating check stubs for free and introduce you to useful tools like free check stub makers.

Why Create Check Stubs?

Check stubs serve multiple purposes:

Financial Record-Keeping: Helps both employees and employers maintain accurate financial records.

Proof of Income: Necessary for loan applications, rental agreements, and other financial transactions.

Tax Filing: Provides detailed information on earnings and deductions needed for filing taxes.

Employment Verification: Used to verify employment history and income by various entities.

Steps to Create Check Stubs for Free

1. Gather Necessary Information

Before creating a check stub, you need to collect all the relevant information. This includes:

Employer Details: Company name, address, and contact information.

Employee Details: Employee name, address, and social security number.

Payment Information: Pay period dates, hourly rate or salary, total hours worked, overtime hours, bonuses, and commissions.

Deductions: Federal and state taxes, social security, Medicare, health insurance, retirement contributions, and any other deductions.

2. Choose a Free Check Stub Maker

There are several free check stub makers available online that you can use to create professional check stubs. One such reliable tool is StubCreator. Here’s why StubCreator stands out:

Free Check Stub Maker: StubCreator offers a free tool to generate check stubs, saving you costs associated with paid services.

User-Friendly Interface: The platform is designed to be easy to use, even for those with little to no experience in creating check stubs.

Accurate Calculations: Built-in calculators ensure that all earnings and deductions are calculated accurately.

3. Enter the Information

Using your chosen free check stub maker, enter all the gathered information into the appropriate fields. Here’s how to do it using StubCreator:

Open StubCreator: Visit the StubCreator website and navigate to the free check stub maker tool.

Fill in Employer Details: Enter the company name, address, and contact information.

Fill in Employee Details: Input the employee’s name, address, and social security number.

Enter Payment Information: Add the pay period dates, hourly rate or salary, total hours worked, overtime hours, bonuses, and commissions.

Enter Deductions: Input all the relevant deductions, including federal and state taxes, social security, Medicare, health insurance, retirement contributions, and any other applicable deductions.

4. Customize the Check Stub

Customization adds a professional touch to your check stubs. Most free check stub makers, including StubCreator, offer various customization options:

Templates: Choose from different templates to match your professional needs.

Company Logo: Add your company logo for a personalized and professional appearance.

Design Options: Select design options that align with your company’s branding.

5. Generate and Save the Check Stub

Once you have entered all the necessary information and customized the check stub to your liking, it’s time to generate the final document:

Review: Carefully review all the details to ensure accuracy.

Generate: Click the “Generate” button to create the check stub.

Save: Save the generated check stub to your computer or device. Most platforms allow you to download the check stub as a PDF for easy printing and sharing.

Benefits of Using a Free Check Stub Maker

Using a free check stub maker like StubCreator comes with several advantages:

Cost-Effective: Save money by using a free tool instead of paid services.

Time-Saving: Quickly generate check stubs without the need for complex software or extensive manual calculations.

Accuracy: Ensure accurate calculations of earnings and deductions with built-in calculators.

Professional Appearance: Create professional-looking check stubs that can be used for official purposes.

Conclusion

Creating check stubs for free is a straightforward process when you use the right tools. By gathering the necessary information, choosing a reliable free check stub maker like StubCreator, and following the steps to enter and customize your data, you can generate professional check stubs with ease.

StubCreator’s user-friendly interface, accurate calculations, and customization options make it an ideal choice for individuals and businesses looking to create check stubs without incurring additional costs. Whether you need to maintain accurate financial records, provide proof of income, or prepare for tax filing, StubCreator has you covered.

#pay stub generator free#free check stub maker#paystub maker free#free pay stub generator#free paystub maker#paycheck stubs

0 notes

Text

How to Handle Paystubs When Changing Jobs

Changing jobs can be an exciting but also challenging time. Amidst the flurry of transitioning to a new role, it's crucial not to overlook the management of your paystubs from your previous employment. Paystubs are not only important for maintaining financial records but also for various administrative and personal finance reasons. Here's a guide on how to handle paystubs effectively when changing jobs, along with insights into utilizing tools like paystub makers and free pay stub generators.

1. Collect Your Paystubs

Before leaving your current job, ensure you gather all your paystubs from the period of your employment. Paystubs serve as proof of income and contain essential details such as earnings, deductions, taxes withheld, and year-to-date (YTD) figures. These documents may be required for future financial planning, tax purposes, or applying for loans.

2. Store and Organize

Once you have collected your paystubs, organize them chronologically and store them securely. Consider keeping both physical copies and digital scans for easy access. Digital storage options like cloud services or dedicated financial management apps can ensure that your paystubs are safe and accessible whenever needed.

3. Understand Tax Implications

Paystubs provide valuable information for tax filing purposes. Ensure that you have records of your earnings and tax withholdings to accurately report your income when filing taxes. This becomes particularly important if you change jobs during the tax year, as you may receive multiple W-2 forms or equivalent documents.

4. Use Paystub Makers and Free Pay Stub Generators

In managing your paystubs, consider leveraging tools like paystub makers and free pay stub generators. These tools simplify the process of creating accurate paystubs, whether for your current employment or for documenting income during job transitions. Key benefits include:

Convenience: Generate paystubs online instantly, eliminating the need to wait for payroll departments or HR offices to provide physical copies.

Accuracy: Paystub makers ensure that all calculations, including earnings, deductions, and taxes, are accurate and compliant with tax regulations.

Accessibility: Access paystub templates anytime, anywhere, and customize them to reflect specific deductions or additional income sources as needed.

5. Plan for Financial Continuity

As you transition to a new job, ensure continuity in your financial planning. Use insights from your paystubs to assess your budget, savings goals, and retirement contributions. Understanding your income patterns and expenses will help you make informed decisions about managing your finances effectively in your new role.

Conclusion

Handling paystubs when changing jobs is a critical aspect of managing your financial records and ensuring smooth transitions. By collecting, organizing, and leveraging tools like paystub makers and free pay stub generators, you can streamline the process and maintain clarity in your financial documentation. Remember, paystubs serve not only as proof of income but also as valuable resources for tax preparation and financial planning. Incorporate these practices into your job transition checklist to maintain financial stability and confidence in managing your career changes.

For more information on how paystub makers and free pay stub generators can support your financial management, explore options like stubcreator and other reliable tools available online.

#paystub generator free#free paystub generator#free pay stub template with calculator#pay stub generator free#free check stub maker#paystub maker free#free pay stub generator#free paystub maker#paycheck stubs#Handle Paystubs When Changing Jobs

0 notes

Link

Know how using a fake stub can lead to illegal issues and penalties. You can, however, avoid the issues by using a free paystub generator and verifying whether you have an original or a fake pay stub.

Browse 10+ payroll templates & Download free pay stub template @ stubcreator. com

#creating fake paystub#how to#how to identify fake paystub#free check stub maker with calculator#stubcreator

2 notes

·

View notes

Link

we have some guidelines and strategies from the business owners that’ll keep small businesses afloat. Let’s check them out.

Read Here: https://stubcreator.com/blog/what-keeps-your-business-going-during-economic-downtimes/

#free pay stub templates#paystub maker free#Paystub Creator#Business Survival Strategies#stubcreator

2 notes

·

View notes

Link

Know How to create check stubs on Stubcreator App in 3 simple steps?

visit @ https://stubcreator.com/app/

0 notes

Link

Here are a few reasons why you should save your paystubs. Read the detailed blog @ stubcreator

https://stubcreator.com/

0 notes

Link

What's the Difference Between Payroll and Income Taxes?

The key difference is that payroll taxes are paid by employer and employee; income taxes are only paid by employers. However, both payroll and income taxes are required to be withheld by employers when they make payroll.

Read the detailed blog @ stubcreator & if you want to generate paystub you can use our free paystub generator.

#Payroll tax vs Income Tax#Payroll#paystub#stubcreator#free check stub maker with calculator#free paystub generator

0 notes

Link

There are different types of pay cycles, and every organization follows a different cycle according to their requirements and management needs. Read more at website.

Try free check stub maker with calculator @ stubcreator

#Free check stub maker#free check stub maker with calculator#Free Pay Stub Generator#pay cycle#What is pay cycle#payroll#stubcreator

0 notes

Link

Few reasons why using a free check stub maker makes a company good, Read More... @ Stubcreator

1 note

·

View note

Photo

Check Stub Template | Blank - Excel - Word Sample

Visit https://stubcreator.com/download-pay-stub-templates/ and download templates for free. Get first paystub absolutely free or $4.99 off @stubcreator

2 notes

·

View notes