#tech startup pitch deck

Explore tagged Tumblr posts

Text

Best Artificial Intelligence Presentation Template for Powerful Tech Industries

Boost Your Business with the Artificial Intelligence Presentation Template – A Sleek, Modern Design for Professional Presentations. Crafted by expert designers, this template seamlessly blends style and functionality, making it the ideal choice to showcase your business with sophistication and impact.

Why You Need a Specialized AI Presentation Template

Artificial intelligence is complex, innovative, and transformative. But explaining its intricacies to investors, clients, or a general audience is not always easy. A generic PowerPoint template just doesn’t cut it. You need a tailored solution that:

Captures the futuristic feel of AI

Communicates data and research effectively

Enhances your brand image

Saves time on design so you can focus on content

The Artificial Intelligence Presentation Template from Graphypix is built specifically with these goals in mind.

Final Thoughts

AI is the future — and how you present it matters. With the right visuals, layout, and flow, your message becomes unforgettable. The Best Artificial Intelligence Presentation Template isn’t just a design tool — it’s your storytelling partner.

#artificial intelligence#ai generated#AI presentation#ai art#ai artwork#ai image#ai model#powerpoint template#powerpoint#presentation template#graphypix#template design#print template#brochure design#brochure template#technology#tech startup pitch deck

0 notes

Text

The Valuation Slide That Wins Investors

The Valuation Slide That Wins Investors

In the glitzy world of startups, where innovation meets ambition, there’s one slide in a pitch deck that can command the attention of everyone in the room – the valuation slide. Whether you’re an early-stage startup or merely gauging the potential of a business idea, presenting the perfect valuation can set the stage for a successful fundraising effort. But how do you nail this slide, especially if you have no revenue yet? Let’s delve deeper.

Why Valuation Matters

The valuation of a startup isn’t just about numbers or potential revenue. It’s a narrative of the company’s potential, vision, and the value it aims to deliver to stakeholders. For investors, valuation serves as a compass – it guides them to ascertain the risk associated with your startup and the potential return on their investment. While revenue is a straightforward measure for established companies, startups often operate in the realm of vision, potential, and innovation. This makes the valuation slide not only about the worth but also about the story behind that worth.

Crafting the Perfect Valuation Slide

1. Simplicity is Key: Don’t overwhelm your audience with complex calculations or jargon. Present a clear, concise valuation figure and back it up with 3-4 key metrics or reasons that support it.

2. Storytelling: Numbers, on their own, can be lifeless. Weave a compelling story around your valuation. How did you arrive at this figure? What milestones or potential growth does this number represent?

3. Visual Appeal: A picture is worth a thousand words. Use charts, graphs, or infographics to represent data. It aids in comprehension and retention.

4. Be Prepared for Questions: The valuation slide will undoubtedly raise eyebrows and questions. Be ready to defend your valuation with data, research, and comparables from the industry.

The Role of Valuation Tools

Not everyone is a financial wizard, and that’s okay. In today’s tech-driven age, tools like ValuationGenius can give you an edge. These platforms provide an approximate valuation based on a range of factors, eliminating the need for deep financial know-how. While this shouldn’t be the sole basis of your valuation, it can serve as a starting point or a validation tool. When combined with market research and industry benchmarks, tools like these can make your valuation slide more credible and robust.

Case Study: Litemeup and the Power of AI in Valuation

Meet Litemeup, a fledgling startup on the brink of transforming the packaging industry with AI-driven design. While they had a groundbreaking concept, they faced a common challenge many early-stage startups grapple with: how to place a valuation on an idea when there’s no product or revenue in play?

Enter ValuationGenius

Without a product, without revenue, and seemingly without the necessary data points that typically inform valuation, Litemeup turned to our tool. ValuationGenius didn’t just spit out a random number. Instead, it provided a range of estimates based on different valuation methods. But what truly stood out was the grounding of these estimates. Each was justified not just by data, but by the wisdom of business development and an inherent understanding of the startup landscape.

So, when Litemeup pitched to investors, they had more than just a vision. They presented a detailed valuation slide that wasn’t built on optimistic projections or vague assumptions but on a solid foundation provided by ValuationGenius. The result? They secured the trust and, subsequently, the investment from stakeholders, proving that even in a world where numbers often dominate, there’s always room for common sense and astute business acumen.

Conclusion

While a startup’s journey is riddled with challenges, presenting the right valuation shouldn’t be one of them. Remember, your valuation is more than just a number. It’s a representation of your startup’s vision, potential, and promise. Craft it with care, back it up with data, and present it with confidence. Value startup with no revenue

#startup valuation#startup#business valuation#online startup valuation calculator#startup valuation calculator#startup valuation tool#valuation calculator startup#online valuation platform

2 notes

·

View notes

Text

6 Coworking Trends in Lower Parel That Will Define Workspaces in 2025

Lower Parel, one of Mumbai’s most vibrant commercial hubs, continues to set the pace for the future of work. With a rich blend of heritage mills-turned-commercial-spaces, modern skyscrapers, and close proximity to corporate giants, this neighborhood has become a magnet for startups, freelancers, creative agencies, and even MNCs seeking flexibility. But beyond location, what’s truly driving workplace innovation here is the dynamic evolution of coworking culture.

In 2025, coworking space in Lower Parel isn’t just about desks and Wi-Fi—it’s about experiences, ecosystems, and employee-first design. Let’s explore the six key coworking trends reshaping the future of work in Lower Parel and why they matter to professionals, startups, and enterprise teams.

1. The Rise of Boutique & Niche Coworking Spaces

In 2025, Lower Parel is seeing a major rise in boutique coworking spaces that cater to specific industries or work styles. While large chains still dominate, niche spaces are carving out their place by offering personalized experiences and curated communities.

Why It’s Trending:

Startups want to work alongside similar businesses (e.g., design studios with other creatives, tech founders with SaaS developers).

Freelancers are seeking smaller, quieter environments with personality.

Wellness, aesthetics, and community are now top priorities over just utility.

Examples:

Art-inspired coworking spaces featuring galleries and mood lighting.

Women-only coworking spaces designed for safety and empowerment.

Legal-tech coworking hubs near court districts offering specialized infrastructure.

In Lower Parel’s premium real estate environment, personalization is becoming a competitive differentiator.

2. Hybrid Plans & Work-On-Demand Flexibility

With hybrid work models solidifying post-pandemic, demand for flexible coworking plans has soared. In Lower Parel, coworking operators are now offering extremely tailored memberships, from hourly passes to weekend-only plans, all designed to meet varying team sizes and work rhythms.

What’s Changing:

Drop-in passes for part-time workers.

Team rotation plans, where companies rotate team members through a few desks.

Credit-based usage: Instead of fixed days, users buy credit hours for space usage.

Why It Matters in Lower Parel:

This flexibility is essential in a location where commercial leases are pricey. Small teams, solopreneurs, and even enterprises are cutting overhead by using coworking spaces like a service—not a liability.

3. Design That Prioritizes Mental Health & Productivity

2025 is the year when mental wellness becomes a built-in design principle. Coworking spaces in Lower Parel are moving beyond ergonomic furniture to integrate biophilic design, sensory lighting, nap zones, meditation pods, and even therapy rooms.

Key Wellness Features:

Green work pods with indoor plants and nature-themed visuals.

Sound-proof rooms and quiet zones for deep work.

Rooftop yoga or meditation decks to de-stress.

Why It’s Happening:

Post-COVID fatigue, digital burnout, and high-stress city life have prompted professionals to seek holistic work environments. Lower Parel’s premium workspaces are now a blend of comfort, productivity, and serenity.

4. Coworking Spaces as Networking & Event Hubs

Networking is no longer an add-on. In 2025, coworking spaces are doubling as professional events venues, creating ongoing value through curated programming. In Lower Parel, known for its luxury hotels and convention centers, this trend is going mainstream.

What’s Hot:

Demo days, product launches, and pitch nights hosted at coworking venues.

Cross-industry mixers every month to boost collaboration.

Skill-up weekends featuring workshops by leaders across finance, tech, marketing, and design.

Why Lower Parel Is Perfect for This:

Its location—central, prestigious, and close to both Bandra and Fort—makes it ideal for drawing elite speakers and high-caliber audiences. Coworking spaces here are becoming the new hubs of “work-meets-innovation.”

5. Tech-Integrated Workspaces with AI & Automation

The smart office era is finally here. Coworking spaces in Lower Parel are rolling out AI-powered tools to enhance comfort, productivity, and efficiency.

Tech Advancements in 2025:

Smart access cards & app-based entry with facial recognition.

AI-powered desk allocation and hot-desk optimization.

Occupancy heatmaps and mood-based lighting.

Voice-activated bookings for meeting rooms, printing, and beverages.

Some high-end coworking spaces in the area also integrate digital concierge services—allowing members to schedule dry-cleaning, order office supplies, or call for cabs, all from a single app.

This is particularly popular among corporate teams and CXOs working out of satellite offices in Lower Parel.

6. Sustainability & Green Certifications Drive Space Choices

A growing number of founders and professionals in 2025 are choosing coworking spaces not just for productivity—but for purpose. Green coworking has become a major deciding factor, and Lower Parel’s top providers are responding with eco-conscious infrastructure and operations.

Popular Green Features:

Solar-powered meeting rooms.

Zero-paper policies and e-waste stations.

Upcycled furniture and eco-friendly construction.

Rainwater harvesting and LEED-certified buildings.

Why Professionals Care:

Eco-conscious choices align with brand identity, investor expectations, and employee values. Many startups—especially in ESG, fintech, and impact domains—now list sustainability certifications of their workplace in pitch decks and brand pages.

In Lower Parel, where image and innovation matter equally, these green credentials boost both perception and performance.

The Future of Coworking in Lower Parel

These six trends make one thing very clear: coworking in Lower Parel has graduated from shared tables to shared ambition. It’s not about space anymore; it’s about value, community, and culture.

Who Benefits Most from These Trends?

Startups wanting scalability without real estate commitment.

Solopreneurs seeking a professional, energizing environment.

Enterprises that need satellite hubs to support hybrid teams.

Creative professionals looking for visibility, mentorship, and connection.

In 2025, choosing a coworking space in Lower Parel means accessing more than just infrastructure—it means becoming part of an ecosystem that supports your growth every single day.

#CoworkingSpaceInLowerParel#FutureOfWork#CoworkingTrends2025#MumbaiStartups#HybridWorkplace#GreenCoworking#SmartOffices

0 notes

Text

Business Visa for Attending Global Startup Events – A Step-by-Step Guide

Tailored guide for Indian startup founders traveling for pitch events, summits, and networking.

Introduction: Opening Global Doors for Indian Innovators

In today’s startup ecosystem, global exposure is no longer optional—it’s essential. From pitch competitions and tech summits to accelerator programs and international networking events, Indian startup founders are stepping onto the world stage to connect with investors, mentors, and collaborators. However, before you book your flight, one thing stands between you and global opportunity: a business visa.

This step-by-step guide walks Indian entrepreneurs through the process of applying for a business visa specifically for attending international startup events.

Step 1: Identify the Right Visa Type

Most countries require a business visitor visa for short-term professional trips, including startup summits, networking forums, and demo days. Some common visa types include:

B1 Visa (USA)

Standard Visitor Visa (UK)

Schengen Business Visa (Europe)

Short-Term Visit Pass (Singapore)

Business Visa (UAE)

It’s important to verify the specific visa category based on your destination and the nature of the event.

Step 2: Gather Your Documents

Unlike traditional business travelers, startup founders may not always have extensive financial history or employer sponsorship. Here’s what to prepare:

Valid passport (with at least 6 months’ validity)

Official invitation letter or event confirmation from the organizers

Startup registration documents (e.g., CIN, GST certificate)

Pitch deck or startup profile

Cover letter detailing the purpose of travel and how the event supports your business

Financial proof (personal or company bank statements, investment proof)

Flight and accommodation details

If you’ve received event sponsorship, include a letter confirming coverage of costs.

Step 3: Apply Online or via VFS

Most embassies and consulates allow online form submissions followed by biometric appointments at visa application centers (VFS or embassy). Ensure all entries are consistent with your supporting documents.

Pro Tip: Apply at least 4–6 weeks in advance to account for processing delays, especially during peak travel seasons.

Step 4: Prepare for Possible Interview

Some countries, such as the USA, may require a short visa interview. Be prepared to explain:

Why you are attending the event

How your startup will benefit

Your intent to return to India after the event

How your trip is being funded

Clear and confident communication is key.

Step 5: Track and Collect Your Visa

Once submitted, use the embassy or VFS tracking system to monitor your application status. Upon approval, verify the visa details—especially dates, number of entries, and purpose mentioned.

Final Thoughts: A Visa Is the First Pitch You Make

When applying for a business visa to attend global startup events, your documents act as your first pitch—not just to the embassy, but to the global business ecosystem. A professional, well-organized application builds trust and opens doors before you even arrive at the venue.

Need help getting your business visa for a global startup event? We help Indian entrepreneurs streamline their visa process and get event-ready with confidence. 👉 [Click Here]

1 note

·

View note

Text

Pulley, 645 Ventures, and Epigram Legal join the Disrupt 2025 agenda

[TECH AND FINANCIAL] Startups live and die by their early hires. And in a world where top talent has options — and stock options — you’ve got to offer more than a ping-pong table and a pitch deck to bring in the right people. At TechCrunch Disrupt’s 20th anniversary, happening on October 27-29 in San Francisco’s Moscone West, we’re digging into the real talk around compensation and equity with a…

0 notes

Text

10 Key Services Offered by Delhi-Based Business Consulting Firms

In the fast-evolving business landscape of Delhi, companies need more than just good products or services — we need strategic guidance, market insight, and operational efficiency. That’s where business consulting firm in Delhi come into play. From startups to established enterprises, consulting firms in Delhi offer a comprehensive suite of services tailored to address diverse business needs. Here are the 10 key services offered by Delhi-based business consulting firms like MakeMaya that help businesses scale, streamline, and succeed.1. Business Strategy DevelopmentConsulting firms assist in defining and refining the long-term direction of a company. We analyze market trends, customer behavior, and competition to create actionable strategic roadmaps that align with business goals.2. Market Research & Feasibility StudiesDelhi consultants offer in-depth market research services that include customer analysis, competitive benchmarking, and feasibility reports. This is vital for businesses looking to launch new products, enter new markets, or expand operations.3. Digital Transformation ConsultingWith Delhi rapidly emerging as a digital hub, firms like MakeMaya help businesses embrace technology — developing digital-first strategies, automating processes, and integrating IT systems for efficiency and scalability.4. Branding & Marketing StrategyBrand identity and marketing execution are critical to business success. Consulting firms offer complete branding solutions — from logo and design to digital campaigns, SEO, and social media strategies — to boost visibility and customer engagement.5. Financial Planning & AnalysisFrom budgeting and forecasting to risk analysis and cost control, business consultants help companies make data-driven financial decisions. We also support fundraising, investor presentations, and valuation.6. Operational Efficiency ImprovementConsultants evaluate current workflows, identify bottlenecks, and redesign processes to optimize resources and boost productivity. This often leads to reduced costs and improved turnaround time.7. Human Resource & Talent AdvisoryHiring, training, and retaining the right talent is crucial. Business consultants provide HR solutions including talent acquisition strategy, performance management systems, organizational structure development, and employee engagement programs.8. Legal & Compliance AdvisoryDelhi-based consulting firms ensure that businesses comply with local laws and industry regulations. We assist with company registrations, GST filings, intellectual property rights, contract drafting, and more.9. Startup Consulting ServicesMakeMaya and similar firms specialize in offering end-to-end startup support — business plan creation, pitch decks, MVP development, go-to-market strategies, and even mentorship programs.10. IT & Web Development ServicesTo stay competitive, businesses need a strong digital presence. Many Delhi consultants offer web and app development, UI/UX design, and ongoing technical support, aligning tech solutions with business goals.ConclusionDelhi’s business consulting ecosystem, with firms like MakeMaya at the forefront, plays a pivotal role in helping companies adapt, grow, and thrive. Whether you’re a startup looking for direction or a large business seeking digital transformation, the right consulting partner can unlock your potential and position you for sustained success.

0 notes

Text

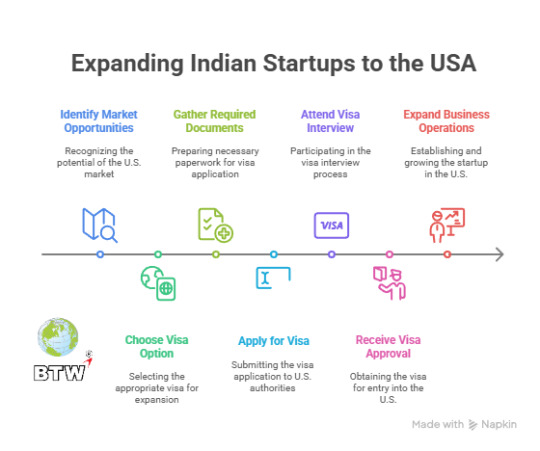

Business Visa for Indian Startups Expanding to USA

The United States remains one of the most attractive markets for Indian startups looking to scale globally. With access to top investors, cutting-edge innovation, and a massive consumer base, expanding to the U.S. can be a game-changer for startups. But before setting foot in this competitive market, founders and executives need the right visa—usually a B1 Business Visa or other relevant categories depending on the nature and duration of the business.

In this blog, we’ll guide Indian startup founders through the visa options, required documents, and key considerations for expanding to the U.S.

Why Expand Your Startup to the USA?

For Indian startups, entering the U.S. market offers several strategic benefits:

Access to funding: Silicon Valley and other U.S. hubs offer access to top venture capital firms.

Large customer base: The U.S. has a mature and affluent market with high adoption rates for tech products.

Innovation ecosystem: Collaborate with top talent, accelerators, and technology partners.

Global credibility: Presence in the U.S. enhances global brand reputation and investor confidence.

Recommended Visa Options for Indian Startup Founders

1. B1 Business Visa (Short-Term Visits)

This is ideal for initial visits to explore business opportunities, attend meetings, raise capital, or negotiate deals.

Key Uses:

Attending investor meetings

Signing contracts or partnerships

Exploring office or accelerator spaces

Meeting customers or vendors

Duration: Generally up to 6 months per visit Eligibility: Must prove the visit is temporary and not for employment Best For: Early-stage explorations, short-term business development

2. L1 Visa (For Intra-Company Transfers)

If your Indian startup has been operational for at least a year and wants to open a U.S. branch or affiliate office, the L1 visa is a strong option.

Key Features:

Allows transfer of executives, managers, or specialized employees

Can lead to a Green Card under EB-1C category

Requires proof of relationship between U.S. and Indian entities

Best For: Mid- to late-stage startups setting up full operations in the U.S.

3. O1 Visa (For Individuals with Extraordinary Ability)

Startup founders with impressive achievements (patents, press coverage, funding, etc.) may qualify for the O1 visa, which is based on exceptional talent.

Best For: Founders with strong portfolios, media presence, or notable funding history.

4. E2 Visa (Investor Visa – Not Available for Indian Citizens Yet)

India is not yet a treaty country for the E2 visa, but this option might open in the future and is worth monitoring. Indian founders sometimes explore it through dual nationality routes.

Key Documents Required (B1 Visa Focus)

For short-term visits under the B1 visa, Indian founders should prepare the following:

Valid Passport (with 6+ months validity)

DS-160 Form confirmation

Visa fee payment receipt

Visa interview appointment confirmation

Passport-size photo (as per U.S. visa standards)

Invitation letter from U.S. partners, VCs, or conferences

Cover letter explaining purpose of visit

Company incorporation documents (India)

Business plan or pitch deck

Financial statements or proof of funding

Evidence of strong ties to India (employment, family, assets)

Tips for Indian Startup Founders

Show strong ties to India: Make it clear you intend to return after your trip.

Prepare your pitch: U.S. visa officers may ask about your startup—be ready.

Avoid work-related tasks on a B1: You cannot operate the U.S. business while on a B1 visa.

Seek legal guidance: Immigration rules can be complex; consulting a U.S. immigration attorney is a smart move.

Frequently Asked Questions (FAQ)

1. Can I raise funding in the U.S. while on a B1 visa?

Yes, you can meet investors and discuss funding, but you cannot actively work for or run your business in the U.S. on a B1 visa.

2. Can I stay in the U.S. long-term on a B1 visa?

No. The B1 is a temporary visa for short stays, typically up to 6 months. If you want to work or operate a company, consider L1 or O1 visas.

3. What are my options if I want to launch a U.S. office?

If your startup has been operational for at least one year, the L1 visa is your best route. It allows you to transfer yourself or key employees to a U.S. entity.

4. Is there a startup visa for the U.S.?

The U.S. does not currently have a dedicated startup visa like some other countries. However, the International Entrepreneur Parole (IEP) program offers limited options for startup founders.

5. Can I bring co-founders or team members?

Yes, if they qualify for similar visas. Each individual must apply separately and meet the eligibility requirements for a B1, L1, or O1 visa.

6. How early should I apply for a U.S. business visa?

It’s recommended to start the process at least 2–3 months in advance to ensure timely scheduling of your visa interview and documentation.

Conclusion

Expanding your Indian startup to the United States can be a transformative step. Whether you’re exploring opportunities, meeting investors, or launching a subsidiary, choosing the right visa path is critical. For short-term visits, the B1 visa is usually sufficient, but if you're looking to set up long-term operations, consider the L1 or O1 categories.

Proper planning, documentation, and legal guidance can ensure a smooth transition as you scale your venture on the global stage. The U.S. market is competitive—but with the right strategy and visa, it’s also full of potential.

0 notes

Text

10 Things Our Clients Love About Our Design Services

When it comes to design, it’s not just about the final visuals—it’s about the experience, the collaboration, and the results. Over the years, we've worked with brands of all sizes and across various industries. And while their goals may differ, the appreciation for quality design and seamless service is a common thread.

At the heart of our work is a commitment to delivering value beyond aesthetics. We aim to solve real business problems, elevate branding, and boost engagement through thoughtful, strategic design. That’s why so many of our clients keep coming back—and refer us to others.

Here are the 10 things our clients say they love most about working with our Graphic Designing Services.

1. We Understand Their Brand Like It’s Our Own

Clients often mention how quickly we “get” their voice, tone, and brand identity. Whether it's a luxury fashion label or a B2B tech startup, we take the time to understand the unique brand DNA—so every visual reflects it authentically.

2. The Design Process Is Collaborative, Not Complicated

Instead of throwing around jargon or confusing workflows, we keep things simple. We invite our clients into the process, ask the right questions, and ensure they feel heard. It’s not just about delivering files—it’s about building relationships.

3. Fast Turnarounds Without Compromising Quality

We know time matters. Many clients come to us with tight timelines, expecting compromise—but are surprised when they get both speed and quality. Thanks to a refined workflow and experienced team, we make it happen without shortcuts.

4. Designs That Actually Drive Results

Whether the goal is clicks, conversions, signups, or shares, our design is never just for show. Clients love that our creatives are backed by marketing know-how and performance insights—because pretty doesn’t always mean effective.

5. Clear Communication from Start to Finish

No vague timelines. No ghosting. No surprises. Clients trust us because we’re transparent, responsive, and proactive throughout the project. That peace of mind is something they value just as much as the design itself.

6. Consistency Across All Platforms

One client told us: “It feels like the same brand, wherever I see it.” And that’s exactly what we aim for. Whether it's your website, social feed, packaging, or pitch deck—we ensure the visual language is consistent and professional across the board.

7. Smart Use of Budget

We respect your budget. Instead of pushing unnecessary extras, we recommend high-impact design investments tailored to your needs. Our clients appreciate that we offer flexible packages and help them get the most value from every rupee or dollar spent.

8. We’re Not Just Designers—We’re Strategic Partners

Great design is rooted in great thinking. That’s why we ask about your goals, target audience, and brand story before jumping into visuals. Clients love that we bring strategic clarity, not just pixels.

9. Versatility Across Design Needs

From logos and brand kits to landing pages, carousels, and infographics—we do it all. And clients love that they don’t need to juggle multiple vendors. One team, one vision, one point of contact.

10. We Make the Experience Fun

Design can be stressful for clients unfamiliar with the process. But our collaborative, friendly approach turns it into something enjoyable—even exciting. We simplify the complex and make space for creativity to thrive.

Conclusion: More Than Just a Service—It’s a Partnership

At the end of the day, what our clients love most is that we treat their brands with as much care as our own. We listen, we deliver, and we evolve with them. It’s not just about beautiful graphics—it’s about building long-term value.

If you're looking for a team that’s as invested in your brand's success as you are, explore our Graphic Designing Services. From strategy to execution, we’re here to help you stand out, stay consistent, and scale with confidence.

0 notes

Text

How Startups Are Using Financial Modelling to Attract Investors in India’s Booming Tech Ecosystem

India’s startup ecosystem is on fire. With over 100 unicorns and thousands of early-stage ventures blossoming across sectors like fintech, edtech, healthtech, SaaS, and e-commerce, the landscape is vibrant—but also fiercely competitive. In this high-stakes environment, financial modelling has emerged as a powerful tool for startups to build credibility, secure funding, and scale with confidence.

For aspiring entrepreneurs and finance professionals alike, mastering financial modelling is no longer optional. If you’re in Kolkata and looking to break into this space, enrolling in the best Financial Modelling Course in Kolkata can give you the practical skills needed to thrive in this startup-driven economy.

Why Financial Modelling Matters in a Startup's Journey

When startups approach angel investors, venture capitalists, or private equity firms, they don’t just pitch an idea—they pitch a vision backed by numbers. These numbers aren’t just pulled from thin air. They come from detailed financial models that forecast how the business will grow, scale, and generate returns.

A robust financial model communicates:

Revenue projections for the next 3–5 years

Operating expenses and burn rate

Break-even analysis

Customer acquisition cost (CAC) and lifetime value (LTV)

Unit economics

Funding requirements and expected ROI

These projections show investors that the startup’s founders understand their market, costs, and how their business will turn a profit—or at least grow fast enough to justify the investment.

The Indian Startup Boom: A Perfect Storm for Financial Modellers

India is now the third-largest startup ecosystem in the world, after the US and China. With the digital economy accelerating, investors are pouring billions into scalable tech ventures. However, investor scrutiny is higher than ever due to recent global funding slowdowns.

Now, it’s not enough to have a great pitch deck. Investors want to see clear, data-driven financial roadmaps. That’s where financial modelling steps in.

Professionals trained through the best Financial Modelling Course in Kolkata are helping startups prepare solid models that can stand up to investor due diligence. From sensitivity analysis to discounted cash flows and cohort-based revenue forecasting, the right models can turn a maybe into a yes.

How Startups Are Using Financial Models to Win Over Investors

1. Validating the Business Idea

Before seeking funding, startups use financial models to check whether the business idea is financially viable. This includes calculating how many customers are needed to reach profitability, and how long the runway is with current capital.

2. Pitch Deck Projections

Every investor pitch today includes financial projections. But not all projections are created equal. Models that reflect realistic assumptions, industry benchmarks, and multiple scenarios inspire investor trust and make the startup stand out.

3. Justifying Valuations

Startups often struggle to justify their high valuations. Solid models using DCF (Discounted Cash Flow) or Comparable Company Analysis help founders support their ask with logic and numbers.

4. Planning for Fund Utilization

Investors want to know: how exactly will the startup spend their money? Financial modelling helps allocate capital efficiently—across product development, marketing, hiring, and operations.

5. Managing Growth

As a startup scales, it needs to continuously update its models to make hiring plans, pricing decisions, and market expansion strategies. Good models aren’t static—they evolve with the business.

Real-World Example: Fintech Startup in Kolkata

Take the example of a rising fintech startup in Kolkata targeting small business lending. When preparing for their Series A round, they built a detailed financial model projecting their revenue based on user acquisition, average loan size, and default rates. They also modeled different growth scenarios: aggressive vs. conservative.

Using these models, they were able to:

Clearly demonstrate when they’d break even

Show the effect of scaling operations

Validate their ₹100 crore valuation ask

They successfully secured funding from a Mumbai-based VC firm—and credited their financial model as a major differentiator.

The Growing Demand for Financial Modelling Skills

Startups aren’t the only ones benefiting. Founders, finance teams, startup analysts, and even venture capital interns are expected to know how to build and interpret financial models.

If you're based in West Bengal and looking to enter this space, joining the best Financial Modelling Course in Kolkata can be your stepping stone. These courses teach:

Excel-based modelling techniques

Three-statement financial models

Valuation methods like DCF and EBITDA multiples

Scenario planning and Monte Carlo simulations

Fundraising and cap table modelling

With these skills, you can work in corporate finance, become a startup CFO, join a VC firm, or even start your own venture with financial clarity.

Final Thoughts

India’s startup boom is not slowing down—and as more founders chase limited capital, financial clarity will be their biggest weapon. Financial modelling is no longer just for investment bankers; it’s now a startup essential.

If you’re looking to be part of this transformation—whether as a founder, finance professional, or investor—now is the time to upskill. Enroll in the best Financial Modelling Course in Kolkata and gain the expertise to turn ideas into investor-ready opportunities.

0 notes

Text

Startup Pitch Deck Template

A pitch deck presentation is an essential tool for any startup or business looking to secure investment.

Why Use a Pitch Deck Presentation Template?

Creating a pitch deck from scratch can be overwhelming, especially for entrepreneurs who are not design-savvy. A pitch deck presentation template offers several benefits:

Time-Saving: Templates provide a ready-made structure that allows you to focus on adding your unique content. You don’t have to worry about design elements like font choices, color schemes, or slide layouts.

Consistency: Templates are designed with consistency in mind. They use a uniform style and visual hierarchy, making it easier for investors to follow your presentation.

Professional Appeal: A polished, visually appealing pitch deck is key to creating a positive impression. A well-designed template ensures that your slides are both aesthetically pleasing and effective in conveying your message.

Guidance: Pitch deck templates often come with suggestions for what information to include in each section. This is especially helpful for entrepreneurs who may not be sure which elements are most important for investors to see.

A pitch deck presentation template is an invaluable tool for creating a compelling pitch that engages investors and showcases the potential of your business. It helps you tell your story clearly, concisely, and in a visually appealing way.

#pitch deck#presentation template#powerpoint template#powerpoint presentation#startup#business startups#startup ideas#startup pitch#startup pitch deck#best startup pitch#tech startup pitch deck#pitch deck for startup#food startup pitch deck#startup pitch deck template#startup pitch deck design

0 notes

Text

Funding Business Plan Services Asia – Secure Investment with a Powerful, Tailored Plan

In the competitive world of business funding, having a solid business plan is more than just an advantage—it’s a necessity. Whether you’re a startup seeking angel investment, an SME applying for a bank loan, or a growth-stage business preparing for venture capital, the quality and clarity of your business plan can make or break your funding journey. At GE Consult Asia, we specialize in Funding Business Plan Services in Asia, helping companies create investor-ready, bank-compliant, and highly persuasive business plans tailored to their industry and region.

As discussed in our Business Plan Basics Q&A, many business owners overlook the strategic importance of a well-prepared funding plan. Investors and financial institutions are looking for more than just ideas—they want proof of viability, profitability, and scalability. That’s where we come in.

Why a Funding Business Plan Is Essential

A funding-focused business plan is not just a document; it is a strategic tool that clearly communicates:

Your vision and mission

Your business model and value proposition

Market opportunity and target audience

Financial forecasts and funding needs

Risk mitigation and growth strategy

For startups and SMEs operating in Asia, funding opportunities are abundant—but so is the competition. A customized, data-driven business plan helps you stand out, showing potential funders that your business is not only visionary but also financially sound and market-ready.

Our Funding Business Plan Services in Asia

At GE Consult Asia, we offer comprehensive, professional business plan writing services specifically geared towards securing funding from investors, banks, and government grant bodies. Our plans are structured, persuasive, and aligned with the expectations of funding entities across Asia.

1. Tailored Business Plans for Funding Applications

We develop fully customized business plans based on your stage, industry, and funding purpose—whether it’s equity funding, venture capital, bank loans, or grant proposals.

2. Financial Projections and Analysis

We prepare detailed, accurate, and realistic financial models including:

3 to 5-year profit and loss statements

Cash flow forecasts

Break-even analysis

Use-of-funds breakdown

ROI estimates and funding risk analysis

These numbers are crucial for gaining investor trust and loan approval.

3. Investor Pitch Decks & Executive Summaries

Alongside your full business plan, we can develop short-form summaries and visually engaging pitch decks perfect for pitching to angel investors, venture capitalists, or at demo days and roadshows.

4. Market Research & Competitive Benchmarking

We provide research-backed insights into your industry, target audience, and competitors, helping you position your business as a compelling opportunity for investment.

5. Bank and Grant Proposal Alignment

If you’re applying for a business loan or government grant in Malaysia or other Asian markets, we ensure your plan meets specific institutional criteria and policy frameworks.

Why Choose GE Consult Asia?

GE Consult Asia is a trusted name in business planning and startup consulting, with a strong reputation across Southeast Asia. Here's what makes our services stand out:

Asia-Focused Expertise – We understand local funding trends, regulatory requirements, and market behavior across countries like Malaysia, Singapore, Indonesia, Thailand, and the Philippines.

Cross-Sector Experience – From tech and logistics to healthcare and manufacturing, our consultants have worked with businesses in a wide range of industries.

Investor-Ready Quality – Our business plans meet the highest professional standards and are formatted for investor presentations and banking reviews.

Personalized Support – Every client receives one-on-one guidance, detailed feedback, and ongoing revisions to ensure the plan is pitch-perfect.

Fast Turnaround – Tight deadline? We offer expedited services without compromising quality.

Who Should Use Our Services?

Our Funding Business Plan Services in Asia are ideal for:

Startups raising seed or Series A funding

SMEs applying for commercial loans

Businesses seeking government or development grants

Social enterprises looking for impact funding

Entrepreneurs preparing for investment pitches

No matter your stage or sector, we help you present your business with confidence and clarity.

Start Your Funding Journey with a Winning Plan

Getting funded starts with showing funders why your business matters—and why it will succeed. With GE Consult Asia, you’ll gain a business plan that tells your story powerfully, backed by strong financials, market insights, and a clear funding strategy.

0 notes

Text

Empowering Entrepreneurs: The Rise of Business Fundraising Platforms in India

In today’s dynamic business environment, access to capital is one of the most crucial factors for growth and sustainability. Whether you are a startup looking to scale or an established enterprise aiming for expansion, securing the right funding at the right time can make all the difference. This is where a business fundraising platform like Funding Walk steps in as a game-changer, offering tailored solutions to help entrepreneurs raise funds for your business efficiently and effectively.

The Need for Business Fundraising Platforms

Traditional fundraising methods such as bank loans, venture capital, or angel investments often come with long wait times, complex paperwork, and stringent eligibility criteria. Many promising businesses in India fail to grow simply because they lack access to timely financial support. A fund raise platform in India bridges this gap by connecting businesses with a variety of funding options, including equity, debt, grants, and more.

These platforms are especially beneficial for:

Startups in early stages

SMEs (Small and Medium Enterprises)

Family-owned businesses exploring modernization

Companies planning mergers, acquisitions, or partnerships

What Makes Funding Walk Unique?

Funding Walk is more than just a platform—it's a trusted partner in your growth journey. The platform specializes in helping Indian businesses not only identify funding opportunities but also prepare investor-ready documentation, pitch decks, and valuation reports.

Some of the key benefits of using Funding Walk include:

Access to a curated network of investors

End-to-end fundraising support

Real-time insights on investor interests

M&A advisory and market intelligence

Whether you’re looking to raise funds for your business to expand operations, launch a new product, or enter a new market, Funding Walk makes the process transparent and streamlined.

How Does the Fundraising Process Work?

Using a business fundraising platform like Funding Walk is easy and structured. Here's how the typical process works:

Initial Consultation – Understand your business model, current stage, and funding requirements.

Documentation & Valuation – Prepare pitch decks, business plans, and perform startup valuations.

Investor Matching – Get connected with angel investors, VCs, private equity firms, and more.

Due Diligence Support – Assistance with financial audits, legal checks, and compliance.

Negotiation & Closure – Help with term sheets, negotiations, and deal closures.

Rising Trends in Indian Fundraising Ecosystem

India’s startup ecosystem is booming, and with it, the landscape of fundraising is rapidly evolving. More than ever, Indian businesses are moving beyond traditional sources and exploring hybrid and digital funding solutions.

Recent mergers and acquisitions updates show that international investors are increasingly showing interest in Indian tech, fintech, and sustainability sectors. Private equity and venture capital firms are scouting for scalable models with strong unit economics.

Some noteworthy trends include:

Rise of strategic M&A for market expansion

Increased investments in climate-tech and AI startups

Cross-border funding opportunities

Sector-specific funds gaining traction (EdTech, HealthTech, Agritech)

This changing environment presents an incredible opportunity for Indian entrepreneurs who are prepared, agile, and digitally savvy.

Challenges and How to Overcome Them

Despite the growing availability of fundraising platforms, many businesses face key challenges such as:

Lack of investor-ready documents

Poor understanding of valuation

Misalignment between founders and investors

Insufficient market data

Funding Walk helps address these problems with expert support in:

Financial modeling and forecasting

Business and marketing strategy review

Competitor analysis

Deal structuring and legal advisory

This ensures that businesses not only raise capital but do so in a way that strengthens their foundation for long-term growth.

Why Now is the Right Time to Fundraise

The Indian economy is poised for exponential growth. With the government's support for entrepreneurship, ease of doing business reforms, and digital transformation sweeping across industries, this is the perfect time to raise funds for your business and leap ahead.

Funding Walk empowers founders to navigate the complexities of fundraising, while also staying updated with the latest mergers and acquisitions updates, funding rounds, and industry shifts.

Conclusion

The future of business in India is entrepreneurial. And at the heart of every successful venture lies the power of strategic capital. Platforms like Funding Walk are revolutionizing how Indian businesses access funding, giving entrepreneurs the tools they need to scale, thrive, and lead.

If you're ready to take the next step and raise funds for your business, partner with Funding Walk—India's trusted fund raise platform. From fundraising support to M&A insights, Funding Walk is here to walk with you, every step of the way.

0 notes

Text

What to Wear for a Corporate Headshot: NYC Professionals’ Guide

In a city that never sleeps and careers that move just as fast, your first impression matters more than ever. Whether you're a finance executive in Midtown, a tech leader in SoHo, or a creative freelancer in Brooklyn, your corporate headshot is your visual handshake. It shows the world not only what you do—but who you are.

So, what should you wear to your corporate headshot session in NYC? Let’s break it down, from outfit choices to grooming tips, so you show up looking like the confident, competent professional you are.

Why Your Outfit Matters for Corporate Headshots

Before we jump into specifics, it’s important to understand this: your clothing sets the tone. A well-chosen outfit helps convey professionalism, credibility, and personal brand—all key ingredients for a standout NYC corporate headshot.

Whether you're using it for LinkedIn, your company bio, or a pitch deck, what you wear impacts how you're perceived.

What to Wear: Outfit Tips for Men

1. Stick to Classic, Tailored Looks

A fitted suit jacket, dress shirt, and solid tie (optional) is a safe and timeless combo.

Avoid loud patterns. Solids or subtle stripes work best.

2. Neutral Colors Win

Charcoal, navy, grey, and white work well with most backdrops.

Avoid bright reds, neon greens, or yellows—they can reflect poorly on your skin.

3. Collar & Fit Matter

Iron your shirt and make sure it fits well—nothing distracts like a rumpled or oversized collar.

4. Grooming Counts

Trim facial hair, moisturize your skin, and consider a quick haircut 2–3 days before your shoot.

What to Wear: Outfit Tips for Women

1. Professional Yet Comfortable

Choose a well-fitted blazer, blouse, or structured dress.

If wearing a dress or top without sleeves, bring a jacket for a more formal look.

2. Avoid Distracting Patterns

Stick with solid colors or soft patterns that won’t overwhelm your face.

3. Color Psychology Matters

Navy and gray suggest professionalism.

Jewel tones (emerald, ruby, sapphire) often photograph beautifully.

4. Jewelry: Keep It Simple

Small studs or a single necklace is enough. Avoid large, shiny accessories.

5. Makeup & Hair

Aim for a natural look. Matte makeup works better under studio lighting.

Bring a brush or comb for quick touch-ups during the shoot.

Gender-Neutral & Personal Branding Considerations

In a modern, inclusive workplace, your outfit should also reflect your personal brand and identity:

Want to look creative? Opt for a bold color or a textured blazer.

Working in law or finance? Stick to conservative, polished looks.

Tech or startups? A clean, well-fitting shirt without a blazer might be perfectly on-brand.

Your corporate photographer in NYC can guide you on what reads well on camera and matches your industry tone.

NYC-Specific Style Tips

Living and working in NYC means you're exposed to some of the most stylish professionals in the world. Keep these in mind:

1. Layer Smartly

Layering adds dimension and polish—think shirt + blazer or blouse + scarf.

NYC weather can shift quickly, so plan outfits that work in both cool and warm studio settings.

2. Footwear

You likely won’t be photographed below the waist, but wear shoes you feel confident standing in.

3. Bring Options

NYC photographers usually allow quick outfit changes. Bring 1–2 backup looks.

Before You Go: Last-Minute Tips

Hydrate and sleep well the night before.

Avoid logos or heavy branding on clothing.

Steam or iron your clothes—creases show up clearly in high-res headshots.

Smile naturally—practice a few expressions in the mirror.

Final Thoughts

Your corporate headshot is more than just a photo—it’s your visual business card. Dressing the part not only helps you look great but also feel great in front of the camera.

In the fast-paced world of NYC business, one image can open a hundred doors. Make sure your outfit helps you walk through every one of them.

0 notes

Text

Startup India Registration Process: Step-by-Step Guide for 2025

Introduction The Startup India initiative, launched by the Government of India, is designed to empower young entrepreneurs and promote job creation, innovation, and wealth generation. If you are starting a new venture in 2025, getting DPIIT-recognized through Startup India registration can unlock tax exemptions, funding access, and ease of doing business.

What Is Startup India Registration? Startup India registration is the official process of enrolling your business under the Government of India’s Startup India scheme to gain benefits such as DPIIT recognition, tax exemptions, and easier compliance requirements.

Eligibility Criteria

Must be a private limited company, LLP, or partnership firm

Should not be older than 10 years

Annual turnover must be below ₹100 crores

Must work on innovation, improvement, or scalability

Should not have been formed by splitting or reconstructing an existing business

Documents Required

Incorporation/Registration certificate

PAN card of business

Brief description of business and innovation

Details of directors and partners

Website or pitch deck (if available)

Startup India Registration Steps (2025)

Incorporate your company (Pvt Ltd/LLP/Partnership)

Create a profile on Startup India portal (startupindia.gov.in)

Apply for DPIIT Recognition

Upload supporting documents

Submit declaration form

Track application status

Benefits of DPIIT Recognition

3-year income tax exemption under Section 80IAC

Faster patent and trademark filing with up to 80% rebate

Exemption from angel tax (Section 56)

Access to ₹10,000 crore Fund of Funds

Self-certification for labour and environmental laws

Eligibility for government tenders

Timeline for Registration

Portal registration: 10–15 minutes

DPIIT approval: Usually within 7–10 working days

Common Mistakes to Avoid

Submitting incomplete pitch deck

Not clearly explaining innovation

Using unregistered or incorrect business entity

Conclusion Registering under Startup India can make your startup more investible, bankable, and growth-ready. Whether you're a tech founder or an ecommerce seller, this is a step you shouldn’t skip.

0 notes

Text

Hiring a Startup Consultant: Investment or Expense? Let’s Break It Down

For every aspiring entrepreneur, one of the first challenges is deciding where to allocate limited resources. In the fast-paced and highly competitive world of startups, every expenditure is scrutinized. Among the many early-stage decisions founders face, one stands out: Should you hire a startup consultant?

While some see a startup consultant as an essential strategic partner, others view it as an avoidable expense. The truth is, it can be either, depending on how and why you hire one. Let’s break down the value proposition, role, and impact of startup consulting firms to help you decide whether this decision is a smart investment or a financial drain.

Understanding the Role of a Startup Consultant

A startup consultant is typically an experienced professional who provides expert guidance on critical aspects of launching and growing a new business. Their areas of expertise can range from business modeling, market research, and branding, to go-to-market strategies, financial planning, and investor readiness.

Startup consulting firms bring a structured and data-driven approach to entrepreneurship. They work closely with founders to identify business opportunities, validate ideas, optimize operations, and build growth strategies. Whether you’re stuck in the ideation phase or preparing to scale, a consultant offers clarity, direction, and executional support.

Why Many Founders Hesitate

The hesitation often stems from budget concerns. Most early-stage startups operate under tight financial constraints, and any non-core expenditure feels risky. Hiring a startup consultant may seem like a luxury, especially when there are product prototypes to build, websites to design, and early hires to pay.

But the key lies in evaluating the return on that investment, not just the immediate outflow. If a consultant can help you avoid costly mistakes, shorten your time to market, or improve your funding prospects, they’re not a cost, they’re a catalyst.

The Value Proposition of a Startup Consultant

Hiring a startup consultant should not be seen as outsourcing your business decisions. Instead, it’s about accelerating your decision-making process through experience and expertise. Here’s how startup consulting firms deliver tangible value:

1. Clarity and Focus: Startups often juggle multiple directions at once, leading to confusion and inefficiency. A consultant helps you prioritize tasks, streamline goals, and create a roadmap based on market realities and proven frameworks.

2. Strategic Planning: From choosing the right business model to identifying revenue streams, startup consultants bring frameworks that help you make data-backed decisions. They assist in aligning your vision with executable strategies.

3. Faster Time-to-Market: A consultant can guide product development by aligning it with real customer needs. This reduces trial-and-error phases and accelerates launch timelines.

4. Enhanced Investor Readiness: Startup consulting firms often assist in preparing pitch decks, refining business plans, and conducting financial forecasting. This enhances your credibility and helps you stand out in front of investors.

5. Risk Mitigation: Startups commonly make avoidable mistakes — launching without validation, hiring too early, or misjudging market demand. Consultants offer an outside-in perspective that helps prevent such errors.

Real-World Examples

Consider a tech startup that initially focused on a B2C model without validating customer demand. After working with a startup consultant, they pivoted to a B2B solution that generated recurring revenue within three months. The consultant’s market insights and positioning advice changed the course of the company.

In another case, a wellness brand was struggling with branding and user engagement. A startup consulting firm helped them redefine their target audience, refine their marketing strategy, and achieve a 40% increase in sales over two quarters.

These aren’t isolated incidents. Across industries, startup consultants have helped early-stage ventures avoid costly detours and build smarter, faster.

How to Determine If It’s the Right Time

Hiring a startup consultant is not a blanket recommendation for every founder. It depends on your current stage and internal capabilities. Ask yourself:

Are you struggling with strategy or execution?

Do you lack experience in certain areas like finance, product, or marketing?

Have you made slow progress despite your efforts?

Are you preparing for funding rounds or a product launch?

If the answer to any of these is yes, working with an expert can significantly increase your efficiency and effectiveness.

Choosing the Right Consultant or Firm

Not all startup consultants are created equal. The right one should understand your industry, share your values, and have a proven track record. Look for startup consulting firms that have worked with businesses of your size and stage. Check for case studies, testimonials, and client success stories. Ensure that the engagement model, whether hourly, project-based, or equity-driven, aligns with your budget and expectations.

Avoid hiring someone who offers generic advice. A good consultant should customize their approach to your startup’s specific goals and challenges.

Final Thoughts

Hiring a startup consultant can absolutely be a wise investment, if done with clear objectives and careful selection. The key is not just in hiring one, but in knowing why you’re hiring them and what you hope to achieve.

Startup consulting firms have the potential to add significant value in areas where founders often struggle. When the outcome is faster growth, smarter decisions, and better funding opportunities, the return on investment can far exceed the initial cost.

So, is a startup consultant an expense or an investment? It depends on your mindset. If you see it as a tool to unlock efficiency, insight, and momentum, it’s one of the most strategic investments you can make in your startup journey.

#startup growth#business strategy#early-stage funding#startup development#startup mentoring#entrepreneurship#startup guidance#consulting services

0 notes

Text

Why Registering an India Private Limited Company is the Smartest Move for Long-Term Business Growth

In today’s dynamic economy, launching a business in India is easier than ever—but scaling it sustainably requires more than just a great idea. It requires structure, credibility, and a future-ready legal foundation. That’s exactly why entrepreneurs and founders across the country are choosing the India Private Limited Company model. It’s not just a business type—it's a gateway to long-term success.

If you’re looking to form a legally recognized business with real growth potential, backed by professional credibility, then a Private Limited Company in India is your best bet. With Bizsimpl, the registration journey becomes smooth, quick, and fully compliant—no stress, no errors.

The Rise of the India Private Limited Company in Modern Industries

The India Private Limited Company structure is not limited to tech startups. Today, it’s the default choice for businesses in sectors like:

Healthtech & MedTech

Logistics and Supply Chain

Manufacturing & Export

Digital Marketing Agencies

Product-based D2C Brands

Consulting Firms & EduTechs

What makes it universally appealing is the combination of professionalism and flexibility. Whether you're running a niche product startup or an operational services company, the Pvt Ltd structure enables you to confidently collaborate with clients, vendors, banks, and investors.

Busting Myths About the India Private Limited Company

Many first-time founders hesitate to register a Private Limited Company in India because of misinformation. Let’s clear up some common myths:

❌ Myth 1: It’s only for big companies

Reality: Even solo entrepreneurs can start a Pvt Ltd company as long as they have one more shareholder and director (they can be the same people). Many companies start small and scale rapidly.

❌ Myth 2: It’s too complex and expensive

Reality: With Bizsimpl, company registration is streamlined, affordable, and online. The long-term benefits far outweigh the one-time registration effort.

❌ Myth 3: It involves too many compliances

Reality: Yes, there are some regulatory steps, but they are manageable and necessary for a serious business. Bizsimpl provides full guidance on how to stay compliant with ease.

Key Reasons Why an India Private Limited Company Accelerates Growth

Let’s explore how this structure directly fuels your business expansion:

📈 Investor-Friendly Structure

An India Private Limited Company is structured in a way that makes equity dilution, share transfer, and cap table management simple. This is crucial for startups seeking Series A or seed funding.

🤝 Better Business Partnerships

Many corporates, governments, and international partners prefer to work only with Pvt Ltd entities due to legal clarity and compliance assurance.

🏦 Bank Loans and Credit Accessibility

Financial institutions and NBFCs favor India Private Limited Companies for loans because of their regulatory track record, audited reports, and professional governance.

📃 Contractual Legitimacy

Contracts signed by a Pvt Ltd Company are enforceable, documented, and hold greater legal standing. This reduces business risk in partnerships.

Early-Stage Advantages: Why You Should Incorporate Early

Founders who register their companies early benefit from:

IP ownership clarity: When your company owns the IP, it’s easier to license, protect, or sell your product or tech later.

First-mover credibility: An early incorporation date adds authority, making your pitch deck and branding more impressive.

Equity planning: Early-stage equity splits and shareholding are easier to structure before revenue and valuation grow.

So, don’t wait for traction—form your India Private Limited Company first and prepare for scale.

How Bizsimpl Makes Company Registration Simple

At Bizsimpl, we understand that entrepreneurs want to focus on growth—not on paperwork. That’s why we’ve optimized the India Private Limited Company registration process to be:

✔ Fast

We work with a structured digital process that ensures every stage—from name approval to incorporation—is done on time without delays.

✔ Reliable

Bizsimpl’s experts thoroughly review every document, name option, and compliance point so your application is never rejected due to common errors.

✔ Transparent

From timelines to fees, Bizsimpl offers complete transparency. You always know what to expect at each stage of your Pvt Ltd company registration.

When Should You Transition to a Pvt Ltd Model?

If you’re currently operating as a sole proprietorship or partnership, it may be time to consider converting to a Private Limited Company in India. Consider making the switch if:

You're growing revenue month-on-month

You want to raise capital or bring in new co-founders

You’re hiring employees or offering ESOPs

You plan to launch a product that requires brand protection

You want to expand into new states or international markets

Why Bizsimpl Is Trusted for India Private Limited Company Formation

Thousands of businesses have chosen Bizsimpl to form their India Private Limited Company, thanks to a consistent record of:

💼 Professional expertise in company registration

🔐 Secure and confidential handling of founder data

⚙️ Automated systems for quick document turnaround

📲 Friendly support team available throughout the process

With Bizsimpl, the process feels less like a formality and more like the official start of your brand journey.

Final Thoughts: Build Your Business Right with an India Private Limited Company

The success of any business begins with the right foundation. By forming an India Private Limited Company, you give your brand the professional identity it needs to grow, compete, and thrive in today’s competitive environment.

With Bizsimpl by your side, you don’t just register a company—you register confidence.

💡 Start Today!

Form your India Private Limited Company with Bizsimpl and make your business official.

✅ 100% online ✅ No hidden steps ✅ Expert help throughout

👉 Visit Bizsimpl.com to get started.

#IndiaPrivateLimitedCompany#Bizsimpl#CompanyRegistrationIndia#PvtLtdIncorporation#StartYourCompany#PrivateLimitedIndia#EntrepreneurIndia

0 notes