#the extreme pressure that the players are under and the unprecedented media/social media scrutiny are enough to make anyone cave

Text

Thinking about how Dele was thrown under the bus at Beşiktaş and getting mad again. :)

#even if you didn't know what he was up to over in turkey it was immediate from the get-go that he was struggling#i'm livid about how little and uneven the support is for players in football#it's gotten better than before and players and teams talk about seeing psychologists more openly#but god. there's still such a lack of understanding or a safety net#when there SHOULD be one because players start YOUNG and they need to be protected nurtured and educated#(i'm saying the educated part because countless retired players talk about how they're not set up for their lives after their careers end)#the extreme pressure that the players are under and the unprecedented media/social media scrutiny are enough to make anyone cave#but these are kids who start with that pressure and some of them make it to the first team when they're still in high school#not to mention that this is the sport that beyond any other sport draws people from all backgrounds#including underprivileged ones and less stable ones#and that's common. and add what dele went through on top of that#god. anyway. really glad that dele did his interview even if it didn't come at the right time

2 notes

·

View notes

Text

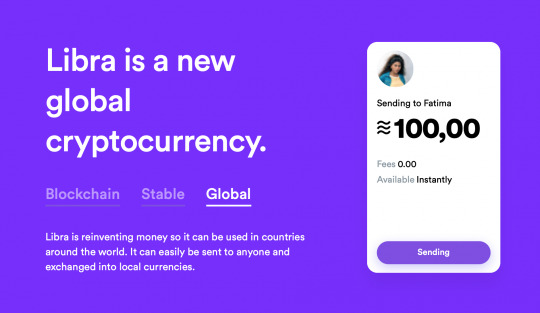

Libra: a powerful democratising force or a dangerous form of surveillance?

In June 2019, Facebook revealed its plans to create and launch Libra, a global cryptocurrency, and an underlying blockchain-based network that will act as the financial infrastructure to support it. Facebook’s ambitions for this technology were vast, promising the new currency could potentially enable some of the 1.7 billion unbanked people around the world to hold their money for free and make instant money transfers globally. Facebook pitched Libra as a democratising social force, which, similarly to how social media technology revolutionised the way we communicate with each other, could revolutionise financial services and global banking systems, bringing cryptocurrencies to millions of people who might be unable to access a banking service. When Facebook announced Libra, the cryptocurrency came across as a powerful new tool that could help tackle inequality and end financial exclusion. However since the announcement, Libra has become controversial, with some regulators and government officials calling for the project to be halted altogether. So what is this controversy all about? Why, when Facebook claims that Libra has the potential to provide financial services to millions of unbanked people, are so many people calling for the experiment to be ended before it has even been started? And are we right to be wary of Facebook venturing from the world of social media to the world of finance?

The Power of the Libra Association

Although Libra is being built by Facebook, when the cryptocurrency was announced it was only presented as a rough draft. All the real details and planning were to be done between all the companies involved in the project as part of the Libra Association, a non-profit organisation which was formed to help oversee and govern Libra as it evolved. However, this lack of detail made it hard for Facebook to explain how Libra would tackle some of the regulatory concerns that were raised shortly after the cryptocurrencies announcement. The Libra Association was originally made up of 28 members, which included venture capital, blockchain, technology, and telecommunications firms. Some of the names in this association included Mastercard, Visa, Uber, eBay and Andreessen Horowitz. This original list promised unprecedented cooperation between some of the biggest names in payments and technology, which could potentially give Libra a powerful head start. eBay and Uber, for example, would be able to use their association with Libra to encourage millions of people to pay for their online transactions using the cryptocurrency. On the other hand, Visa and Mastercard, the world’s two largest payment processing companies, could ensure that Libra is accepted for both online and offline purchases. On top of this, Facebook could leverage its enormous database through Facebook Messenger, WhatsApp and Instagram to provide frictionless payment options for all of its users. With Facebook’s parallel ambition to integrate its digital wallet, Calibra, which would be integrated with all other Facebook products, billions of users would potentially be able to access the cryptocurrency.

So, what is the problem?

In theory, given the power and influence of the members of the Libra Association, the cryptocurrency could generate a huge reach and be a viable alternative currency globally. However, scepticisms surrounding Libra and sustained political pressure by central banks and financial regulators have caused almost a quarter of the original members of the Libra Association to abandon the project. In just the past week, five of the Libra Association’s biggest players: Visa, Mastercard, Stripe, eBay and Mercado Pago, announced that they would be backing out of the project. Governments and regulatory agencies worldwide reacted to Libra more with fear than excitement, and raised important questions about the future of global banking and Facebook’s role in it. Pressure placed on the larger payments companies involved in the Libra Association with letters written to Visa and Mastercard by Democratic senators and members of the Senate Banking Committee, warning that if the companies took the Libra project on, they “can expect a high level of scrutiny from regulators not only on Libra-related payment activities but on all payment activities.”. On top of concerns that the cryptocurrency may pose a threat to global financial systems, regulators were also worried that Libra could become a “dark money” network, which would enable money laundering and increase financing for terrorism.

Facebook’s Reputation

The departure of these companies has created further problems for Libra. The initial participation by these well established, trusted institutions lent the project credibility. However, at a time when Facebook is facing privacy scandals and antitrust regulations, now the project has become more linked to it than ever before. Facebook is already a huge and extremely powerful company, and it is chilling to think of such a large data conglomerate creating a private global currency. Given Facebook’s track record, the decision as to whether or not Facebook should be allowed to undertake this responsibility and power is an extremely important one. Facebook has over 1.5 billion daily active users and 2.3 monthly active users. The world’s population reached 7.7 billion in 2019, meaning a population just under ⅓ the size of the world uses Facebook every month. Facebook’s influence is vast. If it were to use this influence to promote its currency, there is no way of knowing how far-reaching the consequences could be. We think of currencies as an important public good, which should be managed by governments and central banks operating democratically- not by private monopolies, especially ones that have in the past seen personal data as something to exploit rather than to protect. Creating a global currency could make Facebook inextricable from users lives, and tie this company into banking infrastructure. On top of this, since this cryptocurrency would go beyond national regulatory borders, there are no clear answers about how national governments might control or regulate it.

In just the past year Facebook has been involved in several data privacy violations. Facebook offers its users a free service, but to power this service it gathers their data to sell hyper-targeted advertisements. This is how the company makes around 89% of all of its profits- data gathering is crucial to its success. Although Facebook claims that it won’t gather personal data gained from Libra transactions, just a short search reveals that instances in which data from Facebook has been harvested and users’ personal information exploited without their prior consent. It is therefore not impossible, and if anything quite likely, that Facebook will find a way to use Libra to gather unparalleled information about customer purchasing habits, exponentially increasing the company’s monopolistic power and potentially creating what critics have called “the most invasive and dangerous form of surveillance ever designed”.

Facebook’s approach to regulatory breaches is reflected in the way the company chose to announce the Libra project: acting first and dealing with any repercussions afterwards. After all, for a company with as much power as Facebook, there are few fines big enough or punishments strong enough to cause the company any significant losses. This is what is particularly concerning about the Libra project. Especially in the wake of the Cambridge Analytica scandal, it is hard to not worry about how these huge companies are influencing and manipulating their users without their knowledge. Privatising the world’s money challenges and threatens both competition policies and antitrust practices. Although it is impossible to deny that serious steps should be taken to provide financial services to those who are unable to access the traditional banking system, this should be done by a public body, not a group of billion-dollar companies otherwise called the Libra Association.

0 notes