#the percentages in this post are not proven statistics they come from the Academy of Scrolling Down Tumblr Notes

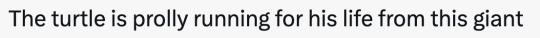

Text

That viral video from last month of a giraffe pushing a tortoise was interesting to me because I saw it in French & Spanish corners of the internet and everyone was referring to the animals in the video as 'she' since giraffe & tortoise are feminine words, meanwhile on the English-speaking internet I saw a minority of people referring to them as 'it' or 'they', an overwhelming majority using masculine words, and almost no one use 'she'

Similarly romance language speakers humanised these animals using women's names while English speakers used men's names:

And of course it would have been different had the giraffe been an elephant (masculine word) but yeah I find it interesting that when it comes to personifying animals and things, speakers of gendered languages will go 50% masculine 50% feminine due to grammatical gender, while speakers of a non-gendered language with a neutral pronoun will go like 80% masculine 18% neutral 2% feminine.

It must feel weird to learn a gendered language and have to accept that a door is 'she', but it also feels weird to learn a non-gendered language like English and then scroll down hundreds of comments under an animal video and all the animals are 'he'. I'm reminded of a cartoon I saw on tumblr once with a speaking lightbulb, and all the comments referred to it as 'he' and a 'guy' (in french & spanish, people would call it she.) I wonder how it affects the way you frame the world in your mind? you ask a French kid to personify a spoon or a mouse or a raindrop, it's going to be a female character by default. I feel like that's something English speakers rarely consider—that compared to languages that are 'visibly', officially gendered in a 50/50 way, English is less neutral, and more masculine-gendered. When anglophones learn about grammatical gender they tend to react like "why is a chair a 'she' that's absurd?", but when the context calls for it they'll call a lightbulb 'he' without thinking about it

#language tag#the percentages in this post are not proven statistics they come from the Academy of Scrolling Down Tumblr Notes#(disclaimer)

1K notes

·

View notes

Text

Opioid Use and Abuse Following an Injury

Learn why car accident victims are at high risk for opioid abuse, and how to avoid falling victim to addiction.

Pain is a common after-effect of motor vehicle accidents, and many accident victims are given prescription pain medications. Unfortunately, the urgency of patient needs, the effectiveness of opioid pain medications, and limited treatment options for those suffering from chronic pain have led to an overreliance on pain medications in the United States — the opioid epidemic.

The American Academy of Pain Medicine recommends that opioid pain medications be used only for chronic, persistent pain that cannot be controlled through conservative pain management. Yet, according to a 2016 article in Pain Medicine, auto accident victims are very likely to receive prescription opioids for their pain, and are also extremely likely to abuse these medications.

According to the article, the two main reasons for this high risk of abuse are:

Potential mental trauma. Traumatic injuries often are associated with mental health disorders such as post-traumatic stress disorder (PTSD) and depression, which are major risk factors for opioid abuse. Anxiety medications known as benzodiazepines (Xanax, Valium, Klonopin, and others) are not recommended for post-traumatic stress disorder but are still commonly prescribed for injury patients, increasing the risk of unfavorable outcomes.

Absence of a Primary Physician. Motor vehicle crash injuries are typically treated by a number of different medical practitioners, including emergency department physicians, physical therapists, orthopedic surgeons, and general practitioners, with no one health care professional taking primary responsibility for the opioids prescribed to the accident victim. Because of the potential for oversight, car accident victims are generally at higher risk for prolonged opioid use and adverse outcomes than a typical patient.

Despite their widespread use, opioids have been found to be no more effective in controlling chronic pain than nonsteroidal anti-inflammatory drugs (NSAIDs) like ibuprofen.

Dependency Versus Addiction

Another study published in the journal Pain concluded that persistent pain reported by injured individuals six weeks after an automobile accident was not statistically different between those prescribed NSAIDs and those given opioids such as oxycodone. But one key difference was found: Those initially prescribed opioids were 17.6 percent more likely to be dependent on them six weeks later.

According to the Pain study, the repeated administration of any opioid almost always results in tolerance and physical dependence, but the short-term results will usually resolve in a few days or weeks after discontinuation of the opioid, depending on the type of medication and the dose.

However, when opioids are prescribed long-term, their analgesic effects can require increasingly higher doses. While addiction only occurs in a relatively small percentage of patients, once it develops it becomes a separate medical illness that will usually not be resolved simply by discontinuation of the drug. Without proper treatment, this addiction can carry a high risk of relapse for years to come.

Avoiding Opioid Abuse

Talking to your doctor about alternative pain management treatments will help you avoid opioid abuse. But if opioids are unavoidable despite your risk level for addiction — family history, previous issues with drug use, or mental illness — following some precautions can stop a potential long-term problem before it takes root.

Use medication only as prescribed. Opioids should only ever be used under the supervision of a physician. If you’ve been taking pain medication for longer than two weeks, it is not safe to abruptly discontinue usage. Speak with your doctor about ways you can safely taper off based on the particular drug and dosage you are using.

Anticipate withdrawal. Understand potential symptoms of opioid withdrawal and what to expect. Depending on the drug, dosage, and length of time you were taking the drug, withdrawal symptoms can last up to five days. Some chronic symptoms may persist for longer, such as anxiety or insomnia. Work to minimize the negative effects by gradually reducing your dosage based on your physician’s recommendations.

Seek support early. Let friends or family members know about your plans to manage opioid withdrawal following your injury. It can be dangerous to go through withdrawal on your own. Seek support through addiction support groups or an appropriate psychological specialist.

Create a plan. With the help of an addiction specialist, be as prepared as possible and follow your withdrawal plan closely. Having such a recovery plan can help you establish goals and see them through.

Alternative Methods for Managing Pain

Learn alternative methods for managing pain that may help ease withdrawal symptoms and avoid relapsing, such as regular exercise, physical therapy, mindfulness, and massage.

While your pain may cause you to want to avoid excessive movement, stretching, strengthening, and cardiovascular exercises can actually help you find relief. It’s advisable to start slowly, stretch thoroughly after any activity, and modify any exercise that might aggravate your particular condition.

In conjunction with exercise, physical therapy can be particularly effective in treating, preventing, and managing pain following an auto accident or other injury. Therapists can help you increase your range of motion and level of flexibility while teaching you how to perform everyday tasks in a way that places less stress on the body. In fact, the CDC recommends alternative treatments like physical therapy because opioids only mask pain rather than improving your physical condition.

Mindfulness meditation has also been proven effective at reducing pain and offers a legitimate alternative for those seeking to avoid pain medications. The practice of focusing on the present moment can be helpful, even if only used a few minutes per day. Focused breathing and calming of the body might sound too easy, but studies indicate mindfulness can be as effective as pain-relieving medicines, without the harmful side effects.

While research is more limited in areas like acupuncture, massage, and tai chi, some find these alternative treatments helpful in avoiding opioids. Talk to your doctor about which option might work best for you, and remember, there are many noninvasive, safe, yet effective treatment options to help you overcome addiction.

The post Opioid Use and Abuse Following an Injury appeared first on The Treatment Specialist.

Opioid Use and Abuse Following an Injury published first on https://familycookwareshop.tumblr.com/

0 notes

Text

Take Charge. Another Boring Net Lease REIT

New Post has been published on http://philippinesoutsourcingjobs.com/take-charge-another-boring-net-lease-reit/

Take Charge. Another Boring Net Lease REIT

In a recent Seeking Alpha article, I explained that “as a REIT analyst, it’s critical to understand the benefits of fragmentation and consolidation. I have found that over the years, many investors seem to get confused by the concept and, more importantly, the benefits to building a competitive scale advantage”.

While many REITs struggle to move the needle by growing externally, the Net Lease REITs are unique because they can seek new properties in practically any market. As I went on to explain:

“More specifically, within the $4 trillion REIT universe, we have witnessed a growing evolution of companies that have built powerful scale advantages by utilizing low cost of capital, acquisitions, development, and dispositions.”

When I was a new lease developer (over 15 years ago), there were just a handful of Net Lease REITs, and today the list is growing in size, with each company hoping to carve out a differentiated slice of the market share.

Some REITs, like Realty Income (NYSE:O), utilize their size and cost of capital advantages, while others, like EPR Properties (NYSE:EPR), seek to carve an “experiential” niche focusing on theaters, waterparks, golf entertainment, and charter schools.

I like to compare Net Lease REITs to banks, remembering that there are super regional banks, regional banks, and community banks. All provide a valuable service based on scale, cost of capital, customer service, and location.

Similarly, the bank industry blossomed in the early ’80s as intrastate banking restrictions were lifted, allowing new players to enter new markets. Many banks shifted funds to commercial real estate lending (during the ’80s). When total real estate loans of banks more than tripled, commercial real estate loans nearly quadrupled.

In my backyard (South Carolina), I witnessed the “merger mania” whereby many southeastern banks were acquired by each other (hoping to keep the New York and West Coast banks out), and eventually, they were acquired by the gorillas: Wells Fargo (NYSE:WFC) and NationsBank.

And as I reflect on history, it seems that the Net Lease REITs are becoming the modern-day banks for corporately-owned real estate. The sale/leaseback business model gives corporations the enhanced ability to monetize real estate assets, allowing capital to be utilized more efficiently, thus generating more attractive returns.

Thanks to the time-tested REIT laws, the Net Lease REITs have become an important property sector in which highly predictable rent checks are turned into highly sustainable dividends.

Today, I plan to provide readers with a new name to the Net Lease REIT sector and one in which we are initiating coverage (in our Intelligent REIT Lab). Excerpts from this article first appeared in the August edition of the Forbes Real Estate Investor.

(Photo Source)

Introducing Essential Properties

Essential Properties Realty Trust (NYSE:EPRT) began trading on June 21st and will join Realty Income, STORE Capital (NYSE:STOR), EPR Properties and others within our Net Lease coverage universe. I have known the company’s president and CEO, Pete Mavoides, for a few years (when he was at Spirit Realty Capital (NYSE:SRC)), and I decided to provide subscribers with an exclusive interview.

Bio: Pete previously served as President and COO at Spirit Realty Capital from 2011 until 2015. During his time at Spirit, he helped transition the company from a privately held $3.2 billion company to a publicly traded $9.1 billion enterprise. Prior to joining SRC, Pete was the president and CEO of Sovereign Investment Company, a private equity firm that focused on investment opportunities relating to long-term, single-tenant, sale-leaseback opportunities. Before Sovereign, Pete worked as an investment banker for five years, helping corporations monetize their real estate assets. He graduated from the United States Military Academy (West Point), served as an officer in the army and received an M.B.A. from the University of Michigan.

Brad Thomas (BT): How is EPRT different from the other peers?

Pete Mavoides (PM): First and foremost, our CEO and COO have over 43 years of collective experience investing and managing net lease assets over multiple credit cycles. As a result, the majority of our annualized base rent (ABR) was acquired from parties who had previously engaged in one or more transactions that involved a member of our senior management team.

In addition, we have deliberately concentrated on smaller-scale, fungible properties that are leased to service-oriented and experience-based tenants, which represent approximately 88% of our ABR as of March 31, 2018.

Furthermore, given our focus on sale-leaseback transactions with middle-market companies, approximately 65% of our ABR as of March 31, 2018, comes from properties subject to master leases, while over 97% of our ABR as of the same date is required to provide us with unit-level financial reporting.

PM: We believe the following points further highlight our differences relative to our peers:

Management is comprised of experienced net lease investment professionals -Essential’s CEO, Pete Mavoides, and COO, Gregg Seibert, have over 43 years of collective experience investing in net lease real estate, which includes purchasing and managing several billions of assets through multiple credit cycles during their careers.

Highly e-commerce resistant portfolio – With 87.6% of our annualized base rent (ABR) being derived from service-oriented and experience-based tenants as of March 31, 2018, we believe we have one of the most e-commerce resistant portfolios in the net lease REIT sector. Customers must come to our tenants’ locations in order to receive a service and/or have an experience, which we believe insulates us from e-commerce pressures.

Focused approach to investing in industry verticals – Essential has chosen a focused approach towards investing in net lease properties as our top seven industries: quick-service restaurants, car washes, casual dining, medical/dental, convenience stores, early childhood education, and automotive service; [these] collectively represent approximately 72% of our ABR as of March 31, 2018.

Smaller-scale, granular properties – As of March 31, 2018, our average investment per property was $1.9M, which is indicative of: 1.) the less specialized nature of our real estate, 2.) our general lack of exposure to Big Box retail assets, and 3.) the highly fungible nature of our properties, which we believe are easier to sell and re-lease in comparison to larger retail boxes.

Strong weighted average four-wall EBITDAR coverage of 2.9x and high portfolio transparency, with over 97% of our tenants (by ABR) reporting unit-level financials to us – As of March, 31, 2018, we received unit-level financials from 97.4% of our tenants as a percentage of ABR, and our weighted average four-wall EBITDAR coverage for those same tenants was 2.9x.

Long-weighted average lease term of 13.8 years – We have no exposure to pharmacy, apparel, general merchandise, electronics, sporting goods, and other soft goods retailers.

BT: Given your background at Spirit Realty, do you believe EPRT will be most comparable with SRC?

PM: Spirit is a large-cap diversified net lease REIT with a portfolio that has been assembled by multiple management teams over the past 15 years. Spirit also generates a portion of its revenues from asset management fees and preferred dividends. Conversely, Essential has a purpose-built portfolio of smaller-scale net lease properties that have been assembled by the same management team over the last 24 months.

BT: What are EPRT target credit metrics, and do you expect to achieve investment grade ratings in the near term? Also, can you tell us about your cost of capital?

PM: Our stated objective is to manage our net debt / EBITDA under 6.0x, which we believe is a balance sheet statistic that is consistent with investment grade issuers in the REIT industry. As such, we would expect to become an investment grade issuer over time.

We recognize that maintaining an attractive cost of capital is critical for any REIT that is external growth-focused. Our recent IPO and private placement give us ample investable capital to execute our growth plan over the near term.

BT: On the sourcing side, how does EPRT expect to grow – one-off deals, portfolios, or a combination thereof?

PM: Similar to our past deal flow, we would anticipate using our long-standing industry relationships to generate the bulk of our external growth from sale-leaseback transactions with middle-market tenants.

BT: What are EPRT’s favored categories? Do you expect to own casual dining properties?

PM: As of March 31, 2018, our largest industry exposure was quick-service restaurants at 18% of ABR, followed by car washes, casual dining, medical/dental, convenience stores, early childhood education, and automotive service. Collectively, these seven industries represent approximately 72% of our ABR as of March 31, 2018, with casual dining being our third-largest industry exposure at approximately 11% of ABR.

BT: Does EPRT plan to become a developer or provide developer funding? If so, how will you mitigate these risks?

PM: We have no intention of becoming a developer. However, we will agree to fund new development for existing tenants that we know and trust. We believe we mitigate risk by investing with relationship tenants that have a proven track record of operating performance.

BT: How about sale/leasebacks? Will EPRT be competitive in that arena?

PM: Most of our acquisitions since inception have come from internally originated sale-leaseback transactions with middle-market tenants. The vast majority of these deals were acquired from or through parties that had previously engaged in one or more transactions that involved a member of our senior management team. As such, we would anticipate the bulk of our future external growth to come from sale-leaseback transactions with middle-market tenants and relationship-based deals.

BT: AMC is listed as a top tenant. How do you mitigate the risks within the theatre business?

PM: As of March 31, 2018, we owned five theaters that represented 4.6% of our ABR. We mitigate risk by focusing on newly renovated and highly profitable movie theaters that are leased to the top theater operators in the U.S.

BT: Finally, what is your targeted AFFO payout ratio? Why?

PM: Our new Board of Directors will decide our future dividend policy and the resulting AFFO payout ratio. We would anticipate our policy on both matters to be generally consistent with our peer group.

Earnings Update

In Q2-18, EPRT’s total revenue increased 63% to $21.7 million, as compared to $13.3 million for the same quarter in 2017. Total revenue for the six months ended June 30, 2018, increased 79% to $41.9 million, as compared to $23.4 million for the same period in 2017.

The company’s net income increased 71% to $3.5 million, as compared to $2.0 million for the same quarter in 2017. Net income for the six months ended June 30, 2018, increased 75% to $4.6 million, as compared to $2.6 million for the same period in 2017.

Its FFO increased 81% to $9.6 million, as compared to $5.3 million for the same quarter in 2017. FFO for the six months ended June 30, 2018, increased 87% to $17.8 million, as compared to $9.5 million for the same period in 2017.

EPRT’s AFFO increased 68% to $8.5 million, as compared to $5.0 million for the same quarter in 2017. AFFO for the six months ended June 30, 2018, increased 79% to $15.9 million, as compared to $8.9 million for the same period in 2017.

The REIT’s Net Debt-to-Annualized Adjusted EBITDAre was 4.4x times, while Pro Forma Net Debt-to-Annualized Adjusted EBITDAre was 3.9x (i.e., adjusted for the receipt of net proceeds resulting from the underwriters’ partial exercise of an option to purchase additional shares).

It has a $300 million unsecured credit facility with no amounts outstanding as of August 7, 2018. The credit facility includes an accordion feature to increase, subject to certain conditions, the maximum availability of the facility by up to $200 million. In addition, we had approximately $151 million of cash and cash equivalents and restricted cash as of August 7, 2018.

Peer Comps

EPRT hasn’t declared a dividend yet; however, the company provided the below commentary on the Q2-18 conference call as it pertains to a potential dividend. The CEO said:

“Our objective is to maximize shareholder value by generating attractive risk-adjusted returns through owning, managing and growing a diverse portfolio of assets leased to tenants operating in service-oriented and experience-based industries. These returns will come from a combination of growing our cash available for distribution and paying a current dividend. To that end, as we disclosed in our S-11 filing, we anticipate paying an $0.84 per share initial annual dividend. I would anticipate our board to review that dividend policy and make a declaration for the third quarter and the five-day stub period very shortly.”

Note: $.84/$13.90 share price = 6.0% (estimated)

EPRT’sconsensus AFFO/share in 2019 for the eight analysts that cover the company is $1.09. Using analyst estimates, we arrive at EPRT’s projected AFFO payout ratio:

Again, based on analyst estimates, we arrive at our P/AFFO multiple for EPRT of 12.8x.

Summary

EPRT has all of the ingredients to become the next Realty Income. Keeping in mind that the way that O was able to become a premium brand is because of the company’s size and cost of capital advantages. As noted, it is becoming increasingly evident that M&A is likely in the Net Lease sector, and it is only a matter of time before consolidation transforms the top players into the next Wells Fargo and Bank of America in the Net Lease sector.

Source: Yahoo Finance

Source: F.A.S.T. Graphs and EPRT Investor Presentation.

Note: Brad Thomas is a Wall Street writer, and that means he is not always right with his predictions or recommendations. That also applies to his grammar. Please excuse any typos, and be assured that he will do his best to correct any errors, if they are overlooked.

Finally, this article is free, and the sole purpose for writing it is to assist with research, while also providing a forum for second-level thinking. If you have not followed him, please take five seconds and click his name above (top of the page).

Peers: O, National Retail Properties (NYSE:NNN), W.P. Carey (NYSE:WPC), Agree Realty Corp. (NYSE:ADC), Four Corners Property Trust (NYSE:FCPT), Getty Realty Corp. (NYSE:GTY), STOR, EPR, VEREIT, Inc. (NYSE:VER), SRC, Global Net Lease, Inc. (NYSE:GNL), and Lexington Realty Trust (NYSE:LXP).

Each week, Brad provides Marketplace subscribers with actionable REIT news, including (1) Friday afternoon subscriber calls, (2) Weekender updates, (3) Google portfolios, (4) Real-time alerts, (5) Early AM REIT news, (6) chat rooms, (7) the monthly newsletter, and (8) earnings results in Google Sheets.

Marketplace subscribers have access to a wide range of services, including weekly property sector updates and weekly Buy/Sell picks. We provide most all research to marketplace subscribers, and we also provide a “weekender” report and a “motivational Monday” report. We stream relevant real-time REIT news so that you can stay informed.

All of our portfolios are updated daily, and subscribers have access to all of the tools via Google Sheets. REITs should be part of your daily diet, and we would like to help you construct an Intelligent REIT portfolio, utilizing our portfolio modeling strategies. Brad reminds all subscribers and prospective subscribers that “the safest dividend is the one that’s just been raised.”

Disclosure: I am/we are long ACC, AVB, BHR, BPY, BRX, BXMT, CCI, CHCT, CIO, CLDT, CONE, CORR, CTRE, CXP, CUBE, DEA, DLR, DOC, EPR, EQIX, ESS, EXR, FRT, GEO, GMRE, GPT, HASI, HT, HTA, INN, IRET, IRM, JCAP, KIM, KREF, KRG, LADR, LAND, LMRK, LTC, MNR, NNN, NXRT, O, OFC, OHI, OUT, PEB, PEI, PK, PSB, PTTTS, QTS, REG, RHP, ROIC, SBRA, SKT, SPG, SRC, STAG, STOR, TCO, TRTX, UBA, UMH, UNIT, VER, VICI, VNO, VNQ, VTR, WPC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

Take Charge. Another Boring Net Lease REIT

New Post has been published on http://philippinesoutsourcingjobs.com/take-charge-another-boring-net-lease-reit/

Take Charge. Another Boring Net Lease REIT

In a recent Seeking Alpha article, I explained that “as a REIT analyst, it’s critical to understand the benefits of fragmentation and consolidation. I have found that over the years, many investors seem to get confused by the concept and, more importantly, the benefits to building a competitive scale advantage”.

While many REITs struggle to move the needle by growing externally, the Net Lease REITs are unique because they can seek new properties in practically any market. As I went on to explain:

“More specifically, within the $4 trillion REIT universe, we have witnessed a growing evolution of companies that have built powerful scale advantages by utilizing low cost of capital, acquisitions, development, and dispositions.”

When I was a new lease developer (over 15 years ago), there were just a handful of Net Lease REITs, and today the list is growing in size, with each company hoping to carve out a differentiated slice of the market share.

Some REITs, like Realty Income (NYSE:O), utilize their size and cost of capital advantages, while others, like EPR Properties (NYSE:EPR), seek to carve an “experiential” niche focusing on theaters, waterparks, golf entertainment, and charter schools.

I like to compare Net Lease REITs to banks, remembering that there are super regional banks, regional banks, and community banks. All provide a valuable service based on scale, cost of capital, customer service, and location.

Similarly, the bank industry blossomed in the early ’80s as intrastate banking restrictions were lifted, allowing new players to enter new markets. Many banks shifted funds to commercial real estate lending (during the ’80s). When total real estate loans of banks more than tripled, commercial real estate loans nearly quadrupled.

In my backyard (South Carolina), I witnessed the “merger mania” whereby many southeastern banks were acquired by each other (hoping to keep the New York and West Coast banks out), and eventually, they were acquired by the gorillas: Wells Fargo (NYSE:WFC) and NationsBank.

And as I reflect on history, it seems that the Net Lease REITs are becoming the modern-day banks for corporately-owned real estate. The sale/leaseback business model gives corporations the enhanced ability to monetize real estate assets, allowing capital to be utilized more efficiently, thus generating more attractive returns.

Thanks to the time-tested REIT laws, the Net Lease REITs have become an important property sector in which highly predictable rent checks are turned into highly sustainable dividends.

Today, I plan to provide readers with a new name to the Net Lease REIT sector and one in which we are initiating coverage (in our Intelligent REIT Lab). Excerpts from this article first appeared in the August edition of the Forbes Real Estate Investor.

(Photo Source)

Introducing Essential Properties

Essential Properties Realty Trust (NYSE:EPRT) began trading on June 21st and will join Realty Income, STORE Capital (NYSE:STOR), EPR Properties and others within our Net Lease coverage universe. I have known the company’s president and CEO, Pete Mavoides, for a few years (when he was at Spirit Realty Capital (NYSE:SRC)), and I decided to provide subscribers with an exclusive interview.

Bio: Pete previously served as President and COO at Spirit Realty Capital from 2011 until 2015. During his time at Spirit, he helped transition the company from a privately held $3.2 billion company to a publicly traded $9.1 billion enterprise. Prior to joining SRC, Pete was the president and CEO of Sovereign Investment Company, a private equity firm that focused on investment opportunities relating to long-term, single-tenant, sale-leaseback opportunities. Before Sovereign, Pete worked as an investment banker for five years, helping corporations monetize their real estate assets. He graduated from the United States Military Academy (West Point), served as an officer in the army and received an M.B.A. from the University of Michigan.

Brad Thomas (BT): How is EPRT different from the other peers?

Pete Mavoides (PM): First and foremost, our CEO and COO have over 43 years of collective experience investing and managing net lease assets over multiple credit cycles. As a result, the majority of our annualized base rent (ABR) was acquired from parties who had previously engaged in one or more transactions that involved a member of our senior management team.

In addition, we have deliberately concentrated on smaller-scale, fungible properties that are leased to service-oriented and experience-based tenants, which represent approximately 88% of our ABR as of March 31, 2018.

Furthermore, given our focus on sale-leaseback transactions with middle-market companies, approximately 65% of our ABR as of March 31, 2018, comes from properties subject to master leases, while over 97% of our ABR as of the same date is required to provide us with unit-level financial reporting.

PM: We believe the following points further highlight our differences relative to our peers:

Management is comprised of experienced net lease investment professionals -Essential’s CEO, Pete Mavoides, and COO, Gregg Seibert, have over 43 years of collective experience investing in net lease real estate, which includes purchasing and managing several billions of assets through multiple credit cycles during their careers.

Highly e-commerce resistant portfolio – With 87.6% of our annualized base rent (ABR) being derived from service-oriented and experience-based tenants as of March 31, 2018, we believe we have one of the most e-commerce resistant portfolios in the net lease REIT sector. Customers must come to our tenants’ locations in order to receive a service and/or have an experience, which we believe insulates us from e-commerce pressures.

Focused approach to investing in industry verticals – Essential has chosen a focused approach towards investing in net lease properties as our top seven industries: quick-service restaurants, car washes, casual dining, medical/dental, convenience stores, early childhood education, and automotive service; [these] collectively represent approximately 72% of our ABR as of March 31, 2018.

Smaller-scale, granular properties – As of March 31, 2018, our average investment per property was $1.9M, which is indicative of: 1.) the less specialized nature of our real estate, 2.) our general lack of exposure to Big Box retail assets, and 3.) the highly fungible nature of our properties, which we believe are easier to sell and re-lease in comparison to larger retail boxes.

Strong weighted average four-wall EBITDAR coverage of 2.9x and high portfolio transparency, with over 97% of our tenants (by ABR) reporting unit-level financials to us – As of March, 31, 2018, we received unit-level financials from 97.4% of our tenants as a percentage of ABR, and our weighted average four-wall EBITDAR coverage for those same tenants was 2.9x.

Long-weighted average lease term of 13.8 years – We have no exposure to pharmacy, apparel, general merchandise, electronics, sporting goods, and other soft goods retailers.

BT: Given your background at Spirit Realty, do you believe EPRT will be most comparable with SRC?

PM: Spirit is a large-cap diversified net lease REIT with a portfolio that has been assembled by multiple management teams over the past 15 years. Spirit also generates a portion of its revenues from asset management fees and preferred dividends. Conversely, Essential has a purpose-built portfolio of smaller-scale net lease properties that have been assembled by the same management team over the last 24 months.

BT: What are EPRT target credit metrics, and do you expect to achieve investment grade ratings in the near term? Also, can you tell us about your cost of capital?

PM: Our stated objective is to manage our net debt / EBITDA under 6.0x, which we believe is a balance sheet statistic that is consistent with investment grade issuers in the REIT industry. As such, we would expect to become an investment grade issuer over time.

We recognize that maintaining an attractive cost of capital is critical for any REIT that is external growth-focused. Our recent IPO and private placement give us ample investable capital to execute our growth plan over the near term.

BT: On the sourcing side, how does EPRT expect to grow – one-off deals, portfolios, or a combination thereof?

PM: Similar to our past deal flow, we would anticipate using our long-standing industry relationships to generate the bulk of our external growth from sale-leaseback transactions with middle-market tenants.

BT: What are EPRT’s favored categories? Do you expect to own casual dining properties?

PM: As of March 31, 2018, our largest industry exposure was quick-service restaurants at 18% of ABR, followed by car washes, casual dining, medical/dental, convenience stores, early childhood education, and automotive service. Collectively, these seven industries represent approximately 72% of our ABR as of March 31, 2018, with casual dining being our third-largest industry exposure at approximately 11% of ABR.

BT: Does EPRT plan to become a developer or provide developer funding? If so, how will you mitigate these risks?

PM: We have no intention of becoming a developer. However, we will agree to fund new development for existing tenants that we know and trust. We believe we mitigate risk by investing with relationship tenants that have a proven track record of operating performance.

BT: How about sale/leasebacks? Will EPRT be competitive in that arena?

PM: Most of our acquisitions since inception have come from internally originated sale-leaseback transactions with middle-market tenants. The vast majority of these deals were acquired from or through parties that had previously engaged in one or more transactions that involved a member of our senior management team. As such, we would anticipate the bulk of our future external growth to come from sale-leaseback transactions with middle-market tenants and relationship-based deals.

BT: AMC is listed as a top tenant. How do you mitigate the risks within the theatre business?

PM: As of March 31, 2018, we owned five theaters that represented 4.6% of our ABR. We mitigate risk by focusing on newly renovated and highly profitable movie theaters that are leased to the top theater operators in the U.S.

BT: Finally, what is your targeted AFFO payout ratio? Why?

PM: Our new Board of Directors will decide our future dividend policy and the resulting AFFO payout ratio. We would anticipate our policy on both matters to be generally consistent with our peer group.

Earnings Update

In Q2-18, EPRT’s total revenue increased 63% to $21.7 million, as compared to $13.3 million for the same quarter in 2017. Total revenue for the six months ended June 30, 2018, increased 79% to $41.9 million, as compared to $23.4 million for the same period in 2017.

The company’s net income increased 71% to $3.5 million, as compared to $2.0 million for the same quarter in 2017. Net income for the six months ended June 30, 2018, increased 75% to $4.6 million, as compared to $2.6 million for the same period in 2017.

Its FFO increased 81% to $9.6 million, as compared to $5.3 million for the same quarter in 2017. FFO for the six months ended June 30, 2018, increased 87% to $17.8 million, as compared to $9.5 million for the same period in 2017.

EPRT’s AFFO increased 68% to $8.5 million, as compared to $5.0 million for the same quarter in 2017. AFFO for the six months ended June 30, 2018, increased 79% to $15.9 million, as compared to $8.9 million for the same period in 2017.

The REIT’s Net Debt-to-Annualized Adjusted EBITDAre was 4.4x times, while Pro Forma Net Debt-to-Annualized Adjusted EBITDAre was 3.9x (i.e., adjusted for the receipt of net proceeds resulting from the underwriters’ partial exercise of an option to purchase additional shares).

It has a $300 million unsecured credit facility with no amounts outstanding as of August 7, 2018. The credit facility includes an accordion feature to increase, subject to certain conditions, the maximum availability of the facility by up to $200 million. In addition, we had approximately $151 million of cash and cash equivalents and restricted cash as of August 7, 2018.

Peer Comps

EPRT hasn’t declared a dividend yet; however, the company provided the below commentary on the Q2-18 conference call as it pertains to a potential dividend. The CEO said:

“Our objective is to maximize shareholder value by generating attractive risk-adjusted returns through owning, managing and growing a diverse portfolio of assets leased to tenants operating in service-oriented and experience-based industries. These returns will come from a combination of growing our cash available for distribution and paying a current dividend. To that end, as we disclosed in our S-11 filing, we anticipate paying an $0.84 per share initial annual dividend. I would anticipate our board to review that dividend policy and make a declaration for the third quarter and the five-day stub period very shortly.”

Note: $.84/$13.90 share price = 6.0% (estimated)

EPRT’sconsensus AFFO/share in 2019 for the eight analysts that cover the company is $1.09. Using analyst estimates, we arrive at EPRT’s projected AFFO payout ratio:

Again, based on analyst estimates, we arrive at our P/AFFO multiple for EPRT of 12.8x.

Summary

EPRT has all of the ingredients to become the next Realty Income. Keeping in mind that the way that O was able to become a premium brand is because of the company’s size and cost of capital advantages. As noted, it is becoming increasingly evident that M&A is likely in the Net Lease sector, and it is only a matter of time before consolidation transforms the top players into the next Wells Fargo and Bank of America in the Net Lease sector.

Source: Yahoo Finance

Source: F.A.S.T. Graphs and EPRT Investor Presentation.

Note: Brad Thomas is a Wall Street writer, and that means he is not always right with his predictions or recommendations. That also applies to his grammar. Please excuse any typos, and be assured that he will do his best to correct any errors, if they are overlooked.

Finally, this article is free, and the sole purpose for writing it is to assist with research, while also providing a forum for second-level thinking. If you have not followed him, please take five seconds and click his name above (top of the page).

Peers: O, National Retail Properties (NYSE:NNN), W.P. Carey (NYSE:WPC), Agree Realty Corp. (NYSE:ADC), Four Corners Property Trust (NYSE:FCPT), Getty Realty Corp. (NYSE:GTY), STOR, EPR, VEREIT, Inc. (NYSE:VER), SRC, Global Net Lease, Inc. (NYSE:GNL), and Lexington Realty Trust (NYSE:LXP).

Each week, Brad provides Marketplace subscribers with actionable REIT news, including (1) Friday afternoon subscriber calls, (2) Weekender updates, (3) Google portfolios, (4) Real-time alerts, (5) Early AM REIT news, (6) chat rooms, (7) the monthly newsletter, and (8) earnings results in Google Sheets.

Marketplace subscribers have access to a wide range of services, including weekly property sector updates and weekly Buy/Sell picks. We provide most all research to marketplace subscribers, and we also provide a “weekender” report and a “motivational Monday” report. We stream relevant real-time REIT news so that you can stay informed.

All of our portfolios are updated daily, and subscribers have access to all of the tools via Google Sheets. REITs should be part of your daily diet, and we would like to help you construct an Intelligent REIT portfolio, utilizing our portfolio modeling strategies. Brad reminds all subscribers and prospective subscribers that “the safest dividend is the one that’s just been raised.”

Disclosure: I am/we are long ACC, AVB, BHR, BPY, BRX, BXMT, CCI, CHCT, CIO, CLDT, CONE, CORR, CTRE, CXP, CUBE, DEA, DLR, DOC, EPR, EQIX, ESS, EXR, FRT, GEO, GMRE, GPT, HASI, HT, HTA, INN, IRET, IRM, JCAP, KIM, KREF, KRG, LADR, LAND, LMRK, LTC, MNR, NNN, NXRT, O, OFC, OHI, OUT, PEB, PEI, PK, PSB, PTTTS, QTS, REG, RHP, ROIC, SBRA, SKT, SPG, SRC, STAG, STOR, TCO, TRTX, UBA, UMH, UNIT, VER, VICI, VNO, VNQ, VTR, WPC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

Take Charge. Another Boring Net Lease REIT

New Post has been published on http://philippinesoutsourcingjobs.com/take-charge-another-boring-net-lease-reit/

Take Charge. Another Boring Net Lease REIT

In a recent Seeking Alpha article, I explained that “as a REIT analyst, it’s critical to understand the benefits of fragmentation and consolidation. I have found that over the years, many investors seem to get confused by the concept and, more importantly, the benefits to building a competitive scale advantage”.

While many REITs struggle to move the needle by growing externally, the Net Lease REITs are unique because they can seek new properties in practically any market. As I went on to explain:

“More specifically, within the $4 trillion REIT universe, we have witnessed a growing evolution of companies that have built powerful scale advantages by utilizing low cost of capital, acquisitions, development, and dispositions.”

When I was a new lease developer (over 15 years ago), there were just a handful of Net Lease REITs, and today the list is growing in size, with each company hoping to carve out a differentiated slice of the market share.

Some REITs, like Realty Income (NYSE:O), utilize their size and cost of capital advantages, while others, like EPR Properties (NYSE:EPR), seek to carve an “experiential” niche focusing on theaters, waterparks, golf entertainment, and charter schools.

I like to compare Net Lease REITs to banks, remembering that there are super regional banks, regional banks, and community banks. All provide a valuable service based on scale, cost of capital, customer service, and location.

Similarly, the bank industry blossomed in the early ’80s as intrastate banking restrictions were lifted, allowing new players to enter new markets. Many banks shifted funds to commercial real estate lending (during the ’80s). When total real estate loans of banks more than tripled, commercial real estate loans nearly quadrupled.

In my backyard (South Carolina), I witnessed the “merger mania” whereby many southeastern banks were acquired by each other (hoping to keep the New York and West Coast banks out), and eventually, they were acquired by the gorillas: Wells Fargo (NYSE:WFC) and NationsBank.

And as I reflect on history, it seems that the Net Lease REITs are becoming the modern-day banks for corporately-owned real estate. The sale/leaseback business model gives corporations the enhanced ability to monetize real estate assets, allowing capital to be utilized more efficiently, thus generating more attractive returns.

Thanks to the time-tested REIT laws, the Net Lease REITs have become an important property sector in which highly predictable rent checks are turned into highly sustainable dividends.

Today, I plan to provide readers with a new name to the Net Lease REIT sector and one in which we are initiating coverage (in our Intelligent REIT Lab). Excerpts from this article first appeared in the August edition of the Forbes Real Estate Investor.

(Photo Source)

Introducing Essential Properties

Essential Properties Realty Trust (NYSE:EPRT) began trading on June 21st and will join Realty Income, STORE Capital (NYSE:STOR), EPR Properties and others within our Net Lease coverage universe. I have known the company’s president and CEO, Pete Mavoides, for a few years (when he was at Spirit Realty Capital (NYSE:SRC)), and I decided to provide subscribers with an exclusive interview.

Bio: Pete previously served as President and COO at Spirit Realty Capital from 2011 until 2015. During his time at Spirit, he helped transition the company from a privately held $3.2 billion company to a publicly traded $9.1 billion enterprise. Prior to joining SRC, Pete was the president and CEO of Sovereign Investment Company, a private equity firm that focused on investment opportunities relating to long-term, single-tenant, sale-leaseback opportunities. Before Sovereign, Pete worked as an investment banker for five years, helping corporations monetize their real estate assets. He graduated from the United States Military Academy (West Point), served as an officer in the army and received an M.B.A. from the University of Michigan.

Brad Thomas (BT): How is EPRT different from the other peers?

Pete Mavoides (PM): First and foremost, our CEO and COO have over 43 years of collective experience investing and managing net lease assets over multiple credit cycles. As a result, the majority of our annualized base rent (ABR) was acquired from parties who had previously engaged in one or more transactions that involved a member of our senior management team.

In addition, we have deliberately concentrated on smaller-scale, fungible properties that are leased to service-oriented and experience-based tenants, which represent approximately 88% of our ABR as of March 31, 2018.

Furthermore, given our focus on sale-leaseback transactions with middle-market companies, approximately 65% of our ABR as of March 31, 2018, comes from properties subject to master leases, while over 97% of our ABR as of the same date is required to provide us with unit-level financial reporting.

PM: We believe the following points further highlight our differences relative to our peers:

Management is comprised of experienced net lease investment professionals -Essential’s CEO, Pete Mavoides, and COO, Gregg Seibert, have over 43 years of collective experience investing in net lease real estate, which includes purchasing and managing several billions of assets through multiple credit cycles during their careers.

Highly e-commerce resistant portfolio – With 87.6% of our annualized base rent (ABR) being derived from service-oriented and experience-based tenants as of March 31, 2018, we believe we have one of the most e-commerce resistant portfolios in the net lease REIT sector. Customers must come to our tenants’ locations in order to receive a service and/or have an experience, which we believe insulates us from e-commerce pressures.

Focused approach to investing in industry verticals – Essential has chosen a focused approach towards investing in net lease properties as our top seven industries: quick-service restaurants, car washes, casual dining, medical/dental, convenience stores, early childhood education, and automotive service; [these] collectively represent approximately 72% of our ABR as of March 31, 2018.

Smaller-scale, granular properties – As of March 31, 2018, our average investment per property was $1.9M, which is indicative of: 1.) the less specialized nature of our real estate, 2.) our general lack of exposure to Big Box retail assets, and 3.) the highly fungible nature of our properties, which we believe are easier to sell and re-lease in comparison to larger retail boxes.

Strong weighted average four-wall EBITDAR coverage of 2.9x and high portfolio transparency, with over 97% of our tenants (by ABR) reporting unit-level financials to us – As of March, 31, 2018, we received unit-level financials from 97.4% of our tenants as a percentage of ABR, and our weighted average four-wall EBITDAR coverage for those same tenants was 2.9x.

Long-weighted average lease term of 13.8 years – We have no exposure to pharmacy, apparel, general merchandise, electronics, sporting goods, and other soft goods retailers.

BT: Given your background at Spirit Realty, do you believe EPRT will be most comparable with SRC?

PM: Spirit is a large-cap diversified net lease REIT with a portfolio that has been assembled by multiple management teams over the past 15 years. Spirit also generates a portion of its revenues from asset management fees and preferred dividends. Conversely, Essential has a purpose-built portfolio of smaller-scale net lease properties that have been assembled by the same management team over the last 24 months.

BT: What are EPRT target credit metrics, and do you expect to achieve investment grade ratings in the near term? Also, can you tell us about your cost of capital?

PM: Our stated objective is to manage our net debt / EBITDA under 6.0x, which we believe is a balance sheet statistic that is consistent with investment grade issuers in the REIT industry. As such, we would expect to become an investment grade issuer over time.

We recognize that maintaining an attractive cost of capital is critical for any REIT that is external growth-focused. Our recent IPO and private placement give us ample investable capital to execute our growth plan over the near term.

BT: On the sourcing side, how does EPRT expect to grow – one-off deals, portfolios, or a combination thereof?

PM: Similar to our past deal flow, we would anticipate using our long-standing industry relationships to generate the bulk of our external growth from sale-leaseback transactions with middle-market tenants.

BT: What are EPRT’s favored categories? Do you expect to own casual dining properties?

PM: As of March 31, 2018, our largest industry exposure was quick-service restaurants at 18% of ABR, followed by car washes, casual dining, medical/dental, convenience stores, early childhood education, and automotive service. Collectively, these seven industries represent approximately 72% of our ABR as of March 31, 2018, with casual dining being our third-largest industry exposure at approximately 11% of ABR.

BT: Does EPRT plan to become a developer or provide developer funding? If so, how will you mitigate these risks?

PM: We have no intention of becoming a developer. However, we will agree to fund new development for existing tenants that we know and trust. We believe we mitigate risk by investing with relationship tenants that have a proven track record of operating performance.

BT: How about sale/leasebacks? Will EPRT be competitive in that arena?

PM: Most of our acquisitions since inception have come from internally originated sale-leaseback transactions with middle-market tenants. The vast majority of these deals were acquired from or through parties that had previously engaged in one or more transactions that involved a member of our senior management team. As such, we would anticipate the bulk of our future external growth to come from sale-leaseback transactions with middle-market tenants and relationship-based deals.

BT: AMC is listed as a top tenant. How do you mitigate the risks within the theatre business?

PM: As of March 31, 2018, we owned five theaters that represented 4.6% of our ABR. We mitigate risk by focusing on newly renovated and highly profitable movie theaters that are leased to the top theater operators in the U.S.

BT: Finally, what is your targeted AFFO payout ratio? Why?

PM: Our new Board of Directors will decide our future dividend policy and the resulting AFFO payout ratio. We would anticipate our policy on both matters to be generally consistent with our peer group.

Earnings Update

In Q2-18, EPRT’s total revenue increased 63% to $21.7 million, as compared to $13.3 million for the same quarter in 2017. Total revenue for the six months ended June 30, 2018, increased 79% to $41.9 million, as compared to $23.4 million for the same period in 2017.

The company’s net income increased 71% to $3.5 million, as compared to $2.0 million for the same quarter in 2017. Net income for the six months ended June 30, 2018, increased 75% to $4.6 million, as compared to $2.6 million for the same period in 2017.

Its FFO increased 81% to $9.6 million, as compared to $5.3 million for the same quarter in 2017. FFO for the six months ended June 30, 2018, increased 87% to $17.8 million, as compared to $9.5 million for the same period in 2017.

EPRT’s AFFO increased 68% to $8.5 million, as compared to $5.0 million for the same quarter in 2017. AFFO for the six months ended June 30, 2018, increased 79% to $15.9 million, as compared to $8.9 million for the same period in 2017.

The REIT’s Net Debt-to-Annualized Adjusted EBITDAre was 4.4x times, while Pro Forma Net Debt-to-Annualized Adjusted EBITDAre was 3.9x (i.e., adjusted for the receipt of net proceeds resulting from the underwriters’ partial exercise of an option to purchase additional shares).

It has a $300 million unsecured credit facility with no amounts outstanding as of August 7, 2018. The credit facility includes an accordion feature to increase, subject to certain conditions, the maximum availability of the facility by up to $200 million. In addition, we had approximately $151 million of cash and cash equivalents and restricted cash as of August 7, 2018.

Peer Comps

EPRT hasn’t declared a dividend yet; however, the company provided the below commentary on the Q2-18 conference call as it pertains to a potential dividend. The CEO said:

“Our objective is to maximize shareholder value by generating attractive risk-adjusted returns through owning, managing and growing a diverse portfolio of assets leased to tenants operating in service-oriented and experience-based industries. These returns will come from a combination of growing our cash available for distribution and paying a current dividend. To that end, as we disclosed in our S-11 filing, we anticipate paying an $0.84 per share initial annual dividend. I would anticipate our board to review that dividend policy and make a declaration for the third quarter and the five-day stub period very shortly.”

Note: $.84/$13.90 share price = 6.0% (estimated)

EPRT’sconsensus AFFO/share in 2019 for the eight analysts that cover the company is $1.09. Using analyst estimates, we arrive at EPRT’s projected AFFO payout ratio:

Again, based on analyst estimates, we arrive at our P/AFFO multiple for EPRT of 12.8x.

Summary

EPRT has all of the ingredients to become the next Realty Income. Keeping in mind that the way that O was able to become a premium brand is because of the company’s size and cost of capital advantages. As noted, it is becoming increasingly evident that M&A is likely in the Net Lease sector, and it is only a matter of time before consolidation transforms the top players into the next Wells Fargo and Bank of America in the Net Lease sector.

Source: Yahoo Finance

Source: F.A.S.T. Graphs and EPRT Investor Presentation.

Note: Brad Thomas is a Wall Street writer, and that means he is not always right with his predictions or recommendations. That also applies to his grammar. Please excuse any typos, and be assured that he will do his best to correct any errors, if they are overlooked.

Finally, this article is free, and the sole purpose for writing it is to assist with research, while also providing a forum for second-level thinking. If you have not followed him, please take five seconds and click his name above (top of the page).

Peers: O, National Retail Properties (NYSE:NNN), W.P. Carey (NYSE:WPC), Agree Realty Corp. (NYSE:ADC), Four Corners Property Trust (NYSE:FCPT), Getty Realty Corp. (NYSE:GTY), STOR, EPR, VEREIT, Inc. (NYSE:VER), SRC, Global Net Lease, Inc. (NYSE:GNL), and Lexington Realty Trust (NYSE:LXP).

Each week, Brad provides Marketplace subscribers with actionable REIT news, including (1) Friday afternoon subscriber calls, (2) Weekender updates, (3) Google portfolios, (4) Real-time alerts, (5) Early AM REIT news, (6) chat rooms, (7) the monthly newsletter, and (8) earnings results in Google Sheets.

Marketplace subscribers have access to a wide range of services, including weekly property sector updates and weekly Buy/Sell picks. We provide most all research to marketplace subscribers, and we also provide a “weekender” report and a “motivational Monday” report. We stream relevant real-time REIT news so that you can stay informed.

All of our portfolios are updated daily, and subscribers have access to all of the tools via Google Sheets. REITs should be part of your daily diet, and we would like to help you construct an Intelligent REIT portfolio, utilizing our portfolio modeling strategies. Brad reminds all subscribers and prospective subscribers that “the safest dividend is the one that’s just been raised.”

Disclosure: I am/we are long ACC, AVB, BHR, BPY, BRX, BXMT, CCI, CHCT, CIO, CLDT, CONE, CORR, CTRE, CXP, CUBE, DEA, DLR, DOC, EPR, EQIX, ESS, EXR, FRT, GEO, GMRE, GPT, HASI, HT, HTA, INN, IRET, IRM, JCAP, KIM, KREF, KRG, LADR, LAND, LMRK, LTC, MNR, NNN, NXRT, O, OFC, OHI, OUT, PEB, PEI, PK, PSB, PTTTS, QTS, REG, RHP, ROIC, SBRA, SKT, SPG, SRC, STAG, STOR, TCO, TRTX, UBA, UMH, UNIT, VER, VICI, VNO, VNQ, VTR, WPC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

Take Charge. Another Boring Net Lease REIT

New Post has been published on http://bestcloudcomputingoffers.com/take-charge-another-boring-net-lease-reit/

Take Charge. Another Boring Net Lease REIT

In a recent Seeking Alpha article, I explained that “as a REIT analyst, it’s critical to understand the benefits of fragmentation and consolidation. I have found that over the years, many investors seem to get confused by the concept and, more importantly, the benefits to building a competitive scale advantage”.

While many REITs struggle to move the needle by growing externally, the Net Lease REITs are unique because they can seek new properties in practically any market. As I went on to explain:

“More specifically, within the $4 trillion REIT universe, we have witnessed a growing evolution of companies that have built powerful scale advantages by utilizing low cost of capital, acquisitions, development, and dispositions.”

When I was a new lease developer (over 15 years ago), there were just a handful of Net Lease REITs, and today the list is growing in size, with each company hoping to carve out a differentiated slice of the market share.

Some REITs, like Realty Income (NYSE:O), utilize their size and cost of capital advantages, while others, like EPR Properties (NYSE:EPR), seek to carve an “experiential” niche focusing on theaters, waterparks, golf entertainment, and charter schools.

I like to compare Net Lease REITs to banks, remembering that there are super regional banks, regional banks, and community banks. All provide a valuable service based on scale, cost of capital, customer service, and location.

Similarly, the bank industry blossomed in the early ’80s as intrastate banking restrictions were lifted, allowing new players to enter new markets. Many banks shifted funds to commercial real estate lending (during the ’80s). When total real estate loans of banks more than tripled, commercial real estate loans nearly quadrupled.

In my backyard (South Carolina), I witnessed the “merger mania” whereby many southeastern banks were acquired by each other (hoping to keep the New York and West Coast banks out), and eventually, they were acquired by the gorillas: Wells Fargo (NYSE:WFC) and NationsBank.

And as I reflect on history, it seems that the Net Lease REITs are becoming the modern-day banks for corporately-owned real estate. The sale/leaseback business model gives corporations the enhanced ability to monetize real estate assets, allowing capital to be utilized more efficiently, thus generating more attractive returns.

Thanks to the time-tested REIT laws, the Net Lease REITs have become an important property sector in which highly predictable rent checks are turned into highly sustainable dividends.

Today, I plan to provide readers with a new name to the Net Lease REIT sector and one in which we are initiating coverage (in our Intelligent REIT Lab). Excerpts from this article first appeared in the August edition of the Forbes Real Estate Investor.

(Photo Source)

Introducing Essential Properties

Essential Properties Realty Trust (NYSE:EPRT) began trading on June 21st and will join Realty Income, STORE Capital (NYSE:STOR), EPR Properties and others within our Net Lease coverage universe. I have known the company’s president and CEO, Pete Mavoides, for a few years (when he was at Spirit Realty Capital (NYSE:SRC)), and I decided to provide subscribers with an exclusive interview.

Bio: Pete previously served as President and COO at Spirit Realty Capital from 2011 until 2015. During his time at Spirit, he helped transition the company from a privately held $3.2 billion company to a publicly traded $9.1 billion enterprise. Prior to joining SRC, Pete was the president and CEO of Sovereign Investment Company, a private equity firm that focused on investment opportunities relating to long-term, single-tenant, sale-leaseback opportunities. Before Sovereign, Pete worked as an investment banker for five years, helping corporations monetize their real estate assets. He graduated from the United States Military Academy (West Point), served as an officer in the army and received an M.B.A. from the University of Michigan.

Brad Thomas (BT): How is EPRT different from the other peers?

Pete Mavoides (PM): First and foremost, our CEO and COO have over 43 years of collective experience investing and managing net lease assets over multiple credit cycles. As a result, the majority of our annualized base rent (ABR) was acquired from parties who had previously engaged in one or more transactions that involved a member of our senior management team.

In addition, we have deliberately concentrated on smaller-scale, fungible properties that are leased to service-oriented and experience-based tenants, which represent approximately 88% of our ABR as of March 31, 2018.

Furthermore, given our focus on sale-leaseback transactions with middle-market companies, approximately 65% of our ABR as of March 31, 2018, comes from properties subject to master leases, while over 97% of our ABR as of the same date is required to provide us with unit-level financial reporting.

PM: We believe the following points further highlight our differences relative to our peers:

Management is comprised of experienced net lease investment professionals -Essential’s CEO, Pete Mavoides, and COO, Gregg Seibert, have over 43 years of collective experience investing in net lease real estate, which includes purchasing and managing several billions of assets through multiple credit cycles during their careers.

Highly e-commerce resistant portfolio – With 87.6% of our annualized base rent (ABR) being derived from service-oriented and experience-based tenants as of March 31, 2018, we believe we have one of the most e-commerce resistant portfolios in the net lease REIT sector. Customers must come to our tenants’ locations in order to receive a service and/or have an experience, which we believe insulates us from e-commerce pressures.

Focused approach to investing in industry verticals – Essential has chosen a focused approach towards investing in net lease properties as our top seven industries: quick-service restaurants, car washes, casual dining, medical/dental, convenience stores, early childhood education, and automotive service; [these] collectively represent approximately 72% of our ABR as of March 31, 2018.

Smaller-scale, granular properties – As of March 31, 2018, our average investment per property was $1.9M, which is indicative of: 1.) the less specialized nature of our real estate, 2.) our general lack of exposure to Big Box retail assets, and 3.) the highly fungible nature of our properties, which we believe are easier to sell and re-lease in comparison to larger retail boxes.

Strong weighted average four-wall EBITDAR coverage of 2.9x and high portfolio transparency, with over 97% of our tenants (by ABR) reporting unit-level financials to us – As of March, 31, 2018, we received unit-level financials from 97.4% of our tenants as a percentage of ABR, and our weighted average four-wall EBITDAR coverage for those same tenants was 2.9x.

Long-weighted average lease term of 13.8 years – We have no exposure to pharmacy, apparel, general merchandise, electronics, sporting goods, and other soft goods retailers.

BT: Given your background at Spirit Realty, do you believe EPRT will be most comparable with SRC?

PM: Spirit is a large-cap diversified net lease REIT with a portfolio that has been assembled by multiple management teams over the past 15 years. Spirit also generates a portion of its revenues from asset management fees and preferred dividends. Conversely, Essential has a purpose-built portfolio of smaller-scale net lease properties that have been assembled by the same management team over the last 24 months.

BT: What are EPRT target credit metrics, and do you expect to achieve investment grade ratings in the near term? Also, can you tell us about your cost of capital?

PM: Our stated objective is to manage our net debt / EBITDA under 6.0x, which we believe is a balance sheet statistic that is consistent with investment grade issuers in the REIT industry. As such, we would expect to become an investment grade issuer over time.

We recognize that maintaining an attractive cost of capital is critical for any REIT that is external growth-focused. Our recent IPO and private placement give us ample investable capital to execute our growth plan over the near term.

BT: On the sourcing side, how does EPRT expect to grow – one-off deals, portfolios, or a combination thereof?

PM: Similar to our past deal flow, we would anticipate using our long-standing industry relationships to generate the bulk of our external growth from sale-leaseback transactions with middle-market tenants.

BT: What are EPRT’s favored categories? Do you expect to own casual dining properties?

PM: As of March 31, 2018, our largest industry exposure was quick-service restaurants at 18% of ABR, followed by car washes, casual dining, medical/dental, convenience stores, early childhood education, and automotive service. Collectively, these seven industries represent approximately 72% of our ABR as of March 31, 2018, with casual dining being our third-largest industry exposure at approximately 11% of ABR.

BT: Does EPRT plan to become a developer or provide developer funding? If so, how will you mitigate these risks?

PM: We have no intention of becoming a developer. However, we will agree to fund new development for existing tenants that we know and trust. We believe we mitigate risk by investing with relationship tenants that have a proven track record of operating performance.

BT: How about sale/leasebacks? Will EPRT be competitive in that arena?

PM: Most of our acquisitions since inception have come from internally originated sale-leaseback transactions with middle-market tenants. The vast majority of these deals were acquired from or through parties that had previously engaged in one or more transactions that involved a member of our senior management team. As such, we would anticipate the bulk of our future external growth to come from sale-leaseback transactions with middle-market tenants and relationship-based deals.

BT: AMC is listed as a top tenant. How do you mitigate the risks within the theatre business?

PM: As of March 31, 2018, we owned five theaters that represented 4.6% of our ABR. We mitigate risk by focusing on newly renovated and highly profitable movie theaters that are leased to the top theater operators in the U.S.

BT: Finally, what is your targeted AFFO payout ratio? Why?

PM: Our new Board of Directors will decide our future dividend policy and the resulting AFFO payout ratio. We would anticipate our policy on both matters to be generally consistent with our peer group.

Earnings Update

In Q2-18, EPRT’s total revenue increased 63% to $21.7 million, as compared to $13.3 million for the same quarter in 2017. Total revenue for the six months ended June 30, 2018, increased 79% to $41.9 million, as compared to $23.4 million for the same period in 2017.

The company’s net income increased 71% to $3.5 million, as compared to $2.0 million for the same quarter in 2017. Net income for the six months ended June 30, 2018, increased 75% to $4.6 million, as compared to $2.6 million for the same period in 2017.

Its FFO increased 81% to $9.6 million, as compared to $5.3 million for the same quarter in 2017. FFO for the six months ended June 30, 2018, increased 87% to $17.8 million, as compared to $9.5 million for the same period in 2017.

EPRT’s AFFO increased 68% to $8.5 million, as compared to $5.0 million for the same quarter in 2017. AFFO for the six months ended June 30, 2018, increased 79% to $15.9 million, as compared to $8.9 million for the same period in 2017.

The REIT’s Net Debt-to-Annualized Adjusted EBITDAre was 4.4x times, while Pro Forma Net Debt-to-Annualized Adjusted EBITDAre was 3.9x (i.e., adjusted for the receipt of net proceeds resulting from the underwriters’ partial exercise of an option to purchase additional shares).

It has a $300 million unsecured credit facility with no amounts outstanding as of August 7, 2018. The credit facility includes an accordion feature to increase, subject to certain conditions, the maximum availability of the facility by up to $200 million. In addition, we had approximately $151 million of cash and cash equivalents and restricted cash as of August 7, 2018.

Peer Comps

EPRT hasn’t declared a dividend yet; however, the company provided the below commentary on the Q2-18 conference call as it pertains to a potential dividend. The CEO said:

“Our objective is to maximize shareholder value by generating attractive risk-adjusted returns through owning, managing and growing a diverse portfolio of assets leased to tenants operating in service-oriented and experience-based industries. These returns will come from a combination of growing our cash available for distribution and paying a current dividend. To that end, as we disclosed in our S-11 filing, we anticipate paying an $0.84 per share initial annual dividend. I would anticipate our board to review that dividend policy and make a declaration for the third quarter and the five-day stub period very shortly.”

Note: $.84/$13.90 share price = 6.0% (estimated)

EPRT’sconsensus AFFO/share in 2019 for the eight analysts that cover the company is $1.09. Using analyst estimates, we arrive at EPRT’s projected AFFO payout ratio:

Again, based on analyst estimates, we arrive at our P/AFFO multiple for EPRT of 12.8x.

Summary

EPRT has all of the ingredients to become the next Realty Income. Keeping in mind that the way that O was able to become a premium brand is because of the company’s size and cost of capital advantages. As noted, it is becoming increasingly evident that M&A is likely in the Net Lease sector, and it is only a matter of time before consolidation transforms the top players into the next Wells Fargo and Bank of America in the Net Lease sector.

Source: Yahoo Finance

Source: F.A.S.T. Graphs and EPRT Investor Presentation.

Note: Brad Thomas is a Wall Street writer, and that means he is not always right with his predictions or recommendations. That also applies to his grammar. Please excuse any typos, and be assured that he will do his best to correct any errors, if they are overlooked.

Finally, this article is free, and the sole purpose for writing it is to assist with research, while also providing a forum for second-level thinking. If you have not followed him, please take five seconds and click his name above (top of the page).

Peers: O, National Retail Properties (NYSE:NNN), W.P. Carey (NYSE:WPC), Agree Realty Corp. (NYSE:ADC), Four Corners Property Trust (NYSE:FCPT), Getty Realty Corp. (NYSE:GTY), STOR, EPR, VEREIT, Inc. (NYSE:VER), SRC, Global Net Lease, Inc. (NYSE:GNL), and Lexington Realty Trust (NYSE:LXP).

Each week, Brad provides Marketplace subscribers with actionable REIT news, including (1) Friday afternoon subscriber calls, (2) Weekender updates, (3) Google portfolios, (4) Real-time alerts, (5) Early AM REIT news, (6) chat rooms, (7) the monthly newsletter, and (8) earnings results in Google Sheets.

Marketplace subscribers have access to a wide range of services, including weekly property sector updates and weekly Buy/Sell picks. We provide most all research to marketplace subscribers, and we also provide a “weekender” report and a “motivational Monday” report. We stream relevant real-time REIT news so that you can stay informed.

All of our portfolios are updated daily, and subscribers have access to all of the tools via Google Sheets. REITs should be part of your daily diet, and we would like to help you construct an Intelligent REIT portfolio, utilizing our portfolio modeling strategies. Brad reminds all subscribers and prospective subscribers that “the safest dividend is the one that’s just been raised.”

Disclosure: I am/we are long ACC, AVB, BHR, BPY, BRX, BXMT, CCI, CHCT, CIO, CLDT, CONE, CORR, CTRE, CXP, CUBE, DEA, DLR, DOC, EPR, EQIX, ESS, EXR, FRT, GEO, GMRE, GPT, HASI, HT, HTA, INN, IRET, IRM, JCAP, KIM, KREF, KRG, LADR, LAND, LMRK, LTC, MNR, NNN, NXRT, O, OFC, OHI, OUT, PEB, PEI, PK, PSB, PTTTS, QTS, REG, RHP, ROIC, SBRA, SKT, SPG, SRC, STAG, STOR, TCO, TRTX, UBA, UMH, UNIT, VER, VICI, VNO, VNQ, VTR, WPC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

0 notes

Text

Children In Poorest Neighborhoods Most Vulnerable To Fatal Child Abuse

(Reuters Health) - Children in America’s poorest communities have three times the risk of dying from child abuse before age 5 as children in the wealthiest neighborhoods, a new study finds.

“We think our study should inform public health leaders and local clinicians to be aware that children living in high-poverty communities are really a vulnerable group at increased risk of death due to child abuse,” lead author Dr. Caitlin Farrell, a pediatrician at Boston Children’s Hospital, said in a phone interview.

Farrell and her team analyzed death certificates for young children and U.S. Census poverty data from 1999 through 2014. For children ages 4 and under, counties with the highest concentrations of poverty had more than triple the rate of child-abuse fatalities compared to counties with the lowest concentrations of poverty, the study reported in Pediatrics found.

Nearly 10 out of every 100,000 children died as a result of child abuse in the most impoverished counties, the study found.

African-American children were the most vulnerable regardless of where they lived.

Among every 100,000 young children, eight African-Americans died from assault, shaken-baby syndrome, abusive head trauma, suffocation, strangulation or another form of child abuse, compared to three white children, the study found.

The fatality rate for African-American children in the richest counties was higher than the fatality rate for white children in the poorest.

Farrell can’t explain why African-American infants and toddlers were most at risk of dying from abuse. She called for more research and for the development of policies and plans aimed specifically at protecting poor children and African-American children.

During the 15 years covered by the study, 11,149 children died of child abuse before turning 5 years old. Children under the age of 3 comprised the vast majority, or 71 percent, of the deaths, the authors wrote.

African-American children represented a disproportionate 37 percent of the nationwide child-abuse deaths.

“We hope our study can serve as a catalyst for researchers to further explore the complex relationship between community poverty and child abuse,” Farrell said. “Ultimately, this information is needed for policymakers, public health officials and clinicians to enact effective prevention strategies.”

In an accompanying editorial, Dr. Robert Block said the study’s findings should come as no surprise.