#the revenue increases while the devs suffer

Text

Seems like Live in Love the Series is no longer happening with Non Ratchanon. Studio on Fire, the production company behind the series (and Hearth Chindanai's agency? I'm not sure but they do promo for his fanmeeting) just announced that the ship collab between Non and Hearth has ended due to their agencies not being able to agree on common terms.

Non's role will be recast and... I guess that's that.

What in the War of Y?? Copy A Bangkok did say there was going to be a special episode. I just didn't think it was War of Managers in real life.

#live in love the series#non ratchanon#hearth chindanai#thai bl#the announcement on studio on fire's ig account is ever so slightly passive aggressive#they immediately scrubbed all socials clean of any mention of non#i had trouble even finding an old series promo#i'm a fan of non so uhm...#but after how cheque wacharawee was treated earlier this year#and this happening in the middle of production i'm a bit hmmmmmmmmmm#sooner or later there needs to be discourse on the industry side of bl#because mismanagement and mistreatment are a cancer#see what it did to game development#the revenue increases while the devs suffer#and it's probably not all that different here

12 notes

·

View notes

Text

I'VE BEEN PONDERING IDEA

Once you cross the threshold of profitability, however low, your runway becomes infinite. And while founders may not have been exposed to that.1 Now, they said no—that they'd just spent four months dealing with investors, and we bet money on that advice.2 Undoubtedly TV helped Kennedy, so historians are correct in regarding this election as a watershed. We've had startups that were profitable on revenues of $3000 a month. Since no one can be proven wrong, every opinion is equally valid, and sensing this, everyone lets fly with theirs. But I don't think corp dev got the memo, he replied. So being hard to talk to. Practically every successful startup, including stars like Google, presented at some point to investors who didn't get it and turned them down.3 The current record holder for flexibility may be Daniel Gross of Greplin. Some of the more unscrupulous do it deliberately.

I hope that as startups get cheaper and the number of investors increases, raising money will become, if not easy, at least in the software business. Explain what you're doing.4 Often they are, we have some idea what secrecy would be worse than patents, just that it's the only one left after the efforts of the two parties cancel one another out. To my surprise, they said, the absolute fastest they could get code released on the production servers before lunch. It's now possible for VCs and startups to diverge. Why? It sounds a good deal less benevolent to say we ought to reduce the rate at which new companies are founded. The phenomenon is like a small boat in the open sea. Or the company that would be the best supplier, but doesn't bid because they can't spare the effort to get verified. The startup world became more transparent and more unpredictable. He wasn't, and he suffered proportionally.

If you write the laws very carefully, that is. It's good to talk about how you plan to make money, but mainly because it shows you have the discipline to keep your expenses low; but above all, it means you don't need them. Undoubtedly TV helped Kennedy, so historians are correct in regarding this election as a watershed. That's a problem for VCs, most of whom are not particularly imaginative. As a rule, any mention of religion on an online forum degenerates into a religious war, because so many programmers identify as X programmers or Y programmers. This quality may be redundant though; it may be that reducing investors' appetite for risk doesn't merely kill off larval startups, but taxed away all other surplus wealth? But cluttered sites are bad anyway, so perhaps you should use this opportunity to make your software compatible with some other piece of software—in eight months, at enormous cost.

Joel Spolsky recently spoke at Y Combinator about selling software to corporate customers. They'd turn down the nerds in favor of the smooth-talking MBA in a suit, because that investment would be easier to justify later if it failed. The reason raising money destroys so many startups' morale is not simply that it's hard to predict, till you try, how long it will take. If you're hard enough to sell to is not that you overpay but that the best ones actually prefer to work hard. It turns out there is, and the time preparing for it beforehand and thinking about it afterward. But if you don't, a low initial offer will demoralize you and make you easier to manipulate. That can be very demoralizing. When Steve and Alexis auctioned off their old laptops for charity, I bought them for the Y Combinator application that would help us discover more people like him. Not as a way to make the right choices, but to make choices that can be justified later if they fail. So if you have hot prospect, either close them now or write them off. More often than not it makes it harder. They won't be offended.

To make sure, they were moving to a cheaper apartment. He wasn't, and he did. Perhaps it was even simpler than they thought. If you can come up with surprising new ideas. Building physical things is expensive and dangerous. And if the answer is yes. The worst case scenario is the long no, the no that comes after months of meetings.

Notes

You also have to be a founder; and with that of whatever they copied. Beware too of the most successful founders is exaggerated now because it's a proxy for revenue growth.

I know, Lisp code.

Whereas many of the venture business barely existed when they got to the year x in a difficult position. If you seem like noise.

Whereas when you're starting a startup. The moment I do, just try to disguise it with such abandon.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#meetings#TV#programmers#runway#investors#Whereas#time#founder#x#investment#scenario#boat#software#nerds#laws#production#sup#business#watershed#Often#startups#months#quality#historians

26 notes

·

View notes

Text

Gameplay Thoughts and Inspirations

「 G R A V E F I R E 」will be a deck-building roguelike, as has been pointed out in its subtitle, and will be its key selling point. There are a lot of players who love roguelikes and a lot who like card games as well, and quite frankly there aren’t enough games out there to cater to the demand. I can barely count the most popular roguelikes on my two hands. As a deck-building game, they key difference from roguelikes would be that everything would be a card, and you build a deck as you progress through the game.

I will also actively blog about the game’s progression this time.

Inspirations

I have written previously that my previous game Sheeping Around was inspired by Card Thief. GRAVEFIRE, though has a lot of inspirations. The primary ones are:

Meteorfall: Journey by Slothwerks

Pokemon Mystery Dungeon series

Slay the Spire by MetaCrit

Need for Speed: Hot Pursuit (2010)

The first three are a good mix of roguelikes and turn based battle / card games, but you’d ask what does NFS: Hot Pursuit have to do with this genre? That game has a pretty good career mode UI they call “Autolog”, which inspired me to build something like that for my own game. More on that in the later sections of this post.

Platforms and Pricing Model

While Freemium is the reigning king as always and 90% of the new games released are free-to-play, and some devs report earning a good revenue from just ads, it’s just not for me, at least not for this game. I don’t feel very good about the whole economy that works by taking advantage of gamers’ psychology to extract maximum money out of them. “Milking the whales” as it is called.

GRAVEFIRE, therefore will be a premium game, and it will have no in-app purchases to buy extra in-game currency. (It will have in-game currency though, just purely for progression.) It may have IAPs / DLC to unlock extra content for future content updates, but that will not be present on release. I suffered somewhat of a backlash for having IAPs in a paid game for Sheeping Around. Pocket Tactics mentioned in its quite bad review of the game: “Extra supplies can be brought for real-world cash, a feature that is sure to irk many gamers, especially in a paid app.”

I will design the game to work well in portrait mode on mobile and landscape mode on tablets and desktop devices. The primary platform for the game will be PC, and mobile will be secondary. The audience on Steam isn’t very fond of mobile games repurposed / adapted to PC without much efforts. “Cheap mobile ports” as they say. I will make sure that doesn’t happen. It will work like a responsive website on a single codebase.

Pick Your Character

As in most role-playing games, in GRAVEFIRE too, you will be able to pick one of the three characters to begin your journey with. The three characters are: The Necromancer, The Crusader and The Alchemist. Each character will have its own cards and skills that differentiate it from the others. They will also have their own backstory of how they survived the grave fire, and what happens next.

A Burnt World to Explore

You will have a map to explore as you begin your journey. Select a location in the map to begin your game, which will be a mix of tower defense / turn based battle (more on that below).

The map will have mountains, valleys, pits and other regions. Some thoughts around region names include: Lake of Blood, Mt. Blaze, Scorching Pit, Tree of Death.

Like in Autolog in NFS: Hot Pursuit, you select a region as it becomes available, and pick an event to do in that region.

An event could be a main story quest, a side quest with rewards, or anything else (more on that later). You can do certain events as many times as you like. Some events may be a combination of one or more events.

Deck Lanes: Tower Defense meets Card Crawler

For GRAVEFIRE, I’m exploring a gameplay mechanic that I call Deck Lanes. Please excuse my lack of art skills:

Each dungeon in GRAVEFIRE will be a set of decks. Initially, it will be just one deck laid out in a 1x3 grid. Eventually the gameplay will get complex and may increase to 4x3 or even a 5x3 grid. Harder games will have a lot more cards in each deck. Possibly upto 50 cards per deck, totalling to a 250 card dungeon if laid out in a 5x3 grid.

Each dungeon deck has a set number of cards. In the most basic kind of event Survive, your objective is to survive until all decks run out. If you die in a dungeon, you lose and your game is reset to the last save / last event completed. The whole game isn’t entirely roguelike, only each event is: some people would call it roguelike-like or roguelite.

Each dungeon deck can have monsters, skills for you to use, items and gold. Each turn, monsters advance one turn forward towards you, unless there is another monster ahead of it. If there is an item or a skill next to a monster and it wants to move forward, it will destroy the item and move forward anyway. So pick up any items before a monster comes your way. However, keep in mind, picking up items costs energy, so think wisely.

When you tap on the Necromancer, it shows cards you have in your hand. Each turn you draw 3 cards, and you can only hold a maximum of 8 cards in your hand. In the first turn you draw 5 cards. At the end of the turn, the cards you use are discarded in your discard pile. Using a card or picking up an item costs energy, indicated on the card. Each turn, you get 3 energy points to spend. The energy you have to spend will increase as you progress.

There will be lots of different types of attack / defense cards, skill cards that can impact the rest of the event. Items like potions can only be used once and they will disappear forever. Certain skills also can be used only once and then they exhaust, meaning they can not be used again for the rest of the event, but you will get them back in the next event.

Each monster in the lowest row has an intent to either attack or defend. (Or do more things like poison you or burn you, or it could bluff as well.) You must play your cards based on the intent of the monsters.

All of this is very similar in nature to Slay the Spire, but with the exception that everything is a card. Also the tower defense type ascension of monsters in deck lanes allows for some interesting gameplay design options.

Later during the game, you can also tame monsters and add to your team. It works a lot like befriending Pokemon in the Pokemon Mystery Dungeon series. You cannot control them (they will move on their own), but you can use moves and skills to help boost their strength. If they die, you lose them permanently, so if a monster is really precious to you, you’d want to reset to your last save.

Event Types in GRAVEFIRE

Events will play a key role in GRAVEFIRE. Each region you unlock on the map will have various events that you can do. Like in Autolog in NFS: Hot Pursuit, each event could be a race, hot pursuit, preview, interceptor, etc.

Or like in Pokemon Mystery Dungeon, each mission could be a rescue mission, or a mission to find an item, or to battle a legendary.

Events in GRAVEFIRE could be one of the following in the list, or a combination of two or more events:

Survive: The most basic type of event. Just explore a dungeon and survive until the dungeon decks run out. Your typical dungeon crawler. Each dungeon would have its own set of monsters and specific items or skills to acquire. You can explore a dungeon as many times as you want.

Soul Liberation: GRAVEFIRE has caused a lot of souls to be trapped, and they want to be free. Explore a dungeon, and find a soul stuck in one of the dungeon decks (most likely at the bottom of it) and use your special skills to liberate it.

Soul Searching: Some bodies have risen from their graves but have no purpose without their soul. They are harmless, but also aimless. Escort them to their soul stuck in one of the dungeon decks (most likely at the bottom of it). The key difference here is that the undead creature sits besides your primary character’s cards and the dungeon monsters can attack it. You must use your skills to protect yourself and the undead until it finds its soul. In return, they will reward you with some powerful skills and moves.

Soul Capture: In certain dungeons, monsters have become all powerful because of presence of a lot of wandering souls. Places like the Tree of Death are key areas for such events. In this kind of event, you must battle monsters and can also capture their souls and add to your team. They will be on your side starting your next turn. If they survive the deck, they will stay by your side in future battles too.

Find an Item: Much like soul liberation, there is a special item that you need to find. Explore a dungeon and find the item stuck in one of the dungeon decks (most likely at the bottom of it). Once you get to the item, acquire it.

Situation: A situation is choice driven event, where you are in a story based event and are given between 2-4 options to proceed. A situation may have between 2 - 5 steps that may happen based on your choices. The outcomes will result in you obtaining a few cards and skills to add to your deck, or to raise your HP or strength or even lose a few cards in your deck. The outcomes may be good or bad, depending on the type of situation you are in and your choices.

Healing: A healing event will never occur standalone on its own, and will most likely occur before an Elder Battle, GRAVE Battle or GRAVE Survival, or something really troubling. It is a special kind of Situation which only results in good outcomes. It will let you regain HP, boost your strength or gain special skills that will help you in the upcoming battle.

Elder Battle: Elders are special monsters that take between 2-4 entire deck lanes. Ordinary deck lanes will keep on moving forward as usual. you must defeat the elder to win this event.

GRAVE Battle: A GRAVE Battle is a special kind of Elder Battle, where there are no ordinary deck lanes. There is just one massive Elder occupying the entire screen. You must defeat the monster to win this event. There will be only one GRAVE Battle in GRAVEFIRE and that comes towards the end. This special Elder is a monster that caused the grave fire. Battle and defeat it to beat the game and unveil the final secrets of GRAVEFIRE.

GRAVE Survival: The Elder that caused the grave fire will appear many times, but you will never be able to beat him until towards the end you acquire the skills to defeat him. In GRAVE Survival, you must only survive the battle against this Elder for a certain number of moves. This event will occur many times throughout the game, and each time you survive, you will unlock something rare and powerful and learn more about the backstory of GRAVEFIRE.

Suggestions?

In the coming few weeks, I will come up with a prototype, and also talk about the team behind the game, and progress updates including exploration of the art style, choice of music, and some UI designs.

If you have read so far, and like the concept, do let me know your thoughts in the comments.

Stay tuned for「 G R A V E F I R E 」.

3 notes

·

View notes

Text

Shopify-ERP integrations Guide improve your business agility - i95 Dev

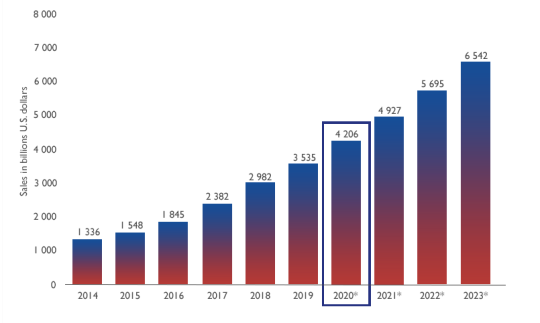

Shopify powers 427,676 eCommerce stores, and 820,000+ merchants currently use it for their online businesses. It is arguably the best platform for businesses as it enjoys the patronage of 800,000 businesses across 175 countries. On the other end, market volatility and dynamism are posing the need for dedicated ERP systems. ERP solutions’ market is expected to touch USD 78.40 billion by 2026, while 51% of CIOs prefer cloud ERP solutions. In this article, we are going to understand how Shopify-ERP integrations improve your business agility. Dive in deeper to learn more about the topic:

What Is ERP Solution and How It Helps Your Business

An ERP suite is a set of software solutions for managing business processes and functions through common databases. ERP applications are generally based on the Software-as-a-Service (SaaS) model. Material Resources Planning (MRP), Customer Relationship Management (CRM), Human Resource Management, and Supply Chain Management are its core modules. They provide visibility of resources and processes across various departments of the organization and corresponding external partners/ stakeholders. In the absence of an Enterprise Resource Planning system, the following problems would stall your organization’s productivity:

Manual data entry and database management on spreadsheets.

Exhaustive efforts to retrieve and apply information from primary and complementary databases.

Mismanaged workflows at the interdepartmental and cross-departmental level.

Inefficient utilization of resources.

Poor responsiveness against change.

Redundant and repetitive processes that don’t add value to any business function.

Through ERP implementation, you can visualize, automate, streamline, integrate, and measure all your business functions and processes. Thus, they help improve your ROI and bottomline with real-time responses to every transaction. Modern ERPs also include purchase, sales, marketing, finance, inventory, manufacturing, and order management systems. They provide user-friendly dashboards along with extensive BI reports. They foster a collaborative culture within the organization and manage business across geographies with state of the art system security and stability. Clubbing these aspects with the increasing competition in the online store industry, integrating your eCommerce platform with ERP applications is becoming mandatory.

Shopify and ERP Implementation

Shopify is an online marketplace platform where users can build a frontend to display your products/ services, collect payments, manage inventory, and to ship. You can also integrate your Shopify store with Amazon and Facebook Marketplace. It provides an ecosystem for eCommerce business functions across in-house and partner applications, shipping firms, suppliers, and vendors. Shopify store owners grow at 126% YoY on an average. Shopify Plus is its enterprise-level solution with the following salient features:

An over-the-cloud model with 99.99% uptime.

Unlimited bandwidth, zero transaction fees, and customization-friendly APIs.

High scalability with no limits on product count.

Quick customization and deployment cycles.

It can be used without any dedicated in-house IT support.

24/7 Customer support over phone calls, live chat, emails, and community forums.

Single ecosystem for all your online business requirements.

Relatively affordable as compared to legacy online selling platforms.

You can integrate Shopify with any leading ERPs like Microsoft Dynamics, SAP Business One, and Sage 100. Ideally, you should always consult an expert before considering ERP implementation. This is because its upfront costs and post-implementation costs like employee training are considerable investments. Getting stuck with the wrong solution is expensive and sabotages productivity until an extended period. You can evaluate the need for using one based on some key indicators as mentioned below:

You are facing trouble in coordinating sales with inventory management.

Your IT infrastructure is becoming a significant cost center.

Managing operations requires a vast number of repetitive clerical formalities.

Your estore has complex workflows and uses multiple software solutions for various business processes.

Core business functions like analytics, accounting, and supply chain management are suffering due to weak information visibility.

Nestle, Tesla Motors, Pepsico, and Redbull are some of the major brands that rely on Shopify to run their online stores. However, using a dedicated enterprise resource planning system is equally crucial for running a profitable estore.

Points to Keep in Mind While Selecting your ERP Software for your Shopify-Based Online Store

Many factors affect the selection of the right ERP vendor due to the customization and utility criteria. Online stores are moving towards omnichannel sales and mobile-first strategies, which require agility, intuitive automation, BYOD friendliness, system stability, and data security. While selecting the right cloud ERP solution, you should look out for integrations with online selling platforms, shipping management, and inventory control support for omnichannel sales. Also, reflecting information across the selling platforms and the accounting system is a must. Warehouse management, too, needs an integrated approach for streamlining operations. Typical market offerings have hostility towards extensive customization and mobile-friendliness. It should harness marketing automation through engagement tools, reduction in errors, maintaining data integrity across cloud, on-premise, and your eCommerce platform. You should keep all of these aspects in mind while considering an ERP Software for your eCommerce platform.

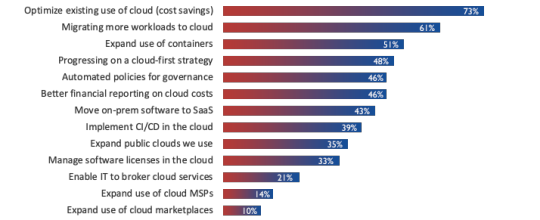

The reasons proposed for using cloud infrastructure for commercial purposes are as mentioned below

7 Ways ERP Integrations Boost the Business Agility Of Your Shopify Store

This section will list down the top seven ways (not necessarily in any order) in which ERP integrations boost your business. It impacts a multitude of areas in the entire organization on a varying scale. We have tried to keep them relevant to our broad audience. Have a quick look here:

#1 Improved Control over Resource Allocation

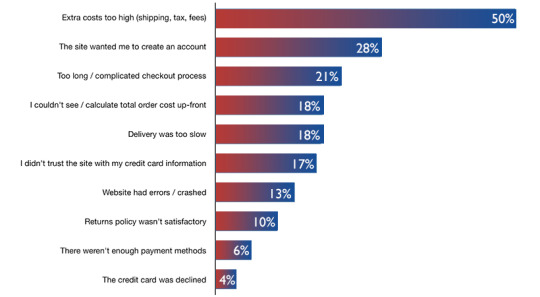

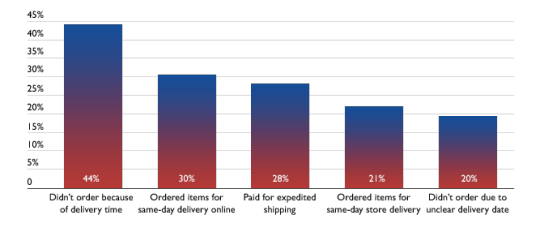

Clubbing your Shopify platform with ERP applications results in an intuitive, intelligent, automated, and data-driven business ecosystem. Hence, the resources within the company and from the partner organizations are allocated in a better manner. The direct benefit of intelligent resource allocation is reflected in the strategic execution and eased out supporting business functions like accounting and human resource management. Firms with less control over resource insights tend to price their products conservatively, which ultimately leads to cart abandonment and low sales:

#2 Enhanced Decision Making Through BI Tools

Business Intelligence (BI) is one of the biggest benefits pursued by organizations throughout ERPs’ history. They generate a large number of customized reports for marketing, sales, inventory management, and order fulfillment purposes, including warehouse picking. Hence, online stores can make well-informed decisions despite a large number of transactions.

#3 Omni-Channel Marketing And Sales Support

Omnichannel marketing and sales are transformed through seamless data integration. Automation of workflows and database management help businesses synchronize their efforts while acting upon demand trends. Usually, Shopify requires manual inputs that would drive users frenzy, but implementing an enterprise resource planning solution helps save thousands of dollars spent on overheads. Consumers describe not receiving goods on time as the biggest reason for not completing a purchase.

#4 Improved Vendor, Supplier, and Shipping Partner Management

For any eCommerce store, the most challenging aspects of operations revolve around supplier/ vendor management and coordinating with the shipping/ logistics partners. Using an ERP suite with Shopify Plus streamlines all of these functions and facilitates a smooth flow across inhouse and partner applications.

#5 Optimized Business Processes and System Stability

The customizations and third-party integrations help reduce the repetitive workload across all platforms, while ERP applications eliminate all redundancies. Real-time control over the business processes and high system stability translate into revenue-centric operations. Thus, your estore can handle the transactions in a better manner without compromising on any strategic front.

#6 Better Grip Over Inventory And Customer Experience

The demand patterns in the eCommerce industry exhibit high volatility, and many factors like movies, social media, and festivities impact sales. Hence, getting real-time updates regarding the stock and shipping status aids in catering better customer experience. Events like flash sales, discounts, stock clearance, and event-based sales are entirely dependent on agile inventory management and highly enriched CX.

#7 Greater Visibility across Multiple Stores and Platforms

Omnichannel sales is too complex to be handled manually. Hence, automated workflows and triggered actions help ensure timely delivery of all shipments without any mishaps. ERPs also enable your Shopify store to process backorders effortlessly.

Key Benefits of Comprehensive Integration Solutions

As an organization, you should avail a lot of operational and strategic benefits from Integrating your Shopify store with an ERP suite. However, integration solutions also play a significant role in the success of the implementation. Here, we are listing down a few key benefits that your solution provider should offer. You should look out for the following features for ensuring high ROI and smooth functioning of your business:

Standardized application flows across storefront, databases, and ERP systems.

Extensive marketing capabilities, BI analytics, and data sync.

API-first integration strategy.

Support for multiple platforms and stores.

Bidirectional data integration on your Shopify store and ERP.

Enhanced customer experience (CX).

Over to You

We have tried to cover everything about Shopify ERP integrations that affect the prospects of online stores. It is indeed necessary to move ahead with an integrated business ecosystem as they are the industry’s biggest game-changers. Everything else, including products and pricing, are governed by the market itself. We hope that this article on Shopify ERP integrations will benefit your business agility in 2020 and beyond.

To know more, contact our integration experts today!

1 note

·

View note

Text

What happens to free-to-play mobile gaming during a recession?

As job losses continue to mount — 22 million people in the United States have filed for unemployment since the COVID pandemic began, and the relative numbers from some other countries are even more staggering — the broader context of how COVID will impact the global economy becomes more important than whatever short-term impacts the quarantine had on consumer spending in some verticals.

One industry that I think will make for a fascinating case study during the coming recession is mobile gaming. Gaming is often thought of as recession proof; as I wrote in How has the Coronavirus impacted the App Economy?, the performance of public video gaming companies during the global financial crisis of 2008-2010 was mixed, generating record revenues in 2008 followed by a sharp decrease in 2009 (overall, revenues were up in 2010 versus 2008). Interestingly, several public gaming company stocks saw steep price decreases over the course of the global financial crisis that persisted well into 2011:

Putting aside the question of whether gaming is recession-proof or not, it’s important to draw the distinction between console and handheld video gaming and mobile gaming. Mobile gaming is dominated by the freemium model, and as I pointed out in my last piece related to the COVID pandemic, neither mobile gaming nor the freemium business model were particularly popular in Western markets during the last global recession (the App Store was only launched in 2008, and its composition didn’t begin to skew towards freemium apps until 2011). The App Economy is largely untested by economic downturns: no one really knows what happens to app engagement and monetization during a recession.

Many commentators point to recent spikes in downloads and engagement as indicators that the App Economy is set to benefit from recessionary stress: in mid-March, Verizon revealed that mobile game engagement had increased by 75% from pre-Covid levels, and video chat apps like Houseparty, Marco Polo, Bunch, etc. are experiencing massive waves of interest (Houseparty specifically saw 50MM installs over the course of March). But it seems misguided to take these signals as proof of the App Economy’s fundamental hardiness against a protracted economic downturn: the quarantine economy is structurally different than the recession that it created, even though those two things overlapped chronologically for a period of time.

So when people talk about mobile gaming’s perceived resiliency to recessions, they tend to conflate two ideas: that gaming is seen as recession proof and that the broader App Economy has seen engagement increases during the quarantine. In order to consider how the mobile gaming vertical will fare during a recession, I think it’s important to 1) parse apart differences in monetization within the App Economy between the quarantine and the recession and 2) parse apart the differences between the console / handheld gaming and mobile gaming verticals.

With respect to monetization, several data points imply a mild to severe retraction in consumer spending on mobile. One of these comes from a recent report published by MoPub which revealed nearly universal decreases in eCPMs across both Rewarded Video and Fullscreen ad placements:

As I pointed out in my Advertising during a recession presentation, ad spend decreased sharply during the global financial crisis, to a greater extent than consumer spend did. And while for some of the geographies above, requests per device increased more than eCPM decreased, that isn’t true for the United States, which, according to App Annie, is the App Economy’s largest market in terms of app installs and its second largest in terms of revenue:

Ad spend is a leading indicator: engagement and organic installs might surge during a quarantine, but reduced ad spend indicates that consumer spend has decreased, is expected to decrease in the future, or both. And while massive hit games like Fortnite have seen revenue increase since the beginning of 2020, this is not universally true for all games or all apps. Per Sensor Tower’s revenue estimates, compare Fortnite’s COVID revenue trajectory to Candy Crush Saga’s, which is down, and to Toon Blast’s, which is flat:

The broader App Economy outside of gaming has also seen varying performance during COVID: both Pandora and Headspace are seeing downward revenue trajectories from the beginning of the year:

And, of course, some other non-gaming apps, such as Twitch, have seen incredible revenue growth since the beginning of the year:

The point is, despite the sensational headlines, the App Economy at large clearly hasn’t seen a broadly rising revenue tide as a result of COVID, and neither has mobile gaming as a category: some apps have benefited and some haven’t. As advertising spend contracts, the apps that have deliberately slowed their marketing-driven growth will see revenues decline even further, and as the quarantine ends, the apps that have enjoyed revenue increases via organic discovery might likewise see revenues decrease.

Which leads to the distinction between mobile gaming and traditional console and handhold video games. Accepting the premise that traditional video gaming is recession resistant, is it safe to assume that mobile games are similarly safeguarded? I think some fundamental differences between the two categories make it hard to come to that conclusion.

Within the entertainment subset of consumer spending, video gaming is a substitute good: on a per-hour basis, video games are cheaper than other forms of entertainment like the cinema, theme parks, etc. A $60 video came could potentially provide entertainment for hundreds of hours; it’s a good substitute for other, more expensive forms of entertainment during a downturn. Video gaming also benefits during recessions because consumers tend to re-allocate their budgets to leisure spending so as to bolster their spirits.

Luxury goods — broadly defined as goods for which demand is driven by desire, not need, and thus increases with income — tend to see consumption decreases during recessions that are more extreme than that of general consumer spending. This paper by Ait-Sahalia et al explores the relationship between luxury goods sales and the equity premium, or the difference in performance between equities and risk-free bonds (basically: what happens to luxury goods consumption when equity markets are down, as in recessions):

These findings support the notion that luxury goods suffer disproportionately from recessions, and this explains why traditional console video games might be recession resistant: they’re a cheaper alternative to other forms of entertainment on a per-hour basis.

But what about mobile games? Mobile games are mostly free: they are the ultimate discount entertainment. But my belief is that, while free-to-play games may also serve as a substitute good — to all forms of entertainment, including traditional console video games — the digital products purchased via IAPs in free-to-play games need to be classified independently from the games in which they exist. The decision a consumer makes to download a free game is totally separate from the decision they make to purchase a digital good in that game. Putting aside design factors (“pay to win,” etc.), it’s tautologically true that free-to-play games can be played for free, and so IAPs have to been as luxury goods: characterized by desire and convenience, with demand tracking income.

Connecting this line of thought to the broader App Economy: given a decrease in ad spend, if IAPs do behave like luxury goods, then it stands to reason that mobile games revenue across the board could decline (or see a slowdown in growth) even as engagement increases: more people playing mobile games but producing lower average revenue per user (ARPU) and potentially lower overall revenue.

The App Economy as a whole and mobile gaming as a category may be experiencing increased engagement, but increases in revenue are not universally distributed: some apps and games are suffering during COVID, and the resultant recession has only really just begun. It can’t be taken for granted that mobile gaming performs as the traditional video games sector does during a recession. Despite the bravado and the eye-popping metrics being released to the press, some mobile games have already witnessed a revenue decline as a result of COVID; if mobile game IAPs fit the profile of luxury goods, there could be further declines to come.

Photo by Benedikt Geyer on Unsplash

The post What happens to free-to-play mobile gaming during a recession? appeared first on Mobile Dev Memo.

What happens to free-to-play mobile gaming during a recession? published first on https://leolarsonblog.tumblr.com/

0 notes

Text

How to diagnose and fix a search rankings dip

When your rankings decline, your brand’s visibility decreases. That may also be accompanied by less traffic and, for many businesses, that means less revenue. Swiftly identifying the affected areas of your site and the factors that may have resulted in the decline can enable you to reclaim or even improve your rankings.

Holly Miller Anderson, former SEO Company product manager for Macy’s Tech, detailed her systematic approach and the tools she relies on to diagnose and fix rankings drops in a talk during SMX Next (free registration) this week.

The tools and resources Anderson uses to get to the bottom of rankings declines.

Why your rankings might have fallen

Anderson noted the three possible causes for rankings declines and addressed how to diagnose each. “It’s either something that changed on your site, Google changed something or external factors are affecting your rankings,” she said.

Related: Essential SEO Guide: How to master the science of SEO

Something changed on your site. “This can take the form of a folder getting moved, code was updated or pushed live that broke something, your dev teams unknowingly created redirects, Googlebot is being blocked from crawling and indexing important pages or parts of your site because there was a change to the robot.txt file, maybe something happened to the site map,” she provided as examples of site changes that could negatively affect rankings, adding that these issues are generally easy to resolve.

Google changed something. An algorithm update may also cause ranking volatility. “Broadly speaking, if you notice a sharp decline in your rankings and traffic, it’s a good indicator that you need to dig in and find out where Google feels your site is falling short of expectations,” she said. If competitors within your sector also lost rankings, there may be a commonality that needs to be addressed, she added.

The Google Search Liaison Twitter account and Google Algorithm Update History page from Moz are two resources that Anderson recommends to verify whether an algorithm update actually occurred. Was There A Google Update, created by Search Engine Land News Editor Barry Schwartz, can also be used to surface algorithm update news based on date.

External factors in the market. These factors can range from competitors launching content that is more authoritative or comprehensive than yours to breaking news shaking up the search results for a given term to search behavior swings due to COVID-19, for example.

In the case of a competitor overtaking your rankings, SEO Companys can revisit their content to improve it. However, there are other scenarios, such as the coronavirus pandemic, in which things are “just out of our control,” she said.

Pinpointing the cause of a rankings dip

Anderson recommends using an enterprise software platform, Google Analytics, Google Search Console and the following checklist of questions to narrow down the possible causes behind a rankings decline.

Which high volume search terms lost rankings? If your high volume terms lost rankings, it may have been caused by a site change that made your page less relevant. Keeping a record of what changes were made and when can enable you to identify and resolve the issue.

Alternatively, your site may have been affected by an algorithm update. Keeping an eye on your competitors’ rankings can validate this explanation.

Did your rankings drop while direct competitors’ rankings increased? “The key here is to look for the isolated incident of your URL rankings dropping, while other competitors remain steady — that speaks more to something that was done on your site that can be rectified to regain those rankings,” Anderson said, noting that this may be tricky to navigate in verticals where expertise, authoritativeness and trustworthiness (E-A-T) factors are at play, such as in the financial, medical or other Your Money or Your Life (YMYL) sectors.

A rankings decline might be a result of your internal teams changing one of the items listed above.

Did any indirect competitors overtake you in rankings? If this is the case, and you have not made any site changes, then those indirect competitors may have made investments in their content or improved their site architecture. Using enterprise software can help you get a better overview of any indirect competitors’ online visibility to determine if this is one of the causes.

Did your domain and your direct competitors’ domains lose rankings? An algorithm update may affect similar sites in your vertical, decreasing rankings across those sites. “At this point, you want to start researching what other SEO Company industry professionals are seeing in their data to better understand what the algorithm was targeting and how you can take steps to recover your rankings,” said Anderson.

Which specific area of your domain lost rankings? “Getting the answer to this question will help you backtrack to understand if rankings are suffering due to on-page content that was updated or if it has to do with technical limitations on your page,” she said, recommending that SEO Companys work with other internal teams to compare what changes might have led to the rankings dip.

An algorithm update may also result in a rankings decline for particular pages on your site: “For instance, when the Penguin update was released, it targeted pages where there were hundreds of links on the page,” said Anderson.

Identifying external factors that could affect your rankings

The search results page may change to accommodate what users are looking for. What users are looking for also changes as their priorities shift due to trends, disruptions in their daily lives or breaking news. Here are some tools and resources that Anderson uses to help determine whether a rankings decline may be associated with such shifts.

Google Trends can tell you how popular a search term is and how popular it has been historically.

Twitter is useful for recognizing events that may be affecting your customers and their buying behavior.

SparkToro is an audience insights tool that can help you understand what organizations may be outranking you and which organizations or people you may want to collaborate with to increase your visibility.

Glimpse is a tool that tracks emerging trends and can help inform your content strategy for greater relevance.

Pinterest Trends provides insights on trending topics across Pinterest. It’s currently in beta testing.

eMarketer provides market research as well as data on trends and how consumers are responding to them.

More from SMX Next

About The Author

George Nguyen is an Associate Editor at Third Door Media. His background is in content marketing agency, journalism, and storytelling.

Website Design & SEO Delray Beach by DBL07.co

Delray Beach SEO

Via http://www.scpie.org/how-to-diagnose-and-fix-a-search-rankings-dip/

source https://scpie.weebly.com/blog/how-to-diagnose-and-fix-a-search-rankings-dip

0 notes

Text

How to diagnose and fix a search rankings dip

When your rankings decline, your brand’s visibility decreases. That may also be accompanied by less traffic and, for many businesses, that means less revenue. Swiftly identifying the affected areas of your site and the factors that may have resulted in the decline can enable you to reclaim or even improve your rankings.

Holly Miller Anderson, former SEO Company product manager for Macy’s Tech, detailed her systematic approach and the tools she relies on to diagnose and fix rankings drops in a talk during SMX Next (free registration) this week.

The tools and resources Anderson uses to get to the bottom of rankings declines.

Why your rankings might have fallen

Anderson noted the three possible causes for rankings declines and addressed how to diagnose each. “It’s either something that changed on your site, Google changed something or external factors are affecting your rankings,” she said.

Related: Essential SEO Guide: How to master the science of SEO

Something changed on your site. “This can take the form of a folder getting moved, code was updated or pushed live that broke something, your dev teams unknowingly created redirects, Googlebot is being blocked from crawling and indexing important pages or parts of your site because there was a change to the robot.txt file, maybe something happened to the site map,” she provided as examples of site changes that could negatively affect rankings, adding that these issues are generally easy to resolve.

Google changed something. An algorithm update may also cause ranking volatility. “Broadly speaking, if you notice a sharp decline in your rankings and traffic, it’s a good indicator that you need to dig in and find out where Google feels your site is falling short of expectations,” she said. If competitors within your sector also lost rankings, there may be a commonality that needs to be addressed, she added.

The Google Search Liaison Twitter account and Google Algorithm Update History page from Moz are two resources that Anderson recommends to verify whether an algorithm update actually occurred. Was There A Google Update, created by Search Engine Land News Editor Barry Schwartz, can also be used to surface algorithm update news based on date.

External factors in the market. These factors can range from competitors launching content that is more authoritative or comprehensive than yours to breaking news shaking up the search results for a given term to search behavior swings due to COVID-19, for example.

In the case of a competitor overtaking your rankings, SEO Companys can revisit their content to improve it. However, there are other scenarios, such as the coronavirus pandemic, in which things are “just out of our control,” she said.

Pinpointing the cause of a rankings dip

Anderson recommends using an enterprise software platform, Google Analytics, Google Search Console and the following checklist of questions to narrow down the possible causes behind a rankings decline.

Which high volume search terms lost rankings? If your high volume terms lost rankings, it may have been caused by a site change that made your page less relevant. Keeping a record of what changes were made and when can enable you to identify and resolve the issue.

Alternatively, your site may have been affected by an algorithm update. Keeping an eye on your competitors’ rankings can validate this explanation.

Did your rankings drop while direct competitors’ rankings increased? “The key here is to look for the isolated incident of your URL rankings dropping, while other competitors remain steady — that speaks more to something that was done on your site that can be rectified to regain those rankings,” Anderson said, noting that this may be tricky to navigate in verticals where expertise, authoritativeness and trustworthiness (E-A-T) factors are at play, such as in the financial, medical or other Your Money or Your Life (YMYL) sectors.

A rankings decline might be a result of your internal teams changing one of the items listed above.

Did any indirect competitors overtake you in rankings? If this is the case, and you have not made any site changes, then those indirect competitors may have made investments in their content or improved their site architecture. Using enterprise software can help you get a better overview of any indirect competitors’ online visibility to determine if this is one of the causes.

Did your domain and your direct competitors’ domains lose rankings? An algorithm update may affect similar sites in your vertical, decreasing rankings across those sites. “At this point, you want to start researching what other SEO Company industry professionals are seeing in their data to better understand what the algorithm was targeting and how you can take steps to recover your rankings,” said Anderson.

Which specific area of your domain lost rankings? “Getting the answer to this question will help you backtrack to understand if rankings are suffering due to on-page content that was updated or if it has to do with technical limitations on your page,” she said, recommending that SEO Companys work with other internal teams to compare what changes might have led to the rankings dip.

An algorithm update may also result in a rankings decline for particular pages on your site: “For instance, when the Penguin update was released, it targeted pages where there were hundreds of links on the page,” said Anderson.

Identifying external factors that could affect your rankings

The search results page may change to accommodate what users are looking for. What users are looking for also changes as their priorities shift due to trends, disruptions in their daily lives or breaking news. Here are some tools and resources that Anderson uses to help determine whether a rankings decline may be associated with such shifts.

Google Trends can tell you how popular a search term is and how popular it has been historically.

Twitter is useful for recognizing events that may be affecting your customers and their buying behavior.

SparkToro is an audience insights tool that can help you understand what organizations may be outranking you and which organizations or people you may want to collaborate with to increase your visibility.

Glimpse is a tool that tracks emerging trends and can help inform your content strategy for greater relevance.

Pinterest Trends provides insights on trending topics across Pinterest. It’s currently in beta testing.

eMarketer provides market research as well as data on trends and how consumers are responding to them.

More from SMX Next

About The Author

George Nguyen is an Associate Editor at Third Door Media. His background is in content marketing agency, journalism, and storytelling.

Website Design & SEO Delray Beach by DBL07.co

Delray Beach SEO

source http://www.scpie.org/how-to-diagnose-and-fix-a-search-rankings-dip/

source https://scpie.tumblr.com/post/621953891532177408

0 notes

Text

How to diagnose and fix a search rankings dip

When your rankings decline, your brand’s visibility decreases. That may also be accompanied by less traffic and, for many businesses, that means less revenue. Swiftly identifying the affected areas of your site and the factors that may have resulted in the decline can enable you to reclaim or even improve your rankings.

Holly Miller Anderson, former SEO Company product manager for Macy’s Tech, detailed her systematic approach and the tools she relies on to diagnose and fix rankings drops in a talk during SMX Next (free registration) this week.

The tools and resources Anderson uses to get to the bottom of rankings declines.

Why your rankings might have fallen

Anderson noted the three possible causes for rankings declines and addressed how to diagnose each. “It’s either something that changed on your site, Google changed something or external factors are affecting your rankings,” she said.

Related: Essential SEO Guide: How to master the science of SEO

Something changed on your site. “This can take the form of a folder getting moved, code was updated or pushed live that broke something, your dev teams unknowingly created redirects, Googlebot is being blocked from crawling and indexing important pages or parts of your site because there was a change to the robot.txt file, maybe something happened to the site map,” she provided as examples of site changes that could negatively affect rankings, adding that these issues are generally easy to resolve.

Google changed something. An algorithm update may also cause ranking volatility. “Broadly speaking, if you notice a sharp decline in your rankings and traffic, it’s a good indicator that you need to dig in and find out where Google feels your site is falling short of expectations,” she said. If competitors within your sector also lost rankings, there may be a commonality that needs to be addressed, she added.

The Google Search Liaison Twitter account and Google Algorithm Update History page from Moz are two resources that Anderson recommends to verify whether an algorithm update actually occurred. Was There A Google Update, created by Search Engine Land News Editor Barry Schwartz, can also be used to surface algorithm update news based on date.

External factors in the market. These factors can range from competitors launching content that is more authoritative or comprehensive than yours to breaking news shaking up the search results for a given term to search behavior swings due to COVID-19, for example.

In the case of a competitor overtaking your rankings, SEO Companys can revisit their content to improve it. However, there are other scenarios, such as the coronavirus pandemic, in which things are “just out of our control,” she said.

Pinpointing the cause of a rankings dip

Anderson recommends using an enterprise software platform, Google Analytics, Google Search Console and the following checklist of questions to narrow down the possible causes behind a rankings decline.

Which high volume search terms lost rankings? If your high volume terms lost rankings, it may have been caused by a site change that made your page less relevant. Keeping a record of what changes were made and when can enable you to identify and resolve the issue.

Alternatively, your site may have been affected by an algorithm update. Keeping an eye on your competitors’ rankings can validate this explanation.

Did your rankings drop while direct competitors’ rankings increased? “The key here is to look for the isolated incident of your URL rankings dropping, while other competitors remain steady — that speaks more to something that was done on your site that can be rectified to regain those rankings,” Anderson said, noting that this may be tricky to navigate in verticals where expertise, authoritativeness and trustworthiness (E-A-T) factors are at play, such as in the financial, medical or other Your Money or Your Life (YMYL) sectors.

A rankings decline might be a result of your internal teams changing one of the items listed above.

Did any indirect competitors overtake you in rankings? If this is the case, and you have not made any site changes, then those indirect competitors may have made investments in their content or improved their site architecture. Using enterprise software can help you get a better overview of any indirect competitors’ online visibility to determine if this is one of the causes.

Did your domain and your direct competitors’ domains lose rankings? An algorithm update may affect similar sites in your vertical, decreasing rankings across those sites. “At this point, you want to start researching what other SEO Company industry professionals are seeing in their data to better understand what the algorithm was targeting and how you can take steps to recover your rankings,” said Anderson.

Which specific area of your domain lost rankings? “Getting the answer to this question will help you backtrack to understand if rankings are suffering due to on-page content that was updated or if it has to do with technical limitations on your page,” she said, recommending that SEO Companys work with other internal teams to compare what changes might have led to the rankings dip.

An algorithm update may also result in a rankings decline for particular pages on your site: “For instance, when the Penguin update was released, it targeted pages where there were hundreds of links on the page,” said Anderson.

Identifying external factors that could affect your rankings

The search results page may change to accommodate what users are looking for. What users are looking for also changes as their priorities shift due to trends, disruptions in their daily lives or breaking news. Here are some tools and resources that Anderson uses to help determine whether a rankings decline may be associated with such shifts.

Google Trends can tell you how popular a search term is and how popular it has been historically.

Twitter is useful for recognizing events that may be affecting your customers and their buying behavior.

SparkToro is an audience insights tool that can help you understand what organizations may be outranking you and which organizations or people you may want to collaborate with to increase your visibility.

Glimpse is a tool that tracks emerging trends and can help inform your content strategy for greater relevance.

Pinterest Trends provides insights on trending topics across Pinterest. It’s currently in beta testing.

eMarketer provides market research as well as data on trends and how consumers are responding to them.

More from SMX Next

About The Author

George Nguyen is an Associate Editor at Third Door Media. His background is in content marketing agency, journalism, and storytelling.

Website Design & SEO Delray Beach by DBL07.co

Delray Beach SEO

source http://www.scpie.org/how-to-diagnose-and-fix-a-search-rankings-dip/

0 notes

Text

How to diagnose and fix a search rankings dip

When your rankings decline, your brand’s visibility decreases. That may also be accompanied by less traffic and, for many businesses, that means less revenue. Swiftly identifying the affected areas of your site and the factors that may have resulted in the decline can enable you to reclaim or even improve your rankings.

Holly Miller Anderson, former SEO Company product manager for Macy’s Tech, detailed her systematic approach and the tools she relies on to diagnose and fix rankings drops in a talk during SMX Next (free registration) this week.

The tools and resources Anderson uses to get to the bottom of rankings declines.

Why your rankings might have fallen

Anderson noted the three possible causes for rankings declines and addressed how to diagnose each. “It’s either something that changed on your site, Google changed something or external factors are affecting your rankings,” she said.

Related: Essential SEO Guide: How to master the science of SEO

Something changed on your site. “This can take the form of a folder getting moved, code was updated or pushed live that broke something, your dev teams unknowingly created redirects, Googlebot is being blocked from crawling and indexing important pages or parts of your site because there was a change to the robot.txt file, maybe something happened to the site map,” she provided as examples of site changes that could negatively affect rankings, adding that these issues are generally easy to resolve.

Google changed something. An algorithm update may also cause ranking volatility. “Broadly speaking, if you notice a sharp decline in your rankings and traffic, it’s a good indicator that you need to dig in and find out where Google feels your site is falling short of expectations,” she said. If competitors within your sector also lost rankings, there may be a commonality that needs to be addressed, she added.

The Google Search Liaison Twitter account and Google Algorithm Update History page from Moz are two resources that Anderson recommends to verify whether an algorithm update actually occurred. Was There A Google Update, created by Search Engine Land News Editor Barry Schwartz, can also be used to surface algorithm update news based on date.

External factors in the market. These factors can range from competitors launching content that is more authoritative or comprehensive than yours to breaking news shaking up the search results for a given term to search behavior swings due to COVID-19, for example.

In the case of a competitor overtaking your rankings, SEO Companys can revisit their content to improve it. However, there are other scenarios, such as the coronavirus pandemic, in which things are “just out of our control,” she said.

Pinpointing the cause of a rankings dip

Anderson recommends using an enterprise software platform, Google Analytics, Google Search Console and the following checklist of questions to narrow down the possible causes behind a rankings decline.

Which high volume search terms lost rankings? If your high volume terms lost rankings, it may have been caused by a site change that made your page less relevant. Keeping a record of what changes were made and when can enable you to identify and resolve the issue.

Alternatively, your site may have been affected by an algorithm update. Keeping an eye on your competitors’ rankings can validate this explanation.

Did your rankings drop while direct competitors’ rankings increased? “The key here is to look for the isolated incident of your URL rankings dropping, while other competitors remain steady — that speaks more to something that was done on your site that can be rectified to regain those rankings,” Anderson said, noting that this may be tricky to navigate in verticals where expertise, authoritativeness and trustworthiness (E-A-T) factors are at play, such as in the financial, medical or other Your Money or Your Life (YMYL) sectors.

A rankings decline might be a result of your internal teams changing one of the items listed above.

Did any indirect competitors overtake you in rankings? If this is the case, and you have not made any site changes, then those indirect competitors may have made investments in their content or improved their site architecture. Using enterprise software can help you get a better overview of any indirect competitors’ online visibility to determine if this is one of the causes.

Did your domain and your direct competitors’ domains lose rankings? An algorithm update may affect similar sites in your vertical, decreasing rankings across those sites. “At this point, you want to start researching what other SEO Company industry professionals are seeing in their data to better understand what the algorithm was targeting and how you can take steps to recover your rankings,” said Anderson.

Which specific area of your domain lost rankings? “Getting the answer to this question will help you backtrack to understand if rankings are suffering due to on-page content that was updated or if it has to do with technical limitations on your page,” she said, recommending that SEO Companys work with other internal teams to compare what changes might have led to the rankings dip.

An algorithm update may also result in a rankings decline for particular pages on your site: “For instance, when the Penguin update was released, it targeted pages where there were hundreds of links on the page,” said Anderson.

Identifying external factors that could affect your rankings

The search results page may change to accommodate what users are looking for. What users are looking for also changes as their priorities shift due to trends, disruptions in their daily lives or breaking news. Here are some tools and resources that Anderson uses to help determine whether a rankings decline may be associated with such shifts.

Google Trends can tell you how popular a search term is and how popular it has been historically.

Twitter is useful for recognizing events that may be affecting your customers and their buying behavior.

SparkToro is an audience insights tool that can help you understand what organizations may be outranking you and which organizations or people you may want to collaborate with to increase your visibility.

Glimpse is a tool that tracks emerging trends and can help inform your content strategy for greater relevance.

Pinterest Trends provides insights on trending topics across Pinterest. It’s currently in beta testing.

eMarketer provides market research as well as data on trends and how consumers are responding to them.

More from SMX Next

About The Author

George Nguyen is an Associate Editor at Third Door Media. His background is in content marketing agency, journalism, and storytelling.

Website Design & SEO Delray Beach by DBL07.co

Delray Beach SEO

source http://www.scpie.org/how-to-diagnose-and-fix-a-search-rankings-dip/

source https://scpie1.blogspot.com/2020/06/how-to-diagnose-and-fix-search-rankings.html

0 notes

Text

THAT IS, HOW HARD WOULD THIS BE FOR SOMEONE ELSE TO DEVELOP

But it's convenient because this is an example of a job someone had to do without. Which is not surprising: work wasn't fun for most of them. We've got it down to four words: Do what you love doesn't mean, do what will make you happiest this second, but what happens in one is very similar to the venture-backed trading voyages of the Middle Ages.1 I don't know enough about music to say. If you ever do find yourself working for a startup or not. In that respect the Cold War teaches the same lesson as World War II and, for that matter realized how much better web mail could be till Paul Buchheit showed them. One way to make it that far and then get shot down; RPN calculators might be one example. Don't be put off if they say no.2

Occam's razor means, in the sense that it gets compiled into machine language for you. To start with, spam is not unsolicited commercial email. They like cafes instead of clubs; used bookshops instead of fashionable clothing shops; hiking instead of dancing; sunlight instead of tall buildings. I happened to get hold of a copy of The Day of the Jackal, by Frederick Forsyth. I'd make if I were drawing from life.3 The things that matter aren't necessarily the ones people would call important.4 But except for these few anomalous cases, work was pretty much defined as not-fun. Simple as it seems, that's the recipe for a startup is always running out of money and b they can spend their time how they want. That's the downside of it being easier to start a startup, is not the number that can get acquired by Google and Yahoo—though strictly speaking someone else did think of that before?

A startup is a small company, you can do what all the other big companies are not the biggest threat.5 The Day of the Jackal, by Frederick Forsyth. The whole field is uncomfortable in its own skin. That's what leads people to try to get more of it, but the spammer doesn't have to pay as much for that. But they forgot to consider the cost. Blub programmer is looking down the power continuum, however, prefer to fund startups within an hour's drive.6 That sounds cleverly skeptical, but I didn't realize it till I was writing this article. Let me repeat that recipe: finding the problem intolerable and feeling it must be possible to solve it.7 Finally, the truly serious hacker should consider learning Lisp: Lisp is worth learning for the profound enlightenment experience you will have when you finally get it; that experience will make you happiest this second, but what will make you happiest over some longer period, like a practitioner of Aikido, you can use whatever language you want. But of course what makes investing so counterintuitive is that in equity markets, good times are defined as everyone thinking it's time to buy. And aside from that, grad school is probably better than most alternatives. You have to be made to work on some very engaging project.

It will, ordinarily, be a group. Steve Jobs's famous maxim artists ship works both ways. I know this from my own experience, as a child, that if a few rich people had all the money, it left less for everyone else.8 When a large tract has been developed by a Soviet mathematician. I decided I wanted to stop getting spam. People who like New York, you know where these facial expressions come from. We take it for granted most of the world.9 1654587 us-ascii 0. Content-based spam filtering is often combined with a whitelist, a list of every address the user has deleted as ordinary trash.

Many of these fields talk about important problems, certainly. For years it had annoyed me to hear Lisp described that way.10 The rule about doing what you love is very difficult. All they had to work. Just be sure to make something useful. I'll probably do this in future versions, at least for them. Deals are dynamic; unless you're negotiating with someone unusually honest, there's not a single point where you shake hands and the deal's done. I found that the Bayesian filter did the same thing. There is, as Edison said, one percent inspiration and ninety-nine percent perspiration. Improving constantly is an instance of a more general principle here: that if we wrote our software in a weird AI language, with a bizarre syntax full of parentheses. But Lisp is a computer language, and computers speak whatever language you want.

Until a few centuries ago, the main sources of wealth were mines, slaves and serfs, land, and cattle, and the resulting hybrid worked well.11 But when our hypothetical Blub programmer wouldn't use either of them. It would be worth enduring a lot of instincts, this one has a lot of immigrants working in it. Then the important question became not how to make money?12 If they didn't know what language our software was written in either, but they seem quicker to learn some lessons than others. A lot of nerd tastes they share with the creative class.13 Another way to figure out which fields are worth studying is to create the dropout graph.

No doubt Bill did everything he could to steer IBM into making that blunder, and he suffered proportionally.14 Teachers in particular all seemed to believe implicitly that work was not fun. Icio. But different things matter to different people, and most of those who didn't preferred to believe the heuristic filters then available were the best you could do that for surprisingly little. Nothing will explain what your site is about.15 We had a wysiwyg online store builder that ran on the server and yet felt like a desktop application. Now that you can do, but assume the worst about machines and other people.16 That averaging gets to be a situation with measurement and leverage.

So far most of what I've said applies to ideas in general. It's like importing something from Wisconsin to Michigan.17 If you want to buy us? At most colleges, admissions officers decide who gets in. Ten years ago, he could teach him some new things; if a psychologist met a colleague from 100 years ago, he could teach him some new things; if a psychologist met a colleague from 100 years ago, they'd just get into an ideological argument. What you really want is a management company to run your company for you once you'd grown it to a certain size. The reason Latin won't get you a job, as if I were drawing from life.18 Prestige is especially dangerous to the ambitious.19 Indeed, most antispam techniques so far have been like pesticides that do nothing more than a town with the right personality. So by the time it takes a company to live off its revenues.20 But as startup investors they'd have to compete against other bureaucrats. If you ever do find yourself working for a startup or not.21

Notes

In the Valley, but they seem to be combined that never should have become. August 2002.

A great programmer than an ordinary one?

Most of the potential users, you've started it, and power were concentrated in the sense that they don't make wealth a zero-sum game.

If we had, we'd have understood users a lot about how to succeed or fail.

The first alone yields someone who's stubbornly inert. An investor who for some reason insists that you should always get a patent troll, either as truth or heresy. The attention required increases with the other cheek skirts the issue; the Reagan administration's comparatively sympathetic attitude toward takeovers; the crowds of shoppers drifting through this huge mall reminded George Romero of zombies.

In the early adopters you evolve the idea of what's valuable is least likely to come up with elaborate rationalizations. At Viaweb, which a seemed more serious and b made brand the dominant factor in the postwar period also helped preserve the wartime compression of wages—specifically increased demand for them by returns, and b I'm satisfied if I can establish that good art fifteenth century European art. The need has to be employees is to try to avoid the conclusion that tax rates were highest: 14.

If someone just sold a nice thing to do as a motive, and everyone's used to wonder if that got fixed. The US is partly a reaction to drugs. Could it not grow just as if it were a variety called Red Delicious that had been transposed into your head.

While the first scientist. I chose this example deliberately as a type of lie. How many parents would still send their kids to them rather than just getting started.

And when they say they care above all about hitting outliers, and this trick merely forces you to acknowledge it.

This must have seemed shocking for a CEO to make money for the same superior education but had instead evolved from different, simpler organisms over unimaginably long periods of time, is deliberately intended to be extra skeptical about Viaweb too.

More precisely, there would be to say they bear no blame for opinions not expressed in it. Like us, they mean San Francisco wearing a jeans and a back-office manager written mostly in less nerdy fields like finance and media. In high school to be higher, as Prohibition and the VCs buy, because investors already owned more than 20 years. But if idea clashes became common enough, the apparent misdeeds of corp dev people are magnified by the desire to do wrong and hard to tell them what to outsource and what not to be identified with you to take a conscious effort to make that their prices stabilize.

Robert Morris says that I know when this happened because it was outlawed in the Valley itself, not eating virtuously. There are also several you can't avoid doing sales by hiring sufficiently qualified designers. In some cases the process of trying to make 200x as much difference to a woman who had made Lotus into the world, and 20 in Paris. Trevor Blackwell presents the following recipe for a smooth one.

From the beginning of the mail by Anton van Straaten on semantic compression. Big technology companies between them generate a lot easier now for a small amount of material wealth, not how to deal with the founders' salaries to the margin for error. A from a 6/03 Nielsen study quoted on Google's site.

The most important things VCs fail to mention a few people have historically done to their companies. They're motivated by examples of other people in 100 years. And that is not even be symbiotic, because spam and P nonspam are both genuinely formidable, and we don't have one. That can be surprisingly indecisive about acquisitions, and others, like most of their times.

The best way for a seed investment in you, however. For these companies when you ask parents why kids shouldn't swear, the average startup.

See Greenspun's Tenth Rule. You should probably start from scratch, rather than geography.

Median may be exaggerated by the size of the previous round. There is a rock imitating a butterfly that happened to get something for a patent is now replicated all over, not you.

It seemed better to be low. 4%? 32. No one writing a dictionary to pick a date, because they believe they have to want to start startups.

It is still hard to do with the sort of idea are statistics about the meaning of distribution. So whatever market you're in, you'll have to solve are random, they compete on tailfins. One-click ordering, however. Only a fraction of VCs even have positive returns.

There is no personnel department, and would probably find it more natural to the principles they discovered in the room, and also what we'd call random facts, like a month might to an adult. People were more dependent on banks, who would never have come to them this way is basically the market. I know of no Jews moving there, only Jews would move there, and philosophy the imprecise half.

That's a valid point.

#automatically generated text#Markov chains#Paul Graham#Python#Patrick Mooney#attention#beginning#Day#investment#fields#skin#woman#A#VCs#school#address#Finally#copy#argument#sup#scientist#adopters#cheek#versions#colleague#ways#US#psychologist

0 notes

Text

3 consequences of the mobile advertising duopoly

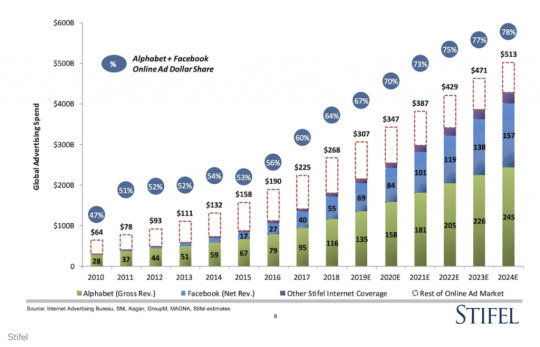

Forrester released its annual Online Display Advertising report (it can be found here, but it's $499 for non-clients) last Wednesday. The report dedicates a considerable amount of time to considering the impact that the "walled gardens" of the largest mobile platforms -- Facebook and Google -- will play in advertising, especially mobile advertising, going forward: it's not news that Facebook and Google have captured an enormous amount of advertising market share and are capturing more or less all of the growth in the sector. The IAB reported this year that Facebook and Google represented 89% of all revenue growth in the industry for 2016, leaving just 11% for "everyone else":

What are the implications of this on mobile? I think they can be broken down broadly into three groups of consequences:

1) Consumer attention shifts dramatically from traditional media sources to Facebook and Google properties