#third party insurance for bike

Text

Third Party Insurance Explained | In Hindi

Third Party insurance kya hota hai? Third party insurance kya hota hai ise samajhne ke liye iss video ko jaroor dekhe.

#first party insurance#third party insurance#third party insurance explained#third party insurance kaise kare online#third party insurance kya hai#third party insurance for bike#third party insurance for car#first party insurance kaise kare#first party insurance vs third party insurance

0 notes

Text

#motor insurance#car insurance#insurance#auto insurance#motor insurance meaning#motor insurance policy#motor insurance in india#types of motor insurance#motor insurance policies#merits of motor insurance#features of motor insurance#limitation of motor insurance#vehicle insurance#introduction of motor insurance#characteristics of motor insurance#bike insurance#cheap car insurance#motor vehicle insurance#third party insurance#motor insurance definition

0 notes

Text

Top Motivators For Online Third-Party Bike Insurance Purchase

The most basic form of two-wheeler coverage is third-party bike insurance, which provides coverage for any harm and losses your vehicle might inflict on a third-party person, item, or vehicle. It is particularly useful in collision or accident situations. Without it, you risk receiving a fine between Rs 1,000 and Rs 2,000. The equivalent is required by law.

0 notes

Text

Everything You Need To Know About Third-Party Bike Insurance

Everything You Need To Know About Third-Party Bike Insurance

Third-party bike insurance is the most basic type. It protects the policyholder against third-party liability (bodily hurt, fatalities, and property damage) from two-wheeler accidents on the road or elsewhere. Third-party property damage compensation is set at Rs. 1 lakh, but a court establishes bodily injury/death compensation.

How do I buy online bike insurance?

Following these steps, you may…

View On WordPress

0 notes

Text

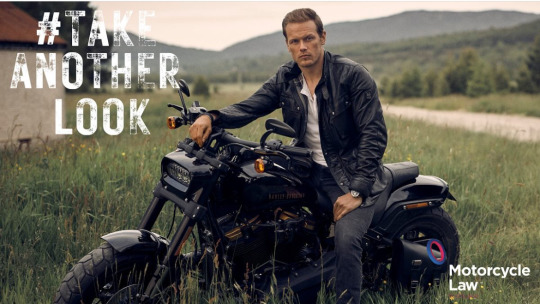

Every Journey Matter!

Note this campaign is a great initiative from the @motorcyclelawscotland team I can't agree more to educate people and save lives. But Why did they choose the photo of SH on this post when he promoted his whisky 🥃 during his 2021 whisky campaign in Scotland?

This photo is in 2021 and was the last time SH was seen on his customised Harley Davidson motorbike after his bike mishap in Scotland 🏴

We don't know exactly what kind of support SH is providing to this volunteering effort by appearing in his promotional material and asking his fans to sign up. However, it's interesting to note that Motorcycle Law Scotland is urging the Scottish community to be involved in this Road Safety campaign and at the same time they following the actor's alcohol business on Instagram.🤷♀️

The one safe option for Road Safety If you're driving, is not to drink any alcohol and not promote it.

As we see Motorcycle Law Scotland 🏴 helps you with your motorcycle accident claim following a bike accident and acting for bikers who have been involved in a motorbike accident.

That means they deal with claims against third-party insurers and can act in cases where your motorbike accident compensation claim is against an uninsured driver and will deal with the motor insurers bureau on your behalf.

There is a time limit of three years from the date of the accident for claiming for injuries in a bike accident, and to ensure that the motorbike accident personal injury claim and compensation for the motorcycle is dealt with well within that time frame. For example, if you had a bike accident in December 2021, this year 2024 is your time limit.

MLS are motorbike personal injury Solicitors, I imagine their clients come to them when they have had a motorbike accident. It is important to remember that in law, there is always the possibility of reasonable doubt, and there is a doubt. Was or is Motorcycle Law Scotland involved in any way in representing SH in his mishap in Scotland? The mishap occurred a year after SH obtained his motorbike licence in 2020, not enough experience.

I believe that MLS' interest in SH is not a sudden one. I would like to know if SH featured in this campaign has completed advanced rider training and passed his test, courtesy of Motorcycle Law Scotland, 🏍️ before providing his photo on his Harley Davidson motorbike. Or MLS has SH fans who misinterpret their role in this campaign 💁♀️

@imahalfemptykindofgirl Yes, it did, but what I was actually referring to was completing advanced motorist training and passing the exam that MLS offers for vulnerable road users.

@summerindigomusic Yep! SH has a customised Triumph Scrambler 1200 XE motorbike, which matches his Sassenach helmet promoting his whisky 🥃 and it’s a very questionable taste.

@imahalfemptykindofgirl Exactly, No wonder he didn't show his Harley Davidson bike and helmet damage. I would like to know what kind of insurance cover he had 🤔

@imahalfemptykindofgirl @gotraveltheworldluv It all comes from others. The cause is not his and it is MLS who is raising awareness, SH is not shedding light on anything. But his completely ridiculous fans think everything that happens in Scotland is his initiative.

Well next time SH will polish the Scottish roads with his ideas💡 and his fans will say Scotland is better off because of him 🤯

22 notes

·

View notes

Text

Liability insurance for the private individual offers a solution

An accident is in a small corner. A ball through a window, a collision with your bicycle. These are examples of damages that could happen to you unintentionally. You can be held liable for this. Liability insurance for the private individual offers a solution. We compare all variants for you. It is not mandatory to take out liability insurance, but this private liability insurance should certainly not be missing from the insurance policies in your Advantage Package. Private liability insurance is very important for a homeowner, but also for other risks for which you, as the owner of a business or as the cause of damage, by you or a family member, can be held liable. This applies to any damage that your children cause, to damage that you cause to others or, for example, to your dog that bites someone. This can be quite expensive! Never the less, recent figures show that some 640,000 households do not have private liability insurance.

upcover is Australia's award winning business insurance provider for small business owners, startups, consultants, freelancers and gig economy workers

We all notice it, everything has become much more expensive. The groceries, petrol and last but not least the energy bill. It is shocking how much people spend on fixed costs these days. In practice, this manifests itself in canceling or not taking out very important insurance policies. Choices are made to make ends meet. Understandable, of course, but not always wise. An unexpected injury to third parties can be enormously expensive. Your child who accidentally kicks a ball through a window. That phone of your acquaintance that you accidentally drop or cause an accident with your beautiful E-Bike that injured an unsuspecting hiker. These are all examples of expenses that may not suddenly be bearable. Liability Insurance E-Bikes are popular. As a result, the number of damages caused by E-Bikes is also increasing rapidly. You do not take out separate liability insurance for an E-Bike as you would with a scooter. Insurers have decided that the E-Bike is covered by the private liability insurance (AVP). Do you own an E-Bike but do not have liability insurance? Then there is even more reason to close this one quickly. Surely you shouldn't think that you will have to pay for such (injury) damage yourself or worse still be able to pay it off for a long time? What does liability insurance cost? In some cases it is also ignorance. Students living away from home who think they are still insured with their parents, for example. This may be covered by some insurers.

We understand all too well that the fixed costs are so high. However, we really want to emphasize that canceling or not taking out very important insurance is very unwise. What if your water pipe bursts and all your belongings are flooded? What if there is a fire and all your belongings are lost? Or a burglary in your home? Home contents insurance really does not have to cost a lot of money and as already described, this also applies to liability insurance. In almost all cases we can make a comparison of different insurers and their policies. So you can be sure that you are getting the best deal for the most favorable conditions. Would you like to receive more information and would you like to make a calculation on the website? We always advise you to take out liability insurance from upcover for private individuals.

2 notes

·

View notes

Text

Two Wheeler Insurance Online with Coverage against Third-Party Liability

Two-wheeler Insurance - Buy/Renew Bike Insurance Policy Online at SBI General Insurance ✓ Third Party Liability ✓ Personal Accident Cover ✓ Protection of NCB (Add-On) ✓ Accidental Damage to Vehicle.

0 notes

Text

The Roadmap to Responsible Riding in India

In the bustling streets of India, where every honk and rev is a symphony of urban life, the journey of a rider is more than just a commute—it's an adventure. However, amid the excitement of the open road, there lies a crucial aspect often overlooked: bike documents. These seemingly mundane papers hold the key to legality, safety, and peace of mind for riders across the nation. Let's delve into why bike documents are indispensable in India and how they pave the way for responsible riding.

The Foundation of Legal Compliance:

1. Registration Certificate (RC):

Think of the RC as your bike's identity card—it proves ownership and registration with the authorities. Without it, your ride might as well be a phantom on the roads.

2. Insurance Certificate:

Third-party insurance isn't just a legal requirement; it's your shield against financial storms. From minor scrapes to major collisions, insurance ensures you're not left stranded on the side of the road.

3. Pollution Under Control (PUC) Certificate:

In a country striving for greener pastures, the PUC certificate is your stamp of approval for environmental responsibility. It's your pledge to keep the air clean and the roads green.

4. Road Tax Receipt:

Paying your dues isn't just about following the rules; it's about contributing to the infrastructure that fuels your adventures. The road tax receipt is your ticket to ride on the nation's highways and byways.

Safeguarding Riders on Every Journey:

1. Legal Assurance:

With all your documents in order, you're not just riding; you're cruising with confidence. Whether it's a routine checkpoint or an unexpected detour, legality is your constant companion on the road.

2. Financial Security:

Accidents are the potholes of life, but with insurance, you're equipped to handle the bumps along the way. It's not just about protecting your bike; it's about safeguarding your financial future.

3. Environmental Consciousness:

The roar of your engine is music to your ears, but it shouldn't be a burden on the planet. With the PUC certificate, you're not just riding; you're paving the way for a cleaner, greener tomorrow.

Embracing Responsible Riding:

1. Peace of Mind:

In a world of uncertainty, your documents are your anchor. With them, you ride with peace of mind, knowing you're not just a rider; you're a responsible steward of the road.

2. Empowerment:

Armed with your documents, you're not just navigating; you're charting your course. With legality, security, and responsibility as your guides, the open road is yours to explore.

3. Community Commitment:

As a rider, you're not just part of a community; you're a guardian of its values. With your documents in hand, you uphold the principles of safety, legality, and environmental consciousness that define responsible riding in India.

Conclusion:

In conclusion, bike documents are more than just paperwork; they're the foundation of responsible riding in India. From legal compliance to financial security and environmental consciousness, these documents embody the values that define the rider community. So, the next time you hit the road, remember: with your documents in order, every journey is not just an adventure—it's a testament to your commitment to responsible riding.

0 notes

Text

Want to buy the best Two Wheeler Insurance policy? Check out Policy Ghar!

Bike insurance, also known as two-wheeler insurance policy is an agreement between a bike owner and a bike insurance provider where the insurer covers the cost of damages to the bike, third-party or in some cases even the bike owner. Looking for best policy offers? Visit Policy Ghar as they provide you with a secure insurance plan. For better experience, Buy Two Wheeler Insurance from Policy Ghar.

0 notes

Text

Riding Safely: Exploring the Advantages of Two-Wheeler Insurance in India

Are you a proud owner of a two-wheeler in India? Whether you ride a motorcycle, scooter, or moped, ensuring its safety and your peace of mind on the road should be a top priority. One of the best ways to do so is by investing in a comprehensive two-wheeler insurance plan. In this blog, we’ll delve into the advantages of two-wheeler insurance in India and how Ginteja helps you discover the best bike insurance plans in India that suit your needs, emphasizing the convenience of online purchases.

Why Buy Two Wheeler Insurance Online?

Due to its convenience, ease of comparison, and cost-effectiveness, the trend to buy two-wheeler insurance online has surged in popularity. With just a few clicks, you can explore various insurance plans, compare their features and prices, and make an informed decision. Ginteja, as an online platform, streamlines this process by providing a user-friendly interface and access to top bike insurance providers in India.

Advantages of Two-Wheeler Insurance

Now, let’s explore the advantages of having a two-wheeler insurance policy:

Financial Protection: In the event of an accident, theft, or damage to your bike, insurance coverage helps you avoid hefty out-of-pocket expenses for repairs or replacements.

Legal Compliance: As per Indian law, having at least third-party liability insurance is mandatory for all two-wheeler owners. It protects you from legal liabilities arising from third-party damages or injuries.

Personal Accident Cover: Many insurance plans include personal accident cover for the owner/driver, providing financial support in case of disability or death due to an accident.

Add-On Benefits: With Ginteja’s best bike insurance plans, you can opt for add-on covers such as zero depreciation, roadside assistance, engine protection, and more, enhancing your overall coverage.

Peace of Mind: Knowing that your two-wheeler is insured gives you peace of mind during your rides, allowing you to focus on enjoying the journey without worrying about unforeseen expenses.

Best Bike Insurance Plans in India

When it comes to selecting the best bike insurance plan in India, several factors come into play. Comprehensive coverage, affordable premiums, an easy claim process, and reliable customer support are some of the key aspects to consider. Ginteja Insurance stands out by offering a range of plans from leading insurance providers, ensuring that you can find a policy tailored to your specific needs and budget.

Ginteja Insurance: Your Trusted Partner

Ginteja Insurance is your trusted partner in safeguarding your two-wheeler. By partnering with reputable insurance companies in India, Ginteja ensures that you get access to the best bike insurance plans available in the market. Whether you need basic third-party liability coverage or comprehensive insurance that protects against theft, accidents, and natural calamities, Ginteja Insurance has you covered.

In Conclusion, Investing in two-wheeler insurance is not just a legal requirement but also a prudent step towards safeguarding your bike and yourself against unforeseen circumstances. Buying insurance online through platforms like Ginteja offers convenience, transparency, and access to the best bike insurance plans in India. Prioritize safety and financial security by choosing the right insurance coverage for your two-wheeler today.

Stay safe on the roads with Ginteja Insurance — your trusted partner for two-wheeler protection!

0 notes

Text

The ultimate guide to choosing the right bike insurance: Tips and considerations

Evaluating and choosing the right bike insurance is important for every rider as it provides financial protection, peace of mind and legal compliance. Selecting the most suitable option can be overwhelming. Kotak General Insurance will walk you through essential tips and considerations to help you make an informed decision while choosing the right bike insurance. Following these bike insurance guides can ensure that your bike is adequately protected and your insurance needs are met.

How to choose bike insurance?

Below are tips and considerations while choosing the right bike insurance:

Evaluate your coverage needs

Consider factors such as the value of your bike, your budget and the level of protection you desire. Assess your coverage requirements before diving into the selection process. Determine if you need basic third-party liability coverage or comprehensive coverage that includes your damage protection. Understanding your needs will help you narrow down your options and choose the most suitable coverage.

Research and compare plans

Take the time to research and compare different insurance plans. Look for a strong track record of customer service and claim settlement. Read customer reviews and ratings to gauge the satisfaction levels of policyholders. Additionally, compare the coverage options, add-ons and premium prices offered.

Check the claim settlement ratio

The claim settlement ratio is an essential indicator as it represents the percentage of claims settled against the total number of claims received. A higher claim settlement ratio indicates a more efficient and customer-friendly insurer. Choose two-wheeler insurance by Kotak General Insurance with a commendable claim settlement ratio to ensure a smooth claims process in the future.

Understand policy terms and conditions

Read and understand the terms and conditions of the insurance policy thoroughly. Pay attention to coverage inclusions, exclusions, deductibles and claim procedures. Look for any limitations or restrictions that may affect your coverage.

Evaluate add-on coverage options

Consider the add-on coverage options offered as add-ons provide additional protection and customisation to your policy. Evaluate the relevance of these add-ons to your needs and select the ones that enhance your policy’s value.

Assess the insured declared value (IDV)

Insured declared value (IDV) is the maximum amount that will be paid in case of a total loss or theft of your bike. It is essential to ensure that the IDV offered by the insurer is suitable for your bike’s current market value. A lower IDV may result in inadequate compensation, while an inflated IDV may lead to higher premiums.

Consider premium costs and discounts

Do not compromise on the quality of coverage while it’s essential to consider the price. Inquire about discounts offered that could be a no-claim bonus (NCB), discounts for installing anti-theft devices or being a member of recognised automobile associations. Availing these discounts can significantly reduce your premium costs.

Evaluate network

Check the cashless network garages and ensure that you have access to hassle-free repairs and claim settlements in case of an accident or damage. It is advisable to choose bike insurance coverage with a robust network that covers locations you frequently visit.

Seek recommendations

Seek recommendations from friends, family or fellow riders who have experience with bike insurance. Their insights and personal experiences can provide valuable information.

Review the customer support

Lastly, assess the quality of customer support offered with prompt and efficient customer service as it is crucial, especially during the claims process. Read reviews or seek feedback to ensure customers are valued and provided excellent support when needed.

Conclusion

Choosing the right bike insurance requires careful consideration of various factors. Understand the policy terms and conditions and follow these tips and considerations to select the right bike insurance that meets your needs, safeguards your bike and provides you with peace on the road.

0 notes

Text

Comparing Zero Depreciation & Return to Invoice Covers in Auto Insurance in Medina and Strongsville, Ohio

Securing a car with an insurance policy helps protect against financial losses that may arise from third-party liabilities or damages to the vehicle. When owning a vehicle in Medina and Strongsville, Ohio, purchasing third-party insurance is mandatory. That said, opting for a comprehensive plan is the wiser choice. Comprehensive auto insurance in Medina and Strongsville, Ohio, provides additional protection for vehicles against unexpected damages, but it does not include coverage for vehicle depreciation or ownership expenses. One way to get this coverage is by paying an extra premium or choosing add-on riders. Zero depreciation cover and return to invoice cover are two common types of riders that provide extra protection to any vehicle.

Comparing the differences between zero depreciation and return to invoice covers:

What's a zero-depreciation cover?

Through consistent use, the worth of a vehicle decreases gradually. The vehicle's value depreciates mainly because of the wear and tear of its parts. When the vehicle's market value decreases, the cost of the claims filed against it also decreases. If a vehicle sustains damage in an accident, the insurance company will cover repair expenses minus the depreciation of the repaired or replaced parts.

Ensure sufficient coverage against claims by choosing the zero-depreciation add-on rider. Having the Zero Depreciation car insurance add-on makes car owners eligible to claim the depreciation value, saving out-of-pocket expenses. This add-on can be purchased for five years from the vehicle purchase date. Insurers usually establish a cap on the amount of zero depreciation and basic insurance claims that can be filed in a year. Remember that with a zero-depreciation policy, the insurer might subtract certain mandatory and voluntary deductibles.

What's Return to Invoice?

For a comprehensive insurance plan, the premium charged by insurers is primarily determined by the estimated market value of the vehicle. That value is referred to as the insured declared value (IDV). If an accident occurs where the vehicle is extensively damaged or stolen, the insurance company will provide compensation equivalent to the vehicle's current market value.

With the Return to Invoice add-on, the insurer covers the purchase or invoice value of the bike, along with registration charges and road tax. It is applicable only when repair costs are over 75% of the IDV, and the vehicle is under three years old. Consider selecting the RTI as a car insurance add-on in an accident-prone region. Typically, the RTI add-on comes at a higher cost and can significantly raise the premium amount.

Zero Depreciation versus Return to Invoice: What's the Difference?

Three fundamental differences exist between zero depreciation and return to invoice covers.

The Zero Depreciation car insurance add-on covers the depreciation of a vehicle's parts being repaired or replaced. An additional feature called Return to Invoice covers the cost of the vehicle in case it is stolen or damaged beyond repair.

Zero depreciation helps cover the gap between repair or replacement costs and their depreciation value. Returning to the invoice helps bridge the gap between the purchase cost and the IDV.

Zero depreciation coverage can be obtained for a maximum of 5 years from the vehicle purchase, while the RTI add-on is accessible for three years from the vehicle purchase.

Insurance add-ons can enhance insurance policies by covering losses not included in the base plan. Consider the location and required coverage to select appropriate add-ons for optimal benefits.

Important: To understand risk factors, terms, and conditions, carefully review the sales brochure before finalizing a purchase. The discount amount may vary depending on the vehicle specification and place of registration. Just like home insurance quotes in Fairlawn and Medina, Ohio, it is essential to compare different insurance add-ons and understand their benefits before making a decision. Additionally, consulting with an insurance agent ensures one of the best coverage for all their needs.

0 notes

Text

Two wheeler insurance provides essential coverage for motorcycles, scooters, and mopeds, offering financial protection against risks including accidents, theft, and third-party liabilities. Comprehensive policies typically include coverage for damage to the insured vehicle due to accidents, natural calamities, theft, and fire, along with personal accident cover for the owner-driver. Additionally, third-party liability insurance is mandatory in many countries, covering the policyholder against legal liabilities arising from injuries or damages caused to third parties. Two-wheeler insurance not only ensures peace of mind for riders but also helps in complying with legal requirements, making it an indispensable investment for all motorcycle owners

0 notes

Text

Navigating Vehicle Rental Requirements in Menorca: What You Need to Know in 2024

Planning a trip to Menorca in 2024? Renting a vehicle is a convenient and efficient way to explore the island's beauty at your own pace. However, before you hit the road, it's essential to understand the requirements for vehicle rental to ensure a smooth and hassle-free experience.

1. Documentation and Identification

When renting a vehicle in Menorca, you'll need to provide certain documents and identification to complete the rental process. Typically, you'll be required to present a valid driver's license, passport, and a major credit card in the driver's name. Additionally, some rental companies may require an International Driving Permit (IDP), especially if your driver's license is not in Roman alphabet characters.

2. Age Restrictions

Most car rental companies in Menorca require drivers to be at least 21 years old, although the minimum age may vary depending on the type of vehicle being rented. Additionally, drivers under the age of 25 may incur a young driver surcharge. Be sure to check the age restrictions and any associated fees with your chosen rental provider.

3. Insurance Coverage

Insurance coverage is a crucial aspect of vehicle rental in Menorca. While basic insurance coverage is typically included in the rental price, it's essential to understand the level of coverage provided. Consider opting for fully comprehensive car hire in Menorca to ensure maximum protection in the event of an accident or damage to the vehicle. This comprehensive coverage often includes collision damage waiver (CDW), theft protection, and third-party liability insurance.

4. Vehicle Options

Menorca offers a variety of vehicle options to suit your travel needs, including cars, scooters, and motorcycles. Whether you prefer the convenience of a car hire at Menorca airport, the agility of a scooter, or the thrill of a motorcycle ride, there's a rental option for you. For example, if you're looking to explore the island's narrow streets and hidden corners, consider rent a 125/125cc bike in Menorca for easy maneuverability and parking.

firt you need to make a choice whether you want to hire car, bike or scooter in menorca

5. Booking in Advance

To ensure availability and secure the best rates, it's recommended to book your vehicle rental in advance, especially during peak travel seasons. Many rental companies, including Binicars, offer online booking platforms where you can easily reserve your desired vehicle ahead of time All you need to do is search on google car hire menorca airport. By booking in advance, you'll have peace of mind knowing that your transportation needs are taken care of, allowing you to focus on enjoying your Menorcan adventure.

Binicars: Your Trusted Rental Partner in Menorca

When it comes to renting a vehicle in Menorca, Binicars is your trusted partner. With a wide range of fully comp car hire Menorca, scooters, and bikes available for rent, Binicars offers flexible rental options to suit every traveler's needs. Whether you're arriving at Menorca airport and need a convenient car hire or prefer to explore the island on a scooter, Binicars has you covered. With transparent pricing, excellent customer service, and a commitment to quality, Binicars ensures a seamless rental experience for your Menorcan getaway.

0 notes