#to put it into perspective you can get ~6 easy tokens a day

Text

This is a PSA to, every day you can, go and exchange materials for provisioner tokens. The easiest ones to do are the chak egg (just do gerent once a day), Auric Ingot (just do octovine once a day), obsidian shard (from just, so many sources) and 5 ectoplasm (you'll get this from any activity that gives you rares)

Why is this important? Because they're the only method of getting the gift of craftsmanship, which is required for pve legendary armour, legendary sigils and legendary runes. Since the gift is 50 tokens a pop it's heavily timegated, so get started now and you won't kick yourself later. Since some of the materials (like the chak egg) don't have much other use you may as well if you ever see yourself having legendary aspirations.

It's also even more important now because in the new expansion arenanet is releasing new pve legendary armour that won't require raids! While I don't strictly know if it's gonna require gifts of craftsmanship, I think it's very likely and if it doesn't, you can just use it on a fancy set of legendary sigils.

#gw2#guild wars 2#to put it into perspective you can get ~6 easy tokens a day#and you need 250 for a full set of legendary armour#so that's over a month of handing in tokens#so seriously#get started now to avoid the pain later

92 notes

·

View notes

Text

Small details that make me ship karumana

Various fans have already contributed supplementary materials as fuel for the karumana ship but I’m here to talk about more minute details of their individual characters that make me believe in a supportive and refreshing relationship that can develop between these two. I plan to discuss details ranging from the start-up ship fuel from the main series to the supplementary material hints in order to provide a more psychological perspective in their compatibility.

Anime: S1 Ep 8 - Karma expresses interest in Okuda when the boys in class asked him who he likes.

The foundations of this ship

Many may claim that their interactions in the series aren’t enough to support a ship but if you look into supplementary material and analyze their individual characters beyond the obvious spotlight ship in the series, you can see how much Matsui Yusei teases fans with karumana ship fuel. According to Okuda’s character profile, she’s someone that the ever-alert Karma has allowed to get close. While in Karma’s character profile, Okuda is said to be the girl he can talk to about anything and his cautious heart and distant nature faded away around her. They’re cited to be the most easy-going boy-girl relationship in the class. In a translated character relationship chart from the official fanbook, Matsui confirms that these two like each other for how comfortable they are with each other, Karma finds her to be the easiest person of the opposite sex to talk to, Okuda feels relaxed around Karma in general, and Karma thinks Okuda is cute.

With these foundational details in mind and by reading beyond what the series gives us, here are a few points that make me believe in Karma and Okuda’s chemistry.

Okuda is not spineless

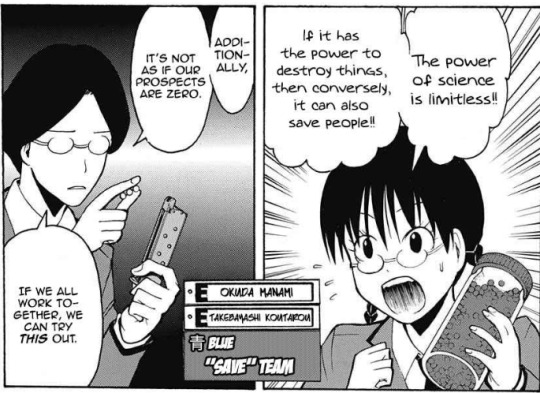

While she appears to be helpless and shy, she can stand her ground on what she believes in. Much like others in 3-E, she is her own character and doesn’t exist to be that token straight ship for Karma. During the class civil war, she chose the “save” team because she believes that if science can destroy, it can also save.

Anime: S2 Ep 17; Manga: Ch 144 - Okuda chooses the Blue team to save Koro-sensei

They could have easily put her in Karma’s team because of friendship and loyalty but the choice to “kill” would simply be against Okuda’s caring and harmless nature, one of the main traits why Karma is so comfortable around her. Later into the game, Isogai and Maehara talk about who they think would win and Okuda yells out that she wants Karma to win, despite being in the “save” team. This shows her own resolve and ability to separate her personal principles from her relationship with Karma.

Manga: Ch 147 - Okuda states why she wants Karma to win

It’s not that she wants Koro-sensei to die, it's that she understood what killing Koro-sensei means for Karma. She, of all people, knew the hard work Karma put on behind the scenes. When others simply dismiss Karma’s achievements as “genius,” she (and Koro-sensei) knew that Karma works hard, no matter how much he tries to hide that side of him to the world. This comes with his resolve that he is not the best and he has to put in effort if he wants to be the most capable in reaching his goal. Okuda sees all that. Given the choice, Okuda would rather save Koro-sensei, yet if things don’t go her way, she trusts that Karma earned the chance to fulfill his goal. This duality illustrates that whether the class decides to save or kill, she can accept it wholeheartedly. She wouldn’t have regrets because she gave it her best shot from a decision she made herself.

Anime: S2 Ep 1 - Karma hides evidence of him studying hard on the last day of summer break

In relationships, it’s important to have set boundaries for what you share with your partner and the things that make you, you. Okuda’s character exemplifies this well as she is not shown to be a side character that follows Karma around, she’s a friend whom Karma can share his vulnerabilities with while being able to keep her individuality intact. While she is known to be lacking in the ability to communicate, in the end, she’s able to say what’s on her mind when it matters—without any filters. She is brave and strong in her own way and has the capability to provide a new perspective—a trait that can stimulate Karma’s intellect. I believe this would blend well in their relationship because Karma seems to be the type who would get bored hanging out with someone who can’t keep up with him. This shows that their relationship can be an equal exchange of support and trust rather than one being subservient or wary of the other.

Additionally, her pure honesty and lack of fear for Karma is a perfect example of how she can stand up on her own. Everyone is afraid of Karma to some extent which makes them avoid him, possibly right according to how Karma likes to push people away with his behavior. Having someone whose basic nature is to not get swept away by the norm, to be able to choose for herself in how she views Karma, and to be overall honest with her intents really paves the way for a mutual trusting relationship.

Anime: S1 Ep 8 - The girls in class find Karma attractive but scary but Okuda disagrees.

What I find interesting in Okuda’s lack of fear for Karma is that she says this even after seeing him directly start a fight with delinquents the day before. This is episode 8, 3 episodes after her debut in episode 5. Assuming that Karma only started approaching her after learning about her poison-making skills, that’s quite a short period to get to know Karma—a known violent delinquent and the most skilled fighter in class—and to claim that he is “not that scary.” This implies that by this time, they have started to get to know each other better, Karma probably treats her well, and that they’ve interacted enough off-screen to arrive at the conclusion that he is not scary. Much like how Karma’s interest in her comes from her chemistry skills rather than her looks, this girl knows Karma is more than his external features and she can speak her mind even though it’s contrary to the public opinion.

Karma’s character development

Manga: Ch 19 - The boys ask Karma who he’s interested in among the girls in class

From the key scene that fueled this ship, many may claim that Karma is just using her for personal gain. I personally believe this argument is made by people who stopped understanding character growth at season 1 or simply cannot grasp at all that humans change over time. As with a lot of relationships, the interest in other people has to start somewhere. For Karma, the interest starts here with the maturity level of a 15 year-old prankster. Being one of the main characters, Karma goes through character development in the way he views the world, himself, and the people surrounding him. He changes a lot in a span of one year so it wouldn’t be impossible to believe that his interest in Okuda grows beyond having a convenient drug dealer.

One common trait that makes Karma comfortable around people like Nagisa and Okuda is that they are seemingly harmless to him. The statement and intent sounds problematic as a standalone but it’s important to point out how Karma uses this information in his relationships. A typical toxic psychopath would prey on their harmlessness to bully them into taking advantage of them. Karma’s comfort hanging around harmless friends stems more from their inability to hurt him rather than his capability to hurt them. Although Karma is labeled as a violent delinquent, he isn’t a low-level scum-type delinquent that starts a fight for the sake of fighting. As far as I can remember, all cases of Karma’s problematic delinquent behavior is fighting with strangers who provoked him first or he was actually trying to defend someone weaker. His friendship with Nagisa started with a common interest and he was comfortable until he felt threatened by Nagisa’s dormant skill for assassination. Not once did he try to take advantage of Nagisa’s pacifist nature for his personal gains. The same applies for his friendship with Okuda—she piqued his interests with her chemistry skills, he learns that she is harmless and comfortable to be with, and a genuine friendship evolves from there. His interest in her skills may be mischievous but he never showed any aggression or intent to take advantage of Okuda. Neither did he force or threaten her to do those for her. She even wrote that she was able to experience challenging experiments because of his requests in her yearbook message to Karma, something that sounds like she actually enjoyed the fruit of his mischievous intents.

Anime: S1 Ep 8 - Karma tells why he’s interested in Okuda

For those who believe that this scene is a weak foundation for liking someone, well, at that point, Karma hasn’t really developed a romantic type of interest in her. As mentioned, this is how his interest in her begins, not the sole reason for him to be attracted to her. Playing around, making mischief happen, sharing fun times is something that develops friendships. A good friendship is the solid foundation for a comfortable romantic relationship later on. Character development is a real thing and these two won’t have the brain of mischievous middle-schoolers for the rest of their lives.

Anime: S2 Ep 6 - The Witch and The Knight used chloroform to save the day

Karma can feel at ease with Okuda

During the Test of Courage, Karma and Okuda were paired up which gave them time alone to talk about something that’s been bothering Karma. As we all know, Karma never shows his vulnerabilities to anyone at this point in time, not even around classmates who are known to get along with him. Koro-sensei had to earn it by looking out for him and it took time for him to warm up yet even then, he wouldn’t be caught casually sharing something as personal as his fear. The exception is Okuda. The series never explicitly shows how Okuda earned that trust but this scene paints something unusual in Karma’s well-guarded nature. It’s not impossible that they’ve shared enough moments off-screen—moments valuable enough for Okuda to earn Karma’s trust halfway through the school year. To note, it appears that Okuda never even initiated asking Karma what’s bothering him and yet, Karma simply shared what’s on his mind to her.

Anime: S2 Ep 1 - Karma talks about his fear to Okuda during the Test of Courage

We don’t actually see this kind of vulnerability display around friends that Karma spent a lot of fun times with on-screen such as Nakamura and Terasaka. During the civil war, Nakamura notices something unusual in Karma, as if something is bothering him but Karma immediately brushes it off and shows his usual face excusing it as having just woken up. Karma and Nakamura have been shown to get along well as fellow pranksters, possibly with more lines in scenes together than Okuda and Karma ever had in the entire series, yet for some reason, this friendship hasn’t reached the point where Karma can at least give a hint of what’s bothering him when he’s alone with Nakamura even after she asks him about his thoughts.

Manga: Ch 144 - Nakamura notices something unusual about Karma at the start of the class civil war

As for Terasaka, he seems to have earned a teasingly trusting friendship with Karma. Terasaka gives his trust in being manipulated by Karma’s wits and Karma seems to show acknowledgement for how this pseudo-Takaoka has grown. Yet the most Karma would show around him is a vague suggestion that he would like to see him in the real world again someday as colleagues. Perhaps this is simply how men communicate with each other but I guess with everything they’ve experienced, Karma acknowledges some sort of friendship with Terasaka, but not enough for him to expound or eloquently communicate why he would like to see Terasaka as a politician when he himself becomes a bureaucrat. Karma’s unsolicited suggestion for Terasaka hints at his vision for his future and how he sees someone like Terasaka in it but his language doesn’t scratch the surface of intimate vulnerability as it did around Okuda in the test of courage.

Anime: S2 Ep 9 - Karma tells Terasaka to become a politician after career counseling with Koro-sensei

Throughout the series, we see Karma come out of his small world and slowly connecting and caring for his classmates. He gets along quite well with them and appreciates their company and how this class allows him to be himself. All this is temporary as they will go their separate ways once they graduate. In addition, Karma also appears to be the type to value the quality friendships he has built. This would imply that in order to maintain a bond with him after graduation, Karma would have to actively show an interest in connecting with them. In the case of Okuda, he seems to be interested in her enough to look forward to spending more time with her after graduation, as shown in his yearbook message to her stating that his year was made more fun with her around and that he’s looking forward for more.

It seems in each relationship he has, there exists an aspect that makes one distinct from the others. The existence of shared interests and getting along, a sense of comfort and security without fear of being betrayed, the willingness to extend effort in seeing them again, and the extent of being able to express in detail his vulnerabilities and deeper musings seem to be some distinct factors that make up Karma’s quality relationships. While each notable friendship satisfies at least one or two categories, none of them have all four except Okuda. The presence of all these qualities in his relationship with Okuda makes her stand out and have the potential to grow from good mischievous friends to lifetime supportive partners.

In the case of battle compatibility, Okuda may be far from giving Karma direct assistance in the battlefield. However, there’s an angle I wish to discuss that makes me think of how it translates to their compatibility. One scene that oddly stood out for me was during their encounter with delinquents in their Kyoto trip. The delinquents attacked, leaving the boys unconscious, subsequently kidnapping Kayano and Kanzaki. Okuda managed to slip away and hide leaving her to check on the boys when the environment became safe.

Anime: S1 Ep 7 - Okuda reappears apologizing for hiding when the delinquents attacked.

What made this scene interesting is that Okuda could have been kidnapped along with Kayano and Kanzaki and the result would have been the same. The boys could have read the trip manual and called Koro-sensei. Sure enough, Koro-sensei could single-handedly save them once they got to the hideout. It didn’t matter whether one, two, or three unarmed girls got kidnapped. So why paint this scene with her being able to slip away without the delinquents getting a chance to grab her?

My interpretation for this small detail is that Karma doesn’t always have to worry about Okuda. Karma gets into a lot of fights. Even in his future career as a bureaucrat, he will surely get into dangerous situations involving politicians. He has always been the type to be on guard 24/7. Even back when he was comfortable around Nagisa who he believed to be harmless and a good friend, he couldn’t let his guard down. Imagine the stress that burdens his shoulders having to keep his guard up for himself and having to extend that to another person. Wouldn’t that be too much for him to sustain in the long run?

Anime: S2 Ep 18 - The feeling Karma got when Nagisa sneakily poked his back while looking for him in WcDonalds

Anime: S2 Ep 18 - Karma and Nagisa hanging out in the middle of their second year

For someone without exemplary combat abilities like Okuda, slipping away to safety is a smart move. Even at that moment, Karma acknowledged that she did the right thing. Of course we know this is not the type of running away in order to abandon a comrade. I believe it’s safe to claim that nobody in 3-E would truly go that route. What Okuda did was wise and if the scenario were a little different, slipping away could have given her the chance to send support, prepare weapons, and an overall better fighting chance than just standing there frozen or getting herself kidnapped. She slipped away using quick thinking and if you think about it, it takes skill to sneak away unnoticed when both ends of a narrow ally are surrounded by big, menacing delinquents. Her ability to act wisely by herself can definitely be a load off Karma’s chest knowing that the people he cares for can take care of themselves should he be rendered unable to protect them.

Additionally, Okuda’s nature is the type that Karma can trust to be capable enough to protect herself without feeling that she’s a threat to him, something rare among his relationships with other friends. This detail is small and subtle but it hints her potential supportive and reassuring dynamic with Karma wherein Okuda can safely lend background assistance without worrying a combat-ready Karma. As Karma mentions back at her later in the series, running away is also a battle strategy. Whether he learned this technique from Okuda or not is a mystery but I like to think that towards the end of the series and almost a year of trust and friendship, some of Okuda’s traits and mindsets have rubbed off on Karma enough for him to adopt it in his strategies.

Anime: S2 Ep 23 - Karma grabs Okuda’s wrist to get away from danger

For someone as cocky as Karma, being able to pull off a humble-yet-wise move is something noteworthy. This humility could be the mixed influence of Koro-sensei’s care and Okuda’s nature. Not only does Okuda provide a load off his shoulders, she is also capable of bringing new perspectives in solving problems for Karma.

In a long-term relationship, Karma deserves to feel at ease. Whether as a friend or a life partner, he deserves someone he can trust not just in opening up, but also at times when he’s vulnerable. For me, this is something that his dynamic with Okuda can provide. She may not be the best to fight alongside others in the frontline but she can provide background support so Karma can be guaranteed that he is not alone in a fight and he will not be coming home to a lonely place after a fight.

From being an approachable friend that he gets along with to a partner he can trust and be vulnerable around, all these seem to point at a special connection Karma feels around Okuda—enough for her to be just the right support he needs while being able to treat her right. Okuda may not talk or stand out much but Karma seems to see traits in her that make him gravitate towards her with ease. She doesn’t stand out in the general crowd but she stands out for Karma, where her traits are appreciated.

____________________

Notes: I have the tendency to lean towards the less popular ships in Anime (such as Yukihira Souma x Tadakoro Megumi in Shokugeki no Souma) over the obvious ships in the spotlight. I believe it has something to do with my inclination to more mature and supportive relationships that appeal to people in their 20s rather than hormone-induced pairings that sound like high school flings targeted for 14 year old girls. To note, I was at that age once but once you hit your 20s, you realize that some ships are more problematic than you remember.

This is my second time watching AC (first time was in 2016) and I honestly don’t recall shipping them back then. I don’t even recall picking up on karumana hints before. But now after rewatching it in my 20s, I find it quite intriguing how I find this couple so cute, while knowing that I’ve grown out of my shoujo manga days. These days, I don’t have tolerance for shoujo-esque ships that are practically “it’s not sexual harassment if he’s hot.” Looking back, a lot of shoujo mangas/anime were like that in my teenage years. While Karma started out with high Marty Stu potential like shoujo main boys, AC developed its characters well such that their characters and future career paths were more realistic—something you come to appreciate as someone who has already gone through their own 7-year timeskip.

#karumana#karmanami#manami okuda#okuda manami#karma x okuda#カル愛#akabane karma#karma akabane x manami okuda#manami okuda x karma akabane#akabane karma x okuda manami#okuda manami x akabane karma#karma x manami#assassination classroom#ansatsu kyoushitsu#korosensei#暗殺教室#殺せんせい#赤羽業#赤羽カルマ#奥田愛美#Nakamura Rio#rio nakamura#shiota nagisa#nagisa shiota#terasaka ryoma#ryoma terasaka#koro-sensei#koro sensei#カルマ#karma akabane

90 notes

·

View notes

Text

THE ART OF SIMPLE LIVING by Shunmyo Masuno

Nowadays, many people have lost their footing—they are worried and confused about how to live their lives. That is why they seek out the extraordinary, in an attempt to reset their mental balance.

But. Still.

Even once you have pushed reset, the extraordinary remains outside of the everyday.

When you return to your regular life, stress accumulates, and the mind frays. Feeling burdened, again you seek out the extraordinary. Does this never-ending cycle sound familiar?

No matter how much you lament the complexities of life, changing the world is no simple task.

If the world is not going the way you want it to, perhaps it is better to change yourself.

Then, whatever world you encounter, you can move through it comfortably and with ease.

Instead of going out of your way to seek the extraordinary, what if you could live in a more carefree way, just by subtly changing your regular, everyday life?

This book is about just that: simple living, Zen style.

Changing your lifestyle doesn’t need to be difficult.

Slight changes in your habits. A subtle shift in your perspective.

You don’t need to go to the ancient Japanese capitals of Kyoto or Nara; you don’t need to climb Mount Fuji; and you don’t need to live near the ocean. With really only minor effort, it is possible to savor the extraordinary.

In this book, I will show you how to do so, with the help of Zen.

Zen is based on teachings that are fundamentally about how humans can live in the world.

In other words, Zen is about habits, ideas, and hints for living a happy life. A treasure trove, if you will, of deep yet simple life wisdom.

(1) Each day is not the same.

I rise each morning at 5:00, and the first thing I do is fill my lungs with the morning air. As I walk around the temple’s main hall, reception hall, and priest’s quarters, opening the rain shutters, my body experiences the changes of the seasons. At 6:30 I perform the Buddhist liturgy by chanting scripture, and then I have breakfast. What follows is whatever the business of that particular day is.

The same process repeats itself every day, but each day is not the same. The taste of the morning air, the moment when the morning sunlight arrives, the touch of the breeze on your cheek, the color of the sky and of the leaves on the trees—everything is constantly shifting. Morning is the time when you can thoroughly experience these changes.

(2) Part with old things before acquiring new ones.

When things aren’t going well, we tend to think we are lacking in something. But if we want to change our current situation, we should first part with something before we look to acquire something else. This is a fundamental tenet of simple living.

Discard your attachments. Let go of your assumptions. Reduce your possessions. Living simply is also about discarding your physical and mental burdens.

The act of discarding, of detaching from mental and physical burdens, from the baggage that weighs us down, is extremely difficult. Sometimes it can be accompanied by real pain, as when we part with someone who is dear to us.

But if you want to improve the way things are, if you want to live with a light heart, you must start by discarding. The moment you detach, a new abundance will flow into your life.

(3) When we eliminate effort, we eliminate life’s pleasures.

What do you do when you want a cup of coffee? If you’re at home, you turn on the coffeemaker. Or if you’re out, you get a cheap cup of coffee. These are both perfectly natural.

But imagine a different scenario.

First, you go out into the woods and collect firewood. You make a fire and boil water. As you grind the coffee beans, you look up at the sky and say, “What a beautiful day.”

Coffee brewed this way is likely to taste much better than coffee from a machine. The reason why, perhaps, is because each step in the process has been brought to life—collecting firewood, starting the fire, grinding the beans. There is nothing extraneous in any of these actions. That is what I call living.

Life requires time and effort. That is to say, when we eliminate time and effort, we eliminate life’s pleasures.

Every so often, experience the flip side of convenience.

(4) Acquiring lots of things isn’t freedom. What’s important is acquiring the mind-set of using things freely.

(5) Whatever it is you’re doing, be grateful for the opportunity. Be happy for the chance to do the work. I don’t mean to sound idealistic here—I’m merely repeating what many great men and women have said before.

If you believe that a task is being forced upon you, then you will see the work as a burden, and it will arouse negative feelings. It is the same in the practice of Zen. The moment you find yourself asking “Why do I have to tidy the garden every morning?” is the moment your training becomes meaningless. Everything we do as human beings is precious. If we are to find meaning in what we do, we must first become our own protagonist in the work. You have the leading role in your work. If you approach work with this attitude, all work becomes meaningful and invaluable.

(6) In anything, the hard part is just to keep going.

(7) You can start something as long as you have the energy. Finishing, too, is easy. The hard part is just to keep going. If you tell yourself, day in and day out, that something is wrong for you, then how will it ever be right for you?

We have a tendency to compare ourselves to others. We envy the light workload of our neighbor. We see someone who is talented and get depressed. But, ultimately, there is pleasure to be found in the repetition of work that suits you.

(8) Life doesn’t always go smoothly. Our efforts sometimes go unrewarded. Despite this, try to believe in yourself and do your best. Do not fear moving forward.

(9) Whether you’re worried about jobs or interpersonal relationships, if you keep everything in your head, you just allow feelings like “I can’t do this” or “That’ll never work” to take hold.

But if you leap into it with both feet, you may be surprised by how easy it is to accomplish something or to come up with a solution. Just like with bungee jumping or riding a roller coaster, the scariest part is not the doing but the moment right before it.

Be honest: Do you plant the seeds of your own anxiety?

It’s a waste of time to get lost in a labyrinth of your own making.

Instead, direct your energies to the reality you’re facing and take one step at a time.

(10) Hard work and perseverance. Some people frown whenever they hear these words.

You may be wondering, “What purpose do they serve?” They serve your own.

When we work hard with our head, heart, and body, we cannot help but grow stronger. We become better equipped to respond to life with a supple mind.

(11) SKILLFULLY DETACH. “Pay no attention” is also Buddhist wisdom.

(12) To live freely, we must acquire an unfettered mind.

(13) And when it’s time to make the final adjustments, it’s best to do it alone.

Decisiveness is about having the ability to trust in yourself.

(14) BE HERE NOW. The you of a moment ago is the past you. What is important is this day, this hour, this moment.

(15) BE GRATEFUL FOR EVERY DAY, EVEN THE MOST ORDINARY.

The happiness to be found in the unremarkable.

(16) The uncertainty of tomorrow makes it all the more important to live in the moment. One must try one’s best to enjoy the present.

(17) Let us make today and every precious day a good day.

(18) By simply recognizing that we are fulfilled, our suffering is greatly diminished.

If you find yourself swept up in feelings of dissatisfaction, take a step back and examine what you hope for and desire. And then ask yourself, “Is that something I truly need?”

(19) By the same token, do not place a value judgment on what you are doing in the moment. Take, for example, breathing: You cannot deem your breathing to be good or bad. Just as you draw one breath after another, perform the routine habitually. Attempting to define things as good or bad breeds worry and stress.

(20) We cannot change what happens in life, but it is within our power to decide how to deal with what happens.

It’s about preparing yourself. That is, it’s about accepting reality for what it is.

Seeing things as they are. Accepting things as they are.

This might sound like giving up, but in fact it is quite the opposite.

(21) Everything will be all right. You’ve made it this far already, haven’t you?

(22) CHERISH BEING ALIVE, EVERY SINGLE DAY. Life really does go by in the blink of an eye.

(23) Come now, open your eyes.

What kind of day should we make today?

(24) PUT YOUR EVERYTHING INTO THE HERE AND NOW.

Life is a long but brief practice.

(25) MAKE EVERY PREPARATION.

Destiny comes for all of us. The winds of destiny blow for all of us. Whether you are able to make the most of an opportunity will depend upon long-standing dedication and preparedness.

(26) We are born into this world, and then we die. These are simply two sides of the same experience. In other words, just as we contemplate how to live, we should contemplate how to die.

(27) MAKE THE MOST OF LIFE.

Life is a precious thing, for our safekeeping.

(28) But Buddhism teaches that a life’s worth is not measured by its duration.

What is important is how we use the life we are given.

How will you use your life today?

4 notes

·

View notes

Text

What is Yield Farming in Crypto.

Welcome to whiteboard programming, where we simplify programming with easy-to-understand whiteboard videos and today I’ll be sharing with you what is yield farming in crypto and how is it different from crypto staking. So let’s get started! Well, Yield farming is also known as liquidity mining and is the method of depositing cryptocurrencies into DeFi protocols in order to gain return for rewards which are generally paid in crypto. Examples of this include Compound and Uniswap. Depositing crypto into DeFi pools is known as providing liquidity, making you a liquidity provider.

Further, to help you better understand what is yield farming let’s first get familiar with a few important terminologies:

1. Yield: On its own, the word yield means to produce. For instance, a carrot plant yields carrots at harvest time. In the context of yield farming, the crypto you deposit into DeFi protocols yields a return paid in more crypto.

2. Farming: So, the pools and protocols wherein you provide liquidity are a lot like farms. You plant your seeds (i.e. provide liquidity), then let them grow over time into fruit-bearing plants (which proportionally means allowing your deposited crypto assets time to generate yields or profits).

3. Liquidity: DeFi protocols like Uniswap, Sushi, and Compound are decentralized exchanges that depend on having crypto assets on hand for people buying and selling or borrowing and lending crypto from one another. Liquidity refers to having those assets on hand. The more liquidity a DeFi protocol has, the better price discovery and overall experience it can offer its users.

4. Mining: In the DeFi world, mining has a similar meaning to farming. In relation, it is used when you provide liquidity to earn rewards in the protocols native token (for eg, if you earn COMP by depositing USDC on Compound), you are mining COMP tokens by providing another token the protocol needs (which in this case is USDC).

5. liquidity pool: It’s basically a smart contract that contains funds. As in return for providing liquidity to the pool, Liquidity Providers get a reward, these incentives can be a percentage of transaction fees generated by the underlying DeFi platform, interest from lenders or a governance token

6.Total Value Locked (or TVL): In some sense, TVL is the aggregate liquidity in liquidity pools. It’s a useful index to measure the health of the DeFi and yield farming market as a whole… also, it’s an effective metric to compare the market share of different DeFi protocols. A good place to track TVL is Defi Pulse. You can check which platforms have the highest amount of ETH or other crypto assets locked in DeFi.

This can give you a general idea about the current state of yield farming. Naturally, the more value is locked, the more yield farming may be going on. It’s worth noting that you can measure TVL in ETH, USD, or even BTC wherein each will give you a different outlook for the state of the DeFi money markets. Also, do note that Yield farming is typically done using ERC-20 tokens on Ethereum, and the rewards are usually also a type of ERC-20 token. Further, As long as the yield farming process is active, users will accumulate rewards.

From the perspective of defi platforms and applications, the main objective of yield Farming is to attract liquidity by rewarding investors who are willing to lend their assets. The platform can redistribute those crypto assets to customers who are interested in using their products and services. In the end, a portion of the fees gained from user transactions is used to repay yield Farmers. Since Defi is decentralised, services like yield farming are automated via smart contracts, which means that there’s almost no risk of losing your assets since developers cannot manually steal your crypto or transfer them without your permission.

Next, let’s discuss How does yield farming works? The concept of Yield farming is closely related to a model called automated market maker (or AMM) and typically involves liquidity providers (LPs) and liquidity pools. Let’s see how it works. Liquidity providers deposit funds into a liquidity pool. This pool powers a marketplace where users can lend, borrow, or exchange tokens. The usage of these platforms incurs fees, which are then paid out to liquidity providers according to their share of the liquidity pool. This is the foundation of how an AMM works.

Here, the rules of distribution will all depend on the unique implementation of the protocol. The bottom line is that liquidity providers get a return based on the amount of liquidity they are providing to the pool. Here, the funds deposited are commonly stablecoins pegged to the USD though this isn’t a general requirement. Some of the most common stablecoins used in DeFi are DAI, USDT, USDC, BUSD, and a few others.

Some protocols will mint tokens that represent your deposited coins in the system. For example, if you deposit DAI into Compound, you’ll get DAI or Compound DAI. Similarly, if you deposit ETH to Compound, you’ll get ETH, or compound ether. As you can imagine, there can be many layers of complexity to this. You could deposit your DAI to another protocol that mints the third token to represent your DAI that represents your DAI. And so on, and so on. Like this, these chains can become really complex and hard to follow but yes, if you do it well, you are sure to earn decent profits.

This boils us down to our next question, How are yield farming returns calculated? Typically, the estimated yield farming returns are calculated annualized. This estimates the returns that you could expect over the course of a year. Some commonly used metrics are Annual Percentage Rate (APR) and Annual Percentage Yield (APY). The difference between them is that APR doesn’t take into account the effect of compounding, while APY does. Compounding, in this case, means directly reinvesting profits to generate more returns.

It’s also worth keeping in mind that these are only estimations and projections and in some cases, even short-term rewards are quite difficult to estimate accurately. Why? Yield farming is a highly competitive and fast-paced market, and the rewards can fluctuate rapidly. If a yield farming strategy works for a while, many farmers will jump on the opportunity, and it may stop yielding high returns. Lastly, the exact reward amount is determined by calculating metrics like Annual Percentage Rate (APR) or Annual Percentage Yield (APY) and interest rate that changes along with the pool’s activity and token value.

Due to this fast pace of DeFi, weekly or even daily estimated returns may make more sense than long-term ones. Seems promising, right? Well, it is, but, there are still yield farming risks involved, and they primarily stem from poor smart contract coding practices. If a project isn’t audited or if a team member unintentionally creates an exploitable smart contract, anyone with sufficient technical knowledge can steal your funds. For example, a lending protocol might use its user funds to fund flash loan services and if this flash loan smart contract has an exploitable attack, John, a hacker, can effectively create loans and not repay them.

Millions of dollars can be drained from liquidity pools within minutes. And unless a developer notices the exploit early on, the team will be unable to recover funds, which may result in losing assets that a yield farmer provided initially.

And if you are planning to venture into this, do note that all Yield farmers are constantly exposed to this form of risk. Next, you should also know about something called Impermanent loss, it is another risk unique for yield farming, but in this case, the risk isn’t tied to security, but instead, Impermanent loss occurs when a cryptocurrency suddenly experiences a gigantic spike in volatility.

Here, if the asset rises in value, the yield farmer would have made more money by simply holding the token. Likewise, the loss is also suffered if an investment declines in value because the yield rate is not high enough to offset the losses. You can understand impermanent loss as very similar to the concept of opportunity cost. And although yield farming generates passive income, users who farm must always think about whether it’s a better idea to sell the asset or store it to speculate profitability.

Next, let’s discuss What is collateralization in DeFi? Typically, if you’re borrowing assets, you need to put up collateral to cover your loan. This essentially acts as insurance for your loan. How is this relevant? Well, this depends on what protocol you’re supplying your funds to, but you may need to keep a close eye on your collateralization ratio as well. Because if your collateral’s value falls below the threshold required by the protocol, your collateral may be liquidated on the open market. But hey! What can you do to avoid liquidation? Well, one thing that can be done is to add more collateral.

To reiterate this, each platform will have its own set of rules for this, i.e., its own required collateralization ratio. In addition, the complete concept commonly works with a notion of over-collateralization. This means that borrowers have to deposit more value than they want to borrow. Why? To reduce the risk of violent market crashes liquidating a large amount of collateral in the system. So now, let’s say that the lending protocol you’re using requires a collateralization ratio of 200%. This means that for every 100 USD of value you put in, you can borrow 50 USD.

However, it’s usually safer to add more collateral than required to reduce liquidation risk even more. With that said, many systems will use very high collateralization ratios (which go as high as 750%) to keep the entire platform relatively safe from liquidation risk. Further, some of the most popular Yield farming platforms and protocols that yield farmers use include Compound Finance, MakerDAO, Synthetix, Aave, Uniswap, and Yearn. Finance lastly, let’s discuss the difference between staking and yield farming, Fundamentally, crypto staking involves a validator who locks up their coins in a network and wait to be randomly selected by the Proof of stake (PoS) protocol at specific intervals to create a block.

So, when yield farming and staking are compared side-by-side, staking usually involves investing a good amount of crypto on the network to boost the chances of being selected as the next block validator. And depending on the coin’s maturity, it can take up to a couple of days before the staking rewards come by for collection.

In contrast, yield farmers move the digital assets more actively from time to time to earn new governance tokens or smaller transaction fees. Unlike staking, yield farmers can deposit multiple coins into liquidity pools across several protocols. For example, yield farmers can deposit ETH (Ether) to Compound to mint cETH (Compound Ether), then consecutively deposit it into one to another protocol that mints third and fourth tokens.

So, you can say that compared to staking, yield farming is more complex, and the chains can be hard to follow. And though yield farming has a higher return rate, it is also risker. With that, I hope this video was helpful to you and served value, if you love my content, feel free to smash that like button and if you haven’t already subscribed to my channel, please do as it keeps me motivated and helps me create more content like this for you.

Read More: Daily Defi: REEF, KAVA, INJ Crypto News July 2021

The post What is Yield Farming in Crypto. appeared first on Crypto Coin Guides.

via What is Yield Farming in Crypto.

0 notes

Photo

The Magic Pill

Third day that we are getting after it in this new year. Maybe some did start on the 1st, but we got to it on the 4th. Enjoyed a few more days of indulgence and slow down before starting anew. And yes, this is another day we are looking at the whole change topic. As I just wrote that last sentence, I was reminded of this saying….

“If it ain’t broke, don’t fix it.”

There are certainly cases where that is true. Some of us change for the sake of change and I guess that may not necessarily be a bad thing. Keeps you on your toes. Keeps you moving and keeps things different. Other times consistency is important, and routine is good too. The quote above, first thing that comes to mind for me is my marriage. Do we have challenges and is it work? Absolutely but it ain’t broke and we are not looking to fix it. There are components that we are definitely looking to change; maybe we can even say fix, but it is all for good and for us to better, both as partners and as individuals.

Whatever our new commitments for 2021 may be, who you may be looking to become or where you may want to go personally, professionally, health, financial, relationships, etc. – IT ALL TAKES WORK! True work. Hard work.

These thoughts were inspired by quote I read by a mentor of mine, Lucas Jadin @ Train 2B Clutch.

“We don’t have a magic token that takes it away.” – Lucas Jadin

This is from three years ago when we were having monthly mentoring sessions. A couple of weeks ago, in reviewing my journals, I came across it and wrote it down in my notes to revisit. Considering we have been talking change the last few days and it is the new year, good timing……or maybe you are sick of this topic 😊…. don’t be afraid of change 😊. Robin and I have been really digging into this as we start our new commitments. Just last night we were discussing meals and nutrition and taking it one meal at a time. That is funny, I am picturing Tom Brady and other NFL players saying, “we are just taking it one game at a time.” But it is a true thought process. We get caught up looking at the long run and the end result. Well, with our new commitments we don’t have an end result. Sure, there are things we want to see happen and changes we want to experience throughout this year. However, if there is one thing, we learned in 2020, this life is full of uncertainty. Looking back, sure this pandemic has made us much more aware of that, but uncertainty has always been here and always will. So, taking each day, each moment, each meal as it is right in front of us is the mindset we are working on. It is a practice. When we get to the end of this year we can evaluate and reflect on the progress we made. Because it is ALL about the progress.

This goes back to Lucas’ quote, there is no magic pill. Even after the year we had we still want this quick fix. We want to be able to snap our fingers for all the pain to go away, for the job to be there, for the money to show up. It takes a lot of work, damn hard work, to make a change. It is not easy and much of what we are discussing here creates that work AND, most of the time that work is what we are doing/saying in between our ears. Looking at the long game or thinking about the quick fix are two topics that can prevent us from getting started or stop us during the journey. We have the tendency to think about 3, 6, 12 months from now and how long we are going to have to continue with these new commitments….”do I want to work this hard at this for that long?” – We may quit. After two weeks on the new exercise program and new eating habits we don’t see any major progress or change….” this isn’t working might as well just go back to my old way.” – We give up trying. I speak this because I’ve battled it and continue to do so in areas of my life.

Maybe I sound like I am contradicting myself? Possibly but I think patience has a lot to do with this. I also believe forgiveness plays into it and compassion for ourselves. As for patience, if we are starting something new and are constantly evaluating ourselves daily, weekly, monthly – may be too much. Also, great to look at your progress but those eval periods need to be in perspective with the level of change and commitment you are now taking on. For example, if you are looking to be able to run 5 miles in 6 months but just started walking around the block on day 1, judging yourself for not being able to run a mile after 3 weeks…. you are being too hard on yourself. Be patient, the progress will get there. Taking that same example, you may be making great progress and after 30 days you are up to a mile run now. However, other commitments or priorities took precedent and you had to make some adjustments, not being able to work on running for 2 weeks. That following time out you may not be able to run the full mile. That is okay, forgive yourself because you had pivot, other things came up. Stay committed, keep showing up, and stay consistent. Look at the progress you’ve made since day one and keep going. Compassion – 4 months in and you are up to 3 miles running and you are feeling fantastic with the progress, but your attention is now switch to another endeavor. Running 5 miles in that 6 months is no longer the top focus or, maybe you get injured and have to step back. Love yourself for the great progress you made and the better person you became by going on this journey. Now, you just have to focus your attention to this new journey that is taking your interest. Maybe time to revisit the running later – love yourself for that and when that time comes.

This is all within our control, this whole change, adjustment thing. We have the power to do it and be it. I know so many times that space between my two ears gets in my way. That is my constant battle and biggest nemesis, my mind. How I talk to myself, how I am listening to myself, and what I am saying. I had this quote that I put out several months ago and I forgot who said it but I will end with it…….

“Don’t say dumb shit out loud.” – I forgot….

Get rid of the dumb shit and listen to the great stuff we have inside of us all.

0 notes

Text

Analysis: There’s Likely Only $3.5b Locked in Ethereum DeFi, Not $6b

When analysts try and gauge the success of Ethereum’s decentralized finance projects, they often look to the “total value locked” metric.

Just today, the metric, up around 1,000% since the start of 2020, surpassed $6 billion for the first time ever. Many Ethereum bulls hailed the achievement of this milestone as a testament to the success of ETH and its applications.

But according to a new analysis by an Ethereum-focused investor and developer, the $6 billion figure is a misnomer. Here’s why.

Related Reading: Crypto Tidbits: MicroStrategy’s $250m Bitcoin Purchase, Ethereum DeFi Boom, BitMEX KYC

There May Only Be $3.5 Billion Locked in Ethereum’s DeFi Space

According to an analysis by Damir Bandalo, a founder of Encode Club and an investor through a number of investor collaboratives, there isn’t $6 billion locked in DeFi.

The issue, he explained, is that the data tracker that exist report values that are counted more than once.

“As we know DeFi is all about composability but that makes it hard to accurately count how much money is truly locked in the system. It gets very easy to count the same $ multiple times. Let me give an example: Let’s say you deposit ETH into @MakerDAO and mint DAI. Take that DAI and go to @CurveFinance and put it into ycurve. Your $ can actually be counted 5 times.”

By his calculations, which were accomplished by removing the double-counting errors, he found that there’s only $3.5 billion worth of value locked in DeFi.

A lot of talk these days around the total value locked in DeFI.

However all of them count the same $ many times.

So I did my own calc to find out how much is actually locked in top 15 DeFi protocols.

Answer: $3.5bil. (compared to $6.7bil on @defipulse)

cc @devops199fan

1/n

— Damir Bandalo (@damirbandalo) August 16, 2020

Related Reading: Is Bitcoin Really In a Bull Market? Here’s Why Analysts Think BTC Isn’t

It’s a Metric Still Growing

Ethereum’s DeFi space is still growing and set to grow even further, though, according to analysts.

Andrew Kang, the founder of Mechanism Capital, released a Twitter thread on the matter at the start of July. It suggests that due to development, market, and other trends, DeFi is just starting.

With recent DeFi token price run-ups, people have been crying "bubble!".

So is it too late to invest or not?

Here are my thoughts on where we are in the state of the DeFi market from an "inside perspective" pic.twitter.com/cDAhpc9tVN

— Andrew Kang (@Rewkang) July 1, 2020

It’s important to note that this growth may eventually come to an end.

Jacob Franek, a co-founder of blockchain data firm Coin Metrics, commented that high transaction fees will be a damper on growth:

“Gas prices will put a hard cap on this DeFi bull run. To be expected and probably a good thing… High gas likely new normal…Not yet just saying it places a natural hard cap on how far this can run. Traders will only pay that much if they’re perfoming significantly well”

There have also been some fears that the incentives being provided by DeFi protocols for growth are inherently not sustainable.

Related Reading: Crypto Tidbits: Goldman Stablecoin, Dave Portnoy Wants Bitcoin, DeFi Boom

Photo by Pepi Stojanovski on Unsplash Price tags: ethusd, ethbtc Charts from TradingView.com Analysis: There's Likely Only $3.5b Locked in Ethereum DeFi, Not $6b

from Cryptocracken Tumblr https://ift.tt/2E6JLPq

via IFTTT

0 notes

Text

Analysis: There’s Likely Only $3.5b Locked in Ethereum DeFi, Not $6b

When analysts try and gauge the success of Ethereum’s decentralized finance projects, they often look to the “total value locked” metric.

Just today, the metric, up around 1,000% since the start of 2020, surpassed $6 billion for the first time ever. Many Ethereum bulls hailed the achievement of this milestone as a testament to the success of ETH and its applications.

But according to a new analysis by an Ethereum-focused investor and developer, the $6 billion figure is a misnomer. Here’s why.

Related Reading: Crypto Tidbits: MicroStrategy’s $250m Bitcoin Purchase, Ethereum DeFi Boom, BitMEX KYC

There May Only Be $3.5 Billion Locked in Ethereum’s DeFi Space

According to an analysis by Damir Bandalo, a founder of Encode Club and an investor through a number of investor collaboratives, there isn’t $6 billion locked in DeFi.

The issue, he explained, is that the data tracker that exist report values that are counted more than once.

“As we know DeFi is all about composability but that makes it hard to accurately count how much money is truly locked in the system. It gets very easy to count the same $ multiple times. Let me give an example: Let’s say you deposit ETH into @MakerDAO and mint DAI. Take that DAI and go to @CurveFinance and put it into ycurve. Your $ can actually be counted 5 times.”

By his calculations, which were accomplished by removing the double-counting errors, he found that there’s only $3.5 billion worth of value locked in DeFi.

A lot of talk these days around the total value locked in DeFI.

However all of them count the same $ many times.

So I did my own calc to find out how much is actually locked in top 15 DeFi protocols.

Answer: $3.5bil. (compared to $6.7bil on @defipulse)

cc @devops199fan

1/n

— Damir Bandalo (@damirbandalo) August 16, 2020

Related Reading: Is Bitcoin Really In a Bull Market? Here’s Why Analysts Think BTC Isn’t

It’s a Metric Still Growing

Ethereum’s DeFi space is still growing and set to grow even further, though, according to analysts.

Andrew Kang, the founder of Mechanism Capital, released a Twitter thread on the matter at the start of July. It suggests that due to development, market, and other trends, DeFi is just starting.

With recent DeFi token price run-ups, people have been crying "bubble!".

So is it too late to invest or not?

Here are my thoughts on where we are in the state of the DeFi market from an "inside perspective" pic.twitter.com/cDAhpc9tVN

— Andrew Kang (@Rewkang) July 1, 2020

It’s important to note that this growth may eventually come to an end.

Jacob Franek, a co-founder of blockchain data firm Coin Metrics, commented that high transaction fees will be a damper on growth:

“Gas prices will put a hard cap on this DeFi bull run. To be expected and probably a good thing… High gas likely new normal…Not yet just saying it places a natural hard cap on how far this can run. Traders will only pay that much if they’re perfoming significantly well”

There have also been some fears that the incentives being provided by DeFi protocols for growth are inherently not sustainable.

Related Reading: Crypto Tidbits: Goldman Stablecoin, Dave Portnoy Wants Bitcoin, DeFi Boom

Photo by Pepi Stojanovski on Unsplash Price tags: ethusd, ethbtc Charts from TradingView.com Analysis: There's Likely Only $3.5b Locked in Ethereum DeFi, Not $6b

from CryptoCracken SMFeed https://ift.tt/2E6JLPq

via IFTTT

0 notes

Text

Analysis: There’s Likely Only $3.5b Locked in Ethereum DeFi, Not $6b

When analysts try and gauge the success of Ethereum’s decentralized finance projects, they often look to the “total value locked” metric.

Just today, the metric, up around 1,000% since the start of 2020, surpassed $6 billion for the first time ever. Many Ethereum bulls hailed the achievement of this milestone as a testament to the success of ETH and its applications.

But according to a new analysis by an Ethereum-focused investor and developer, the $6 billion figure is a misnomer. Here’s why.

Related Reading: Crypto Tidbits: MicroStrategy’s $250m Bitcoin Purchase, Ethereum DeFi Boom, BitMEX KYC

There May Only Be $3.5 Billion Locked in Ethereum’s DeFi Space

According to an analysis by Damir Bandalo, a founder of Encode Club and an investor through a number of investor collaboratives, there isn’t $6 billion locked in DeFi.

The issue, he explained, is that the data tracker that exist report values that are counted more than once.

“As we know DeFi is all about composability but that makes it hard to accurately count how much money is truly locked in the system. It gets very easy to count the same $ multiple times. Let me give an example: Let’s say you deposit ETH into @MakerDAO and mint DAI. Take that DAI and go to @CurveFinance and put it into ycurve. Your $ can actually be counted 5 times.”

By his calculations, which were accomplished by removing the double-counting errors, he found that there’s only $3.5 billion worth of value locked in DeFi.

A lot of talk these days around the total value locked in DeFI.

However all of them count the same $ many times.

So I did my own calc to find out how much is actually locked in top 15 DeFi protocols.

Answer: $3.5bil. (compared to $6.7bil on @defipulse)

cc @devops199fan

1/n

— Damir Bandalo (@damirbandalo) August 16, 2020

Related Reading: Is Bitcoin Really In a Bull Market? Here’s Why Analysts Think BTC Isn’t

It’s a Metric Still Growing

Ethereum’s DeFi space is still growing and set to grow even further, though, according to analysts.

Andrew Kang, the founder of Mechanism Capital, released a Twitter thread on the matter at the start of July. It suggests that due to development, market, and other trends, DeFi is just starting.

With recent DeFi token price run-ups, people have been crying "bubble!".

So is it too late to invest or not?

Here are my thoughts on where we are in the state of the DeFi market from an "inside perspective" pic.twitter.com/cDAhpc9tVN

— Andrew Kang (@Rewkang) July 1, 2020

It’s important to note that this growth may eventually come to an end.

Jacob Franek, a co-founder of blockchain data firm Coin Metrics, commented that high transaction fees will be a damper on growth:

“Gas prices will put a hard cap on this DeFi bull run. To be expected and probably a good thing… High gas likely new normal…Not yet just saying it places a natural hard cap on how far this can run. Traders will only pay that much if they’re perfoming significantly well”

There have also been some fears that the incentives being provided by DeFi protocols for growth are inherently not sustainable.

Related Reading: Crypto Tidbits: Goldman Stablecoin, Dave Portnoy Wants Bitcoin, DeFi Boom

Photo by Pepi Stojanovski on Unsplash Price tags: ethusd, ethbtc Charts from TradingView.com Analysis: There's Likely Only $3.5b Locked in Ethereum DeFi, Not $6b

from Cryptocracken WP https://ift.tt/2E6JLPq

via IFTTT

0 notes

Photo

New Post has been published on http://cryptonewsuniverse.com/free-cryptocurrency-complete-guide-to-earning-free-crypto/

Free Cryptocurrency: Complete Guide to Earning Free Crypto

Free Cryptocurrency: Complete Guide to Earning Free Crypto

This article will cover the main methods that can be leveraged in order to obtain free crypto coins & tokens

The last couple of years have marked an increase in the overall public awareness of cryptocurrencies worldwide.

In return, a larger number of people have expressed their interest in purchasing or earning digital currencies. While buying your favorite coin via an exchange is likely the easiest way to enter the cryptocurrency market, this industry is full of surprises – therefore a noticeable amount of coin can be earned for free. As such, this article will cover the main methods that can be leveraged in order to obtain free crypto. Do keep in mind that most of these methods require a bit of effort, since nothing is ever truly free. However, these methods do not entail having to work a fulltime job, nor do they imply any monetary investment from your part.

Free Crypto from Coinbase Earn

Coinbase is largely seen as one of the most popular digital currency exchanges, especially in the United States. While the platform facilitates the purchase and sale of crypto, it also offers its users the opportunity to earn several coins, including but not limited to Orchid, Tezos, Dai, EOS, Stellar, Zcash, Basic Attention Token and Ox.Free crypto at Coinbase Earn.

For example, at the moment you can earn the following cryptos for free:

Orchid: users can earn up to $52 OXT by completing a free course meant to teach you the basics of this privacy-focused coin;

Tezos: completing a course on Tezos and learning about its openness, safety or upgradability will earn you $6 XTZ;

Dai: a similar course-based offer is available for Dai as well, thus granting course participants $20 DAI;

EOS: you can earn up to $50 EOS by completing a course on this coin, and learning more about its goal of facilitating the development of blockchain-based apps;

Stellar Lumens: the completion of a quick course on how Stellar connects payment systems, banks and individuals will earn you $50 XLM;

Zcash: this coin is known for its privacy-focused philosophy – course completion will grant you an undisclosed amount of ZEC tokens;

Basic Attention Token: $8-worth of BAT can be earned by reading on BAT’s vision of fixing the web;

0x: last but not least, educating yourself on OX’s token-based idea of the future web will award you several ZRX tokens.

Do keep in mind that there is a catch to these courses. You must be the holder of a Coinbase exchange account, where all tokens will be credited.

Earning Free Crypto via Airdrops

Airdrops are one of the simplest and most effective methods of earning extra cryptocurrency, especially in the form of newly-announced tokens. The idea behind airdrops is quite simple – innovative and newly-launched projects choose to hold airdrops as an effective marketing strategy, meant to pique the interest of the cryptocurrency community. Participating in an airdrop is bound to be quite simple. It entails owning an active Ethereum wallet that is ERC-20 compatible, an email address, Telegram account, and in some cases, a Twitter account. Once these criteria are met, you will have to look for Initial Coin Offerings (ICOs), Security Token Offerings (STOs), and token-based start-ups that have announced an upcoming airdrop.

Most of these platforms will require you to sign-up, by entering your ERC-20 address and email. For marketing purposes, some airdrops may require you to follow them on Twitter, or join the Telegram chat group. This ensures that you’re kept in the loop and quickly become aware of news concerning the token. Recently, KYC&AML regulations have made it mandatory for numerous airdrops to request identifying details. This is due to the money laundering potential associated with these events. Therefore, if you’re keen on protecting your online privacy, airdrops might not be the best choice for you. Recently, numerous wallet providers such as Blockchain.com have started sponsoring airdrops.In other words, you are announced whenever a partner start-up is holding an airdrop of their new tokens, and can earn the tokens directly in your wallet. Similarly, there are numerous websites which scour the web looking for new airdrop events. Following will help ensure that you will be one of the first people to know about upcoming airdrops.

Leveraging Bounties for Free Coin

Bounties are quite similar to airdrops, in the sense that they represent free coins given away by crypto project developers. There’s one key difference, however – bounties generally imply that you do some type of work in exchange for the coin. With this in mind, here are the main types of bounties, alongside a quick description for each:

Bug bounties

Bug bounty campaigns are generally well-paid, yet they are only relevant to people who hold development skills. Programmers throughout the world actively attempt to crack the code of online platforms, while also testing for potential bugs. As such, crypto and blockchain-based companies may hold bounty campaigns, where developers analyse platform functionality and report any bugs. Over the last couple of years, there have been numerous instances in which white-hat hackers discovered vulnerabilities or significant bugs in web platforms. In return for this service, and based on the severity of the vulnerability discovered, companies can offer tens of thousands of dollars as compensation.

Signature campaigns

This marketing strategy is often implemented on forums such as Bitcointalk. In exchange for a monthly bounty, forum users add a specific signature, thus indirectly promoting the products and services of a crypto company. Most businesses holding signature campaigns require forum users to have a higher membership level, which can be obtained through frequent high-quality posts. In return for buying the signature space, companies offer a monthly bounty in tokens.

Translations

Crypto start-ups are always interested in having their content translated into multiple languages. Since many start-ups run on a limited budget, a good method to go about this is to launch a translation bounty. Here, native users translate specific portions of text, in exchange for a number of tokens.

Social media, images, blog posts and video bounties

Last but not least, we also have other promotional bounties. Some companies may ask you to write and post a positive article on their services, whereas others may require you to edit videos, share posts on social media, or create promotional images. Based on these aspects, bounties do, in fact, represent a method of earning free tokens, yet they imply actual work. Luckily, the work is generally quite easy (apart from bug bounties), and can be completed rather quickly.

The Earning Potential of Affiliate Marketing and Referrals

At this point in time, most experts define affiliate marketing as the process associated with promoting products and services of various companies, in exchange for a commission on each sale. A recent research study concluded that US-based affiliate spending may reach $6.8 billion by the end of 2020. As such, affiliate marketing represents a significant revenue stream for numerous companies, especially those which operate in the online ecosystem. Therefore, it only makes sense that numerous crypto and blockchain-related businesses have launched their very own affiliate marketing campaigns. Getting involved is bound to be simple – in most instances, you need an account, and a personalized link, which can be shared across the web.

Any service or product that is purchased using your affiliate link or referral code will be credited with a percentage of the sale. Affiliate marketing can earn you free cryptocurrency as long as you are active online. This implies sharing the link as part of valuable content on a variety of platforms, such as crypto discussion forums, Reddit, YouTube, Facebook, Twitter, Instagram, or your personal blog. The possibilities are endless. Your success depends directly on the size of your audience and your overall online reach. However, this means that actual work needs to be carried out in order to get this free crypto. On the other hand, once your links are live, affiliate marketing becomes a lucrative source of passive income, which can be leveraged for a prolonged period of time.

To put things into perspective, here are several crypto-related affiliate campaigns:

Coinbase: if new users sign up using your personalized affiliate link, you are eligible to obtain 50% of the fees charged by the exchange platform for all transactions;

TREZOR: this platform offers 10% of net sales carried out by users who have signed up using your referral;

Ledger: this affiliate program promises to credit 12% – 15% of all sales;

LocalBitcoins: you can expect to earn 20% of the trading fee associated with each transaction that is carried out by referred users;

Binance: this exchange platform offers 20%-40% commissions on transaction fees.

Do keep in mind the fact that these conditions may be modified unilaterally by the website. Therefore, it is always recommended that you carry out your due diligence, and carefully research the affiliate marketing conditions associated with each of the examples given above. Additionally, note that this list isn’t exhaustive – in fact, there are hundreds of crypto-related affiliate opportunities on the market at this moment. It certainly isn’t unusual for affiliate marketing to become a main income stream, especially if done right. People have reported earning hundreds of thousands of dollars monthly using affiliate marketing strategies. Given the fact that we are referring to the digital currency market, your income potential is further increased by crypto price volatility. However, this entails that you treat it as a fulltime job until enough of your links are published on the web.

Other Free Crypto Offers

A quick search will likely unveil numerous other free cryptocurrency sources. Here are a few examples that we consider relevant:

Crypto.com

This crypto debit card company has launched a cash-back system that allows users to earn tokens on each purchase you make. Values vary between 1% and 5%, yet users can also expect several offers on third-party platforms such as Netflix, Spotify, Expedia or Airbnb;

Celsius Network

This lending platform allows users to deposit cryptocurrency, and earn an interest as other users borrow it. It advertises itself as a safe method of earning passive income by using your existing coins;

Wirex

Yet another digital currency card company, Wirex advertises a 0.5% bitcoin-based cashback scheme on all purchases made via the card.

Cryptocurrency gambling

Cryptocurrency gambling can also act as a method for earning free coins, yet extra care should be practiced if you decide to wager your coins. Do keep in mind that most casinos offer crypto faucets, which give out an amount of free coin every time they are clicked on (they are programmed against abuse, however, and serve as a method of encouraging users to keep on playing). If you do decide to try your luck at a casino, make sure that you choose a platform that relies on a provably-fair protocol. Otherwise, you may expose yourself to rigged games that are bound to steal your hard-earned crypto.

Keep an Eye Out for Scams

Over the last couple of years, the popularity of the cryptocurrency market has increased exponentially. The rise in public awareness was mostly fuelled by intense volatility, and record-breaking prices. With this in mind, the market is still seen as a way to get rich quickly. While there is significant money-making potential in crypto, this perception has led to the appearance of numerous scams, meant to fraud people out of their money. Whenever dealing in crypto, there are two aspects worth keeping in mind: if an offer sounds too good to be true, it probably is. Also, you should never risk more than you can afford to lose. Cybersecurity practices dictate that it’s best to always carry out in-depth research on any platform or service that you decide to use. Similarly, you should never give out your personal details or private keys to third parties. Protection against scams and other forms of fraudulent activity is basically non-existent, whereas transactions are irreversible, therefore due diligence is essential.

The Bottom Line

Based on everything that has been highlighted in this guide, most people are only a few clicks away from earning free cryptocurrency. There are hundreds, if not thousands of offers that you can take advantage of, while most imply an insignificant amount of work. On the other hand, those who are serious about creating a crypto-based income stream will be happy to know that affiliate marketing and bug bounty hunting are highly-lucrative passive income streams.

Article Produced By

Daniel Dob

Daniel Dob is a freelance writer, trader, and digital currency journalist, with over 7 years of writing experience. His main niches are cryptocurrencies, business, fintech, internet marketing, and finance. When he's not writing, you can find him reading, traveling, or taking one of his hobbies to the next level.

https://blockonomi.com/free-cryptocurrency/

0 notes

Text

LVLSRVRYHI-050: The Dance Pit | The Levels Are Very High

Hi Anuradha, how's it going? I usually start these things with a bit of an intro, so for anyone who doesn't know: who are you? Where are you from?

Hi! It’s 3am and I think I’m finally done answering all these questions!

My grandfather named me Anuradha, though I’m still not 100% sure on how to “correctly” pronounce my name. I was born in Bangladesh, a year before Maluma. My star sign is a Capricorn and I’ve been living in the South Bronx for the past 21 years.

What are some of your early musical memories?

I remember hearing Usher's Confessions album everywhere in 2004; Burn, Confessions Part II, and Yeah on rotation. That and Gasolina. That’s when I remember paying attention to music more (I think I’ve blocked most memories of MTV’s TRL out of my head), and then came the emo phase of ’07.

I also remember, though this isn't particularly musical, enjoying the Spice Girls lollipops that came with the stickers which is earlier in memory.

Whilst you run parties and a mix series as The Dance Pit, my first introduction to you was through (I think) the second issue of your zine Club Etiquette and then I kind of worked backwards from there. What first pushed you towards organising a zine? How did the specific idea for Club Etiquette come about?

Mungo asked me if there were any parties he could play when he came over in 2015. I told him if I couldn’t find any, I’d put one on, which I decided to anyway.

At the same time, I was going to the club pretty regularly and would see the same people and we would always talk about what annoyed us, both on large and small scales, so thought a guideline would be handy, to be more conscientious of one’s surroundings and others. My school radio station (shouts to WBAR!) used to create zines, so thought that would be the most direct (least-bureaucratic) method. Since it was a guideline on “club etiquette,” that’s just what I decided to call it, although I still think the name sounds a bit bougie and will probably change it at some point.

My background is in activist theatre, so I was taught that anything I take on has to have a greater social purpose, cause what’s the point otherwise? (Don’t @ me with “art for art’s sake” – it may be for some people, but I have no time for it when so many other narratives don’t get heard).

Whitney Wei's illustrations that adorn the covers and grow throughout the pages of Club Etiquette provide the zine with this homemade warmth that carries over even into its digital copies, something that usually gets lost in the move to screens and online spaces of discussion. Did you find that it was important for you to produce the zine with that physicality in tact?

Yes, shouts to Whitney! And Carmela Tzigana (who drew the Vol.6 cover). All cover aesthetic skills and most illustrations are credited to Whitney, who, regardless of the landscapes or deadlines I throw at her, manages to create something grounded and finely-detailed.

It makes me happy that you say that the physicality carries over (cause there is def some blood, sweat, and tears in some of those physical copies). I also really don’t like reading on computer screens, so if other people don’t mind and get past that, that’s great!

Tangibility, in a larger sense, is super important to me. Being able to cross over what’s written in the zine and enacting it in physical club spaces (or everyday life) is the reason why it was made in the first place. Theory is cool and all and part of the process, but actually putting ideas in practice is how I grow, and know what works.

A lot of Club Etiquette's material is necessarily born out of very personal and difficult experiences, but you also focus on some of the more lighthearted or even mundane aspects of club-going - 4am foodspots, hangovers, health tips, tv picks etc. I tend to find that these are the parts of the zine that fill me with the most nostalgia (for faceless nights I've mostly forgotten). What was the idea behind including them? How do you find the balance between them and the more serious aspects of each issue?

I love the mundane. I also think there’s often a glamorization of going out needing to be the “best, most peak, night” of one’s life, like having a couple of nights where things get hella turnt is chill, but for me to constantly be at that level, I couldn’t do that. My club schedule is pretty routine and focusing on how to make up for lost sleep, or what to eat after I’ve danced for five hours straight, or what I watch when I don’t go out is really necessary for my survival.