#tracxn

Explore tagged Tumblr posts

Text

Tracxn posts flat scale in FY24; profit declines 80%

Based on its financial documents, Tracxn, a well-known data and research platform, had a difficult fiscal year that ended in March 2024. The company saw a notable 80% fall in earnings during the same period, despite a little 5.9% increase in revenue over the prior fiscal year.

Revenue Growth and Sources

Tracxn’s financial records show that the company’s revenue from operations increased by 5.9%, from Rs 78.1 crore in FY23 to Rs 82.7 crore in FY24. Remarkably, Tracxn’s main revenue stream in FY24 came from selling subscriptions for software and data access.

International Market Presence

Tracxn’s revenue generation was significantly impacted by its global reach, as over 70% of its collections came from sources outside of India. The business is well-established in international markets, including those in the US, Singapore, the UK, Germany, and APAC (a region that does not include India).

Expenditure Overview

Even while revenue increased, Tracxn saw an increase in a number of different categories of expenses. Benefits for employees made up 88.3% of the total costs, which was a significant amount of the spending. The company’s overall cost growth was also influenced by costs associated with information technology, travel, legal, and depreciation.

Profit Decline and Deferred Tax Expenses

There are a number of reasons for Tracxn’s significant drop in profits, one of which is the way deferred tax expenses were set up in the prior fiscal year. As a result, earnings dropped by 80%; in FY24, the company reported earnings of Rs 6.5 crore, down from Rs 33.1 crore in FY23.

Financial Performance Analysis

The financial results of Tracxn show how difficult it is for knowledge-based companies to continue growing and remaining profitable. The corporation struggles with margin constraints and fierce rivalry for talent inside the industry, despite its substantial scale and global influence.

Market Cap and Investor Expectations

With its present market capitalization of about Rs 982 crore, Tracxn’s valuation indicates investor exuberance that has been moderated by projections of higher margins and profitability. The business’s potential for future growth and success is demonstrated by its strategic alliances and support from well-known investors as Peak XV, Accel, and Elevation Capital.

Read more: Marketing News, Advertising News, PR and Finance News, Digital News

0 notes

Text

Million Technologies Private Limited (MTPL), operating through themtpl.com, is an Indian electronics and technology company specializing in the sale of computer peripherals and consumer electronics.

Million Technologies Private Limited (MTPL), operating through themtpl.com, is an Indian electronics and technology company specializing in the sale of computer peripherals and consumer electronics. Established on September 23, 2019, and headquartered in Gurugram, Haryana, MTPL has rapidly expanded its presence in the Indian tech retail market.The Company Check

Founding and Leadership

MTPL was co-founded by Shubham Srivastava and Kiran, both of whom have been serving as directors since the company's inception. Shubham Srivastava, in particular, brings over a decade of experience in the technology sector, having been self-employed in the industry since 2012. The Company Check+1LinkedIn+1LinkedIn

Business Focus and Product Range

The company offers a diverse range of products, including:

Keyboards: Wireless, gaming, and combo sets

Mice: Wired and wireless options

Audio Devices: Headsets and other audio accessories

Webcams: For personal and professional use

Printers: Single and multi-function models

Televisions: Various models for home entertainment

MTPL emphasizes affordability, offering competitive pricing with significant discounts on various products. They provide free shipping on orders over ₹130, a 30-day money-back guarantee, 24/7 customer support, and flexible payment options.

Financial Growth and Performance

Since its establishment, MTPL has demonstrated significant financial growth. According to financial reports for the fiscal year ending March 31, 2023, the company's revenue increased by approximately 174%, and its net worth experienced a surge of nearly 70%. Tracxn+1rubbernews.com+1The Company Check

Company Registration and Contact Information

Corporate Identification Number (CIN): U72900HR2019PTC082717

Registered Address: H-127, Sushant Shopping Arcade, Sushant Lok-1, Gurugram, Haryana, 122002

Contact Number: +91 8851441698

Email: [email protected]

Official Website: themtpl.comLinkedIn+4The Company Check+4Zauba Corp+4Million Technologies Private Limited+3Million Technologies Private Limited+3The Company Check+3

Future Outlook

MTPL aims to continue its growth trajectory by expanding its product offerings and enhancing customer experience. The company is focused on leveraging technology to provide quality products at affordable prices, thereby strengthening its position in the Indian electronics market.

For more information or to explore their product range, visit their official website.

#themtpl#Indian electronics#technology company#online marketing#online shopping#online store#business#electronic

0 notes

Text

Early Access Investing: How to Find Gems in the Unlisted Market

In recent years, India’s unlisted stock market has quietly gained traction among savvy investors looking for early access to high-growth companies. For those willing to do their research, this market offers a unique chance to invest in tomorrow’s big brands before the IPO buzz.

This approach is often called Early Access Investing, and it’s all about finding promising companies while they’re still private. Let’s break down how it works, and how you can spot potential winners in the unlisted space.

Why Early Access Investing?

Getting in early allows investors to buy shares at a lower valuation before market hype drives prices up. When the company grows or goes public, the potential upside can be significant. It’s the same principle venture capitalists use, but now it’s more accessible to retail and HNI investors.

How to Find Hidden Gems

Here are some practical tips for finding promising unlisted companies:

1. Track Upcoming IPOs

If a company is preparing to go public, chances are its unlisted shares are already being traded. Keep an eye on DRHP filings (Draft Red Herring Prospectus) on SEBI’s website or financial news platforms.

2. Follow Startups & Funding News

Use platforms like YourStory, Entrackr, and Tracxn to follow high-growth startups receiving investor funding. These companies often allow early investors to exit through the unlisted market.

3. Use Trusted Platforms

Websites like UnlistedZone, Planify, and Capitallinked offer access to unlisted shares and track prices, financials, and IPO plans. These platforms also share analyst reviews and insights.

4. Look for ESOP Opportunities

This opens a door for retail investors to purchase valuable shares directly from insiders.

5. Analyze Company Fundamentals

Before investing, check for:

Revenue and profit growth

Management team experience

Market share and industry potential

IPO timeline, if any

Risks to Keep in Mind

Low liquidity: It may take time to exit your position.

Lack of regular updates: These companies aren’t required to disclose financials publicly.

Regulatory and tax complexity: Different rules apply compared to listed stocks.

So while the rewards can be high, it’s important to invest carefully and selectively.

Conclusion

With the right research, timing, and patience, you can uncover hidden gems and potentially earn significant returns.

It’s not just about chasing IPO gains it’s about being ahead of the curve.

0 notes

Text

Венчурные инвесторы Юго-Восточной Азии не хотят рисковать

New Post has been published on https://er10.kz/read/it-novosti/venchurnye-investory-jugo-vostochnoj-azii-ne-hotjat-riskovat/

Венчурные инвесторы Юго-Восточной Азии не хотят рисковать

Венчурные инвесторы в Юго-Восточной Азии становятся все более осторожными. Все чаще они стремятся вкладывать средства в зрелые прибыльные компании, отказываясь от сотрудничества с высокорисковыми технологическими стартапами.

Инвестиции венчурного капитала в технологические компании Юго-Восточной Азии сократи��ись примерно на 80% в период с 2022 по 2024 год — с около $10,1 млрд до примерно $2,2 млрд. Об этом свидетельствуют данные платформы Tracxn.

– Наблюдается массовый уход в безопасность. Многие венчурные инвесторы сейчас делают ставку на компании, которые демонстрируют прибыльность, а не потенциал быстрого роста, – отмечает соучредитель и генеральный директор маркетплейса Carro Аарон Тан.

За последние два года многие венчурные фонды начали действовать скорее как фонды прямых инвестиций, нацеливаясь на стабильную доходность. Капитал все чаще направляется в традиционные офлайн-бизнесы: логистические компании, ресторанные сети, магазины и даже фермы.

Значительная часть инвесторов считает, что наиболее конкурентоспособными оказываются бизнесы, сочетающие онлайн- и офлайн-присутствие.

Эксперты отмечают, что многие стартапы в регионе остаются убыточными, а фонды привлекли слишком много средств, не обеспечив должной отдачи своим инвесторам. К этому добавляется слабость макроэкономики в Юго-Восточной Азии.

0 notes

Text

Venture capitalists in Southeast Asia turn to offline businesses

Funding by VC investors in tech-based companies has declined by about 79% between 2022 and 2024, from around $10.1 billion to approximately $2.2 billion, according to data intelligence platform Tracxn. Koumaru | Istock | Getty Images Venture capitalists typically have a strong appetite for risk, but some investors in Southeast Asia are becoming increasingly cautious. “I think there’s a huge…

0 notes

Text

How CFA Professionals Are Shaping the Future of Fintech

The pace of evolution of finance is no longer limited to trading floors and investment banks. With digital transformation impacting every nook of the industry, the juncture of finance with technology—Fintech—has today become one of the dynamic and opportunity-rich sectors. For candidates pursuing a CFA course in Bengaluru or already having the CFA title, the fintech space opens up interesting vistas beyond the traditional domain.

From algorithmic trading to robo-advisors, blockchain platforms to digital payment ecosystems, fintech is not about the future; it is about now. Where does the CFA terrain fit into such a frenzied world?

Let's break it down.

Reasons for the Boom in Fintech

The boom in the fintech sector has been the buzzword for the last some years. In 2024, a report by Tracxn stated that the fintech ecosystem in India occupied the third position globally for funding. With innovations in digital lending, insure-tech, and blockchain infrastructure, there has probably never been a higher demand for professionals with a financial mindset and technological capabilities.

Recent developments in the industry also hint at significant collaboration between traditional banks and fintech companies. For instance, large institutions are partnering with startups to enhance customer experience using AI-driven credit scoring and risk analytics. The result? An increasing need for professionals who appreciate the granularity of finance and can grasp with pace and subtlety the nuances of technology integration.

The CFA Edge in a Fintech Role

The Chartered Financial Analyst (CFA) title is recognized worldwide for its rigor in investment analysis, portfolio management, and ethical conduct. Whilst fintech may sound very tech-oriented at first, most roles in the industry cannot do without an underlying good financial understanding, exactly what the CFA program provides.

Here is where CFA professionals can uniquely add value:

1. Strong Analytical Foundations

Fintech roles in product management, financial modeling, and algorithm development need strong analytical aptitude. CFA charterholders have the training to interpret financial data, assess for risks, and make informed decisions; these are critical traits for any fintech product team.

2. Market Insights

Market knowledge is crucial when building a trading bot or designing a robo-advisor. CFA candidates and charterholders arrive with such market insights coupled with structured knowledge about asset classes, which would render them fitting partners to data scientists and engineers.

3. Compliance and Ethics

Ethics is one of the pillars of CFA curriculum. In the fintech environment where innovation frequently glides a pace ahead of regulation, having professionals who understand the compliance framework and will enforce transparency can act as a focal safeguard against legal mishaps.

4. Client-Centric Financial Innovation

Many fintech products are B2C—apps or platforms or services designed for common person. A CFA background helps ensure that these products are not merely innovative but match real financial needs and risk profiles.

The Career Scope for CFA Professionals in the Fintech Industry

Fintech provides a variety of roles where CFA skills are not just relevant but are critical. Some of the career roles include:

Product Manager - WealthTech: Responsible for supervising the development of investment platforms or robo-advisors.

Financial Data Analyst: The focus is on working with big data teams in the build-and-improve process of financial models.

Compliance Analyst: Ensuring product and service regulatory requirements are delivered upon.

Investment Strategist - Fintech Startup: Setting algorithmic trading strategies or digital advisory tools.

Risk Manager - Digital Lending: To evaluate borrower risk with data collected from non-traditional sources while utilizing various AI models.

Up-Skilling for the Fintech Surge

While CFA programs do provide a strong financial background, supplementing the financing with some technology skills could further open doors. Most useful would be Python, SQL, data visualization, and blockchain. Many CFA candidates today are engaging in scripting basics and economic APIs as a part of their own learning.

Then comes networking. Attending fintech meetups, being active in LinkedIn communities, and looking for what is happening in the start-up world can expose candidates to live occurrences and job leads. Networking is life within the fintech space, and those who early engage build invaluable capital for their professional lives.

CFA in Fintech: Real Synergy

There is a shifting view about regions where traditional finance professionals made success in fintech. With the increasing rapidity of fintech hubs, the synergy between CFA training with modern financial innovation is now becoming crystal clear.

Major fintech players are no longer interested only in tech graduates: they are hiring individuals who can cross over from code to capital. This is where the CFA comes in: someone who can bring structure, strategy, and compliance to the creative tech-infused solutions.

Conclusion: The Future is Hybrid

Fintech disrupts the financial industry as it exists today, and the most wanted guys tomorrow will be the ones speaking both languages of finance and technology. Presidency in CFA is an excellent ground of credibility, analytical capacity, and ethics, which fintech start-ups and scale-ups need.

The change has been actuated, particularly in regions witnessing rapid emergence as talent hubs for fintech innovation. Take, for instance, the rising demand for professionals enrolling in a CFA Training Program in bengaluru, where the fintech job market is booming due to increased VC funding, tech infrastructure, and global connectivity.

In this space, CFA professionals are not merely filling places in fintech, they are actually the architects of its future. Whether you are a potential candidate or a charter holder, it is time for you to look into ways to adapt and upgrade your skills, thus maturing into this fast-paced frontier. Your next grand opportunity may not happen in a conventional firm; it might land in the next disruptive fintech idea.

0 notes

Text

0 notes

Text

Indian Tech Startup Ecosystem Sees Growth in 2024 with Six New Unicorns and Record Exits

India's technology startup ecosystem witnessed significant growth in 2024, with six new unicorns — startups valued at $1 billion or more — marking a sharp increase from just two in the previous year. These new unicorns span various sectors, including lending, logistics, software, and generative intelligence.

In terms of funding, Indian tech startups raised $11.3 billion in 2024, reflecting a 6% increase from $10.7 billion in 2023. Globally, 86 technology startups reached unicorn status this year.

However, the journey to becoming a unicorn took longer in 2024. On average, it took Indian startups 7.3 years to reach a $1 billion valuation from their Series-A funding round, compared to 4.2 years in 2023. Additionally, it required 9.2 funding rounds, up from 4.5 in the previous year, as reported by Tracxn.

2024 also saw an increase in exits, with 113 startups acquired, compared to 140 in 2023. Notably, Innoven Capital recorded a record 10 exits, followed by Peak XV Partners and 360 One, each with eight exits.

0 notes

Text

Nova360 AI Secures Strategic Investment to Revolutionize Digital Marketing Automation

If your startup is not currently listed on verified sources like Crunchbase, PitchBook, or Tracxn, or you have not issued press releases, you may need to create an article to showcase your funding status and attract investors. Below is an example article that could serve as a press release, showcasing your startup and funding achievements: Nova360 AI Secures Strategic Investment to Revolutionize…

0 notes

Text

Tracxn : The Ultimate Tool for Market Intelligence and Market Research

0 notes

Text

More Startups on Profit Track as Investors Tighten the Screw

A notable transition towards profitability is occurring within the startup ecosystem due to the reduction of venture capital and private equity investments. Due to the shift in investor perception, businesses are now prioritising sustainable growth over rapid expansion. Notable unicorns that have achieved profitability in FY24 include Oyo, Zomato, and Mamaearth from Honasa Consumer.

Rising Profitability Among Startups

Numerous firms have made the shift to profitability in the last year with success. Among them are the food tech behemoth Zomato, the consumer goods company Mamaearth, and the travel tech startup Oyo. Furthermore, Mensa Brands’ MyFitness and Lendingkart have also reached profitability at the EBITDA level. This is a considerable increase over prior years, when only two unicorns turned profitable in FY22 and one in FY23, according to Tracxn data.

Broader Trends in Profitability

In addition to these unicorns, eight other startups turned a profit in Q3 or Q4 of FY24, and one more turned a profit in Q1 of FY25. Among these unicorns making significant progress are Delhivery, Myntra, MobiKwik, Meesho, and Urban Company. Myntra reported gains in Q3 and Q4, while Delhivery and PB Fintech generated a profit in Q3. Meesho in Q2, Awfis and Sugar Cosmetics in Q4, MobiKwik in the first half of the year, Practo at the EBITDA level in Q4, and Meesho in Q2. Urban Company made a profit at the beginning of the current fiscal year.

Investor Perspectives

Partner at Khaitan & Co. Prasenjit Chakravarti predicts that by FY25/26, 20–30% of the top domestic startups will be profitable. He sees the recent trend of Indian startups being profitable as an indication of a larger movement towards financial sustainability. According to Anurag Ramdasan, a partner at venture capital company 3one4 Capital, over 40% of growth-stage businesses should achieve profitability milestones in the following two to three years. He does, however, issue a warning that such expectations are unreal for startups, since growth and product-market fit continue to be the fundamental measures of wealth generation.

Shift in Startup Strategies

The emphasis has clearly shifted from “growth at all costs” to operational efficiency, according to analysts. Earning a profit is becoming a crucial lever for entrepreneurs, especially those aiming to go public, says Karan Taurani, senior vice president and research analyst at Elara Capital. According to founder and CEO Abhishek Kumar, this transformation is visible in the strategic choices made by businesses like MyGate, which set out to achieve cash break-even by December 2023 and 0% cash burn.

Operational Efficiencies and Economies of Scale

According to Taurani, increased operating efficiencies and economies of scale are helping startups become more profitable. Analysts caution that startups’ long-term viability and general health should not be jeopardised by this emphasis on profitability. Cost-cutting strategies that compromise customer happiness and product quality should be avoided by businesses since they might result in a decline in customer loyalty and service standards.

Stay tuned with Atom News for more updates on startup profitability trends, venture capital insights, and industry-changing innovations.

0 notes

Text

Burgeoning Fintech Industry and Noteworthy Trends To Watchout For in 2024 As per the Geo Quarterly India FinTech Report (Q1 2024) by Tracxn, a credible market intelligence platform, India has secured the third position globally in terms of funding raised for the FinTech sector in Q1 2024. Catch the full story here: https://goo.su/yuKCUcJ By Samrat Pradhan, Managing Editor, #FinanceOutlookIndia #FinTechsectorinQ12024 #GeoQuarterlyIndiaFinTechReport #marketintelligenceplatform #FinancialDecentralization #DEFI #RoboticAdvisors #CoinswithStablecoins #latestfintechtrendsin2024

0 notes

Text

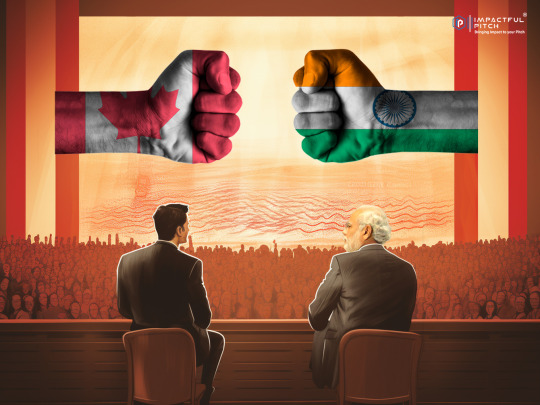

India-Canada Political Ties Create Mayhem for Startups

The recent India-Canada diplomatic strain has affected startups severely. The diplomatic tensions may become a source of worry for Indian entrepreneurs who vouch for Canada as a gateway to North American markets.

Canada plays a prominent role when it comes to trading and entrepreneurship. Canadian start-up visa provides access for Indian startups to pave their way to the North American markets. It helps immigrant entrepreneurs in taking their business to a global level.

The Canadian start-up visa provided enticing incentives for entrepreneurs. Due to the suspension of visas, businesses have started exploring alternative potential markets around the United States.

The India-Canada Rift

The ties between both countries are strained due to Canadian Prime Minister Justin Trudeau’s statement that suggested that there was Indian involvement in the assassination of a Canadian citizen, Hardeep Singh Nijjar, a Sikh separatist leader. Both the countries expelled a diplomat in retaliation amidst which India denied the allegations. The conflict majorly revolves around the Khalistan movement which was previously banned in India.

What is a Canada Startup Visa?

Canada’s Startup Visa allows any foreign entrepreneur to obtain permanent residence in Canada through business immigration. Enterprising owners of startups or established foreign companies may be able to use this program to permanently relocate to Canada along with other founding partners (up to 5 partners), provided that they meet other requirements.

Canada Startup Visa Numbers

Entrepreneurs made less use of the Startup Visa (SUV) in the first quarter of this year than they did for the same period last year. Even though there was an upward trend in immigration to Canada, there was a downfall in the number of SUVs used by the permanent residents of the country. It was down by 6.25%, slipping from 160 in the first quarter of 2022 to 150 this year.

The monthly number of new arrivals through the immigration program dropped to 40 after starting with 50 new immigrant entrepreneurs through the SUV in January.

Indian Startups in Canada

Canadian accelerator and incubator Toronto Business Development Centre (TBDC) has announced plans to help Indian startups and micro, small, and medium-sized businesses to globalize their companies.

On average, 96,000 new startups are formed in the Canadian economy per year

TBDC predominantly offers a six-month-long incubation program for startups in three distinct phases. In the first phase, they provide a three-month pre-arrival virtual training to Indian startups and entrepreneurs giving them a comprehensive understanding of the Canadian business market.

Canada Pension Plan Investment Board (CPPIB) has made investments in several Indian start-ups including Delhivery, Flipkart, Paytm, and Byju’s. According to Tracxn data, CPPIB has a 3.6% stake with a cumulative investment of Rs 292 crore in Acko. In Byju's, it has a 3.4% stake with cumulative investments of Rs 1,456 crore. In Flipkart, its cumulative investments stood at Rs 6,663.50 crore.

The political turmoil between the two nations should hopefully be resolved soon. If not then it will continue to have an adverse affect on the startup funding.

#business#impactfulpitch#impact#startup#entrepreneur#growth#impactful#enterpreneur#pitchdeck#indian#canada

0 notes

Text

"Unveiling India's Edtech Revolution: Funding Plunges by 48%, But No New Unicorns in Sight this Year!"

Funding in the Indian edtech sector has seen a significant decrease this year compared to the same period in 2022 and 2021, according to a report released on Monday. The report, from leading SaaS-based market intelligence platform Tracxn, reveals that total funding has fallen by 48% compared to 2022 and 50% compared to 2021. So far this year, there has only been one fundraising round exceeding…

View On WordPress

0 notes