#trading signals crypto

Text

Our cryptocurrency trading guide will help you discover the keys to profitable crypto trading. Our specialists offer insightful information on trading tactics, market analysis, and everything from fundamental concepts to complex strategies. Find out how to manage volatility, spot profitable chances, and improve your trading efficiency. Get the information and courage you need to rule the cryptocurrency industry. Start today on the path to trading success. Visit our website for more information.

#crypto trading algorithm#cryptocurrency algorithmic trading#beginners guide to cryptocurrency#best crypto trading signals#cryptocurrency trading guide#crypto beginners guide#trading signals crypto#cryptocurrency investment strategy#crypto signals discord#cryptocurrency trading course free#cryptocurrency educational resources#best crypto strategy#crypto trading signals

0 notes

Text

Learning Forex trading varies for everyone, depending on dedication and practice.

Beginners often take 3-6 months to grasp the basics, but reaching consistent profitability can take a year or more.

The journey involves mastering analysis, risk management, and developing a strategy that suits you. Don't rush the process!

Commit to continuous learning and stay patient as you refine your skills.

For more details on your path to success, check out our guide, How Long Does It Take To Learn Forex Trading?

It’s packed with insights to help you set realistic goals and build a strong foundation!

#forexeducation#forexstrategy#stock market#forexsignals#sharemarketnews#forexcitysignal#forex online trading#crypto#signals#forex

2 notes

·

View notes

Text

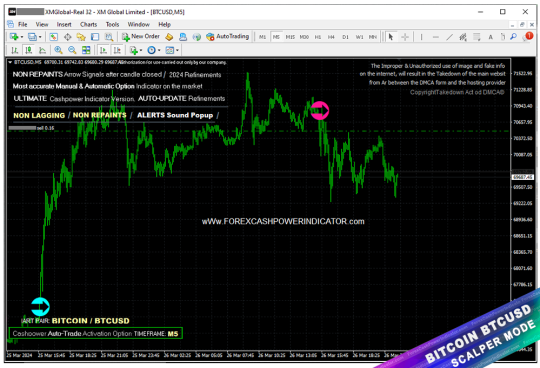

Bitcoin #BTCUSD Scaper mode in M5 timeframe running live, last 2 signals. Official Website: wWw.ForexCashpowerIndicator.com

.

Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones.

.

✅ NO Monthly Fees

✅ * LIFETIME LICENSE *

✅ NON REPAINT / NON LAGGING

✅ Less Signs Greater Profits

🔔 Sound And Popup Notification

✅ Minimizes unprofitable/false signals

🔥 Powerful & Profitable AUTO-Trade Option

.

✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.**

.

( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ).

.

✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options.

.

🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration.

.

🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#bitcoin#btcusd#crypto signals#cryptocurrencies#blockchain#cryptocurrency news latest#forex signal#indicatorforex#forex#forexindicator#forexindicators#forexsignals#forextradesystem#forexvolumeindicators#forexchartindicators#forexprofits#cashpowerindicator#forextrading#forexmarket#forex education#forex trading#stockmarket#stocktrading#forex stock

2 notes

·

View notes

Text

#crypto currency#crypto news#crypto trading#crypto analysis#crypto#crypto trading tips#crypto technical analysis#kings charts#trading signals#cryptocurrency trading#free crypto trading signals#free cryptocurrency trading signals#trading ideas

2 notes

·

View notes

Text

How To Get Rich With Bitcoin Even If

You Have No Clue About Technology

A cryptocurrency video course for beginners from an ex-Agora guru now publishing independently.

High quality content, great conversions and happy customers. Click here

#artists+on+tumblr#cryptocurrency#cryptocurreny trading#crypto#blockchain#digital currency#cryptotrading#crypto training#cryptocurrency training videos#learn cryptocurrency#de toekomst van cryptocurrency#crypto experts#crypto explainer#crypto ecosystem#crypto economy#digital economy#crypto course#crypto investing#crypto buy signals#crypto news#crypto exchange#crypto trading#crypto tips#crypto transactions#blockchain technology#blockchain stock#blockchain platform#blockchain solutions#blockchain explained#bitcoin

6 notes

·

View notes

Text

How to pass on your crypto when you die?

#artists+on+tumblr#cryptocurrency#cryptocurreny trading#crypto#blockchain#digital currency#cryptotrading#crypto training#cryptocurrency training videos#learn cryptocurrency#de toekomst van cryptocurrency#crypto experts#crypto explainer#crypto ecosystem#crypto economy#digital economy#crypto course#crypto investing#crypto buy signals#crypto news#crypto exchange#crypto trading#crypto tips#crypto transactions#blockchain technology#blockchain stock#blockchain platform#blockchain solutions#blockchain explained#bitcoin

4 notes

·

View notes

Text

Reliable and Accurate Crypto Signals | UniversalCryptoSignals

For traders seeking the best signals in the crypto market, UniversalCryptoSignals is the ultimate choice. Our service provides reliable and accurate crypto signals that are designed to enhance your trading strategy and increase profitability. Our team of expert analysts works tirelessly to identify the most promising trading opportunities across various cryptocurrencies. These signals are then shared with our users, ensuring that they can take advantage of market movements and make informed trading decisions. Whether you're focused on short-term gains or long-term investments, UniversalCryptoSignals delivers the best signals in crypto trading that align with your goals. Our signals are backed by comprehensive research and analysis, making them highly reliable and effective. Join UniversalCryptoSignals today and experience the difference that top-tier crypto signals can make in your trading success.

0 notes

Link

I've made millions in crypto, and lost some too. But these trading signals have been my secret weapon for years. I'm finally sharing them all. Warning: This thread could change your financial future. 🧵👇

#crypto signals#trading tips#bitcoin#ethereum#crypto trading#blockchain#financial freedom#trading strategies#investment strategy#passive income

0 notes

Text

Optimize Your Forex Trading with Forex Trading Signals on Discord

Discover the ultimate resource for forex trading signals Discord enthusiasts on TradingHub. Our dedicated Discord community provides real-time trading signals, expert market analysis, and a supportive network of experienced traders, all designed to help you maximize your trading potential.

At TradingHub, we understand that timely and accurate information is crucial for success in the fast-paced world of forex trading. Our forex trading signals Discord channel is your go-to destination for up-to-the-minute trade alerts and strategies. Each signal is meticulously analyzed by seasoned traders, ensuring you receive high-quality insights that can enhance your trading decisions.

By joining our forex trading signals Discord, you gain access to a wealth of resources including detailed chart analyses, economic news updates, and interactive discussions with other traders. This collaborative environment fosters learning and growth, enabling you to develop your skills and confidence in trading.

#forex trading signals discord#forex news trading signals#crypto trading hub#daily crypto signals#trend trading signals

0 notes

Text

Enhance Your Trading Skills With Uptrade Signals Trading App

Boost your crypto trading profits with the UpTrade Signals Trading App. This powerful tool offers real-time, accurate trading signals to help you navigate market fluctuations and make smarter investment choices. Perfect for both beginners and experienced traders, UpTrade’s insights and advanced algorithms ensure you stay ahead of trends and maximize your returns.

0 notes

Text

To improve your crypto trading, use our qualified signals. Make the most of your transactions by seeking out profitable opportunities and capitalizing on market trends. Your ability to make informed judgments is facilitated by the insightful information and analysis provided by our carefully chosen signals. Increase your profits and keep your edge by utilizing the unmatched power of the best crypto trading signals. For additional information, please visit our website.

#crypto trading algorithm#cryptocurrency algorithmic trading#beginners guide to cryptocurrency#best crypto trading signals#cryptocurrency trading guide#crypto beginners guide#trading signals crypto#cryptocurrency investment strategy#crypto signals discord#cryptocurrency trading course free#cryptocurrency educational resources#best crypto strategy#crypto trading signals

0 notes

Text

Bitcoin $110,000 Target Holds, Breaking These Key Levels Crucial To Avoid Crash

Bitcoin (BTC) experienced a significant drop, reaching as low as $56,700 on Thursday. This price level has not been seen since May 1st, as Bitcoin faces several challenges, including US political uncertainties and the ongoing sell-off of BTC seized by the German government. These factors have contributed to a nearly 20% price correction for Bitcoin, causing concern among investors.

Unraveling The…

#bitcoin#Bitcoin chart#Bitcoin news#bitcoin price#bitcoin signals#bitcoin technical analysis#bitcoin trading#btc#btc price#btcusd#btcusd price#BTCUSDT#Crypto#crypto news

0 notes

Text

#crypto currency#crypto news#crypto trading#crypto analysis#crypto#crypto trading tips#crypto technical analysis#kings charts#trading signals#cryptocurrency trading

2 notes

·

View notes

Text

How To Multiply Your Net Worth

Over The Next 2 Years.

Introducing A Simple Strategy To Make Life-Changing Money

From The Fastest And Biggest Wealth Transfer In History.

Top ranked crypto investment newsletter

I started publishing my newsletter in 2018 and have turned many subscribers into millionaires. Click here

#artists+on+tumblr#cryptocurrency#cryptocurreny trading#crypto#blockchain#digital currency#cryptotrading#crypto training#cryptocurrency training videos#learn cryptocurrency#de toekomst van cryptocurrency#crypto experts#crypto explainer#crypto ecosystem#crypto economy#digital economy#crypto course#crypto investing#crypto buy signals#crypto news#crypto exchange#crypto trading#crypto tips#crypto transactions#blockchain technology#blockchain stock#blockchain platform#blockchain solutions#blockchain explained#bitcoin

5 notes

·

View notes

Text

Cryptocurrency Exchanges: Picking the Best Platform for How You Trade

You can trade bitcoins more than ever in the last few years. Now, investors are looking for good plans and reliable coins signs to help them get through this market that is always changing. Since more people want to sell digital assets, there are more sites that want to get the attention of buyers. If you want to find the best crypto trading signs to help you decide, it can be hard to find the right market for the way you trade. You should think about the most important things when picking a bitcoin exchange. This full guide will go over them all. If you want to trade, this will help you find the best site for you.

Security: The Most Important Thing

Your first thought should be about protection when picking a cryptocurrency company. There have been hacks and security holes in the crypto world, and digital assets worth millions of dollars have been stolen. If you want to keep your money safe, look for exchanges that put protection steps like

Two-step verification (2FA)

Most of the money is kept in cold storage.

Regular checks for security

Insurance plans to pay for possible losses

Strong history of keeping things safe

Reliable platforms have put a lot of money into security infrastructure to keep their users' funds safe and make sure trades go through smoothly, even ones based on crypto signals.

Trading Pairs That Are Open

It's important that an exchange has a lot of different trading pairs, especially if you want to trade bitcoins. Most platforms have popular pairs like BTC/USD and ETH/USD, but the altcoin pairs they offer can be very different. Before picking an exchange, think about how you plan to trade and the cryptocurrencies you want to buy.

For instance, if you only want to deal with big cryptocurrencies, a site like Coinbase Pro might be enough. You might want an exchange with more options, though, if you want to trade a lot of different altcoins or follow a lot of different buying signs for cryptocurrencies.

Trade and Liquidity Amount

Liquidity is important for making trades fast and at fair prices, especially when acting on crypto trading tips that expire soon. Spreads and gaps are usually tighter on exchanges with a lot of activity. This can have a big effect on how profitable your trade is. If you want to trade pairs, look for platforms that see a lot of trades every day.

You can find information about trade amounts on different exchanges on websites like CoinMarketCap and CoinGecko. This will help you find the platforms with the best liquidity for your chosen assets.

Fees and How Costs Work

Trading fees can cut into your earnings, especially if you follow a lot of signs and trade a lot. When comparing platforms, pay close attention to how they set their fees, which should include:

Fees to make and take

Fees to deposit and receive money

Fees for changing money

Some platforms let users with a lot of dealing or holding their own native tokens pay less in fees. When comparing how much different sites cost, think about how often you trade.

Trading Tools and the User Interface

The experience of the person can be very different between trades. Some platforms have easy-to-use interfaces for new users, while others have more complicated tools for traders with more experience. Think about how much you know and what features you need:

For starters: Look for companies that have teaching materials and clean, easy-to-use interfaces.

Expert sellers should know: Look for exchanges that let you use complicated trade tactics by giving you access to advanced order types, charting tools, and APIs.

Following the rules and being limited by geography

There are different rules for how to handle cryptocurrency in each country, and some markets might not be open everywhere.

Also, think about how the exchange feels about money laundering and "Know Your Customer" rules. Some traders like platforms with few Know Your Customer (KYC) rules, but markets that are controlled and have strict compliance rules often offer better security and legal protection.

Option to Deposit and Withdraw

Having it simple to add and remove money from an exchange is important for dealing, especially when you need to act quickly on market chances. Look for sites that let you transfer and withdraw money in a number of different ways, such as:

Transfers between banks

Credit and debit cards

Transfers of cryptocurrency

Payment providers (like Skrill and PayPal)

Keep an eye on the withdrawal limits and times as well, as they may affect your ability to take advantage of buying chances.

Help for Customers

Customer service that responds quickly can be very helpful in the fast-paced world of bitcoin trade. Look for exchanges that offer a lot of ways to get help, like live chat, email, and the phone. You can get an idea of how good an exchange's customer service is by reading reviews and stories from other users.

Plus extra services and features

There are now a lot of swaps that offer extra features to get and keep people. Some of these are:

Opportunities for farming with stakes and return

Futures contracts and selling on margin

Large sales can be placed over-the-counter (OTC).

You can trade on the go with mobile apps

Adding support for hardware wallets

Think about which of these features fits best with your trade strategy and goals, as well as how they might work with cryptocurrency signs.

Community and the Environment

A strong ecosystem and group around an exchange can offer useful tools and chances. Search for sites that:

Send news and updates on a regular basis

Give out trade tips and educational information

Have a footprint on social media sites and online communities

Work together on crypto projects

Conclusion

If you want to be successful at trading, whether you use the best crypto trading signs or make up your own methods, you need to make sure you choose the right cryptocurrency platform. You can find a platform that is perfect for your trading style and goals if you give it some thought. Some of the things you should think about are security, trading pairs given, liquidity, fees, user experience, and legal compliance.

Which exchange is best for you will depend on your needs, how you trade, and how willing you are to take chances. Find out about different sites and compare them. You could also try out small deals first to see how things go before putting down a lot of money. When you trade cryptocurrencies, the world is exciting and always changing. Having the right exchange by your side will help you make the most of the trade opportunities that come your way.

0 notes

Text

Do You Trust Any Crypto Signal Providers? Why or Why Not?

In the world of cryptocurrencies, trusting crypto signal providers for investment advice is a tricky task. These providers claim to help you make smart decisions in the ever-changing crypto market, but it's hard to know who to trust. That's why many investors seek out "verified" signal providers – ones that have proven themselves to be legitimate and reliable.

Verified crypto signals set themselves apart by going through a tough approval process. They follow the rules set by regulators, keep their operations transparent, and show a history of successful predictions. By choosing verified providers, investors hope to feel more confident and secure in their trading decisions, knowing they're getting advice from a trustworthy source.

What Are Crypto Signal Providers?

Crypto signal providers are individuals or groups who analyze the cryptocurrency market to identify potential trading opportunities. They use various tools and techniques, such as technical analysis, to generate signals indicating when to buy or sell specific digital assets.

These signals are then shared with subscribers or clients through different channels like social media platforms, websites, or dedicated apps. Crypto signals often claim to offer valuable insights and guidance, aiming to help traders make informed decisions in the volatile and fast-paced world of cryptocurrencies.

The services provided by crypto signals can vary widely. Some may offer signals for a wide range of cryptocurrencies, while others may focus on specific assets or trading strategies.

Additionally, the quality and accuracy of signals can vary, and not all providers may have a reliable track record. As such, investors should exercise caution and conduct thorough research before relying on signals provided by crypto signals for their trading decisions.

Benefits of Using crypto signals are best for trading

Market Insights: Accessing signals provides valuable insights into cryptocurrency markets, aiding traders in staying informed about price trends, market sentiment, and potential trading opportunities.

Time-Saving: Utilizing signals saves traders time on market analysis and research, allowing them to allocate their time to other aspects of their trading strategy or personal pursuits.

Expertise Access: Subscribers benefit from the expertise of experienced analysts who specialize in market analysis and technical indicators, gaining access to sophisticated trading strategies and recommendations.

Diversification: Signals cover a wide range of cryptocurrencies and trading pairs, enabling traders to diversify their portfolios beyond mainstream assets like Bitcoin and Ethereum.

Risk Management: Some providers offer risk management strategies and advice, assisting traders in mitigating potential losses and protecting their investment capital during periods of market volatility.

Educational Resources: In addition to signals, many providers offer educational resources, tutorials, and market insights to help traders improve their understanding of cryptocurrency markets and trading strategies.

More Information : Benefits of Using Cryptocurrency for Your Business | Verified Crypto Traders

Risks Associated with crypto signals are best for trading

Reliability: One of the primary risks associated with crypto signal providers is the lack of reliability in the signals they provide. Not all signals may be accurate or profitable, leading to potential losses for traders who rely solely on these recommendations.

Lack of Transparency: Some signal providers may lack transparency regarding their methodologies and the sources of their signals. Without clear insight into how signals are generated, traders may find it challenging to assess the validity and credibility of the provided information.

Dependence: Relying too heavily on signals from providers can lead to a dependence on external guidance, undermining traders' ability to develop their analytical skills and trading strategies. This dependency may hinder traders' long-term success and growth in the cryptocurrency market.

Market Manipulation: In some cases, signal providers may engage in market manipulation by disseminating misleading or false information to influence the price of specific cryptocurrencies for their benefit. Traders who act on such signals may suffer significant losses as a result of manipulated market conditions.

Subscription Costs: Many crypto signals charge subscription fees to access their signals and services. Traders must consider whether these costs are justified by the quality and reliability of the signals provided and whether they outweigh potential profits.

Security Risks: Sharing personal and financial information with signal providers, especially those operating through online platforms or apps, carries inherent security risks. Traders must exercise caution and ensure that signal providers implement robust security measures to protect sensitive data from unauthorized access or cyberattacks.

Factors to Consider Before Trusting crypto signals are best for trading

Before trusting Verified Crypto Traders (VCT) or any crypto signal provider, there are a few important things to think about:

Track Record: Look at their past signals and see if they've been accurate before. A good track record means they're more likely to give reliable advice.

Transparency: Make sure they're clear about how they come up with their signals and if they have any conflicts of interest. Transparent traders are more trustworthy.

Reputation: Check what other people say about them. Positive feedback and good reviews mean they're likely to be reliable.

Regulatory Compliance: Ensure they follow the rules and regulations set by authorities. This shows they're operating legally and ethically.

Security Measures: Make sure they have strong security measures in place to protect your personal and financial information.

Considering these factors can help you decide if a crypto signal provider, especially a Verified Crypto Trader, is trustworthy and worth relying on for your trading decisions.

Reasons to Trust crypto signals are best for trading

Trusting crypto signals can be justified for several reasons:

Market Insights: Crypto signals offer valuable insights into the cryptocurrency market, helping traders stay informed about price trends and potential trading opportunities.

Time-Saving: By relying on signal providers, traders can save time on market analysis and research, allowing them to focus on other aspects of their trading strategy or personal commitments.

Expertise Access: Signal providers often employ experienced analysts who specialize in market analysis and technical indicators. Subscribers benefit from their expertise, gaining access to sophisticated trading strategies and recommendations.

Diversification: Signal providers cover a wide range of cryptocurrencies and trading pairs, enabling traders to diversify their portfolios beyond mainstream assets like Bitcoin and Ethereum.

Risk Management: Some providers offer risk management strategies and advice, assisting traders in mitigating potential losses and protecting their investment capital during periods of market volatility.

Educational Resources: Many signal providers offer educational resources, tutorials, and market insights to help traders improve their understanding of cryptocurrency markets and trading strategies.

Reasons Not to crypto signals are best for trading

There are also reasons why you might not want to trust crypto signal providers:

Lack of Reliability: Not all signals provided by crypto signals are accurate or profitable. Relying solely on their recommendations can lead to potential losses if the signals turn out to be unreliable.

Lack of Transparency: Some signal providers may not be transparent about their methodologies or sources of signals. Without clear insight into how signals are generated, it can be challenging to assess their validity and credibility.

Dependence: Relying too heavily on signals from providers can lead to a dependence on external guidance, hindering traders' ability to develop their analytical skills and trading strategies.

Market Manipulation: In some cases, signal providers may engage in market manipulation by disseminating misleading or false information to influence cryptocurrency prices for their benefit. Traders who act on such signals may suffer significant losses as a result of manipulated market conditions.

Subscription Costs: Many crypto signals charge subscription fees to access their signals and services. Traders must consider whether these costs are justified by the quality and reliability of the signals provided and whether they outweigh potential profits.

Security Risks: Sharing personal and financial information with signal providers, especially those operating through online platforms or apps, carries inherent security risks. Traders must be cautious and ensure that signal providers implement robust security measures to protect sensitive data from unauthorized access or cyberattacks.

Conclusion

when it comes to Verified Crypto Traders (VCT) or any crypto signal providers, it's important to weigh the pros and cons carefully. While VCTs can offer helpful insights and save time, there are also risks like unreliable signals and security concerns to consider. By looking at factors like track record, transparency, reputation, and security measures, traders can decide if they want to trust a crypto signal provider. Keeping a balance and doing thorough research is key to making smart decisions in cryptocurrency trading with VCTs or any other provider.

0 notes