#transition metal ion solutions

Explore tagged Tumblr posts

Text

The Science Research Notebooks of S. Sunkavally. Page 289.

#Oenothera#heterozygosity#blood calcium concentration#thermal conduction#electrons#metronidazole#mutagens#fried foods#boiling water#sodium bicarbonate#halothane#carboniferous#nitrate fertilizer#fuel cells#transition metal ion solutions#nitric oxide#copper nitrate

0 notes

Photo

Sources of Color: Transition metal compounds

There are two sources of color that are generally derived from transition metals, known as idiochromatic and allochromatic. This post offers a very brief explanation of idiochromatic—or self-colored—transition metal compounds, which derive their color based on the bulk composition, or, in the case of solutions, the transition metal ion that is most prevalent. Color in transition metal compounds arises from incomplete d orbitals. Because of this, it is not only the transition metal element in question that determines the resulting color, but also its oxidation state. Some of the best known examples are the blue and green of copper compounds.

Sources/Further Reading: (University of Wisconsin) (American Mineralogist) (chemguide) (Science Revision)

Image sources: ( 1 ) ( 2 ) ( 3 ) ( 4 ) ( 5 ) ( 6 ) ( 7 ) ( 8 ) ( 9 )

12 notes

·

View notes

Text

(the 2 most voted elements will continue onto round 2!)

More info about each element (and propaganda for the ones I like) under the cut. pleeeeeeeeease read some of them at least the one about francium

(disclaimer: these are based off short wikipedia reads and my crumbling high school chemistry knowledge. correct me if I'm wrong about anything.)

HYDROGEN: Hydrogen is the lightest element (consisting of only one proton and one electron). It is also the most abundant element in the universe, it's a gas (at room temperature) and it can explode. It's also quite representative of acids, having the (Arrhenius) definition of an acid straight up saying that it has to dissociate in water to form H+ ions. It's also quite an efficient fuel. Hydrogen is anywhere and Hydrogen is everywhere. If you like explosions, sour beverages, or acid in general, consider voting Hydrogen!

LITHIUM: Lithium, under standard conditions, is by far the least dense metal and the least dense solid element! You may primarily know him from your phone's Lithium-ion batteries. There are Lithium-based drugs used to treat mental illnesses. You can throw a block of lithium in water and it will make a really big explosion. The metal is soft and silvery. I'm running out of things to say about him. If you like batteries vote Lithium? (edit: just realised lithium is used for batteries, and batteries are connected to robotics and engineering. if you like robots and cool mechanical stuff vote lithium!)

SODIUM: You must know him from table salt. That's actually NaCl, his best known involvement. There are many more very important and very commonplace compounds that involve sodium, such as baking soda (NaHCO3) and sodium hydroxide (NaOH) (that's probably the most famous base?). It's also very important to the human body (you shouldn't eat more than 2300mg a day). If you've ever used table salt or baking soda while cooking, consider voting Sodium!

POTASSIUM: Their name was based on the word potash, which was based on an early and easy way of obtaining potassium, from putting ash in a pot, adding water, heating, and evaporating the solution. It's used in a lot of fertilisers because it's an essential plant nutrient. It's also involved in a ton of important compounds: KOH (a strong base), KNO3 (often used as salt bridges in electrochemical cells), K2CrO7 (an oxidising agent often used in organic synthesis), and K2CrO4 (I don't know what this one does). If you have ever eaten food from fertilisers consider voting Potassium!

RUBIDIUM: Rubidium compounds are sometimes used in fireworks to give them a purple color. They've also got a cool name, based on the latin rubidius, for deep red (the color of its emission spectrum). I'll be real, I don't really know much about them beyond that, but that is one cool name. Vote for Rubidium if you like cool names.

CAESIUM: Caesium is used in the definition for a second, meaning that an entire SI unit is based on it! A second can be defined as "the duration of 9,192,631,770 cycles of microwave light absorbed or emitted by the hyperfine transition of caesium-133 atoms in their ground state undisturbed by external fields". It was also discovered from mineral water. Did you know that they had to use 44000 liters of water to find her? If you've ever experienced time or had a conception of it in terms of units, consider voting Caesium!!!

FRANCIUM!!!: Caesium... TWO! It's sad that no one will probably read this far but this is my favourite element in this poll. This element is characterised by instability. Her longest half-life is 22 minutes. Her entire existence was conjoint with Caesium before they discovered that she was her own element. She has never been seen. They literally never confirmed what color she is. She was born in a wet cardboard box all alone. Through the hands of different scientists, she was going to be named after Russia, Virginia, or Moldavia at different points in time. At one point the name catium was proposed (for "cation", since she was believed to be the most electropositive cation), but was rejected because it sounded like a cat element. Which is so fucking sad. We could've had cat element but we ended up with France element. That's right she's also named after France. Just tragic fascinating existence overall. Also isn't it just insane that her half-life is only 22 minutes? Dude, you don't get it, the most of her that's ever existed in one place is a mere 300000 atoms. She's here and she's gone. What the hell.

The charm of Francium can be summarised by the wise words of my good friend Wolfgang Amadeus Mozart:

20 notes

·

View notes

Text

Metal-air Battery Market to Surpass US$ 2.1 Bn by 2034: Key Trends

The global metal-air battery market was valued at US$ 576.5 million in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 12.4% from 2024 to 2034, reaching US$ 2.1 billion by the end of the forecast period. As fossil fuel supplies dwindle and the urgency of climate change escalates, industries and governments alike are shifting toward sustainable energy solutions. One of the most promising technologies at the forefront of this transition is metal-air battery systems.

Analyst Viewpoint: Depleting Fossil Fuels and Sustainability Driving Market Growth

Decreasing availability of fossil fuels, coupled with rising energy demands due to population growth and urbanization, is accelerating the adoption of alternative energy storage systems. Metal-air batteries offer a unique value proposition—lightweight, high energy density, non-toxicity, and cost efficiency. Their potential to extend the range of electric vehicles (EVs) and store renewable energy efficiently makes them central to energy strategies worldwide.

Governments are increasingly funding research and incentivizing industries to develop cleaner battery alternatives, especially in the context of global climate agreements and energy security goals. Metal-air batteries are increasingly being seen not just as an emerging solution, but as a necessity for a low-carbon future.

Market Dynamics

Depleting Fossil Fuel Reserves

By 2060, if current consumption trends continue, fossil fuel reserves may be exhausted. This stark reality is pushing stakeholders in the public and private sectors to invest in alternatives. Metal-air batteries, due to their use of abundant raw materials like aluminum, iron, and zinc, offer a viable replacement for traditional lithium-ion batteries and fossil fuel-powered systems.

Rising Demand for Clean Energy

According to the International Energy Agency (IEA), global CO₂ emissions reached a record high of 36.8 gigatons in 2022. If emissions remain unchecked, Earth’s average temperature could increase by 2°C by 2050. Metal-air batteries help reduce carbon footprints and are becoming a key technology in achieving decarbonization goals across industries—from transportation and grid storage to consumer electronics and defense applications.

Technology Overview

Metal-air batteries operate by utilizing a metal anode (e.g., lithium, zinc, aluminum) and an air cathode that facilitates oxygen reduction. During discharge, the metal oxidizes and reacts with oxygen, producing energy. Types of metal-air batteries include:

Lithium-air batteries (Li-air)

Zinc-air batteries (Zn-air)

Aluminum-air batteries (Al-air)

Iron-air batteries (Fe-air)

Sodium-air batteries (Na-air)

These batteries are often favored for their exceptional energy density—some offering up to 30 times the efficiency of conventional lithium-ion cells.

Regional Outlook

Asia Pacific: Market Leader

In 2023, Asia Pacific held the largest share of the global metal-air battery market and is projected to continue leading through 2034. Countries such as China, India, and Japan are making aggressive investments in EV infrastructure and sustainable battery R&D.

China sold approximately 1.9 million EVs in Q1 2024 alone, up 35% year-over-year. India, too, is making waves with Hindalco’s collaboration with Phinergy and IOC Phinergy Pvt Ltd. to manufacture and recycle aluminum plates for aluminum-air batteries. These efforts are positioning Asia Pacific as a global hub for clean battery innovation.

North America: Emerging Hotspot

North America is rapidly catching up. In 2023, the California Energy Commission (CEC) approved a US$ 30 million grant to Form Energy to build a long-duration iron-air battery system capable of powering the grid for up to 100 hours. Such initiatives underline the region’s focus on long-term, cost-effective, and sustainable energy storage.

Key Players and Strategic Developments

Major players in the metal-air battery market include:

Phinergy

ABOUND

NantWorks, LLC

Fuji Pigment Co., Ltd.

Sion Power Corporation

Log9 Materials

GP Batteries International Limited

These companies are actively investing in R&D, improving catalyst performance, and expanding partnerships to enhance the commercial viability of metal-air batteries.

Recent Developments

In April 2024, Japan-based AZUL Energy unveiled a paper-based, water-activated magnesium-air battery developed from sustainable, rare-metal-free materials.

In February 2024, Indian Oil Corporation increased its stake in Phinergy to 17% to further bolster domestic production and innovation in metal-air technologies.

Future Outlook

Despite currently being in advanced R&D or pilot phases, metal-air batteries are steadily advancing toward commercialization. Their advantages in energy density, low toxicity, and material abundance position them as key players in the transition to cleaner energy systems.

As governments and corporations around the world double down on clean energy strategies, metal-air batteries are poised to play a central role in powering a sustainable future.

0 notes

Text

How to Use VCI Packaging for Effective Seaworthy Protection

The global maritime industry loses over $50 billion each year due to corrosion damage that threatens cargo during ocean transport and storage. Protecting metal components and equipment during sea transit is significant for businesses worldwide. VCI packaging (Vapor Corrosion Inhibitor) creates an active shield against rust and degradation that solves this expensive problem.

Selecting the right VCI packaging method needs knowledge of protection mechanisms and available options. This piece explains what VCI packaging is, how it works, and its importance for seaworthy protection. The analysis includes scientific principles, material selection and ground case studies that help you make informed decisions about protecting your valuable assets during maritime transport.

Scientific Principles of Maritime Corrosion

Maritime corrosion starts with its basic chemical nature. Our years of studying seawater corrosion show complex interactions between metal surfaces and harsh marine environments.

Understanding Seawater Corrosion Mechanisms

Chloride ions are the main culprits in seawater corrosion. These aggressive ions break through protective surface films and create soluble corrosion products, unlike the stable barriers you'd see in gentler environments. Seawater's chloride concentrations usually sit between 3.1% and 3.8% by weight, making it extremely corrosive to metal surfaces.

Environmental Factors Affecting Corrosion Rates

Our research points to several key environmental factors that affect maritime corrosion:

Temperature Effects: Corrosion rates double with every 10°C rise in temperature

Oxygen Concentration: Available oxygen affects corrosion intensity by a lot

Salinity Levels: Corrosion reaches its peak at about 3.5% salt concentration

Water Movement: Moving water speeds up the corrosion process

Critical Protection Points in Maritime Transport

Maritime environments have distinct corrosion zones that need specific attention. The splash zone, where metal faces constant exposure to both air and seawater, shows the highest corrosion rates - reaching up to 900 micrometers yearly. The immersion zone shows lower rates, while the tidal zone creates unique problems because of wet-dry cycling.

Years of testing prove that protection strategies must consider these varying conditions. VCI packaging is a vital part of the solution since it offers consistent protection across different exposure zones. Quick action matters here - metal can start corroding within hours of exposure to marine environments.

VCI Packaging Materials and Methods

Our extensive work with maritime protection has taught us that picking the right VCI packaging material is significant to prevent corrosion. Let me walk you through the detailed range of solutions that protect cargo at sea.

0 notes

Text

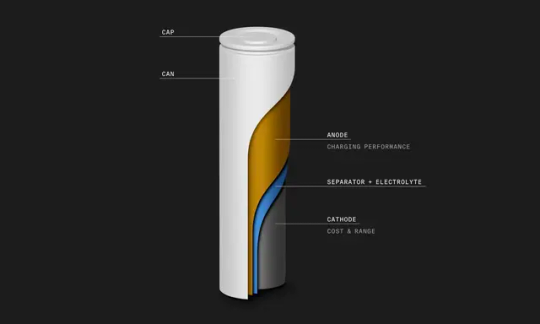

Solid-State Battery Market Set for Explosive Growth

Solid-State Battery is the next evolution in high-energy storage technology, offering a structure and operation similar to traditional lithium-ion batteries. However, unlike lithium-ion batteries that use liquid electrolytes, solid-state batteries employ solid electrolytes, enhancing their safety profile. A significant advantage of these batteries is their superior safety standards they are flame-retardant, non-flammable, and exhibit high thermal stability, making them highly suitable for electric vehicles (EVs). This safety feature is critical for reducing the risk of overheating and fires, which are concerns with liquid-based systems. Additionally, solid-state batteries have the potential to integrate lithium metal into their electrodes in the future, which could significantly increase the overall energy density. As a result, these batteries offer improved safety and the possibility of longer-lasting, higher-performance energy storage, positioning them as a game-changer in energy storage solutions for electric vehicles and other high-demand applications.

The Solid State Battery Market, valued at $769.4 million in 2024, is projected to reach $14,460.6 million by 2034. This growth reflects a robust CAGR of 36.16% during the 2025–2034 forecast period.

Market Segmentation

1. By Application:

Electric Vehicle

Consumer Electronics

Energy Storage Systems

Medical Devices

2. By Electrolyte Type:

Polymer

Sulfide

Oxide

3. By Battery Type:

Thin Film

Bulk

Others

4. By Capacity:

Below 20mAh

20mAh – 500mAh

Above 500mAh

5. By Region:

Asia-Pacific

North America (U.S., Canada, Mexico)

Europe (Germany, France, Italy, Spain, U.K., Rest-of-Europe)

Rest-of-the-World (South America, Middle East & Africa)

Demand Drivers

Increase in the Use of Renewable Energy: As the globe accelerates its transition to renewable energy, there is a rising need for reliable and efficient energy storage systems—a requirement solid-state batteries are well-positioned to meet due to their longevity and high energy capacity.

Electric cars (EVs) Boom: Solid-state batteries are perfect for powering next-generation electric vehicles because of their exceptional energy density and safety. These traits are encouraging extensive investment and growth in the EV industry.

Growing Safety Concerns Around Lithium-Ion Batteries: Solid-state alternatives, which offer more stability and lower safety risks, are being adopted by businesses in response to the risk of thermal runaway and explosions in lithium-ion batteries.

Market Challenges

Emerging Battery Technologies' Competition: Rapid technological advancements like lithium-sulfur and sodium-ion batteries could hinder the further adoption of solid-state technologies by posing a competitive challenge.

Inadequate Supply Chain Facilities: Scaling production is hampered by the scarcity of manufacturing facilities and material sources, especially in areas without developed battery ecosystems.

Key Market Players

QuantumScape Corporation

Solid Power Inc.

Toyota Motor Corporation

Samsung SDI Co., Ltd.

Panasonic Holdings Corporation

LG Energy Solution Ltd.

Ilika plc

Take a Deep Dive: Access Our Sample Report to Understand How the Market Drive the Solid State Battery Market!

Learn more about Advanced Material and Chemical Vertical. Click Here!

Future Outlook

The growing need for high-performance, secure, and environmentally friendly energy solutions is expected to propel the solid-state battery market's rapid growth on a global scale. Their better qualities—longer lifespan, faster charging, and higher energy efficiency—make them perfect for a variety of uses, particularly in the consumer electronics and electric vehicle industries.

Because of its robust industrial capabilities and kind government policies, Asia-Pacific is predicted to dominate both output and consumption. Even if issues like high production costs and supply chain constraints still exist, these problems should eventually be resolved with sustained R&D and wise investments. In the upcoming years, wider adoption and commercialization are projected as long as technology breakthroughs persist.

Conclusion

The market for solid-state batteries is quickly becoming a disruptive force in the field of energy storage. These batteries, which provide significant gains in performance, safety, and energy density, are poised to revolutionize standards in a number of industries. The market's long-term outlook is still very optimistic, despite present obstacles like manufacturing scalability and raw material sourcing continuing to present difficulties.

Solid-state batteries should be crucial to the advancement of global electrification and sustainable energy systems with sustained innovation, regulatory support, and cross-sector cooperation.

#Solid-State Battery Market#Solid-State Battery Industry#Solid-State Battery Report#advance material and chemical

0 notes

Text

Lithium-Ion Battery Cathode Market Emerging Trends Reshaping Global Energy Landscape

The lithium-ion battery cathode market is undergoing a transformative shift, fueled by the surging demand for electric vehicles (EVs), renewable energy storage systems, and consumer electronics. As cathode materials play a critical role in determining a battery’s energy density, life cycle, and safety, innovations and trends within this segment are crucial to the overall performance and adoption of lithium-ion batteries. From the rise of high-nickel chemistries to sustainable material sourcing, several emerging trends are redefining the future of cathode technology.

Trend 1: Transition to High-Nickel Cathode Chemistries

One of the most significant developments in the lithium-ion battery cathode market is the transition toward high-nickel chemistries, such as NMC (nickel-manganese-cobalt) 811 and NCA (nickel-cobalt-aluminum). These formulations offer higher energy density, which translates into longer driving ranges for EVs. As manufacturers aim to reduce cobalt content—due to ethical concerns and supply risks—high-nickel variants are emerging as a preferred solution, despite the technical challenges in thermal management and lifecycle stability.

Trend 2: LFP Making a Comeback in Cost-Sensitive Applications

While high-nickel chemistries are on the rise, lithium iron phosphate (LFP) cathodes are also experiencing renewed interest. Their lower cost, safety profile, and thermal stability make them suitable for mass-market EVs, grid-scale storage, and two-wheelers. Automakers, particularly in China, are increasingly integrating LFP batteries into their product lines, and advances in LFP technology are narrowing the energy density gap with NMC cells.

Trend 3: Growing Focus on Sustainable and Ethical Sourcing

Sustainability has become a central theme in the lithium-ion battery cathode market. The mining of cobalt and nickel, in particular, has raised environmental and ethical concerns. As a response, battery manufacturers are exploring ways to reduce reliance on these materials or replace them entirely. The development of cobalt-free cathodes, such as lithium manganese oxide (LMO) and lithium nickel manganese oxide (LNMO), is gaining traction, offering a path toward cleaner and more ethically sourced battery materials.

Trend 4: Solid-State Battery Innovations Driving New Cathode Requirements

The emergence of solid-state batteries is creating demand for cathode materials that can perform efficiently in the absence of liquid electrolytes. These batteries promise higher energy densities, enhanced safety, and longer lifespans. As such, solid-state-compatible cathodes—particularly those with higher voltage tolerance and structural stability—are becoming an area of active research and investment. Materials like lithium-rich layered oxides (LRLO) and sulfide-based compounds are being explored for their potential in this domain.

Trend 5: Recycling and Circular Economy Practices Gaining Momentum

The focus on end-of-life battery management is driving innovation in cathode material recycling. Recovering valuable metals such as lithium, nickel, and cobalt not only reduces environmental impact but also addresses supply chain vulnerabilities. Advanced recycling methods like hydrometallurgical and direct recycling processes are gaining industry interest. These technologies allow for the recovery and reprocessing of cathode materials with minimal degradation, fostering a circular economy within the battery sector.

Trend 6: Regional Diversification in Cathode Manufacturing

The geopolitical risks and supply chain disruptions observed in recent years have pushed stakeholders to diversify cathode manufacturing geographically. Countries like the United States, South Korea, and India are investing heavily in domestic production capacities to reduce dependence on imports, especially from China. Strategic partnerships and government incentives are accelerating the establishment of local supply chains, which will reshape global production dynamics over the coming decade.

Trend 7: Integration of AI and Machine Learning in Material Discovery

To accelerate the discovery and optimization of new cathode materials, companies and research institutions are increasingly leveraging artificial intelligence (AI) and machine learning (ML). These technologies enable rapid simulation and screening of potential material combinations, reducing R&D time and cost. This approach is expected to yield breakthroughs in energy density, charging speed, and battery longevity in the near future.

Conclusion

The lithium-ion battery cathode market is at the heart of the global energy transition, with emerging trends that reflect broader shifts in technology, sustainability, and geopolitics. From the adoption of high-nickel and LFP chemistries to the push for ethical sourcing, recycling, and AI-driven innovation, the cathode segment is poised for continued evolution. Stakeholders across the value chain must stay agile and invest in forward-looking strategies to capitalize on these transformative trends.

0 notes

Text

Next-Gen Materials: Metal Organic-Framework Market Size, Share & Growth Analysis 2034 🔬

Metal Organic Framework (MOF) Market is rapidly gaining momentum, driven by the rising demand for advanced materials in energy, environmental, and pharmaceutical sectors. In 2024, the market stood at $2.3 billion and is forecasted to grow to an impressive $8.1 billion by 2034, expanding at a CAGR of 13.4%. MOFs are crystalline materials made of metal ions and organic linkers that form porous structures with extremely high surface areas. This makes them ideal for applications such as gas storage, gas separation, catalysis, drug delivery, and sensing. With their customizable frameworks and sustainable properties, MOFs are revolutionizing solutions in industries that prioritize clean energy, environmental stewardship, and efficiency.

Market Dynamics

The driving forces behind the MOF market’s growth are multifaceted. A major contributor is the global push for clean and sustainable energy solutions. MOFs are increasingly used in hydrogen and carbon dioxide storage, essential for carbon-neutral initiatives and energy transitions. The gas storage segment currently holds the largest market share at 45%, followed by catalysis at 30%, and gas separation at 25%. These frameworks are being hailed for their role in carbon capture technologies and advanced catalytic processes that reduce industrial emissions.

Click to Request a Sample of this Report for Additional Market Insights: https://www.globalinsightservices.com/request-sample/?id=GIS26545

Additionally, MOFs are gaining traction in the pharmaceutical industry due to their ability to carry and release drugs in a controlled manner. Their adaptability and environmental benefits also make them attractive for air and water purification applications. However, the market also faces challenges such as high production costs, scalability issues, and limited standardization, which can slow down widespread industrial adoption. Overcoming these barriers with technological innovations and regulatory support is crucial to unlocking the full potential of MOFs.

Key Players Analysis

Several companies are leading the charge in MOF innovation and commercialization. BASF SE is one of the market’s most influential players, known for its deep R&D investments and broad industrial collaborations. MOF Technologies is focused on scalable production processes, ensuring MOFs can be manufactured efficiently for large-scale applications. NuMat Technologies, another key player, is leveraging MOFs for gas storage and separation, offering custom-engineered solutions for clients.

Emerging companies such as Framework Solutions, Eco Metals Research, and Porous Tech Labs are also making waves by pushing the boundaries of what MOFs can achieve in energy and healthcare sectors. The competitive landscape is evolving quickly, with collaborations between academic institutions and industrial leaders driving further research and commercialization.

Regional Analysis

Asia-Pacific leads the global MOF market, fueled by rapid industrial growth in countries like China and India. These nations are investing heavily in MOF-based solutions for clean energy, petrochemical processes, and environmental remediation. The region’s robust chemical industry further supports market expansion.

North America holds a significant share, with the United States spearheading research and development. The presence of major players and well-established infrastructure enables quicker adoption of MOF technologies. Meanwhile, Europe follows closely behind, with Germany and the UK focusing on carbon capture, renewable energy, and stringent environmental regulations to drive demand.

Latin America is emerging as a promising market, especially in Brazil and Mexico, where industrial applications such as water treatment and gas purification are gaining attention. The Middle East and Africa are gradually adopting MOFs, particularly for oil and gas operations. Countries like Saudi Arabia and the UAE are exploring the use of MOFs for efficient resource utilization, supported by national agendas to diversify economies.

Recent News & Developments

Innovation is at the heart of recent market developments. The cost of MOFs — ranging from $150 to $500 per kilogram — has become more competitive due to improvements in synthesis techniques. Researchers and manufacturers are focusing on eco-friendly production methods, reducing toxic solvent use and improving the sustainability of MOFs.

BASF and MOF Technologies are pioneering scalable production processes, enabling broader commercial adoption. Collaborations between research institutions and industrial stakeholders are expanding MOF applications in electronics, sensing, and drug delivery. New patent filings and government-supported R&D programs are further accelerating market activity, especially in North America and Asia-Pacific.

Browse Full Report : https://www.globalinsightservices.com/reports/metal-organic-framework-market/

Scope of the Report

This comprehensive analysis covers the global MOF market from 2018 to 2034, with 2024 as the base year. It explores trends across types, applications, end users, synthesis technologies, and materials. The study evaluates growth patterns, key drivers, and restraints, while also examining competitive strategies such as mergers, acquisitions, product launches, and research partnerships.

The report includes value-chain analysis, SWOT evaluations, and local market assessments, helping stakeholders identify emerging opportunities and risks. With a deep dive into consumer behavior, regulatory frameworks, and regional dynamics, this research equips businesses with actionable insights to navigate the evolving MOF market and position themselves for long-term success.

Discover Additional Market Insights from Global Insight Services:

Compressor Oil Market :https://www.globalinsightservices.com/reports/compressor-oil-market/

Flame Retardants Market : https://www.globalinsightservices.com/reports/flame-retardants-market/

Titanium Nitride Coating Market : https://www.globalinsightservices.com/reports/titanium-nitride-coating-market/

Laboratory Glassware Market : https://www.globalinsightservices.com/reports/laboratory-glassware-market/

Thermoplastic Polyurethane (TPU) Market : https://www.globalinsightservices.com/reports/thermoplastic-polyurethane-tpu-market/

#metalorganicframeworks #mofmarket #cleanenergymaterials #gasstorageinnovation #sustainablematerials #moftechnology #catalystdevelopment #environmentalsolutions #pharmaapplications #nanomaterialsmarket

About Us:

Global Insight Services (GIS) is a leading multi-industry market research firm headquartered in Delaware, US. We are committed to providing our clients with highest quality data, analysis, and tools to meet all their market research needs. With GIS, you can be assured of the quality of the deliverables, robust & transparent research methodology, and superior service.

Contact Us:

Global Insight Services LLC 16192, Coastal Highway, Lewes DE 19958 E-mail: [email protected] Phone: +1–833–761–1700 Website: https://www.globalinsightservices.com/

0 notes

Text

India’s Green Push in Advanced E-Waste Recycling

As the volume of discarded electronics grows at an alarming rate, India has taken a firm step toward building a circular economy. Through policy reform, digital infrastructure, and technology adoption, the country is now focusing on advanced e-waste recycling methods that align with environmental sustainability goals.

From smart collection systems to AI-powered sorting and stricter EPR compliance, India is entering a new phase of waste management that treats electronic waste as a resource rather than refuse.

Why Advanced E-Waste Recycling Is Urgent in India

India is the third-largest generator of e-waste globally, with over 1.6 million tonnes produced annually and growing. Much of this waste is composed of valuable and recoverable materials, such as copper, aluminum, gold, and rare earth elements that are either lost or improperly handled due to outdated processes.

Traditional, informal recycling practices have led to unsafe working conditions, low recovery efficiency, and serious environmental damage. In response, the government and private sector are driving investments in sustainable e-waste management, aiming to modernize how India collects, processes, and recycles electronics.

Policy and Regulatory Backing: CPCB and EPR Framework

The Central Pollution Control Board (CPCB) and the Ministry of Environment, Forest and Climate Change (MoEFCC) have laid down a clear legal foundation to support modern recycling systems. The latest updates to the E-Waste (Management) Rules emphasize:

Mandatory EPR registration for producers and importers

Use of CPCB-certified recyclers for material processing

Real-time monitoring of e-waste movement through the EPR portal

Strict documentation of recycling targets and material recovery

These policies encourage transparency, accountability, and traceability in India’s e-waste value chain. Brands and bulk consumers are now expected to work with authorized e-waste disposal companies and avoid informal sector practices entirely.

The Role of Technology in E-Waste Recycling

Advanced recycling technologies are redefining how electronic waste is processed. Companies are now adopting automation and data-driven systems for technology recycling, particularly in metropolitan hubs like Chennai, Bengaluru, Cochin, and Hyderabad.

Some key innovations include:

AI-Based Sorting: Machines identify and segregate components such as circuit boards, lithium-ion batteries, and plastics with high precision.

Robotic Dismantling Units: These systems reduce human exposure to hazardous materials while improving operational efficiency.

Hydrometallurgical and Pyrometallurgical Techniques: Used to extract metals from e-waste with minimal environmental impact.

Secure Data Destruction Technologies: To ensure compliance in IT asset disposition (ITAD) and protect sensitive business data.

Together, these technologies allow for safer, smarter, and more environmentally responsible electronic waste recycling.

Strengthening India’s Circular Economy Through Green E-Waste Solutions

India’s green e-waste revolution is more than just a compliance effort it’s a movement toward environmental responsibility. By integrating technology, policy, and public awareness, India aims to shift from a linear to a circular economy where waste becomes a resource.

Benefits of this green transition include:

Increased resource recovery through efficient material separation

Reduced dependency on raw imports for metals and minerals

Lower carbon emissions from landfill reduction and cleaner recycling processes

Creation of formal employment in waste management and green tech sectors

This shift not only benefits the environment but also builds long-term economic resilience in the electronics and IT hardware sectors.

Conclusion

India’s green push in advanced e-waste recycling is a critical step in managing the country’s growing electronic waste crisis. By adopting smarter technologies, complying with EPR rules, and building partnerships with CPCB-approved recyclers, businesses can contribute meaningfully to a cleaner, more sustainable future.

This transformation is not just a responsibility it’s a strategic opportunity to lead in the era of eco-conscious innovation.

For more details, visit www.techazar.in

#EWasteRecycling#SustainableEWaste#GreenIndiaInitiative#TechnologyRecycling#CircularEconomyIndia#EWasteSolutions#ElectronicWasteDisposal#EPRCompliance#CPCBApproved#EcoFriendlyBusiness#RecycleElectronics#DigitalWasteManagement#ITAssetDisposition#AdvancedRecycling#SmartWasteSolutions#SustainableTechnology#RecyclingInnovation#GreenElectronics#EnvironmentFriendly#ElectronicWasteIndia

0 notes

Text

Global Ultra Fine Copper Market is experiencing robust expansion, with current valuations reaching US$ 2.3 billion in 2024 and projected to grow at 5.9% CAGR to US$ 3.5 billion by 2032. This remarkable trajectory stems primarily from accelerating demand in electronics manufacturing, particularly for printed circuit boards (PCBs), conductive inks, and semiconductor packaging. The market's evolution mirrors broader industrial shifts toward miniaturization and high-performance materials in sectors ranging from electric vehicles to renewable energy infrastructure.

Download FREE Sample Report: https://www.24chemicalresearch.com/download-sample/291617/global-ultra-fine-copper-market-2025-150

Market Overview & Regional Analysis

Asia-Pacific commands the ultra-fine copper landscape with over 60% market share, driven by China's dominant electronics manufacturing ecosystem and South Korea's advanced semiconductor industry. Japan follows closely with its leadership in nanoparticle technologies, while Taiwan's PCB manufacturers create sustained downstream demand. Meanwhile, North America demonstrates strong R&D capabilities, particularly in conductive ink formulations for flexible electronics, with the U.S. accounting for 78% of regional consumption.

Europe maintains technological leadership in specialty applications, with Germany's automotive sector integrating ultra-fine copper in Li-ion battery components. Emerging markets in Southeast Asia present new growth frontiers, propelled by regional governments' push to establish semiconductor manufacturing hubs and Vietnam's emergence as a PCB production center.

Key Market Drivers and Opportunities

The proliferation of 5G infrastructure deployment globally has become a paramount growth catalyst, requiring ultra-fine copper for high-frequency PCB substrates. Similarly, the electric vehicle revolution demands advanced battery technologies where copper nanoparticles enhance conductivity in anode materials. Photovoltaic applications show particular promise, with the solar industry transitioning to copper-based metallization paste for higher cell efficiency.

Medical technologies present another frontier, as antimicrobial copper nanoparticles gain traction in healthcare surfaces and wearable devices. The additive manufacturing sector is also evolving rapidly, with metal 3D printing adopting ultra-fine copper powders for complex electrical components. Advanced packaging solutions for semiconductors are driving innovation in copper micro-powder applications for thermal management.

Challenges & Restraints

Supply chain vulnerabilities pose persistent challenges, with copper price volatility impacting production economics. Technical bottlenecks in achieving sub-100nm particle consistency remain problematic for some manufacturers, while oxidation sensitivity during processing continues to compromise product yields. Environmental compliance costs have escalated for copper nanoparticle producers, particularly concerning workplace safety standards in powder handling.

Alternative materials such as conductive polymers and silver nanoparticles present competitive pressure in certain applications. Trade policies also introduce uncertainty, including China's export controls on advanced materials and evolving REACH regulations in Europe that affect copper compound classifications.

Market Segmentation by Type

Nano Copper Particle Powder (20-100nm)

Micro Copper Particle Powder (1-20μm)

Market Segmentation by Application

Electronics (PCBs, Conductive Inks, IC Packaging)

Energy Storage (Battery Anodes, Supercapacitors)

Additive Manufacturing (3D Printing Powders)

Antimicrobial Applications (Medical Devices, Coatings)

Catalysts & Chemical Processing

Key Market Players

Mitsui Mining & Smelting

Sumitomo Metal Mining

GGP Metalpowder

Fukuda Metal Foil & Powder

Nippon Atomized Metal Powders

DOWA Electronics Materials

Jinchuan Group

Shenzhen Nonfemet

Haotian Nano

Ningbo Guangbo

Report Scope and Methodology

This comprehensive analysis evaluates the ultra-fine copper market across all major regions and applications from 2024 through 2032. The report employs a multi-layered research methodology combining:

Volume and value analysis of production and consumption

Detailed competitive landscape assessment

Technological trend mapping

Regulatory impact evaluation

Supply chain analysis

Primary research includes interviews with 45+ industry stakeholders across the value chain, while secondary research incorporates patent analysis, trade data, and corporate filings. Market sizing utilizes a bottom-up approach with cross-verification through producer capacity tracking.

Get Full Report Here: https://www.24chemicalresearch.com/reports/291617/global-ultra-fine-copper-market-2025-150

Recent Industry Developments

Market leaders are aggressively expanding production capacities to meet demand. Sumitomo Metal Mining recently commissioned a new nanoparticle facility in Japan targeting 400MT annual output for electronics applications. GGP Metalpowder introduced a proprietary anti-oxidation coating technology for copper powders in Q1 2024, while DOWA Electronics acquired a German additive manufacturing materials startup to strengthen its European footprint.

Technological breakthroughs include Fujikura's development of sub-50nm copper particles for next-gen semiconductor packaging and Heraeus' conductive ink formulations achieving 95% bulk conductivity. Regulatory changes such as China's tightened export controls on advanced powder metallurgy products are reshaping trade flows, prompting manufacturers to consider regional production strategies.

Future Outlook

The market is expected to witness accelerated adoption of sustainable production methods, including electrochemical synthesis routes that reduce energy consumption by 30-40% compared to conventional processes. Emerging high-growth segments include solid-state battery components and flexible hybrid electronics, each potentially representing $500M+ opportunities by 2028.

Regional dynamics will continue evolving, with India poised to emerge as a significant consumer market as it develops domestic electronics manufacturing capabilities. Technological convergence is anticipated between ultra-fine copper and other advanced materials like 2D materials for next-generation thermal interface solutions.

About 24chemicalresearch

Founded in 2015, 24chemicalresearch has rapidly established itself as a leader in chemical market intelligence, serving clients including over 30 Fortune 500 companies. We provide data-driven insights through rigorous research methodologies, addressing key industry factors such as government policy, emerging technologies, and competitive landscapes.

Plant-level capacity tracking

Real-time price monitoring

Techno-economic feasibility studies

With a dedicated team of researchers possessing over a decade of experience, we focus on delivering actionable, timely, and high-quality reports to help clients achieve their strategic goals. Our mission is to be the most trusted resource for market insights in the chemical and materials industries.

International: +1(332) 2424 294 | Asia: +91 9169162030

Website: https://www.24chemicalresearch.com/

Follow us on LinkedIn: https://www.linkedin.com/company/24chemicalresearch

#Globalultrafinecoppermarketforecast#globalultrafinecoppermarketoutlook#globalultrafinecoppermarketkeytrends#globalultrafinecoppermarketrevenue#globalultrafinecoppermarketanalysis

0 notes

Text

How Magnetic GPS Trackers Work and Why They’re Ideal for Tracking

As asset and vehicle tracking becomes an essential component of modern business operations and personal safety, magnetic GPS trackers are gaining popularity for their discreet design, ease of use, and powerful functionality. These compact devices offer a smart, no-fuss solution for monitoring cars, bikes, containers, or any valuable movable property without the need for hardwiring or permanent installation.

Whether you’re managing a fleet, monitoring logistics, or enhancing personal vehicle security, understanding how magnetic GPS trackers work can help you decide if they’re the right fit for your tracking needs.

What Is a Magnetic GPS Tracker?

A magnetic GPS tracker is a small, portable GPS device equipped with high-strength magnets that allow it to be easily attached to a vehicle or metal surface. Unlike traditional wired trackers, it requires no installation expertise, which makes it ideal for temporary or hidden tracking scenarios.

These devices use Global Positioning System (GPS) technology to determine their precise location and send that data via mobile networks (GSM/4G) to a cloud platform or mobile app where users can view real-time updates.

How Magnetic GPS Trackers Work

The operation of a magnetic GPS tracker involves three core components:

1. GPS Module

The device receives satellite signals to calculate its exact position using triangulation. GPS signals help the device determine latitude, longitude, speed, and direction.

2. Cellular Transmitter (GSM/4G)

Once the location is calculated, the device sends this data to a central server via cellular networks. The more advanced models support real-time tracking and instant alerts using mobile or web platforms.

3. Power Supply

Magnetic GPS trackers typically run on rechargeable lithium-ion batteries. Battery life can range from a few days to several weeks or even months, depending on usage and reporting frequency.

Many trackers are equipped with motion sensors, which help extend battery life by activating only when movement is detected. Some models also offer a standby mode when idle.

Key Features of Magnetic GPS Trackers

Magnetic GPS trackers are designed to be versatile and low-maintenance. Here are the standout features that make them a preferred choice for many users:

Magnetic Mounting: No wiring required. Attach it under a vehicle or to any metal surface.

Real-Time Tracking: View live location updates via a mobile app or desktop dashboard.

Geo-Fencing: Set up virtual boundaries and receive instant alerts when the tracker enters or exits a designated area.

Movement Alerts: Get notified when the tracker starts moving or is tampered with.

Route History Playback: Review past travel routes for audit, billing, or verification purposes.

Water and Dust Resistance: Most trackers come with IP65 or higher ratings for outdoor use.

Long Battery Life: Varies from 10 days to several months, depending on model and usage.

Use Cases: Where Magnetic GPS Trackers Shine

1. Vehicle Surveillance and Anti-Theft

Attach a magnetic GPS tracker under a car or bike to monitor unauthorized movement and prevent theft. These trackers are often used by vehicle owners for peace of mind and by recovery services to track stolen assets.

2. Fleet Management

Businesses can deploy magnetic trackers to temporarily monitor new or rented fleet vehicles without modifying internal wiring or investing in permanent installations.

3. Asset Tracking

Track valuable cargo, shipping containers, or heavy equipment during transit or while in storage. The magnetic attachment allows for flexible placement based on the asset’s size and material.

4. Personal Use

Parents may use them to track teenage drivers, or individuals may use them to secure luggage during travel. They are also commonly used by investigative services or for law enforcement purposes (with appropriate legal permissions).

Advantages of Magnetic GPS Trackers

Quick Deployment: No tools or installation required.

Discreet Tracking: Compact size and magnetic design make it easy to hide.

Flexible Use: Easily move the device between vehicles or assets.

Cost-Effective: No installation cost, and many options are available for different budgets.

Remote Monitoring: Access location and data from anywhere via mobile apps.

Are There Any Limitations?

While magnetic GPS trackers offer great convenience, there are some limitations:

Battery Dependency: Unlike wired trackers, they rely on battery life. It's important to monitor and recharge as needed.

Signal Disruption: Tracking accuracy may drop in areas with poor GPS signal, such as underground parking lots or dense urban environments.

Tampering Risk: If not hidden well, the device could be discovered and removed.

Conclusion

Magnetic GPS trackers provide an ideal solution for individuals and businesses seeking a simple, effective way to monitor vehicles and movable assets. With no complex installation, powerful features, and flexible applications across industries, these trackers deliver both convenience and reliability.

From theft prevention to logistics optimization, the benefits of adopting magnetic GPS tracking are hard to ignore. As tracking technology continues to evolve, these devices offer a practical entry point into modern GPS-based asset monitoring.

If you’re considering a versatile tracking solution, a magnetic GPS tracker might just be the tool you need.

0 notes

Text

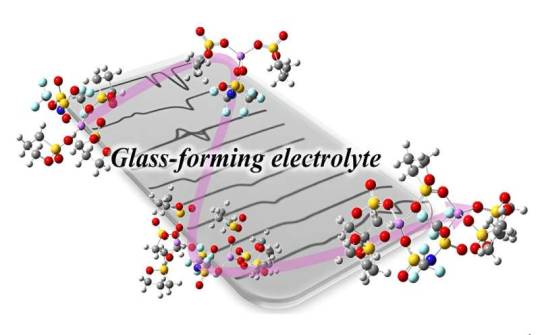

Novel glass-forming liquid electrolyte shows glass transition across broad range

As the world shifts towards a more sustainable future, the development of advanced electrochemical devices, such as rechargeable batteries with higher energy densities and efficient electrodeposition capabilities, has become increasingly crucial. In recent years, ultra-concentrated electrolyte solutions, where metal salts are dissolved at concentrations two to three times higher than those in a single solvent, or mixtures where metal salts are excessively dissolved in a single solvent, have gained attention as new electrolyte solutions. These solutions remain liquid at room temperature and enable high ion conduction and high-efficiency, high-quality metal film formation. However, the physicochemical or thermodynamic definition of these liquids remains unclear. Moreover, identifying the dissolved species and understanding their structures, which are crucial for their use as electrolytes, is extremely challenging.

Read more.

15 notes

·

View notes

Text

Powering the Circular Economy: The Urgency and Opportunity in Recycling EV Batteries

As the world races towards electrification, from two-wheelers to trains and grid-scale energy storage, lithium-ion batteries are taking center stage. With their unmatched performance, these batteries are not just powering vehicles—they are propelling the clean energy transition. However, with this accelerated deployment comes a pressing question: What happens when these batteries reach the end of their first life?

At LOHUM, we believe that the solution lies not just in innovation, but in sustainability. Our mission is to power the world sustainably through circular energy solutions, and at the heart of that mission is battery recycling and reuse.

The Growing Challenge of EV Battery Waste

The surge in electric vehicle (EV) adoption globally is rewriting the rules of transportation. Analysts predict that by 2030, over 2 million metric tonnes of EV batteries will be retired annually, representing more than half a million vehicles per year. In India alone, where EV adoption is gaining momentum through both public and private sector support, the need for a robust ecosystem for recycling of EV batteries in India has never been more urgent.

Modern EV batteries, especially those in passenger vehicles, are expected to last between 8 to 12 years. But as this wave of first-generation EVs begins to retire, the opportunity—and responsibility—to build a closed-loop system becomes clear.

Batteries Deserve a Second Life

When a battery no longer meets the demands of high-performance EVs, it still holds considerable potential. With more than 70-80% of its capacity intact, such batteries can be refurbished or repurposed for less energy-intensive applications—such as solar energy storage, backup power, or off-grid use.

Projects like the 300 kWh second-life EV battery storage system at UC Davis in California showcase how retired vehicle batteries can serve for another 6 to 10 years in stationary roles. This model isn’t just technically viable—it is economically compelling.

At LOHUM, we are pioneering India’s most advanced second-life battery ecosystem, integrating AI-driven diagnostics, safe refurbishment, and certified performance standards to extend the battery lifecycle, reduce environmental burden, and create new market opportunities.

EV Lithium-Ion Batteries Reverse Logistics: The Hidden Backbone

Efficient recycling starts long before a battery reaches a processing facility. One of the most overlooked but vital pillars of a circular battery economy is EV lithium-ion batteries reverse logistics.

This includes the safe collection, transport, tracking, and sorting of batteries across vast geographies and complex supply chains. At LOHUM, we’ve developed a pan-India reverse logistics network, supported by smart traceability systems that ensure compliance, safety, and cost-effectiveness.

Without reverse logistics infrastructure, recycling cannot scale. With it, we unlock the flow of valuable resources and turn waste into wealth.

Revolutionizing Recycling: Beyond Black Mass

Traditional recycling processes—like pyrometallurgy—are energy intensive, costly, and environmentally taxing. They burn batteries at high temperatures (~1500°C), recovering only select metals like cobalt and nickel while losing lithium and aluminum to slag.

But there’s a smarter way.

Recent research from Worcester Polytechnic Institute reveals a new cathode recycling technique that not only maintains the integrity of the battery’s crystalline structure but also outperforms newly manufactured cathodes. By preserving engineered cathode particles and simply "topping them off" with precise elemental adjustments, this approach enhances both charge rate and lifespan.

Such innovations align with LOHUM’s proprietary recycling processes, where we extract high-purity materials through sustainable hydrometallurgy and direct cathode recycling, dramatically reducing environmental impact and production costs.

The Mineral Equation: Supply, Risk, and Opportunity

Materials like cobalt, lithium, and nickel represent nearly 50% of the cost of a lithium-ion battery. Yet their price volatility—fluctuating up to 300% in a single year—poses a major risk to battery manufacturers and OEMs.

Additionally, over 60% of the world’s cobalt is sourced from the Democratic Republic of Congo, a region fraught with ethical and environmental concerns. Relying on virgin mining alone isn’t just unsustainable—it’s unsound business.

By recycling and reusing critical minerals, LOHUM offers a viable path to reduce raw material dependency, stabilize supply chains, and improve energy security. Our process enables the recovery of up to 95% of high-value materials, reintegrating them into the battery production ecosystem.

Policy and Infrastructure: Building the Circular Future

Countries like the U.S. and China are investing heavily in battery recycling infrastructure. California is developing mandates to ensure 100% of EV batteries sold are either reused or recycled at end of life.

In India, policy is catching up with the need. With the introduction of the Battery Waste Management Rules and incentives for Extended Producer Responsibility (EPR), momentum is building. But execution demands leadership.

LOHUM is proud to partner with both government and industry to develop standards, invest in recycling R&D, and expand domestic production capacity for secondary battery materials. We are not only building facilities but shaping the framework for a sustainable, scalable recycling ecosystem in India.

Toward a Billion-Dollar Circular Opportunity

As global demand for lithium-ion batteries skyrockets, the market for battery recycling and secondary material supply is expected to approach a trillion dollars in the coming decade. For India to lead, the time to act is now.

The recycling of EV batteries in India is not a side project—it’s central to our energy independence, economic growth, and environmental stewardship. With industry leaders like LOHUM driving innovation in EV lithium-ion batteries reverse logistics and closed-loop materials recovery, India has the potential to become a global powerhouse in sustainable battery manufacturing.

At LOHUM, we don’t just see discarded batteries—we see the future. And we’re building it.

Visit us at: Li-ion Battery Repurposing Technology

Originally published on: Blogger

#lohum#critical minerals#lithium battery reusing and recycling#battery waste management#li-ion battery waste management#3 wheeler ev battery#reverse logistics for lithium-ion batteries#lithium battery waste recycling

0 notes

Text

Future Of Clean Energy

As India accelerates its transition toward sustainability, the nation's commitment to reducing carbon emissions has spurred remarkable advancements across multiple sectors. From renewable energy to smart infrastructure, these technologies showcase how green tech companies in India drive meaningful change while leveraging advanced materials to enhance performance. India's National Green Hydrogen Mission has positioned the country as a potential global leader. Unlike conventional hydrogen production methods that rely on fossil fuels, green hydrogen utilizes renewable energy for electrolysis.

The intermittent nature of solar and wind energy demands sophisticated storage solutions. Next-generation solid-state and liquid metal technologies offer higher energy density, faster charging, and improved safety than traditional lithium-ion batteries.

Material science plays a critical role in these storage breakthroughs. Aramid reinforced plastic is ideal for battery enclosures due to its exceptional thermal stability and strength. Its lightweight properties also contribute to overall system efficiency.

India's EV market is experiencing explosive growth, with electric two-wheelers leading the charge. Beyond passenger vehicles, electrification is expanding to buses, trucks, and even agricultural equipment. Green tech companies in India are developing indigenous solutions across the EV value chain - from battery management systems to charging infrastructure, which are reducing costs while improving performance. Simultaneously, material advancements enable lighter, more durable vehicle components to extend the range and enhance safety.

Modernizing India's power infrastructure is essential for integrating renewable energy. Given India's diverse climatic conditions, the durability of grid components is paramount. Aramid reinforced plastic is also increasingly used in critical infrastructure due to its resistance to extreme temperatures, moisture, and mechanical stress. This ensures consistent performance while minimizing maintenance requirements across transmission networks.

Advanced waste-to-energy technologies can now convert municipal solid waste into electricity, synthetic fuels, and industrial feedstocks. Many green tech companies in India are commercializing these solutions. Their systems address waste disposal issues and contribute to energy security - a perfect example of sustainable innovation solving multiple problems simultaneously.

These technologies represent just a glimpse of India's green transformation. With continued investment in research, the country is well-positioned to emerge as a global sustainability leader. The collaboration between innovative tech companies and material science breakthroughs like aramid reinforced plastic demonstrates how technological convergence can accelerate progress.India's green tech revolution is about more than meeting climate targets—it's about building a cleaner, more prosperous future for future generations.

0 notes

Text

What Makes Metal-air Batteries a Game-Changer in the EV Market?

The global metal-air battery market was valued at US$ 576.5 million in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 12.4% from 2024 to 2034, reaching US$ 2.1 billion by the end of the forecast period. As fossil fuel supplies dwindle and the urgency of climate change escalates, industries and governments alike are shifting toward sustainable energy solutions. One of the most promising technologies at the forefront of this transition is metal-air battery systems.

Analyst Viewpoint: Depleting Fossil Fuels and Sustainability Driving Market Growth

Decreasing availability of fossil fuels, coupled with rising energy demands due to population growth and urbanization, is accelerating the adoption of alternative energy storage systems. Metal-air batteries offer a unique value proposition—lightweight, high energy density, non-toxicity, and cost efficiency. Their potential to extend the range of electric vehicles (EVs) and store renewable energy efficiently makes them central to energy strategies worldwide.

Governments are increasingly funding research and incentivizing industries to develop cleaner battery alternatives, especially in the context of global climate agreements and energy security goals. Metal-air batteries are increasingly being seen not just as an emerging solution, but as a necessity for a low-carbon future.

Market Dynamics

Depleting Fossil Fuel Reserves

By 2060, if current consumption trends continue, fossil fuel reserves may be exhausted. This stark reality is pushing stakeholders in the public and private sectors to invest in alternatives. Metal-air batteries, due to their use of abundant raw materials like aluminum, iron, and zinc, offer a viable replacement for traditional lithium-ion batteries and fossil fuel-powered systems.

Rising Demand for Clean Energy

According to the International Energy Agency (IEA), global CO₂ emissions reached a record high of 36.8 gigatons in 2022. If emissions remain unchecked, Earth’s average temperature could increase by 2°C by 2050. Metal-air batteries help reduce carbon footprints and are becoming a key technology in achieving decarbonization goals across industries—from transportation and grid storage to consumer electronics and defense applications.

Technology Overview

Metal-air batteries operate by utilizing a metal anode (e.g., lithium, zinc, aluminum) and an air cathode that facilitates oxygen reduction. During discharge, the metal oxidizes and reacts with oxygen, producing energy. Types of metal-air batteries include:

Lithium-air batteries (Li-air)

Zinc-air batteries (Zn-air)

Aluminum-air batteries (Al-air)

Iron-air batteries (Fe-air)

Sodium-air batteries (Na-air)

These batteries are often favored for their exceptional energy density—some offering up to 30 times the efficiency of conventional lithium-ion cells.

Regional Outlook

Asia Pacific: Market Leader

In 2023, Asia Pacific held the largest share of the global metal-air battery market and is projected to continue leading through 2034. Countries such as China, India, and Japan are making aggressive investments in EV infrastructure and sustainable battery R&D.

China sold approximately 1.9 million EVs in Q1 2024 alone, up 35% year-over-year. India, too, is making waves with Hindalco’s collaboration with Phinergy and IOC Phinergy Pvt Ltd. to manufacture and recycle aluminum plates for aluminum-air batteries. These efforts are positioning Asia Pacific as a global hub for clean battery innovation.

North America: Emerging Hotspot

North America is rapidly catching up. In 2023, the California Energy Commission (CEC) approved a US$ 30 million grant to Form Energy to build a long-duration iron-air battery system capable of powering the grid for up to 100 hours. Such initiatives underline the region’s focus on long-term, cost-effective, and sustainable energy storage.

Key Players and Strategic Developments

Major players in the metal-air battery market include:

Phinergy

ABOUND

NantWorks, LLC

Fuji Pigment Co., Ltd.

Sion Power Corporation

Log9 Materials

GP Batteries International Limited

These companies are actively investing in R&D, improving catalyst performance, and expanding partnerships to enhance the commercial viability of metal-air batteries.

Recent Developments

In April 2024, Japan-based AZUL Energy unveiled a paper-based, water-activated magnesium-air battery developed from sustainable, rare-metal-free materials.

In February 2024, Indian Oil Corporation increased its stake in Phinergy to 17% to further bolster domestic production and innovation in metal-air technologies.

Future Outlook

Despite currently being in advanced R&D or pilot phases, metal-air batteries are steadily advancing toward commercialization. Their advantages in energy density, low toxicity, and material abundance position them as key players in the transition to cleaner energy systems.

As governments and corporations around the world double down on clean energy strategies, metal-air batteries are poised to play a central role in powering a sustainable future.

0 notes

Text

Why do transition metals form colored compounds?

You’re here — which means you’ve already heard your teacher say something like, “Transition metals form colored compounds due to d-orbital splitting,” and your brain just went: “Umm… what?” 😵💫 Don’t worry — we’re not doing the textbook route here. Let’s ditch the jargon, grab a cup of chai (or coffee), and break it down like friends. You’ll see how these colorful metal compounds actually work and why they're not just pretty — they’re super clever little science nerds in disguise. —

Why Do Transition Metals Form Colored Compounds?

Okay, let’s get the basics out of the way first. Transition metals = those elements in the middle block of the periodic table (like iron, copper, chromium, etc.) Colored compounds = like those vivid blue copper solutions or purple manganese salts you see in chemistry labs. But WHY are they so colorful, when most other elements form boring white or clear stuff? Answer: It's all because of what’s going on with their electrons — specifically, the d-orbitals. Let’s explain that without frying your brain. —

🎨 Imagine Transition Metals Like Paint Palettes Transition metals have a special set of electron zones called d-orbitals. Think of these like five different chairs in a lounge where electrons chill. Now, when these metals bond with other atoms (like in a compound), something wild happens: The energies of those “d-chairs” shift! Some go a little higher, some stay lower. This is called "d-orbital splitting." Now here’s the fun part: Electrons love to jump between these chairs. But they can’t just hop up on their own — they need energy. And guess where that energy comes from? 🌈 Light. When white light hits a transition metal compound, some of that light gets used to boost an electron from a lower-energy d-orbital to a higher one. But not all colors get used — some get absorbed, and the ones that don't? They bounce off and hit your eyes. That’s the color you SEE. — 🧪 Example Time: Why Is Copper Sulfate Solution Blue? When light shines on a copper compound like CuSO₄ (copper sulfate), the compound absorbs certain colors from the light — mainly red and yellow. What’s left? Blue. So your eyes see a beautiful blue solution. But it’s not “dyed” blue — it’s physics and electrons doing a tiny dance show. — 🔍 So What Affects the Color? Good question. Not all transition metal compounds are the same shade. Here's what changes the color: 1. Which metal it is (like Fe vs. Cu vs. Cr) 2. What other atoms or ions are bonded to it (called ligands) 3. The number of d-electrons 4. The shape of the complex (yep, geometry affects vibes too) All of these things affect how much the d-orbitals split and which light gets absorbed. — 🎯 So Why Don't Other Elements Do This? Because most other elements don’t have partially filled d-orbitals! If the d-orbitals are totally empty or full, no electron-jumping happens = no light absorbed = no color. Just boring white or clear stuff. Transition metals sit in the perfect spot: d-orbitals are just kinda full — which makes them perfect for this colorful energy show. — 💡 Final Thoughts So next time you see a bright blue or deep green chemical in a lab, remember: It’s not just pretty — it’s electrons vibing to specific energy tunes. Transition metals are the rockstars of the periodic table, and their concerts are visible through color. — 📌 Disclaimer: This easy version is meant to help you understand the concept better. If your exam or teacher expects a textbook explanation and you write this one instead, we’re not responsible if it affects your marks. Use this for understanding, not copy-pasting. — 🔗 Related Articles from EdgyThoughts.com: Why Do Electrons Occupy Orbitals in Specific Order? 2025 https://edgythoughts.com/why-do-electrons-occupy-orbitals-in-specific-order-2025 Why Is Eigenvalue Decomposition So Important? 2025 https://edgythoughts.com/why-is-eigenvalue-decomposition-so-important-2025 🌐 External Resource: Want to get a deeper (but still friendly) breakdown? https://en.wikipedia.org/wiki/Transition_metal_complex Read the full article

#chemistrybehindmetalcolorssimple#coloroftransitionmetalcompoundseasy#coloredcompoundsininorganicchemistry#colorfulchemistryreactionsexplained#coppersulfatesolutioncolorreason#dorbitalelectronjumpingexplained#dorbitalsplittingstudentguide#funwaytolearntransitionmetalcolors#highschoolchemistrytransitionmetals#ligandseffectonmetalcolor#metalcolorchangeswithligands#sciencebehindbluegreenmetalsalts#transitionmetalcolorsexplainedforstudents#transitionmetalcomplexcolors#transitionmetalscolorandlightabsorption#visiblelightandelectrontransitions#whatcausescoloredmetalions#whycoppersolutionsareblue#whytransitionmetalsarecolored2025

0 notes