#trendidentifier

Explore tagged Tumblr posts

Text

good indicators for forex trading

📊 Good Indicators for Forex Trading: The Ultimate Guide for Profitable Trades

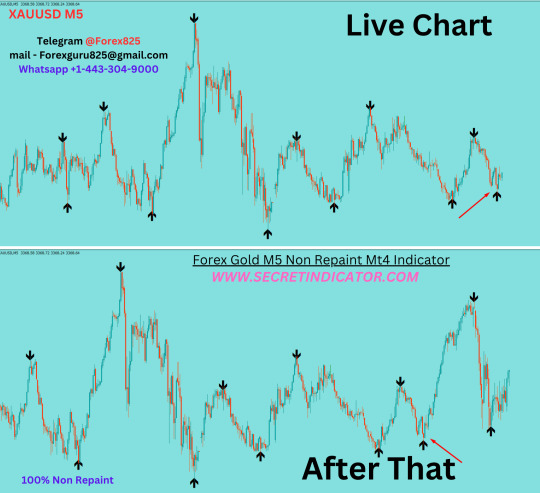

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

Telegram Channel

✅ Introduction

Forex trading is both an art and a science. While price action and market psychology play key roles, technical indicators help traders make objective, data-driven decisions. Whether you’re a beginner or an experienced trader, choosing the right indicators can dramatically improve your entries, exits, risk management, and profitability.

But with hundreds of forex indicators available — from the classic moving averages to exotic custom tools — how do you know which ones truly work?

This detailed article explores:

What forex indicators do

The core types of indicators

The best and most commonly used indicators

How to use them effectively in combination

Common mistakes and tips for better results

📌 Table of Contents

What Are Forex Indicators?

Types of Technical Indicators

Why Indicators Matter in Forex Trading

The Top 10 Good Indicators for Forex

Deep Dive into the Most Effective Indicators

Best Indicator Combinations

Tips for Using Indicators Effectively

Common Mistakes to Avoid

How to Backtest and Optimize Indicators

Final Thoughts

1. 📉 What Are Forex Indicators?

Forex indicators are mathematical calculations based on price, volume, or open interest. They analyze past market data to help traders make predictions about future price movements. Indicators are typically plotted on or below a chart and can signal:

Trend direction

Reversal zones

Entry/exit points

Market strength

Volatility

Overbought/oversold levels

They don't predict the future perfectly, but when used correctly, they help you make probability-based decisions.

2. 📊 Types of Technical Indicators

Forex indicators fall into several major categories:

🔹 Trend Indicators

Identify the direction and strength of market trends.

Examples: Moving Averages, MACD, ADX, Ichimoku Cloud

🔹 Momentum Indicators

Measure the speed of price movement to find overbought/oversold areas.

Examples: RSI, Stochastic Oscillator, CCI

🔹 Volatility Indicators

Measure the rate of price fluctuations, showing when the market is quiet or explosive.

Examples: Bollinger Bands, ATR (Average True Range)

🔹 Volume Indicators

Gauge trading volume, often used to confirm the validity of price moves.

Examples: OBV, Volume Oscillator, Chaikin Money Flow

🔹 Custom or Composite Indicators

Combine multiple tools or custom formulas.

Examples: TDI (Traders Dynamic Index), Supertrend, Pivot Point Indicator

Each type has a purpose. Great trading strategies usually combine 2–3 different types.

3. 🧠 Why Indicators Matter in Forex Trading

Trading without indicators is like driving without a speedometer or GPS — possible, but risky and uncertain.

Good indicators help:

Define trading rules

Add objectivity to decision-making

Reduce emotional trading

Confirm entries and exits

Prevent overtrading in choppy markets

Identify trends early or avoid weak ones

They don’t guarantee success — but they increase your statistical edge.

4. ✅ The Top 10 Good Indicators for Forex Trading

Here are ten indicators that are time-tested, effective, and widely used by traders across all levels: RankIndicatorTypeUse Case1Moving Averages (EMA/SMA)TrendIdentify direction and smooth price2Relative Strength Index (RSI)MomentumSpot overbought/oversold areas3MACDTrend/MomentumSignal trend changes via crossovers4Bollinger BandsVolatilityBreakout signals, range bounds5ADXTrend StrengthMeasure trend strength (not direction)6Stochastic OscillatorMomentumShort-term reversal entries7ATRVolatilitySet dynamic stop-loss based on volatility8Ichimoku CloudTrendComplete trend system with signals9Fibonacci RetracementSupport/ResistanceIdentify pullback and entry zones10Volume Indicators (OBV/CMF)VolumeConfirm trends and breakouts

Let’s now explore some of the best ones in detail.

5. 🔍 Deep Dive: Best Indicators Explained

🔹 1. Moving Averages (EMA & SMA)

Simple Moving Average (SMA): averages price over a period.

Exponential Moving Average (EMA): gives more weight to recent prices.

Popular Uses:

50 EMA & 200 EMA crossovers = trend change

Price above 200 EMA = long bias, below = short bias

Use slope of EMA for trend strength

Pro Tip: Use moving average channels for dynamic support/resistance.

🔹 2. Relative Strength Index (RSI)

Ranges from 0 to 100

Above 70 = Overbought (possible sell)

Below 30 = Oversold (possible buy)

How to Use:

Divergence between RSI and price = strong reversal signal

Combine with support/resistance zones

Use RSI > 50 in uptrends, < 50 in downtrends

🔹 3. MACD (Moving Average Convergence Divergence)

Consists of:

MACD line (12 EMA – 26 EMA)

Signal line (9 EMA of MACD)

Histogram (difference between MACD and signal)

Strategy:

MACD line crossing above signal = buy signal

Use MACD divergence to detect early trend reversals

🔹 4. Bollinger Bands

3 lines: Upper, Middle (SMA), Lower band

Bands widen with volatility, contract in calm markets

Trading Ideas:

Price touches lower band + oversold RSI = potential long

Breakout with volume = trend beginning

Range-bound strategy: buy at lower band, sell at upper

🔹 5. ADX (Average Directional Index)

Measures trend strength, not direction

Value > 25 = trend is gaining momentum

Value < 20 = market is ranging

Combine with:

+DI and –DI lines to see bull vs bear strength

Trendline or MA to confirm direction

🔹 6. Stochastic Oscillator

Two lines: %K and %D

Values > 80 = overbought, < 20 = oversold

How to Trade:

Buy when %K crosses above %D in oversold zone

Sell when %K crosses below %D in overbought zone

Best in ranging or corrective phases

🔹 7. ATR (Average True Range)

Measures volatility, not direction

Use for:

Setting realistic stop-losses based on market behavior

Filtering out low-volatility trades

Adjusting position sizing dynamically

🔹 8. Ichimoku Cloud

A complete system: trend, momentum, and future resistance zones

Components:

Kumo Cloud: dynamic S/R

Tenkan & Kijun: short-term trend crossovers

Chikou Span: lagging confirmation

Works best on H4 and D1 timeframes.

🔹 9. Fibonacci Retracement

Tool based on key price ratios (0.382, 0.5, 0.618)

Great for pullback entries in trends

Strategy:

Price retraces to 61.8% + MA support = strong long setup

Combine with candle signals or trendline breaks

🔹 10. Volume Indicators

OBV (On-Balance Volume): volume flow

Chaikin Money Flow: volume + price pressure

Use them to:

Confirm breakouts

Spot early accumulation/distribution

Add strength to RSI/MACD setups

6. 🔗 Best Indicator Combinations

No single indicator is perfect. Here are some powerful combos:

✅ RSI + Bollinger Bands

RSI confirms overbought/oversold

BB shows volatility edge

✅ ADX + Moving Averages

MA shows direction, ADX confirms trend strength

✅ MACD + Volume

MACD gives direction change

Volume confirms if it’s real

✅ Stochastic + Fibonacci

Stochastic entry after Fib retracement level

Always look for confluence of signals before entering a trade.

7. 🧠 Tips for Using Indicators Effectively

Use indicators to confirm, not control decisions

Stick to 2–3 indicators max — don’t clutter your chart

Adjust indicator settings based on timeframe and strategy

Use support/resistance and candlestick patterns as base context

Watch for divergence for early reversal warnings

8. ❌ Common Mistakes to Avoid

Over-reliance on indicators

Using too many conflicting tools

Not backtesting indicators

Ignoring market context

Trading all signals — not all are valid

Remember: Indicators follow price, not the other way around. Context is king.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex factory#forex market#forex education#forex online trading#forex broker#crypto#forex news#forex#forex indicators#forex ea

0 notes

Photo

Momentum trade setups, Advanced histogram, precise entry & exit levels, mobile alerts - in the All-in-one indicator.

What more can you expect? Grab it now. https://tradersir.com/most-accurate-professional-forex-indicator-metatrader-trend/

0 notes

Link

Related Posts:Great MetaTrader Indicator List 2019Elliott Wave Indicator VideoElliott Wave Indicator for Objective Elliott Wave TradingIntro Video For Elliott Wave TrendIdentifying Corrective Wave in Elliott WaveExcel ZigZag Indicator – Free Technical Indicator DownloadElliott Wave TradingElliott Wave Trend Basic Guide Line

0 notes

Text

Facebook Scraping Tool: Essentials You Should Know In 2019

People often have a question on their mind, do Facebook scrapping really effective? Well, the answer is yes it’s undoubtedly effective. Instead of focusing solely on the Facebook, we will discuss social media scraping attributes to an automatic web scraping tool that performs the task of gathering data not only from various social networking sites (Facebook, LinkedIn, Instagram and etc.), also includes articles, blogs, and informative sites.

Done with the definition? Now, we will move further and illuminate how social media scraping to help the business to grow.

Use of scrap data you get from social media

Scraped data from social media is helpful to business in many ways. First and foremost benefit is that this data is that they are considered to be the compelling sets of data useful for business to learn the behavior of the audience they exactly want to target. In this way, it generates broader business opportunities and makes business capable of expanding their sales with a better profit margin. As a priority, the Instagram and Facebook scraping tool are used the most, nowadays. Apart from that, scrapped data is of enormous use, some of them have been given below:-

Customer attitude Identification

Once you collected reviews from different social media channels, you will have the ease of analyzing them to recognize customer’s attitude towards a particular product, their expression, the way of writing and frame of reference will help you in this respect. Moreover, learning your customer attitude helps you to understand what exactly the customer wishes, how to satisfy them, and also ascertaining their occupied rate of engagement. Altogether, this analysis helps in accomplishing your business goals in addition to setting up a successful ad campaign.

Target Numerous Portion Of Market

Target market refers to the association of customers (including individual and organization) which is the reason for entire steps taken by an organization, right from designing, planning to maintain equilibrium in the marketing mix appropriate for the demand and expectation of that group. Here, scraped data let you determine to whom exactly your product should be advertised. It saves both your time and effort and helps to grab potential customers.

Monitor your brand online

Brand monitoring is not limited to hearing your customer’s voice, it is associated with knowing the strategy of your competitor as well as industries that are similar to your niche of business. Try to raise information more than your product or services, such as customer assistance, sales revenue, a rate of social engagement and every single notch where engagement arrives. Determine the current market trendIdentifying relevant market trend is crucial for building a marketing strategy in order to win the throne of success. Depending on the change in trends, you just need to shift oversight of your industry, and the rest, the business will remain in the same flow.

At last, we end up with the conclusion that scraping tools and data accustomed by them, are worth for your business. Still, so many people claim these tools are of no use, without reading the advantages mentioned in most of the articles. Hope this guide will make your thoughts clear of using scraping tools for the growth of your business.

0 notes

Photo

Do pros miss out on any trades? Then why should you?

Get powerful signals from Trend Power on your mobile and trade from anywhere. And never miss a trade just because you're away from the terminal.

Trade from anywhere with Trend Power! Reach us now for more details. https://tradersir.com/most-accurate-professional-forex-indicator-metatrader-trend/

0 notes

Link

Related Posts:Intro Video for Optimal Turning Point Pattern ScannerIntro Video for Advanced Price Pattern ScannerOptimum Chart Simple Intro 1 VideoElliott Wave Indicator VideoElliott Wave Trend Basic Guide LineSupport and Resistance with Elliott Wave TrendIdentifying Corrective Wave in Elliott WaveElliott Wave Indicator for Objective Elliott Wave Trading

0 notes

Link

Related Posts:Elliott Wave Indicator for Objective Elliott Wave TradingIntro Video For Elliott Wave TrendIdentifying Corrective Wave in Elliott WaveElliott Wave Indicator for MetaTrader 5Elliott Wave Indicator VideoElliott Wave Trend Basic Guide LineGreat MetaTrader Indicator List 2019Elliott Wave Trend-Basic Tutorial 1

0 notes

Link

Related Posts:Elliott Wave Indicator for MetaTrader 5Great MetaTrader Indicator List 2019Elliott Wave Indicator VideoElliott Wave Indicator for Objective Elliott Wave TradingExcel ZigZag Indicator – Free Technical Indicator DownloadIntro Video For Elliott Wave TrendIdentifying Corrective Wave in Elliott WaveElliott Wave Trading

0 notes

Link

Related Posts:Elliott Wave Indicator for MetaTrader 5Great MetaTrader Indicator List 2019Elliott Wave Indicator VideoMost advanced Elliott Wave Software for your TradingElliott Wave Indicator for Objective Elliott Wave TradingExcel ZigZag Indicator – Free Technical Indicator DownloadIntro Video For Elliott Wave TrendIdentifying Corrective Wave in Elliott Wave

0 notes

Link

Related Posts:Intro Video For Elliott Wave TrendIdentifying Corrective Wave in Elliott WaveMost advanced Elliott Wave Software for your TradingElliott Wave Trend Basic Guide LineElliott Wave Indicator for MetaTrader 5Elliott Wave Indicator VideoSupport and Resistance with Elliott Wave TrendElliott Wave Trend-Basic Tutorial 1

0 notes

Link

Related Posts:Elliott Wave Indicator for Objective Elliott Wave TradingIntro Video For Elliott Wave TrendIdentifying Corrective Wave in Elliott WaveElliott Wave Indicator for MetaTrader 5Elliott Wave Indicator VideoMost advanced Elliott Wave Software for your TradingElliott Wave Trend Basic Guide LineGreat MetaTrader Indicator List 2019

0 notes

Link

Related Posts:Intro Video For Elliott Wave TrendIdentifying Corrective Wave in Elliott WaveMost advanced Elliott Wave Software for your TradingElliott Wave Trend Basic Guide LineElliott Wave Indicator for MetaTrader 5Elliott Wave Indicator VideoSupport and Resistance with Elliott Wave TrendElliott Wave Trend-Basic Tutorial 1

0 notes

Link

Related Posts:Elliott Wave Indicator for Objective Elliott Wave TradingIntro Video For Elliott Wave TrendIdentifying Corrective Wave in Elliott WaveElliott Wave Indicator for MetaTrader 5Elliott Wave Indicator VideoMost advanced Elliott Wave Software for your TradingElliott Wave Trend Basic Guide LineGreat MetaTrader Indicator List 2019

0 notes

Link

Related Posts:Elliott Wave Indicator for Objective Elliott Wave TradingIntro Video For Elliott Wave TrendIdentifying Corrective Wave in Elliott WaveElliott Wave Indicator for MetaTrader 5Elliott Wave Indicator VideoMost advanced Elliott Wave Software for your TradingElliott Wave Trend Basic Guide LineGreat MetaTrader Indicator List 2019

0 notes

Link

Related Posts:Elliott Wave Indicator for Objective Elliott Wave TradingIntro Video For Elliott Wave TrendIdentifying Corrective Wave in Elliott WaveElliott Wave Indicator for MetaTrader 5Elliott Wave Indicator VideoMost advanced Elliott Wave Software for your TradingElliott Wave Trend Basic Guide LineGreat MetaTrader Indicator List 2019

0 notes

Link

Related Posts:Elliott Wave Indicator for MetaTrader 5Great MetaTrader Indicator List 2019Elliott Wave Indicator VideoMost advanced Elliott Wave Software for your TradingExcel ZigZag Indicator – Free Technical Indicator DownloadElliott Wave Indicator for Objective Elliott Wave TradingIntro Video For Elliott Wave TrendIdentifying Corrective Wave in Elliott Wave

0 notes