#technicalindicator

Explore tagged Tumblr posts

Text

First Trade | AUD/USD Price Movements | Golden Cross Formation

As the first trade commences, the AUD/USD currency pair is under close observation for its price movements. Traders are particularly interested in the recent Golden Cross formation that occurred on the pair's chart. The Golden Cross is a technical indicator where the 50-day moving average crosses above the 200-day moving average, signaling a potential bullish trend reversal. This occurrence is viewed as a strong buy signal by some traders, as it indicates that the short-term price momentum may be gaining strength over the long-term trend. Market participants are closely analyzing the AUD/USD pair's price action and monitoring key support and resistance levels to make informed trading decisions. As the trading session progresses, the impact of the Golden Cross formation on the pair's price movements will be closely monitored.

#FirstTrade#AUDUSD#CurrencyPair#PriceMovements#GoldenCrossFormation#TechnicalIndicator#BullishTrend#MovingAverages#TradingSignal#ForexMarket#MarketAnalysis#TradingStrategy#CurrencyTrading#ForexTrading#TraderInsights

0 notes

Text

5 Best Technical Analysis Course Online in India

Technical analysis is one of the most effective methods traders use to predict future price movements by analyzing past market data, primarily price and volume. The stock market’s complexities can be unraveled with the right knowledge and tools. This article highlights the 5 best technical analysis courses online in India, focusing on key aspects like Dow Theory in technical analysis, Nifty technical analysis, chart patterns, and the fundamental vs. technical analysis debate.

We’ll also explore how ISMT Institute of Stock Market Training excels in providing top-notch in technical analysis course.

About Technical Analysis Course

Technical Analysis Course is a technique used to assess and gauge the future value developments of financial instruments, like stocks, wares, monetary forms, and files, in light of verifiable value information and exchanging volume. Not at all like fundamental analysis, which looks at an organization’s monetary wellbeing and characteristic worth, technical analysis centers exclusively around cost and volume examples to go with exchanging choices.

Advantages & Disadvantages Of Technical Analysis Course

Advantages of Technical Analysis Course

Timing: Helps traders identify precise entry and exit points for trades.

Versatility: Applicable to various financial instruments, including stocks, commodities, forex, and indices.

Simplicity: Relies on price charts and technical indicators, making it easier to learn and apply compared to fundamental analysis.

Quick Analysis: Allows for rapid decision-making, which is particularly useful for short-term trading strategies.

Disadvantages of Technical Analysis Course

Short-Term Focus: Primarily used for short to medium-term trading, which may not be suitable for long-term investments.

Market Noise: Can be influenced by short-term market fluctuations and false signals.

Over-Reliance on Patterns: Solely relying on technical analysis can lead to ignoring fundamental factors that impact price movements.

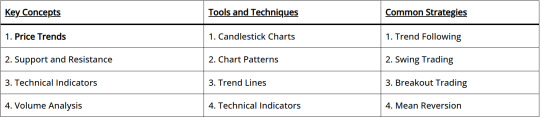

Key Concepts, Tools and Techniques & Common Strategies In Technical Analysis Course Online

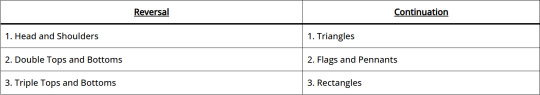

Technical Analysis Chart Patterns

Technical analysis chart patterns are vital tools for traders and investors, helping to predict future price movements by analyzing historical price data. These patterns are formed by the price movements of a stock or index over time and are used to identify potential market trends and reversals. This guide covers some of the most important chart patterns in technical analysis, their significance, and how to use them effectively.

Using Chart Patterns Effectively

Confirm the Pattern: Ensure the pattern is fully formed before acting on it. Prematurely acting on incomplete patterns can lead to false signals.

Volume Analysis: Volume should confirm the pattern. For example, in a head and shoulders pattern, volume should decrease during the formation of the head and increase on the breakout.

Set Target Prices: Measure the height of the pattern and project it from the breakout point to set target prices. For instance, in a double top pattern, the height from the peak to the support level can be projected downward from the breakout point to estimate the price target.

Use Stop-Loss Orders: Protect your capital by setting stop-loss orders at strategic points. For example, place a stop-loss just above the right shoulder in a head and shoulders pattern.

Combine with Other Indicators: Use other technical indicators, such as moving averages, RSI, and MACD, to confirm the signals provided by chart patterns.

Key Patterns

Dow Theory in Technical Analysis Course

Dow Theory in technical analysis course is one of the foundational concepts of technical analysis, developed by Charles Dow, the co-founder of Dow Jones & Company and the creator of the Wall Street Journal. Dow Theory in technical analysis provides a framework for understanding market trends and is based on the observation of market behavior through indices. This theory remains highly relevant and is widely used by traders and investors to predict market movements.

Key Principles of Dow Theory In Technical Analysis

Dow Theory consists of six tenets that form the basis of its market analysis approach:

1. The Market Discounts Everything

This principle asserts that all known information, including earnings, future prospects, and market news, is already reflected in stock prices. According to Dow, the market quickly assimilates information, and price movements are a result of the collective actions of investors.

2. The Market Has Three Trends

Dow Theory Technical Analysis Course identifies three types of market trends:

Primary Trend: It can be a bull market (upward trend) or a bear market (downward trend).

Secondary Trend: It represent corrections within a primary trend.

Minor Trend: It often influenced by day-to-day market fluctuations and noise.

3. Primary Trends Have Three Phases

Each primary trend is broken down into three phases:

Accumulation Phase: In a bear market, it’s the phase when these investors start selling, anticipating a downturn.

Public Participation Phase: This phase is typically supported by improving or deteriorating market conditions.

Excess Phase: The final phase usually sees the highest levels of activity and marks the culmination of the primary trend.

4. The Averages Must Confirm Each Other

According to Dow Theory Technical Analysis Course, for a trend to be considered valid, the movement of one market index must be confirmed by another. Originally, Dow used the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA). The idea is that if one average moves in a certain direction, the other should follow, reflecting a broad market consensus.

5. Volume Confirms the Trend

Volume should increase in the direction of the primary trend. In a bull market, higher volumes should accompany upward movements, while in a bear market, increased volumes should accompany downward movements. This principle asserts that volume is a secondary but essential indicator of the strength of a price movement.

6. A Trend Is Assumed to Be in Effect Until It Gives Definite Signals of Reversal

This principle is akin to Newton’s first law of motion, suggesting that a trend will continue in its existing direction until a clear reversal signal is observed. This means that traders should assume a trend remains in place until the weight of evidence suggests otherwise.

Nifty Technical Analysis Course

Nifty technical analysis course involves examining the Nifty 50 index’s historical price data to forecast future price movements. The Nifty 50 index comprises the top 50 companies listed on the National Stock Exchange (NSE) of India, making it a vital indicator of the Indian stock market’s overall health.

Importance of Nifty Technical Analysis

Market Sentiment: Nifty technical analysis helps traders gauge the market sentiment and identify potential bullish or bearish trends.

Risk Management: By analyzing historical data and patterns, traders can set stop-loss levels and manage their risks effectively.

Entry and Exit Points: Technical analysis provides insights into optimal entry and exit points, helping traders maximize their profits.

Key Concepts in Nifty Technical Analysis

1. Dow Theory in Technical Analysis Course

Dow Theory, developed by Charles Dow, is a foundational concept in technical analysis course. It consists of six tenets that help traders understand market trends:

Market Discounts Everything: All information, including news and events, is reflected in the stock prices.

Three Market Trends: The market has three trends – primary (long-term), secondary (medium-term), and minor (short-term).

Primary trends have three phases: Accumulation, public participation, and distribution phases.

Indices Confirm Each Other: For a trend to be valid, it should be confirmed by other market indices.

Volume Confirms Trends: Volume should increase in the direction of the trend.

Trends Persist Until a Clear Reversal: A trend remains in effect until there are clear signals of its reversal.

2. Nifty Technical Indicators

Technical indicators are mathematical calculations based on historical price, volume, or open interest data. Popular indicators used in Nifty in technical analysis course include:

Moving Averages: Help smooth out price data to identify the trend direction. Common types include Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Relative Strength Index (RSI): Measures the speed and change of price movements, indicating overbought or oversold conditions.

MACD (Moving Average Convergence Divergence): Shows the relationship between two moving averages and helps identify momentum and trend strength.

Bollinger Bands: Consist of a moving average with two standard deviation lines, indicating volatility and potential price reversals.

Applying Dow Theory to Nifty In Technical Analysis Course

When applying Dow Theory to the Nifty 50 index, traders can use the same principles to analyze market trends. Here’s how these principles can be practically applied:

Analyzing Market Trends

Primary Trends: Identify long-term trends in the Nifty 50. Look for price patterns that indicate whether the market is in a bullish or bearish phase.

Secondary Trends: Observe corrections within the primary trend. Use secondary trends to identify buying or selling opportunities.

Volume Analysis: Check if volume supports the observed price movements. Higher volumes during upward or downward movements confirm the strength of the trend.

Confirmation with Other Indices: Compare movements in the Nifty 50 with other indices like the Nifty Next 50 or sectoral indices. Confirmation across multiple indices strengthens the trend analysis.

Benefits of Dow Theory in Technical Analysis Course

Framework for Trend Identification: Dow Theory provides a clear framework for identifying and understanding market trends, essential for making informed trading decisions.

Improved Timing of Trades: By recognizing different phases of a trend, traders can better time their entry and exit points.

Enhanced Risk Management: Understanding market phases and volume trends helps traders manage their risk more effectively.

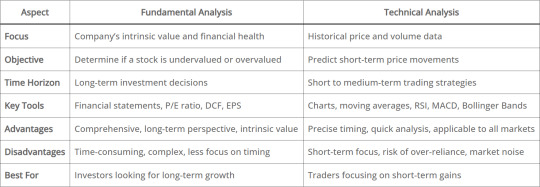

Difference Between Fundamental Analysis and Technical Analysis

In the world of stock market investing and trading, two primary methodologies are used to analyze securities and make investment decisions: fundamental analysis and technical analysis. Both approaches offer unique insights and are often employed by different types of investors depending on their investment goals and strategies. Here’s a comprehensive look at the differences between fundamental analysis and technical analysis:

Fundamental Analysis vs Technical Analysis

Investors and traders in the stock market employ various strategies to make informed decisions about buying and selling securities. Two primary approaches are fundamental analysis and technical analysis. Each method offers unique insights and tools, and understanding their differences can help investors choose the best approach for their investment goals.

Fundamental Analysis

Advantages

Long-Term Perspective: Helps in identifying long-term investment opportunities.

Intrinsic Value Focus: Provides a basis for comparing the stock’s market price to its intrinsic value.

Comprehensive Analysis: Involves a thorough examination of all aspects of a company’s performance and external factors affecting it.

Disadvantages

Time-Consuming: Requires detailed analysis and continuous monitoring of various factors.

Complex: Involves understanding financial statements and valuation models.

Less Focus on Timing: Not particularly useful for short-term trading due to its emphasis on long-term value.

Technical Analysis

Advantages

Timing: Helps in identifying precise entry and exit points for trades.

Quick Analysis: Less time-consuming compared to fundamental analysis.

Applicable to Any Security: Can be used for stocks, commodities, forex, and other trading instruments.

Disadvantages

Short-Term Focus: May not be effective for long-term investment decisions.

Risk of Over-Reliance: Solely relying on technical analysis can lead to ignoring fundamental aspects that affect price movements.

Market Noise: Can be influenced by short-term market noise and false signals.

Comparing Fundamental and Technical Analysis

ISMT Institute of Stock Market Training

The ISMT Institute of Stock Market Training is renowned for offering comprehensive technical analysis courses. These courses are designed to equip traders with the necessary skills to analyze the Nifty index and make informed trading decisions.

Comprehensive Curriculum: Covers key aspects of technical analysis, including Dow Theory, Nifty Technical Analysis, chart patterns, and technical indicators.

Flexible Learning: Offers both in-person and online classes, allowing students to learn at their own pace.

Expert Instructors: Classes are conducted by industry experts with extensive experience in stock market trading.

Practical Training: Provides hands-on training with real-time market data to ensure practical understanding and application.

Ongoing Support: Offers mentorship and support even after the course completion, helping students navigate the stock market with confidence.

CONCLUSION

Choosing the right technical analysis course can significantly impact your trading success. Each of the highlighted courses offers unique advantages, catering to different learning preferences and professional needs. The ISMT Institute of Stock Market Training stands out with its comprehensive curriculum, expert faculty, and flexible online classes, making it a top choice for aspiring traders.

Whether you prefer a structured certification course like those offered by NSE and NIFM or the flexible, self-paced learning options from Coursera and Udemy, these top five technical analysis courses in India provide excellent opportunities to enhance your trading skills and market knowledge. By understanding and applying technical analysis, traders can make more informed decisions and navigate the complexities of the stock market with greater confidence.

By ENQUIRE in a reputable ISMT Best Stock Market Course In India (Varanasi) provides both Online & Offline courses to gain knowledge and skills in the world of trading and investment.

#technicalanalysis#tradingcourse#learnstocktrading#indianstockmarket#onlinetradingcourse#financialeducation#stockmarketindia#stocktraderlife#onlinecoursesindia#technicalindicators#ismtinstitute#ismt#learnfromismt

0 notes

Text

youtube

Learn how to use the Money Flow Index (MFI) — one of the most powerful yet underrated technical indicators.

Perfect for stock traders, technical analysts, and beginners who want to use volume + price in one effective tool.

Read the full blog: https://navia.co.in/blog/money-flow-index-mfi/

Download the app - https://open.navia.co.in/index-navia.php?datasource=DMO-YT

Don't forget to like, share, and subscribe for more trading strategies!

#moneyflowindex#mfiindicator#technicalanalysis#stockmarketindia#tradingforbeginners#stocktradingtips#volumeanalysis#priceaction#tradingstrategies#niftytrading#stockmarketeducation#technicalindicators#overboughtoversold#bullishdivergence#bearishdivergence#breakoutstrategy#tradingtools#momentumtrading#indianstockmarket#naviatrading#chartpatterns#learntrading#intradaytrading#swingtrading#indicatorbasics#investingforbeginners#candlestickpatterns#macdtrading#bollingerbands#Youtube

0 notes

Text

Bitcoin Profit Secrets

Description

Discover the methods and techniques used by the most successful Bitcoin investors so you too can profit and succeed!

Bitcoin has been on the news every single day these past few months. When we turn on the television, visit our favorite news website, or browse our Facebook feed, everyone’s talking about Bitcoin!

The Bitcoin hype is at a fever pitch right now, and everyone wants to make a profit. In fact, many brave souls have tried to profit from the Bitcoin gold rush, but many have failed.

This guide will give you the background on Bitcoin, how it started, who developed it, why it was developed in the first place, and why it’s so much better than any national currency on earth.

Also you will learn how to acquire your first bitcoin, how to mine it, how to trade or invest it, and so much more!

Guide 1: What is Bitcoin and Cryptocurrency Guide 2: How Is The Value of Bitcoin Determined Guide 3: Different techniques to acquiring bitcoin Guide 4: Everything you need to know about Bitcoin Mining Guide 5: Storing your Bitcoin and other cryptocurrency safely Guide 6: Trading and Selling your Bitcoin for profit Guide 7: Using Bitcoin as an investment strategy Guide 8: Accepting and using Bitcoin in your business Guide 9: Protect yourself against fraud and theft Guide 10: The Future of Cryptocurrency

Get access to this ebook forever. Access it offline, anytime, anywhere. Once downloaded, the purchase can't be refunded.

Language: English File: PDF Size: 1,45 MB Pages: 96

#bitcoin#cryptotrading#bitcoinprofit#cryptocurrency#investing#blockchain#financialfreedom#passiveincome#cryptoinvesting#bitcoinsecrets#wealthbuilding#digitalcurrency#cryptocommunity#investmentstrategy#bitcoinwealth#moneymaking#cryptotips#bitcoininvestment#financialliteracy#cryptosuccess#chartpatterns#daytrading#forextrading#investsmart#markettrends#priceaction#riskmanagement#swingtrading#technicalindicators#tradingcommunity

0 notes

Text

Silgan Holdings Technical Indicators: Analyzing Key Trends for Investors

Explore the key technical indicators for Silgan Holdings, a leading packaging company. Learn how to analyze trends using tools like moving averages, RSI, and MACD to make informed investment decisions. Understanding Silgan Holdings' stock performance through these technical indicators can help you assess its future growth potential.

For more information visit at :

https://kalkine.com/company/nyse-slgn/

#SilganHoldings#TechnicalIndicators#StockAnalysis#Investing#TechnicalAnalysis#RSI#MACD#StockMarket#InvestingTips

0 notes

Text

Bollinger Bands. How does it work?

Bollinger Bands are a popular technical analysis tool for tracking price volatility and trends in commodities, forex, equities, and futures markets. This indicator consists of three bands—Upper, Middle, and Lower—plotted on a two-dimensional chart. The Middle Band is a simple moving average (SMA), while the Upper and Lower Bands represent two standard deviations above and below this SMA.

Bollinger Bands contract when market volatility is low and expand during high volatility, helping traders make more informed decisions. These bands can be applied across various time frames, from hourly and daily to weekly or monthly, making them versatile for both short- and long-term strategies.

How Bollinger Bands Are Constructed?

Learn more: https://www.investchannels.com/bollinger-bands-how-does-it-work/

#BollingerBands#TradingStrategies#ForexTrading#MarketAnalysis#TechnicalIndicators#FinancialMarkets#PriceVolatility#Forex#Commodities#Equities#Futures#TechnicalAnalysis#DayTrading#TradingTools#StockMarket#SwingTrading#InvestmentStrategies#PriceTrends#MarketVolatility#CryptoTrading#ChartPatterns#RiskManagement#TradingCommunity#TradingInsights#FinancialFreedom#InvestingBasics#ForexSignals#ForexTips#SmartInvesting#TradeSmart

0 notes

Video

youtube

The Ultimate Bitcoin Trading Strategy: Unveiling the Secrets to Crypto Wealth on BingX!

#bitcointrading #cryptowealth #BingXplatform #tradingstrategy #technicalindicators #movingaverages #BollingerBands #RSI #supportandresistance #priceaction #cryptonews #marketanalysis #cryptoprofits #cryptoGains #BingXtools #advancedcharting #analytics #execution #lowfees #personalizedmarketanalysis #tradingsignals #advancedordertypes #riskmanagement #cryptomillionaire #BingXreferralcode

#youtube#bitcointrading#cryptowealth#bingxplatform#tradingstrategy#technicalindicators#technical indicators#movingaverages#moving averages#bollingerbands#bollinger bands#rsi

0 notes

Text

Nifty Index: Is a Market Correction Coming? Analysts Predict a Slide to Key Support Level #200dayexponentialmovingaverage #chartpatterns #marketcorrection #Niftyindex #technicalindicators

#Business#200dayexponentialmovingaverage#chartpatterns#marketcorrection#Niftyindex#technicalindicators

0 notes

Text

Ethereum (ETH) Accumulation Signals Bullish Momentum

Title: Ethereum (ETH) Accumulation Signals Bullish Momentum Crypto Whale Accumulates Ethereum (ETH) Amid Bullish Sentiment According to Lookonchain data, a crypto whale has been accumulating Ethereum (ETH) on personal wallets, withdrawing 39,900 ETH from exchanges like Binance, Bybit, Bitfinex, and OKX since February 1st. Subsequently, the user borrowed 56.8 million DAI from the Spark credit platform and exchanged the decentralized stablecoin for ETH. ETH Primed for Breakout The significant accumulation of ETH and borrowing activity suggests strong confidence in price appreciation. With the current price of ETH at $2661 and a daily increase of 2.4%, Ethereum appears poised for a breakout. Analyzing the 4-hour chart, ETH may encounter resistance around $2720. A breakthrough above this level could propel ETH towards $3000. However, failure to clear this hurdle might lead to a retreat to the next support near the Fibonacci retracement level at $0.786. In the event of a downturn, ETH's price could drop to $235. Nevertheless, convergence and divergence of moving averages (MACD) indicate a low probability of short-term price decline. Ethereum's Technical Indicators Additionally, the 12-day EMA (blue) crossing above the 26-day EMA (orange) signals bullish sentiment, suggesting a potential for further upward movement. If this trend continues, ETH could overcome resistance at $2720. Ethereum's Total Value Locked (TVL) Hits Yearly High DeFiLlama data shows Ethereum's Total Value Locked (TVL) reaching $41.23 billion, aligning with ETH's price surge to a new yearly high. Short-Term Outlook and Potential Price Targets In the short term, ETH may target the $3000 level. Further growth could see ETH reaching $3500, potentially establishing a new all-time high by the end of 2024. Read the full article

#Accumulation#Cryptowhale#DeFiLlama#Ethereum(ETH)#movingaverages#Pricebreakout#resistancelevels#supportlevels#technicalindicators#TotalValueLocked(TVL)

0 notes

Text

The non-repainting indicator that renders confidence to you. Make better trades with Trend Power.

Make it yours now https://tradersir.com/most-accurate-professional-forex-indicator-metatrader-trend/

#trendpower#fxindicator#technicalindicator#technicalanalysis#accurateindicator#nonrepainting#mt4platform#mt5platform#tradersir

0 notes

Video

youtube

Heikin Ashi Mastery Elevate Your Trading Game with Powerful Strategies 2023

#youtube#youtube trending#HeikinAshiStrategies#TradingTechniques#CandlestickPatterns#DayTradingSuccess#TechnicalAnalysis#MarketInsights#TradingWisdom#ScalpingStrategies#ChartingTools#FinancialMarkets#TradeSmart#ProfitableTrading#CandlestickAnalysis#TechnicalIndicators

0 notes

Text

Mastering the Art of Technical Analysis in Trading

Unlocking the Potential of Technical Analysis: A Comprehensive Guide to Trading Success. By Amir Shayan

Mastering the Art of Technical Analysis in Trading

Trading in financial markets can be an exhilarating and potentially lucrative endeavor. Whether you are a seasoned trader or just starting, one thing is certain: success in trading requires a deep understanding of market trends, price movements, and the ability to make well-informed decisions. This is where technical analysis comes into play. Mastering the art of technical analysis is essential for traders seeking to navigate the complexities of the market and increase their chances of profitability.

What is Technical Analysis?

Technical analysis is a method of evaluating financial assets by analyzing historical price and volume data. Traders use various chart patterns, technical indicators, and other quantitative tools to identify potential entry and exit points for trades. Unlike fundamental analysis, which focuses on a company's financial health and intrinsic value, technical analysis is primarily concerned with price action and market psychology. Technical analysts believe that historical price movements and trading volumes provide valuable insights into future price movements. They study charts and patterns to identify trends, support and resistance levels, and potential reversal points. By understanding these patterns and signals, traders can make informed decisions and improve their chances of success.

Key Principles of Technical Analysis

- Market Discounts Everything: Technical analysts believe that all relevant information about a financial asset is reflected in its price. This principle suggests that fundamental factors, news, and external events are already factored into the market price. - Price Moves in Trends: Technical analysis is built on the idea that markets move in trends. These trends can be upward (bullish), downward (bearish), or sideways (consolidation). Traders aim to identify and follow these trends to make profitable trades. - History Repeats Itself: Technical analysis is based on the premise that market behavior is repetitive due to human psychology. Certain chart patterns, like head and shoulders or double tops, tend to repeat over time, creating opportunities for traders. - Support and Resistance Levels: Traders use support and resistance levels to identify potential price reversal points. Support is a price level where an asset's price tends to find buying interest, while resistance is a level where selling interest is prevalent. - Volume Confirmation: Volume is a crucial component of technical analysis. Traders look for volume confirmation to validate the strength of a trend or potential reversal. High volume during a price move suggests strong market participation and increases the reliability of the pattern.

Commonly Used Technical Analysis Tools

- Candlestick Charts: Candlestick charts are popular among technical analysts due to their visual representation of price movements. Each candlestick shows the open, high, low, and close prices for a specific time period. Bullish candlesticks are typically green, indicating price increases, while bearish candlesticks are red, indicating price decreases. - Moving Averages: Moving averages smooth out price data to identify trends over specific timeframes. The most common types are simple moving averages (SMA) and exponential moving averages (EMA). Traders use moving averages to spot trend changes and potential support and resistance levels. - Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It oscillates between 0 and 100, with readings above 70 indicating overbought conditions and readings below 30 suggesting oversold conditions. - Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of an asset's price. It consists of the MACD line, the signal line, and the histogram. Traders use MACD crossovers and divergences to identify trend reversals and momentum shifts. - Fibonacci Retracement Levels: Fibonacci retracement levels are horizontal lines that indicate potential support and resistance levels based on the Fibonacci sequence. Traders use these levels to identify areas where price may reverse and continue in the direction of the prevailing trend.

How to Use Technical Analysis in Trading

- Identify Trends: The first step in technical analysis is to identify the prevailing trend. Traders use moving averages, trendlines, and chart patterns to spot uptrends, downtrends, or sideways trends. - Spot Support and Resistance Levels: Support and resistance levels are crucial for making trading decisions. Traders can use horizontal lines on a chart to identify these levels and anticipate potential price movements around them. - Use Technical Indicators: Incorporate technical indicators like RSI, MACD, and stochastic oscillators to confirm price movements and identify potential entry and exit points. - Recognize Chart Patterns: Chart patterns, such as head and shoulders, triangles, and flags, provide valuable insights into potential market reversals or continuation of trends. - Combine Multiple Indicators: Traders often use a combination of indicators to strengthen their analysis and reduce false signals. However, it's essential not to overcrowd the chart with too many indicators.

The Limitations of Technical Analysis

While technical analysis is a powerful tool, it is not without limitations: - Subjectivity: Technical analysis involves interpretation, and different traders may draw different conclusions from the same data. - Backward-Looking: Technical analysis relies on historical data, which may not always be indicative of future price movements. - Emotional Factors: Emotional biases can impact trading decisions, even with a solid technical analysis strategy. - Not Suitable for All Markets: Technical analysis may be less effective in less liquid or manipulated markets.

Conclusion

Technical analysis is a valuable skill for traders looking to navigate the complexities of financial markets successfully. By understanding key principles, using various tools, and gaining experience, traders can enhance their decision-making abilities and improve their chances of profitability. Remember that no strategy guarantees success in trading, and risk management is equally important. As with any skill, mastering the art of technical analysis requires dedication, practice, and continuous learning. Whether you are an aspiring trader or an experienced investor, incorporating technical analysis into your trading toolkit can provide you with valuable insights and a deeper understanding of market movements. Remember to stay disciplined, manage your risk wisely, and continuously refine your technical analysis skills as you progress on your trading journey. Read the full article

#chartpatterns#financialmarkets#markettrends#PriceMovements#Riskmanagement#Technicalanalysis#technicalindicators#Tradingpsychology#tradingstrategies#Tradingtools

0 notes

Text

First Trade | Technical Indicators Point to DOWNTREND but Is a REVERSAL Imminent?

As the markets open, traders are closely watching the first trade for potential signals. Technical indicators are currently pointing to a DOWNTREND, suggesting a bearish sentiment in the market. However, seasoned traders are also on the lookout for any signs of a possible REVERSAL. Market dynamics can be unpredictable, and sudden shifts in investor sentiment or external factors can lead to a change in direction. The first trade can often set the tone for the day's trading activities, but it's essential to remain vigilant and adapt to changing market conditions. Traders may rely on various indicators, patterns, and volume analysis to gauge market sentiment and make informed decisions. As they keep a close eye on price movements, volume trends, and potential resistance levels, they are ready to act swiftly if a reversal pattern emerges.

#StockMarket#TradingStrategies#TechnicalIndicators#Downtrend#MarketSentiment#ReversalPattern#MarketVolatility#FirstTrade#StockTrading#MarketAnalysis

0 notes

Text

Bitcoin Breakthrough - Training Guide

Bitcoin is a cryptocurrency and a virtual type of money. It’s really like having an online version of money or cash.

You can use Bitcoin to purchase products and services and more and more vendors are accepting Bitcoin as a form of payment these days.

Now is a very good time to take an interest in Bitcoin and invest in it. It has been going strong for 10 years and its popularity has soared.

In order to make the best returns on Bitcoin investments you need to understand what it really is and how it works.

With this step by step guide:

you will learn how to avoid scams in cryptocurrency you will learn how work the blockchain technolog you will be able to keep your bitcoins safe in the best wallets you will know the best way to obtain bitcoins and the best investment strategies you will learn the advice you need to follow to make a good return on your investment

Get access to this ebook forever. Access it offline, anytime, anywhere. Once downloaded, the purchase can't be refunded.

Language: English File: PDF Size: 6,91 MB Pages: 33

#bitcoinbreakthrough#cryptotraining#bitcoinguide#blockchaineducation#investinbitcoin#cryptosuccess#digitalcurrency#bitcointips#learncrypto#cryptoinvesting#bitcoinforbeginners#financialfreedom#cryptoknowledge#bitcoinstrategy#wealthbuilding#bitcoincommunity#cryptotrends#investsmart#futureoffinance#bitcoinjourney#chartpatterns#daytrading#forextrading#technicalindicators#swingtrading#riskmanagement#markettrends#priceaction#tradingcommunity

0 notes

Text

Is Unity the Next Big Thing? Discover the Shocking Forecast Behind Its Stock Price!

Discover how to forecast stock price trends with an in-depth analysis of Unity Software Inc. Uncover insights into its core business. #UnitySoftwareInc #U #Stockpriceforecasting #Technicalindicators #Gamingstocks #AR/VRtechnology #Investmentstrategies #Technicalanalysis

In the high-stakes world of tech stocks, predicting the future of a dynamic, fast-growing company like Unity Software Inc. can feel like deciphering a complex code. But what if you could unlock the secrets behind its 3D engine and emerging technologies to forecast its next market move? Dive in and discover the insights that could reshape your investment strategy. Continue reading Is Unity the…

#3D development platform#AR/VR technology#Competitive Landscape#Gaming stocks#Investment#Investment Insights#Investment strategies#Revenue growth analysis#Stock Forecast#Stock Insights#Stock price forecasting#Technical analysis#Technical indicators#U

0 notes

Video

youtube

DiA Quant: The Ultimate Trading App for Copying Crypto Trades?

#DiAQuant #CryptoTrading #CopyTrading #AI #MachineLearning #AutomatedTrading #PortfolioOptimization #MarketAnalysis #RiskManagement #Cryptocurrency #TradingApp #BingXExchange #ReferralCode #Volatility #InvestmentStrategy #ExpertTraders #MarketInsights #RiskMitigation #Diversification #RealTimeData #TechnicalIndicators #TrendAnalysis #CryptoMarkets #FinancialGoals #UserExperience #TradingPerformance

#youtube#DiAQuant#cryptotrading#copytrading#ai#ai generated#machinelearning#automatedtrading#automated trading#portfoliooptimization

0 notes