#vinod nair

Text

Rbi: RBI interest rate decision, global trends to drive markets in holiday-shortened week: Analysts - Times of India

NEW DELHI: RBI‘s interest rate decision, macroeconomic data and global trends would dictate terms in the equity market in a holiday-shortened week, analysts said.Besides, the focus will also be on foreign portfolio investors’ trading activity, they added.Equity markets will remain closed on Tuesday for ‘Mahavir Jayanti‘ and on Friday on account of ‘Good Friday’.“Investment by FIIs, who are…

View On WordPress

0 notes

Text

Nifty Posts 34th Record This Year As Private Banks Rally: Market Wrap

A rally in banking and financial stocks pushed India's benchmark equity indices to another record on Tuesday amid strong domestic cues. The NSE Nifty 50 hit a fresh record for the 34th time this year, while the 1,000-point journey of the S&P BSE Sensex to cross the milestone of 78,000 was done in 11 sessions. The Nifty closed 183.45 points, or 0.78%, higher at 23,721.30, while the Sensex ended 712.44 points, or 0.92%, up at 78,053.52. During the day, the Nifty rose as much as 0.92% to 23,754.1, while the Sensex advanced as high as 1.06% to 78,053.5. The domestic market experienced a financial sector-driven rally, primarily led by private banks, according to Vinod Nair, head of research at Geojit Financial Services. "However, profit booking was evident in sectors such as realty, power, metals and mid-caps." During the session, the Nifty 50 companies' market capitalisation rose by Rs 92,000 crore. The Nifty Bank scaled past the 52,500 mark, led by Axis Bank Ltd., HDFC Bank Ltd. and ICICI Bank Ltd. The index rose for the second session in a row and closed 1.77% higher at 52,620.15. The Nifty Bank is trading in a strong uptrend with higher highs and higher lows intact on the daily chart, according to Kunal Shah, senior technical and derivative analyst at LKP Securities. "The support now stands at 52,000, and intraday dips should be viewed as a buying opportunity for targets of 53,000/53,500." Shares of HDFC Bank Ltd., ICICI Bank Ltd., Axis Bank Ltd., Reliance Industries Ltd., and Larsen & Toubro Ltd. contributed the most to the gains in the Nifty. While those of PowerGrid Corp., Tata Steel Ltd., Asian Paints Ltd., Eicher Motors Ltd., and Bharti Airtel weighed on the index. Most sectoral indices on the NSE traded lower, with the Nifty Realty being the top loser.

0 notes

Text

Sensex hits 82,000, Nifty 25,000 for 1st time as US rate cut nears - Information Today Internet - BLOGGER

https://www.merchant-business.com/sensex-hits-82000-nifty-25000-for-1st-time-as-us-rate-cut-nears/?feed_id=152879&_unique_id=66ad988ad23ad

MUMBAI: A strong US market close the previous night backed by dovish comments by theFed chief lifted sentiment onDalal Street on Thursday which saw the sensex break above the 82,000 mark for the first time and the Nifty above the 25,000 milestone. The indices, however, closed lower than their respective all-time highs as profit taking at higher levels had set in due to the rising geopolitical tensions in West Asia, market players said.The day’s session started on a high note with the sensex rallying to an intraday high at 82,129 points while Nifty recorded its all-time high at 25,078 points.At close, the sensex was at 81,868 points, up 126 points (0.2%) while Nifty was at 25,011 points, up 60 points (0.2%).Outside of the leading indices, there was strong selling due to the brewing tensions between Israel, Lebanon, Iran and some other countries in West Asia. As a result, BSE’s midcap index closed 0.8% lower while the smallcap index was down 0.7%.According to Vinod Nair of Geojit Financial Services, the domestic market started on a positive note, taking cues from the global market following the US Federal Reserve chairman’s indication that a rate cut in the world’s largest economy could come as soon as Sept, mainly because of easing inflationary pressures. “However, the broader market closed (with) a negative bias due to escalating geopolitical tensions in (West Asia) leading to rising crude oil prices.”On a sectoral basis, capital goods and realty were impacted by profit-booking coupled with auto sectors owing to below-expected monthly auto sales figures, Nair wrote in a note. The session’s negative undercurrent pulled down investors’ wealth by about Rs 70,000 crore with BSE’s market capitalisation now at nearly Rs 475 lakh crore. While midcap and smallcap stocks have made significant gains in the past few months, it is believed that large-cap stocks may see increased investor interest in the near future, said Neeraj Chadawar of Axis SecuritiesIn Thursday’s market, HDFC Bank, Reliance Industries and PowerGrid contributed the most to the sensex’s gain but selling in Mahindra, Infosys and L&T moderated its rise. Foreign funds were net buyers in Thursday’s market with a net inflow figure of Rs 2,089 crore while domestic institutions were net sellers at Rs 337 crore, BSE data showed.“India Business News: The day’s session started on a high note with the sensex rallying to an intraday high at 82,129 points while Nifty recorded its all-time high at 25,07”Source Link: https://timesofindia.indiatimes.com/business/india-business/sensex-hits-82000-nifty-25000-for-1st-time-as-us-rate-cut-nears/articleshow/112209637.cms

http://109.70.148.72/~merchant29/6network/wp-content/uploads/2024/08/pexels-photo-9154520.jpeg

Sensex hits 82,000, Nifty 25,000 for 1st time as US rate cut nears - Information Today Internet - #GLOBAL

BLOGGER - #GLOBAL

0 notes

Text

Sensex, Nifty Rally Recoup Nearly Half Of Tuesday's Rout: Market Wrap

India's equity gauges staged a recovery on Wednesday as they recovered most of the losses incurred by the worst market crash in four years in the previous session. The surge came after the National Democratic Alliance pledged support to form a government for the third term. The NSE Nifty 50 closed 688.95 points higher, or 3.15%, at 22,573.45, while the S&P BSE Sensex ended 2,303.1 points up, or 3.2%, at 74,382. Intraday, the Nifty rose as much as 3.59% to 22,670.4, the highest intraday rise since Feb. 1, 2021, while the Sensex advanced 3.41% to 74,534.8.

The market capitalisation of Nifty 50 companies rose by Rs 5.3 lakh crore during trade. After opening at Rs 83.46, the Indian rupee strengthened 15 paise to Rs 83.37 against the US dollar. The yield on the 10-year bond was trading flat at 7.03%. The stock volatility gauge, India VIX—which rose over 50% during poll counting—fell over 30% to 18.6 during the session.

The Indian markets exhibited a spirited recovery driven by broad-based buying across sectors, as political stability appears assured, according to Vinod Nair, head of research at Geojit Financial Services Ltd. "However, attention will remain on the formation of the government and the forthcoming RBI policy meeting."

To get more updates on option trading and check optionperks's best features option strategy builder and option index executor

0 notes

Text

Stock Market Closing: Market Declines Due to Weak Global Cues, Sensex and Nifty Drop by 1 Percent

The stock market concluded the fourth day of the trading week in the red. Both stock exchanges recorded a decline of nearly 1 percent. Meanwhile, the Indian Rupee saw a slight increase of 2 paise against the US Dollar. It's worth noting that crude oil prices continue to fluctuate.

Amidst significant negative trends in global markets, continuous foreign fund outflows, equity benchmark indices Sensex and Nifty witnessed a decline of approximately 1 percent on Thursday. Traders also pointed out that heavy selling pressure in major companies like Reliance Industries, Infosys, and TCS had an impact on the market sentiment.

Read more : Petrol and Diesel Prices Today: Updated Fuel Rates in These Cities, Find Out Today's Prices

Today, the BSE Sensex closed at 65,508.32, down 610.37 points or 0.92 percent. During the day, it slipped to 65,423.39 after falling by 695.3 points or 1.05 percent. The Nifty ended at 19,523.55, down 192.90 points or 0.98 percent.

Top Gainers and Losers Tech Mahindra saw the most significant decline in the Sensex pack today, dropping by 4.59 percent. It was followed by Asian Paints, Vipro, Kotak Mahindra Bank, Bajaj Finserv, Infosys, TCS, Mahindra and Mahindra, Hindustan Unilever, IndusInd Bank, Reliance Industries, and JSW Steel, all witnessing substantial losses.

On the flip side, Larsen and Toubro, Bharti Airtel, Power Grid, and Axis Bank's shares were among the top gainers.

Global Market Overview In Asian markets, the Shanghai Composite closed in the red, while Tokyo and Hong Kong ended lower. South Korea had a holiday, leading to a halt in trading. European markets were trading with a negative bias. On Wednesday, the US markets closed mixed.

Global crude oil benchmark Brent Crude slipped by 0.38 percent to $96.18 per barrel. According to exchange data, Foreign Institutional Investors (FIIs) sold equities worth ₹354.35 crore on Wednesday.

Vinod Nair, Chief Research Officer at Geojit Financial Services, commented that the selling was broad-based as investors remained cautious due to the fluctuations in oil prices. If crude oil continues to stay above $90 per barrel, it poses a risk to inflation and reduces operating margins. Currently, high interest rates and the tapering of the US bond yields are affecting FIIs' staying in sell mode.

Market Recap from Yesterday In the previous session on Wednesday, the BSE benchmark index gained 173.22 points or 0.26 percent to close at 66,118.69. Meanwhile, the Nifty increased by 51.75 points or 0.26 percent to end at 19,716.45.

Rupee Strengthens The Indian Rupee closed at ₹83.20 (last) against the US Dollar on Thursday, marking a 2 paise increase due to rising crude oil prices and improvements in greenback. It opened at ₹83.22 against the US Dollar and traded in the range of ₹83.25 to ₹83.13 during the day's trading. Today, the Rupee closed at ₹83.20 against the US Dollar, which is 2 paise higher than the previous close of ₹83.22. On Wednesday, after sluggish trading, the Rupee had closed at ₹83.22 against the US Dollar."

Read the full article

0 notes

Text

Dhanya Rajesh Wiki/Bio, Age, Height, Weight, Family, Net Worth

Dhanya Rajesh Wiki: Dhanya Rajesh is a popular Indian TikToker and social media personality. She was born on May 23, 1998, in Kasaragod, Kerala, India. She is 24 years old and currently lives in Kasaragod. Dhanya completed her graduation from CK Nair Arts and Management College, Kasaragod, Kerala, India. She has a huge fan following on her social media accounts, especially TikTok. She is known for her performance, styling, and innocent looks. She gained popularity for her videos in which she performed popular Tollywood songs.

Dhanya Rajesh Wiki/Bio

Dhanya Rajesh Height, weight, and More

Dhanya Rajesh Career Information

Dhanya Rajesh Net Worth Information

10 Interesting Facts about Dhanya Rajesh

Conclusion

Dhanya's parents are Rajesh and Suja. She has two brothers named Vinu Rajesh, Sarang Doshti, and Noufal Pm and a sister named Akshara Rajesh, Arunima DK, Greenshma Vinod, and Prasi Mullachery. She is a Hindu by religion and belongs to the Leo zodiac sign. Her height is 5' 3" (161 cm), and she weighs around 50 kg (110 lbs). She has black eyes and black hair.

Dhanya Rajesh Wiki, Bio

Dhanya Rajesh Wiki/Bio

NameDhanya RajeshFull NameDhanya Suja RajeshOther NameHelen of SpartaDate of Birth23 May 1998CategoryBiographyAge24 Years OldBirth PlaceKasaragod, Kerala, IndiaLive InKasaragodProfessionTikToker and Social Media PersonalityNationalityIndianReligionHinduismHometownKasaragod, KeralaZodiac SignLeoSchool/High SchoolGovernment Higher Secondary School Chemnad, Paravanadukkam, Kerala, IndiaCollege/UniversityCK Nair Arts and Management College, Kasaragod, Kerala, IndiaEducation QualificationGraduateFather NameRajeshMother NameSujaBrother NameVinu Rajesh, Sarang Doshti, Noufal PmSister NameAkshara Rajesh, Arunima DK, Greenshma Vinod, Prasi MullacheryBoyfriend-Marital StatusUnmarriedEmail ID-Residence AddressKasaragod, Kerala, IndiaInstagram@helenofsparta_officialFacebook-Twitter@helen_of_spart

Dhanya Rajesh has a massive following on her social media accounts, especially TikTok, where she uploads videos performing popular Tollywood songs. Her innocent looks and styling make her videos stand out. Dhanya completed her graduation from CK Nair Arts and Management College, Kasaragod, Kerala, India. She belongs to a Hindu family and has two brothers and a sister. She is currently unmarried and does not have a boyfriend.

Dhanya Rajesh Height, weight, and More

Dhanya Rajesh is a popular TikToker and social media personality known for performing on popular Tollywood songs. She is also admired for her innocent looks and styling. Dhanya has a charming personality and is loved by her fans for her talent and hard work.

Dhanya Rajesh's height is 5' 3" (161 cm), and she weighs around 50 kg (110 lbs). She has an hourglass figure with body measurements of 32-28-34. Dhanya has black eyes and black hair that complements her looks perfectly. She wears a shoe size of 6 (US) and a dress size of 2-4 (US). Dhanya does not have any tattoos or piercings.

NameDhanya RajeshHeight5' 3" (161 cm)Weight50 kg (110 lbs)Body Measurements32-28-34Eye ColourBlackHair ColourBlackShoe Size6 (US)Dress Size2-4 (US)Figure TypeHourglassTattoo(s)NonePiercing(s)NoneLast Updated2023

Dhanya Rajesh is a talented TikToker and social media personality known for her performances on popular Tollywood songs. She has an hourglass figure with body measurements of 32-28-34, and her height is 5' 3" (161 cm). Dhanya weighs around 50 kg (110 lbs) and has black eyes and black hair that complements her looks perfectly. She wears a shoe size of 6 (US) and a dress size of 2-4 (US). Dhanya has no tattoos or piercings, but she has a charming personality that her fans love.

Dhanya Rajesh Career Information

Dhanya Rajesh is a talented TikToker and social media personality who gained popularity for her videos on TikTok. She has accumulated 732.1K followers on her TikTok account and has millions of likes on her videos. Dhanya is known for her performances on popular Tollywood songs, and her innocent looks and styling make her videos stand out.

In addition to her social media presence, Dhanya is a fashion influencer and has collaborated with various fashion brands. Her popularity on social media led her to endorse different products on her Instagram account. Dhanya has also participated in a few fashion shows and events, showcasing her talent as a fashion influencer.

Dhanya Rajesh's career in social media has been successful, and she has gained a substantial following due to her talent and hard work. Her popularity on social media has led her to endorse various products and collaborate with fashion brands. She is a talented TikToker and social media personality with a bright future ahead of her.

NameDhanya RajeshProfessionTikToker and Social Media PersonalityCareer DebutTikTokTikTok Followers732.1KTotal TikTok LikesMillionsEndorsementsVarious ProductsFashion CollaborationsVarious Fashion BrandsFashion Shows/EventsFewLast Updated2023

Dhanya Rajesh's career began as a social media personality, and she gained popularity for her videos on TikTok. She has accumulated 732.1K followers on her TikTok account and has millions of likes on her videos. Dhanya is known for her performances on popular Tollywood songs, and her innocent looks and styling make her videos stand out. She has endorsed various products on her Instagram account and collaborated with fashion brands. Dhanya has also participated in a few fashion shows and events, showcasing her talent as a fashion influencer.

Dhanya Rajesh Net Worth Information

Dhanya Rajesh's net worth is estimated to be around $0.7 million. She earns significant money from her social media accounts and brand endorsements. Dhanya is also a fashion influencer and has collaborated with various fashion brands.

Dhanya Rajesh's net worth is estimated to be $0.7 million. She earns significant money from her social media accounts, brand endorsements, and collaborations with fashion brands.

NameDhanya RajeshProfessionTikToker and Social Media PersonalityNet Worth (approx)$0.7 MillionAnnual Income$100K-$300KMonthly Income$8.3K-$25KWeekly Income$2K-$6.25KDaily Income$286-$892Brand EndorsementsVarious BrandsLast Updated2023

Dhanya Rajesh's net worth is estimated to be around $0.7 million. She earns an annual income of $100K-$300K and a monthly income of $8.3K-$25K. Her weekly income is $2K-$6.25K, and her daily income is $286-$892. She earns significant money from her brand endorsements and collaborations with fashion brands.

10 Interesting Facts about Dhanya Rajesh

- Dhanya Rajesh is a popular Indian TikToker and social media personality.

- She was born on May 23, 1998, in Kasaragod, Kerala, India.

- Dhanya completed her graduation from CK Nair Arts and Management College, Kasaragod, Kerala, India.

- She has a huge fan following on her social media accounts, especially TikTok.

- Dhanya is known for her performance in popular Tollywood songs.

- Her innocent looks and styling make her videos stand out.

- Dhanya belongs to a Hindu family and has two brothers and a sister.

- She is currently unmarried and does not have a boyfriend.

- Dhanya is a fashion influencer and has collaborated with various fashion brands.

- Her net worth is estimated to be around $0.7 million.

Conclusion

In conclusion, Dhanya Rajesh is a talented TikToker and social media personality with a huge fan following. She gained popularity for her videos on TikTok and is known for performing popular Tollywood songs. Her innocent looks and styling make her videos stand out.

Dhanya is also a fashion influencer and has collaborated with various fashion brands. Her net worth is estimated at around $0.7 million, and she earns significant money from her social media accounts and brand endorsements.

Read the full article

0 notes

Photo

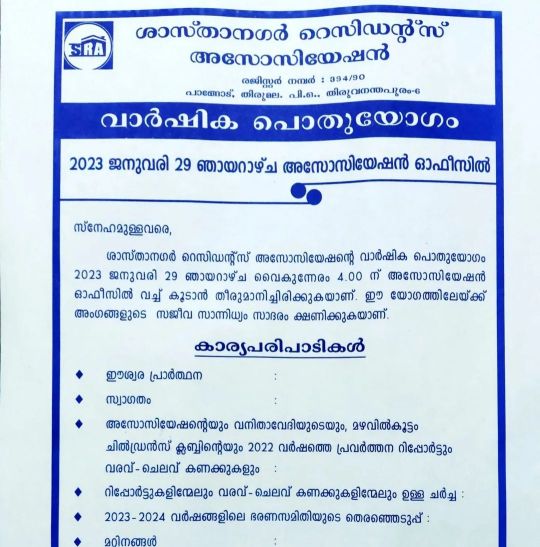

പ്രിയപ്പെട്ട നഗർ നിവാസികളെ, ശാസ്താനഗർ റെസിഡൻസ് അസോസിയേഷൻ്റെയും വനിതാ വേദിയുടെയും മഴവിൽക്കൂട്ടം ചിൽഡ്രൺസ് ക്ലബിൻ്റെയും 2023-25 പ്രവർത്തന വർഷത്തേയ്ക്ക് തിരഞ്ഞെടുക്കപ്പെട്ട ഭാരവാഹികൾ *Residents' Association* President - Shri. Nedumcaud Radhakrishnan, SRA77, 9745108765 Vice President - Shri. M. Abdul Majeed, SRA191, 9447309084 Secretary: Shri. G. Binukumar, SRA48, 7558829665 Joint Secretaries - Shri. B. Suresh Kumar, SRA21, 8111989633 & Shri. Avani Binu, SRA170A, 8136997738 Treasurer - Shri. R. Muraleedharan Nair, SRA 58, 9446575057 *Members* 1. Shri. Rajeev R. Nair, SRA 9 2. Shri. Umesh B., SRA 63 3. Shri. Satheesh P. Nair, SRA 156 4. Shri. Rajesh Nair, SRA 247B 5. Shri. S. Sreeju, SRA 153 6. Shri. Sobhan Babu, SRA 108 7. Shri. G. Reji, SRA 243 8. Shri. N. Mineesh, SRA 45 9. Shri. G.S. Renjith, SRA 230 19. Shri. G. Vinod Kumar, SRA 142 11. Shri. G. Mahesh, SRA 138 12. Shri. Madhusoodhanan, SRA 18 12. Shri. Jayachandran Nair, SRA 101 14. Shri. J.S. Madhu Gopan, SRA 105 15. Shri. Manoj Sasidharan, SRA 133 *SRA Vanitha Vedhi* President - Dr. D. Thankam, SRA 181 Vice President - Smt. P. Padmakumari, SRA 211 Secretary - Smt. D. Geetha, SRA 182 Joint Secretary - Smt. Rema Suresh, SRA 21 Treasurer - Smt. Kavitha Suresh, SRA 150 *Members* 1. Smt. S. Indira Devi, SRA 144A 2. Smt. Chithra Mahesh, SRA 138 3. Smt. Amritha K, SRA 61 4. Smt. Supriya Sunil, SRA 153B 5. Smt. Sreedevi, SRA 149 6. Smt. G. Sindhu, SRA 223 7. Smt. Sobhana Rajeev, SRA 245 *Mazhavilkkoottam Children's Club* President - Kumari. Devika N., SRA 108 Vice Presidents - Kumari. Niya Raj, SRA 247(B) & Master. Jyothish, SRA 148 Secretary - Master. Navan B. Nair, SRA 170A Joint Secretaries - Master. Aryan, SRA 216 & Kumari. Vani, SRA 64 Treasurer - Kumari. Athira S., SRA 4 *Members* 1. Master. Manav Umesh, SRA 63 2. Master. Yadhu Nandhan, SRA 108 3. Master. Madhav Umesh, SRA 63 4. Kumari. Nanma Nair, SRA 50 5. Kumari. Nandha Krishna, SRA 62 6. Kumari. Neha Raj, SRA 247(B) 7. Kumari. Sradha, SRA 61 സസ്നേഹം, സെക്രട്ടറി, SRA. (at Sastha Nagar Residents' Association ശാസ്താ നഗർ പാങ്ങോട്) https://www.instagram.com/p/CoC4CnTvl_N/?igshid=NGJjMDIxMWI=

0 notes

Text

Stock Market Highlights: Nifty forms Doji candle on daily charts ... - Economic Times

Stock Market Highlights: Nifty forms Doji candle on daily charts … – Economic Times

Economic Times | 01 Nov, 2022 | 10:24PM IST– Mr. Ajit Mishra, VP – Research, Religare Broking– Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services#EarningsWithETNOW | Uber Q3 revenue at $8.34 bn vs est of $8.1 bn Uber sees Q4 gross bookings at $30 bn to $31 bn… https://t.co/yPc63gHzWX– Vinod Nair, Head of Research at Geojit Financial Services#AutoSales | Auto sales are…

View On WordPress

0 notes

Photo

Voda Idea surges 15% ahead of AGR verdict NEW DELHI: After three days of trading with negative bias, buyers returned to Vodafone Idea as the stock spiked 15 per cent in anticipation of a favourable verdict in the AGR case.

0 notes

Text

Kalyan Jewellers appoints former CAG Vinod Rai as Chairman

Kalyan Jewellers India Ltd on Monday appointed former CAG Vinod Rai as its Chairman and independent non-executive director.

The appointment will be subject to regulatory and shareholders' approvals, the company said in a stock exchange filing.

T S Kalyanaraman will continue as Managing Director on the company's board.

Vinod Rai was the former Comptroller and Auditor General of India (CAG) and the former chair of the United Nations Panel of External Auditors.

Rai has held various positions within the central as well as state governments, and has been instrumental in various reforms. He has also served as the Chairman of the Banks Board Bureau, a body set up by the government to reform public banking in the country.

Rai has been awarded the Padma Bhushan, India's third highest civilian award, in recognition of his services to the country.

He has Masters degrees in economics as well as public administration from Delhi School of Economics, University of Delhi, and the Harvard Kennedy School, Harvard University, USA, respectively.

"It is a privilege for me to be associated with Kalyan Jewellers, a company which has built the highest levels of trust amongst its stakeholders, conducts its business in an ethical and transparent manner and upholds the standards of good corporate governance," Rai said.

Kalyan Jewellers has a well-recognised brand, pan-India footprint and a strong management team at the helm of the business, he said.

Read more

0 notes

Text

3 & The Emerald Stone of Irene | Vinod Raman Nair | Book Review

3 & The Emerald Stone of Irene | Vinod Raman Nair | Book Review

Publisher : Notion Press; 1st edition (20 October 2021)

Language : English

Paperback : 292 pages

A book that offers a vibrant mix of genres seems like an attractive prospect for eclectic readers. When historical fiction is combined with fantasy and adventure, we get 3 & The Emerald Stone of Irene. This book by Vinod Raman Nair revolves around the conquest of Byzantium in 782 AD.…

View On WordPress

#3 & The Emerald Stone of Irene#Book Blogging#Book Reviews#Bookish Fame#Books#Indian Book Blogger#Vinod Raman Nair

0 notes

Text

Nifty, Sensex End Higher Led By HDFC Bank, Power Grid But Kotak Bank Weighs: Market Wrap

India's benchmark equity indices ended Thursday on a positive note, with gains led by HDFC Bank Ltd. and Power Grid Corp. of India, but the upside was limited due to losses in the shares of ICICI Bank Ltd. and Kotak Mahindra Bank Ltd. The NSE Nifty 50 ended 52.30 points up, or 0.23%, at 22,657.15, and the S&P BSE Sensex gained 128.33 points, or 0.17%, to close at 74,611.11. The Nifty has been in consolidation mode and some weakness can be seen in the next one or two sessions, said Nagaraj Shetti, technical and derivative analyst at HDFC Securities Ltd. Broader markets ended higher on the BSE. The S&P BSE Midcap closed 0.91% higher, and the S&P BSE Smallcap was up 0.29%. "The broader market largely traded range-bound, while positive commentary from the auto companies on recent volume numbers led the sector to outperform," said Vinod Nair, head of research at Geojit Financial Services Ltd. On BSE, 15 of the 20 sectors advanced and five declined. Market breadth was evenly split between buyers and sellers. Around 1,913 stocks rose, 1,924 stocks declined, and 120 stocks remained unchanged on the BSE.

0 notes

Text

Memories of a busy Onam

Memories of a busy Onam

[ad_1]

Bharatanatyam dancer Aswathy V Nair is missing the stage. Like most performing artistes, the Onam season used to a busy one for Aswathy. “I see little chances for any dance programmes happening this year,” she says.

“During Onam last year, I had three shows in Chennai,” she says. “I have also performed during the Kerala Government’s Onam celebrations.”

In 2006, it was during Onam that…

View On WordPress

#Aswathy V Nair#COVID-19#Kanakakunnu Palace#Marimayam#Nishagandhi stage#Oru Cheru Punchiri#performance#Rajashree Warrier#stage#Vinod Kovoor

0 notes

Video

undefined

tumblr

I.T. experts Vinod Nair, Vice President-Operations, Infomatics Services Pvt. Ltd. and Tejas Fadia, Head: Pre-Sales & Implementation-Finance Solutions, Infomatics Services Pvt. Ltd. discuss the relevance of Data Science in the current times. Watch how Data Science and Artificial Intelligence have the potential to predict the future. Statistics and data science are helping the government across countries to analyze COVID – 19 data and take better measures to control the situation.

This an excerpt from the webinar ‘New Technology Areas – Data Science / Analytics’ organised by Aptech Learning on May 23, 2020.

You can pursue a career in Data Science with Aptech Learning’s career courses.

0 notes

Text

UNSOLD PLAYERS AUCTION

1. David Miller sold for 3 Cr to GT

2. Sam Billings sold for 2 Cr to KKR

3. Wriddhiman Saha sold for 1.9 Cr to GT

4. Matthew Wade sold for 2.4 Cr to GT

5. C Hari Nishanth sold for 20L to CSK

6. Anmolpreet Singh sold for 20L to MI

7. Vishnu Vinod sold for 50 L to SRH

8. N Jagadeesan sold for 20 L to CSK

9. Chris Jordan sold for 3.6 Cr to CSK

10. Lungisani Ngidi sold for 50 L to DC

11. Karn Sharma sold for 50 L to RCB

12. Kuldeep Sen sold for 20 L to RR

13. Alex Hales sold for 1.5 Cr to KKR

14. Evin Lewis sold for 2 Cr to LSG

15. Karun Nair sold for 1.4 Cr to RR

16. Glenn Phillips sold for 1.5 Cr to SRH

17. Tim Seifert sold for 50 L to DC

18. Ramandeep Singh sold for 20 L to MI

19. Nathan Ellis sold for 75 L to PBKS

20. Dhruv Jurel sold for 20 L to RR

21. Atharva Taide sold for 20 L to PBKS

22. Fazalhaq Farooqi sold for 50 L to SRH

23. Teja Baroka sold for 20 L to RR

24. Bhanuka Rajupaksa sold for 50 L to PBKS

25. Gurkeerat Singh sold for 50 L to GT

26. Rahul Buddhi sold for 20 L to MI

27. Benny Howell sold for 40 L to PBKS

28. Varun Aaron sold for 50 L to GT

29. Tim Southee sold for 1.5 Cr to KKR

30. K Bhagath Varma sold for 20 L to CSK

31. Arjun Tendulkar sold for 30 L to MI

32. Shubham Garhwal sold for 20 L to RR

33. Umesh Yadav sold for 2 Cr to KKR

34. Mohammad Nabi sold for 1 Cr to KKR

35. Vicky Ostwal sold for 20 L to DC

36. James Neesham sold for 1.5 Cr to RR

37. Siddharth Kaul sold for 75 L to RCB

38. Nathan Coulter Nile sold for 2 Cr to RR

39. B Sai Sudharsan sold for 20L to LSG

40. Aryan Juyal sold for 20L to MI

41. Livnith Sisodia sold for 20L to RCB

42. Rassie van der dussen sold for 1 Cr to RR

43. Aman Khan sold for 20 L to KKR

44. Daryl Mitchell sold for 75 L to RR

45. Fabian Allen sold for 75 L to MI

46. David Willey sold for 2 Cr to RCB

And that's the end of IPL 2022 AUCTIONS

1 note

·

View note