#was gonna do a side blog for dc & stuff but decided to just throw it on this blog 😭

Note

Aims I didn’t know you were a Grayson girlie too 😔😔 our taste is one and the same fr 🤞🏽

YES !!! omg we just have immaculate taste 🤭 i’ve been dying to talk about him w someone fr >_< !! he was the blueprint sighs. but lowkey haven’t focused on him at all since i met kuroo and went into a deep dive of anime !! but he’s back like a stinky ex boyfie :/ !

#i do love dc >_<#was gonna do a side blog for dc & stuff but decided to just throw it on this blog 😭#⁺. ʚ streaming with:#ଘ(੭ˊᵕˋ)੭ lem ༶ ⋆#♡ my sister wife ♡#<- our lil shared blorbo list keeps growing and im so giddy over it#i feel like we are at a lil sleepover & gossiping about our men 🤭

4 notes

·

View notes

Text

Bunker, Busting Out

Hey there, pickups and collectibles. More Red Hood? Sure, I'm down for it. This backlog ain't gonna clear itself, y'know~?

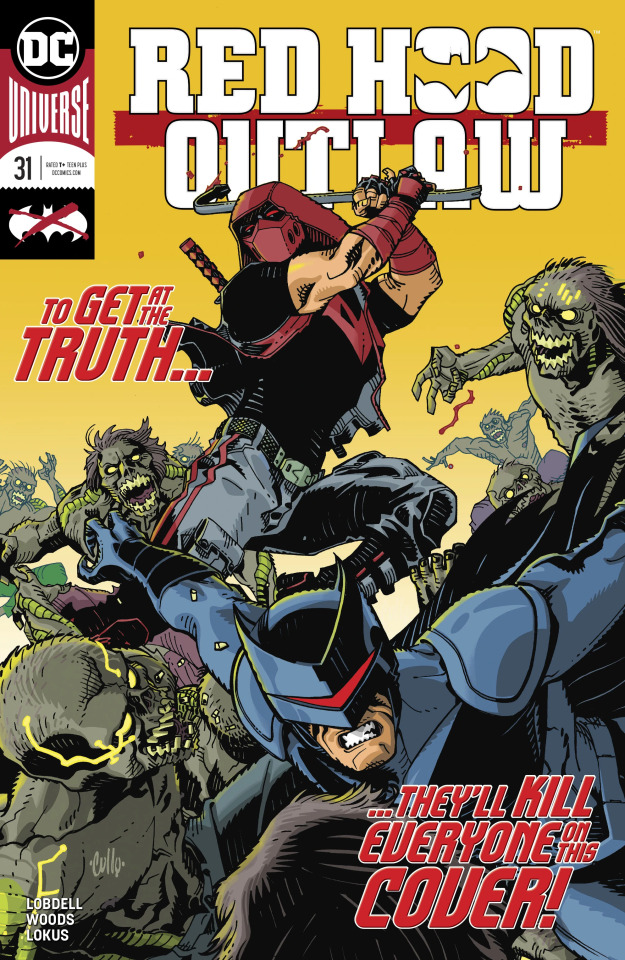

Here's the cover:

They'll kill everyone on this cover? You promise? Even Jason and Wingman? Because I'm assuming "they" refers to the writers here. But, like, either way, why should I care? It's a whole bunch of zomblers or something. Does it really matter if they kill them? Because even if I don't like heroes killing, I'm okay with it if it's the undead. This isn't really such an exciting tagline as you might think, comic~

So we open on one of those conspiracy corkboards. You know, with the various photos at suspicious angles and all connected with bits of string. This one is made of pictures of Jason, Artemis, and Bizarro. It's even headlined with a "Dark Trinity" caption. Despite their theming, I'm not sure these chumps compare to the actual DC Trinity. This Dark Trinity is more like a Trinity Lite. Anyway, observing this corkboard is our triple-faced crime boss, Solitary. The three faces makes him something of a one-man Dark Trinity himself, don't they? He's monologuing, of course; some rambling nonsense about Gotham needing its true prince, and a prince needing his subjects.

This leads straight into the present moment, where we left off last issue. Solitary is still monologuing, continuing his royalty spiel. Jason is as tired of it as the reader. I also want to call attention to a thing I usually ignore in every issue: the title. Because this one is spectacular. This issue is internally titled "Outlawed & Ordered", and it's written in a white font with blue and red outlines for each respective word. That's some titling cheesiness normally reserved for the headers of this very blog, and I love it. Wish I'd thought of it~

Regardless, Jason starts a battle with Solitary, chucking the crowbar he carries at him. Jason, no. Never throw your melee weapon. Solitary shows why as he easily Matrix-dodges out of its way, chiding Jason for even attempting it. Jason chides him for thinking he would think it'd work. What he was actually aiming for, you see, was Bunker's stasis tube. Solitary is all "shit", and hastily scrambles over to activate his leftover Mondays (the Solomon Grundy clones he controls. I feel like I have to explain that every time, because "activates his Mondays" is such a weird phrase).

Jason tackles Solitary, since he's tired of fighting Mondays. Ugh, me too. The work week is so rough, am I right? But before Jason can dent his face, Solitary reveals his power: he controls perception. Like, you make a perception roll, and he just straight-up says "no". Jason hasn't actually tackled him to the ground, he's standing over here now. This is an annoying power. So he's actually over at the controls, for real this time, and starts to activate his Mondays again. Before he can, though, he's suddenly surrounded by a bunch of floating bricks. Yep, Bunker's finally awake and pushing his way out of his stasis tube.

Solitary is practically pissing himself just by Bunker being out and about, and he scarpers. Jason offers a supportive hand to Bunker, and despite the outfit change, Bunker remembers him from the "Death of the Family" storyline. He's about the only one willing to remember that awful storyline, let me tell you. Either way, he mostly remembers Red Robin vouching for Jason, so the pair team up. And by team up, I mean split up, because the very next page after Jason asks for a favour, we see him running alone down another hallway (along with that dog he saved), in pursuit of Solitary.

Hey, remember how Wingman was on the cover? Yeah, the writers just remembered that too, and he jumps out at Jason, promising to finish the fight they started last issue. He still wants Jason to come back to Gotham with him, but since he can't give a straight answer, Jason isn't interested in hearing him out. The fight's interrupted by some tremors, which is Bunker leveling the building, and Jason uses the opportunity to escape from combat, thus losing out on the EXP from the encounter. Deeper into the complex he goes, where he finds Solitary again.

Solitary decides to open up, and it turns out "perceptions" means a hell of a lot more than it lets on, as he can basically holographically project his memories. Solitary figures this is as good a time as any for an origin story, and tells about how he used to be a run-of-the-mill guy stuck in the prison system for a crime he didn't commit. Unfortunately for him, he didn't escape and form the A-Team. Instead, he offered his body for science, in exchange for a lessened sentence. Or rather, offered his mind. The experiments meshed him together with two other prisoners, and that's why he has the triple face thing going on.

All of that is pretty standard comic book stuff, but here's the fun bit: Solitary refers to Jason by name. I know we also do, but mostly it's because Jason is both easier to type repeatedly, and it makes him seem like more of a dork when I'm talking about him. But the reason Solitary's doing it here is because he's pulling a Darth Vader on him. Jason, he is your father. But Jason refuses to search his feelings, because he knows it isn't true. His dad had a tattoo of a batarang on one arm, as a reminder of the time he lost to Batman. And when Jason tears off Solitary's sleeve, no such tattoo is present.

Whether it's true or not, Jason doesn't buy it, and he's not dumb enough to fall for the perception thing again. The dog is barking at something in a corner, so that's where Jason strikes. Solitary's trick can fool the human eye, but not a dog's nose. Leaving Solitary to bleed out with a crowbar lodged in his guts, Jason escapes the complex.

The comic ends with Jason having completed his cross-country trip. He's made it to the other side of the US, where Roy's grave is. Jason returns Roy's stupid trucker hat, laying it on top of the headstone. He makes Roy a promise that he's going to make sure nothing like this happens again. And so, to that end, he, Bunker, Wingman, and even that dog all are going to return to Gotham.

I think last week’s issue was better, but this isn’t an awful issue or anything. At least we learned a little more about Solitary. Whether or not he actually is Jason’s father isn’t important, what’s important is that he believes he is, and that’s certainly something. The fact that it’s played a bit ambiguously is actually a good way to handle it, and makes it more interesting. Wingman’s pretty meh, but Bunker’s actually a welcome addition to the team, so we’ll see what freshness he can bring to the story next~

Boy, they sure didn’t fight any zombies like on the cover, did they~?

3 notes

·

View notes

Text

Net Worth Update: $709,372.08 (+$21,000)

Heyo! That time again to check in with your money and see where you’re standing! AKA the best time of the month – NET WORTH DAY! Who’s with me?? :)

We personally hit a brand new milestone over here crossing into the $700’s for the first time, but what’s even more exciting if I’m being completely honest, is the rapid growth of our new Spavings Account! Haha… I haven’t done jack to make the stock market rise as it’s been doing every crazy month, but I have been working hard paying attention to all those spavings up in here! They’re beautiful! :)

(Okay, it wasn’t that hard keeping track of it all, but still – it’s shiny and new! Ooh look, a squirrel!)

Here’s a current snapshot of our account:

If you recall, last month I was inspired by The Lady in Black to start keeping track of all these “savings” you get in life that really aren’t savings, but more so “spavings” (a mixture of “saving” and “spending” i.e. fake savings! Like when you save money by spending money!), and in an attempt to try and see how much I can save over the months, I’ve decided to physically bank it in hopes of maxing out a Roth IRA.

After the first two weeks I saved $35.68, and over the past two’ish weeks I’ve amassed another $92.68! Which is either good or bad depending on how you look at it, haha… (but let’s go with good, okay? It’s much more fun that way ;))

Unfortunately at this rate it looks like it’ll take 43 months to pull off a maxed IRA ($5,500), so I’ll probably start throwing in other “free money” I come across as well to help speed up the process here – similar to what we did with my old Challenge Everything experiment where we tacked on found money on the street, random bonuses/cash back checks, birthday and Christmas money (sorry Mom!), etc.

So huzzah to both Spavings and Net Worthing! But let’s get back to the meat and potatoes here…

November’s Net Worth Break Down

[This marks net worth update #109 for us, which we’ve continually shared since Feb of 2008. It does get a little weird the higher our money gets here, but seeing someone else’s money so transparently was what got ME to start paying attention to my own finances 10 years ago (and in fact is the reason this blog exists!) so I continue to share these in hopes they have the same motivational effects on YOU. Just click away if they annoy you!]

CASH SAVINGS (+$1,930.78): A nice comeback from last month when we LOST $2,000! So really they just end up canceling each other out :) Next month’s report will be much juicier if a pending deal goes through, but until then mums the word. (Or ‘moms’ the word? Who’s hiding the word?)

*NEW* SPAVINGS FUND! (+$128.36): My favorite part of the month, as we’ve since discovered! Technically this should be folded under “Cash Savings” above, but again I’m just so excited about this that I wanted to separate it out so I can easily keep track and be motivated each month… Not unlike why we’re keeping this $$$ in a *separate bank account* too – so it doesn’t lose its charm and get intermingled with everything else going on! It helps to track some of this stuff separately so you can appreciate it more :)

THRIFT SAVINGS PLAN (TSP) (+$652.05): This is my 2nd favorite section, now bumped from the #1 slot it previously held before Spavings kicked it out. And it all stems from my wife’s new’ish job she took last year when going back into the workforce again and helping us become DIKS! Dual Income, Kids :) Her paycheck helps cover the ridiculous costs of living in the DC area here, but it’s her TSP investments that really turns me on. Free matching of contributions and great funds to choose from – a win/win! TSPs are similar to 401(k)s btw, only for government employees.

ROTH IRAs (+$3,800.36): A nice jump here too, although again nothing to do with me as we haven’t contributed anything lately… I’m not gonna say what I always say here even though I’m tempted (mmmmarrrkeettt crassssshhhh commmingggg – damnit!) but let’s just say we all better be prepared :)

SEP IRA (+$14,245.47): Same with this hunk a meat too. Nothing new added and just riding along the market… (we’ll be doing a major investment here soon though once our taxes are finalized for the year as it all ties into how much I’m legally able to contribute to my SEP. Another similar tool to 401(k)s btw, only for those who are self-employed and which don’t come with any free matches, womp womp.)

Here’s a snapshot of all our money with Vanguard since marrying them a few years back (we’re fully invested into VTSAX):

CAR VALUES (-$68.00): Nothing much exciting going on here either. Just the cars doing what they do naturally – depreciating! Here’s a look at what both our cars are currently worth per KBB (haven’t had the energy to look into minivans yet – we still have time before Babygeddon, right?? RIGHT??)

Lexus RX350: $11,447.00

Toyota Corolla: $3,707.00

CAR LOAN: (-$472.76): This side of the coin IS rather exciting! $400+ chipped away every month we go here, and if all goes well with what’s up my sleeves this will be all wiped away by next month! And if not, because you know – I just totally jinxed everything here – we’ll just keep going as-is as I’m perfectly fine holding onto debt that we can pay off at any given point in time. Even though I hear you debt-haters snickering over there! ;)

And that’s it for November! A Spavings/Net Worth milestone!

Here’s a broader look at how the past 12 months have transpired as well:

And then here’s the kids’ net worths which shant be left out either. Soon to be THREE reports – ack!

Hope your month went exceptionally well too! We’ll return next month with net worth report #110, but as always the takeaway here is quite clear: invest as much as you can now, and then be as lazy as possible and let TIME do its thing from there. There really is no magic to it!

As always, you can find the full list of my net worth updates here, and then of course we’re still tracking over 400 other $$$ bloggers’ worths over at Rockstar Finance as well: Blogger Net Worth Tracker. I’m currently #110 on the list, dropping down two slots since last month.

Here’s to a fiscally fruitful December!

PS: Winners of the $500 Christmas Stimulus will be announced on Friday!

Net Worth Update: $709,372.08 (+$21,000) published first on http://ift.tt/2ljLF4B

0 notes

Text

Net Worth Update: $709,372.08 (+$21,000)

Heyo! That time again to check in with your money and see where you’re standing! AKA the best time of the month – NET WORTH DAY! Who’s with me?? :)

We personally hit a brand new milestone over here crossing into the $700’s for the first time, but what’s even more exciting if I’m being completely honest, is the rapid growth of our new Spavings Account! Haha… I haven’t done jack to make the stock market rise as it’s been doing every crazy month, but I have been working hard paying attention to all those spavings up in here! They’re beautiful! :)

(Okay, it wasn’t that hard keeping track of it all, but still – it’s shiny and new! Ooh look, a squirrel!)

Here’s a current snapshot of our account:

If you recall, last month I was inspired by The Lady in Black to start keeping track of all these “savings” you get in life that really aren’t savings, but more so “spavings” (a mixture of “saving” and “spending” i.e. fake savings! Like when you save money by spending money!), and in an attempt to try and see how much I can save over the months, I’ve decided to physically bank it in hopes of maxing out a Roth IRA.

After the first two weeks I saved $35.68, and over the past two’ish weeks I’ve amassed another $92.68! Which is either good or bad depending on how you look at it, haha… (but let’s go with good, okay? It’s much more fun that way ;))

Unfortunately at this rate it looks like it’ll take 43 months to pull off a maxed IRA ($5,500), so I’ll probably start throwing in other “free money” I come across as well to help speed up the process here – similar to what we did with my old Challenge Everything experiment where we tacked on found money on the street, random bonuses/cash back checks, birthday and Christmas money (sorry Mom!), etc.

So huzzah to both Spavings and Net Worthing! But let’s get back to the meat and potatoes here…

November’s Net Worth Break Down

[This marks net worth update #109 for us, which we’ve continually shared since Feb of 2008. It does get a little weird the higher our money gets here, but seeing someone else’s money so transparently was what got ME to start paying attention to my own finances 10 years ago (and in fact is the reason this blog exists!) so I continue to share these in hopes they have the same motivational effects on YOU. Just click away if they annoy you!]

CASH SAVINGS (+$1,930.78): A nice comeback from last month when we LOST $2,000! So really they just end up canceling each other out :) Next month’s report will be much juicier if a pending deal goes through, but until then mums the word. (Or ‘moms’ the word? Who’s hiding the word?)

*NEW* SPAVINGS FUND! (+$128.36): My favorite part of the month, as we’ve since discovered! Technically this should be folded under “Cash Savings” above, but again I’m just so excited about this that I wanted to separate it out so I can easily keep track and be motivated each month… Not unlike why we’re keeping this $$$ in a *separate bank account* too – so it doesn’t lose its charm and get intermingled with everything else going on! It helps to track some of this stuff separately so you can appreciate it more :)

THRIFT SAVINGS PLAN (TSP) (+$652.05): This is my 2nd favorite section, now bumped from the #1 slot it previously held before Spavings kicked it out. And it all stems from my wife’s new’ish job she took last year when going back into the workforce again and helping us become DIKS! Dual Income, Kids :) Her paycheck helps cover the ridiculous costs of living in the DC area here, but it’s her TSP investments that really turns me on. Free matching of contributions and great funds to choose from – a win/win! TSPs are similar to 401(k)s btw, only for government employees.

ROTH IRAs (+$3,800.36): A nice jump here too, although again nothing to do with me as we haven’t contributed anything lately… I’m not gonna say what I always say here even though I’m tempted (mmmmarrrkeettt crassssshhhh commmingggg – damnit!) but let’s just say we all better be prepared :)

SEP IRA (+$14,245.47): Same with this hunk a meat too. Nothing new added and just riding along the market… (we’ll be doing a major investment here soon though once our taxes are finalized for the year as it all ties into how much I’m legally able to contribute to my SEP. Another similar tool to 401(k)s btw, only for those who are self-employed and which don’t come with any free matches, womp womp.)

Here’s a snapshot of all our money with Vanguard since marrying them a few years back (we’re fully invested into VTSAX):

CAR VALUES (-$68.00): Nothing much exciting going on here either. Just the cars doing what they do naturally – depreciating! Here’s a look at what both our cars are currently worth per KBB (haven’t had the energy to look into minivans yet – we still have time before Babygeddon, right?? RIGHT??)

Lexus RX350: $11,447.00

Toyota Corolla: $3,707.00

CAR LOAN: (-$472.76): This side of the coin IS rather exciting! $400+ chipped away every month we go here, and if all goes well with what’s up my sleeves this will be all wiped away by next month! And if not, because you know – I just totally jinxed everything here – we’ll just keep going as-is as I’m perfectly fine holding onto debt that we can pay off at any given point in time. Even though I hear you debt-haters snickering over there! ;)

And that’s it for November! A Spavings/Net Worth milestone!

Here’s a broader look at how the past 12 months have transpired as well:

And then here’s the kids’ net worths which shant be left out either. Soon to be THREE reports – ack!

Hope your month went exceptionally well too! We’ll return next month with net worth report #110, but as always the takeaway here is quite clear: invest as much as you can now, and then be as lazy as possible and let TIME do its thing from there. There really is no magic to it!

As always, you can find the full list of my net worth updates here, and then of course we’re still tracking over 400 other $$$ bloggers’ worths over at Rockstar Finance as well: Blogger Net Worth Tracker. I’m currently #110 on the list, dropping down two slots since last month.

Here’s to a fiscally fruitful December!

PS: Winners of the $500 Christmas Stimulus will be announced on Friday!

Net Worth Update: $709,372.08 (+$21,000) posted first on http://ift.tt/2lnwIdQ

0 notes

Text

Design Challenge Judge Daniel Crowe: One Cool Diabetologist Living with Type 1

New Post has been published on http://type2diabetestreatment.net/diabetes-mellitus/design-challenge-judge-daniel-crowe-one-cool-diabetologist-living-with-type-1/

Design Challenge Judge Daniel Crowe: One Cool Diabetologist Living with Type 1

Please welcome a brand new judge this year in the 2011 DiabetesMine Design Challenge, Dr. Daniel Crowe. He is Medical Director of the Diabetes Program at Southboro Medical Group in Massachusetts, and a long-time type 1 himself.

As a diabetologist who wears his very own insulin pump and CGM, Dan brings a unique perspective to this contest and the prospects of innovative diabetes tools:

DM) First off, can you tell us what it's like to be a type 1 patient AND a diabetes doctor?

DC) Every day patients have the opportunity to learn that I too have diabetes, and they usually really sit back and say, "Wow, you understand!" That's almost always what they say.

We also have a team of diabetics. My nurse practitioner is a type 1 on a pump, and her nurse is, too!

So when we have patients who are new to us and not sure if they want a pump, we say, "Do you want to meet some pump patients?" Then the three of us come in the room, and it's really powerful.

What are your thoughts about being involved in this competition?

I keep switching hats, as I'm trying to understand it from a patient and a clinical world viewpoint.

As a patient, I'm very familiar with the daily frustrations with technologies not meeting the challenge. I'm excited to see some really innovative people coming up with things that will actually 'shift the paradigm.'

As a physician, the issue everyone's worried about as we get more and more data coming across our desktops is that at some point, we're going to get saturated. We need something else!

From the patient side, how could better-designed gadgets and programs potentially improve your own life?

If we judge design by how easy it is to use (level of complexity), functionality (does it interface well with current diabetes technology?), and reliability (accuracy, precision, does it break down often, is there good customer service?), then design is critically important, and a well-designed innovation would potentially have a significant impact.

We definitely agree that complex data logging alone is not the Holy Grail...

We doctors already are inundated with data that's presented in ways to try to "one-up" the competition but most still miss the mark. What's missing is information from the patient that allows much wiser interpretation.

For example, teleheath communication is being used for congestive heart patients, so cardiologists are getting loads of data too. There's a tremendous potential for overwhelming the system. It's all good stuff, but who's gonna look at it?

With diabetes you have so many data points. If you download a whole month of data from an insulin pump, it's overwhelming. If you then throw in patient-entered information like 'I forgot a shot,' 'I exercised for 2 hours,' — it's just so much!

Also, patients don't want to take the extra time to enter detailed diary-type information.

If data overload is the problem, then what characteristics do you think would make a "killer app" for diabetes care?

I like to think about different types of variation in terms of common cause — common things we do that can cause common variables.

"Diabetes Personal Calculator" - anyone tried it?

If someone can think about a way to create statistical analysis that allows the interpreter to determine if BG variation is due to "common cause variation" — (carb counting errors, changes in physical activity, stress, sleep variation, etc.) versus "special cause variation" (insulin was exposed to excesses of temperature, incorrect code on meter, expired strips, illness, vacation, etc.), that would be incredibly helpful.

To date, 'smart meters' and pumps still are not used adequately by enough patients to allow these day-to-day variations to be categorized in ways useful for better data interpretation.

So... an app that was really easy to use that allowed both glucose/ insulin/ medication/ carb intake data entry along with fun ways to prompt for things that might fall under either 'common cause' or 'special cause' variation which then would analyze and interpret the data based on these variations would be phenomenal!

It could look for patterns that would prompt questions like "did you forget your glipizide/Novolog?" or "check to make sure strip codes and expiration dates are OK?" or "you may be consuming too many carbs at meals," etc.

Is there any cool technology that you're using in your practice?

I'm awaiting arrival of my new iPad 2 — though that's not about the exam room chuckles But I was at a meeting at Brigham Women's Hospital where they're using it with patients while they're in the waiting room while waiting for a physician to come in. These are COPD patients, and they answer a questionnaire on the iPad that helps the doctor decide whether they need a certain kind of test. That saves a lot of time...

There are gonna be all kinds of ways to incorporate this technology into the clinic. In a few years, it'll be common practice for patients to use smart tablets of some sort during their wait time. This will be a very helpful way for clinicians to do initial screening.

But you know, the medical world is often one of the stragglers in terms of technology.

How do you define "success" for yourself and other patients living with diabetes?

Good clinical control (good, safe A1c plus low variability) plus a happy patient who feels they are in control (the diabetes doesn't control them) without breaking the patient's or the medical group's budget.

We're thrilled to have you as one of our this year. Again as both healthcare professional and patient yourself, what would you most like to see materialize out of this contest?

I think something that challenges the industry to change a paradigm would be great.

Thank you, Dan. We hope you know that doctors like you are game-changers too!

Disclaimer: Content created by the Diabetes Mine team. For more details click here.

Disclaimer

This content is created for Diabetes Mine, a consumer health blog focused on the diabetes community. The content is not medically reviewed and doesn't adhere to Healthline's editorial guidelines. For more information about Healthline's partnership with Diabetes Mine, please click here.

Type 2 Diabetes Treatment

Type 2 Diabetes Diet

Diabetes Destroyer Reviews

Original Article

0 notes

Text

Net Worth Update: $709,372.08 (+$21,000)

Heyo! That time again to check in with your money and see where you’re standing! AKA the best time of the month – NET WORTH DAY! Who’s with me?? :)

We personally hit a brand new milestone over here crossing into the $700’s for the first time, but what’s even more exciting if I’m being completely honest, is the rapid growth of our new Spavings Account! Haha… I haven’t done jack to make the stock market rise as it’s been doing every crazy month, but I have been working hard paying attention to all those spavings up in here! They’re beautiful! :)

(Okay, it wasn’t that hard keeping track of it all, but still – it’s shiny and new! Ooh look, a squirrel!)

Here’s a current snapshot of our account:

If you recall, last month I was inspired by The Lady in Black to start keeping track of all these “savings” you get in life that really aren’t savings, but more so “spavings” (a mixture of “saving” and “spending” i.e. fake savings! Like when you save money by spending money!), and in an attempt to try and see how much I can save over the months, I’ve decided to physically bank it in hopes of maxing out a Roth IRA.

After the first two weeks I saved $35.68, and over the past two’ish weeks I’ve amassed another $92.68! Which is either good or bad depending on how you look at it, haha… (but let’s go with good, okay? It’s much more fun that way ;))

Unfortunately at this rate it looks like it’ll take 43 months to pull off a maxed IRA ($5,500), so I’ll probably start throwing in other “free money” I come across as well to help speed up the process here – similar to what we did with my old Challenge Everything experiment where we tacked on found money on the street, random bonuses/cash back checks, birthday and Christmas money (sorry Mom!), etc.

So huzzah to both Spavings and Net Worthing! But let’s get back to the meat and potatoes here…

November’s Net Worth Break Down

[This marks net worth update #109 for us, which we’ve continually shared since Feb of 2008. It does get a little weird the higher our money gets here, but seeing someone else’s money so transparently was what got ME to start paying attention to my own finances 10 years ago (and in fact is the reason this blog exists!) so I continue to share these in hopes they have the same motivational effects on YOU. Just click away if they annoy you!]

CASH SAVINGS (+$1,930.78): A nice comeback from last month when we LOST $2,000! So really they just end up canceling each other out :) Next month’s report will be much juicier if a pending deal goes through, but until then mums the word. (Or ‘moms’ the word? Who’s hiding the word?)

*NEW* SPAVINGS FUND! (+$128.36): My favorite part of the month, as we’ve since discovered! Technically this should be folded under “Cash Savings” above, but again I’m just so excited about this that I wanted to separate it out so I can easily keep track and be motivated each month… Not unlike why we’re keeping this $$$ in a *separate bank account* too – so it doesn’t lose its charm and get intermingled with everything else going on! It helps to track some of this stuff separately so you can appreciate it more :)

THRIFT SAVINGS PLAN (TSP) (+$652.05): This is my 2nd favorite section, now bumped from the #1 slot it previously held before Spavings kicked it out. And it all stems from my wife’s new’ish job she took last year when going back into the workforce again and helping us become DIKS! Dual Income, Kids :) Her paycheck helps cover the ridiculous costs of living in the DC area here, but it’s her TSP investments that really turns me on. Free matching of contributions and great funds to choose from – a win/win! TSPs are similar to 401(k)s btw, only for government employees.

ROTH IRAs (+$3,800.36): A nice jump here too, although again nothing to do with me as we haven’t contributed anything lately… I’m not gonna say what I always say here even though I’m tempted (mmmmarrrkeettt crassssshhhh commmingggg – damnit!) but let’s just say we all better be prepared :)

SEP IRA (+$14,245.47): Same with this hunk a meat too. Nothing new added and just riding along the market… (we’ll be doing a major investment here soon though once our taxes are finalized for the year as it all ties into how much I’m legally able to contribute to my SEP. Another similar tool to 401(k)s btw, only for those who are self-employed and which don’t come with any free matches, womp womp.)

Here’s a snapshot of all our money with Vanguard since marrying them a few years back (we’re fully invested into VTSAX):

CAR VALUES (-$68.00): Nothing much exciting going on here either. Just the cars doing what they do naturally – depreciating! Here’s a look at what both our cars are currently worth per KBB (haven’t had the energy to look into minivans yet – we still have time before Babygeddon, right?? RIGHT??)

Lexus RX350: $11,447.00

Toyota Corolla: $3,707.00

CAR LOAN: (-$472.76): This side of the coin IS rather exciting! $400+ chipped away every month we go here, and if all goes well with what’s up my sleeves this will be all wiped away by next month! And if not, because you know – I just totally jinxed everything here – we’ll just keep going as-is as I’m perfectly fine holding onto debt that we can pay off at any given point in time. Even though I hear you debt-haters snickering over there! ;)

And that’s it for November! A Spavings/Net Worth milestone!

Here’s a broader look at how the past 12 months have transpired as well:

And then here’s the kids’ net worths which shant be left out either. Soon to be THREE reports – ack!

Hope your month went exceptionally well too! We’ll return next month with net worth report #110, but as always the takeaway here is quite clear: invest as much as you can now, and then be as lazy as possible and let TIME do its thing from there. There really is no magic to it!

As always, you can find the full list of my net worth updates here, and then of course we’re still tracking over 400 other $$$ bloggers’ worths over at Rockstar Finance as well: Blogger Net Worth Tracker. I’m currently #110 on the list, dropping down two slots since last month.

Here’s to a fiscally fruitful December!

PS: Winners of the $500 Christmas Stimulus will be announced soon… on Friday!

Net Worth Update: $709,372.08 (+$21,000) posted first on http://ift.tt/2lnwIdQ

0 notes

Text

Net Worth Update: $709,372.08 (+$21,000)

Heyo! That time again to check in with your money and see where you’re standing! AKA the best time of the month – NET WORTH DAY! Who’s with me?? :)

We personally hit a brand new milestone over here crossing into the $700’s for the first time, but what’s even more exciting if I’m being completely honest, is the rapid growth of our new Spavings Account! Haha… I haven’t done jack to make the stock market rise as it’s been doing every crazy month, but I have been working hard paying attention to all those spavings up in here! They’re beautiful! :)

(Okay, it wasn’t that hard keeping track of it all, but still – it’s shiny and new! Ooh look, a squirrel!)

Here’s a current snapshot of our account:

If you recall, last month I was inspired by The Lady in Black to start keeping track of all these “savings” you get in life that really aren’t savings, but more so “spavings” (a mixture of “saving” and “spending” i.e. fake savings! Like when you save money by spending money!), and in an attempt to try and see how much I can save over the months, I’ve decided to physically bank it in hopes of maxing out a Roth IRA.

After the first two weeks I saved $35.68, and over the past two’ish weeks I’ve amassed another $92.68! Which is either good or bad depending on how you look at it, haha… (but let’s go with good, okay? It’s much more fun that way ;))

Unfortunately at this rate it looks like it’ll take 43 months to pull off a maxed IRA ($5,500), so I’ll probably start throwing in other “free money” I come across as well to help speed up the process here – similar to what we did with my old Challenge Everything experiment where we tacked on found money on the street, random bonuses/cash back checks, birthday and Christmas money (sorry Mom!), etc.

So huzzah to both Spavings and Net Worthing! But let’s get back to the meat and potatoes here…

November’s Net Worth Break Down

[This marks net worth update #109 for us, which we’ve continually shared since Feb of 2008. It does get a little weird the higher our money gets here, but seeing someone else’s money so transparently was what got ME to start paying attention to my own finances 10 years ago (and in fact is the reason this blog exists!) so I continue to share these in hopes they have the same motivational effects on YOU. Just click away if they annoy you!]

CASH SAVINGS (+$1,930.78): A nice comeback from last month when we LOST $2,000! So really they just end up canceling each other out :) Next month’s report will be much juicier if a pending deal goes through, but until then mums the word. (Or ‘moms’ the word? Who’s hiding the word?)

*NEW* SPAVINGS FUND! (+$128.36): My favorite part of the month, as we’ve since discovered! Technically this should be folded under “Cash Savings” above, but again I’m just so excited about this that I wanted to separate it out so I can easily keep track and be motivated each month… Not unlike why we’re keeping this $$$ in a *separate bank account* too – so it doesn’t lose its charm and get intermingled with everything else going on! It helps to track some of this stuff separately so you can appreciate it more :)

THRIFT SAVINGS PLAN (TSP) (+$652.05): This is my 2nd favorite section, now bumped from the #1 slot it previously held before Spavings kicked it out. And it all stems from my wife’s new’ish job she took last year when going back into the workforce again and helping us become DIKS! Dual Income, Kids :) Her paycheck helps cover the ridiculous costs of living in the DC area here, but it’s her TSP investments that really turns me on. Free matching of contributions and great funds to choose from – a win/win! TSPs are similar to 401(k)s btw, only for government employees.

ROTH IRAs (+$3,800.36): A nice jump here too, although again nothing to do with me as we haven’t contributed anything lately… I’m not gonna say what I always say here even though I’m tempted (mmmmarrrkeettt crassssshhhh commmingggg – damnit!) but let’s just say we all better be prepared :)

SEP IRA (+$14,245.47): Same with this hunk a meat too. Nothing new added and just riding along the market… (we’ll be doing a major investment here soon though once our taxes are finalized for the year as it all ties into how much I’m legally able to contribute to my SEP. Another similar tool to 401(k)s btw, only for those who are self-employed and which don’t come with any free matches, womp womp.)

Here’s a snapshot of all our money with Vanguard since marrying them a few years back (we’re fully invested into VTSAX):

CAR VALUES (-$68.00): Nothing much exciting going on here either. Just the cars doing what they do naturally – depreciating! Here’s a look at what both our cars are currently worth per KBB (haven’t had the energy to look into minivans yet – we still have time before Babygeddon, right?? RIGHT??)

Lexus RX350: $11,447.00

Toyota Corolla: $3,707.00

CAR LOAN: (-$472.76): This side of the coin IS rather exciting! $400+ chipped away every month we go here, and if all goes well with what’s up my sleeves this will be all wiped away by next month! And if not, because you know – I just totally jinxed everything here – we’ll just keep going as-is as I’m perfectly fine holding onto debt that we can pay off at any given point in time. Even though I hear you debt-haters snickering over there! ;)

And that’s it for November! A Spavings/Net Worth milestone!

Here’s a broader look at how the past 12 months have transpired as well:

And then here’s the kids’ net worths which shant be left out either. Soon to be THREE reports – ack!

Hope your month went exceptionally well too! We’ll return next month with net worth report #110, but as always the takeaway here is quite clear: invest as much as you can now, and then be as lazy as possible and let TIME do its thing from there. There really is no magic to it!

As always, you can find the full list of my net worth updates here, and then of course we’re still tracking over 400 other $$$ bloggers’ worths over at Rockstar Finance as well: Blogger Net Worth Tracker. I’m currently #110 on the list, dropping down two slots since last month.

Here’s to a fiscally fruitful December!

PS: Winners of the $500 Christmas Stimulus will be announced soon… on Friday!

Net Worth Update: $709,372.08 (+$21,000) published first on http://ift.tt/2ljLF4B

0 notes