#web3 wallet example

Explore tagged Tumblr posts

Text

STON.fi: Empowering Builders with Exceptional Opportunities

When people talk about STON.fi, they often focus on its robust features—trading, staking, liquidity provision, swapping, and the influential Stonbassador program. All of these make STON.fi a prominent decentralized exchange (DEX) on The Open Network (TON) blockchain. But, here’s what most people are missing: STON.fi is so much more than a trading platform.

STON.fi: A Revolutionary DeFi Ecosystem

STON.fi has established itself as a reliable and efficient DeFi platform where users can trade with ease, earn through staking, provide liquidity, and enjoy a seamless swapping experience. Its Stonbassador program further amplifies its community-driven approach by rewarding those who actively contribute to its growth.

But here’s the thing—STON.fi’s true innovation extends beyond just trading and community-building. It’s about empowering visionaries. It’s about creating an environment where creativity and technical brilliance can thrive.

What’s the Secret Sauce? The STON.fi Grant Program

STON.fi is raising the bar with its Grant Program, a powerful initiative designed to fuel the dreams of Web3 developers and creators. This is where STON.fi shows its commitment to innovation and progress within the blockchain space.

Imagine having a killer idea for a Web3 product but lacking the resources to bring it to life. That’s where the STON.fi Grant Program comes in, offering up to $10,000 in funding along with vital support to turn ideas into groundbreaking projects.

What Makes This Grant Program So Special

1. Generous Funding: Access financial backing of up to $10,000 to take your project from concept to reality.

2. Technical Support & Guidance: The STON.fi team isn’t just throwing money at you—they’re providing genuine support to help you overcome challenges.

3. Powerful Tools & Resources: Through the STON.fi SDK, developers gain the necessary tools to build confidently and efficiently.

4. A Nurturing Community: Join a network of innovators who are all working towards a better Web3 future.

Projects Already Making Waves

Curious about how the STON.fi Grant Program is already making an impact? Here are two fantastic examples:

StartON Launchpad: This innovative platform focuses on providing a community-driven solution for launching tokens. By integrating the STON.fi SDK, StartON Launchpad has streamlined the process of creating liquidity pools—making it fast, automated, and secure. But they’re not stopping there. Plans are underway to introduce swapping functionalities, allowing users to trade tokens directly within the application.

Gifties: Think about sending digital gifts via Telegram—sounds simple, right? Gifties has made that vision a reality by giving users the ability to send tokens like STON and other assets as gifts. Thanks to their integration with STON.fi SDK, they’ve made gifting a seamless experience.

Is This Your Chance to Shine

The STON.fi Grant Program isn’t limited to big, established teams. It’s for every developer and innovator out there with a powerful idea. It’s about turning potential into results. Whether you’re working on a decentralized application, a DeFi tool, or something entirely new, this is your moment.

Apply Now and Bring Your Vision to Life

STON.fi isn’t just another DeFi platform—it’s a launching pad for creativity and innovation. If you’ve been searching for the perfect opportunity to turn your ideas into reality, the STON.fi Grant Program might just be the breakthrough you need.

Don’t wait. Apply today. Your journey begins here.

3 notes

·

View notes

Text

How to Make Your Crypto Work Harder for You with STON.fi Farming

If you’re like I was a few months ago, you might be wondering: "What’s all the fuss about crypto farming?" Maybe you’ve heard about it, but it still sounds a little intimidating. The truth is, crypto farming can be as simple as putting your money into a savings account. But instead of interest, you’re earning more tokens for helping a platform maintain liquidity.

Let’s break it down and make this as easy to understand as possible. After all, crypto is supposed to make life easier, right?

What Exactly is Crypto Farming:Think of It as Growing Your Own Garden

Imagine you’ve got a garden at home. You plant a few seeds, take care of them, and over time, they grow into something valuable—let’s say fruits or vegetables. Instead of just enjoying the results, you put in the effort to nurture your garden, knowing that over time, you’ll get even more rewards.

Crypto farming is very much like this. Instead of seeds, you’re planting your tokens into a platform like STON.fi. These tokens "grow" over time, and in return, you earn rewards—extra tokens for your contribution.

By farming, you’re essentially helping a decentralized platform function. The tokens you stake provide liquidity, meaning others can trade tokens easily, and in exchange for your help, you earn more tokens.

Why Does Crypto Farming Matter

In the world of DeFi (decentralized finance), liquidity is essential. It’s like having enough cash in your wallet to make purchases at any time. Without liquidity, trading or swapping tokens becomes a lot harder. Farming is how we make sure that liquidity is available, and it’s how platforms like STON.fi reward people like you and me for making it all happen.

But here’s the thing: you don’t have to be a crypto expert to get involved in farming. It’s actually one of the easiest ways to make your crypto work for you, even if you’re just starting out.

Why STON.fi Makes Farming Simple

When I first got into crypto, I was overwhelmed by all the technical jargon and complex platforms. But STON.fi stood out to me because it’s designed to make farming as easy as possible.

The platform is user-friendly and clear, so you don’t need to know all the ins and outs of coding or crypto algorithms. It’s simple, intuitive, and gives you plenty of options to choose from. Plus, with STON.fi, you get to be part of a community-driven ecosystem where your contributions really matter.

How STON.fi Works: The Basics of Farming Pools

In a farm pool, you essentially “deposit” your tokens into the system, just like putting your money into a savings account. These pools are what keep the platform running smoothly. Without liquidity (your tokens), the platform wouldn’t be able to handle all the trades and transactions. By contributing, you’re helping everything flow easily.

In exchange for your help, STON.fi rewards you with more tokens. The beauty of this is that, just like with farming, the more you contribute, the more you stand to earn.

Examples of Farming Pools on STON.fi

Here’s where things get interesting: there are a variety of farming pools you can get involved in on STON.fi. Let’s go over a few of them to help you understand the kind of returns you can expect:

1. JETTON/USDt V2 Extended

Rewards: 22,500 JETTON (~$6,000)

Farming Period: Until December 30

Lock-Up Period: 15 days

This pool is for the bold, supporting the growing blockchain gaming ecosystem. If you believe in the future of Web3 gaming, this is a great place to start.

2. hTON/TON V2

Rewards: 30,866 HPO (~$777)

Farming Period: Until December 24

Lock-Up Period: None

This one offers flexibility, which is perfect if you want to dip your toes into farming without locking up your assets for long periods.

3. HPO/hTON V2

Rewards: 61,733 HPO (~$1,600)

Farming Period: Until December 24

Lock-Up Period: None

With no lock-up period and high rewards, this one offers a nice balance between risk and reward.

4. TON/uTON

Rewards: 411 STON + 345 uTON (~$3,700)

Farming Period: Until January 16

Lock-Up Period: None

If you believe in the TON ecosystem, this is a great pool to support its development while earning some extra tokens.

Why I Believe in Farming: Lessons I’ve Learned

When I first started farming, I wasn’t sure what to expect. But the more I got into it, the more I realized that it’s one of the smartest ways to grow your crypto portfolio. Here are some things I’ve learned along the way:

Start Small: Like with any investment, I didn’t dive all in right away. I started with a smaller amount to test things out and understand how farming worked.

Research: Before jumping into any farming pool, I made sure to read up on the token, the project, and the rewards structure. Knowledge is power, especially when it comes to DeFi.

Diversify: I spread my tokens across different pools instead of putting all my eggs in one basket. This gave me the flexibility to earn from multiple sources while minimizing risk.

How to Start Farming on STON.fi

It’s actually quite simple to get started with farming on STON.fi. Here’s how I did it:

1. Choose a Pool: Look at the available pools, read through the details, and pick one that fits your goals.

2. Provide Liquidity: Deposit the token pairs required for the pool you’ve selected. You’ll receive LP (liquidity provider) tokens in return.

3. Start Earning: Once your tokens are in the pool, you can start earning rewards in the form of more tokens. It’s that simple!

Farm now

In Conclusion: Your Crypto Can Work Smarter for You

Farming on STON.fi is one of the easiest ways to get your crypto working for you. It’s like putting your money into a savings account, but better. Instead of just earning interest, you’re earning tokens that help power a decentralized platform.

Whether you’re new to crypto or have been in the game for a while, farming is an opportunity you don’t want to miss. The key is to start small, do your research, and watch your rewards grow. Farming isn’t just for the pros—it’s for anyone who wants to make their crypto assets work harder and smarter.

If you’re ready to start, jump into a farm pool today. Your tokens are waiting to work for you!

4 notes

·

View notes

Text

Base: activity in Mainnet. Free NFTs on Base.

Base is a secure, inexpensive and user-friendly tool for Ethereum L2 developers that was created to attract users to web3. It’s worth mentioning that Base is built as an MIT OP Stack in collaboration with Optimism. And as stated by the Base team, they specifically joined Core Dev working on the OP Stack to make it publicly available to everyone.

According to the developers, Base is the easiest way for decentralized applications to use the products and distribution of Coinbase, which has over 110 million users with over $80 billion in assets in the Coinbase ecosystem, thereby once again putting an emphasis on scalability.

For almost six months, there has been a testnet. Activity in which was steadily covered in our airdrops section, and recently the project team announced the launch of Mainnet.

Preparation

To interact with the network, you will need to add it to our wallet. If you have already done this, you can skip this point.

Go to the site, connect the wallet and click Add to Metamask:

Preparation

Next, you will need to transfer funds. To do this, you can use both the official bridge and third-party ones. Each of these methods has its pros and cons.

Official Bridge

According to the crypto-community, this method is the most reliable and correct, but the deposit can only be made from the Ethereum Mainnet.

Go to the site and connect the wallet.

Enter the desired amount, click Deposit ETH and confirm the transaction:

Official Bridge

Stargate Bridge

Using this protocol has several pluses, namely: additional activity in LayerZero and the ability to make a transfer from the L2 network.

Go to the site and connect the wallet.

Choose the network from which we will transfer, for example, Optimism. Enter the desired amount, click Transfer and confirm the transaction:

Stargate Bridge

Orbiter Bridge

Another cross-chain protocol from which users expect a drop.

Go to the site and connect the wallet.

Choose the network from which we will transfer. You can choose L1 or any L2 and Base. Enter the desired amount, click Send and confirm the transaction:

Orbiter Bridge

Note: you don’t have to focus on one bridge. You can combine them, thereby hitting multiple protocols. For example, deposit funds using Stargate and withdraw via Orbiter.

Interacting with DeFi

Focusing on the criteria of past airdrops from similar L2, we can assume that this item is one of the main ones. It is desirable not only to make swaps of a couple of dollars, but also to gain the volume of transactions.

In the guide we will touch only a part of the protocols deployed on Base. A more extensive list can be found on DefiLlama. But always keep DYOR in mind.

SushiSwap

Go to the site and connect the wallet. If another network is selected, switch it to the right one:

Interact with SushiSwap. Step 1

Choose tokens for exchange. Enter the desired amount, click Swap and confirm the transaction:

Interact with SushiSwap. Step 2

Go to the Pools tab and select the Base network:

Interact with SushiSwap. Step 3

Select a token pair and click on it. Next Create position:

Interact with SushiSwap. Step 4

Click Full Range and add funds to the pool as shown in the screenshot:

Interact with SushiSwap. Step 5

You can find your position on the My Positions section. To withdraw liquidity, click on it. Then select the Remove tab. Specify the amount of funds you want to withdraw, click Remove and confirm the transaction:

Interact with SushiSwap. Step 6

Maverick

Go to the website and connect the wallet.

Choose tokens to exchange and make the exchange:

Interact with Maverick. Step 2

Next, open the Pools tab, select the desired pair and click on it:

Interact with Maverick. Step 3

Click Next. Select a mod (you can use Static) and click Next again. Enter the desired amount and confirm the addition of liquidity as shown in the screenshot:

Interact with Maverick. Step 4

You can find your position on the Portfolio tab. To close it, click Manage and then Remove. Select Select All and confirm the withdrawal of assets:

Interact with Maverick. Step 5

Aave

A borrowing protocol that allows you to borrow tokens against your cryptocurrency and also gives you the opportunity to lend your tokens at a small APR. In this article, let’s look at this particular mechanic.

Go to the site and connect the wallet.

Change the network to Base, if necessary, and click Supply:

Interact with Aave. Step 2

Enter the desired amount and confirm the addition by clicking Supply ETH:

Interact with Aave. Step 3

Withdraw assets by clicking Withdraw on the homepage.

Interacting with NFT

In this section, we will show you how to commit NFT to MintFun and provide you with a list of marketplaces that support Base.

MintFun

If you want to learn more about this marketplace and earn points for mint, you can visit our guide.

Go to the site, connect your wallet and select the Base network, as shown in the screenshot:

Interacting with MintFun. Step 1

Leaf through the page below, select your favorite collection and click on Mint Now:

Note: the site has both free and paid collections.

Interact with MintFun. Step 2

Choose the quantity of NFTs and confirm the mint.

NFTs can be sold and bought on the following marketplaces: OpenSea, Element, Zonic.

New Activity

Onchain Daily on Galxe

Go to Galxe and perform active tasks. To find out which activities you need to perform, click Detail:

Onchain Daily on Galxe. Step 1

In this task, you need to mint the NFT on the site:

Onchain Daily on Galxe. Step 2

Perform other tasks by analogy and watch for new ones:

Onchain Daily on Galxe. Step 3

Mint NFT

Go to Zora’s site and mint the memorable NFT:Mint a commemorative NFT on Zora

Note: mint deadline is March 1, 2024 at 22:00 (Kiev).

Getting Roles in Discord

The project has an extensive list of roles in Discord. You can get them with the help of Guild for various tasks. What actions you need to perform to get this or that role is described in detail on the portal itself.

Go to the Discord of the project and pass verification.

Open the site, connect to the portal using the wallet and social networks:

Next, look at the available roles and get the desired ones by performing this or that action.

Note: if you’ve been interacting with the Base network for a long time, some roles will count automatically.

After execution, return to the Discord of the project. Open the rolles branch, click Join BaseGuild to verify and get roles:

Base Onchain Summer

The project team has launched Onchain Summer campaign. The activity involves completing quests to accumulate points, which can later be spent in the Shop tab on merch. Predominantly the quests consist of minting various NFTs, the average price of which at the time of writing is around $2.5 in ETH.

There have been no official announcements about this or that prize pool in dollar equivalent. At the time of writing, the only confirmed rewards are merch. The store will launch in July, but it is not yet known how many points are needed to convert into physical merchandise. Do your own research and consider all risks because the costs are substantial.

Despite this, the campaign is official and the possibility of additional announcements cannot be ruled out. So for those who are active in Base with an eye on drops, it may be worth it to accumulate a few levels with risk management in mind.

Follow the link and connect Coinbase Wallet.

Choose a quest from the proposed categories and perform it according to the instructions on the site:

Note: verification of completion and crediting of points may be delayed.

Conclusion

The network has entered Mainnet relatively recently, but already has an extensive infrastructure that simply cannot be covered in one guide. If you are interested in this blockchain, the best solution is to explore and interact with different dApps yourself. This will multiply your chances of a drop if the project team decides to make one.

Highlights:

Blockchain has an extensive infrastructure.

You need to be active periodically.

You don’t need to perform all the above activities at once. The best solution is to stretch the walkthrough over several days.

It is important to rack up not only the number of transactions but also the volume of transactions.

2 notes

·

View notes

Text

Yield Farming in DeFi:

If you’ve been poking around in the world of Web3 and crypto, chances are you’ve heard the term yield farming. It might sound like another buzzword, but for many projects, it’s become a powerful tool to grow, engage users, and boost liquidity in meaningful ways.

So what is yield farming, really? At its core, it’s about putting your crypto to work. You lock or stake assets into DeFi protocols and earn rewards — sometimes it’s more tokens, sometimes it’s interest, or even a cut of transaction fees. For startups and builders, that means turning idle assets into a source of growth or bootstrapping a community around your token.

Why Should Businesses Even Care About Yield Farming? Here’s the thing: yield farming isn’t just about making a quick buck. It’s a way to activate your project. Here’s how businesses are using it smartly:

🔹 Pulling in liquidity – Rewarding users for providing liquidity can make your token easier to trade and less volatile. That’s a big deal if you're building your own ecosystem.

🔹 Keeping users around – High-yield opportunities attract users who know how DeFi works. And once they're in, they usually stick around for the ride.

🔹 Token utility boost – If your platform has a token (for governance, access, whatever), farming helps get it moving instead of just sitting in wallets.

Of course, it’s not all upside. Risks like impermanent loss and smart contract bugs are real. So it’s not “set and forget.” You need to build your strategy with care and think long-term.

Want to Try Yield Farming in Your Business? Start Here. Thinking about integrating farming into your Web3 project? Here’s a simple approach to keep things solid:

1️⃣ Pick the right network – Are you on Ethereum, Solana, or a Layer 2 like Arbitrum? Each has pros and cons. Choose what fits your user base and token model.

2️⃣ Design your rewards wisely – Don’t just throw tokens at users. Think about how rewards can be sustainable. Maybe it’s your native token, maybe a stablecoin – or a smart combo.

3️⃣ Stay safe – Use audited contracts, educate your community, and maybe even offer insurance through DeFi tools like Nexus Mutual. Trust matters a lot in this space.

For example: imagine a real estate platform that lets users stake tokenized property shares to earn rewards. That’s not just yield farming — that’s building engagement and value all in one.

Where Is Yield Farming Headed? The space is moving fast. Yield farming is no longer just “deposit and earn.” We're seeing things like auto-compounding vaults, farming across chains, and even staking NFTs for yield.

What does that mean for you? If you’re creative with how you design farming mechanics — like tiered rewards or long-term staking perks — you’ll stand out from the crowd.

How do you see yield farming fitting into your Web3 idea? Could it be a way to grow your user base or activate a token you’re launching?

1 note

·

View note

Text

Next-Gen Token Development for a Smarter Digital Future

The quick evolution of blockchain technology has opened up new doors in digital finance, with tokenization being one of its most revolutionary features. As businesses globally transition towards decentralized and transparent ecosystems, next-generation token development is increasing. Tokens have become crucial in value, ownership, and access rights representation across industries like finance, real estate, gaming, and healthcare.

In this article, we’ll explore the existing token development environment, with emphasis on international cryptocurrency adoption, and the position of top token development.

Market Analyze

Token and cryptocurrency adoption have experienced rapid growth in numerous countries, driven by demand for financial inclusion, technological advancements, and safe digital environments. With more businesses and individuals shifting towards decentralized finance (DeFi), Web3 applications, and digital asset management, the demand for token development globally is experiencing a tremendous boost.

As per industry reports, the global tokenization market was worth more than $2 billion in 2023 and is expected to reach more than $10 billion by 2030, growing at a CAGR of more than 20%. The growth is attributed to the increased use of blockchain technology in different industries such as finance, real estate, gaming, art, and supply chain management.

For Example:

The first country to recognize Bitcoin as legal tender, El Salvador's bold move highlights a growing trend among developing countries looking to leverage tokenization for economic growth.

Overview of Token Development Company – Security Tokenizer

Security Tokenizer is a leading and end-to-end token development company in today's digital era. Having extensive experience in blockchain technology and a global mindset, the company has consistently assisted many businesses in deploying secure, scalable, and compliant tokens on various platforms.

Security Tokenizer is skilled at designing tokens by global standards and industry compliance. They serve a wide range of token types, including utility tokens, security tokens, non-fungible tokens (NFTs), and asset-backed tokens. With the businesses shifting toward decentralized models, Security Tokenizer provides the technical and strategic know-how to deploy tokenized projects.

Their dedication to innovation, security, and transparency make them a trusted partner to develop the token token, smart contract building, and blockchain integration.

What Services Are Offered in Token Development Company

Security Tokenizer offers a complete range of token development services aimed at enabling businesses and startups in various sectors. Services include:

Custom Token Development

Develop tokens on major blockchain networks such as Ethereum, Binance Smart Chain, Solana, Polygon, and Tron, customized for unique use cases such as fundraising, governance, and rewards.

Security Token Offering (STO) Development

Create and deploy compliant security tokens for equity, debt, or asset-backed fundraising. Services encompass legal structuring, smart contract development, and investor dashboards.

Utility Token Development

Create tokens that drive decentralized applications, providing users with access to features and rewarding ecosystem participation.

NFT Token Development

Create non-fungible tokens for digital collectibles, gaming assets, intellectual property, and real-world asset tokenization.

Token Wallet Integration

Secure digital wallets built into web and mobile applications, providing hassle-free storage and transfer of digital currency.

Smart Contract Development & Auditing

Solid smart contracts to execute transactions and validate rules with top-notch security and performance, supported by thorough auditing services.

Token Migration & Upgrades

Token migration support from old blockchain networks to new ones or token standard updates to satisfy contemporary protocols.

DeFi Token Development

Develop tokens for decentralized finance use cases such as staking, lending, yield farming, and governance.

Security Tokenizer Provides the Token Development Services

ERC Token Development

Security Tokenizer specializes in ERC token development, including ERC-20, ERC-721 (NFTs), and ERC-1155 standards on the Ethereum blockchain. These tokens are widely adopted and ideal for DeFi platforms, crowdfunding, and utility applications. The team ensures smart contract efficiency, compatibility with wallets, and security compliance.

Tron Token Development

For projects requiring high throughput and low transaction costs, Tron token development offers a robust alternative. Security Tokenizer builds tokens using TRC-10 and TRC-20 standards, suitable for dApps, gaming ecosystems, and digital content platforms. These tokens are optimized for performance and network scalability.

Token Generator Platform

Security Tokenizer also offers a user-friendly token generator platform, enabling users to create and deploy custom tokens without needing deep technical knowledge. This platform supports multiple blockchains, allowing businesses to accelerate their token launch while maintaining control over supply, distribution, and features.

BEP20 Token Development

Security Tokenizer delivers BEP20 token development services on the Binance Smart Chain, known for its low fees and rapid transactions. These tokens are perfect for decentralized finance, NFT projects, and crypto exchanges, offering cross-chain compatibility and secure smart contract integration.

ICO Development

To support fundraising efforts, Security Tokenizer provides end-to-end ICO development services. From whitepaper drafting and tokenomics to wallet integration and marketing support, the company ensures a successful Initial Coin Offering for startups and enterprises.

Step-by-Step Token Development Process

Token development is an iterative and very technical process of evolving a business idea into a tangible, blockchain-based digital asset. At Security Tokenizer, the process is carefully designed to yield maximum efficiency, transparency, and accuracy in accordance with the specific requirements of every client.

Requirement Analysis

The process starts with an in-depth review of the client's business model, goals, target market, and desired use of the token. This step is used to lay a solid foundation by matching the development strategy to the client's goals and market expectations.

Token Design & Tokenomics

Then, an economic model of the token is designed. This involves specifying the purpose of the token, total supply, method of circulation, reward system, and methods of ensuring long-term value. Good tokenomics is important for user adoption, investor demand, and the sustainability of the project.

Blockchain Selection

Selecting the proper blockchain network is crucial. Depending on the project's speed, cost, security, and scalability needs, Security Tokenizer suggests the optimal network, including Ethereum, Binance Smart Chain, Solana, Tron, or Polygon.

Smart Contract Development

Professional developers develop secure and trusted smart contracts to execute token operations such as transfers, staking, or voting automatically. They test the contracts extensively to eliminate bugs or loopholes.

UI/UX and Platform Integration

User interfaces are crafted for smooth interaction with the token ecosystem. It could be a wallet, dashboard, or decentralized application (dApp); smooth integration brings smooth user experience.

Testing & Security Auditing

Extensive testing and third-party security audits are performed to ensure the smart contract's performance, functionality, and security before it's deployed.

Deployment

After completion, the token is deployed onto the chosen blockchain. Network configuration, activation of the contract, and checkups are part of this phase.

Post-Launch Support

After deployment, Security Tokenizer offers ongoing support—keeping track of the token's performance, providing upgrades, and applying essential security patches to guarantee long-term success.

End of Words

With countries economy moving at high speed, token creation is at the innovation, opening up new possibilities to trade, invest, and engage in decentralized environments. The shift from conventional assets to tokenized digital representations is no longer a thing of the future, it is here now.

Security Tokenizer, being a reliable token development company, is enabling businesses to tap into this next-gen revolution through secure, scalable, and future-proof token solutions. From a startup wanting to issue a utility token to an enterprise looking to tokenise real-world assets, the technical expertise of Security Tokenizer can help turn your idea into reality with accuracy and effect.

#token development company#token development services#best token development company#crypto token development#cryptocurrency development#altcoin development#stable coin development#ethereum token development#TRON token development#ERC20 Token development.

0 notes

Text

Play-and-Earn vs Play-to-Earn: The New Web3 Model

The evolution of gaming has undergone several paradigm shifts—from pixelated 2D experiences to expansive 3D worlds, and now, to decentralized digital ecosystems fueled with blockchain development. One of the most significant transformations in the Web3 space has been the emergence of new economic models in gaming. Among these, the Play-to-Earn (P2E) model was once seen as revolutionary, but it is now being refined into a more sustainable and player-centric framework—Play-and-Earn (P&E). While the two terms may sound similar, their underlying philosophies and economic implications are markedly different.

Understanding Play-to-Earn (P2E)

The Play-to-Earn model gained massive popularity during the NFT boom of 2021, offering players the opportunity to earn real-world value, often in the form of tokens or NFTs, by simply playing blockchain-based games. In essence, it turned gaming into a financial activity where users were incentivized to grind through levels or complete tasks for financial rewards.

Titles like Axie Infinity, Gods Unchained, and The Sandbox epitomized this model. Players invested time and, in many cases, money to acquire digital assets that could be traded or sold for cryptocurrency. The appeal was obvious: get paid to play. For gamers in developing countries, this was seen as an economic lifeline during the COVID-19 pandemic.

The Rise of Play-and-Earn (P&E)

Recognizing the shortcomings of P2E, developers and blockchain visionaries have begun advocating for a more balanced model—Play-and-Earn. The core principle of this model is that gameplay must be enjoyable and rewarding, even without the promise of significant financial return. Earnings are seen as a supplementary benefit, not the main objective.

This subtle shift places user experience and engagement at the forefront. In Play-and-Earn ecosystems, players invest time because the game is inherently fun, challenging, or socially engaging. Economic incentives exist, but they complement rather than dominate the core gameplay loop.

Games like Big Time, Illuvium, and Ember Sword are positioning themselves within this framework, aiming to attract both traditional gamers and crypto enthusiasts. The focus is on long-term value creation, sustainable economies, and actual player enjoyment.

Why the Shift Matters for the Future of Web3 Gaming

This pivot from P2E to P&E reflects the maturing understanding of what the future of blockchain in gaming should look like. In the early days of Web3 gaming, developers were primarily driven by the hype surrounding NFTs and token-based economies. Many projects are launched without considering gameplay depth or long-term engagement.

The P&E model corrects this imbalance. It insists that to be successful, Web3 games must stand on equal footing with traditional titles in terms of gameplay mechanics, storylines, graphics, and community features. It also promotes better economic design—where in-game assets may still have real-world value, but not at the cost of user enjoyment.

For example, a P&E game might offer rewards for competitive gameplay, guild-based quests, or achievements, but only as a layer on top of an already engaging experience. This helps build loyal communities, increases retention, and attracts both casual players and core gamers.

Challenges in Implementing the P&E Model

While Play-and-Earn offers a more sustainable vision, it is not without its own challenges:

User Expectations

Many early adopters of Web3 games still expect fast returns and speculative asset value growth. Educating users on the new model is essential. For that, you should seek help from a leading game development company in the USA.

Monetization Balance

Developers must balance monetization with fairness. If earnings are too low, players may feel unrewarded; too high, the game risks becoming exploitative.

Onboarding Non-Crypto Gamers

Seamless onboarding, with minimal friction around wallet creation and asset custody, is crucial to draw mainstream gamers into P&E platforms.

Regulatory Oversight

As real money enters the ecosystem through tokenized assets, games must navigate legal complexities surrounding securities, gambling laws, and digital ownership. To do so, you should connect with an established NFT development company like Red Apple Technologies.

Final Thoughts: Building a Better Web3 Gaming Ecosystem

Play-and-Earn represents a critical recalibration of priorities in Web3 game development. Rather than turning games into passive income machines, this model emphasizes the fusion of entertainment, ownership, and optional earnings. It creates space for players who value gameplay as much as—or more than—financial incentives.

In the long term, this shift can help blockchain games shed their speculative reputation and move closer to mainstream adoption. As developers refine their approach and the infrastructure becomes more user-friendly, P&E games have the potential to offer the best of both worlds: the immersive fun of gaming and the empowering economics of Web3.

#Web3#PlayToEarn#PlayAndEarn#BlockchainGaming#CryptoGames#NFTGaming#MetaverseGaming#EarnWhilePlaying#FutureOfGaming#Web3Games#TokenEconomy#CryptoRewards#NFTGames

0 notes

Text

how does blockchain technology contribute to the concept of web3

1. Introduction

Welcome to the next era of the internet—Web3. It’s more than just a buzzword. It’s a whole new world where users gain control, data is decentralized, and privacy is prioritized. But what’s fueling this revolutionary change? You guessed it—blockchain technology. Let’s take a deep dive into how blockchain is reshaping the internet as we know it.

2. What Is Web3?

Web3 is the third generation of the internet. Unlike Web1 (read-only) and Web2 (interactive but centralized), Web3 is decentralized. It empowers users instead of corporations, thanks to technologies like blockchain that remove the need for intermediaries.

3. A Quick Look at Blockchain Technology

Blockchain is a distributed ledger system. It keeps data secure, transparent, and immutable across a network of nodes. Each transaction is recorded in blocks, and once confirmed, it can’t be changed—making it ideal for the trustless environment of Web3.

4. Understanding the Backbone — Blockchain Explained

The Core Principles of Blockchain

Decentralization

No central authority controls the system. Users interact peer-to-peer, which boosts transparency and removes single points of failure.

Transparency and Immutability

Every transaction is publicly verifiable and cannot be altered once validated. That’s trust without needing to trust anyone!

How Blockchain Networks Operate

Every node in a blockchain network stores a copy of the ledger. When a new block is created, it’s verified by consensus mechanisms like Proof of Work or Proof of Stake before being added.

5. Web3 and Blockchain — A Powerful Partnership

Why Blockchain Is Essential for Web3

Without blockchain, Web3 would still rely on centralized servers. Blockchain allows for true ownership of data, secure identity management, and self-executing smart contracts.

The Transition from Web2 to Web3

Web2 is dominated by tech giants like Google and Meta. Web3 shifts power back to the users, with decentralized apps (dApps) and platforms that run on transparent protocols.

6. Key Benefits of Blockchain Technology in Web3

User Empowerment and Data Ownership

Blockchain gives users control over their own data. Imagine owning your digital identity like you own your house.

Decentralized Identity

Say goodbye to logging into sites using your email. Your wallet becomes your identity, making for safer, seamless logins.

Enhanced Security and Trust

Thanks to blockchain’s immutable nature, data breaches are drastically reduced. Users no longer need to trust corporations to keep their info safe.

7. Use Cases of Blockchain in Web3

Decentralized Finance (DeFi)

DeFi allows people to borrow, lend, and trade assets without banks.

Real-World Example: Uniswap

Uniswap is a decentralized exchange where users can swap crypto tokens without middlemen, using automated smart contracts.

Decentralized Autonomous Organizations (DAOs)

DAOs are internet-native organizations governed by code, not CEOs. Decisions are made through token-holder voting.

NFTs and Digital Ownership

Non-fungible tokens prove ownership of unique digital items—from art to music to virtual real estate.

Web3 Social Platforms

Platforms like Lens Protocol let users own their content and move it across apps without losing followers.

8. The Role of Blockchain in Web3 App Development

Smart Contracts as the Backbone

Smart contracts are self-executing programs that run on the blockchain. They eliminate the need for third-party enforcement.

Real-Time Data Integrity

Because data is recorded on the blockchain, it's tamper-proof and trustworthy—great for apps that need transparency.

Developer Opportunities and Challenges

Web3 app development opens new doors but comes with learning curves—especially around blockchain infrastructure and gas fees.

9. Use of Blockchain Technology in Financial Services

Transparent Transactions

Every transaction on a blockchain is traceable, making auditing and compliance easier than ever.

Elimination of Intermediaries

No need for middlemen like brokers or banks. This reduces costs and speeds up transactions.

Cross-Border Payments

Sending money across borders is faster and cheaper with blockchain-based stablecoins and crypto networks.

10. Real World Examples of Web3 and Blockchain Synergy

Ethereum Ecosystem

Ethereum is the go-to platform for Web3 development. It supports smart contracts and hosts countless dApps.

Polkadot and Interoperability

Polkadot connects different blockchains, allowing them to share data and assets seamlessly.

Filecoin for Decentralized Storage

Filecoin stores data across a decentralized network instead of centralized servers, giving users full control.

11. Security Aspects of Blockchain in Web3

Can Blockchain Be Hacked?

It's extremely difficult, but not impossible. A hacker would need to control over 51% of the network, which is highly improbable for well-established blockchains.

Measures That Protect Blockchain Systems

Cryptographic hashing, consensus mechanisms, and decentralization make blockchain one of the most secure digital infrastructures.

12. The Future of Web3 Development

Scalability Solutions

Tech like Layer 2 rollups and sharding are making blockchain faster and cheaper to use.

Interoperability Between Networks

Projects like Cosmos and Polkadot are building bridges between blockchains for a more connected ecosystem.

13. Challenges and Solutions

Scalability and Speed

Solution: Implementing Layer 2 and optimizing consensus algorithms.

Regulatory Issues

Solution: Creating hybrid solutions that balance decentralization with compliance.

Adoption Barriers

Solution: Better UX and education to help users and developers transition smoothly.

14. Final Thoughts

Blockchain isn’t just a piece of tech—it’s the foundation of Web3. From secure identities and transparent financial systems to decentralized apps and user empowerment, the use of blockchain technology is redefining our digital future. So, as the world shifts toward decentralization, are you ready to embrace the Web3 revolution?

#technology#blockchain development#web3 development#web3#blockchain business#blockchain technology in healthcare#blockchain technology#blockchain#blockchain basics

0 notes

Text

The Rise of RWA (Real World Assets) on Chain: Tokenizing Everything from Real Estate to Treasuries

In the evolving world of decentralized finance (DeFi), one of the most exciting trends shaping the future of blockchain is the tokenization of Real World Assets (RWAs). What was once confined to crypto-native tokens and smart contracts is now expanding into the tangible, regulated economy—bringing real estate, government bonds, invoices, art, and commodities onto public blockchains.

This movement isn't just theoretical—it’s already happening. With major players like BlackRock, JPMorgan, and Goldman Sachs exploring tokenized financial instruments, and DeFi protocols integrating real-world yield, RWA tokenization is poised to bridge the gap between traditional finance (TradFi) and Web3.

What Are Real World Assets (RWAs)?

Real World Assets (RWAs) refer to physical or off-chain financial assets that are represented as digital tokens on the blockchain. These can include:

Real estate (residential, commercial)

U.S. Treasuries and bonds

Trade receivables and invoices

Private equity and venture capital

Luxury items, art, and commodities

Through tokenization, these assets become liquid, divisible, and accessible to global investors—without intermediaries or complex legal friction.

Why RWAs Matter in Crypto

1. Yield in a Post-DeFi Boom Era

With on-chain DeFi yields declining post-2021, investors are looking for sustainable, real-world-backed returns. Tokenized T-Bills and short-term bonds, for example, offer 4–5% annualized yields with low risk—something protocols like Ondo Finance, Maple, and Goldfinch now offer.

2. Liquidity for Illiquid Markets

Fractionalizing real estate or private equity allows smaller investors to access asset classes once exclusive to institutional players—creating 24/7, globally accessible secondary markets.

3. Programmability and Transparency

Smart contracts automate payments, ownership transfers, and compliance checks—reducing fraud and improving efficiency for everything from rent payments to supply chain finance.

Key Use Cases of RWA Tokenization

Asset TypeTokenized FormatExample Use CaseReal EstateNFTs or ERC-20 tokensFractional property ownershipTreasuriesERC-20s or yield-bearing tokensOn-chain stable yield for DeFiInvoicesNFT-backed debt instrumentsSME lending & liquidityPrivate EquityLP tokensVenture exposure in DeFi pools

One powerful example is the tokenization of short-term U.S. Treasuries. Protocols mint yield-bearing stablecoins backed 1:1 by T-bills. Investors earn real-world interest, while the token remains composable across the DeFi ecosystem.

How It Works: From Real World to On-Chain

Origination – A legal entity holds the real asset (property, bond, etc.).

Tokenization – A digital token representing fractional ownership or debt is issued.

Custody – A regulated custodian ensures the asset is compliant and legally backed.

On-Chain Utility – Tokens are used in DeFi: traded, staked, or lent for yield.

This approach requires robust legal structures, trusted custodians, and compliance checks, often integrated through oracles, identity layers, and auditable smart contracts.

Related Innovations Powering RWAs

The infrastructure enabling RWAs is tightly connected to several breakthroughs in blockchain architecture, such as:

Zero-Knowledge Proofs & zk-Rollups – Privacy and scalability are critical when onboarding regulated institutions. ZKPs, as explored in our article on Zero-Knowledge Proofs and zk-Rollups, allow confidential but verifiable asset transfers and identity checks—essential for compliant RWA transactions.

Account Abstraction (ERC-4337) – Custom wallet logic enables RWA investors to automate yield distribution, KYC authorization, and gasless interactions. Read how Account Abstraction and ERC-4337 are building the next generation of smart wallets tailor-made for financial applications.

MEV Awareness – With billions of dollars flowing through RWA markets, fair transaction ordering becomes critical. Our deep dive into MEV and how bots profit from blockchain congestion explores the risks of transaction manipulation—a concern for sensitive RWA interactions such as auctions or settlements.

Challenges in Bringing RWAs On-Chain

Despite the enthusiasm, RWA tokenization isn’t without obstacles:

Legal & Regulatory Ambiguity – Who owns a tokenized real estate deed if the token is lost? Cross-border laws vary dramatically.

Liquidity & Market Depth – While fractionalization helps, many RWA markets still lack enough active buyers/sellers.

Custodial Trust – Decentralization is compromised when token value relies on a central entity holding real-world assets.

Pricing & Oracles – Real-time, trustworthy price feeds for off-chain assets remain a challenge.

However, continued innovation in oracles, governance, and legal engineering is gradually overcoming these barriers.

How Cryptonary Is Helping Investors Navigate RWAs

Cryptonary, a leading crypto research and education platform, has been instrumental in demystifying RWA investing. Through in-depth analysis, guides, and protocol breakdowns, Cryptonary helps investors:

Evaluate the risk-reward profiles of tokenized bond protocols

Understand legal frameworks behind real estate and invoice tokenization

Navigate emerging platforms like Centrifuge, Clearpool, and Maple

Stay informed on regulatory trends, especially in Europe and the U.S.

By connecting technical innovation with investor education, Cryptonary plays a crucial role in making RWAs not just a trend—but a long-term, mainstream crypto use case.

Final Thoughts

Real World Assets on-chain represent crypto’s most tangible opportunity to interface with traditional finance. By bringing yield, liquidity, and ownership from the real world to programmable blockchains, RWA tokenization could fuel the next multi-trillion dollar wave in DeFi.

With supporting innovations like zk-Rollups, Account Abstraction, and MEV-aware architecture, and with communities like Cryptonary leading the educational front, investors now have the tools—and confidence—to participate in this new financial frontier.

#cryptocurrency#cryptomarket#cryptotools#crypto#blockchain#digitalcurrency#defi#bitcoin#cryptonews#ethereum#solana

0 notes

Text

DWF Labs Becomes Official Market Maker for JST Token

Hold onto your wallets, folks! DWF Labs just got a juicy upgrade as the official market maker for the $JST token on the TRON blockchain. 🌟 What does this mean for you, the savvy crypto connoisseur? Well, it's all about liquidity and stability in the JUST ecosystem, which translates to potentially smoother trading and a less bumpy ride for those looking to invest in the DeFi space.

With this partnership, we’re looking at a boost in $JST’s trading conditions – think of it as a CBD-infused green tea for your crypto portfolio. 🥤 Expect to see reduced spreads and a whole lot more action as market volatility takes a hit. And let's be honest, who doesn’t want fewer panic sells triggered by sudden price jumps? 🙃

JST Liquidity Boosted by DWF Labs Partnership

DWF Labs isn’t just some run-of-the-mill market maker; they’re here to flex their Web3 mastery and pump the $JST with some much-needed liquidity. Talk about a power move! ⚡ The JUST Foundation aims to slap that DeFi presence into gear, and this collaboration is a key piece of the puzzle.

Market-Making Deals Historically Increase Liquidity

History shows us that these market-making gigs often turn out to be a liquidity party, with examples like Wintermute setting the stage for successful DeFi tokens. 🎉 As $JST rides this wave, we might just see an uptick in trading volumes and a decrease in slippage - basically, it’s all about making your trading experience as smooth as butter on a hot pancake! 🥞

“We’re excited to collaborate with the JUST Foundation to support the growth of $JST. At DWF Labs, we focus on backing ecosystems that drive real-world impact in decentralized finance. Strengthening liquidity and accessibility for $JST is an important step as the DeFi space continues to evolve and grow.” - Andrei Grachev, Managing Partner, DWF Labs

So, if you’re not already familiar with $JST and the perks this partnership brings, now's the time to dive in! 💰 Get all the juicy details and how this could affect you at kanalcoin.com. Your crypto journey is about to get a serious upgrade - don’t just stand there, let’s make some moves! 🚀

Disclaimer: This website provides information only and is not financial advice. Cryptocurrency investments are risky. We do not guarantee accuracy and are not liable for losses. Conduct your own research before investing.

#CryptoNews #DWF #JST #DeFi #TRON #MarketMaker #Liquidity #Blockchain #InvestSmart #CryptoCommunity

0 notes

Text

AddTon: TONCOIN Project Overview

TONCOIN ARBITRAGE TRADING AND APY STAKING PROGRAM based on the work of Dr. Nikolai Duro

Abstract :

The Open Network (TON) is a fast, secure and scalable blockchain and network project, capable of handling millions of transactions per second if necessary, and both user-friendly and service provider–friendly. We aim for it to be able to host all reasonable applications currently proposed and conceived. One might think about TON as a huge distributed supercomputer, or rather a huge super server, intended to host and provide a variety of services. This text is not intended to be the ultimate reference with respect to all implementation details. Some particulars are likely to change during the development and testing phases.

About TONCOIN Blockchain :

Blockchain Name: The Open Network (TON Blockchain)

Founders: Pavel Durov (Founder of Telegram) and Nikolai Durov (Chief Architect)

Initial Development: 2018–2019 (transitioned to a community-led project after regulatory issues)

Token Symbol: TON

Blockchain Type: Layer-1 (Comparable to Ethereum, Solana)

Consensus Mechanism: Proof-of-Stake (PoS)

Special Note: Nikolai Durov designed the blockchain’s technical foundation: Infinite sharding, vertical scaling, instant payments.

TONCOIN Ecosystem Overview

Wallets: Telegram Wallet (integrated), Tonkeeper, Tonhub, OpenMask, MyTonWallet

DEX Platforms: STON.fi, Dedust.io, Megaton Finance

Browser Extensions: Tonkeeper Extension, OpenMask Browser Wallet

Web3 Applications: TON DNS, TON Storage, TON Sites, Telegram Wallet Bots

Gaming Initiatives: TON Punks, Fanton Fantasy League, Tap Fantasy Game, StormTrade (gaming and trading dApp)

NFT Marketplaces: Getgems.io, TON Diamonds, Disintar.io

Other Projects: TON Proxy, TON Payments, TON Wallet Bots, Open League (Gaming)

TONCOIN Global Market Position:

Listed on: Binance, OKX, KuCoin, Bybit, MEXC, Huobi, etc.

Market Presence: Active in 340+ markets globally.

Ranking: Consistently Top 15 on CoinMarketCap and CoinGecko

Daily Trading Volume: Exceeds $100 million.

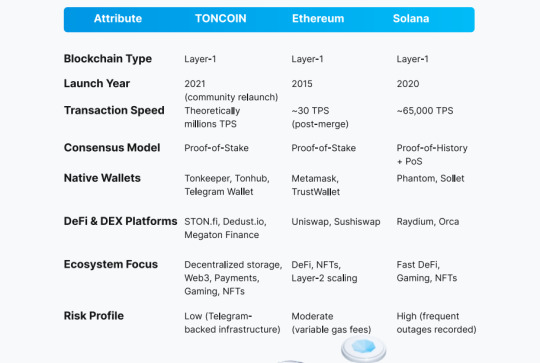

Blockchain Industry Comparison:

How Addton.io Arbitrage Trading Works:

Focus Asset:

Addton.io only works on TONCOIN. Trading pair: TONCOIN/USDC (uses price gaps between TON and USDC)

Trading Platforms:

Trading happens only on decentralized exchanges (DEX)

STON.fi

Dedust.io

AI-Powered Arbitrage Bot:

A specialized AI trading bot has been developed. The bot monitors real-time TONCOIN prices across both exchanges.

Price Difference Capture:

When there is a price difference (example ) If the STON.fi TON price = $2.00 and the Dedust.io TON price = $2.05, then the bot automatically buys from the lower price exchange (STON.fi) and sells at the higher price exchange (Dedust.io).

Profit Generation:

Through this buying-selling cycle, organic profit is generated (without speculative risk). No leverage, no betting — only real price gap arbitrage.

Daily Operations:

The bot remains active from Monday to Friday (Saturday–Sunday off). Profits are distributed daily to staking participants.

Security:

There is no centralized risk, as trading occurs only through decentralized (on-chain) DEXs.

Program Launch and Ecosystem & Partnership:

Endorsed by the TON Blockchain community.

Supported by the Tapmoon Ecosystem.

Launch of The Open Network Classic Blockchain:

Native Token: TONCOIN Classic (CTON) Ticker: CTON Launch Price: $0.003 Participants will receive CTON tokens equal to their staking package value

Income Distribution and Incentives:

Participants will benefit from:

Daily arbitrage profits credited in TONCOIN.

CTON token bonus matching the staking package.

Special promotions and rewards in TAPS Token.

Risk Mitigation and Client Protection

TAPS Token Compensation

In case of trading losses, TAPS Tokens will be awarded.

Guaranteed CTON Tokens

Regardless of trading performance, CTON tokens will be distributed, securing future asset value.

Project Name Description:

Project Name : Description TON DNS : Web3 domain naming system TON Proxy : Decentralized VPN and privacy services TON Storage : Blockchain file storage TON Sites : Decentralized web hosting TON Payments : Layer-2 micropayment solutions STON.fi : Largest DEX on TON Dedust.io : Major decentralized exchange Megaton Finance : DeFi trading platform Getgems.io : NFT marketplace TON Diamonds : Premium NFT marketplace Disintar.io : NFT creation and trading platform Fanton Fantasy League : Fantasy sports gaming Tap Fantasy : Game Metaverse gaming Storm Trade : Trading and gaming hybrid dApp Open League : Decentralized esports and gaming platform

Why Choose Addton TONCOIN Staking Program?

Built on Telegram’s original blockchain vision (Pavel and Nikolai Durov)

Pure AI-based decentralized arbitrage trading.

Daily profits + bonus rewards in TONCOIN, CTON, and TAPS.

Dual protection model for user assets.

Integrated with Tapmoon Ecosystem.

Strong and growing TON Blockchain ecosystem support.

Website | twitter(X) | Telegram | Reddit | Facebook | Youtube

1 note

·

View note

Text

Why Your Blockchain Project Needs an Experienced Smart Contract Developer

As blockchain adoption accelerates across industries, smart contracts have become the engine driving innovation in DeFi, NFTs, dApps, and beyond. These self-executing contracts—written directly into code—automate trust, enforce rules, and remove intermediaries. But with this powerful technology comes great responsibility. One mistake in your smart contract could lead to security breaches, lost funds, or reputational damage.

That’s why hiring an experienced smart contract developer isn't just an option—it’s a necessity for any serious blockchain project.

What Is a Smart Contract Developer?

A smart contract developer is a blockchain expert who writes and deploys secure, decentralized applications (dApps) using smart contract languages like Solidity, Vyper, Rust, or Move. They are responsible for creating the logic behind token transfers, lending protocols, NFT minting, staking, DAOs, and much more.

They don’t just code—they engineer bulletproof systems that execute automatically without human involvement.

1. Security Is Everything

A poorly written smart contract can be exploited. In the blockchain space, this means irreversible loss. Smart contract hacks have led to multi-million dollar losses across the DeFi landscape.

An experienced developer understands:

Reentrancy attacks

Integer overflows and underflows

Front-running vulnerabilities

Oracle manipulation

Delegatecall risks

They follow industry best practices, conduct thorough audits, and write test cases to eliminate risk before deployment.

2. Optimized for Gas and Cost

Blockchain operations aren't free. Every interaction with a smart contract consumes gas fees—which can add up quickly on platforms like Ethereum.

A skilled smart contract developer can:

Write clean, optimized code to reduce gas costs

Use design patterns like minimal proxy contracts (EIP-1167)

Choose the right storage structures and loops

Avoid redundant operations

This ensures your users enjoy low fees—and your protocol stays efficient and scalable.

3. Cross-Platform Compatibility

A senior developer understands the nuances of different blockchains:

Ethereum – The go-to for DeFi and NFTs, using Solidity.

Polygon – Ethereum-compatible with lower fees.

Solana – Ultra-fast but requires Rust development.

Binance Smart Chain (BSC) – Affordable and EVM-compatible.

Avalanche, Near, Fantom – Other emerging ecosystems.

Whether you're building on a single chain or going multi-chain, experience ensures seamless integration.

4. Audit-Ready Code

Most blockchain projects require independent smart contract audits to gain trust and secure investor confidence. Experienced developers:

Write readable, modular code

Follow audit guidelines (OpenZeppelin standards, for example)

Prepare documentation and test coverage

Handle bug fixes post-audit quickly

This saves time and money during the audit process and builds confidence with your community.

5. Integration with Frontend and Oracles

Smart contracts don’t work in isolation—they power apps that users interact with.

A seasoned developer knows how to:

Integrate with frontend frameworks like React or Vue

Connect with Chainlink oracles for real-world data

Link contracts with wallets (MetaMask, Trust Wallet)

Support cross-chain messaging and APIs

This ensures smooth UX and powerful backend logic.

6. Stay Updated with Evolving Standards

The Web3 space evolves fast. Developers need to stay ahead with updates like:

New ERC standards (e.g., ERC-4626 for yield-bearing vaults)

Layer-2 rollups like Arbitrum and Optimism

ZK-rollups and privacy-enhancing tech

Account abstraction and modular chains

Only experienced professionals can adapt quickly without compromising your roadmap.

7. Project Longevity and Maintenance

Smart contracts are not "set it and forget it" systems. They require:

Ongoing maintenance

Upgrades via proxy patterns or contract migration

Bug fixes and governance changes

Community and DAO integration

An experienced developer builds with the long-term in mind—supporting future upgrades and sustainability.

Final Thoughts

Blockchain is trustless—but that doesn’t mean you should trust just anyone to build your smart contracts. Whether you’re launching a DeFi protocol, NFT marketplace, or enterprise blockchain solution, the success of your project depends on the reliability, security, and performance of your smart contracts.

Hire a smart contract developer who brings not just code—but clarity, confidence, and experience to your blockchain journey.

0 notes

Text

In 2025, Stellar (XLM) stands as a leading example of how blockchain can solve real-world financial problems at scale. It has proven that decentralization can coexist with compliance, and innovation can serve inclusion—not just speculation. Built by the Stellar Development Foundation (SDF), Stellar is one of the most policy-aligned and practical blockchain protocols, designed from the ground up for fast, affordable cross-border payments and seamless fiat integration. Its core mission is to connect global financial systems while empowering unbanked populations, underfunded NGOs, and fintech disruptors in emerging markets. Where other chains chase headlines, Stellar builds bridges. With stablecoins, CBDCs, and remittance corridors actively running on-chain, the network has become the quiet engine of financial connectivity. Its combination of KYC-ready anchors, near-zero fees, and instant finality makes it not only efficient—but essential—for institutions seeking responsible blockchain integration. Why Stellar Stands Out Stellar distinguishes itself as a purpose-built blockchain that embraces real-world practicality over hype. It is engineered not just to be fast or efficient, but to serve as the connective tissue between existing financial systems and the promise of Web3. ⚡ Speed and Affordability Transactions on Stellar settle in 2–5 seconds and cost less than a fraction of a cent. This ultra-low cost structure makes the network ideal for micropayments, international remittances, and high-frequency transactions where traditional fees would be unsustainable. It is particularly well-suited for developing economies where every cent matters. 🌍 Regulatory Collaboration Stellar has built a strong reputation by proactively working with governments, NGOs, and financial institutions. Its partnerships with organizations like MoneyGram, Circle (USDC), and the UNHCR showcase a proven ability to operate within compliant frameworks. Its architecture supports KYC, AML, and auditability, ensuring it remains compatible with evolving financial regulations. 🔗 Fiat-Blockchain Bridge The network’s anchor system allows for seamless fiat-to-crypto conversion via licensed entities, enabling users to send and receive digital assets without ever touching a centralized exchange. These fiat on/off-ramps tokenize deposits, manage trustlines, and ensure that Stellar remains rooted in the real-world economy—making it one of the most grounded and usable blockchain platforms for financial service providers. Real-World Use Cases Stellar’s real-world adoption reflects its commitment to solving high-impact problems in underserved regions and legacy systems. Its use cases emphasize cross-border inclusion, humanitarian relief, and the modernization of financial infrastructure: - USDC on Stellar: Circle’s stablecoin runs natively on Stellar, offering instant, low-fee cross-border transactions via mobile apps and fintech APIs. - MoneyGram Access: A breakthrough in global financial access—users in 180+ countries can convert physical cash to USDC or XLM and back at MoneyGram locations, even without a bank account or smartphone. - UNHCR Refugee Aid: Stellar facilitates secure and transparent disbursement of humanitarian funds to refugees, enabling programmable assistance with full traceability and compliance. - African Fintech Corridors: Startups in Nigeria, Kenya, and Ghana are using Stellar to route local currencies through USDC corridors, significantly reducing FX costs and enhancing transparency. - Latin American Pilots: In Brazil, Colombia, and Argentina, Stellar is powering pilot programs for digital wallets, programmable stablecoins, and blockchain-based micro-savings products in underserved communities. These deployments show that Stellar is not merely theoretical—it is operational, impactful, and already changing lives. Technical Outlook (as of Today) Stellar (XLM) is currently trading around $0.11, maintaining a consistent consolidation pattern that signals accumulation. The market is showing mixed signals but with a slight bullish bias based on early technical indicators: - Support Zones: $0.095 (minor), $0.082 (major structural) - Resistance Levels: $0.125 (short-term breakout), $0.14 (psychological barrier) - Trend: Sideways with low volatility, forming a tightening price range—typical pre-breakout behavior - Momentum: RSI hovers at 51 (neutral), indicating balanced buying/selling pressure - MACD: Close to a bullish crossover, suggesting upward momentum could follow If price breaks and holds above $0.125 with volume confirmation, it could trigger a mid-term rally targeting $0.14–$0.16. Failure to hold $0.095 may lead to a retest of long-term support around $0.082. Traders are watching for breakout confirmation before committing capital at scale. 2025–2027 Forecast Stellar's price outlook for the coming years is underpinned by its real-world utility, increasing institutional traction, and upcoming technological developments like Soroban smart contracts. If adoption by governments, NGOs, and financial institutions continues to grow, Stellar could be well-positioned for steady appreciation. 2025 - Baseline: $0.15 – $0.25Reflects steady growth driven by increased wallet adoption, USDC volume growth, and expansion in Latin American fintech corridors. - Bullish Scenario: $0.30 – $0.40Likely if Stellar becomes the blockchain of record for multiple digital wallet programs and partners with new national CBDC pilots. 2026 - Baseline: $0.25 – $0.38Supported by Soroban's mainstream rollout, greater anchor integration, and scalable retail use cases. - Bullish Scenario: $0.50 – $0.65Based on growing stablecoin adoption, institutional custody partnerships, and tokenization of real-world assets like gold or carbon credits. 2027 - Baseline: $0.35 – $0.50Resulting from expanded Stellar-based payment infrastructure in regions like Africa, Southeast Asia, and South America. - Bullish Scenario: $0.75 – $1.00+If Stellar secures a role in G20-level CBDC corridors, becomes a primary rail for global USDC flows, or enters new regulated securities markets. These forecasts are speculative and depend on market trends, regulatory alignment, and real-world execution. But if Stellar continues delivering on its roadmap, its utility-focused model could drive sustainable long-term growth. Roadmap Highlights Stellar's 2025–2026 roadmap is focused on transforming the network from a payment rail into a fully programmable and institution-ready financial layer. The key initiatives below highlight Stellar’s commitment to real-world adoption, developer empowerment, and policy-compliant innovation: - Soroban Smart Contracts: Set to go live in full production, Soroban introduces secure and scalable smart contract capabilities to Stellar. Developers can build DeFi protocols, NFT marketplaces, automated payment logic, and permissioned applications directly on-chain. - Stellar Turrets: A novel system for managing off-chain transaction automation. Turrets enable developers and institutions to trigger Stellar transactions based on external data or scheduled conditions, expanding real-world programmability. - Institutional Custody & Treasury Integration: In 2025, Stellar is prioritizing partnerships with custody providers, payment processors, and regulated fintechs to facilitate seamless onboarding of large financial players and compliance-conscious institutions. - Real-World Tokenization (RWAs): The network is expanding support for tokenized real-world assets including fiat currencies, sovereign bonds, commodities (e.g. tokenized gold), and purpose-bound tokens for aid disbursement or social finance programs. Stellar’s roadmap represents not just upgrades to its tech stack, but a shift toward universal financial infrastructure—bridging programmable money with institutional-grade delivery and compliance frameworks. Final Thoughts Stellar is not just a blockchain project—it’s a mission-driven platform that is redefining how global finance can operate inclusively, affordably, and transparently. In a sea of speculative protocols, Stellar continues to lead with purpose, proving that meaningful impact and scalability are not mutually exclusive. Its blend of near-zero fees, regulatory alignment, and production-ready infrastructure has made it a preferred choice for humanitarian agencies, governments, and fintech innovators alike. Whether it's powering last-mile remittances, facilitating digital cash distribution, or enabling programmable financial applications, Stellar offers a stable, compliant foundation for the future of value exchange. As Soroban smart contracts go live and real-world tokenization expands, Stellar is evolving into a full-spectrum financial ecosystem. It’s not only enabling access—but building the very bridges that connect tomorrow’s financial systems. 🔗 Learn more at: https://stellar.org Read the full article

0 notes

Text

How to Submit a Crypto Press Release for AI & Blockchain Integrations

In 2025, the worlds of AI (Artificial Intelligence) and blockchain are coming together like never before. Many new crypto projects now use both technologies to build smarter, faster, and more secure platforms.

If you’re launching one of these exciting new projects, there’s one important thing you must do:

Submit crypto press release content to tell the world about it!

But what’s the best way to do that, especially if your project involves AI and blockchain? In this blog, we’ll explain everything in a super simple way—perfect for beginners, small teams, and even first-time crypto builders.

Let’s dive in! 🚀

🤖 What Is AI + Blockchain?

Before we get into the press release part, let’s understand what AI and blockchain do together.

AI helps your platform think, learn, and make smart decisions.

Blockchain keeps your data safe, clear, and easy to track.

Together, they power smart crypto tools like AI trading bots, NFT image generators, and DeFi automation platforms.

Now, how do you let people know about your new project?

You submit a crypto press release!

📰 What Is a Crypto Press Release?

A press release is a short news story about your project. It shares:

What your project does

What makes it special (AI + blockchain!)

When your token launches

How people can join or invest

You submit crypto press release content to crypto news websites, so they can publish it for their readers, investors, and traders to see.

✅ Why Press Releases Work for AI & Blockchain Projects

There are hundreds of new crypto projects every week. A well-written press release helps yours stand out.

Here’s why submitting a press release is smart:

It builds trust.

It shares your vision.

It attracts investors and users.

It boosts your SEO so you show up on Google.

And when your project includes AI, many tech lovers and crypto fans will be even more excited!

📌 Where to Submit Crypto Press Release in 2025

Here are top platforms to submit your press release and reach the right audience:

CoinGabbar.com – Great for new and trending crypto projects.

CoinTelegraph – Trusted by millions of crypto readers worldwide.

Bitcoinist & NewsBTC – Popular platforms for blockchain and tech stories.

Yahoo Finance – Reach readers in both crypto and traditional finance.

CryptoDaily – Strong support for AI, DeFi, and Web3 innovations.

Pro Tip: Some platforms are free, others charge a small fee for wide distribution. If you’re on a budget, try submitting to a few top sites and sharing it on social media too.

✍️ How to Write a Simple & Powerful Press Release

When you submit crypto press release content for your AI + blockchain project, keep it simple and strong. Here’s what to include:

1. Title That Grabs Attention

Example: “New AI-Powered Crypto Wallet Launches on Blockchain – Presale Live Now!”

2. Short Introduction

Tell readers what your project is, who made it, and what’s new.

3. Main Features

How does AI help users?

What blockchain is it built on?

Why is it better than other platforms?

4. Important Dates

Presale or token launch

Airdrop start/end date

App or feature release

5. Call-to-Action (CTA)

Example: “Join our Telegram for updates” or “Visit our presale page now!”

💬 Extra Tips for AI + Blockchain Projects

To get the best results when you submit crypto press release stories, follow these tips:

Use simple language. Not everyone understands deep tech.

Highlight the AI part. Investors love smart, future-ready platforms.

Add links. Make it easy for people to learn more.

Include images or logos. It helps your project look real and professional.

📣 Share It Everywhere!

After you submit crypto press release content to news sites, make sure to:

Post it on Twitter, Telegram, and Discord

Add it to your website or blog

Send it in email newsletters

The more people see it, the more viral your project can become!

🚀 Final Thoughts

In 2025, projects that combine AI and blockchain are leading the way in crypto. But even the best ideas need attention. A smart press release helps you tell the world what you’re building and why it matters.

So, if you’re getting ready to launch something exciting, don’t wait.

Submit your crypto press release today — and give your project the spotlight it deserves!

0 notes

Text

The Ultimate Guide to Use a Crypto Events Calendar to Track Global Web3 Summits and Crypto Meetups

The crypto world is growing fast, and new things are happening every day. From Web3 meetups to big international conferences, there are many events you don’t want to miss. But with so much going on, how do you keep track of everything?

That’s where a crypto events calendar comes in handy. It helps you stay up to date with the latest happenings in the blockchain space — whether it’s a crypto event today, a conference next week, or a global summit next month.

Let’s break it down and see how you can use a crypto events calendar to stay ahead, learn new things, and meet great people in the crypto world.

Why Crypto Events Matter in 2025

Crypto isn’t just about charts and prices. It’s about people, ideas, and building the future of the internet. That’s what Web3 is all about.

When you attend a crypto conference or join a local meetup, you get a chance to:

Learn from experts

Discover new blockchain projects

Get early access to launches

Network with builders, traders, and investors

In short, crypto events help you grow — whether you're a beginner or a pro.

What Is a Crypto Events Calendar?

A cryptocurrency events calendar is a tool or website that lists upcoming events in the crypto space. It shows:

Dates of the events

Topics (NFTs, DeFi, Web3, AI, etc.)

Location (online or offline)

Who’s speaking

How to register or join

It’s like a school calendar — but for everything happening in the world of crypto.

Where to Find a Good Crypto Events Calendar

There are many websites that track crypto events, but not all are easy to use. Here are a few tips on what to look for:

Daily updates so you don’t miss any important crypto event today

Filter options to sort by country, topic, or type of event

Mobile-friendly design for quick checking on your phone

Reliable info with only verified events and correct details

How to Use a Crypto Events Calendar Like a Pro

Using the calendar is simple, but getting the most out of it takes a little planning. Here’s a step-by-step guide:

1. Bookmark Your Favorite Calendar

Choose a crypto website that regularly updates its events list. Bookmark it in your browser so you can check it every morning.

2. Set Alerts for Events You Like

Many calendars let you set email alerts or notifications. Use them to remind you about events you want to attend — especially if it’s a big blockchain conference or a speaker you admire.

3. Make a Personal Events List

Open a Google Sheet or write down your own event list. Include:

Event name

Date and time

Platform (Zoom, Twitter Space, in-person)

Why it interests you

This keeps things organized so you’re always ready.

4. Attend at Least One Event Weekly