#west virginia student loan debt

Text

By Sharon Zhang

TruthOut

Oct. 6, 2022

An explosive new investigation of data from the Paycheck Protection Program (PPP) finds that, in Donald Trump’s final days in office, his administration rushed to eliminate oversight for loans which were flagged for potential fraud or further investigation — and wiped flags from nearly every one of the largest PPP loans.

As the Project on Government Oversight (POGO) revealed in a report published Wednesday, over the course of several weeks before President Joe Biden was inaugurated, the Trump administration went on a spree of eliminating flags on PPP loans, the majority of which went directly to personally enriching the richest Americans. Officials in the Small Business Administration (SBA) eliminated 2.7 million flags between December 2020 and January 2021, as the administration was in its lame duck period.

Special preference was given to the largest loans, which often also went to the largest corporations. On January 16, 2021, four days before President Joe Biden’s inauguration, Trump’s SBA wiped 99 percent of special review flags, which were given out to every loan above $2 million for separate investigatory purposes.

If the Trump administration did, indeed, go on a spree to mass-clear potential fraud flags before Trump left office, it is no surprise that it appeared to have favored the very largest loan recipients. Trump continually gave huge financial favors to large corporations during his time in office — and though most large corporations were exempt from receiving PPP loans, some large corporations managed to skirt the rules and receive loans anyway.

Out of the $800 billion given out in the program, flagged loans accounted for at least $189 billion. Because the vast majority of PPP loans — 95 percent — have been forgiven, it’s likely that many of these loans that had previously been flagged have been forgiven entirely.

Not all flagged loans were necessarily fraudulent; many of them had flags indicating clear reasons that the recipient may have submitted a fraudulent application or should at least have been investigated as such. The most common flag, applied to over 785,000 loans, showed that the businesses didn’t exist before February 2020 and were therefore ineligible.

It’s unclear how many loans went to businesses for their intended purpose of saving small businesses from pandemic impacts. But a report done earlier this year estimated that only between about a quarter and a third of PPP loans went to saving workers’ jobs. The rest — about 66 to 77 percent — went to business owners and people like shareholders.

Many loans went directly to the rich. Several billionaires or companies owned by billionaires received loans, like Republican fundraiser Joe Farrell or Kanye West’s apparel company, valued at $3 billion.

One loan, POGO found, went to a hotel owned by West Virginia Gov. Jim Justice, a Republican who is the richest man in the state and a former billionaire. The loan was worth $8.9 million and appeared to have been flagged eight times by the SBA. Another loan with nine flags, worth over $5 million, appears to belong to a Kentucky hospitality corporation whose annual revenue of $850 million would likely make it too large to receive a PPP loan.

Other loans, which are very often forgiven, went to politicians or their campaigns — including several far right politicians who have spent the last months spouting diatribes about how people buried in student debt aren’t “deserving” of debt relief. People like Representatives Majorie Taylor Greene (R-Georgia) Mike Kelly (R-Pennsylvania) and Matt Gaetz (R-Florida) had hundreds of thousands of PPP loans forgiven.

In a previous investigation in 2020, POGO found that there were at least 113 loan recipients, making up hundreds of millions of PPP loans, who political contributions worth about $11 million immediately after receiving the loan.

#trump administration#paycheck protection program#ppp#project on government oversight#john farrell#kanye west#marjorie taylor greene#matt gaetz#jim justice#republicans cheat

2 notes

·

View notes

Text

Attempt to kill Biden student debt relief plan tied to income fails in U.S. Senate

U.S. Senate Republicans on Wednesday night failed to garner enough votes to block a new Biden administration rule on an income-driven repayment plan for federal student loans.

by Ariana Figueroa, Wisconsin Examiner November 16, 2023

WASHINGTON — U.S. Senate Republicans on Wednesday night failed to garner enough votes to block a new Biden administration rule on an income-driven repayment plan for federal student loans.

The resolution did not pass, 49-50. Sen. Joe Manchin III of West Virginia was the sole Democrat who joined Republicans in backing the resolution. Sen.…

View On WordPress

0 notes

Text

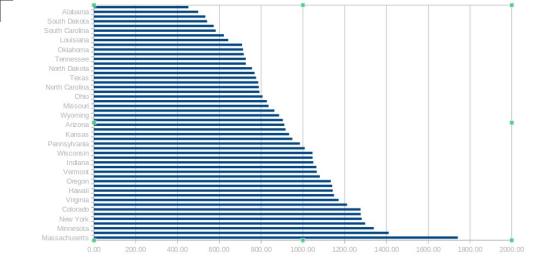

Student Loan Forgiveness Programs by State

Many Americans are worried about the impact of student loan debt, but it’s important to understand that relief options are available, often depending on where you live.

We have compiled a comprehensive list of student loan forgiveness programs that are specific to each state. These programs are designed to assist individuals in managing their student debt, as each state offers distinct programs that can help reduce or eliminate the debt. These programs are usually linked to certain professions or public service obligations, which can be beneficial for those who are struggling with loan repayment.

If you’re a recent graduate or someone who has been dealing with student loans for a while, this list can be very useful. We’ve compiled comprehensive data on what each state has to offer, who’s eligible, and how to apply. Our goal is to provide you with the necessary information and resources to take control of your financial situation.

Understanding the Concept of State-Specific Student Loan Forgiveness

State-specific student loan forgiveness programs are initiatives run by individual state governments to help their residents manage and potentially eliminate their student loan debt.

These programs are separate from federal loan forgiveness programs and are often designed to meet the unique needs and priorities of each state.

For instance, many states offer loan forgiveness programs that are targeted towards specific professions, such as healthcare, education, and law, which are in high demand or underserved in their region.

These programs are often referred to as Loan Repayment Assistance Programs (LRAPs).

Unlike federal forgiveness programs, LRAPs don’t automatically discharge a portion of your loan balance. Instead, they provide funds that you can use towards your student loans, usually in exchange for a commitment to serve in your profession in that state for a certain period.

How State-Level Loan Forgiveness Programs Work

The specifics of how state-level loan forgiveness programs work can vary greatly from one state to another. However, most of these programs have a few common elements.

Firstly, you typically need to be a resident of the state offering the program. Secondly, you usually need to work in a specific field or profession that is eligible for the program. This could include professions such as teachers, nurses, doctors, lawyers, and more.

In many cases, you may also need to commit to working in a specific area of the state, often in a community that is underserved or experiencing a shortage in your profession. The length of this service commitment can vary, but it’s typically a few years.

The amount of loan forgiveness provided can also vary widely, with some programs offering to forgive a set dollar amount, while others may forgive a percentage of your loans. Some states even offer tiered forgiveness amounts that increase with each year of service.

Remember, each state-based program has its own rules and regulations, so it’s important to read the program requirements carefully before applying.

Full List of Student Loan Forgiveness Program by State

Choose Your State Below

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming

0 notes

Text

Overview of Upstart Credit

Upstart can be a good choice for those with less-than-perfect credit or no established credit history. But with Upstart’s high average APRs and origination fees, borrowers with good to excellent credit can likely find better rates elsewhere.

Upstart is one of several lenders that offer loans for people with less-than-perfect credit. See more of the best personal loans for bad credit.

Overview of Upstart Credit

Pros Explained

Can be used for education expenses: Most personal loan companies prohibit borrowers from using loan funds for education-related expenses, such as college tuition or student loan repayment. But Upstart explicitly states that those expenses are permissible uses for its loans.1

No credit score minimum: Upstart states that its credit score minimum is 300 (which is the lowest possible score), but it may also accept borrowers with no credit history at all. Many lenders require scores that are good to excellent—a score between 670 and 850—so Upstart’s low minimum is a standout feature.2

Broad range of loan amounts: While some lenders have maximums of $25,000 or less, Upstart offers up to $50,000 in personal loans.

Quick loan disbursement: Some personal loan lenders can take days to disburse funds after approving your application. With Upstart, most loans are disbursed within one business day.3

Cons Explained

Average APR given to borrowers is relatively high:According to Upstart, the average five-year loan originated through its platform will have an APR of 26.48%.4 That’s significantly higher than the average APR of all personal loans as reported by the Federal Reserve. Borrowers with good to excellent credit can likely find lower rates with other lenders.

Potentially high origination fee: Upstart charges origination fees. Depending on the lender and the borrower’s profile, the fee can be as high as 10% of the loan amount. Not all lenders charge origination fees, so borrowers with strong credit profiles should shop around.5

Not available in all states: Upstart loans aren’t available to residents of West Virginia or Iowa. If you live in either state, you’ll have to find another lender to take out a personal loan.6

Upstart’s loan minimums vary by state.3

Georgia:$3,100

Hawaii: $2,100

Massachusetts:$7,000

Types of Personal Loans Offered by Upstart

All of Upstart’s personal loans are unsecured, so there’s no collateral. Loans originated through Upstart can be used for a wide range of purposes, including:3

Financing a dream wedding

Renovating your kitchen or bathroom

Consolidating credit card debt

Paying for elective medical procedures

Moving to another state

Lenders usually prohibit borrowers from using personal loans for education expenses or student loan repayment. But Upstart allows borrowers to use its personal loans to pay for college tuition or certificate programs, and you can even use the loan to pay off your student loan debt.

However, loans cannot be used for education purposes in California, Connecticut, Illinois, Washington, or Washington, D.C.1

Since personal loan rates are usually higher than student loan rates, it’s usually not a good idea to pay off student loans with personal loans. Learn more about student loan refinancing and see our best picks to see if you qualify for a lower interest rate.

Time to Receive Funds

Upstart boasts quick disbursement times. It takes just a few minutes to apply online, and you usually receive a decision within minutes. Personal loan funds may be transferred the next business day as long as you accept the loan terms by 5:00 p.m. ET, Monday through Friday (loans used for educational purposes are subject to a three-day wait period).

According to the company, 99% of personal loan funds are sent within one business day after signing the loan agreement.3

Borrower Requirements

To qualify for a loan from Upstart, you must meet the following criteria:6

You must have a valid U.S. address and Social Security number

You must be 18 years old

You must have a full-time job, a full-time job offer with a start date within six months, a regular part-time job, or another source of income

You must have a credit score of at least 300 or an insufficient credit history to generate a credit score

Residents of West Virginia or Iowa aren’t eligible for Upstart’s loans.

Upstart Personal Loan Features

Upstart uses AI-driven algorithms to review loan applications. Its AI platform considers other factors besides credit scores, such as education and employment, to determine borrowers’ eligibility for a loan. As a result, borrowers without established credit histories or less-than-perfect credit may be more likely to get a loan through Upstart than with other lenders.

Upstart also has educational tools and calculators customers can use to better manage their finances. And the company operates an affiliate program. Those with websites, blogs, or other social media platforms can promote Upstart and earn 1% of each funded loan.7

Before taking out a personal loan, use our personal loan calculator to estimate your monthly payments and see how much you’ll pay in interest over time.

Co-Signers and Co-Applicants

While some lenders allow co-signed or joint applications, Upstart doesn’t offer that option; you must qualify for the loan on your own.8

Can You Refinance a Personal Loan With Upstart?

If your credit or income has improved since you took out a loan, you may consider refinancing your debt to get a lower rate. Unlike some lenders that allow borrowers to refinance and adjust the terms of an existing loan, Upstart doesn’t have a specific option for personal loan refinancing.

However, borrowers can take out a second Upstart loan and use it to pay off existing debt.

You can qualify for a second loan through Upstart if:9

You've made on-time payments for the six previous consecutive months.

You have no past-due payments.

You have no more than one outstanding Upstart loan.

You have no more than $50,000 of outstanding principal.

Customer Service

Customer support is available through phone or email seven days a week from 9:00 a.m. until 8:00 p.m. ET.10

Phone: (855) 438-8778

Email: [email protected]

Customer Satisfaction

Upstart has a strong reputation among customers. On Trustpilot, it has a 4.9 (Excellent) TrustScore based on over 39,000 reviews.11 And in the 2022 J.D. Power U.S. Consumer Lending Satisfaction Study, Upstart was ranked 7th out of 22 lenders, with an above-average score.12

Applying for an Upstart Personal Loan

Upstart has a pre-qualification tool you can use to check your eligibility and view available rates. The pre-qualification process takes just a few minutes, and it doesn’t impact your credit.

If you decide to proceed, you can select your desired loan term and loan amount and complete an application online. The application will prompt you to enter your contact information, Social Security number, and income. Upstart will also ask you to consent to a hard credit check.

It usually takes just a few minutes to receive a decision. If you accept the loan terms, loan funds are usually released within one business day.

While Upstart has a loan pre-qualification tool, your actual rate may be different based on your credit history and other factors. When you submit your application, Upstart will perform a hard credit inquiry, which can affect your credit.

Alternative Personal Loan Lenders

Upstart Happy Money Rocket Loans APR Range 6.7%–35.99% 10.50%–29.99% 9.12%–29.99% Loan Amount $1,000–$50,000 $5,000–$40,000 $2,000–$45,000 Loan Terms 3 or 5 years 24–60 months 36–60 months Recommended Minimum Credit Score No credit history needed 640 Not disclosed Origination Fee 0%–10% 0%–5% 1%–7% Time to Receive Loan 1 business day 2 business days Same day

Final Verdict

Upstart stands out from other lenders with its AI-driven platform, low credit score requirements, and available loan amounts. Borrowers without established credit histories or lower credit scores who have struggled to find lenders willing to work with them may find that they have a better chance of getting a loan through Upstart.

However, Upstart’s APRs can be high, and origination fees can be as high as 10%. For borrowers that have good credit, Upstart’s loans may be too expensive, and they may be better off shopping around. You can get quotes from leading personal loan lenders that offer lower-than-average APRs, and some shopping around could save you some money.

Methodology

Investopedia is dedicated to providing consumers with unbiased, comprehensive reviews of personal loan lenders. To rate providers, we collected hundreds of data points across more than 40 lenders, including interest rates, fees, loan amounts, and repayment terms, to ensure that our reviews help users make informed decisions for their borrowing needs.

0 notes

Text

Biden V. Nebraska; The Future Of President Biden’s Student Loan Debt Relief Program

By Emily Gill, Rutgers University–New Brunswick Class of 2026

March 6, 2023

In August 2022, President Joe Biden announced a student loan relief plan, which he used executive action to pass. This plan stated it would cancel up to $10,000 of debt for individuals who made less than $125,000 per year (or $250,000 for married couples), and up to $20,000 for Pell Grant

recipients. [1] Additionally, student loan payments were paused. In September 2022, six states: Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina, filed a lawsuit at the district level (in Missouri), stating that this plan was violating separation of powers and the Administrative Procedure Act. This suit was dismissed. The states then appealed, and in November 2022 the United States 8th Circuit Court of Appeals granted an injunction. [2] December 2022, the Supreme Court granted a certiorari before judgment, and then February 28, 2023, they heard the oral arguments for the case Biden v. Nebraska.

Legislation Involved

The legislation that allowed Biden to make changes to the student-loan programs, was the Higher Education Relief Opportunities for Students (or HEROES) Act of 2003. This act was passed in response to the attacks that took place September 11, 2001, and allowed the federal government to make changes in student-loan programs in times of emergency. [3] The former Secretary of Education, Betsy DeVos, invoked this in response to COVID-19, and then the current Secretary of Education, Miguel Cardona, re-invoked the act. Also involved is the Administrative Procedure Act, established in 1946, which controls how federal administrative agencies establish regulations. [4] Other legislation involved in the case is Article III of the United States Constitution, which has to do with the judicial branch and separation of powers.

People and Entities Involved

The petitioners for this case are President Joe Biden and Secretary of Education Miguel Cardona. The respondents are the states of Nebraska, Missouri, Arkansas, Iowa, Kansas and South Carolina. The petitioners were represented by the Solicitor General of the United States, Elizabeth B. Prelogar, and the respondents were represented by James Campbell, who is the Solicitor General of Nebraska. The states of Massachusetts, California, Colorado, Connecticut, Delaware, Hawai‘i, Illinois, Maryland, Michigan, Minnesota, Nevada, New Jersey, New Mexico, New York, North Carolina, Oregon, Pennsylvania, Rhode Island, Vermont, Washington, Wisconsin and The District of Columbia filed a brief as amicus curiae to the petitioner. [5] While the states of Utah, Ohio, Alabama, Alaska, Florida, Georgia, Idaho, Indiana, Louisiana, Mississippi, Montana, New Hampshire, Oklahoma, Tennessee, Texas, West Virginia, and Wyoming, filed as amicus curiae in support of the respondent. [6] Former Secretary of Education Betsy

DeVos also filed as amicus curiae in support of the respondent. Higher Education Loan Authority of the State of Missouri, or MOHELA, was also a major entity involved.

The Case

The questions being asked in this case were:

1. Whether respondents have Article III standing

2. Whether the plan exceeds the Secretary’s statutory authority or is arbitrary and capricious For an entity to have “Article III standing” in bringing forward a lawsuit they must have proof of actual or imminent injury. [7] The respondents claimed that they have Article III standing based on the harm that it would harm the states’ tax revenues. A large part of the respondents argument also revolved around the potential harm to the Higher Education Loan Authority of the State of Missouri, or MOHELA. MOHELA is a company that services student loans, and Nebraska Solicitor General Campbell argues that this program will drastically decrease its revenue and undermine its abilities. General Solicitor Prelogar disagreed and stated that the states “bare disagreement with this policy is not the sort of concrete injury that Article III demands.” [8] She also argues that congress authorized the Secretary to change provisions of Title IV of the Higher Education Act to provide relief during emergencies, so he is not acting outside of the scope of what is allowed (which is what question two is asking). In her argument, Prelogar argued that the states do not have the right to challenge the program and that the “Secretary acted within the heartland of his authority and in line with the central purpose of the HEROES Act in providing that relief here.” [9] Essentially, Secretary Cardona is not violating the Administrative Procedure Act.

Implications and Outcomes

What is being decided in the case is not necessarily whether or not Biden’s plan is allowed to continue but rather if the states have the legal standing to bring suits over the plan. Some have theorized that the respondent’s argument, which focuses greatly on the harm brought to MOHELA, may work in the petitioner's favor. MOHELA is a separate entity than the state of Missouri, however, in his argument Campbell argued that the “state has the authority to speak for them.” [10] Additionally, the company itself currently holds debt. MOHELA was allowed to suspend payments to the Lewis and Clark Discovery Fund (which is a program created to fund higher-education initiatives) and was able to extend that suspension to 2024. As Justice Ketanji Brown said, "So we're talking about a fund that hasn't been contributed into because the state has waived the obligation to do so for at least a temporary period of time, and then, even if the funds were to go into this particular fund, you don't have a set of plans that you are planning to pursue with them?" [11] Many justices seemed skeptical of the injuries to MOHELA, which may work in the favor of the petitioner.

If Biden’s debt forgiveness plan is allowed to continue, many Americans will have debt greatly reduced, and many may become debt free. Analysis from the United States Census Bureau found that about 29% of student loan borrowers would have all of their debt forgiven under this plan. [12] The Court is not expected to make a decision until at least June 2023.

______________________________________________________________

[1]https://www.whitehouse.gov/briefing-room/statements-releases/2022/08/24/fact-sheet-president-biden-an

nounces-student-loan-relief-for-borrowers-who-need-it-most/

[2] https://www.scotusblog.com/case-files/cases/biden-v-nebraska-2/

[3] https://www.justice.gov/d9/2022-11/2022-08-23-heroes-act.pdf

[4] https://www.britannica.com/topic/Administrative-Procedures-Act

[5]https://www.supremecourt.gov/DocketPDF/22/22-506/251977/20230111134618507_Brief%20of%20Mas

sachusetts%20et%20al.%20in%20Nos.%2022-506%20and%2022-535.pdf

[6]https://www.supremecourt.gov/DocketPDF/22/22-506/253914/20230203115132734_Biden%20v.%20Ne

braska_%20FINAL.pdf

[7]https://epic.org/issues/consumer-privacy/article-iii-standing/#:~:text=In%20construing%20these%20term

s%2C%20the,that%20is%20concrete%20and%20particularized

[8] https://www.oyez.org/cases/2022/22-506

[9] https://www.oyez.org/cases/2022/22-506

[10] https://www.oyez.org/cases/2022/22-506

[11]https://africa.businessinsider.com/politics/why-a-student-loan-companys-involvement-in-a-case-seeking-t

o-block-bidens-debt-relief/6y8mjnm.amp

[12]https://www.brookings.edu/blog/fixgov/2023/03/01/the-supreme-court-takes-up-student-loan-forgiveness-

0 notes

Text

Nevada Mailbox: Newsom urges California lawmakers not to tax forgiven federal student loans

Nevada Mailbox: Newsom urges California lawmakers not to tax forgiven federal student loans

Nevada Mailbox

Newsom urges California lawmakers not to tax forgiven federal student loans

by Nevada Mailbox on Sunday 06 November 2022 12:54 AM UTC-05 | Tags: #nevadamailbox nevada-mailbox

Gov. Gavin Newsom said the Legislature should move quickly to prevent borrowers from paying state taxes on the student debt forgiven through a new Biden administration initiative.

Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York City NY New York New York NY North Carolina North Dakota Wisconsin Katie Oklahoma Goodfield Illinois

November 05, 2022 at 12:01PM

Tags:

#nevadamailbox

nevada-mailbox

Bouckville New York Pipestone Minnesota Glen Allan Mississippi Delaplaine Arkansas Champion Nebraska LaCrosse Washington West Springfield Town Massachusetts Creswell North Carolina Eagle Wisconsin Orange Virginia Newington Virginia Edwards Missouri

https://unitedstatesvirtualmail.blogspot.com/2022/11/nevada-mailbox-newsom-urges-california.html

November 06, 2022 at 12:58AM

Marcell Minnesota Thedford Nebraska Sentinel Oklahoma Jermyn Pennsylvania Etna California Viola Tennessee Chaffee New York Ponderay Idaho

https://kentuckyvirtualpostoffice.blogspot.com/2022/11/nevada-mailbox-newsom-urges-california.html

November 06, 2022 at 03:22AM

0 notes

Text

..."For those unfamiliar, Dark Brandon is a Democratic meme that inverts the anti-Biden “Let’s Go Brandon” meme; if you don’t feel like reading an explainer, all you need to know is that Biden’s surprising string of legislative victories this summer has turned the right-wing narrative of Biden as frail and ineffectual on its head. Last month, Biden and the Democrats shocked the political universe after striking a deal with West Virginia Sen. Joe Manchin to pass some of Biden’s most ambitious climate and health policies through the Inflation Reduction Act. Biden also signed two bipartisan bills – one to enhance economic competitiveness against China, while the other was the first gun safety bill to pass Congress in 30 years. On top of that, he canceled thousands of dollars in student loan debt for millions of Americans.

Keep in mind these victories — which generated a steady stream of favorable coverage — all came after Biden was widely assumed to have hit a wall and exhausted his ability to pass any more substantive bills. Instead Biden as Dark Brandon pierced through the trope of Washington as a place where useful policies suffer slow, painful deaths — and at a time when political polarization is as high as it’s been in recent memory.

Beyond these policies, there’s been a consistent rhythm of positive news that helped revive Biden’s ratings, primarily among disillusioned Democrats. Gas prices have declined 26% since June, easing a highly visible source of financial stress for consumers. And while the public’s concern about inflation remains, Americans are trending optimistic about the economy. Perception of the economy as a tough place for consumers is still Biden’s greatest vulnerability, but the fact that some of the anxiety — and news cycles — about rising prices are improving bodes well for him."

1 note

·

View note

Video

youtube

Ignorant Joe Manchin tore into President Joe Biden's student loan forgiveness plan and says students should earn their debt relief. Ana Kasparian and Cenk Uygur discuss on The Young Turks. Watch LIVE weekdays 6-8 pm ET. http://youtube.com/theyoungturks/live Read more HERE: https://www.huffpost.com/entry/joe-manchin-biden-student-debt-relief_n_63187006e4b000d9884bbbd9 "Sen. Joe Manchin (D-W.Va.) on Tuesday criticized President Joe Biden’s student loan forgiveness plan, arguing there are other ways to support student borrowers. 'I just thought that it was excessive,' Manchin said, adding that he disagrees with the announcement proposing to forgive $10,000 per student borrower for those making up to $125,000 annually. Pell Grant recipients will be eligible for up to $20,000 in debt cancellation. But Manchin said he would have taken a different course of action. 'When people were calling me from back in West Virginia, I would give them all the options they had that would reduce their loan by going to work in the federal government,' Manchin said. He continued: 'You have to earn it.'" *** The largest online progressive news show in the world. Hosted by Cenk Uygur and Ana Kasparian. LIVE weekdays 6-8 pm ET. Help support our mission and get perks. Membership protects TYT's independence from corporate ownership and allows us to provide free live shows that speak truth to power for people around the world. See Perks: ▶ https://www.youtube.com/TheYoungTurks/join SUBSCRIBE on YOUTUBE: ☞ http://www.youtube.com/subscription_center?add_user=theyoungturks FACEBOOK: ☞ http://www.facebook.com/TheYoungTurks TWITTER: ☞ http://www.twitter.com/TheYoungTurks INSTAGRAM: ☞ http://www.instagram.com/TheYoungTurks TWITCH: ☞ http://www.twitch.com/tyt 👕 Merch: http://shoptyt.com ❤ Donate: http://www.tyt.com/go 🔗 Website: https://www.tyt.com 📱App: http://www.tyt.com/app 📬 Newsletters: https://www.tyt.com/newsletters/ If you want to watch more videos from TYT, consider subscribing to other channels in our network: The Watchlist https://www.youtube.com/watchlisttyt Indisputable with Dr. Rashad Richey https://www.youtube.com/indisputabletyt Unbossed with Nina Turner https://www.youtube.com/unbossedtyt The Damage Report ▶ https://www.youtube.com/thedamagereport TYT Sports ▶ https://www.youtube.com/tytsports The Conversation ▶ https://www.youtube.com/tytconversation Rebel HQ ▶ https://www.youtube.com/rebelhq TYT Investigates ▶ https://www.youtube.com/channel/UCwNJt9PYyN1uyw2XhNIQMMA #TYT #TheYoungTurks #BreakingNews 220709_TA04-Joe-Manchin-Slams-Student-Debt by The Young Turks

0 notes

Text

Shocking Ways to Have a Suspended License

Picture this; you are driving to work. You see a police officer trailing you but think nothing of it. Then the infamous blue and red lights start flashing. You wonder what the reason could be.

Were you speeding, tailgating, using your phone, or your headlights out?

Tension builds as the officer walks back to your car with your license and registration.

Next thing you know, the officer informs you that your license is suspended.

“Suspended?! How?!”

You start talking to yourself — Don’t you remember that ticket you got on vacation four months back? Well, you forgot to pay for it, which now got your license suspended without you knowing.

Here you are, thinking you are just living life with nothing to worry and now you are currently getting arrested and taken to the police station.

“What just happened? Did I just get arrested because I forgot to pay a lousy ticket?”

Unfortunately, yes. There are many ways to get your license suspended without knowing it. The obvious ones include:

Reckless driving

Forgetting to pay for tickets

Driving under the influence

Failing to appear in court

Accumulation of points

Some of the reasons can be related to your driving, while others can be nondriving violations that result in the suspension of your driver’s license!

Here are some surprising reasons you might have never known:

Defaulting on your student loans

Missing a payment doesn’t only lower your credit. It could lead to a suspension of your driver’s license in certain states!

States like: Florida, Illinois, Texas, Virginia, Georgia, Iowa, Kentucky, Massachusetts, Washington, Alaska, Minnesota, Louisiana, and South Dakota.

So, in addition to dealing with your lender, you’ll need to deal with the Department of Motor Vehicles.

Using your license illegally, let me explain.

Illegal activity with your driver’s license can include:

carrying a fake ID

providing false information on your driver’s license

giving your license to your underage friend so they can get into a club or bar.

You get the idea. Any suspicious activity with your driver’s license can risk license suspension.

Don’t forget to pay your debts to the state.

If you live in South Dakota, Iowa, or Massachusetts, you can lose your license if you fail to pay your state debt. A temporary suspension will go into effect if your debts are $10,000 or more.

Typically the state will notify you of the situation before anything happens, so be on the lookout.

Failed to pay your child support this month?

Failing to pay child support can lead to suspension.

Missing child support payments could cause a license suspension in many states. The grace period varies from state to state, but a temporary suspension can be at play. States do notify delinquent parents for a chance to correct the issue.

This rule applies to the following States; Alabama, California, Colorado, Georgia, Idaho, Illinois, Indiana, Iowa, Kentucky, Minnesota, Montana, New Mexico, Oregon, South Dakota, Utah, Vermont, Virginia, and West Virginia.

There are many reasons to get a suspended license. A lot of the time, it’s a headache to get out of it. Spend many hours waiting in DMV lines to get proper applications, risk going through the court system with a hired attorney, and pay additional fines along the way.

If only there were a way to know your license status before risking the event of being pulled over, heavily ticketed, and arrested. Avoidsuspension.com is here to help!

Become fully aware of your driver’s license status by getting email notifications and text messages to resolve the issue before it worsens. With fast response rates and affordable subscriptions, AvoidSuspension cares for its subscribers and seeks to provide relief for people who might be driving with a suspended license without their knowledge.

Head over to Avoidsuspension.com today and sign up!

#avoidsuspension

References:

#avoidsuspension#driving license#driving laws and regulations#how to avoid suspension#expired licenses#dmv

0 notes

Link

#wv chapter 7 bankruptcy attorney#foreclosure defense attorney#bankruptcy attorneys clarksburg#bankruptcy lawyers in clarksburg wv#clarksburg chapter 13 bankruptcy lawyers#west virginia student loan debt#clarksburg bankruptcy lawyers#clarksburg wv bankruptcy attorney

1 note

·

View note

Text

#politics#us politics#news#fox business#rep. alexandria ocasio cortez#ny#new york#student loan debt#student debt forgiveness#student loan forgiveness#cancel student debt#cancel student loans#biden administration#fuck manchin#sen. joe manchin#wv#west virginia#executive order

12 notes

·

View notes

Text

What Do I Need to Apply?

To apply for HAMP, you will need to provide your lender with support that demonstrates your financial hardship. In general, this includes your mortgage statements, proof of any other debts and expenses due each month, like student loan payments, tuition payments, car payments, and any other regular obligations, prior year tax returns, pay stubs that demonstrate your income, and any other documentation that you feel will be helpful.

Be prepared to explain your situation, demonstrating openly and honestly why you are seeking assistance with your payments. Once you have collected the information you need, fill out the forms provided and schedule time with your mortgage lender to discuss your options.

Also get to know more about here https://www.ynphomesolutions.com

Details

Company Name: YNP Home Solutions

Address: 376 Falcon Drive Suite 201 Falling Waters, West Virginia 25419

Phone Number: (240) 244-3953

Google Map URL: https://goo.gl/maps/F8y5aBD1F57P9dYn7

1 note

·

View note

Text

upstart offer code: All the Stats, Facts, and Data You'll Ever Need to Know

How to use?

You can look for a financing to refinance through Upstart.com/ Again Promotion Code or Upstart.com My Provide Code and after that comply with the on-screen instructions. The entire process ought to just take 5 minutes tops.

Who is actually Startup?

They bill themselves as an on the web financing market place that offers private car loans utilizing non-traditional variables, including learning as well as employment, to forecast credit reliability.

Upstart Reviews Listed Here is what some of the hefty players in the individual car loan blogging site sector have to state regarding the promotion.

What you need to understand about Startup individual finances

Upstart is an internet finance company. Terms differ by condition, and also finances aren't available to homeowners of Iowa or even West Virginia. Takes into consideration factors past your credit report

When considering you for a private funding, startup searches beyond your debt scores. Aside from your credit rating, credit rating documents and existing income, it considers your line of work as well as company, any sort of degrees you gained, your area of research study, as well as the college or educational institution you attended. Started by past Google.com employees, Startup utilizes expert system and also maker knowing to automate the loaning procedure. Rates of interest might be actually higher

All Startup personal financings have a set enthusiasm cost. Upstart details on its own web site that the average APR on a five-year financing is actually 24.95%.

Upstart provides limited loan-term options. You can choose either a 3- or five-year condition. There is actually no prepayment fine, so you may compensate off your lending earlier without an expense. You'll require to look in other places if you wish a shorter lending condition.

A closer examine an Upstart individual lending

If you're considering a private car loan via Upstart, below are actually some added details to recognize.

In many states, Upstart's private financing quantities vary from $1,000 to $50,000. (Startup may offer different phrases on Credit Karma.).

signers for an individual loan aren't accepted.

Startup fees both overdue fees and also origination fees, with source fees ranging coming from 0% to 8%.

Listed below are actually a few of Upstart's minimal demands to acquire a lending.

A credit report rating of 300 or higher when you apply directly via Startup if you possess one.

No insolvencies in the final twelve month or even presently delinquent profiles on your credit history files.

Fewer than 6 inquiries on your credit report documents in the previous six months, not including queries connected to student upstart.com/myoffer or auto fundings or mortgage loans.

And bear in mind: Upstart may reverse your lending permission if there is actually a significant decrease in your credit report ratings or even you take on added financial obligation in between the moment your finance is given and when you acquire backing. That a loan is actually good for.

An Upstart private loan might be suitable for an individual along with a limited credit report and also fair to really good credit rating. Since the loan provider lets you get personal-loan prequalification, Startup could possibly likewise be actually perfect for a person who desires to go shopping around as well as review lending offers. Always remember, being prequalified isn't an assurance that you'll be actually used a car loan-- you'll still require to provide more info just before you may be authorized and also obtain a main lending provide.

You may prefer to appear elsewhere if you're considering acquiring a much larger amount. You would certainly end up paying out $1,600 if you were asked for the maximum source fee-- 8%-- on a $20,000 car loan. Lenders typically reduce the fee from the lending volume.

Exactly how to apply along with Upstart.

1 note

·

View note

Text

13 Things About upstart.com/myoffer You May Not Have Known

Just how to administer?

You can obtain a loan to re-finance using Upstart.com/ Again Promotion Code or Upstart.com My Offer Code and after that follow the on-screen instructions. The whole method must just take 5 moments tops.

That is actually Upstart?

They tout on their own as an online loan marketplace that provides individual loans using non-traditional variables, including learning and job, to forecast credit reliability.

Upstart Reviews Here is what several of the hefty hitters in the individual car loan blog site field must say about the provide.

What you need to recognize regarding Startup personal loans

Startup is an on-line lender. Conditions vary through condition, as well as lendings aren't on call to homeowners of Iowa or West Virginia. Looks at aspects past your credit report

Startup appears past your credit scores when considering you for an individual funding. Established through previous Google.com workers, Upstart utilizes fabricated intellect as well as machine knowing to automate the loaning procedure.

All Upstart private loans possess a set rates of interest. The beginning rate of interest is higher than what some other financial institutions give, as well as the max is just one of the best presently charged through standard personal lending lending institutions. Upstart keep in minds on its web site that the typical APR on a five-year loan is actually 24.95%. Lowest three-year condition

Upstart offers minimal loan-term possibilities. You can opt for either a three- or five-year phrase. There is actually no early repayment fine, therefore you may compensate off your funding earlier without an expense. If you want a shorter financing condition, you'll need to appear somewhere else.

A closer consider a Startup personal car loan

If you are actually considering a private lending by means of Upstart, right here are some additional details to understand.

In many states, Startup's personal lending amounts vary from $1,000 to $50,000. (Startup might use various terms on Credit score Aura.).

endorsers for a private finance may not be accepted.

Upstart costs both overdue fees and origin fees, with origin expenses ranging from 0% to 8%.

Here are actually several of Upstart's minimal requirements to get a finance.

If you have one, a credit report of 300 or much higher when you use directly by means of Upstart.

No bankruptcies in the last one year or even presently delinquent accounts on your credit reports.

Far fewer than 6 questions on your credit score documents in the previous 6 months, not featuring concerns connected to student or even automobile car loans or even home mortgages.

And also make note: Startup might withdraw your financing confirmation if there is actually a notable come by your credit history or you take on additional financial obligation between the amount of time your financing is given and when you acquire funding. Who a car loan is actually good for.

An Upstart private car loan could possibly be helpful for an individual with a limited credit report and also reasonable to excellent debt. Considering that the lending institution permits you use for personal-loan prequalification, Upstart can additionally be suitable for somebody that wishes to search and match up finance offers. Remember, being prequalified isn't a promise that you'll be used a funding-- you'll still need to give additional info prior to you can easily be authorized and get a formal car loan offer.

If you're considering obtaining a bigger amount, you might intend to appear elsewhere. If you were actually charged the optimum origination expense-- 8%-- on a $20,000 lending, you 'd find yourself paying out $1,600. Lenders upstart offer code normally take off the expense coming from the finance volume.

Exactly how to use along with Upstart.

1 note

·

View note

Text

Crunching the Numbers: Minimum wage, rent, and childcare

While I was making up my yet-again revised budgets thanks to my changing employment conditions, I started wondering where I would fare if I was in the same situation now as I was 25 years ago.

The current federal minimum wage is $7.25; at 40 hours a week, that's $1160 a month (before taxes). The current average rent in the US is $997 a month, with a median value of $810. As you can see from the graph below, that's only seven states below $800 average rent... which means that even if you manage to get 40 hours a week at a minimum wage job, and if there is no income tax, and you live in those seven states... you still have only $300 a month to pay all the rest of your utilities, insurance, food, and gas. Everywhere else, it's even less, and in a third of the states, you literally are owing money every month.

You do the math.

No number of "skip the expensive coffee" is going to make a difference here.

What about household incomes, then? Sure, let's presume that the household has two adults, with the same assumptions as above. That would increase the household income to $2320 (before taxes), and makes things a bit more doable.

At least, until you figure in children.

The current average cost of childcare in the United States is $930 a month, with a median of $908 a month.

Many families who make the median income in their states cannot afford to send their infant or toddler to child care. In some states, child care costs can take up to 18% of their family’s income.

In 28 U.S. states, the annual cost of child care exceeds the cost of college tuition. In Florida, for example, center-based infant care costs about $9,238 per year and public college tuition and fees cost about $4,455 per year. In Washington, D.C., infant care is $24,243 annual, more than four times the annual cost of college tuition.

The chart below shows monthly average child care costs per state. In fully a quarter of all states, that average childcare cost eliminates any income gain from a second minimum-wage earner working full time, and in nine of them, it actually would cost money for the second adult in the household to work a minimum wage job. And that's if you only have one kid.

I use these examples, because this is exactly where I was a quarter century or so ago, working a minimum wage job and trying to support my spouse and infant child. That wasn't enough money then - and in West Virginia! - even before my minimum wage job cut my hours drastically, forcing me to join the military in order to support my family.

It's not simply a matter of education, either. While the cultural capital of knowing how to create a skills-based resume might have helped, I still didn't make enough to continue my college education at the time. Even when I did have the ability to go back to college years later, trying to attend college while working a full time job is freaking hard and will also put you further in debt if that education doesn't immediately pay off in terms of higher income, starting the whole cycle over again. (And let's not even mention "private" student loans.)

I want to stop and be clear here: These things I'm describing are not intentional or a conspiracy . This is just free-market capitalism and people trying to maximize their profits inside that system. They're playing the game the way it's meant to be played. This is the way capitalism is supposed to work.

It also, as a side-effect, keeps people who don't make a lot of money in a position where they cannot improve their situation. And that side-effect is really, really useful to the people who currently do make a lot of money.

This information is really easy to find. It's really easy to add these bits of information together and see the bleak financial facing anyone who isn't already independently wealthy. It's pretty easy to see how keeping a bunch of workers barely able to stay afloat leaves them no time or ability to do anything but work for those who own the big businesses.

And the fact that our politicians and business leaders continue to do nothing about this... well, that, my friends, is intentional.

So what are you going to do about it?

Featured Photo by Sharon McCutcheon on Unsplash

Reflect on this as you hear "pro-life" politicians spew their rhetoric; if they cared about children, this would not be the case.

With the possible exception of private student loans, which are universally tools of evil.

Read the full article

0 notes

Text

Mortgage, Groupon and card debt: how the bottom half bolsters U.S. economy

Jonathan Spicer, Reuters, July 23, 2018

PHILADELPHIA (Reuters)--By almost every measure, the U.S. economy is booming. But a look behind the headlines of roaring job growth and consumer spending reveals how the boom continues in large part by the poorer half of Americans fleecing their savings and piling up debt.

A Reuters analysis of U.S. household data shows that the bottom 60 percent of income-earners have accounted for most of the rise in spending over the past two years even as the their finances worsened--a break with a decades-old trend where the top 40 percent had primarily fueled consumption growth.

With borrowing costs on the rise, inflation picking up and the effects of President Donald Trump’s tax cuts set to wear off, a negative shock--a further rise in gasoline prices or a jump in the cost of goods due to tariffs--could push those most vulnerable over the edge, some economists warn.

That in turn could threaten the second-longest U.S. expansion given consumption makes up 70 percent of the U.S. economy’s output.

To be sure, the housing market is far from the dangerous leverage reached in 2007 before the crash. With unemployment near its lowest since 2000 and job openings at record highs, people may also choose to work even more hours or take extra jobs rather than cut back on spending if the money gets tight.

In fact, a growing majority of Americans says they are comfortable financially, according to the Federal Reserve’s report on the economic well-being of U.S. households published in May and based on a 2017 survey.

Yet by filtering data on household finances and wages by income brackets, the Reuters analysis reveals growing financial stress among lower-income households even as their contribution to consumption and the broad economy grows.

The data shows the rise in median expenditures has outpaced before-tax income for the lower 40 percent of earners in the five years to mid-2017 while the upper half has increased its financial cushion, deepening income disparities.

It is this recovery’s paradox. A hot job market and other signs of economic health encourage rich and poor alike to spend more, but tepid wage growth for many middle-class and lower-income Americans means they need to dip into their savings and borrow more to do that.

As a result, over the past year signs of financial fragility have been multiplying, with credit card and auto loan delinquencies on the rise and savings plumbing their lowest since 2005.

Myna Whitney, 27, a certified medical assistant at Drexel University’s gastroenterology unit in Philadelphia, experienced that firsthand.

Three years ago, confident that a steady full-time job offered enough financial security, she took out loans to buy a Honda Odyssey and a $119,000 house, where she lives with her mother and aunt.

Since then she has learned that making $16.47 an hour--more than about 40 percent of U.S. workers--was not enough.

“I was dipping into my savings account every month to just make all of the payments.” Whitney says. With her savings now down to $900 from $10,000 she budgets down to toilet paper and electricity.

“God forbid I get a ticket, or something breaks on the car. Then it’s just more to recover from.”

Stephen Gallagher, economist at Societe Generale, says stretched finances of those in the middle dimmed the economy’s otherwise positive outlook.

“They are taking on debt that they can’t repay. A drop in savings and rise in delinquencies means you can’t support the (overall) spending,” he said. An oil or trade shock could lead to “a rather dramatic scaling back of consumption,” he added.

In the past, rising incomes of the upper 40 percent of earners have driven most of the consumption growth, but since 2016 consumer spending has been primarily fueled by a run-down in savings, mainly by the bottom 60 percent of earners, according to Oxford Economics.

This reflects in part better access to credit for low-income borrowers late in the economic cycle.

Yet it is the first time in two decades that lower earners made a greater contribution to spending growth for two years in a row.

“It’s generally really hard for people to cut back on expenses, or on a certain lifestyle, especially when the context of the economy is actually really positive,” said Gregory Daco, Oxford’s chief U.S. economist. “It’s essentially a weak core that makes the back of the economy a bit more susceptible to strains and potentially to breaking.”

While the Fed expects the labor market to get even hotter this year and next, policymakers have been perplexed that wages do not reflect that.

With inflation factored in, average hourly earnings dropped by a penny in May from a year ago for 80 percent of the country’s private sector workers, including those in the vast healthcare, fast food and manufacturing industries, Bureau of Labor Statistics figures show.

“It stinks,” says Jennifer Delauder, 44, who runs a medical lab at Huttonsville Correctional Center in West Virginia. In seven years her hourly wage has risen by about $2 to $14.

She took on two part-time jobs to help pay rent, utilities and a student loan. But she still sometimes trims her weekly $15 grocery budget to make ends meet, or even gathers broken fans, car parts, and lanterns to sell as scrap metal. A $2,000 hospital bill early this year wiped out her savings.

Even so, Delauder, a grandmother, recently signed papers for a mortgage of up to $150,000 on a house. “I’m paying rent for a house. I might as well pay for a house that I own,” she said.

Hourly wages for lower- and middle-income workers rose just over 2 percent in the year to March 2017, compared with about 4 percent for those near the top and bottom, while spending jumped by roughly 8 percent.

That reflects both higher costs of essentials such as rent, prescription drugs and college tuition but also some increased discretionary spending, for example at restaurants.

Economists say one symptom of financial strain was last year’s spike in serious delinquencies on U.S. credit card debt, which many poorer households use as a stop-gap measure. The $815-billion market is not big enough to rattle Wall Street, but could be an early sign of stress that might spread to other debt as the Fed continues its gradual policy tightening.

More borrowers have also been falling behind on auto loans, which helped bring leverage on non-mortgage household debt to a record high in the first quarter of this year.

While painting a broadly positive picture, the Fed’s well-being survey also noted that one in four adults feared they could not cover an emergency $400 expense and one in five struggled with monthly bills. This month the central bank reported to Congress that rising delinquencies among riskier borrowers represented “pockets of stress.”

That many Americans lack any financial safety net remains a concern, New York Fed President John Williams told Reuters in an interview last month. “Even though the overall picture is pretty good, pretty solid, or strong,” he said, “this is a problem that continues to hang over half of our country.”

8 notes

·

View notes