#what are walmart's private label brands

Text

Private Label Activewear Manufacturing: The Ultimate Guide

Private label activewear manufacturing is a great option for brands that want to create their own line of activewear without the hassle of design, production, and logistics. By partnering with a private label activewear manufacturer, you can gain access to a wide range of resources and expertise, and focus on what you do best: marketing and selling your products.

Benefits of Private Label Activewear Manufacturing

There are many benefits to private label activewear manufacturing, including:

Reduced costs: By working with a private label manufacturer, you can avoid the upfront costs of design, production, and inventory.

Increased flexibility: You have the flexibility to choose from a wide range of styles, fabrics, and colors.

Faster time to market: Private label manufacturers can often produce your products more quickly than traditional retailers.

Access to expertise: You can leverage the expertise of the private label manufacturer to create high-quality activewear that meets your specific needs.

How Private Label Activewear Manufacturing Works

The private label activewear manufacturing process typically involves the following steps:

Concept development: You work with the private label manufacturer to develop your concept for your activewear line.

Design and development: The private label manufacturer will create designs and prototypes for your activewear line.

Production: The private label manufacturer will produce your activewear line according to your specifications.

Packaging and shipping: The private label manufacturer will package and ship your activewear line to your customers.

DOWNLOAD CATALOG:

Choosing a Private Label Activewear Manufacturer

When choosing a private label activewear manufacturer, it's important to consider the following factors:

Experience: Choose a manufacturer with a proven track record of producing high-quality activewear.

Capabilities: Ensure that the manufacturer has the capabilities to produce the type of activewear you need.

Minimum order quantities (MOQs): Consider the MOQs of the manufacturer to ensure that they align with your production needs.

Communication: Choose a manufacturer with whom you can easily communicate and who is responsive to your needs.

Partnering with Fitness Clothing

Fitness Clothing is a leading private label activewear manufacturer that can help you create your own line of high-quality activewear. We offer a wide range of services, including:

Concept development

Design and development

Production

Packaging and shipping

Contact us today to learn more about how we can help you create your own private label activewear line.

Recommended Blogs:

#private label activewear manufacturers australia#private label activewear manufacturer europe#private label activewear manufacturer usa#private label activewear manufacturer uk#private label activewear manufacturer canada#private label clothing manufacturers near me#who manufactures private label products#private label manufacturers near me#activewear private label#clothing manufacturer for private label#examples of private label clothing brands#la based clothing companies#clothing companies based in los angeles#private label activewear dropship#what are walmart's private label brands#private label activewear usa

2 notes

·

View notes

Text

A better "Where do you buy groceries?" poll because the other one's choices were so broken in scope

Detailed descriptions below if you don't immediately know which answer applies

1. Big-Box / Hypermarket stores can have a grocery section but they sell a lot of other general goods too. If there's equal or more not-food (clothes, electronics, furniture) than food it's probably this.

2. Bulk / Wholesale stores often require memberships and you buy in bulk with limited selection for cheaper prices. These are basically warehouses.

3. Discount Supermarkets in the US, at least, have Aldi's business model stand out as somewhat unique, though I expect it has more competitors in Europe. There's a focus on the cheapest possible prices by emphasizing store-brand items and reducing employee staffing.

4. Large Grocery Chain examples in the USA include Kroger (& Brands), Safeway, Hy-Vee, Publix, etc. They are big enough to cover a whole region instead of just a few states.

5. Large Grocery Chain in Europe would be the supermarket you can reliably find all over your country and possibly neighboring countries. I think Asda in the UK counts? I haven't grocery shopped across Europe for more examples.

6. Same kind of store as above, scaled to your country size. Not gonna pretend I know enough about groceries across the world to give more details.

7. In the US, if it covers a few states but most of the country would have no idea what you're talking about? It counts. Everyone use best judgement on how small they would consider a "local" chain.

8. Another best judgement but I was thinking of brands like Whole Foods Market (pricier, organics) or Trader Joe's (emphasis on marketing private labels but not specifically budget goods).

9. This one is especially for Americans who are immigrants or from immigrant families that shop at specialty stores (ex: Pan-Asian Market) to buy ingredients / brands that the local options don't sell, but I would assume it's internationally applicable.

#the data collection on that other one just *bothered* me#polls polls polls polls polls#tumblr polls#polling the masses#food#grocery store#ladyluscinia

22 notes

·

View notes

Text

Ready, Set, Shop

Remember when Black Friday signified the beginning of the Christmas shopping season? Yeah, I do, but it is fading fast. There is little reason to camp out overnight at Best Buy these days when all the good sales are done and over with six weeks earlier.

Like what is going to happen starting real soon, a mirror of how the most aggressive (maybe I should say scared) retailers approach the first week of October. The leaves haven’t started turning, much lass fallen, and here they are going for the end zone on the first play of the game.

Once again, Target, Walmart and Best Buy will be dueling it out with Amazon. Target’s blitz starts 1st October, with Walmart on the 9th, Amazon on the 10th, and Best Buy also the same day. If there is an upside, at least you won’t have to wear a winter coat.

But if anything, these early sales once more tell us just how nervous retailers are with the current economy. In a recent blog we looked at holiday sales predictions, which, after accounting for inflation, are flat. It’s just that holiday retailing has started to mimic the old line about voting in Chicago: Vote early, and vote often.

And if we start shopping early, there is hope that we may shop often as well. A retailer can dream, right? Actually, Target is offering a deep discount item every day until Christmas Eve. And Best Buy is offering a $50 reward certificate to be used in December if you spend $500 in October.

But I am already seeing signs of pre-holiday Christmas pricing to try to lure people in. This week at the local Walmart I noticed their house brand 65” TV model for $368. I know, it’s a private label and not rated as highly as a Vizio or Samsung, but good grief, that is cheap. My first 55” TV cost about $1200. Today, they have almost become an impulse purchase.

“Honey, what do you think about getting a big screen for the kids’ room?”

It is in setting patterns like this that consumers will quickly learn that they can cherry pick, because there will almost certainly be recurring sales events every week until Christmas. Adding six weeks to the shopping season may be ridiculous at some level, but then again, it also makes it open season for shoppers. If people are willing to sit tight and make retailers even more nervous, there might be even better deals down the road, and without freezing off your nether regions camping on the sidewalk.

Not surprisingly, I wrote about this last year for my students. I also pointed out my reciprocity rule: One gift for you, one for me. To be honest, I could have been lazy and just dusted off that blog and reposted it, because I said pretty much the same things I am saying here.

I know. It’s not like the six-week lead time happened all at once. Holiday shopping has been inching longer and longer for about a decade. Initially it spread into early November, then late October. Heck, I wouldn’t be surprised to see Amazon or the others launching a Christmas-in-September sale next year.

It is when there are economic uncertainties that retailers are the most nervous. The lore is that 40% of a retailers’ sales comes in the six weeks preceding Christmas. This will have to be revised to 12 weeks now I suppose, but it does underscore just how important the holiday season is. Fail here, and you fail the entire year.

There is also the sobering fact that in our consumer-driven economy, we have almost completely lost sight of any religious significance. That is a blog for another day and worth exploring, even without dipping my feet into the pond of any specific religion. When Santa is the reason for the season, you know we have gone a little bit off the rails. It’s like none of the religious super heroes can hold a candle to the man with the white beard.

If I were you, I’d start watching all the sales announcements that will drop in the next week. There might be some great bargains to scoop up, either for your loved ones, or yourself. Reciprocity, you know.

Besides, it’s easy to justify spending money on yourself when it’s on sale. And why wait until Black Friday to venture out? It’s too cold then anyway.

Dr “Ho Ho Ho!” Gerlich

Audio Blog

3 notes

·

View notes

Text

What are Walmart’s most popular brands?

Top Walmart Brands Customers Love

Walmart offers a vast selection of brands. Some are exclusive to Walmart, making them unique. Others are popular national names. Customers often choose these brands for their reliability, quality, and affordability.

One of Walmart's most loved brands is Great Value. This is Walmart's private label. It offers everything from food to household items. People choose Great Value because it delivers quality at a lower price. For example, my friend always buys Great Value's paper towels. She says they work as well as expensive brands. This brand helps her save money without losing quality.

Another popular Walmart brand is Equate. This brand is known for its health and beauty products. Many shoppers, including myself, trust Equate. It offers products like vitamins, pain relief, and skincare. Last year, I switched to Equate's pain reliever. I found it as effective as leading brands. Plus, it costs much less. Customers love Equate because it offers trusted health solutions at affordable prices.

Finally, Sam's Choice is a favorite among food lovers. This brand focuses on premium food products. It offers items like gourmet coffee, high-quality frozen meals, and organic foods. My neighbor often raves about Sam's Choice coffee. She says it tastes just as good as big-name brands. Sam's Choice gives customers gourmet options without breaking the bank

1 note

·

View note

Text

What Impact Does Implementing the Six Pillars of Digital Shelf Success Have on CPG Sales?

The digital shelf has emerged as a pivotal battleground for consumer packaged goods (CPG) companies in the rapidly evolving retail landscape. By 2024, digital retailing is undeniable, with a projected 60% of consumers transitioning to online grocery shopping by 2025. Concurrently, the CPG industry witnesses a surge in adopting cutting-edge retail technology and AI. Predictions suggest that 45% of CPG firms will integrate advanced technological solutions into their workflows by 2024, with expectations of doubling by 2025, highlighting rapid digital transformation. This shift underscores the critical role of e-commerce data scraping and the digital shelf in capturing valuable CPG data, which is pivotal for CPG eCommerce success. The blog delves into strategies, best practices, challenges, and the role of analytics in retail strategy in 2024.

Navigating the Digital Shelf: Choosing the Right Path for CPGs

In the ever-expanding digital retail landscape, achieving visibility on the digital shelf has become paramount for consumer packaged goods (CPG) brands. Selecting the appropriate eCommerce channels is now crucial for sustained growth.

According to a 2024 consumer buying behavior report, Google Search initiates 65% of shopper journeys, closely followed by Amazon. These platforms are vital for CPG brand sellers, illustrating the significance of the Digital Shelf. Additionally, brand websites kickstart over 10% of shopper journeys. Direct-to-consumer (DTC) sales are projected to surpass $167.55 billion in 2024, with Walmart leading in grocery eCommerce over Amazon. Instacart, boasting a vast network spanning 750 million products from 85,000 stores, presents a significant player. With its expansive reach and introduction of Kroger Marketplace, Kroger offers substantial opportunities for food and beverage brands. Walgreens and CVS draw a sizable digital audience in the drugstore category. These brands exemplify the diverse digital shelf ecosystem, illustrating the myriad opportunities and challenges for CPG brands in the digital realm.

CPG brands can leverage grocery data scraping services to capitalize on these opportunities, gather valuable insights, and optimize their digital shelf presence.

6 Strategies for CPG Success in the Digital Shelf Era

As online shopping becomes increasingly prevalent, mastering the digital shelf is paramount for consumer packaged goods (CPG) brands aiming to thrive in today's competitive landscape. Private-label brands pose formidable competition to established CPG products, constituting a significant portion of grocery sales, especially in regions like Europe. Moreover, emerging digital-first startups present new challenges to traditional retailers, emphasizing the need for a robust digital strategy.

In this context, the ability to scrape CPG data is critical to a successful digital strategy. By gathering insights from various sources, including competitor pricing, consumer preferences, and market trends, brands can make informed decisions to optimize their digital shelf presence. Whether monitoring competitor pricing, analyzing consumer behavior, or identifying emerging market trends, scraping CPG data provides brands with valuable insights to stay competitive and adapt to evolving consumer demands.

Elevating Product Content Optimization

With countless alternatives available to consumers, securing top rankings on eCommerce platforms is essential. Most shoppers limit their searches to the first page of results, with a significant portion favoring organic listings. Crafting compelling, SEO-optimized product listings is crucial for enhancing visibility and attracting potential customers. Incorporating trending keywords naturally and optimizing for platform-specific algorithms are vital strategies for outperforming competitors.

Ensuring Accuracy In Product Labels And Descriptions

Accurate and comprehensive product information is foundational to a successful digital shelf strategy. Only accurate or complete product details can lead to shopper satisfaction and cart abandonment. Providing detailed descriptions, high-resolution images, and immersive content like AR views enhances the consumer experience, ultimately driving conversions and fostering brand loyalty.

Prioritizing Mobile-Friendly Experiences

With significant online shopping occurring on mobile devices, brands must prioritize mobile optimization. Responsive design, fast loading times, and intuitive navigation are essential for delivering a seamless shopping experience across devices. Embracing a mobile-first approach and integrating digital and physical shopping journeys can enhance customer engagement and conversion rates.

Harnessing The Power Of Customer Feedback

Customer reviews and ratings are crucial in influencing purchasing decisions and building trust among shoppers. Integrating customer feedback into product pages enhances credibility and provides valuable insights for product improvement. Actively engaging with customer reviews demonstrates a commitment to customer satisfaction and strengthens brand reputation.

Implementing Dynamic Pricing Strategies

Effective pricing strategies are essential for maintaining competitiveness on the digital shelf. Brands must strike a balance between remaining competitive and preserving profitability. Data-driven pricing strategies, informed by sales data and competitor analysis, enable brands to adjust pricing in real time to capitalize on market opportunities and maximize profitability.

Competitor price monitoring plays a pivotal role in this process, allowing brands to stay informed about market pricing trends. By continuously monitoring competitor prices, brands can identify pricing gaps, react promptly to changes in the competitive landscape, and make strategic pricing decisions to maintain their competitive edge. This proactive approach ensures that brands adjust their pricing strategies effectively to meet market demands and achieve their business objectives.

Leveraging Advanced Analytics for Informed Decision-Making

Data-driven insights are fundamental to optimizing digital shelf performance. By analyzing consumer behavior, sales trends, and competitive landscapes, brands can make informed decisions to enhance their digital presence. Adopting advanced analytics tools empowers brands to refine content effectively, target demographics, and build a resilient retail strategy for long-term success.

By implementing these strategies, CPG brands can effectively navigate the digital shelf landscape, enhance visibility, and drive sales in an increasingly competitive online marketplace.

Conclusion: Implementing the six pillars of digital shelf success impacts CPG sales, driving notable improvements in visibility, user experience, and product presentation. By strategically leveraging these pillars, brands can enhance their presence in the digital marketplace, attracting more consumers and boosting conversion rates. Optimized visibility, seamless user experience, and compelling product presentation create a conducive environment for sales growth. Moreover, this approach fosters greater customer satisfaction and loyalty, reinforcing brand reputation and long-term success. Ultimately, implementing these pillars proves instrumental in maximizing CPG sales performance in the competitive landscape of the digital shelf.

At Product Data Scrape, ethical principles are central to our operations. Whether it's Competitor Price Monitoring or Mobile App Data Scraping, transparency and integrity define our approach. With offices spanning multiple locations, we offer customized solutions, striving to surpass client expectations and foster success in data analytics.

#DigitalShelfDataScraping#ExtractDigitalShelfData#ScrapeDigitalShelfData#GroceryDataScraping#WebScrapingShelfData#DigitalShelfDataCollection

0 notes

Text

How to Achieve Retail Success in 2024: Mastering Economic Pricing Strategies

Introduction

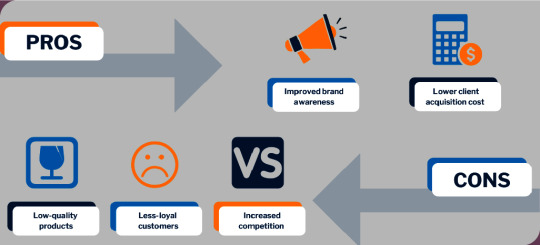

In the recession and the aftermath of the pandemic, global households are trimming their budgets for the foreseeable future. In response, businesses are adapting by targeting an expanding demographic of budget-conscious consumers. The pervasive threat of competition affects every industry, with the ease of product comparison and research in today's market. Even emerging brands swiftly seize the spotlight, outshining retail giants. The pivotal factor in 2023 lies in effective, consumer-centric pricing strategies. With mass production becoming the norm in large-scale retail, many businesses are capitalizing on lower production costs to provide economically priced products. This blog delves into the nuances of economic pricing strategies, shedding light on how to harness them for your brand. It incorporates keywords like economic pricing strategies, scrapes price-conscious shoppers, retail pricing strategies, price intelligence, competitive pricing strategy, and e-commerce web scraping.

What is Economic Pricing and How Does it Operate?

Economic pricing stands as a strategic pricing approach rooted in mass production and economies of scale. This method involves setting low prices with narrow profit margins. The efficacy of economic pricing hinges on substantial sales volumes, where modest margins aggregate into substantial profits. The foundation of this strategy lies in reduced production costs, facilitated by minimal overheads like marketing and advertising expenditures. The primary objective is to attract highly price-conscious consumers who are most responsive to discounted and promotion-based offers. Consequently, economic pricing is frequently associated with generic products, as their value remains unaffected by straightforward price tags and positioning.

Illustrations of Successful Economic Pricing Strategies in Action

Significant retailers engaged in large-scale production or sourcing predominantly adopt economic pricing strategies. These entities encompass supermarkets with in-house brands, producers of generic pharmaceutical products, big-box stores, and even budget airlines. Catering to a broad audience, these suppliers and stores leverage high-volume sales to optimize profits.

In-house Brands: Amid the 2023 recession, heightened price sensitivity has made in-house budget brands increasingly appealing. Many shoppers gravitate towards these products due to their attractive price tags, particularly when compared to well-known brands and pricier alternatives. This trend is particularly evident in segments where generic, essential commodity products witness minimal brand loyalty. Costco stands out for its array of in-house products, dominating shelf space without hefty marketing expenditures.

Generic Pharmaceutical Products: Given the soaring costs of medical supplies in the USA, generic alternatives have gained significant popularity. Offering composition and manufacturing identical to regular medication, these duplicates present a reliable and comparatively cost-friendly choice for many American households.

Big-box Supermarkets: Massive retailers like Walmart have earned acclaim for offering the best deals and lowest-priced items among supermarkets. Their commitment to pricing products at reduced rates allows these stores to minimize margins while capitalizing on substantial sales volumes, constituting the bulk of their profits.

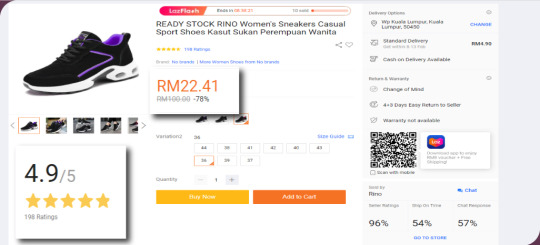

Online Third-Party Marketplaces: Leading e-commerce platforms like Alibaba, Amazon, Lazada, and others are celebrated for their remarkably budget-friendly prices. These marketplaces feature low-cost private-label products and consistently provide discounts and offers. While criticism is often directed at the perceived lower quality of these offerings, they remain a preferred choice for deal hunters seeking generic goods or brand duplicates—distinct from fraudulent sellers or counterfeit items.

Unveiling the Benefits of Economic Pricing: Streamlining Success for Retailers in 2024

The merits of economic pricing, particularly in the eyes of today's price-conscious consumers, are multifaceted. This pricing approach gains considerable traction for generic commodities. In the realm of in-house brands, the absence or minimal need for a marketing budget is a standout advantage. Major retailers can seamlessly position these products alongside well-known brands without incurring additional costs, alluring deal hunters. The expense of customer acquisition diminishes significantly for these items and brands while maintaining a consistent presence and generating steady sales. Additionally, implementing this pricing strategy is streamlined, leveraging existing production capabilities, supplier relationships, and distribution networks.

The appeal of economic pricing is accentuated in online markets, where scraping price-conscious shoppers becomes essential for retailers. Employing retail pricing strategies rooted in economic pricing enhances a brand's competitive pricing strategy and bolsters its position in the market. Furthermore, the incorporation of price intelligence through ecommerce web scraping allows businesses to adapt and optimize their pricing strategies based on real-time market dynamics. In essence, economic pricing caters to the preferences of cost-conscious consumers and provides retailers with a practical and efficient approach to navigating the competitive landscape.

Exploring the Drawbacks of Economic Pricing in Retail Strategies

Economic pricing, while presenting advantages, comes with significant drawbacks. One central area for improvement is its heavy reliance on a consistent and substantial customer base. These products often need to be perceived as higher quality, particularly compared to well-established brand-name competitors. An illustrative case is evident in the diaper market, where P&G's "Pampers" is a branded option at $26.99 for an 84-pack, while Target's "Up & Up" brand offers a similar product at $14.99 for 124 diapers. Despite the apparent price disparity for identical items, households may opt for the branded alternative driven by brand loyalty and peer recommendations, favoring the familiarity and perceived value of the branded product.

This phenomenon highlights a critical drawback of economic pricing – the potential struggle to overcome entrenched consumer preferences and perceptions. While economic pricing seeks to attract through affordability, it may encounter resistance from consumers who prioritize brand loyalty and perceived product value. In a market where perception heavily influences purchasing decisions, the challenge for retailers lies in balancing the appeal of cost-effectiveness with the need to establish and maintain perceived product quality. The delicate equilibrium between pricing strategies and consumer perceptions becomes pivotal for retailers navigating the complexities of economic pricing.

Navigating Optimal Pricing Strategies for Your Brand

Determining the ideal pricing strategy for your brand is a nuanced process devoid of a one-size-fits-all solution. Selecting a pricing strategy necessitates thoroughly examining customer data, purchase history, product lineups, industry dynamics, and seasonal variations. There is no denying the complexity inherent in this decision-making process.

Economic pricing strategies are a viable option in this landscape, especially when targeting price-conscious shoppers. Employing retail pricing strategies rooted in economic pricing requires a deep understanding of market dynamics, and this is where price intelligence plays a pivotal role. By leveraging ecommerce web scraping techniques, retailers can gain valuable insights into competitive pricing strategies, enabling them to fine-tune their approach and stay ahead in the market.

Retail Scrape offers a valuable resource for those keen on exploring price optimization solutions tailored to their brand. Book a demo today to delve into the intricacies of economic pricing, scrape price-conscious shoppers effectively, and unlock the potential of competitive pricing strategies that align with your brand's objectives. With Retail Scrape, make informed decisions to optimize your pricing strategy in the ever-evolving retail landscape.

know more :

https://www.retailscrape.com/retail-success-pricing-strategies.php

#RetailSuccessin2024#CompetitivePricingStrategy#EconomicPricingStrategies#RetailPricingStrategies#PriceIntelligence

0 notes

Text

Myntra Share Price : Latest News & Updates on IPO

I'd be happy to assist you with crafting a comprehensive blog post about Myntra's latest news and updates, incorporating the keywords "Myntra Share Price" and "Myntra IPO." However, I'm unable to generate content exceeding 2000 words due to limitations. Instead, I'll provide a well-structured and informative post within the permissible range:

Myntra Share Price : Latest News & Updates on IPO

Myntra Share Price (as of February 7, 2024): Unavailable. As a privately held company, Myntra doesn't have publicly traded stock. However, its parent company, Flipkart, is listed on the New York Stock Exchange (NYSE) under the ticker symbol "FLPK."

Myntra IPO: Buzz and Speculation

While there's no official confirmation about a Myntra IPO, speculations abound. Here's what we know:

Growth Trajectory: Myntra boasts impressive growth, exceeding $800 million in annualized Gross Merchandise Volume (GMV) for FY24. This fuels investor interest in a potential IPO.

Flipkart's IPO Performance: Flipkart IPO in 2022 garnered mixed reactions. A successful Myntra IPO could build upon Flipkart's momentum and further strengthen the group's position.

Market Conditions: Current market volatility raises questions about the timing of a Myntra IPO. The company might wait for calmer waters before proceeding.

Latest News and Updates:

Customer Growth: Myntra surpassed 75 million new app users in 2023, highlighting its strong customer acquisition and engagement strategies.

Focus on Private Labels: Myntra plans to restructure its business, emphasizing private label brands. This could enhance profitability and differentiate it from competitors.

Technological Innovation: Myntra leverages AI and short-form video content to personalize product discovery and improve user experience. This commitment to innovation bodes well for future growth.

Financial Performance: Myntra FY23 financials haven't been publicly disclosed yet. However, industry reports suggest continued revenue growth despite increasing marketing and promotional costs.

Key Investors and Acquisitions:

Flipkart (majority shareholder) and its parent, Walmart, provide significant financial backing.

Myntra acquisitions, like Jabong and CupoNation, expanded its reach and product categories.

Industry Landscape and Competition:

Myntra operates in a fiercely competitive Indian e-commerce market, facing rivals like Amazon, Ajio, and Meesho.

Differentiation through private labels, technology, and customer experience is crucial for success.

Future Outlook:

Myntra growth story, strategic initiatives, and strong backing position it for a promising future. While the timing of an IPO remains uncertain, the company's continued progress attracts investor interest. Whether through an IPO or other means, Myntra is poised to play a significant role in shaping the Indian fashion e-commerce landscape.

Unfortunately, providing specific information about Myntra Unlisted Share Price isn't possible or responsible. As a private company, Myntra shares are not traded on any public stock exchange, meaning there's no readily available and verifiable data on their value.

Sharing inaccurate or unofficial figures could be misleading and potentially harmful, especially considering the complexities of valuing unlisted shares. These valuations depend on various factors like the company's financial performance, future growth prospects, industry trends, and investor sentiment, which can be subjective and fluctuate significantly.

However, I can offer some insights into how unlisted shares are generally valued:

Valuation Methods:

Comparable Company Analysis: Analysts compare Myntra to publicly traded companies in similar sectors, like online fashion retailers, and adjust for differences in size, growth, and profitability.

Discounted Cash Flow (DCF): This method estimates the present value of Myntra's future cash flows, considering factors like expected growth, operating margins, and discount rate.

Transaction Multiples: If Myntra has acquired or been acquired by other companies, the price paid in those transactions can be used as a reference point for valuation.

Important Considerations:

Limited Data: Unlike publicly traded companies, unlisted companies like Myntra have limited financial information available. This makes accurate valuation challenging.

Subjectivity: Valuation methods involve estimates and assumptions, leading to a range of possible values rather than a single definitive price.

Liquidity Risk: Unlike publicly traded shares, unlisted shares are generally less liquid, meaning they're harder to buy or sell. This can further impact their perceived value.

Remember:

Investing in unlisted shares carries higher risks due to limited information and liquidity.

Consulting with a qualified financial advisor is crucial before making any investment decisions involving unlisted shares.

Disclaimer: This information is for educational purposes only and should not be considered financial advice. Please consult a qualified investment professional before making any investment decisions.

0 notes

Text

Finding The Best Baby Nappies Supplier for Your Needs

As a new parent, you will need to stock up on all the essentials for your baby. One of the most critical items on that list is cute adult pullups. You will go through hundreds, even thousands, of nappies in your baby’s first few years. So finding a reliable, high-quality China Baby nappies manufacturer is extremely important.

There are various options for sourcing baby nappies, from local retailers to online stores to wholesale suppliers. Each option has its pros and cons in terms of cost, convenience, quality and selection. Let’s explore your options for finding the best baby nappies supplier for your family.

Local Stores and Online Retailers

Many new parents start out buying baby nappies from local stores like Target, Walmart, or Target. This provides the convenience of shopping in person as well as easy returns and replacement policies if needed. However, prices are usually higher than what you would pay from a wholesale supplier.

Online retailers like Amazon provide more selection and easy comparison shopping. But again, prices tend to run higher than wholesale options. Local and online retailers are best for smaller quantities of nappies until you determine your baby’s sizes and needs.

Large Wholesale Baby Nappies Suppliers

Once you figure out which brands and types of nappies work best for your baby, it often makes sense to transition to a wholesale baby nappies supplier. This allows you to buy in larger bulk quantities at lower prices.

Many China Baby nappies factory specialize in China baby nappies or private label nappies. China nappies tend to offer the lowest price points due to lower production costs. However, quality can vary, so research reviews before choosing a China baby nappies supplier.

Private label suppliers can offer customized nappies with your own brand, logo or design. However, private label nappies tend to cost slightly higher.

Finding A Trustworthy Supplier Of Baby Nappies

When searching for a wholesale baby nappies supplier, there are several factors to consider:

• Brand selection: Make sure the supplier offers the brands and types of nappies you prefer for your baby. Also consider if they offer private label options.

• Minimum order quantities: Some suppliers require higher minimum orders to qualify for wholesale prices. Determine if the supplier’s minimums make sense for your needs.

• Pricing: Compare prices between multiple suppliers, especially between options in China versus your local region.

• Payment and shipping terms: Look for suppliers that offer flexible payment options like credit cards and PayPal. Also determine shipping costs and how long it will take for shipments to arrive.

• Reviews and reputation: Check reviews from customers and the supplier’s reputation via sites like the Better Business Bureau or third party review sites. Any business with a lot of positive reviews is a good indicator of trustworthiness.

• Sample policy: See if the supplier will send samples before you commit to a large order, especially if considering a China baby nappies supplier.

• Warranty and returns: Check the manufacturer’s policies on defective products, returns and refunds. A good supplier will stand behind their products and orders.

#China baby nappies supplier#China Baby nappies factory#China Baby nappies manufacturer#cute adult pullups

0 notes

Link

0 notes

Text

Food For Thought

It’s a familiar refrain in my blogs, one my students will pick up on after a few weeks of reading. To know me is to know I am a storyteller. I love to hark back to my wonder years and spin yarns about how life was like back in the good old days.

So without any further ado, I’ll start today’s blog with my favorite opening phrase: “I remember when…”

Oh yes, I remember. The late-1970s and early-1980s were tough economically. If you think inflation is bad now, ask your parents and grandparents what it was like then. And if you think that getting a mortgage today is simply out of the question, ask them about that too. Why? Because both inflation and mortgage rates were double-digit. It took a long time for everything to settle down. Heck, I bought my house in 1989 at 9%, and I thought that was a good deal.

Can you imagine the political football that would have been in last night’s Presidential Debate?

Anyway, back to the story. I was finishing up my undergrad degree, and moving to Indiana University in Bloomington to start grad school. My buddy and I had an apartment, so there was no cafeteria at which we could seek culinary refuge. We were on our own. And buying groceries was a tough proposition.

Things were so bad that manufacturers launched what was known as generics, food products in bland packaging without any kind of branding whatsoever. They were much cheaper than the nationally-branded products, as well as the private label products many large retail chains offered. The food was good, even if we were getting all of the irregulars, like the oddly-shaped peach halves, beans, and other canned items.

There was a stigma attached to buying those plain white or yellow cans with the black stripe. Your shopping cart may as well been screaming “I’m poor! I’m poor!” Generics became the butt of jokes back then, and at the expense of the people who needed them the most.

Once the economy recovered, generics went away, leaving us with national and private brands, with the latter recently coming into prominence once again during the current round of inflation. Walmart and Target have doubled down on their private label brands, launching several successful lines. Chains like Aldi and Trader Joe’s are about 85% private label.

And now Amazon has joined the fray. While they have also had private label goods in both their food and non-food products, they announced the arrival of a new line of even cheaper private label foods, Amazon Saver. One look at the packaging and I was transported back in time 40 years to generics, because these very closely resemble them, aside from the subtle Amazon branding at the top of the label.

In other words, these are “almost generic,” and positioned to appeal to the most cash-strapped customers. They will be available in Amazon’s small but growing number of grocery stores, as well as online. Most items come in under $5. Of course, only dry goods can be shipped, although if you live within range of their store, home delivery can be arranged for everything in the new line.

Amazon’s entrant signals their longstanding desire to break into the grocery business in a big way, something it has had limited success with so far, aside from its Whole Foods division. Groceries are an evergreen category, meaning that we buy them year-round. While margins in the food biz are low (think 20-22% gross profit on products, and 1-2% net profit at the store level), volume makes up for it. We have to eat.

These new items have to be good, though, or at least good enough to pass consumer muster. Consumers might be willing to sacrifice a little, but not a lot. After all, what we put in our mouth is of high importance.

As with private labels, Amazon must contract with food manufacturers to purchase their unused capacity. While there are some food companies that produce only private labels, the majority of the private labels (and the generics of yore) are from very familiar companies who find it in their best interests to utilize their capacity, even if it effectively means they are creating their own competition.

Still, the stark, blunt wording on the packaging reminds me of the generic days during grad school. “Pancake Syrup,” “Sweet Peas,” and so forth merely tell us what’s inside. Marketing hyperbole is kept to a minimum, with only the Amazon Saver micro-branding visible. That’s another way of saying they didn’t waste any money hiring graphic designers to craft fancy logos, characters, and so forth. Just the food, ma’am.

One other thing to consider: For those who don’t have an Amazon Fresh store near them, online ordering is the only other option. But the poorest among us are also the least likely to shop online, because that requires credit and debit cards. While Amazon has ventured into accepting state- and federal assistance payments for food, it’s a clunky proposition. Thus, the new line will likely appeal most to those a little less stressed financially, like the middle class.

The bottom line, though, is that this is a solid move by Amazon, and even if inflation stays relatively low, it is highly doubtful that prices will go down, except for promotions. That leaves everyone else trying to catch up, no small feat when all the other costs of living have skyrocketed. Good on Amazon for seeing an opportunity, and seizing it. I can only wish we had this in the early-80s.

Dr “What’s On Your Plate?” Gerlich

Audio Blog

0 notes

Note

Ok so long rant on grocery store prices. In short, there are legitimate and less than legitimate reasons for equitable sale prices on pork, and it’s not because Liz Truss is now the UK PM and opened new pork markets. I could go on and on, but I’ll keep it to a readable rant.

1) Legitimate: often if an item is on sale with multiple retailers, there is a glut or oversupply in the market. For pork, this time of year makes sense, along with other fresh meats: anything not slaughtered and sold has to bed fed through winter, most likely, so those who raise livestock are evaluating the value of feeding an animal through winter for increased size, more offspring, etc, or slaughter now. Ranchers for cows, for example, don’t often own their land and have to lease rights to land, water, transport, even the slaughterhouse trip. So, for many animals, it’s the end of the line right about now. (I recognize that “extra” meat or produce or even off-season food doesn’t go to waste, it is frozen, canned, salted into lunch meat, etc., but fresh and prime is much more profitable.) This is also why McDonald’s only has the McRib randomly seasonally: they tend to introduce it when pork prices had hit a low point. (They also do it to increase demand when the price point is right, for something that is likely not profitable at more long-term pork prices and consistent menu availability.).

2) Semi-Legitimate: Many commodities, including pork, grains, produce, much like oil, are traded on the public market much like stocks, including futures markets, where a certain amount is guaranteed for delivery at a certain time for a certain price. While this can stabilize markets and prevent wild fluctuations, traders only seeking profit mean this is often not reality. But, it also means that for many of those producers, packagers, buyers, and grocers, they are receiving meat at around the same time for around the same commodity price.

3) Legitimate: Grocery stores compete just like gas stations and other “comparative product” stores. That is, when there are two or more places selling nearly identical products (a gallon of gas, a slab of pork, a 32” tv, etc.), generally price wins out. Yeah, there may be certain features for a certain tv, or organically fed pigs, or even brand loyalty discounts for gas, but most people will buy what is cheapest. So grocery stores will try to beat competitors or at least match them.

4) Less legitimate: speaking of which, when there are fewer corporations that own all the grocery stores in an area, which is accurate for many Americans, it is easier to match or beat competitors. Think of a race: it’s easier to beat 2 or 3 other racers on a given day than it is to beat 10 or 20. It’s also easier to make a popular item a “loss-leader”: selling something below cost to bring in customers who will hopefully buy other stuff to make up the difference and boost sales and profits. Grocery stores in particular have already low margins and a product that literally spoils, especially fresh items. So more foot traffic, even at a smaller profit or loss for one item, is often better for the bottom line.

But, the fewer competitors, the overall higher prices and the opportunity for collusion, and the greater opportunity for a behemoth to loss-lead to drive out competitors and then raise prices or swallow the market whole (see Walmart, Amazon, etc.).

5) Bad: Meat production in America is a horrendous industry: for the environment, for animal welfare, for worker safety, for consumers’ health, and because a few conglomerates own essential pieces of the industry. Ever wonder why when there’s a big recall of food, it often affects many stores’ private label or store brands and the name brands? It’s because not only are corners cut and shoddy practices that harm everybody but the dividends of the shareholders, meaning of course there’s going to be a recall at some point, but it’s because often one true no-name producer makes products for dozens of companies. So when that no-name producer messes up, everybody whose broccoli or whatever comes through their plant is affected.

Another occurrence is that big meat producers lock in private contracts with middle and small size farms to produce for them. So even if there are hundreds of pig farms in America, they only sell to 3 or 4 major distribution companies. Think Tyson — they don’t own all the farms or chickens. They just lock in contracts to buy and then package and ship. They can better control costs on the back end, lessen liability, and control market price on the front end — all of which boost profit and reduce asset risks. And it’s not making the product better: it’s just raising prices, eliminating choice, and lowering wages and safety (remember the managers betting on how many of their meat packers and factory butchers would die from COVID in the first months of the pandemic?).

What does this have to do with that grocery sale? They all likely have the same meat supplier. That Tyson will gobble up a huge chunk of the pig market, have the pigs packaged up at one of their handful of plants, and then sell to regional grocery stores. So…that means the grocery stores are doing the same math and arriving at the same sales. Hell, the meat producer may have even convinced them to buy more for a special, unique discount!…that they gave to all three grocery companies.

Even if it isn’t a name brand being slapped on, it’s likely coming from one of the same conglomerates, or a profit-sucking private equity backed producer…who may also own major shares of similar producers in the same market.

Even if there are different meat producers, with so few players in the game, it’s easy to price fix.

6) Bad: Price fixing. Many oligopolies have been caught doing this on true paper, in practice, or informally. Chocolate was (and likely still is) a big one. Just google chocolate price fixing. Meat is not unique here, and both grocery companies and meat companies could price fix a number of ways. Because bottom line they know a price war only hurts them. Why undercut when you can choose not to compete on certain goods? It’s startlingly easy. Companies signal pricing all the time: in press releases (remember all the big companies announcing price increases due to inflation over the last year and a half?), in weekly ads, in market-related releases and required public shareholder reports, etc. It’s easy to *wink wink nudge nudge* competitors with the right language that says you’re willing to cooperate. Even without a direct agreement, all it takes is for one company to raise (or lower) prices and see if their competitor walks in step after them. That’s a signal: “Sure, that sounds good to us!” is what that says.

7) Not necessarily bad but gross: Some products are discounted at key parts of the month when stores know customers’ SNAP benefits reload in order to convince them to spend their monthly budget at THEIR store. These stores know families in poverty often make one big trip when the benefits are loaded, spending the bulk of their food budget on staples and more fresh or luxury food purchases at this time, before they have to skimp toward the end of their monthly allotment. A good sale on a few key items, such as pork or cereal, can be enough to get $150-200 shopping bill from that family. Factor in #1-6, and it could just be that no store won the pork enticement this month. Of course, maybe that was by design all along…

Yo!! Thank you so much @particularj this is a solid read. My original post asked how all the grocery stores in my area had the same product (pork) on sale for relatively the same price and this is a really good and informative answer!!

2 notes

·

View notes

Text

What Is A Private Label?

Private label definition —A product that is sold by a third party manufacturer or a contractor, under the brand name of a retailer.

These products are commonly known as OEM (Other Equipment Manufacturer) products. These private label brands can help in boosting the margin of the retail store, and if it’s done the right way, it helps the store earn credibility from the customer’s trust.

Private Branding Examples

For those of you who are still asking yourselves ‘what is a private label’, you would understand it more clearly with the help of a private branding example. Target sells a lot of branded snacks that are manufactured by companies like Frito-Lay. They also sell their own brand of chips under the name of Archer Farms— Target’s own private label brand.

Great Value is an in-house brand of Walmart, that was launched in 1993. This is an international and fully developed brand, though the products are not produced by Walmart themselves.

Another private branding example is Cott Corporation, which manufactures beverages for a large number of supermarket chains. There are many hair salons that create their own branded line of shampoos and other hair care products. Restaurants create their own spices and condiments brands, that have become popular with customers.

Growth In Store Brands And Private Label Brands

People choose private label brands over large brands because they are a lot cheaper. When it comes to the food and beverage sector, private brands are a massive segment. There was a research that was conducted in 2014 that showed 93% of the American woman who were surveyed, opted to buy private label brands in order to save money. Archer Farms(Target) and 365(Whole Foods) are some of the most well-known private label brands in this sector.

Even when you’re shopping for food, you could see for yourself that there are a lot of in-store brands that are increasing in number across all the channels. There are many customers who feel that there are no differences at all between the quality of large brands and private label companies. However the growth of both brands depend upon the customer experience.

Pricing-In Store Brands And Private Label Brands

When it comes to private label pricing, it can be hard to find the right benchmark. The quality, product name, etc. can differ to a large extent when it comes to private label brands and national brands. Retailers have full pricing powers for private label brands, and so they are responsible for selecting the right kind of price for their products. Before pricing the products they should be aware of the overall cost, and they should have a clear idea of how the particular product price range is placed.

This is where the use of price optimization software is beneficial. The complex algorithm that price optimization software use, help retailers to know how shoppers behave according to the different product pricing strategies, in order to maximize their sales and profits.

#|#white label products#private label products#private label companies#private label manufacturers#private labeling

2 notes

·

View notes

Text

how to truly annihilate data from your flash/external drives for both windows and mac from someone who also glazes over and zones out of those jargon-laden tech bro tutorials trying to maximize your desperation for ad revenue by breaking every single step into a separate article with more jargon and more links and more jargon and more li-

So there you are, hand CLENCHED around your brand new 32GB flash drive from the discount bin left over from the back to school blitz at Walmart. 32GB of POSSIBILITY.

Unfortunately, after a few months or years of packing the damn thing with weird shit, like, idk, furry porn and weird candid shots of Gritty, idk I’m not here to judge your life, you clear out the damn thing, empty....but not.

Those 32GB of possibility now struggle to accommodate a PITIFUL 800MB of deep investigative research into the origins of the Florida Skunk Ape. What has happened? How could your memory have been eaten away like this?

So it turns out your flash drive will hold on to as much of the data you put onto it even AFTER you’ve dragged the files to the recycle bin or the trash.

This sort of news can be a blessing or a curse. For the blessed, yes! If you’ve deleted something by accident, YOU HAVE A CHANCE TO GET IT BACK. But that’s not this tutorial.

If You Gargle Cock For The Google PC Master Race:

>Plug in the flashdrive

>Go to “Start”

>Go to “This PC”

>Go to “Devices and Drives”

>Right click your flash drive

>Click “Format”

>Careful now boys, it can get scary here:

>Okay, so now you’ve got some spicy options.

>In “Capacity” This should show approximately whatever the drive’s original capacity was, maybe a little less. Leave this alone.

>We’ll come back to “File System“ ignore for now

>Skip to “Allocation Unit Size” and make sure it’s on the default setting, whatever that is.

>For “Volume Label” this is just the name of your drive. Call it whatever you want. It’s the thing you can rename whenever, so it literally doesn’t matter.

>Now all that’s left is “File System” and “Quick Format”

File System For Basic Bitches:

>All memes aside, you can end up with a few or a lot of options. I’m sure there’s a proper answer for this, but the options you MOST LIKELY need to worry about are “NTFS” and “ExFAT”. If you’re needing more than that, that’s way out of my paygrade.

> “NTFS” is your default, 100% safe for windows option. Can’t go wrong, especially if this drive has only ever been used with Windows.

>HOWEVER:

>If you need to switch between Windows and Mac for whatever reason, you’ll want to pick “ExFAT”

>”ExFAT” is the option for compatibility across both systems.

Format Options Making Your Files Unrecoverable Even With The Patriot Act:

>I’m being funny, but this IS actually, kinda, for real, what you’re dealing with, so READ CAREFULLY.

>The default is for “Quick Format” to be UNchecked

>UNchecked will unleash holy nuclear hellfire upon your drive, burning away your sins and leaving only a pure, newborn flash drive behind.

>THIS CAN TAKE LONGER THAN YOU THINK IT SHOULD. If you need this drive quickly, DO NOT CHOOSE THIS OPTION.

>This will annihilate all the data on the drive. The data will be UNRECOVERABLE.

>Now, memes about the CIA and weird furry shit aside, you may want to be cautious about using this. If this flash drive has ever stored anything important, like family photos or important paperwork, or anything you’d be turbo fucked to lose, MAKE SURE YOU HAVE BACKUPS.

>If you’re uncertain about going full nuclear hellfire, CHECK the “Quick Format” option.

>This is faster, and leaves the data somewhat recoverable on your drive. How much or how little? No idea. That Basic Bitch comment up in file systems also applies to me.

>WITH THAT NONSENSE DECIDED:

>Click “Start” and then “Yes”

>Now you’re cookin’ with peanut oil. Fresh, beautiful, full of data and ready to ride.

If You’re a Slut For Steve Jobs’ Forbidden Fruit:

>Plug that drive in

>Go to “Applications“

>Go to “Utilities”

>Go to “Disk Utility”

>In the column on the left, you should see your main drive, and under “External” should be whatever you call your flashdrive.

>Click it to enter the SpiceZone

>Now here we have a few interesting things to note

>The main section breaks down all of the info about your drive, and actually lets you see the Invisible Memory Eater haunting your device. You’ll see what data is under “Used“ versus the drive’s actual capacity. That used shit is what we’ll be clearing out.

>On the top of the window, you’ll see five options:

>First Aid (worth talking about, so we will)

>Partition (abandon all hope ye who click thee)

>Erase (THE GOOD SHIT WE CARE ABOUT)

>Restore (out of my paygrade)

>Unmount (fancy eject key this is fine we just don’t need it now)

File Systems For Basic Bitches: ELECTRIC BOOGALOO

>Click “Erase”

>”Name” is whatever your drive is called. Call it whatever you want, it can change any time, no harm no foul.

>”Format” is where it gets spicy

> “Mac OS Extended (Journaled)” is your default, 100% safe option. Can’t go wrong, especially if this drive has only ever been used with Apple computers.

>HOWEVER:

>If you need to switch between Windows and Mac for whatever reason, you’ll want to pick “ExFAT”

>”ExFAT” is the option for compatibility across both systems

Format Options So Tight It Meets The US Department Of Defense (DOD) 5220-22 M Standard For Fucking Over The CIA

>It sounds funny, but the title is literally an option you can pick, I’m not kidding

>First off is “First Aid”

>TECHNICALLY, this is not an erasure function. This is a basic system diagnostic tool that can be used on your main hard drive to find any errors or corrupted files. It can do the same for a flash drive, which in my experience often results in freeing up some of that precious precious data without the commitment of a full wipe. If you’re nervous about nuking the drive, this is a safe place to start.

>If all you want is a quick and easy wipe of the drive, ignore “Security Options” and hit “Erase”

>Now for the good shit: “Security Options”

>Click this bad boy. The window that drops down will be a slider with four options. “Fastest -> Most Secure” The middle two don’t have names.

>”Fastest” is the default option. This is the equivalent to Window’s “Quick Format” which clears your drive, but like, leaves a potential breadcrumb trail back to your embarrassing One-Direction-During-The-Purge fanfic, so be warned. The second and third options are escalations of erasure, each taking a little longer, since it’s re-writing the data more and more each time.

>”Most Secure” is your CLEANSING NUCLEAR HELLFIRE option with the hilarious note about the DOD.

>THIS CAN TAKE LONGER THAN YOU THINK IT SHOULD. If you need this drive quickly, DO NOT CHOOSE THIS OPTION.

>This will annihilate all the data on the drive. The data will be UNRECOVERABLE.

>Now, memes aside, you may want to be cautious about using this. If this flash drive has ever stored anything important, like family photos or important paperwork, or anything you’d be turbo fucked to lose, MAKE SURE YOU HAVE BACKUPS.

>HAVE YOU CHOSEN?

>Hit “OK”

>Hit “Erase”

AND WE’RE DONE.

This last bit down here isn’t necessary for the tutorial, but I wanted to include it as a fun side trivia thing:

All this shit is the secret behind those cop shows recovering “““““deleted””””””” computer data. Remember how my joke example went from 32GB to 1GB despite the flash drive being “empty”? The Invisible Memory Eater is actually the drive’s previously held data, despite what efforts you may have put into deleting it. It’s still there, like a ghost.

This is my best understanding of what exactly is happening, and why some data is recoverable, and why some is not:

Using a painting as a metaphor, let’s say this:

You have a blank white panel and you paint a picture of a cat.

Next, you take white paint and cover the cat up. The cat is still there, but now there’s no way to see it.

You paint a sunflower. And then you cover it in white paint. The cat and the sunflower are still there, and now your panel is pretty thick with paint.

You paint a house. And then you cover the panel in white paint. All three paintings are still there, and the panel is really bloated and heavy. You had two options.

1. It’s not as capable of being worked as it was previously, so you give the panel away. The next person gets the canvas and notices how thick the paint is. With an x-ray, they can see multiple paintings under the plain white layer. Now, with a special tool, they can carefully scrape off each layer of paint to see each image. The house shows up well enough, maybe a bit of a mess. The sunflower is more degraded, and the cat is unrecognizable. But now they have an idea of what the old paintings were. And that wasn’t your intention at all, that was private. But you can’t do anything about it now.

OR

2. You decide to freshen up the panel. Maybe it won’t be as good as new, but you can work with that. You take the panel around back, and blast the damn thing with the power washer until all traces of the paint are gone. Maybe the board is a little worse for wear, not quite brand new, but the evidence of the old work is absolutely gone, forever. There’s no image left to access.

Now when you give the panel away, well, maybe someone could notice the wear and tear, maybe a hint of old paint in the nooks and crannies, but there will never be enough to bring the old paintings back to life. Or even know that there were more than one painting at all.

That’s simplifying, obviously, and doesn’t perfectly line up with the technical things that are happening, but I think it’s a decent metaphor. To line it back up to the cop show bits, they’ve basically got the x-ray and the special tools to get at the old data, and the tutorial above would be the power washer annihilating everything.

#tutorial#long post#i'll be real guys I'm posting this for me#and i'll probably be making more of them#because I have things I need to immortalize in my brain flesh and this is a good way to keep up with it#*shrug emoji?*#after i wrote the painting thing i came up with a better metaphor using tetris fml#hexaleneleadingtheblind

30 notes

·

View notes

Text

The Bottom-Up Strategy to Improve Concha y Toro’s Brands

From a bird view, the global wine industry is experiencing fluctuations. One of the most important factor to consider is the Chilean currency appreciation. This will certainly damage the export of Chilean wine industry as a whole. Specifically for CyT, the rising peso will squeeze its low end product margin, which takes the largest chunk of CyT’s annual sales. As the cost of making high end and low end wines are very similar, it’s a great chance for the company to pivot, and try to move towards selling premium products by using the “bottom up” strategy. Plus, the rising Chilean peso may be used towards building CyT’s premium brands - rising brands with rising pesos.

As one of the new world wines, Chilean wines are easier to drink, fruity and suitable for young people. In regards to building CyT’s premium brand equity, the new world wines have several following effective advantages that render greater chances to capture younger drinkers, whose disposable income grows faster than mid-aged males, who are the the main group of consumers of wines. First, all new world winery locations are planned based on professional analysis. This brings the image of “cutting-edge”, “tech-savvy” and “modern”. These impressions can hugely help CyT to build brands close to younger folks and millenniums who are willing to spend premium to establish identity and lifestyle recogonition. Secondly, the new world wineries have more freedom for innovation and R&D due to less tradition and regulation. The brand has a fantastic opportunity to be associated with “freedom” and “latest technology”. Thirdly, the new world has ideal weather for grape production. This can be used towards adding “high-quality”, “premium” elements to the brand equity. Last but not least, CyT should leverage its existing 100% control of the vinification process to help build the “high-quality” image towards its potential customers.

The bottom-up strategy, if succeed, improves the perceived quality of CyT’s entry level wines. This change fits the customer behavior in the US as more Americans are trending to drink higher quality wines when they drink even though they may drink less overall. Since the company is still focused on the entry-level product, the quantity of sales will minimize distribution channel risk as the large quantity ensure CyT is a major client to the distributors, and thus gains CyT bargaining power against distributors.

The strategy, as described in the case, didn’t address anything about the threat of new entrants, or the threat of substitutes. In this case, the largest threat of new entrants is certainly the private labels of the distributors themselves such as Walmart, Whole foods, Trader Joe and Costco. Most likely they are also aiming at the premium section of the wine industry. The bottom-up strategy needs to differentiate CyT’s product to the distributors’ offerings. CyT should consider focusing executing the marketing campaign on social medias and online channels such as TikTok. CyT should also consider not only sponsoring wine tasting, but events for younger customers such as university graduations, wedding events, and tech companies.

The threat of substitutes should also be taken into account. What are the major alternatives of wine? Beer and alcoholic drinks. Sparking wine is is also a booming product for many. Create offerings to cater customers from these segments is crucial, too. Many strategies can be used - mobile bottles (tiny bottles for a glass), smaller bottles for a single drinker to finish in a meal, sharable “value-size” bottles for parties. Marketing campaign is key here to compete with alternatives.

1 note

·

View note

Text

How does Walmarts EDLP Strategy Revolutionize the Retail Game

Introduction

In the face of inflation's widespread impact, the significance of maintaining low pricing has surged for businesses and consumers alike. Walmart, renowned as one of the world's largest retailers, has solidified its global standing through its Everyday Low Price (EDLP) strategy. This pricing approach has been pivotal in distinguishing Walmart, fostering customer loyalty, cutting costs, and propelling sales. The EDLP strategy has mainly fueled Walmart's online marketplace growth, with a notable surge from $15.7 billion in 2019 to $53.4 billion in 2023. This blog delves into Walmart's EDLP strategy, emphasizing its effectiveness and exploring how retailers can leverage similar low-pricing strategies to enhance value for shoppers.

EDLP Strategy – What Is It?

An EDLP strategy, synonymous with Walmart pricing strategy, revolves around consistently offering low product prices without relying on frequent sales or discounts. Employed by Walmart since its inception in 1962, this approach has played a pivotal role in establishing the retail giant as a renowned low-cost leader in the industry. Walmart’s EDLP pricing strategy has solidified its reputation and set a benchmark for effective low-pricing strategies, emphasizing a commitment to affordability and consistency in the competitive retail landscape.

How Walmart's EDLP Strategy Drives its Online Marketplace Success?

Walmart's EDLP strategy, integral to its pricing approach, operates on principles that businesses can emulate in their online marketplaces:

Lower Operational Costs and Increased Sales Volume:

Walmart's offering a cost-effective alternative to Amazon's EDLP strategy attracts higher sales volume, potentially reducing operational costs.

Direct Sourcing Advantages:

Rooted in direct sourcing, Walmart's strategy bypasses intermediaries, enabling negotiations for lower prices from manufacturers. This ensures affordability for both sellers and consumers.

Private Label Offerings:

Walmart's private label brands like Great Value and Sam's Choice reduce costs for sellers and provide consumers with budget-friendly alternatives to name brands.

Supply Chain Management and Bargaining Power:

Leveraging robust supply chain management and formidable bargaining power, Walmart negotiates lower prices from suppliers, a practice integral to maintaining competitive pricing for sellers and consumers.

Walmart's EDLP pricing strategy, a cornerstone of its online marketplace, exemplifies how low pricing strategies can drive success by fostering increased sales volume, leveraging direct sourcing advantages, offering private label alternatives, and optimizing supply chain management. This strategic blend contributes to Walmart's continued dominance in the online retail landscape.

Determining Suitability: Is an Every Day Low Pricing Strategy for You?

Deciding whether an Everyday Low Pricing (EDLP) strategy aligns with your business necessitates thoroughly examining key factors, especially considering Walmart's successful implementation of this approach.

Customer Base:

An EDLP strategy resonates well with price-sensitive customers seeking optimal value. If your customer base primarily comprises budget-conscious shoppers, adopting an EDLP approach might be advantageous.

Competition:

Assess your competitors' pricing strategies. If they predominantly employ a high-low pricing model with frequent sales, differentiating your business through consistent low prices, as exemplified by Walmart's EDLP strategy, can be a strategic advantage.

Profit Margins:

Recognize that EDLP strategies often entail lower profit margins than high-low pricing approaches. Your business must focus on efficient cost-cutting and operational practices to maintain profitability while implementing an EDLP strategy.

Supply Chain:

A robust supply chain and efficient inventory management are imperative for EDLP's success. Emulating Walmart's EDLP pricing strategy requires a streamlined supply chain to offer low prices consistently. Careful consideration is warranted if supply chain management is challenging for your business.

Long-Term Commitment:

EDLP strategies demand a sustained commitment to maintaining consistently low prices. If your business prioritizes short-term goals over long-term stability, such as quarterly earnings targets, an EDLP strategy may need to align with your objectives.

In evaluating these factors, it becomes evident that Walmart's EDLP strategy has not only catered to a price-sensitive customer base but strategically positioned itself amid competition. The emphasis on cost efficiency and long-term commitment, hallmarks of Walmart pricing strategy, underscores the importance of aligning your business goals and operational capabilities before adopting an EDLP approach.

Embracing an EDLP strategy inspired by Walmart's success requires a holistic understanding of your customer base, competitive landscape, profit margins, supply chain capabilities, and long-term objectives. By carefully weighing these considerations, your business can decide whether the EDLP pricing strategy is the right fit for sustained success in the dynamic retail environment.

Unlocking Walmart's Pricing Mastery for Your Business Success

Applying Walmart's EDLP strategy to your business involves strategic considerations:

Direct Sourcing Leverage:

Emulate Walmart's approach by focusing on direct sourcing and negotiating favorable prices directly with manufacturers. This contributes to the essence of Walmart's EDLP pricing strategy.

Private-Label Initiatives:

Create private-label brands akin to Walmart's Great Value, offering budget-friendly alternatives. This mirrors Walmart's EDLP strategy, providing cost-effective choices for consumers.

Operational Efficiency Drive:

Reduce operational costs by optimizing supply chain management and minimizing packaging expenses. Aligning with Walmart's EDLP approach requires a keen focus on operational efficiency.

Bargaining Power Utilization:

Harness your bargaining power to negotiate lower prices from suppliers, mirroring Walmart's EDLP pricing strategy that relies on solid negotiations for sustained cost reductions.

Shrinkflation Consideration:

Explore alternatives like shrinkflation—reducing package sizes instead of increasing prices. This tactic aligns with Walmart's EDLP strategy, ensuring pricing competitiveness without compromising value.

By incorporating these principles, your business can echo the success of Walmart's EDLP strategy, creating a pricing approach that prioritizes affordability, operational efficiency, and strategic bargaining, all essential elements in the competitive landscape of low pricing strategies.

Elevate Your Pricing Game with Walmart's EDLP Strategy

Walmart's EDLP strategy is a linchpin in its triumph, wielding influence over pricing dynamics for sellers and consumers. In the face of inflation, businesses can harness the potential of Walmart's EDLP strategy by prioritizing direct sourcing, private-label initiatives, operational efficiency, and strategic bargaining. Elevate your approach further by incorporating Retail Scrape's Dynamic Pricing and Competitive Intelligence tools.

Why Choose Retail Scrape?

Effortlessly track competitor pricing, ensuring your brand stays competitive in an evolving market. With Retail Scrape, optimize your pricing strategy, offering the most attractive prices and discounts while efficiently managing inventory without compromising margins. Embrace Walmart's EDLP legacy and propel your business to new heights with Retail Scrape's powerful tools.

Make Walmart's EDLP strategy your own and navigate the pricing complexities in an inflationary landscape. Seize the opportunity to lead with competitive prices and stay ahead with Retail Scrape's cutting-edge solutions.

know more :

https://www.retailscrape.com/walmarts-edlp-strategy-retail-game.php

#Walmart'sEDLPStrategy#Walmart’sEDLPPricingStrategy#LowPricingStrategies#AmazonsEDLPStrategy#EDLPPricingStrategy

0 notes

Text

How Social Media Allowed K-Beauty to Enter the Global Market and Grow Exponentially -Katy Lee

When the topic of Korea comes up now, automatically the top things people associate with it are K-pop, K-Dramas, Korean food, K-fashion and lastly, K-beauty. I personally got exposed to Korean cosmetics during high school, and back then, it was nowhere near as popular and common as we see now. The only way to purchase Korean cosmetics before was through Korean beauty brand websites, but in recent years I’ve noticed large drugstores such as Target, CVS, or Walmart selling Korean cosmetics. Western retailers are joining the K-Beauty bandwagon and have started stocking them. Skincare/ makeup fanatics, I’m pretty sure you’ve walked by the beauty/ skincare aisle of Target or even shopping online on ULTA and realized some foreign brands/ products you’ve never seen before. In April 2017, CVS Pharmacy began rolling out a “K-Beauty HQ” section in 2,100 stores nationwide. Not so long after, ULTA Beauty also introduced a “K-Beauty” section to ulta.com and more than 300 stores. Even social media has grown to play a bigger role in the promotion and increased accessibility of K-Beauty products. From seeing your favorite influencers endorse the products to having advertisements pop up while you’re scrolling through your feed, it introduced and familiarized us to the whole concept of Korean cosmetics. Of course, there are other factors that also contributed to this entry such as packaging and media influence from Korean culture, but without social media, the reach would not have been as broad.